AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF PILGRIM’S PRIDE CORPORATION This Amended and Restated Certificate of Incorporation (this “Certificate of Incorporation”) was duly adopted in accordance with Sections 242 and 245 of the General Corporation Law of the State of Delaware (the “DGCL”). The original certificate of incorporation of the corporation was filed with the Secretary of State of the State of Delaware on September 11, 1986. ARTICLE I NAME The name of the corporation is Pilgrim’s Pride Corporation (the “Corporation”). ARTICLE II REGISTERED OFFICE AND REGISTERED AGENT The address of the registered office of the Corporation in the State of Delaware is 1209 Orange Street in the City of Wilmington, County of New Castle, 19801. The name of the registered agent of the Corporation at that address is The Corporation Trust Company. ARTICLE III CORPORATE PURPOSE The purpose of the Corporation is to engage in any lawful act or activity for which a corporation may be organized under the DGCL. ARTICLE IV CAPITAL STOCK Section 4.1. Shares and Classes Authorized. The total number of shares of all classes of stock which the Corporation shall have authority to issue is 850,000,000, consisting of 800,000,000 shares of Common Stock, par value $.01 per share (the “Common Stock”) and 50,000,000 shares of Preferred Stock, par value $.01 per share (the “Preferred Stock”). Section 4.2. Preferred Stock. The Board of Directors of the Corporation (the “Board”) is authorized, subject to any limitations prescribed by law, to provide for the issuance of shares of Preferred Stock in series and, by filing a certificate pursuant to the applicable law of the State of Delaware (a “Preferred Stock Designation”), to establish from time to time the number of shares to be included in each such series, and to fix the designation, voting rights, powers, preferences, and rights of the shares of each such series and any qualifications, limitations or restrictions thereof. The number of authorized shares of Preferred Stock may be increased or decreased (but not below sum of the number of shares thereof then outstanding and the number of shares into which any preferred or other securities may be converted or for which they may be exchanged) by the affirmative vote of the holders of a majority of the voting power of all of the then- outstanding shares of capital stock of the Corporation entitled to vote thereon, without a vote of the holders of the Preferred Stock, or of any series thereof, irrespective of the provisions of Section 242(b)(2) of the Exhibit 3.1

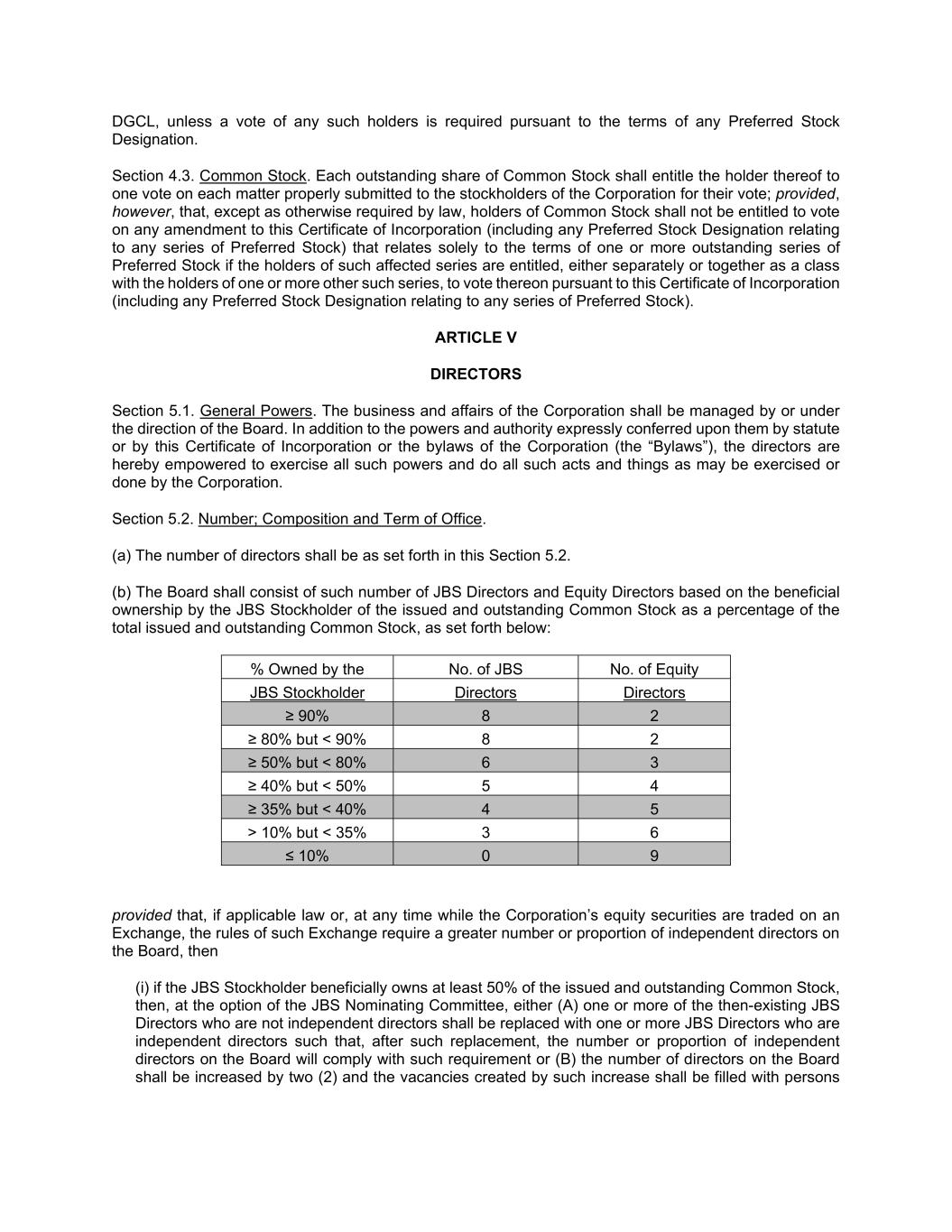

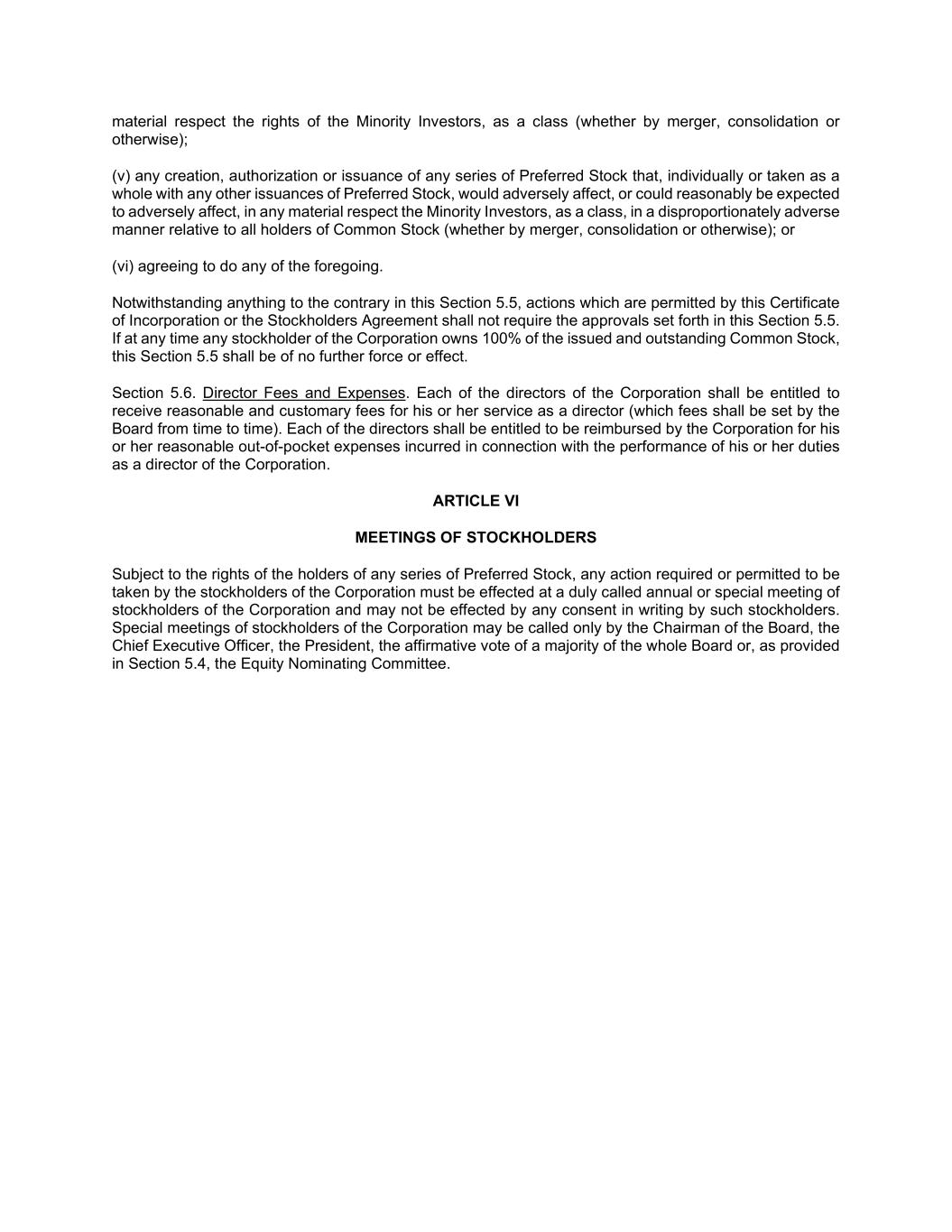

DGCL, unless a vote of any such holders is required pursuant to the terms of any Preferred Stock Designation. Section 4.3. Common Stock. Each outstanding share of Common Stock shall entitle the holder thereof to one vote on each matter properly submitted to the stockholders of the Corporation for their vote; provided, however, that, except as otherwise required by law, holders of Common Stock shall not be entitled to vote on any amendment to this Certificate of Incorporation (including any Preferred Stock Designation relating to any series of Preferred Stock) that relates solely to the terms of one or more outstanding series of Preferred Stock if the holders of such affected series are entitled, either separately or together as a class with the holders of one or more other such series, to vote thereon pursuant to this Certificate of Incorporation (including any Preferred Stock Designation relating to any series of Preferred Stock). ARTICLE V DIRECTORS Section 5.1. General Powers. The business and affairs of the Corporation shall be managed by or under the direction of the Board. In addition to the powers and authority expressly conferred upon them by statute or by this Certificate of Incorporation or the bylaws of the Corporation (the “Bylaws”), the directors are hereby empowered to exercise all such powers and do all such acts and things as may be exercised or done by the Corporation. Section 5.2. Number; Composition and Term of Office. (a) The number of directors shall be as set forth in this Section 5.2. (b) The Board shall consist of such number of JBS Directors and Equity Directors based on the beneficial ownership by the JBS Stockholder of the issued and outstanding Common Stock as a percentage of the total issued and outstanding Common Stock, as set forth below: % Owned by the No. of JBS No. of Equity JBS Stockholder Directors Directors ≥ 90% 8 2 ≥ 80% but < 90% 8 2 ≥ 50% but < 80% 6 3 ≥ 40% but < 50% 5 4 ≥ 35% but < 40% 4 5 > 10% but < 35% 3 6 ≤ 10% 0 9 provided that, if applicable law or, at any time while the Corporation’s equity securities are traded on an Exchange, the rules of such Exchange require a greater number or proportion of independent directors on the Board, then (i) if the JBS Stockholder beneficially owns at least 50% of the issued and outstanding Common Stock, then, at the option of the JBS Nominating Committee, either (A) one or more of the then-existing JBS Directors who are not independent directors shall be replaced with one or more JBS Directors who are independent directors such that, after such replacement, the number or proportion of independent directors on the Board will comply with such requirement or (B) the number of directors on the Board shall be increased by two (2) and the vacancies created by such increase shall be filled with persons

designated by the JBS Nominating Committee who are independent directors such that the number or proportion of independent directors on the Board will comply with such requirement; or (ii) if the JBS Stockholder beneficially owns less than 50% of the issued and outstanding Common Stock, then one or more of the then-existing JBS Directors who are not independent directors shall be replaced with one or more JBS Directors who are independent directors such that, after such replacement, the number or proportion of independent directors on the Board will comply with such requirement. In the event that the size of the Board is expanded pursuant to this Section 5.2, no person shall be nominated or appointed as a director if the Equity Nominating Committee reasonably determines that such person (A) is unethical or lacks integrity or (B) is a competitor or is affiliated with a competitor of the Corporation or any of its material subsidiaries. As used in this Certificate of Incorporation, a Person shall be deemed the “beneficial owner” of, shall be deemed to have “beneficial ownership” of and shall be deemed to “beneficially own” any Common Stock which such Person or any of such Person’s Affiliates is deemed to beneficially own, directly or indirectly, within the meaning of Rule 13d-3 of the Exchange Act; provided, however, that beneficial ownership by the JBS Stockholder will not include shares of Common Stock held by members of a “group” (as that term is used in Rule 13d-5 under the Exchange Act) other than JBS USA and its Affiliates. Notwithstanding anything in this Section 5.2(b) or Article XII to the contrary, so long as the JBS Stockholder beneficially owns at least 80% of the issued and outstanding Common Stock, the JBS Nominating Committee may choose to maintain only six (6) JBS Directors on the Board, in which case there shall be three (3) Equity Directors on the Board. (c) At each annual meeting of stockholders, each director elected to succeed a director whose term expires shall be elected for a term of office to expire at the next annual meeting of stockholders after his or her election, with each director to hold office until his or her successor shall have been duly elected and qualified or until the earlier of his or her death, resignation or removal in accordance with this Certificate of Incorporation and the Bylaws. The election of directors need not be by written ballot unless the Bylaws so provide. Directors need not be stockholders. Section 5.3. Vacancies. Subject to Section 5.2, any vacancy on the Board, howsoever resulting, shall be filled only by the affirmative vote of a majority of the remaining directors then in office, even if less than a quorum, or by the sole remaining director; provided, however, that (a) a vacancy in the directorship of a JBS Director may be filled only through the affirmative vote of a majority of directors on the JBS Nominating Committee, even if less than a quorum, or by the sole remaining director on the JBS Nominating Committee, or if no directors remain on the JBS Nominating Committee, by the stockholders and (b) a vacancy in the directorship of an Equity Director may be filled only by the affirmative vote of a majority of directors on the Equity Nominating Committee, even if less than a quorum, or by the sole remaining director on the Equity Nominating Committee or if no directors remain on the Equity Nominating Committee, by the stockholders. The term of office of any director elected to fill a vacancy shall expire at the next annual meeting of stockholders after his or her election, with each director to hold office until his or her successor shall have been duly elected and qualified or until the earlier of his or her death, resignation or removal in accordance with this Certificate of Incorporation and the Bylaws. Section 5.4. Special Nominating Committees. (a) (i) The Board shall establish two committees (collectively, the “Special Nominating Committees”), which shall be designated as the “JBS Nominating Committee” and the “Equity Nominating Committee,” each of which shall have the power and authority of the Board with respect to the matters described in Sections 5.3 and 5.4. The JBS Nominating Committee shall consist solely of JBS Directors, and the Equity Nominating Committee shall consist solely of all of the Equity Directors. (ii) The JBS Nominating Committee shall have the exclusive authority to nominate the JBS Directors, fill vacancies pursuant to Section 5.3 and select the members of the JBS Nominating Committee; and the Equity Nominating Committee shall have the exclusive authority to nominate the Equity Directors, fill vacancies pursuant to Section 5.3, select the members of the Equity Nominating Committee, and shall be entitled to call a special meeting of stockholders of the Corporation to comply with Section 3.01(d) of the

Stockholders Agreement. Any member or alternate member of the Equity Nominating Committee shall be removed only by the approval of a majority of the members of the Equity Nominating Committee. (iii) For so long as the JBS Stockholder is the beneficial owner of 35% or more of the outstanding Common Stock, no person shall be nominated as an Equity Director pursuant to this Certificate of Incorporation if JBS USA reasonably determines that such person (i) is unethical or lacks integrity or (ii) is a competitor or is affiliated with a competitor of the Corporation. (iv) Two (2) Equity Directors (or one (1) if there is only one (1) Equity Director on the Board) shall satisfy the independence requirements of Rule 10A-3 under the Exchange Act and be financially literate for purposes of the applicable listing standards of the Exchange on which the Common Stock is then listed, or if the Common Stock is not then listed, then for purposes of Section 303A.07 of The New York Stock Exchange Listed Company Manual (or any successor rule) (“financially literate”), and, for so long as there are two (2) or more Equity Directors on the Board, at least one (1) Equity Director shall qualify as an “audit committee financial expert” as that term is used in Item 407 of Regulation S-K under the Exchange Act (or any successor rule). (v) If the JBS Stockholder beneficially owns at least 50% of the issued and outstanding Common Stock, at least two (2) JBS Directors shall (A) be independent directors, (B) satisfy the independence requirements of Rule 10A-3 under the Exchange Act and (C) be financially literate. (b) Notwithstanding anything herein to the contrary, to the maximum extent permitted by law, the Equity Nominating Committee, acting by majority vote, shall have the right to control the Corporation’s exercise of its rights and remedies under the Stockholders Agreement, including, without limitation, (i) the granting of (or refusal to grant) any approvals, consents or waivers by the Corporation thereunder, (ii) the giving (or withholding) of any notices by the Corporation thereunder, (iii) the approval (or disapproval) of the Corporation’s entry into any amendment or supplement to the Stockholders Agreement and (iv) the initiation, prosecution or settlement of any claim, action, suit, arbitration, inquiry, proceeding or investigation arising in connection therewith. The Equity Directors shall be permitted to retain separate advisors (legal or financial) at the expense of the Corporation in connection with the performance of their duties under Sections 5.3, 5.4 and 5.5 and Articles VI and IX of this Certificate of Incorporation or under Sections 3.01(d), 3.03 and 6.21 of the Stockholders Agreement. (c) Except for the JBS Nominating Committee, any committee designated or appointed by the Board shall have at least one Equity Director as a member thereof. Section 5.5. Approval of Certain Matters. The approval of any of the following matters shall require, in addition to any approval required by law, (a) the affirmative vote of a majority of the directors present at a meeting of the Board at which a quorum is present and (b) the affirmative vote of at least a majority of the Equity Directors: (i) the creation of any committee of the Board with, or the delegation to any committee of the Board of, any power or authority which, individually or taken as a whole with any other power and/or authority, would adversely affect, or could reasonably be expected to adversely affect, in any material respect, the rights of the Minority Investors; (ii) any change in the size of the Board; (iii) any action that would reasonably be expected to cause the Corporation to no longer satisfy the listing requirements of any Exchange on which any shares of capital stock of the Corporation are listed or quoted; (iv) any amendment or repeal of this Section 5.5, Sections 5.2, 5.3, 5.4 or 5.6 or Articles VI, VIII, IX, X, XI or XII, or any other amendment to this Certificate of Incorporation that, individually or taken as a whole with any other amendments, would adversely affect, or could reasonably be expected to adversely affect, in any

material respect the rights of the Minority Investors, as a class (whether by merger, consolidation or otherwise); (v) any creation, authorization or issuance of any series of Preferred Stock that, individually or taken as a whole with any other issuances of Preferred Stock, would adversely affect, or could reasonably be expected to adversely affect, in any material respect the Minority Investors, as a class, in a disproportionately adverse manner relative to all holders of Common Stock (whether by merger, consolidation or otherwise); or (vi) agreeing to do any of the foregoing. Notwithstanding anything to the contrary in this Section 5.5, actions which are permitted by this Certificate of Incorporation or the Stockholders Agreement shall not require the approvals set forth in this Section 5.5. If at any time any stockholder of the Corporation owns 100% of the issued and outstanding Common Stock, this Section 5.5 shall be of no further force or effect. Section 5.6. Director Fees and Expenses. Each of the directors of the Corporation shall be entitled to receive reasonable and customary fees for his or her service as a director (which fees shall be set by the Board from time to time). Each of the directors shall be entitled to be reimbursed by the Corporation for his or her reasonable out-of-pocket expenses incurred in connection with the performance of his or her duties as a director of the Corporation. ARTICLE VI MEETINGS OF STOCKHOLDERS Subject to the rights of the holders of any series of Preferred Stock, any action required or permitted to be taken by the stockholders of the Corporation must be effected at a duly called annual or special meeting of stockholders of the Corporation and may not be effected by any consent in writing by such stockholders. Special meetings of stockholders of the Corporation may be called only by the Chairman of the Board, the Chief Executive Officer, the President, the affirmative vote of a majority of the whole Board or, as provided in Section 5.4, the Equity Nominating Committee.

ARTICLE VII NON-VOTING EQUITY SECURITIES The Corporation shall not issue any class of non-voting equity securities unless and solely to the extent permitted by Section 1123(a)(6) of the United States Bankruptcy Code (the “Bankruptcy Code”) as in effect on the date of filing this Certificate of Incorporation with the Secretary of State of the State of Delaware; provided, however, that this Article VII: (a) will have no further force and effect beyond that required under Section 1123(a)(6) of the Bankruptcy Code; (b) will have such force and effect, if any, only for so long as Section 1123(a)(6) of the Bankruptcy Code is in effect and applicable to the Corporation; and (c) in all events may be amended or eliminated in accordance with applicable law from time to time in effect. ARTICLE VIII LIMITATION OF DIRECTORS’ LIABILITY A director of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability (a) for any breach of the director’s duty of loyalty to the Corporation or its stockholders, (b) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (c) under Section 174 of the DGCL, or (d) for any transaction from which the director derived an improper personal benefit. If the DGCL is amended to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Corporation shall be eliminated or limited to the fullest extent permitted by the DGCL, as so amended. Any repeal or modification of the foregoing paragraph shall not adversely affect any right or protection of a director of the Corporation existing at the time of such repeal or modification. ARTICLE IX BYLAWS The Board is expressly empowered to adopt, amend or repeal the Bylaws. Any adoption, amendment or repeal by the Board of the Bylaws or any provisions thereof that, individually or taken as a whole, would adversely affect, or could reasonably be expected to adversely affect, in any material respect, the rights of the Minority Investors, as a class, in each case, shall require the approval of at least a majority of the total authorized number of directors, including the approval of at least a majority of the Equity Directors. Subject to applicable law and the rights of the holders of any series of Preferred Stock, the stockholders shall also have the power to adopt, amend or repeal the Bylaws by the affirmative vote of the holders of a majority of the voting power of the then-outstanding shares of the capital stock of the Corporation entitled to vote generally in the election of directors, present in person or represented by proxy, at a meeting at which a quorum is present, voting together as a single class; provided, however, that, in addition to such vote, the affirmative vote of the holders of a majority of the voting power of all of the then-outstanding shares of the capital stock of the Corporation entitled to vote generally in the election of directors (other than shares of capital stock of the Corporation beneficially owned by the JBS Stockholder), voting together as a single class, shall be required to adopt, amend or repeal the Bylaws or any provisions thereof. ARTICLE X RELATED-PARTY TRANSACTIONS Section 10.1. Independent Committee Oversight. Neither the Corporation nor any of its subsidiaries shall enter into any transaction required to be disclosed under Item 404 of Regulation S-K under the Exchange

Act unless the audit committee or another committee, in each case, comprised solely of independent directors first reviews, evaluates and approves the transaction, such approval to be evidenced by a resolution stating that such committee has, in good faith, unanimously determined that such transaction complies with the provisions of this Section 10.1. Section 10.2. Terms of Transactions; Retention of Proceeds. Neither the Corporation nor any of its subsidiaries shall sell, lease, transfer or otherwise dispose of any of its properties or assets to, or for the benefit of, or purchase or lease any property or assets from, or for the benefit of, the JBS Stockholder, except on terms that are fair and reasonable to the Corporation and no less favorable to the Corporation or the relevant subsidiary than those that could have been obtained in a comparable transaction by the Corporation or such subsidiary on an arms’-length basis from an unrelated Person. The Corporation and its subsidiaries shall retain the proceeds of any sale or disposition by any of them of any of their respective properties or assets, whether now owned or hereafter acquired. ARTICLE XI AMENDMENT Subject to Section 5.5, the Corporation reserves the right to amend or repeal any provision contained in this Certificate of Incorporation in the manner prescribed by the laws of the State of Delaware and all rights conferred upon stockholders are granted subject to this reservation. ARTICLE XII DEFINITIONS For purposes of this Certificate of Incorporation, the following terms have the meanings set forth below: “Affiliate” has the meaning set forth in Rule 12b-2 under the Exchange Act. “Equity Directors” means the two (2) directors designated as “Equity Directors” on Schedule 3.01(a)(iii) to the Stockholders Agreement, their successors as nominated by the Equity Nominating Committee and elected by the stockholders of the Corporation or appointed by the Equity Nominating Committee to fill any vacancy pursuant to Section 5.3 and any other person, other than a JBS Director, nominated by the Minority Investors to succeed an Equity Director in accordance with this Certificate of Incorporation and the Bylaws and elected by the stockholders of the Corporation; provided that, if at any time the ownership by the JBS Stockholder of the issued and outstanding Common Stock as a percentage of the total issued and outstanding Common Stock changes to a threshold amount set forth in Section 5.2(b), then the number of Equity Directors shall be changed to the corresponding number of Equity Directors set forth in Section 5.2(b); provided further that each person serving as an Equity Director must qualify as an independent director. “Exchange” means any national securities exchange registered under Section 6 of the Exchange Act. “Exchange Act” means the Securities Exchange Act of 1934, as amended. “independent director” has the meaning ascribed to such term in the applicable listing standards of the Exchange on which the Common Stock is then listed, or if the Common Stock is not then listed, then as such term is defined in Section 303A.02 of The New York Stock Exchange Listed Company Manual (or any successor rule). “JBS Directors” means the six (6) initial directors designated as “JBS Directors” on Schedule 3.01(a)(i) to the Stockholders Agreement, their successors as nominated by the JBS Nominating Committee pursuant to this Certificate of Incorporation and elected by the stockholders of the Corporation or appointed by the JBS Nominating Committee or the stockholders to fill any vacancy pursuant to Section 5.3; provided that,

if at any time the ownership by the JBS Stockholder of the issued and outstanding Common Stock as a percentage of the total issued and outstanding Common Stock changes to a threshold amount set forth in Section 5.2(b), then the number of JBS Directors shall be changed to the corresponding number of JBS Directors set forth in Section 5.2(b). “JBS Stockholder” means JBS USA or any of its Affiliates. “JBS USA” means JBS USA Holdings, Inc., or any successor thereto. “JBS USA Common Stock” means the common stock of JBS USA listed on an Exchange. “Minority Investors” means the stockholders of the Corporation other than the JBS Stockholder. “Person” means any individual, partnership, company, firm, corporation, limited liability company, association, trust, unincorporated organization or other entity, as well as any syndicate or group that would be deemed to be a person under Section 13(d)(3) of the Exchange Act. “Stockholders Agreement” means the Stockholders Agreement dated December 28, 2009 between the Corporation and JBS USA (as amended by amendment no. 1 thereto dated December 17, 2012 and amendment no. 2 thereto dated December 30, 2024), a copy of which will be made available to any stockholder of the Corporation upon written request. “Transfer” means to sell, transfer, convey, grant an option in or with respect to, otherwise dispose of or take any other similar action, directly or indirectly.

[Signature page to Amended and Restated Certificate of Incorporation] IN WITNESS WHEREOF, the Corporation has caused this Amended and Restated Certificate of Incorporation to be executed on its behalf on this 30th day of December, 2024. PILGRIM’S PRIDE CORPORATION By: /s/ Matthew Galvanoni Name: Matthew Galvanoni Title: Chief Financial Officer