Exhibit 99.2

Annual General Meeting of New Gold Inc.

Management Information Circular

March 16, 2018

Notice of Annual GENERAL Meeting of Shareholders

Notice is hereby given that the annual general meeting of shareholders (“Meeting”) of New Gold Inc. (“New Gold” or the “Company”) will be held at Vantage Venues, 150 King Street West, 27th Floor, Toronto, Ontario, on Wednesday, April 25, 2018 at 4:00 pm (Eastern time) for the following purposes:

| 1. | receiving the audited consolidated financial statements of the Company for the year ended December 31, 2017 and the auditor’s report on those statements; |

| 2. | setting the size of the board of directors of the Company at seven directors; |

| 3. | electing the directors of the Company; |

| 4. | appointing Deloitte LLP as auditor of the Company and authorizing the directors to fix their remuneration; |

| 5. | considering and, if deemed appropriate, passing, with or without variation, a non-binding advisory resolution on executive compensation; and |

| 6. | conducting such other business properly brought before the Meeting or any adjournment or postponement thereof. |

The record date for the Meeting is March 6, 2018. The record date is the date for the determination of the registered holders of common shares entitled to receive notice of, and to vote at, the Meeting and any adjournment or postponement thereof.

This notice is accompanied by a management information circular (“Circular”) and either a form of proxy or a voting instruction form. If previously requested, a copy of the audited consolidated financial statements and management’s discussion and analysis (“MD&A”) of New Gold for the year ended December 31, 2017 will also accompany this notice. Copies of New Gold’s annual and interim financial statements and MD&A are also available under New Gold’s profile on SEDAR at www.sedar.com, on EDGAR at www.sec.gov and on New Gold’s website at www.newgold.com. As described in the notice and access notification mailed to shareholders, New Gold is using the notice and access method for delivering this notice and the Circular to shareholders. This notice and the Circular will be available on New Gold’s website at www.newgold.com/annualmeeting2018 and under New Gold’s profile on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

We value your opinion and participation in the Meeting as a shareholder of New Gold. Please review the accompanying Circular before voting as it contains important information about the Meeting. It is important that you exercise your vote, either in person at the Meeting, by telephone, on the internet or by completing and returning the enclosed form of proxy or voting instruction form. Any questions regarding voting your shares should be directed to our proxy solicitation agent Kingsdale Advisors who can be reached by toll-free telephone in North America at 1-866-581-1477, by collect call outside North America at 416-867-2272, or by email at contactus@kingsdaleadvisors.com. Any proxies to be used or acted on at the Meeting must be deposited with New Gold’s transfer agent by 4:00 pm (Eastern time) on April 23, 2018, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of any adjourned or postponed Meeting.

DATED at Toronto, Ontario this 16th day of March, 2018.

By Order of the Board of Directors

Ian Pearce

Chair of the Board

| 1 |  |

Table of contents

| MANAGEMENT INFORMATION CIRCULAR | 3 |

| VOTING INFORMATION | 3 |

| Voting Process – Registered Shareholders | 4 |

| Voting Process – Non-Registered Shareholders | 6 |

| BUSINESS OF THE MEETING | 8 |

| Receiving the Audited Consolidated Financial Statements | 8 |

| Board Size Resolution | 8 |

| Election of Directors | 8 |

| Appointment of Auditor | 18 |

| Say on Pay Advisory Vote | 18 |

| STATEMENT OF EXECUTIVE COMPENSATION | 20 |

| Compensation Governance | 20 |

| Compensation Discussion and Analysis | 24 |

| Summary Compensation Table | 38 |

| Termination and Change of Control Benefits | 42 |

| EQUITY COMPENSATION PLANS | 44 |

| STATEMENT OF DIRECTOR COMPENSATION | 52 |

| CORPORATE GOVERNANCE PRACTICES | 58 |

| Board of Directors | 58 |

| Board of Directors Governance | 65 |

| OTHER INFORMATION | 69 |

| SCHEDULE A – Board of Directors Mandate | 71 |

| 2 |  |

MANAGEMENT INFORMATION CIRCULAR

GENERAL INFORMATION

This management information circular (“Circular”) has been prepared for the holders of common shares (“shareholders”) of New Gold Inc. (“New Gold” or the “Company”) in connection with the solicitation of proxies by management of New Gold for use at New Gold’s annual general meeting of shareholders (“Meeting”) to be held at 4:00 pm (Eastern time) on April 25, 2018 at Vantage Venues, 150 King Street West, 27th Floor, Toronto, Ontario, for the purposes set out in the accompanying notice of meeting (“Notice of Meeting”). References in this Circular to the Meeting include any adjournment(s) or postponement(s) thereof.

Unless otherwise stated, the information contained in this Circular is as of March 7, 2018. Unless otherwise stated, all dollar amounts in this Circular refer to United States dollars. Canadian dollars are referred to as “C$”. Unless otherwise stated, any United States dollar amounts which have been converted from Canadian dollars have been converted at an exchange rate of US$1.00 = C$1.2986 for 2017, US$1.00 = C$1.3236 for 2016, and US$1.00 = C$1.2767 for 2015, being the average rate for 2017 and the average noon rate for 2016 and 2015 quoted by the Bank of Canada for each respective year.

The record date for the Meeting is March 6, 2018. The record date is the date for determining the shareholders entitled to receive notice of, and to vote at, the Meeting. The deadline for receiving duly completed and executed forms of proxy or submitting your proxy by telephone or internet is 4:00 pm (Eastern time) on April 23, 2018, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of any adjourned or postponed Meeting.

While it is expected that the solicitation will be made by mail, proxies may be solicited personally or by telephone by directors, officers and employees of New Gold. The Company will also be using the services of Kingsdale Advisors (“Kingsdale”) to solicit proxies. Fees for Kingsdale’s solicitation services are anticipated to be C$47,500 plus disbursements, and a fee per telephone call. All costs of this solicitation will be borne by New Gold. Shareholders with questions about voting their shares may contact Kingsdale by toll-free telephone in North America at 1-866-581-1477, by collect call outside North America at 416-867-2272, or by email at contactus@kingsdaleadvisors.com.

New Gold urges shareholders to review this Circular before voting.

VOTING INFORMATION

Meeting Materials

New Gold is using the notice and access process (“Notice and Access”) provided under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) for the delivery of the Notice of Meeting, Circular, financial statements and management’s discussion and analysis (“MD&A”) for the year ended December 31, 2017 (collectively, the “Meeting Materials”) to registered and beneficial shareholders for the Meeting. New Gold has adopted the Notice and Access delivery process in order to further its commitment to environmental sustainability and to reduce its printing and mailing costs.

Under Notice and Access, instead of receiving printed copies of the Meeting Materials, shareholders receive a Notice and Access notification containing details of the Meeting date, location and purpose, as well as information on how they can

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 3 |  |

access the Meeting Materials electronically. Shareholders with existing instructions on their account to receive printed materials will receive a printed copy of the Meeting Materials.

Shareholders may request that printed copies of the Meeting Materials be sent to them by postal delivery at no cost to them up to one year from the date this Circular is filed on SEDAR. Requests may be made through New Gold’s website, www.newgold.com, or by calling 1-888-315-9715. To receive the Meeting Materials in advance of the proxy deposit date and Meeting date, New Gold must receive requests for printed copies of the Meeting Materials at least seven business days in advance of the proxy deposit date and time.

Voting Process – Registered Shareholders

Voting by Proxy

A form of proxy will accompany the Notice of Meeting or the Notice and Access notification sent to registered shareholders. The persons named in the form of proxy are officers and/or directors of New Gold. Registered shareholders at the close of business on March 6, 2018 may vote in person at the Meeting, or by proxy as follows:

| By telephone: | Call toll free in North America 1-866-732-8683 or outside North America 1-312-588-4290. If you return your proxy by telephone, you cannot appoint any person other than the officers and/or directors named on the form of proxy as your proxy holder. |

| On the internet: | Go to www.investorvote.com and follow the instructions on the screen. You will need to enter your 15-digit control number. If you submit your proxy via the internet, you can appoint another person, who need not be a shareholder, to represent you at the Meeting by inserting such person’s name in the blank space provided on the internet form. Complete your voting instructions and date and submit the internet form. Make sure the person you appoint is aware that he or she has been appointed, and attends the Meeting. If you appoint a person (other than the persons named in the form of proxy) to represent you at the Meeting, that person must attend the Meeting for your shares to be voted. |

| By mail or fax: | Complete the form of proxy and return it to Computershare Trust Company of Canada, Attention: Proxy Department, 8th Floor, 100 University Avenue, Toronto ON, M5J 2Y1 in the envelope provided or fax a copy of the completed form to Computershare at 1-866-249-7775. If you return your proxy by mail or fax, you can appoint another person, who need not be a shareholder, to represent you at the Meeting by inserting such person’s name in the blank space provided in the form of proxy and striking out the names of the persons listed in the form of proxy. Complete your voting instructions and date and sign the form. Make sure the person you appoint is aware that he or she has been appointed, and attends the Meeting. If you appoint a person (other than the persons named in the form of proxy) to represent you at the Meeting, that person must attend the Meeting for your shares to be voted. |

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 4 |  |

| By appointing another person to attend in person: | A shareholder can appoint another person, who need not be a shareholder, to represent such shareholder at the Meeting by inserting that person’s name in the blank space provided in the form of proxy and striking out the names of the persons listed in the form of proxy, or by completing another proper form of proxy. A shareholder appointing a proxy holder may indicate the manner in which the appointed proxy holder is to vote regarding any specific item by checking the space opposite the item on the proxy. If the shareholder giving the proxy wishes to confer discretionary authority regarding any item of business, the space opposite the

item should be left blank. The common shares represented by the proxy submitted by a shareholder will be voted or withheld from voting by the proxy holder in accordance with the directions, if any, given in the proxy. |

The deadline for receiving duly completed and executed forms of proxy or submitting your proxy by telephone or internet is by 4:00 pm (Eastern time) on April 23, 2018, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of any adjourned or postponed Meeting. The time limit for deposit of proxies may be waived or extended by the Chair of the Meeting at his or her discretion, without notice.

Revocation of Proxies

A proxy submitted by a shareholder may be revoked by written notice, signed by the shareholder or by the shareholder’s attorney authorized in writing (or, if the shareholder is a corporation, by a duly authorized officer or attorney), and deposited either:

| (i) | at the Company’s corporate office (New Gold Inc., 181 Bay Street, Suite 3510, Toronto, Ontario, M5J 2T3, Attention: Corporate Secretary) at any time up to and including the last business day before the day of the Meeting or any adjournment or postponement thereof; or |

| (ii) | with the Chair of the Meeting on the day of the Meeting or, if adjourned or postponed, any reconvening of the Meeting or in any other manner permitted by law. |

The revocation of a proxy does not affect any matter on which a vote has been taken before the revocation.

Exercise of Discretion by Proxies

The persons named in the form of proxy will vote (or, if applicable, withhold from voting) the common shares in respect of which they are appointed in accordance with the direction of the shareholders appointing them. If the shareholder specifies a choice with respect to any matter to be acted upon, the shareholder’s common shares will be voted accordingly.In the absence of such direction, the relevant common shares will be voted in favour of all the matters described below.

The form of proxy confers discretionary authority on the persons named in the proxy with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. At the time of printing of this Circular, management knows of no such amendments, variations or other matters to come before the Meeting. However, if any such amendments, variations or other matters which are not now known to management should properly come before the Meeting, the proxy will be voted on such matters in accordance with the best judgment of the named proxy holders.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 5 |  |

Voting Process – Non-Registered Shareholders

Only registered shareholders of New Gold, or the persons they appoint as their proxy holders, are permitted to vote at the Meeting. Most equity investors in New Gold are “non-registered” shareholders (“Non-Registered Shareholders”) because the common shares they beneficially own are not registered in their names. Common shares beneficially owned by a Non-Registered Shareholder are generally registered either:

| (i) | in the name of an intermediary (“Intermediary”) that the Non-Registered Shareholder deals with in respect of the common shares of New Gold (Intermediaries include, among others, banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or |

| (ii) | in the name of a depository or clearing agency (such as CDS Clearing and Depository Services Inc. or The Depository Trust and Clearing Corporation) in which the Intermediary is a participant. |

In accordance with applicable securities law requirements, New Gold has distributed copies of the Notice and Access notification, the Meeting Materials and the form of proxy (which includes a place to request copies of this Circular and annual and/or interim financial statements and MD&A or to waive the receipt of such documents) to the Intermediaries and clearing agencies for distribution to Non-Registered Shareholders. Management of New Gold does not intend to pay for Intermediaries to forward the Meeting Materials and Form 54-101F7 – Request for Voting Instructions Made by Intermediary to objecting beneficial owners under NI 54-101. An objecting beneficial owner will not receive the materials unless the objecting beneficial owner’s Intermediary assumes the cost of delivery.

Intermediaries are required to forward the Notice and Access notification to Non-Registered Shareholders unless a Non-Registered Shareholder has otherwise instructed the Intermediary. Intermediaries often use service companies (such as Broadridge Financial Solutions, Inc.) to forward the Notice and Access notification (or printed copies of the Meeting Materials if previously requested) to Non-Registered Shareholders.Each Intermediary has its own procedures which should be carefully followed by Non-Registered Shareholders to ensure that their common shares are voted by the Intermediary on their behalf at the Meeting.Generally, Non-Registered Shareholders who have not otherwise instructed the Intermediary will receive the Notice and Access notification together with either:

| (i) | more typically, a voting instruction form which is not signed by the Intermediary and which, when properly completed and signed by the Non-Registered Shareholder and returned to the Intermediary or its service company, will constitute voting instructions which the Intermediary must follow. (In some cases, the completion of the voting instruction form by telephone, facsimile or over the internet is permitted.) Typically, the voting instruction form will consist of a one-page pre-printed form; or |

| (ii) | a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted to the number of common shares beneficially owned by the Non-Registered Shareholder but which is otherwise not completed by the Intermediary. Because the Intermediary has already signed the form of proxy, it is not required to be signed by the Non-Registered Shareholder when submitting the proxy. In this case, the Non-Registered Shareholder who wishes to submit a proxy should carefully follow the instructions of their Intermediary, including those regarding when and where the completed proxy is to be delivered. |

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 6 |  |

In either case, the purpose of these procedures is to enable Non-Registered Shareholders to direct the voting of the common shares of New Gold that they beneficially own. If a Non-Registered Shareholder who receives one of the forms described above wishes to vote at the Meeting (or have another person attend and vote on behalf of the Non-Registered Shareholder), the Non-Registered Shareholder should strike out the names of the persons listed in the form of proxy and insert the name of the Non-Registered Shareholder or such other person’s name in the blank space provided or, in the case of a voting instruction form, follow the directions indicated on the form.In either case, Non-Registered Shareholders should carefully follow the instructions of their Intermediary, including those regarding when and where the proxy or voting instruction form is to be delivered. There may be deadlines for Non-Registered Shareholders that are earlier than the deadlines for proxies from registered shareholders set out above.If you have any questions or require more information with respect to voting at the Meeting, please contact our proxy solicitation agent, Kingsdale, by email at contactus@kingsdaleadvisors.com or by telephone at 1-866-581-1477 (toll free within North America) or 416-867-2272 (outside of North America).

A Non-Registered Shareholder who has submitted voting instructions to an Intermediary should contact their Intermediary for information with respect to revoking their voting instructions.

New Gold may utilize the Broadridge QuickVote™ service to assist Non-Registered Shareholders with voting their shares over the telephone. Alternatively, Kingsdale may contact such Non-Registered Shareholders to assist them with conveniently voting their shares directly over the phone. If you have any questions about the Meeting, please contact Kingsdale by telephone at 1-866-581-1477 (toll-free in North America) or 1-416-867-2272 (collect outside North America) or by email at contactus@kingsdaleadvisors.com.

Voting Securities and Principal Shareholders

The record date for the determination of shareholders entitled to receive notice of, and to vote at, the Meeting is March 6, 2018. Each registered shareholder on the record date will be entitled to vote at the Meeting or any adjournment or postponement thereof. As at the close of business on March 6, 2018, 578,635,838 common shares of New Gold were issued and outstanding. Each common share entitles the holder to one vote on all matters to be acted on at the Meeting.

Except as noted below, to the knowledge of the directors and executive officers of New Gold, as at the date of this Circular, no person or company beneficially owns, or controls or directs, directly or indirectly, voting securities carrying 10% or more of the voting rights attached to any class of voting securities of New Gold. According to public filings with the United States Securities and Exchange Commission, at December 31, 2017, Van Eck Associates Corporation had control of 80,228,183 common shares of New Gold, which represents approximately 14% of the issued and outstanding shares.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 7 |  |

BUSINESS OF THE MEETING

| 1. | Receiving the Audited Consolidated Financial Statements |

New Gold’s consolidated financial statements, including the auditor’s report thereon, for the year ended December 31, 2017 will be placed before the Meeting. The audited consolidated financial statements are available on New Gold’s website at www.newgold.com, SEDAR at www.sedar.com and EDGAR at www.sec.gov. Printed copies will be mailed to registered shareholders and Non-Registered Shareholders who requested them. For information on how to request a printed copy of New Gold’s audited consolidated financial statements, please see “Meeting Materials” on page 3 of this Circular.

The Company’s Articles require that the board of directors (the “Board”) of New Gold consist of the greater of three directors or the number set by ordinary resolution. At the Meeting, the seven persons named below will be proposed for election as directors of the Company. New Gold is asking shareholders to set, by ordinary resolution, the number of directors of the Company at seven.

Unless directed otherwise in the form of proxy, the persons named in the form of proxy intend to vote FOR setting the Board size at seven persons.

At the Meeting, the seven persons named below will be proposed for election to the Board (“Nominees”). Five of the seven Nominees (71%) are independent, which is greater than the proportion of independent directors currently on the Board.

Over the course of 2017 and 2018, the Board has undertaken a renewal process, with a view to replacing long-tenured directors and also streamlining the size of the Board. As part of that process, Marilyn Schonberner joined the Board in June 2017 and two new proposed directors, Gillian Davison and Margaret Mulligan, were identified, both of whom are included in the list of Nominees. In addition, Vahan Kololian, Martyn Konig and Randall Oliphant will not be standing for re-election at the Meeting. They have each served on the Board for almost nine years (in addition to serving as directors of one of the Company’s predecessors, Western Goldfields Inc.) and agreed not to stand for re-election in order to facilitate the Board renewal. Kay Priestly will also not be standing for re-election due to her other commitments. The Company thanks Messrs. Kololian, Konig and Oliphant and Ms. Priestly for their valuable contributions over the years that have helped build and shape New Gold. Because Messrs. Kololian, Konig and Oliphant and Ms. Priestly are currently on the Board, they are included in disclosure about the current Board in this Circular.

Unless authority to do so is withheld, the persons named in the form of proxy intend to vote FOR the election of each of the Nominees.

Management does not contemplate that any of the Nominees will be unable to serve as a director, but if that should occur for any reason before the Meeting, the persons named in the proxy reserve the right to nominate and vote for the election of another individual at their discretion. Each director elected will hold office until the close of the first annual meeting of shareholders of New Gold following his or her election or until his or her successor is duly elected or appointed, unless his or her office is earlier vacated in accordance with the Articles of New Gold.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 8 |  |

The Board has adopted an Advance Notice Policy for the nomination of directors in certain circumstances. A copy of the Advance Notice Policy is available on New Gold’s website at www.newgold.com. As of the date of this Circular, the Company has not received notice of any director nominations in connection with the Meeting.

The Board has adopted a Majority Voting Policy which stipulates that if a Nominee receives a greater number of votes “withheld” from his or her election than votes “in favour” of his or her election, the Nominee will submit his or her resignation promptly after such meeting (to take effect upon acceptance by the Board) for consideration by the Corporate Governance and Nominating Committee. After reviewing the matter, the Corporate Governance and Nominating Committee will make a recommendation to the Board, and the Board’s subsequent decision will be publicly disclosed (with reasons for its decision in the event the Board declines to accept the resignation). The Nominee will not participate in any Corporate Governance and Nominating Committee or Board deliberations regarding the resignation offer. The Majority Voting Policy does not apply in circumstances involving contested director elections. A copy of the Majority Voting Policy is available on New Gold’s website at www.newgold.com.

The following pages contain brief biographies for each of the Nominees. The information provided includes the following for each Nominee: their principal occupation; description of their principal occupation, business or employment within the past five years; details of residence; independence status; age; date they first became a director of New Gold; areas of expertise; and number of common shares, other securities, share units and stock options of New Gold beneficially owned directly or indirectly, or over which control or direction is exercised by the Nominee as at March 7, 2018. The biographies have each been reviewed by the respective Nominee.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 9 |  |

United Kingdom Age: 46 Proposed New Director Independent | Gillian Davidson Gillian Davidson has 20 years of experience as an internal and external advisor to companies and other organizations regarding sustainability, social license and community relations. Most recently, Dr. Davidson was the Head of Mining and Metals for the World Economic Forum from 2014 to 2017, where she led global and regional engagement and multi-stakeholder initiatives to advance responsible and sustainable mining. From 2008 to 2014, she was Director of Social Responsibility at Teck Resources Limited, supporting social and environmental commitments and performance across the mining lifecycle. Before joining Teck, Dr. Davidson held roles related to community development, environment and natural resources as a consultant and in government. Dr. Davidson presently serves as a director on the board of Lydian International Limited. Dr. Davidson has an Honours Master of Arts in Geography from the University of Glasglow, a PhD in Development Economics and Economic Geography from the University of Liverpool and is an alumnus of the Governor General of Canada’s Leadership Conference. Dr. Davidson’s principal occupation is as a consultant. |

| Securities Held(1) |

| | Number of

Common

Shares | Number of

DSUs | Number of

Options | Total at-risk value

of securities

held(2) |

| March 7, 2018 | - | - | - | - |

Ms. Davidson, who has been nominated for election to the Board for the first time at the Meeting, has until April 2021 to achieve compliance with the Company’s Share Ownership Guidelines.

| Areas of Expertise | | Director Election – Voting Results(3) |

| Mining Industry and Operations; Corporate Governance; Health, Safety, Environment and/or Risk Management; Public Company Board; Government Relations and/or Legal. | | Year | For | Withheld |

| | Not applicable | |

| | | | |

| | | | |

Board and Committee Membership

and Attendance 2017(4) | | | Other Public

Directorships | |

| Not applicable | | | Lydian International Limited | Since 2016 |

| | | | | |

| | | | | |

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 10 |  |

Alberta, Canada Age: 64 Director since July 8, 2008 Independent | JAMES ESTEY James Estey is the retired Chairman of UBS Securities Canada Inc. and has over 30 years of experience in the financial markets. He is Chair of the Board of Gibson Energy Inc. and of PrairieSky Royalty Ltd. Mr. Estey also serves on the Advisory Board of the Edwards School of Business. Mr. Estey’s principal occupation is as a Corporate Director. |

| Securities Held(1) |

| | Number of Common Shares | Number of DSUs | Number of Options | Total at-risk value

of securities held(2) |

| March 7, 2018 | 397,585 | 118,177 | 228,347 | $1,282,732 |

| March 10, 2017 | 549,585 | 97,143 | 223,186 | $1,879,206 |

| Change | (152,000) | 21,034 | 5,161 | $(596,474) |

Meets the Company’s Share Ownership Guidelines.

| Areas of Expertise | | Director Election – Voting Results(3) |

| Capital Markets and Accounting; Corporate Governance; Public Company Board; Strategic Planning and M&A. | | Year | For | Withheld |

| | 2017 | 93.6% | 6.4% |

| | 2016 | 99.6% | 0.4% |

| | 2015 | 99.5% | 0.5% |

Board and Committee Membership

and Attendance 2017(4) | | | Other Public Directorships | |

| Board | 9 of 9 | | Gibson Energy Inc. | Since 2011 |

| Compensation Committee | 3 of 3 | | PrairieSky Royalty Ltd. | Since 2014 |

| | | | | |

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 11 |  |

Ontario, Canada Age: 59 Proposed New Director Independent | Margaret Mulligan Margaret (Peggy) Mulligan has over 35 years of experience in audit and finance. From 2008 to 2010, Ms. Mulligan was the Executive Vice President and Chief Financial Officer of Biovail Corporation and from 2005 to 2007 she was the Executive Vice President and Chief Financial Officer of Linamar Corporation. From 1994 to 2004, Ms. Mulligan was the Senior Vice President, Audit and Chief Inspector and then the Executive Vice President, Systems and Operations of The Bank of Nova Scotia. Before joining Scotiabank, she was an Audit Partner with PricewaterhouseCoopers. She holds a Bachelor of Math (Honours) from the University of Waterloo and is a Chartered Professional Accountant, FCPA, CA. Ms. Mulligan also serves as a director on the boards of Canadian Western Bank, ClearStream Energy Services Inc. and Ontario Power Generation, as well as the Ladies Professional Golf Association. Ms. Mulligan’s principal occupation is a Corporate Director. |

| Securities Held(1) |

| | Number of Common

Shares | Number of DSUs | Number of Options | Total at-risk value

of securities

held(2) |

| March 7, 2018 | - | - | - | - |

Ms. Mulligan, who has been nominated for election to the Board for the first time at the Meeting, has until April 2021 to achieve compliance with the Company’s Share Ownership Guidelines.

| Areas of Expertise | | Director Election – Voting Results(3) |

| Capital Markets and Accounting; Corporate Governance; Health, Safety, Environment and/or Risk Management; Public Company Board; Talent Management; Strategic Planning and M&A; Government Relations and/or Legal. | | Year | For | Withheld |

| | Not applicable | |

| | | | |

| | | | |

Board and Committee Membership

and Attendance 2017(4) | | | Other Public

Directorships | |

| Not applicable | | | Canada Western Bank | Since 2017 |

| | | | ClearStream Energy Services Inc. | Since 2014 |

| | | | | |

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 12 |  |

Ontario, Canada Age: 61 Director since April 27, 2016 Independent | Ian Pearce Ian Pearce is the Chair of the Board of New Gold. Mr. Pearce has over 25 years of experience in the mining industry. From 1993 to 2003, Mr. Pearce held progressively more senior engineering and project management roles with Fluor Inc., including managing numerous significant development projects in the extractive sector. From 2003 to 2006, Mr. Pearce held executive roles at Falconbridge Limited, including Chief Operating Officer, and he subsequently served as Chief Executive Officer of Xstrata Nickel, a subsidiary of Xstrata plc, from 2006 to 2013. From 2013 to 2017, Mr. Pearce was a partner of X2 Resources, a private partnership focused on building a mid-tier diversified mining and metals group. Mr. Pearce currently serves as the Chair of the Board of Nevsun Resources Ltd. and MineSense Technologies Ltd., a technology company seeking to improve the ore extraction and recovery process, as well as a director of Outotec Oyj. He holds a Higher National Diploma in Engineering (Mineral Processing) and a Bachelor of Science degree from the University of the Witwatersrand in South Africa. Mr. Pearce’s principal occupation is as a Corporate Director. |

| Securities Held(1) |

| | Number of Common Shares | Number of DSUs | Number of Options | Total at-risk value

of securities held(2) |

| March 7, 2018 | 27,200 | 63,850 | 117,198 | $226,447 |

| March 10, 2017 | 27,200 | 13,369 | 49,172 | $117,814 |

| Change | - | 50,481 | 68,026 | $108,633 |

Mr. Pearce joined the New Gold Board in April 2016. As a result, he has until April 2019 to achieve compliance with the Company’s Share Ownership Guidelines.

| Areas of Expertise | | Director Election – Voting Results(3) |

| Mining Industry and Operations; Corporate Governance; Health, Safety, Environment and/or Risk Management; Public Company Board; Talent Management; Strategic Planning and M&A. | | Year | For | Withheld |

| | 2017 | 96.9% | 3.1% |

| | 2016 | 99.6% | 0.4% |

| | 2015 | N/A | N/A |

Board and Committee Membership

and Attendance 2017(4) | | | Other Public Directorships | |

| Board, Chair | 9 of 9 | | Outotec Oyj | Since 2015 |

| Compensation Committee, Chair | 2 of 2 | | Nevsun Resources Ltd. | Since 2017 |

| HSE and CSR Committee | 2 of 2 | | | |

| Corporate Governance and Nominating Committee | 2 of 2 | | | |

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 13 |  |

Ontario, Canada Age: 38 Director since 2017

Non-Independent | HANNES PORTMANN Hannes Portmann is President and Chief Executive Officer of New Gold. Mr. Portmann joined the Company in 2009 following its merger with Western Goldfields Inc. with the primary focus of leading New Gold’s corporate development and investor relations teams. Since that time, he has taken on progressively more responsibility for other facets of the business, and was appointed Executive Vice President of Business Development in December 2015 with added responsibility for human resources and exploration, and most recently was appointed President and Chief Executive Officer of New Gold in January 2017. Previously, Mr. Portmann held roles in the Merrill Lynch Investment Banking Mining Group and in the assurance and advisory practices of PricewaterhouseCoopers LLP. Mr. Portmann holds a Bachelor of Science in Mining Engineering from Queen’s University, a Masters of Management and Professional Accounting from the Rotman School of Management, University of Toronto and is a Chartered Professional Accountant, CPA, CA. |

| Securities Held(1) |

| | Number of Common Shares | Number of PSUs(5) | Number of Options | Total at-risk value

of securities held(2) |

| March 7, 2018 | 113,227 | 399,000 | 1,403,913 | $1,273,941 |

| March 10, 2017 | 94,335 | 298,000 | 940,000 | $1,233,905 |

| Change | 18,892 | 101,000 | 463,913 | $40,036 |

Mr. Portmann was appointed President in December 2016. As a result, he has until December 2019 to achieve compliance with the Company’s Share Ownership Guidelines.

| Areas of Expertise | | Director Election – Voting Results(3) |

| Mining Industry and Operations; Capital Markets and Accounting; Strategic Planning and M&A. | | Year | For | Withheld |

| | 2017 | 99.5% | 0.5% |

| | 2016 | N/A | N/A |

| | 2015 | N/A | N/A |

Board and Committee Membership

and Attendance 2017(4) | | | Other Public Directorships | |

| Board | 6 of 6 | | None | |

| | | | | |

| | | | | |

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 14 |  |

Alberta, Canada Age: 58 Director since June 20, 2017 Independent | Marilyn Schonberner Marilyn Schonberner is the Chief Financial Officer and Senior Vice President, and an Executive Director, of Nexen Energy ULC. In that role, she is responsible for the overall financial management of Nexen, including accounting, audit, tax, planning, treasury and insurance. Ms. Schonberner joined Nexen in 1997 and since that time has held positions of increasing responsibility including General Manager of Human Resources Services; Director of Corporate Audit; Director of Business Services U.K.; and Treasurer and Vice President of Corporate Planning. Prior to joining Nexen, she spent over 15 years in finance, strategic planning and organization development in the energy sector and as a consultant. Ms. Schonberner holds a Bachelor of Commerce from the University of Alberta and a Master of Business Administration from the University of Calgary. She is a CPA, CMA and a Certified Internal Auditor. Ms. Schonberner completed the Senior Executive Development Programme at the London Business School and is currently enrolled in the Directors Education Program at the Institute of Directors. |

| Securities Held(1) |

| | Number of Common Shares | Number of DSUs | Number of Options | Total at-risk value

of securities held(2) |

| March 7, 2018 | - | 33,954 | - | $84,446 |

| March 10, 2017 | - | - | - | - |

| Change | - | 33,954 | - | $84,446 |

Ms. Schonberner joined the New Gold Board in June 2017. As a result, she has until June 2020 to achieve compliance with the Company’s Share Ownership Guidelines.

| Areas of Expertise | | Director Election – Voting Results(3) |

| Capital Markets and Accounting; Corporate Governance; Health, Safety, Environment and/or Risk Management; Talent Management; Strategic Planning and M&A. | | Year | For | Withheld |

| | Not applicable | | |

| | | | |

| | | | |

Board and Committee Membership

and Attendance 2017(4) | | | Other Public Directorships | |

| Board | 5 of 5 | | Wheaton Precious Metals Corporation | Since 2018 |

| | | | | |

| | | | | |

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 15 |  |

Virginia, United States

Age: 71

Director since June 1, 2009

Non-Independent | RAYMOND THRELKELD Raymond Threlkeld has over 30 years of mineral industry experience. He served as Interim Chief Operating Officer of New Gold from December 19, 2016 to September 1, 2017. From 2009 to 2013, Mr. Threlkeld was the President and Chief Executive Officer of Rainy River Resources Ltd. From 2005 to 2009, Mr. Threlkeld was the Chief Operating Officer of Silver Bear Resources Inc. From 2006 to 2009, he was the President and Chief Executive Officer of Western Goldfields Inc. From 1996 to 2005, Mr. Threlkeld held various senior management positions in precious metal mine development with Barrick Gold Corporation and Coeur d’Alene Mines Corporation including in connection with the development of the Pierina Mine in Peru, the Bulyanhulu Mine in Tanzania and the Veladero Mine in Argentina. Mr. Threlkeld has had exploration acquisition success in the western United States in addition to his management and project development experience. Mr. Threlkeld currently serves on the boards of directors of Euromax Resources Ltd., Kirkland Lake Gold Ltd. and Northern Empire Resources Corp. Mr. Threlkeld holds a Bachelor of Science in Geology from the University of Nevada Mackay School of Earth Sciences and Engineering. Mr. Threlkeld’s principal occupation is a Corporate Director and consultant on natural resource development. |

| Securities Held(1) |

| | Number of Common Shares | Number of DSUs | Number of Options | Total at-risk value

of securities held(2) |

| March 7, 2018 | 154,234 | 79,766 | 198,586 | $581,973 |

| March 10, 2017 | 154,234 | 58,732 | 223,186 | $619,543 |

| Change | - | 21,034 | -24,600 | $(37,570) |

Meets the Company’s Share Ownership Guidelines.

| Areas of Expertise | | Director Election – Voting Results(3) |

| Mining Industry and Operations; Capital Markets and Accounting; Health, Safety, Environment and/or Risk Management; Public Company Board; Strategic Planning and M&A. | | Year | For | Withheld |

| | 2017 | 97.6% | 2.4% |

| | 2016 | 99.5% | 0.5% |

| | 2015 | 91.0% | 9.0% |

Board and Committee Membership

and Attendance 2017(4) | | | Other Public Directorships | |

| Board | 9 of 9 | | Euromax Resources Ltd. | Since 2016 |

| HSE and CSR Committee, Chair | 2 of 2 | | Kirkland Lake Gold Ltd. | Since 2016 |

| | | | Northern Empire Resources Corp. | Since 2017 |

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 16 |  |

| (1) | Information regarding the securities held by each Nominee, including the number of common shares beneficially owned directly or indirectly or over which control or direction is exercised, has been provided by the relevant Nominee. |

| (2) | Represents the total at-risk value of all common shares, DSUs, PSUs and Options (each as defined below) held by the respective Nominees as at March 7, 2018. |

The at-risk value as at March 7, 2018 was calculated as follows: (a) the at-risk value of common shares was calculated using the closing price of the Company’s common shares on the Toronto Stock Exchange (“TSX”) on March 7, 2018 of C$3.22; (b) the at-risk value of DSUs and PSUs was calculated by multiplying the number of DSUs and/or PSUs held by the closing price of the Company’s common shares on the TSX on March 7, 2018 of C$3.22; and (c) the at-risk value of unexercised Options was calculated using the closing price of the Company’s common shares on the TSX on March 7, 2018 of C$3.22 and subtracting the exercise price of the in-the-money Options. These amounts were then converted at an exchange rate of US$1.00 = C$1.2947, being the average daily rate quoted by the Bank of Canada on March 7, 2018.

The following table shows a breakdown of the at-risk value at March 7, 2018 for each type of security held by the Nominees:

| Name | At-risk value of Common Shares ($) | At-risk value of DSUs or PSUs ($) | At-risk value of Options ($) |

| Gillian Davidson | - | - | - |

| James Estey | 988,819 | 293,914 | - |

| Margaret Mulligan | - | - | - |

| Ian Pearce | 67,648 | 158,799 | - |

| Hannes Portmann | 281,603 | 992,338 | - |

| Marilyn Schonberner | - | 84,446 | - |

| Raymond Threlkeld | 383,590 | 198,383 | - |

The at-risk value as at March 10, 2017 was calculated as follows: (a) the at-risk value of common shares was calculated using the closing price of the Company’s common shares on the TSX on March 10, 2017 of C$3.91; (b) the at-risk value of DSUs and PSUs was calculated by multiplying the number of DSUs or PSUs held by the closing price of the Company’s common shares on the TSX on March 10, 2017 of C$3.91; and (c) the at-risk value of unexercised Options was calculated using the closing price of the Company’s common shares on the TSX on March 10, 2017 of C$3.91 and subtracting the exercise price of the in-the money Options. These amounts were then converted at an exchange rate of US$1.00 = C$1.3464, being the noon rate quoted by the Bank of Canada on March 10, 2017.

| (3) | Annual voting results for the last three years in which the Nominee was nominated for election to the Board. |

| (4) | Attendance by each director at Board and Committee meetings is based on the number of meetings held during the period of the calendar year during which the director was a member of the Board and/or the applicable Committee. For more information on changes in Committee membership in 2017 see the section titled “Meetings of the Board and Committees of the Board” on page 64. |

| (5) | On the Entitlement Date (as defined below) of the PSUs, the cash payment and/or number of shares to be issued in satisfaction of the PSU will vary from 50% to 150% of the number of PSUs granted, based on the Achieved Performance (as defined below). |

Cease Trade Orders or Bankruptcies

As at the date of this Circular, no Nominee is, or has been within the past ten years, a director, chief executive officer or chief financial officer of any company (including New Gold) that:

| (i) | was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days (collectively, an “Order”), that was issued while the Nominee was acting in the capacity as director, chief executive officer or chief financial officer; or |

| (ii) | was subject to an Order that was issued after the Nominee ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while the Nominee was acting in the capacity as director, chief executive officer or chief financial officer. |

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 17 |  |

As at the date of this Circular, no Nominee:

| (i) | is, or has been within the past ten years, a director or executive officer of any company (including New Gold) that, while the Nominee was acting in that capacity, or within a year of the Nominee ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; |

| (ii) | has, within the past ten years, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the Nominee; or |

| (iii) | has been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable shareholder in deciding whether to vote for a proposed director. |

Additional Information Regarding the Board

For additional information regarding New Gold’s Board, including compensation and corporate governance practices, see “Statement of Director Compensation” and “Corporate Governance Practices”.

Shareholders will be asked to consider and, if deemed appropriate, pass an ordinary resolution to appoint Deloitte LLP as auditor of New Gold to hold office until the close of the next annual meeting of shareholders of New Gold. It is also proposed that shareholders authorize the directors to fix the remuneration to be paid to the auditor. Deloitte LLP has been the auditor of New Gold (or its predecessors) since 2007. Additional information with respect to the Company’s auditor can be found in New Gold’s latest Annual Information Form available at www.sedar.com.

Unless authority to do so is withheld, the persons named in the accompanying proxy intend to vote FOR the appointment of Deloitte LLP as auditor of New Gold until the close of the next annual meeting of shareholders of New Gold and to authorize the directors to fix their remuneration.

| 5. | Say on Pay Advisory Vote |

The Board has adopted a policy that provides for an annual advisory shareholder vote on executive compensation, known as “Say on Pay”. The Say on Pay Policy is designed to enhance accountability for the Board’s compensation decisions by giving shareholders a formal opportunity to provide their views on the Board’s approach to executive compensation through an annual non-binding advisory vote. The Company will disclose the results of the vote as part of its report on voting results for each annual general meeting. The results will not be binding; the Board will remain fully responsible for its compensation decisions and will not be relieved of these responsibilities by the advisory vote. However, the Board will take the results into account, as appropriate, when considering future compensation policies, procedures and decisions and in determining whether there is a need to modify the level and nature of their engagement with shareholders.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 18 |  |

If the advisory resolution is not approved by a majority of the votes cast at an annual meeting, the Board will consult with shareholders (particularly those who are known to have voted against the resolution) in order to understand their concerns, and will review New Gold’s approach to compensation in the context of those concerns. Results from the Board’s review will be discussed in New Gold’s management information circular for the following year.

Shareholders are encouraged to review and consider the detailed information regarding New Gold’s approach to compensation under the heading “Statement of Executive Compensation” on page 20.

At the Meeting, shareholders will be asked to consider the following non-binding advisory resolution on the acceptance of New Gold’s approach to executive compensation, known as “Say on Pay”. The resolution conforms to the form of resolution recommended by the Canadian Coalition for Good Governance. Shareholders may vote for or against the following resolution:

“BE IT RESOLVED THAT on an advisory basis, and not to diminish the role and responsibilities of the Board, the shareholders accept the Board’s approach to executive compensation disclosed under the section entitled “Statement of Executive Compensation” in the Management Information Circular of the Company dated March 16, 2018 delivered in advance of the Meeting.”

The Board and management recommend the adoption of the Say on Pay advisory resolution. Shareholders who vote against the resolution are encouraged to contact the Board using the contact information provided under the heading “Contacting the Board of Directors” on page 67.

Unless directed otherwise in the form of proxy, the persons named in the accompanying proxy intend to vote FOR the Say on Pay advisory resolution.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-581-1477 or email contactus@kingsdaleadvisors.com.

| 19 |  |

STATEMENT OF EXECUTIVE COMPENSATION

Compensation Governance

Compensation Philosophy and Objectives

New Gold is an intermediate gold producer with a portfolio of assets in Canada, the United States, Mexico and Australia. To achieve its growth strategy, New Gold focuses on:

| · | delivering on operational targets (safety, cost, production, environment and social responsibility); |

| · | maintaining a strong financial position; |

| · | internal growth through project development and continuous improvement of existing operations; and |

| · | external growth through value enhancing merger and acquisition opportunities. |

New Gold’s executive compensation philosophy and objectives are designed to support these areas of focus. The compensation program is designed to provide the flexibility necessary to accommodate the needs of New Gold in the different business conditions in which it operates. The Company’s executive compensation philosophy is to focus on bonuses and long term incentives to reward performance while benchmarking base salaries to the median of market compensation, which means that executive officers should not expect automatic annual salary increases.

The objectives of New Gold’s executive compensation program are:

| · | attracting and retaining talented executives; |

| · | rewarding individual and corporate performance; and |

| · | aligning executive compensation with shareholders’ interests. |

Composition and Role of the Compensation Committee

The Compensation Committee is comprised of Ian Pearce (Chair), James Estey and Kay Priestly, each of whom is an independent director. Collectively, the Compensation Committee members have extensive compensation-related experience in the mining and finance sectors both as senior executives and as members of the boards of directors and committees of other public and private corporations:

| · | Mr. Pearce is the Chair of New Gold. He is also the Chair of Nevsun Resources Ltd. and MineSense Technologies Ltd. and a director of Outotec Oyj. He previously held senior executive positions at Falconbridge Limited and served as Chief Executive Officer of Xstrata Nickel. |

| · | Mr. Estey is the Chairman of Gibson Energy Inc. and of PrairieSky Royalty Ltd. (in addition to serving on the committees responsible for compensation at both companies), and the former Chairman of UBS Securities Canada Inc. |

| · | Ms. Priestly is a director of TechnipFMC plc and has previously held senior executive positions with Rio Tinto plc, Turquoise Hill Resources Ltd. and Arthur Andersen LLP (where she served as Managing Partner, People). |

Each member draws on his or her respective management and governance experience to provide relevant governance and compensation-related expertise to the Company’s executive compensation policies and practices. The Board is confident that the collective experience of the Compensation Committee members ensures that the Committee has the knowledge and experience to execute its mandate effectively and to make executive compensation decisions in the best interests of the Company.

| 20 |  |

The role of the Compensation Committee is to assist the Board in approving and monitoring the Company’s guidelines and practices with respect to compensation and benefits, as well as administering the Company’s equity-based compensation plans. The Compensation Committee’s responsibilities include, among other things:

| • | ensuring that the Company has programs to attract and develop executive officers of the highest calibre; |

| • | reviewing corporate goals and objectives relevant to the compensation of executive officers and making recommendations to the Board regarding such goals and objectives; |

| • | recommending to the Board the annual salary, bonus and other compensation of executive officers based on performance against the goals and objectives approved by the Board; |

| • | reviewing succession plans for the Company’s executive officers and reporting to the Board on succession planning; and |

| • | establishing a clear and concise compensation philosophy for the Company. |

The Compensation Committee is also responsible for developing the annual performance review for the President and Chief Executive Officer and providing its recommendations to the Board. The Board assesses the effectiveness of the President and Chief Executive Officer in attaining New Gold’s corporate objectives, budgets and milestones.

Benchmarking

It is the Company’s intention to provide total direct compensation packages to its executive officers that are competitive with those of its industry peers in order to ensure its executive officers are appropriately rewarded and retained. To assess the competitiveness of New Gold’s executive compensation packages and practices, the Compensation Committee compares the Company to a peer group of similar companies in the gold mining industry.

The 2017 peer group consists of the nine companies listed below (the “Peer Group”). The Peer Group was selected based on the criteria listed below, which are all applicable to each Peer Group company. Kirkland Lake Gold Ltd. and Torex Gold Resources Inc. were added to the Peer Group in 2017 as they fit the selection criteria. Agnico-Eagle Mines Limited and Kinross Gold Corporation were removed as their revenue and/or market capitalization were above the range considered.

| 2017 Peer Group Companies | | | Peer Group Criteria: |

| Alamos Gold Inc. | IAMGold Corporation | ü gold mining company ü comparable market capitalization ü comparable revenue ü head office in Canada |

| B2 Gold Corp. | Kirkland Lake Gold Ltd. |

| Centerra Gold Inc. | Torex Gold Resources Inc. |

| Detour Gold Corporation | Yamana Gold Inc. |

| Eldorado Gold Corporation | |

The Compensation Committee considered Peer Group compensation for comparable roles in reviewing and recommending executive compensation for 2017.

Compensation Consultants

Independent compensation consultants assist New Gold by providing information on the executive compensation packages and practices of both Peer Group companies and the broader market, as well as providing analysis of general trends and practices in executive compensation.

| 21 |  |

In 2017, Mercer LLC (“Mercer”) provided New Gold with market compensation benchmarking data for executive level positions. Logan Human Resources Management Inc. (“Logan HR”) provided analysis of the Peer Group’s executive compensation packages, long-term incentive plans and board of directors’ compensation. Mercer and Logan HR provided similar services in 2016. Fees paid to Mercer and Logan HR for these compensation-related services are set out in the table below. They were each originally retained in 2013.

In addition to the executive compensation assistance described above, Mercer and Logan HR also provided other services to the Company in 2016 and 2017. Mercer provided salary surveys related to mining and general industries for non-executive employees. In 2016, the Company also used Mercer’s compensation localizer tool to generate compensation information for the relocation of certain employees. Logan HR did not provide other services to New Gold in 2017, however, in 2016, Logan HR provided career transition services to various former employees. Fees paid for these other services are set out in the table below.

The provision of these additional services did not require pre-approval of the Board or the Compensation Committee. The fees paid for all services provided by Mercer and Logan HR in 2016 and 2017 are set out in the table below.

| Consultant | Year | Fees for executive and director compensation related services ($) | Fees for all other services ($) |

| Mercer | 2017 | 15,016 | 4,466 |

| 2016 | 15,375 | 11,389 |

| Logan HR | 2017 | 8,971 | - |

| 2016 | 9,746 | 12,693 |

Compensation Risk Management and Mitigation

The Compensation Committee considers the implications and risks of the Company’s executive compensation program as part of making its compensation recommendations to the Board and in carrying out its responsibilities generally. When a significant change in the design of the executive compensation program is contemplated, the Compensation Committee engages independent compensation consultants to review the executive compensation policies and practices and identify areas of potential risk. In particular, the Committee wishes to ensure that executives are not incented to take inappropriate or excessive risks.

The Compensation Committee has not identified any risks in the Company’s existing compensation policies and practices that it believes would be reasonably likely to have a material adverse effect on the Company.

Some of the risk-mitigating features of New Gold’s executive compensation program are set out below:

Balanced Compensation Mix

Executive compensation packages are designed to balance fixed and variable compensation as well as short and long-term incentives. This mix rewards both short and long-term performance, while providing a fixed base compensation through salary, which helps to mitigate the risk of encouraging short-term goals at the expense of long-term sustainability and creating shareholder value.

Board and Compensation Committee Discretion

The year-end compensation review process allows the Compensation Committee and the Board to take into account factors not considered in the Company Scorecard (as defined below) when considering annual performance-based bonuses and long-term incentives. These additional factors may include value-enhancing additional key results and

| 22 |  |

achievements and the share price performance shareholders experienced during the year. Taking such additional factors into account, the Compensation Committee and the Board may adjust awards upwards or downwards to ensure better alignment of executive compensation with Company performance and shareholder returns.

Say on Pay Policy

The Company has adopted a say on pay policy that requires it to have a non-binding advisory vote at each year’s annual meeting to give shareholders an opportunity to provide their views on New Gold’s approach to executive compensation. At the Company’s last annual meeting of shareholders on April 27, 2017, 91.38% of votes cast voted in favor of the Say on Pay advisory resolution and 8.62% voted against.

Anti-Hedging Policy for Directors and Executive Officers

The Company has adopted a formal policy that prohibits executive officers and directors from purchasing financial instruments that are designed to hedge or offset a decrease in the market value of common shares or other securities of the Company held by the executive officer or director.

Executive Compensation Clawback Policy

The Company has adopted an executive compensation clawback policy, which allows the Board to require reimbursement of excess bonus and equity-based compensation paid or granted to the President and Chief Executive Officer or the Chief Financial Officer after adoption of the policy in certain circumstances where the Company is required to restate its financial statements, the executive engaged in fraud or willful misconduct which caused or significantly contributed to the reason for the restatement, and the bonus and equity-based compensation paid to the executive would have been lower had it been based on the restated financial statements.

Share Ownership Guidelines

To better align executive compensation with shareholders’ interests, the Board has approved share ownership guidelines for the President and Chief Executive Officer as well as the Company’s directors (“Share Ownership Guidelines”). The Share Ownership Guidelines require New Gold’s President and Chief Executive Officer to own an amount of common shares, PSUs and RSUs (but not Options) equivalent in value to at least three times his base salary; a requirement that must be met within three years of his appointment. As Mr. Portmann was appointed President on December 19, 2016, he has until December 19, 2019 to comply with the Share Ownership Guidelines. Refer to the section titled “Share Ownership Guidelines for Directors” on page 53 of this Circular for more information about the Share Ownership Guidelines with respect to the Company’s directors. While Mr. Portmann is the only NEO subject to the Share Ownership Guidelines, all the NEOs hold common shares and/or PSUs, which align their interests with those of shareholders. The following table shows the number of common shares and PSUs held by each NEO, as well as the value of those common shares and PSUs as at December 31, 2017.

| Name | Number of

Common Shares

Held | Number of PSU Held(1) | Total Value of

Common Shares and PSUs(2) | Multiple of

Base Salary(3) |

| Hannes Portmann(4) | 113,227 | 399,000 | $1,686,327 | 2.7x |

| Paula Myson | - | 50,000 | $164,607 | 0.4x |

| Lisa Damiani | 22,988 | 281,000 | $1,000,774 | 3.1x |

| Cory Atiyeh | 30,376 | 129,100 | $525,019 | 1.7x |

| Mark Petersen | 45,938 | 172,000 | $717,484 | 2.5x |

| 23 |  |

| (1) | On the Entitlement Date (as defined below) of the PSUs, the cash payment and/or number of shares to be issued in satisfaction of the PSUs will vary from 50% to 150% of the number of PSUs granted, based on the Achieved Performance (as defined below). |

| (2) | Total value of common shares and PSUs is calculated by multiplying the number of common shares or PSUs held by the closing price of New Gold’s common shares on the TSX on December 29, 2017 of C$4.13 and converted at an exchange rate of US$1.00 = C$1.2545, being the average daily rate quoted by the Bank of Canada on December 29, 2017. |

| (3) | Calculated using the base salary stated in the Summary Compensation Table on page 38, except for Ms. Myson where her full year base salary was used rather than the amount actually received for the portion of the year during which Ms. Myson was an officer. See footnote 2 to the Summary Compensation Table on page 38. |

| (4) | Mr. Portmann has until December 19, 2019 to comply with the Share Ownership Guidelines. |

Succession Planning for Executive Officers

The Company has a formal succession planning process for its executive officers. As part of this process, the Compensation Committee conducts an annual review of the succession plan for the Company’s executive officers and reports to the Board on succession planning. The entire Board is responsible for working with the Compensation Committee to evaluate and nominate a potential successor to the position of President and Chief Executive Officer in accordance with the succession plan.

The Compensation Committee most recently reviewed the succession plans for the Company’s executive officers on February 20, 2018. As part of its review process, the committee identified potential successors and evaluated the readiness of such potential successors to assume the relevant position.

Compensation Discussion and Analysis

Named Executive Officers

The five individuals profiled on the following five pages are referred to in this Circular as the named executive officers (“NEOs”). The profile for each NEO includes a description of his or her role and responsibilities at New Gold, as well as details of his or her direct compensation for 2017 and the prior two years. For additional details regarding the compensation paid to NEOs, including how the figures were calculated, refer to the Summary Compensation Table on page 38 of this Circular.

| 24 |  |

| HANNES PORTMANN President and Chief Executive Officer Mr. Portmann has been working with mining companies in a financial capacity since his career began, including acting in advisory roles on merger and acquisition mandates as well as equity and debt offerings at Merrill Lynch prior to joining New Gold. As President and Chief Executive Officer, Mr. Portmann is responsible for leadership and overall management of the Company, including developing and executing on current and long-term objectives, delivering strong results, fostering a high performance culture consistent with New Gold’s values and acting as a key corporate representative in dealing with stakeholders groups. |

| |

Key 2017 Results · Drove significant personnel changes at senior levels of the company, both at Rainy River and corporately, to support successful completion of construction at Rainy River and delivery of strong operational results · Completed fulsome review of corporate strategy with leadership team which was presented to, and supported by, the Board of Directors · Held leadership offsite focused on team building and a recommitment to the company’s five core values · Continued open and effective communication with company stakeholders · Led in a manner consistent with New Gold’s values |

| |

Elements of Direct Compensation · Mr. Portmann’s annual performance-based awards for 2017 were based 80% on corporate performance and 20% on personal performance. · Mr. Portmann’s 2017 bonus and long term incentive award were 82% and 158% of his salary, respectively. |  |

| | |

| Direct Compensation | 2017 | 2016 | 2015 |

| Fixed compensation | | | |

| Salary | $616,048(1) | $302,206 | $258,489 |

| Variable compensation | | | |

| Bonus | $502,079 | $302,206 | $156,660 |

| Long term incentives | | | |

| PSU award | $496,774 | $260,298 | $350,114 |

| Stock Option award | $478,508(1) | $270,463 | $157,407 |

| Total direct compensation | $2,093,409 | $1,135,173 | $922,670 |

| |

| (1) | Mr. Portmann elected to receive C$150,000 of his 2017 salary in Options and was granted 107,913 Options on March 20, 2017. This amount is included in the “Salary” amount in the table above and is not included in the “Stock Option award” amount, which comprises the 456,000 Options granted to Mr. Portmann on December 18, 2017 in respect of 2017 performance. |

| 25 |  |

| Paula Myson Executive Vice President and Chief Financial Officer Ms. Myson has over 25 years of experience in finance, treasury, corporate development, investor relations and risk management in public companies. Ms. Myson is a Chartered Financial Analyst and a Certified Professional in Investor Relations. At New Gold Ms. Myson is responsible for financial reporting, taxation, finance, treasury, metals marketing and financial risk management. Ms. Myson is a key representative with our bank syndicate and bondholders. |

| |

Key 2017 Results · Led restructuring of finance and technology functions · Collaborated with CEO in the review and reduction of corporate costs · Led the Finance group in maintaining a disciplined financial control environment · Led the integration of a new operation into reporting and control environments · Management of overall liquidity |

| |

Elements of Direct Compensation · Ms. Myson’s annual performance-based awards for 2017 were based 70% on corporate performance and 30% on personal performance. · Ms. Myson’s 2017 bonus and long term incentive award were 86% and 126%(1) of her salary, respectively. |  |

| | |

| Direct Compensation | 2017 | 2016 | 2015 |

| Fixed compensation | | | |

| Salary | $120,322 | - | - |

| Variable compensation | | | |

| Bonus | $103,188 | - | - |

| Long term incentives | | | |

| PSU award | $77,808(1) | - | - |

| Stock Option award | $73,455(1) | - | - |

| Total direct compensation | $374,773 | - | - |

| |

| (1) | Ms. Myson’s long term incentive award comprises the 70,000 Options and 26,000 PSUs she was granted on December 18, 2017 in respect of 2017 performance and excludes the 44,117 Options and 24,000 PSUs she was granted on September 14, 2017 in connection with her appointment as Executive Vice President and Chief Financial Officer. |

| 26 |  |

| LISA DAMIANI Vice President, General Counsel and Corporate Secretary Ms. Damiani has over 20 years of experience in corporate and securities law and mergers and acquisitions with a focus on the mining sector and has received extensive recognition in the industry. At New Gold, Ms. Damiani is responsible for the legal and corporate governance functions of the Company, in addition to government relations, including indigenous groups. |

| |

Key 2017 Results · Led the legal group in managing New Gold’s legal risks and potential disputes · Assumed responsibility for government relations portfolio, including indigenous groups, in expanded role · Led negotiation and completion of three additional Participation Agreements with First Nations at Rainy River · Assumed oversight of efforts to obtain Schedule 2 amendment, with amendment promulgated in September 2017 · Key role in the $173 million equity financing, $300 million debt refinancing, $65 million sale of El Morro stream and agreement to sell Peak Mines for $58 million |

| |

Elements of Direct Compensation · Ms. Damiani’s annual performance-based awards for 2017 were based 60% on corporate performance and 40% on personal performance. · Ms. Damiani’s 2017 bonus and long term incentive award were 86% and 140% of her salary, respectively. |  |

| | |

| Direct Compensation | 2017 | 2016 | 2015 |

| Fixed compensation | | | |

| Salary | $327,276 | $294,651 | $297,642 |

| Variable compensation | | | |

| Bonus | $282,612 | $294,651 | $109,658 |

| Long term incentives | | | |

| PSU award | $233,424 | $213,256 | $315,084 |

| Stock Option award | $224,563 | $220,641 | $124,262 |

| Total direct compensation | $1,067,875 | $1,023,199 | $846,646 |

| |

| 27 |  |

| Cory atiyeh Vice President, Operations Mr. Atiyeh has over 30 years of experience in the mining industry. He has been a General Manager of various mines in the United States and Australia, including New Gold’s Mesquite mine, of which he was the General Manager from 2006 to his appointment as Vice President, Operations in 2016. At New Gold, Mr. Atiyeh is responsible for the Company’s operating mines. |

| |

Key 2017 Results · Led site teams to deliver production and cost targets that beat the Company’s guidance · Actively involved in successful completion of construction at Rainy River, including mill commissioning ahead of schedule at Rainy River · Led New Gold’s business improvement program with focus on operational efficiency and cost reduction |

| |

| |

Elements of Direct Compensation · Mr. Atiyeh’s annual performance- based awards for 2017 were based 60% on corporate performance and 40% on personal performance. · Mr. Atiyeh’s 2017 bonus and long term incentive award were 47% and 87% of his salary, respectively. |  |

| Direct Compensation | 2017 | 2015 | 2014 |

| Fixed compensation | | | |

| Salary | $309,400 | $300,000 | $287,000 |

| Variable compensation | | | |

| Bonus | $144,771 | $168,000 | $96,900 |

| Long term incentives | | | |

| PSU award | $137,660 | $75,267 | $137,937 |

| Stock Option award | $132,219 | $77,106 | $68,095 |

| Total direct compensation | $724,050 | $620,373 | $589,932 |

| 28 |  |

| Mark Petersen Vice President, Exploration Mr. Petersen is an economic geologist with over 30 years of experience that includes exploration leadership roles in major, mid-tier and junior mining companies. His track record includes the successful discovery and advancement of several precious and base metals mines for both New Gold as well as previous employers. He is a Certified Professional Geologist with the American Institute of Professional Geologists and a Registered Member of the Society for Mining, Metallurgy and Exploration. At New Gold, Mr. Petersen is responsible for the Company’s exploration function, involving both organic and accretive growth initiatives. |

| |

Key 2017 Results · Led New Gold’s exploration team in the execution of disciplined growth strategy, delivering on the company’s exploration objectives on schedule and under budget · Guided resource and reserve growth at Rainy River, New Afton, Peak Mines and other sites · Principal technical advisor in the agreement to sell Peak Mines for $58 million · Key role formulating priorities and scope to guide leadership’s recommitment to company’s core five values · Secured new exploration property in central BC, Canada adding to company’s longer term growth pipeline |

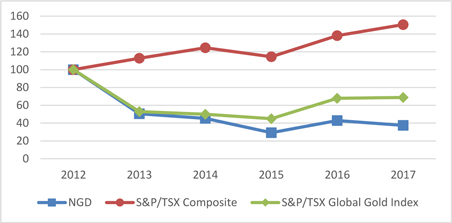

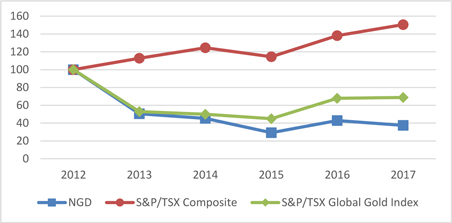

| |