Exhibit 99.2

OPERATING AND FINANCIAL HIGHLIGHTS

OPERATING HIGHLIGHTS

All dollar figures are in United States dollars and tabular dollar amounts are in millions, unless otherwise noted.

New Gold Inc. (“New Gold” or the “Company”) is an intermediate gold producer with operating mines in Canada, the United States, Australia and Mexico, development projects in Canada and a stream on gold production from a development property in Chile. For the six months ended June 30, 2016, the New Afton Mine in Canada (“New Afton”), the Mesquite Mine in the United States (“Mesquite”), the Peak Mines in Australia (“Peak Mines”) and the Cerro San Pedro Mine in Mexico (“Cerro San Pedro”) combined to produce 190,234 gold ounces, 51.1 million pounds of copper and 0.7 million silver ounces, continuing the Company’s solid start to the year. For the three months ended June 30, 2016, the Company’s mine sites produced 99,423 gold ounces, 25.7 million pounds of copper and 0.3 million silver ounces.

New Gold’s production costs remained competitive compared to the broader gold mining space as New Gold had total cash costs(1) of $334 per gold ounce sold and all-in sustaining costs(1) of $721 per gold ounce sold in the second quarter of 2016. We believe New Gold continues to establish itself as one of the lowest cost producers in the industry.

| 1 |  |

FINANCIAL HIGHLIGHTS

New Gold maintains a strong liquidity position with total available liquidity of $474 million, comprised of $220 million in cash and cash equivalents and $179 million available for drawdown under the Company’s $300 million revolving credit facility, each as at June 30, 2016, and $75 million representing the second instalment of the deposit to be paid in connection with the Company’s stream agreement relating to Rainy River.

|  |

| 1. | The Company uses certain non-GAAP financial performance measures throughout this Management’s Discussion and Analysis (“MD&A”). For a detailed description of each of the non-GAAP measures used in this MD&A and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 2. | Payment of the $75 million second instalment of the stream deposit is expected to be received late in the third quarter or early in the fourth quarter of 2016, subject to certain conditions. |

| 3. | Of the $300 million credit facility, $121 million is utilized for letters of credit as at June 30, 2016. The credit facility also provides the Company with the option to draw an additional $50 million above and beyond the base $300 million, subject to lender participation. |

| Three months ended June 30 | Six months ended June 30 | |||

| (in millions of U.S. dollars, except where noted) | 2016 | 2015 | 2016 | 2015 |

| Operating information | ||||

| Gold production (ounces) | 99,423 | 86,442 | 190,234 | 181,419 |

| Gold sales (ounces) | 101,820 | 87,754 | 187,851 | 180,152 |

| Average realized price ($/ounce)(1) | 1,267 | 1,191 | 1,239 | 1,210 |

| Total cash costs per gold ounce sold ($/ounce)(1) | 334 | 410 | 343 | 449 |

| All-in sustaining costs per gold ounce sold ($/ounce)(1) | 717 | 922 | 736 | 969 |

| Financial Information | ||||

| Revenue | 180.3 | 167.7 | 334.8 | 336.6 |

| Net (loss) earnings | (8.8) | 9.4 | 18.0 | (34.4) |

| Adjusted net earnings (loss)(1) | 13.7 | (1.3) | 13.4 | (6.4) |

| Cash generated from operations | 79.2 | 56.9 | 140.7 | 126.7 |

| Cash generated from operations before changes in non-cash operating working capital(1) | 82.4 | 62.7 | 144.5 | 130.1 |

| Cash and cash equivalents | 219.5 | 326.8 | 219.5 | 326.8 |

| Capital expenditures (sustaining capital) (1) | 27.1 | 35.7 | 49.5 | 73.5 |

| Capital expenditures (growth capital) (1) | 111.1 | 38.2 | 196.1 | 69.6 |

| Share Data | ||||

| (Loss) earnings per basic share ($) | (0.02) | 0.02 | 0.04 | (0.07) |

| Adjusted net earnings (loss) per basic share(1) ($) | 0.03 | - | 0.03 | (0.01) |

| 2 |  |

Contents

| OPERATING HIGHLIGHTS | 1 |

| FINANCIAL HIGHLIGHTS | 2 |

| OUR BUSINESS | 4 |

| OPERATING, DEVELOPMENT AND FINANCIAL HIGHLIGHTS | 5 |

| CORPORATE DEVELOPMENTS | 10 |

| CORPORATE SOCIAL RESPONSIBILITY | 11 |

| OUTLOOK FOR 2016 | 13 |

| KEY PERFORMANCE DRIVERS | 13 |

| FINANCIAL RESULTS | 16 |

| REVIEW OF OPERATING MINES | 21 |

| DEVELOPMENT AND EXPLORATION REVIEW | 30 |

| FINANCIAL CONDITION REVIEW | 34 |

| NON-GAAP FINANCIAL PERFORMANCE MEASURES | 41 |

| ENTERPRISE RISK MANAGEMENT AND RISK FACTORS | 51 |

| CRITICAL JUDGMENTS AND ESTIMATION UNCERTAINTIES | 53 |

| ACCOUNTING POLICIES | 53 |

| CONTROLS AND PROCEDURES | 54 |

| CAUTIONARY NOTES | 55 |

| 3 |  |

MANAGEMENT’S DISCUSSION AND ANALYSIS

For the three and six months ended June 30, 2016

The following Management’s Discussion and Analysis (“MD&A”) provides information that management believes is relevant to an assessment and understanding of the consolidated financial condition and results of operations of New Gold Inc. and its subsidiaries (“New Gold” or the “Company”). This MD&A should be read in conjunction with New Gold’s unaudited condensed consolidated financial statements for the three and six months ended June 30, 2016 and 2015 and New Gold’s audited consolidated financial statements for the years ended December 31, 2015 and 2014 which were prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). This MD&A contains forward-looking statements that are subject to risks and uncertainties, as discussed in the cautionary note contained in this MD&A. The reader is cautioned not to place undue reliance on forward-looking statements. All dollar figures are inUnited States dollars and tabular dollar amounts are in millions, unless otherwise noted. This MD&A has been prepared as at July 27, 2016. Additional information relating to the Company, including the Company’s Annual Information Form, is available on SEDAR at www.sedar.com.

OUR BUSINESS

New Gold is an intermediate gold producer with operating mines in Canada, the United States, Australia and Mexico and development projects in Canada. The Company’s principal operating assets consist of the New Afton gold-copper Mine in Canada (“New Afton”), the Mesquite gold Mine in the United States (“Mesquite”), the Peak Mines gold-copper Mine in Australia (“Peak Mines”) and the Cerro San Pedro gold-silver Mine in Mexico (“Cerro San Pedro”). In addition, New Gold’s principal development projects are its 100%-owned Rainy River (“Rainy River”) and Blackwater (“Blackwater”) projects, both in Canada. In addition, the Company owns a 4% stream on future gold production from the El Morro project located in Chile (“El Morro”). El Morro forms part of Goldcorp Inc. and Teck Resources Limited’s NuevaUnión project (formerly Project Corridor).

New Gold’s operating portfolio is diverse both geographically and in the range of commodities it produces. The assets produce gold with copper and silver by-products at total cash costs and all-in sustaining costs below the industry average. With a strong liquidity position, a simplified balance sheet and an experienced management team and Board of Directors, the Company has a solid platform to continue to execute its growth strategy, both organically and through value-enhancing accretive acquisitions, to further establish itself as an industry-leading intermediate gold producer.

| 4 |  |

OPERATING, DEVELOPMENT AND FINANCIAL HIGHLIGHTS

OPERATING AND DEVELOPMENT HIGHLIGHTS

| Three months ended June 30 | Six months ended June 30 | |||

| 2016 | 2015 | 2016 | 2015 | |

| Operating information | ||||

| Gold (ounces): | ||||

| Produced(1) | 99,423 | 86,442 | 190,234 | 181,419 |

| Sold(1) | 101,820 | 87,754 | 187,851 | 180,152 |

| Copper (millions of pounds): | ||||

| Produced(1) | 25.7 | 23.6 | 51.1 | 46.6 |

| Sold(1) | 25.2 | 23.7 | 50.4 | 45.8 |

| Silver (millions of ounces): | ||||

| Produced(1) | 0.3 | 0.4 | 0.7 | 0.8 |

| Sold(1) | 0.3 | 0.4 | 0.7 | 0.8 |

| Average realized price(1) (2): | ||||

| Gold ($/ounce) | 1,267 | 1,191 | 1,239 | 1,210 |

| Copper ($/pound) | 2.14 | 2.72 | 2.14 | 2.66 |

| Silver ($/ounce) | 17.39 | 16.23 | 15.96 | 16.41 |

| Total cash costs per gold ounce sold ($/ounce) (2)(3) | 334 | 410 | 343 | 449 |

| All-in sustaining costs per gold ounce sold ($/ounce) (2)(3) | 717 | 922 | 736 | 969 |

Total cash costs per gold ounce sold on a co-product basis ($/ounce) (2)(3) | 609 | 704 | 625 | 717 |

All-in sustaining costs per gold ounce sold on a co-product basis ($/ounce)(2)(3) | 871 | 1,007 | 885 | 1,038 |

| 1. | Production is shown on a total contained basis while sales are shown on a net payable basis, including final product inventory and smelter payable adjustments, where applicable. |

| 2. | The Company uses certain non-GAAP financial performance measures throughout this MD&A. Average realized price, total cash costs and all-in sustaining costs per gold ounce sold and total cash costs and all-in sustaining costs on a co-product basis are non-GAAP financial performance measures with no standard meaning under IFRS. For further information and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 3. | The calculation of total cash costs and all-in sustaining costs per gold ounce sold is net of by-product silver and copper revenue. Total cash costs and all-in sustaining costs on a co-product basis remove the impact of other metal sales that are produced as a by-product of the Company’s gold production and apportions the cash costs to each metal produced on a percentage of revenue basis. If silver and copper revenue were treated as co-products, co-product total cash costs for the three months ended June 30, 2016 would be $8.21 per silver ounce (2015 – $9.37) and $1.15 per pound of copper (2015 - $1.76) and co-product all-in sustaining costs for the three months ended June 30, 2016 would be $11.81 per silver ounce (2015 - $13.51) and $1.59 per pound of copper (2015 - $2.45).For the six months ended June 30, 2016, co-product total cash costs would be $7.85per silver ounce (2015 - $9.54) and $1.20per pound of copper (2015 - $1.72) and co-product all-in sustaining costs for the six months ended June 30, 2016 would be $11.20per silver ounce (2015 - $13.90) and $1.65per pound of copper (2015 - $2.43). |

| 5 |  |

Gold production for the three months ended June 30, 2016 was 99,423 ounces, compared to 86,442 ounces in the prior-year period.Higher production from New Afton, Mesquite and Peak Mines was only partially offset by planned lower production from Cerro San Pedro, which was in its final months of active mining during the quarter. Cerro San Pedro completed active mining in late June and has now transitioned to residual leaching.

Gold production for the six months ended June 30, 2016 was 190,234 ounces, compared to 181,419 ounces in the prior-year period. Higher production from New Afton, Mesquite and Peak Mines was partially offset by planned lower production from Cerro San Pedro.As a result of the Company’s strong production for the six months ended June 30, 2016, the Company is well positioned to meet its full-year gold production guidance.

Gold sales were101,820 ounces for the three months ended June 30, 2016, compared to 87,754 ounces in the prior-year period.Timing of sales at the end of the period resulted in a difference between ounces sold and ounces produced.Gold sales for the six months ended June 30, 2016 was 187,851 ounces, compared to 180,152 ounces in the prior-year period.

Copper production for the three months ended June 30, 2016 was 25.7 million pounds compared to 23.6 million pounds produced in the prior-year period.Higher copper production from New Afton, reflecting increased mill throughput, was partially offset by lower copper production at Peak Mines.

Copper production for the six months ended June 30, 2016 was 51.1million pounds, compared to 46.6 million pounds in the prior-year period. As a result of the Company’s strong copper production in the first half of 2016, the Company now anticipates that it will exceed the high end of its full-year copper production guidance of 81.0 to 93.0 million pounds.

Copper sales were 25.2 million pounds for the three months ended June 30, 2016 compared to 23.7 million pounds in the prior-year period.Copper sales for the six months ended June 30, 2016 were 50.4 million pounds, compared to 45.8 million pounds in the prior-year period. Copper sales volumes were higher than the prior-year periods as a result of higher production.

Silver production for the three months ended June 30, 2016 was 0.3 million ounces, consistent with0.4 million ounces in the prior-year period.Silver production for the six months ended June 30, 2016 was 0.7million ounces, consistent with 0.8 million ounces in the prior-year period.

Total cash costs per gold ounce sold, net of by-product sales, were $334 per ounce for the three months ended June 30, 2016 compared to $410 per ounce in the prior-year period.Total cash costs per gold ounce sold, net of by-product sales, were $343for the six months ended June 30, 2016 compared to $449 in the prior-year period.The decrease in cash costs relative to the prior-year periods was primarily driven by lower operating costs due to the depreciation of the Canadian and Australian dollars relative to the U.S. dollar, increased copper sales volumes, and the Company’s business improvement initiatives, which were partially offset by lower by-product credits as a result of lower average realized copper prices.

All-in sustaining costs per gold ounce sold were $717 per ounce for the three months ended June 30, 2016, compared to $922 per ounce in the prior-year period.All-in sustaining costs per gold ounce sold were $736 for the six months ended June 30, 2016, compared to $969 in the prior-year period. The decrease in all-in sustaining costs relative to the prior-year periods was driven by the decrease in cash costs noted above and lower sustaining capital expenditures.

Based on the Company’s operating results for the six months ended June 30, 2016, and assuming current commodity prices and foreign exchange rates, the Company now expects a reduction to its 2016 full-year total cash costs and all-in sustaining costs from the Company’s original guidance range. For further information, refer to the “Outlook for 2016” section of this MD&A.

| 6 |  |

For a detailed review of the Company’s operating mines, refer to the “Review of Operating Mines” sections of this MD&A.

For the three months ended June 30, 2016, capital expenditures on Rainy River totalled $107.6 million, compared to$32.9 million in the prior-year period. The increased activity during the period resulted in the project team continuing to achieve many project advancements: notably, completion of the enclosure of the grinding building, substantial completion of plant site earthworks, installation of mechanical, piping, electrical and instrumentation in the grinding building and process facilities, substantial completion of power line construction, substantial completion of the pre-leach thickener tank and commencement of the training and recruitment of the operations team. For the six months ended June 30, 2016, capital expenditures on Rainy River totalled $189.8 million, compared to $51.9 million in the prior-year period. For a detailed project update please refer to the “Development and Exploration Review” section of this MD&A.

The Company has continued its exploration success.The Company’s exploration efforts during the first half of 2016 were centered on New Afton and the Peak Mines. At New Afton, New Gold has completed approximately 60% of the Company's planned 10,000-metre 2016 exploration program. Based on the encouraging results received to date, the Company plans to complete the remainder of its budgeted program during the second half of the year. At the Peak Mines, the Company is drill testing multiple targets. At Chronos, over 100 additional holes have been drilled which have successfully expanded the dimensions of the mineralized zone. At Anjea, a localized zone of higher gold grades has also been intercepted during the recent drilling of Anjea East. Additionally, the 2016 drilling program continues to return positive results from a separate lens of silver-lead-zinc mineralization situated approximately 40 metres west of the Anjea zone, providing further upside potential for future development at Great Cobar. The Company provided an update on its exploration results in a news release issued June 27, 2016. Please refer to the “Corporate Developments” section of this MD&A for more information.

| 7 |  |

FINANCIAL HIGHLIGHTS

| Three months ended June 30 | Six months ended June 30 | |||

| (in millions of U.S. dollars, except where noted) | 2016 | 2015 | 2016 | 2015 |

| FINANCIAL INFORMATION | ||||

| Revenue | 180.3 | 167.7 | 334.8 | 336.6 |

| Operating margin(1) | 95.6 | 69.5 | 168.2 | 138.8 |

| Earnings from mine operations | 33.3 | 18.6 | 48.3 | 32.8 |

| Net (loss) earnings | (8.8) | 9.4 | 18.0 | (34.4) |

| Adjusted net earnings (loss)(1) | 13.7 | (1.3) | 13.4 | (6.4) |

| Cash generated from operations | 79.2 | 56.9 | 140.7 | 126.7 |

| Cash generated from operations before changes in non-cash operating working capital(1) | 82.4 | 62.7 | 144.5 | 130.1 |

| Capital expenditures (sustaining capital) (1) | 27.1 | 35.7 | 49.5 | 73.5 |

| Capital expenditures (growth capital) (1) | 111.1 | 38.2 | 196.1 | 69.6 |

| Total assets | 3,773.7 | 3,910.5 | 3,773.7 | 3,910.5 |

| Cash and cash equivalents | 219.5 | 326.8 | 219.5 | 326.8 |

| Long-term debt | 788.5 | 879.3 | 788.5 | 879.3 |

| Share Data | ||||

| (Loss) earnings per share: | ||||

| Basic ($) | (0.02) | 0.02 | 0.04 | (0.07) |

| Diluted ($) | (0.02) | 0.02 | 0.04 | (0.07) |

| Adjusted net earnings (loss) per basic share ($)(1) | 0.03 | - | 0.03 | (0.01) |

| Share price as at June 30 (TSX – Canadian dollars) | 5.65 | 3.35 | 5.65 | 3.35 |

| Weighted average outstanding shares (basic) (millions) | 511.2 | 509.1 | 510.8 | 508.8 |

| 1. | The Company uses certain non-GAAP financial performance measures throughout this MD&A. Operating margin, adjusted net loss, adjusted net loss per basic share, capital expenditures (sustaining and growth) and cash generated from operations before changes in non-cash operating working capital are non-GAAP financial performance measures with no standard meaning under IFRS. For further information and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

Revenue was $180.3 million for the three months ended June 30, 2016, compared to $167.7 million in the prior-year period.Revenue for the three months ended June 30, 2016 benefitted from an increase in metal sales volume and higher realized gold and silver prices when compared to the prior-year period.

Revenue was $334.8million for the six months ended June 30, 2016, consistent with $336.6 million in the prior-year period. The benefit from higher metal sales volume and higher realized gold prices was offset by lower realized copper and silver prices when compared to the prior-year period.

Earnings from mine operations were $33.3 million for the three months ended June 30, 2016, compared to $18.6 million in the prior-year period.The increase in earnings from mine operations was primarily due to higher revenue and lower operating expenses as a result of the Company’s business improvement initiatives, the reduction in mining activity at Cerro San Pedro and the depreciation of the Canadian and Australian dollars and the Mexican Peso relative to the U.S. dollar, partially offset by higher depreciation and depletion.

Earnings from mine operations were $48.3for the six months ended June 30, 2016, compared to $32.8 million in the prior-year period. Similarly, the increase in earnings from mine operations was primarily due to lower operating expenses, partially offset by higher depreciation and depletion.

| 8 |  |

The Company’s net loss was $8.8 million or $0.02 per basic share for the three months ended June 30, 2016, compared to net earnings of $9.4 million or $0.02 per basic share in the prior-year period. Net earnings were negatively impacted by a foreign exchange loss and an unrealized loss on the revaluation of the gold stream obligation derivative instrument in the current period. This was partially offset by reduced finance costs in the current period as more interest was capitalized to Rainy River than in the prior-year period.

Net earnings were $18.0 million for the six months ended June 30, 2016, compared to a net loss of $34.4 million in the prior-year period. Similarly, net earnings were impacted by the increase in earnings from mine operations, reduced finance costs and an unrealized loss on the revaluation of the gold stream obligation derivative instrument as noted above. For the six months ended June 30, 2016, net earnings also benefitted from a foreign exchange gain.

Adjusted net earnings for the three months ended June 30, 2016 was $13.7 million or $0.03 per basic share, compared to an adjusted net loss of $1.3 million or $nil per basic share in the prior-year period.Adjusted net earnings was impacted by higher revenue, reduced operating expenses and reduced finance costs as the Company has capitalized more interest to its qualifying development properties than in the prior-year period. Adjusted net earnings for the six months ended June 30, 2016 was $13.4 million or $0.03 per basic share, compared to an adjusted net loss of $6.4 million in the prior-year period.

For further information on the Company’s financial results, please refer to the “Financial Results” section of this MD&A.

Cash generated from operations for the three months ended June 30, 2016 was $79.2 million, compared to $56.9 million in the prior-year period.Cash generated from operations for the six months ended June 30, 2016 was $140.7 million, compared to $126.7 million in the prior-year period. For the three and six months ended June 30, 2016, the increase in cash generated from operations was primarily due to higher metal sales volumes and lower operating expenses. For the three months ended June 30, 2016, cash generated from operations also benefitted from higher revenue.

Cash and cash equivalents were $219.5 million as at June 30, 2016, compared to $298.3 million as at March 31, 2016 and $335.5 million as at December 31, 2015.For the three and six months ended June 30, 2016, cash generated from operations was offset by cash used in investing activities (including sustaining capital expenditures and growth capital expenditures, primarily on Rainy River).

For further information on the Company’s liquidity and cash flow position, please refer to the “Liquidity and Cash Flow” section of this MD&A.

| 9 |  |

CORPORATE DEVELOPMENTS

New Gold’s strategy involves strong operational execution at its current assets and disciplined growth both through organic initiatives and value-enhancing mergers and acquisitions. Since the middle of 2009, New Gold has focused on enhancing the value of its portfolio of assets, while also continually looking for compelling external growth opportunities. The Company strives to maintain a strong financial position while continually reviewing strategic alternatives with the view of maximizing long-term shareholder value. New Gold’s objective is to pursue corporate development initiatives that will leave the Company and its shareholders in a fundamentally stronger position.

On June 27, 2016 New Gold provided an update on its exploration results at the New Afton C-zone and the Peak Mines.

New Afton C-Zone

In February 2016, the Company announced the results of its New Afton C-zone feasibility study, which added 25 million tonnes of gold and copper ore to New Afton's mineral reserves and outlined the potential to add five years of mine life at current throughput rates. The primary focus of 2016 exploration activities at New Afton has been to test the potential to increase the C-zone mineral resource immediately around the currently contemplated block cave volume. Drilling along strike from the upper portions of the current C-zone block cave volume has intercepted copper-gold mineralization extending up to 75 metres to the west. Year to date, New Gold has completed approximately 60% of the Company's planned 10,000-metre 2016 exploration program at New Afton. Based on the encouraging results received to date, the Company plans to complete the remainder of its $6 million budgeted program during the second half of the year. Results of the 2016 exploration program will be incorporated into New Gold's 2016 year-end mineral reserve and resource estimates.

Peak Mines

In November 2015, New Gold announced the discovery of two new zones of polymetallic mineralization, Chronos and Anjea, both located adjacent to current and past-producing mines distributed along the nine-kilometre Peak Mines corridor. Chronos is a zone of gold-silver-lead-zinc mineralization located adjacent to the Peak mill and directly above the Perseverance ore body which is currently being mined. Anjea is a zone of copper-gold and silver-lead-zinc mineralization located adjacent to the historic Great Cobar mine and approximately nine kilometres north of the Peak mill. After discovering these two new zones in 2015, New Gold's objective in 2016 has been to further delineate the Chronos and Anjea mineral resources for incorporation into the Company's 2016 year-end mineral reserve and resource estimates.

The focus of the Company's 2016 drilling at Chronos has been on delineating the overall limits of the zone, including the East and West lenses, to support an Inferred mineral resource estimate and delineating the Main lens to the Measured and Indicated classification level for incorporation into New Gold's 2016 year-end mineral reserve estimates and the Peak Mine's longer-term mine plan. Since the November 2015 announcement of the Chronos discovery, over 100 additional holes have been drilled which have successfully expanded the dimensions of the mineralized zone. When compared to November 2015, the 2016 delineation drilling program has grown the Chronos zone from 280 to 350 metres in vertical height, extended it from 45 metres to 120 metres along strike, and increased the average thickness from a range of 10 to 25 metres to approximately 40 metres.

Similar to Chronos, the Anjea zone is made up of sub-parallel vertically oriented lenses, Anjea East and Anjea West. While both lenses consist predominantly of copper mineralization with subordinate amounts of gold, a localized zone of higher gold grades has also been intercepted during the recent drilling of Anjea East. Additionally, the 2016 drilling program continues to return positive results from a separate lens of silver-lead-zinc mineralization situated approximately 40 metres west of the Anjea zone, providing further upside potential for future development at Great Cobar. The drilling completed to date at Anjea is expected to be sufficient for inclusion in the Company's Inferred mineral resource estimate at the end of 2016. However, as both the Anjea zones remain open at depth, New Gold plans to follow up with additional drilling during the second half of the year.

| 10 |  |

Exploration of three earlier stage targets along the Peak Mines corridor has also returned positive results to date. The three targets, Dapville, Gladstone and Proteus, are all located within one kilometre of the New Cobar and Chesney mines. The Company's 2016 exploration budgeted program at the Peak Mines totals $8 million, which is expected to include approximately 10,000 metres of drilling at each of Chronos and Anjea, as well as continued drill testing of other prospective targets along the Peak Mines corridor.

CORPORATE SOCIAL RESPONSIBILITY

New Gold is committed to excellence in corporate social responsibility. The Company considers its ability to make a lasting and positive contribution toward sustainable development a key driver to achieving a productive and profitable business. New Gold aims to achieve this objective through the protection of the health and well-being of its people and host communities as well as employing industry-leading practices in the areas of environmental stewardship and community engagement and development.

| Environmental and community HIGHlights for Q2 2016 | |||

| · | New Gold completed its 2015 Corporate Responsibility Report (now available on the Company’s website). | ||

| · | Cerro San Pedro continues to work with communities as it moves toward closure by supporting an entrepreneurship program, including a local fair to encourage small business. The site entered the first phase of closure at the end of Q2. | ||

| · | Rainy River continues to work toward final approvals of amendments to its existing permits. The team also continues to work with local regulators, communities, First Nations and other Aboriginal groups during the project’s construction phase. | ||

As a participant and supporter of the United Nations Global Compact, New Gold’s policies and practices are guided by its principles with regard to human rights, labour, environmental stewardship and anti-corruption. As a member of the Mining Association of Canada (“MAC”), New Gold’s operations adopt the MAC’s Towards Sustainable Mining protocols.

New Gold’s corporate social responsibility objectives include promoting and protecting the welfare of its employees through safety-first work practices, upholding fair employment practices and encouraging a diverse workforce, where people are treated with respect and are supported to realize their full potential. New Gold believes that its people are its most valued assets. The Company strives to create a culture of inclusiveness that begins at the top and is reflected in its hiring, promotion and overall human resources practices. New Gold encourages tolerance and acceptance in worker-to-worker relationships. In each of its host communities, the Company strives to be an employer of choice through the provision of competitive wages and benefits, and through the implementation of policies of recognizing and rewarding employee performance and promoting from within wherever possible.

The Company is committed to preserving the long-term health and viability of the natural environments that host its operations. Wherever New Gold operates – in all stages of mining activity, from early exploration and planning, to commercial mining operations through to eventual closure – the Company is committed to excellence in environmental management. From the earliest site investigations, New Gold carries out comprehensive environmental studies to establish baseline measurements for flora, fauna, earth, air and water. During operations, the Company promotes the efficient use of raw materials and resources and works to minimize environmental impacts and maintain robust monitoring programs. After mining activities are complete, New Gold’s objective is to restore the land to a sustainable end land use or to an alternative land use determined through consultation with local stakeholders.

| 11 |  |

New Gold is committed to establishing relationships based on mutual benefit and active participation with its host communities to contribute to healthy and sustainable communities. Wherever the Company’s operations interact with Indigenous peoples, New Gold promotes understanding of and respect for traditional values, customs and culture and takes meaningful action to consider their interests through collaborative agreements aimed at creating jobs, training and lasting socio-economic benefits. New Gold aims to foster open communication with local residents and community leaders and strives to partner in the long-term sustainability of those communities. The Company believes that by thoroughly understanding the people, their histories, and their needs and aspirations, we can engage in a meaningful and sustainable development process.

| 12 |  |

OUTLOOK FOR 2016

As a result of the Company’s strong gold production in the first half of 2016, New Gold is well positioned to meet its full-year gold production guidance of 360,000 to 400,000 ounces. Additionally, as a result of the Company’s copper production being higher than planned for the first half of 2016, the Company now anticipates that it will exceed the high end of its full-year copper production guidance of 81.0 to 93.0 million pounds. Consolidated full-year silver production is expected to be at, or slightly below, the low end of the guidance range of 1.6 to 1.8 million ounces.

For the six months ended June 30, 2016, New Gold’s all-in sustaining costs per ounce and total cash costs per ounce were both well below the prior-year period and are tracking below the Company’s 2016 cost guidance. Based on New Gold’s first half operating results, and assuming current commodity prices and foreign exchange rates, the Company now expects its 2016 full-year total cash costs to be $360 to $400 per ounce, a $75 per ounce reduction from the Company’s original guidance range of $435 to $475 per ounce. As total cash costs form a component of all-in sustaining costs, New Gold similarly expects a $75 per ounce reduction from its 2016 full-year all-in sustaining costs to approximately $750 to $790 per ounce as compared to the Company’s original guidance range of $825 to $865 per ounce.

KEY PERFORMANCE DRIVERS

There is a range of key performance drivers that is critical to the successful implementation of New Gold’s strategy and the achievement of its goals. The key internal drivers are production volumes and costs. The key external drivers are market prices of gold, copper and silver, as well as foreign exchange rates.

Production Volumes and Costs

New Gold’s portfolio of operating mines produced 99,423 gold ounces for the three months ended June 30, 2016 and 190,234 gold ounces for the six months ended June 30, 2016.

Total cash costs and all-in sustaining costs for the three months ended June 30, 2016, net of by-product sales, were $334 and $717 per gold ounce sold, respectively. For the six months ended June 30, 2016 total cash costs and all-in sustaining costs, net of by-product sales, were $343 and $736 per gold ounce sold, respectively. As a low cost producer, the Company continues to be positioned favourably among its peers.

Commodity Prices

| 13 |  |

Gold prices

The price of gold is the largest single factor affecting New Gold’s profitability and operating cash flows. As such, the current and future financial performance of the Company is expected to be closely related to the prevailing price of gold. In the first quarter of 2016, the Company entered into gold price option contracts to match its 2016 production in order to further increase cash flow certainty and reduce exposure to fluctuations in gold price. The Company purchased put options with a strike price of $1,200 per ounce covering 270,000 ounces of gold and simultaneously sold call options with a strike price of $1,400 per ounce covering an equivalent 270,000 ounces. At June 30, 2016, there were 180,000 ounces outstanding related to these gold price option contracts.

For the three months ended June 30, 2016, New Gold’s average realized gold price was $1,267 per ounce compared to the London Bullion Market Association (“LBMA”) p.m. average gold price of $1,259 per ounce. For the six months ended June 30, 2016, New Gold’s average realized gold price was $1,239 per ounce compared to the LBMA p.m. average gold price of $1,220 per ounce. New Gold achieved a higher realized gold price compared to the LBMA p.m. average primarily as a result of provisionally priced sales settling in the quarter at a higher price than recorded in previous months, the mark-to-market of unsettled ounces at the end of the period and the timing of sales.

As a low cost producer, we believe New Gold is in a strong position to operate both in a low gold price environment and to take advantage of higher gold prices through the Company’s existing operations and growth projects.

Copper prices

For the three months ended June 30, 2016, New Gold’s average realized copper price was $2.14 per pound, which was consistent with the average London Metals Exchange copper price of $2.15 per pound. For the six months ended June 30, 2016, New Gold’s average realized copper price was $2.14 per pound, which was consistent with the average London Metals Exchange copper price of $2.13 per pound.

Silver prices

For the three months ended June 30, 2016, New Gold’s average realized silver price was $17.39 per ounce compared to the LBMA p.m. average silver price of $16.77 per ounce. The average realized silver price was higher than the market price due to the timing of sales. For the six months ended June 30, 2016, New Gold’s average realized silver price was $15.96 per ounce, consistent with the LBMA p.m. average silver price of $15.80 per ounce.

Foreign Exchange Rates

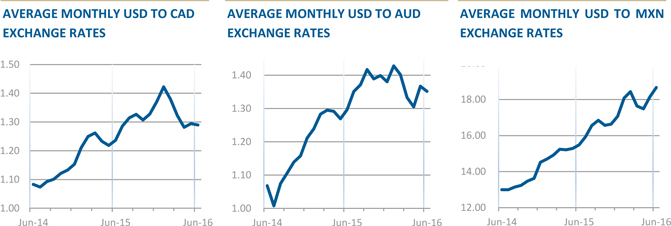

The Company operates in Canada, the United States, Australia and Mexico, while revenue is predominantly generated in U.S. dollars. As a result, the Company has foreign currency exposure with respect to costs not denominated in U.S. dollars. New Gold’s operating results and cash flows are influenced by changes in various exchange rates against the U.S. dollar. The Company has exposure to the Canadian dollar through New Afton, Rainy River and Blackwater, as well as through corporate administration costs. The Company also has exposure to the Australian dollar through Peak Mines, and to the Mexican peso through Cerro San Pedro.

The Canadian dollar against the U.S. dollar as at June 30, 2016 remained consistent with March 31, 2016. The average Canadian dollar against the average U.S. dollar for the three months ended June 30, 2016 weakened by approximately 5% when compared to the prior-year period. A weaker Canadian dollar decreases costs in U.S. dollar terms at the Company’s Canadian operations, as well as capital costs at the Company’s Canadian development properties as a significant portion of the capital costs are denominated in Canadian dollars.

The Australian dollar weakened against the U.S. dollar by approximately 3% from March 31, 2016 to June 30, 2016. The average Australian dollar against the average U.S. dollar for the three months ended June 30, 2016 weakened by approximately 4% when compared to the prior-year period. The strengthening or weakening of the Australian dollar impacts costs in U.S. dollar terms at the Company’s Australian operation, Peak Mines.

| 14 |  |

The Mexican peso weakened against the U.S. dollar by approximately 7% from March 31, 2016 to June 30, 2016. The average Mexican peso against the average U.S. dollar for the three months ended June 30, 2016 weakened by approximately 18% when compared to the prior-year period. The strengthening or weakening of the Mexican peso impacts costs in U.S. dollar terms at the Company’s Mexican operation, Cerro San Pedro.

For an analysis of the impact of foreign exchange fluctuations on operating costs for the three and six months ended June 30, 2016 relative to prior-year periods, refer to the “Review of Operating Mines” sections for New Afton, Peak Mines and Cerro San Pedro.

Economic Outlook

The LBMA p.m. gold price increased by approximately 7% during the second quarter of 2016 and has increased by almost 25% since the start of the year. Gold has benefitted from lowered market expectations for the trajectory of increases in U.S. interest rates in particular, as well as accommodative monetary policy across other economies generally. Furthermore, the British referendum on June 23rd on membership in the European Union resulted in a decision to leave, surprising markets and driving several major currency moves and volatility across wider markets. The referendum outcome has introduced a new set of uncertainties into the global economy that have helped to propel gold higher, fulfilling its role as a safe haven asset. As a low cost producer with a pipeline of development projects, New Gold believes it is particularly well positioned both to operate in a lower gold price environment and to take advantage of higher prices in the gold market.

Economic events can have significant effects on the price of gold, through currency rate fluctuations, the relative strength of the U.S. dollar, supply of and demand for gold, and macroeconomic factors such as interest rates and inflation expectations. Management anticipates that the long-term economic environment should provide support for precious metals and for gold in particular, and believes the prospects for the business are favourable. New Gold’s growth plan is focused on organic and acquisition-led growth, and the Company plans to remain flexible in the current environment to be able to respond to opportunities as they arise.

| 15 |  |

FINANCIAL RESULTS

Summary of Quarterly and Year-to-Date Financial Results

| Three months ended June 30 | Six months ended June 30 | |||

| (in millions of U.S. dollars, except where noted) | 2016 | 2015 | 2016 | 2015 |

| FINANCIAL RESULTS | ||||

| Revenue | 180.3 | 167.7 | 334.8 | 336.6 |

| Operating expenses | 84.7 | 98.2 | 166.6 | 197.8 |

| Depreciation and depletion | 62.3 | 50.9 | 119.9 | 106.0 |

| Earnings from mine operations | 33.3 | 18.6 | 48.3 | 32.8 |

| Corporate administration | 5.9 | 5.5 | 11.6 | 11.5 |

| Share-based payment expenses | 2.8 | 1.9 | 5.8 | 4.0 |

| Exploration and business development | 2.0 | 1.2 | 4.5 | 2.3 |

| Earnings from operations | 22.6 | 10.0 | 26.4 | 15.0 |

| Finance income | 0.2 | 0.4 | 0.5 | 0.6 |

| Finance costs | (3.1) | (10.6) | (7.7) | (21.4) |

| Other (losses) gains | ||||

| Unrealized (loss) gains on share purchase warrants | (0.1) | 7.0 | (0.5) | 11.5 |

| (Loss) gain on foreign exchange | (4.9) | 4.2 | 29.0 | (31.8) |

| Other loss on disposal of assets | (0.2) | (0.8) | (0.3) | (0.7) |

| Unrealized loss on revaluation of gold stream obligation | (10.4) | - | (25.5) | - |

| Loss on revaluation of gold price option contracts | (7.6) | - | (4.3) | - |

| Revaluation of AFS securities | 0.7 | - | 0.7 | - |

| Other | (0.2) | 0.1 | (0.1) | 0.1 |

| (Loss) earnings before taxes | (3.0) | 10.3 | 18.2 | (26.7) |

| Income tax expense | (5.8) | (0.9) | (0.2) | (7.7) |

Net (loss) earnings | (8.8) | 9.4 | 18.0 | (34.4) |

| Adjusted net earnings (loss)(1) | 13.7 | (1.3) | 13.4 | (6.5) |

| 1. | The Company uses certain non-GAAP financial performance measures throughout this MD&A. Operating margin, adjusted net loss, adjusted net loss per basic share, capital expenditures (sustaining and growth) and cash generated from operations before changes in non-cash operating working capital are non-GAAP financial performance measures with no standard meaning under IFRS. For further information and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

Revenue

For the three months ended June 30, 2016, the $12.6 million, or 8%, increase in revenue was attributable to the combined impact of a $8.1 million increase driven by higher realized gold and silver prices and a $19.1 million increase due to higher metal sales volumes, which was partially offset by a $14.6 million decrease driven by lower realized copper prices. For the six months ended June 30, 2016, revenue was consistent with the prior-year period, as the impact of higher metal sales volumes and higher realized gold prices was offset by lower realized silver and copper prices.

A detailed discussion of production is included in the “Review of Operating Mines” section of this MD&A. The average realized prices for the second quarter of 2016 were $1,267 per gold ounce, $2.14 per pound of copper and $17.39 per silver ounce, compared to $1,191 per gold ounce, $2.72 per pound of copper and $16.23 per silver ounce in the prior-year period.

| 16 |  |

Operating expenses

For the three and six months ended June 30, 2016, the decrease in operating expenses reflects the combined benefit of the depreciation of the Canadian and Australian dollars and the Mexican Peso relative to the U.S. dollar, the reduction in mining activity at Cerro San Pedro and the Company’s business improvement initiatives.

Depreciation and depletion

For the three and six months ended June 30, 2016, the increase in depreciation and depletion reflects increased production and the lower depletion basis for the Company’s operating mines when compared to the prior-year period. Higher depreciation and depletion at New Afton, Mesquite and Peak Mines was partially offset by lower depreciation and depletion at Cerro San Pedro.

Earnings from mine operations

For the three and six months ended June 30, 2016, earnings from mine operations increased as the benefit from higher metal sales volumes, higher realized gold and silver prices and reduced operating expenses offset lower realized copper prices and the increase in depreciation and depletion.

Corporate administration and share-based payment expenses

For the three and six months ended June 30, 2016, corporate administration costs were consistent with the prior-year period. For the three and six months ended June 30, 2016, the increase in share-based payment expenses was primarily driven by the appreciation of the Company’s share price in the current year, which resulted in higher share-based compensation costs for the Company’s cash-settled share-based payment arrangements.

Exploration and business development

Expensed exploration in the current period was primarily incurred at Peak Mines and New Afton. The prior-year period included expensed exploration costs primarily incurred at Peak Mines and Blackwater. Exploration costs at Rainy River were capitalized to mineral interest in both current and prior-year periods.

Capitalized exploration costs were $1.1 million for the three months ended June 30, 2016 compared to $0.4 million in the prior-year period. Capitalized exploration in the current period was primarily incurred at the Peak Mines, the New Afton C-zone and Rainy River. The prior-year period included capitalized exploration primarily incurred at the Peak Mines and Rainy River. The decrease in capitalized exploration costs was due to increased exploration activity at the New Afton C-zone. Please refer to the “Development and Exploration review” section of this MD&A for further details on the Company’s exploration and business development activities.

Other gains and losses

The following other gains and losses are added back for the purposes of adjusted net earnings:

Share purchase warrants

For the three and six months ended June 30, 2016, the Company recorded a loss on share purchase warrants when compared to a gain in the prior-year period. As the traded value of the New Gold share purchase warrants increases or decreases, a related loss or gain on the mark-to-market of the liability is reflected in earnings.

Gold stream obligation

For the three and six months ended June 30, 2016, the Company had an unrealized loss on the revaluation of the gold stream obligation derivative instrument related to the change in the risk-free discount rate used to value this obligation and the increase in gold prices. The gain or loss on the revaluation of the gold stream obligation as a result of the change in the Company’s own credit risk is recorded in other comprehensive income.

| 17 |  |

Gold price option contracts

During the first quarter of 2016, the Company entered into gold price option contracts whereby it sold a series of call option contracts and purchased a series of put option contracts. Derivative instruments are fair valued at the end of each reporting period. For the three and six months ended June 30, 2016, the Company recognized a loss on the revaluation of gold price option contracts due primarily to the increase in gold prices and the passage of time.

Foreign exchange

Movements in foreign exchange are due to the revaluation of the non-monetary assets and liabilities at the balance sheet date and the appreciation of both the Canadian and Australian dollars compared to the U.S. dollar in the current period.

Income tax

Income tax expense for the six months ended June 30, 2016 reflects an effective tax rate of 1%. This compares to income tax expense reflecting an effective tax rate of 29% in the prior-year period. The primary reason for the change in the unadjusted effective tax rate is the impact of foreign exchange movements on the deferred tax related to non-monetary assets and liabilities on translation. For the six months ended June 30, 2016, the Company recorded a foreign exchange gain of $29.0 million on non-monetary assets and liabilities compared to a foreign exchange loss of $31.8 million in the prior-year period with no associated tax impact. The effect on the tax rate is higher in the second quarter of 2016, primarily as a result of the weakening of the U.S. dollar from December 31, 2015 to June 30, 2016.

On an adjusted net earnings (loss) basis, the adjusted tax expense for the six months ended June 30, 2016 was $5.8 million, compared to an adjusted tax recovery of $0.2 million in the prior-year period. The adjusted tax recovery excludes the impact of foreign exchange, the loss on revaluation of the gold stream obligation and the gain on revaluation of the gold price option contracts.

Net earnings (loss)

For the three months ended June 30, 2016, net loss was negatively impacted by other losses of $22.7 million compared to other gains of $10.5 million in the prior-year period. This was partially offset by increased earnings from operations when compared to the prior-year period. For the six months ended June 30, 2016, net earnings benefitted from higher other gains and increased earnings from operations when compared to the prior-year period.

| 18 |  |

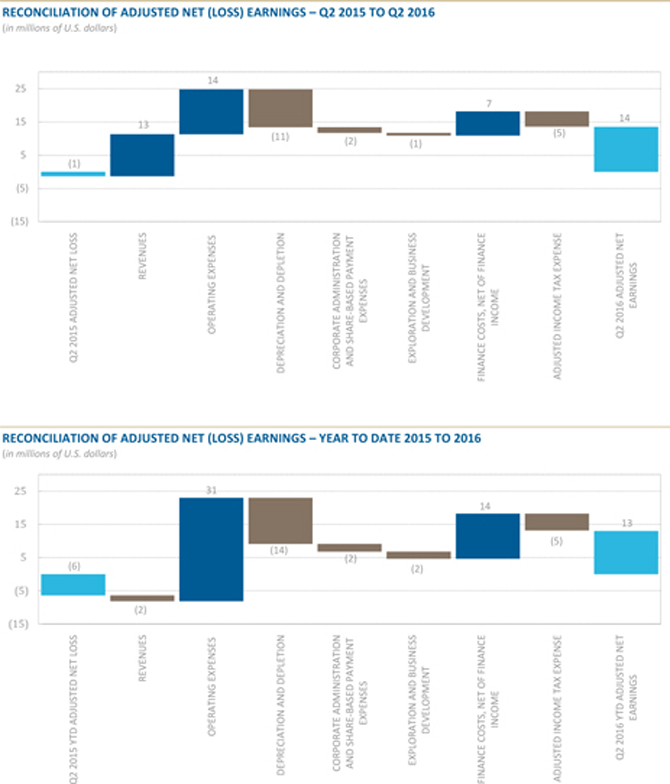

Adjusted net loss

Please see below for a reconciliation of adjusted net earnings for the three and six months ended June 30, 2016 from the prior-year periods.

| 19 |  |

The net earnings have been adjusted, including the associated tax impact, for costs in “Other gains (losses)” on the unaudited condensed consolidated income statement. Key entries in this grouping are: the fair value changes for the gold stream obligation; share purchase warrants and the gold option contracts; foreign exchange gain or loss; and loss on disposal of assets. Other adjustments to net earnings also include inventory write-downs. The adjusted entries are also impacted for tax to the extent that the underlying entries are impacted for tax in the unadjusted net earnings.

Key Quarterly Operating and Financial Information

Selected financial and operating information for the current and previous quarters is as follows:

(in millions of U.S. dollars, except where noted) | Q2 2016 | Q1 2016 | Q4 2015 | Q3 2015 | Q2 2015 | Q1 2015 | Q4 2014 | Q3 2014 | Q2 2014 |

| Operating information | |||||||||

| Gold production (ounces) | 99,423 | 90,811 | 131,719 | 122,580 | 86,442 | 94,977 | 105,992 | 93,367 | 89,460 |

| Gold sales (ounces) | 101,820 | 86,031 | 133,005 | 115,695 | 87,754 | 92,398 | 104,224 | 88,168 | 84,736 |

| Revenue | 180.3 | 154.5 | 199.0 | 177.3 | 167.7 | 168.9 | 188.1 | 169.3 | 178.1 |

| Net earnings (loss) | (8.8) | 26.8 | (9.5) | (157.8) | 9.4 | (43.8) | (431.9) | (59.6) | 16.2 |

| per share: | |||||||||

| Basic ($) | (0.02) | 0.05 | (0.02) | (0.31) | 0.02 | (0.09) | (0.86) | (0.12) | 0.03 |

| Diluted ($) | (0.02) | 0.05 | (0.02) | (0.31) | 0.02 | (0.09) | (0.86) | (0.12) | 0.03 |

| Adjusted net (loss) earnings | 13.7 | (0.4) | 2.6 | (8.5) | (1.3) | (4.9) | 13.4 | 5.4 | 8.2 |

| per share: | |||||||||

| Basic ($) | 0.03 | Snil | 0.01 | (0.02) | Snil | (0.01) | 0.03 | 0.01 | 0.02 |

| Diluted ($) | 0.03 | $nil | 0.01 | (0.02) | $nil | (0.01) | 0.03 | 0.01 | 0.02 |

A detailed discussion of production is included in the “Operating Highlights” section of this MD&A.

| 20 |  |

REVIEW OF OPERATING MINES

New Afton Mine, British Columbia, Canada The New Afton Mine is located near Kamloops, British Columbia, Canada. The mine is a large underground gold-copper deposit. New Afton’s property package consists of the nine square kilometre Afton mining lease which centers on the New Afton Mine as well as 118 square kilometres of exploration licenses covering multiple mineral prospects within the historic Iron Mask mining district. At December 31, 2015, the mine had 1.2 million ounces of Proven and Probable gold Mineral Reserves and 1.1 billion pounds of Proven and Probable copper Mineral Reserves, with 1.2 million ounces of Measured and Indicated gold Mineral Resources, exclusive of Mineral Reserves, and 971 million pounds of Measured and Indicated copper Mineral Resources, exclusive of Mineral Reserves. A summary of New Afton’s operating results is provided below. |

AT-A-GLANCE 2016 GUIDANCE: Gold:90,000 - 100,000 ounces copper:75 - 85 million pounds

Q2 2016 Production: Gold:25,287 Ounces copper:22.1 million pounds Total cash costs/oz:($547) ALL-IN SUSTAINING COSTS/OZ:($131) |

| Three months ended June 30 | Six months ended June 30 | |||

| (in millions of U.S. dollars, except where noted) | 2016 | 2015 | 2016 | 2015 |

| Operating information | ||||

| Ore mined (thousands of tonnes) | 1,363 | 1,155 | 2,917 | 2,364 |

| Ore processed (thousands of tonnes) | 1,394 | 1,202 | 2,782 | 2,417 |

| Average grade: | ||||

| Gold (grams/tonne) | 0.68 | 0.76 | 0.68 | 0.76 |

| Copper (%) | 0.84 | 0.88 | 0.85 | 0.88 |

| Recovery rate (%): | ||||

| Gold | 82.8 | 82.7 | 82.3 | 81.5 |

| Copper | 86.1 | 85.7 | 85.4 | 83.8 |

| Gold (ounces): | ||||

| Produced(1) | 25,287 | 24,358 | 50,355 | 48,270 |

| Sold(1) | 26,302 | 24,245 | 51,433 | 47,124 |

| Copper (millions of pounds): | ||||

| Produced(1) | 22.1 | 19.9 | 44.5 | 39.5 |

| Sold(1) | 22.6 | 20.1 | 44.6 | 39.2 |

| Silver (millions of ounces): | ||||

| Produced(1) | 0.1 | 0.1 | 0.1 | 0.1 |

| Sold(1) | 0.1 | 0.1 | 0.1 | 0.1 |

| Average realized price (1)(2): | ||||

| Gold ($/ounce) | 1,280 | 1,198 | 1,239 | 1,227 |

| Copper ($/pound) | 2.15 | 2.73 | 2.14 | 2.66 |

| Silver ($/ounce) | 18.67 | 16.47 | 16.73 | 16.21 |

| Total cash costs per gold ounce sold ($/ounce)(2)(3) | (547) | (940) | (593) | (889) |

| All-in sustaining costs per gold ounce sold ($/ounce)(2)(3) | (131) | (235) | (198) | (295) |

| Total cash costs on a co-product basis(2)(3) | ||||

| Gold ($/ounce) | 543 | 466 | 516 | 480 |

| Copper ($/pound) | 0.91 | 1.06 | 0.89 | 1.04 |

| All-in sustaining costs on a co-product basis(2)(3) | ||||

| Gold ($/ounce) | 711 | 708 | 672 | 689 |

| Copper ($/pound) | 1.19 | 1.61 | 1.16 | 1.49 |

| 21 |  |

| Three months ended June 30 | Six months ended June 30 | |||

| (in millions of U.S. dollars, except where noted) | 2016 | 2015 | 2016 | 2015 |

| Financial Information: | ||||

| Revenue | 76.3 | 77.6 | 146.9 | 150.2 |

| Operating margin(2) | 48.0 | 51.7 | 94.2 | 99.6 |

| Earnings from mine operations | 11.0 | 17.7 | 22.3 | 32.3 |

| Capital expenditures (sustaining capital)(2) | 10.3 | 16.7 | 19.1 | 27.4 |

| Capital expenditures (growth capital) (2) | 1.0 | 4.3 | 2.0 | 13.2 |

| 1. | Production is shown on a total contained basis while sales are shown on a net payable basis, including final product inventory and smelter payable adjustments, where applicable. |

| 2. | We use certain non-GAAP financial performance measures throughout our MD&A. Total cash costs and all-in sustaining costs per gold ounce sold, total cash costs and all-in sustaining costs on a co-product basis, average realized price, operating margin, and capital expenditures (sustaining capital and growth capital) are non-GAAP financial performance measures with no standard meaning under IFRS. For further information and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 3. | The calculation of total cash costs per gold ounce is net of by-product revenue while total cash costs and all-in sustaining costs on a co-product basis removes the impact of other metal sales that are produced as a by-product of our gold production and apportions the cash costs to each metal produced on a percentage of revenue basis. |

Quarterly operating results

Production

For the three and six months ended June 30, 2016, the increase in gold production was primarily due to the benefit of an increase in mill throughput more than offsetting a planned decrease in gold grade. As a result of the successful completion of the mill expansion in mid-2015, New Afton’s average mill throughput during the second quarter of 2016 was 15,320 tonnes per day.

For the three and six months ended June 30, 2016, the increase in copper production was primarily due to the combined benefit of higher mill throughput and an increase in copper recovery, partially offset by a decrease in copper grade.

Revenue

For the three months ended June 30, 2016, revenue was consistent with the prior-year period. The $1.3 million, or 2% change in revenue was attributed to the impact of a $10.8 million decrease driven by lower metal prices, partially offset by a $9.5 million increase in metal sales volumes. For the six months ended June 30, 2016, revenue was similarly consistent with the prior-year period. The benefit from higher metal sales volumes was offset by lower metal prices.

At the end of the period, New Afton’s exposure to the impact of movements in market metal prices for provisionally priced contracts was 32,400 ounces of gold and 47.1 million pounds of copper. Exposure to these movements in market metal prices is reduced by 29,300 ounces of gold swaps and 43.4 million pounds of copper swaps outstanding as at June 30, 2016, with settlement periods ranging from July 2016 to August 2016.

Earnings from mine operations

For the three and six months ended June 30, 2016, the decrease in earnings from mine operations was primarily due to lower realized copper prices, higher operating expenses and higher depreciation and depletion relative to the prior-year period, partially offset by higher metal sales volumes. Operating expenses were higher than in the prior-year period primarily as a result of increased mining activity and throughput.

Total cash costs and all-in sustaining costs

The increase in costs relative to the prior-year period was primarily attributable to the impact of lower by-product revenues only being partially offset by the combined benefit of higher gold production, the depreciation of the Canadian dollar relative to the U.S. dollar and a decrease in sustaining capital expenditures.

| 22 |  |

For the three months ended June 30, 2016, total cash costs were impacted by a $6 million, or $406 per ounce, decrease in by-product revenues relative to the prior-year period as the benefit of higher copper sales volumes was more than offset by the decrease in the realized price. All-in sustaining costs were impacted by the increase in total cash costs noted above, but also benefitted from a decrease in sustaining capital expenditures.

For the six months ended June 30, 2016, total cash costs were impacted by an $8 million, or $348 per ounce, decrease in by-product revenues relative to the prior-year period as a result of the decrease in the realized copper price. Similarly, all-in sustaining costs benefitted from a decrease in sustaining capital expenditures.

Capital expenditures

In both the current period and the prior-year period, sustaining capital expenditures primarily related to mine development costs and the dam raise projects. For the three and six months ended June 30, 2016, the decrease in growth capital expenditures was as a result of the completion of the mill expansion in the second quarter of 2015.

Impact of foreign exchange on operations

New Afton’s operations continue to be impacted by fluctuations in the valuation of the U.S. dollar against the Canadian dollar. For the three months ended June 30, 2016, the value of the U.S. dollar averaged $1.29 against the Canadian dollar compared to $1.23 in the prior-year period, resulting in a positive impact on cash costs of $63 per gold ounce sold. For the six months ended June 30, 2016, the value of the U.S. dollar averaged $1.33 against the Canadian dollar compared to $1.25 in the prior-year period, resulting in a positive impact on cash costs of $103 per gold ounce sold.

Exploration activities

During the second quarter of 2016 underground drilling continued at New Afton to test the potential to expand the C-zone block cave mineral reserve beyond its currently defined limits with the goals of expanding the mineral reserve to improve the economics of the C-zone expansion and delineating additional mineral resources along strike and down plunge of the New Afton mineralized system. The Company provided an update of drill results in a news release issued June 27, 2016.

| 23 |  |

Mesquite Mine, California, USA The Company’s Mesquite Mine is located in Imperial County, California, approximately 70 kilometres northwest of Yuma, Arizona and 230 kilometres east of San Diego, California. It is an open pit, run-of-mine heap leach operation. The mine was operated between 1985 and 2001 by Goldfields Mining Corporation, subsequently Santa Fe Minerals Corporation, and finally Newmont Mining Corporation with Western Goldfields Inc. acquiring the mine in 2003. The mine resumed production in 2008. New Gold acquired Mesquite as part of the business combination with Western Goldfields in mid-2009. At December 31, 2015, the mine had 1.5 million ounces of Proven and Probable gold Mineral Reserves and 831,000 ounces of Measured and Indicated gold Mineral Resources, exclusive of Mineral Reserves. A summary of Mesquite’s operating results is provided below. |

AT-A-GLANCE 2016 GUIDANCE: Gold:130,000 - 140,000 ounces

Q2 2016 Production: Gold: 25,564 ounces Total cash costs/oz:$611 ALL-IN SUSTAINING COSTS/OZ:$999 |

| Three months ended June 30 | Six months ended June 30 | |||

| (in millions of U.S. dollars, except where noted) | 2016 | 2015 | 2016 | 2015 |

| Operating information | ||||

| Ore mined and placed on leach pad (thousands of tonnes) | 4,274 | 4,892 | 9,506 | 6,389 |

| Waste mined (thousands of tonnes) | 10,864 | 13,505 | 21,226 | 27,284 |

| Ratio of waste to ore | 2.54 | 2.76 | 2.23 | 4.27 |

| Average grade: | ||||

| Gold (grams/tonne) | 0.41 | 0.32 | 0.39 | 0.32 |

| Gold (ounces): | ||||

| Produced(1)(2) | 25,564 | 22,501 | 52,935 | 48,188 |

| Sold(1) | 31,115 | 21,391 | 56,043 | 49,225 |

| Average realized price (3): | ||||

| Gold ($/ounce) | 1,262 | 1,190 | 1,235 | 1,204 |

| Total cash costs per gold ounce sold ($/ounce)(3) | 611 | 839 | 618 | 867 |

| All-in sustaining costs per gold ounce sold ($/ounce)(3) | 999 | 1,533 | 1,044 | 1,632 |

| FINANCIAL INFORMATION | ||||

| Revenue | 39.2 | 25.5 | 69.2 | 59.3 |

| Operating margin(3) | 20.4 | 7.6 | 35.1 | 17.1 |

| Earnings from mine operations | 10.5 | 1.1 | 16.3 | 2.4 |

| Capital expenditures(sustaining capital)(3) | 11.8 | 14.6 | 23.3 | 37.1 |

| 1. | Production is shown on a total contained basis while sales are shown on a net payable basis, including final product inventory, where applicable. |

| 2. | Tonnes of ore processed each period does not necessarily correspond to ounces produced during the period, as there is a time delay between placing tonnes on the leach pad and pouring gold ounces. |

| 3. | We use certain non-GAAP financial performance measures throughout our MD&A. Total cash costs and all-in sustaining costs per gold ounce sold, average realized price, operating margin and capital expenditures (sustaining capital) are non-GAAP financial performance measures with no standard meaning under IFRS. For further information and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

Quarterly operating results

Production

For the three months ended June 30, 2016, the increase in production relative to the prior-year period was primarily attributable to an increase in gold grade which was only partially offset by a decrease in ore tonnes mined and placed on the leach pad. For the six months ended June 30, 2016, the increase in production relative to the prior-year period was attributable to an increase in gold grade and an increase in ore tonnes mined and placed on the leach pad as the focus in the prior-year period was on waste stripping.

| 24 |  |

Revenue

For the three months ended June 30, 2016, the $13.7 million, or 54%, increase in revenue was attributed to the combined impact of a $2.2 million increase driven by higher metal prices and a $11.5 million increase in metal sales volumes. For the six months ended June 30, 2016, the increase in revenue was similarly attributed to the combined impact of higher metal prices and increased metal sales volumes.

Earnings from mine operations

For the three and six months ended June 30, 2016, the increase in earnings from mine operations is attributable to higher revenue partially offset by higher depreciation and depletion. Despite higher production and sales for the three and six months ended June 30, 2016, operating expenses were consistent with the prior-year period as a result of lower diesel prices and the Company’s business improvement initiatives.

Total cash costs and all-in sustaining costs

For the three and six months ended June 30, 2016, the decrease in total cash costs per gold ounce sold relative to the prior-year period was primarily attributable to higher production and lower diesel prices. For the three and six months ended June 30, 2016, the decrease in all-in sustaining costs per gold ounce sold was primarily attributable to lower cash costs and sustaining capital expenditures relative to the prior-year periods.

Capital expenditures

For the three and six months ended June 30, 2016, the decrease in capital expenditures was a result of lower capitalized waste stripping expenditures as the focus in the prior-year periods was on waste stripping and additional spending in the prior-year periods as a result of the leach pad expansion conducted in 2015.

Exploration activities

No exploration activities were conducted at Mesquite during the first half of 2016.

| 25 |  |

Peak Mines, New South Wales, Australia The Company’s Peak Mines gold-copper mining operation is an underground mine/mill operation located in the Cobar Mineral Field near Cobar, New South Wales, Australia. Peak Mines was originally built by Rio Tinto Plc and commenced production in 1992. At December 31, 2015, the mine had 267,000 ounces of Proven and Probable gold Mineral Reserves and 82 million pounds of Proven and Probable copper Mineral Reserves, with 440,000 ounces of Measured and Indicated gold Mineral Resources, exclusive of Mineral Reserves, and 94 million pounds of Measured and Indicated copper Mineral Resources, exclusive of Mineral Reserves. A summary of Peak Mines’ operating results is provided below: |

AT-A-GLANCE 2016 GUIDANCE: Gold:80,000 – 90,000 ounces copper:6 – 8 million pounds

Q2 2016 Production: Gold: 31,285 ounces copper:3.6 million pounds Total cash costs/oz:$521 ALL-IN SUSTAINING COSTS/OZ:$706 |

| Three months ended June 30 | Six months ended June 30 | |||

| (in millions of U.S. dollars, except where noted) | 2016 | 2015 | 2016 | 2015 |

| Operating information | ||||

| Ore mined (thousands of tonnes) | 191 | 171 | 360 | 343 |

| Ore processed (thousands of tonnes) | 163 | 177 | 327 | 354 |

| Average grade: | ||||

| Gold (grams/tonne) | 7.01 | 3.31 | 5.37 | 3.43 |

| Copper (%) | 1.11 | 1.08 | 1.01 | 1.02 |

| Recovery rate (%): | ||||

| Gold | 94.5 | 90.4 | 94.4 | 91.6 |

| Copper | 89.2 | 88.0 | 90.5 | 88.6 |

| Gold (ounces): | ||||

| Produced(1) | 31,285 | 14,892 | 50,881 | 34,320 |

| Sold(1) | 27,784 | 13,837 | 44,934 | 33,566 |

| Copper (millions of pounds): | ||||

| Produced(1) | 3.6 | 3.7 | 6.6 | 7.1 |

| Sold(1) | 2.5 | 3.6 | 5.8 | 6.6 |

| Average realized price (2): | ||||

| Gold ($/ounce) | 1,272 | 1,184 | 1,264 | 1,208 |

| Copper ($/pound) | 2.12 | 2.66 | 2.16 | 2.66 |

| Total cash costs per gold ounce sold(2)(3) | 521 | 1,157 | 620 | 974 |

| All-in sustaining costs per gold ounce sold(2)(3) | 706 | 1,549 | 827 | 1,337 |

| Total cash costs on a co-product basis(2)(3) | ||||

| Gold ($/ounce) | 623 | 1,141 | 736 | 1,026 |

| Copper ($/pound) | 1.10 | 2.72 | 1.32 | 2.41 |

| All-in sustaining costs on a co-product basis(2)(3) | ||||

| Gold ($/ounce) | 782 | 1,386 | 904 | 1,276 |

| Copper ($/pound) | 1.36 | 3.27 | 1.61 | 2.96 |

| FINANCIAL INFORMATION | ||||

| Revenue | 40.2 | 24.9 | 67.9 | 56.4 |

| Operating margin(2) | 21.4 | 1.0 | 28.9 | 8.0 |

| Earnings (loss) from mine operations | 6.7 | (6.6) | 1.2 | (10.6) |

| Capital expenditures (sustaining capital) (2) | 3.2 | 4.2 | 4.9 | 10.0 |

| 1. | Production is shown on a total contained basis while sales are shown on a net payable basis, including final product inventory and smelter payable adjustments, where applicable. |

| 2. | We use certain non-GAAP financial performance measures throughout our MD&A. Total cash costs and all-in sustaining costs per gold ounce sold, total cash costs and all-in sustaining costs on a co-product basis, average realized price, operating margin and capital expenditures (sustaining capital) are non-GAAP financial performance measures with no standard meaning under IFRS. For further information and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 3. | The calculation of total cash costs per gold ounce is net of by-product copper revenue. Total cash costs and all-in sustaining costs on a co-product basis removes the impact of other metal sales that are produced as a by-product of our gold production and apportions the cash costs to each metal produced on a percentage of revenue basis. |

| 26 |  |

Quarterly operating results

Production

For the three and six months ended June 30, 2016, the increase in gold production was attributable to the combination of higher gold grade and recovery which was only partially offset by lower throughput. Gold production in the prior-year periods was below average due to the impact of geotechnical challenges in the Peak Mines’ most gold-rich ore body, Perseverance, which limited the amount of ore that was mined and processed from this area.

Revenue

For the three months ended June 30, 2016, the $15.3 million, or 61%, increase in revenue was attributed to the combined impact of a $1.6 million increase driven by higher metal prices and a $13.7 million increase as a result of increased metal sales volumes. For the six months ended June 30, 2016, the increase in revenue was similarly attributed to the combined impact of higher metal prices and increased metal sales volumes.

At the end of the period, Peak Mines’ exposure to the impact of movements in market metal prices for provisionally priced contracts was 3,300 ounces of gold and 4.8 million pounds of copper. Exposure to these movements in market metal prices was reduced by 4.6 million pounds of copper swaps outstanding at the end of the period, with settlement periods ranging from July 2016 to September 2016.

Earnings (loss) from mine operations

For the three and six months ended June 30, 2016, the increase in earnings from mine operations was primarily attributable to the combined benefit of higher revenue and lower operating expenses. Operating expenses were lower than in the prior-year periods due to the depreciation of the Australian dollar relative to the U.S. dollar and the Company’s business improvement initiatives.

Total cash costs and all-in sustaining costs

For the three and six months ended June 30, 2016, the decrease in total cash costs per gold ounce sold was attributable to the increase in production as well as the depreciation of the Australian dollar relative to the U.S. dollar, partially offset by a decrease in by-product revenue as both copper sales volumes and average realized copper prices were lower than in the prior-year periods. The decrease in all-in sustaining costs per gold ounce sold was a result of the decrease in total cash costs described above and the decrease in sustaining capital expenditures.

Capital expenditures

For the three months ended June 30, 2016, capital expenditures were consistent with the prior-year period. For the six months ended June 30, 2016, the decrease in capital expenditures is a result of reductions in capital development as there were loader and truck purchases in the first quarter of the prior year and a reduction in capitalized exploration. Capital expenditures are related to mine and infrastructure development.

Impact of Foreign Exchange on Operations

Peak Mines’ operations continue to be impacted by fluctuations in the valuation of the U.S. dollar against the Australian dollar. For the three months ended June 30, 2016, the value of the U.S. dollar averaged $1.34 against the Australian dollar compared to $1.29 in the prior-year period, resulting in a positive impact on cash costs of $29 per gold ounce sold. For the six months ended June 30, 2016, the value of the U.S. dollar averaged $1.36 against the Australian dollar compared to $1.28 in the prior-year period, resulting in a positive impact on cash costs of $62 per gold ounce sold.

| 27 |  |

Exploration Activities

During the second quarter of 2016, exploration at the Peak Mines operation continued to focus on delineating mineral resources in the Chronos and Anjea zones as well as earlier stage prospects along the Peak Mine Corridor. Results of this work continue to offer good potential to extend the long-term life of the Peak Mines operation. The Company provided an update of drill results in a news release issued June 27, 2016. For more information, please refer to the “Corporate Developments” section of this MD&A.

Cerro San Pedro Mine, San Luis Potosí, Mexico The Cerro San Pedro Mine is located in the state of San Luis Potosí in central Mexico, approximately 20 kilometres east of the city of San Luis Potosí. The mine is a gold-silver, open pit, run-of-mine heap leach operation. At December 31, 2015, the mine had 13,000 ounces of Proven and Probable gold Mineral Reserves and 419,000 ounces of Proven and Probable silver Mineral Reserves. A summary of Cerro San Pedro’s operating results is provided below: |

AT-A-GLANCE 2016 GUIDANCE: Gold:60,000 – 70,000 ounces silver:1.3 – 1.5 million ounces

Q2 2016 Production: Gold:17,287 ounces SILVER:0.2 MILLION OUNCES Total cash costs/oz:$898 ALL-IN SUSTAINING COSTS/OZ:$941 |

| Three months ended June 30 | Six months ended June 30 | |||

| (in millions of U.S. dollars, except where noted) | 2016 | 2015 | 2016 | 2015 |

| Operating information | ||||

| Ore mined and placed on leach pad (thousands of tonnes) | 1,531 | 5,323 | 3,221 | 8,497 |

| Waste mined (thousands of tonnes) | 617 | 881 | 2,721 | 5,803 |

| Ratio of waste to ore | 0.40 | 0.17 | 0.84 | 0.68 |

| Average grade: | ||||

| Gold (grams/tonne) | 0.61 | 0.71 | 0.49 | 0.59 |

| Silver (grams/tonne) | 17.84 | 26.51 | 14.38 | 24.14 |

| Gold (ounces) | ||||

| Produced(1)(2) | 17,287 | 24,691 | 36,063 | 50,641 |

| Sold(1) | 16,619 | 28,281 | 35,441 | 50,237 |

| Silver (millions of ounces) | ||||

| Produced(1)(2) | 0.2 | 0.3 | 0.5 | 0.6 |

| Sold(1) | 0.2 | 0.4 | 0.5 | 0.6 |

| Average realized price(3): | ||||

| Gold ($/ounce) | 1,251 | 1,189 | 1,216 | 1,202 |

| Silver ($/ounce) | 16.77 | 16.24 | 15.67 | 16.42 |

| Total cash costs per gold ounce sold ($/ounce)(3)(4) | 898 | 879 | 917 | 944 |

| All-in sustaining costs per gold ounce sold ($/ounce)(3)(4) | 941 | 889 | 947 | 955 |

| Total cash costs on a co-product basis(2)(3) | ||||

| Gold ($/ounce) | 952 | 926 | 962 | 981 |

| Silver ($/ounce) | 12.76 | 12.65 | 12.40 | 13.40 |

| All-in sustaining costs on a co-product basis(2)(3) | ||||

| Gold ($/ounce) | 988 | 934 | 987 | 991 |

| Silver ($/ounce) | 13.25 | 12.76 | 12.72 | 13.54 |

| 28 |  |

| Three months ended June 30 | Six months ended June 30 | |||

| (in millions of U.S. dollars, except where noted) | 2016 | 2015 | 2016 | 2015 |

| FINANCIAL INFORMATION | ||||

| Revenue | 24.6 | 39.7 | 50.8 | 70.7 |

| Operating margin(3) | 5.8 | 9.1 | 10.0 | 14.1 |

| Earnings from mine operations | 5.1 | 6.4 | 8.5 | 8.7 |

| Capital expenditures (sustaining capital)(3) | 0.5 | 0.3 | 0.7 | 0.5 |

| 1. | Production is shown on a total contained basis while sales are shown on a net payable basis, including final product inventory adjustments, where applicable. |

| 2. | Tonnes of ore processed each period does not necessarily correspond to ounces produced during the period, as there is a time delay between placing tonnes on the leach pad and pouring gold ounces. |