Fiscal 2006 4th Quarter Earnings Call

1

All statements in this information other than historical facts are forward-

looking statements which involve risks and uncertainties, and which are subject to

change at any time. Such statements are based on our current expectations. We

undertake no obligation to update such statements to reflect new information, events

or otherwise. In addition to the assumptions and other factors referred to in this

information, cautionary factors set forth in our public filings with the Securities and

Exchange Commission, among others, could cause actual results to differ materially

from those currently contemplated.

Non-GAAP Measures: The company from time to time refers to various

non-GAAP financial measures. We believe that this information is useful to

understanding the operating results and ongoing performance of our underlying

businesses. See our public filings with the SEC or the investor relations section of

our website www.joyglobal.com for reconciliations of material non-GAAP financial

measures to their related GAAP measures.

Forward-Looking Statements & Non-

GAAP Measures

2

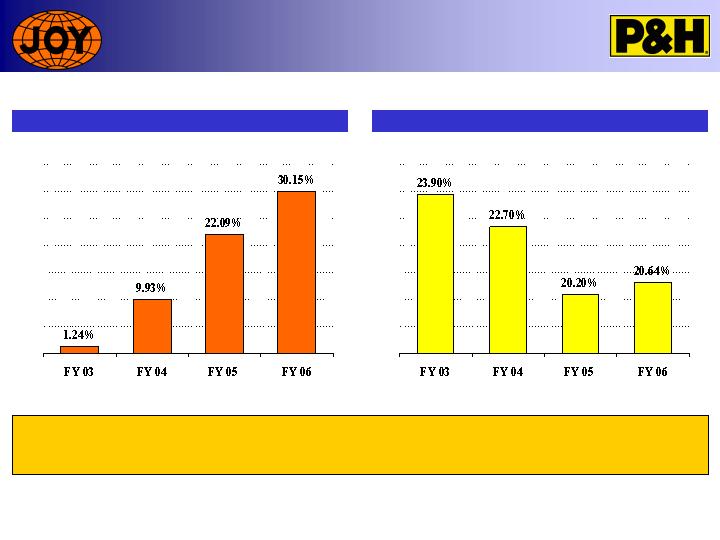

Solid Growth in Fiscal 2006

($ in millions)

FY2006

FY2005

% CHANGE

New Orders

$2,589

$2,291

13.0%

Net Sales

$2,402

$1,927

24.6%

Gross Profit Margin

31.4%

29.2%

Operating Income

$442

$267

65.5%

EBITDA

$484

$307

57.7%

Diluted EPS

$2.50

$1.20

108.3%

Free Cash Flow

$287

$187

53.5%

3

2.

Note 1. Excluding reversal effects of U.S. Federal Tax Valuation Reserve, or $0.88 per share

Note 2. EBITDA, less cash taxes, CAPEX, interest expense and changes in non-cash working capital

1.

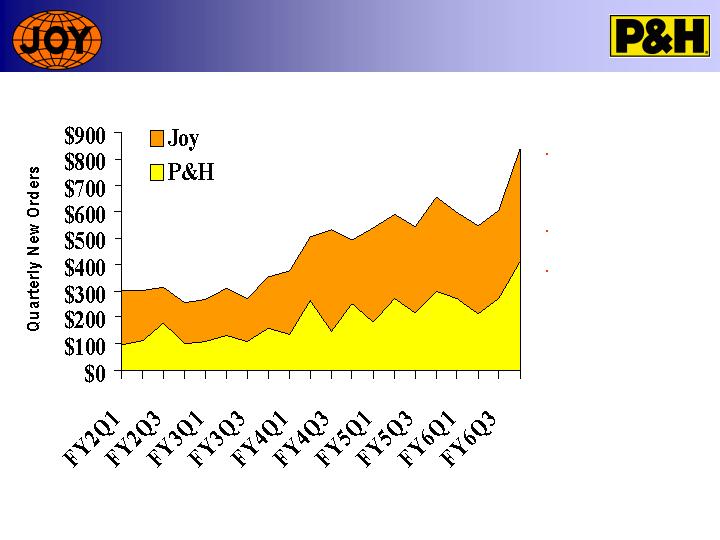

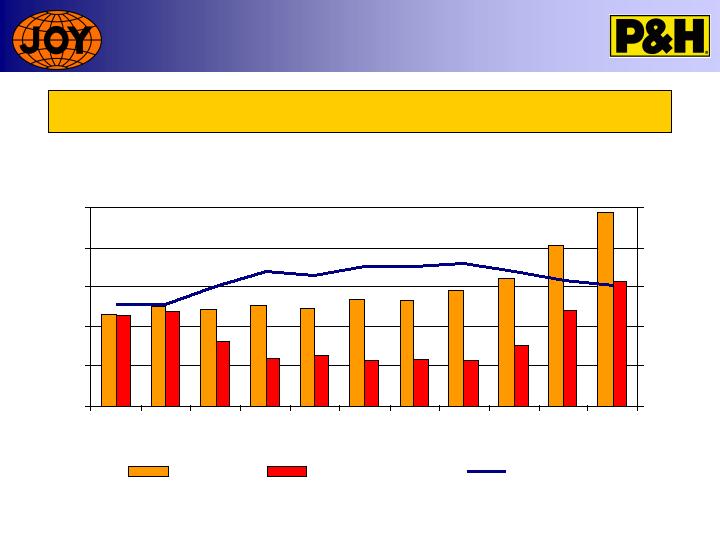

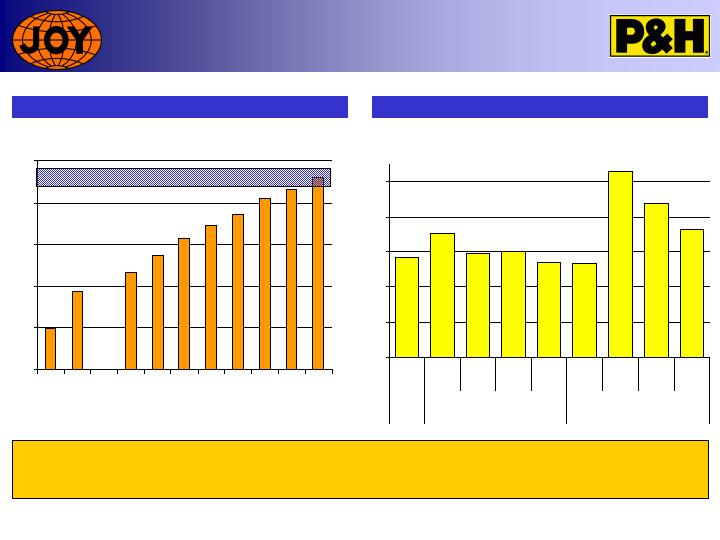

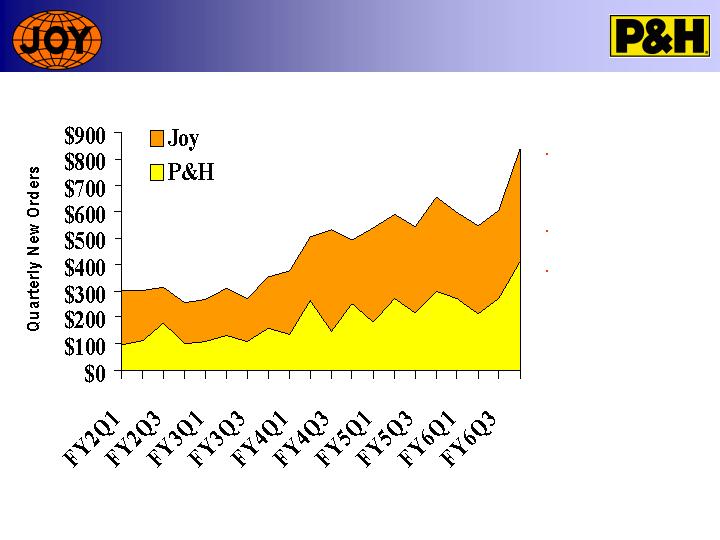

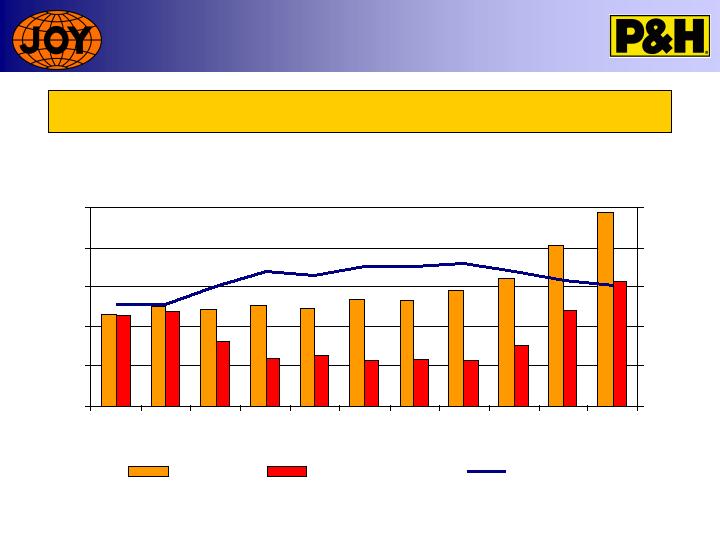

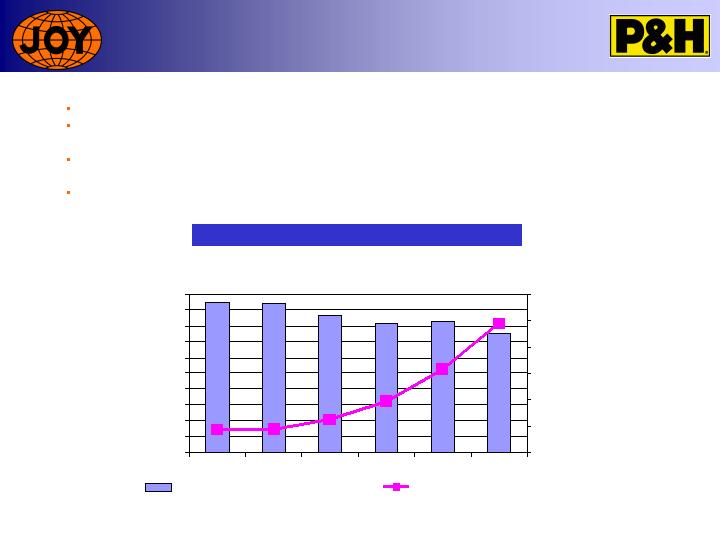

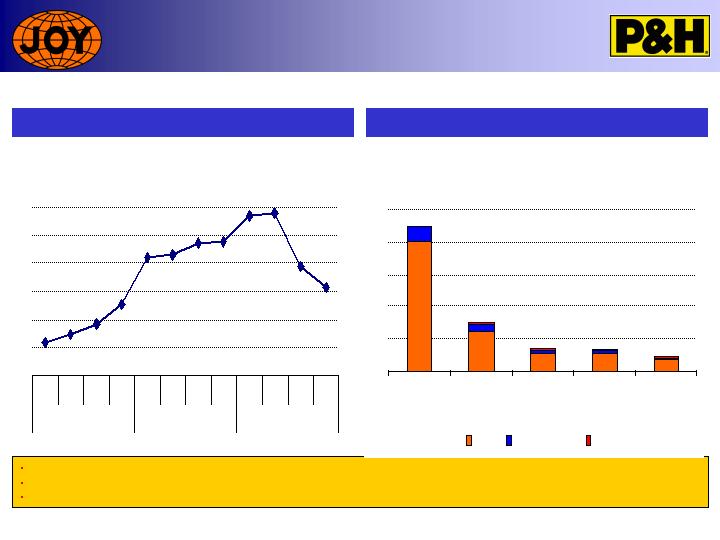

Cycle Continuing to Develop

Q4 new orders very

strong, but

“lumpiness” will

continue

$836 million of total

orders in Q4

Aftermarket remains

strong with 15%

increase in bookings –

14 th consecutive

quarter of double-

digit growth.

Million $

4

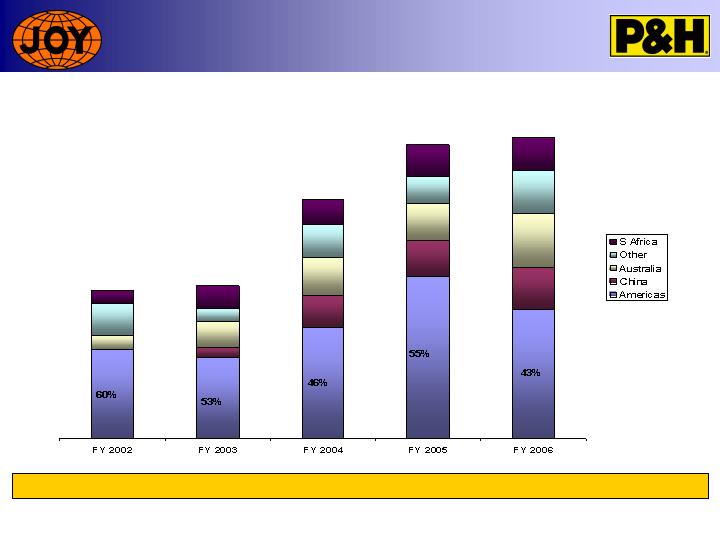

Joy Mining Booking Trends

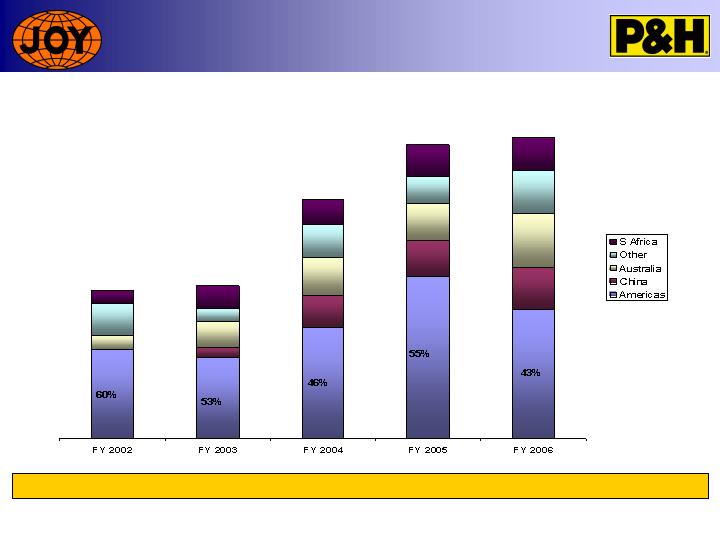

By Geography

Current softness in U.S. underground coal more than offset by new order growth in other markets

5

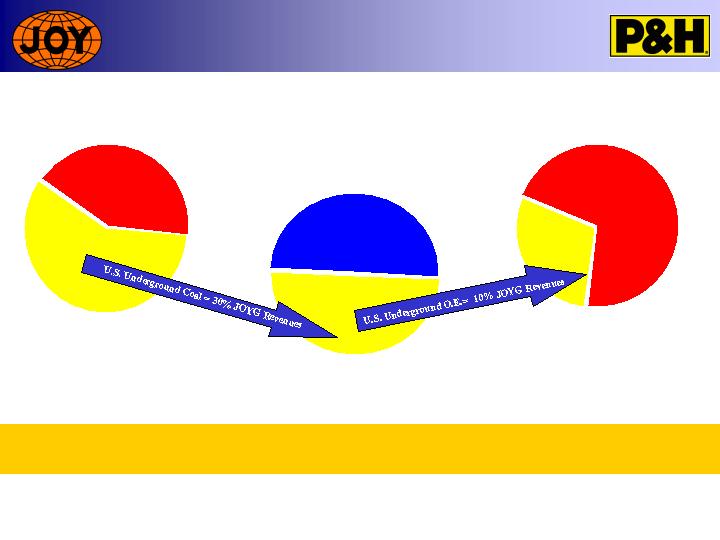

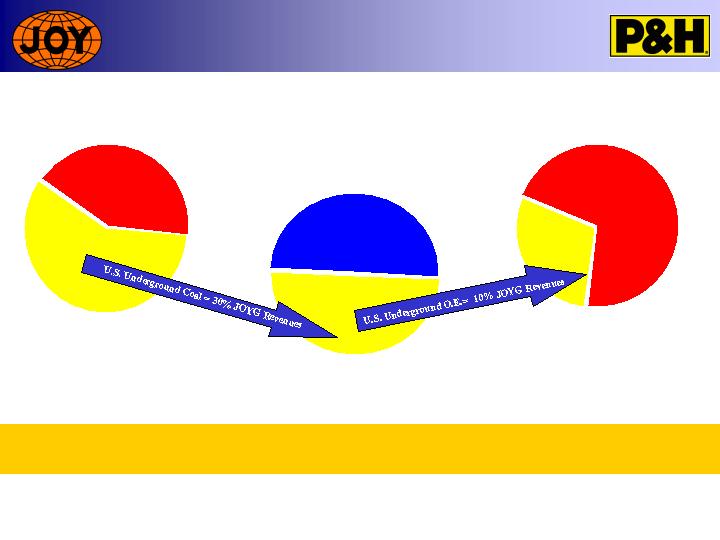

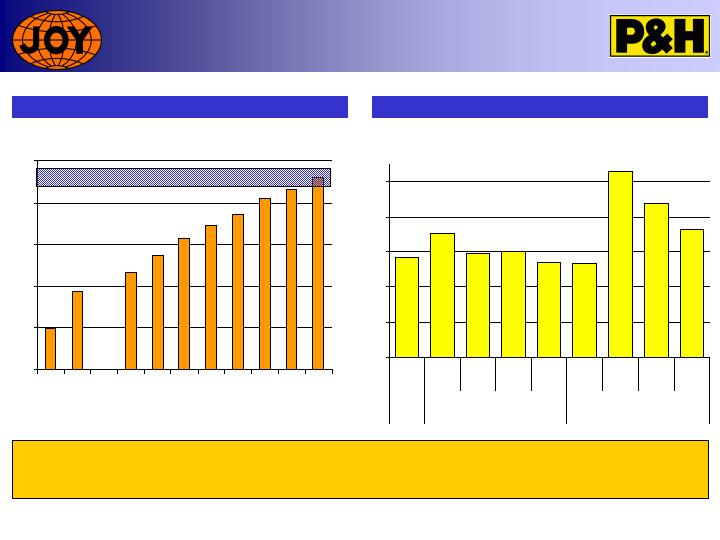

Surface Commodity Diversification

Strength

4th Qtr. Unit Shovel Orders

Fiscal 2006 Unit Shovel Orders

Near-term softness in U.S. coal markets having no noticeable effect on strong original

equipment order rates at P&H Mining Equipment!

6

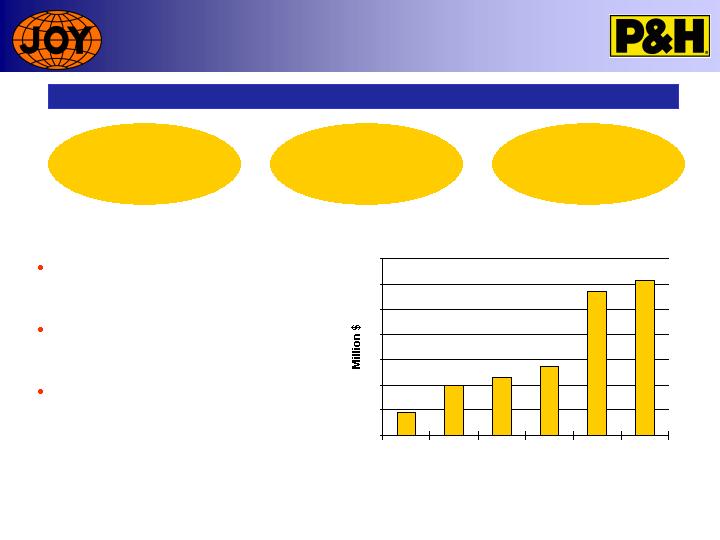

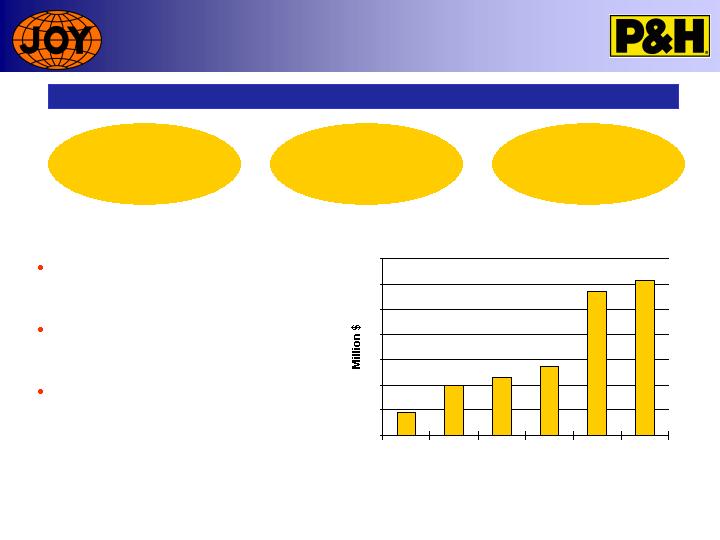

Our aftermarket business has grown rapidly again in fiscal 2006, increasing by more than

20% for the second consecutive year!

Aftermarket Growth Continues

Sales in

Million $

AM Sales

%

7

$0

$300

$600

$900

$1,200

$1,500

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

0%

20%

40%

60%

80%

100%

Aftermarket

Original Equipment

AM Sales %

International 50%

U.S. 50%

Aftermarket 2/3

O.E. 1/3

Representative Effects of Slowdown in

U.S. Coal

Revenue Mix

Geographic Mix

% Contribution to Revenues

P&H Mining 40%

Joy Mining 60%

Overall, U.S. underground original equipment business represents only 10% of

“normalized” JOYG revenues

8

0

50

100

150

200

250

300

350

2001

2002

2003

2004

2005

2006

9

Emerging Markets Strategy

Develop

Local

Resources

Build

Aftermarket

Revenues

Foundation

Customers

Emerging markets sales totaled $307

mm in fiscal 2006, or 13% of JOYG total

revenues.

Continue to expect $500MM in annual

revenues from China alone by fiscal

2010

Expansion of Baotou facility,

development of Tianjin, China facility and

Polish service center underway -

Russian service center being upgraded

% of Total 4% 9% 10% 10% 15% 13%

Emerging Markets Growth Opportunity

Joy Global’s Emerging Market Sales

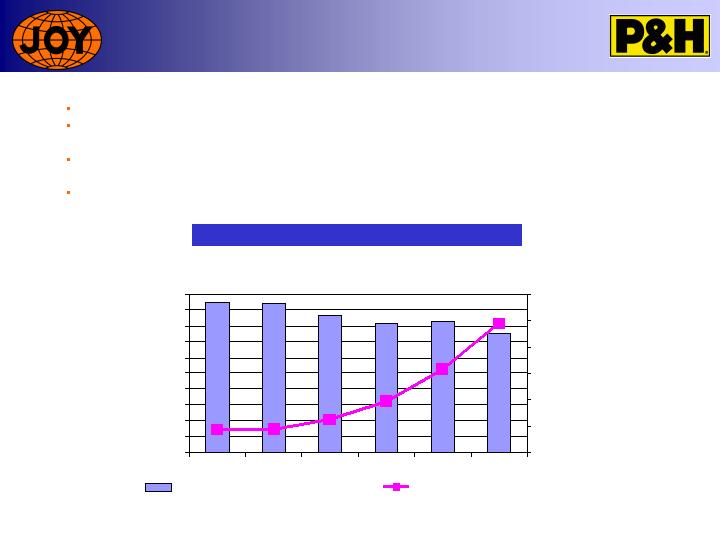

Capacity Continues to Increase

Overall OE production levels will continue to increase (Milwaukee & Tianjin)

Commitment to high level of aftermarket support continues to limit growth in OE

shipping levels

De-bottlenecking approach to capacity expansion minimizes roofline additions and

fixed cost base

Next 12 month JOYG revenue growth forecasted at 13-25% overall

Revenue Per Square Foot

Thousand Square

Feet

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

2001

2002

2003

2004

2005

2006

150

250

350

450

550

650

750

Manufacturing Capacity - Square Foot

Revenue Per Square Foot

10

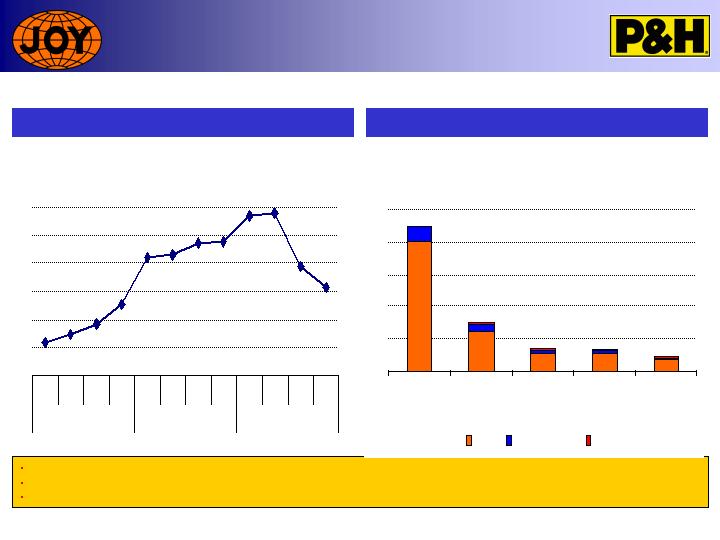

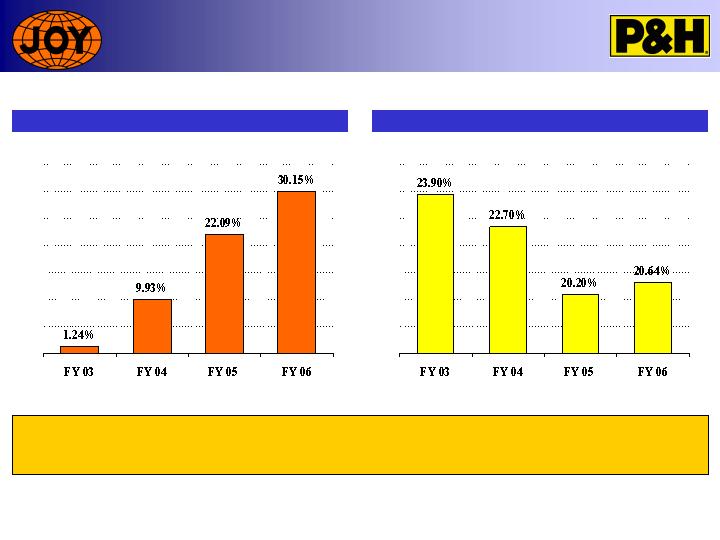

EBIT Performance Marches Higher and

Incremental Profitability Remains Strong

LTM EBIT %

Quarterly Incremental Profitability

EBIT performance is in target range. Outstanding incremental performance again in Q4. Fiscal 2007

results anticipated to be at low end of incremental target range with more challenging comparables,

acquisition related non-cash charges and revenue mix contributing to this anticipation.

0%

4%

8%

12%

16%

20%

FY03

FY04

F5Q1

F5Q2

F5Q3

FY05

F6Q1

F6Q2

F6Q3

FY06

11

Target Range

0%

10%

20%

30%

40%

50%

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

FY04

FY05

FY06

Target Range

Strong ROIC and W.C. Velocity

Performance

ROIC

W.C. Velocity

Although working capital velocity performance slipped slightly in fiscal 2006, overall strength in

this metric contributes to cash flow generation which contributes to high ROIC performance due to

commitment of returning excess cash to shareholders

1.

Note 1. Excluding reversal effects of U.S. Federal Tax Valuation Reserves

12

(million)

FY2005

FY2006

OUTLOOK

COMMENTS

OP plus deprec/amort

$306.8

$483.7

$570-635

Current 12-month guidance

(-) Net Cash Interest

(16.5)

(4.6)

(20) – (25)

Effect of bond placement

(-) Cash Taxes

(14.4)

(37.9)

(50) – (75)

10-15% cash tax rate

(-) Change in Working Capital

(50.6)

(104.7)

(60) – (120)

Solid W/C control required

(-) Capital Expenditures

(38.8)

(49.1)

(55) – (70)

Expect CAPEX at 2-2.5%+ of sales

Free Cash Flow

$186.5

$287.4

$280-450

Shares Outstanding

121.8

117.5

110

13

Current 12-month guidance continues to provide for free cash flow in the range of 10-

15% of the increased revenue forecast – key remains the control of working capital!

Maintaining Attractive

Free Cash Flow

Return of Cash to Shareholders

Increased Dramatically in FY06

Quarterly Dividends

Quarterly Share Repurchase - FY 2006

$/sh.

Million

$

Note: As of December 15th ,

$210 million additional

buybacks in FY07Q1

14

0

0.02

0.04

0.06

0.08

0.1

0.12

0.14

0.16

Q1

04

Q2

04

Q3

04

Q4

04

Q1

05

Q2

05

Q3

05

Q4

05

Q1

06

Q2

06

Q3

06

Q4

06

Q1

07

-

5

10

15

20

Dividend Payout

Dividend Per Share

$197M

Q3

$27M

Q2

$10M

Q1

$61M

Q4

Reduced Outstanding Shares and

Equity Grants

Actual O/S Shares

Equity Grants

Million

Shares

112

114

116

118

120

122

124

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

FY04

FY05

FY06

15

Creditor’s Committee allocated 10% equity pool (11.25M shares) which were distributed by FY03

Each annual equity grant in last 3 years approximating 1% of outstanding

Less than 113 million shares outstanding on December 15th

0

2

4

6

8

10

FY2001-02

FY03

FY04

FY05

FY06

Options

Performance Units

Others

Million

Shares

Notes:

Uncertainly of effects from near-term softness in U.S. coal influencing overall

revenue guidance range

Stamler impact of 5% percentage points of revenue growth, and $11M

amortization costs

Strong operating performance continues to drive EBIT sales percent in the

“high teens” targeted range

EPS affected by higher interest costs offset by lower total outstanding shares

Tax rate assumed in FY07 of 33%

FY06 EPS excludes discreet tax credits

Summary of Forward Guidance

($ in millions)

FY2007

FY2006

CHANGE

Net Sales

$2,700-3,000

2,402

$

12.5-25.0%

Operating Income

$510-570

442

$

15-30%

Gross Profit Margin

31.7%

31.4%

Diluted EPS

$2.85-3.25

2.50

$

14-31%

16

Increased Q4 Earnings Guidance

A

A – EPS excludes discrete tax adjustments

17

------ Guidance Given ------

------- Actual Results -------

Sales(B)

Oper E(M)

EPS

Sales(B)

Oper E(M)

EPS

FY02 - Total Year

1.20-1.35

---

---

1.15

(15)

(0.25)

FY03 - Total Year

1.10-1.20

---

---

1.22

48

0.17

FY04 - Total Year

1.25-1.40

72-97

.27-.40

1.43

108

0.46

FY04 Q2 - FY05 Q1

1.30-1.50

80-105

.29-.47

1.53

142

0.63

FY04 Q3 - FY05 Q2

1.45-1.65

105-130

.45-.60

1.68

185

0.79

FY04 Q4 - FY05 Q3

1.60-1.80

137-165

.60-.75

1.82

229

0.92

FY05 - Total Year

1.70-1.90

165-195

.75-.91

1.93

267

1.20

FY05 Q2 - FY06 Q1

1.90-2.10

228-258

1.10-1.27

2.11

315

1.50

FY05 Q3 - FY06 Q2

2.00-2.20

265-295

1.33-1.50

2.20

361

1.80

FY05 Q4 - FY06 Q3

2.15-2.35

315-365

1.60-1.87

2.29

398

2.18

FY06 - Total Year

2.25-2.45

360-410

1.85-2.15

2.40

442

2.50

FY06 Q2 - FY07 Q1

2.35-2.55

385-435

2.05-2.35

---

---

---

FY06 Q3 - FY07 Q2

2.50-2.70

440-490

2.40-2.70

---

---

---

FY06 Q4 - FY07 Q3

2.65-2.95

470-550

2.60-2.95

---

---

---

FY07 - Total Year

2.70-3.00

510-575

2.85-3.25

---

---

---

14th straight quarter of increased guidance – specific issues considered this quarter in addition to normal guidance

deliberations included; a) effects of near-term softness in U.S. coal versus continued strength in overall markets, b)

Stamler adjustments and estimated effects, and c) forecasted effects of stock buyback program in fiscal 2007

Fiscal 2006 4th Quarter Earnings Call

18