As filed with the Securities and Exchange Commission on July 17, 2009

Registration No. [__________]

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

| | ¨ Pre-Effective Amendment No. | | ¨ Post-Effective Amendment No. |

(Check appropriate box or boxes)

ECLIPSE FUNDS

(Exact Name of Registrant as Specified in Charter)

51 Madison Avenue, New York, New York 10010

(Address of Principal Executive Offices)

(212) 576-7000

(Registrant’s Area Code and Telephone Number)

Marguerite E. H. Morrison, Esq.

Eclipse Funds

51 Madison Avenue

New York, New York 10010

(Name and Address of Agent for Service)

With copies to:

Sander M. Bieber, Esq.

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter be effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

Title of securities being registered: Investor Class, Class A, Class B, Class C and Class I shares of beneficial interest, par value $0.01 per share, of the following series of the Registrant: MainStay Small Company Value Fund.

An indefinite amount of the Registrant’s securities has been registered under the Securities Act of 1933 pursuant to Rule 24f-2 under the Investment Company Act of 1940. In reliance upon such Rule, no filing fee is being paid at this time.

THE MAINSTAY FUNDS

MAINSTAY SMALL CAP GROWTH FUND

51 MADISON AVENUE

NEW YORK, NEW YORK 10010

SPECIAL MEETING OF SHAREHOLDERS

To Be Held On Friday, October 16, 2009

To Our Shareholders:

The Board of Trustees (the “Board”) of The MainStay Funds (the “Trust”) has called a Special Meeting of Shareholders (the “Special Meeting”) of the MainStay Small Cap Growth Fund (the “Small Cap Growth Fund”). The Special Meeting is scheduled to begin at 11:00 am Eastern time, on Friday, October 16, 2009, at the offices of New York Life Investment Management LLC (“New York Life Investments”), 169 Lackawanna Avenue, Parsippany, New Jersey 07054.

At the Special Meeting, you will be asked to consider and vote on the proposed transaction described below. Note that this proposed transaction is part of a larger initiative involving a number of funds in the MainStay Group of Funds that is designed to create a stronger, more cohesive family of funds overall.

The Trust, a Massachusetts business trust, currently offers 20 separate series of funds. The accompanying Notice of Special Meeting and Proxy Statement/Prospectus relate solely to the Small Cap Growth Fund.

At the Special Meeting, as a shareholder of the Small Cap Growth Fund, you will be asked to consider and vote upon the following proposals:

1. To approve an Agreement and Plan of Reorganization providing for: (i) the acquisition of all of the assets and the assumption of all of the liabilities of the Small Cap Growth Fund by the MainStay Small Company Value Fund, a series of Eclipse Funds (the “Small Company Value Fund,” and collectively with the Small Cap Growth Fund, the “Funds,” and each a “Fund”), in exchange for shares of beneficial interest of the Small Company Value Fund having an aggregate net asset value equal to the aggregate net asset value of the shares of beneficial interest of the Small Cap Growth Fund; and (ii) the subsequent distribution of the shares and liquidation and dissolution of the Small Cap Growth Fund (the “Reorganization”); and

2. To transact such other business as may properly come before the Special Meeting or any adjournments or postponements thereof.

The Board of the Trust, after careful consideration, unanimously approved the proposal and recommends that shareholders vote “FOR” the proposal.

If the Reorganization takes place, you will become a shareholder of the Small Company Value Fund on the date the Reorganization occurs.

After considering the recommendation of New York Life Investments, the investment advisor to each Fund, the Board of the Trust concluded that the Reorganization would benefit the shareholders of the Small Cap Growth Fund for several reasons, including the potential for cost savings over time due to economies of scale from combined portfolio assets and possible decreased expenses. The Board reviewed the Reorganization proposed by New York Life Investments in the context of New York Life Investments’ larger initiative involving a number of funds in the MainStay Group of Funds, including the Funds, among other factors.

As a shareholder of the Small Cap Growth Fund, you are being asked to consider and vote on an Agreement and Plan of Reorganization. The accompanying materials describe the proposed transaction and compare the strategies and expenses of the Funds for your evaluation. In addition to being asked to consider and vote on an Agreement and Plan of Reorganization, Exhibit A to the accompanying Proxy Statement/Prospectus serves as an Information Statement to shareholders of Small Cap Growth Fund and furnishes information about Epoch Investment Partners, Inc. (“Epoch”), which was recently appointed Subadvisor to the Small Cap Growth Fund pursuant to an exemptive order issued by the U.S. Securities and Exchange Commission. We are not asking you for a proxy and you are requested not to send us a proxy with respect to the appointment of Epoch described in the Information Statement at Exhibit A. You are only being asked to consider and vote on an Agreement and Plan of Reorganization.

A Proxy Statement/Prospectus that describes the Reorganization is enclosed. Your vote on the Agreement and Plan of Reorganization is very important to us, regardless of the number of shares of the Small Cap Growth Fund you own. Whether or not you plan to attend the Special Meeting in person, please read the Proxy Statement/Prospectus and cast your vote promptly. You may cast your vote simply by completing, signing and returning the enclosed proxy card by mail in the postage-paid envelope provided or by following the instructions on the voting instruction card for voting your proxy on the Internet or by touch-tone telephone. If you have any questions before you vote, please contact the Funds by calling toll-free 800-MAINSTAY (624-6782). It is important that your vote be received no later than the time of the Special Meeting on Friday, October 16, 2009.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

| Sincerely, |

| |

| /s/ Stephen P. Fisher |

| Stephen P. Fisher |

| President |

| The MainStay Funds |

THE MAINSTAY FUNDS

MAINSTAY SMALL CAP GROWTH FUND

51 MADISON AVENUE

NEW YORK, NEW YORK 10010

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 16, 2009

To Our Shareholders:

NOTICE IS HEREBY GIVEN that a SPECIAL MEETING OF SHAREHOLDERS (the “Special Meeting”) of the MainStay Small Cap Growth Fund (the “Small Cap Growth Fund”), a series of The MainStay Funds, a Massachusetts business trust (the “Trust”), will be held at the offices of New York Life Investment Management LLC (“New York Life Investments”), 169 Lackawanna Avenue, Parsippany, New Jersey 07054, on Friday, October 16, 2009 at 11:00 am Eastern time.

At the Special Meeting, as a shareholder of the Small Cap Growth Fund, you will be asked to consider and vote upon the following proposals:

1. To approve an Agreement and Plan of Reorganization providing for: (i) the acquisition of all of the assets and the assumption of all of the liabilities of the Small Cap Growth Fund by the MainStay Small Company Value Fund, a series of Eclipse Funds (the “Small Company Value Fund,” and collectively with the Small Cap Growth Fund, the “Funds,” and each a “Fund”) as of the close of business on July 27, 2009 (the “Record Date”), in exchange for shares of beneficial interest of the Small Company Value Fund having an aggregate net asset value equal to the aggregate net asset value of the shares of beneficial interest of the Small Cap Growth Fund; and (ii) the subsequent distribution of the shares and liquidation and dissolution of the Small Cap Growth Fund (the “Reorganization”); and

2. To transact such other business as may properly come before the Special Meeting or any adjournments or postponements thereof.

Your attention is directed to the accompanying combined Proxy Statement/Prospectus for further information regarding the Special Meeting and the Reorganization. You may vote at the Special Meeting if you are the record owner of shares of the Small Cap Growth Fund. If you attend the Special Meeting, you may vote your shares in person. Even if you do not attend the Special Meeting, you may authorize a proxy to vote on your behalf simply by completing, signing and returning the enclosed proxy card by mail in the postage-paid envelope provided or by following the instructions on the voting instruction card for voting your proxy on the Internet or by touch-tone telephone.

Your vote is very important to us. Whether or not you plan to attend the Special Meeting in person, please vote the enclosed proxy. If you have any questions, please contact the Funds for additional information by calling toll-free at 800-MAINSTAY (624-6782).

| By Order of the Board of Trustees, |

| |

| /s/ Marguerite E. H. Morrison |

| Marguerite E. H. Morrison |

| Chief Legal Officer and Secretary |

| August [__], 2009 |

IMPORTANT NOTICE:

YOUR VOTE IS VERY IMPORTANT TO US, NO MATTER HOW MANY SHARES

YOU OWN. PLEASE VOTE BY SIGNING AND DATING THE ENCLOSED PROXY

CARD AND RETURNING IT IN THE ACCOMPANYING POSTAGE-PAID RETURN

ENVELOPE OR BY FOLLOWING THE ENCLOSED INSTRUCTIONS TO

AUTHORIZE YOUR PROXY ON THE INTERNET OR OVER THE TELEPHONE.

YOU CAN HELP AVOID THE ADDITIONAL EXPENSE OF FURTHER

SOLICITATIONS BY PROMPTLY VOTING THE ENCLOSED PROXY.

QUESTIONS AND ANSWERS RELATING TO THE PROPOSAL

What are the Proposed Changes to the Small Cap Growth Fund?

As a shareholder of Small Cap Growth Fund, you are being asked to approve an Agreement and Plan of Reorganization that provides for the reorganization (the “Reorganization”) of the Small Cap Growth Fund with and into the Small Company Value Fund. Should the Reorganization take place, the Small Cap Growth Fund will subsequently be liquidated and dissolved.

In considering the Reorganization, a shareholder should be aware that, in connection with the Board’s decision to engage Epoch Investment Partners, Inc. (“Epoch”) as the Small Cap Growth Fund’s Subadvisor effective June 29, 2009, the Board approved modifications to the Small Cap Growth Fund’s principal investment strategies, investment process, principal risks and primary benchmark index so that they are materially identical to those of the Small Company Value Fund. These modifications, which took effect on August 14, 2009, are discussed in a Supplement dated June 29, 2009 to the Small Cap Growth Fund’s Prospectus. Therefore, on the date of the Special Meeting, it is not anticipated that there will be any material differences between the principal investment strategies, investment process, principal risks, and primary benchmark index of the Small Cap Growth Fund and those of the Small Company Value Fund.

What Will I Receive in Exchange for My Shares if the Reorganization is Approved?

If the Reorganization takes place, in exchange for the shares of the Small Cap Growth Fund you currently hold, you will become a shareholder of the corresponding class of shares of the Small Company Value Fund on the on the close of business on October 28, 2009, or on such other date as the parties may agree (the “Closing Date”).

What did the Board Consider When They Approved the Reorganization?

In evaluating the Reorganization, the Funds’ Boards of Trustees (collectively, the “Board”), including all of the Trustees who are not “interested persons” of the Funds’ (as that term is defined in the Investment Company Act of 1940, as amended, (the “1940 Act”)), considered detailed information provided by New York Life Investment Management LLC (“New York Life Investments”) in support of its recommendation to approve the Reorganization and other factors, including: (1) that the shareholders of the Small Cap Growth Fund may benefit by becoming shareholders of the larger, combined Small Company Value Fund that may be better positioned over time to realize lower expenses through achieving economies of scale; (2) that the Reorganization is part of a larger initiative of New York Life Investments designed to reposition, rationalize and streamline the MainStay Group of Funds in order to reduce duplication among funds, strengthen the fund lineup overall, and offer funds with asset levels to potentially benefit shareholders with economies of scale; (3) that the Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes; (4) the proposed allocation of the direct and indirect costs of the Reorganization between New York Life Investments and the Funds; and (5) possible alternatives to the Reorganization, which could include the possible liquidation of the Small Cap Growth Fund. The Board also compared the investment objectives and strategies of the Small Cap Growth Fund with the Small Company Value Fund, both before and after the recent modifications to the Small Cap Growth Fund’s investment objectives and strategies described above. The Board considered the expected impact of the proposed Reorganization on the pro forma total fund operating expenses that current shareholders of the Small Cap Growth Fund pay and the likelihood that New York Life Investments would propose changes to the current contractual expense limitations of the Small Cap Growth Fund if the Reorganization is not approved by shareholders of the Small Cap Growth Fund. Based on these considerations and others, the Board determined that the interests of the shareholders of the Small Cap Growth Fund and the Small Company Value Fund will not be diluted as a result of the Reorganization, and that the Reorganization is in the best interests of the shareholders of each Fund.

More information about the Board’s considerations may be found in the Section of the accompanying Proxy Statement/Prospectus entitled “Information about the Reorganization—Board Considerations.”

Was there any Change to the Subadvisor of Small Cap Growth Fund and Do Shareholders Need to Approve This Change?

The Board approved the appointment of Epoch as the Small Cap Growth Fund’s Subadvisor effective June 29, 2009, pursuant to an exemptive order (“Order”) issued by the U.S. Securities and Exchange Commission (“SEC”). Exhibit A to the Proxy Statement/Prospectus serves as an Information Statement and furnishes information about Epoch as required under the Order. This change is also discussed in the Supplement dated June 29, 2009 to the Small Cap Growth Fund’s Prospectus. Shareholders of the Small Cap Growth Fund are not being asked to approve Epoch as a Subadvisor.

Will there be any Changes to the Portfolio Managers as a Result of the Reorganization?

Because the Board approved Epoch as the Small Cap Growth Fund’s Subadvisor and the Small Company Value Fund’s interim subadvisor effective June 29, 2009, it is likely that there will be no change to the Small Cap Growth Fund’s portfolio managers as a result of the Reorganization. It should be noted, however, that the interim agreement with Epoch with respect to the Small Company Value Fund will expire on November 26, 2009 and Epoch will cease managing the Small Company Value Fund unless that Fund’s shareholders approve a subadvisory agreement with Epoch. In separate proxy materials sent to shareholders of the Small Company Value Fund, those shareholders are being asked to approve Epoch as that Fund’s Subadvisor at a special meeting also scheduled for October 16, 2009.

Should the Small Company Value Fund’s shareholders not approve Epoch as the Fund’s Subadvisor, New York Life Investments will work with the Board to consider alternatives for management of the Small Company Value Fund. However, the proposed Reorganization described in the accompanying Proxy Statement/Prospectus is not contingent upon the approval of Epoch as Subadvisor to the Small Company Value Fund. These changes are discussed in the Supplement dated June 29, 2009 to the Small Company Value Fund’s prospectus.

Are Any Further Changes Anticipated to the Small Company Value Fund Prior to the Reorganization?

On or about October 16, 2009, it is anticipated that the Small Company Value Fund will change its name to the MainStay U.S. Small Cap Fund, pending the approval by the Small Company Value Fund’s shareholders of the Subadvisory Agreement with Epoch. No changes are anticipated with respect to the Small Company Value Fund’s investment objectives or strategies in connection with this name change.

Will Shareholders of the Small Cap Growth Fund Pay Higher Fees and Expenses Following the Reorganization?

Absent currently effective expense limitation agreements, on a pro forma basis assuming the Reorganization had occurred, the total annual fund operating expenses for the combined Small Company Value Fund are expected to be lower than current total annual fund operating expenses applicable to all share classes of the Small Cap Growth Fund. However, when applying the current expense limitations for the Small Cap Growth Fund and the Small Company Value Fund, the pro forma net total annual operating expenses for the combined Small Company Value Fund are expected to be higher than all classes of the Small Cap Growth Fund.

Please see the section of the accompanying Proxy Statement/Prospectus entitled “Comparison of Fees and Expenses” for more information regarding the current total annual fund operating expenses of the Funds, and how these expenses are expected to change as a result of the Reorganization.

What are the Tax Implications for the Reorganization?

Completion of the Reorganization is conditioned upon receiving an opinion of counsel to the effect that the proposed Reorganization will qualify as a tax-free reorganization for federal income tax purposes. The Small Cap Growth Fund will pay any dividends out of net investment income or distribution of capital gains to shareholders as required prior to the Reorganization and Small Cap Growth Fund shareholders may be responsible for the tax consequences of these distributions. However, it is currently anticipated that there will not be a capital gain distribution prior to the Reorganization.

If Approved, When Will the Reorganization Occur?

If approved by shareholders and all the contingencies set forth in the Agreement and Plan of Reorganization are satisfied, the Reorganization will take place on the Closing Date, which is scheduled to occur on or about October 28, 2009.

Will Small Cap Growth Fund Shareholders Bear the Expenses of the Reorganization?

New York Life Investments has agreed to bear one-third of the direct expenses relating to the Reorganization, including solicitation costs. The remaining two-thirds of the direct expenses will be borne by the Small Cap Growth Fund. However, due to a written expense limitation agreement in place with respect to the Small Cap Growth Fund, it is likely that New York Life Investments also will indirectly bear some or all of those direct costs. New York Life Investments estimates the total cost of the Reorganization to be between $[__________] and $[__________]. The Small Cap Growth Fund will bear any costs associated with making portfolio adjustments in anticipation of the Reorganization, including brokerage fees and expenses.

Has the Board Approved the Reorganization?

Yes, the Board has approved the Reorganization and recommends that shareholders vote “FOR” the Reorganization.

INSTRUCTIONS FOR SIGNING PROXY CARDS

THE FOLLOWING GENERAL RULES FOR SIGNING PROXY CARDS MAY BE OF ASSISTANCE TO YOU AND MAY HELP AVOID THE TIME AND EXPENSE INVOLVED IN VALIDATING YOUR VOTE IF YOU FAIL TO SIGN YOUR PROXY CARD PROPERLY.

1. INDIVIDUAL ACCOUNTS: Sign your name exactly as it appears in the registration on the proxy card.

2. JOINT ACCOUNTS: Both parties must sign: the names of the parties signing should conform exactly to the names shown in the registration on the proxy card.

3. ALL OTHER ACCOUNTS: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration.

| FOR EXAMPLE: | | |

| | | |

| REGISTRATION | | VALID |

| CORPORATE ACCOUNTS | | |

| (1) ABC Corp. | | ABC Corp. John Doe, Treasurer |

| (2) ABC Corp. | | John Doe |

| (3) ABC Corp. c/o John Doe | | John Doe |

| (4) ABC Corp. Profit Sharing Plan | | John Doe |

| PARTNERSHIP ACCOUNTS | | |

| (1) The XYZ Partnership | | Jane B. Smith, Partner |

| (2) Smith and Jones, Limited Partnership | | Jane B. Smith, General Partner |

| TRUST ACCOUNTS | | |

| (1) ABC Trust | | Jane B. Doe, Trustee |

| (2) Jane B. Doe, Trustee u/t/d 01/01/01 | | Jane B. Doe, Trustee u/t/d/01/01/01 |

| | | |

| CUSTODIAL OR ESTATE ACCOUNTS | | |

| (1) John B. Smith, Cust f/b/o John B. Smith, Jr. UGMA/UTMA | | John B. Smith, Custodian f/b/o/ John B. Smith Jr., UGMA/UTMA |

| (2) Estate of John B. Smith | | John B. Smith, Jr., Executor Estate of John B. Smith |

PLEASE CHOOSE ONE OF THE FOLLOWING OPTIONS TO VOTE YOUR SHARES:

1. AUTHORIZE YOUR PROXY THROUGH THE INTERNET. You may authorize your proxy by logging into the Internet site located on your proxy card and following the instructions on the website. In order to log in you will need the control number found on your proxy card.

2. AUTHORIZE YOUR PROXY BY TELEPHONE. You may authorize your proxy by telephone by calling the toll-free number located on your proxy card. Please make sure to have your proxy card available at the time of the call.

3. VOTE BY MAIL. You may cast your vote by signing, dating, and mailing the enclosed proxy card in the postage-paid return envelope provided.

4. VOTE IN PERSON AT THE SPECIAL MEETING.

PROXY STATEMENT/PROSPECTUS

August [__], 2009

MAINSTAY GROUP OF FUNDS

ECLIPSE FUNDS

51 MADISON AVENUE

NEW YORK, NEW YORK 10010

(212) 576-7000

PROXY STATEMENT FOR:

MAINSTAY SMALL CAP GROWTH FUND

PROSPECTUS FOR:

MAINSTAY SMALL COMPANY VALUE FUND

Introduction

This combined Proxy Statement/Prospectus is being furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of The MainStay Funds (the “Trust”), a Massachusetts business trust, on behalf of the MainStay Small Cap Growth Fund (the “Small Cap Growth Fund”), a series of the Trust, for a Special Meeting of Shareholders of the Small Cap Growth Fund (“Special Meeting”). The Special Meeting will be held on Friday, October 16, 2009 beginning at 11:00 am Eastern time, at the offices of New York Life Investment Management LLC (“New York Life Investments” or the “Manager”), 169 Lackawanna Avenue, Parsippany, New Jersey 07054.

As is more fully described in this Proxy Statement/Prospectus, the purpose of the Special Meeting is to vote on a proposed reorganization (the “Reorganization”) as described below:

1. To approve an Agreement and Plan of Reorganization providing for: (i) the acquisition of all of the assets and the assumption of all of the liabilities of the Small Cap Growth Fund by the MainStay Small Company Value Fund (the “Small Company Value Fund”), a series of Eclipse Funds, in exchange for shares of beneficial interest of the Small Company Value Fund having an aggregate net asset value equal to the aggregate net asset value of the shares of beneficial interest of the Small Cap Growth Fund; and (ii) the subsequent distribution of the shares and liquidation and dissolution of the Small Cap Growth Fund (the “Reorganization”); and

2. To transact such other business as may properly come before the Special Meeting or any adjournments or postponements thereof.

Because shareholders of the Small Cap Growth Fund are being asked to approve the Reorganization, this Proxy Statement also serves as a Prospectus for the Small Company Value Fund (collectively with Small Cap Growth Fund, the “Funds,” and each a “Fund”). The approximate mailing date of this Proxy Statement is August [26], 2009. Each Fund is a series of an open-end management investment company.

Each Fund offers Investor Class, Class A, Class B, Class C and Class I shares only. If the Reorganization is approved by shareholders of the Small Cap Growth Fund, holders of the shares of Small Cap Growth Fund will receive shares of the corresponding class of the Small Company Value Fund in an amount equal to the value of their Small Cap Growth Fund shares. See “Information About the Reorganization” below.

Epoch Investment Partners, Inc. (“Epoch”) serves as interim subadvisor to the Small Company Value Fund and has also been appointed to replace MacKay Shields LLC (“MacKay Shields”) as the Subadvisor to the Small Cap Growth Fund effective June 29, 2009. Under the terms of an exemptive order (“Order”) issued by the U.S. Securities and Exchange Commission (“SEC”), the Board of Trustees appointed Epoch as Subadvisor without the necessity of shareholder approval. Exhibit A to this Proxy Statement/Prospectus serves as an Information Statement and furnishes information about Epoch as required under the Order. We are not asking you for a proxy on the approval of Epoch as Subadvisor to the Small Cap Growth Fund and you are requested not to send us a proxy on this change. You are only being asked to consider and vote on an Agreement and Plan of Reorganization.

This Proxy Statement/Prospectus, which you should retain for future reference, sets forth information that shareholders of the Small Cap Growth Fund should know about the Small Company Value Fund before voting on the Reorganization. A Statement of Additional Information (“SAI”) relating to this Proxy Statement/Prospectus, dated August [__], 2009 containing additional information about the Reorganization and the parties thereto, has been filed with the SEC and is incorporated herein by reference. For more information about the Funds, including a more detailed discussion of the investment objectives, policies and restrictions of the Funds, see the Prospectus and SAI for the Funds, each dated March 2, 2009, as supplemented from time to time, which also are incorporated herein by reference and are available upon request from the Funds without charge.

Each Fund also provides periodic reports to its shareholders that highlight certain important information about the Funds, including investment results and financial information. The annual reports for each Fund dated October 31, 2008 and the semiannual reports for each Fund dated April 30, 2009 are incorporated herein by reference. You may receive a copy of the most recent Prospectus, SAI, annual and semiannual reports for each of the Funds, without charge, by writing to MainStay Funds, 169 Lackawanna Avenue, Parsippany, New Jersey 07054, by calling toll-free 800-MAINSTAY (624-6782), or by visiting our web site at mainstayinvestments.com.

You also may review and copy information about each Fund (including the SAI) at the SEC’s Public Reference Room at 100 F Street N.E., Washington, D.C. 20549, or you may obtain copies of this information, after paying a duplicating fee, by electronic mail at publicinfo@sec.gov, or by writing the SEC’s Public Reference Section at the above address. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-202-551-8090. Reports and other information about the Funds are also available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov.

THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED THAT THIS PROXY STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

| 1 |

| The Reorganization | 1 |

| Board Recommendation | 3 |

| COMPARATIVE INFORMATION RELATING TO THE REORGANIZATION | 4 |

| Comparison of Investment Objectives, Strategies, Risk Factors and Management | 4 |

| Description of Fund Classes | 8 |

| Purchase, Redemption and Exchange Features | 8 |

| Comparison of Fees and Expenses | 8 |

| Past Performance of Small Company Value Fund | 13 |

| INFORMATION ABOUT THE REORGANIZATION | 16 |

| The Reorganization Agreement | 16 |

| Reasons for the Reorganization | 17 |

| Board Considerations | 17 |

| Tax Considerations | 19 |

| Expenses of the Reorganization | 21 |

| Material Differences in the Rights of Fund Shareholders | 22 |

| INFORMATION ABOUT THE MANAGEMENT OF THE FUNDS | 22 |

| The Board | 22 |

| The Investment Advisor | 22 |

| Subadvisor | 24 |

| Advisory and Subadvisory Fees | 24 |

| Portfolio Managers | 25 |

| MORE ABOUT INVESTMENT STRATEGIES AND RISKS | 27 |

| SHAREHOLDER GUIDE | 30 |

| VOTING INFORMATION | 61 |

| Voting of Proxies | 61 |

| Quorum Requirements | 61 |

| Votes Necessary to Approve the Reorganization | 62 |

| Effect of Abstentions and Broker “Non-Votes” | 62 |

| Adjournments | 62 |

| Payment of Solicitation Expenses | 63 |

| Other Matters to Come Before the Special Meeting | 63 |

| Future Shareholder Proposals | 63 |

| OTHER INFORMATION | 64 |

| Financial Highlights | 64 |

| Forms of Organization | 64 |

| Distributor | 64 |

| Custodian | 64 |

| Independent Registered Public Accounting Firm | 64 |

| Shareholder Reports | 65 |

| Information Requirements | 65 |

| Security Ownership of Management and Principal Shareholders | 65 |

| Vote of Fund Shares by New York Life Investments | 65 |

| Capitalization | 65 |

EXHIBITS

| Information Statement for the Shareholders of the MainStay Small Cap Growth Fund | A-1 |

| Form of Agreement and Plan of Reorganization | B-1 |

| Fundamental Investment Policies of the Small Company Value Fund and the Small Cap Growth Fund | C-1 |

| Similarities and Differences in the Organization of The MainStay Funds and Eclipse Funds | D-1 |

| E-1 |

| Principal Shareholders of the Funds | F-1 |

SUMMARY

This Summary is qualified in its entirety by reference to the additional information contained elsewhere in this Proxy Statement/Prospectus and the Agreement and Plan of Reorganization (the “Reorganization Agreement”), a form of which is attached to this Proxy Statement/Prospectus as Exhibit B. Shareholders should read this entire Proxy Statement/Prospectus carefully. For more complete information regarding each Fund, please read each Fund’s Prospectus.

The Reorganization

At a meeting held on June 23, 2009, the Boards of Trustees of the Funds (collectively, the “Board”), in each case by a unanimous vote, approved the Reorganization Agreement. Subject to the approval of the shareholders of the Small Cap Growth Fund, the Reorganization Agreement provides for:

| | • | the acquisition of all of the assets and the assumption of all of the liabilities of the Small Cap Growth Fund by the Small Company Value Fund in exchange for shares of beneficial interest of the Small Company Value Fund having an aggregate net asset value equal to the aggregate net asset value of the shares of beneficial interest of the Small Cap Growth Fund; |

| | • | the distribution of shares of the Small Company Value Fund to the shareholders of the Small Cap Growth Fund; and |

| | • | the subsequent liquidation and dissolution of the Small Cap Growth Fund. |

The Reorganization is subject to approval by the shareholders of the Small Cap Growth Fund. The Reorganization, if approved by shareholders, is scheduled to take place on or about the close of business on October 28, 2009, or on such other date as the parties may agree (the “Closing Date”). As a result of the Reorganization, each shareholder of the Small Cap Growth Fund will become the owner of the number of full and fractional shares of the Small Company Value Fund, having an aggregate net asset value equal to the aggregate net asset value of the same class of shares of the Small Cap Growth Fund held by that shareholder as of the close of business on the Closing Date. No sales charges will be imposed as a result of the Reorganization. See “Information About the Reorganization” below.

The Reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. See “Information About the Reorganization” below. Prior to the Reorganization, the Small Cap Growth Fund will pay any dividends out of net investment income or distribution of capital gains to shareholders as required. These distributions will be taxable to Small Cap Growth Fund shareholders that are subject to taxation. However, it is currently anticipated that there will not be a capital gain distribution prior to the Reorganization.

The Reorganization will not affect your right to purchase and redeem shares, to exchange among other MainStay Funds with which you would have been able to exchange prior to the Reorganization, or to receive dividends and other distributions (except that after the Reorganization, you will receive any dividends and distributions from the Small Company Value Fund rather than the Small Cap Growth Fund).

IN CONSIDERING WHETHER TO APPROVE THE REORGANIZATION YOU SHOULD NOTE THAT:

| | · | The Reorganization is part of a larger initiative to reposition, rationalize and streamline the MainStay Group of Funds in order to reduce duplication among funds, strengthen the fund lineup overall, and offer funds with higher asset levels to potentially benefit shareholders through economies of scale; |

| | · | The Funds are each managed by New York Life Investments and subadvised by Epoch (see “Information About the Management of the Funds” below); |

| | · | As of August 14, 2009, the Funds have the same portfolio managers and materially identical investment objectives, strategies, principal risks and primary benchmark indices; |

| | · | Each Fund historically has focused on investing in securities of companies with small market capitalizations; |

| | · | Total assets of the Small Cap Growth Fund and Small Company Value Fund, as of April 30, 2009, were approximately $80 million and $183 million, respectively; |

| | · | New York Life Investments expects shareholders of the Funds over time to benefit from potential economies of scale, including decreased expenses with two investment portfolios becoming one larger investment portfolio; |

| | · | While recognizing that past performance is not a guarantee of future results, particularly in light of the fact that the Small Cap Growth Fund and the Small Company Value Fund each recently appointed a new subadvisor and modified its principal investment strategies, investment process, principal risks, and primary benchmark index, the performance of the Small Company Value Fund, as of April 30, 2009, gross of expenses, outperformed the Small Cap Growth Fund on an absolute basis over the previous one-, three-, five- and ten-year time periods; |

| | · | Absent currently effective expense limitation agreements, on a pro forma basis assuming the Reorganization had occurred, the total annual fund operating expenses for the combined Small Company Value Fund are expected to be lower than current total annual fund operating expenses applicable to all share classes of the Small Cap Growth Fund. However, when applying the current expense limitations for the Small Cap Growth Fund and the Small Company Value Fund, the pro forma net total annual operating expenses for the combined Small Company Value Fund are expected to be higher than all classes of the Small Cap Growth Fund; |

| | · | The Small Cap Growth Fund has benefited from historical expense caps and waivers. However, if the Reorganization is not approved by Small Cap Growth Fund shareholders, New York Life Investments likely would seek Board approval to modify or eliminate the current expense caps and waivers (in this regard, shareholders may wish to note that New York Life Investments had initially proposed Board consideration of modifications to ease the expense caps and waivers in place with respect to this Fund in connection with the Board’s most recent annual review of the Fund’s investment advisory and subadvisory agreements, but had determined not to pursue these modifications in light of its proposal to reorganize the Small Cap Growth Fund); |

| | · | The Small Cap Growth Fund will bear two-thirds of the direct expenses, including solicitation costs, relating to the Reorganization and New York Life Investments will bear directly the remaining one-third of these costs (although it is likely that New York Life Investments also will indirectly bear some or all of the costs apportioned to the Small Cap Growth Fund pursuant to an expense limitation agreement in place with respect to this Fund); |

| | · | The Small Cap Growth Fund will bear the costs associated with making its portfolio adjustments in anticipation of the Reorganization, including brokerage fees and expenses; |

| | · | New York Life Investments intends the Reorganization to qualify as a tax-free reorganization, and completion of the Reorganization is conditioned upon receiving an opinion of counsel to that effect, therefore avoiding any federal tax consequences to the shareholders of the Small Cap Growth Fund; and |

| | · | The Reorganization will not result in a dilution of the economic interests of Small Cap Growth Fund shareholders because such shareholders will receive Small Company Value Fund shares with the same aggregate net asset value as their Small Cap Growth Fund shares. |

Approval of the Reorganization will require the affirmative vote of the holders of a majority of the “outstanding voting securities” of the Small Cap Growth Fund, as specified under the Investment Company Act of 1940, as amended (the “1940 Act”). See “Voting Information” below.

Board Recommendation

For the reasons set forth below in the sections of the Proxy Statement/Prospectus entitled “Reasons for the Reorganization” and “Board Considerations,” the Board, including all of the Trustees who are not “interested persons” of the Funds (as that term is defined in the 1940 Act), has concluded that the Reorganization would be in the best interests of each Fund, and that the interests of the Small Cap Growth Fund’s existing shareholders would not be diluted as a result of the Reorganization. The Board, therefore, has submitted the Reorganization Agreement for approval by you, the shareholders of the Small Cap Growth Fund.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE REORGANIZATION.

COMPARATIVE INFORMATION RELATING TO THE

REORGANIZATION

Comparison of Investment Objectives, Strategies, Risk Factors and Management

This section sets forth the investment objectives, principal investment strategies, risk factors and management of the Small Company Value Fund, and compares these objectives, strategies, and factors with those of the Small Cap Growth Fund. Except as described further below, there are no material differences between the fundamental investment restrictions of the Small Company Value Fund and Small Cap Growth Fund.

Effective June 29, 2009, the Small Cap Growth Fund retained Epoch as its Subadvisor. Exhibit A serves as an Information Statement to shareholders of the Small Cap Growth Fund and furnishes information about Epoch in connection the Board��s appointment of Epoch as Subadvisor to the Small Cap Growth Fund pursuant to the Order issued by the SEC. Effective June 29, 2009, the Small Company Value Fund retained Epoch as its interim subadvisor. Both Funds have the same portfolio managers.

In addition, effective August 14, 2009, Small Cap Growth Fund’s principal investment strategies, investment process, primary benchmark index, and principal risks were modified such that they are materially identical to the Small Company Value Fund’s. These modifications are discussed in a Supplement dated June 29, 2009 to the Small Cap Growth Fund’s Prospectus. Accordingly, there are not expected to be any significant differences between the portfolio composition or management of the Small Company Value Fund and Small Cap Growth Fund on the date of the Special Meeting, and the information listed below applies equally to the Small Cap Growth Fund and the Small Company Value Fund.

Investment Objective

Each Fund’s investment objective is to seek long-term capital appreciation by investing primarily in securities of small-cap companies.

Principal Investment Strategies

Each Fund normally invests at least 80% of its assets in companies with market capitalizations at the time of investment comparable to companies in the Russell 2500TM Index and invests primarily in common stocks and securities convertible into common stock. The Funds may also engage in the lending of portfolio securities.

The Russell 2500TM Index measures the performance of the small to mid-cap segment of the U.S. equity universe, commonly referred to as “mid” cap. The Russell 2500TM Index is a subset of the Russell 3000® Index. It includes approximately 2,500 of the smallest securities based on a combination of their market cap and current index membership. The market capitalizations of companies in this Index fluctuate and as of May 31, 2009, they ranged from $45 million to $7 billion.

Investment Process

Epoch, each Fund’s Subadvisor, believes small and mid capitalization companies offer a highly attractive investment opportunity due to the low level of research coverage they receive (and thus potentially undiscovered investment opportunities), and the fact that these businesses are typically more focused and offer higher growth potential than larger companies. Epoch takes a long-term approach to investing, and relies primarily on its proprietary fundamental research. The portfolio is constructed using this bottom-up process.

Epoch desires to produce superior risk adjusted returns by building portfolios of businesses with outstanding risk/reward profiles without running a high degree of capital risk. Epoch analyzes a business in the same manner a private investor would in looking to purchase the entire company. Epoch only invests in those businesses it understands and where it has confidence in the company’s management and financial strength. Epoch seeks businesses that generate “free cash flow” and securities that have unrecognized potential, yet possess a combination of above average free cash flow growth, and/or below average valuation.

Epoch sells or reduces a position in a security when it sees the objectives of its investment thesis failing to materialize, or when it believes those objectives have been met and the valuation of the company’s shares fully reflect the opportunities once thought unrecognized in share price. When Epoch believes that objectives are not being met it can be for a number of reasons: the economic or competitive environment might be changing; company management’s execution could be disappointing; or worst case, management proves to be less than forthright or have an inappropriate assessment of the company’s state and the task at hand.

Principal Risks

The Funds’ investments in common stocks and other equity securities are subject to the risks of changing economic, stock market, industry and company conditions and the risks inherent in management’s ability to anticipate such changes that can adversely affect the value of the Fund’s holdings. Opportunities for greater gain often come with the possibility of a greater risk of loss. Some of the securities in which the Fund may invest, therefore, may carry above-average risk compared to the risk of securities found in common stock indices, such as the Dow Jones Industrial Average and the S&P 500® Index.

In comparison to stocks of companies with larger capitalizations, stocks of small-capitalization companies may have:

| | · | greater spreads between their bid and ask prices; |

| | · | fewer shares outstanding and thus significantly lower trading volumes; and/or |

| | · | cyclical, static or moderate growth prospects. |

Small-capitalization companies may be more vulnerable to adverse business or market developments than large-capitalization companies.

The principal risk of growth stocks is that investors expect growth companies to increase their earnings at a rate that is generally higher than the rate expected for non-growth companies. If these expectations are not met, the market price of the stock may decline significantly, even if earnings show an absolute increase. Growth company stocks also typically lack the dividend yield that can cushion stock prices in market downturns.

The principal risk of investing in value stocks is that they may never reach what the Subadvisor believes is their full value or that they may even go down in value. In addition, different types of stocks tend to shift in and out of favor depending on market and economic conditions and therefore the Fund’s performance may be lower or higher than that of funds that invest in other types of equity securities.

The Funds’ use of securities lending presents certain risks. The risk of securities lending is that the financial institution that borrows securities from the Fund could go bankrupt or otherwise default on its commitment under the securities lending agreement and the Fund might not be able to recover the loaned securities or their value.

In a securities lending transaction, a Fund lends securities from its portfolio to a broker-dealer (or other financial intermediary) for a period of time. The Fund receives interest and/or a fee and a promise that the securities will be returned on a fixed date.

Due to their trading strategies, the Funds may experience a portfolio turnover rate of over 100%. Funds with high turnover rates (over 100%) often have higher transaction costs (which are paid by the Fund) and may generate short-term capital gains (on which you may pay taxes, even if you do not sell any shares by year-end).

Portfolio turnover measures the amount of trading a Fund does during the year.

Fundamental Investment Restrictions

The Small Cap Growth Fund and Small Company Value Fund have each adopted fundamental investment restrictions (i.e., policies that require shareholder approval to modify) that differ in certain respects. For example, while both Funds have adopted a fundamental investment restriction regarding borrowing activities, the Small Company Value Fund is more limited than the Small Cap Growth Fund in terms of the degree to which the Small Company Value Fund may borrow. The Small Company Value Fund also has adopted various fundamental restrictions that are not also fundamental restrictions of the Small Cap Growth Fund. These include restrictions on (1) purchasing securities on margin, (2) selling securities short, and (3) investing in puts, calls, straddles, spreads or combinations thereof, among others. While these activities carry certain risks and represent differences between the Funds, New York Life Investments does not believe that these differences are material to the manner in which the Funds are managed or result in one Fund being subject to materially greater risk than the other. For a complete comparison of the Funds’ fundamental investment restrictions, please see Exhibit C to this Proxy Statement/Prospectus.

The following tables contain information regarding the assets, holdings, and management of the Funds. Unless otherwise indicated, this information is as of April 30, 2009 and does not, therefore reflect certain changes in the Small Cap Growth Fund’s and Small Company Value Fund’s management, investment objective and strategies that took effect on August 14, 2009. Please note that as a result of these more recent changes, the information provided about the Funds is expected to be substantially similar to one another on the date of the Special Meeting.

| As of April 30, 2009 | Small Cap Growth Fund | Small Company Value Fund |

| Net Assets | $80.2 million | $183.1 million |

| Number of Holdings | 101 | 91 |

| Portfolio Composition | 90.3% - Equities 4.7% - Exchange Traded Fund 5.0% - Cash | 96.7% - Equities 3.3% - Cash |

| Primary Benchmark | Russell 2500TM Index1 | Russell 2500TM Index1 |

| % of AUM in Top 10 Holdings | 21.4% | 17.6% |

| Portfolio Turnover Rate (As of 10/31/08) | 75% | 158% |

| Investment Manager | New York Life Investment

Management LLC | New York Life Investment

Management LLC |

Subadvisor2 | Epoch | Epoch |

Portfolio Managers3 | David N. Pearl, CFA, William

W. Priest, CFA and Michael A.

Welhoelter, CFA | David N. Pearl, CFA, William

W. Priest, CFA and Michael A.

Welhoelter, CFA |

| 1 | The Russell 2500TM Index is a broad index featuring 2,500 stocks that cover the small and mid-cap market capitalizations. The Russell 2500TM Index is a market cap weighted index that includes the smallest 2,500 companies covered in the Russell 3000® universe of United States-based listed equities. You cannot invest directly in an index. Effective August 14, 2009, the Funds selected the Russell 2500TM Index as their primary benchmark index due to a change in subadvisor. Prior to that date, the Small Cap Growth Fund’s primary benchmark was the Russell 2000® Growth Index and the Small Company Value Fund’s primary benchmark was the Russell 2000® Value Index. |

| 2 | Epoch became the Subadvisor to the Small Cap Growth Fund and interim subadvisor to the Small Company Value Fund on June 29, 2009. |

| 3 | Messrs. Pearl, Priest and Welhoelter became the portfolio managers of the Small Cap Growth Fund and the Small Company Value Fund on June 29, 2009, as a result of the appointment of Epoch as the Subadvisor to Small Cap Growth Fund and interim subadvisor to the Small Company Value Fund. If shareholders of Small Company Value Fund approve the subadvisory agreement with Epoch at a meeting to be held on October 16, 2009, the portfolio managers listed above will continue to serve as portfolio managers on an ongoing basis. |

Top Ten Holdings as of June 30, 2009:

| Small Cap Growth Fund | | | | | Small Company Value Fund | | | |

Name | | % Net Assets | | | Name | | % Net Assets | |

| [_] | | | [_ | %] | | | | | [_ | %] |

| | | [_ | %] | | | | | [_ | %] |

| | | [_ | %] | | | | | [_ | %] |

| | | [_ | %] | | | | | [_ | %] |

| | | [_ | %] | | | | | [_ | %] |

| | | [_ | %] | | | | | [_ | %] |

| | | [_ | %] | | | | | [_ | %] |

| | | [_ | %] | | | | | [_ | %] |

| | | [_ | %] | | | | | [_ | %] |

| | | [_ | %] | | | | | [_ | %] |

Description of Fund Classes

As noted above, both Funds offer Investor Class, Class A, Class B, Class C and Class I shares. The corresponding classes of shares of each Fund have the same class-specific features.

Purchase, Redemption and Exchange Features

The Funds have the same policies with respect to purchases, redemptions and exchanges by shareholders. See the “Shareholder Guide” for a detailed description of purchase, redemption and exchange features.

Comparison of Fees and Expenses

The following discussion describes and compares the fees and expenses of the Funds. Expenses of the Funds are based upon the operating expenses as of April 30, 2009. Pro forma fees show estimated expenses of the Small Company Value Fund after giving effect to the proposed Reorganization. Pro forma numbers are estimated in good faith and are hypothetical.

Class A

Shareholder Fees (fees paid directly from shareholder’s investment) | | Small Cap Growth Fund | | | Small Company Value Fund | | | Small Company Value Fund Pro Forma Combined | |

| | | | | | | | | | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of Offering Price) | | | 5.50 | % | | | 5.50 | % | | | 5.50 | % |

Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the original offering price or redemption proceeds) (1) | | None | | | None | | | None | |

| Redemption Fee/Exchange Fee (as a percentage of redemption proceeds) | | None | | | None | | | None | |

| | | | | | | | | | | | | |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Management Fees (2) | | | 1.01 | % | | | 0.85 | % | | | 0.85 | % |

Distribution and/or Service (12b-1) Fees (3) | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % |

Other Expenses (4) | | | 0.72 | % | | | 0.58 | % | | | 0.58 | % |

Acquired (Underlying) Fund Fees and Expenses (5) | | | 0.01 | % | | | 0.00 | % | | | 0.00 | % |

Total Annual Fund Operating Expenses (6) | | | 1.99 | % | | | 1.68 | % | | | 1.68 | % |

Fee Recoupments/(Waivers/Reimbursements) (6) | | | (0.50 | )% | | | (0.15 | )% | | | (0.15 | )% |

Net Annual Fund and Underlying Fund Expenses (6) | | | 1.49 | % | | | 1.53 | % | | | 1.53 | % |

Net Annual Fund Operating Expenses (excluding Underlying Fund Operating Expenses) (6) | | | 1.48 | % | | | 1.53 | % | | | 1.53 | % |

Class I

Shareholder Fees (fees paid directly from shareholder’s investment) | | Small Cap Growth Fund | | | Small Company Value Fund | | | Small Company Value Fund Pro Forma Combined | |

| | | | | | | | | | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of Offering Price) | | None | | | None | | | None | |

Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the original offering price or redemption proceeds) (1) | | None | | | None | | | None | |

| Redemption Fee/Exchange Fee (as a percentage of redemption proceeds) | | None | | | None | | | None | |

| | | | | | | | | | |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets) | | | | | | | | | |

| | | | | | | | | | |

Management Fees (2) | | | 1.01 | % | | | 0.85 | % | | | 0.85 | % |

Distribution and/or Service (12b-1) Fees (3) | | None | | | None | | | None | |

Other Expenses (4) | | | 0.72 | % | | | 0.58 | % | | | 0.58 | % |

Acquired (Underlying) Fund Fees and Expenses (5) | | | 0.01 | % | | | 0.00 | % | | | 0.00 | % |

Total Annual Fund Operating Expenses (6) | | | 1.74 | % | | | 1.43 | % | | | 1.43 | % |

Fee Recoupments/(Waivers/Reimbursements) (6) | | | (0.80 | )% | | | (0.26 | )% | | | (0.26 | )% |

Net Annual Fund and Underlying Fund Expenses (6) | | | 0.94 | % | | | 1.17 | % | | | 1.17 | % |

Net Annual Fund Operating Expenses (excluding Underlying Fund Operating Expenses) (6) | | | 0.93 | % | | | 1.17 | % | | | 1.17 | % |

Class B

Shareholder Fees (fees paid directly from shareholder’s investment) | | Small Cap Growth Fund | | | Small Company Value Fund | | | Small Company Value Fund Pro Forma Combined | |

| | | | | | | | | | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of Offering Price) | | None | | | None | | | None | |

Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the original offering price or redemption proceeds) (1) | | | 5.00 | % | | | 5.00 | % | | | 5.00 | % |

| Redemption Fee/Exchange Fee (as a percentage of redemption proceeds) | | None | | | None | | | None | |

| | | | | | | | | | | | | |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Management Fees (2) | | | 1.01 | % | | | 0.85 | % | | | 0.85 | % |

Distribution and/or Service (12b-1) Fees (3) | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

Other Expenses (4) | | | 1.09 | % | | | 0.68 | % | | | 0.86 | % |

Acquired (Underlying) Fund Fees and Expenses (5) | | | 0.01 | % | | | 0.00 | % | | | 0.00 | % |

Total Annual Fund Operating Expenses (6) | | | 3.11 | % | | | 2.53 | % | | | 2.71 | % |

Fee Recoupments/(Waivers/Reimbursements) (6) | | | (0.77 | )% | | | (0.15 | )% | | | (0.33 | )% |

Net Annual Fund and Underlying Fund Expenses (6) | | | 2.34 | % | | | 2.38 | % | | | 2.38 | % |

Net Annual Fund Operating Expenses (excluding Underlying Fund Operating Expenses) (6) | | | 2.33 | % | | | 2.38 | % | | | 2.38 | % |

Class C

Shareholder Fees (fees paid directly from shareholder’s investment) | | Small Cap Growth Fund | | | Small Company Value Fund | | | Small Company Value Fund Pro Forma Combined | |

| | | | | | | | | | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of Offering Price) | | None | | | None | | | None | |

Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the original offering price or redemption proceeds) (1) | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| Redemption Fee/Exchange Fee (as a percentage of redemption proceeds) | | None | | | None | | | None | |

| | | | | | | | | | | | | |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Management Fees (2) | | | 1.01 | % | | | 0.85 | % | | | 0.85 | % |

Distribution and/or Service (12b-1) Fees (3) | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

Other Expenses (4) | | | 1.09 | % | | | 0.68 | % | | | 0.86 | % |

Acquired (Underlying) Fund Fees and Expenses (5) | | | 0.01 | % | | | 0.00 | % | | | 0.00 | % |

Total Annual Fund Operating Expenses (6) | | | 3.11 | % | | | 2.53 | % | | | 2.71 | % |

Fee Recoupments/(Waivers/Reimbursements) (6) | | | (0.77 | )% | | | (0.15 | )% | | | (0.33 | )% |

Net Annual Fund and Underlying Fund Expenses (6) | | | 2.34 | % | | | 2.38 | % | | | 2.38 | % |

Net Annual Fund Operating Expenses (excluding Underlying Fund Operating Expenses) (6) | | | 2.33 | % | | | 2.38 | % | | | 2.38 | % |

Investor Class

Shareholder Fees (fees paid directly from shareholder’s investment) | | Small Cap Growth Fund | | | Small Company Value Fund | | | Small Company Value Fund Pro Forma Combined | |

| | | | | | | | | | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of Offering Price) | | | 5.50 | % | | | 5.50 | % | | | 5.50 | % |

Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of the original offering price or redemption proceeds) (1) | | None | | | None | | | None | |

| Redemption Fee/Exchange Fee (as a percentage of redemption proceeds) | | None | | | None | | | None | |

| | | | | | | | | | | | | |

Annual Fund Operating Expenses (expenses that are deducted from Fund assets) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Management Fees (2) | | | 1.01 | % | | | 0.85 | % | | | 0.85 | % |

Distribution and/or Service (12b-1) Fees (3) | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % |

Other Expenses (4) | | | 1.09 | % | | | 0.68 | % | | | 0.86 | % |

Acquired (Underlying) Fund Fees and Expenses (5) | | | 0.01 | % | | | 0.00 | % | | | 0.00 | % |

Total Annual Fund Operating Expenses (6) | | | 2.36 | % | | | 1.78 | % | | | 1.96 | % |

Fee Recoupments/(Waivers/Reimbursements) (6) | | | (0.77 | )% | | | (0.15 | )% | | | (0.33 | )% |

Net Annual Fund and Underlying Fund Expenses (6) | | | 1.59 | % | | | 1.63 | % | | | 1.63 | % |

Net Annual Fund Operating Expenses (excluding Underlying Fund Operating Expenses) (6) | | | 1.58 | % | | | 1.63 | % | | | 1.63 | % |

| (1) | Generally, Investor Class and Class A shares are not subject to a contingent deferred sales charge upon redemption. A contingent deferred sales charge of 1.00% may be imposed on certain redemptions effected within one year of the date of purchase of Investor Class or Class A shares that were purchased at net asset value. The amount of the contingent deferred sales charge which may be applicable to Class B shares will depend on the number of years since you purchased the shares being redeemed. A contingent deferred sales charge of 1.00% may be imposed on redemptions of Class C shares within one year of the date of purchase. |

| | |

| (2) | The management fee for the Small Company Value Fund is an annual percentage of the Fund’s average daily net assets as follows: 0.85% on assets up to $1 billion and 0.80% on assets in excess of $1 billion. Expense information in the table has been restated to reflect current fees. The management fee for the Small Cap Growth Fund is an annual percentage of the Small Cap Growth Fund’s average daily net assets plus a fee for fund accounting services previously provided by New York Life Investments under a separate fund accounting agreement. Effective August 1, 2008, New York Life Investments has contractually agreed to waive a portion of its management fee so that the management fee does not exceed 0.85% on assets up to $1 billion and 0.80% on assets in excess of $1 billion. Without this waiver, the actual management fee would be 1.00% on assets up to $1 billion and 0.95% on assets in excess of $1 billion. Effective August 1, 2008, the Small Cap Growth Fund’s Fund Accounting Agreement was incorporated into the Fund’s management agreement, resulting in a 0.03% increase in the Small Cap Growth Fund’s management fees. This increase in management fees was offset by a 0.03% decrease in the Fund’s “Other Expenses,” resulting in no net increase in total annual fund operating expenses. |

| |

| |

| | |

| (3) | Because the 12b-1 fee is an ongoing fee charged against the assets of a Fund, long-term shareholders may indirectly pay an amount that is more than the economic equivalent of paying other types of sales charges. |

| | |

| (4) | “Other Expenses” include, among other things, fees payable for transfer agency services, which may differ between the classes. |

| | |

| (5) | In addition to the “Total Annual Fund Operating Expenses” that the Funds bear directly, the Funds’ shareholders indirectly bear the expenses of the other funds in which the Funds invest (“Underlying Funds”). The table shows the Funds’ estimated indirect expense from investing in Underlying Funds based on the allocation of each Fund’s assets among the Underlying Funds. This expense may be higher or lower over time depending on the actual investments of the Fund’s assets in the Underlying Funds and the actual expenses of the Underlying Funds. |

| (6) | Each class of shares of the Funds is subject to an expense limitation agreement with New York Life Investments. For the Small Company Value Fund, effective February 13, 2009, New York Life Investments has entered into a written expense limitation agreement under which it has agreed to waive a portion of the Fund’s management fee or reimburse the expenses of the appropriate class of the Fund so that the total ordinary operating expenses of a class do not exceed the following percentages of average daily net assets: Investor Class, 1.63%; Class A, 1.53%; Class B, 2.38%; Class C, 2.38%; and Class I, 1.17%. These expense limitations may be modified or terminated only with the approval of the Board. Prior to February 13, 2009, New York Life Investments had a written expense limitation agreement that set the expense limitations at 1.55% for Class A shares, 2.40% for Class B shares and 2.40% for Class C shares and 1.19% for Class I shares. For the Small Cap Growth Fund, effective April 1, 2008 (February 28, 2008 for Investor Class shares), New York Life Investments has entered into a written expense limitation agreement under which it has agreed to waive a portion of the Fund’s management fee or reimburse the expenses of the appropriate class of the Fund so that the total ordinary operating expenses of a class do not exceed the following percentages of average daily net assets: Investor Class, 1.58%; Class A, 1.48%; Class B, 2.33%; Class C, 2.33%; and Class I, 0.93%. These expense limitations may be modified or terminated only with the approval of the Board. Prior to April 1, 2008, New York Life Investments had a written expense limitation agreement that set the expense limitations at 2.23% for Class B shares and 2.23% for Class C Shares. The limitations for Class A shares and Class I shares were the same as in the April 1, 2008 agreement. Under each of these expense limitation agreements, New York Life Investments may recoup the amount of certain management fee waivers or expense reimbursements from a Fund pursuant to the agreements, if such action does not cause the Fund to exceed existing expense limitations and the recoupment is made within three years after the year in which New York Life Investments incurred the expense. The term “total ordinary operating expenses” excludes taxes, interest, litigation, extraordinary expenses, brokerage and other transaction expenses relating to the purchase or sale of portfolio investments, and the fees and expenses of any other funds in which a Fund invests. |

| |

| |

Examples

The following examples are intended to help you compare the costs of investing in each Fund and the potential combined Fund with the cost of investing in other mutual funds. The examples assume that you invest $10,000 in each Fund and in the potential combined Fund after the Reorganization for the time periods indicated and reflects what you would pay if you redeemed all your shares at the end of each time period shown or if you continued to hold them. The examples also assume that your investment has a 5% return each year, that each Fund’s operating expenses remain the same and that all dividends and distributions are reinvested. Your actual costs may be higher or lower than those shown.

Small Company Value Fund

| Expenses After | | Class A | | | Class I | | | Class B* | | | Class C | | | Investor Class | |

| | | | | | | | | Assuming no redemption | | | Assuming redemption at the end of each period | | | Assuming no redemption | | | Assuming redemption at the end of each period | | | | |

| 1 Year | | $ | 697 | | | $ | 119 | | | $ | 241 | | | $ | 741 | | | $ | 241 | | | $ | 341 | | | $ | 707 | |

| 3 Years | | $ | 1,037 | | | $ | 427 | | | $ | 773 | | | $ | 1,073 | | | $ | 773 | | | $ | 773 | | | $ | 1,066 | |

| 5 Years | | $ | 1,399 | | | $ | 757 | | | $ | 1,332 | | | $ | 1,532 | | | $ | 1,332 | | | $ | 1,332 | | | $ | 1,448 | |

| 10 Years | | $ | 2,416 | | | $ | 1,691 | | | $ | 2,715 | | | $ | 2,715 | | | $ | 2,854 | | | $ | 2,854 | | | $ | 2,518 | |

| * | The above example reflects Class B shares converting into Investor Class shares in years 9-10; fees could be lower if you are eligible to convert to Class A shares instead. |

Small Cap Growth Fund

| Expenses After | | Class A | | | Class I | | | Class B* | | | Class C | | | Investor Class | |

| | | | | | | | | Assuming no redemption | | | Assuming redemption at the end of each period | | | Assuming no redemption | | | Assuming redemption at the end of each period | | | | |

| 1 Year | | $ | 692 | | | $ | 95 | | | $ | 236 | | | $ | 736 | | | $ | 236 | | | $ | 336 | | | $ | 702 | |

| 3 Years | | $ | 1,093 | | | $ | 416 | | | $ | 822 | | | $ | 1,122 | | | $ | 824 | | | $ | 824 | | | $ | 1,175 | |

| 5 Years | | $ | 1,519 | | | $ | 760 | | | $ | 1,434 | | | $ | 1,634 | | | $ | 1,438 | | | $ | 1,438 | | | $ | 1,674 | |

| 10 Years | | $ | 2,701 | | | $ | 1,732 | | | $ | 2,930 | | | $ | 2,930 | | | $ | 3,094 | | | $ | 3,094 | | | $ | 3,041 | |

| * | The above example reflects Class B shares converting into Investor Class shares in years 9-10; fees could be lower if you are eligible to convert to Class A shares instead. |

Small Company Value Fund — Pro Forma Combined

| Expenses After | | Class A | | | Class I | | | Class B* | | | Class C | | | Investor Class | |

| | | | | | | | | Assuming no redemption | | | Assuming redemption at the end of each period | | | Assuming no redemption | | | Assuming redemption at the end of each period | | | | |

| 1 Year | | $ | 697 | | | $ | 119 | | | $ | 241 | | | $ | 741 | | | $ | 241 | | | $ | 341 | | | $ | 707 | |

| 3 Years | | $ | 1,037 | | | $ | 427 | | | $ | 810 | | | $ | 1,110 | | | $ | 810 | | | $ | 810 | | | $ | 1,101 | |

| 5 Years | | $ | 1,399 | | | $ | 757 | | | $ | 1,405 | | | $ | 1,605 | | | $ | 1,405 | | | $ | 1,405 | | | $ | 1,520 | |

| 10 Years | | $ | 2,416 | | | $ | 1,691 | | | $ | 2,836 | | | $ | 2,836 | | | $ | 3,017 | | | $ | 3,017 | | | $ | 2,684 | |

| * | The above example reflects Class B shares converting into Investor Class shares in years 9-10; fees could be lower if you are eligible to convert to Class A shares instead. |

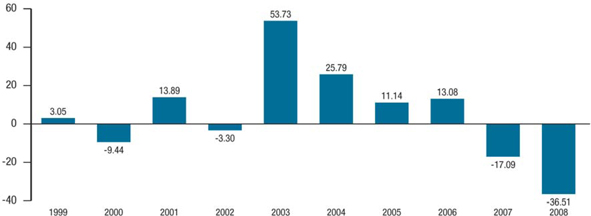

Past Performance of Small Company Value Fund

The following bar chart and tables indicate some of the risks of investing in the Small Company Value Fund. The bar chart shows you how the Small Company Value Fund’s calendar year performance has varied over the last ten years. The table shows how the Small Company Value Fund’s average annual total returns (before and after taxes) for one-, five- and ten-year periods compare to those of a broad-based securities market index. Average annual total returns reflect actual sales loads, service and/or distribution fees. Sales loads are not reflected in the bar chart or in the best and worst quarterly returns. Absent expense limitations and/or fee waivers, performance would have been lower. Performance data for the classes varies based on differences in their fee and expense structures. Performance figures for Class A and B shares, first offered on January 2, 2004, include the historical performance of Class I shares through January 1, 2004, adjusted for differences in certain contractual expenses and fees. Performance figures for Class C shares, first offered on January 2, 2004, include the historical performance of the L Class shares (which were redesignated as Class C shares on January 2, 2004) from December 30, 2002 through January 1, 2004 and the historical performance of the Class I shares through December 29, 2002, adjusted for differences in certain contractual expenses and fees. Performance figures for Investor Class shares, first offered on February 28, 2008, include the historical performance of Class A shares through February 27, 2008, adjusted for differences in expenses and fees. It is expected that the combined Small Company Value Fund will retain the performance history of the Small Company Value Fund after the Reorganization. As with all mutual funds, past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Unadjusted, the performance shown for the newer classes might have been lower. Effective January 30, 2009, the Fund changed its investment objective and principal investment strategies. The past performance in the bar chart and table reflect the Fund’s prior investment objective and principal investment strategies.

As of June 30, 2009, Class I shares of the Small Company Value Fund had a year-to-date return of 15.57%.

Annual Returns, Class I Shares

(by calendar year 1999–2008)

Best and Worst Quarterly Returns, Class I Shares

| (1999 – 2008) | | Return | | | Quarter/Year | |

| Highest returns/best quarter | | | 21.15 | % | | | 4Q/03 | |

| Lowest return/worst quarter | | | -25.23 | % | | | 4Q/08 | |

Average Annual Total Returns

(for the period ended December 31, 2008)1

| | 1 year | 5 years | 10 years |

MainStay Small Company Value Fund Return Before Taxes on Distributions Investor Class Class A Class B Class C Class I | -40.36% -40.31% -40.46% -37.94% -36.51% | -5.15% -5.13% -5.08% -4.81% -3.61% | 1.82% 1.83% 1.63% 1.65% 2.77% |

Return After Taxes on Distributions2 Class I | -36.98% | -5.19% | 1.65% |

Return After Taxes on Distributions and Sale of Fund Shares2 Class I | -23.48% | -3.01% | 2.30% |

Russell 2500TM Index3 (reflects no deductions for fees, expenses or taxes) | -36.79% | -0.98% | 4.08% |

Russell 2000® Value Index4 (reflects no deductions for fees, expenses or taxes) | -28.92% | 0.27% | 6.11% |

| 1 | See above under “Past Performance of Small Company Value Fund” for a discussion regarding the inception date of certain classes (as applicable) and the use of historical performance for those share classes. |

| 2 | After-tax returns are calculated using the historical highest individual federal marginal tax rates and do not reflect the impact of state and local taxes. In some cases, the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns shown are for Class I shares of the Fund. After-tax returns for Investor Class, Class A, B and C shares may vary. |

| 3 | Effective August 14, 2009, the Fund’s primary benchmark index is the Russell 2500TM Index. The Russell 2500TM Index is a broad index featuring 2,500 stocks that cover the small and mid cap market capitalizations. The Russell 2500TM is a market cap weighted index that includes the smallest 2,500 companies covered in the Russell 3000® universe of United States-based listed equities. The Fund has selected the Russell 2500TM Index as its primary benchmark index in replacement of the Russell 2000® Growth Index because it believes Russell 2500TM Index is more reflective of the Fund’s current investment style. You cannot invest directly in an index. |

| 4 | The Russell 2000® Value Index measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which, in turn, measures the performance of the 3,000 largest U.S. companies based on total market capitalization. Total returns assume reinvestment of all dividends and capital gains. You cannot invest directly in an index. |

INFORMATION ABOUT THE REORGANIZATION

The Reorganization Agreement

The terms and conditions of the Reorganization under which the proposed transactions may be consummated are set forth in the Reorganization Agreement. Significant provisions of the Reorganization Agreement are summarized below. This summary is qualified in its entirety by reference to the Reorganization Agreement, a form of which is attached as Exhibit B.

The Reorganization Agreement contemplates the transfer of all of the assets of the Small Cap Growth Fund and the assumption of the liabilities of the Small Cap Growth Fund by the Small Company Value Fund in exchange for shares of beneficial interest of the Small Company Value Fund having an aggregate net asset value equal to the aggregate net asset value of the shares of beneficial interest of the Small Cap Growth Fund. The Small Cap Growth Fund would then distribute to its shareholders the portion of the same class of shares of the Small Company Value Fund to which each such shareholder is entitled, with each shareholder receiving the same class of shares of the Small Company Value Fund having an aggregate net asset value equal to the aggregate net asset value of the shares of the Small Cap Growth Fund held by that shareholder as of the close of business on the Closing Date. Thereafter, the Small Cap Growth Fund would be liquidated and dissolved.

The obligations of the Funds under the Reorganization Agreement are subject to various conditions, including approval of the Reorganization by the shareholders of the Small Cap Growth Fund. The Reorganization Agreement also requires that each of the Funds take, or cause to be taken, all actions, and do or cause to be done, all things reasonably necessary, proper or advisable to consummate and make effective the transaction contemplated by the Reorganization Agreement.

Costs associated with portfolio adjustments that would occur between the time of shareholder approval of the Reorganization and the Closing Date will be borne by the Small Cap Growth Fund. In light of the recent modifications to the Small Cap Growth Fund discussed above, it is not anticipated that there will be any significant portfolio adjustments needed as part of the Reorganization.

Dividend and capital gain distributions to Small Cap Growth Fund shareholders made prior to the Reorganization may result in tax consequences for the Small Cap Growth Fund shareholders. It is currently anticipated that there will not be any capital gain distributions prior to the Reorganization.

Until the Closing Date, shareholders of the Small Cap Growth Fund will continue to be able to redeem or exchange their shares of that Fund. Redemption or exchange requests received after the Closing Date will be treated as requests received by the Small Company Value Fund for the redemption or exchange of its shares.

The Reorganization Agreement may be terminated by the Board if circumstances should develop that, in the opinion of Board, make proceeding with the Agreement inadvisable for a Fund. Please refer to Exhibit B to review the terms and conditions of the Reorganization Agreement.

Accounting and Performance History

The Small Company Value Fund will be the accounting survivor in the Reorganization. Furthermore, the combined Small Company Value Fund will retain the performance history of the Small Company Value Fund.

Reasons for the Reorganization