UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-00958

| T. Rowe Price New Horizons Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2015

Item 1. Report to Shareholders

| New Horizons Fund | December 31, 2015 |

The views and opinions in this report were current as of December 31, 2015. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

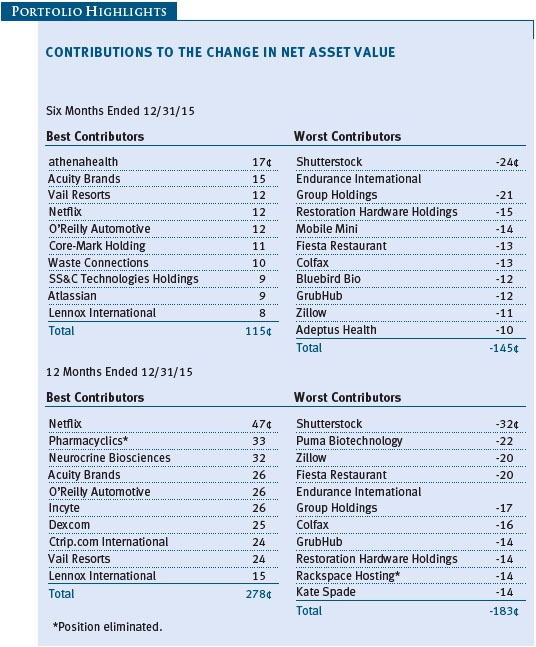

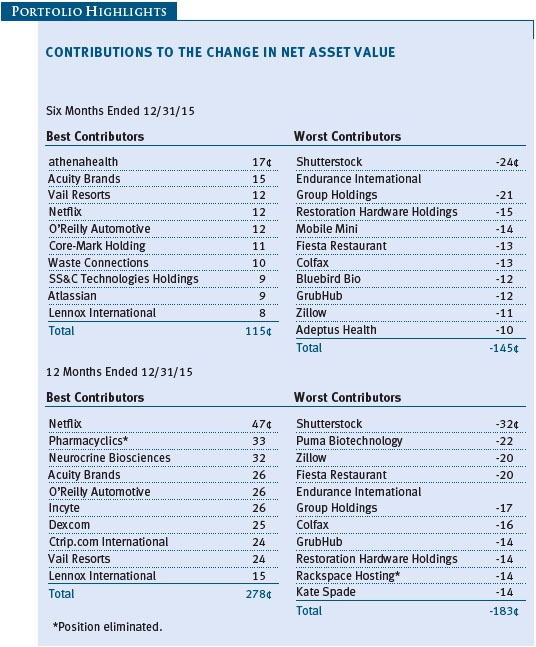

Small-cap growth stocks lost ground for the year, underperforming large-cap equities but outpacing small-cap value companies. Within the small-cap growth universe, the consumer staples and health care sectors generated the best returns. The fund outperformed its Lipper peer group and its benchmark index thanks to strong stock selection.

PERFORMANCE REVIEW

The New Horizons Fund returned 4.50% for the year ended December 31, 2015, outperforming the -1.38% return of its benchmark, the Russell 2000 Growth Index, as a result of stock selection. The fund also outpaced the Lipper Small-Cap Growth Funds Index’s -1.15% return. The New Horizons Fund was in the top 2% of its Lipper small-cap growth funds peer group for the trailing 3-, 5-, and 10-year periods ended December 31, 2015. Based on cumulative total return, Lipper ranked the fund 41 of 558, 6 of 489, 1 of 437, and 5 of 311 for the 1-, 3-, 5-, and 10-year periods ended December 31, 2015, respectively. (Past performance cannot guarantee future results.)

MARKET ENVIRONMENT

Major U.S. stock indexes were mixed in 2015. In the first part of the year, equities benefited from steady economic and employment growth; generally favorable corporate earnings outside of the energy sector, which has been hammered by plummeting oil prices since mid-2014; increased merger activity; and aggressive stimulus measures by central banks in Europe and Asia. Large-cap U.S. indexes reached their highest levels of the year in May, while smaller-cap benchmarks peaked about one month later. During the summer, global equities fell sharply in response to a plunge in Chinese stocks, which stemmed from the country’s decelerating economy and uncertainty regarding China’s policy responses, including an unexpected August currency devaluation. After much anticipation, the Federal Reserve raised the federal funds target rate range by 0.25 percentage points on December 16.

Small-cap growth stocks rebounded in the fourth quarter after selling off sharply in the third quarter but ended the year in negative territory, with the Russell 2000 Growth Index down about 1%. Small-cap growth stocks outperformed their small-cap value peers for the year. Meanwhile, small-cap stocks underperformed their large-cap counterparts but outperformed mid-caps over the same period.

STRATEGY REVIEW

In his book Team of Teams, General Stanley McChrystal offers a guiding framework for organizations that confront uncertainty. Reflecting on his leadership of the military’s elite Joint Special Operations Task Force in Iraq, McChrystal differentiates systems that are complicated from those that are complex. Complicated systems operate like mechanical devices with linear input-output interactions—picture a microchip or an internal combustion engine. While a complicated system may have a confusing number of inputs to keep track of, one can clearly predict how changing a few inputs will alter the whole system. Complex systems, on the other hand, are indeterminate. The game of chess has a set of logical rules that define how each piece can move, but it is a complex system because every turn features a wide array of possible countermoves. When one player shifts their pawn to D3 at the start of the match, it will not lead to a predictable response but a new set of nearly infinite contingencies.

Growth investing is undeniably a complex problem. The concept of complexity applies particularly well to industries undergoing structural change. We cannot succeed by tracking several macroeconomic data points, generating earnings estimates for our companies, and running valuation metrics through a computer. Rather, we are grappling with a world that is on the forefront of change. Our work demands that we interpret a constant stream of new, often-surprising data points and place them in an appropriate context. As a result, when we are measuring the probability of different outcomes, we have to rely heavily on our qualitative understanding of business strategies and industry trends.

Industries with structural change are complex systems because they are controlled by indeterminate factors—not only the behavior of individual human beings, but also businesses’ strategic advantages and society’s changing desires as a whole. In this year-end review, in addition to our portfolio review of performance, we would like to share some of the underlying work that we have done on the consumer companies in the portfolio. Significant changes have occurred in the consumer space in recent years. We have studied the sector’s underlying forces in detail to make sure we approach this part of the portfolio with the right framework.

CONSUMER PORTFOLIO REVIEW

One way to predict how society’s habits will change over time is to study young adults. As the Millennial Generation (born 1980–2000) becomes the majority of consumers in the next decade, successful consumer businesses will need to evolve in order to support their worldview. Generations form many of their perspectives and habits early in life, so formative events have predictive power. Each generation is known for a few differentiating characteristics. For instance, the Greatest Generation (born 1900–1920) was impacted by the dutiful patriotism of World War II, and Generation X (born 1960–1980) developed a distinct cultural nihilism in the wake of Vietnam. Based on our research, we find that millennials have been greatly affected by the financial crisis, ballooning student loan totals, and the rapid development of information technology. We expect these developments to affect their behavior as consumers.

As they age, millennials are likely to be value-conscious consumers. Most feel that their financial opportunities will be more constrained than those of their parents, and they are learning thrifty behaviors as a result of high personal debt levels and tepid economic growth. In contrast with baby boomers, who are known for being optimistic and spendthrift, we expect millennials to be bargain-seekers in certain areas.

Partly because of our view on millennial frugality, we added to our position in Burlington Stores this year. The off-price retailing channel offers significant savings to shoppers, and Burlington’s peers have proven to be durable due to their lack of fashion exposure. Burlington still has a significant growth opportunity ahead of it. Near-term comparable sales will get better if the company can improve its merchandising strategy, and we think management is taking the right approach thus far. As it gains scale, we also expect Burlington to benefit from fixed-cost leverage and to widen margins to match its peers. (Please refer to the fund’s portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

In their consumption habits, millennials in particular value experiences more than ownership. They would rather post an interesting trip on social media than flaunt an expensive house or car. We think sustainable businesses that play to this experiential theme can continue to do well.

Vail Resorts remains one of our largest holdings and was a top performance contributor for the period. The company owns an irreplaceable set of ski resorts, including six of the 10 most visited mountains in North America. Vail has a proven management team that has demonstrated business model innovation by building its Epic Season Pass program and a formidable marketing organization. This has resulted in strong growth and a competitive advantage as it deploys capital both internally and externally.

Millennials have grown up around the modern revolution in information technology. They are used to having access to information and numerous choices at their fingertips, and they see their smartphones as remote controls for the world. As a result, the television market has been changing dramatically. Consumers increasingly want to choose what they watch on demand. Young people in particular favor this option over a traditional programming lineup with preset airtimes that are interrupted by commercials.

We continue to own Netflix, which was our best contributor in 2015. Through superior scale and investments in content, the company was able to transition away from its DVD delivery business beginning in 2011 and become the dominant player in the pay TV market. Today, Netflix has proven its business model in the U.S. and looks to have increasing success across the globe as it invests in content internationally.

Across all generations, Americans are increasingly looking for products that are unique. We find that many retail strategies are most successful either offering good value to the lower end of the market or by being differentiated, especially at the high end. It is a misconception that millennials don’t care about brand loyalties—they are not loyal to traditional brands like Coca-Cola, but they can be very loyal to brands that they consider unique.

For a few years, wealthier furniture buyers have favored higher-end products that speak to their identities. While Restoration Hardware Holdings has been a successful holding for us in recent years, the company was a significant performance detractor in 2015. The company offers highly aesthetic furniture from niche producers on a broader scale, and it combines online sales with a luxurious in-store experience at its design galleries. We still favor Restoration Hardware, but we are conscious that increased competition or economic weakness among wealthier adults could be potential risks going forward.

Of course, determining the durability of certain enterprises can be challenging. When a company creates a successful business model, it is difficult to gauge how much competition will be attracted to the same opportunity. Disruptive growth companies have to develop a competitive advantage against other entrants, not just existing industry leaders.

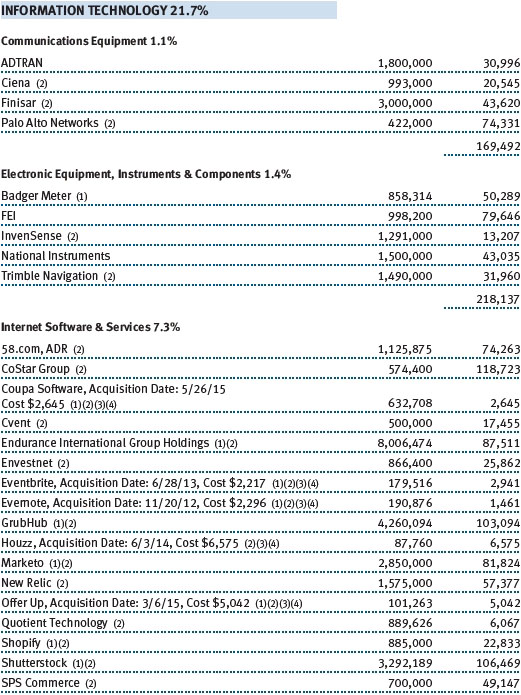

GrubHub, a food-delivery service that connects consumers to restaurants in major cities, was one of our worst detractors for the year. The company experienced success early on by gaining density in major cities, which helped create network effects as it attracted more users. However, the company’s moat is not impenetrable, and there is a looming fear that increased competition from Amazon, Uber, and other early-stage companies could limit GrubHub’s growth plans. Understanding important sociological shifts helps us manage the complexity of growth investing. We strive to position our consumer investments around what consumers will care about in the future, not just what they are visibly doing today. This serves as a framework for understanding which businesses can succeed for years to come.

BROADER PORTFOLIO REVIEW

Among our industrials investments, Acuity Brands continues to perform well and was a top contributor for the overall portfolio in 2015. The company is revolutionizing the LED lighting space with products that are energy-efficient and carry superior automation features. Its innovation process is ahead of expectations, helping it take significant share from competitors in recent years. As it grows, the company hopes to expand into new technologies and business uses, including lights with sensors that can count traffic in a retail store. Acuity has a strong track record of beating its own expectations, and we think it has significant growth left in its existing technologies.

In 2015, the fund also derived a significant positive contribution from Lennox International, an HVAC company that is executing well. Lennox has improved its distribution strategy by sending its products straight to dealers. This effort has helped drive share gains, and Lennox continues to improve its relationships with dealers by providing diagnostic tools, an inventory management app, and other features that differentiate it from competitors. The commercial side is facing more challenges given slowing growth at Wal-Mart and other retailers. However, Lennox sees an opportunity to boost its emergency replacement business and initiate other internal improvements on the commercial side.

Colfax was one of our largest detractors for the year. The company has significant exposure to emerging market economies, which recently experienced a slowdown in gross domestic product growth and affected Colfax’s sales. This year, Colfax brought in a new CEO to help improve its operational discipline, especially at its fabrication technology business. We expect the company to benefit from internal improvements and are willing to look beyond some cyclicality in the macro environment. Colfax has a differentiated capital deployment process led by its Board of Directors, and we think it will be able to leverage future mergers and acquisitions to compound capital over a long period of time.

In biotech, Pharmacyclics was one of the best contributors to the fund. A few years ago, Pharmacyclics developed ibrutinib, one of the most effective oncology drugs ever made. The drug increases the efficacy of chemotherapy for multiple tumor types while lessening side effects from the treatment. Ibrutinib has become a commercial success, leading to numerous clinical trials to find other applications for the drug. In March, AbbVie acquired Pharmacyclics to benefit from its flagship asset.

Dexcom also performed well during the year. Among companies that manufacture a continuous glucose monitor (CGM) for diabetics, Dexcom is the only competitor that has proven its product/market fit. Ongoing growth in CGM adoption should be a tailwind for Dexcom, and we think it is well positioned to stay ahead of competitors in the space. While its growth probably won’t be as explosive as it was in the initial stages, we think Dexcom can continue to grow its core business of servicing Type 1 diabetics at a healthy rate. Increased European distribution and more adoption among Type 2 diabetics could be supplemental sources of growth.

Our largest detractor in biotech was Puma Biotechnology. The company may have an opportunity to realize significant distribution of neratinib, a new drug that inhibits a protein called HER2 that is critical in certain types of breast cancer. However, data from clinical trials last year showed that the drug was effective for a smaller population of patients than expected. As the company continues its approval process with the Food and Drug Administration, we expect that neratinib may have commercial potential with a subset of high-risk patients. However, we are monitoring the situation closely.

OUTLOOK

Small-cap stocks have now underperformed large-cap companies since 2014, bringing valuations down and close to longer-term averages. The price-to-earnings (P/E) ratio of the fund’s holdings at the end of December was 31.6, which was down from December 31, 2014. Small-cap growth valuations are still modestly elevated relative to large-caps, however. For example, the fund’s P/E ratio relative to the same measure for the S&P 500 Index on expected 12-month forward earnings was 1.95 at the end of December, down slightly from 2.01 at the beginning of 2015. Heightened market volatility and U.S. monetary policy tightening historically have been negative factors for the relative performance of small-cap stocks versus large-caps. However, we remain confident in our ability to find smaller companies that are poised to grow rapidly and to hold them for the long term, even through the downturns and valuation adjustments that are part of every market cycle.

Particularly in the current environment of economic uncertainty, thorough company analysis is an essential element of successful small-cap growth investing. Our overall goal is to own companies that are leading-edge early-stage or durable growers with the potential to become much larger, successful firms over time as a result of their innovative business models. These stocks have the ability to generate solid long-term returns for our shareholders.

Thank you for investing with T. Rowe Price.

Respectfully submitted,

Henry Ellenbogen

President of the fund and chairman of its Investment Advisory Committee

January 22, 2016

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF INVESTING

As with all stock and bond mutual funds, each fund’s share price can fall because of weakness in the stock or bond markets, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets.

Investing in small companies involves greater risk than is customarily associated with larger companies. Stocks of small companies are subject to more abrupt or erratic price movements than larger-company stocks. Small companies often have limited product lines, markets, or financial resources, and their managements may lack depth and experience. Such companies seldom pay significant dividends that could cushion returns in a falling market.

GLOSSARY

Alpha: Excess return above that of the benchmark.

Gross domestic product: The total market value of all goods and services produced in a country in a given year.

Initial public offering: The first sale of stock to the public by a formerly private company.

Lipper indexes: Fund benchmarks that consist of a small number (10 to 30) of the largest mutual funds in a particular category as tracked by Lipper Inc.

Price/book ratio: A valuation measure that compares a stock’s market price with its book value; i.e., the company’s net worth divided by the number of outstanding shares.

Price/earnings (P/E) ratio: A valuation measure calculated by dividing the price of a stock by its current or projected earnings per share. The ratio is a measure of how much investors are willing to pay for the company’s earnings.

Russell 2000 Growth Index: An index that tracks the performance of small-cap stocks with higher price-to-book ratios and higher forecast growth values.

Russell 2000 Index: An unmanaged index that tracks the stocks of 2,000 small U.S. companies.

Russell 2000 Value Index: An index that tracks the performance of small-cap stocks with lower price-to-book ratios and lower forecast growth values.

S&P 500 Index: An unmanaged index that tracks the stocks of 500 primarily large-cap U.S. companies.

Note: Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell indexes. Russell® is a trademark of Russell Investment Group.

Performance and Expenses

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

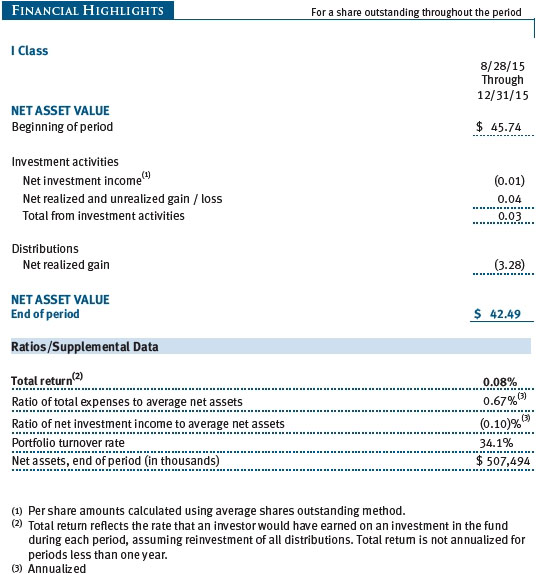

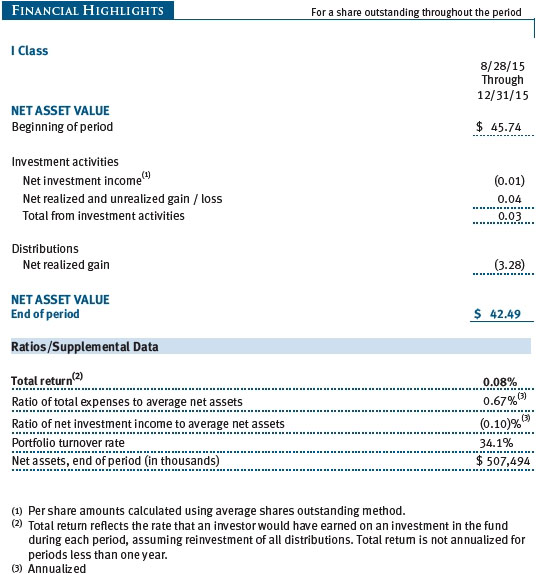

Please note that the fund has two share classes: The original share class (Investor Class) charges no distribution and service (12b-1) fee, and the I Class shares are also available to institutionally oriented clients and impose no 12b-1 or administrative fee payment. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000. The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; or accounts of an investor who is a T. Rowe Price Preferred Services, Personal Services, or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $100,000). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

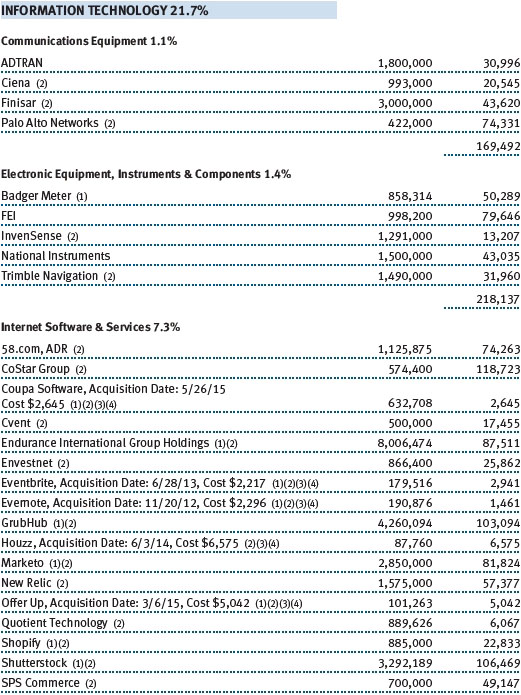

The accompanying notes are an integral part of this Portfolio of Investments.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| Notes to Financial Statements |

T. Rowe Price New Horizons Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks long-term capital growth by investing primarily in common stocks of small, rapidly growing companies. The fund has two classes of shares: the New Horizons Fund original share class, referred to in this report as the Investor Class, offered since June 3, 1960, and the New Horizons Fund–I Class (I Class), offered since August 28, 2015. I Class shares generally are available only to investors meeting a $1,000,000 minimum investment or certain other criteria. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to both classes; and, in all other respects, the same rights and obligations as the other class.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid by each class annually. Capital gain distributions, if any, are generally declared and paid by the fund annually.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Class Accounting Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to both classes, investment income, and realized and unrealized gains and losses are allocated to the classes based upon the relative daily net assets of each class.

Rebates Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $257,000 for the year ended December 31, 2015.

In-Kind Redemptions In accordance with guidelines described in the fund’s prospectus, the fund may distribute portfolio securities rather than cash as payment for a redemption of fund shares (in-kind redemption). For financial reporting purposes, the fund recognizes a gain on in-kind redemptions to the extent the value of the distributed securities on the date of redemption exceeds the cost of those securities. Gains and losses realized on in-kind redemptions are not recognized for tax purposes and are reclassified from undistributed realized gain (loss) to paid-in capital. During the year ended December 31, 2015, the fund realized $119,949,000 of net gain on $213,074,000 of in-kind redemptions.

New Accounting Guidance In May 2015, FASB issued ASU No. 2015-07, Fair Value Measurement (Topic 820), Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent). The ASU removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient and amends certain disclosure requirements for such investments. The ASU is effective for interim and annual reporting periods beginning after December 15, 2015. Adoption will have no effect on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s financial instruments are valued and each class’s net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business.

Fair Value The fund’s financial instruments are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The T. Rowe Price Valuation Committee (the Valuation Committee) has been established by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes procedures to value securities; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; oversees the selection, services, and performance of pricing vendors; oversees valuation-related business continuity practices; and provides guidance on internal controls and valuation-related matters. The Valuation Committee reports to the Board and has representation from legal, portfolio management and trading, operations, risk management, and the fund’s treasurer.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. OTC Bulletin Board securities are valued at the mean of the closing bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices for domestic securities and the last quoted sale or closing price for international securities.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted to reflect the fair value of such securities at the close of the NYSE. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, the fund will adjust the previous quoted prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust quoted prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with quoted prices and information to evaluate or adjust those prices. The fund cannot predict how often it will use quoted prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares quoted prices, the next day’s opening prices in the same markets, and adjusted prices.

Actively traded equity securities listed on a domestic exchange generally are categorized in Level 1 of the fair value hierarchy. Non-U.S. equity securities generally are categorized in Level 2 of the fair value hierarchy despite the availability of quoted prices because, as described above, the fund evaluates and determines whether those quoted prices reflect fair value at the close of the NYSE or require adjustment. OTC Bulletin Board securities, certain preferred securities, and equity securities traded in inactive markets generally are categorized in Level 2 of the fair value hierarchy.

Debt securities generally are traded in the OTC market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Generally, debt securities are categorized in Level 2 of the fair value hierarchy; however, to the extent the valuations include significant unobservable inputs, the securities would be categorized in Level 3.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation and are categorized in Level 1 of the fair value hierarchy. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Thinly traded financial instruments and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded.

Subject to oversight by the Board, the Valuation Committee regularly makes good faith judgments to establish and adjust the fair valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of an equity investment with limited market activity, such as a private placement or a thinly traded public company stock, the Valuation Committee considers a variety of factors, which may include, but are not limited to, the issuer’s business prospects, its financial standing and performance, recent investment transactions in the issuer, new rounds of financing, negotiated transactions of significant size between other investors in the company, relevant market valuations of peer companies, strategic events affecting the company, market liquidity for the issuer, and general economic conditions and events. In consultation with the investment and pricing teams, the Valuation Committee will determine an appropriate valuation technique based on available information, which may include both observable and unobservable inputs. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants, transaction information can be reliably obtained, and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the issue. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants. Depending on the relative significance of unobservable inputs, including the valuation technique(s) used, fair valued securities may be categorized in Level 2 or 3 of the fair value hierarchy.

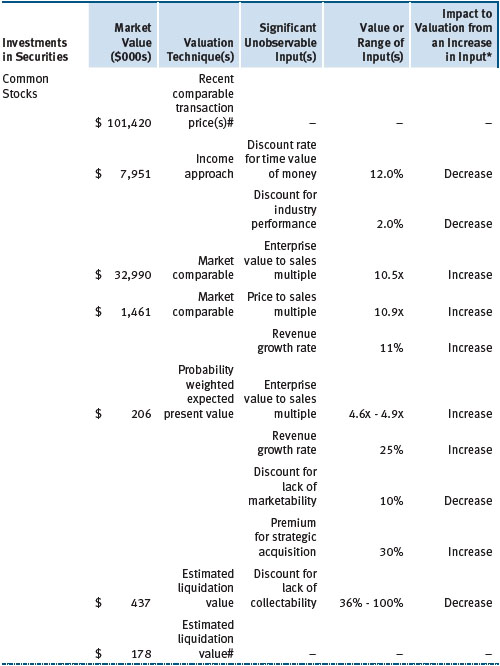

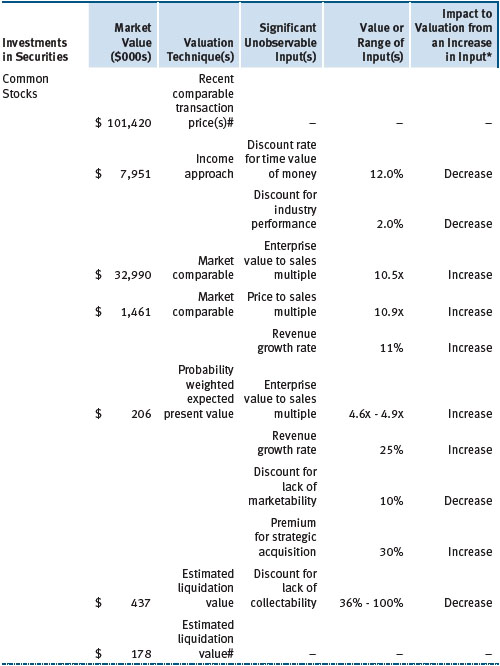

Valuation Inputs The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on December 31, 2015:

There were no material transfers between Levels 1 and 2 during the year ended December 31, 2015.

Following is a reconciliation of the fund’s Level 3 holdings for the year ended December 31, 2015. Gain (loss) reflects both realized and change in unrealized gain/loss on Level 3 holdings during the period, if any, and is included on the accompanying Statement of Operations. The change in unrealized gain/loss on Level 3 instruments held at December 31, 2015, totaled $47,110,000 for the year ended December 31, 2015. Transfers into and out of Level 3 are reflected at the value of the financial instrument at the beginning of the period. During the year, transfers out of Level 3 were because observable market data became available for the security.

In accordance with GAAP, the following table provides quantitative information about significant unobservable inputs used to determine the fair valuations of the fund’s Level 3 assets, by class of financial instrument; it also indicates the sensitivity of the Level 3 valuations to changes in those significant unobservable inputs. Because the Valuation Committee considers a wide variety of factors and inputs, both observable and unobservable, in determining fair values, the unobservable inputs presented do not reflect all inputs significant to the fair value determination.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

Bank Loans The fund may invest in bank loans, which represent an interest in amounts owed by a borrower to a syndication of lenders. Bank loans are generally noninvestment grade and often involve borrowers whose financial condition is troubled or highly leveraged. Bank loans may be in the form of either assignments or participations. A loan assignment transfers all legal, beneficial, and economic rights to the buyer, and transfer typically requires consent of both the borrower and agent. In contrast, a loan participation generally entitles the buyer to receive the cash flows from principal, interest, and any fee payments; however, the seller continues to hold legal title to the loan. As a result, the buyer of a loan participation generally has no direct rights against the borrower and is exposed to credit risk of both the borrower and seller of the participation. Bank loans often have extended settlement periods, usually may be repaid at any time at the option of the borrower, and may require additional principal to be funded at the borrowers’ discretion at a later date (unfunded commitments). Until settlement, the fund maintains liquid assets sufficient to settle its unfunded loan commitments. The fund reflects both the funded portion of a bank loan as well as its unfunded commitment in the Portfolio of Investments. However, to the extent a credit agreement provides no initial funding of a tranche and funding of the full commitment at a future date(s) is at the borrower’s discretion and considered uncertain, no loan is reflected in the Portfolio of Investments until paid.

Securities Lending The fund may lend its securities to approved brokers to earn additional income. Its securities lending activities are administered by a lending agent in accordance with a securities lending agreement. Security loans generally do not have stated maturity dates, and the fund may recall a security at any time. The fund receives collateral in the form of cash or U.S. government securities, valued at 102% to 105% of the value of the securities on loan. Collateral is maintained over the life of the loan in an amount not less than the value of loaned securities; any additional collateral required due to changes in security values is delivered to the fund the next business day. Cash collateral is invested by the lending agent(s) in accordance with investment guidelines approved by fund management. Additionally, the lending agent indemnifies the fund against losses resulting from borrower default. Although risk is mitigated by the collateral and indemnification, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities, collateral investments decline in value, and the lending agent fails to perform. Securities lending revenue consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower, compensation to the lending agent, and other administrative costs. In accordance with GAAP, investments made with cash collateral are reflected in the accompanying financial statements, but collateral received in the form of securities is not. At December 31, 2015, there were no securities on loan.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $5,240,052,000 and $6,308,122,000, respectively, for the year ended December 31, 2015.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Reclassifications to paid-in capital relate primarily to the current net operating loss, redemptions in kind, and a tax practice that treats a portion of the proceeds from each redemption of capital shares as a distribution of taxable net investment income or realized capital gain. For the year ended December 31, 2015, the following reclassifications were recorded to reflect tax character (there was no impact on results of operations or net assets):

Distributions during the years ended December 31, 2015 and December 31, 2014, were characterized for tax purposes as follows:

At December 31, 2015, the tax-basis cost of investments and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the deferral of losses from wash sales and the realization of gains/losses on passive foreign investment companies for tax purposes. The fund intends to retain realized gains to the extent of available capital loss carryforwards. Net realized capital losses may be carried forward indefinitely to offset future realized capital gains. During the year ended December 31, 2015, the fund utilized $33,789,000 of capital loss carryforwards.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management agreement between the fund and Price Associates provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.35% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.275% for assets in excess of $400 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At December 31, 2015, the effective annual group fee rate was 0.29%.

The I Class is subject to an operating expense limitation (I Class limit) pursuant to which Price Associates is contractually required to pay all operating expenses of the I Class, excluding management fees, interest, borrowing-related expenses, taxes, brokerage commissions, and extraordinary expenses, to the extent such operating expenses, on an annualized basis, exceed 0.05% of average net assets. This agreement will continue until April 30, 2018, and may be renewed, revised or revoked only with approval of the fund’s Board. The I Class is required to repay Price Associates for expenses previously paid to the extent the class’s net assets grow or expenses decline sufficiently to allow repayment without causing the class’s operating expenses to exceed the I Class limit. However, no repayment will be made more than three years after the date of a payment or waiver.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates provides certain accounting and administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend-disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the Investor Class. For the year ended December 31, 2015, expenses incurred pursuant to these service agreements were $92,000 for Price Associates; $3,069,000 for T. Rowe Price Services, Inc.; and $4,790,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

Additionally, the fund is one of several mutual funds in which certain college savings plans managed by Price Associates may invest. As approved by the fund’s Board of Directors, shareholder servicing costs associated with each college savings plan are borne by the fund in proportion to the average daily value of its shares owned by the college savings plan. For the year ended December 31, 2015, the fund was charged $228,000 for shareholder servicing costs related to the college savings plans, of which $135,000 was for services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2015, less than 1% of the outstanding shares of the Investor Class were held by college savings plans.

The fund is also one of several mutual funds sponsored by Price Associates (underlying Price funds) in which the T. Rowe Price Spectrum Funds (Spectrum Funds), as well as the T. Rowe Price Retirement Funds and T. Rowe Price Target Retirement Funds (Retirement Funds) may invest. Neither the Spectrum Funds nor the Retirement Funds invest in the underlying Price funds for the purpose of exercising management or control. Pursuant to separate special servicing agreements, expenses associated with the operation of the Spectrum Funds and Retirement Funds are borne by each underlying Price fund to the extent of estimated savings to it and in proportion to the average daily value of its shares owned by the Spectrum Funds and Retirement Funds, respectively. Expenses allocated under these agreements are reflected as shareholder servicing expenses in the accompanying financial statements. For the year ended December 31, 2015, the fund was allocated $76,000 of Spectrum Funds’ expenses and $2,326,000 of Retirement Funds’ expenses. Of these amounts, $984,000 related to services provided by Price. At period-end, the amount payable to Price pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2015, less than 1% of the outstanding shares of the Investor Class were held by the Spectrum Funds and 9% were held by the Retirement Funds.

In addition, other mutual funds, trusts, and other accounts managed by Price Associates or its affiliates (collectively, Price funds and accounts) may invest in the fund; however, no Price fund or account may invest for the purpose of exercising management or control over the fund. At December 31, 2015, less than 1% of the I Class’s outstanding shares were held by Price funds and accounts.

The fund may invest in the T. Rowe Price Reserve Investment Fund, the T. Rowe Price Government Reserve Investment Fund, or the T. Rowe Price Short-Term Reserve Fund (collectively, the Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The Price Reserve Investment Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. The Price Reserve Investment Funds pay no investment management fees.

As of December 31, 2015, T. Rowe Price Group, Inc., or its wholly owned subsidiaries owned 5,466 shares of the I Class representing less than 1% of the fund’s net assets.

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of

T. Rowe Price New Horizons Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price New Horizons Fund, Inc. (the “Fund”) at December 31, 2015, the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2015 by correspondence with the custodian and brokers, and confirmation of the underlying fund by correspondence with the transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 17, 2016

| Tax Information (Unaudited) for the Tax Year Ended 12/31/15 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included $1,229,477,000 from long-term capital gains, subject to a long-term capital gains tax rate of not greater than 20%.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our website, troweprice.com. To access it, click on the words “Social Responsibility” at the top of our corporate homepage. Next, click on the words “Conducting Business Responsibly” on the left side of the page that appears. Finally, click on the words “Proxy Voting Policies” on the left side of the page that appears.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through our website, follow the above directions to reach the “Conducting Business Responsibly” page. Click on the words “Proxy Voting Records” on the left side of that page, and then click on the “View Proxy Voting Records” link at the bottom of the page that appears.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| About the Fund’s Directors and Officers |

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting or potentially affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and business and regulatory affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

Independent Directors

| Name | | |

| (Year of Birth) | | |

| Year Elected* | | |

| [Number of T. Rowe Price | | Principal Occupation(s) and Directorships of Public Companies and |

| Portfolios Overseen] | | Other Investment Companies During the Past Five Years |

| | | |

| William R. Brody, M.D., Ph.D. | | President and Trustee, Salk Institute for Biological Studies (2009 to |

| (1944) | | present); Director, BioMed Realty Trust (2013 to present); Director, |

| 2009 | | Novartis, Inc. (2009 to 2014); Director, IBM (2007 to present) |

| [181] | | |

| | | |

| Anthony W. Deering | | Chairman, Exeter Capital, LLC, a private investment firm (2004 to |

| (1945) | | present); Director, Brixmor Real Estate Investment Trust (2012 to |

| 2001 | | present); Director and Advisory Board Member, Deutsche Bank North |

| [181] | | America (2004 to present); Director, Under Armour (2008 to present); |

| | Director, Vornado Real Estate Investment Trust (2004 to 2012) |

| | | |

| Bruce W. Duncan | | President, Chief Executive Officer, and Director, First Industrial |

| (1951) | | Realty Trust, an owner and operator of industrial properties (2009 to |

| 2013 | | present); Chairman of the Board (2005 to present) and Director (1999 |

| [181] | | to present), Starwood Hotels & Resorts, a hotel and leisure company |

| | | |

| Robert J. Gerrard, Jr. | | Chairman of Compensation Committee and Director, Syniverse |

| (1952) | | Holdings, Inc., a provider of wireless voice and data services for |

| 2012 | | telecommunications companies (2008 to 2011); Advisory Board |

| [181] | | Member, Pipeline Crisis/Winning Strategies, a collaborative |

| | working to improve opportunities for young African Americans |

| | (1997 to present) |

| | |

| Paul F. McBride | | Former Company Officer and Senior Vice President, Human |

| (1956) | | Resources and Corporate Initiatives, Black & Decker Corporation |

| 2013 | | (2004 to 2010) |

| [181] | | |

| | | |

| Cecilia E. Rouse, Ph.D. | | Dean, Woodrow Wilson School (2012 to present); Professor and |

| (1963) | | Researcher, Princeton University (1992 to present); Director, MDRC, a |

| 2012 | | nonprofit education and social policy research organization (2011 to |

| [181] | | present); Member, National Academy of Education (2010 to present); |

| | Research Associate, National Bureau of Economic Research’s Labor |

| | Studies Program (2011 to present); Member, President’s Council of |

| | Economic Advisers (2009 to 2011); Chair of Committee on the Status |

| | of Minority Groups in the Economic Profession, American Economic |

| | Association (2012 to present) |

| | |

| John G. Schreiber | | Owner/President, Centaur Capital Partners, Inc., a real estate |

| (1946) | | investment company (1991 to present); Cofounder and Partner, |

| 2001 | | Blackstone Real Estate Advisors, L.P. (1992 to present); Director, |

| [181] | | General Growth Properties, Inc. (2010 to 2013); Director, Blackstone |

| | Mortgage Trust, a real estate financial company (2012 to present); |

| | Director and Chairman of the Board, Brixmor Property Group, Inc. |

| | (2013 to present); Director, Hilton Worldwide (2013 to present); |

| | Director, Hudson Pacific Properties (2014 to present) |

| | | |

| Mark R. Tercek | | President and Chief Executive Officer, The Nature Conservancy |

| (1957) | | (2008 to present) |

| 2009 | | |

| [181] | | |

| |

| *Each independent director serves until retirement, resignation, or election of a successor. |

Inside Directors

| Name | | |

| (Year of Birth) | | |

| Year Elected* | | |

| [Number of T. Rowe Price | | Principal Occupation(s) and Directorships of Public Companies and |

| Portfolios Overseen] | | Other Investment Companies During the Past Five Years |

| | | |

| Edward C. Bernard | | Director and Vice President, T. Rowe Price; Vice Chairman of the |

| (1956) | | Board, Director, and Vice President, T. Rowe Price Group, Inc.; |

| 2006 | | Chairman of the Board, Director, and President, T. Rowe Price |

| [181] | | Investment Services, Inc.; Chairman of the Board and Director, |

| | T. Rowe Price Retirement Plan Services, Inc., and T. Rowe Price |

| | Services, Inc.; Chairman of the Board, Chief Executive Officer, |

| | Director, and President, T. Rowe Price International and T. Rowe |

| | Price Trust Company; Chairman of the Board, all funds |

| | | |

| Brian C. Rogers, CFA, CIC | | Chief Investment Officer, Director, and Vice President, T. Rowe Price; |

| (1955) | | Chairman of the Board, Chief Investment Officer, Director, and Vice |

| 2013 | | President, T. Rowe Price Group, Inc.; Vice President, T. Rowe Price |

| [127] | | Trust Company |

| |

| *Each inside director serves until retirement, resignation, or election of a successor. |

Officers

| Name (Year of Birth) | | |

| Position Held With New Horizons Fund | | Principal Occupation(s) |

| | | |

| Francisco M. Alonso (1978) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Preston G. Athey, CFA, CIC (1949) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Ziad Bakri, M.D., CFA (1980) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc.; formerly, Vice President, Cowen |

| | and Company (to 2011) |

| | | |

| Brian W.H. Berghuis, CFA (1958) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Michael F. Blandino (1971) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Darrell N. Braman (1963) | | Vice President, Price Hong Kong, Price |

| Vice President | | Singapore, T. Rowe Price, T. Rowe Price Group, |

| | Inc., T. Rowe Price International, T. Rowe Price |

| | Investment Services, Inc., and T. Rowe Price |

| | Services, Inc. |

| | | |

| Christopher W. Carlson (1967) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Eric L. DeVilbiss, CFA (1983) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Henry M. Ellenbogen (1973) | | Vice President, T. Rowe Price, T. Rowe Price |

| President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| John R. Gilner (1961) | | Chief Compliance Officer and Vice President, |

| Chief Compliance Officer | | T. Rowe Price; Vice President, T. Rowe Price |

| | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc. |

| | | |

| Barry Henderson (1966) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Rhett K. Hunter (1977) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Dominic Janssens (1965) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Paul J. Krug, CPA (1964) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Patricia B. Lippert (1953) | | Assistant Vice President, T. Rowe Price and |

| Secretary | | T. Rowe Price Investment Services, Inc. |

| | | |

| Catherine D. Mathews (1963) | | Vice President, T. Rowe Price, T. Rowe Price |

| Treasurer and Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| David Oestreicher (1967) | | Director, Vice President, and Secretary, |

| Vice President | | T. Rowe Price Investment Services, Inc., T. Rowe |

| | Price Retirement Plan Services, Inc., T. Rowe |

| | Price Services, Inc., and T. Rowe Price Trust |

| | Company; Chief Legal Officer, Vice President, |

| | and Secretary, T. Rowe Price Group, Inc.; Vice |

| | President and Secretary, T. Rowe Price and |

| | T. Rowe Price International; Vice President, |

| | Price Hong Kong and Price Singapore |

| | | |

| Timothy E. Parker, CFA (1974) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| John W. Ratzesberger (1975) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company; |

| | formerly, North American Head of Listed |

| | Derivatives Operation, Morgan Stanley |

| | (to 2013) |

| | | |

| Deborah D. Seidel (1962) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., T. Rowe Price Investment Services, |

| | Inc., and T. Rowe Price Services, Inc. |

| | | |

| Corey D. Shull, CFA (1983) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Michael F. Sola, CFA (1969) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Taymour R. Tamaddon, CFA (1976) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Justin Thomson (1968) | | Vice President, T. Rowe Price Group, Inc., and |

| Vice President | | T. Rowe Price International |

| | | |

| J. David Wagner, CFA (1974) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Thomas H. Watson (1977) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Jeffrey T. Zoller (1970) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | International, and T. Rowe Price Trust Company |

| |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least 5 years. |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Bruce W. Duncan qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Duncan is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $2,158,000 and $2,283,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price New Horizons Fund, Inc.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date February 17, 2016 | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date February 17, 2016 | | |

| |

| |

| By | /s/ Catherine D. Mathews |

| | Catherine D. Mathews |

| | Principal Financial Officer |

| |

| Date February 17, 2016 | | |