Pilgrim’s Pride Corporation (NASDAQ: PPC) Proposal to Acquire Hillshire Brands May 27, 2014

Forward Looking Statements Statements contained in this presentation that state the intentions, plans, hopes, beliefs, anticipations, expectations or predictions of the future of Pilgrim’s Pride Corporation and its management are considered forward-looking statements. These forward-looking statements include statements of anticipated changes in the business environment in which Pilgrim’s operates and in Pilgrim’s future operating results relating to Pilgrim’s offer and the potential benefits of a transaction with Hillshire. There is no assurance that the potential transaction will be consummated, and it is important to note that actual results could differ materially from those projected in such forward-looking statements. Forward-looking statements in this presentation should be evaluated together with other factors that could cause actual results to differ materially from those projected in such forward-looking statements, particularly those risks described under “Risk Factors” in Pilgrim’s Annual Report on Form 10-K and subsequent filings with the Securities and Exchange Commission. Pilgrim’s Pride Corporation undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Today’s Agenda Transaction Overview Pilgrim’s-Hillshire Key Financial Metrics JBS Perspective

Compelling Value for Hillshire and PPC Shareholders Creation of a branded, protein-focused company with strong, consistent earnings and complementary competencies: US$12B+ in combined revenues and $1.4B in LTM EBITDA PPC strong operational efficiency systems and process Hillshire iconic brands, innovation and marketing capabilities Shared culture of partnering with customers in complementary channels: PPC strong in foodservice and supermarket deli and Hillshire strong in retail Strong cost synergy opportunities and top line expansion into higher margin branded products in North America and internationally Broad supply base of raw materials and growth platform through affiliation with JBS Manageable leverage and commitment to optimal capital structure

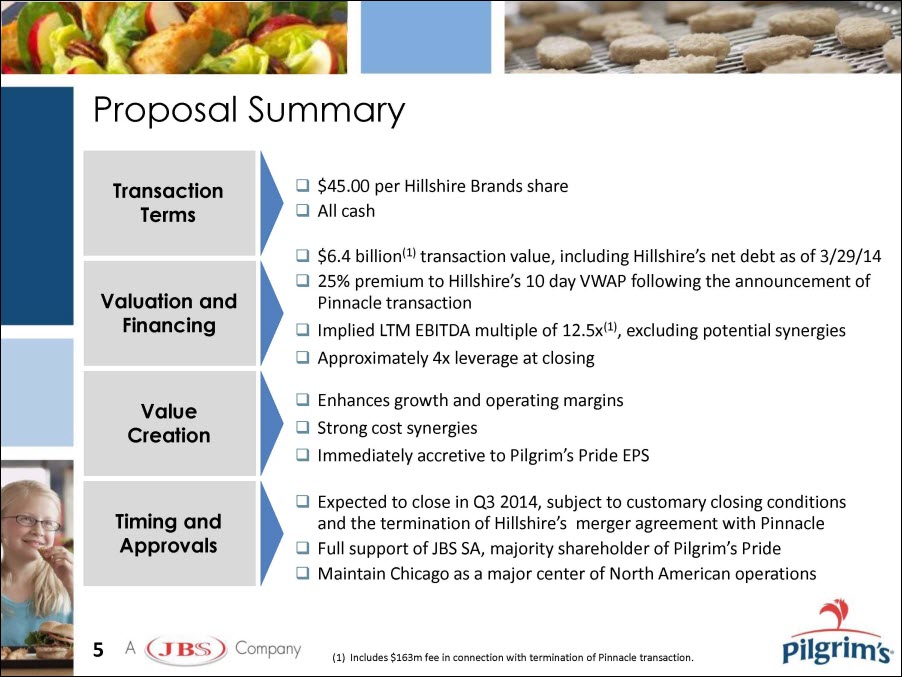

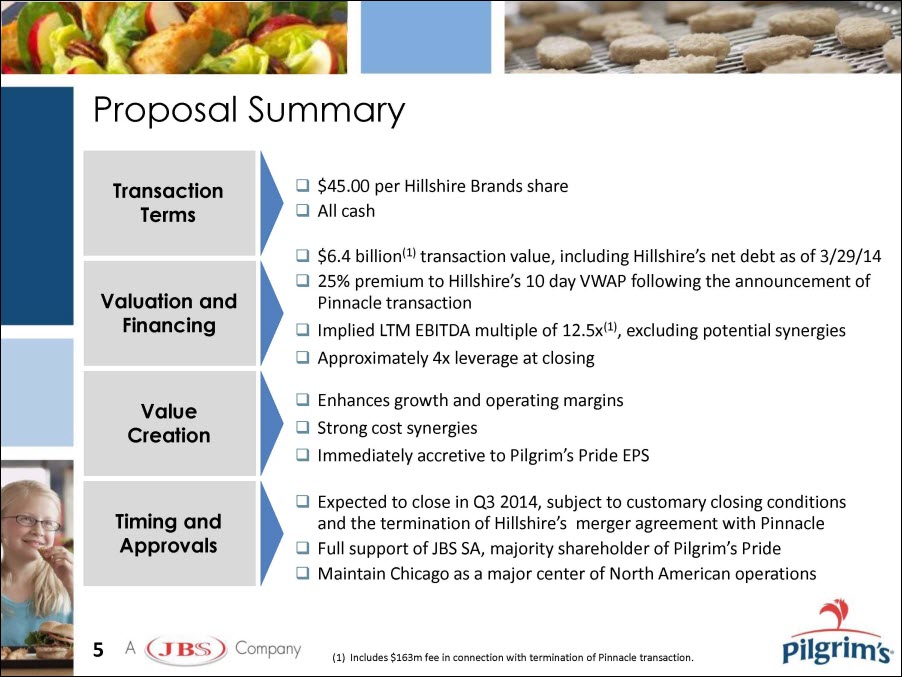

Proposal Summary Transaction Terms $45.00 per Hillshire Brands share All cash Valuation and Financing $6.4 billion(1) transaction value, including Hillshire’s net debt as of 3/29/14 25% premium to Hillshire’s 10 day VWAP following the announcement of Pinnacle transaction Implied LTM EBITDA multiple of 12.5x(1), excluding potential synergies Approximately 4x leverage at closing Value Creation Enhances growth and operating margins Strong cost synergies Immediately accretive to Pilgrim’s Pride EPS Timing and Approvals Expected to close in Q3 2014, subject to customary closing conditions and the termination of Hillshire’s merger agreement with Pinnacle Full support of JBS SA, majority shareholder of Pilgrim’s Pride Maintain Chicago as a major center of North American operations (1) Includes $163m fee in connection with termination of Pinnacle transaction.

Today’s Agenda Transaction Overview Pilgrim’s-Hillshire Key Financial Metrics JBS Perspective

PPC- Global, Vertically Integrated Poultry Producer Sales 79% in U.S., 11% in Mexico, 10% to export 3,900 growers, 36 hatcheries, 28 feed mills 35,700 employees; based in Greeley, Colorado LTM SALES .392 EBITDA/% MARGIN 93/10.6% BRANDS US Sales by Channel Retail 50% Foodservice 50% CUSTOMERS Foodservice Retail BRANDS CUSTOMERS PRODUCTS Fresh Chicken Prepared Chicken Value-added export and other chicken products

Hillshire Brands Snapshot HILLSHIRE BRANDS Substantially all sales in U.S. (99%), Headquartered in Chicago, Illinois 89% branded sales/11% unbranded in FY 2013 13 food processing facilities (10 meat and 3 bakery) and 5 distribution centers in U.S. ~9,100 employees; LTM Sales $4bn /Oper. Income $0.4bn (10.1%) Sales by Channel Foodservice & Other 26% Retail 74% RETAIL SUMMARY FINANCIALS LTM SALES 2.93 OPER. INCOME/% MARGIN(1) 324/ 11.1% FOODSERVICE SUMMARY FINANCIALS LTM SALES 1.05 OPER. INCOME/% MARGIN(1) 80/ 7.6% KEY BRANDS = #1 market share in respective category KEY BRANDS Meat Bakery Note: Hillshire Brands fiscal years shown ending June 29, 2013 and June 30, 2012. (1) Segment operating income before allocation of corporate overhead, as reported.

PPC-Hillshire Combined PILGRIM’S PRIDE HILLSHIRE BRANDS COMBINED LTM SALES $8.4 $4.0 $12.4 LTM EBITDA $0.9 $0.5 $1.4 (1) % MARGIN 10.6% 11.6% 11.0% SALES BREAKDOWN PORTFOLIO OF BRANDS Meat 67% Meat-Centric 20% Bakery & Other 13% Meat 89% Meat- Centric 6% Bakery & Other 4% (1) Not including synergies. Fresh Poultry 80% Prepared Products 20%

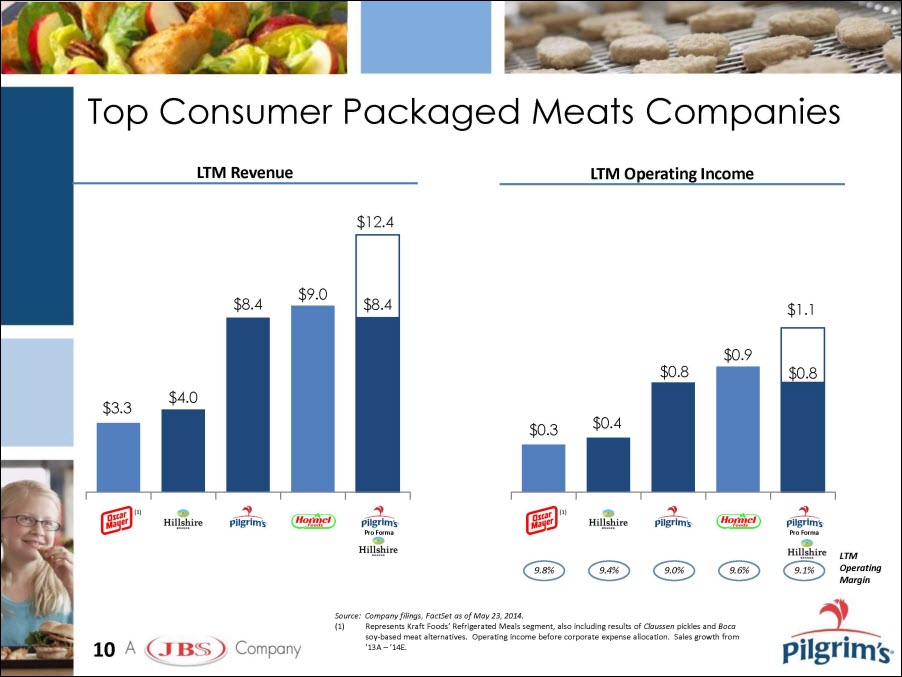

Top Consumer Packaged Meats Companies LTM Revenue LTM Operating Income $3.3 $4.0 $8.4 $9.0 $8.4 $12.4 LTM Operating Margin (1) $0.3 $0.4 $0.8 $0.9 $0.8 $1.1 (1) 9.4% 9.6% 9.1% 9.8% 9.0% Source: Company filings, FactSet as of May 23, 2014. (1) Represents Kraft Foods’ Refrigerated Meals segment, also including results of Claussen pickles and Boca soy-based meat alternatives. Operating income before corporate expense allocation. Sales growth from ’13A – ’14E.

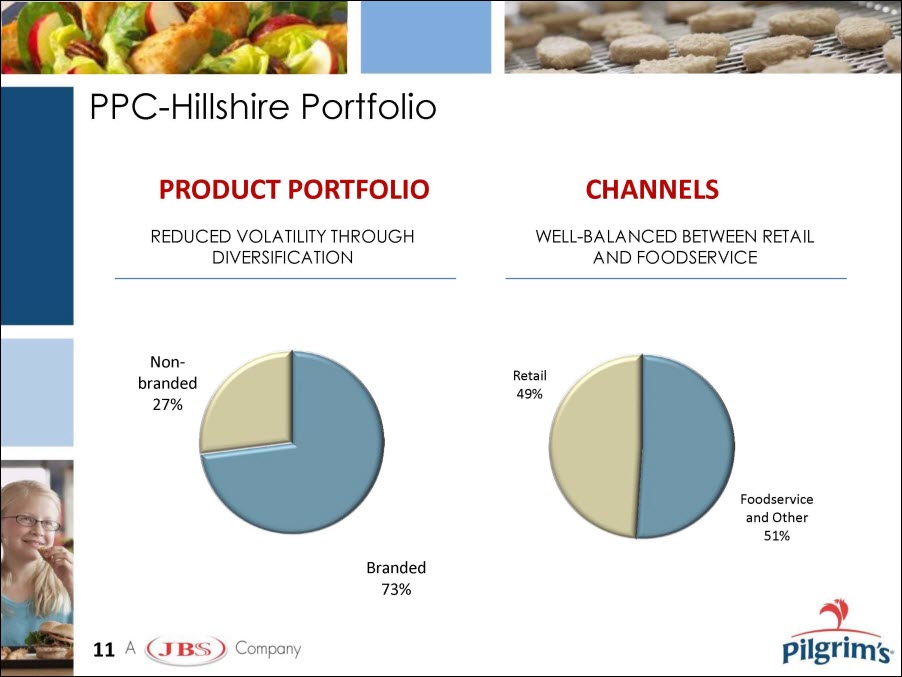

PPC-Hillshire Portfolio PRODUCT PORTFOLIO REDUCED VOLATILITY THROUGH DIVERSIFICATION CHANNELS WELL-BALANCED BETWEEN RETAIL AND FOODSERVICE Branded 73% Non-branded 27% Foodservice and Other 51% Retail 49%

Synergy Opportunities SG&A PROVEN HISTORY OF EFFICIENT INTEGRATION Shared Services optimization Consolidation of Distribution/ Brokers Leverage marketing and sales infrastructure OPERATIONAL EXCELLENCE UNIQUE RESULT-ORIENTED CULTURE Labor Management Zero Based Budgeting Cold Storage/ Freight Consolidation SOURCING VALUE-CHAIN EFFICIENCY Integration of value chain in fast-growing chicken categories Economies of Scale on Packaging and Ingredients Enhanced raw material sourcing capabilities through JBS network

Proven History of Efficient Integration PPC SG&A Evolution ($mm and % of Sales) De-layering: Closer to customers Shared Service Center consolidation Zero-Base Budget PPC Operational Improvements ($mm) $642MM Operational Improvements 2011-2013 in PPC Result oriented culture with commitment at every level of the organization

Top Line Growth – Brand Extensions Brand Category Hillshire Share Position Relative Market Share Breakfast Sausage #1 2.8X Frozen Protein Breakfast #1 8.6X Smoked Sausage #1 2.8X Lunchmeat #3 0.3X Hot Dogs #1 1.1X Corn Dogs #1 1.3X Super Premium Sausage #1 1.8X Extend Hillshire brands into more categories Create sales opportunities using PPC and Hillshire’s relationships Pursue joint opportunities in school lunch and institutional Expand natural and antibiotic-free products Expand brands in Mexico and internationally

Today’s Agenda Transaction Overview Pilgrim’s-Hillshire Key Financial Metrics JBS Perspective

Indicative Purchase Price Build ($ in millions, except per share data) Offer Price $45.00 % Premium to 10 day VWAP following May 12th Announcement 25% Fully Diluted Shares Outstanding 126.0 Implied Equity Value $5,671 Gross Financial Debt $942 Cash (389) Net Debt $553 Termination Fee $163 Enterprise Value $6,387 Implied LTM EBITDA Multiple 12.5x

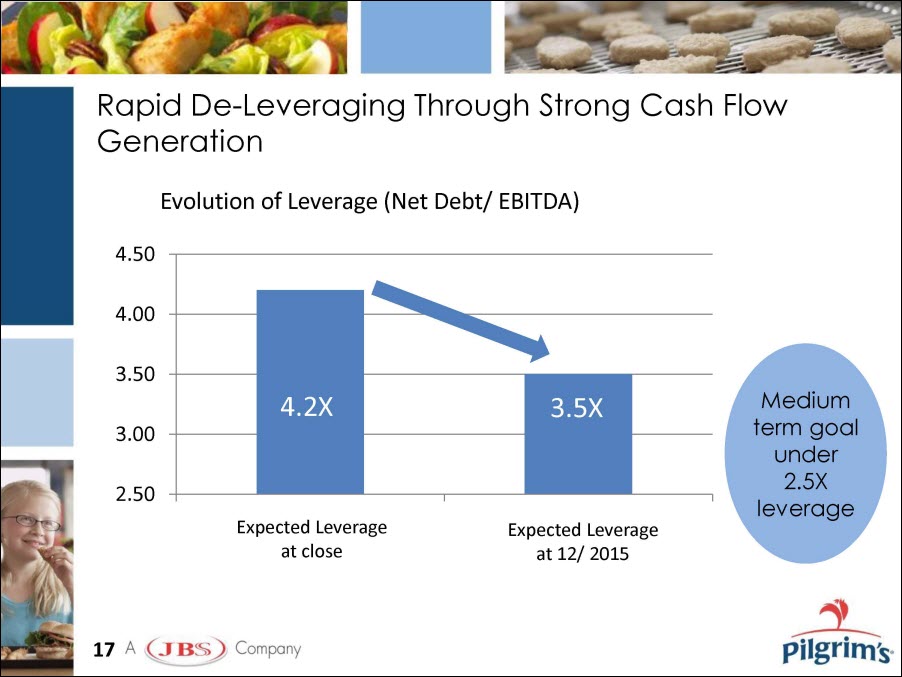

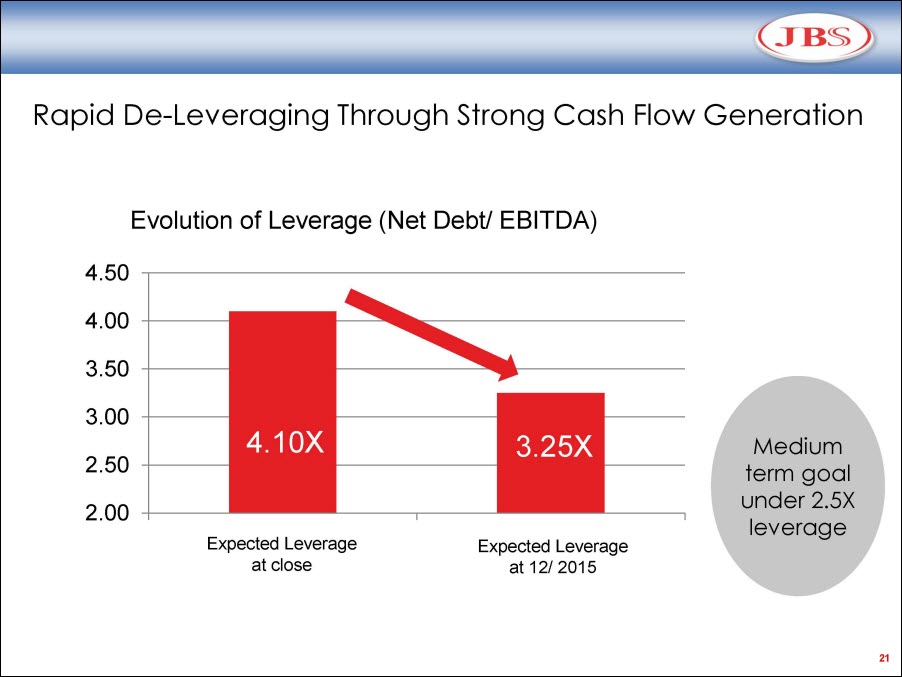

Rapid De-Leveraging Through Strong Cash Flow Generation Expected Leverage at close Expected Leverage at 12/ 2015 3.5X 4.2X Evolution of Leverage (Net Debt/ EBITDA) Medium term goal under 2.5X leverage

Today’s Agenda Transaction Overview Pilgrim’s-Hillshire Key Financial Metrics JBS Perspective

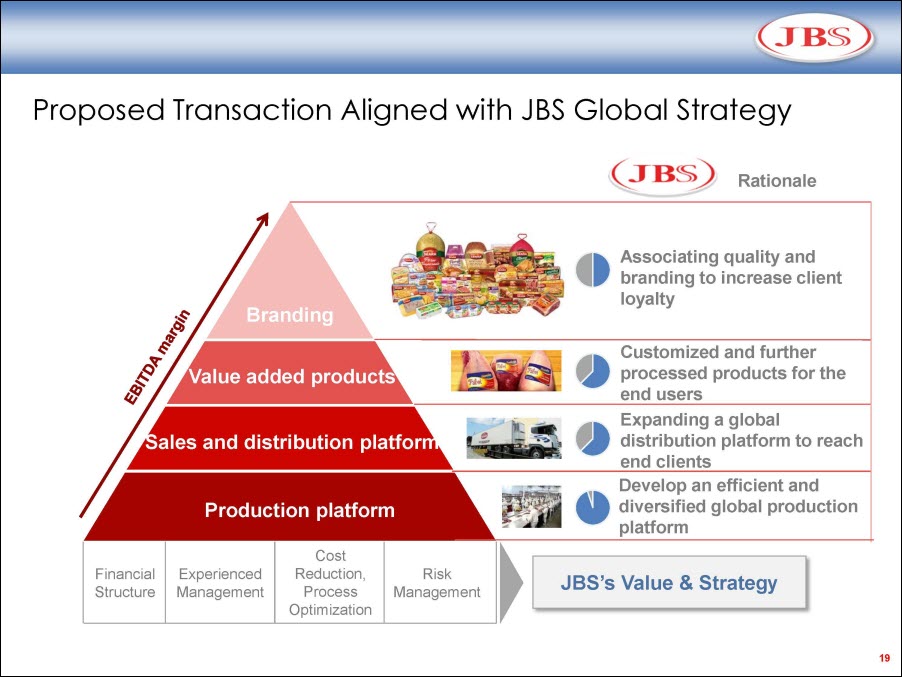

Proposed Transaction Aligned with JBS Global Strategy Rationale Branding Associating quality and branding to increase client loyalty Value added products Customized and further processed products for the end users Sales and distribution platform Expanding a global distribution platform to reach end clients Production platform Develop an efficient and diversified global production platform Financial Structure Experienced Management Cost Reduction, Process Optimization Risk Management JBS’s Value & Strategy EBITDA margin

Proposed Acquisition Accretive to JBS Shareholders Creates a platform for strong growth in branded value added products with higher margins in the largest consumer market in the world Accelerates JBS value added sales opportunities in existing businesses through Hillshire’s culture of brand building and innovation Generates more consistent earnings through further diversification Promotes collaboration in R&D between US and Brazil leading to launching of more innovative products Drives strong cost saving opportunities across the enterprise

Rapid De-Leveraging Through Strong Cash Flow Generation Evolution of Leverage (Net Debt/ EBITDA) Expected Leverage at close 4.10X Expected Leverage at 12/ 2015 3.25X Medium term goal under 2.5X leverage

Compelling Value for Hillshire and PPC Shareholders Creation of a branded, protein-focused company with strong, consistent earnings and complementary competencies: US$12B+ in combined revenues and $1.4B in LTM EBITDA PPC strong operational efficiency systems and process Hillshire iconic brands, innovation and marketing capabilities Shared culture of partnering with customers in complementary channels: PPC strong in foodservice and supermarket deli and Hillshire strong in retail Strong cost synergy opportunities and top line expansion into higher margin branded products in North America and internationally Broad supply base of raw materials and growth platform through affiliation with JBS Manageable leverage and commitment to optimal capital structure