Exhibit 99.2

Welcome to Webster

Investment by Warburg Pincus

July 27, 2009

Webster Financial Corporation

Forward Looking Statement

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about Webster Financial Corporation’s (“Webster” or “WBS”) future financial condition, operating results, cost savings, management’s expectations regarding future growth opportunities and business strategy and other statements contained in this presentation that are not historical facts, as well as other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning. These forward-looking statements are based upon the current beliefs and expectations of Webster’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) changes in general economic conditions, either nationally or locally in the areas in which we conduct or will conduct our business; (2) the interest rate environment may compress margins and adversely affect net interest income; (3) increases in competitive pressures among financial institutions and businesses offering similar products and services; (4) higher defaults on our loan portfolio than we expect; (5) changes in management’s estimate of the adequacy of the allowance for loan losses; (6) the risks associated with continued diversification of assets and adverse changes to credit quality; (7) difficulties associated with achieving expected future financial results; (8) legislative or regulatory changes or changes in accounting principles, policies or guidelines; (9) management’s estimates and projections of interest rates and interest rate policy; and (10) cost savings and accretion to earnings from mergers and acquisitions may not be fully realized or may take longer to realize than expected. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Webster’ reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available at the SEC’s Internet site (http://www.sec.gov). Webster cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date they were made. Except as required by law, Webster does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made.

2

Webster

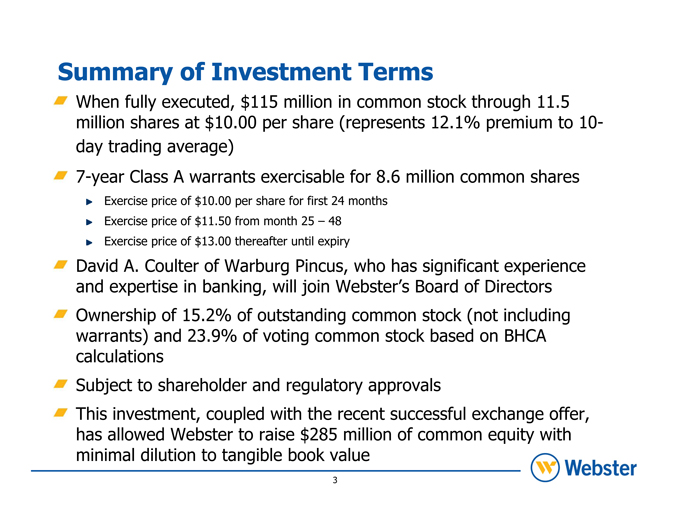

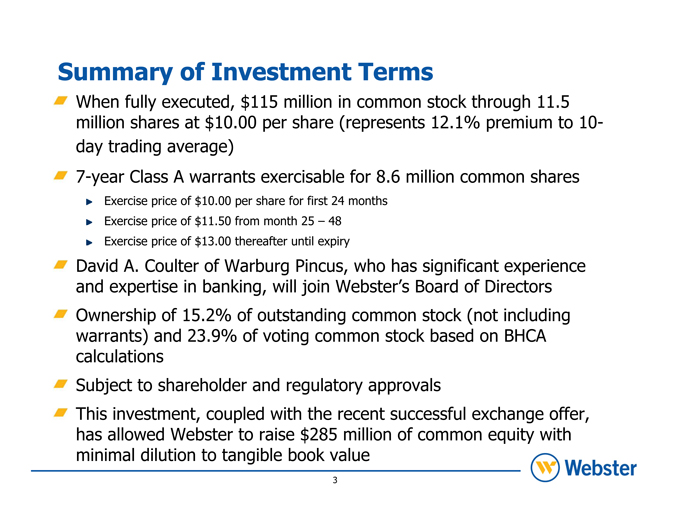

Summary of Investment Terms

When fully executed, $115 million in common stock through 11.5 million shares at $10.00 per share (represents 12.1% premium to 10-day trading average) 7-year Class A warrants exercisable for 8.6 million common shares

Exercise price of $10.00 per share for first 24 months Exercise price of $11.50 from month 25 – 48 Exercise price of $13.00 thereafter until expiry

David A. Coulter of Warburg Pincus, who has significant experience and expertise in banking, will join Webster’s Board of Directors Ownership of 15.2% of outstanding common stock (not including warrants) and 23.9% of voting common stock based on BHCA calculations Subject to shareholder and regulatory approvals This investment, coupled with the recent successful exchange offer, has allowed Webster to raise $285 million of common equity with minimal dilution to tangible book value

3

Webster

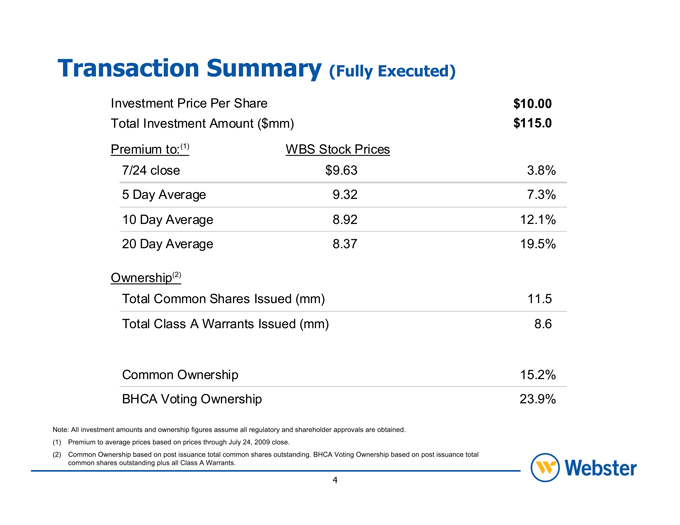

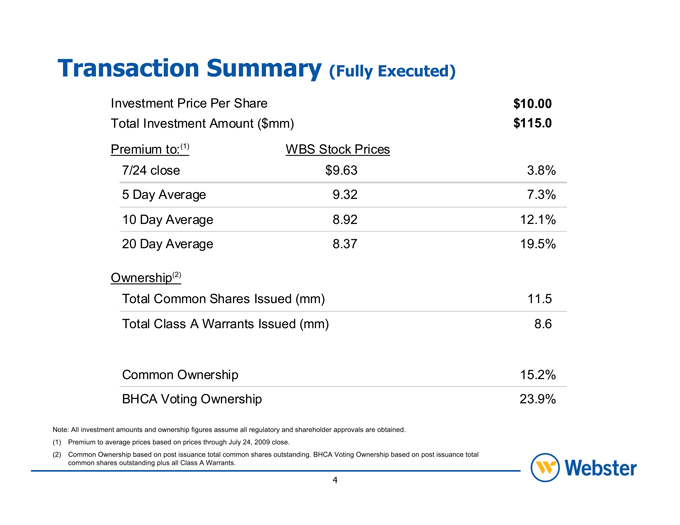

Transaction Summary (Fully Executed)

Investment Price Per Share $10.00 Total Investment Amount ($mm) $115.0 Premium to:(1) WBS Stock Prices 7/24 close $9.63 3.8%

5 Day Average 9.32 7.3%

10 Day Average 8.92 12.1%

20 Day Average 8.37 19.5%

Ownership(2)

Total Common Shares Issued (mm) 11.5 Total Class A Warrants Issued (mm) 8.6

Common Ownership 15.2% BHCA Voting Ownership 23.9%

Note: All investment amounts and ownership figures assume all regulatory and shareholder approvals are obtained. (1) Premium to average prices based on prices through July 24, 2009 close.

(2) Common Ownership based on post issuance total common shares outstanding. BHCA Voting Ownership based on post issuance total common shares outstanding plus all Class A Warrants.

4

Webster

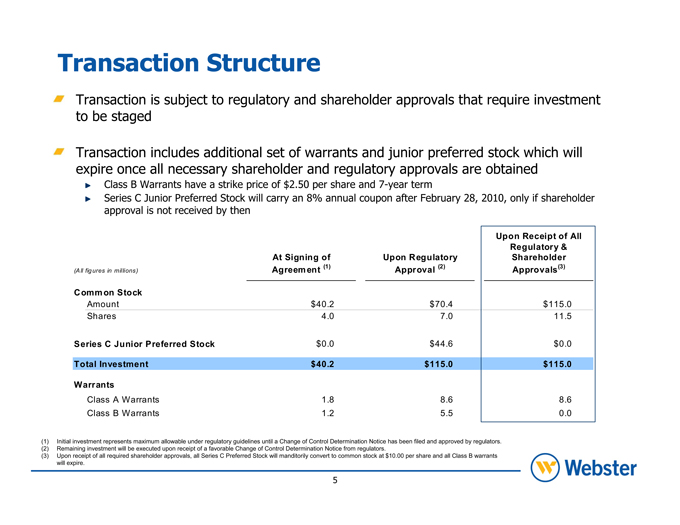

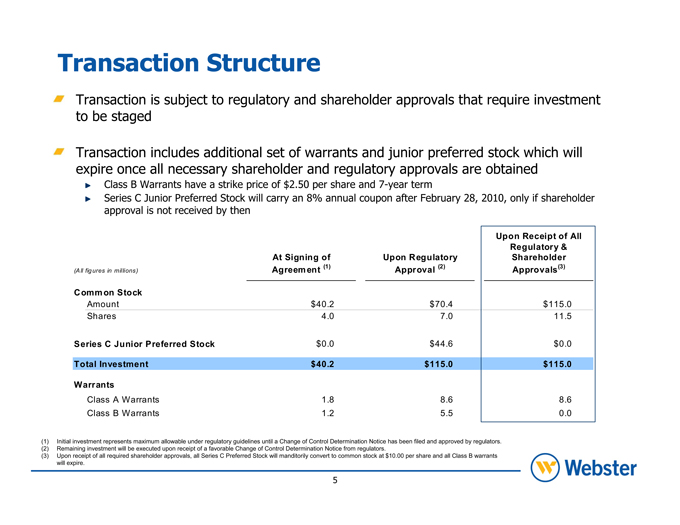

Transaction Structure

Transaction is subject to regulatory and shareholder approvals that require investment to be staged

Transaction includes additional set of warrants and junior preferred stock which will expire once all necessary shareholder and regulatory approvals are obtained

Class B Warrants have a strike price of $2.50 per share and 7-year term

Series C Junior Preferred Stock will carry an 8% annual coupon after February 28, 2010, only if shareholder approval is not received by then

Upon Receipt of All Regulatory & At Signing of Upon Regulatory Shareholder A (1) Approval (2) A (3)

(All figures in millions) greement pprovals

Common Stock

Amount $40.2 $70.4 $115.0 Shares 4.0 7.0 11.5

Series C Junior Preferred Stock $0.0 $44.6 $0.0

Total Investment $40.2 $115.0 $115.0

Warrants

Class A Warrants 1.8 8.6 8.6 Class B Warrants 1.2 5.5 0.0

(1) Initial investment represents maximum allowable under regulatory guidelines until a Change of Control Determination Notice has been filed and approved by regulators. (2) Remaining investment will be executed upon receipt of a favorable Change of Control Determination Notice from regulators.

(3) Upon receipt of all required shareholder approvals, all Series C Preferred Stock will manditorily convert to common stock at $10.00 per share and all Class B warrants will expire.

5

Webster

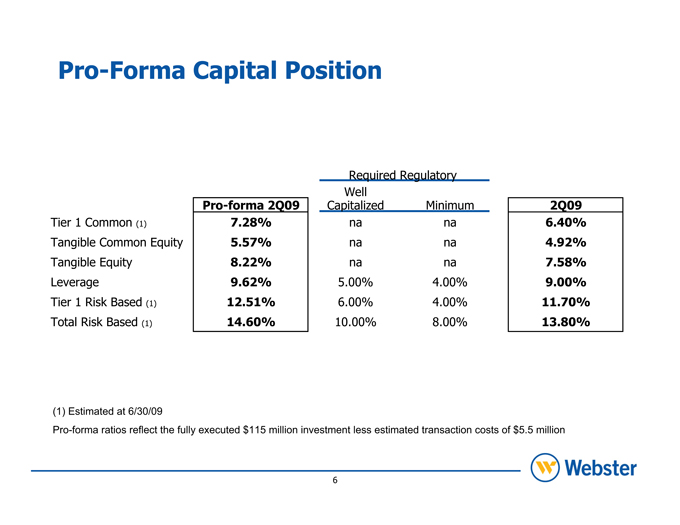

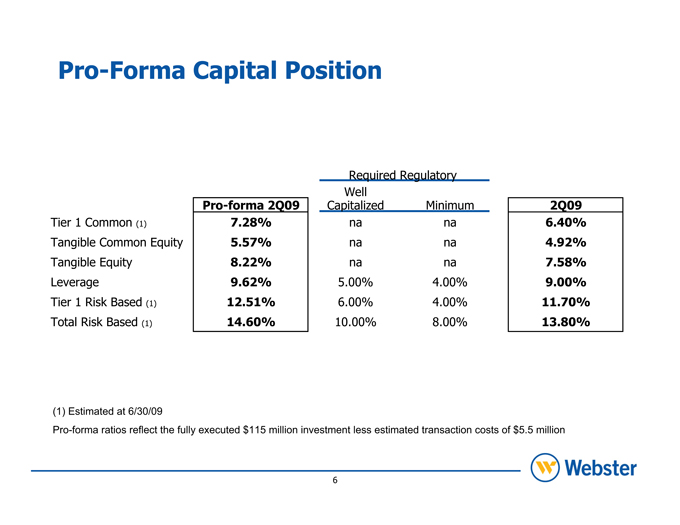

Pro-Forma Capital Position

Required Regulatory Well

Pro-forma 2Q09 Capitalized Minimum 2Q09 Tier 1 Common (1) 7.28% na na 6.40% Tangible Common Equity 5.57% na na 4.92% Tangible Equity 8.22% na na 7.58% Leverage 9.62% 5.00% 4.00% 9.00% Tier 1 Risk Based (1) 12.51% 6.00% 4.00% 11.70% Total Risk Based (1) 14.60% 10.00% 8.00% 13.80%

(1) Estimated at 6/30/09

Pro-forma ratios reflect the fully executed $115 million investment less estimated transaction costs of $5.5 million

6

Webster

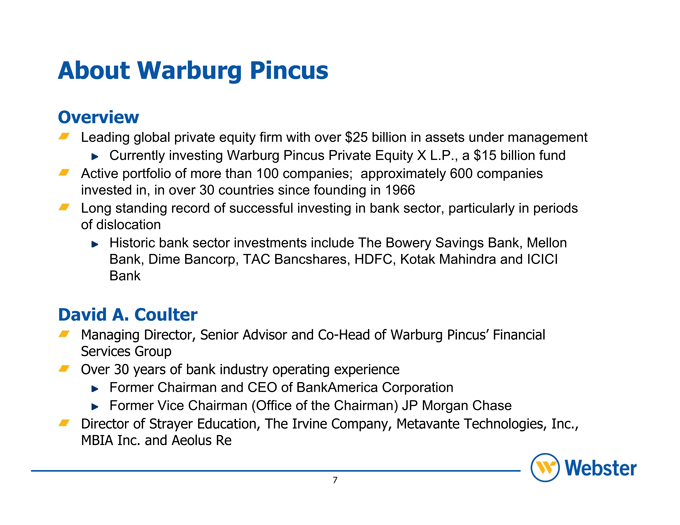

About Warburg Pincus

Overview

Leading global private equity firm with over $25 billion in assets under management Currently investing Warburg Pincus Private Equity X L.P., a $15 billion fund Active portfolio of more than 100 companies; approximately 600 companies invested in, in over 30 countries since founding in 1966 Long standing record of successful investing in bank sector, particularly in periods of dislocation Historic bank sector investments include The Bowery Savings Bank, Mellon Bank, Dime Bancorp, TAC Bancshares, HDFC, Kotak Mahindra and ICICI

Bank

David A. Coulter

Managing Director, Senior Advisor and Co-Head of Warburg Pincus’ Financial Services Group Over 30 years of bank industry operating experience

Former Chairman and CEO of BankAmerica Corporation

Former Vice Chairman (Office of the Chairman) JP Morgan Chase

Director of Strayer Education, The Irvine Company, Metavante Technologies, Inc., MBIA Inc. and Aeolus Re

7

Webster