Exhibit 99.2

OPERATING AND FINANCIAL HIGHLIGHTS

OPERATING HIGHLIGHTS

All dollar figures are in United States dollars and tabular dollar amounts are in millions, unless otherwise noted.

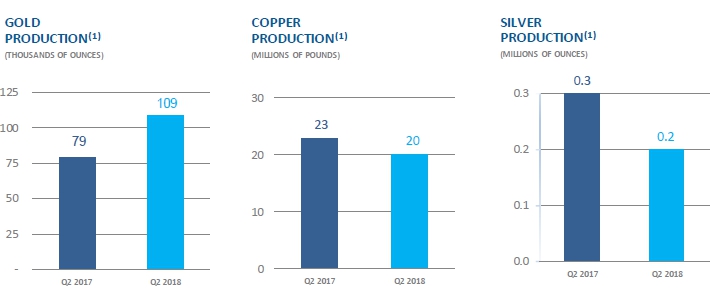

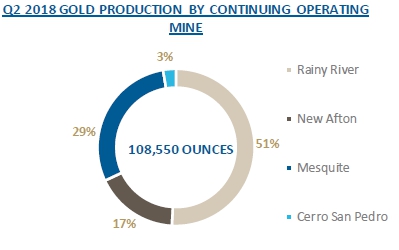

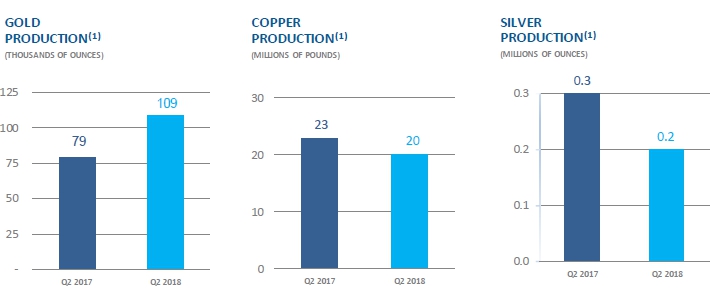

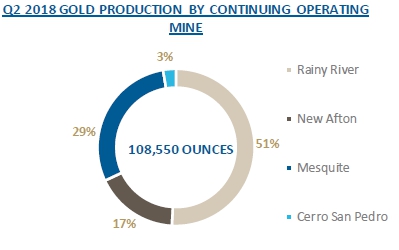

New Gold Inc. (“New Gold” or the “Company”) is an intermediate gold producer with operating mines in Canada, the United States and Mexico, and a development project in Canada. For the three months ended June 30, 2018, the Rainy River Mine in Canada (“Rainy River”), the New Afton Mine in Canada (“New Afton”), the Mesquite Mine in the United States (“Mesquite”), and the Cerro San Pedro Mine in Mexico (“Cerro San Pedro”), which has been is in residual leaching since June 2016, combined to produce 108,550 gold ounces, 20.4 million pounds of copper and 0.2 million silver ounces. The Company completed the sale of the Peak Mines in Australia (��Peak Mines”) in early April 2018. For the six months ended June 30, 2018, the Company’s continuing operating mines combined to produce 205,432 gold ounces, 42.6 million pounds of copper and 0.4 million silver ounces.

| 1. | Amounts presented are on a continuing basis and exclude production from Peak Mines, which was classified as a discontinued operation prior to sale. |

| 1 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

FINANCIAL HIGHLIGHTS

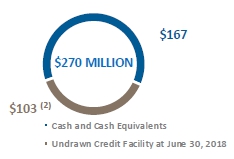

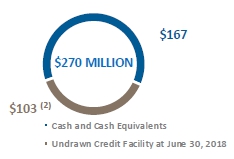

As at June 30, 2018, New Gold has total available liquidity of $270 million, comprised of $167 million in cash and cash equivalents and $103 million available for drawdown under the Company’s $400 million revolving credit facility.  |  |

| | | Three months ended June 30 | Six months ended June 30 |

| | 2018 | 2017 | 2018 | 2017 |

| Operating information | | | | | |

| Gold production from continuing operations (ounces) | | 108,550 | 79,025 | 205,432 | 140,005 |

| Gold production (ounces) | | 108,550 | 105,064 | 230,864 | 194,391 |

| Gold sales from continuing operations (ounces) | | 105,924 | 73,707 | 204,612 | 133,620 |

| Gold sales (ounces) | | 105,924 | 99,235 | 226,087 | 186,538 |

| Gold revenue ($/ounce)(1) | | 1,279 | 1,246 | 1,292 | 1,242 |

| Gold average realized price from continuing operations ($/ounce)(1) | | 1,297 | 1,278 | 1,312 | 1,277 |

| Operating expenses per gold ounce sold from continuing operations ($/ounce)(1) | | 680 | 603 | 725 | 604 |

| All-in sustaining costs per gold ounce sold from continuing operations ($/ounce)(1) | | 877 | 665 | 1,037 | 617 |

| Financial Information | | | | | |

| Revenue | | 195.3 | 143.8 | 388.5 | 268.3 |

| Asset impairment, net of tax | | 282.1 | - | 282.1 | - |

| (Loss) earnings from continuing operations | | (301.6) | 17.8 | (330.7) | 48.8 |

| Net (loss) earnings | | (302.0) | 23.1 | (331.5) | 60.7 |

| Adjusted net (loss) earnings from continuing operations(1) | | (1.8) | 8.9 | (17.9) | 10.2 |

| Operating cash flows generated from continuing operations | | 66.0 | 56.3 | 116.2 | 113.6 |

| Operating cash flows generated from continuing operations before changes in non-cash operating working capital(1) | | 88.1 | 56.5 | 155.5 | 105.8 |

| Cash and cash equivalents | | 167.4 | 198.8 | 167.4 | 198.8 |

| Total capital expenditures (sustaining) from continuing operations(1) | | 36.5 | 16.2 | 92.5 | 25.3 |

| Total capital expenditures (growth) from continuing operations(1) | | 13.6 | 163.4 | 26.3 | 292.7 |

| Share Data | | | | | |

| (Loss) earnings per share from continuing operations ($) | | (0.52) | 0.03 | (0.57) | 0.09 |

| (Loss) earnings per basic share ($) | | (0.52) | 0.04 | (0.57) | 0.11 |

| Adjusted net (loss) earnings per basic share from continuing operations(1)($) | | (0.00) | 0.02 | (0.03) | 0.02 |

| | | | | | |

| 1. | The Company uses certain non-GAAP financial performance measures throughout this MD&A. For a detailed description of each of the non-GAAP measures used in this MD&A and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 2. | Of the $400 million credit facility, $180 million has been drawn and $117 million has been utilized for letters of credit, both as at June 30, 2018. |

| 2 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

Contents

| OPERATING HIGHLIGHTS | 1 |

| FINANCIAL HIGHLIGHTS | 2 |

| OUR BUSINESS | 4 |

| OPERATING AND FINANCIAL HIGHLIGHTS | 5 |

| CORPORATE DEVELOPMENTS | 10 |

| CORPORATE SOCIAL RESPONSIBILITY | 10 |

| OUTLOOK FOR 2018 | 12 |

| KEY PERFORMANCE DRIVERS | 13 |

| FINANCIAL RESULTS | 16 |

| REVIEW OF OPERATING MINES | 23 |

| DISCONTINUED OPERATIONS | 33 |

| DEVELOPMENT AND EXPLORATION REVIEW | 34 |

| FINANCIAL CONDITION REVIEW | 36 |

| NON-GAAP FINANCIAL PERFORMANCE MEASURES | 42 |

| ENTERPRISE RISK MANAGEMENT AND RISK FACTORS | 63 |

| CRITICAL JUDGMENTS AND ESTIMATION UNCERTAINTIES | 65 |

| ACCOUNTING POLICIES | 65 |

| CONTROLS AND PROCEDURES | 67 |

| CAUTIONARY NOTES | 68 |

| 3 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

MANAGEMENT’S DISCUSSION AND ANALYSIS

For the three months ended June 30, 2018

The following Management’s Discussion and Analysis (“MD&A”) provides information that management believes is relevant to an assessment and understanding of the consolidated financial condition and results of operations of New Gold Inc. and its subsidiaries (“New Gold” or the “Company”). This MD&A should be read in conjunction with New Gold’s unaudited condensed consolidated interim financial statements for the six months ended June 30, 2018 and 2017 and related notes, which are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). This MD&A contains forward-looking statements that are subject to risks and uncertainties, as discussed in the cautionary note contained in this MD&A. The reader is cautioned not to place undue reliance on forward-looking statements. All dollar figures are inUnited States dollars and tabular dollar amounts are in millions, unless otherwise noted. This MD&A has been prepared as at July 25, 2018. Additional information relating to the Company, including the Company’s Annual Information Form, is available on SEDAR at www.sedar.com.

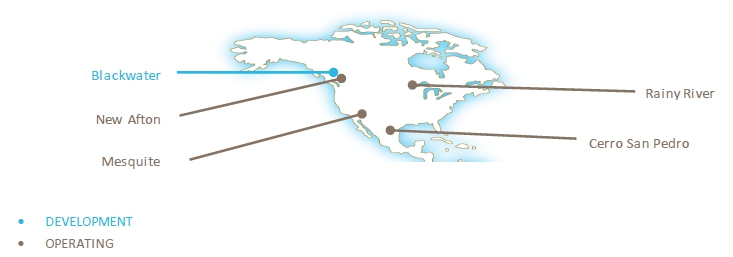

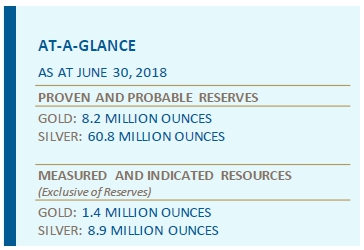

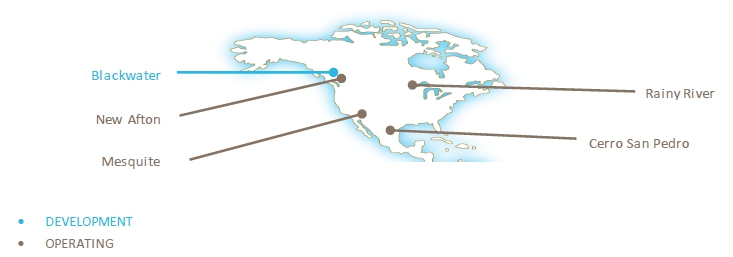

OUR BUSINESS

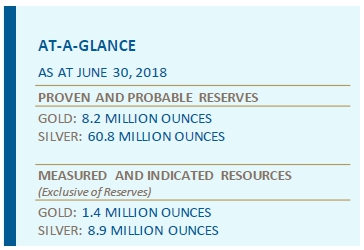

New Gold is an intermediate gold producer with operating mines in Canada and the United States and a development project in Canada. The Company’s operating properties consist of the Rainy River gold mine in Canada (“Rainy River”), New Afton gold-copper mine in Canada (“New Afton”) and the Mesquite gold mine in the United States (“Mesquite”). The Company’s Cerro San Pedro gold-silver mine in Mexico (“Cerro San Pedro”) has been in residual leaching since June 2016. The Peak Mines gold-copper mine in Australia (“Peak Mines”) was sold in early April 2018. New Gold’s development project is its 100%-owned Blackwater gold-silver project (“Blackwater”), located in Canada.

New Gold’s operating portfolio is diverse in the range of commodities it produces. The assets produce gold, with copper and silver by-products. The Company believes it has a solid platform to continue to execute its growth strategy, both organically and through value-enhancing transactions, to further establish itself as an industry-leading intermediate gold producer.

| 4 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

OPERATING AND FINANCIAL HIGHLIGHTS

OPERATING HIGHLIGHTS

| | Three months ended June 30 | Six months ended June 30 |

| | 2018 | 2017 | 2018 | 2017 |

| Operating information | | | | |

| Gold (ounces): | | | | |

| Produced from continuing operations(1) | 108,550 | 79,025 | 205,432 | 140,005 |

| Produced(1) | 108,550 | 105,064 | 230,864 | 194,391 |

| Sold from continuing operations(1) | 105,924 | 73,707 | 204,612 | 133,620 |

| Sold(1) | 105,924 | 99,235 | 226,087 | 186,538 |

| Copper (millions of pounds): | | | | |

| Produced from continuing operations(1) | 20.4 | 22.2 | 42.6 | 43.3 |

| Produced(1) | 20.4 | 26.4 | 47.0 | 50.3 |

| Sold from continuing operations(1) | 19.6 | 20.8 | 40.9 | 40.7 |

| Sold(1) | 19.6 | 24.1 | 45.6 | 47.1 |

| Silver (millions of ounces): | | | | |

| Produced from continuing operations(1) | 0.2 | 0.3 | 0.4 | 0.5 |

| Produced(1) | 0.2 | 0.3 | 0.4 | 0.6 |

| Sold from continuing operations(1) | 0.2 | 0.2 | 0.4 | 0.4 |

| Sold(1) | 0.2 | 0.3 | 0.4 | 0.5 |

| Revenue from continuing operations(1) | | | | |

| Gold ($/ounce) | 1,279 | 1,246 | 1,292 | 1,242 |

| Copper ($/pound) | 2.91 | 2.32 | 2.89 | 2.33 |

| Silver ($/ounce) | 15.89 | 16.72 | 16.00 | 16.90 |

| Average realized price from continuing operations(1) (2) | | | | |

| Gold ($/ounce) | 1,297 | 1,278 | 1,312 | 1,277 |

| Copper ($/pound) | 3.18 | 2.56 | 3.16 | 2.56 |

| Silver ($/ounce) | 16.49 | 17.22 | 16.56 | 17.37 |

| Operating expenses per gold ounce sold from continuing operations ($/ounce)(3) | 680 | 603 | 725 | 604 |

| Operating expenses per copper pound sold from continuing operations ($/pound)(3) | 1.67 | 1.21 | 1.75 | 1.21 |

| Operating expenses per silver ounce sold from continuing operations ($/ounce)(3) | 8.64 | 8.10 | 9.15 | 8.22 |

| Total cash costs per gold ounce sold from continuing operations ($/ounce) (2)(4) | 453 | 289 | 502 | 265 |

| All-in sustaining costs per gold ounce sold from continuing operations ($/ounce) (2)(4) | 877 | 665 | 1,037 | 617 |

Total cash costs per gold ounce sold from continuing operations on a co-product basis ($/ounce)(2)(4) | 696 | 632 | 744 | 637 |

All-in sustaining costs per gold ounce sold from continuing operations on a co-product basis ($/ounce)(2)(4) | 984 | 866 | 1,099 | 849 |

| 1. | Production is shown on a total contained basis while sales are shown on a net payable basis, including final product inventory and smelter payable adjustments,

where applicable. |

| 2. | The Company uses certain non-GAAP financial performance measures throughout this MD&A. Average realized price, total cash costs and all-in sustaining costs per gold ounce sold and total cash costs and all-in sustaining costs on a co-product basis are non-GAAP financial performance measures with no standard meaning under IFRS. For further information and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 3. | Operating expenses are apportioned to each metal produced on a percentage of revenue basis. |

| 4. | The calculation of total cash costs and all-in sustaining costs per gold ounce sold is net of by-product silver and copper revenue. Total cash costs and all-in sustaining costs on a co-product basis remove the impact of other metal sales that are produced as a by-product of the Company’s gold production and apportions the cash costs to each metal produced on a percentage of revenue basis. If silver and copper revenue were treated as co-products, co-product total cash costs for the three months ended June 30, 2018 from continuing operations would be $9.22 per silver ounce sold (2017 - $8.58) and $1.93 per copper pound sold (2017 - $1.44) and co-product all-in sustaining costs for the three months ended June 30, 2018 would be $12.88 per silver ounce sold (2017 - $11.73) and $2.63 per copper pound sold (2017 - $1.91).Co-product total cash costs for the six months ended June 30, 2018 would be $9.69 per silver ounce sold (2017 - $8.65) and $2.01 per copper pound sold (2017 - $1.44) and co-product all-in sustaining costs for the six months ended June 30, 2018 would be $14.18 per silver ounce sold (2017 - $11.53) and $2.87 per copper pound sold (2017 - $1.87). |

| 5 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

The Company completed the sale of Peak Mines in early April 2018, as a result Peak Mines has been classified as a discontinued operation. Operating highlights are disclosed on a continuing operations basis.

Gold production from continuing operations of 108,550 ounces for the three months ended June 30, 2018 increased by 37% compared to the 79,025 ounces in the prior-year period. Gold production for the six months ended June 30, 2018 was also higher than the prior-year period. Higher production was due to the startup of Rainy River, partially offset by planned lower production at Cerro San Pedro, Mesquite, and New Afton.

Gold sales from continuing operations were 105,924 ounces for the three months ended June 30, 2018, compared to 73,707 ounces in the prior-year period. Higher sales were attributable to the higher production due to the startup of Rainy River. Timing of sales resulted in a difference between ounces sold and ounces produced. Gold sales were 204,612 for the six months ended June 30, 2018, compared to 133,620 in the prior-year period.

Copper production from continuing operations for the three months ended June 30, 2018 decreased to 20.4 million pounds compared to the prior-year period due to planned lower copper production in the period.Copper production for the six months ended June 30, 2018 was 42.6 million pounds, compared to 43.3 million pounds in the prior-year period.

Copper sales from continuing operations were 19.6 million pounds for the three months ended June 30, 2018, compared to 20.8 million pounds in the prior-year period.Lower copper sales were attributable to the decrease in production compared to the prior-year period. Copper sales for the six months ended June 30, 2018 were 40.9 million pounds, compared to 40.7 million pounds in the prior-year period.

Operating expenses from continuing operations per gold ounce for the three and six months ended June 30, 2018 were $680 and $725, respectively. This compared to $603 and $604 for the prior-year three and six month periods.The increase was mainly due to higheroperating expenses at Rainy River in its second full quarter of operation due to start-up challenges impacting both production and costs.

Total cash costs per gold ounce sold from continuing operations, net of by-product sales, were $453 per ounce for the three months ended June 30, 2018 compared to $289 per ounce in the prior-year period. The increase in total cash costs was primarily driven by the higher operating expenses, coupled with lower than run-rate production at Rainy River, resulting in higher per ounce costs.

Total cash costs per gold ounce sold, net of by-product sales, were $502 per ounce for the six months ended June 30, 2018, an increase compared to $265 per ounce in the prior-year period, drivenby the higher operating expenses, coupled with lower than run-rate production at Rainy River, resulting in higher per ounce costs.

All-in sustaining costs per gold ounce sold from continuing operations were $877 for the three months ended June 30, 2018, compared to $665 in the prior-year period. The increase in all-in sustaining costs relative to the prior-year quarter was attributable to the combined impact of a $164 per ounce increase in total cash costs and a $48 per ounce, or $17 million, increase in the Company’s consolidated sustaining costs, which include New Gold’s cumulative sustaining capital, exploration, general and administrative, and amortization of reclamation expenditures. The increase in consolidated total cash costs was primarily driven by the lower than run-rate quarterly production at Rainy River, resulting in higher per ounce costs. The increase in consolidated sustaining costs was primarily related to Rainy River sustaining capital expenditures as the operation continues its first full year of operations.

All-in sustaining costs per gold ounce sold from continuing operations were $1,037 for the six months ended June 30, 2018, compared to $617 in the prior-year period. The increase in all-in sustaining costs relative to the prior-year period was driven by the increase in total cash costs noted above and higher sustaining capital expenditures at Rainy River as the operation continues its start-up year.

| 6 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

Due to the variability during the Rainy River process facility’s start up performance and lower gold grade and recoveries, the Company is lowering its 2018 annual production guidance for Rainy River from earlier estimates. Annual consolidated gold production for 2018 is expected to be between 415,000 and 480,000 ounces, with Rainy River contributing between 210,000 and 250,000 ounces. Annual consolidated copper production remains in line with the original guidance range of 75 to 85 million pounds. A detailed discussion on the updated 2018 guidance is included in the “Outlook 2018” section of this MD&A.

The Company has completed an updated Rainy River life-of-mine plan (“LOM”) and will release an updated National Instrument (“NI”) 43-101 Technical Report for Rainy River in early August. The updated LOM contains updated per unit costs, changes to the sequencing in gold production and a less than 3% reduction in gold production over the LOM. The updated LOM incorporates changes to open pit design and extraction sequencing, resulting in higher ore tonnes mined and processed at a lower average gold grade. As outlined in the “Financial Results” section of this MD&A the Company has recorded an after-tax impairment charge of $282.1 million relating to Rainy River. For a detailed review of the Company’s operating mines, refer to the “Review of Operating Mines” sections of this MD&A.

FINANCIAL HIGHLIGHTS

| | Three months ended June 30 | Six months ended June 30 |

| (in millions of U.S. dollars, except where noted) | 2018 | 2017 | 2018 | 2017 |

| FINANCIAL INFORMATION | | | | |

| Revenue | 195.3 | 143.8 | 388.5 | 268.3 |

| Operating margin(1) | 89.4 | 72.5 | 165.3 | 134.6 |

| Revenue less cost of goods sold | 12.3 | 19.4 | 20.0 | 35.6 |

| Asset impairment, net of tax | 282.1 | - | 282.1 | - |

| (Loss) earnings from continuing operations | (301.6) | 17.8 | (330.7) | 48.8 |

| Net (loss) earnings | (302.0) | 23.1 | (331.5) | 60.7 |

| Adjusted net (loss) earnings from continuing operations(1) | (1.8) | 8.9 | (17.9) | 10.2 |

| Operating cash flows generated from continuing operations | 66.0 | 56.3 | 116.2 | 113.6 |

| Operating cash flows generated from continuing operations before changes in non-cash operating working capital(1) | 88.1 | 56.5 | 155.5 | 105.8 |

| Capital expenditures (sustaining capital) from continuing operations(1) | 36.5 | 16.2 | 92.5 | 25.2 |

| Capital expenditures (growth capital) from continuing operations(1) | 13.6 | 163.4 | 26.3 | 292.7 |

| Total assets | 3,517.1 | 4,143.4 | 3,517.1 | 4,143.4 |

| Cash and cash equivalents | 167.4 | 198.8 | 167.4 | 198.8 |

| Long-term debt | 959.1 | 880.1 | 959.1 | 880.1 |

| | | | | |

| Share Data | | | | |

| (Loss) earnings share from continuing operations(2): | | | | |

| Basic ($) | (0.52) | 0.03 | (0.57) | 0.09 |

| Diluted ($) | (0.52) | 0.03 | (0.57) | 0.09 |

| (Loss) earnings per share: | | | | |

| Basic ($) | (0.52) | 0.04 | (0.57) | 0.11 |

| Diluted ($) | (0.52) | 0.04 | (0.57) | 0.11 |

| Adjusted net earnings (loss) per basic share ($)(1) | (0.00) | 0.02 | (0.03) | 0.02 |

| Share price as at June 30 (TSX – Canadian dollars) | 2.74 | 4.12 | 2.74 | 4.12 |

| Weighted average outstanding shares (basic) (millions) | 578.7 | 575.8 | 578.7 | 552.1 |

| | | | | | | |

| 1. | The Company uses certain non-GAAP financial performance measures throughout this MD&A. Operating margin, adjusted net loss (earnings), adjusted net loss (earnings) per basic share, capital expenditures (sustaining and growth) and operating cash flows generated from continuing operations before changes in non-cash operating working capital are non-GAAP financial performance measures with no standard meaning under IFRS. For further information and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 7 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

Revenue was $195.3 million for the three months ended June 30, 2018, compared to $143.8 million in the prior-year period.Revenue benefitted fromhigher gold sale volumes and prices. Relative to the prior-year period, gold sales increased by 44%, which were attributable to the production from Rainy River, and the average realized gold price increased by $19 per ounce, or 1%.

Revenue was $388.5 million for the six months ended June 30, 2018, compared to $268.3 million in the prior-year period.Relative to the prior-year period, gold sales increased by 53%, and the average realized gold price increased by $35 per ounce, or 3% as a result of bothhigher metal prices and higher gold sales volumes.

Revenue less cost of goods sold for the three months ended June 30, 2018 was $12.3 million compared to $19.4 million in the prior-year period.Revenue less cost of goods sold was$20.0million for the six months ended June 30, 2018, compared to $35.6million in the prior-year period. The decrease wasdriven by higher depreciation and depletion due to the addition of production from Rainy River, which was only partially offset by the increase in operating margin.

For the three months ended June 30, 2018 the loss from continuing operations was $301.6 million, compared to a gain of $17.8 million in the prior-year period. The loss from continuing operations included a net impact of an after-tax impairment charge of $282.1 million relating to Rainy River, a $8.1 million pre-tax foreign exchange loss, finance costs of $18.0 million, a $2.3 million expense relating to severance and other termination benefits and, a $6.3 million gain on the revaluation of the gold stream obligation. The prior-year period included a $17.6 million pre-tax foreign exchange gain, a $2.3 million loss on the revaluation of the Company’s gold option contracts and, a pre-tax loss of $2.0 million on the revaluation of the gold stream obligation. The net loss was $0.4 million higher than the loss from continuing operations due to due to settlement of the closing adjustment on the sale of Peak Mines.

For the six months ended June 30, 2018, the loss from continuing operations was $330.7 million, compared to a gain of $48.8 million in the prior-year period. The net loss includes the net impact of an after-tax impairment charge in the current year of $282.1 million relating to Rainy River, a $28.0 million pre-tax foreign exchange loss, finance costs of $34.7 million, a $2.3 million expense relating to severance and other termination benefits, a $9.6 million gain on the revaluation of the gold stream obligation and a $6.4 million gain on the revaluation of copper price option contracts. The prior-year period included a $22.0 million pre-tax foreign exchange gain, a $12.9 million loss on the revaluation of the Company’s gold option contracts and, a pre-tax loss of $5.0 million on the revaluation of the gold stream obligation. The net loss was $0.8 million higher than the loss from continuing operations due to settlement of the closing adjustment on the sale of Peak Mines.

Adjusted net loss from continuing operations for the three months ended June 30, 2018 was $1.8 million, or $0.00 per basic share, compared to adjusted net earnings of $8.9 million or $0.02 per basic share in the prior-year period.Adjusted net loss from continuing operations were primarily impacted by an increase in depreciation and depletion expenses of $24.0 million, an increase in finance costs less finance income of $16.9 million, as the Company ceased capitalization of interest to its qualifying development property due to the commencement of commercial production at Rainy River, which were partially offset by an increase in operating margin of $16.9 million, a decrease of $4.0 million in exploration and business development, and corporate general and administrative expenses and increase in income tax recovery of $9.0 million when compared to the prior-year period.

| 8 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

Adjusted net loss for the six months ended June 30, 2018 was $17.9 million or $0.03 per basic share, compared to an adjusted net earnings of $10.2 million or $0.02 per basic share in the prior-year period. Adjusted net loss from continuing operations was primarily impacted by an increase in depreciation and depletion expenses of $46.3 million, an increase in finance costs less finance income of $31.9 million, as the Company ceased capitalization of interest to its qualifying development property due to the commencement of commercial production at Rainy River, which were partially offset by an increase in operating margin of $30.7 million, a decrease of $7.0 million in exploration and business development, and corporate general and administrative expenses and increase in income tax recovery of $12.4 million when compared to the prior-year period.

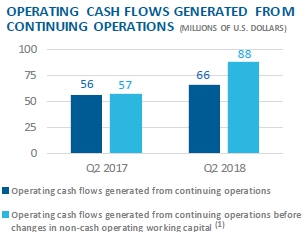

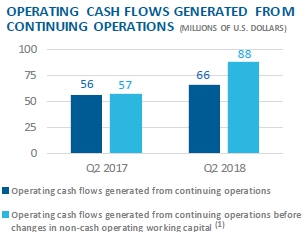

Operating cash flows generated from continuing operations for the three months ended June 30, 2018 were $66.0 million, compared with $56.3 million in the prior-year period. Operating cash flows generated from continuing operations before changes in non-cash working capital for the three months ended June 30, 2018 were $88.1 million compared with $56.5 million in the prior-year period. The increase was due to an increase in operating margin and an income tax refund received at Mesquite. Operating cash flows generated from continuing operations for the three months ended June 30, 2018 were higher than the prior-year period, due to the increase in operating margin, partially offset by the increase in stockpile inventory at Rainy River.

Operating cash flows generated from continuing operations for the six months ended June 30, 2018 were $116.2 million, compared with $113.6 million in the prior-year period. Operating cash flows generated from continuing operations before changes in non-cash working capital for the six months ended June 30, 2018 were $155.5 million compared with $105.8 million in the prior-year period. The increase was due to an increase in operating margin, decrease in exploration and business development, corporate general and administrative expenses, and an income tax refund received at Mesquite. Operating cash flows generated from continuing operations for the six months ended June 30, 2018 were consistent with the prior-year period, as the increase in operating margin was offset by the increase in stockpile inventory at Rainy River and the prior-year period including an outstanding concentrate receivable of $21 million at New Afton.

For further information on the Company’s liquidity and cash flow position, please refer to the “Liquidity and Cash Flow” section of this MD&A. For further information on the Company’s financial results, please refer to the “Financial Results” section of this MD&A.

| 9 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

CORPORATE DEVELOPMENTS

New Gold’s strategy involves strong operational execution at its current assets and disciplined growth through both organic initiatives and value-enhancing transactions. Since the middle of 2009, New Gold has focused on enhancing the value of its portfolio of assets, while also continually looking for compelling external growth opportunities. New Gold’s objective is to pursue corporate development initiatives that will maximize long-term shareholder value.

In early April 2018, the Company completed the sale of Peak Mines located in New South Wales, Australia. The sale of Peak Mines further enables the Company to focus on its Americas-centric portfolio of operating mines and development projects.

CORPORATE SOCIAL RESPONSIBILITY

| | | CORPORATE SOCIAL RESPONSIBILITY HIGHlights for Q2 2018 • New Afton received a Canadian Industry Partnership for Energy Conservation (“CIPEC”) Leadership Award. • New Afton obtained a Mines Act permit amendment for rockfill construction at the Tailings Storage Facility. • The 2018 educational support program was carried out in the main schools of the Cerro de San Pedro municipality, a total of 70 students were assisted. • Mesquite was recertified in full compliance with the International Cyanide Management Code. |

New Gold is committed to excellence in corporate social responsibility. The Company considers its ability to make a lasting and positive contribution toward sustainable development a key driver to achieving a productive and profitable business. New Gold aims to achieve this objective through the protection of the health and well-being of its people and host communities as well as employing industry-leading practices in the areas of environmental stewardship and community engagement and development.

As a participant of the United Nations Global Compact, New Gold’s policies and practices are guided by its principles with regard to human rights, labour, environmental stewardship and anti-corruption. As a member of the Mining Association of Canada (“MAC”), all New Gold’s operations adopt the MAC’s Towards Sustainable Mining protocols.

New Gold is committed to protect the welfare of its employees and contractors through safety-first work practices, to upholding fair employment practices and encouraging a diverse workforce, where people are treated with respect and are supported to realize their full potential. The Company strives to create a culture of inclusiveness and tolerance that begins at the top and is reflected in its hiring, promotion and overall human resources practices. In each of its host communities, the Company strives to be an employer of choice through the provision of competitive wages and benefits, and through the implementation of policies of recognizing and rewarding employee performance and promoting from within wherever possible.

The Company is committed to preserving the long-term health and viability of the natural environments that host its operations. Wherever New Gold operates – in all stages of mining activity, from early exploration and planning, to commercial mining operations through to eventual closure – the Company is committed to excellence in environmental management. From the earliest site investigations, New Gold carries out comprehensive environmental studies to establish baseline measurements for flora, fauna, earth, air and water. During operations, the Company promotes the efficient use of raw materials and resources and works to minimize environmental impacts and maintain robust monitoring programs. After mining activities are complete, New Gold’s objective is to restore the land to a sustainable end use.

| 10 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

The New Gold environmental management standards are based on internationally recognized standards. The standards serve to guide site-level management systems to ensure that site operations identify and appropriately manage their environmental aspects, adopt a consistent approach to identifying and controlling environmental risks, report progress through audits and assessments, and adopt a high level of environmental stewardship. All sites are expected to have an annual external audit, peer audit or self-assessment based on our audit schedule.

As part of the implementation process, each operation has also compiled a register of significant environmental risks. This register contains the main environmental risks for each operation and allows corporate representatives to test the adequacy and effectiveness of controls as well as emergency preparedness and mitigation measures associated with these greatest potential risks.

On July 24, 2017, New Gold was charged with two breaches of the Lakes and Rivers Improvement Act (Ontario) in connection with water overtopping a dam on the Rainy River construction site prior to completion of construction of the dam. On July 11, 2018, New Gold pleaded guilty to one charge and was sentenced to a fine of C$100,000 (plus a mandatory surcharge of 25%); the other charge was withdrawn.

New Gold is committed to establishing relationships based on mutual benefit and active participation with its host communities to contribute to healthy and sustainable communities. Wherever the Company’s operations interact with Indigenous peoples, New Gold promotes understanding of, and respect for traditional values, customs and culture and takes meaningful action to consider their interests through collaborative agreements aimed at creating jobs, training and other lasting socio-economic benefits.

The New Gold community engagement and development standards provide guidance to our sites to identify our communities of interest, and effectively engage and sustain dialogue, and to find opportunities to contribute to long-term development within our host communities. They also drive us to monitor and continually improve our processes and performance. The standards are based on several internationally recognized principles and values. At each site, the standards are being progressively implemented to guide site-level management systems to ensure that site operations appropriately identify and engage with local communities of interest, respect human rights, identify opportunities for sustainable community investments, and make commercially reasonable efforts to maximize local hiring and contracting.

Our standards also guide our operations to adopt a consistent approach to identifying and controlling social risks and to report progress through audits and assessments. All sites are expected to have an annual external audit, peer audit or self-assessment based on an audit schedule.

| 11 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

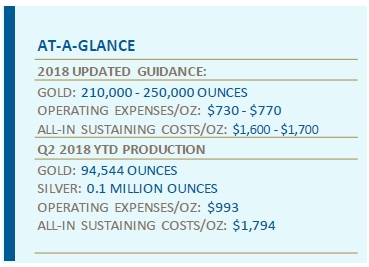

OUTLOOK FOR 2018

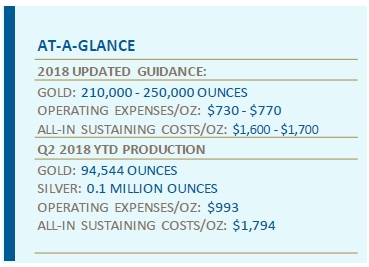

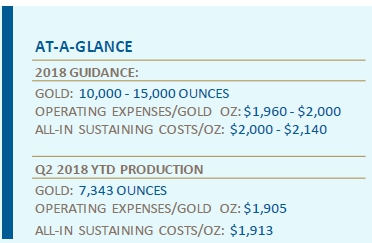

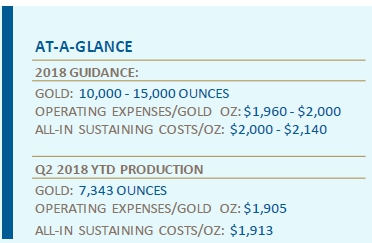

New Gold has provided an updated 2018 outlook as Rainy River is well into its start-up year. Gold production at New Afton, the Company’s largest cash flow contributor, Mesquite and Cerro San Pedro remain in line with New Gold’s original guidance. However, largely due to the variability in the process facility’s start up performance and lower gold grade and recoveries, the Company is lowering its 2018 annual production guidance for Rainy River from earlier estimates.

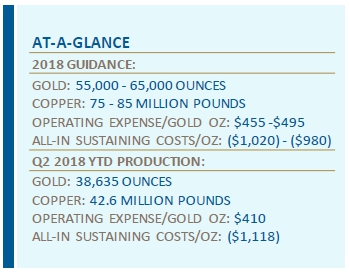

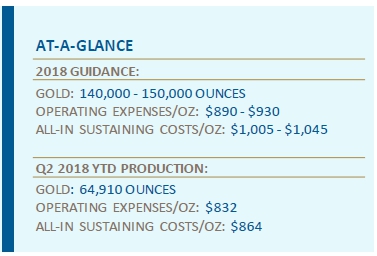

Annual consolidated gold production for 2018 is expected to be between 415,000 and 480,000 ounces, with Rainy River contributing between 210,000 and 250,000 ounces. Annual consolidated copper production remains in line with the original guidance range of 75 to 85 million pounds.

New Gold expects its consolidated 2018 all-in sustaining costs to be between $1,080 to $1,120 per ounce and its total cash costs to be between $445 to $485 ounce, and operating expense to be between $655 to $695 per gold ounce. These estimates have increased due to Rainy River’s revised 2018 production outlook and a $15 million increase in Rainy River’s sustaining capital expenditures associated with completing the full tailings dam footprint. Growth capital at Rainy River is also expected to increase by $15 million due to higher underground development costs. For the balance of the year, the cost targets include assumptions for gold, silver and copper prices of $1,300 per ounce, $16.00 per ounce and $3.00 per pound and a Canadian dollar exchange rate of $1.30 to the U.S. dollar.

| Gold Production (Koz) | Q2’2018 | YTD’2018 | Original Guidance | Revised Guidance |

| Rainy River | 55 | 95 | 310 - 350 | 210 - 250 |

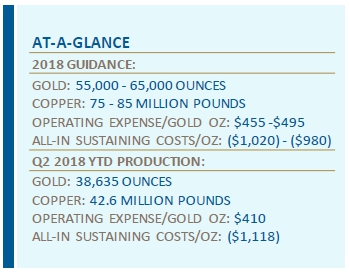

| New Afton | 19 | 39 | 55 - 65 | No change |

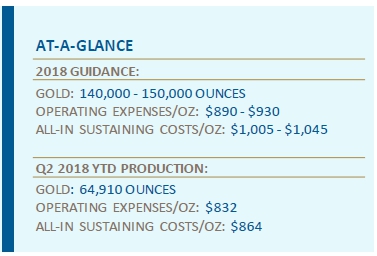

| Mesquite | 32 | 65 | 140 - 150 | No change |

| Cerro San Pedro | 3 | 7 | 20 - 30 | 10 - 15 |

| Consolidated | 109 | 205 | 525 - 595 | 415 - 480 |

| Gold Operating Expense ($/oz) | Q2’2018 | YTD’2018 | Original Guidance | Revised Guidance |

| Rainy River | $802 | $993 | $430 - $470 | $730 - $770 |

| New Afton | $412 | $410 | $455 - $495 | No change |

| Mesquite | $848 | $832 | $890 - $930 | No change |

| Cerro San Pedro | $2,425 | $1,905 | $1,255 - $1,295 | $1,960 - $2,000 |

| Consolidated | $680 | $725 | $555 - $595 | $655 - $695 |

| All-in Sustaining Costs ($/oz) | Q2’2018 | YTD’2018 | Original Guidance | Revised Guidance |

| Rainy River | $1,295 | $1,794 | $990-$1,090 | $1,600 - $1,700 |

| New Afton | ($917) | ($1,118) | ($1,020)-($980) | No change |

| Mesquite | $875 | $864 | $1,005-1,045 | No change |

| Cerro San Pedro | $2,522 | $2,020 | $1,330-$1,370 | $2,000 - $2,140 |

| Consolidated | $877 | $1,037 | $860-$900 | $1,080 - $1,120 |

| 1. | Consolidated silver production is estimated to be approximately 0.7 million ounces in 2018. |

| 2. | Operating expenses are apportioned to each metal produced on a percentage of revenue basis. |

| 3. | Net of by-product silver and copper revenues.

|

| 12 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

KEY PERFORMANCE DRIVERS

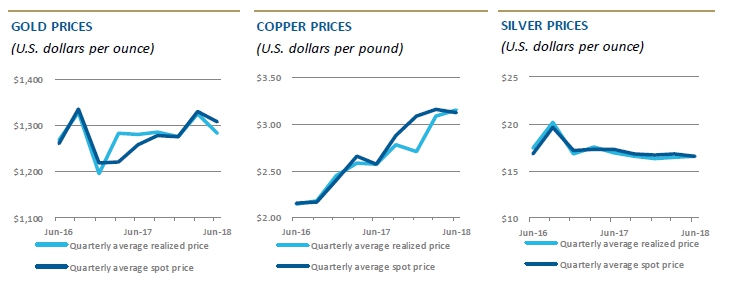

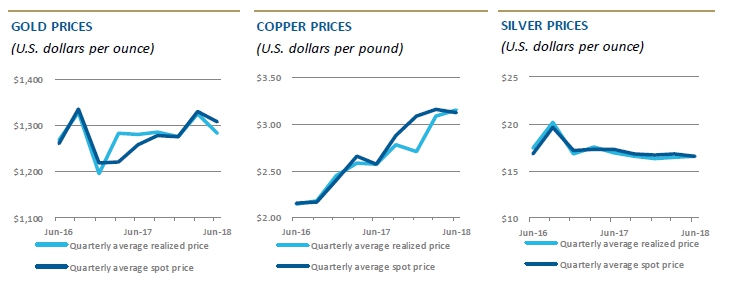

There is a range of key performance drivers that are critical to the successful implementation of New Gold’s strategy and the achievement of its goals. The key internal drivers are production volumes and costs. The key external drivers are market prices of gold, copper and silver, as well as foreign exchange rates.

Production Volumes and Costs

New Gold’s portfolio of continuing operating mines produced 108,550 gold ounces for the three months ended June 30, 2018 and 205,432 gold ounces for the six months ended June 30, 2018.

Operating expenses per gold ounce sold from continuing operations for the three months ended June 30, 2018 were $680, compared to $603 in the prior-year period. Operating expenses per copper pound sold from continuing operations for the three months ended June 30, 2018 were $1.67, compared to $1.21 in the prior-year period. Operating expenses per silver ounce sold from continuing operations for the three months ended June 30, 2018 were $8.64 compared to $8.10 in the prior-year period.

For the three months ended June 30, 2018, total cash costs and all-in sustaining costs from continuing operations, net of by-product sales, were $453 and $877 per gold ounce sold, respectively. In the prior-year period, total cash costs and all-in sustaining costs were $289 and $665 per gold ounce sold, respectively.

For the six months ended June 30, 2018 total cash costs and all-in sustaining costs, net of by-product sales, were $744 and $1,099 per gold ounce sold, respectively. Compared to $637 total cash costs and $867 all-in sustaining costs in the prior-year periods.

For an analysis of the impact of production volumes and costs for the three months ended June 30, 2018 relative to prior-year periods, refer to the “Operating Highlights” section of this MD&A.

Commodity Prices

| 13 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

Gold prices

The price of gold is the single largest factor affecting New Gold’s profitability and operating cash flows. As such, the current and future financial performance of the Company is expected to be closely related to the prevailing price of gold.

For the three months ended June 30, 2018, New Gold’s gold revenue per ounce and average realized gold price per ounce were $1,279 and $1,297, respectively, compared to the London bullion market (“LBMA”) p.m. average gold price of $1,306 per ounce. For the six months ended June 30, 2018, New Gold’s gold revenue per ounce and average realized gold price per ounce were $1,292 and $1,312, respectively, compared to the LBMA p.m. average gold price $1,318 per ounce.

Copper prices

In October 2017, New Gold entered into copper price option contracts covering approximately 60 million pounds of its 2018 production, with put options at a strike price of $3.00 per pound and call options at a strike price of $3.37 per pound, at a nominal cost to the Company. Call options sold and put options purchased are treated as derivative financial instruments and mark-to-market at each reporting period on the consolidated statement of financial position with changes in fair value recognized in other gains and losses.

For the three months ended June 30, 2018, New Gold’s copper revenue per pound and average realized copper price per pound were $2.91 and $3.18, respectively, is slightly above the average London Metal Exchange (“LME”) copper price of $3.12 per pound. For the six months ended June 30, 2018, New Gold’s copper revenue per pound and average realized copper price per pound were $2.89 and $3.16, respectively, compared to the average LME copper price of $3.14 per pound.

Silver prices

For the three months ended June 30, 2018, New Gold’s silver revenue per ounce and average realized silver price per ounce were $15.89 and $16.49 respectively, compared to the LBMA p.m. average silver price of $16.53 per ounce. For the six months ended June 30, 2018, New Gold’s silver revenue per ounce and average realized silver price per ounce were $16.00 and $16.56, respectively, compared to the LBMA p.m. average silver price of $16.65 per ounce.

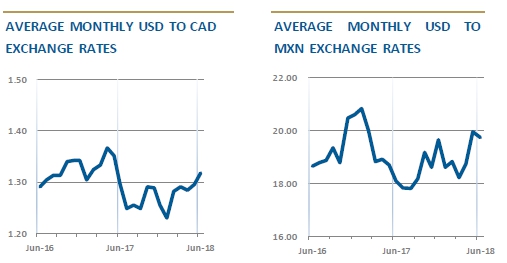

Foreign Exchange Rates

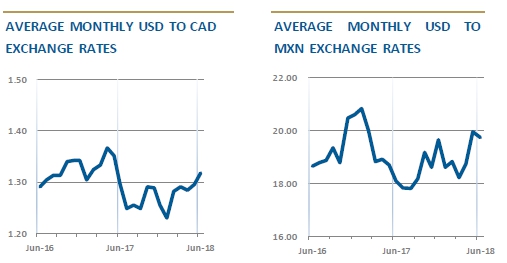

The Company operates in Canada, the United States, and Mexico, while revenue is generated in U.S. dollars. As a result, the Company has foreign currency exposure with respect to costs not denominated in U.S. dollars. New Gold’s operating results and cash flows are influenced by changes in various exchange rates against the U.S. dollar. The Company has exposure to the Canadian dollar through New Afton, Rainy River and Blackwater, as well as through corporate administration costs. The Company also has exposure to the Mexican peso through Cerro San Pedro.

The Canadian dollar weakened against the U.S. dollar by approximately 2% from March 31, 2018 to June 30, 2018. The average Canadian dollar against the average U.S. dollar for the three months ended June 30, 2018 strengthened by approximately 4% when compared to the prior-year period. The strengthening or weakening of the Canadian dollar impacts costs in U.S. dollar terms at the Company’s Canadian operations, as well as capital costs at the Company’s Canadian development properties as a significant portion of operating and capital costs are denominated in Canadian dollars.

The Mexican peso weakened against the U.S. dollar by approximately 8% from March 31, 2018 to June 30, 2018. The average Mexican peso against the average U.S. dollar for the three months ended June 30, 2018 weakened by approximately 5% when compared to the prior-year period. The strengthening or weakening of the Mexican peso impacts costs in U.S. dollar terms at the Company’s Mexican operation, Cerro San Pedro, as a portion of operating costs are denominated in Mexican pesos.

| 14 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

For an analysis of the impact of foreign exchange fluctuations on operating costs for the three and six months ended June 30, 2018 relative to prior-year periods, refer to the “Review of Operating Mines” sections for Rainy River, New Afton and Cerro San Pedro.

Economic Outlook

The LBMA p.m. gold price decreased by 3% since the start of 2018, and decreased by 6% during the second quarter. Global politics have continued to exhibit volatility over the quarter. The U.S administration has proceeded with tariffs on several major trading partners, focusing on China as well as several long-standing allies. This has prompted retaliatory tariffs in turn, driving further escalation as well as concern and uncertainty in the markets as the objectives and consequences of a trade war strategy are not clear. Notwithstanding these developments, the global economy has been performing relatively well, with central bankers continuing on the path of a gradual normalization of interest rates.

Prospects for gold are encouraged by several structural factors. Mine supply has been plateauing as high quality deposits become more difficult to find and more expensive to develop and mine. Exploration budgets have been cut in recent years, increasing the likelihood that supply will remain muted, even in the face of increasing gold prices. Gold held in exchange-traded products is significantly below the peak in 2012, suggesting that the broad investment community has capacity to add length to positions as sentiment improves.

Economic events can have significant effects on the price of gold, through currency rate fluctuations, the relative strength of the U.S. dollar, gold supply and demand, and macroeconomic factors such as interest rates and inflation expectations. Management anticipates that the long-term economic environment should provide support for precious metals and for gold in particular, and believes the prospects for the business are favourable. New Gold’s growth plan is focused on organic and acquisition-led growth, and the Company plans to remain flexible in the current environment to be able to respond to opportunities as they arise.

| 15 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

FINANCIAL RESULTS

Summary of Quarterly Financial Results

| | Three months ended June 30 | Six months ended June 30 |

| (in millions of U.S. dollars, except where noted) | 2018 | 2017 | 2018 | 2017 |

| FINANCIAL RESULTS | | | | |

| Revenue | 195.3 | 143.8 | 388.5 | 268.3 |

| Operating expenses | 105.9 | 71.3 | 223.2 | 133.7 |

| Depreciation and depletion | 77.1 | 53.1 | 145.3 | 99.0 |

| Revenue less cost of goods sold | 12.3 | 19.4 | 20.0 | 35.6 |

| Corporate administration | 5.5 | 5.9 | 10.9 | 13.4 |

| Corporate restructuring | 2.3 | - | 2.3 | - |

| Share-based payment expenses | 0.1 | 2.6 | 1.5 | 3.8 |

| Asset Impairment | 383.7 | - | 383.7 | - |

| Exploration and business development | 0.4 | 1.5 | 1.0 | 3.2 |

| (Loss) earnings from operations | (379.7) | 9.4 | (379.4) | 15.2 |

| Finance income | 0.6 | 0.3 | 1.1 | 0.6 |

| Finance costs | (18.0) | (1.1) | (34.7) | (2.3) |

| Other gains and losses | | | | |

| Unrealized gain on share purchase warrants | - | 0.1 | - | 1.2 |

| (Loss) gain on foreign exchange | (8.1) | 17.6 | (28.0) | 22.0 |

| Gain on disposal of El Morro stream | - | - | - | 33.0 |

| Other gain on disposal of assets | 0.1 | (0.1) | 0.1 | 0.1 |

| Revaluation of AFS securities | (0.1) | (0.2) | (0.1) | (0.1) |

| (Loss) gain on copper forward contracts and copper option contracts | (0.4) | 0.2 | 6.4 | 1.2 |

| Unrealized gain (loss) on revaluation of gold stream obligation | 6.3 | (2.0) | 9.6 | (5.0) |

| Loss on revaluation of gold price option | - | (2.3) | - | (12.9) |

| Other | (0.1) | 1.4 | 1.5 | 0.9 |

| (Loss) earnings before taxes | (399.4) | 23.3 | (423.5) | 53.9 |

| Income tax recovery (expense) | 97.8 | (5.5) | 92.8 | (5.1) |

Net (loss) earnings from continuing operations | (301.6) | 17.8 | (330.7) | 48.8 |

| (Loss) earnings from discontinued operations | (0.4) | 5.3 | (0.8) | 11.9 |

| Net (loss) earnings | (302.0) | 23.1 | (331.5) | 60.7 |

| Adjusted (loss) earnings from continuing operations(1) | (1.8) | 8.9 | (17.9) | 10.2 |

| 1. | The Company uses certain non-GAAP financial performance measures throughout this MD&A. For a detailed description of each of the non-GAAP measures used in this MD&A and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 16 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

Revenue

For the three months ended June 30, 2018, the $51.5 million, or 36%, increase in revenue was due to the combined impact of a $13.8 million increase, driven by higher gold and copper prices and a $37.7 million increase in gold sales volumes. The average realized prices for the three months ended June 30, 2018 were $1,297 per gold ounce, $3.18 per pound of copper and $16.49 per silver ounce. This compared to $1,278 per gold ounce, $2.57 per pound of copper and $16.96 per silver ounce in the prior-year period.

For the six months ended June 30, 2018, the $120.2 million, or 45% increase in revenue was primarily driven by higher gold sales volumes and higher metal prices. The average realized prices for the six months ended June 30, 2018 were $1,312 per gold ounce, $3.16 per pound of copper and $16.56 per silver ounce. This compared to $1,277 per gold ounce, $2.56 per pound of copper and $17.24 per silver ounce in the prior-year period. A detailed discussion of production is included in the “Review of Operating Mines” section of this MD&A.

Operating expenses

For the three and six months ended June 30, 2018, operating expenses increased compared with the prior-year period mainly due to higher operating expenses at Rainy River in its start-up year.

Depreciation and depletion

For the three and six months ended June 30, 2018, depreciation and depletion increased compared with prior-year periods due to depreciation and depletion being recognized at Rainy River in its start-up year.

Revenue less cost of goods sold

For the three and six months ended June 30, 2018,revenue less cost of goods sold decreased primarily due to higher operating expenses, and higher depreciation and depletion, which was partially offset by the increased revenue.

Corporate administration and share-based payment expenses

For the three and six months ended June 30, 2018, the decrease in corporate administration resulted from the corporate restructuring which occurred in the fourth quarter of 2017. For the three and six months ended June 30, 2018, the decrease in share-based payment expenses were primarily attributable to the decrease of the Company’s share price in the current period, which resulted in lower costs for the Company’s cash-settled share-based payment arrangements.

During the three months ended June 30, 2018, the Company recognized approximately $2.3 million related to severance and other termination benefits.

Asset impairment

In accordance with the Company’s accounting policies, the recoverable amount of an asset or cash generating unit (“CGU”) is estimated when an indication of impairment exists. As at June 30, 2018, indicators of impairment existed at the Rainy River CGU.

The Company has completed an updated Rainy River LOM and will release an updated NI 43-101 Technical Report for Rainy River in early August. The updated LOM contains updated per unit costs, changes to the sequencing in gold production and a less than 3% reduction in gold production over the LOM. The updated LOM incorporates changes to open pit design and extraction sequencing, resulting in higher ore tonnes mined and processed at a lower average gold grade. The Company has identified the changes to the LOM and increased cost estimates at Rainy River as indicators of impairment as at June 30, 2018.

For the three and six months ended June 30, 2018, the Company recorded an after-tax impairment loss of $282.1 million within net loss, as noted below:

| 17 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

| | | | Six months ended June 30, 2018 |

| (in millions of U.S. dollars) | | | | Rainy River |

| Impairment charge included within NET LOSS | | | |

| Rainy River depletable mining properties | | | | 383.7 |

| Tax recovery | | | | (101.6) |

| Total impairment charge after tax | | | | 282.1 |

(i) Methodology and key assumptions

Impairment is recognized when the carrying amount of a CGU exceeds its recoverable amount. A CGU is the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets. Each operating mine and development project represents a separate CGU as each mine site or project has the ability to, or the potential to, generate cash inflows that are separately identifiable and independent of each other. The Company has the following CGUs: Rainy River, New Afton, Mesquite, Cerro San Pedro, and Blackwater. Other assets consist of corporate assets and exploration properties.

The Company uses fair value less cost of disposal to determine the recoverable amount of an asset as it believes that this will generally result in a value greater than or equal to the value in use. When there is no binding sales agreement, fair value less costs of disposal is estimated as the discounted future after-tax cash flows expected to be derived from a mine site, less an amount for costs to sell estimated based on similar past transactions. The inputs used in the fair value measurement constitute Level 3 inputs under the fair value hierarchy.

(a) Rainy River CGU:

Key estimates and judgments include production levels, operating costs and other capital expenditures reflected in the Company’s LOM plans, the value of in-situ ounces and land holdings, as well as economic factors beyond management’s control, such as gold and silver prices, discount rates and foreign exchange rates. The Company considers this approach to be consistent with the valuation approach taken by market participants.

Life-of-Mine plans

Estimated cash flows are based on LOM plans which estimate expected future production, commodity prices, foreign exchange assumptions, operating costs and capital costs. The current LOM plan is 14 years. LOM plans use proven and probable mineral reserves only and do not utilize mineral resource estimates for a CGU. When options exist for the future extraction and processing of these resources, an estimate of the value of the unmined mineral resources (also referred to as in-situ ounces) is included in the determination of fair value.

In-situ ounces

In-situ ounces are excluded from the LOM plans due to the need to continually reassess the economic returns on and timing of specific production options in the current economic environment. The value of in-situ ounces has been estimated based on an enterprise value per equivalent resource ounce, with the enterprise value based on the market capitalization of a subset of publicly traded companies.

Discount rates

When discounting estimated future cash flows, the Company uses a real after-tax discount rate that is designed to approximate what market participants would assign. This discount rate is calculated using the Capital Asset Pricing Model (“CAPM”). The CAPM includes market participants’ estimates for equity risk premium, cost of debt, target debt to equity, risk-free rates and inflation. For the June 30, 2018 impairment analysis, a real discount rate of 4.50% was used (2017 - real discount rate of 4.00%).

| 18 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

Commodity prices and exchange rates

Commodity prices and exchange rates are estimated with reference to external market forecasts. The rates applied have been estimated using consensus commodity prices and exchange rate forecasts. For impairment analysis, the following commodity prices and exchange rate assumptions were used:

| | As at June 30, 2018 | As at December 31, 2017 |

| (in U.S. dollars, except where noted) | 2018 - 2023 Average | Long-term | 2018 - 2022 Average | Long-term |

| Commodity prices | | | | |

| Gold ($/ounce) | 1,313 | 1,300 | 1,300 | 1,300 |

| Silver ($/ounce) | 18.00 | 18.17 | 19.16 | 19.25 |

| Exchange rates | | | | |

| CAD:USD | 1.24 | 1.23 | 1.24 | 1.24 |

Significant judgments and assumptions are required in making estimates of fair value. It should be noted that CGU valuations are subject to variability in key assumptions including, but not limited to, long-term gold prices, currency exchange rates, discount rates, production, operating and capital costs. Any variation in one or more of the assumptions used to estimate fair value could result in a change in a CGU’s fair value.

(ii) Impact of impairment tests

The Company calculated the recoverable amount of the Rainy River CGU using the fair value less cost of disposal method as noted above. For the three and six months ended June 30, 2018, the Company recorded pre-tax impairment losses of $383.7 million, $282.1 million net of tax, within net loss.

(iii) Sensitivity analysis

After effecting the impairment for the Rainy River CGU, the fair value of this CGU is assessed as being equal to its respective carrying amount as at June 30, 2018. Any variation in the key assumptions used to determine fair value would result in a change of the assessed fair value. It is estimated that changes in the key assumptions would have the following approximate impact on the fair value of the Rainy River CGU at June 30, 2018:

| | | | As at June 30, 2018 |

| (in millions of U.S. dollars) | | | | Rainy River |

| Impact of changes in the key assumptions used to determine fair value | | |

| $100 per ounce change in gold price | | | | 265.2 |

| 0.5% change in discount rate | | | | 21.5 |

| 5% change in foreign exchange rate | | | | 111.2 |

| 5% change in operating costs | | | | 104.9 |

| 5% change in in-situ ounces | | | | 19.3 |

Finance income and finance costs

For the three and six months June 30, 2018, finance costs increased as the Company ceased capitalization of interest to its qualifying development property due to the commencement of commercial production at Rainy River.

Other gains and losses

The following other gains and losses are added back for the purposes of adjusted net earnings:

| 19 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

Gold stream obligation

For the three and six months ended June 30, 2018, the unrealized gain on revaluation of the gold stream obligation derivative instrument was due to the increase in the reference discount rate, only partially offset by accretion expense.

Copper price option contracts

In the prior year, the Company entered into copper price option contracts by purchasing put options at a strike price of $3.00 per pound and selling call options at a strike price of $3.37 per pound for 27,600 tonnes (approximately 60 million pounds) of copper production during 2018.

These derivative instruments are fair valued at the end of each reporting period. For the three months ended June 30, 2018, the Company recognized a loss of $0.4 million on the revaluation of the copper price option contracts resulting from the expiry of an option unexercised. For the six months ended June 30, 2018, the Company recognized a gain of $6.4 million on the revaluation of the copper price option contracts resulting from the decrease in copper prices.

Foreign exchange

Movements in foreign exchange are due to the revaluation of the non-monetary assets and liabilities at the balance sheet date and the appreciation or depreciation of the Canadian dollars and Mexican peso compared to the U.S. dollar in the current period.

Other prior-year period gains and losses

During the first quarter of 2017, the Company sold its 4% stream on future gold production from El Morro for $65.0 million cash. As a result, the Company recorded a gain on disposal of $33.0 million representing the difference between the net proceeds received and the carrying value of the asset. A gain on the mark-to-market of share purchase warrants was also recorded as the traded value of the New Gold share purchase warrants decreased. In June 2017 all share purchase warrants expired unexercised, thus there was no earnings impact for the three and six months ended June 30, 2018.

In the prior year, the Company entered into gold price option contracts whereby it sold a series of call option contracts and purchased a series of put option contracts. These derivative instruments were fair valued at the end of each reporting period, recording a loss of $12.9 million during the six months ended June 30, 2017. On December 31, 2017, these options expired and no further gold price option contracts have been entered into in 2018.

Income tax

Income tax recovery from continuing operations for the six months ended June 30, 2018 was $92.8 million on a loss before taxes of $423.5 million compared to an expense of $5.1 million on earnings before tax of $53.9 million in prior-year period, reflecting an effective tax rate of 21.9% in 2018 compared to 9.46% in 2017. The primary reason for the change in the unadjusted effective tax rate is the change in unrecognized deferred tax assets relating to mining tax, lower tax rate applicable on the disposal of the El Morro stream in the prior-year period and the impact of foreign exchange movements on the deferred tax related to non-monetary assets and liabilities.

For the six months ended June 30, 2018, the Company recorded a foreign exchange loss of $33.8 million on non-monetary assets and liabilities, compared to a gain of $24.4 million in the prior-year period with no associated tax impact. For the six months ended June 30, 2018 the unadjusted effective tax rate was impacted due to higher income tax rate in the province of British Columbia.

On an adjusted net (loss) earnings basis, the adjusted tax recovery from continuing operations for the three months ended June 30, 2018, was $9.3 million, compared to $0.3 million in the prior year. The adjusted tax expense excludes the impact of the impairment loss at Rainy River, corporate restructuring costs and other gains and losses on the consolidated income statement. Please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A.

| 20 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

Net (loss) earnings

For the three and six months ended June 30, 2018, the net loss was impacted by the impairment charge at Rainy River, an increase in depreciation and depletion expenses, finance costs, and foreign exchange loss, which were only partially offset by higher operating margin when compared to the prior period.

Adjusted net (loss) earnings from continuing operations

Net losses have been adjusted for the impairment loss at Rainy River, corporate restructuring costs and other gains and losses on the consolidated income statement. Key elements in other gains and losses are: the fair value changes for the gold stream obligation; fair value changes for gold and copper option contracts; foreign exchange gain or loss, and gain or loss on disposal of assets. The adjusted entries are also impacted for tax to the extent that the underlying entries are impacted for tax in the unadjusted net earnings. Please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A.

| 21 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

Key Quarterly Operating and Financial Information

Selected financial and operating information for the current and previous quarters is as follows:

| | | | | | | | | | |

(in millions of U.S. dollars, except where noted) | Q2 2018 | Q1 2018 | Q4 2017 | Q3

2017 | Q2

2017 | Q1

2017 | Q4

2016 | Q3

2016 | Q2

2016 |

| Operating information | | | | | | | | | |

| Total gold production (ounces)(1) | 108,550 | 122,315 | 145,992 | 82,027 | 105,064 | 89,327 | 95,883 | 95,546 | 99,423 |

| Gold production from continuing operations (ounces)(1) | 108,550 | 96,882 | 110,240 | 67,653 | 79,025 | 60,980 | 77,026 | 57,565 | 68,138 |

| Total gold sales (ounces)(1) | 105,924 | 120,163 | 143,644 | 79,904 | 99,235 | 87,304 | 93,936 | 96,452 | 101,820 |

| Gold sales from continuing operations (ounces)(1) | 105,924 | 98,688 | 108,782 | 67,052 | 73,707 | 59,913 | 75,887 | 56,038 | 74,036 |

| | | | | | | | | | |

| Revenue | 195.3 | 193.2 | 193.5 | 142.5 | 143.8 | 124.5 | 140.7 | 125.2 | 140.1 |

| | | | | | | | | | |

| Earnings from continuing operations | (301.6) | (29.1) | (179.6) | 29.2 | 17.8 | 30.9 | (23.3) | 0.8 | (14.1) |

| per share: | | | | | | | | | |

| Basic ($) | (0.52) | (0.05) | (0.31) | 0.05 | 0.03 | 0.06 | (0.05) | $nil | (0.03) |

| Diluted ($) | (0.52) | (0.05) | (0.31) | 0.05 | 0.03 | 0.06 | (0.05) | $nil | (0.03) |

| Earnings from discontinued operations, net of tax | (0.4) | (0.4) | (16.0) | (2.2) | 5.3 | 6.6 | 1.0 | 3.3 | 0.2 |

| Net earnings | (301.6) | (29.5) | (195.6) | 27.0 | 23.1 | 37.5 | (22.3) | 4.1 | (13.9) |

| per share: | | | | | | | | | |

| Basic ($) | (0.52) | (0.05) | (0.34) | 0.05 | 0.04 | 0.07 | (0.04) | 0.01 | (0.03) |

| Diluted ($) | (0.52) | (0.05) | (0.34) | 0.05 | 0.04 | 0.07 | (0.04) | 0.01 | (0.03) |

| | | | | | | | | | |

A detailed discussion of production is included in the “Operating Highlights” section of this MD&A.

| 22 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

REVIEW OF OPERATING MINES

Rainy River Mine, Ontario, Canada Rainy River is a gold mine located approximately 50 kilometres northwest of Fort Frances, a town of approximately 8,000 people, in northwestern Ontario, Canada. The property is located near infrastructure and is comprised of approximately 192 square kilometres of freehold and leasehold patented surface rights and mining rights, properties and unpatented mining claims. Rainy River enhances New Gold’s operational platform through its significant production scale and exciting longer-term exploration potential in a stable mining jurisdiction. |  |

| | Three months ended June 30 | Six months ended June 30 |

| (in millions of U.S. dollars, except where noted) | 2018 | 2017 | 2018 | 2017 |

| Operating information | | | | |

| Ore mined (thousands of tonnes) | 3,280 | - | 6,547 | - |

| Ore processed (thousands of tonnes) | 1,506 | - | 3,084 | - |

| Waste mined (thousands of tonnes) | 6,495 | - | 13,347 | - |

| Ratio of waste-to-ore | 1.98 | - | 2.04 | - |

| Average grade: | | | | |

| Gold (grams/tonne) | 1.24 | - | 1.15 | - |

| Silver (%) | 1.87 | - | 1.95 | - |

| Recovery rate (%): | | | | |

| Gold | 87.0 | - | 84.0 | - |

| Silver | 60.0 | - | 58.0 | - |

| Gold (ounces): | | | | |

| Produced(1) | 55,219 | - | 94,544 | - |

| Sold(1) | 51,832 | - | 92,712 | - |

| Silver (millions of ounces): | | | | |

| Produced(1) | 0.1 | - | 0.1 | - |

| Sold(1) | 0.1 | - | 0.1 | - |

| Revenue | | | | |

| Gold ($/ounce) | 1,301 | - | 1,313 | - |

| Silver ($/ounce) | 16.54 | - | 16.64 | - |

| Average realized price(2): | | | | |

| Gold ($/ounce) | 1,301 | - | 1,313 | - |

| Silver ($/ounce) | 16.54 | - | 16.64 | - |

| Operating expenses per gold ounce sold ($/ounce)(4) | 802 | - | 993 | - |

| Operating expenses per silver ounce sold ($/ounce)(4) | 10.20 | - | 12.59 | - |

| Total cash costs per gold ounce sold(2)(3) | 796 | - | 988 | - |

| All-in sustaining costs per gold ounce sold(2)(3) | 1,295 | - | 1,794 | - |

| Total cash costs on a co-product basis(2)(3) | | | | |

| Gold ($/ounce) | 802 | - | 993 | - |

| Silver ($/ounce) | 10.20 | - | 12.59 | - |

| | | | | |

| 23 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

| | Three months ended June 30 | Six months ended June 30 |

| (in millions of U.S. dollars, except where noted) | 2018 | 2017 | 2018 | 2017 |

| Operating information | | | | |

| All-in sustaining costs on a co-product basis(2)(3) | | | | |

| Gold ($/ounce) | 1,295 | - | 1,787 | - |

| Silver ($/ounce) | 16.46 | - | 22.65 | - |

| FINANCIAL INFORMATION | | | | |

| Revenue | 68.3 | - | 123.6 | - |

| Operating margin(2) | 26.4 | - | 30.1 | - |

| Revenue less cost of goods sold | 2.3 | - | (11.5) | - |

| Capital expenditures (sustaining capital)(2) | 24.5 | - | 73.4 | - |

| Capital expenditures (growth capital)(2) | 11.0 | 160.1 | 21.2 | 286.4 |

| 1. | Production is shown on a total contained basis while sales are shown on a net payable basis, including final product inventory and smelter payable adjustments, where applicable. |

| 2. | We use certain non-GAAP financial performance measures throughout our MD&A. Total cash costs and all-in sustaining costs per gold ounce sold, total cash costs and all-in sustaining costs on a co-product basis, average realized price, and operating margin and capital expenditures (sustaining capital) are non-GAAP financial performance measures with no standard meaning under IFRS. For further information and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

| 3. | The calculation of total cash costs per gold ounce is net of by-product silver revenue. Total cash costs and all-in sustaining costs on a co-product basis removes the impact of other metal sales that are produced as a by-product of our gold production and apportions the cash costs to each metal produced on a percentage of revenue basis. |

| 4. | Operatingexpenses are apportioned to each metal produced on a percentage of revenue basis. For further information and a detailed reconciliation, please refer to the “Non-GAAP Financial Performance Measures” section of this MD&A. |

Operating results

Production

Rainy River continues to demonstrate further increases in throughput, grade and recovery through the second quarter of 2018. Rainy River mined a total of 3.3 million tonnes of ore during the quarter. The mine processed 1.5 million tonnes of ore at an average gold grade of 1.24 grams per tonne with recoveries of 87%.

Process facility performance continued to improve, however, operational and mechanical challenges consistent with startups impacted availability during the second quarter. Some issues encountered during the quarter included: failure of the gearbox in one of two cyanide destruct tanks which precluded deposition of tailings and resulted in a temporary shutdown; re-lining of cyanide destruction tanks; increased wear on leach tank screens which required replacement; replacement of conveyor feed belt; and longer than planned crusher shut down. Review and implementation of design improvements is underway to reduce reoccurrence and increase operational stability.

Importantly, the crushing and grinding circuit is robust and is operating consistently, and the process facility continues to demonstrate its operational potential with throughput rates increasingly achieving over 24,000 tonnes per day. As previously discussed, the Company is implementing a plan to increase Rainy River’s throughput to a steady 24,000 tonne per day rate. This expansion project is on time, and adjustments to the back end of the process facility are expected to be completed by the beginning of the fourth quarter at minimal capital, allowing for an immediate increase to Rainy River’s throughput rate.

Gold recoveries in the second quarter showed steady improvement, increasing to 87%, compared to 81% in the first quarter. Recoveries are expected to continue to improve throughout 2018 as the mine achieves consistent steady state operations.

Gold grades increased in the second quarter to 1.24 grams per tonne from 1.08 grams per tonne in the first quarter, however, were below the Company’s original plan of 1.4 grams per tonne, impacting the production outlook in 2018. Mine dilution was greater than planned and segregation of discrete higher-grade zones has been less predictable than originally contemplated during the first and second quarters. The experience gained to date has been applied to the updated production forecast for 2018 and Rainy River’s updated LOM plan, and work is underway to improve ore segregation in a manner consistent with local mine scale geology and grade distribution.

| 24 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

Since the commencement of mining in 2017, total ore mined has reconciled in alignment with the global mineral reserve estimate. Improvements to grade control practices, sampling procedures and mine planning criteria are being developed and implemented to mitigate the impact of local variations in mined gold grades on both near-term production forecasts and LOM reserve estimates.

Revenue

For the three and six months ended June 30, 2018, the increase in revenue was attributable to higher gold sales volumes and higher gold prices.

Revenue less cost of goods sold

For the three and six months ended June 30, 2018, revenue less cost of goods sold was $2.3 million and a loss of $11.5 million, with the loss primarily driven by higher operating expenses.

Asset impairment

For the three and six months ended June 30, 2018, the Company has recorded an after-tax impairment charge of $282.1 million relating to Rainy River. Please refer to the “Financial Results” section of this MD&A.

Operating expenses, total cash costs and all-in sustaining costs

For the three months and six months ended June 30, 2018, operating expense per gold ounce sold was $802 and $993 compared to $1,432 for the 2017 operating period, due to higher gold sales volumes.

For the three months ended June 30, 2018, total cash costs and all-in sustaining costs per gold ounce sold were $796 and $1,295.

For the six months ended June 30, 2018, total cash costs and all-in sustaining costs per gold ounce sold were $988 and $1,794. In addition, sustaining capital expenditures in the first quarter of 2018 included amounts paid in the quarter but incurred in the fourth quarter of 2017.

Capital expenditures

For the three months and six months ended June 30, 2018, the decrease in capital expenditures related primarily to project development spending in 2017. Capital expenditure in the current period primarily relates to tailings dam construction and capitalized stripping.

Impact of foreign exchange on operations

Rainy River’s operations are impacted by fluctuations in the valuation of the U.S. dollar against the Canadian dollar. For the three months ended June 30, 2018, the value of the U.S. dollar averaged $1.29 against the Canadian dollar, compared to $1.34 in the second quarter of 2017, resulting in a negative impact on total cash costs of $30 per gold ounce sold against prior-year period foreign exchange rates.

For the six months ended June 30, 2018, the value of the U.S dollar averaged $1.27 against the U.S. dollar compared to $1.29 in the prior-year period. This had a negative impact on total cash costs of $39 per gold ounce sold against prior-year period foreign exchange rates.

| 25 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

Updated outlook for 2018

As Rainy River is well into its start-up year, the Company has provided an updated 2018 outlook for the operation. Annual consolidated gold production at Rainy River for 2018 is expected to be between 210,000 and 250,000 ounces. The Company expects Rainy River’s 2018 all-in sustaining costs to be between $1,600 to $1,700 per ounce. A detailed discussion on the updated 2018 guidance is included in the “Outlook 2018” section of this MD&A.

The Company has completed an updated Rainy River LOM and will release an updated NI 43-101 Technical Report for Rainy River in early August. The updated LOM contains updated per unit costs, changes to the sequencing in gold production and a less than 3% reduction in gold production over the LOM. The updated LOM incorporates changes to open pit design and extraction sequencing, resulting in higher ore tonnes mined and processed at a lower average gold grade.

| 26 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

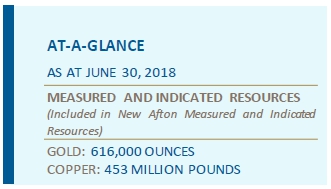

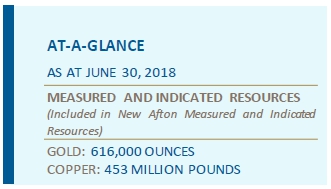

New Afton Mine, British Columbia, Canada The New Afton Mine is located near Kamloops, British Columbia. At December 31, 2017, the mine had 1.0 million ounces of Proven and Probable Gold Mineral Reserves and 941 million pounds of Proven and Probable Copper Mineral Reserves, with 1.2 million ounces of Measured and Indicated Gold Mineral Resources, exclusive of Mineral Reserves, and 968 million pounds of Measured and Indicated Copper Mineral Resources, exclusive of Mineral Reserves. A summary of New Afton’s operating results is provided below. |  |

| | Three months ended June 30 | Six months ended June 30 |

| (in millions of U.S. dollars, except where noted) | 2018 | 2017 | 2018 | 2017 |

| Operating information | | | | |

| Ore mined (thousands of tonnes) | 1,243 | 1,436 | 2,692 | 3,043 |

| Ore processed (thousands of tonnes) | 1,347 | 1,531 | 2,637 | 2,971 |

| Average grade: | | | | |

| Gold (grams/tonne) | 0.50 | 0.54 | 0.54 | 0.55 |

| Copper (%) | 0.82 | 0.83 | 0.88 | 0.82 |

| Recovery rate (%): | | | | |

| Gold | 85.5 | 80.4 | 84.8 | 80.1 |

| Copper | 83.8 | 81.6 | 83.5 | 81.0 |

| Gold (ounces): | | | | |

| Produced(1) | 18,637 | 21,273 | 38,635 | 42,210 |

| Sold(1) | 17,945 | 19,573 | 36,430 | 40,289 |

| Copper (millions of pounds): | | | | |

| Produced(1) | 20.4 | 22.8 | 42.6 | 43.3 |

| Sold(1) | 19.6 | 20.8 | 40.9 | 40.7 |

| Silver (millions of ounces): | | | | |

| Produced(1) | 0.1 | 0.1 | 0.2 | 0.2 |

| Sold(1) | 0.1 | 0.1 | 0.1 | 0.1 |

| Revenue | | | | |

| Gold ($/ounce) | 1,190 | 1,170 | 1,204 | 1,170 |

| Copper ($/pound) | 2.91 | 2.32 | 2.89 | 2.33 |

| Silver ($/ounce) | 15.15 | 15.92 | 15.04 | 16.01 |

| Average realized price(1)(2): | | | | |

| Gold ($/ounce) | 1,299 | 1,291 | 1,318 | 1,286 |

| Copper ($/pound) | 3.18 | 2.56 | 3.16 | 2.56 |

| Silver ($/ounce) | 16.53 | 17.56 | 16.46 | 17.60 |

| 27 |  WWW.NEWGOLD.COM TSX:NGD American: NGD WWW.NEWGOLD.COM TSX:NGD American: NGD |

| | Three months ended June 30 | Six months ended June 30 |

| (in millions of U.S. dollars, except where noted) | 2018 | 2017 | 2018 | 2017 |

| Operating information | | | | |

| Operating expenses per gold ounce sold ($/ounce)(4) | 412 | 426 | 410 | 442 |

| Operating expenses per copper pound sold ($/pound)(4) | 1.01 | 0.85 | 0.98 | 0.88 |

| Total cash costs per gold ounce sold ($/ounce)(2)(3) | (1,604) | (1,059) | (1,654) | (941) |

| All-in sustaining costs per gold ounce sold ($/ounce)(2)(3) | (917) | (358) | (1,118) | (434) |

| Total cash costs on a co-product basis(2)(3) | | | | |

| Gold ($/ounce) | 520 | 547 | 524 | 558 |