UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

T ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED October 29, 2010

OR

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD From to _______

Commission File number 001-09299

JOY GLOBAL INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 39-1566457 |

| (State of Incorporation) | (I.R.S. Employer Identification No.) |

| 100 East Wisconsin Ave, Suite 2780, Milwaukee, Wisconsin | 53202 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (414) 319-8500

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of each exchange on which registered |

| Common Stock, $1 Par Value | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Preferred Stock Purchase Rights

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes T No £

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No T

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. T

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes T No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filed or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer T | Accelerated filer £ | Non-accelerated filer £ | Smaller reporting company £ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes £ No T

The aggregate market value of the voting and non-voting common stock held by non-affiliates, as of April 30, 2010 the last business day of our most recently completed second fiscal quarter, was approximately $5.9, billion, based on a closing price of $56.80 per share.

The number of shares outstanding of registrant’s common stock, as of December 7, 2010, was 103,620,460.

Documents incorporated by reference: the information required by Part III, Items 10, 11, 12, 13, and 14, is incorporated herein by reference to the proxy statement for the registrant’s 2011 annual meeting of stockholders.

INDEX TO

ANNUAL REPORT ON FORM 10-K

For The Year Ended October 29, 2010

| | | | Page |

| PART I | | | |

| | Item 1. | | 5 |

| | Item 1A. | | 12 |

| | Item 1B. | | 17 |

| | Item 2. | | 18 |

| | Item 3. | | 20 |

| | Item 4. | | 20 |

| | | | 21 |

| | | | |

| PART II | | | |

| | Item 5. | | 22 |

| | Item 6. | | 24 |

| | Item 7. | | 25 |

| | Item 7A. | | 37 |

| | Item 8. | | 39 |

| | Item 9. | | 39 |

| | Item 9A. | | 39 |

| | Item 9B. | | 40 |

| | | | |

| PART III | | | |

| | Item 10. | | 41 |

| | Item 11. | | 41 |

| | Item 12. | | 41 |

| | Item 13. | | 41 |

| | Item 14. | | 41 |

| | | | |

| PART IV | | | |

| | Item 15. | | 42 |

This Page

Intentionally

Left Blank

This document contains forward-looking statements, which are made in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. When used in this document, terms such as “anticipate,” “believe,” “estimate,” “expect,” “indicate,” “may be,” “objective,” “plan,” “predict,” “should,” “will be,” and similar expressions are intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). Forward-looking statements are based upon our expectations at the time they are made. Forward-looking statements involve risks and uncertainties and are not guarantees of future performance; actual results may differ for a variety of reasons, many of which are beyond our control. Although we believe that our expectations are reasonable, we can give no assurance that our expectations will prove to be correct. Important factors that could cause actual results to differ materially from such expectations (“Cautionary Statements”) are described generally below and disclosed elsewhere in this document, including in Item 1A, “Risk Factors,” Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and Item 7A, “Quantitative and Qualitative Disclosures about Market Risk.” All subsequent written or oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the Cautionary Statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

We describe these and other risks and uncertainties in greater detail under Item 1A “Risk Factors” below.

General

Joy Global Inc. (“we” and “us”) is a leading manufacturer and servicer of high productivity mining equipment for the extraction of coal and other minerals and ores. Our equipment is used in major mining regions throughout the world to mine coal, copper, iron ore, oil sands, and other minerals. Our underground mining machinery segment (“Joy Mining Machinery” or “Joy”) is a major manufacturer of underground mining equipment for the extraction of coal and other bedded minerals and offers comprehensive service locations near major mining regions worldwide. Our surface mining equipment segment (“P&H Mining Equipment” or “P&H”) is a major producer of surface mining equipment for the extraction of ores and minerals and provides ex tensive operational support for many types of equipment used in surface mining. Sales of original equipment for the mining industry, as a class of products, accounted for 40%, 45%, and 42% of our consolidated net sales for fiscal 2010, 2009, and 2008, respectively. Aftermarket sales, which includes revenues from maintenance and repair services, diagnostic analysis, fabrication, mining equipment and electric motor rebuilds, equipment erection services, training, and sales of replacement parts, account for the remainder of our consolidated sales for each of those years.

We are the direct successor to a business begun over 125 years ago and were known as Harnischfeger Industries, Inc. (the “Predecessor Company”) prior to our emergence from protection under Chapter 11 of the U.S. Bankruptcy Code on July 12, 2001.

At the beginning of 2010, we completed the integration of Continental Crushing and Conveying by combining this segment into our Underground Mining Machinery and Surface Mining Equipment segments. Crushing and conveying results related to surface applications are reported as part of the Surface Mining Equipment segment, while total crushing and conveying results are included in the Underground Mining Machinery segment to reflect the overall management responsibility for this product line. Eliminations include the surface applications of crushing and conveying included in both operating segments. Prior year segment results, bookings and backlog have been recast to reflect this change.

Underground Mining Machinery

Joy is the world’s largest producer of high productivity underground mining machinery for the extraction of coal and other bedded materials. We have significant facilities in Australia, South Africa, the United Kingdom, China, and the United States as well as sales offices and service facilities in India, Poland, and Russia. Joy products include: continuous miners; shuttle cars; flexible conveyor trains; complete longwall mining systems (consisting of powered roof supports, an armored face conveyor, and a longwall shearer); continuous haulage systems; battery haulers; roof bolters; crushing equipment; and conveyor systems. Joy also maintains an extensive network of service and replacement parts distribution centers to rebuild and service equipment and to sell replacement parts and consumables in support of its installed base. This network includes five service centers in the United States and eight outside the United States, all of which are strategically located in major underground mining regions.

Products and Services:

Continuous miners – Electric, self-propelled continuous miners cut material using carbide-tipped bits on a horizontal rotating drum. Once cut, the material is gathered onto an internal conveyor and loaded into a haulage vehicle or continuous haulage system for transportation to the main mine belt.

Longwall shearers – A longwall shearer moves back and forth on an armored face conveyor parallel to the material face. Using carbide-tipped bits on cutting drums at each end, the shearer cuts 1.2 to 6.5 meters of material on each pass and simultaneously loads the material onto the armored face conveyor for transport to the main mine belt.

Powered roof supports – Roof supports perform a jacking-like function that supports the mine roof during longwall mining. The supports advance with the longwall shearer and armored face conveyors, resulting in controlled roof falls behind the supports. A longwall face may range up to 400 meters in length.

Armored face conveyors – Armored face conveyors are used in longwall mining to transport material cut by the shearer away from the longwall face.

Shuttle cars – Shuttle cars, a type of rubber-tired haulage vehicle, are electric-powered with umbilical cable. They are used to transport material from continuous miners to the main mine belt where self-contained chain conveyors in the shuttle cars unload the material onto the belt. Some models of Joy shuttle cars can carry up to 22 metric tons of coal.

Flexible conveyor trains (FCT) – FCT’s are electric-powered, self-propelled conveyor systems that provide continuous haulage of material from a continuous miner to the main mine belt. The FCT uses a rubber belt similar to a standard fixed conveyor. The FCT’s conveyor belt operates independently from the track chain propulsion system, allowing the FCT to move and convey material simultaneously. Available in lengths of up to 570 feet, the FCT is able to negotiate multiple 90-degree turns in an underground mine infrastructure.

Roof bolters – Roof bolters are roof drills used to bore holes in the mine roof and to insert long metal bolts into the holes to reinforce the mine roof.

Battery haulers – Battery haulers perform a similar function to shuttle cars. Shuttle cars are powered through cables and battery haulers are powered by portable rechargeable batteries.

Continuous haulage systems – The continuous haulage system provides a similar function as the FCT in that it transports material from the continuous miner to the main mine belts on a continuous basis versus the batch process used by shuttle cars and battery haulers, but it does so with different technology. It is made up of a series of connected bridge structures that utilize chain conveyors that transport the coal from one bridge structure to the next bridge structure and ultimately to the main mine belts.

Feeder breakers – Feeder breakers are a form of crusher that use rotating drums with carbide-tipped bits to break down the size of the mined material for loading onto conveyor systems or feeding into processing facilities. Mined material is typically loaded into the feeder breaker by a shuttle car or battery hauler in underground applications and by haul trucks in surface applications.

Conveyor systems – Conveyor systems are used in both above- and under-ground applications. The primary component of a conveyor system is the terminal which itself comprises a drive, discharge, take-up and tail loading section.

High angle conveyors – The Continental high angle conveyor is a versatile method for elevating or lowering materials continuously from one level to another at extremely steep angles. One of the differentiating factors of the Continental technology is the use of the proprietary fully equalized pressing mechanism which secures material toward the center of the belt while gently, but effectively, sealing the belt edges together. The high angle conveyor has throughput rates ranging from 0.30 to 4,400 tons per hour.

Joy’s service and support infrastructure quickly and efficiently provides customers with high-quality parts, exchange components, repairs, rebuilds, whole machine exchanges, and services. Joy’s cost-per-ton programs allow its customers to pay fixed prices for each ton of material mined in order to match equipment costs with revenues, and its component exchange programs minimize production disruptions for repair or scheduled rebuilds. Both programs reduce customer capital requirements and ensure quality aftermarket parts and services for the life of the contract. Joy sells its products and services directly to its customers through a global network of sales and marketing personnel.

The Joy business has demonstrated cyclicality over the years. The primary drivers of the cyclicality are commodity prices (particularly coal prices) and coal production levels. Joy’s business is particularly sensitive to conditions in the coal mining industry, which accounts for substantially all of Joy’s sales. Other drivers of cyclicality include product life cycles, new product introductions, governmental regulations, competitive pressures and industry consolidation.

Surface Mining Equipment

P&H is the world’s largest producer of electric mining shovels and a leading producer of rotary blasthole drills and walking draglines for open-pit mining operations. P&H has facilities in Australia, Brazil, Canada, Chile, China, South Africa, and the United States, as well as sales offices in India, Mexico, Peru, Russia, the United Kingdom, and Venezuela. P&H products are used in mining copper, coal, iron ore, oil sands, silver, gold, diamonds, phosphate, and other minerals and ores. P&H also provides logistics and a full range of life cycle management service support for its customers through a global network of P&H MinePro Services® operations strategically located within major mining regions. In some markets, P&H MinePro Services also provides electric motor rebuilds and other selected products and services to the non-mining industrial segment. P&H also sells used electric mining shovels in some markets.

Products and Services:

Electric mining shovels – Mining shovels are primarily used to load copper ore, coal, iron ore, oil sands, gold, and other mineral-bearing materials and overburden into trucks or other conveyances. There are two basic types of mining loaders: electric shovels and hydraulic excavators. Electric mining shovels typically feature larger dippers, allowing them to load greater volumes of material, while hydraulic excavators are smaller and more maneuverable. The electric mining shovel offers the lowest cost per ton of mineral mined. Its use is determined by the size of the mining operation and the availability of electricity. Dippers can range in size from 12 to 82 cubic yards.

Walking draglines – Draglines are primarily used to remove overburden to uncover coal or mineral deposits and then to replace the overburden as part of reclamation activities. P&H’s draglines are equipped with bucket sizes ranging from 30 to 160 cubic yards.

Blasthole drills – Most surface mines require breakage or blasting of rock, overburden, or ore using explosives. A blasthole drill creates a pattern of holes to contain the explosives. Drills are usually described in terms of the diameter of the hole they bore. Blasthole drills manufactured by P&H bore holes ranging in size from 9 7/8 to 17.5 inches in diameter and can exert a pull down force up to 150,000 lbs.

P&H MinePro Services provides life cycle management support, including equipment erections, relocations, inspections, service, repairs, rebuilds, upgrades, used equipment, new and used parts, enhancement kits, and training. The term “life cycle management” refers to our strategy to maximize the productivity of our equipment over the equipment’s entire operating life cycle through the optimization of the equipment, its operating and maintenance procedures, and its upgrade and refurbishment. Each life cycle management program is specifically designed for a particular customer and that customer’s application of our equipment. Under each program, we provide aftermarket products and services to support the equipment during its operating life cycle. Under some of the pr ograms, the customer pays us an amount based upon hours of operation or units of production achieved by the equipment. The amount to be paid per unit is determined by the economic model developed on a case-by-case basis, and is set at a rate designed to include both the estimated costs and anticipated profit.

P&H MinePro Services personnel and MinePro distribution centers are strategically located close to customers in major mining centers around the world, supporting P&H and other brands. P&H sells its products and services directly to its customers through a global network of sales and marketing personnel. The P&H MinePro Services distribution organization also represents other leading providers of equipment and services to the mining industry and associated industries, which we refer to as “Alliance Partners.” Some of the P&H Alliance Partner relationships include the following companies:

| · | Berkley Forge and Tool Inc. | | · | LeTourneau Inc. |

| · | Bridon American Corporation | | · | Phillippi-Hagenbach Inc. |

| · | Central Queensland Mining Supplies | | · | Prodinsa Wire Rope |

| · | Dux Machinery | | · | Wire Rope Industries Ltd. |

| · | Hensley Industries Inc. | | · | Wire Rope Corporation of America, Inc. |

| · | Hitachi Mining Division | | | |

For each Alliance Partner, we enter into an agreement that provides us with the right to distribute certain Alliance Partners’ products in specified geographic territories. Specific sales of new equipment are typically based on “buy and resell” arrangements or are direct sale from the Alliance Partner to the ultimate customer with a commission paid to us. The type of sales arrangement is typically agreed at the time of the customer’s commitment to purchase. Our aftermarket sales of parts produced by Alliance Partners are generally made under “buy and resell” arrangements. To support Alliance Partners’ products in certain geographic regions, we typically hold in inventory All iance Partners’ parts.

P&H’s businesses are subject to cyclical movements in the markets. Sales of original equipment are driven to a large extent by commodity prices and demand. Copper, coal, oil sands, gold and iron ore mining accounted for approximately 90% of total P&H sales in recent years. Rising commodity prices and demand typically lead to the expansion of existing mines, opening of new mines, or re-opening of less efficient mines. Although the aftermarket segment is much less cyclical, severe reductions in commodity prices and/or demand can result in the removal of machines from mining production, and thus dampen demand for parts and services. Conversely, significant increases in commodity prices and/or demand can result in higher use of equipment and generate requirements for mor e parts and services.

Operational Excellence - Joy Global Business System

In order to become a world class company serving the mining industry, we have developed the Joy Global Business System as an extension of our operational excellence initiatives.

The Joy Global Business System is:

| | · | Developing world class products, processes and people |

| | · | Building on common global processes, methods and metrics |

| | · | Servicing and adapting to local customer needs |

The major objectives of the Joy Global Business System are:

| | · | Safety - establishment of a zero-harm mentality |

| | · | Velocity - cycle time reductions and on time/on specification all the time |

| | · | Productivity - doing more with less by working and investing smarter |

| | · | Quality - flawless execution in everything we do |

| | · | Customer Satisfaction - every customer is a reference for our products |

Seasonality

All of our business segments are subject to moderate seasonality, with the first quarter of our fiscal year generally experiencing lower sales due to a decrease in working days caused by the U.S. Thanksgiving and year-end holidays.

Financial Information

Financial information about our business segments and geographic areas of operation is contained in Item 8 – Financial Statements and Supplementary Data and Item 15 – Exhibits and Financial Statement Schedules.

Employees

As of October 29, 2010, we employed 11,900 employees worldwide, with 5,600 employed in the United States. Collective bargaining agreements or similar type arrangements cover 37% of our U.S. workforce and 30% of our international employees. In 2011, union agreements are to expire for 3% of our employees with the largest covering the AMICUS union at our facilities in the United Kingdom and the Teamsters Union at our facility in Meadowlands, Pennsylvania.

Customers

Joy and P&H sell their products primarily to large global and regional mining companies. No customer or affiliated group of customers accounted for 10% or more of our consolidated net sales for 2010.

Competitive Conditions

Joy and P&H conduct their domestic and foreign operations under highly competitive market conditions, requiring that their products and services be competitive in price, quality, service, and delivery. The customers for these products are generally large mining companies with substantial purchasing power.

Joy’s continuous miners, longwall shearers, powered roof supports, armored face conveyors, continuous haulage systems, shuttle cars, and battery haulers compete with similar products made by a number of established and emerging worldwide manufacturers of such equipment. Joy’s rebuild services compete with a large number of local repair shops and also compete with various regional suppliers in the sale of replacement parts for Joy equipment.

P&H’s shovels and draglines compete with similar products produced by one significant competitor and with hydraulic excavators, large rubber-tired front-end loaders, and bucket wheel excavators made by several international manufacturers. P&H’s large rotary blasthole drills compete with several worldwide drill manufacturers. As high productivity mining becomes more widely accepted internationally, especially in emerging markets, global manufacturing capability is becoming a competitive advantage, but it is still most important to have repair and rebuild capability near the customer’s operations. P&H MinePro Services competes with a large number of primarily regional suppliers in the sale of parts.

Joy and P&H compete on the basis of providing superior productivity, reliability, and service that lowers the overall cost of production for their customers. Joy and P&H compete with local and regional service providers in the provision of maintenance, rebuild and other services to mining equipment users.

Backlog

Backlog represents unfilled customer orders for our original equipment and aftermarket products and services. Customer orders included in backlog as of October 29, 2010 represent contracts to purchase specific original equipment, products or services by customers who have satisfied our credit review procedures. Through October 31, 2008, backlog related to our Surface Mining Equipment division was recorded with a letter of intent and deposits to secure production slots. During the third quarter of fiscal 2009, we recorded a $605.9 million adjustment to our backlog based on our new booking policy requiring a contract. The following table provides backlog by business segment as of our fiscal year end. These backlog amounts exclude customer arrangements under long-term equipment life cycle management programs. Such programs extend for up to 13 years and totaled approximately $987.2 million as of October 29, 2010. Sales already recognized by fiscal year-end under the percentage-of-completion method of accounting are also excluded from the amounts shown.

| In thousands | | 2010 | | | 2009 | | | 2008 | |

| | | | | | | | | | |

| Underground Mining Machinery | | $ | 1,208,181 | | | $ | 926,719 | | | $ | 1,528,666 | |

| Surface Mining Equipment | | | 637,050 | | | | 575,192 | | | | 1,707,334 | |

| Eliminations | | | (24,973 | ) | | | (31,033 | ) | | | (61,266 | ) |

| Total Backlog | | $ | 1,820,258 | | | $ | 1,470,878 | | | $ | 3,174,734 | |

Of the $1.8 billion of backlog, approximately $170.7 million is expected to be recognized as revenue beyond fiscal 2011.

The increase in backlog for our Underground Mining Machinery division as of October 29, 2010 as compared to October 30, 2009 was primarily related to increased demand for original equipment and aftermarket products and services globally. The increase in backlog for our Surface Mining Equipment division was primarily due to increased new orders for electric mining shovels as the global economy continues to recover.

The decrease in backlog for our Surface Mining Equipment division as of October 30, 2009 as compared to October 31, 2008 was due to the $605.9 million backlog adjustment during the third quarter of 2009 and decreased bookings in most markets as a result of our customers’ cautious global economic outlook for mined commodities. The decrease in Underground Mining Machinery is primarily correlated to decreased demand for U.S. underground coal.

Eliminations include the surface applications of crushing and conveying included in both operating segments.

Raw Materials

We utilize a supplier risk management monitoring process to analyze our suppliers to determine holistic risk of production disruption as it relates to procurement of materials. Based on the results of the continuous evaluations, we partner with our suppliers to address issues identified. We believe this process gives us greater clarity into the drivers of supplier performance and provides us with early indications of potential supplier issues.

Joy purchases electric motors, gears, hydraulic parts, electronic components, castings, forgings, steel, clutches, and other components and raw materials from outside suppliers. P&H purchases raw and semi-processed steel, castings, forgings, copper, and other materials from a number of suppliers. In addition, component parts such as engines, bearings, controls, hydraulic components, and a wide variety of mechanical and electrical items are purchased from a group of pre-qualified suppliers.

Patents and Trademarks

We own numerous patents and trademarks and license technology from others relating to our products and manufacturing methods. We have also granted patent and trademark licenses to other manufacturers and receive royalties under most of these licenses. While we do not consider any particular patent or license or group of patents or licenses to be material to our business segments, we believe that in the aggregate our patents and licenses are significant in distinguishing many of our product lines from those of our competitors. The recorded cost of patents and trademarks by segment are as follows:

| | | Underground | | | Surface | | | | |

| | | Mining | | | Mining | | | | |

| In thousands | | Machinery | | | Equipment | | | Consolidated | |

| | | | | | | | | | |

| Patents | | | | | | | | | |

| Gross Carrying Value | | $ | 21,206 | | | $ | - | | | $ | 21,206 | |

| Accumulated Amortization | | | (7,964 | ) | | | - | | | | (7,964 | ) |

| Net Carrying Value | | $ | 13,242 | | | $ | - | | | $ | 13,242 | |

| | | | | | | | | | | | | |

| Trademarks | | $ | 75,400 | | | $ | - | | | $ | 75,400 | |

Research and Development

We are strongly committed to pursuing technological development through the engineering of new products and systems, the improvement and enhancement of licensed technology, and related acquisitions of technology. Research and development expenses were $29.8 million, $22.3 million, and $16.4 million for 2010, 2009, and 2008, respectively.

Environmental, Health and Safety Matters

Our domestic activities are regulated by federal, state, and local statutes, regulations, and ordinances relating to both environmental protection and worker health and safety. These laws govern current operations, require remediation of environmental impacts associated with past or current operations, and under certain circumstances provide for civil and criminal penalties and fines as well as injunctive and remedial relief. Our foreign operations are subject to similar requirements as established by their respective countries. We believe that we have substantially satisfied these diverse requirements.

Compliance with environmental laws and regulations did not have a material effect on capital expenditures, earnings, or our competitive position in 2010. Because these requirements are complex and, in many areas, rapidly evolving, there can be no guarantee against the possibility of additional costs of compliance. However, we do not expect that our future compliance with environmental laws and regulations will have a material effect on our capital expenditures, earnings or competitive position, and do not expect to make any material capital expenditures for environmental control facilities in fiscal 2011.

Our operations or facilities have been and may become the subject of formal or informal enforcement actions or proceedings for alleged noncompliance with either environmental or worker health and safety laws or regulations. Such matters have typically been resolved through direct negotiations with the regulatory agency and have typically resulted in corrective actions or abatement programs. However, in some cases, fines or other penalties have been paid.

International Operations

For information on the risks faced by our international operations, see Item 1A. - Risk Factors.

Available Information

Our internet address is: www.joyglobal.com. We make our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act available free of charge through our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

Our international operations are subject to many uncertainties, and a significant reduction in international sales of our products could adversely affect us.

In addition to the other risk factors below, our international operations are subject to various political, economic, and other uncertainties that could adversely affect our business. A significant reduction of our international business due to any of these risks would adversely affect our sales. In 2010, 2009, and 2008, approximately 56%, 50%, and 52%, respectively of our sales were derived from sales outside the United States. Risks faced by our international operations include:

| | · | international political and trade issues and tensions; |

| | · | regional or country specific economic downturns; |

| | · | fluctuations in currency exchange rates, particularly the Australian dollar, British pound sterling, Brazilian real, Canadian dollar, Chilean peso, Chinese renminbi, and South African rand; |

| | · | complications in complying with a variety of foreign laws and regulations, which may adversely affect our operations and ability to compete effectively in certain jurisdictions or regions; |

| | · | unexpected changes in regulatory requirements, up to and including the risk of nationalization or expropriation by foreign governments; |

| | · | higher tax rates and potentially adverse tax consequences including restrictions on repatriating earnings, adverse tax withholding requirements, and double taxation; |

| | · | difficulties protecting our intellectual property; |

| | · | increased risk of litigation and other disputes with customers; |

| | · | longer payment cycles and difficulty in collecting accounts receivable; |

| | · | costs and difficulties in integrating, staffing and managing international operations, especially in rapidly growing economies such as China; |

| | · | transportation delays and interruptions; |

| | · | natural disasters and the greater difficulty in recovering from them as compared to the United States in some of the foreign countries in which we operate, especially in countries prone to earthquakes, such as Indonesia, India, China, and Chile; |

| | · | uncertainties arising from local business practices and cultural considerations; and |

| | · | custom matters and changes in trade policy or tariff regulations. |

We expect that the percentage of our sales occurring outside the United States will increase over time largely due to increased activity in China, India, and other emerging markets. The foregoing risks may be particularly acute in emerging markets, where our operations are subject to greater uncertainty due to increased volatility associated with the developing nature of the economic, legal, and governmental systems of these countries. If we are unable to successfully manage the risks associated with expanding our global business or to adequately manage operational fluctuations, it could adversely affect our business, financial condition, or results of operations.

The cyclical nature of our original equipment manufacturing business could cause fluctuations in our operating results.

Our business, in particular our original equipment manufacturing business, is cyclical in nature. The cyclicality of Joy’s original equipment sales is driven primarily by commodity prices, product life cycles, competitive pressures, and other economic factors affecting the mining industry such as company consolidation. P&H’s original equipment sales are subject to cyclical movements based in large part on changes in coal, copper, iron ore, oil, and other commodity prices. Falling commodity prices have in the past and may in the future lead to reductions in the production levels of existing mines, a contraction in the number of existing mines, and the closure of less efficient mines. Decreased mining activity is likely to lead to a decrease in demand for new mining machinery.& #160; As a result of this cyclicality, we have previously experienced significant fluctuation in our business, results of operations, and financial condition. We expect that cyclicality in our equipment manufacturing business may cause us to experience further significant fluctuation in our business, financial condition, or results of operations.

We operate in a highly competitive environment, which could adversely affect our sales and pricing.

Our domestic and foreign manufacturing and service operations are subject to significant competitive pressures. We compete on the basis of product performance, customer service, availability, reliability, productivity, and price. Many of our customers are large global mining companies that have substantial bargaining power, and some of our sales require us to participate in competitive tenders where we must compete on the basis of various factors, including performance guarantees and price. We compete directly and indirectly with other manufacturers of surface and underground mining equipment and with manufacturers of parts and components for such products. Some of our competitors are larger than us and, as a result, may have broader product offerings and greater access to financial resources. � 60;As a result, certain of our competitors may pursue aggressive pricing or product strategies that may cause us to lose sales or reduce the prices we charge for our original equipment and aftermarket products and services. These actions may lead to reduced revenues, lower margins, and/or a decline in market share, any of which may adversely affect our business and results of operations.

We are largely dependent on the continued demand for coal, which is subject to economic and climate related risks.

Over two-thirds of our revenues come from our coal-mining customers. Many of these customers supply coal for steel production and/or as fuel for the production of electricity in the United States and other countries. Demand for steel is affected by the global level of economic activity and economic growth. The pursuit of the most cost effective form of electricity generation continues to take place throughout the world. Coal combustion generates significant greenhouse gas emissions and governmental and private sector goals and mandates to reduce greenhouse gas emissions may increasingly affect the mix of electricity generation sources. Further developments in connection with legislation, regulations or ot her limits on greenhouse gas emissions and other environmental impacts or costs from coal combustion, both in the United States and in other countries, could diminish demand for coal as a fuel for electricity generation. If lower greenhouse gas emitting forms of electricity generation, such as nuclear, solar, natural gas or wind power, become more prevalent or cost effective, or diminished economic activity reduces demand for steel, demand for coal will be reduced. When demand for coal is reduced, the demand for our mining equipment could be adversely affected,

We require cash to service our indebtedness, which reduces the cash available to finance our business.

Our ability to service our indebtedness will depend on our future performance, which will be affected by prevailing economic conditions and financial, business, regulatory, and other factors. Some of these factors are beyond our control. If we cannot generate sufficient cash flow from operations to service our indebtedness and to meet our other obligations and commitments, we might be required to refinance our debt or to dispose of assets to obtain funds for such purpose. There is no assurance that refinancings or asset dispositions could be effected on a timely basis or on satisfactory terms, if at all, particularly if credit market conditions worsen. Furthermore, there can be no assurance that refinancings or asset dispositions would be permitted by the terms of our debt instruments.

Our unsecured revolving credit agreement contains certain financial tests. If we do not satisfy such tests, our lenders could declare a default under our debt instruments, and our indebtedness could be declared immediately due and payable. Our ability to comply with the provisions of our unsecured revolving credit agreement may be affected by changes in economic or business conditions beyond our control.

Our unsecured revolving credit agreement contains covenants that limit our ability to incur indebtedness, acquire other businesses and impose various other restrictions. These covenants could affect our ability to operate our business and may limit our ability to take advantage of potential business opportunities as they arise. We cannot be certain that we will be able to comply with the foregoing financial ratios or covenants or, if we fail to do so, that we will be able to obtain waivers from our lenders.

Significant changes in our actual investment return on pension assets, discount rates and other factors could affect our results of operations, equity and pension funding requirements in future periods.

Our results of operations may be affected by the amount of income or expense that we record for our defined benefit pension plans and certain other retirement benefits. We measure the valuation of our pension plans annually as of our fiscal year end in order to determine the funded status of and our funding obligation with respect to such plans. This annual valuation of our pension plans is highly dependent on certain assumptions used in actuarial valuations, which include actual and expected return on pension assets and discount rates. These assumptions take into account current and expected financial market data, other economic conditions such as interest rates and inflation, and other factors such as plan asset allocation and future salary increases. If actual rates of return on pension a ssets materially differ from assumptions, our pension funding obligations may increase or decrease significantly. Our funding obligation is determined under governmental regulations and is measured based on value of our assets and liabilities. An adverse change in our funded status due to the volatility of returns on pension assets and the discount rate could increase our required future contributions to our plans, which may adversely affect our results of operations and financial condition.

For a more detailed discussion regarding how our financial statements may be affected by pension and other retirement plan accounting policies, see “Critical Accounting Policies - Pension and Postretirement Benefits and Costs” on page 33 within Item 7 of this Form 10-K.

Our continued success depends on our ability to protect our intellectual property, which cannot be assured.

Our future success depends in part upon our ability to protect our intellectual property. We rely principally on nondisclosure agreements and other contractual arrangements and trade secret law and, to a lesser extent, trademark and patent law, to protect our intellectual property. However, these measures may be inadequate to protect our intellectual property from infringement by others or prevent misappropriation of our proprietary rights. In addition, the laws of some foreign countries do not protect proprietary rights to the same extent as do U.S. laws. Our inability to protect our proprietary information and enforce our intellectual property rights through infringement proceedings could adversely affect our business, financial condition or results of operations.

Demand for our products may be adversely impacted by regulations related to mine safety.

Our principal customers are surface and underground mining companies. The mining industry has encountered increased scrutiny as it relates to safety regulations primarily due to recent high profile mine accidents. Current or proposed legislation on safety standards and the increased cost of compliance may induce customers to discontinue or limit their mining operations, and may discourage companies from developing new mines, which in turn could diminish demand for our products.

Demand for our products may be adversely impacted by environmental regulations impacting the mining industry or electric utilities.

Many of our customers supply coal as a power generating source for the production of electricity in the United States and other countries. The operations of these mining companies are geographically diverse and are subject to or impacted by a wide array of regulations in the jurisdictions where they operate, including those directly impacting mining activities and those indirectly affecting their businesses, such as applicable environmental laws. The high cost of compliance with environmental regulations may also cause customers to discontinue or limit their mining operations, and may discourage companies from developing new mines. Additionally, government regulation of electric utilities may adversely impact the demand for coal to the extent that such regulations cause electric utilities to select alt ernative energy sources, such as natural gas, and renewable energy technologies as a source of electric power. As a result of these factors, demand for our mining equipment could be adversely affected by environmental regulations impacting the mining industry or altering the consumption patterns of electric utilities.

Our manufacturing operations are dependent upon third party suppliers, making us vulnerable to supply shortages and price increases, and we are also limited by our plant capacity constraints.

In the manufacture of our products, we use large amounts of raw materials and processed inputs including steel, engine components, copper and electronic controls. We obtain raw materials and certain manufactured components from third party suppliers. Our ability to grow revenues is constrained by the capacity of our plants, our ability to supplement that capacity with outside sources, and our success in securing critical supplies such as steel and copper. To reduce material costs and inventories, we rely on supplier arrangements with preferred vendors as a source for “just in time” delivery of many raw materials and manufactured components. Because we maintain limited raw material and component inventories, even brief unanticipated delays in delivery by suppliers, including those due to capacity constraints, labor disputes, impaired financial condition of suppliers, weather emergencies, or other natural disasters, may adversely affect our ability to satisfy our customers on a timely basis and thereby affect our financial performance. This risk increases as we continue to change our manufacturing model to more closely align production with customer orders. If we are not able to pass raw material or component price increases on to our customers, our margins could be adversely affected. Any of these events could adversely affect our business, financial condition, or results of operations.

Labor disputes and increasing labor costs could adversely affect us.

Many of our principal domestic and foreign operating subsidiaries are parties to collective bargaining agreements with their employees. Collective bargaining agreements or similar type arrangements cover 37% of our U.S. workforce and 30% of our international employees. In 2011, collective bargaining agreements are scheduled to expire for 3% of our employees. As such, we cannot provide assurance that disputes, work stoppages, or strikes will not arise in the future. In addition, when existing collective bargaining agreements expire, we cannot be certain that we will be able to reach new agreements with our employees. Such new agreements may be on substantially different terms and may result in increased di rect and indirect labor costs. Future disputes with our employees could adversely affect our business, financial condition, or results of operations.

A material disruption to one of our significant manufacturing plants could adversely affect our ability to generate revenue.

We produce most of our original equipment and aftermarket parts for each product type at a limited number of principal manufacturing facilities. If operations at one or more of these significant facilities were to be disrupted as a result of equipment failures, natural disasters, power outages or other reasons, our business, financial conditions, or results of operations could be adversely affected. Interruptions in production could increase costs and delay delivery of some units. Production capacity limits could cause us to reduce or delay sales efforts until capacity is available.

Our business could be adversely affected by our failure to develop new technologies.

The mining industry is a capital-intensive business, with extensive planning and development necessary to open a new mine. The success of our customers’ mining projects is largely dependent on the efficiency with which the mine operates. If we are unable to provide continued technological improvements in our equipment that meet our customers’ expectations, or the industry’s expectations, on mine productivity, the demand for our mining equipment could be substantially adversely affected.

We are subject to litigation risk, which could adversely affect us.

We and our subsidiaries are involved in various unresolved legal matters that arise in the normal course of operations, the most prevalent of which relate to product liability (including asbestos and silica related liability), employment, and commercial matters. In addition, we and our subsidiaries become involved from time to time in proceedings relating to environmental matters. Also, as a normal part of their operations, our subsidiaries may undertake contractual obligations, warranties, and guarantees in connection with the sale of products or services. Some of these claims and obligations involve significant potential liability.

Product liability claims could adversely affect us.

The sale of mining equipment entails an inherent risk of product liability and other claims. Although we maintain product liability insurance covering certain types of claims, our policies are subject to substantial deductibles. We cannot be certain that the coverage limits of our insurance policies will be adequate or that our policies will cover any particular loss. Insurance can be expensive, and we may not always be able to purchase insurance on commercially acceptable terms, if at all. Claims brought against us that are not covered by insurance or that result in recoveries in excess of insurance coverage could adversely affect our business, financial condition, or results of operations.

If we are unable to retain qualified employees, our growth may be hindered.

Our ability to provide high quality products and services depends in part on our ability to retain skilled personnel in the areas of senior management, product engineering, servicing, and sales. Competition for such personnel is intense and our competitors can be expected to attempt to hire our skilled employees from time to time. In particular, our results of operations could be adversely affected if we are unable to retain customer relationships and technical expertise provided by our management team and our professional personnel.

We rely on significant customers, the loss of one or more of which could adversely affect our operating results, financial condition and existing business.

We are dependent on maintaining significant customers by delivering reliable, high performance mining equipment and other products on a timely basis. We do not consider ourselves to be dependent upon any single customer; however, our top ten customers collectively accounted for approximately 34% of our sales for 2010. Our sales have become more concentrated in recent years as consolidation has occurred in the mining industry. The consolidation and divestitures in the mining industry may result in different equipment preferences among current and former significant customers. The loss of one or more of our significant customers could, at least on a short- term basis, have an adverse effect on our business, financial condition, or results of operations.

We may acquire other businesses or engage in other transactions, which may adversely affect our operating results, financial condition, and existing business.

From time to time, we explore transaction opportunities which may complement our core business. These transaction opportunities may come in the form of acquisitions, joint ventures, start ups or other structures. Any such transaction may entail any number of risk factors including (without limitation) general business risk, integration risk, technology risk, and market acceptance risk. Additionally, any such transaction may require utilization of debt, equity or other capital resources or expenditures and our management’s time and attention, and may not create value for us or our stockholders.

Item 1B. Unresolved Staff Comments

None.

As of October 29, 2010, the following principal properties of our operations were owned, except as indicated. Our worldwide corporate headquarters are currently housed in 10,000 square feet of leased space in Milwaukee, Wisconsin. All of these properties are generally suitable for the operations currently conducted at them.

Underground Mining Machinery Locations

| | | | Floor Space | | Land Area | | |

| | Location | | (Sq. Ft.) | | (Acres) | | Principal Operations |

| | | | | | | | |

| | Franklin, Pennsylvania | | 830,900 | | 58 | | Component and parts production |

| | | | | | | | |

| | Warrendale, Pennsylvania | | 71,250 | | 13 | | Administration and warehouse |

| | | | | | | | |

| | Reno, Pennsylvania | | 121,400 | | 22 | | Chain manufacturing |

| | | | | | | | |

| | Brookpark, Ohio | | 85,000 | | 4 | | Machining manufacturing |

| | | | | | | | |

| | Solon, Ohio | | 101,200 | | 11 | | Gear manufacturing |

| | | | | | | | |

| * | Bluefield, Virginia | | 102,160 | | 15 | | Component repair and complete machine rebuilds |

| * | Duffield, Virginia | | 101,310 | | 11 | | Component repair and complete machine rebuilds |

| * | Homer City, Pennsylvania | | 91,124 | | 10 | | Component repair and complete machine rebuilds |

| * | Wellington, Utah | | 76,250 | | 60 | | Component repair and complete machine rebuilds |

| | Lebanon, Kentucky | | 88,250 | | 12 | | Component repair and complete machine rebuilds |

| | | | | | | | |

| * | Meadowlands, Pennsylvania | | 117,900 | | 12 | | Global distribution center |

| | | | | | | | |

| | Millersburg, KY | | 115,000 | | 14 | | Administration, manufacturing and warehouse |

| | | | | | | | |

| | Winfield, Alabama | | 250,000 | | 33 | | Manufacturing, sales, engineering, administration |

| | | | | | | | |

| | Salyersville, Kentucky | | 125,842 | | 14 | | Manufacturing |

| | | | | | | | |

| | Belton, South Carolina | | 191,000 | | 24 | | Manufacturing, sales, administration |

| | | | | | | | |

| * | McCourt Road, Australia | | 97,392 | | 33 | | Original equipment, component repairs and complete machine rebuilds |

| | | | | | | | |

| | Parkhurst, Australia | | 76,639 | | 19 | | Component repairs, complete machine rebuilds and original equipment |

| | | | | | | | |

| | Wollongong, Australia | | 26,996 | (1) | 4 | | Component repair and complete machine rebuilds |

| | | | | | | | |

| | Somersby, Australia | | 49,655 | | 3 | | Manufacturing original equipment, component repairs , |

| | | | | | | | Engineering, administration |

| * | Steeledale, South Africa | | 250,381 | | 13 | | Component repairs and manufacturing |

| * | Wadeville, South Africa | | 333,393 | | 29 | | Original equipment, component repair and complete machine rebuilds |

| | | | | | | | |

| | Pinxton, England | | 76,000 | | 10 | | Component repair and complete machine rebuilds |

| | | | | | | | |

| | Wigan, England | | 60,000 | (4) | 3 | | Engineering and administration |

| * | Worcester, England | | 178,000 | | 14 | | Original equipment and component repairs |

| | | | | | | | |

| | Sunderland, England | | 100,850 | (7) | 5 | | Manufacturing, engineering, sales & administration |

| | | | | | | | |

| * | Tychy, Poland | | 52,312 | (4) | 8 | | Original equipment, component repair and complete machine rebuilds |

| | | | | | | | |

| | Baotou, China | | 76,800 | (6) | 5 | | Component repair and rebuild facility |

| | Tianjin, China | | 63,680 | (8) | 8 | | Original equipment and sales office |

| | Wuxi, China | | 185,421 | | 26 | | Original equipment, component repairs and complete machine rebuilds |

| | | | | | | | |

| | Kuzbass, Russia | | 15,750 | | 3 | | Component repair and rebuild facility |

| | | | | | | | |

| | Kolata, India | | 3,100 | | 1 | | Sales office |

| | Nagpur, India | | 11,000 | | 1 | | Component repair workshop |

Surface Mining Equipment Locations

| | | | Floor Space | | Land Area | | |

| | Location | | (Sq. Ft.) | | (Acres) | | Principal Operations |

| | | | | | | | |

| | Milwaukee, Wisconsin | | 684,000 | | 46 | | Electric mining shovels, electric draglines and large diameter electric and diesel rotary blasthole drills |

| | | | | | | | |

| * | Milwaukee, Wisconsin | | 180,000 | | 13 | | Electrical products |

| | | | | | | | |

| * | Gillette,Wyoming | | 60,000 | | 6 | | Motor rebuild service center |

| | Evansville, Wyoming | | 25,000 | | 6 | | Motor rebuild service center |

| | Mesa, Arizona | | 40,000 | | 5 | | Motor rebuild service center |

| * | Elko, Nevada | | 30,000 | | 5 | | Motor rebuild service center & welding services |

| | Elko Nevada | | 28,000 | (5) | 4 | | Machine/Mechanical shop |

| | Kilgore, Texas | | 12,400 | | 4 | | Motor rebuild service center |

| | | | | | | | |

| * | Calgary, Canada | | 6,000 | (5) | 1 | | Climate control system manufacturing |

| | Edmonton, Canada | | 32,581 | (3) | 4 | | Motor rebuild service center |

| * | Fort McMurray, Canada | | 68,000 | | 2 | | Rebuild shop |

| | | | | | | | |

| | Tianjin, China | | 130,000 | (8) | 3 | | Original equipment |

| | | | | | | | |

| * | Bassendean, Australia | | 72,500 | | 5 | | Components and parts for mining shovels |

| * | Mackay, Australia | | 36,425 | | 3 | | Components and parts for mining shovels |

| * | Hemmant, Australia | | 23,724 | | 2 | | Motor rebuild service center |

| | East Maitland, Australia | | 32,916 | (2) | 1 | | Motor rebuild service center |

| * | Murarrie, Australia | | 15,000 | (4) | 1 | | Administrative and Sales Office |

| | Rutherford, Australia | | 15,640 | (2) | 4 | | Motor rebuild service center |

| | | | | | | | |

| * | Belo Horizonte, Brazil | | 37,700 | | 1 | | Components and parts for mining shovels |

| | | | | | | | |

| * | Santiago, Chile | | 6,800 | | 1 | | Rebuild service center |

| * | Antofagasta, Chile | | 21,000 | | 1 | | Rebuild service center |

| | | | | | | | |

| | Kolkata, India | | 3,100 | | 1 | | Sales office |

| | (1) | Under a month to month lease |

| | (2) | Under a lease expiring in 2011 |

| | (3) | Under a lease expiring in 2012 |

| | (4) | Under a lease expiring in 2013 |

| | (5) | Under a lease expiring in 2014 |

| | (6) | Under a lease expiring in 2018 |

| | (7) | Under a lease expiring in 2020 |

| | (8) | Under a lease expiring in 2021 |

| | * | Property includes a warehouse |

Joy Mining also operates warehouses in Nashville, Illinois; Brookwood, Alabama; Henderson, Kentucky; Pineville, West Virginia; Green River, Wyoming; Carlsbad, New Mexico; Price, Utah; Lovely, Kentucky; Norton, Virginia; and Witbank, South Africa. All warehouses are owned except for the warehouses in Nashville, Illinois; Henderson, Kentucky; Price, Utah; Lovely, Kentucky; and Tychy, Poland, which are leased. In addition, Joy Mining has sales offices in Mt. Vernon, Illinois; Eagle Pass, Texas; Abington, Virginia; Secunda, South Africa and Kolata, India. Joy Mining also has a smart services and training facility at Witbank, South Africa.

P&H also operates warehouses in Cleveland, Ohio; Hibbing and Virginia, Minnesota; Charleston, West Virginia; Negaunee, Michigan; Gilbert, Arizona; Hinton, Sparwood, Labrador City, Fort McMurray and Sept. Iles, Canada; Iquique and Calama, Chile; Johannesburg, South Africa; and Puerto Ordaz, Venezuela. The warehouses in Hibbing, Fort McMurray, Johannesburg, and Calama are owned, while the others are leased. In addition, P&H leases sales offices throughout the United States and in principal surface mining locations in other countries, such as Chijuajua, Mexico and Kolkata, India.

Item 3. Legal Proceedings

We and our subsidiaries are involved in various unresolved legal matters that arise in the normal course of operations, the most prevalent of which relate to product liability (including over 1,000 asbestos and silica-related cases), employment, and commercial matters. Although the outcome of these matters cannot be predicted with certainty and favorable or unfavorable resolutions may affect our results of operations on a quarter-to-quarter basis, based upon our case evaluations and the availability of insurance coverage we believe that the outcome of such legal and other matters will not have a material adverse effect on our consolidated financial position, results of operations, or liquidity.

During the Chapter 11 reorganization of our Predecessor Company, in 1999 through the filing of a voluntary petition under Chapter 11 of the United States Bankruptcy Code, the Wisconsin Department of Workforce Development (“DWD”) filed claims against Beloit Corporation (“Beloit”), a former majority owned subsidiary, and us in federal bankruptcy court seeking “at least” $10 million in severance benefits and penalties, plus interest, on behalf of former Beloit employees. DWD’s claim against Beloit included unpaid severance pay allegedly due under a severance policy Beloit established in 1996. DWD alleges that Beloit violated its alleged contractual obligations under the 1996 policy when it amended the policy in 1999. The Federal District Court for the District of Delaware removed DWD’s claims from the bankruptcy court and granted summary judgment in our favor on all of DWD’s claims in December 2001. DWD appealed the decision and the judgment was ultimately vacated in part and remanded. Following further proceedings, DWD’s only remaining claim against us is that our Predecessor Company tortiously interfered with Beloit’s employees’ severance benefits in connection with Beloit's decision to amend its severance policy. We concluded a trial on DWD’s remaining claim during the week of March 1, 2010. On September 21, 2010 the court granted judgment in our favor. DWD then filed a post-judgment motion asking the court to change its decision. We await a ruling on DWD’s latest motion. If the court denies DWD’s motion, we expect that DWD will file an appeal with the United States Court of Appeals for the Third Circuit. We do not believe these p roceedings will have a significant effect on our financial condition, results of operations, or liquidity.

Because DWD's claims were still being litigated as of the effective date of our Plan of Reorganization, the Plan of Reorganization provided that the claim allowance process with respect to DWD's claims would continue as long as necessary to liquidate and determine these claims.

The following table shows certain information for each of our executive officers, including position with the corporation and business experience. Our executive officers are elected each year at the organizational meeting of our Board of Directors, which follows the annual meeting of shareholders, and at other meetings as needed.

| | | | | Current Office and | | Years as |

| Name | | Age | | Principal Occupation | | Officer |

| | | | | | | |

| Michael W. Sutherlin | | 64 | | President and Chief Executive Officer and a director since 2006. Previously, Executive Vice President (“EVP”) of Joy Global Inc. and President and Chief Operating Officer of Joy Mining Machinery from 2003 to 2006. | | 8 |

| | | | | | | |

| Michael S. Olsen | | 59 | | EVP, Chief Financial Officer and Treasurer since December 2008. Senior Vice President of Finance of Joy Mining Machinery from February 2003 to December 2008 and, from July 2006 to December 2008 Vice President and Chief Accounting Officer and until December 2009, Chief Accounting Officer. | | 4 |

| | | | | | | |

| Dennis R. Winkleman | | 60 | | EVP Administration since February 2010; EVP Human Resources from 2000 to February 2010. | | 10 |

| | | | | | | |

| Edward L. Doheny II | | 48 | | EVP of Joy Global Inc., and President and Chief Operating Officer of Joy Mining Machinery since 2006. Prior to joining Joy Global, Mr. Doheny was with Ingersoll-Rand Corporation, where he was President of Industrial Technologies from 2003 to 2005 and President of Shared Services in 2003. | | 5 |

| | | | | | | |

| Randal W. Baker | | 47 | | EVP of Joy Global Inc., and President and Chief Operating Officer of P&H Mining Equipment Inc. since 2009. Prior to joining Joy Global, Mr. Baker was with CNH Global N.V., where he was President and Chief Executive Officer of the agricultural equipment business from 2006 to 2009, Senior Vice President Logistics and Supply Chain from 2005 to 2006, and Vice President North American Marketing from 2004 to 2005. | | 2 |

| | | | | | | |

| Sean D. Major | | 46 | | EVP, General Counsel and Secretary since October 2007. EVP and General Counsel from April 2007 to October 2007. EVP from January 2007 to April 2007. Prior to joining Joy Global, Mr. Major was employed by Johnson Controls, Inc., holding roles of increasing legal responsibility since 1998, most recently as Assistant General Counsel & Assistant Secretary. | | 4 |

| | | | | | | |

| Eric A. Nielsen | | 51 | | EVP – Business Development since May 2010. Prior to joining Joy Global, Mr. Nielsen was President of Terex Corporation’s Material Processing and Mining Group since 2008 and held various management positions with Volvo Construction Equipment, most recently as President and CEO of Volvo Excavators and Volvo Construction Equipment Korea | | 1 |

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the Nasdaq Global SelectMarket under the symbol “JOYG.” As of December 2, 2010, there were approximately 91,000 shareholders of record. The following table sets forth the high and low sales prices and dividend payments for our common stock during the periods indicated.

| | | Price per Share | | | Dividends | |

| | | High | | | Low | | | Per Share | |

| Fiscal 2010 | | | | | | | | | |

| Fourth Quarter | | $ | 73.94 | | | $ | 53.66 | | | $ | 0.175 | |

| Third Quarter | | $ | 60.75 | | | $ | 44.25 | | | $ | 0.175 | |

| Second Quarter | | $ | 65.93 | | | $ | 42.45 | | | $ | 0.175 | |

| First Quarter | | $ | 61.29 | | | $ | 45.47 | | | $ | 0.175 | |

| | | | | | | | | | | | | |

| Fiscal 2009 | | | | | | | | | | | | |

| Fourth Quarter | | $ | 59.30 | | | $ | 35.32 | | | $ | 0.175 | |

| Third Quarter | | $ | 42.25 | | | $ | 26.75 | | | $ | 0.175 | |

| Second Quarter | | $ | 27.75 | | | $ | 15.38 | | | $ | 0.175 | |

| First Quarter | | $ | 33.16 | | | $ | 14.30 | | | $ | 0.175 | |

We did not make any purchases of our common stock, par value $1.00 per share, during fiscal 2010. Under our share repurchase program, management is authorized to repurchase up to $2.0 billion in shares of common stock in the open market or through privately negotiated transactions until December 31, 2011. The dollar amount of shares that may yet be purchased under the program is $883.4 million.

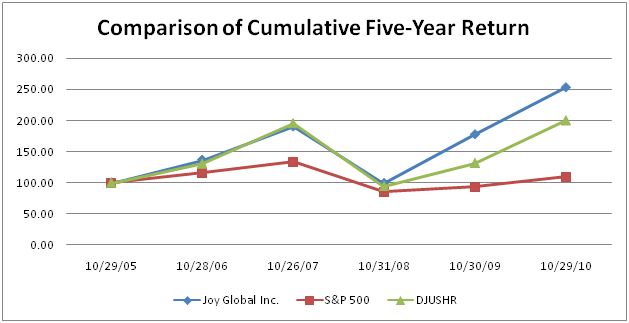

The following graph sets forth the cumulative total shareholder return, including reinvestment of dividends on a quarterly basis, on common stock during the preceding five years, as compared to the cumulative total returns of the Standard and Poor’s (“S&P”) 500 Composite Stock Index and the Dow Jones United States Commercial Vehicle Truck Index (“DJUSHR”). The DJUSHR was known as the Dow Jones U.S. Total Market Heavy Machinery Index until December 20, 2004. This graph assumes $100 was invested on October 31, 2005, in Common Stock, the S&P 500 Composite Stock Index, and the DJUSHR.

| | | 10/29/2005 | | | 10/28/2006 | | | 10/26/2007 | | | 10/31/2008 | | | 10/30/2009 | | | 10/29/2010 | |

| | | | | | | | | | | | | | | | | | | |

| Joy Global Inc. | | | 100 | | | | 137 | | | | 190 | | | | 99 | | | | 178 | | | | 254 | |

| S&P 500 | | | 100 | | | | 116 | | | | 133 | | | | 85 | | | | 94 | | | | 109 | |

| DJUSHR | | | 100 | | | | 131 | | | | 195 | | | | 95 | | | | 132 | | | | 200 | |

Item 6. Selected Financial Data

The following table sets forth certain selected historical financial data on a consolidated basis. The selected consolidated financial data was derived from our Consolidated Financial Statements. Prior to fiscal 2007 our fiscal year end was the Saturday nearest October 31. Each of our fiscal quarters consists of 13 weeks, except for any fiscal years consisting of 53 weeks that will add one week to the first quarter. On December 18, 2006, we further amended our bylaws so that starting in fiscal 2007 our fiscal year-end date will be the last Friday in October. The selected consolidated financial data should be read in conjunction with our Consolidated Financial Statements appearing in Item 8 – Financial Statements and Su pplementary Data and Item 15 – Exhibits and Financial Statement Schedules.

RESULTS OF OPERATIONS

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | October 29, | | | October 30, | | | October 31, | | | October 26, | | | October 28, | |

| In thousands except per share amounts | | 2010 | | | 2009 | | | 2008 (1) | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | | | | |

| Net sales | | $ | 3,524,334 | | | $ | 3,598,314 | | | $ | 3,418,934 | | | $ | 2,547,322 | | | $ | 2,401,710 | |

| Operating income | | | 697,103 | | | | 702,312 | | | | 551,204 | | | | 473,275 | | | | 442,397 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations | | $ | 461,499 | | | $ | 454,650 | | | $ | 373,137 | | | $ | 279,784 | | | $ | 414,856 | |

| Income from discontinued operations | | | - | | | | - | | | | 1,141 | | | | - | | | | - | |

| Cumulative effect of change in accounting principle | | | - | | | | - | | | | - | | | | - | | | | 1,565 | |

| Net income | | $ | 461,499 | | | $ | 454,650 | | | $ | 374,278 | | | $ | 279,784 | | | $ | 416,421 | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic Earnings Per Share | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations | | $ | 4.47 | | | $ | 4.44 | | | $ | 3.47 | | | $ | 2.54 | | | $ | 3.41 | |

| Income from discontinued operations | | | - | | | | - | | | | 0.01 | | | | - | | | | - | |

| Cumulative effect of change in accounting principle | | | - | | | | - | | | | - | | | | - | | | | 0.01 | |

| Net income per common share | | $ | 4.47 | | | $ | 4.44 | | | $ | 3.48 | | | $ | 2.54 | | | $ | 3.42 | |

| | | | | | | | | | | | | | | | | | | | | |

| Diluted Earnings Per Share | | | | | | | | | | | | | | | | | | | | |

| Income from continuing operations | | $ | 4.40 | | | $ | 4.41 | | | $ | 3.44 | | | $ | 2.51 | | | $ | 3.37 | |

| Income from discontinued operations | | | - | | | | - | | | | 0.01 | | | | - | | | | - | |

| Cumulative effect of change in accounting principle | | | - | | | | - | | | | - | | | | - | | | | 0.01 | |

| Net income per common share | | $ | 4.40 | | | $ | 4.41 | | | $ | 3.45 | | | $ | 2.51 | | | $ | 3.38 | |

| | | | | | | | | | | | | | | | | | | | | |

| Dividends Per Common Share | | $ | 0.70 | | | $ | 0.70 | | | $ | 0.625 | | | $ | 0.60 | | | $ | 0.45 | |

| | | | | | | | | | | | | | | | | | | | | |

| Working capital | | $ | 1,338,603 | | | $ | 1,023,243 | | | $ | 597,778 | | | $ | 784,256 | | | $ | 627,894 | |

| Total Assets | | $ | 3,284,041 | | | $ | 3,008,279 | | | $ | 2,644,313 | | | $ | 2,134,903 | | | $ | 1,954,005 | |

| Total Long-Term Obligations | | $ | 396,668 | | | $ | 542,217 | | | $ | 559,330 | | | $ | 396,497 | | | $ | 98,519 | |

(1) – In February 2008, we acquired N.E.S. Investment Co. and its wholly owned subsidiary, Continental Global Group, Inc. (“Continental”), a worldwide leader in conveyor systems for bulk material handling in mining and industrial applications.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the Consolidated Financial Statements and related notes. References made to years are for fiscal year periods. Dollar amounts are in thousands, except share and per-share data and as indicated.

The purpose of this discussion and analysis is to enhance the understanding and evaluation of the results of operations, financial position, cash flows, indebtedness, and other key financial information of Joy Global Inc. and its subsidiaries for 2010, 2009, and 2008. For a more complete understanding of this discussion, please read the Notes to Consolidated Financial Statements included in this report.

Overview

We have been manufacturing mining equipment for over 125 years. We operate in two business segments: Underground Mining Machinery, comprised of our Joy Mining Machinery business and Surface Mining Equipment, comprised of our P&H Mining Equipment business. Joy is a leading producer of high productivity underground mining equipment used primarily for the extraction of coal. P&H is the world’s largest producer of high productivity electric mining shovels and a major producer of walking draglines and large rotary blasthole drills, used primarily for surface mining of copper, coal, iron ore, oil sands, and other minerals.

In addition to selling original equipment, we provide parts, components, repairs, rebuilds, diagnostic analysis, training, and other aftermarket services for our installed base of machines. In the case of Surface Mining Equipment, we also provide aftermarket services for equipment manufactured by other companies, including manufacturers with which we have ongoing relationships and which we refer to as “Alliance Partners.” We emphasize our aftermarket products and services as an integral part of lowering our customers’ cost per unit of production and are focused on continuing to grow this part of our business.

Operating Results

Bookings for 2010 were $3.9 billion, an increase of 39% from $2.8 billion, excluding $250.9 million and $63.2 million of order cancellations for original equipment and aftermarket parts and service, respectively, in 2009. The 2010 bookings included the $108.9 million favorable effect of foreign currency translation. The increase in bookings consisted of a $708.6 million increase in original equipment and $385.7 million increase in aftermarket parts and service. The increase in both original equipment and aftermarket orders reflects our customers’ commitment to both brown field and green field projects as the global demand for commodities continues to increase, most significantly in emerging markets.

Net sales for 2010 totaled $3.5 billion, compared with $3.6 billion in 2009, and included a $138.5 million favorable effect of foreign currency translation. The decrease in net sales was the result of a $201.6 million decrease in original equipment shipments, partially offset by $127.6 million increase in aftermarket parts and service. In 2009, shipments increased on declining order rates as we reduced backlog while meeting scheduled delivery dates. Net sales for the underground equipment business decreased by 6.7% in 2010 compared to 2009, while net sales for the surface mining equipment business increased by 4.0%.

Operating income was $697.1 million in 2010, compared to $702.3 million in 2009 and included a $20.9 million favorable effect of foreign currency translation. The decrease in operating income was primarily the result of decreased sales volumes and increased retiree benefit costs of $36.1 million. These unfavorable items were partially offset by favorable pricing realization and the mix of products sold, decreased material input costs and elimination of severance and related expenses of $14.4 million recorded in 2009.

Net income was $461.5 million or $4.40 per diluted share in 2010, compared with $454.7 million or $4.41 per diluted share in 2009.

Market Outlook

The commodity end-markets have strong fundamentals and a positive outlook despite slow economic recovery in the industrialized countries and slower growth in the emerging markets, particularly China, which results from efforts to balance economic growth while containing inflation.

After recovering beginning in the second half of 2009 and continuing into 2010, copper demand hit an all-time high in June of 2010 and continues to run well above its prior five year range. This was not driven by China alone, and in fact, China demand has leveled from 2009 while demand from the rest of the world has increased significantly since the beginning of 2010. Copper prices have moved steadily up during 2010 in response to both increasing demand and limited capacity to expand mine production in the near term. The longer term outlook is further impacted by the continued trend of declining ore grades.

The seaborne demand for both thermal and metallurgical coal continues to be driven by China, India, and the other emerging markets. China continues to import coal at an annualized rate of more than 140.0 million metric tons, up from imports of 104.0 million metric tons last year. India also continues to import more coal, with its imports expected to triple during the next five years. In addition to emerging market demand, coal burn has been increasing in Europe and stockpiles there have been drawn down. Seaborne thermal coal prices have been increasing on the projection that continued demand growth from the emerging markets will keep supply under pressure.