Exhibit 99.2

|

OPERATING AND FINANCIAL HIGHLIGHTS

OPERATING HIGHLIGHTS

All dollar figures are in United States dollars and tabular dollar amounts are in millions, unless otherwise noted.

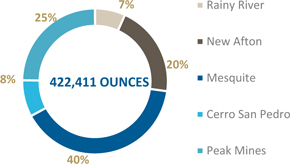

New Gold Inc. (“New Gold” or the “Company”) is an intermediate gold producer with operating mines in Canada, the United States, Australia and Mexico, and a development project in Canada. For the year ended December 31, 2017, the Rainy River Mine in Canada (“Rainy River”), the New Afton Mine in Canada (“New Afton”), the Mesquite Mine in the United States (“Mesquite”), the Peak Mines in Australia (“Peak Mines”), which has been classified as a discontinued operation during 2017, and the Cerro San Pedro Mine in Mexico (“Cerro San Pedro”), which has been is in residual leaching since June 2016, combined to produce 422,411 gold ounces (430,949 gold ounces inclusive of the Rainy River pre commercial production period), 104.3 million pounds of copper and 1.2 million silver ounces. For the three months ended December 31, 2017, the Company’s operating mines combined to produce 145,992 gold ounces (154,530 gold ounces inclusive of the Rainy River pre commercial production period), 28.1 million pounds of copper and 0.3 million silver ounces. New Gold’s Rainy River Mine commenced commercial production during the fourth quarter of 2017.

New Gold’s production costs remained very competitive compared to the broader gold mining industry as New Gold had operating expenses(2)of $646 per gold ounce sold, all-in sustaining costs from continuing operations(2)of $668 per gold ounce sold, and all-in sustaining costs(2) of $727 per gold ounce sold in 2017.

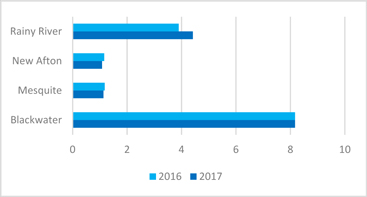

2017 gold production by operating mine

| 1. | Amounts presented include production from Peak Mines, which has been classified as a discontinued operation for the year ended December 31, 2017. |

| 2. | The Company uses certain non-GAAP financial performance measures throughout this Management’s Discussion and Analysis (“MD&A”). For a detailed description of each of the non-GAAP measures used in this MD&A and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 1 |  |

|

FINANCIAL HIGHLIGHTS

| 2017 | 2016 | 2015 | |

| Operating information(4) | ||||

| Gold production from continuing operations (ounces) | 317,898 | 274,214 | 345,866 | |

| Gold production (ounces) | 422,411 | 381,663 | 435,718 | |

| Gold sales from continuing operations (ounces) | 309,454 | 274,843 | 339,587 | |

| Gold sales (ounces) | 410,086 | 378,239 | 428,852 | |

| Gold revenue from continuing operations ($/ounce)(1) | 1,247 | 1,207 | 1,122 | |

| Gold average realized price from continuing operations ($/ounce)(1) | 1,278 | 1,246 | 1,152 | |

| Operating expenses per gold ounce sold from continuing operations ($/ounce)(1) | 646 | 623 | 606 | |

| All-in sustaining costs per gold ounce sold from continuing operations ($/ounce)(1) | 668 | 675 | 867 | |

| All-in sustaining costs per gold ounce sold ($/ounce)(1) | 727 | 692 | 903 | |

| Financial Information | ||||

| Revenue | 604.4 | 522.8 | 582.9 | |

| (Loss) earnings from continuing operations | (101.7) | 5.5 | (168.3) | |

| Net (loss) | (108.0) | (7.0) | (201.4) | |

| Adjusted net earnings from continuing operations(1) | 21.3 | 19.4 | 1.8 | |

| Adjusted net earnings (loss)(1) | 49.3 | 14.6 | (10.9) | |

| Operating cash flows generated from continuing operations | 275.0 | 225.0 | 245.8 | |

| Cash generated from operations | 342.2 | 282.2 | 262.6 | |

| Cash generated from operations before changes in non-cash operating working capital(3) | 299.2 | 301.8 | 276.4 | |

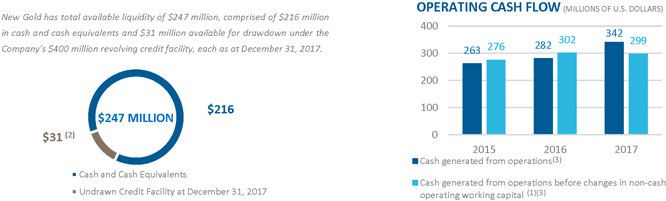

| Cash and cash equivalents | 216.2 | 185.9 | 335.5 | |

| Total capital expenditures (sustaining capital)(1) | 88.4 | 87.4 | 121.5 | |

| Total capital expenditures (growth capital)(1) | 513.4 | 479.6 | 268.0 | |

| Share Data | ||||

| (Loss) earnings per share from continuing operations ($) | (0.18) | (0.02) | (0.33) | |

| (Loss) earnings per basic share ($) | (0.19) | (0.01) | (0.40) | |

| Adjusted net earnings per basic share from continuing operations(1)($) | 0.04 | 0.04 | 0.00 | |

| Adjusted net earnings (loss) per basic share(1)($) | 0.09 | 0.03 | (0.02) |

| 1. | The Company uses certain non-GAAP financial performance measures throughout this MD&A. For a detailed description of each of the non-GAAP measures used in this MD&A and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 2. | Of the $400 million credit facility, $230 million has been drawn and $139 million has been utilized for letters of credit, both as at December 31, 2017. |

| 3. | Amounts presented include operating cash flows from Peak Mines, which has been classified as a discontinued operation for the year ended December 31, 2017. |

| 4. | Gold production excludes 8,538 gold ounces produced during Rainy River’s pre commercial production period. |

| 2 |  |

|

Contents

| OPERATING HIGHLIGHTS | 1 |

| FINANCIAL HIGHLIGHTS | 2 |

| OUR BUSINESS | 4 |

| OPERATING AND FINANCIAL HIGHLIGHTS | 5 |

| CORPORATE DEVELOPMENTS | 11 |

| CORPORATE SOCIAL RESPONSIBILITY | 12 |

| NEW GOLD’S INVESTMENT THESIS | 15 |

| OUTLOOK FOR 2018 | 16 |

| KEY PERFORMANCE DRIVERS | 17 |

| FINANCIAL RESULTS | 21 |

| REVIEW OF OPERATING MINES | 34 |

| DISCONTINUED OPERATIONS | 45 |

| MINERAL RESERVES AND RESOURCES UPDATE(1) | 51 |

| FINANCIAL CONDITION REVIEW | 54 |

| NON-GAAP FINANCIAL PERFORMANCE MEASURES | 61 |

| ENTERPRISE RISK MANAGEMENT AND RISK FACTORS | 91 |

| CRITICAL JUDGMENTS AND ESTIMATION UNCERTAINTIES | 107 |

| ACCOUNTING POLICIES | 107 |

| CONTROLS AND PROCEDURES | 108 |

| MINERAL RESERVES AND MINERAL RESOURCES | 109 |

| CAUTIONARY NOTES | 114 |

| 3 |  |

|

MANAGEMENT’S DISCUSSION AND ANALYSIS

For the year ended December 31, 2017

The following Management’s Discussion and Analysis (“MD&A”) provides information that management believes is relevant to an assessment and understanding of the consolidated financial condition and results of operations of New Gold Inc. and its subsidiaries (“New Gold” or the “Company”). This MD&A should be read in conjunction with New Gold’s audited consolidated financial statements for the years ended December 31, 2017 and 2016 and related notes, which are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). This MD&A contains forward-looking statements that are subject to risks and uncertainties, as discussed in the cautionary note contained in this MD&A. The reader is cautioned not to place undue reliance on forward-looking statements. All dollar figures are inUnited States dollars and tabular dollar amounts are in millions, unless otherwise noted. This MD&A has been prepared as at February 20, 2018. Additional information relating to the Company, including the Company’s Annual Information Form, is available on SEDAR at www.sedar.com.

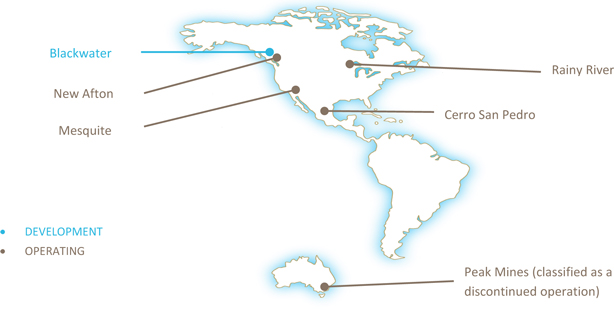

OUR BUSINESS

New Gold is an intermediate gold producer with operating mines in Canada, the United States and Australia, and a development project in Canada. The Company’s operating properties consist of the Rainy River gold mine in Canada (“Rainy River”), New Afton gold-copper mine in Canada (“New Afton”), the Mesquite gold mine in the United States (“Mesquite”), and the Peak Mines gold-copper mine in Australia (“Peak Mines”) which has been classified as a discontinued operation during 2017. The Company’s Cerro San Pedro gold-silver mine in Mexico (“Cerro San Pedro”) has been in residual leaching since June 2016. New Gold’s development project is its 100%-owned Blackwater gold-silver project (“Blackwater”), located in Canada. On February 17, 2017, the Company sold its 4% stream on future gold production from the El Morro property located in Chile (“El Morro”) to an affiliate of Goldcorp Inc. for $65 million cash.

New Gold’s operating portfolio is diverse in the range of commodities it produces. The assets produce gold, with copper and silver by-products, at low costs. The Company believes it has a solid platform to continue to execute its growth strategy, both organically and through value-enhancing accretive acquisitions, to further establish itself as an industry-leading intermediate gold producer.

| 4 |  |

|

OPERATING AND FINANCIAL HIGHLIGHTS

OPERATING HIGHLIGHTS

| Three months ended December 31 | Year ended December 31 | ||||||||||||||||

| 2017 | 2016 | 2017 | 2016 | 2015 | |||||||||||||

| Operating information | |||||||||||||||||

| Gold (ounces): | |||||||||||||||||

| Produced from continuing operations(1) | 110,240 | 77,296 | 317,898 | 274,214 | 345,866 | ||||||||||||

| Produced(1) | 145,992 | 95,883 | 422,411 | 381,663 | 435,718 | ||||||||||||

| Sold from continuing operations(1) | 108,782 | 75,887 | 309,454 | 274,843 | 339,587 | ||||||||||||

| Sold(1) | 143,644 | 93,936 | 410,086 | 378,239 | 428,852 | ||||||||||||

| Copper (millions of pounds): | |||||||||||||||||

| Produced from continuing operations(1) | 24.6 | 21.4 | 90.6 | 87.3 | 85.9 | ||||||||||||

| Produced(1) | 28.1 | 25.6 | 104.4 | 102.3 | 100.0 | ||||||||||||

| Sold from continuing operations(1) | 22.0 | 21.1 | 84.5 | 84.9 | 79.7 | ||||||||||||

| Sold(1) | 24.9 | 24.6 | 96.6 | 99.2 | 92.9 | ||||||||||||

| Silver (millions of ounces): | |||||||||||||||||

| Produced from continuing operations(1) | 0.3 | 0.3 | 1.0 | 1.1 | 1.7 | ||||||||||||

| Produced(1) | 0.3 | 0.3 | 1.2 | 1.3 | 1.9 | ||||||||||||

| Sold from continuing operations(1) | 0.2 | 0.2 | 0.9 | 1.1 | 1.7 | ||||||||||||

| Sold(1) | 0.3 | 0.3 | 1.1 | 1.3 | 1.8 | ||||||||||||

| Revenue from continuing operations(1) : | |||||||||||||||||

| Gold ($/ounce) | 1,252 | 1,181 | 1,247 | 1,207 | 1,122 | ||||||||||||

| Copper ($/pound) | 2.44 | 2.24 | 2.41 | 2.03 | 2.21 | ||||||||||||

| Silver ($/ounce) | 15.84 | 16.35 | 16.41 | 16.71 | 15.20 | ||||||||||||

| Average realized price from continuing operations(1) (2): | |||||||||||||||||

| Gold ($/ounce) | 1,274 | 1,199 | 1,278 | 1,242 | 1,152 | ||||||||||||

| Copper ($/pound) | 2.70 | 2.47 | 2.66 | 2.23 | 2.42 | ||||||||||||

| Silver ($/ounce) | 16.29 | 16.78 | 16.88 | 17.09 | 15,38 | ||||||||||||

| Operating expenses per gold ounce sold from continuing operations ($/ounce)(3) | 738 | 771 | 646 | 623 | 606 | ||||||||||||

| Operating expenses per copper pound sold from continuing operations ($/pound)(3) | 1.56 | 1.57 | 1.34 | 1.11 | 1.27 | ||||||||||||

| Operating expenses per silver ounce sold from continuing operations ($/ounce)(3) | 9.44 | 10.66 | 8.54 | 8.55 | 8.66 | ||||||||||||

| Total cash costs per gold ounce sold from continuing operations ($/ounce) (2)(4) | 572 | 288 | 360 | 259 | 618 | ||||||||||||

| Total cash costs per gold ounce sold ($/ounce) (2)(4) | 533 | 360 | 403 | 349 | 443 | ||||||||||||

| All-in sustaining costs per gold ounce sold from continuing operations ($/ounce) (2)(4) | 774 | 590 | 668 | 675 | 867 | ||||||||||||

| All-in sustaining costs per gold ounce sold ($/ounce) (2)(4) | 771 | 619 | 727 | 692 | 809 | ||||||||||||

Total cash costs per gold ounce sold on a co-product basis ($/ounce)(2)(4) | 746 | 647 | 697 | 634 | 661 | ||||||||||||

All-in sustaining costs per gold ounce sold on a co-product basis ($/ounce)(2)(4) | 916 | 812 | 909 | 861 | 903 | ||||||||||||

| 1. | Production is shown on a total contained basis while sales are shown on a net payable basis, including final product inventory and smelter payable adjustments, where applicable. |

| 2. | The Company uses certain non-GAAP financial performance measures throughout this MD&A. Average realized price, total cash costs and all-in sustaining costs per gold ounce sold and total cash costs and all-in sustaining costs on a co-product basis are non-GAAP financial performance measures with no standard meaning under IFRS. For further information and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 3. | Operating expenses are apportioned to each metal produced on a percentage of revenue basis. |

| 4. | The calculation of total cash costs and all-in sustaining costs per gold ounce sold is net of by-product silver and copper revenue. Total cash costs and all-in sustaining costs on a co-product basis remove the impact of other metal sales that are produced as a by-product of the Company’s gold production and apportions the cash costs to each metal produced on a percentage of revenue basis. If silver and copper revenue were treated as co-products, co-product total cash costsfor the year ended December 31, 2017 from continuing operations would be $8.98per silver ounce sold (2016 - $8.19) and $1.58per copper pound sold (2016 - $1.22) and co-product all-in sustaining costs for the year ended December 31, 2017 would be $11.52per silver ounce sold (2016 - $11.74) and $1.98 percopper poundsold (2016 - $1.66). Co-product total cash costsfor the three months ended December 31, 2017 from continuing operations would be $9.90per silver ounce sold (2016 - $8.80)and $1.83 percopper pound sold (2016 - $1.41) and co-product all-in sustaining costs for the year ended December 31, 2017 would be $11.67per silver ounce sold (2016 - $11.39) and $2.13per copper pound sold (2016 - $1.79). |

| 5 |  |

|

The Company began a process for the sale of Peak Mines and entered into a binding agreement with Aurelia Metals Limited (“Aurelia”) in 2017; closing of the sale of the asset is expected in the first quarter of 2018. As such Peak Mines has been classified as a discontinued operation. Operating highlights are disclosed on a continuing and total basis, where appropriate.

Rainy River reached commercial production in the fourth quarter of 2017. From an accounting perspective, the Company recognized commercial production effective November 1, 2017, being the first day of the month following satisfaction of the commercial production criteria. Prior to the commercial production date the mine produced 8,538 gold ounces, with the associated proceeds reducing the capital costs of the project. Gold ounces produced for the year ended December 31, 2017 are shown exclusive of the pre commercial period, unless otherwise noted. Other operating and financial information represent the post commercial production period.

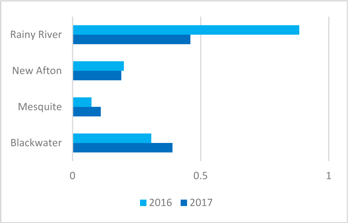

Gold production from continuing operations of 317,898 ounces for the year ended December 31, 2017 was higher than the 274,214 ounces in the prior-year period. Higher production at Mesquite and additional ounces from Rainy River’s start-up were partially offset by planned lower production at New Afton and Cerro San Pedro. Cerro San Pedro’s production decreased as the mine is in the residual leaching phase. Gold production from total operations of 422,411 ounces (430,949 ounces including the Rainy River pre commercial production period) was above the prior-year period. The combination of Rainy River’s start up, Mesquite’s very strong year and solid operating results at New Afton and Peak Mines, enabled the Company to achieve its guidance range of 380,000 to 430,000 ounces.

For the three months ended December 31, 2017, gold production from continuing operations was 110,240 compared with 77,926 in the prior-year period. Higher production was attributable to Mesquite’s strong fourth quarter gold production and the additional ounces from Rainy River’s start-up.In the fourth quarter of 2017, the Company delivered record quarterly gold production of 145,992 ounces (including Peak Mines).

Gold sales from total operations were 410,086 ounces for the year ended December 31, 2017, compared to 378,239 ounces in the prior-year period.Timing of sales at the end of the period resulted in a difference between ounces sold and ounces produced. Gold sales were 143,644 ounces for the three months ended December 31, 2017, compared to 93,936 ounces in the prior-year period.

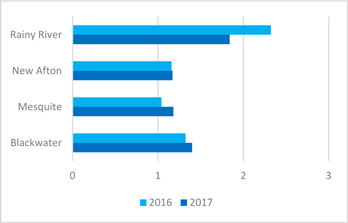

Copper production from continuing operations and total operations for the year ended December 31, 2017 increased compared to the prior-year period due to higher grades and higher ore tonnes processed at New Afton. Total copper production of 104.4 million pounds achieved the Company’s guidance range of 100 to 110 million pounds. Copper production for the quarter ended December 31, 2017 was higher than the prior-year quarter.

Copper sales from total operations were 96.6 million pounds for the year ended December 31, 2017, compared to 99.2 million pounds in the prior-year period.Timing of sales at the end of the period resulted in a difference between pounds sold and pounds produced. For the three months ended December 31, 2017, copper sales were 24.9 million pounds consistent with the prior-period of 24.6 million pounds.

| 6 |  |

|

Operating expenses from continuing operations per gold ounce for the year ended December 31, 2017 was $646,an increase from the prior-year of $623 due to increased process flow solution at Mesquite operations and higher operating expenses at Rainy River which commenced commercial production in the fourth quarter of 2017. Operating expense per ounce of gold sold achieved the guidance range of $630 to $670 per ounce. For the three months ended December 31, 2017, operating expenses from continuing operations per gold ounce sold was $738 compared with $771 in the prior-year period due tothe prior-year period beingnegatively impacted by a heap leach silver inventory write-down of $24.0 million at Cerro San Pedro.

Total cash costs per gold ounce sold from continuing operations, net of by-product sales, were $360 per ounce for the year ended December 31, 2017 compared to $259 per ounce in the prior year. The increase in total cash costs was primarily driven by higher operating expenses partially offset by the effect of by-product revenues which benefitted from an increase in the realized copper price.

Total cash costs per gold ounce sold from continuing operations, net of by-product sales, were $572 per ounce for the three months ended December 31, 2017 compared to $288 per ounce in the prior year. The increase in total cash costs was primarily driven by higher operating expenses partially offset by the effect of by-product revenues which benefitted from an increase in the realized copper price.

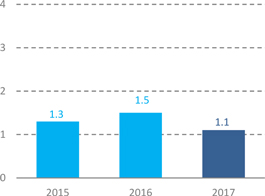

All-in sustaining costs per gold ounce sold from continuing operations were $668 for the year ended December 31, 2017, compared to $675 in the prior year.In addition to the Company’s strong operating performance, all-in sustaining costs benefitted from the timing of sustaining capital expenditure payments at Rainy River. All-in sustaining costs per gold ounce sold from continuing operations was positively impacted by the exclusion of Peak Mines consolidated sustaining costs. All-in sustaining costs from all operations were $727 per ounce for the year ended December 31, 2017, compared to $692 per ounce in the prior-year period and came in below the guidance range of $760 to $800 per ounce which had previously been lowered by $65 per ounce in the second quarter of 2017.

All-in sustaining costs per gold ounce sold from continuing operations were $774 for the three months ended December 31, 2017, compared to $590 in the prior-year period. All-in sustaining costs from all operations were $771 for the three months ended December 31, 2017, compared to $619 in the prior-year period. This increase was due to the start-up of Rainy River and slightly higher sustaining costs at Mesquite and lower gold and silver sale volumes at Cerro San Pedro.

Rainy River achieved commercial production in the fourth quarter of 2017 with mining and milling activities continuing to progress well during the quarter. Rainy River produced 37,047 ounces during the fourth quarter including the pre- commercial period, with an additional 8,607 ounces of gold inventory in circuit at the end of the period. The milling rate for December averaged 21,000 tonnes per day, which is the nameplate capacity for the facility. Gold production for 2017, including gold inventory in circuit, totalled 45,654 ounces. This was slightly lower than the guidance range of 50,000 to 60,000 ounces, as the mill ramp-up began hitting nameplate throughput slightly later in the fourth quarter than planned, resulting in lower total tonnes milled. Consistent with the Company’s plans, during the two month initial commercial production period, the gold grade averaged 0.94 gram per tonne with recoveries of 86%. With the mill operating at nameplate capacity, Rainy River is well positioned to deliver strong production in 2018. All-in sustaining costs for the year ended December 31, 2017 were above the guidance range of $1,400 to $1,440 per ounce primarily due to lower gold sales volumes.

For a detailed review of the Company’s operating mines, refer to the “Review of Operating Mines” sections of this MD&A.

| 7 |  |

|

FINANCIAL HIGHLIGHTS

| Three months ended December 31 | Year ended December 31 | |||||||||||||||||||

| (in millions of U.S. dollars, except where noted) | 2017 | 2016 | 2017 | 2016 | 2015 | |||||||||||||||

| FINANCIAL INFORMATION(3) | ||||||||||||||||||||

| Revenue | 193.5 | 140.7 | 604.4 | 522.8 | 582.9 | |||||||||||||||

| Operating margin(1) | 76.5 | 46.5 | 283.4 | 247.3 | 261.9 | |||||||||||||||

| Revenue less cost of goods sold(2) | 6.0 | (10.6) | 63.1 | 47.2 | 68.0 | |||||||||||||||

| (Loss) earnings from continuing operations(2) | (179.6) | (23.3) | (101.7) | (8.6) | 34.2 | |||||||||||||||

| Net loss(2) | (195.6) | (22.3) | (108.0) | (7.0) | (201.4) | |||||||||||||||

| Adjusted net earnings from continuing operations(1) (2) | 6.2 | 1.5 | 21.3 | 19.4 | 1.8 | |||||||||||||||

| Adjusted net earnings (loss)(1)(2) | 32.5 | (4.9) | 49.3 | 14.6 | (10.9) | |||||||||||||||

| Operating cash flows generated from continuing operations | 91.2 | 49.1 | 275.0 | 225.0 | 245.8 | |||||||||||||||

| Cash generated from continuing operations before changes in non-cash operating working capital(1) | 64.8 | 64.6 | 234.1 | 245.3 | 265.1 | |||||||||||||||

| Capital expenditures (sustaining capital)(1) | 27.4 | 15.7 | 88.3 | 87.4 | 121.5 | |||||||||||||||

| Capital expenditures (growth capital)(1) | 84.2 | 149.1 | 513.4 | 479.6 | 268.0 | |||||||||||||||

| Total assets(2) | 4,017.3 | 3,933.0 3,831.5 | 4,017.3 | 3,933.0 3,831.5 | 3,675.5 | |||||||||||||||

| Cash and cash equivalents | 216.2 | 185.9 | 216.2 | 185.9 | 335.5 | |||||||||||||||

| Long-term debt | 1,007.7 | 889.5 | 1,007.7 | 889.5 | 787.6 | |||||||||||||||

| Share Data | ||||||||||||||||||||

| (Loss) earnings per share from continuing operations(2): | ||||||||||||||||||||

| Basic ($) | (0.31) | (0.05) | (0.18) | (0.02) | (0.33) | |||||||||||||||

| Diluted ($) | (0.31) | (0.05) | (0.18) | (0.02) | (0.33) | |||||||||||||||

| (Loss) earnings per share(2): | ||||||||||||||||||||

| Basic ($) | (0.34) | (0.04) | (0.19) | (0.01) | (0.40) | |||||||||||||||

| Diluted ($) | (0.34) | (0.04) | (0.19) | (0.01) | (0.40) | |||||||||||||||

| Adjusted net earnings (loss) per basic share ($)(1)(2) | 0.06 | (0.01) | 0.09 | 0.03 | (0.02) | |||||||||||||||

| Adjusted net earnings per basic share from continuing operations ($)(1)(2) | 0.01 | - | 0.04 | 0.04 | - | |||||||||||||||

| Share price as at December 31 (TSX – Canadian dollars) | 4.13 | 4.71 | 4.13 | 4.71 | 3.22 | |||||||||||||||

| Weighted average outstanding shares (basic) (millions) | 578.1 | 513.0 | 564.7 | 511.8 | 509.0 | |||||||||||||||

| 1. | The Company uses certain non-GAAP financial performance measures throughout this MD&A. Operating margin, adjusted net loss, adjusted net loss per basic share, capital expenditures (sustaining and growth) and cash generated from operations before changes in non-cash operating working capital are non-GAAP financial performance measures with no standard meaning under IFRS. For further information and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 2. | Prior-year period comparatives have been revised. Please refer to the “Key Quarterly Operating and Financial Information” section of this MD&A for further information. |

| 3. | As the Companyhas entered into a binding agreement to sell the Peak Mines and the Company expects to close the sale in the first quarter of 2018, Peak Mines has been classified as a discontinued operation.Financial highlights are disclosed on a continuing and total basis, where appropriate. |

Revenue was $604.4 million for the year ended December 31, 2017, compared to $522.8 million in the prior year. Revenue benefitted from the higher gold sales volumes and higher gold and copper prices when compared to the prior year. Relative to the prior year, the average realized price increased by $36 (3%) per ounce of gold and $0.43 (19%) per pound of copper.

Revenue was $193.5 million for the three months ended December 31, 2017, compared to $140.7 million in the prior-year period. The increase is due to higher metal sales volumes and higher gold and copper prices. Relative to the prior-year period, gold sales increased by 53%, mainly attributable to the startup of Rainy River and Mesquite’s strong quarter. Average realized gold price increased by $75 (6%) per ounce and the copper price increased by $0.23 (9%) per pound compared to the prior-year period.

| 8 |  |

|

Revenue less cost of goods sold for the year ended December 31, 2017 was $63.1 million compared to $47.2 million in the prior year.Revenue less cost of goods sold was $6.0million for the three months ended December 31, 2017, compared to a loss of $10.6 million in the prior year period. This increase in the three months and year ended December 31, 2017 wasdriven by the higher gold sales and higher metal prices.

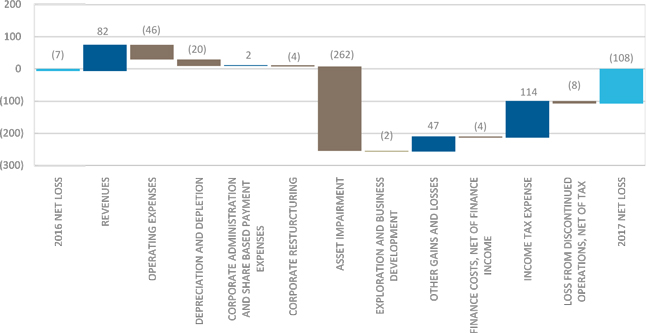

For the year ended December 31, 2017, the loss from continuing operations was $101.7 million compared to an $8.6 million loss in the prior year. The net loss includes the net impact of an after-tax impairment charge in the current year of $181.0 million relating to Rainy River, a $43.8 million non-cash foreign exchange gain, a $33.0 million pre-tax gain on the disposal of the El Morro stream, a $21.8 million pre-tax loss on the revaluation of the Company’s gold stream obligation, a $18.3 million pre-tax loss on the revaluation of Company’s gold and copper price option contracts and copper forward contracts, and a $3.3 million gain on the modification of long-term debt. The prior year included a $31.1 million pre-tax loss on the revaluation of the Company’s gold stream obligation, a non-cash $27.3 million inventory write-down at Cerro San Pedro, a $12.0 million non-cash foreign exchange gain, and a $10.5 million gain on the revaluation of gold price option contracts. The net loss was higher than the loss from continuing operations due to a non-cash loss of $49.0 million from the sale of Peak Mines, partially offset by strong earnings from operations from Peak Mines for the year ended December 31, 2017.

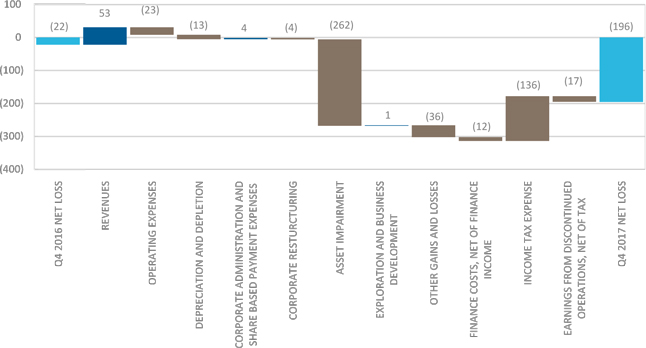

The loss from continuing operations was $179.6 million for the three months ended December 31, 2017, compared to $23.3 million in the prior-year period. The fourth quarter loss from continuing operations included a net impact of an after-tax impairment charge of $181.0 million relating to Rainy River, a $17.0 million loss on the revaluation of the gold stream obligation, and a $8.8 million pre-tax foreign exchange loss, finance costs of $12.7 million, and a $4.2 million expense relating to the Company’s restructuring of its corporate office workforce. The prior-year period included a non-cash $27.3 million inventory write-down at Cerro San Pedro, a $5.1 million pre-tax foreign exchange loss, an $11.4 million gain on the revaluation of the Company’s gold option contracts, and a pre-tax gain of $3.3 million on the revaluation of the gold stream obligation. The net loss was higher than the loss from continuing operations due to due to a non-cash loss of $49.0 million from the sale of Peak Mines, which was only partially offset by strong earnings from operations from Peak Mines for the three months ended December 31, 2017.

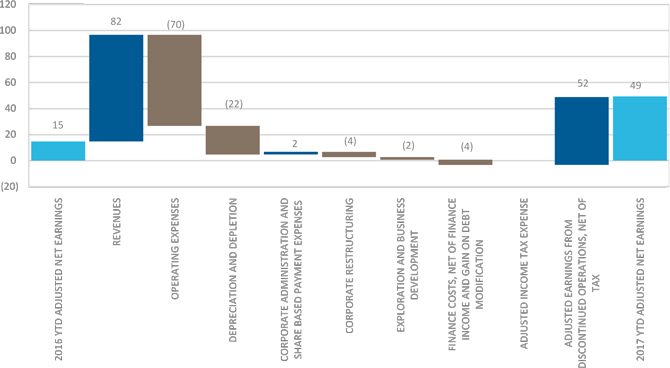

Adjusted net earnings from continuing operations for the year ended December 31, 2017 were $21.3 million, or $0.04 per basic share, compared to $19.4 million or $0.04 per basic share in the prior year.Adjusted net earnings from continuing operations were primarily impacted by higher operating expenses, net of inventory write-downs, of $69.5 million, higher depreciation and depletion, net of inventory write-downs, of $23.5 million, higher net finance costs of $6.9 million (excluding gains on debt modification), partially offset by higher revenue of $81.6 million. Adjusted net earnings from continuing operations benefitted from an adjusted tax recovery of $8.8 million. For the year ended December 31, 2017, adjusted net earnings were $49.3 million or $0.09 per share when compared to $14.6 million or $0.03 per share in the prior year. Adjusted earnings for the year ended December 31, 2017 positively benefitted from higher adjusted earnings from discontinued operations, resulting from the cessation of depreciation and depletion at Peak Mines upon classification to discontinued operations.

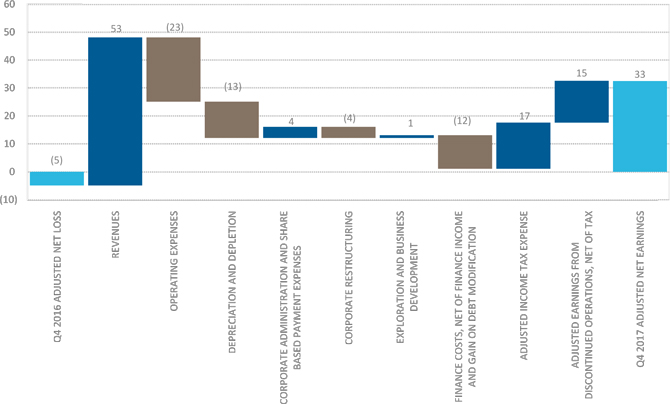

Adjusted net earnings from continuing operations for the three months ended December 31, 2017 were $6.2 million or $0.01 per basic share, compared to adjusted net earnings from continuing operations of $1.5 million or $nil per basic share in the prior-year period. Adjusted net earnings from continuing operations were positively impacted by higher revenue of $52.8 million, lower corporate administration (including share-based payment expenses) of $3.8 million and lower exploration and business development expenses of $1.2 million. Additionally, adjusted earnings from continuing operations benefitted from an adjusted tax recovery of $17.1 million. This was partially offset by higher operating expenses, net of inventory write-downs, of $46.8 million, higher depreciation and depletion, net of inventory write-downs, of $16.9 million, and higher net finance costs of $11.8 million. For the three months ended December 31, 2017, adjusted net earnings were $32.5 million or $0.06 per share when compared to an adjusted net loss of $4.9 million or $0.01 per share in the prior-year period. Adjusted earnings for the three months ended December 31, 2017 positively benefitted from higher adjusted earnings from discontinued operations, resulting from increased revenues at Peak Mines and the cessation of depreciation and depletion at Peak Mines upon classification to discontinued operations.

| 9 |  |

|

For the year ended December 31, 2017, cash generated from continuing operations was $275.0 million, compared to $225.0 million in the prior year. Cash generated from continuing operations before changes in non-cash working capital for the year ended December 31, 2017 was $234.1 million compared with $245.3 million in the prior year as higher operating margins, were offset by higher income taxes paid and a $4.2 million expense relating to the Company’s restructuring of its corporate office workforce. Cash generated from continuing operations for the year ended December 31, 2017 was higher than the prior-year period, benefitting from an increase in trade and other payables at Rainy River and the collection of a concentrate receivable of $21.2 million at New Afton which was outstanding at December 31, 2016.

For the year ended December 31, 2017, cash generated from operations was $342.2 million, compared to $282.2 million in the prior-year period, benefitting from the cash generated from continuing operations working capital movements noted above.

Cash generated from continuing operations for the three months ended December 31, 2017 was $91.2 million, compared with $49.1 million in the prior-year period. Cash generated from continuing operations before changes in non-cash working capital for the three months ended December 31, 2017 of $64.8 was in line with the prior-year period. Cash generated from continuing operations benefitted from an increase in trade and other payables at Rainy River, while the prior year-period included an outstanding concentrate receivable of $21.2 million at New Afton.

For the three months ended December 31, 2017, cash generated from operations was $118.9 million, compared to $51.9 million in the prior-year period, benefitting from the cash generated from continuing operations, working capital movements noted above and higher gold sales volumes at Peak Mines.

For further information on the Company’s liquidity and cash flow position, please refer to the “Liquidity and Cash Flow” section of this MD&A. For further information on the Company’s financial results, please refer to the “Financial Results” section of this MD&A.

| 10 |  |

|

CORPORATE DEVELOPMENTS

New Gold’s strategy involves strong operational execution at its current assets and disciplined growth through both organic initiatives and value-enhancing mergers and acquisitions. Since the middle of 2009, New Gold has focused on enhancing the value of its portfolio of assets, while also continually looking for compelling external growth opportunities. New Gold’s objective is to pursue corporate development initiatives that will maximize long-term shareholder value.

On February 17, 2017, New Gold sold its 4% stream on future gold production from El Morro to an affiliate of Goldcorp Inc. for $65.0 million cash. This transaction provided the Company with additional liquidity as the Company advanced the construction of Rainy River.

In 2017, New Gold entered into an agreement with a syndicate of underwriters to purchase, on a bought deal basis, 53,600,000 common shares of New Gold (plus an over-allotment option) at a price of $2.80 per share. On March 10, 2017, New Gold closed the bought deal financing of 61,640,000 common shares (including the over-allotment) for net proceeds to New Gold of approximately $164.7 million (gross proceeds of $172.9 million less equity issuance costs of $8.2 million).

On June 27, 2017, New Gold entered into gold price option contracts covering 120,000 ounces of New Gold’s second half 2017 gold production. New Gold purchased put options with a strike price of $1,250 per ounce covering 120,000 ounces of gold and simultaneously sold call options with a strike price of $1,400 per ounce covering an equivalent 120,000 ounces. The contracts covered 20,000 ounces of gold per month for six months beginning in July 2017. The net cost of entering into the option contracts was approximately $1 million.

In October 2017, the Company entered into copper price option contracts by purchasing put options at a strike price of $3.00 per pound and selling call options at a strike price of $3.37 per pound for 27,600 tonnes (approximately 60 million pounds) of copper production during 2018 (“copper option contracts”).

On November 20, 2017, New Gold announced that the Company had entered into a binding agreement with Aurelia to sell the Peak Mines for cash consideration of $58.0 million subject to a closing adjustment. Aurelia paid a $3.0 million deposit, which will be retained by New Gold in certain circumstances if the transaction is not completed. The transaction is subject to customary closing conditions, including consent from the New South Wales Minister responsible for the Mining Act 1992 for the transfer of control of certain exploration licenses, and is expected to close in the first quarter of 2018.

| 11 |  |

|

CORPORATE SOCIAL RESPONSIBILITY

CORPORATE SOCIAL RESPONSIBILITY HIGHlights for 2017 · For the fourth time, New Gold was recognized as the top ranking mining company, and ninth overall in the Future 40 Most Responsible Corporate Leaders in Canada by Corporate Knights, which identifies Canada’s emerging sustainability leaders from small to mid-cap corporations. · A New Gold Indigenous relations strategy was developed to address five key pillars: engagement, capacity building, economic development, inclusion and environmental stewardship. · A New Gold local procurement standard was established to optimize local procurement and business opportunities and support sustainable economic development in the communities where we operate. · Independent Tailings Review Board conducted meetings at New Afton and Rainy River to ensure that best New Gold practices are adopted in Tailings Management. · New Afton received the 2016 Towards Sustainable Mining Leadership Award from the Mining Association of Canada and the 2016 J.T, Ryan Safety Award for Metal Mines for the lowest accident frequency in British Columbia and Yukon. · New Afton’s Safety Initiative Committee received the BC Chief Inspector’s Recognition Award. · New Afton held Health & Career Fairs at local First Nations communities and held a fundraiser for the Kamloops Foodbank. · New Afton underwent an external audit of its Environmental Management System. This resulted in only minor findings and the site will be certified under ISO14001:2015. · The New Afton community and mine rescue teams provided critical support to a local Indigenous community to prepare for and protect from the BC wildfires. · Cerro San Pedro achieved level A or greater for all protocols in Towards Sustainable Mining initiative including AAA rating for all performance indicators in the Community and Aboriginal Outreach protocol. · Cerro San Pedro was recertified by the International Cyanide Management Institute. · Cerro San Pedro held a Biodiversity Day event at local schools and built a potable water tank for the local community · The Todos par Cerro de San Pedro foundation launched a microfinancing program and provided a microloan to its first local small business owner. · Cerro San Pedro Mine continued to reclaim and revegetate waste piles as part of its closure and reclamation plan as well as complete the fencing off of the open pit area. · Peak Mines participated in Clean Up Australia Day and the Cobar Shire Festival of the Miners Ghost. · Continued working toward Environmental Assessment Approval and Participation Agreements with first Nations at Blackwater.

|

CORPORATE SOCIAL RESPONSIBILITY Targets for 2018 · Achieve a minimum of AA ranking at the Mining Association of Canada’s Towards Sustainable Mining Aboriginal and Community Relations Protocol at Canadian operations. · Reduce reportable environmental incidents across all operations. · Reduce the Total Reportable Injury Frequency Rate (TRIFR). · Establish guidance for workforce with regard to high-risk activities such as working at heights, confined space, lock-out/tag-out and hazardous substances.

|

| 12 |  |

|

New Gold is committed to excellence in corporate social responsibility. The Company considers its ability to make a lasting and positive contribution toward sustainable development a key driver to achieving a productive and profitable business. New Gold aims to achieve this objective through the protection of the health and well-being of its people and host communities as well as employing industry-leading practices in the areas of environmental stewardship and community engagement and development.

As a participant of the United Nations Global Compact, New Gold’s policies and practices are guided by its principles with regard to human rights, labour, environmental stewardship and anti-corruption. As a member of the Mining Association of Canada (“MAC”), New Gold’s operations adopt the MAC’s Towards Sustainable Mining protocols.

New Gold’s objectives include protecting the welfare of its employees and contractors through safety-first work practices, upholding fair employment practices and encouraging a diverse workforce, where people are treated with respect and are supported to realize their full potential. The Company strives to create a culture of inclusiveness and tolerance that begins at the top and is reflected in its hiring, promotion and overall human resources practices. In each of its host communities, the Company strives to be an employer of choice through the provision of competitive wages and benefits, and through the implementation of policies of recognizing and rewarding employee performance and promoting from within wherever possible.

The Company is committed to preserving the long-term health and viability of the natural environments that host its operations. Wherever New Gold operates – in all stages of mining activity, from early exploration and planning, to commercial mining operations through to eventual closure – the Company is committed to excellence in environmental management. From the earliest site investigations, New Gold carries out comprehensive environmental studies to establish baseline measurements for flora, fauna, earth, air and water. During operations, the Company promotes the efficient use of raw materials and resources and works to minimize environmental impacts and maintain robust monitoring programs. After mining activities are complete, New Gold’s objective is to restore the land to a sustainable end land use.

The New Gold environmental management standards are based on internationally recognized standards. The standards serve to guide site-level management systems to ensure that site operations identify and appropriately manage their environmental aspects, adopt a consistent approach to identifying and controlling environmental risks, report progress through audits and assessments, and adopt a high level of environmental stewardship. All sites are expected to have an external audit, peer audit or self-assessment annually based on our audit schedule.

As part of the implementation process, each operation has also compiled a register of significant environmental risks. This register contains the main environmental risks for each operation and allows corporate representatives to test the adequacy and effectiveness of controls as well as emergency preparedness and mitigation measures associated with these greatest potential risks.

In 2017, New Gold was subject to charges in relation to two incidents from 2016. Specifically, on July 13, 2017, New Gold was charged with five breaches of the Environmental Protection Act (Ontario) in connection with alleged effluent discharges at the Rainy River project in July 2016 in excess of permit limits. On November 9, 2017, New Gold plead guilty to discharging un-ionized ammonia above the ECA limit on July 27, 2016 and failing to report a July 20, 2016 discharge above the standard for un-ionized ammonia. The three remaining charges were withdrawn. New Gold was sentenced to a fine of C$100,000 for the July 27, 2016 discharge and C$50,000 for the failure to report the July 20, 2016 discharge. A mandatory victim surcharge of 25% applies to the fines, for a total amount owing of C$187,500. In addition, on July 24, 2017, New Gold was charged with two breaches of the Lakes and Rivers Improvement Act (Ontario) in connection with water allegedly overtopping a dam on the Rainy River construction site prior to completion of construction of the dam. New Gold takes all environmental incidents seriously and is in the process of evaluating this matter.

| 13 |  |

|

New Gold is committed to establishing relationships based on mutual benefit and active participation with its host communities to contribute to healthy and sustainable communities. Wherever the Company’s operations interact with Indigenous peoples, New Gold promotes understanding of, and respect for traditional values, customs and culture and takes meaningful action to consider their interests through collaborative agreements aimed at creating jobs, training and other lasting socio-economic benefits.

The New Gold community engagement and development standards provide guidance to our sites to identify our communities of interest, and effectively engage and sustain dialogue, and to find opportunities to contribute to long-term development within our host communities. They also drive us to monitor and continually improve our processes and performance. The standards are based on several internationally recognized principles and values. At each site, the standards are being progressively implemented to guide site-level management systems to ensure that site operations appropriately identify and engage with local communities of interest, respect human rights, identify opportunities for sustainable community investments, and makes commercially reasonable efforts to maximize local hiring and contracting.

Our standards also guide our operations to adopt a consistent approach to identifying and controlling social risks and to report progress through audits and assessments. All sites are expected to have an external audit, peer audit or self-assessment annually based on an audit schedule.

| 14 |  |

|

NEW GOLD’S INVESTMENT THESIS

Our primary focus is the exploration, development and operation of our portfolio of gold producing assets. We currently have an established foundation, with our four producing assets providing us with the cash flow that should position us to grow the business as we further explore and develop our exciting development projects. As we deliver on what we believe is an industry-leading organic growth profile, we intend to remain focused on the following key strengths that have helped New Gold become a leading intermediate producer.

| PORTFOLIO OF ASSETS IN TOP-RATED JURISDICTIONS | New Gold has a diverse portfolio of assets. Operating assets consist of Rainy River and New Afton in Canada, Mesquite in the United States, Peak Mines in Australia (classified as a discontinued operation) and Cerro San Pedro in Mexico, which transitioned into residual leaching in the second half of 2016. Our significant development project is the Blackwater project in Canada. All assets are located in jurisdictions that have been ranked in the top five mining jurisdictions based on the Behre Dolbear Report “2015 Ranking of Countries for Mining Investment”. In 2017, 43% of our revenue was generated from Canada, 22% from Australia, 28% from the United States and 7% from Mexico, and over 92% of our gold reserves are located in Canada. | |

| INVESTED AND EXPERIENCED TEAM | New Gold has an invested and experienced executive management team and Board of Directors with extensive mining sector knowledge, a successful track record of identifying and developing mines and significant experience in leading successful mining companies. Our Board of Directors provides valuable stewardship and includes individuals with a breadth of knowledge across the mining sector that the Company believes provides New Gold with a distinct competitive advantage. | |

| ESTABLISHED TRACK RECORD | New Gold has a portfolio of mines that have a history of delivering on consolidated Company guidance. In 2017, New Gold achieved its production guidance at low costs which enabled us to generate robust margins. New Gold produced 422,411 gold ounces at operating expenses per gold ounce sold of $664 and all-in sustaining costs of $727 per gold ounce sold net of by-product sales. | |

| PEER-LEADING GROWTH PIPELINE | In addition to our operating mines, we have development potential that significantly enhances our production base and growth profile. As at December 31, 2017, the Rainy River mine contains Proven and Probable Mineral Reserves of 4.4 million gold ounces and 12.8 million silver ounces. The Blackwater project contains Proven and Probable Mineral Reserves of 8.2 million gold ounces and 61 million silver ounces. Please refer to the “Mineral Reserves and Mineral Resources” section of this MD&A for further details | |

| A HISTORY OF VALUE CREATION | Since the middle of 2008, New Gold has grown through the acquisition of largely single asset companies which has further strengthened the Company. The experience of our management team and Board of Directors has allowed the Company to be opportunistic in its corporate development initiatives. In addition, New Gold continues to look for opportunities to organically increase the value of each of its operations. |

| 15 |  |

|

OUTLOOK FOR 2018

Gold Production(1) | Copper Production(1) | Operating Expense(2) (4) | Operating Expense(2) (4) | All-in Sustaining Costs(3) (4) | |

| (thousands of ounces) | (millions of pounds) | (per gold ounce sold) | (per copper pound sold) | (per gold ounce sold) | |

| Rainy River | 310 - 350 | - | $430 - $470 | - | $990 - $1,090 |

| New Afton | 55 - 65 | 75 - 85 | $455 - $495 | $1.10 - $1.30 | ($1,020) - ($980) |

| Mesquite | 140 - 150 | - | $890 - $930 | - | $1,005 - $1,045 |

| Cerro San Pedro | 20 - 30 | - | $1,255 - $1,295 | - | $1,330 - $1,370 |

| Total | 525 - 595 | 75 - 85 | $555 - $595 | $1.35 - $1.55 | $860 - $900 |

| 1. | Consolidated silver production is estimated to be approximately 0.9 million ounces in 2018. |

| 2. | Operating expenses are apportioned to each metal produced on a percentage of revenue basis. |

| 3. | Net of by-product silver and copper revenues. |

| 4. | For details on the key assumptions, which apply to all 2017 and 2018 production and cost guidance contained in this MD&A, refer to “Total Operating Expense and All-in Sustaining Costs per Gold Ounce Sold” below. |

Production

New Gold’s 2018 consolidated gold production is expected to increase by approximately 30% relative to the prior year due to the benefit of the first full year of operations at Rainy River more than offsetting the planned decreases in gold production at New Afton, Mesquite and Cerro San Pedro, and the sale of Peak Mines. Consolidated copper production for 2018 is expected to decrease relative to the prior year primarily due to the sale of Peak Mines and planned lower mill throughput at New Afton. Consolidated silver production is scheduled to remain in line with 2017 at approximately 0.9 million ounces.

Consistent with previous years, New Gold’s 2018 full-year gold production is not scheduled to be evenly distributed across the four quarters. Approximately 60% of the Company’s consolidated gold production is expected to occur evenly in the second and fourth quarters.

Total Operating Expense and All-in Sustaining Costs per Gold Ounce Sold

New Gold’s by-product pricing assumptions for 2018 are $3.20 per copper pound, which was in line with spot prices and approximates the mid-point of the Company’s copper collar pricing, and $17.00 per silver ounce which is in line with spot prices. The 2018 assumptions for the Canadian dollar and Mexican peso exchange rates of $1.25 and $18.00 to the U.S. dollar were in line with spot exchange rates at the time guidance was set.

The Company’s operating expense per gold ounce is expected to decrease in 2018, as a higher proportion of gold sales will be from the lower operating expense per ounce Rainy River Mine. Operating expense per copper pound in 2018 is expected to increase relative to the prior year due to lower mill throughput and copper grades at New Afton.

New Gold’s 2018 all-in sustaining costs are expected to increase relative to the prior year. The Company’s 2018 consolidated total cash costs, which form a component of all-in sustaining costs, are expected to be $360 to $400 per ounce. Sustaining costs for 2018, including sustaining capital, exploration, general and administrative and amortization or reclamation expenditures, are expected to increase by approximately $145 million relative to the prior year primarily due to an increase in sustaining capital expenditures during Rainy River’s first full year of operation. This increase is expected to be partially offset by lower capital and exploration expenditures at New Afton, Mesquite and Cerro San Pedro, as well as a sustainable reduction in corporate general and administration expenditures.

| 16 |  |

|

Consistent with previous years, New Gold’s 2018 full-year gold production is not scheduled to be evenly distributed across the four quarters. Approximately 60% of the Company’s consolidated gold production is expected to occur evenly in the second and fourth quarters. The Company’s sustaining capital profile is also not scheduled to be evenly distributed across the four quarters. Approximately 40% of the sustaining capital is expected to occur in the first quarter with the remaining 60% to occur evenly over the second, third and fourth quarters. As a result of the combined impact of planned lower first quarter production and higher sustaining capital spend profile, the first quarter is expected to have a higher all-in sustaining cost relative to the full-year guidance range.

KEY PERFORMANCE DRIVERS

There is a range of key performance drivers that are critical to the successful implementation of New Gold’s strategy and the achievement of its goals. The key internal drivers are production volumes and costs. The key external drivers are market prices of gold, copper and silver, as well as foreign exchange rates.

Production Volumes and Costs

New Gold’s portfolio of continuing operating mines produced 317,898 gold ounces for the year ended December 31, 2017 and 110,240 gold ounces for the three months ended December 31, 2017.

Operating expenses per gold ounce sold from continuing operations for the year ended December 31, 2017 was $646, compared to $623 in the prior-year period. Operating expenses per copper pound sold from continuing operations for the year ended December 31, 2017 was $1.34, compared to $1.11 in the prior-year period. Operating expenses per silver ounce sold from continuing operations for the year ended December 31, 2017 was $8.54, compared to $8.55 in the prior-year period.

Operating expenses per gold ounce sold from continuing operations for the three months ended December 31, 2017 were $738, compared to $771 in the prior-year period. Operating expenses per copper pound sold from continuing operations for the three months ended December 31, 2017 were $1.56, compared to $1.57 in the prior-year period. Operating expenses per silver ounce sold from continuing operations for the three months ended December 31, 2017 were $9.44 compared to $10.66 in the prior-year period.

For the year ended December 31, 2017, total cash costs and all-in sustaining costs from continuing operations, net of by-product sales, were $360 and $668 per gold ounce sold, respectively. In the prior-year periods, total cash costs and all-in sustaining costs were $259 and $675 per gold ounce sold, respectively.

For the three months ended December 31, 2017, total cash costs and all-in sustaining costs from continuing operations, net of by-product sales, were $572 and $774 per gold ounce sold, respectively. In the prior-year periods, total cash costs and all-in sustaining costs were $288 and $590 per gold ounce sold, respectively.

For an analysis of the impact of production volumes and costs for the year ended December 31, 2017 relative to prior-year periods, refer to the “Operating Highlights” section of this MD&A.

| 17 |  |

|

Commodity Prices

Gold prices

The price of gold is the single largest factor affecting New Gold’s profitability and operating cash flows. As such, the current and future financial performance of the Company is expected to be closely related to the prevailing price of gold. In the third quarter of 2016, the Company entered into gold price option contracts related to its production for the first half of 2017. New Gold purchased put options with a strike price of $1,300 per ounce covering 120,000 ounces of gold and simultaneously sold call options with a strike price of $1,400 per ounce covering an equivalent 120,000 ounces.

In June 2017, the Company entered into further gold option contracts for the periods July 2017 to December 2017 with a strike price of $1,250 per ounce covering 120,000 ounces of gold and simultaneously sold call options with a strike price of $1,400 per ounce covering an equivalent 120,000 ounces. For the year ended December 31, 2017, the Company recognized $7.4 million in revenue related to these gold price option contracts. At December 31, 2017, the contracts have expired. No further gold price option contracts have been entered into for 2018. For the year ended December 31, 2017, New Gold’s gold revenue per ounce and average realized gold price from continuing operations per ounce were $1,247 and $1,278 respectively, compared to the LBMA p.m. average gold price of $1,257 per ounce. For the three months ended December 31, 2017, New Gold’s gold revenue per ounce and average realized gold price per ounce were $1,252 and $1,274, respectively, compared to the LBMA p.m. average gold price of $1,274 per ounce. The difference between New Gold’s average realized gold price and the LBMA p.m. average gold price is primarily a result of the gold price option contracts described above.

Copper prices

In November 2016, the Company entered copper swap contracts for 5.3 million pounds of copper per month from January through June 2017, at a fixed price of $2.52 per pound settling against the LME monthly average price. In February 2017, the Company entered into further copper swap contracts for 7.3 million pounds of copper per month from July 2017 through December 2017 at a fixed price of $2.73 per pound. The copper forward contracts are treated as derivative financial instruments and mark-to-market at each reporting period on the consolidated statement of financial position with changes in fair value recognized in other gains and losses. As at December 31, 2017, all of the aforementioned copper forward contracts have expired.

| 18 |  |

|

For the year ended December 31, 2017, New Gold’s copper revenue per pound and average realized copper price per pound from continuing operations per pound were $2.41 and $2.66, respectively, compared to the average LME copper price of $2.79 per pound. For the three months ended December 31, 2017, New Gold’s copper revenue per pound and average realized copper price per pound were $2.44 and $2.70, respectively, compared to the average LME copper price of $3.09 per pound. The difference between New Gold’s average realized copper price and the LME average copper price is primarily a result of the copper forward contracts described above.

On October 18, 2017, New Gold entered into copper price option contracts covering approximately 60 million pounds of its 2018 production, with put options at a strike price of $3.00 per pound and call options at a strike price of $3.37 per pound, at a nominal cost to the Company. Call options sold and put options purchased are treated as derivative financial instruments and mark-to-market at each reporting period on the consolidated statement of financial position with changes in fair value recognized in other gains and losses.

Silver prices

For the year ended December 31, 2017, New Gold’s silver revenue per ounce and average realized silver price per ounce from continuing operations were $16.41 and $16.88, respectively, compared to the LBMA p.m. average silver price of $16.80 per ounce. For the three months ended December 31, 2017, New Gold’s silver revenue per ounce and average realized silver price per ounce were $15.84 and $16.29 respectively, compared to the LBMA p.m. average silver price of $16.70 per ounce. The difference between New Gold’s average realized silver price and the LBMA p.m. average silver price is as a result of timing of spot sales.

Foreign Exchange Rates

The Company operates in Canada, the United States, Australia and Mexico, while revenue is generated in U.S. dollars. As a result, the Company has foreign currency exposure with respect to costs not denominated in U.S. dollars. New Gold’s operating results and cash flows are influenced by changes in various exchange rates against the U.S. dollar. The Company has exposure to the Canadian dollar through New Afton, Rainy River and Blackwater, as well as through corporate administration costs. The Company also has exposure to the Australian dollar through Peak Mines, and to the Mexican peso through Cerro San Pedro.

The average Canadian dollar against the average U.S. dollar for the year ended December 31, 2017 strengthened by approximately 2% when compared to the prior year. The Canadian dollar weakened against the U.S. dollar by approximately 1% from September 30, 2017 to December 31, 2017. The strengthening or weakening of the Canadian dollar impacts costs in U.S. dollar terms at the Company’s Canadian operations, as well as capital costs at the Company’s Canadian development property, as a significant portion of operating and capital costs are denominated in Canadian dollars.

The average Australian dollar against the average U.S. dollar for the year ended December 31, 2017 strengthened by approximately 3% when compared to the prior year. The Australian dollar weakened against the U.S. dollar by approximately 0.3% from September 30, 2017 to December 31, 2017. The strengthening or weakening of the Australian dollar impacts costs in U.S. dollar terms at the Company’s Australian operation, Peak Mines, as a significant portion of operating costs are denominated in Australian dollars.

The average Mexican peso against the average U.S. dollar for the year ended December 31, 2017 weakened by approximately 1% when compared to the prior year. The Mexican peso weakened against the U.S. dollar by approximately 8% from September 30, 2017 to December 31, 2017. The strengthening or weakening of the Mexican peso impacts costs in U.S. dollar terms at the Company’s Mexican operation, Cerro San Pedro, as a portion of operating costs are denominated in Mexican pesos.

| 19 |  |

|

For an analysis of the impact of foreign exchange fluctuations on operating costs for the year ended December 31, 2017 relative to prior-year periods, refer to the “Review of Operating Mines and Discontinued Operations” sections for Rainy River, New Afton, Peak Mines and Cerro San Pedro.

Economic Outlook

The LBMA p.m. gold price increased by 6% since the start of 2017, declining by 4% during the fourth quarter. The current U.S administration continues to generate considerable uncertainty and unpredictability, and U.S. economic data has been mixed. Although the Federal Reserve is expected to increase the pace of interest rate hikes in 2018 and most asset markets continue to set new highs, there are numerous U.S legislative hurdles on the horizon, as well as continuing challenges with Brexit and ongoing geopolitical concerns. Against this backdrop, gold has started 2018 well.

Prospects for gold are encouraged by several structural factors. Mine supply has been plateauing as high quality deposits become more difficult to find and more expensive to develop and mine. Exploration budgets have been cut in recent years, increasing the likelihood that supply will remain muted, even in the face of increasing gold prices. Gold held in exchange-traded products is significantly below the peak in 2012, suggesting that the broad investment community has capacity to add length to positions as sentiment improves. As a low all-in sustaining cost producer with a pipeline of development projects, New Gold believes it is particularly well positioned both to operate in a lower gold price environment and to take advantage of higher prices in the gold market.

Economic events can have significant effects on the price of gold, through currency rate fluctuations, the relative strength of the U.S. dollar, gold supply and demand, and macroeconomic factors such as interest rates and inflation expectations. Management anticipates that the long-term economic environment should provide support for precious metals and for gold in particular, and believes the prospects for the business are favourable. New Gold’s growth plan is focused on organic and acquisition-led growth, and the Company plans to remain flexible in the current environment to be able to respond to opportunities as they arise.

| 20 |  |

|

FINANCIAL RESULTS

Summary of Quarterly and Year-to-Date Financial Results

| Three months ended December 31 | Year ended December 31 | ||||

| (in millions of U.S. dollars, except where noted) | 2017 | 2016 | 2017 | 2016 | 2015 |

| FINANCIAL RESULTS(3) | |||||

| Revenue | 193.5 | 140.7 | 604.4 | 522.8 | 582.9 |

| Operating expenses | 117.0 | 94.2 | 321.0 | 275.5 | 321.0 |

| Depreciation and depletion(2) | 70.5 | 57.1 | 220.3 | 200.1 | 193.9 |

| Revenue less cost of goods sold(2) | 6.0 | (10.6) | 63.1 | 47.2 | 68.0 |

| Corporate administration | 4.9 | 6.4 | 23.7 | 22.9 | 20.4 |

| Corporate restructuring | 4.2 | - | 4.2 | - | 3.0 |

| Share-based payment expenses | (1.8) | 0.5 | 5.1 | 8.3 | 7.3 |

| Asset impairment | 268.4 | 6.4 | 268.4 | 6.4 | (13.6) |

| Exploration and business development | 1.3 | 2.5 | 6.4 | 4.1 | 16.7 |

| (Loss) earnings from operations(2) | (271.0) | (26.4) | (244.7) | 5.5 | 37.2 |

| Finance income | 0.2 | 0.7 | 1.1 | 1.4 | 1.3 |

| Finance costs | (12.7) | (1.4) | (13.2) | (9.9) | (37.9) |

| Other gains and losses | |||||

| Unrealized gain on share purchase warrants | - | 1.5 | 1.2 | 0.2 | 14.2 |

| (Loss) gain on foreign exchange | (8.8) | (5.1) | 43.8 | 12.0 | (98.2) |

| Loss on disposal of El Morro project | - | - | - | - | (180.3) |

| Gain on disposal of El Morro stream | - | - | 33.0 | - | - |

| Other gain (loss) on disposal of assets | 0.2 | (0.1) | 0.3 | 0.1 | (4.4) |

| Revaluation of AFS securities | (0.1) | (0.2) | (0.2) | 0.5 | (0.2) |

| Gain (loss) on copper forward contracts and copper option contracts | 0.3 | - | (4.4) | - | - |

| Unrealized (loss) gain on revaluation of gold stream obligation | (17.0) | 3.3 | (21.8) | (31.1) | 6.2 |

| Gain (loss) on revaluation of gold price option | 0.3 | 11.4 | (13.9) | 10.5 | 6.0 |

| Financial instrument transaction costs | - | - | - | - | (2.4) |

| Company’s share of the net loss of El Morro | - | - | - | - | (0.8) |

| Other | 0.1 | (0.2) | 1.2 | 0.1 | (0.2) |

| Loss before taxes(2) | (308.5) | (16.5) | (217.6) | (10.7) | (262.4) |

| Income tax recovery (expense)(2) | 128.9 | (6.8) | 115.9 | 2.1 | 94.1 |

| Net loss from continuing operations(2) | (179.6) | (23.3) | (101.7) | (8.6) | (168.3) |

| (Loss) earnings from discontinued operations | (16.0) | 1.0 | (6.3) | 1.6 | (33.1) |

| Net loss | (195.6) | (22.3) | (108.0) | (7.0) | (201.4) |

| Adjusted earnings from continuing operations(1) (2) | 6.2 | 1.5 | 21.3 | 19.4 | 1.8 |

| Adjusted net earnings (loss)(1) (2) | 32.5 | (4.9) | 49.3 | 14.6 | (10.9) |

| 1. | The Company uses certain non-GAAP financial performance measures throughout this MD&A. For a detailed description of each of the non-GAAP measures used in this MD&A and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 2. | Prior-year period comparatives have been revised. Please refer to the “Key Quarterly Operating and Financial Information” section of this MD&A for further information. |

| 3. | As the Company began a process for the sale of Peak Mines and the Company expects to close the sale in the first quarter of 2018, Peak Mines has been classified as a discontinued operation. Financial highlights are disclosed on a continuing and total basis, where appropriate. |

| 21 |  |

|

Revenue

The $81.6 million, or 16%, increase in revenue for the year ended December 31, 2017 was due to the combined impact of a $45.0 million increase driven by higher gold and copper prices and a $36.6 million increase in metal sales volumes. The average realized prices for the year ended December 31, 2017 were $1,278 per gold ounce, $2.66 per pound of copper and $16.88 per silver ounce, compared to $1,242 per gold ounce, $2.33 per pound of copper and $17.09 per silver ounce in the prior year.

For the three months ended December 31, 2017, the $52.8 million increase in revenue was attributable to higher gold and copper prices. The 38% increase in revenue was due to the combined impact of a $9.8 million increase driven by higher gold and copper prices and a $43.0 million increase in metal sales volumes. The average realized prices for the three months ended December 31, 2017 were $1,274 per gold ounce, $2.70 per pound of copper and $16.29 per silver ounce. This compared to $1,199 per gold ounce, $2.47 per pound of copper and $16.78 per silver ounce in the prior-year period.

A detailed discussion of production is included in the “Review of Operating Mines” section of this MD&A.

Operating expenses

For the year and three months ended December 31, 2017, operating expenses increased compared with the prior-year periods. Higher operating costs at Mesquite were due to higher process solution flow which drove higher production. The increase in operating costs was also attributable to Rainy River as the mine commenced commercial production in the fourth quarter of 2017. This was partially offset by lower operating costs at Cerro San Pedro, as the mine has been in residual leaching since June 2016. The prior-year period operating expenses included a non-cash heap leach inventory write-down of $24.0 million at Cerro San Pedro.

Depreciation and depletion

For the three months and year ended December 31, 2017, depreciation and depletion increased compared with prior-year periods due to higher production from the Mesquite operations compared to prior periods, and depreciation and depletion being recognized at Rainy River as the mine commenced commercial production in the fourth quarter.

Revenue less cost of goods sold

For the three months and year ended December 31, 2017,revenue less cost of goods sold increased primarily due to higher revenues, partially offset by higher operating expenses and depreciation and depletion.

Corporate administration and share-based payment expenses

For the year ended December 31, 2017, corporate administration was consistent with the prior-year period. For the three months ended December 31, 2017, the decrease in corporate administration costs was due to a reduction in salaries and benefits expenses as the Company initiated a restructuring plan that impacted its corporate office workforce. As a result, the Company incurred $4.2 million in severance and termination related charges in the quarter.

For the three months and year ended December 31, 2017, the decrease in share-based payment expenses was a result of a lower amount of share units due to the above-noted restructuring and a decrease in share price used to value share-based compensation when compared to the prior-year period.

| 22 |  |

|

Asset impairment

In accordance with the Company’s accounting policies, the recoverable amount of an asset is estimated when an indication of impairment exists. As at December 31, 2017, indicators of impairment existed at the Rainy River cash generating unit (‘CGU’).

In January 2018, the Company announced higher estimated operating expenses and capital expenditures over Rainy River’s first nine years of operations. The Company has identified the revised operating expense and capital expenditure estimates at Rainy River as an indicator of impairment.

For the year ended December 31, 2017, the Company recorded an after-tax impairment loss of $181.0 million within net loss, as noted below:

| Year ended December 31, 2017 | |

| (in millions of U.S. dollars) | Rainy River |

| Impairment charge included within NET LOSS | |

| Rainy River depletable mining properties | 268.4 |

| Tax recovery | (87.4) |

| Total impairment charge after tax | 181.0 |

In the prior year, indicators of impairment existed at the Rainy River CGU and for the Company’s 3% NSR royalty on the production of the Rio Figueroa property (“Rio Figueroa NSR”). The Company had identified the revised capital cost and three-month delay at the Rainy River project and the lack of activity on the Rio Figueroa project as indicators of impairment in the prior year and performed an impairment assessment to determine the recoverable amount of these CGUs at December 31, 2016. In the prior year, an impairment loss of $6.4 million was recorded relating to Rio Figueroa NSR. No impairment loss was recorded at Rainy River in the prior year as the carrying value exceeded the recoverable amount as at December 31, 2016.

For the year ended December 31, 2016, the Company recorded an impairment charge of $6.4 million within net loss, as noted below:

| Year ended December 31, 2016 | |

| (in millions of U.S. dollars) | Rio Figueroa NSR |

| Impairment charge included NET LOSS | |

| Exploration and evaluation assets | 6.4 |

(i) Methodology and key assumptions

Impairment is recognized when the carrying amount of a CGU exceeds its recoverable amount. A CGU is the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets. Each operating mine and development project represents a separate CGU as each mine site or project has the ability to, or the potential to, generate cash inflows that are separately identifiable and independent of each other. The Company has the following CGUs: New Afton, Mesquite, Peak Mines, Cerro San Pedro, Rainy River, and Blackwater. Other assets consist of corporate assets and exploration properties.

As outlined in the accounting policies, the Company uses fair value less cost of disposal to determine the recoverable amount of an asset as it believes that this will generally result in a value greater than or equal to the value in use. When there is no binding sales agreement, fair value less costs of disposal is estimated as the discounted future after-tax cash flows expected to be derived from a mine site, less an amount for costs to sell estimated based on similar past transactions. The inputs used in the fair value measurement constitute Level 3 inputs under the fair value hierarchy.

| 23 |  |

|

(a) Rainy River CGU:

Key estimates and judgements include production levels, operating costs, project costs and other capital expenditures reflected in the Company’s life-of-mine (‘LOM’) plans, the value of in-situ ounces, exploration potential and land holdings, as well as economic factors beyond management’s control, such as gold, and silver prices, discount rates and foreign exchange rates. The Company considers this approach to be consistent with the valuation approach taken by market participants.

Life-of-Mine plans

Estimated cash flows are based on LOM plans which estimate expected future production, commodity prices, exchange assumptions, operating costs and capital costs. The current Rainy River LOM plan is 13 years. LOM plans use proven and probable mineral reserves only and do not utilize mineral resource estimates for a CGU. When options exist for the future extraction and processing of these resources, an estimate of the value of the unmined mineral resources (also referred to as in-situ ounces) is included in the determination of fair value.

In-situ ounces

In-situ ounces are excluded from the LOM plans due to the need to continually reassess the economic returns on and timing of specific production options in the current economic environment. The value of in-situ ounces has been estimated based on an enterprise value per equivalent resource ounce, with the enterprise value based on the market capitalization of a subset of publicly traded companies.

Discount rates

When discounting estimated future cash flows, the Company uses a real, after-tax discount rate that is designed to approximate what market participants would assign. This discount rate is calculated using the Capital Assets Pricing Model (‘CAPM’). The CAPM includes market participant’s estimates for equity risk premium, cost of debt, target debt to equity, risk-free rates and inflation. For the December 31, 2017 impairment analysis, a real discount rate of 4.00% was used (2016 - real discount rates of 5.50%). The decrease in the real discount rate was due to the removal of the project development risk premium and stronger bond markets.

Commodity prices and exchange rates

Commodity prices and exchange rates are estimated with reference to external market forecasts. The rates applied have been estimated using consensus commodity prices and exchange rate forecasts. For impairment analysis, the following commodity prices and exchange rate assumptions were used:

| As at December 31, 2017 | As at December 31, 2016 | |||

| (in U.S. dollars, except where noted) | 2018 - 2022 Average | Long-term | 2017 - 2021 Average | Long-term |

| Commodity prices | ||||

| Gold ($/ounce) | 1,300 | 1,300 | 1,325 | 1,300 |

| Silver ($/ounce) | 19.16 | 19.25 | 19.66 | 20.00 |

| Exchange rates | ||||

| CAD:USD | 1.24 | 1.24 | 1.31 | 1.30 |

Significant judgments and assumptions are required in making estimates of fair value. It should be noted that CGU valuations are subject to variability in key assumptions including, but not limited to, long-term gold prices, currency exchange rates, discount rates, production, operating and capital costs. An adverse change in one or more of the assumptions used to estimate fair value could result in a reduction in a CGU’s fair value.

| 24 |  |

|

(b) Rio Figueroa NSR:

Key estimates and judgments used in the fair value less cost of disposal calculation are estimates of production levels, probability of the project being developed and economic factors beyond management’s control, such as copper prices and discount rates.

(ii) Impact of impairment tests

The Company calculated the recoverable amount of the Rainy River CGU using the fair value less cost of disposal method as noted above. For the year ended December 31, 2017, the Company recorded pre-tax impairment losses of $268.4 million, $181.0 million net of tax, within net loss. The fair value of the Rainy River CGU was negatively impacted by the higher development capital costs incurred to date as well as higher expected all-in sustaining costs over the LOM.