UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Materials Pursuant to sec. 240.14a-12 |

|

Joy Global Inc.

|

| (Exact Name of Registrant as Specified in its Charter) |

|

| Payment of Filing Fee (Check the appropriate box) |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.1 |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

Notice of 2014

Annual Meeting of

Shareholders and

Proxy Statement

TABLE OF CONTENTS

JOY GLOBAL INC.

100 E. Wisconsin Avenue, Suite 2780

Milwaukee, Wisconsin 53202

NOTICE OF ANNUAL MEETING

The annual meeting of shareholders of Joy Global Inc. will be held at 100 E. Wisconsin Avenue, 2nd Floor Conference Room, Milwaukee, Wisconsin, on Tuesday, March 4, 2014 at 7:30 a.m. for the following purposes:

| | 1. | to elect eight persons to the Board of Directors; |

| | 2. | to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for Fiscal 2014; |

| | 3. | to conduct an advisory vote on our named executive officers’ compensation; |

| | 4. | to transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting. |

Shareholders of record at the close of business on January 3, 2014 are entitled to receive notice of and to vote at the annual meeting and any adjournment or postponement of the meeting. A list of shareholders entitled to vote will be available at our headquarters at least 10 days prior to the meeting and may be inspected there during business hours by any shareholder for any purpose germane to the meeting.

Whether or not you plan to attend the meeting, it is important that your shares be represented and voted at the annual meeting. We urge you to vote your shares at your earliest convenience by submitting your proxy by Internet, telephone, or by marking, signing, and dating the enclosed proxy card and returning it in the enclosed envelope. If you decide to attend the annual meeting, you will be able to vote in person, even if you have previously submitted your proxy.

By order of the Board of Directors,

Sean D. Major

Executive Vice President,

General Counsel and Secretary

January 24, 2014

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on March 4, 2014. Our proxy statement and 2013 annual report to shareholders are available at http://investors.joyglobal.com/financials.cfm.

PROXY STATEMENT SUMMARY

To assist you in reviewing the proposals to be acted upon at our 2014 annual meeting of shareholders, including the election of directors and the advisory vote on our named executive officers’ compensation, this summary highlights information contained elsewhere in this proxy statement as well as information about our Fiscal 2013 financial performance. For additional information regarding these topics, please review the complete proxy statement and our Annual Report on Form 10-K for the year ended October 25, 2013.

Business Highlights

We are a leading manufacturer and servicer of high productivity mining equipment for the extraction of coal and other minerals and ores. We manufacture and market original equipment and aftermarket parts and services for both underground and surface mining and certain industrial applications. Our equipment is used in major mining regions throughout the world to mine coal, copper, iron ore, oil sands, gold and other minerals. We also offer comprehensive service locations near major mining regions worldwide and provide extensive operational support for equipment used in surface and underground mining.

Our Fiscal 2013 results were influenced by a very challenging mining market. Most of the major commodities that are mined by our customers were in a significant supply surplus following several years of investment in production capacity. As a result, commodity prices fell 20% to 40% from peak sales and mining industry capital expenditures fell by more than 40%. Despite these downward trends, our Fiscal 2013 operating results also reflect our focus on reducing costs and emphasizing operational excellence initiatives, including streamlining our businesses and a rebranding initiative. Through this focus, we lowered our cost base while protecting profit margins. These actions enabled us to continue significant cash generation while investing in strategic growth initiatives to position us to capitalize when improved market conditions return. The following table highlights key metrics of our financial performance for Fiscal 2013 and the two preceding fiscal years.

| | | | | | | | | | | | |

| Financial Highlights | | Fiscal 2013 | | | Fiscal 2012 | | | Fiscal 2011 | |

| (in thousands, except per-share information) | | | | | | | | | |

Net Sales | | | $5,012,697 | | | | $5,660,889 | | | | $4,403,906 | |

Gross Profit | | | $1,623,213 | | | | $1,877,087 | | | | $1,506,301 | |

Gross Profit Percentage | | | 32.4% | | | | 33.2% | | | | 34.2% | |

Operating Income | | | $821,661 | | | | $1,172,559 | | | | $920,179 | |

Operating Income Percentage | | | 16.4% | | | | 20.7% | | | | 20.9% | |

Net Income | | | $533,713 | | | | $762,201 | | | | $609,656 | |

Diluted Earnings Per Share | | | $4.99 | | | | $7.13 | | | | $5.72 | |

Cash Dividends Per Share | | | $0.70 | | | | $0.70 | | | | $0.70 | |

Shares Outstanding (avg.) | | | 106,996 | | | | 106,889 | | | | 106,537 | |

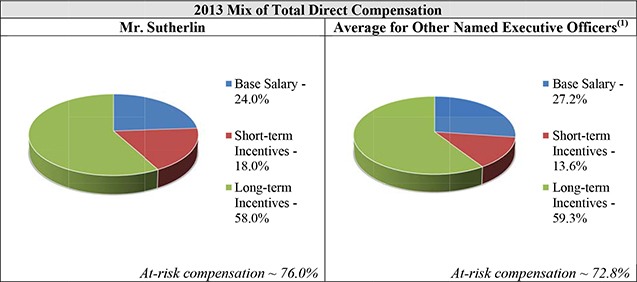

Compensation Highlights

The Human Resources and Nominating Committee of the Board of Directors designs our compensation program to be competitive with manufacturing companies of comparable size and complexity in order to attract, retain and incentivize talented executive officers and employees. This program reflects the Committee’s belief that incentive compensation should be directly linked to performance in order to promote the attainment of our performance objectives, with an emphasis on building long-term shareholder value. In Fiscal 2013, the Board took the following actions related to our compensation programs:

1

| | • | | Limited the practice of providing tax “gross-ups,” or reimbursements to employees for the payment of individual income taxes incurred due to the receipt of perquisites, other than for relocation expenses and club initiation fees; and |

| | • | | Continued our practice of including provisions in all equity award agreements providing for the clawback of such awards if we are required to restate our financial statements as a result of material noncompliance with any financial reporting requirement. |

Fiscal 2013 executive compensation is set forth in the Summary Compensation Table and described in the Compensation Discussion and Analysis in this proxy statement. The table below is an overview of total direct compensation received by our named executive officers in Fiscal 2013, which indicates the significance of performance-based compensation, consisting of short-term cash incentives and long-term equity awards, relative to base salary. The table does not include all of the information included in the Summary Compensation Table.

| | | | | | | | | | |

Named Executive

Officer | | 2013 Base

Salary | | Short-Term

Incentives | | Stock and

Option Awards | | 2013 Total Direct

Compensation | | % Change

from 2012(1) |

Michael W. Sutherlin | | $1,134,615 | | $850,962 | | $2,745,520 | | $4,731,097 | | (27.8%) |

James M. Sullivan | | $524,231 | | $275,221 | | $712,512 | | $1,511,964 | | - |

Randal W. Baker | | $776,923 | | $407,885 | | $2,868,180 | | $4,052,988 | | 70.9% |

Edward L. Doheny II | | $853,788 | | $445,240 | | $3,549,440 | | $4,848,468 | | 140.9% |

Sean D. Major | | $446,346 | | $200,856 | | $549,624 | | $1,196,826 | | (7.2%) |

Michael S. Olsen | | $125,192 | | $65,726 | | - | | $190,918 | | - |

| | (1) | Change from Fiscal 2012 total direct compensation is not reported for Mr. Sullivan or Mr. Olsen. Mr. Sullivan joined the company as an Executive Vice President on October 1, 2012 and succeeded Mr. Olsen as Chief Financial Officer on December 18, 2012. Mr. Olsen retired on February 1, 2013. |

Corporate Governance Developments

The Board of Directors believes that establishing and maintaining effective corporate governance is critical to fulfilling its oversight responsibility. The Board has enacted corporate governance policies to promote a culture of compliance among our directors, officers, and employees that is focused on the ethical achievement of our long-term strategic goals. In the past year, we have taken the following actions to promote good corporate governance:

| | • | | Executed on our succession process for the positions of Chief Executive Officer and Chief Financial Officer; |

| | • | | Sought the views of our shareholders regarding whether we should adopt a majority voting standard for the future election of directors in uncontested elections; |

| | • | | In response to the strong preference of our shareholders for a majority voting standard, the Board of Directors amended our bylaws to implement a majority voting standard for the election of directors in uncontested elections and to require an incumbent director who is not elected under this standard to promptly tender his or her resignation; |

2

| | • | | Implemented mandatory online training under our Worldwide Business Conduct Policy Training and Certification Program for all U.S. salaried employees, equivalent employees based outside the United States, and certain third parties; |

| | • | | Appointed Steven L. Gerard as Lead Independent Director to succeed Richard B. Loynd, who had served in that role since 2007; |

| | • | | Completed our annual review of committee charters and reviewed and updated our Corporate Governance Principles to include updated director qualification criteria, including providing for enhanced consideration of director and board diversity; and |

| | • | | Conducted our annual review of Board and committee effectiveness. |

| | | | |

| Shareholder Actions |

Company Proposals | | Board Recommendation | | Page Reference |

Election of Directors | | For each nominee | | 9 |

Ratification of appointment of our independent registered public accounting firm | | For | | 14 |

Advisory vote on our named executive officers’ compensation | | For | | 15 |

Election of Directors (Proposal 1)

This proxy statement contains important information about the qualifications and experience of each of the director nominees who you are asked to elect. The Human Resources and Nominating Committee performs an annual assessment to see that our directors have the skills and experience to effectively oversee our management and operations. The Board of Directors has determined that each of its nominees possesses the required qualifications, experience, commitment, and integrity necessary for continued service on the Board of Directors.

| | | | | | | | | | | | |

| Board Nominees |

| | | | | Director | | | | Experience/ | | | | |

| Name | | Age | | Since | | Principal Occupation | | Qualifications | | Independent | | Committees |

| | | | | | | |

Edward L. Doheny II | | 51 | | 2013 | | President and Chief Executive Officer, | | •Leadership | | No | | Executive |

| | | | | | | Joy Global Inc. | | •Industry | | | | |

| | | | | | | | | •Global | | | | |

| | | | | | | | | •Governance | | | | |

| | | | | | | |

Steven L. Gerard | | 68 | | 2001 | | Chairman and Chief Executive Officer, | | •Leadership | | Yes | | HRN(1) |

| | | | | | | CBIZ, Inc. | | •Accounting | | | | Executive |

| | | | | | | | | •Governance | | | | |

| | | | | | | | | •Industry | | | | |

| | | | | | | |

John T. Gremp | | 62 | | 2011 | | Chairman and Chief Executive Officer, | | •Leadership | | Yes | | HRN(1) |

| | | | | | | FMC Technologies, Inc. | | •Industry | | | | |

| | | | | | | | | •Global | | | | |

| | | | | | | | | •Governance | | | | |

3

| | | | | | | | | | | | |

| Board Nominees |

| | | | | Director | | | | Experience/ | | | | |

| Name | | Age | | Since | | Principal Occupation | | Qualifications | | Independent | | Committees |

| | | | | | | |

John Nils Hanson | | 72 | | 1996 | | Chairman, | | •Leadership | | Yes | | Executive |

| | | | | | | Joy Global Inc. | | •Industry | | | | |

| | | | | | | | | •Global | | | | |

| | | | | | | | | •Governance | | | | |

| | | | | | | |

Gale E. Klappa | | 63 | | 2006 | | Chairman and Chief Executive Officer, | | •Leadership | | Yes | | Audit |

| | | | | | | Wisconsin Energy Corporation | | •Accounting | | | | |

| | | | | | | | | •Finance | | | | |

| | | | | | | | | •Industry | | | | |

| | | | | | | | | •Governance | | | | |

| | | | | | | |

Richard B. Loynd | | 86 | | 2001 | | President, | | •Governance | | Yes | | HRN(1) |

| | | | | | | Loynd Capital Management | | •Leadership | | | | Executive |

| | | | | | | | | •Industry | | | | |

P. Eric Siegert | | 48 | | 2001 | | Senior Managing Director, | | •Accounting | | Yes | | Audit |

| | | | | | | Houlihan, Lokey, Howard & Zukin | | •Finance | | | | |

| | | | | | | | | •Industry | | | | |

| | | | | | | |

James H. Tate | | 66 | | 2001 | | Independent Consultant | | •Accounting | | Yes | | Audit |

| | | | | | | | | •Finance | | | | |

| | | | | | | | | •Industry | | | | |

(1) Human Resources and Nominating Committee

Ratification of Appointment of Independent Registered Public Accounting Firm (Proposal 2)

As a matter of good corporate governance, we ask that our shareholders ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for Fiscal 2014. Set forth below is a summary of fees paid to Ernst & Young for services provided in Fiscal 2013 and Fiscal 2012.

| | | | | | | | |

| | | 2013 | | | 2012 | |

| | | | |

| | | (in millions) | |

Audit Fees | | $ | 3.20 | | | $ | 3.32 | |

Audit-Related Fees | | | 0.00 | | | | 0.00 | |

Tax Fees | | | 0.52 | | | | 0.84 | |

| | | | | | | | |

Total | | $ | 3.72 | | | $ | 4.16 | |

| | | | | | | | |

Advisory Vote on Our Named Executive Officers’ Compensation (Proposal 3)

For the fourth consecutive year, our shareholders are being asked to cast a non-binding advisory vote on our named executive officers’ compensation. We are gratified that shareholders have overwhelmingly supported our executive compensation program in prior years, with this proposal receiving the affirmative vote of 95%, 97% and 96% of votes cast by shareholders at the 2013, 2012 and 2011 annual meetings, respectively. In evaluating this proposal, we recommend that you review our Compensation Discussion and Analysis, which explains how and why the Human Resources and Nominating Committee arrived at its executive compensation actions and decisions for Fiscal 2013.

4

INFORMATION ABOUT THIS PROXY SOLICITATION

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Joy Global Inc., a Delaware corporation (the “corporation��� or the “company”), for use at the 2014 annual meeting of shareholders to be held at 100 E. Wisconsin Avenue, 2nd Floor Conference Room, Milwaukee, Wisconsin, on Tuesday, March 4, 2014 at 7:30 a.m. and at any adjournment or postponement of the annual meeting. The proxy statement, proxy card, and annual report are being mailed to shareholders on or about January 24, 2014.

Proxies

Properly signed and dated proxies received by the Secretary prior to or at the annual meeting will be voted as instructed on the proxies or, in the absence of such instruction:

| | • | | for the election to the Board of Directors of the persons nominated by the Board; |

| | • | | for the ratification of Ernst & Young LLP as our independent registered public accounting firm for Fiscal 2014; |

| | • | | for our named executive officers’ compensation; and |

| | • | | in accordance with the best judgment of the persons named in the proxy on any other matters which may properly come before the meeting. |

Any proxy may be revoked by the person executing it at any time before the polls close at the annual meeting by filing with the Secretary a written revocation or a duly executed form of proxy bearing a later date, or by voting in person at the annual meeting. The Board of Directors has appointed a representative of Broadridge Financial Solutions to act as an independent inspector at the annual meeting.

Record Date, Shares Outstanding and Quorum

Shareholders of record of our common stock, par value $1.00 per share (the “Common Stock”), at the close of business on January 3, 2014 (the “Record Date”) may vote on all matters presented at the annual meeting. As of the Record Date, 101,185,562 shares of Common Stock were outstanding and entitled to vote at the annual meeting. Each share of Common Stock is entitled to one vote.

A quorum is required to transact business at our annual meeting. Holders of at least a majority of the shares of our Common Stock must be present at the annual meeting in person or by proxy to constitute a quorum. Abstentions, shares for which authority is withheld to vote for director nominees, and broker non-votes (i.e., proxies from brokers or nominees regarding proposals for which such broker or nominee lacks discretionary voting authority where the beneficial owners or other persons entitled to vote have not provided voting instructions) will be considered present for the purpose of establishing a quorum. Once a share is represented at the annual meeting, it is deemed present for quorum purposes throughout the meeting, including any adjourned meeting, unless a new record date is set for the adjourned meeting.

If less than a majority of the outstanding shares of Common Stock are present or represented by proxy at the meeting, a majority of the shares that are present or represented by proxy at the meeting may adjourn the meeting from time to time without further notice.

5

Required Vote

Proposal 1: Election of Directors. In September 2013, the Board of Directors amended our bylaws to adopt a majority voting standard for the election of directors in uncontested elections. Under this standard, beginning at the 2014 annual meeting directors will be elected by the affirmative vote of a majority of votes cast. A “majority” of votes cast means that the number of votes “for” the election of a director nominee exceed the number of votes “withheld” with respect to such nominee. If an incumbent director in an uncontested election is not elected, he or she would be required to promptly tender his or her resignation to the Board of Directors. In the event of a contested election, which is one in which the number of candidates exceed the number of directors to be elected, the individuals receiving the largest number of votes will be elected up to the maximum number of directors to be chosen in the election.

Any shares not voted due to abstention or broker non-vote will not affect the election of directors. If you hold your shares in “street name,” your broker or other nominee will not have discretionary authority to vote your shares if you do not provide instructions as to how your shares should be voted on this proposal.

Proposal 2: Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for Fiscal 2014.The affirmative vote of a majority of the shares of Common Stock that are present in person or represented by proxy and entitled to vote at the meeting is required to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2014. Any shares present and not voted, whether by abstention or otherwise, will have no effect on the vote to ratify the appointment of our independent registered public accounting firm. If you hold your shares in “street name,” your broker or other nominee will have discretionary authority to vote your shares if you do not provide instructions as to how your shares should be voted on this proposal.

Proposal 3: Advisory vote on our named executive officers’ compensation. At the 2011 annual meeting, shareholders expressed their preference for conducting annual advisory votes on our named executive officers’ compensation. Consistent with this preference, the Board of Directors determined that such votes will occur annually. This vote permits shareholders to express their approval or disapproval of our executive compensation practices for our named executive officers, as disclosed in this proxy statement. Although the outcome of this vote is not binding on us, we will consider the outcome of this vote when developing our compensation policies and practices, and when making compensation decisions in the future. Any shares present and not voted, whether by broker non-vote, abstention, or otherwise, will have no effect on this advisory vote regarding our named executive officers’ compensation. If you hold your shares in “street name,” your broker or other nominee will not have discretionary authority to vote your shares if you do not provide instructions as to how your shares should be voted on this proposal.

6

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table lists the beneficial ownership of Common Stock as of January 17, 2014, by any person who beneficially owns more than 5% of our Common Stock, each of the persons nominated for election as directors, each of the executive officers named in the Summary Compensation Table, and our executive officers and directors as a group. Beneficial ownership of these shares consists of sole voting power and sole investment power, except as noted below. In addition to beneficial ownership of shares set forth in this table, each of our named executive officers and non-employee directors owns restricted stock units as set forth in the stock awards columns of the Outstanding Equity Awards at Fiscal Year-End 2013 table on page 38 and in the stock awards column of footnote 2 to the Director Compensation table on page 50, respectively.

| | | | | | |

| Name and Address of Beneficial Owner | | Shares Owned(1) | | | | Percent of Class |

| | | |

The Vanguard Group, Inc. | | 6,242,411(2) | | | | 6.17% |

100 Vanguard Boulevard | | | | | | |

Malvern, Pennsylvania 19355 | | | | | | |

| | | |

Michael W. Sutherlin | | 537,002 | | | | * |

| | | |

James M. Sullivan | | 10,840 | | | | * |

| | | |

Randal W. Baker | | 59,843 | | | | * |

| | | |

Edward L. Doheny II | | 123,447 | | | | * |

| | | |

Sean D. Major | | 47,960 | | | | |

| | | |

Michael S. Olsen | | 46,853 | | | | * |

| | | |

Steven L. Gerard | | 8,693 | | | | * |

| | | |

John T. Gremp | | - | | | | - |

| | | |

John Nils Hanson | | 206,791(3) | | | | * |

| | | |

Gale E. Klappa | | - | | | | - |

| | | |

Richard B. Loynd | | 11,898 | | | | * |

| | | |

P. Eric Siegert | | 3,345 | | | | * |

| | | |

James H. Tate | | 5,659 | | | | * |

| | | |

All executive officers and directors as a group (14 persons) | | 1,086,846(4) | | | | 1.0% |

| (1) | The beneficial ownership information presented in this proxy statement is based on information furnished by the specified persons and is determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, the number of shares reflected in this column includes (i) shares of Common Stock issuable upon the exercise of stock options that are exercisable within 60 days of January 17, 2014, and (ii) shares to be received upon the vesting of restricted stock units within 60 days of January 17, 2014. This information is not necessarily to be construed as an admission of beneficial ownership for other purposes. |

None of the shares shown as owned by directors or executive officers have been pledged as security.

7

Named executive officers and directors also hold restricted stock units that are not included in the beneficial ownership table because vesting will not occur within 60 days of January 17, 2014. The amounts of restricted stock units held by named executive officers and directors are described elsewhere in this proxy statement.

The amounts above include the following number of shares such person or group may acquire upon (1) exercise of stock options exercisable within 60 days of January 17, 2014, (2) shares such person or group has a right to acquire upon settlement of deferred stock units, and (3) shares to be distributed to such person or group upon settlement of restricted stock units within 60 days of January 17, 2014:

| | | | | | |

| | | Name | | Number of shares | |

| | Mr. Sutherlin | | | 364,549 | |

| | Mr. Sullivan | | | 10,667 | |

| | Mr. Baker | | | 49,000 | |

| | Mr. Doheny | | | 83,298 | |

| | Mr. Major | | | 26,001 | |

| | Mr. Olsen | | | 25,166 | |

| | Mr. Gerard | | | 1,398 | |

| | Mr. Hanson | | | 1,398 | |

| | Mr. Loynd | | | 1,398 | |

| | Mr. Tate | | | 1,398 | |

| | All executive officers and directors as a group | | | 576,439 | |

| (2) | Amount in table derived from Amendment No. 1 to Schedule 13G filed on February 11, 2013. |

| (3) | Includes 30,000 shares of Common Stock from the Hanson Family Foundation of which Mr. Hanson is a trustee, as well as 133,886 shares of Common Stock transferred to the following grantor retained annuity trusts of which Mr. Hanson is the Grantor: 7,199 shares to Avon 4-2011 Trust; 10,675 shares to Avon 6-2011 Trust; 12,325 shares to Avon 8-2011 Trust; 13,250 shares to Avon 10-2011 Trust; 8,073 shares to Avon 2-2012; 12,130 shares to Avon 4-2012; 13,428 shares to Avon 6-2012; 14,041 shares to Avon 8-2012; and 14,382 shares to Avon 10-2012. |

| (4) | Includes 12,349 shares owned and 12,166 shares underlying stock options exercisable within 60 days of January 17, 2014, by an executive officer not named in the Summary Compensation Table. |

8

PROPOSAL #1: ELECTION OF DIRECTORS

The Board of Directors consists of eight members. All members of the Board of Directors are elected by the holders of Common Stock at each annual meeting. The following table shows certain information, including the principal occupation and recent business experience for each of the eight individuals nominated by the Board of Directors for election at the 2014 annual meeting. All of the nominees are presently directors whose terms expire in 2014 and who are nominated to serve terms ending at the 2015 annual meeting following the election and qualification of their successors.

If an incumbent director nominee receives a greater number of votes “withheld” than “for” in an uncontested election, the director must promptly tender his resignation for consideration by the Human Resources and Nominating Committee and the Board (with the affected director recusing himself from the deliberations). The Board will be free to accept or reject the resignation and will disclose its decision within 90 days of certification of the vote results. If a director’s resignation is accepted by the Board, or if a new nominee for director is not elected, then the Board may fill the resulting vacancy. If a director’s resignation is not accepted by the Board, the director will continue to serve until the 2015 annual meeting and until the election and qualification of his successor.

The Board of Directors believes that each of its nominees possesses the required qualifications, including the experience, knowledge, education, skills, and character necessary for continued service on the Board of Directors. Through their prior experience on our Board of Directors and in our industry, each nominee is well-versed in our operations, markets and strategy, as well as with the duties and responsibilities of serving as a director of a public company in our industry. In addition, the nominees are familiar with the governance requirements applicable to public companies through experience serving in management or as directors of other publicly traded companies. The Board of Directors believes that each nominee’s experience and personal qualities will permit each nominee to make a substantial and active contribution to Board deliberations. If for any unforeseen reason any of these nominees should not be available for election, the proxies will be voted for such person or persons as may be nominated by the Board of Directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR EACH OF EDWARD L. DOHENY II, STEVEN L. GERARD, JOHN T. GREMP, JOHN NILS HANSON, GALE E. KLAPPA, RICHARD B. LOYND, P. ERIC SIEGERT, AND JAMES H. TATE TO SERVE AS A DIRECTOR AND TO HOLD OFFICE UNTIL OUR 2015 ANNUAL MEETING OF SHAREHOLDERS AND UNTIL THEIR SUCCESSORS ARE ELECTED AND QUALIFIED, OR UNTIL THEIR EARLIER DEATH, RESIGNATION, OR REMOVAL.

9

| | | | |

| | | | | Director Since |

| | |

Edward L. Doheny II | | President, Chief Executive Officer and a director since December 2013. Previously, Mr. Doheny served as the Executive Vice President of the corporation and President and Chief Operating Officer of its underground mining machinery business from 2006 to 2013. Prior to joining Joy Global, Mr. Doheny spent 20 years with Ingersoll-Rand Co. in a series of senior executive positions of increasing responsibility, including President of Industrial Technologies from 2003 to 2005, President of Shared Services in 2003 and previously as President of the Air Solutions Group. Mr. Doheny also serves as a director of John Bean Technologies Corporation. He is 51. | | 2013 |

| | |

| | Mr. Doheny’s experience with the company and in our industry, including his current leadership of the corporation, led the Board to conclude that he should continue to serve as a director for a full term commencing at the 2014 Annual Meeting. | | |

| | |

Steven L. Gerard | | Chairman and Chief Executive Officer of CBIZ, Inc., a leading provider of integrated business services and products headquartered in Cleveland, Ohio. Mr. Gerard has served as Chief Executive Officer and a director since 2000 and as Chairman since 2002. Mr. Gerard is a director of Lennar Corporation since 2000. He is 68. | | 2001 |

| | |

| | Mr. Gerard’s experience as a director since 2001, his service as our Lead Independent Director and member of our Human Resources and Nominating Committee and his prior service as a member of our Audit Committee, in addition to his 23 years of significant experience in senior management, including as a chief executive officer and director of other public companies, led the Board to conclude that he should continue to serve as a director. | | |

10

| | | | |

| | | | | Director Since |

| | |

John T. Gremp | | Chairman and Chief Executive Officer for FMC Technologies, Inc. Mr. Gremp has served as Chief Executive Officer of FMC Technologies, Inc., a major manufacturer of oilfield equipment since March 2011 and as Chairman since November 2011. Mr. Gremp previously served as President and Chief Operating Officer from April 2010 to February 2011 and as Executive Vice President of FMC Technologies’ Energy Systems business from January 2007 to March 2010. He served as Vice President of FMC Technologies’ Energy Production Systems business from 2004 to December 2006. Mr. Gremp previously served in a series of management positions of increasing responsibility after joining the company in 1975. He has served as a director of FMC Technologies, Inc. since 2011. He is 62. | | 2011 |

| | |

| | The Board believes Mr. Gremp should continue to serve on the Board of Directors based on his service to date and his experience as the Chief Executive Officer of a large, publicly traded company that designs and manufactures equipment used in the energy industry. In making this determination, the Board also considered Mr. Gremp’s operations management experience, which includes prior leadership of each of FMC Technologies’ business segments, and his knowledge and understanding of the financial, regulatory, legal and accounting issues affecting public companies of our size, and his management experience of international companies. | | |

| | |

John Nils Hanson | | Chairman. Mr. Hanson has served as our Chairman since 2000. He previously served as our President and Chief Executive Officer from 1999 to 2006. Mr. Hanson ran a series of industrial product and capital goods businesses before joining Joy Technologies Inc. in 1990, where he served as President of the Underground Mining Machinery Division until its acquisition by us in 1995. He has a Ph.D. in nuclear engineering/reactor physics. Mr. Hanson has also served as a director of Arrow Electronics, Inc. since 1998. He is 72. | | 1996 |

| | |

| | The Board believes that Mr. Hanson should continue to serve on the Board of Directors based on his leadership of the Board through 12 years of significant growth, his seven years of experience as our Chief Executive Officer, and his significant knowledge and deep understanding of our business and industry. | | |

11

| | | | |

| | | | | Director Since |

| | |

Gale E. Klappa | | Chairman and Chief Executive Officer of Wisconsin Energy Corporation, a Milwaukee-based holding company with subsidiaries in utility and non-utility businesses since 2004. Mr. Klappa has more than 20 years of experience working at a senior executive level in the public utility industry, including service as the Executive Vice President, Chief Financial Officer and Treasurer of The Southern Company. Since 2010, Mr. Klappa has also served as a director of Badger Meter, Inc., a publicly traded leader in the development and manufacture of flow management solutions. He is 63. | | 2006 |

| | |

| | Mr. Klappa’s experience as chief executive officer of a publicly traded company and service as Chair of our Audit Committee, coupled with his industry knowledge and understanding of public company financial statement requirements led the Board to conclude that he should continue serving as a director. | | |

| | |

Richard B. Loynd | | President of Loynd Capital Management. Mr. Loynd has previously served as Chairman and/or Chief Executive Officer, or as a director, of a number of public companies doing business in the industrial and consumer product areas. He is 86. | | 2001 |

| | |

| | Mr. Loynd’s service as chair of our Human Resources and Nominating Committee and as our Lead Independent Director from 2007 to 2013, coupled with his deep understanding of our operations, industry, markets and management, and his 50 years of experience as a senior executive, led the Board to conclude that he should continue to serve as a director. | | |

| | |

P. Eric Siegert | | Senior Managing Director of Houlihan Lokey Howard & Zukin, an international investment banking firm. He is 48. | | 2001 |

| | |

| | Mr. Siegert’s service as a director since 2001, his service on the Audit Committee, and his significant understanding of financial matters and public company financial statement requirements led the Board to conclude that he should continue serving as a director. | | |

12

| | | | |

| | | | | Director Since |

| | |

James H. Tate | | Independent consultant. From 2005 to 2006, Mr. Tate was Executive Vice President, Chief Administrative Officer, and Chief Financial Officer of TIMCO Aviation Services, Inc. Mr. Tate previously served as the Senior Vice President and Chief Financial Officer of Thermadyne Holdings Corporation from 1995 to 2004. Mr. Tate also served as our acting Chief Financial Officer from March 4, 2008 to December 9, 2008. Mr. Tate’s career includes 18 years as an accountant with Ernst & Young, LLP, including six years as an audit partner. He is 66. | | 2001 |

| | |

| | Mr. Tate’s service as a director since 2001, his many years of experience as a member of the Audit Committee, and as acting Chief Financial Officer during 2008, coupled with his industry knowledge and understanding of financial matters, led the Board to conclude that he should continue serving as a director. | | |

13

PROPOSAL #2: RATIFICATION OF THE APPOINTMENT OF OUR

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has appointed Ernst & Young LLP as our independent registered public accounting firm (“Independent Auditor”) for the fiscal year ending October 31, 2014. Ernst & Young has been our Independent Auditor since Fiscal 2002. For additional information regarding our relationship with Ernst & Young, please refer to the Audit Committee Report on page 56 and the Audit Fees disclosure on page 58.

Although ratification is not required under our Certificate of Incorporation, bylaws, Audit Committee Charter, or otherwise, the Board of Directors is submitting the selection of the Independent Auditor to shareholders for ratification as a matter of corporate governance practice. A representative of the Independent Auditor is expected to be present at the 2014 annual meeting. The representative will have the opportunity to make a statement if he or she desires to do so and is expected to be available to respond to appropriate shareholder questions at the meeting.

If the shareholders do not approve the appointment of the Independent Auditor for Fiscal 2014, the adverse vote will be considered a direction to the Audit Committee to consider other auditing firms for Fiscal 2015. However, the Audit Committee will still have discretion to determine which audit firm to appoint for Fiscal 2015 and, due to the difficulty in making a substitution of auditing firms so long after the beginning of the current fiscal year, the appointment for Fiscal 2014 will stand unless the Audit Committee finds other good reason for making a change. If the shareholders ratify the appointment of the Independent Auditor, the Audit Committee may, in its discretion, select a different auditing firm at any time during the year if it determines that such a change would be in the best interests of us and our shareholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR ADOPTION OF PROPOSAL #2 TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL 2014.

14

PROPOSAL #3: ADVISORY VOTE ON OUR NAMED EXECUTIVE OFFICERS’

COMPENSATION

At the 2011 annual meeting, our shareholders expressed their preference that we conduct annual non-binding advisory votes on executive compensation. Consistent with this preference, we are providing shareholders with the opportunity to cast a non-binding advisory vote on our named executive officers’ compensation, as disclosed in this proxy statement.

We believe our executive compensation and compensation policies and practices are focused on pay-for-performance principles, reflect a strong alignment with the interests of our long-term shareholders, assist us in hiring, retaining, and incentivizing our executive officers, and are reasonable in comparison to the compensation practices of our competitors and other manufacturing companies of similar size and complexity. We also believe that our compensation policies and programs and Fiscal 2013 compensation decisions, as each is described in this proxy statement, appropriately reward our named executive officers for our performance and for their individual performance. You are strongly encouraged to read the full details of our compensation policies and programs under “Executive Compensation” below.

Because this vote is advisory, it will not be binding on the Board of Directors or the Human Resources and Nominating Committee, nor will it overrule any prior decision or require the Board or Committee to take any action. However, the Board and the Human Resources and Nominating Committee will review the voting results and may consider the outcome of the vote when making future decisions about executive compensation programs.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR OUR NAMED EXECUTIVE OFFICERS’ COMPENSATION.

15

CORPORATE GOVERNANCE

Board of Directors Structure and Operations

The Board of Directors is responsible for the oversight of the management and direction of the corporation and for establishing broad corporate policies. The Board’s approach to corporate governance is reflected in our Corporate Governance Principles and the structure of Board committees that operate under written charters. The Corporate Governance Principles and charters for the Board’s three standing committees – Audit, Human Resources and Nominating, and Executive – may be viewed on our website: www.joyglobal.com.

The Board of Directors is comprised of eight directors. The Board determined that all directors other than Mr. Doheny are independent under New York Stock Exchange listing standards.

The directors completed a self-assessment of Board performance.

Board Leadership Structure

The Board of Directors determines the most suitable leadership structure from time to time. Our bylaws provide that the offices of Chief Executive Officer and Chairman of the Board are separate positions, but may be held by the same person. Currently, Edward Doheny serves as our Chief Executive Officer and John Hanson, our former Chief Executive Officer who retired in 2007, serves as Chairman of the Board, and Steven Gerard serves as our Lead Independent Director. In 2007, the Board appointed a Lead Independent Director at a time when Mr. Hanson was not considered to be an independent director due to his prior employment as our Chief Executive Officer. Notwithstanding the Board of Directors’ determination that Mr. Hanson is now independent under New York Stock Exchange listing standards, the Board has elected to retain our existing leadership structure and division of responsibilities between the positions of Chairman and Lead Independent Director, and the separation of these positions from the position of Chief Executive Officer. The Board of Directors concluded that this leadership structure and division of responsibilities between the positions of Chairman, Lead Independent Director and Chief Executive Officer has served us well in the past and we anticipate maintaining this structure for the current year.

In Fiscal 2013, the Board designated Steven Gerard as Lead Independent Director. Prior to Mr. Gerard’s designation, Richard Loynd served as Lead Independent Director since the Board created the position in 2007. The Lead Independent Director’s responsibilities include:

| | • | | leading meetings of the independent directors, including executive sessions of the independent directors held in conjunction with meetings of the full board of directors; |

| | • | | calling meetings of the independent directors and setting the agenda for such meetings; |

| | • | | briefing the Chief Executive Officer and any other director not participating in a meeting of independent directors regarding matters discussed in the executive sessions or meetings of the independent directors, and reporting back to the independent directors as appropriate; |

| | • | | soliciting suggestions from management on matters that they would like the independent directors to review or act upon in their meetings or executive sessions; |

| | • | | chairing meetings of the Board when the Chairman is not in attendance; |

16

| | • | | acting as representative or spokesman for the independent directors where advisable in communications with shareholders, other stakeholders or the media; and |

| | • | | generally acting as liaison among the directors and with management. |

Risk Management

As stated in our Corporate Governance Principles, the Board of Directors is responsible for assessing the major risks facing us and for reviewing options to mitigate such risks as part of its general oversight duties. In executing this responsibility, the Board has delegated authority to the Audit Committee to directly oversee our major financial risk exposures and the steps management has taken to monitor and control such exposures, including risk assessment, internal control, management of financial risks, and risk management policies generally. It is the role of management to present these and other material risks in a clear and understandable manner as part of its broader responsibility to keep the Board of Directors well-informed on all matters of significance to the corporation. We believe that our current leadership structure facilitates this clear delineation of responsibility with respect to our risk management process.

Meetings

The Board of Directors held 7 meetings during Fiscal 2013. Each incumbent director who served on the Board during Fiscal 2013 attended at least 87% of the Board meetings and committee meetings of which he was a member that were held during the fiscal year. The Board of Directors met without the Chief Executive Officer four times in Fiscal 2013. Each person serving as a director at the time of the 2013 annual meeting attended the 2013 annual meeting and we expect all directors to attend the 2014 annual meeting.

Communications

Shareholders, employees, and other interested parties may communicate with the Board of Directors, a committee of the Board, or particular directors by sending communications in care of the Secretary at Joy Global Inc., 100 E. Wisconsin Avenue, Suite 2780, Milwaukee, Wisconsin 53202. Shareholders, employees, and other interested parties also may submit communications electronically at http://investors.joyglobal.com/interestedparties.cfm. The Secretary will forward all such communications to the Board of Directors, the applicable committee, or to particular directors as appropriate. Communications intended as or relating to shareholder proposals pursuant to Rule 14a-8 under the Exchange Act must be addressed to the Secretary as specified under the heading “Submission of Shareholder Proposals” below.

Governance, Ethics, and Communications Policies

Corporate Governance Principles

The Board of Directors has adopted Corporate Governance Principles to set forth its guiding principles concerning our governance practices relating to the size and function of the Board of Directors. The Corporate Governance Principles address, among other items, the Board’s principles regarding director independence, the functions of the Chairman and Lead Independent Director, executive sessions of independent directors, committee structure and responsibilities, evaluations of the board and the Chief Executive Officer, succession planning, and management responsibilities. You may find our Corporate Governance Principles on our website, www.joyglobal.com, under the Corporate Governance tab of the Investor Center page.

17

Code of Ethics

The Board of Directors has adopted a Code of Ethics applicable to the Chief Executive Officer and senior financial officers, including the Chief Financial Officer and Chief Accounting Officer. The most recent version of the Code of Ethics, which is consistent with SEC regulations and New York Stock Exchange listing standards, is available on our website at www.joyglobal.com, under the Corporate Governance tab of the Investor Center page. In the event of any amendment to, or waiver from, a provision of the Code of Ethics, we will promptly post the date and nature of such amendment or waiver, as well as related information, on our website.

Worldwide Business Conduct Policy and Employee Training and Certification

The Board of Directors has adopted the Joy Global Inc. Worldwide Business Conduct Policy, which governs the actions of all officers, employees, and directors of Joy Global and our subsidiaries. The Worldwide Business Conduct Policy is designed to foster compliance with all applicable legal requirements and to reflect our commitment to the highest principles of business ethics and integrity. The Worldwide Business Conduct Policy is published in the primary language of the countries in which we operate and is made available to all employees. The Worldwide Business Conduct Policy is available on our website, www.joyglobal.com, under the Corporate Governance tab of the Investor Center page.

We require U.S. full-time salaried employees who are not members of a collective bargaining group, equivalent employees outside of the United States, and certain third parties worldwide to complete the Joy Global Inc. Worldwide Business Conduct Policy Training and Certification Program on an annual basis. This program includes completion of online ethics training and certification that the employee or third party has reviewed the Worldwide Business Conduct Policy and has disclosed all known violations of this policy to management. The online ethics training provides guidance on how to properly identify potential Worldwide Business Conduct Policy violations and appropriately respond to possible violations. In Fiscal 2013, approximately 6,000 employees and third parties completed the mandatory program, which was conducted in the primary language of the countries where those employees and such third parties were required to participate.

Employee Hotline

Communications from employees regarding accounting, internal accounting controls, auditing matters, or any violation of the Joy Global Inc. Worldwide Business Conduct Policy may be directed to the Secretary, or may be made anonymously through the Joy Global Inc. Employee Hotline. Employees may access the Employee Hotline 24 hours a day, seven days a week through a toll-free number or by making an online report with our third-party Employee Hotline service provider. We prohibit retaliation against any employee who raises a good faith concern regarding compliance with the Worldwide Business Conduct Policy or any other corporate governance policy.

Committees

The Board’s standing committees are the Audit Committee, the Human Resources and Nominating Committee, and the Executive Committee. In addition, the Board may from time to time authorize additional ad hoc committees, as it deems appropriate.

18

Audit Committee and Audit Committee Financial Expert

The Audit Committee is a separately designated committee of the Board, established in accordance with Section 3(a)(58)(A) of the Exchange Act. Current members of the Audit Committee are Gale E. Klappa (Chair), P. Eric Siegert, and James H. Tate. The Board of Directors has determined that Messrs. Klappa and Tate are each audit committee financial experts within the meaning of SEC rules. The Board of Directors has also determined that all members of the Audit Committee are independent and financially literate under New York Stock Exchange Listed Company Manual Sections 303A.02 and 303A.07, respectively.

The Audit Committee has the sole authority to appoint and replace the Independent Auditor and is directly responsible for the compensation and oversight of the Independent Auditor. The Audit Committee met eight times during Fiscal 2013. The primary function of the Audit Committee is to oversee:

| | (1) | the integrity of our financial statements, including our internal control over financial reporting; |

| | (2) | the Independent Auditor’s qualifications and independence; |

| | (3) | the performance of our internal audit function and the Independent Auditor; |

| | (4) | our overall risk management profile, including risk assessment, management of financial risks and risk management policies; and |

| | (5) | compliance with legal and regulatory requirements. |

Human Resources and Nominating Committee

Current members of the Human Resources and Nominating Committee are Richard B. Loynd (Chair), Steven L. Gerard, and John T. Gremp. The Human Resources and Nominating Committee met five times during Fiscal 2013. The Board of Directors has determined that all members of the Human Resources and Nominating Committee are independent under New York Stock Exchange Listed Company Manual Section 303A.02.

The primary functions of the Human Resources and Nominating Committee are to:

| | (1) | develop and recommend to the Board corporate governance principles; |

| | (2) | review management staffing and make recommendations to the Board; |

| | (3) | review and approve management compensation programs; |

| | (4) | administer our equity and incentive compensation plans; |

| | (5) | evaluate the Board and management; |

| | (6) | evaluate Board practices and make recommendations to the Board; |

| | (7) | develop and recommend qualifications for directors to the Board; |

| | (8) | manage a process for identifying and evaluating director nominees; |

| | (9) | evaluate and recommend to the Board director nominees; |

| | (10) | develop and recommend to the Board director compensation programs; and |

| | (11) | formulate and make recommendations to the Board regarding succession planning. |

The Human Resources and Nominating Committee will consider director candidates recommended by shareholders. Shareholder nominations of directors for election at an annual meeting of shareholders must be directed to our principal executive offices, 100 E. Wisconsin Avenue, Suite 2780, Milwaukee, Wisconsin 53202, to the attention of the Secretary, not less than 90 days before the date of such meeting. A shareholder nomination of a director candidate must comply with, and contain all of the information specified in, our bylaws.

19

When reviewing director candidates, the Human Resources and Nominating Committee is directed by our Corporate Governance Principles to consider the following qualifications for service as a director:

| | (1) | the background, experience, skills and education of the candidate, which shall include, but not be limited to, consideration of public company experience, industry background, international experience, leadership, diversity (viewed comprehensively, including with respect to background, experience, skill, education, age, gender, race, ethnicity and national origin), capital markets, accounting, legal or regulatory expertise and other qualities it deems important to enhance the ability of the Board of Directors to manage and direct our affairs; |

| | (2) | ability to comprehend and advise with respect to our goals and strategy and ability to effectively oversee management’s actions to implement a strategic plan to accomplish our goals. |

| | (3) | a history of conducting his or her professional and personal affairs with the utmost integrity and observing the highest standards of values, character, and ethics; and |

| | (4) | a willingness to invest the time necessary to prepare for Board and committee meetings, to attend Board and committee meetings, to be present at annual shareholder meetings, and to be available for consultation with other directors and executive management. |

The Human Resources and Nominating Committee also believes that it is generally desirable for all non-employee directors to be able to satisfy the criteria for independence established by the SEC and New York Stock Exchange listing standards. The Board of Directors has determined that each director, other than Mr. Doheny, is a non-employee director and is independent under New York Stock Exchange listing standards.

The Human Resources and Nominating Committee and the Board of Directors have also developed procedures for identifying and evaluating persons recommended to be nominated for election as directors, including nominees recommended by shareholders. Under these procedures, the Committee will, among other things:

| | (1) | review the qualifications and performance of incumbent directors to determine whether the Committee recommends that they be nominated for a further term; |

| | (2) | investigate and review the backgrounds and qualifications of candidates recommended by shareholders, management, or other directors to determine their eligibility to be nominated to become directors; |

| | (3) | consider the appropriateness of adding additional directors to the Board; and |

| | (4) | interview candidates for nomination. |

In evaluating candidates for the Board of Directors, the Human Resources and Nominating Committee considers the qualifications discussed above. The Human Resources and Nominating Committee will seek to include diverse candidates meeting these qualifications, including women and minority candidates, in the pool of candidates from which it recommends director nominees, consistent with applicable law and the exercise of its fiduciary duties. In addition, if the committee engages a director search firm or other professional to assist in the identification of director nominees, it will provide instructions that diverse candidates meeting our director qualification standards be identified in the candidate pool. The Committee intends to monitor this issue over time.

20

Executive Committee

Current members of the Executive Committee are John Nils Hanson (Chair), Edward L. Doheny, Steven L. Gerard, and Richard B. Loynd. The Executive Committee may act upon a matter when it determines that prompt action is in the best interests of the corporation and it is not feasible to call a meeting of the full Board. In connection with the performance of its responsibilities, the Executive Committee has all powers of the Board of Directors, except as prohibited by law or otherwise limited by our Certificate of Incorporation or bylaws or by Board resolution.

In addition, the Executive Committee possesses authority to consider specific proposals to:

| | (1) | modify the corporation’s capital structure; |

| | (2) | acquire or divest businesses; |

| | (4) | make significant investments in the corporation; or |

| | (5) | entertain strategic alliances with the corporation. |

The Executive Committee does not have regularly scheduled meetings and did not meet during Fiscal 2013.

21

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis discusses our compensation policies and determinations that apply to our named executive officers. This discussion and analysis also includes a discussion of our compensation philosophy, including our emphasis on performance-based compensation, the role of the Human Resources and Nominating Committee, the process through which compensation is determined, and the components of our compensation program for named executive officers. When we refer to our named executive officers, we are referring to the following individuals whose Fiscal 2013 compensation is set forth below in the Summary Compensation Table and subsequent compensation tables:

| | • | | Michael W. Sutherlin, our former President and Chief Executive Officer; |

| | • | | James M. Sullivan, our Executive Vice President and Chief Financial Officer; |

| | • | | Randal W. Baker, our Executive Vice President and Chief Operating Officer, who during Fiscal 2013 served as Executive Vice President, Joy Global Inc., and President and Chief Operating Officer of our surface mining equipment business; |

| | • | | Edward L. Doheny II, our President and Chief Executive Officer, who during Fiscal 2013 served as Executive Vice President, Joy Global Inc., and President and Chief Operating Officer of our underground mining machinery business; |

| | • | | Sean D. Major, our Executive Vice President, General Counsel and Secretary; and |

| | • | | Michael S. Olsen, our former Executive Vice President and Chief Financial Officer. |

Messrs. Baker, Doheny and Major were our three most highly compensated executive officers, other than Mr. Sutherlin and Mr. Sullivan, who were serving as executive officers at the end of Fiscal 2013. Mr. Sullivan succeeded Mr. Olsen as Chief Financial Officer on December 18, 2012 and Mr. Olsen retired from the corporation on February 1, 2013. Mr. Doheny succeeded Mr. Sutherlin as President and Chief Executive Officer on December 18, 2013. Mr. Sutherlin will retire from the corporation on February 1, 2014.

Compensation Objectives and Process

Executive Compensation Philosophy

Our goal is to attract and retain experienced and talented executive officers and to motivate them to achieve financial and strategic objectives that are aligned with the long-term creation of shareholder value. We believe that our executive officers should receive compensation that is competitive with other manufacturing companies of comparable size and complexity. Furthermore, we believe that incentive compensation for our executives should be directly linked to our performance by ensuring that actual realized pay varies above or below targeted compensation opportunity based on our performance against key operating goals, as well as changes in our share price. The over-arching objective of our executive compensation program is to provide base salaries in a competitive range, annual cash incentive opportunities that reward above-average performance with above-average pay, and stock-based incentive programs designed to facilitate achievement of long-term corporate financial goals and build executive stock ownership in alignment with the interests of our shareholders.

22

Pay for Performance

Our executive compensation program is designed to increase the proportion of performance-based or “at-risk” pay as a percentage of total compensation as an executive’s responsibilities increase. We believe that since our senior executives have more opportunity to affect our performance, these officers should be held most accountable for results. We consider performance-based pay to include annual equity awards and cash incentive awards that are linked to our performance. We believe this emphasis on performance-based compensation as the most significant aspect of our executive officers’ compensation package aligns such executives’ interests with those of shareholders and provides strong incentives to these individuals to execute our corporate strategy and improve our overall performance.

We have also considered the views of our shareholders in determining to continue making performance-based compensation the largest component of executive officer compensation packages. In this regard, we have considered the approval of our named executive officers’ compensation by 95% of the votes cast at our 2013 annual meeting. We view such approval as indicative of broad shareholder support for a substantial performance-based component to our compensation program for named executive officers and concluded that no revisions to our compensation program were necessary in direct response to this vote.

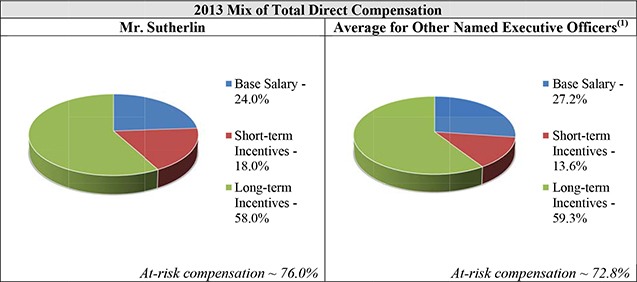

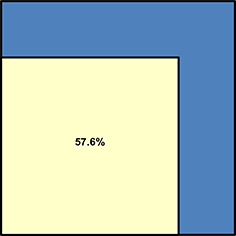

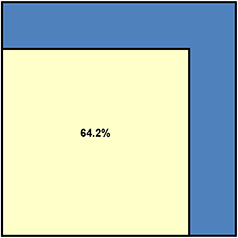

The mix of direct compensation for Fiscal 2013 for our Chief Executive Officer and the average of our other named executive officers is reflected in the table below. The following mix of direct compensation reflects our commitment to pay for performance principles:

| | • | | Equity is the most significant component of compensation, with realized compensation dependent upon our performance over a number of years; |

| | • | | Short-term incentive compensation is based on annual operating and individual performance; and |

| | • | | Base salary is less than 25% of total direct compensation. |

| | (1) | Excluding Mr. Olsen, our former Chief Financial Officer, who retired on February 1, 2013. |

23

The Human Resources and Nominating Committee

Our Board of Directors’ Human Resources and Nominating Committee (as used in this Compensation Discussion and Analysis, the “Committee”) serves as our compensation committee and is charged with overseeing and administering all compensation actions related to our named executive officers. The Committee’s charter, which is available on our website, permits the Committee to delegate authority to the Committee chair or to a subcommittee.

The Committee is specifically authorized in its charter to retain external legal, accounting, or other advisors and consultants. The Committee has retained Frederic W. Cook & Co. (“Cook & Co.”) as its independent executive compensation consultant. Cook & Co. was retained directly by the Committee, performs no other services for us, and works with management only under the direction of the Committee chair. Among other tasks assigned by the Committee, in Fiscal 2013 Cook & Co.:

| | • | | prepared an annual presentation on the competitiveness of compensation to be paid to our Chief Executive Officer and other named executive officers; |

| | • | | prepared an analysis on executive compensation and benefits to be delivered to the Committee; and |

| | • | | assisted in the design of variable incentive plans and indirect components of the total compensation program, as described in detail below. |

Our Chief Executive Officer and Executive Vice President, Human Resources work with internal resources and Cook & Co. to design programs, implement Committee decisions, recommend amendments to existing, or the adoption of new, compensation and benefit programs and plans applicable to executive officers, and prepare necessary briefing materials for the Committee’s review as part of its decision-making process.

Our Compensation Decision Process

We have not entered into employment agreements with our named executive officers that determine their annual compensation. Instead, the Committee conducts an annual process to establish executive compensation based upon its evaluation of prior performance and objectives and metrics it selects to measure future performance. The Committee annually reviews our compensation structure and programs, including potential risks that may be associated with particular forms of compensation; retirement, benefit, severance programs; and management succession plans. The Committee also annually reviews the role of the Chief Executive Officer in our performance, his role in advancing our strategic objectives, and other factors relating to his individual performance during the year, as well as to establish his performance objectives and targets for the coming year. In addition to our annual process, the Committee made compensation decisions in Fiscal 2013 for Messrs. Doheny and Baker in connection with our executive leadership succession process.

The annual compensation process concludes at the Committee’s first meeting of the fiscal year, which is normally held in early December. At this meeting, the Committee evaluates performance against targets for the just-concluded performance periods, and preliminarily determines the associated corporate performance payout components, determines awards earned by executive officers under our annual incentive program for the previous fiscal year, and establishes target compensation for executive officers for the upcoming year.

24

Before the Committee makes the foregoing determinations, the Chief Executive Officer provides his recommendations to the Committee on compensation actions for all executive officers, other than himself. The Chief Executive Officer also discusses with the Committee his assessment of the performance of our executive officers and any other factors that he believes the Committee should consider in making compensation decisions. The Committee reviews competitive market compensation data for our executive officers compared to similarly situated executives in a peer group, which for Fiscal 2013 consisted of the 14 manufacturing companies listed below, supplemented by third party survey data.

| | |

• AGCO Corporation | | • Ingersoll-Rand plc |

• Cameron International Corporation | | • The Manitowoc Company, Inc. |

• Crane Co. | | • Oshkosh Corporation |

• Dover Corporation | | • Pentair Ltd. |

• Flowserve Corporation | | • Terex Corporation |

• Harsco Corporation | | • The Timken Company |

• Illinois Tool Works Inc. | | • Trinity Industries, Inc. |

In selecting the peer group, the Committee considered publicly traded manufacturing companies with reasonably comparable business operations, market capitalization and revenues. The peer group companies generally utilize similar business models and, like Joy Global, operate in highly competitive global markets. However, we are the only large, stand-alone public company in the United States that manufactures and services equipment for the mining industry. Accordingly, cyclical fluctuations in the mining industry due to commodity price volatility, competitive pressures or economic factors affecting the industry may cause our results for any particular period to differ significantly from those of some or all of the manufacturing companies included in the peer group. The Committee evaluates peer group composition annually and makes changes as it deems appropriate. For Fiscal 2013, the peer group was expanded to include AGCO Corporation, Cameron International Corporation, Oshkosh Corporation and The Timken Company, and NACCO Industries, Inc. was removed. The Committee determined, in consultation with Cook & Co., to make the peer group more closely correspond with our size and industry and to expand its size in order to increase the statistical significance of conclusions derived from analysis of peer group compensation practices.

Our compensation programs for executives take into account marketplace compensation for executive talent, internal equity with our employees, past practices, corporate, business unit and individual results, and the talents, skills, and experience of our individual executive officers. With respect to our Chief Executive Officer, the Committee, with the input of Cook & Co., reviews a range of salary adjustments and incentive plan payouts for the most recently concluded one- and three-year performance periods. The Committee then recommended targets for the upcoming one- and three-year performance periods based upon benchmarking studies for other chief executives within our peer group.

The Committee begins by establishing target levels of total compensation for our executive officers for a given year. The targets take into account and reflect the considerations discussed in more detail below, including the use of peer benchmarking, internal pay equity, and salary grade structure. Once an overall target compensation level is established, the Committee considers the weight of each principal component of compensation within the intended total target compensation. The principal components of compensation include base salary, annual cash incentives, stock options, performance shares, and restricted stock units, each of which is described in the next section of this proxy statement.

25

With respect to performance-based compensation, the Committee establishes, in consultation with management, and in consideration of the annual budget and long-term strategic plan approved by the Board of Directors, performance criteria for compensating our executives at the beginning of each performance period. At the conclusion of a performance period, we measure our performance under the pre-established criteria for such program. We utilize multiple measures of performance under our programs to ensure that no single aspect of performance is rewarded in isolation among the various performance criteria affecting shareholder value. We believe this approach results in a balanced evaluation of executive performance and prevents performance incentives from being distorted in a manner that may adversely affect our operations. We have utilized the following measures of overall performance in evaluating performance-based compensation for each of the three most recently completed fiscal years:

| | • | | return on average trade working capital; |

| | • | | earnings per share; and |

| | • | | return on invested capital. |

Components of Executive Compensation

Our executive compensation program has five principal components that are intended, collectively, to compensate and create incentives for our executives with respect to annual and long-term performance. These five principal components are base salary, annual cash incentives, awards of stock options, performance shares, and restricted stock units. In addition to these principal components, we also provide our executives with retirement, health, and other personal benefits as described below.

Salary. Base salary is an important component of our executive compensation program, and is intended to provide our executive officers with a level of stable income that is competitive within our peer group. There are also motivational and reward aspects to base salary, as base salary can be adjusted from year to year to account for considerations such as individual performance and time in position. Base salary is also a factor in determining the amount of awards under, and eligibility to participate in, many of our compensation and benefits arrangements. The Committee establishes base salaries for our named executive officers annually at its first meeting of the fiscal year. Salaries are benchmarked against peer group survey data for other executive officer benchmark positions. The competitive objective for the salary range midpoint is the 50th percentile of market data for companies in our peer group. As part of our executive succession planning process, the base salaries for Messrs. Doheny and Baker were increased in March 2013 in connection with their respective designations for appointment to their current positions.

Annual Cash Incentives. We establish annual cash incentives for our executives and managers to achieve selected financial, strategic, and other business goals. This plan is intended to link employee pay to the performance of the business and reward employees for improvements in profitability and asset utilization.

As a part of our One Joy Global initiative, beginning in Fiscal 2013 the formula under which we award two-thirds of our annual cash incentive opportunity was calculated using a payout factor based entirely on our consolidated results, rather than weights assigned to corporate and business unit performance based on each individual’s area of responsibility. This formula is calculated based on our profitability and application of a multiplier based on trade working capital velocity. The resulting payout factor ranges from 0.0 to 2.0, increasing as our profitability and operating efficiency improve, with a payout factor of 1.0 representing the attainment of our target levels. This method of

26

determining cash incentive awards is intended to drive an appropriate balance under which trade working capital performance complements, but does not offset, profitability. For Fiscal 2013, application of this formula resulted in a payout factor of 0.75. For Fiscal 2011 and 2012, the payout factor for Joy Global was 1.97 and 1.19, respectively.

The remaining one-third of the annual cash incentive opportunity is variable, based on executives’ and managers’ performance measured against a variety of individual performance objectives that are established early in the fiscal year and designed to align with our overall business plans. Individual objectives for named executive officers consist of non-financial goals, such as leadership development and operational excellence, as well as business unit or function-specific operational goals. The degree of difficulty in achieving the individual goals varies. In Fiscal 2013 the payout factors for the remaining one-third of the incentive opportunity varied among executives and managers based upon the Committee’s assessments of their performance against individual performance goals and objectives.