Financial Results For The Fourth Quarter Ended December 29th 2024 Pilgrim’s Pride Corporation (NASDAQ: PPC)

Cautionary Notes and Forward-Looking Statements Statements contained in this press release that state the intentions, plans, hopes, beliefs, anticipations, expectations or predictions of the future of Pilgrim’s Pride Corporation and its management are considered forward-looking statements. Without limiting the foregoing, words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “should,” “targets,” “will” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include: matters affecting the poultry industry generally; the ability to execute the Company’s business plan to achieve desired cost savings and profitability; future pricing for feed ingredients and the Company’s products; outbreaks of avian influenza or other diseases, either in Pilgrim’s Pride’s flocks or elsewhere, affecting its ability to conduct its operations and/or demand for its poultry products; contamination of Pilgrim’s Pride’s products, which has previously and can in the future lead to product liability claims and product recalls; exposure to risks related to product liability, product recalls, property damage and injuries to persons, for which insurance coverage is expensive, limited and potentially inadequate; management of cash resources; restrictions imposed by, and as a result of, Pilgrim’s Pride’s leverage; changes in laws or regulations affecting Pilgrim’s Pride’s operations or the application thereof; new immigration legislation or increased enforcement efforts in connection with existing immigration legislation that cause the costs of doing business to increase, cause Pilgrim’s Pride to change the way in which it does business, or otherwise disrupt its operations; competitive factors and pricing pressures or the loss of one or more of Pilgrim’s Pride’s largest customers; currency exchange rate fluctuations, trade barriers, exchange controls, expropriation and other risks associated with foreign operations; disruptions in international markets and distribution channels, including, but not limited to, the impacts of the Russia-Ukraine conflict; the risk of cyber-attacks, natural disasters, power losses, unauthorized access, telecommunication failures, and other problems on our information systems; and the impact of uncertainties of litigation and other legal matters described in our most recent Form 10-K and Form 10-Q, including the In re Broiler Chicken Antitrust Litigation, as well as other risks described under “Risk Factors” in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and subsequent filings with the Securities and Exchange Commission. The forward looking statements in this release speak only as of the date hereof, and the Company undertakes no obligation to update any such statement after the date of this release, whether as a result of new information, future developments or otherwise, except as may be required by applicable law Actual results could differ materially from those projected in these forward-looking statements as a result of these factors, among others, many of which are beyond our control. In making these statements, we are not undertaking, and specifically decline to undertake, any obligation to address or update each or any factor in future filings or communications regarding our business or results, and we are not undertaking to address how any of these factors may have caused changes to information contained in previous filings or communications. Although we have attempted to list comprehensively these important cautionary risk factors, we must caution investors and others that other factors may in the future prove to be important and affecting our business or results of operations This presentation may include information that may be considered non-GAAP financial information as contemplated by SEC Regulation G, Rule 100, including EBITDA, Adjusted EBITDA, LTM EBITDA, Net Debt, Free Cash Flow, Adjusted EBITDA Margin and others. Accordingly, we have provided tables in the accompanying appendix and in our previous filings with the SEC that reconcile these measures to their corresponding GAAP-based measures and explain why these measures are useful to investors, which can be obtained from the Consolidated Statements of Income provided with our previous filings with the SEC. Our method of computation may or may not be comparable to other similarly titled measures used in filings with the SEC by other companies. See the consolidated statements of income and consolidated statements of cash flows included in our financial statements. 2

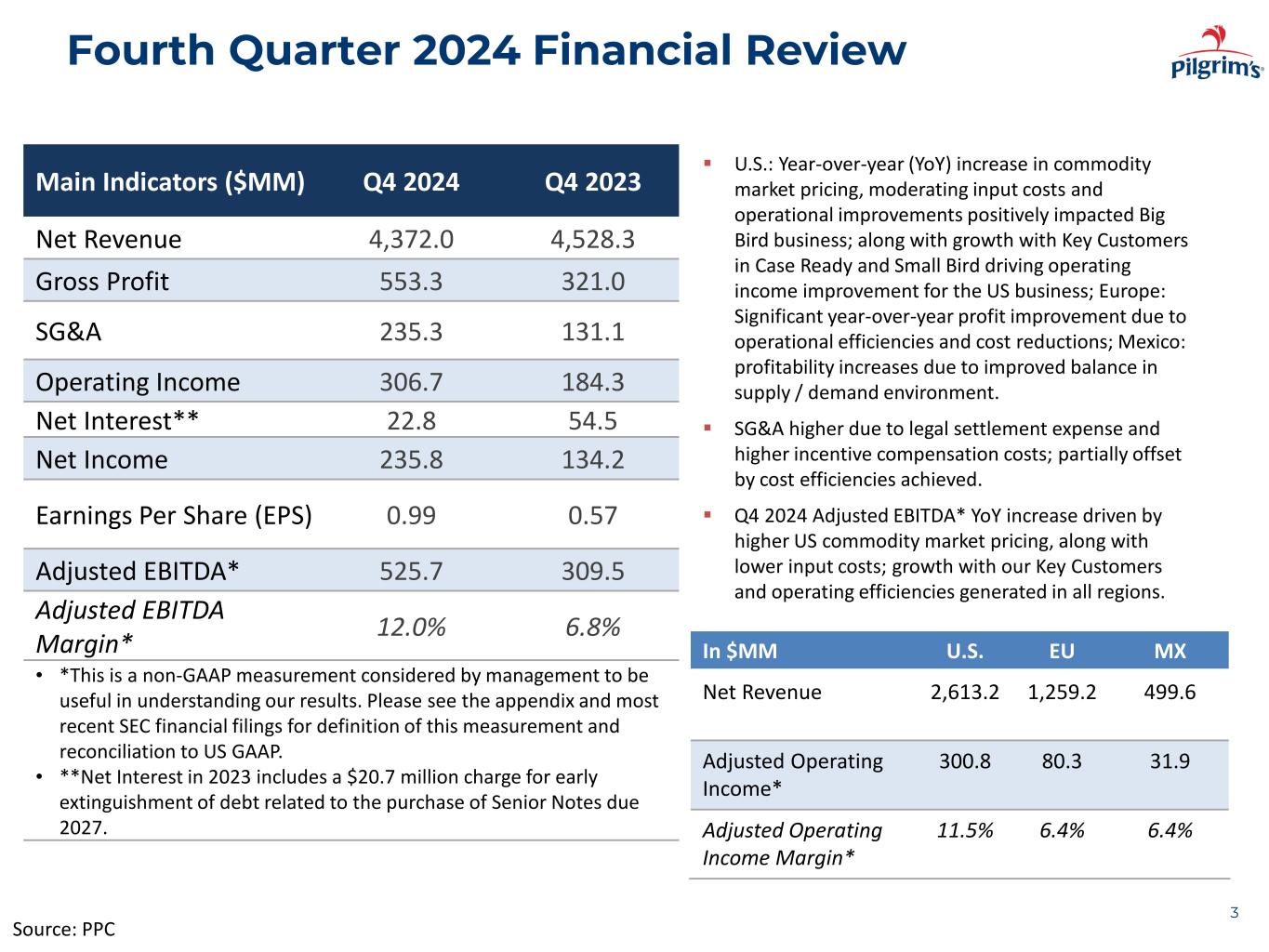

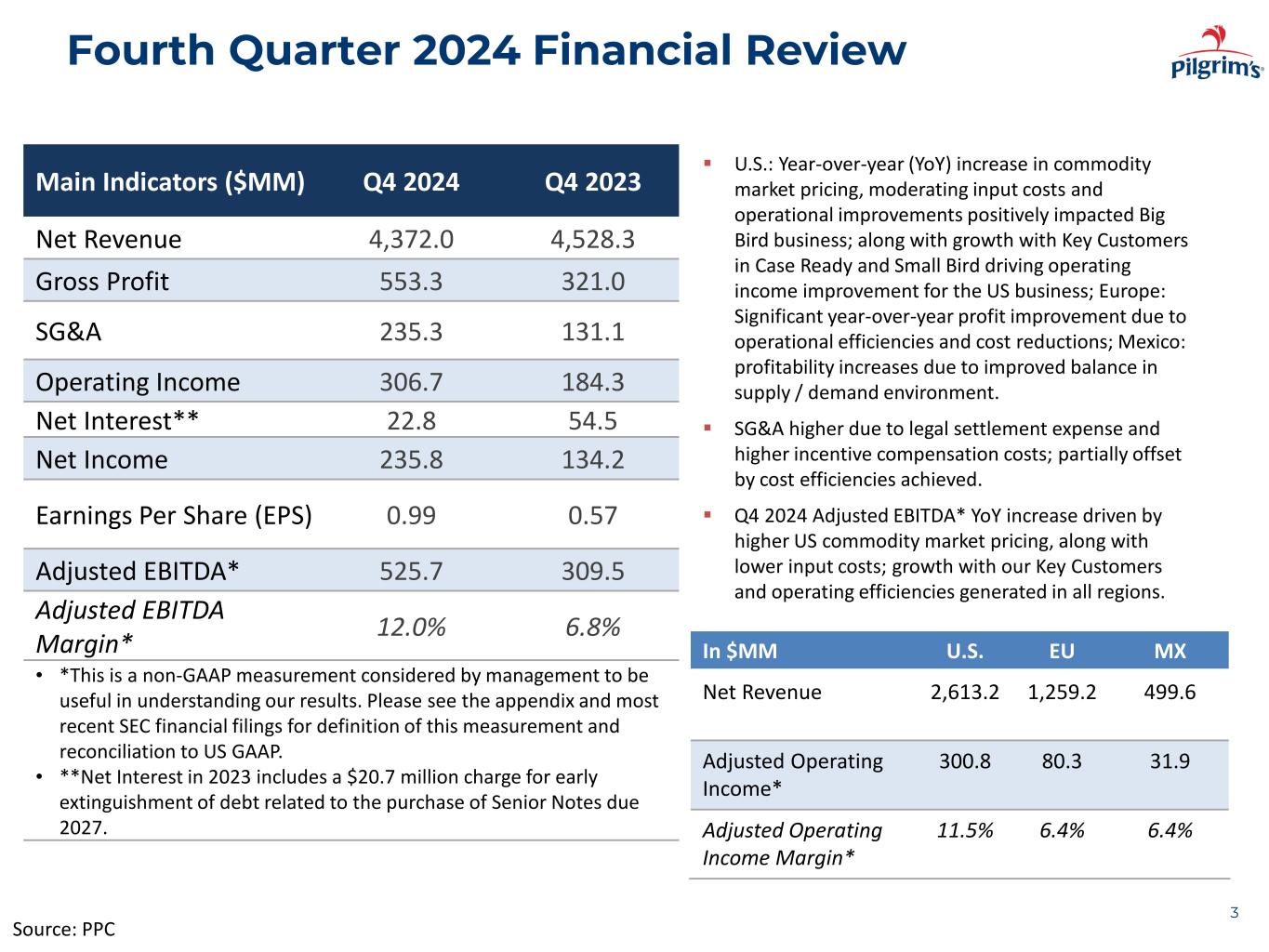

Fourth Quarter 2024 Financial Review 3 Main Indicators ($MM) Q4 2024 Q4 2023 Net Revenue 4,372.0 4,528.3 Gross Profit 553.3 321.0 SG&A 235.3 131.1 Operating Income 306.7 184.3 Net Interest** 22.8 54.5 Net Income 235.8 134.2 Earnings Per Share (EPS) 0.99 0.57 Adjusted EBITDA* 525.7 309.5 Adjusted EBITDA Margin* 12.0% 6.8% • *This is a non-GAAP measurement considered by management to be useful in understanding our results. Please see the appendix and most recent SEC financial filings for definition of this measurement and reconciliation to US GAAP. • **Net Interest in 2023 includes a $20.7 million charge for early extinguishment of debt related to the purchase of Senior Notes due 2027. U.S.: Year-over-year (YoY) increase in commodity market pricing, moderating input costs and operational improvements positively impacted Big Bird business; along with growth with Key Customers in Case Ready and Small Bird driving operating income improvement for the US business; Europe: Significant year-over-year profit improvement due to operational efficiencies and cost reductions; Mexico: profitability increases due to improved balance in supply / demand environment. SG&A higher due to legal settlement expense and higher incentive compensation costs; partially offset by cost efficiencies achieved. Q4 2024 Adjusted EBITDA* YoY increase driven by higher US commodity market pricing, along with lower input costs; growth with our Key Customers and operating efficiencies generated in all regions. In $MM U.S. EU MX Net Revenue 2,613.2 1,259.2 499.6 Adjusted Operating Income* 300.8 80.3 31.9 Adjusted Operating Income Margin* 11.5% 6.4% 6.4% Source: PPC

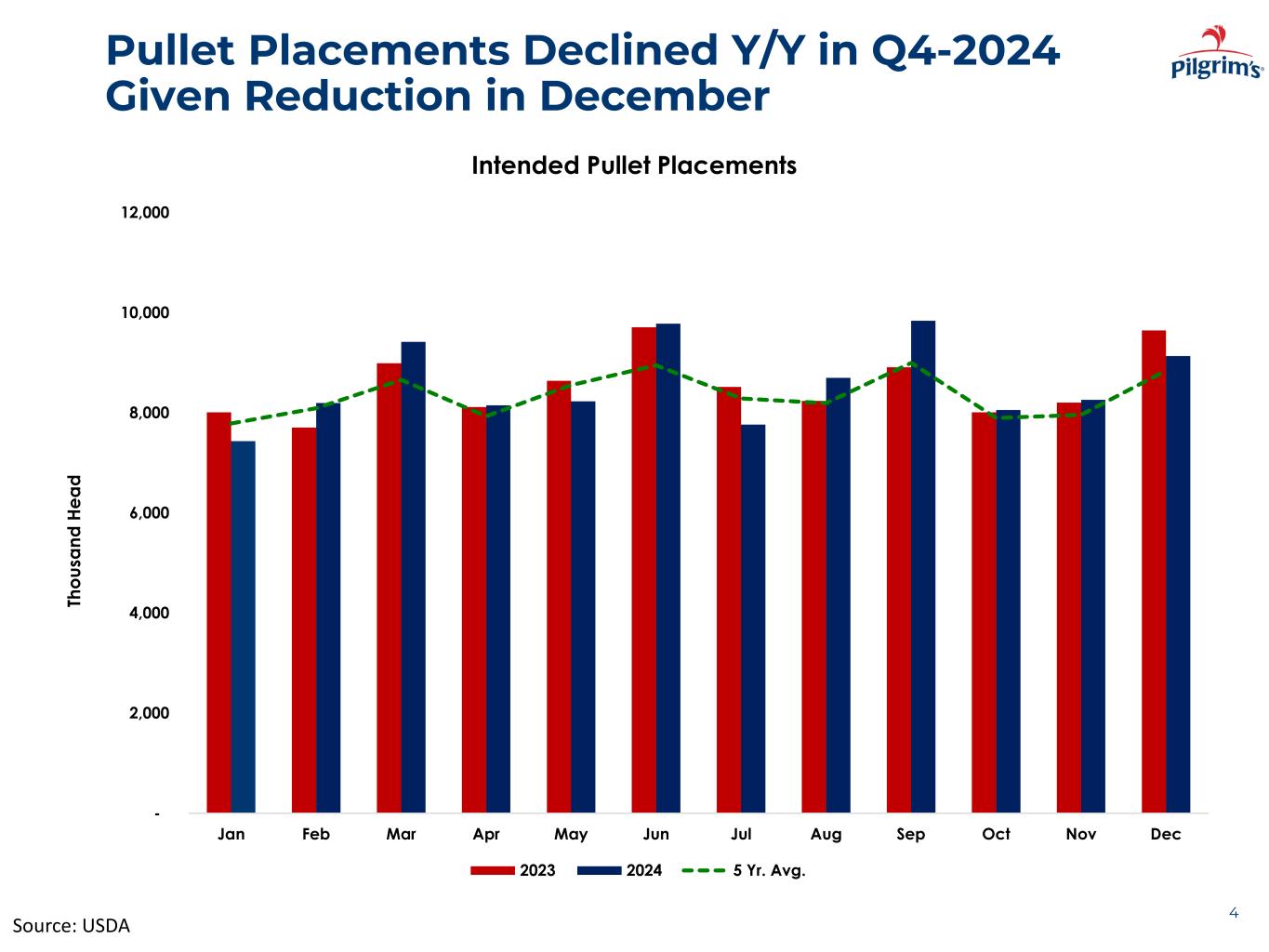

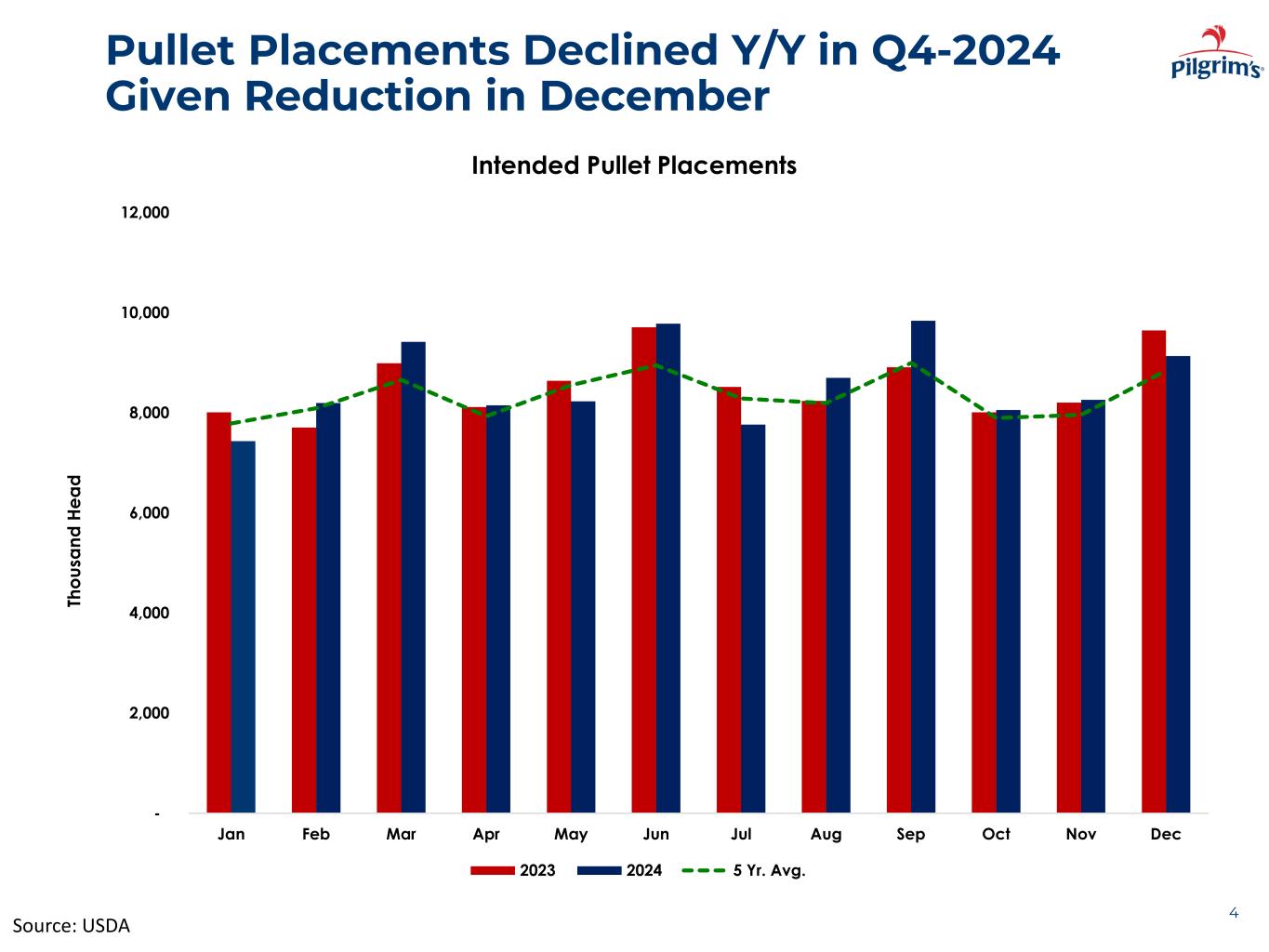

Pullet Placements Declined Y/Y in Q4-2024 Given Reduction in December Trailing 8-month placements increased 1.6% vs. year ago. 4 Source: USDA - 2,000 4,000 6,000 8,000 10,000 12,000 Jan Feb Mar Apr May Jun Jul Aug S p Oct Nov Dec Th ou sa nd H ea d Intended Pullet Placements 2023 2024 5 Yr. Avg.

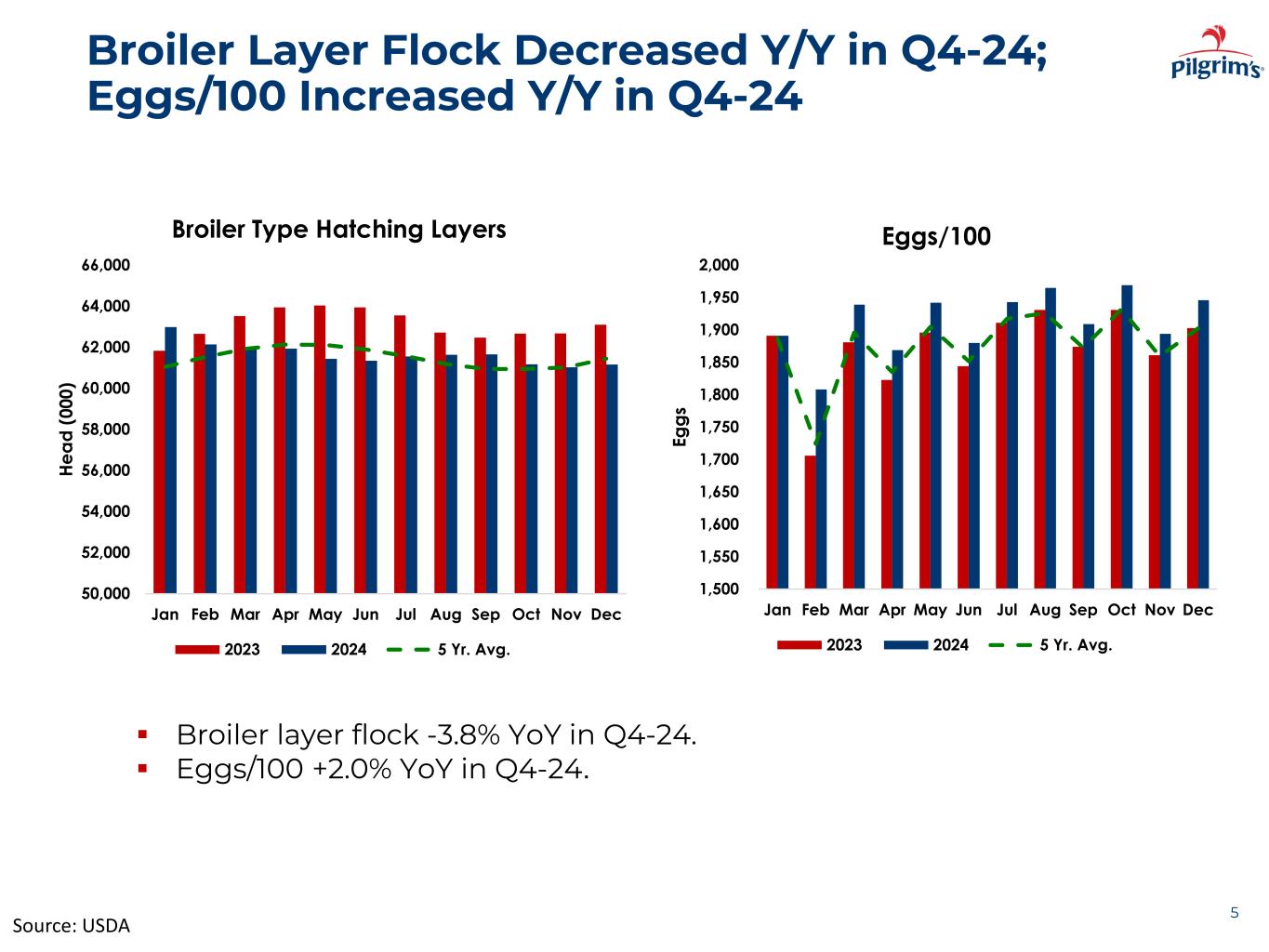

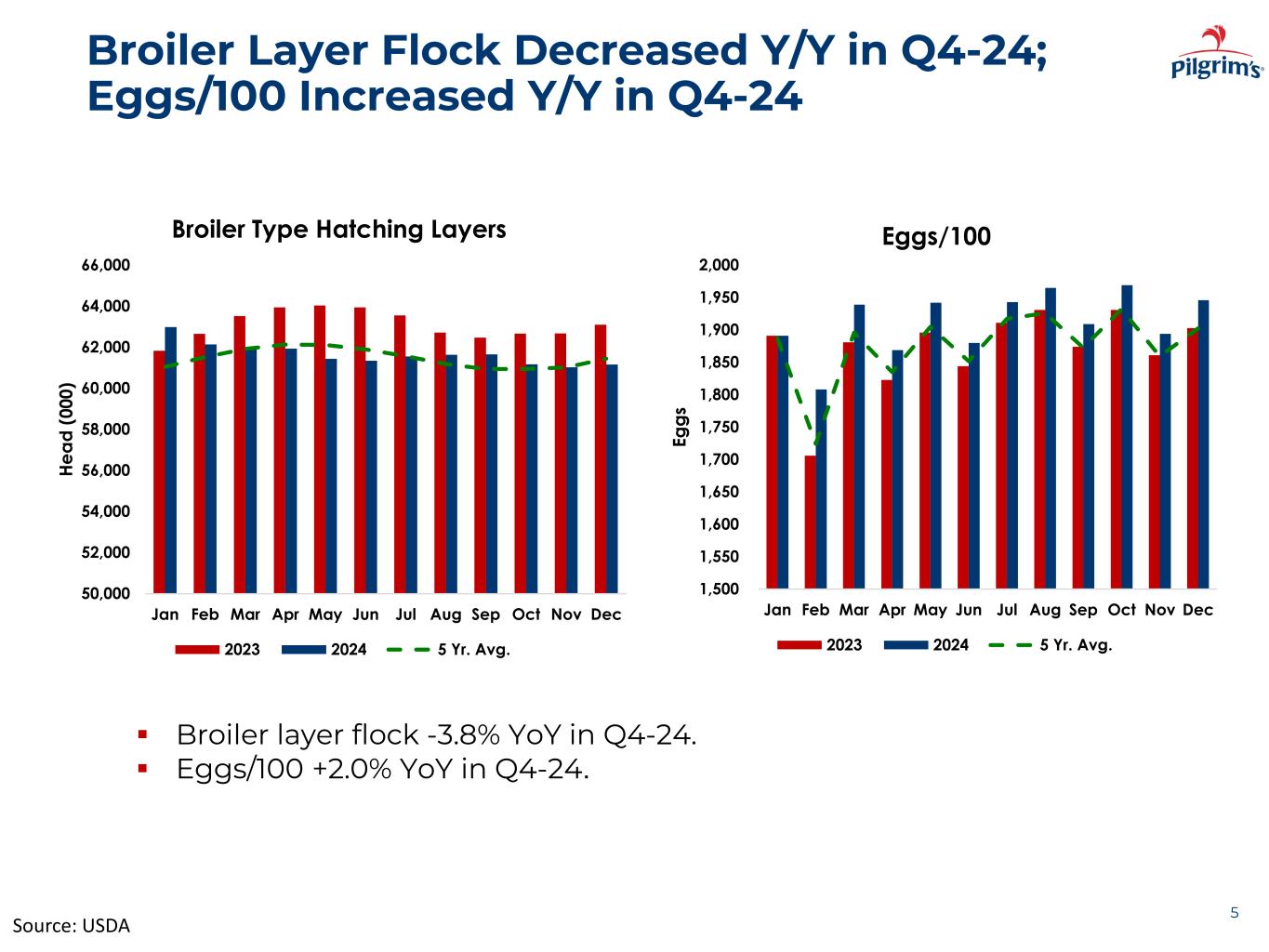

50,000 52,000 54,000 56,000 58,000 60,000 62,000 64,000 66,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec He ad (0 00 ) Broiler Type Hatching Layers 2023 2024 5 Yr. Avg. Broiler Layer Flock Decreased Y/Y in Q4-24; Eggs/100 Increased Y/Y in Q4-24 5 Broiler layer flock -3.8% YoY in Q4-24. Eggs/100 +2.0% YoY in Q4-24. Source: USDA 1,500 1,550 1,600 1,650 1,700 1,750 1,800 1,850 1,900 1,950 2,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Eg gs Eggs/100 2023 2024 5 Yr. Avg.

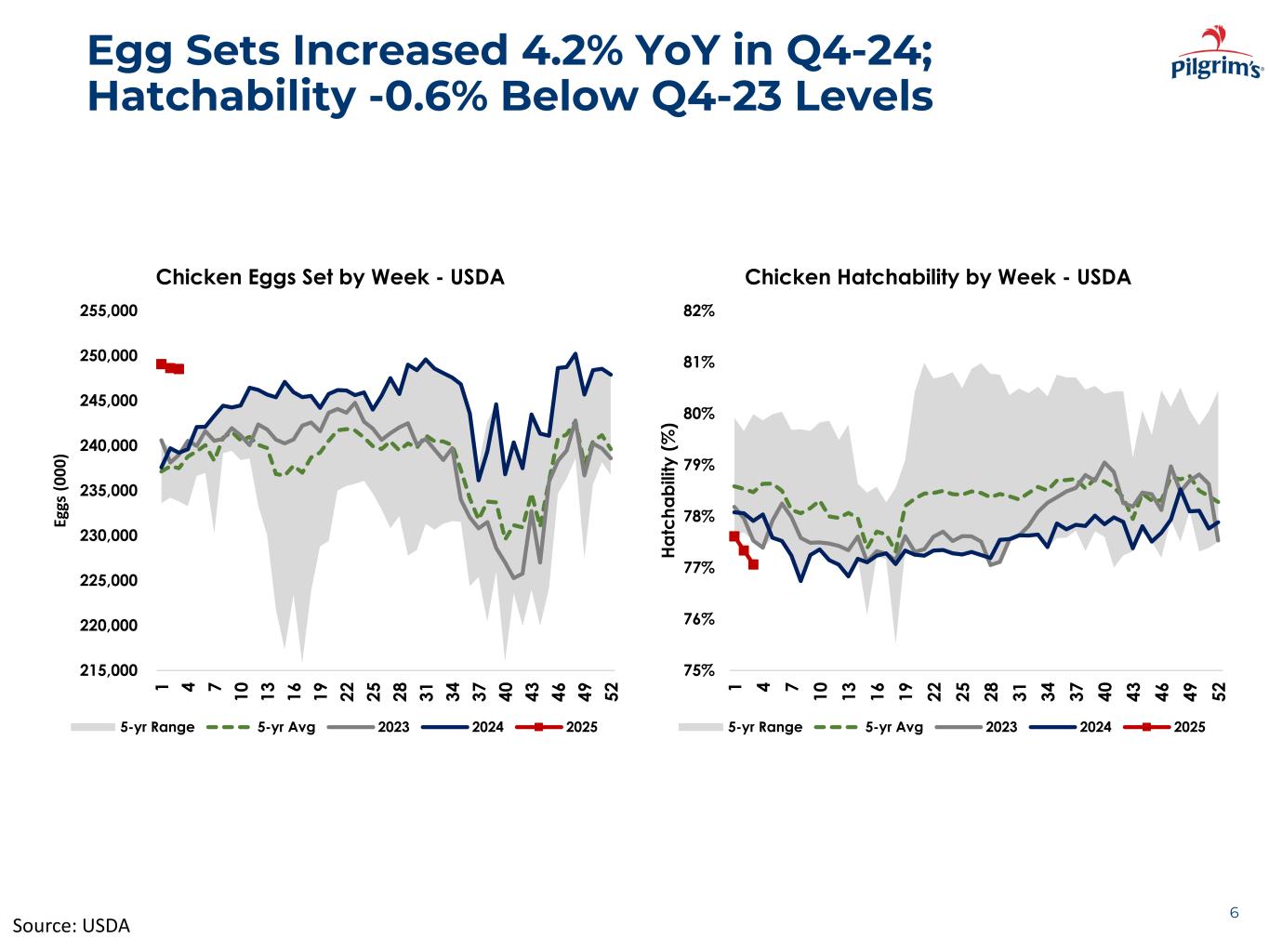

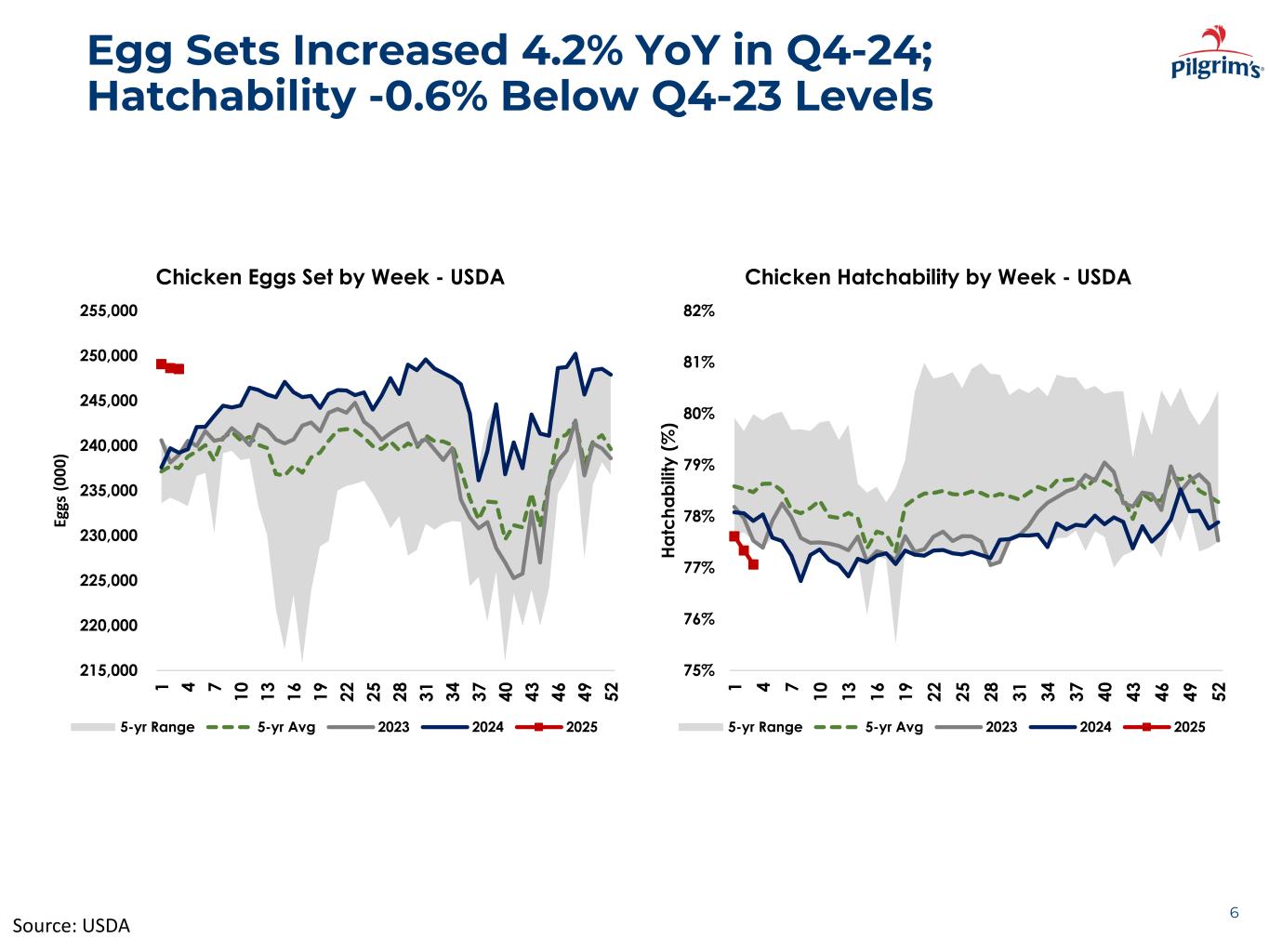

Egg Sets Increased 4.2% YoY in Q4-24; Hatchability -0.6% Below Q4-23 Levels 6 Source: USDA 215,000 220,000 225,000 230,000 235,000 240,000 245,000 250,000 255,000 1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52 Eg gs (0 00 ) Chicken Eggs Set by Week - USDA 5-yr Range 5-yr Avg 2023 2024 2025 75% 76% 77% 78% 79% 80% 81% 82% 1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52 Ha tc ha bi lit y (% ) Chicken Hatchability by Week - USDA 5-yr Range 5-yr Avg 2023 2024 2025

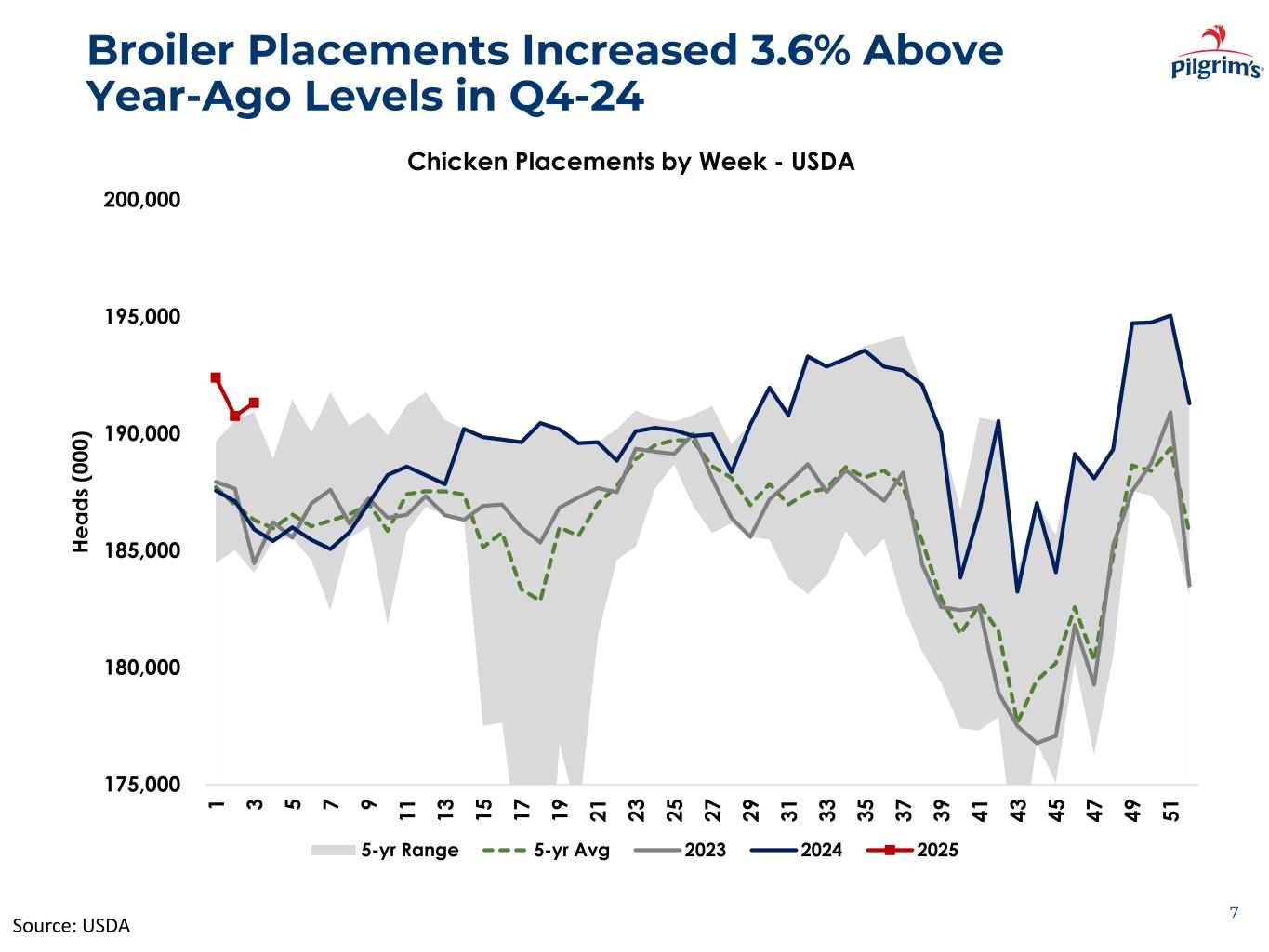

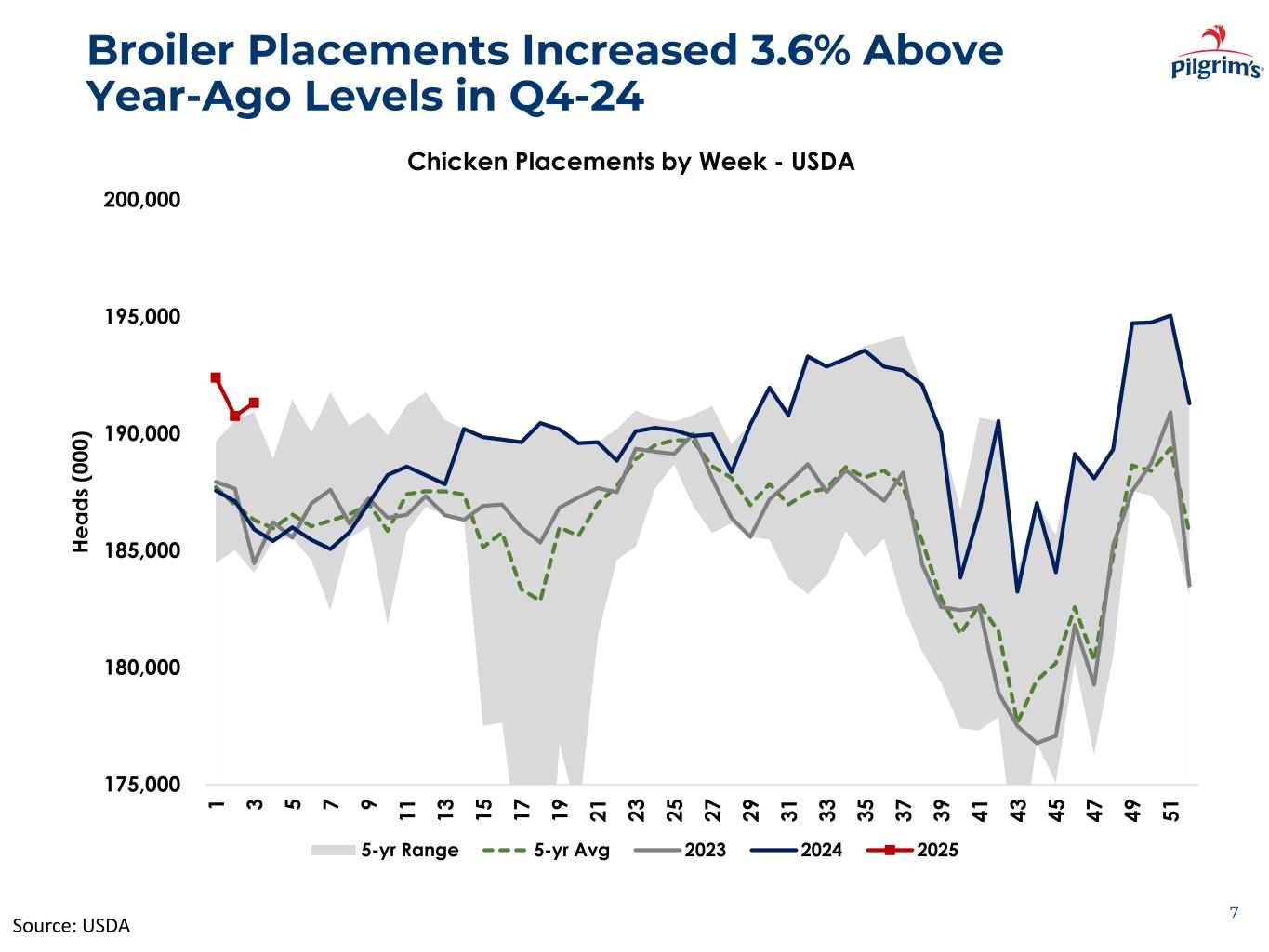

Broiler Placements Increased 3.6% Above Year-Ago Levels in Q4-24 7 Source: USDA 175,000 180,000 185,000 190,000 195,000 200,000 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 He ad s (0 00 ) Chicken Placements by Week - USDA 5-yr Range 5-yr Avg 2023 2024 2025

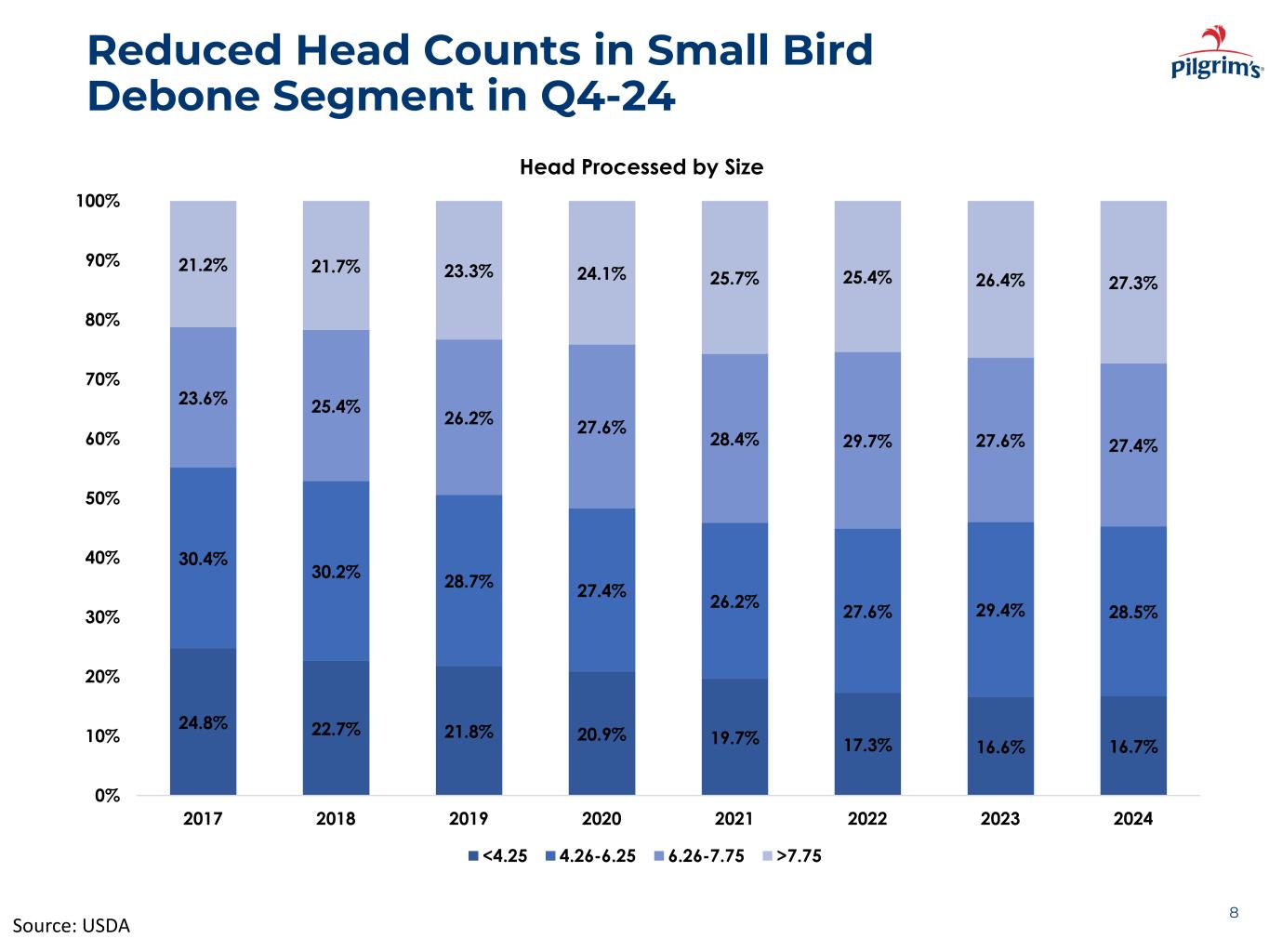

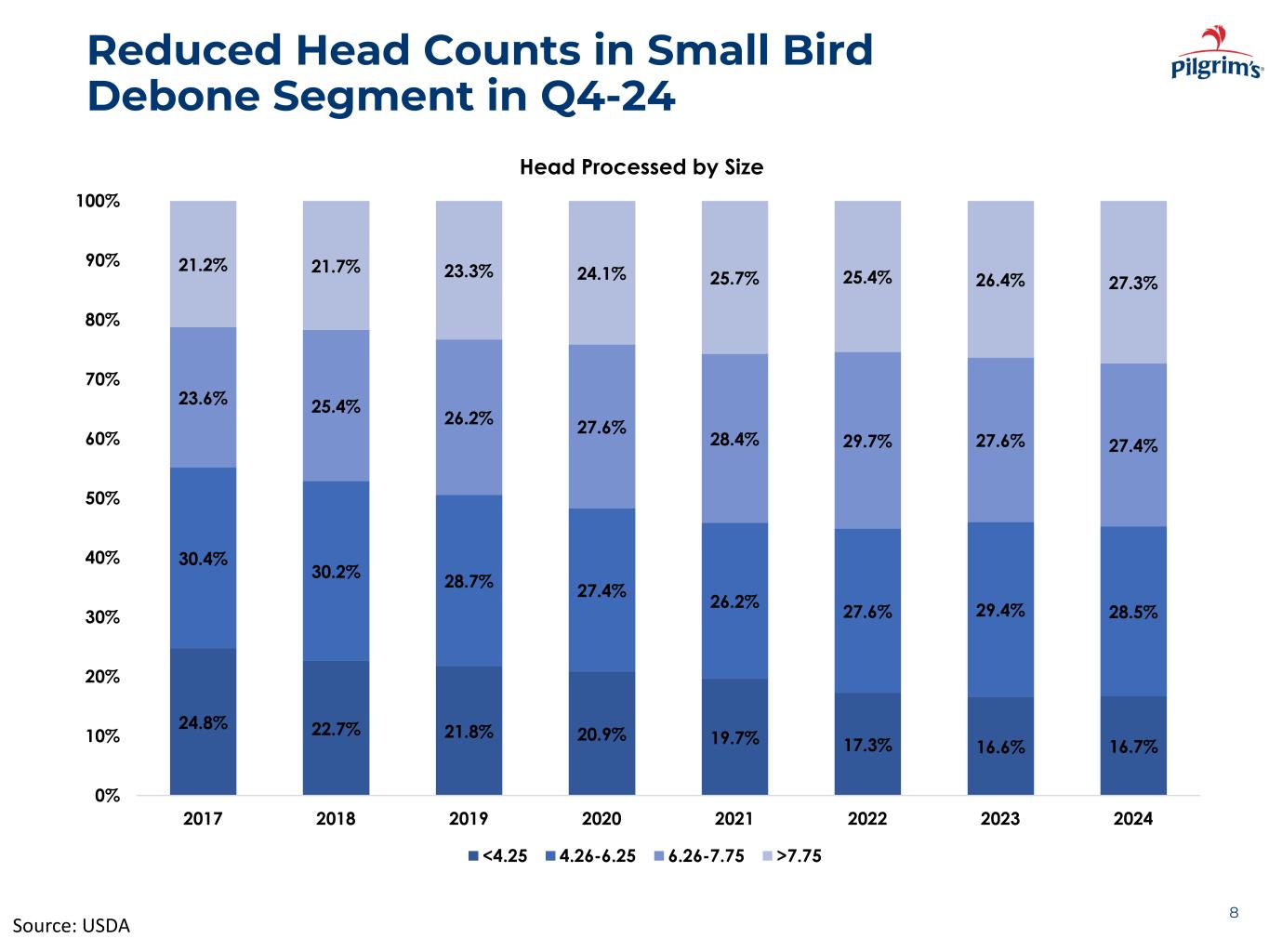

Reduced Head Counts in Small Bird Debone Segment in Q4-24 8 Source: USDA 24.8% 22.7% 21.8% 20.9% 19.7% 17.3% 16.6% 16.7% 30.4% 30.2% 28.7% 27.4% 26.2% 27.6% 29.4% 28.5% 23.6% 25.4% 26.2% 27.6% 28.4% 29.7% 27.6% 27.4% 21.2% 21.7% 23.3% 24.1% 25.7% 25.4% 26.4% 27.3% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2017 2018 2019 2020 2021 2022 2023 2024 Head Processed by Size <4.25 4.26-6.25 6.26-7.75 >7.75

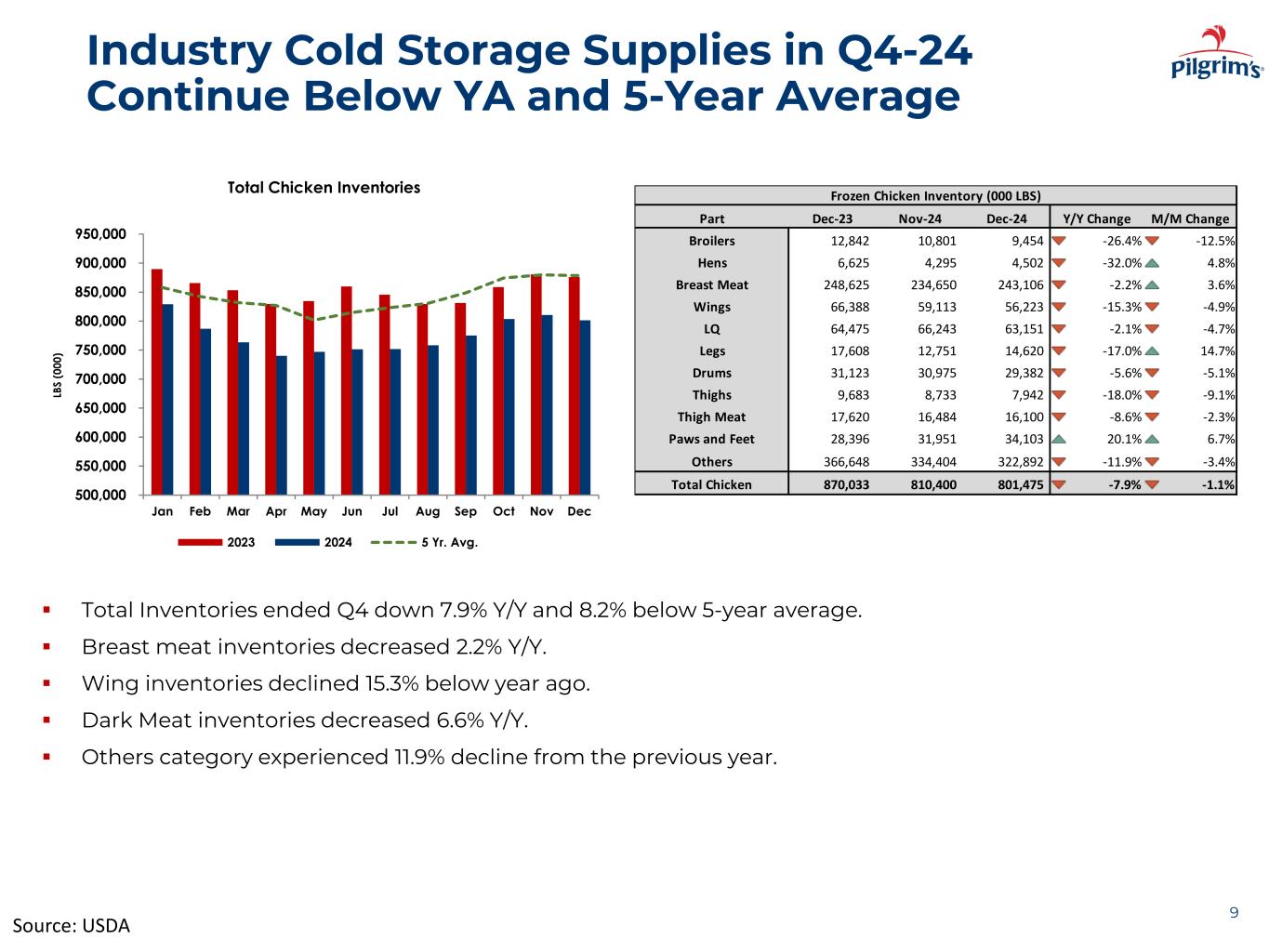

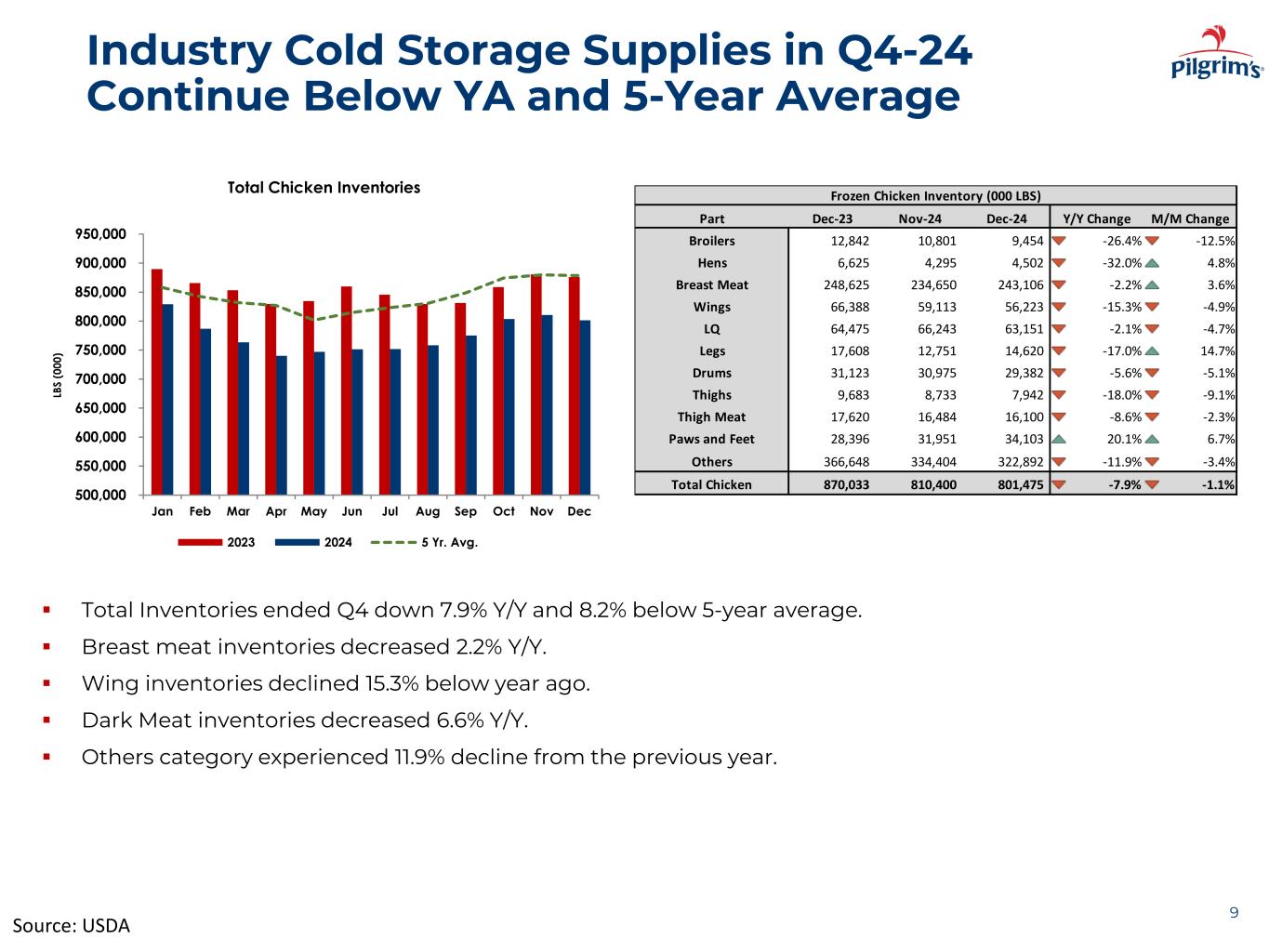

Industry Cold Storage Supplies in Q4-24 Continue Below YA and 5-Year Average Total Inventories ended Q4 down 7.9% Y/Y and 8.2% below 5-year average. Breast meat inventories decreased 2.2% Y/Y. Wing inventories declined 15.3% below year ago. Dark Meat inventories decreased 6.6% Y/Y. Others category experienced 11.9% decline from the previous year. 9 Source: USDA Part Dec-23 Nov-24 Dec-24 Y/Y Change M/M Change Broilers 12,842 10,801 9,454 -26.4% -12.5% Hens 6,625 4,295 4,502 -32.0% 4.8% Breast Meat 248,625 234,650 243,106 -2.2% 3.6% Wings 66,388 59,113 56,223 -15.3% -4.9% LQ 64,475 66,243 63,151 -2.1% -4.7% Legs 17,608 12,751 14,620 -17.0% 14.7% Drums 31,123 30,975 29,382 -5.6% -5.1% Thighs 9,683 8,733 7,942 -18.0% -9.1% Thigh Meat 17,620 16,484 16,100 -8.6% -2.3% Paws and Feet 28,396 31,951 34,103 20.1% 6.7% Others 366,648 334,404 322,892 -11.9% -3.4% Total Chicken 870,033 810,400 801,475 -7.9% -1.1% Frozen Chicken Inventory (000 LBS) 500,000 550,000 600,000 650,000 700,000 750,000 800,000 850,000 900,000 950,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec LB S (0 00 ) Total Chicken Inventories 2023 2024 5 Yr. Avg.

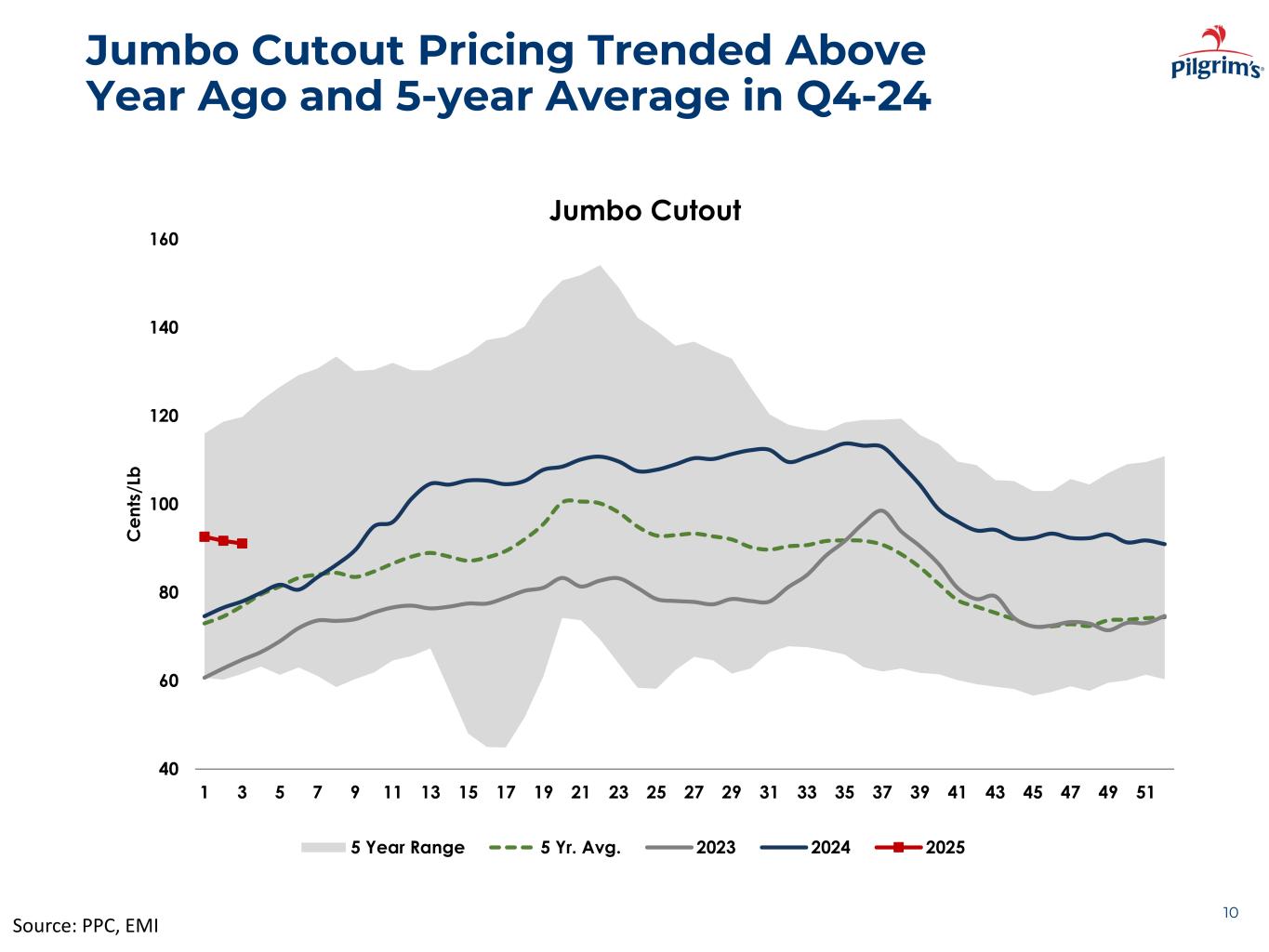

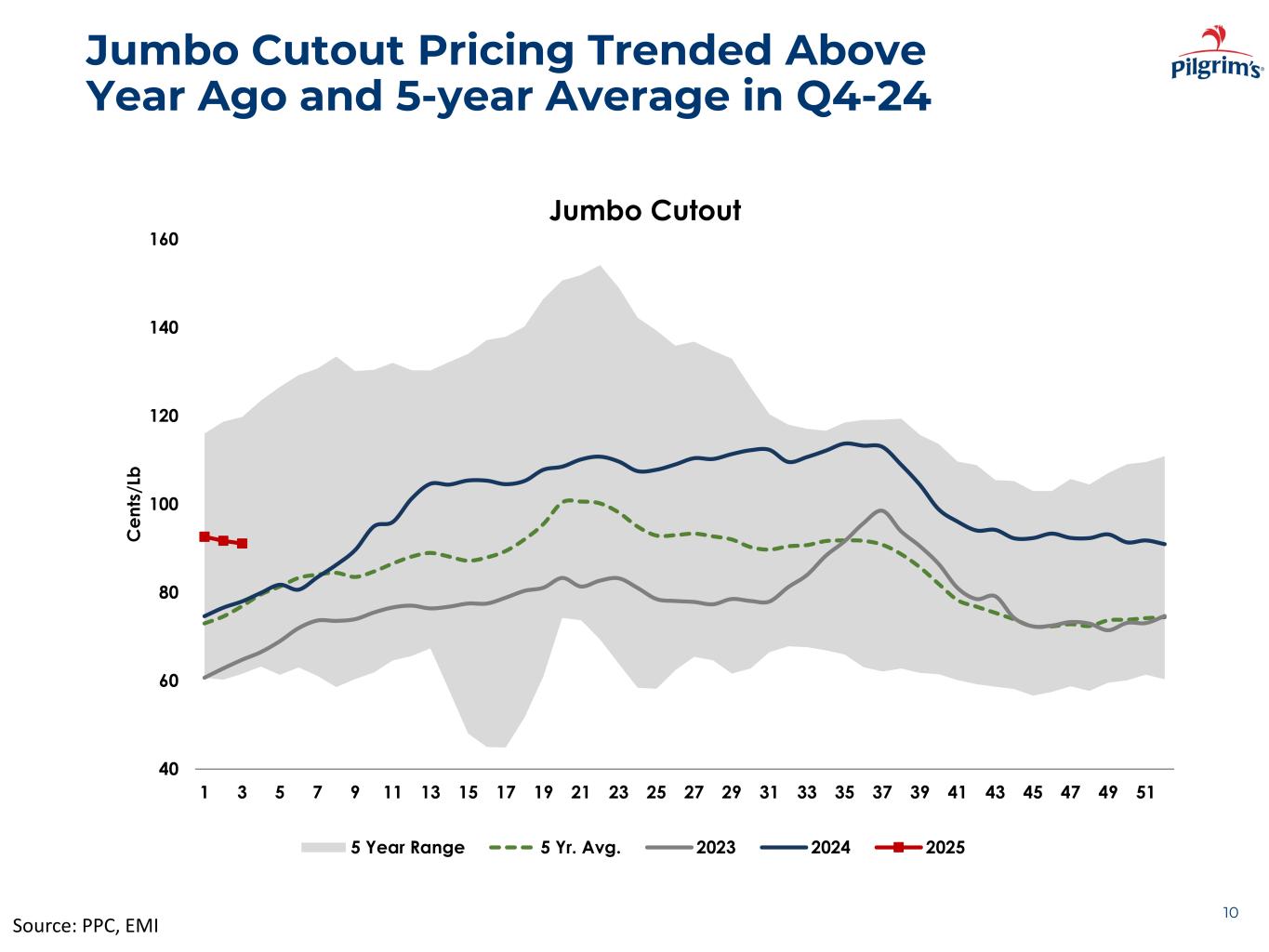

Jumbo Cutout Pricing Trended Above Year Ago and 5-year Average in Q4-24 10 Source: PPC, EMI 40 60 80 100 120 140 160 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 C en ts /L b Jumbo Cutout 5 Year Range 5 Yr. Avg. 2023 2024 2025

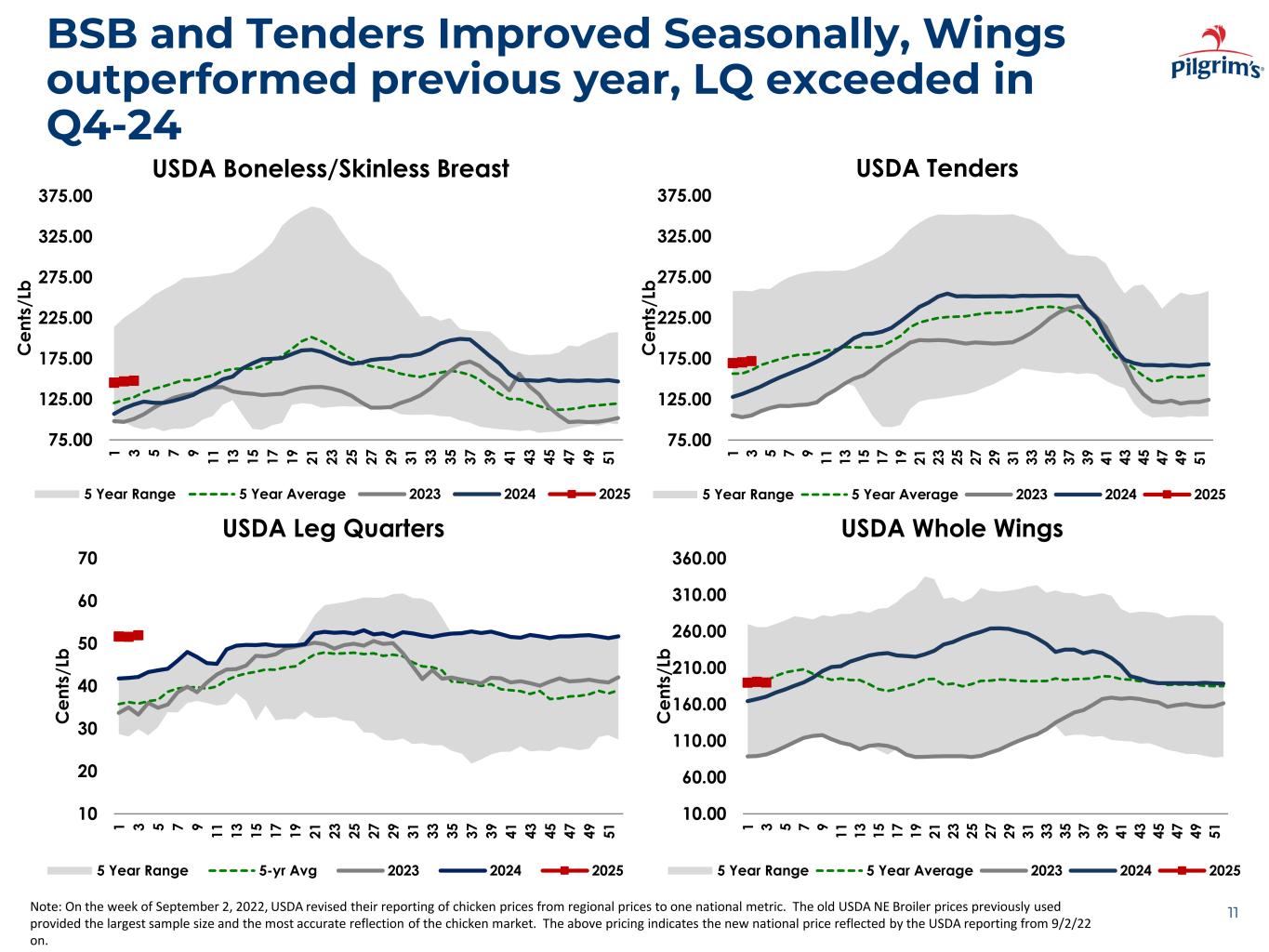

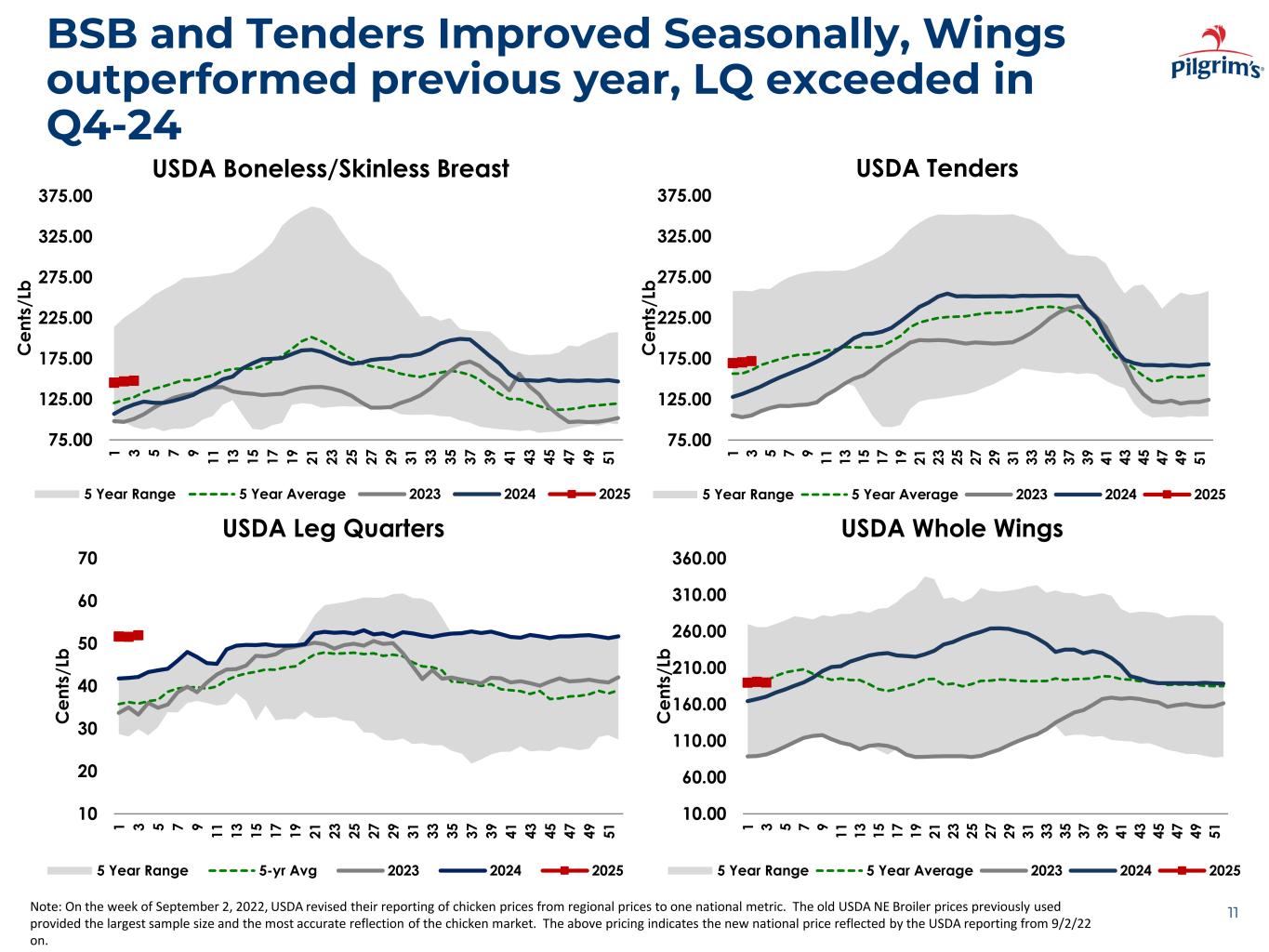

BSB and Tenders Improved Seasonally, Wings outperformed previous year, LQ exceeded in Q4-24 11Note: On the week of September 2, 2022, USDA revised their reporting of chicken prices from regional prices to one national metric. The old USDA NE Broiler prices previously used provided the largest sample size and the most accurate reflection of the chicken market. The above pricing indicates the new national price reflected by the USDA reporting from 9/2/22 on. 75.00 125.00 175.00 225.00 275.00 325.00 375.00 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 C en ts /L b USDA Boneless/Skinless Breast 5 Year Range 5 Year Average 2023 2024 2025 10 20 30 40 50 60 70 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 C en ts /L b USDA Leg Quarters 5 Year Range 5-yr Avg 2023 2024 2025 75.00 125.00 175.00 225.00 275.00 325.00 375.00 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 C en ts /L b USDA Tenders 5 Year Range 5 Year Average 2023 2024 2025 10.00 60.00 110.00 160.00 210.00 260.00 310.00 360.00 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 C en ts /L b USDA Whole Wings 5 Year Range 5 Year Average 2023 2024 2025

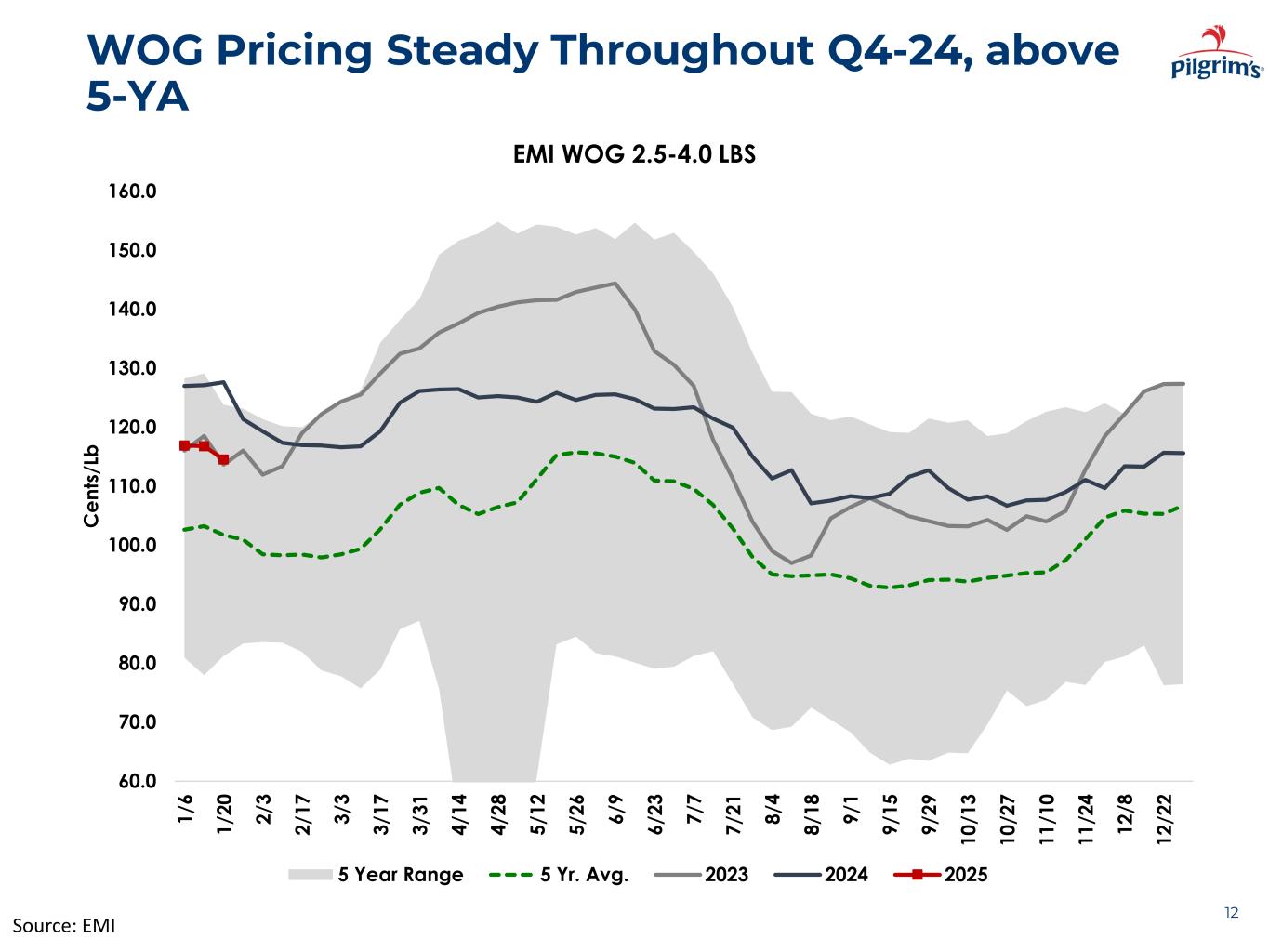

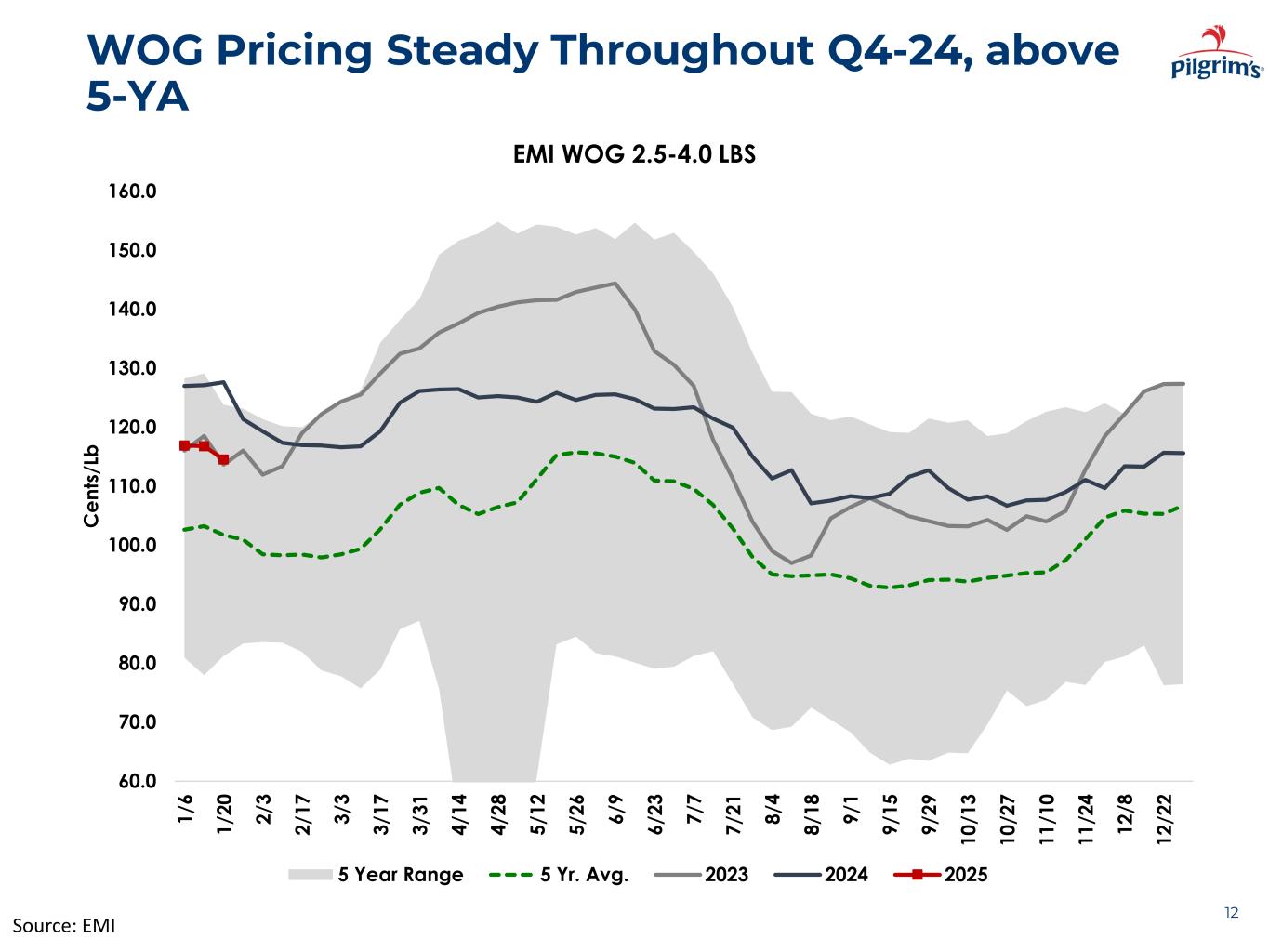

WOG Pricing Steady Throughout Q4-24, above 5-YA 12 Source: EMI 60.0 70.0 80.0 90.0 100.0 110.0 120.0 130.0 140.0 150.0 160.0 1/ 6 1/ 20 2/ 3 2/ 17 3/ 3 3/ 17 3/ 31 4/ 14 4/ 28 5/ 12 5/ 26 6/ 9 6/ 23 7/ 7 7/ 21 8/ 4 8/ 18 9/ 1 9/ 15 9/ 29 10 /1 3 10 /2 7 11 /1 0 11 /2 4 12 /8 12 /2 2 C en ts /L b EMI WOG 2.5-4.0 LBS 5 Year Range 5 Yr. Avg. 2023 2024 2025

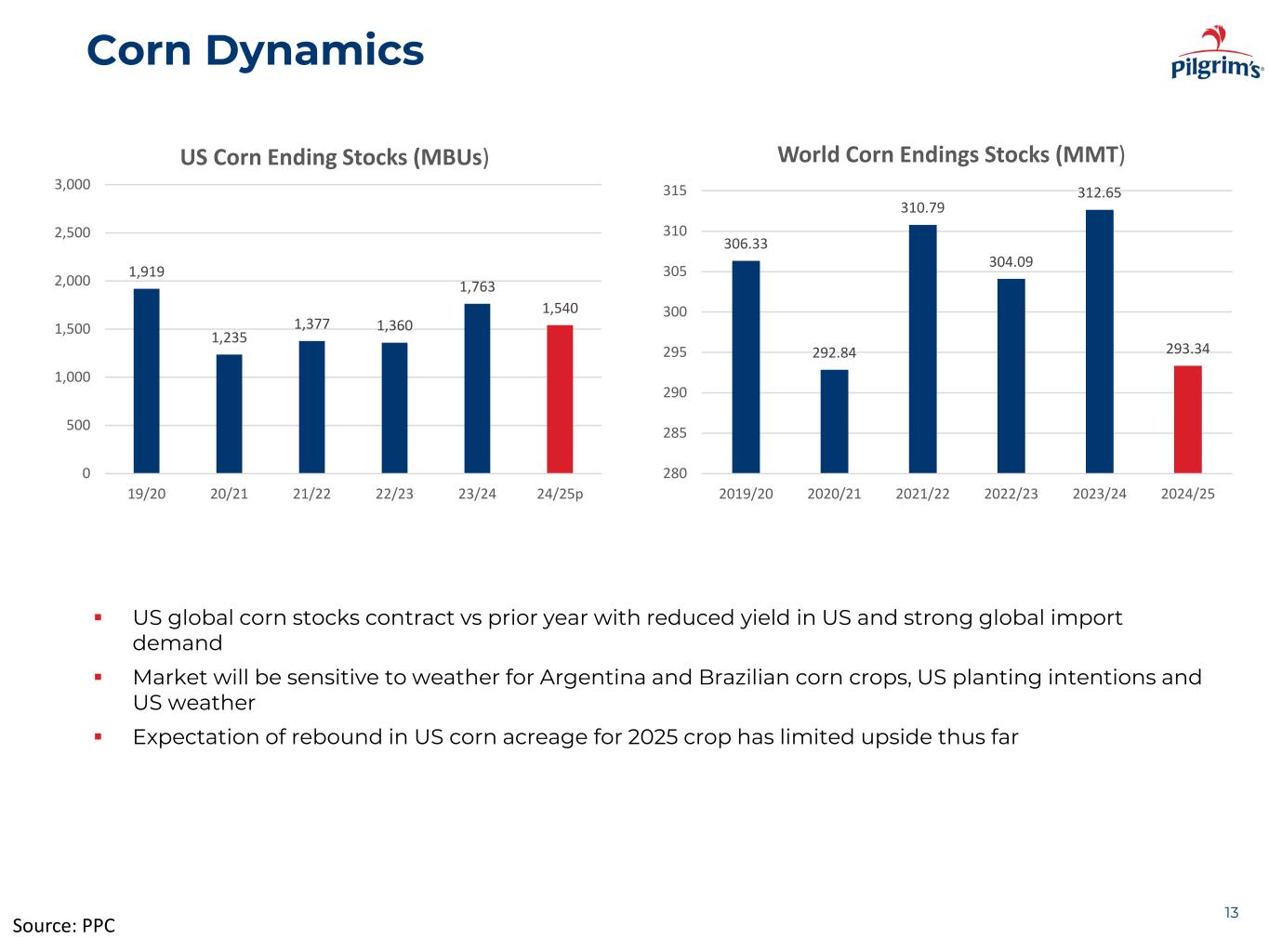

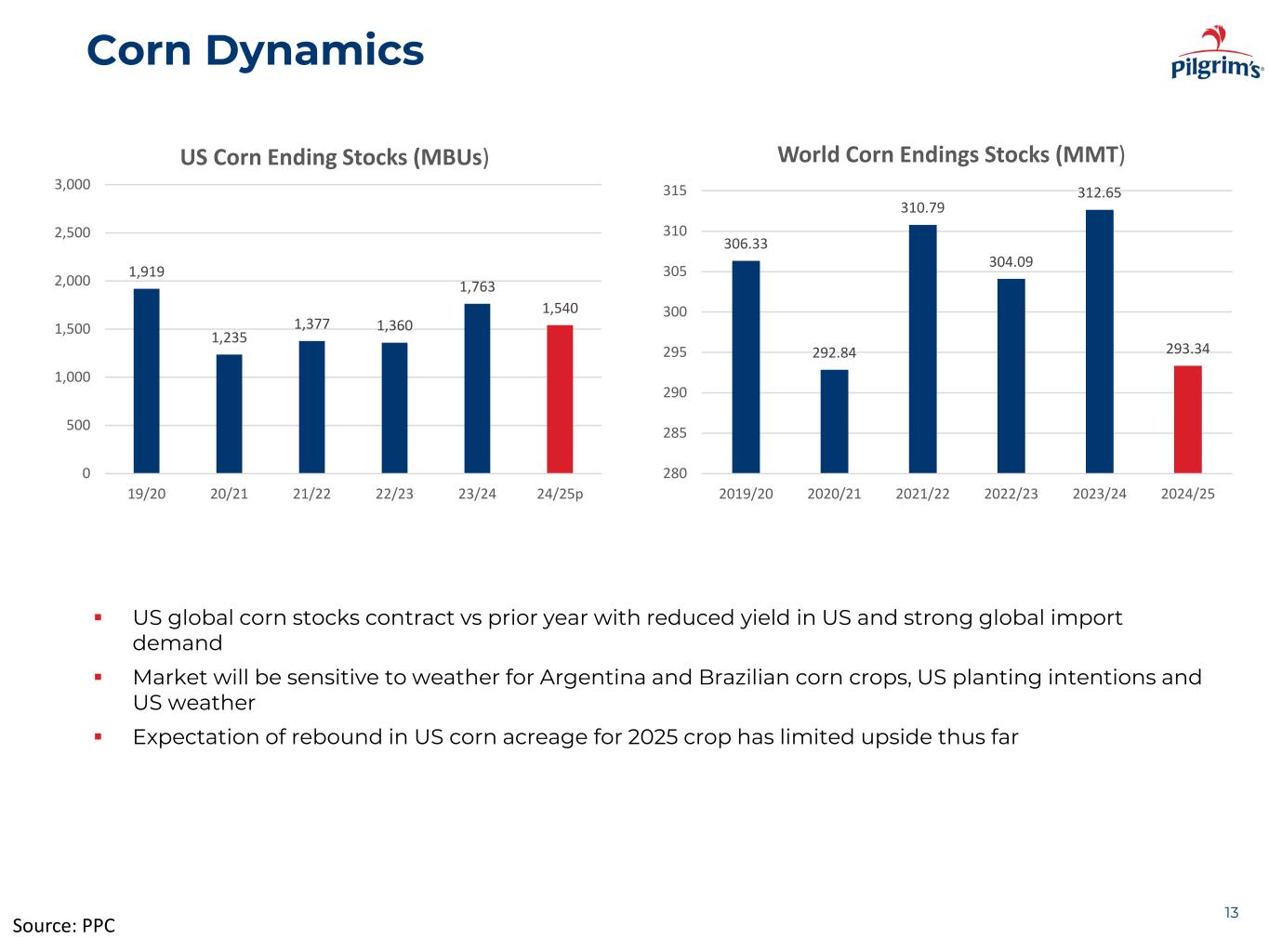

Corn Dynamics 13 Source: PPC US global corn stocks contract vs prior year with reduced yield in US and strong global import demand Market will be sensitive to weather for Argentina and Brazilian corn crops, US planting intentions and US weather Expectation of rebound in US corn acreage for 2025 crop has limited upside thus far 1,919 1,235 1,377 1,360 1,763 1,540 0 500 1,000 1,500 2,000 2,500 3,000 19/20 20/21 21/22 22/23 23/24 24/25p US Corn Ending Stocks (MBUs) 306.33 292.84 310.79 304.09 312.65 293.34 280 285 290 295 300 305 310 315 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 World Corn Endings Stocks (MMT)

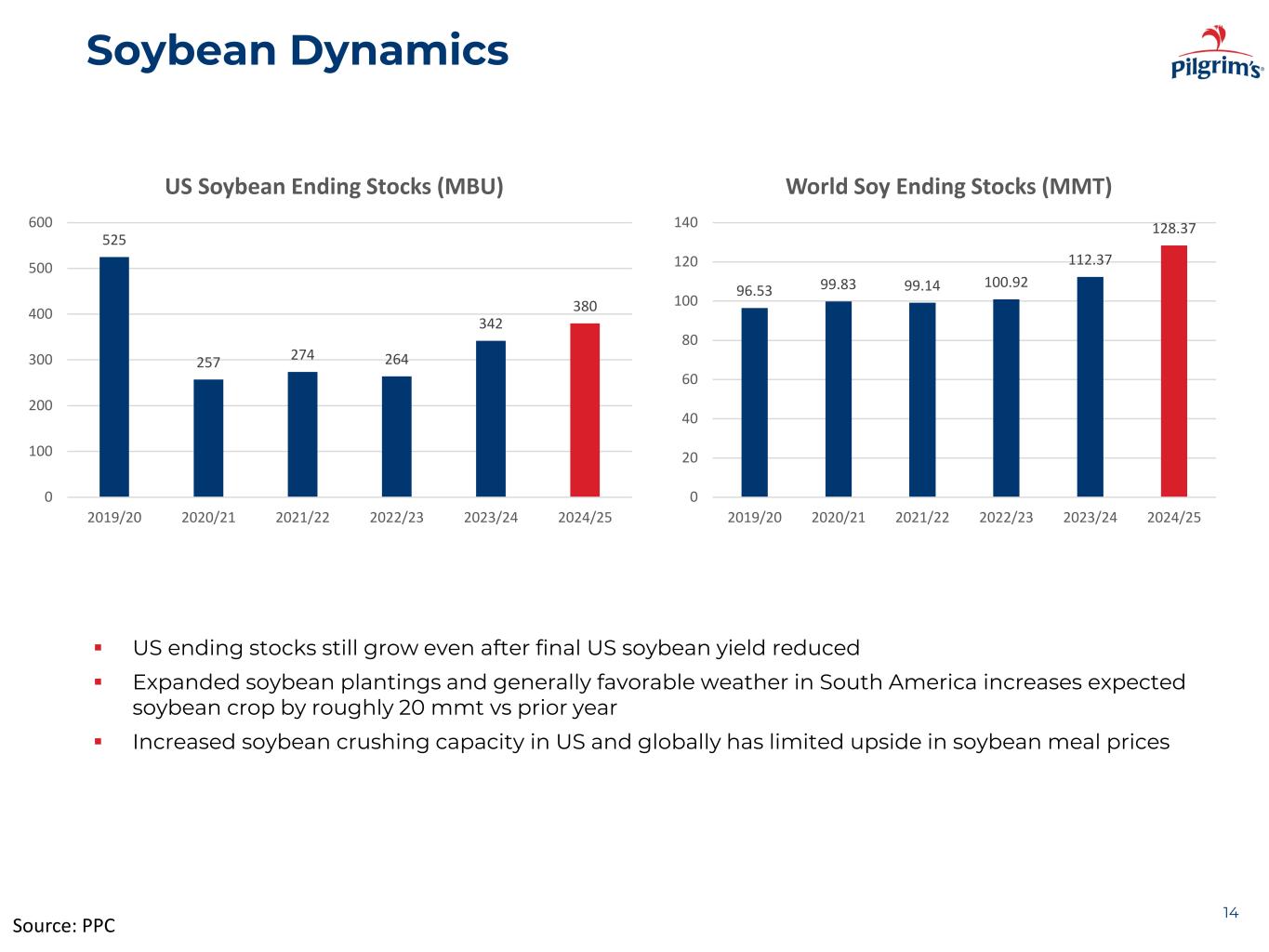

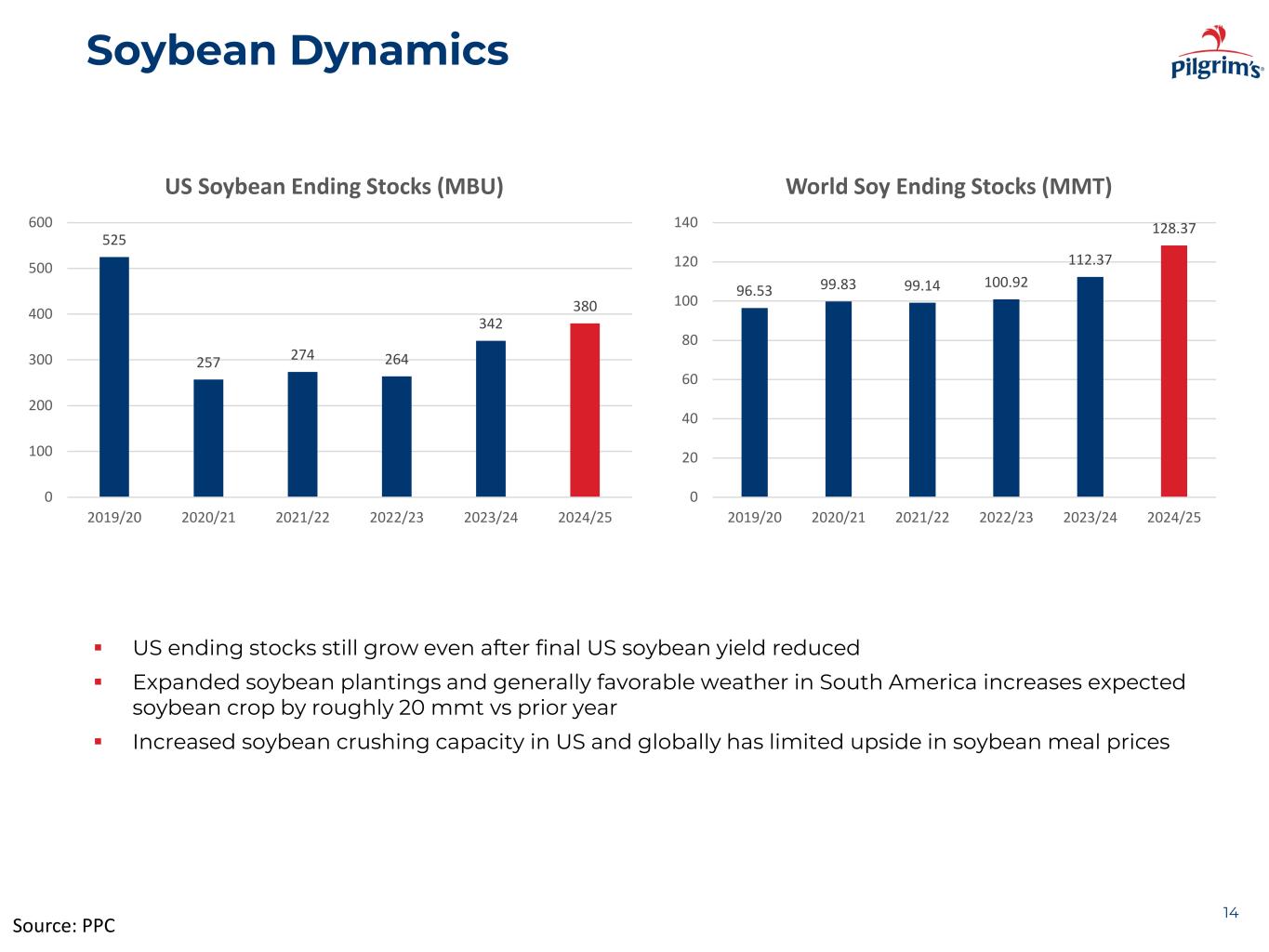

Soybean Dynamics 14 Source: PPC US ending stocks still grow even after final US soybean yield reduced Expanded soybean plantings and generally favorable weather in South America increases expected soybean crop by roughly 20 mmt vs prior year Increased soybean crushing capacity in US and globally has limited upside in soybean meal prices 96.53 99.83 99.14 100.92 112.37 128.37 0 20 40 60 80 100 120 140 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 World Soy Ending Stocks (MMT) 525 257 274 264 342 380 0 100 200 300 400 500 600 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 US Soybean Ending Stocks (MBU)

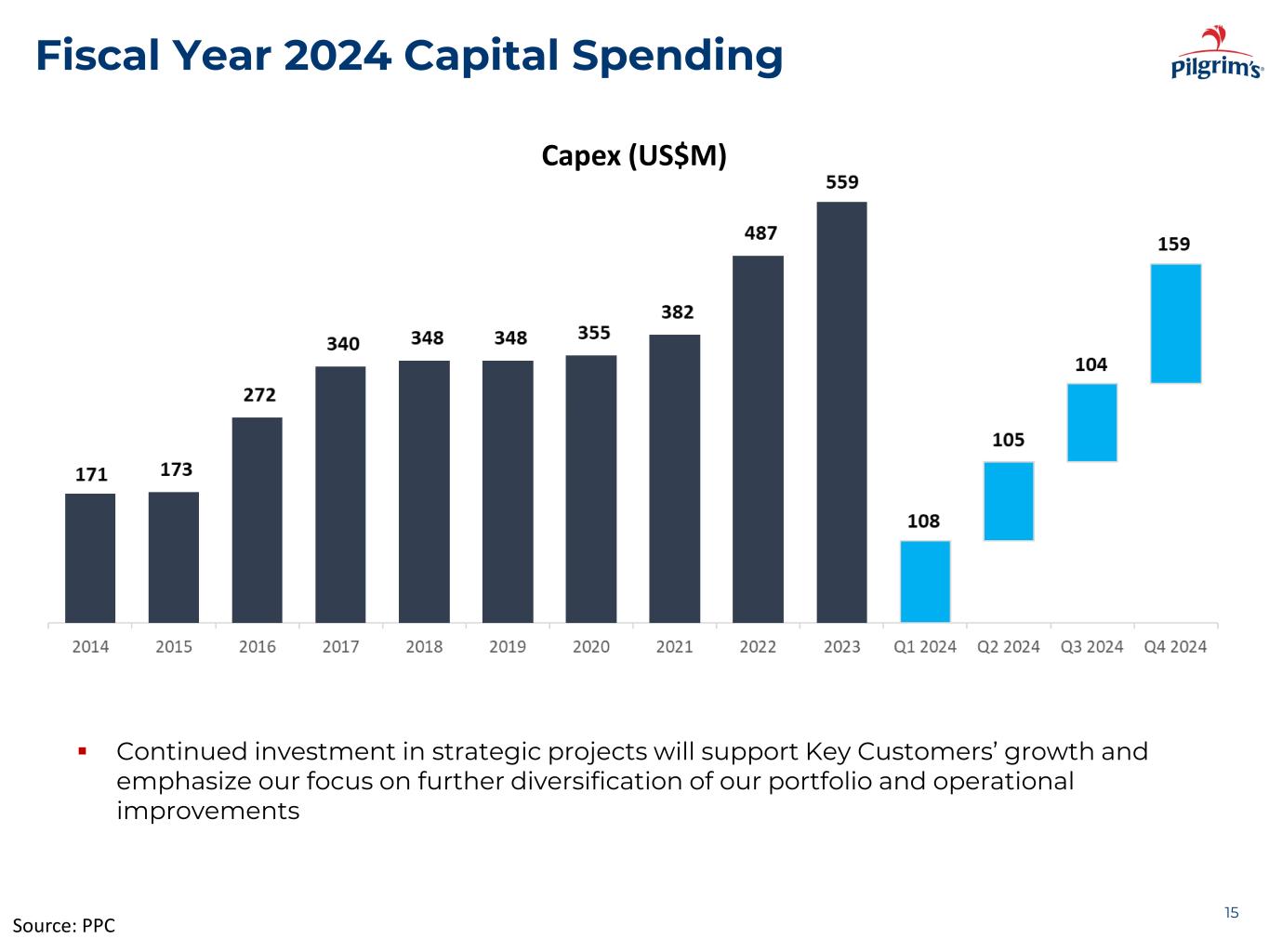

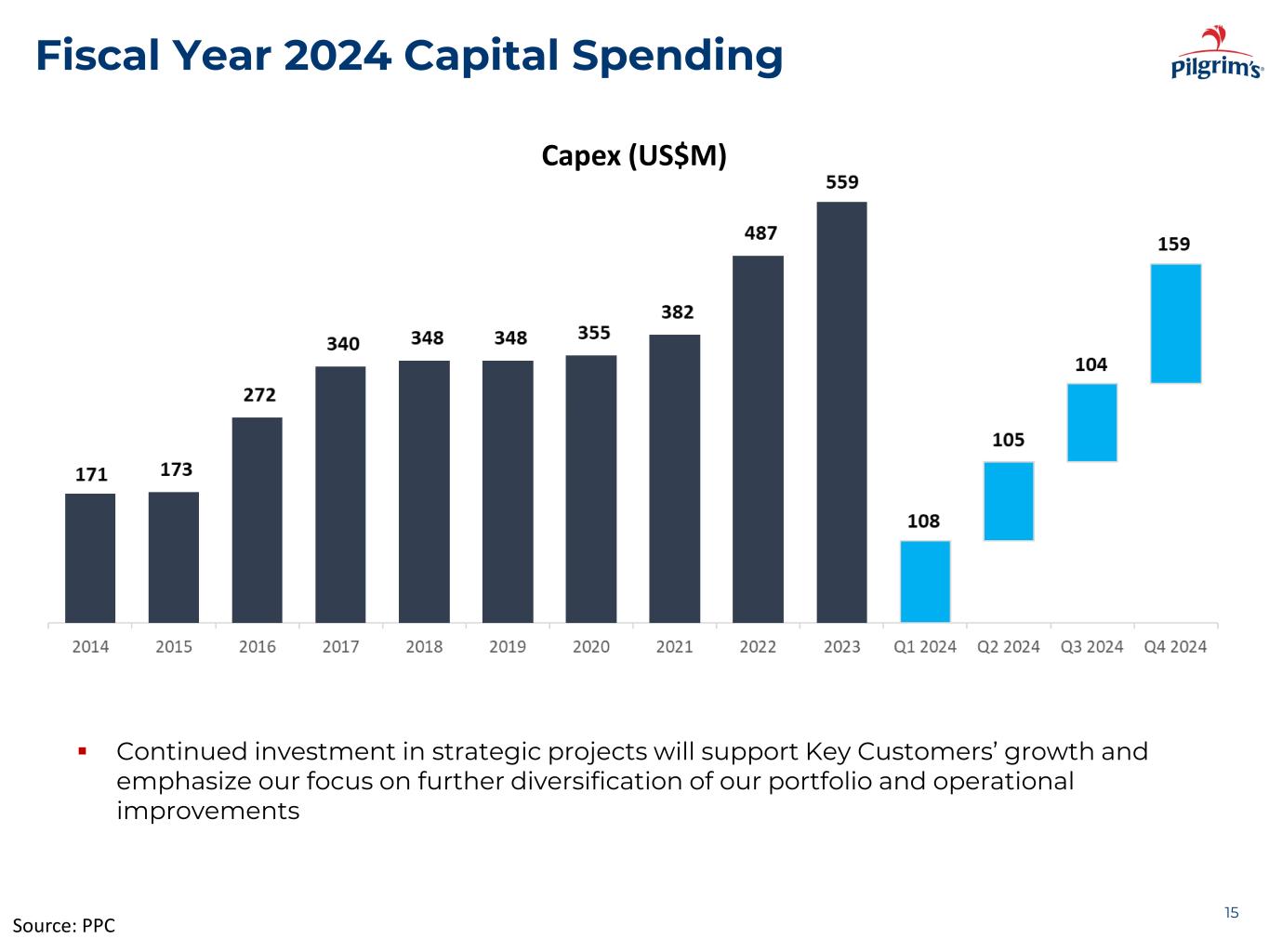

Fiscal Year 2024 Capital Spending 15 Capex (US$M) Source: PPC Continued investment in strategic projects will support Key Customers’ growth and emphasize our focus on further diversification of our portfolio and operational improvements

APPENDIX 16

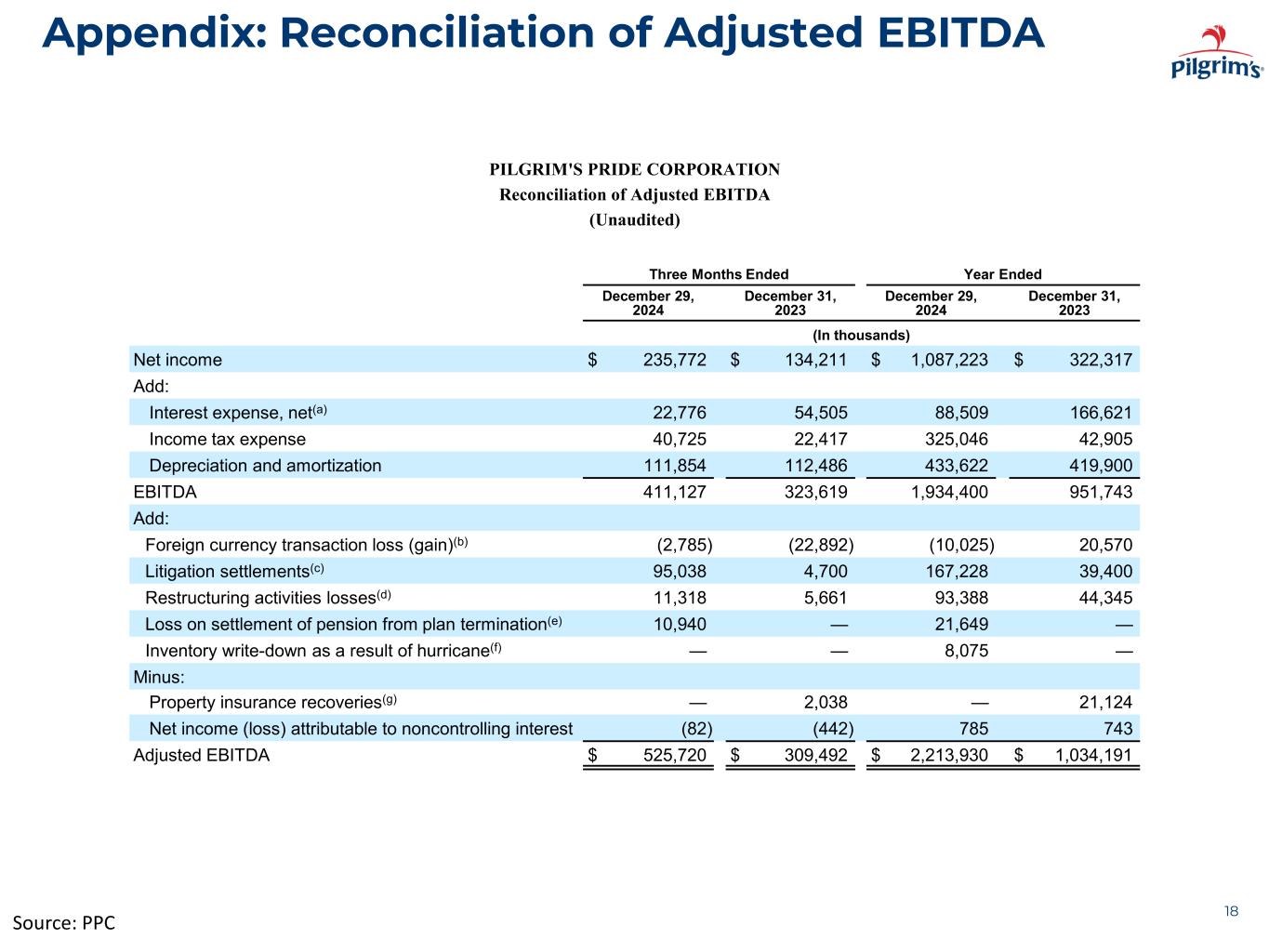

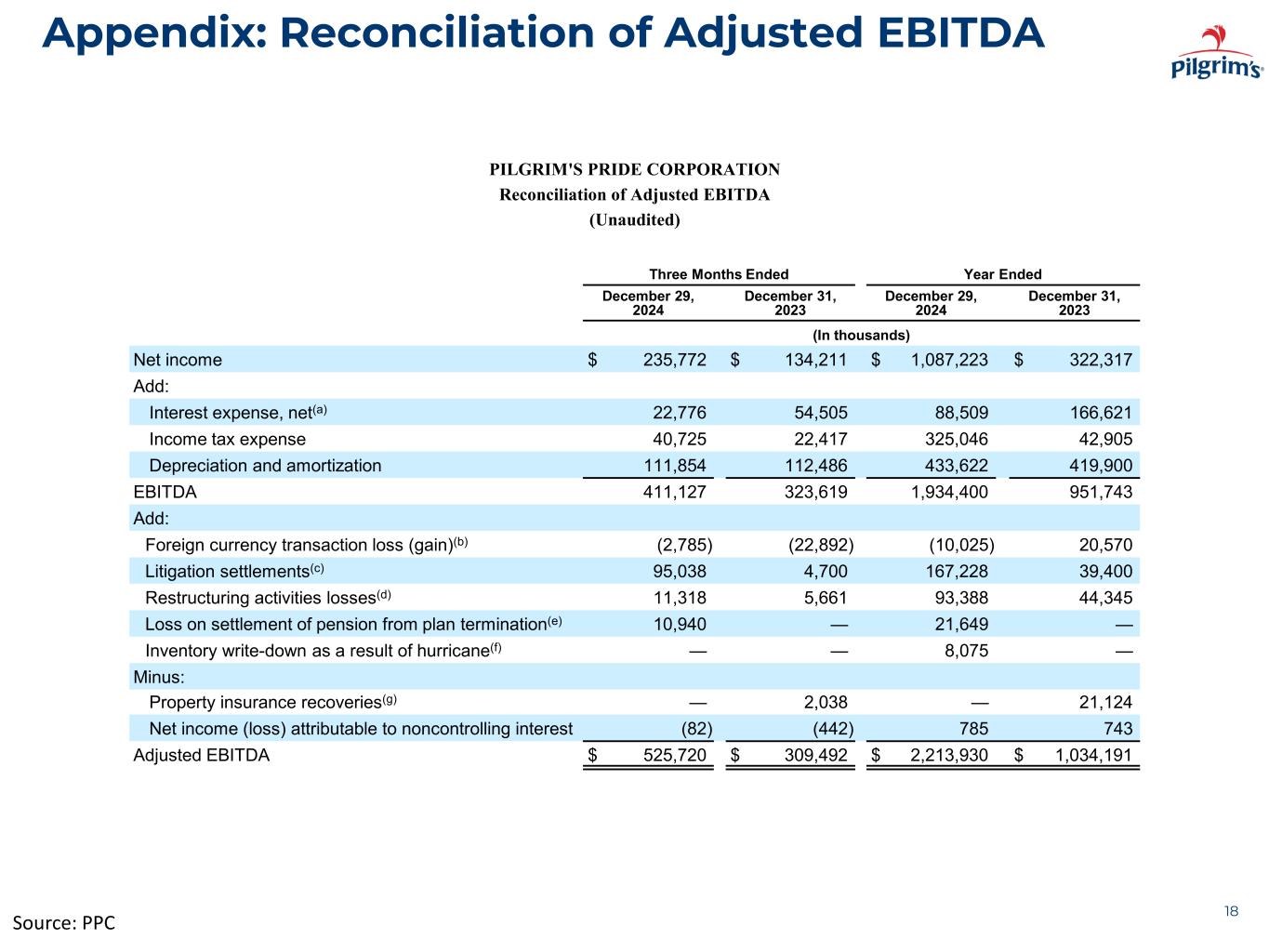

Appendix: Reconciliation of Adjusted EBITDA 17 Source: PPC “EBITDA” is defined as the sum of net income (loss) plus interest, taxes, depreciation and amortization. “Adjusted EBITDA” is calculated by adding to EBITDA certain items of expense and deducting from EBITDA certain items of income that we believe are not indicative of our ongoing operating performance consisting of: (1) foreign currency transaction losses (gains), (2) costs related to litigation settlements, (3) restructuring activities losses, (4) loss on settlement of pension from plan termination, (5) inventory write- down as a result of hurricane, and (6) net income attributable to noncontrolling interest. EBITDA is presented because it is used by management and we believe it is frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of results prepared in conformity with accounting principles generally accepted in the U.S. (“U.S. GAAP”), to compare the performance of companies. We believe investors would be interested in our Adjusted EBITDA because this is how our management analyzes EBITDA applicable to continuing operations. The Company also believes that Adjusted EBITDA, in combination with the Company’s financial results calculated in accordance with U.S. GAAP, provides investors with additional perspective regarding the impact of certain significant items on EBITDA and facilitates a more direct comparison of its performance with its competitors. EBITDA and Adjusted EBITDA are not measurements of financial performance under U.S. GAAP. EBITDA and Adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as substitutes for an analysis of our results as reported under U.S. GAAP. In addition, other companies in our industry may calculate these measures differently limiting their usefulness as a comparative measure. Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as an alternative to net income as indicators of our operating performance or any other measures of performance derived in accordance with U.S. GAAP. These limitations should be compensated for by relying primarily on our U.S. GAAP results and using EBITDA and Adjusted EBITDA only on a supplemental basis.

Appendix: Reconciliation of Adjusted EBITDA 18Source: PPC PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted EBITDA (Unaudited) Three Months Ended Year Ended December 29, 2024 December 31, 2023 December 29, 2024 December 31, 2023 (In thousands) Net income $ 235,772 $ 134,211 $ 1,087,223 $ 322,317 Add: Interest expense, net(a) 22,776 54,505 88,509 166,621 Income tax expense 40,725 22,417 325,046 42,905 Depreciation and amortization 111,854 112,486 433,622 419,900 EBITDA 411,127 323,619 1,934,400 951,743 Add: Foreign currency transaction loss (gain)(b) (2,785) (22,892) (10,025) 20,570 Litigation settlements(c) 95,038 4,700 167,228 39,400 Restructuring activities losses(d) 11,318 5,661 93,388 44,345 Loss on settlement of pension from plan termination(e) 10,940 — 21,649 — Inventory write-down as a result of hurricane(f) — — 8,075 — Minus: Property insurance recoveries(g) — 2,038 — 21,124 Net income (loss) attributable to noncontrolling interest (82) (442) 785 743 Adjusted EBITDA $ 525,720 $ 309,492 $ 2,213,930 $ 1,034,191

Appendix: Reconciliation of Adjusted EBITDA 19 Source: PPC a. Interest expense, net, consists of interest expense less interest income. b. Prior to April 1, 2024, the Company measures the financial statements of its Mexico reportable segment as if the U.S. dollar were the functional currency. Accordingly, we remeasure assets and liabilities, other than nonmonetary assets, of the Mexico reportable segment at current exchange rates. We remeasure nonmonetary assets using the historical exchange rate in effect on the date of each asset’s acquisition. Currency exchange gains or losses resulting from these remeasurements were previously recognized in the line item Foreign currency transaction losses (gains) in the Condensed Consolidated Statements of Income. Effective April 1, 2024, the Company changed the functional currency of its Mexico reportable segment from U.S. dollar to Mexican peso, which means all translation gains/losses on outstanding balances are now recognized in accumulated other comprehensive income. Transactional functional currency gains/losses are included in the line item Foreign currency transaction losses (gains) in the Condensed Consolidated Statements of Income. c. This represents expenses recognized in anticipation of probable settlements in ongoing litigation. d. Restructuring activities losses are related to costs incurred, such as severance, asset impairment, contract termination, and others, as part of multiple ongoing restructuring initiatives throughout our Europe reportable segment. e. This represents a loss recognized on the settlement of pension plan obligations related to an ongoing plan termination of our two U.S. defined benefit plans. f. This primarily represents broiler losses incurred as a result of Hurricane Helene in late September 2024. g. This represents property insurance recoveries primarily for the property damage losses incurred as a result of the tornado in Mayfield, KY in December 2021.

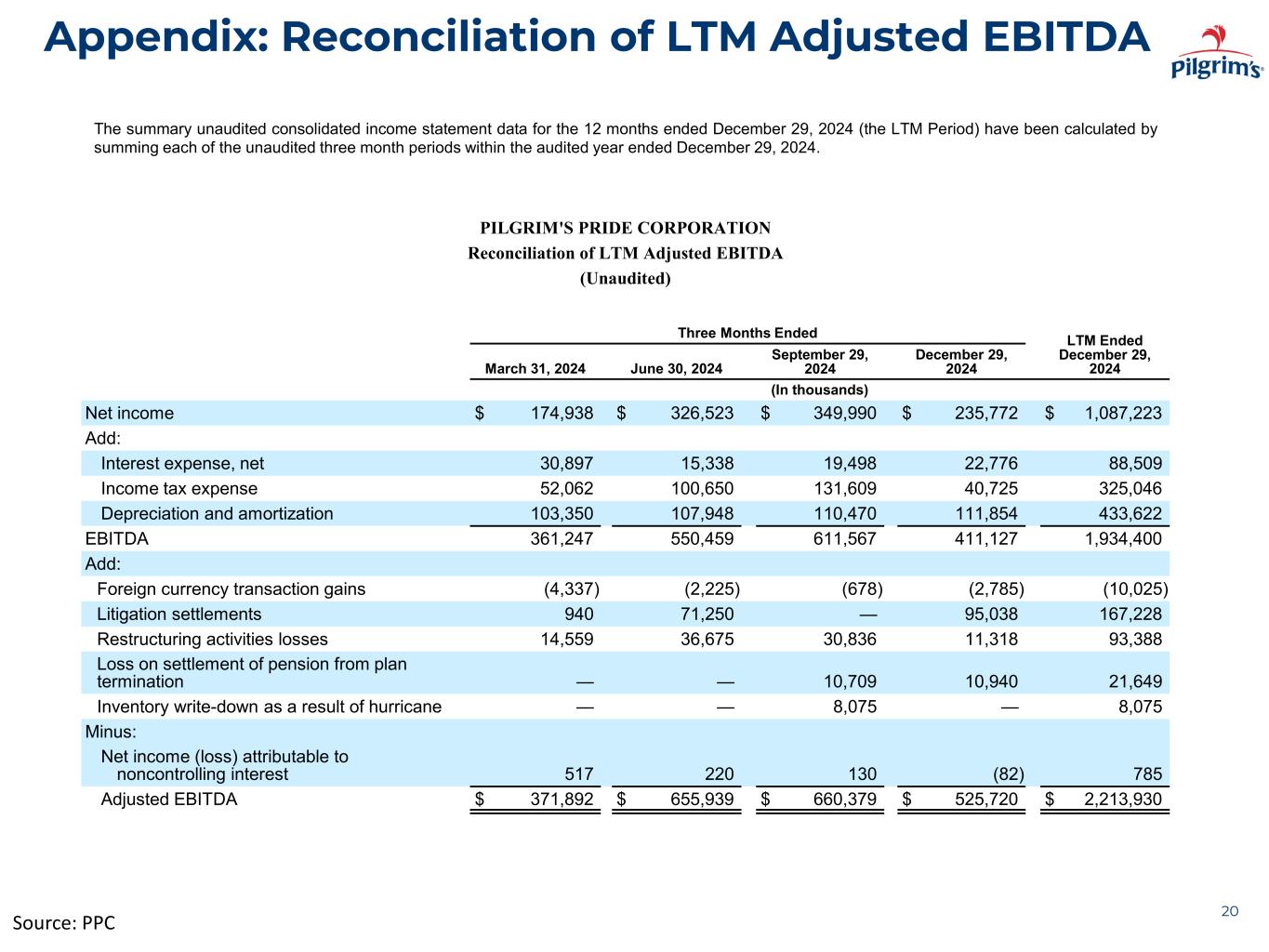

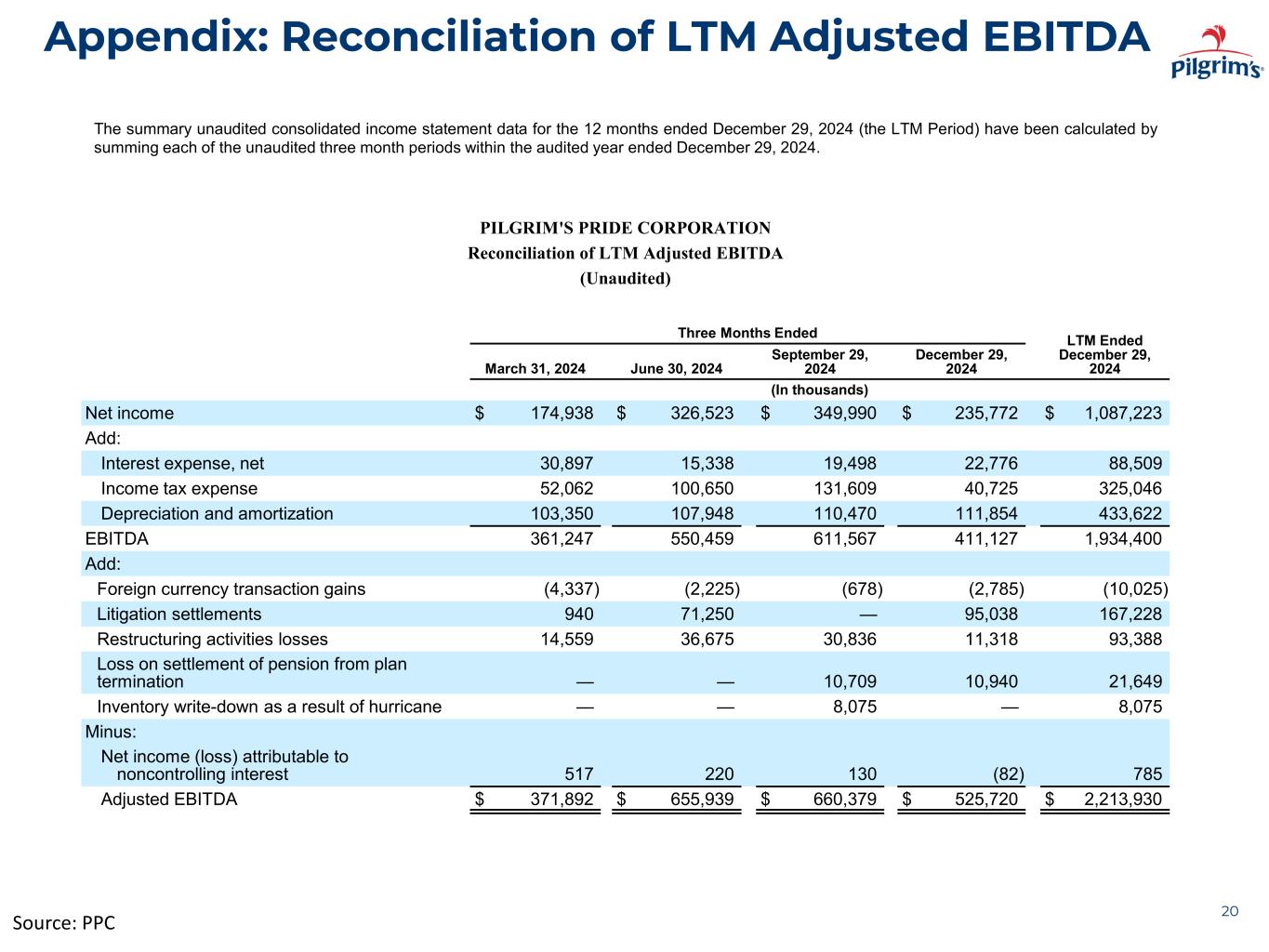

Appendix: Reconciliation of LTM Adjusted EBITDA 20Source: PPC The summary unaudited consolidated income statement data for the 12 months ended December 29, 2024 (the LTM Period) have been calculated by summing each of the unaudited three month periods within the audited year ended December 29, 2024. PILGRIM'S PRIDE CORPORATION Reconciliation of LTM Adjusted EBITDA (Unaudited) Three Months Ended LTM Ended December 29, 2024March 31, 2024 June 30, 2024 September 29, 2024 December 29, 2024 (In thousands) Net income $ 174,938 $ 326,523 $ 349,990 $ 235,772 $ 1,087,223 Add: Interest expense, net 30,897 15,338 19,498 22,776 88,509 Income tax expense 52,062 100,650 131,609 40,725 325,046 Depreciation and amortization 103,350 107,948 110,470 111,854 433,622 EBITDA 361,247 550,459 611,567 411,127 1,934,400 Add: Foreign currency transaction gains (4,337) (2,225) (678) (2,785) (10,025) Litigation settlements 940 71,250 — 95,038 167,228 Restructuring activities losses 14,559 36,675 30,836 11,318 93,388 Loss on settlement of pension from plan termination — — 10,709 10,940 21,649 Inventory write-down as a result of hurricane — — 8,075 — 8,075 Minus: Net income (loss) attributable to noncontrolling interest 517 220 130 (82) 785 Adjusted EBITDA $ 371,892 $ 655,939 $ 660,379 $ 525,720 $ 2,213,930

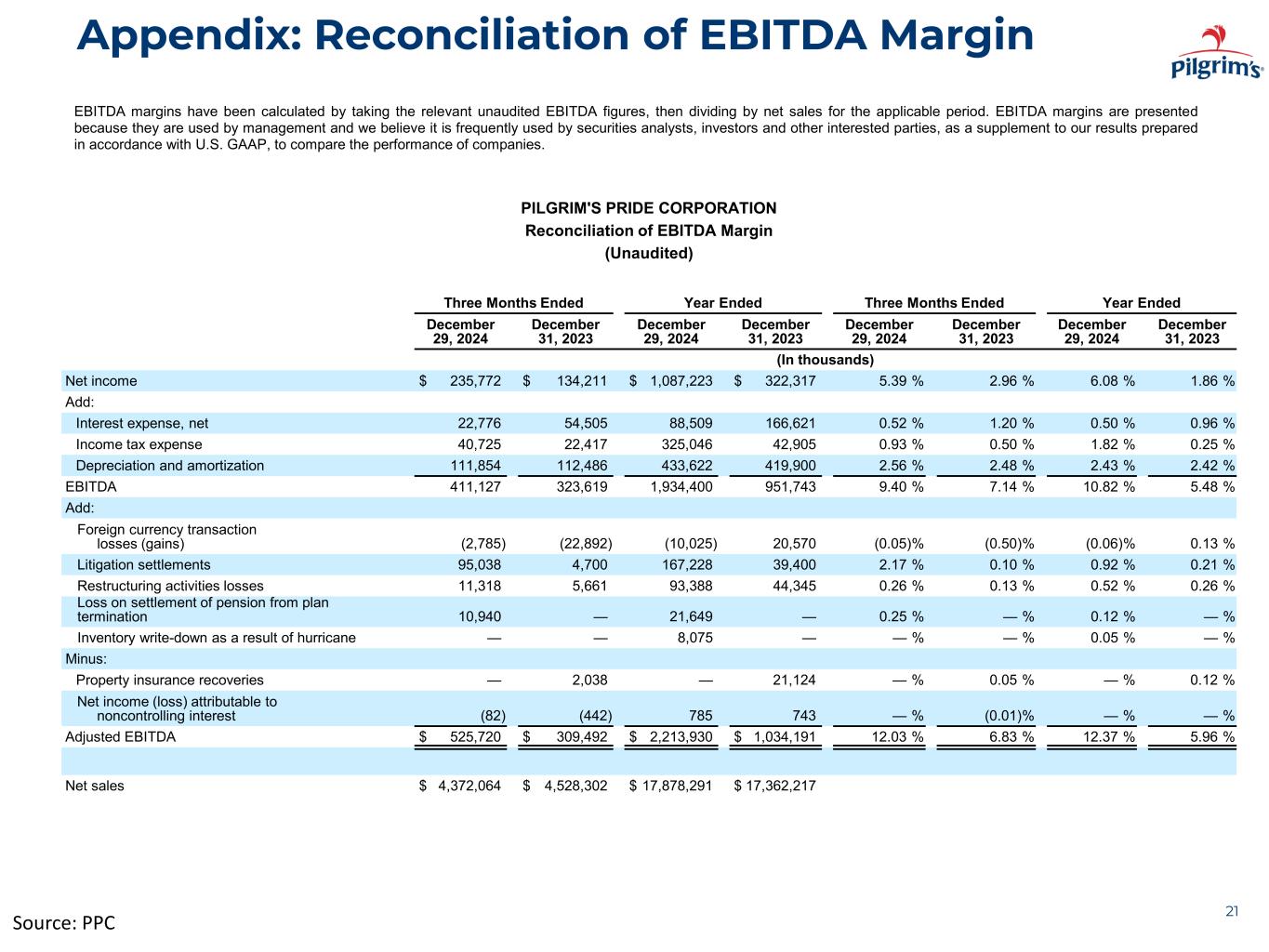

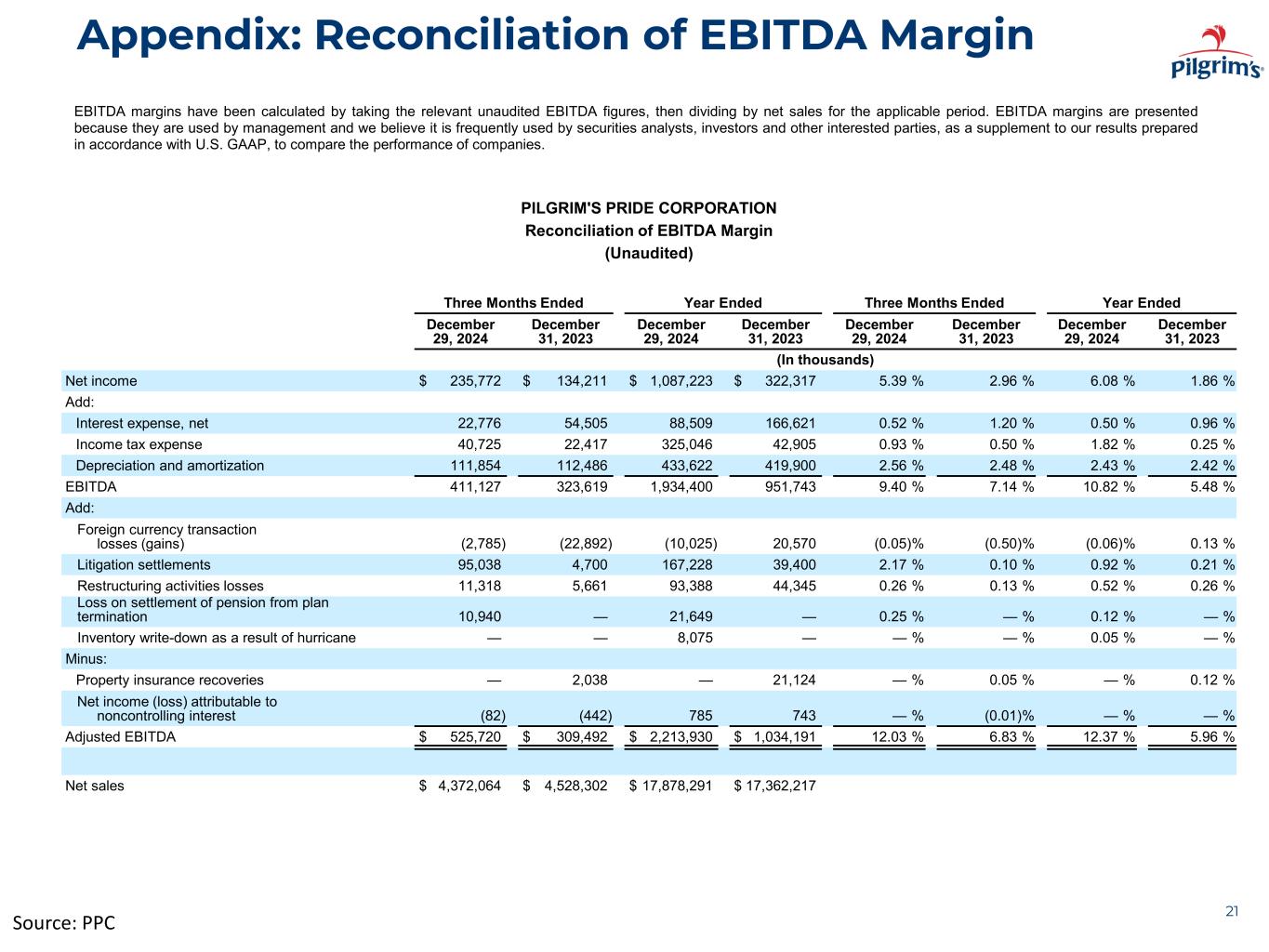

Appendix: Reconciliation of EBITDA Margin 21Source: PPC EBITDA margins have been calculated by taking the relevant unaudited EBITDA figures, then dividing by net sales for the applicable period. EBITDA margins are presented because they are used by management and we believe it is frequently used by securities analysts, investors and other interested parties, as a supplement to our results prepared in accordance with U.S. GAAP, to compare the performance of companies. PILGRIM'S PRIDE CORPORATION Reconciliation of EBITDA Margin (Unaudited) Three Months Ended Year Ended Three Months Ended Year Ended December 29, 2024 December 31, 2023 December 29, 2024 December 31, 2023 December 29, 2024 December 31, 2023 December 29, 2024 December 31, 2023 (In thousands) Net income $ 235,772 $ 134,211 $ 1,087,223 $ 322,317 5.39 % 2.96 % 6.08 % 1.86 % Add: Interest expense, net 22,776 54,505 88,509 166,621 0.52 % 1.20 % 0.50 % 0.96 % Income tax expense 40,725 22,417 325,046 42,905 0.93 % 0.50 % 1.82 % 0.25 % Depreciation and amortization 111,854 112,486 433,622 419,900 2.56 % 2.48 % 2.43 % 2.42 % EBITDA 411,127 323,619 1,934,400 951,743 9.40 % 7.14 % 10.82 % 5.48 % Add: Foreign currency transaction losses (gains) (2,785) (22,892) (10,025) 20,570 (0.05)% (0.50)% (0.06)% 0.13 % Litigation settlements 95,038 4,700 167,228 39,400 2.17 % 0.10 % 0.92 % 0.21 % Restructuring activities losses 11,318 5,661 93,388 44,345 0.26 % 0.13 % 0.52 % 0.26 % Loss on settlement of pension from plan termination 10,940 — 21,649 — 0.25 % — % 0.12 % — % Inventory write-down as a result of hurricane — — 8,075 — — % — % 0.05 % — % Minus: Property insurance recoveries — 2,038 — 21,124 — % 0.05 % — % 0.12 % Net income (loss) attributable to noncontrolling interest (82) (442) 785 743 — % (0.01)% — % — % Adjusted EBITDA $ 525,720 $ 309,492 $ 2,213,930 $ 1,034,191 12.03 % 6.83 % 12.37 % 5.96 % Net sales $ 4,372,064 $ 4,528,302 $ 17,878,291 $ 17,362,217

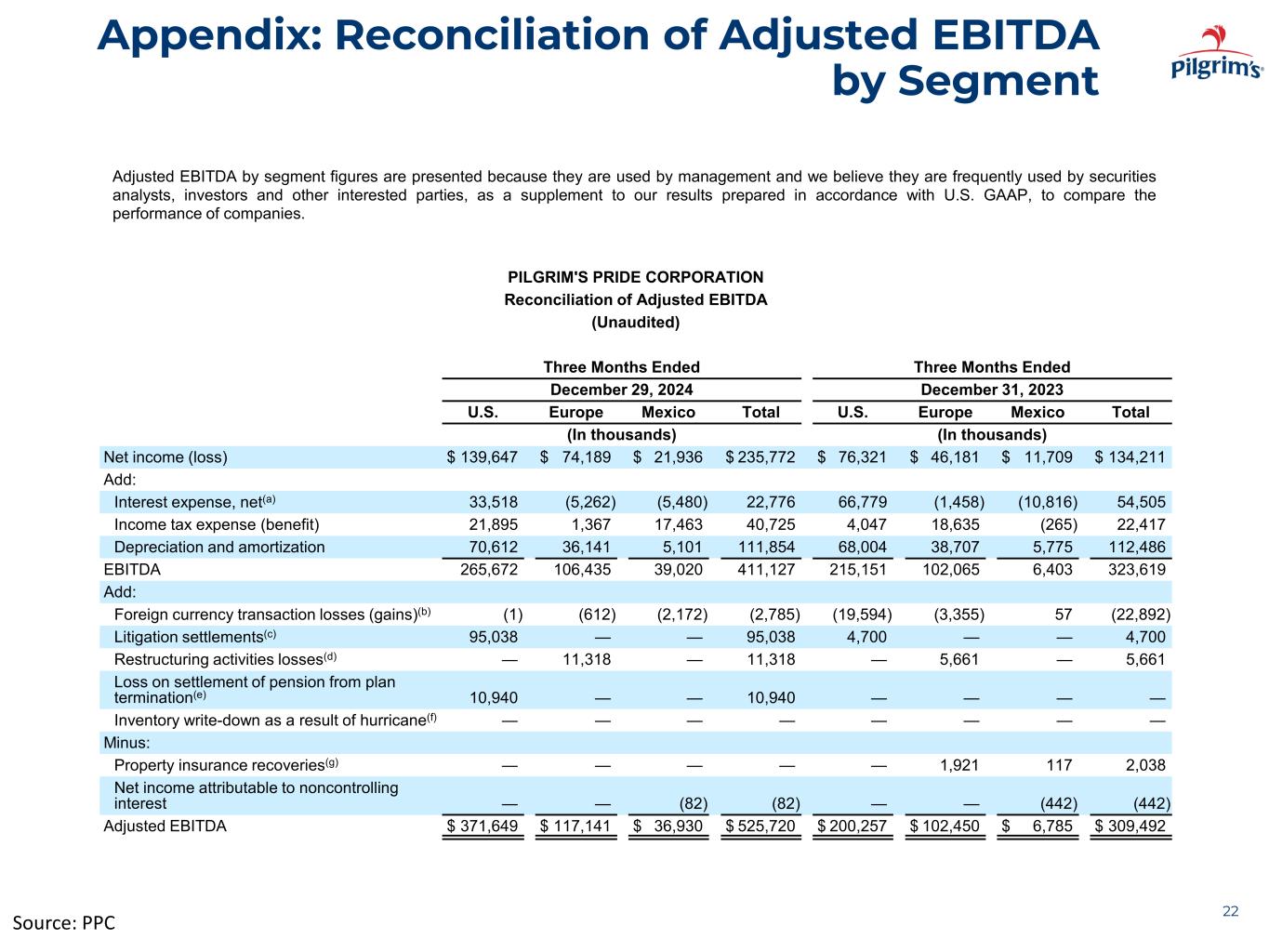

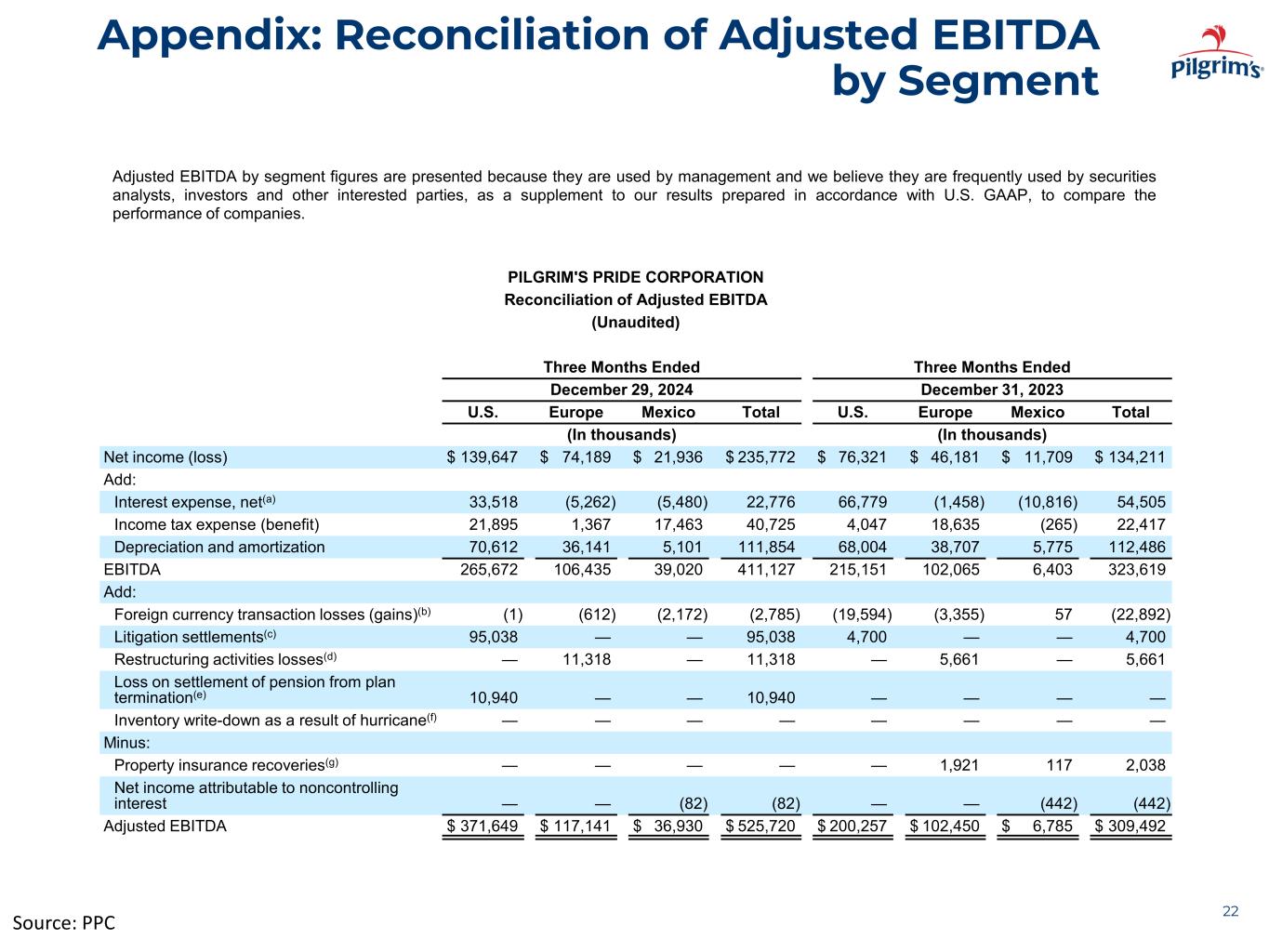

Appendix: Reconciliation of Adjusted EBITDA by Segment 22Source: PPC PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted EBITDA (Unaudited) Three Months Ended Three Months Ended December 29, 2024 December 31, 2023 U.S. Europe Mexico Total U.S. Europe Mexico Total (In thousands) (In thousands) Net income (loss) $ 139,647 $ 74,189 $ 21,936 $ 235,772 $ 76,321 $ 46,181 $ 11,709 $ 134,211 Add: Interest expense, net(a) 33,518 (5,262) (5,480) 22,776 66,779 (1,458) (10,816) 54,505 Income tax expense (benefit) 21,895 1,367 17,463 40,725 4,047 18,635 (265) 22,417 Depreciation and amortization 70,612 36,141 5,101 111,854 68,004 38,707 5,775 112,486 EBITDA 265,672 106,435 39,020 411,127 215,151 102,065 6,403 323,619 Add: Foreign currency transaction losses (gains)(b) (1) (612) (2,172) (2,785) (19,594) (3,355) 57 (22,892) Litigation settlements(c) 95,038 — — 95,038 4,700 — — 4,700 Restructuring activities losses(d) — 11,318 — 11,318 — 5,661 — 5,661 Loss on settlement of pension from plan termination(e) 10,940 — — 10,940 — — — — Inventory write-down as a result of hurricane(f) — — — — — — — — Minus: Property insurance recoveries(g) — — — — — 1,921 117 2,038 Net income attributable to noncontrolling interest — — (82) (82) — — (442) (442) Adjusted EBITDA $ 371,649 $ 117,141 $ 36,930 $ 525,720 $ 200,257 $ 102,450 $ 6,785 $ 309,492 Adjusted EBITDA by segment figures are presented because they are used by management and we believe they are frequently used by securities analysts, investors and other interested parties, as a supplement to our results prepared in accordance with U.S. GAAP, to compare the performance of companies.

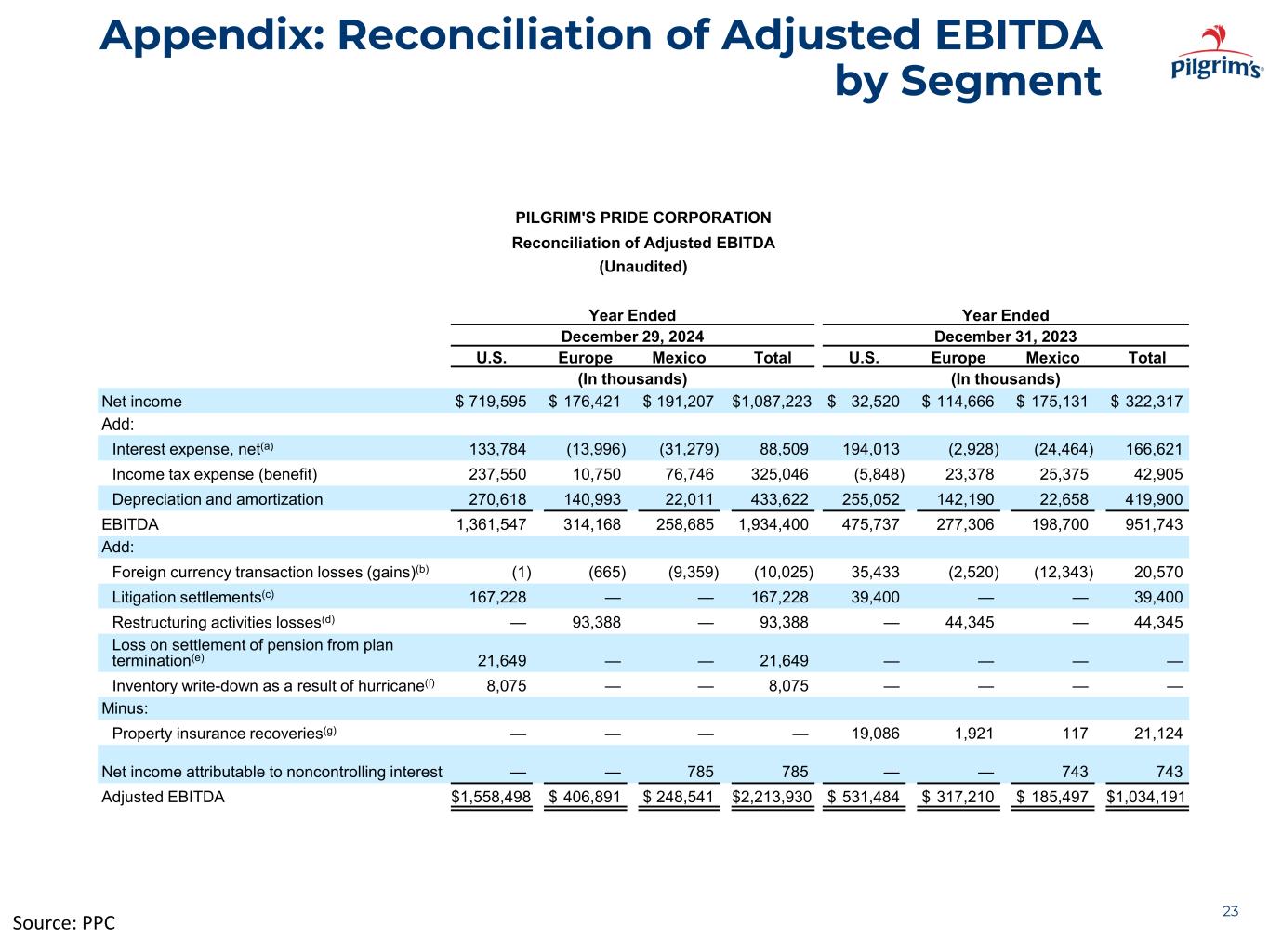

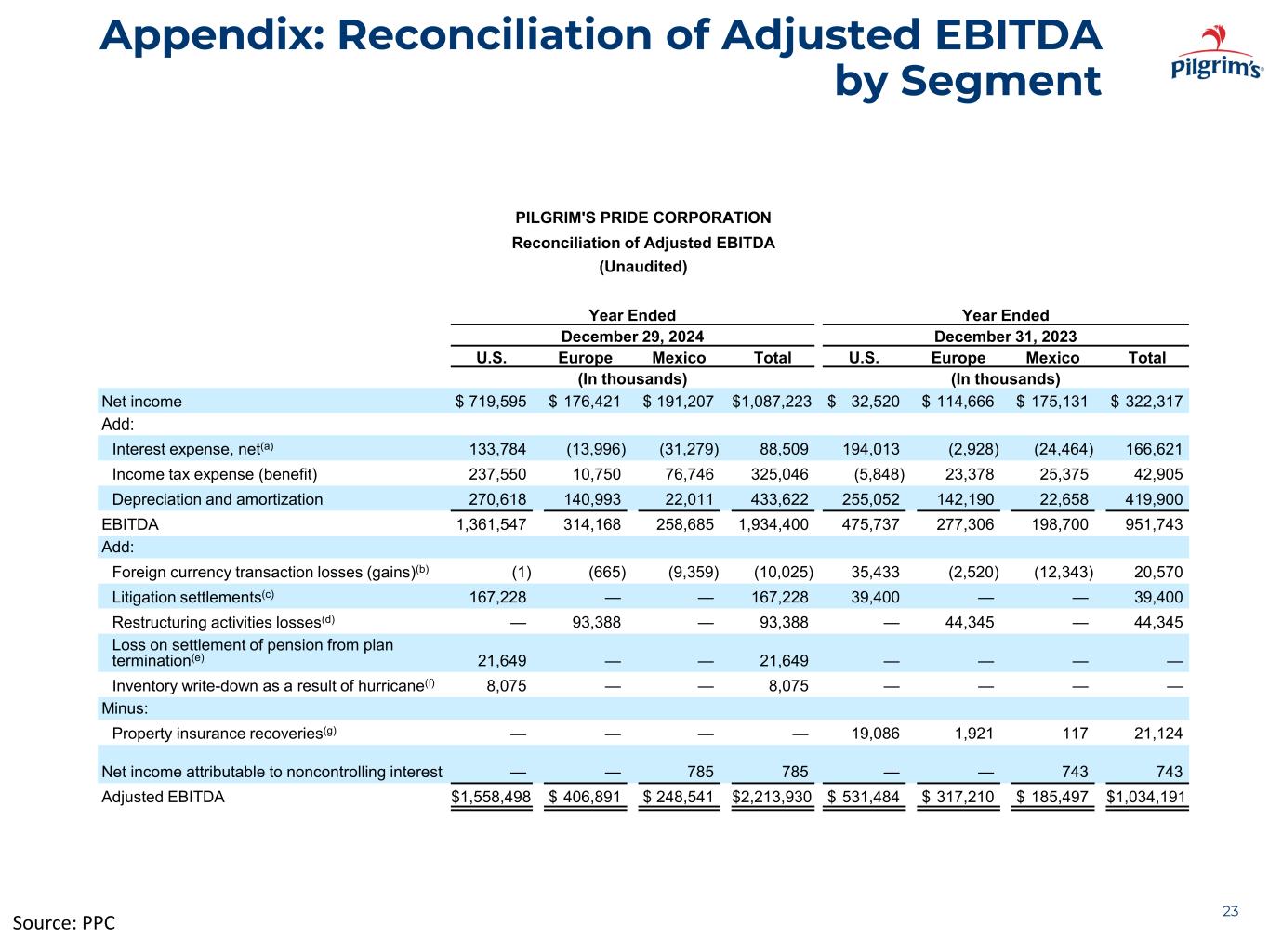

Appendix: Reconciliation of Adjusted EBITDA by Segment 23Source: PPC PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted EBITDA (Unaudited) Year Ended Year Ended December 29, 2024 December 31, 2023 U.S. Europe Mexico Total U.S. Europe Mexico Total (In thousands) (In thousands) Net income $ 719,595 $ 176,421 $ 191,207 $1,087,223 $ 32,520 $ 114,666 $ 175,131 $ 322,317 Add: Interest expense, net(a) 133,784 (13,996) (31,279) 88,509 194,013 (2,928) (24,464) 166,621 Income tax expense (benefit) 237,550 10,750 76,746 325,046 (5,848) 23,378 25,375 42,905 Depreciation and amortization 270,618 140,993 22,011 433,622 255,052 142,190 22,658 419,900 EBITDA 1,361,547 314,168 258,685 1,934,400 475,737 277,306 198,700 951,743 Add: Foreign currency transaction losses (gains)(b) (1) (665) (9,359) (10,025) 35,433 (2,520) (12,343) 20,570 Litigation settlements(c) 167,228 — — 167,228 39,400 — — 39,400 Restructuring activities losses(d) — 93,388 — 93,388 — 44,345 — 44,345 Loss on settlement of pension from plan termination(e) 21,649 — — 21,649 — — — — Inventory write-down as a result of hurricane(f) 8,075 — — 8,075 — — — — Minus: Property insurance recoveries(g) — — — — 19,086 1,921 117 21,124 Net income attributable to noncontrolling interest — — 785 785 — — 743 743 Adjusted EBITDA $1,558,498 $ 406,891 $ 248,541 $2,213,930 $ 531,484 $ 317,210 $ 185,497 $1,034,191

Appendix: Reconciliation of Adjusted EBITDA 24 Source: PPC a. Interest expense, net, consists of interest expense less interest income. b. Prior to April 1, 2024, the Company measures the financial statements of its Mexico reportable segment as if the U.S. dollar were the functional currency. Accordingly, we remeasure assets and liabilities, other than nonmonetary assets, of the Mexico reportable segment at current exchange rates. We remeasure nonmonetary assets using the historical exchange rate in effect on the date of each asset’s acquisition. Currency exchange gains or losses resulting from these remeasurements were previously recognized in the line item Foreign currency transaction losses (gains) in the Condensed Consolidated Statements of Income. Effective April 1, 2024, the Company changed the functional currency of its Mexico reportable segment from U.S. dollar to Mexican peso, which means all translation gains/losses on outstanding balances are now recognized in accumulated other comprehensive income. Transactional functional currency gains/losses are included in the line item Foreign currency transaction losses (gains) in the Condensed Consolidated Statements of Income. c. This represents expenses recognized in anticipation of probable settlements in ongoing litigation. d. Restructuring activities losses are related to costs incurred, such as severance, asset impairment, contract termination, and others, as part of multiple ongoing restructuring initiatives throughout our Europe reportable segment. e. This represents a loss recognized on the settlement of pension plan obligations related to an ongoing plan termination of our two U.S. defined benefit plans. f. This primarily represents broiler losses incurred as a result of Hurricane Helene in late September 2024. g. This represents property insurance recoveries primarily for the property damage losses incurred as a result of the tornado in Mayfield, KY in December 2021.

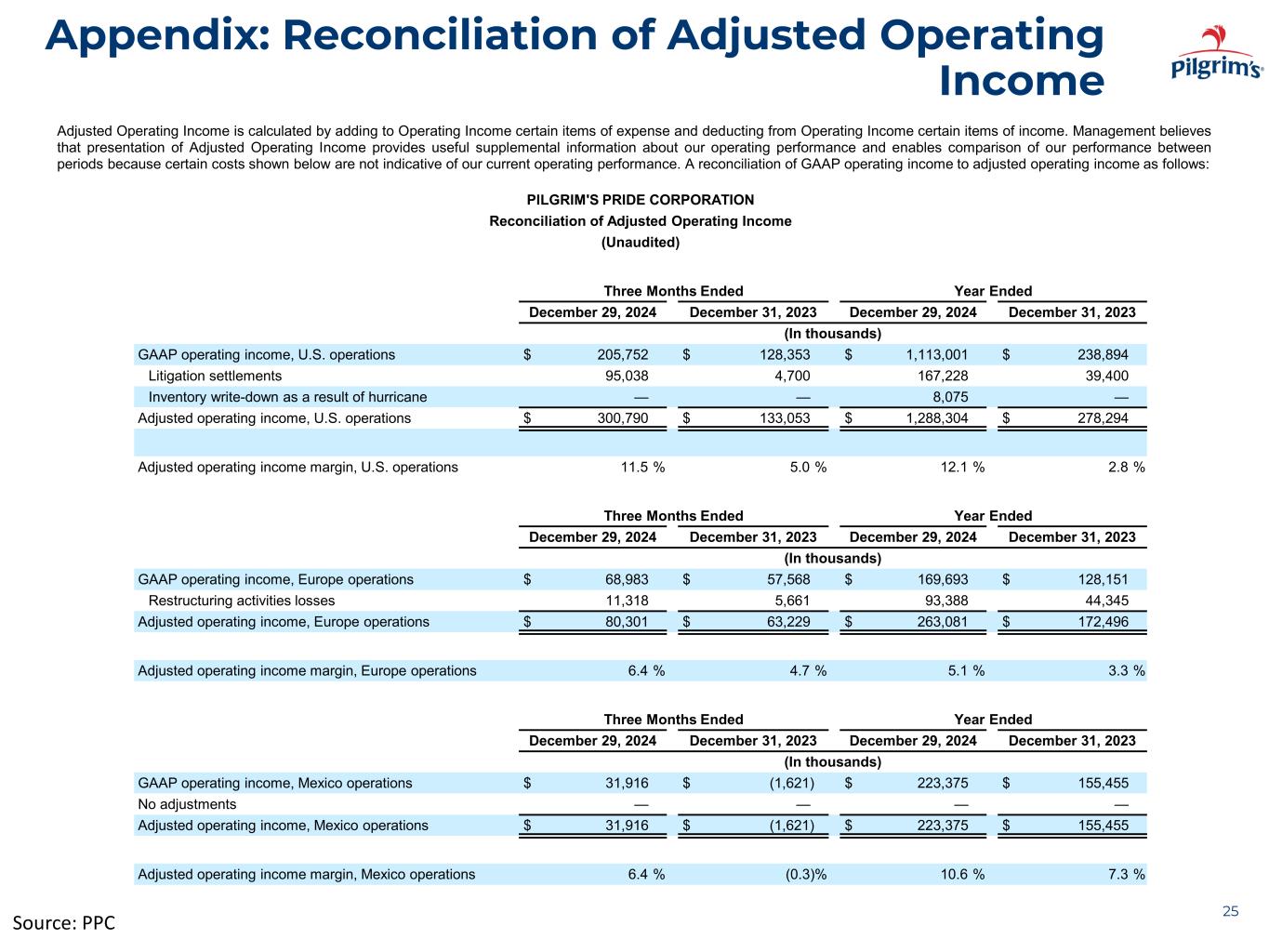

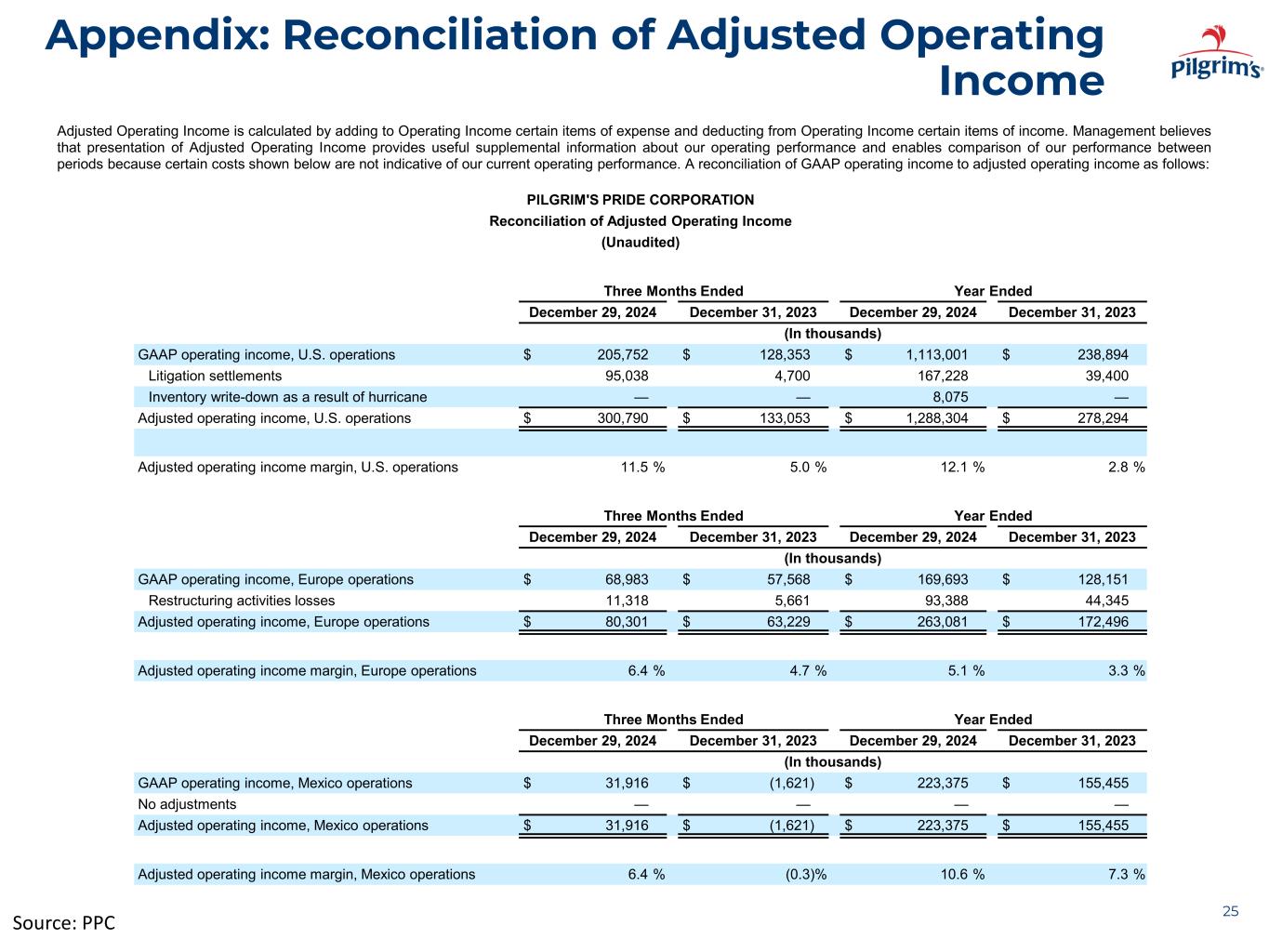

Appendix: Reconciliation of Adjusted Operating Income 25Source: PPC Adjusted Operating Income is calculated by adding to Operating Income certain items of expense and deducting from Operating Income certain items of income. Management believes that presentation of Adjusted Operating Income provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of GAAP operating income to adjusted operating income as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted Operating Income (Unaudited) Three Months Ended Year Ended December 29, 2024 December 31, 2023 December 29, 2024 December 31, 2023 (In thousands) GAAP operating income, U.S. operations $ 205,752 $ 128,353 $ 1,113,001 $ 238,894 Litigation settlements 95,038 4,700 167,228 39,400 Inventory write-down as a result of hurricane — — 8,075 — Adjusted operating income, U.S. operations $ 300,790 $ 133,053 $ 1,288,304 $ 278,294 Adjusted operating income margin, U.S. operations 11.5 % 5.0 % 12.1 % 2.8 % Three Months Ended Year Ended December 29, 2024 December 31, 2023 December 29, 2024 December 31, 2023 (In thousands) GAAP operating income, Europe operations $ 68,983 $ 57,568 $ 169,693 $ 128,151 Restructuring activities losses 11,318 5,661 93,388 44,345 Adjusted operating income, Europe operations $ 80,301 $ 63,229 $ 263,081 $ 172,496 Adjusted operating income margin, Europe operations 6.4 % 4.7 % 5.1 % 3.3 % Three Months Ended Year Ended December 29, 2024 December 31, 2023 December 29, 2024 December 31, 2023 (In thousands) GAAP operating income, Mexico operations $ 31,916 $ (1,621) $ 223,375 $ 155,455 No adjustments — — — — Adjusted operating income, Mexico operations $ 31,916 $ (1,621) $ 223,375 $ 155,455 Adjusted operating income margin, Mexico operations 6.4 % (0.3)% 10.6 % 7.3 %

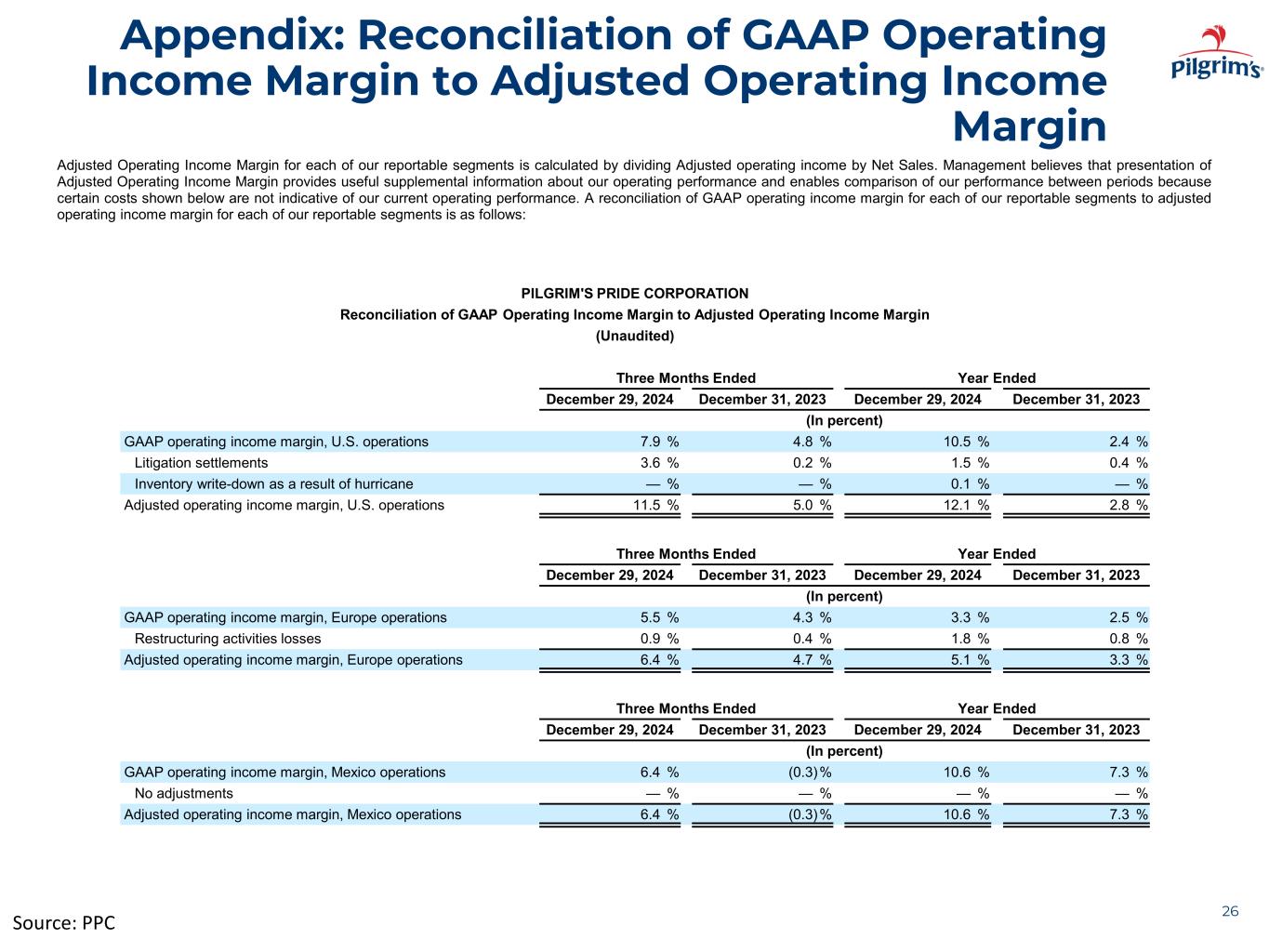

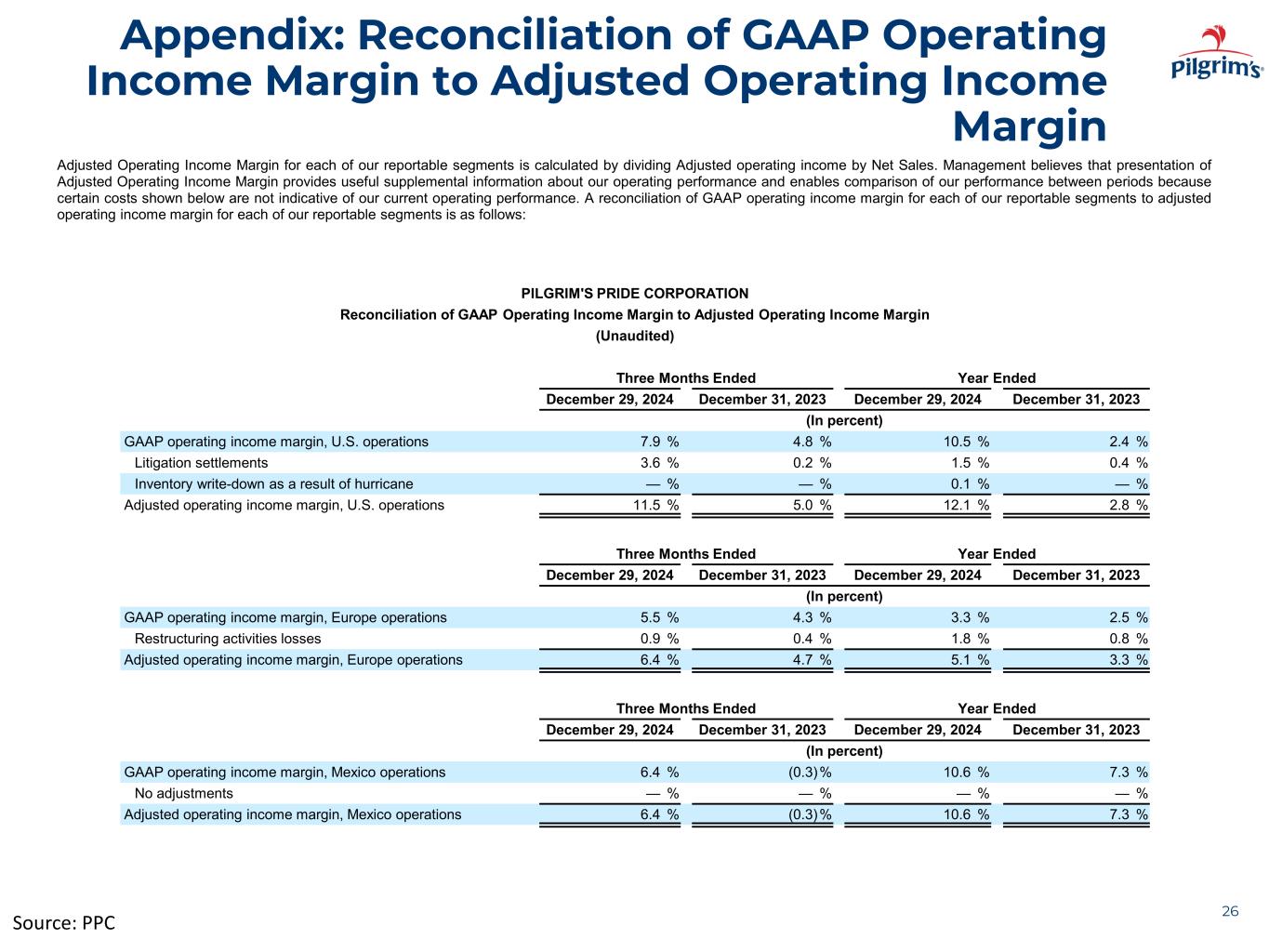

Appendix: Reconciliation of GAAP Operating Income Margin to Adjusted Operating Income Margin 26Source: PPC Adjusted Operating Income Margin for each of our reportable segments is calculated by dividing Adjusted operating income by Net Sales. Management believes that presentation of Adjusted Operating Income Margin provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of GAAP operating income margin for each of our reportable segments to adjusted operating income margin for each of our reportable segments is as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of GAAP Operating Income Margin to Adjusted Operating Income Margin (Unaudited) Three Months Ended Year Ended December 29, 2024 December 31, 2023 December 29, 2024 December 31, 2023 (In percent) GAAP operating income margin, U.S. operations 7.9 % 4.8 % 10.5 % 2.4 % Litigation settlements 3.6 % 0.2 % 1.5 % 0.4 % Inventory write-down as a result of hurricane — % — % 0.1 % — % Adjusted operating income margin, U.S. operations 11.5 % 5.0 % 12.1 % 2.8 % Three Months Ended Year Ended December 29, 2024 December 31, 2023 December 29, 2024 December 31, 2023 (In percent) GAAP operating income margin, Europe operations 5.5 % 4.3 % 3.3 % 2.5 % Restructuring activities losses 0.9 % 0.4 % 1.8 % 0.8 % Adjusted operating income margin, Europe operations 6.4 % 4.7 % 5.1 % 3.3 % Three Months Ended Year Ended December 29, 2024 December 31, 2023 December 29, 2024 December 31, 2023 (In percent) GAAP operating income margin, Mexico operations 6.4 % (0.3)% 10.6 % 7.3 % No adjustments — % — % — % — % Adjusted operating income margin, Mexico operations 6.4 % (0.3)% 10.6 % 7.3 %

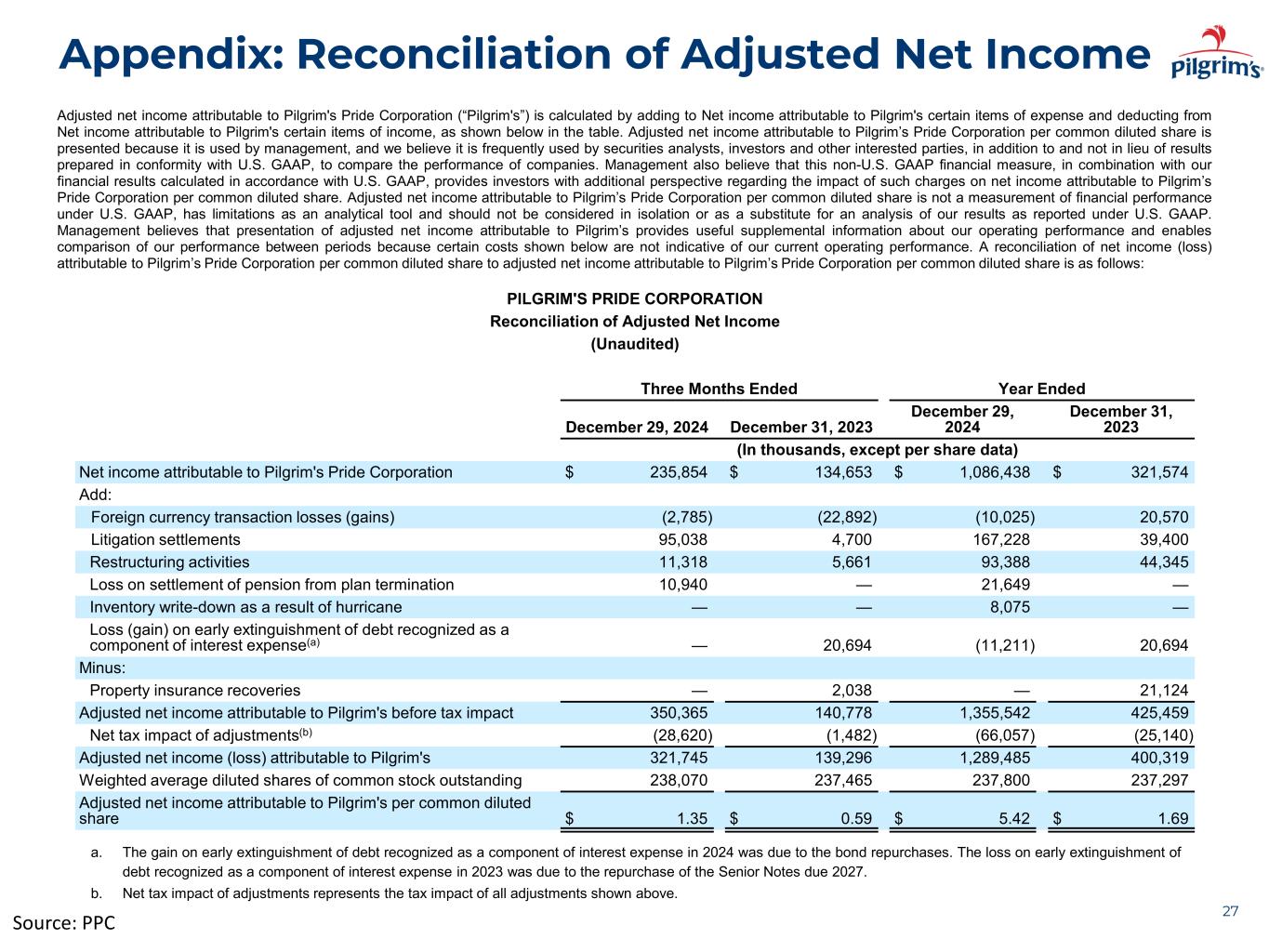

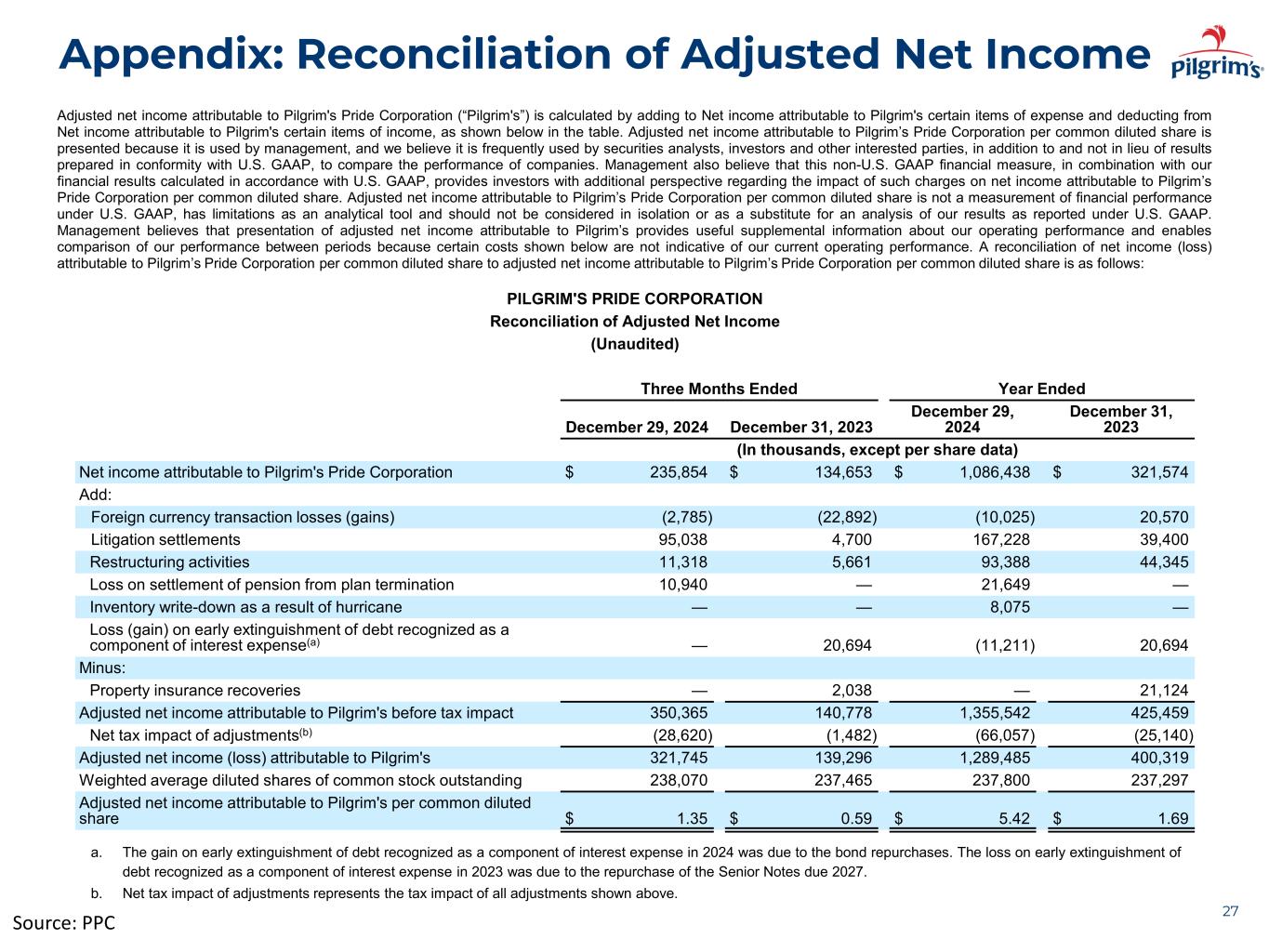

Appendix: Reconciliation of Adjusted Net Income 27Source: PPC Adjusted net income attributable to Pilgrim's Pride Corporation (“Pilgrim's”) is calculated by adding to Net income attributable to Pilgrim's certain items of expense and deducting from Net income attributable to Pilgrim's certain items of income, as shown below in the table. Adjusted net income attributable to Pilgrim’s Pride Corporation per common diluted share is presented because it is used by management, and we believe it is frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of results prepared in conformity with U.S. GAAP, to compare the performance of companies. Management also believe that this non-U.S. GAAP financial measure, in combination with our financial results calculated in accordance with U.S. GAAP, provides investors with additional perspective regarding the impact of such charges on net income attributable to Pilgrim’s Pride Corporation per common diluted share. Adjusted net income attributable to Pilgrim’s Pride Corporation per common diluted share is not a measurement of financial performance under U.S. GAAP, has limitations as an analytical tool and should not be considered in isolation or as a substitute for an analysis of our results as reported under U.S. GAAP. Management believes that presentation of adjusted net income attributable to Pilgrim’s provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of net income (loss) attributable to Pilgrim’s Pride Corporation per common diluted share to adjusted net income attributable to Pilgrim’s Pride Corporation per common diluted share is as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of Adjusted Net Income (Unaudited) Three Months Ended Year Ended December 29, 2024 December 31, 2023 December 29, 2024 December 31, 2023 (In thousands, except per share data) Net income attributable to Pilgrim's Pride Corporation $ 235,854 $ 134,653 $ 1,086,438 $ 321,574 Add: Foreign currency transaction losses (gains) (2,785) (22,892) (10,025) 20,570 Litigation settlements 95,038 4,700 167,228 39,400 Restructuring activities 11,318 5,661 93,388 44,345 Loss on settlement of pension from plan termination 10,940 — 21,649 — Inventory write-down as a result of hurricane — — 8,075 — Loss (gain) on early extinguishment of debt recognized as a component of interest expense(a) — 20,694 (11,211) 20,694 Minus: Property insurance recoveries — 2,038 — 21,124 Adjusted net income attributable to Pilgrim's before tax impact 350,365 140,778 1,355,542 425,459 Net tax impact of adjustments(b) (28,620) (1,482) (66,057) (25,140) Adjusted net income (loss) attributable to Pilgrim's 321,745 139,296 1,289,485 400,319 Weighted average diluted shares of common stock outstanding 238,070 237,465 237,800 237,297 Adjusted net income attributable to Pilgrim's per common diluted share $ 1.35 $ 0.59 $ 5.42 $ 1.69 a. The gain on early extinguishment of debt recognized as a component of interest expense in 2024 was due to the bond repurchases. The loss on early extinguishment of debt recognized as a component of interest expense in 2023 was due to the repurchase of the Senior Notes due 2027. b. Net tax impact of adjustments represents the tax impact of all adjustments shown above.

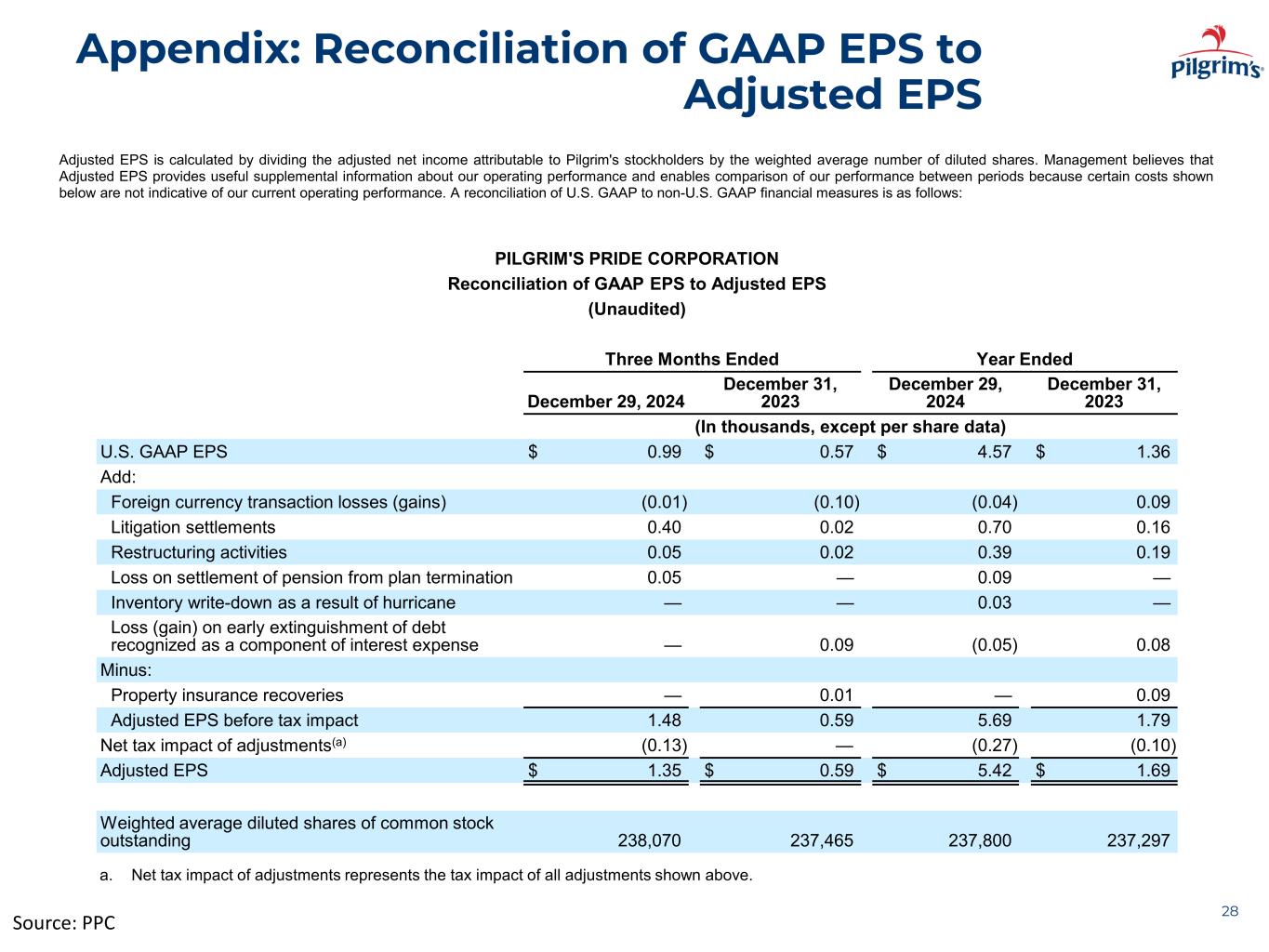

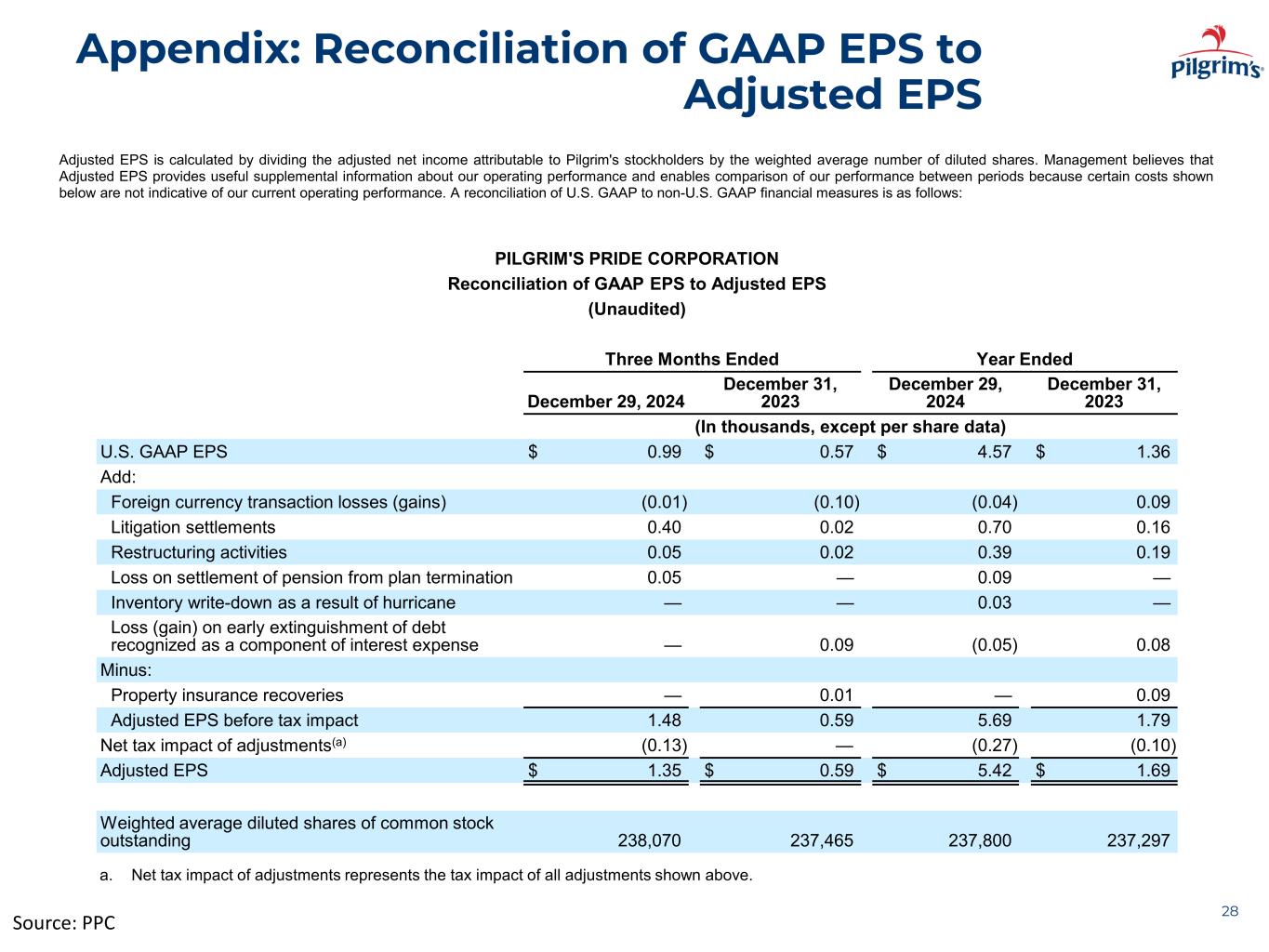

Appendix: Reconciliation of GAAP EPS to Adjusted EPS 28Source: PPC Adjusted EPS is calculated by dividing the adjusted net income attributable to Pilgrim's stockholders by the weighted average number of diluted shares. Management believes that Adjusted EPS provides useful supplemental information about our operating performance and enables comparison of our performance between periods because certain costs shown below are not indicative of our current operating performance. A reconciliation of U.S. GAAP to non-U.S. GAAP financial measures is as follows: PILGRIM'S PRIDE CORPORATION Reconciliation of GAAP EPS to Adjusted EPS (Unaudited) Three Months Ended Year Ended December 29, 2024 December 31, 2023 December 29, 2024 December 31, 2023 (In thousands, except per share data) U.S. GAAP EPS $ 0.99 $ 0.57 $ 4.57 $ 1.36 Add: Foreign currency transaction losses (gains) (0.01) (0.10) (0.04) 0.09 Litigation settlements 0.40 0.02 0.70 0.16 Restructuring activities 0.05 0.02 0.39 0.19 Loss on settlement of pension from plan termination 0.05 — 0.09 — Inventory write-down as a result of hurricane — — 0.03 — Loss (gain) on early extinguishment of debt recognized as a component of interest expense — 0.09 (0.05) 0.08 Minus: Property insurance recoveries — 0.01 — 0.09 Adjusted EPS before tax impact 1.48 0.59 5.69 1.79 Net tax impact of adjustments(a) (0.13) — (0.27) (0.10) Adjusted EPS $ 1.35 $ 0.59 $ 5.42 $ 1.69 Weighted average diluted shares of common stock outstanding 238,070 237,465 237,800 237,297 a. Net tax impact of adjustments represents the tax impact of all adjustments shown above.

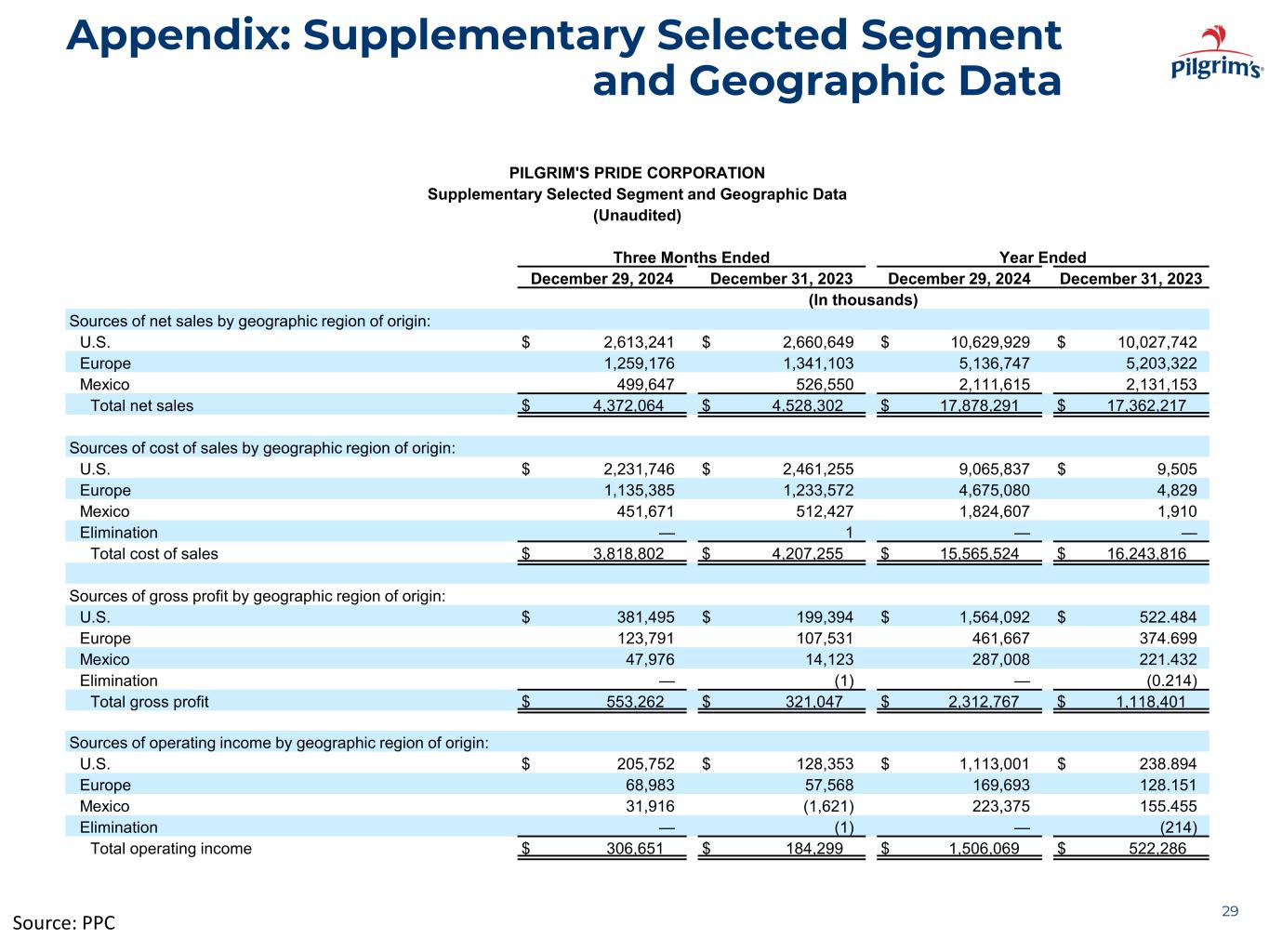

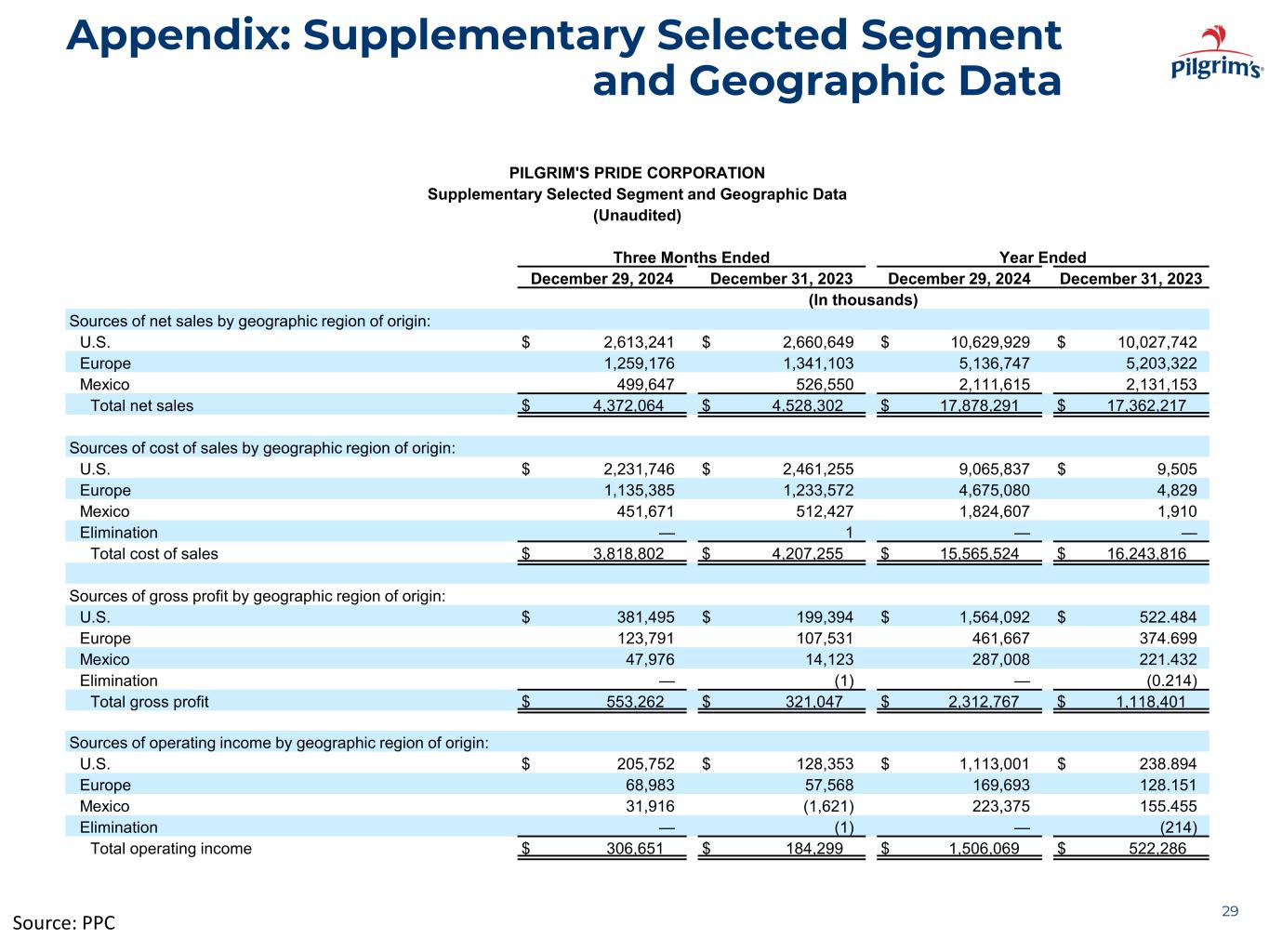

Appendix: Supplementary Selected Segment and Geographic Data 29Source: PPC PILGRIM'S PRIDE CORPORATION Supplementary Selected Segment and Geographic Data (Unaudited) Three Months Ended Year Ended December 29, 2024 December 31, 2023 December 29, 2024 December 31, 2023 (In thousands) Sources of net sales by geographic region of origin: U.S. $ 2,613,241 $ 2,660,649 $ 10,629,929 $ 10,027,742 Europe 1,259,176 1,341,103 5,136,747 5,203,322 Mexico 499,647 526,550 2,111,615 2,131,153 Total net sales $ 4,372,064 $ 4,528,302 $ 17,878,291 $ 17,362,217 Sources of cost of sales by geographic region of origin: U.S. $ 2,231,746 $ 2,461,255 9,065,837 $ 9,505 Europe 1,135,385 1,233,572 4,675,080 4,829 Mexico 451,671 512,427 1,824,607 1,910 Elimination — 1 — — Total cost of sales $ 3,818,802 $ 4,207,255 $ 15,565,524 $ 16,243,816 Sources of gross profit by geographic region of origin: U.S. $ 381,495 $ 199,394 $ 1,564,092 $ 522.484 Europe 123,791 107,531 461,667 374.699 Mexico 47,976 14,123 287,008 221.432 Elimination — (1) — (0.214) Total gross profit $ 553,262 $ 321,047 $ 2,312,767 $ 1,118,401 Sources of operating income by geographic region of origin: U.S. $ 205,752 $ 128,353 $ 1,113,001 $ 238.894 Europe 68,983 57,568 169,693 128.151 Mexico 31,916 (1,621) 223,375 155.455 Elimination — (1) — (214) Total operating income $ 306,651 $ 184,299 $ 1,506,069 $ 522,286