Exhibit 99.2

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE NORTHERN DISTRICT OF TEXAS

FORT WORTH DIVISION

| | | | |

| In re | | § | | Chapter 11 |

| | § | | |

| PILGRIM’S PRIDE CORPORATION,et al., | | § | | Case No. 08-45664 (DML) |

| | § | | |

Debtors. | | § | | |

| | § | | (JOINTLY ADMINISTERED) |

DISCLOSURE STATEMENT FOR THE DEBTORS’ JOINT PLAN OF

REORGANIZATION UNDER CHAPTER 11 OF THE BANKRUPTCY CODE

The Bankruptcy Court has not approved this proposed disclosure statement as containing adequate information pursuant to section 1125(b) of the Bankruptcy Code for use in the solicitation of acceptances or rejections of the chapter 11 plan described herein and attached hereto. Accordingly, the filing and dissemination of this disclosure statement are not intended to be, and should not in any way be construed as, a solicitation of votes on the plan, nor should the information contained in this disclosure statement be relied on for any purpose until a determination by the Bankruptcy Court that the proposed disclosure statement contains adequate information.

The Debtors reserve the right to amend or supplement this proposed disclosure statement at or before the hearing to consider this disclosure statement.

| | |

| WEIL, GOTSHAL & MANGES LLP |

|

200 Crescent Court, Suite 300 Dallas, Texas 75201 (214) 746-7700 |

|

767 Fifth Avenue New York, New York 10153 (212) 310-8000 |

|

Attorneys for Debtors and Debtors in Possession |

| | |

| Dated: | | Fort Worth, Texas |

| | September 17, 2009 |

TABLE OF CONTENTS

| | |

| | | Page |

| |

I. INTRODUCTION | | 1 |

| |

II. EXECUTIVE SUMMARY | | 4 |

| |

A. Summary of Classification and Treatment of Claims and Equity Interests Under Plan | | 4 |

| |

B. Overview of Chapter 11 Process | | 6 |

| |

III. OVERVIEW OF THE DEBTORS’ OPERATIONS | | 7 |

| |

A. History of Pilgrim’s Pride | | 7 |

| |

B. The Debtors’ Businesses | | 7 |

| |

1. Introduction | | 7 |

| |

2. Assets and Capacity Utilization | | 8 |

| |

3. Lines of Business | | 9 |

| |

4. Product Types—U.S | | 9 |

| |

5. Markets for Chicken Products—U.S | | 10 |

| |

6. Markets for Other Products—U.S | | 12 |

| |

7. Product Types—Mexico | | 15 |

| |

8. Markets for Chicken Products—Mexico | | 15 |

| |

9. Competition | | 15 |

| |

10. Key Customers | | 16 |

| |

11. Regulation and Environmental Matters | | 16 |

| |

C. Employees and Employee Compensation and Benefit Programs | | 16 |

| |

D. Debtors’ Significant Indebtedness | | 17 |

| |

1. The Credit Agreements | | 17 |

| |

2. Purchase Receivables | | 18 |

| |

3. Indentures | | 18 |

| |

4. Industrial Revenue Bond Debt | | 18 |

| |

5. Trade Debt | | 19 |

| |

E. Common Stock | | 19 |

| |

IV. OVERVIEW OF CHAPTER 11 CASES | | 20 |

| |

A. Significant Events Leading to the Commencement of the Chapter 11 Cases | | 20 |

| |

1. Increase in Corn and Soybean Meal Prices | | 20 |

| |

2. Increase in the Cost of Energy | | 20 |

DS-i

TABLE OF CONTENTS

(continued)

| | |

| | | Page |

| |

3. Oversupply in the Poultry Industry | | 20 |

| |

4. Competitive Environment | | 21 |

| |

5. The Need for a Financial Restructuring | | 21 |

| |

6. Prepetition Restructuring Efforts | | 22 |

| |

B. Commencement of Chapter 11 Cases and First Day Orders | | 23 |

| |

1. Case Administration | | 23 |

| |

2. Critical Obligations | | 23 |

| |

3. Business Operations | | 24 |

| |

4. Financial Operations | | 24 |

| |

C. Debtor-in-Possession Financing | | 24 |

| |

D. Appointment of Statutory Committees and Fee Review Committee | | 24 |

| |

1. Creditors’ Committee | | 24 |

| |

2. Equity Committee | | 25 |

| |

3. Fee Review Committee | | 25 |

| |

E. Restructuring Efforts During Bankruptcy | | 25 |

| |

F. Material Asset Sales | | 27 |

| |

1. ADM Joint Venture | | 27 |

| |

2. Plant City Distribution Center | | 27 |

| |

3. Cincinnati, Ohio Distribution Center | | 27 |

| |

4. Excess Land Sale | | 27 |

| |

5. Farmerville Complex | | 27 |

| |

6. Other Sales | | 27 |

| |

G. Negotiations and Settlements with the Unions | | 27 |

| |

H. 2009 Performance Bonus Plans | | 29 |

| |

I. Exclusivity | | 29 |

| |

J. Schedules and Statements | | 29 |

| |

K. Claims Reconciliation Process | | 30 |

| |

1. Unsecured Claims Bar Date | | 30 |

| |

2. Section 503(b)(9) Claims Bar Date | | 30 |

| |

3. Administrative Expense Claim Bar Date | | 31 |

| |

4. Debtors’ Procedures for Objecting to Proofs of Claims and Administrative Expense Claims and Notifying Claimants of Objection | | 31 |

DS-ii

TABLE OF CONTENTS

(continued)

| | |

| | | Page |

| |

L. Establishment of Alternative Dispute Resolution Process | | 31 |

| |

M. Significant Material Litigation | | 32 |

| |

1. Donning and Doffing Litigation | | 32 |

| |

2. Securities Litigation | | 33 |

| |

3. Grower Litigation | | 34 |

| |

4. ERISA Litigation | | 34 |

| |

5. Environmental Litigation | | 35 |

| |

6. City of Clinton, Arkansas | | 35 |

| |

N. Rejection and Assumption of Contracts | | 36 |

| |

O. PBGC Matters | | 36 |

| |

V. Stock Purchase Agreement | | 37 |

| |

A. Purchase of New PPC Common Stock | | 37 |

| |

B. The Plan Sponsor | | 39 |

| |

1. General Background | | 39 |

| |

2. Business Segments | | 39 |

| |

3. Plants | | 40 |

| |

4. Financial Performance | | 41 |

| |

C. Anticipated Initial Public Offering | | 41 |

| |

D. Other Offerings | | 44 |

| |

E. Conversion of New PPC Common Stock to JBS USA Common Stock | | 44 |

| |

F. Corporate Governance | | 45 |

| |

G. Financing | | 45 |

| |

H. Synergies Created as a Result of the Plan Sponsor Transaction | | 46 |

| |

I. Stockholders Agreement | | 46 |

| |

J. Plan Support Agreement | | 48 |

| |

VI. THE CHAPTER 11 PLAN | | 48 |

| |

A. Summary and Treatment of Unclassified and Classified Claims and Equity Interests | | 48 |

| |

B. Description and Treatment of Classified Claims and Equity Interests | | 54 |

| |

1. Priority Non-Tax Claims against PPC, PFS Distribution Company, PPC Transportation Company, To-Ricos, To-Ricos Distribution, Pilgrim’s Pride Corporation of West Virginia, Inc., and PPC Marketing, Ltd. (Classes 1(a)-(g)) | | 54 |

DS-iii

TABLE OF CONTENTS

(continued)

| | |

| | | Page |

| |

2. Bank of Montreal Secured Claims Against PPC, To-Ricos and To-Ricos Distribution (Classes 2(a)-(c)) | | 54 |

| |

3. CoBank Secured Claims against PPC (Class 3) | | 55 |

| |

4. Secured Tax Claims against PPC, PFS Distribution Company, PPC Transportation Company, To-Ricos, To-Ricos Distribution, Pilgrim’s Pride Corporation of West Virginia, Inc., and PPC Marketing, Ltd (Classes 4(a)-(g)) | | 55 |

| |

5. Other Secured Claims against PPC, PFS Distribution Company, PPC Transportation Company, To-Ricos, To-Ricos Distribution, Pilgrim’s Pride Corporation of West Virginia, Inc., and PPC Marketing, Ltd. (Classes 5(a)-(g)) | | 56 |

| |

6. Note Claims against PPC (Classes 6(a)-(c)) | | 56 |

| |

7. General Unsecured Claims against PPC, PFS Distribution Company, PPC Transportation Company, To-Ricos, To-Ricos Distribution, Pilgrim’s Pride Corporation of West Virginia, Inc., and PPC Marketing, Ltd (Classes 7(a)-(g) | | 57 |

| |

8. Intercompany Claims (Class 8) | | 57 |

| |

9. Flow Through Claims against PPC, PFS Distribution Company, PPC Transportation Company, To-Ricos, To-Ricos Distribution, Pilgrim’s Pride Corporation of West Virginia, Inc., and PPC Marketing, Ltd (Classes 9(a)-(g)) | | 58 |

| |

10. Equity Interests in PPC (Class 10(a)) | | 58 |

| |

11. Equity Interests in PFS Distribution Company, PPC Transportation Company, To-Ricos, To-Ricos Distribution, Pilgrim’s Pride Corporation of West Virginia, Inc., and PPC Marketing, Ltd Class 10(b)-(g) | | 59 |

| |

C. Claim Resolution Process | | 59 |

| |

1. Allowance of Claims and Equity Interests | | 59 |

| |

2. Claim Objections | | 60 |

| |

3. Resolution of Disputed Claims | | 60 |

| |

4. Estimation of Claims | | 60 |

| |

5. No Interest Pending Allowance | | 61 |

| |

D. Timing and Manner of Distributions | | 61 |

| |

1. Timing of Distributions | | 61 |

| |

2. Delivery of Distributions | | 61 |

| |

3. Unclaimed Distributions | | 62 |

| |

4. Manner of Payment | | 62 |

DS-iv

TABLE OF CONTENTS

(continued)

| | |

| | | Page |

| |

5. Fractional Shares | | 62 |

| |

6. Setoffs and Recoupment | | 63 |

| |

E. Treatment of Executory Contracts and Unexpired Leases | | 63 |

| |

1. Contracts to be Assumed or Rejected | | 63 |

| |

2. Payment of Cure Amounts | | 64 |

| |

3. Rejection Damage Claims | | 64 |

| |

4. Indemnification Obligations | | 64 |

| |

5. Change in Control Agreements | | 65 |

| |

6. Employment Agreements with Don Jackson and Jerry Wilson | | 66 |

| |

7. Retiree Benefits | | 67 |

| |

F. Conditions Precedent to Confirmation of Plan and Occurrence of the Effective Date of Plan | | 67 |

| |

G. Waiver of Conditions | | 67 |

| |

H. Effects of Failure of Conditions to Effective Date | | 67 |

| |

I. Effects of Confirmation on Claims and Equity Interests | | 68 |

| |

1. Vesting of Asset | | 68 |

| |

2. Discharge of Claims and Termination of Equity Interests | | 68 |

| |

3. Discharge of Debtors | | 68 |

| |

4. Injunction or Stay | | 68 |

| |

5. Term of Injunction or Stays | | 69 |

| |

6. Injunction Against Interference with Plan | | 69 |

| |

7. Exculpation | | 69 |

| |

8. Releases by Holders of Claims and Equity Interests | | 69 |

| |

9. Releases by Debtors and Reorganized Debtors | | 70 |

| |

10. Avoidance Actions | | 71 |

| |

11. Retention of Causes of Action/Reservation of Rights | | 71 |

| |

12. Limitation on Exculpation and Releases of Professionals | | 71 |

| |

J. Dissolution of Statutory Committees and Fee Review Committee | | 71 |

| |

K. Jurisdiction and Choice of Law | | 72 |

| |

L. Amendments or Modifications of the Plan | | 73 |

| |

M. Revocation or Withdrawal of the Plan | | 74 |

| |

N. Severability | | 74 |

DS-v

TABLE OF CONTENTS

(continued)

| | |

| | | Page |

| |

O. Governing Law | | 74 |

| |

VII. REORGANIZED DEBTORS | | 75 |

| |

A. Select Historical Financial Information | | 75 |

| |

B. Financial Projections (Five (5) Year Business Plan) | | 75 |

| |

1. Consolidated Projected Financial Statements | | 77 |

| |

2. Purpose and Objectives | | 77 |

| |

3. Key Drivers of the Projections | | 77 |

| |

4. Cost Assumptions in the Projections | | 78 |

| |

5. Poultry Industry Outlook in the Projections | | 79 |

| |

6. Commodity Factor: Grain/Feed Ingredients | | 79 |

| |

C. Valuation | | 80 |

| |

D. Corporate Governance and Management of the Reorganized Debtors | | 82 |

| |

1. Initial Board of Directors | | 82 |

| |

2. Officers | | 83 |

| |

3. Consulting Agreement | | 83 |

| |

4. Management Incentive Plans | | 83 |

| |

E. Description of Certain Securities to be Issued Pursuant to the Plan | | 84 |

| |

1. New PPC Common Stock | | 84 |

| |

F. Exit Financing | | 85 |

| |

VIII. CERTAIN RISK FACTORS | | 85 |

| |

A. Certain Risks Related to the Plan | | 86 |

| |

1. The Debtors may not be able to obtain confirmation of the Plan | | 86 |

| |

2. Undue delay in confirmation of the Plan may significantly disrupt operations of the Debtors | | 86 |

| |

3. Holders of Equity Interests in PPC may face significant losses in the event of a subsequent liquidation or financial reorganization by the Debtors | | 86 |

| |

4. The satisfaction or waiver of the closing conditions to the SPA is a condition precedent for the confirmation of the Plan and may prevent or delay confirmation of the Plan if such conditions are not satisfied or waived as provided in the SPA | | 87 |

| |

5. If the Plan Sponsor’s ownership percentage in the Reorganized PPC increases to 90% or more there will be no Equity Directors on the Reorganized PPC’s board of directors | | 87 |

DS-vi

TABLE OF CONTENTS

(continued)

| | |

| | | Page |

| |

B. Risks Related to the Capitalization of the Reorganized Debtors | | 87 |

| |

1. The Reorganized Debtors’ future financial and operating flexibility may be adversely affected by their significant leverage as a result of the Exit Facility | | 87 |

| |

2. The covenants in the Exit Facility could hinder the Reorganized Debtors’ business activities and operations | | 88 |

| |

3. The Debtors may not be able to list the New PPC Common Stock on a national securities exchange or an active market for shares of New PPC Common Stock may not develop | | 89 |

| |

4. The purchase price paid by the Plan Sponsor for the New PPC Common Stock is not intended to represent the trading or market value of New PPC Common Stock and there is no assurance that a holder will be able to sell the New PPC Common Stock at such a price or at all | | 89 |

| |

5. The Plan Sponsor will hold a majority of the New PPC Common Stock and will have the ability to control the vote on most matters brought before the holders of New PPC Common Stock | | 90 |

| |

6. In the event the Plan Sponsor completes an initial public offering, all of the then-outstanding shares of New PPC Common Stock may be exchanged, at the option of the Plan Sponsor, for shares of common stock of the Plan Sponsor | | 90 |

| |

C. Risks Related to the Financial and Operational Results of the Reorganized Debtors | | 91 |

| |

1. The Chapter 11 Cases may have negatively affected the businesses of the Reorganized Debtors, including relationships with certain customers, suppliers and vendors, which could adversely impact the Reorganized Debtors’ future financial and operating results | | 91 |

| |

2. The Debtors’ actual financial results may vary significantly from the financial projections included in this Disclosure Statement | | 91 |

| |

3. The expected synergies between the Plan Sponsor and PPC may not materialize | | 91 |

| |

4. Industry cyclicality can affect earnings of the Reorganized Debtors, especially due to fluctuations in commodity prices of feed ingredients and chicken | | 92 |

| |

5. Outbreaks of livestock diseases in general and poultry diseases in particular, including avian influenza, can significantly affect the Reorganized Debtors’ ability to conduct their operations and demand for their products | | 93 |

| |

6. If the Reorganized Debtors’ poultry products become contaminated, they may be subject to product liability claims and product recalls | | 94 |

DS-vii

TABLE OF CONTENTS

(continued)

| | |

| | | Page |

| |

7. Product liability claims or product recalls can adversely affect the business reputation of the Reorganized Debtors and expose them to increased scrutiny by federal and state regulators | | 94 |

| |

8. The Reorganized Debtors are exposed to risks relating to product liability, product recall, property damage and injuries to persons for which insurance coverage is expensive, limited and potentially inadequate | | 95 |

| |

9. Competition in the chicken industry with other vertically integrated poultry companies may make the Reorganized Debtors unable to compete successfully in these industries, which could adversely affect their business | | 95 |

| |

10. The loss of one or more of the largest customers could adversely affect the business of the Reorganized Debtors | | 96 |

| |

11. The foreign operations of the Reorganized Debtors pose special risks to their business and operations | | 96 |

| |

12. Disruptions in international markets and distribution channels could adversely affect the business of the Reorganized Debtors | | 97 |

| |

13. Regulation, present and future, is a constant factor affecting the business of the Reorganized Debtors | | 97 |

| |

14. New immigration legislation or increased enforcement efforts in connection with existing immigration legislation could cause the costs of doing business to increase, cause the Reorganized Debtors to change the way they conduct business or otherwise disrupt their operations | | 97 |

| |

15. Loss of essential employees could have a significant negative impact on the Reorganized Debtors’ business | | 98 |

| |

16. Extreme weather or natural disasters could negatively impact the business of the Reorganized Debtors | | 98 |

| |

D. Risks Related to the JBS Common Stock | | 99 |

| |

1. The Plan Sponsor is controlled by JBS S.A., which is a publicly traded company in Brazil, whose interests may conflict with the holders of JBS Common Stock | | 99 |

| |

2. The Plan Sponsor’s directors who have relationships with its controlling stockholder may have conflicts of interest with respect to matters involving the Plan Sponsor | | 99 |

| |

3. The Plan Sponsor is expected to be a “controlled company” within the meaning of the NYSE rules, and, as a result, will rely on exemptions from certain corporate governance requirements that provide protection to stockholders of other companies | | 100 |

DS-viii

TABLE OF CONTENTS

(continued)

| | |

| | | Page |

| |

4. There has been no prior public market for the JBS Common Stock and the trading price of the JBS Common Stock may be adversely affected if an active trading market does not develop | | 100 |

| |

5. The stock price of the JBS Common Stock may be volatile, and holders of JBS Common Stock may be unable to resell their shares at or above the offering price or at all | | 100 |

| |

6. Actual dividends paid on shares of JBS Common Stock may not be consistent with the dividend policy adopted by the Plan Sponsor’s board of directors | | 101 |

| |

7. Provisions in the Plan Sponsor’s amended and restated certificate of incorporation and amended and restated bylaws and Delaware law may discourage, delay or prevent a change of control or changes in management | | 101 |

| |

8. Holders of JBS Common Stock may be subject to dilution | | 102 |

| |

E. Risks Related to the Financial and Operational Results of the Plan Sponsor | | 102 |

| |

1. Outbreaks of BSE, Foot-and-Mouth Disease, or FMD, or other species-based diseases in the United States, Australia or elsewhere may harm demand for the Plan Sponsor’s products | | 102 |

| |

2. Any perceived or real health risks related to the food industry could adversely affect the ability of the Plan Sponsor to sell its products. If its products become contaminated, the Plan Sponsor may be subject to product liability claims and product recalls | | 103 |

| |

3. The Plan Sponsor’s pork business could be negatively affected by concerns about A(H1N1) influenza | | 104 |

| |

4. The Plan Sponsor’s results of operations may be negatively impacted by fluctuations in the prevailing market prices for livestock | | 104 |

| |

5. The Plan Sponsor’s businesses are subject to government policies and extensive regulations affecting the cattle, hog, beef and pork industries | | 105 |

| |

6. Compliance with environmental requirements may result in significant costs, and failure to comply may result in civil liabilities for damages as well as criminal and administrative sanctions and liability for damages | | 106 |

| |

7. The Plan Sponsor’s export and international operations expose it to political and economic risks in foreign countries, as well as to risks related to currency fluctuations | | 107 |

| |

8. Deterioration of economic conditions could negatively impact the business of the Plan Sponsor | | 108 |

| |

9. Failure to successfully implement the Plan Sponsor’s business strategies may affect plans to increase revenue and cash flow | | 109 |

DS-ix

TABLE OF CONTENTS

(continued)

| | |

| | | Page |

| |

10. The Plan Sponsor’s business strategies require substantial capital and long-term investments, which it may be unable to fund | | 109 |

| |

11. The Plan Sponsor may not be able to successfully integrate any growth opportunities undertaken in the future | | 110 |

| |

12. The Plan Sponsor faces competition in its business, which may adversely affect its market share and profitability | | 110 |

| |

13. Changes in consumer preferences could adversely affect the business of the Plan Sponsor | | 111 |

| |

14. The Plan Sponsor’s business could be materially adversely affected as a result of adverse weather conditions or other unanticipated extreme events in its areas of operations | | 111 |

| |

15. The Plan Sponsor’s performance depends on favorable labor relations with employees and compliance with labor laws. Any deterioration of those relations or increase in labor costs due to compliance with labor laws could adversely affect the business of the Plan Sponsor | | 112 |

| |

16. The consolidation of customers could negatively impact business of the Plan Sponsor | | 113 |

| |

17. The Plan Sponsor is dependent on certain key members of management | | 113 |

| |

18. The Plan Sponsor’s debt could adversely affect its business | | 113 |

| |

IX. CERTAIN FEDERAL TAX CONSEQUENCES OF THE PLAN | | 114 |

| |

A. Consequences to Holders of Equity Interests in PPC | | 115 |

| |

1. Information Reporting and Backup Withholding | | 116 |

| |

B. Consequences to the Debtors | | 116 |

| |

1. Cancellation of Debt | | 116 |

| |

2. Potential Limitations on NOL Carryforwards and Other Tax Attributes | | 117 |

| |

3. Alternative Minimum Tax | | 118 |

| |

X. CERTAIN SECURITIES LAW MATTERS | | 118 |

| |

A. Issuance and Resale of New PPC Common Stock | | 118 |

| |

B. Issuance and Resale of JBS USA Common Stock | | 121 |

| |

C. Listing | | 121 |

| |

XI. ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF THE PLAN | | 121 |

| |

A. Liquidation Under Chapter 7 | | 121 |

| |

B. Alternative Plan | | 122 |

| |

C. Staying in Chapter 11 | | 122 |

| |

XII. VOTING PROCEDURES AND REQUIREMENTS | | 122 |

DS-x

TABLE OF CONTENTS

(continued)

| | |

| | | Page |

| |

A. Solicitation Package | | 122 |

| |

B. Voting Procedures | | 122 |

| |

C. Voting/Election Deadline | | 123 |

| |

D. Vote Required for Acceptance by a Class | | 123 |

| |

XIII. CONFIRMATION OF THE PLAN | | 124 |

| |

A. Confirmation Hearing | | 124 |

| |

B. Objections to Confirmation | | 124 |

| |

C. Requirements for Confirmation—Consensual Plan | | 124 |

| |

1. Elements of 1129(a) of the Bankruptcy Code | | 124 |

| |

D. Best Interests Tests/Liquidation Analysis | | 126 |

| |

E. Feasibility | | 126 |

| |

F. Requirements for Confirmation—Non-Consensual Plan | | 126 |

| |

1. No Unfair Discrimination | | 126 |

| |

2. Fair and Equitable Test | | 127 |

| |

G. Reservation of “Cram Down” Rights | | 127 |

| |

XIV. Conclusion and Recommendation | | 128 |

DS-xi

I.

INTRODUCTION

The Debtors submit this Disclosure Statement pursuant to section 1125 of title 11 of the United States Code (the “Bankruptcy Code”) to holders of claims and equity interests against the Debtors in connection with (i) the solicitation of acceptances of the Debtors’ joint plan of reorganization under the Bankruptcy Code, dated September 17, 2009 (the “Plan”), filed by the Debtors with the United States Bankruptcy Court for the Northern District of Texas (the “Bankruptcy Court”) and (ii) the hearing to consider confirmation of the Plan (the “Confirmation Hearing”) scheduled for [ ], 2009 at [ ]:00 [ ].m. (Central Time).UNLESS OTHERWISE DEFINED HEREIN, ALL CAPITALIZED TERMS CONTAINED HEREIN HAVE THE MEANINGS ASCRIBED TO THEM IN THE PLAN.

Annexed as Exhibits to this Disclosure Statement are copies of the following documents:

| | • | | Order of the Bankruptcy Court, dated [ ], 2009 (the “Disclosure Statement Order”), approving, among other things, this Disclosure Statement and establishing certain procedures with respect to the solicitation and tabulation of votes to accept or reject the Plan (annexed without exhibits) (Exhibit B); |

| | • | | Pilgrim’s Pride Corporation’s Annual Report on Form 10-K, as amended, for the fiscal year ended September 27, 2008 (annexed without exhibits) (Exhibit C); |

| | • | | Pilgrim’s Pride Corporation’s Form 10-Qs for the quarters ending December 27, 2008, March 28, 2009 and June 27, 2009 (all annexed without exhibits) (Exhibit D); |

| | • | | JBS USA Holdings, Inc. Form S-1, filed with the United States Securities and Exchange Commission (the “SEC”) on July 22, 2009 (annexed without exhibits) (Exhibit E); |

| | • | | The Debtors’ Financial Projections (Exhibit F); |

| | • | | The Debtors’ Liquidation Analysis (Exhibit G); and |

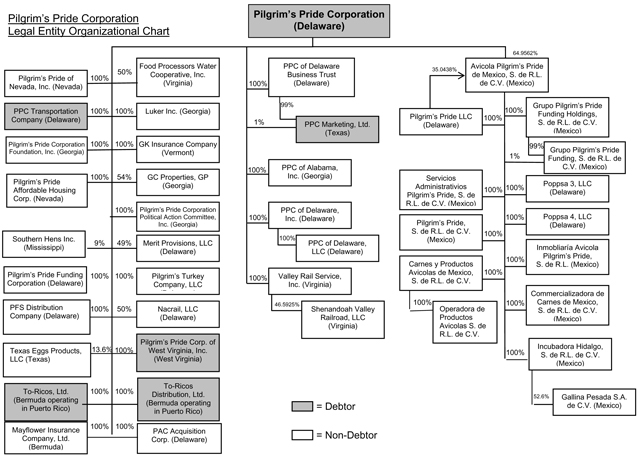

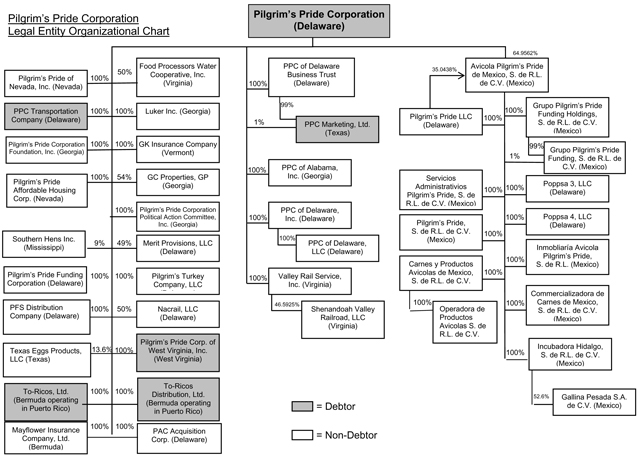

| | • | | Organizational Chart (Exhibit H). |

A Ballot for the acceptance or rejection of the Plan is enclosed with the Disclosure Statement submitted to the holders of Claims and Equity Interests that the Debtors believe may be entitled to vote to accept or reject the Plan.

On [ ], 2009, after notice and a hearing, the Bankruptcy Court entered the Disclosure Statement Order, approving this Disclosure Statement as containing adequate information of a kind and in sufficient detail to enable a hypothetical investor of the relevant classes to make an informed judgment whether to accept or reject the Plan. APPROVAL OF THIS DISCLOSURE STATEMENT DOES NOT, HOWEVER, CONSTITUTE A DETERMINATION BY THE BANKRUPTCY COURT AS TO THE FAIRNESS OR MERITS OF THE PLAN.

DS-1

The Disclosure Statement Order, a copy of which is annexed hereto as Exhibit B, sets forth in detail, among other things, the deadlines, procedures and instructions for voting to accept or reject the Plan and for filing objections to confirmation of the Plan, the record date for voting purposes and the applicable standards for tabulating Ballots. In addition, detailed voting instructions accompany each Ballot. Each holder of a Claim entitled to vote on the Plan should read the Disclosure Statement, the Plan, the Disclosure Statement Order, and the instructions accompanying the Ballots in their entirety before voting on the Plan. These documents contain important information concerning the classification of Claims and Equity Interests for voting purposes and the tabulation of votes. No solicitation of votes to accept the Plan may be made except pursuant to section 1125 of the Bankruptcy Code.

As described in more detail herein, the Debtors’ Plan provides for payment in full of all Claims. The Plan is predicated upon reorganization of the Debtors as a going concern and the purchase of majority of the Reorganized PPC’s common stock by JBS USA Holdings, Inc. (“Plan Sponsor”). The Disclosure Statement describes:

| | • | | The businesses of the Debtors and the reasons why they commenced their Chapter 11 Cases (Section III). |

| | • | | Significant events that have occurred in the Debtors’ Chapter 11 Cases (Section IV). |

| | • | | The transaction with the Plan Sponsor (Section V). |

| | • | | The material terms of the Plan, including, without limitation, how the Plan treats creditors and equity holders, how distributions under the Plan will be made and the manner in which disputed claims are to be resolved, and the conditions precedent to the Effective Date of the Plan (Section VI). |

| | • | | Certain financial information about the Debtors, including their 5-year projections (Section VII). |

| | • | | The procedure for selecting the Board of Directors (Section VII). |

| | • | | Certain risk factors creditors should consider before voting (Section VIII). |

| | • | | Certain tax laws issues (Section IX). |

| | • | | Certain securities laws issues (Section X). |

| | • | | Alternatives to confirmation of the Plan (Section XI). |

| | • | | Instructions for submitting votes on the Plan and who is entitled to vote (Section XII). |

| | • | | The procedure for confirming the Plan (Section XIII). |

Please note that if there is any inconsistency between the Plan and this Disclosure Statement, the terms of the Plan will govern.

Additional financial information about the Debtors can be found in the annual report on Form 10-K, as amended, for the year ended September 27, 2008 and the quarterly reports on Form 10-Q for the first three quarters of fiscal year 2009, which were filed by Pilgrim’s Pride Corporation (“PPC”) with the SEC on December 11, 2008 (as amended on January 26, 2009), February 5, 2009, May 7, 2009 and August 3, 2009, respectively. Copies of these documents without exhibits is attached hereto as

DS-2

Exhibit C andExhibit D. Additional information about the Plan Sponsor including detailed financial information can be found on the Form S-1, which was filed with the SEC on July 22, 2009. A copy of the Plan Sponsor’s Form S-1 without exhibits is attached hereto asExhibit E. Copies of all SEC filings may be obtained over the internet atwww.sec.gov.

This Disclosure Statement, the Plan [and correspondence from the Equity Committee urging equity holders to vote in favor of the Plan] are the only materials equity holders should use to determine whether to vote to accept or reject the Plan.

The Plan is the product of extensive negotiations between and among, the Debtors, the Creditors’ Committee, the Equity Committee, and the Plan Sponsor.

The Debtors, [and the Equity Committee] believe that the Plan is in the best interest of, and provides the highest and most expeditious recoveries to holders of all Claims and Equity Interests. The Debtors [and the Equity Committee] urge all holders of Equity Interests entitled to vote on the Plan to vote in favor of the Plan.

Additional copies of this Disclosure Statement are available upon request made to the Voting Agent, at the following address:

Pilgrim’s Pride Ballot Processing Center

c/o Kurtzman Carson Consultants LLC

2335 Alaska Avenue

El Segundo, CA 90245

T: (888) 830-4659

www.kccllc.net/pilgrimspride

The summaries of the Plan and other documents related to the restructuring of the Debtors are qualified in their entirety by the Plan and its exhibits. The financial and other information included in this Disclosure Statement are for purposes of soliciting acceptances of the Plan only. The financial and other information regarding the Plan Sponsor has been provided by the Plan Sponsor and has not been independently verified by the Debtors.

The Bankruptcy Code provides that only creditors and equity holders who vote on the Plan will be counted for purposes of determining whether the requisite acceptances have been attained. Failure to timely deliver a properly completed ballot by the voting deadline will constitute an abstention (i.e. will not be counted as either an acceptance or a rejection), and any improperly completed or late ballot will not be counted.

THIS DISCLOSURE STATEMENT HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC, NOR HAS THE SEC PASSED ON THE ACCURACY OR ADEQUACY OF THE STATEMENTS CONTAINED HEREWITH. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

IRS CIRCULAR 230 NOTICE: TO ENSURE COMPLIANCE WITH IRS CIRCULAR 230, HOLDERS OF CLAIMS AND EQUITY INTERESTS IN THE DEBTORS ARE HEREBY NOTIFIED THAT: (A) ANY DISCUSSION OF FEDERAL TAX ISSUES CONTAINED OR REFERRED TO IN THIS DISCLOSURE STATEMENT IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, BY HOLDERS OF CLAIMS OR EQUITY INTERESTS FOR THE PURPOSE OF AVOIDING PENALTIES THAT MAY BE IMPOSED ON THEM UNDER THE INTERNAL REVENUE CODE; (B) SUCH DISCUSSION IS

DS-3

WRITTEN IN CONNECTION WITH THE PROMOTION OR MARKETING BY THE DEBTORS OF THE TRANSACTIONS OR MATTERS.

II.

EXECUTIVE SUMMARY

The Plan provides for a reorganization of the Debtors’ businesses as a going concern. The Plan contemplates that the Debtors will emerge with at least $1,650,000,000 in available financing and that the Plan Sponsor will purchase a majority of common stock of the Reorganized PPC to fund distributions under the Plan. All holders of Claims will be paid in full, unless otherwise agreed by such holder. Holders of Equity Interests will receive certain amount of common stock of the Reorganized PPC.

| A. | Summary of Classification and Treatment of Claims and Equity Interests Under Plan |

The following table divides the claims against and equity interests in the Debtors into separate classes and summarizes the treatment for each class. The table also identifies which classes are impaired or unimpaired and entitled to vote on the Plan based on rules set forth in the Bankruptcy Code. Finally, the table indicates an estimated recovery for each class.Important Note: The recoveries described in the following table represent the Debtors’ best estimates of those values given the information available at this time. These estimates do not predict the potential trading prices for the common stock of the Reorganized PPC.

| | | | | | | | | |

CLASS | | DESIGNATION | | STATUS | | ENTITLED TO VOTE? | | ESTIMATED

RECOVERY | |

CLASSES 1(a) – (g) | |

Class 1(a) | | Priority Non-Tax Claims against PPC | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 1(b) | | Priority Non-Tax Claims against PFS Distribution Company | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 1(c) | | Priority Non-Tax Claims against PPC Transportation Company | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 1(d) | | Priority Non-Tax Claims against To-Ricos, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 1(e) | | Priority Non-Tax Claims against To-Ricos Distribution, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 1(f) | | Priority Non-Tax Claims against Pilgrim’s Pride Corporation of West Virginia, Inc. | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 1(g) | | Priority Non-Tax Claims against PPC Marketing, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

CLASSES 2(a) – (c) | | | | | | | | | |

Class 2(a) | | BMO Secured Claims against PPC | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 2(b) | | BMO Secured Claims against To-Ricos, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 2(c) | | BMO Secured Claims against To-Ricos Distribution, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

DS-4

| | | | | | | | | |

CLASS | | DESIGNATION | | STATUS | | ENTITLED TO VOTE? | | ESTIMATED

RECOVERY | |

CLASS 3 | |

Class 3 | | CoBank Secured Claims against PPC | | Unimpaired | | No (deemed to accept) | | 100 | % |

CLASSES 4(a) – (g) | | | | | | | | | |

Class 4(a) | | Secured Tax Claims against PPC | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 4(b) | | Secured Tax Claims against PFS Distribution Company | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 4(c) | | Secured Tax Claims against PPC Transportation Company | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 4(d) | | Secured Tax Claims against To-Ricos, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 4(e) | | Secured Tax Claims against To-Ricos Distribution, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 4(f) | | Secured Tax Claims against Pilgrim’s Pride Corporation of West Virginia, Inc. | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 4(g) | | Secured Tax Claims against PPC Marketing, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

CLASSES 5(a) – (g) | | | | | | | | | |

Class 5(a) | | Other Secured Claims against PPC | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 5(b) | | Other Secured Claims against PFS Distribution Company | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 5(c) | | Other Secured Claims against PPC Transportation Company | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 5(d) | | Other Secured Claims against To-Ricos, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 5(e) | | Other Secured Claims against To-Ricos Distribution, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 5(f) | | Other Secured Claims against Pilgrim’s Pride Corporation of West Virginia, Inc. | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 5(g) | | Other Secured Claims against PPC Marketing, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

CLASSES 6(a) – (c) | | | | | | | | | |

Class 6(a) | | Senior Note Claims against PPC | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 6(b) | | Senior Subordinated Note Claims against PPC | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 6(c) | | Subordinated Note Claims against PPC | | Unimpaired | | No (deemed to accept) | | 100 | % |

CLASSES 7(a) – (g) | | | | | | | | | |

Class 7(a) | | General Unsecured Claims against PPC | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 7(b) | | General Unsecured Claims against PFS Distribution Company | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 7(c) | | General Unsecured Claims against PPC Transportation Company | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 7(d) | | General Unsecured Claims against To-Ricos, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

Class 7(e) | | General Unsecured Claims against To-Ricos Distribution, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

DS-5

| | | | | | | | | |

CLASS | | DESIGNATION | | STATUS | | ENTITLED TO VOTE? | | ESTIMATED

RECOVERY | |

| Class 7(f) | | General Unsecured Claims against Pilgrim’s Pride Corporation of West Virginia, Inc. | | Unimpaired | | No (deemed to accept) | | 100 | % |

| Class 7(g) | | General Unsecured Claims against PPC Marketing, Ltd. | | Unimpaired | | No (deemed to accept) | | 100 | % |

| CLASS 8 | | | | | | | | | |

| Class 8 | | Intercompany Claims | | Unimpaired | | No (deemed to accept) | | 100 | % |

| CLASS 9 | | | | | | | | | |

| Class 9 | | Flow-Through Claims | | Unimpaired | | No (deemed to accept) | | 100 | % |

CLASSES 10(a) – (g) | | | | | | | | | |

| Class 10(a) | | Equity Interests in PPC | | Impaired | | Yes | | N/A | |

| Class 10(b) | | Equity Interests in PFS Distribution Company | | Unimpaired | | No (deemed to accept) | | N/A | |

| Class 10(c) | | Equity Interests in PPC Transportation Company | | Unimpaired | | No (deemed to accept) | | N/A | |

| Class 10(d) | | Equity Interests in To-Ricos, Ltd. | | Unimpaired | | No (deemed to accept) | | N/A | |

| Class 10(e) | | Equity Interests in To-Ricos Distribution, Ltd. | | Unimpaired | | No (deemed to accept) | | N/A | |

| Class 10(f) | | Equity Interests in Pilgrim’s Pride Corporation of West Virginia, Inc. | | Unimpaired | | No (deemed to accept) | | N/A | |

| Class 10(g) | | Equity Interests in PPC Marketing, Ltd. | | Unimpaired | | No (deemed to accept) | | N/A | |

| B. | Overview of Chapter 11 Process |

Chapter 11 is the principal reorganization chapter of the Bankruptcy Code, pursuant to which a debtor in possession may reorganize its business for the benefit of its creditors, equity holders, and other parties-in-interest. The commencement of a chapter 11 case creates an estate comprising all the legal and equitable interests of the debtor in possession as of the date the petition is filed. Sections 1101, 1107, and 1108 of the Bankruptcy Code provide that a debtor may continue to operate its business and remain in possession of its property as a “debtor in possession” unless the bankruptcy court orders the appointment of a trustee.

The filing of a chapter 11 petition triggers the automatic stay provisions of the Bankruptcy Code. Section 362 of the Bankruptcy Code provides, among other things, for an automatic stay of all attempts by creditors or other third parties to collect pre-petition claims from the debtor or otherwise interfere with its property or business. Exempted from the automatic stay are governmental authorities seeking to exercise regulatory or policing powers. Except as otherwise ordered by the bankruptcy court, the automatic stay remains in full force and effect until the effective date of a confirmed plan of reorganization.

The formulation of a plan of reorganization is the principal purpose of a chapter 11 case. The plan sets forth the means for satisfying the holders of claims against and interests in the debtor’s estate. Unless a trustee is appointed, only the debtor may file a plan during the first 120 days of a chapter 11 case (the “Exclusive Filing Period”). However, section 1121(d) of the Bankruptcy Code permits the bankruptcy court to extend or reduce the Exclusive Filing Period upon a showing of “cause.” Following the filing of a plan, a debtor must solicit acceptances of the plan within a certain time period (the “Exclusive Solicitation Period”). The Exclusive Solicitation Period may also be extended or reduced by the bankruptcy court upon a showing of “cause.”

DS-6

III.

OVERVIEW OF THE DEBTORS’ OPERATIONS

| A. | History of Pilgrim’s Pride |

Formed in 1946 as a retail feed store partnership between Lonnie A. “Bo” Pilgrim and his brother, Aubrey E. Pilgrim, PPC has been a publicly traded company since 1986. PPC was incorporated in 1968 in Texas and reincorporated in 1986 in Delaware. Business operations in Mexico are conducted through non-debtor subsidiaries organized under the laws of Mexico.

PPC is the direct or indirect parent company of each of the other Debtors. The Debtors are organized in various jurisdictions ranging from Texas to Bermuda. PPC is also the indirect or direct parent company of certain non-debtor entities that are located in the United States and in foreign jurisdictions, including Mexico. Business operations in the United States are carried out by the Debtors and the Debtors’ non-debtor affiliates.

Pilgrim’s Pride’s headquarters are located in Pittsburg, Texas. Prior to the Commencement Date, Pilgrim’s Pride owned 34 processing plants in the United States and 3 processing plants in Mexico. In the United States, the processing plants were supported by 42 hatcheries, 31 feed mills and 12 rendering plants. In Mexico, the processing plants were supported by 7 hatcheries, 4 feed mills and 2 rendering plants. In addition, prior to the Commencement Date, Pilgrim’s Pride owned 12 prepared food production facilities in the United States.

PPC acquired WLR Foods, Inc. in 2001 and the chicken division of ConAgra Foods, Inc. in 2003. In December 2006, PPC acquired a majority of the outstanding common stock of Gold Kist Inc. (“Gold Kist”) through a tender offer. PPC acquired the remaining shares of Gold Kist in January 2007, making Gold Kist its wholly-owned subsidiary. The chart annexed hereto asExhibit H illustrates Pilgrim’s Pride’s corporate structure as of September 15, 2009.

Prior to the Commencement Date, Pilgrim’s Pride contracted with more than 5,500 growers working on over 6,000 farms, many of whom are small farm owners, who either raise and care for the chickens Pilgrim’s Pride uses for breeding or who grow the broiler chickens from hatchlings until they are ready to be processed. Pilgrim’s Pride maintains title to and ownership of the chickens and feed ingredients fed to them, but Pilgrim’s Pride contracts with growers to administer feed and tend to the chickens used for breeding and for the broiler chickens until they reach certain targeted weights. The growers are independent contractors. The growers own, operate and provide the farms, the chicken houses, equipment, utilities and labor necessary to tend the chickens. Once the broiler chickens have reached a certain weight and meet other specifications, these chickens are returned to Pilgrim’s Pride to be processed, packaged and transported to customers.

| B. | The Debtors’ Businesses |

Under the well-established Pilgrim’s Pride brand name, the Debtors’ fresh chicken retail line is sold in the southeastern, central, southwestern and western regions of the U.S., throughout Puerto Rico, and in the northern and central regions of Mexico. The Debtors’ prepared chicken products meet the needs of some of the largest customers in the food service industry across the U.S. Additionally, the Debtors export commodity chicken products to approximately 80 countries.

DS-7

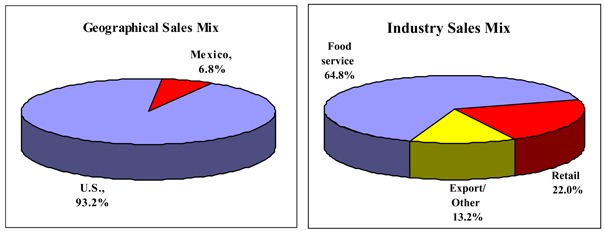

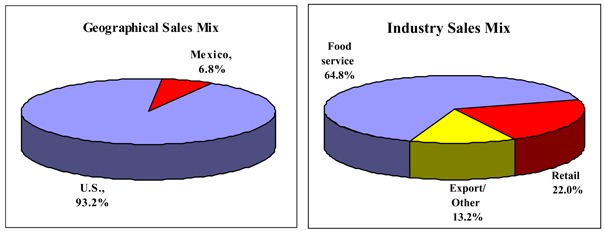

In fiscal 2008, PPC sold 8.4 billion pounds of dressed chicken and its net sales totaled $8.5 billion. Approximately 93.2% of PPC’s sales were attributed to its U.S. operations while 6.8% was attributed to its operations in Mexico. Of the Company’s U.S. chicken sales of $7.1 billion, approximately 65% was sold to foodservice, 22% to retail, and the remaining 13% to export and other channels.

PPC has consistently applied a long-term business strategy of focusing its growth efforts on the historically higher-value prepared chicken products and has become a recognized industry leader in this market. Accordingly, PPC focused its sales efforts on the foodservice industry, principally chain restaurants and food processors. More recently, PPC also focused its sales efforts on retailers seeking value-added products.

| | 2. | Assets and Capacity Utilization |

As of September 1, 2009, PPC operates 28 poultry processing plants located in Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, North Carolina, South Carolina, Tennessee, Texas, Virginia, and West Virginia. PPC’s U.S. chicken processing plants have weekly capacity to process 36.9 million broilers and are expected to operate at 85% of capacity in 2009. In the U.S., the processing plants are supported by 34 hatcheries, 27 feed mills, eight rendering plants and three pet food plants. The hatcheries, feed mills, rendering plants and pet food plants are expected to operate at 79%, 73%, 37% and 58% of capacity, respectively, in fiscal year 2009. Capacity utilization for PPC’s rendering plants is very low because a fire in late 2008 left one of its larger plants inoperable for the first half of fiscal 2009. This rendering plant returned to its pre-fire utilization level in May 2009.

PPC has three chicken processing plants in Mexico that have a combined capacity to process 3.27 million broilers per week and are expected to operate at 73% of capacity in 2009. These plants are supported by six hatcheries, four feed mills and two rendering facilities. The Mexico hatcheries, feed mills and rendering facilities are expected to operate at 94%, 77% and 65% of capacity, respectively, in 2009.

DS-8

PPC has one chicken processing plant in Puerto Rico with the capacity to process 0.3 million broilers per week based on one eight-hour shift per day. This plant is supported by one hatchery and one feed mill, which are expected to operate at 82% and 80% of capacity, respectively, in 2009. For segment reporting purposes, PPC includes Puerto Rico with its U.S. operations.

PPC also operates nine prepared food production facilities. These plants are located in Alabama, Georgia, South Carolina, Tennessee, Texas and West Virginia. These plants have the capacity to produce approximately 1.24 billion pounds of further-processed product per year. In fiscal year 2009, these plants are expected to operate at approximately 85% of capacity.

PPC operates in two business segments as (i) a producer and seller of chicken products and (ii) a seller of other products.

PPC’s chicken products consist primarily of:

(1)Fresh Chicken: Fresh chicken products, which are refrigerated (non-frozen) whole or cut-up chickens sold to the foodservice industry either pre-marinated or non-marinated. Fresh chicken also includes prepackaged case-ready chicken, which includes various combinations of freshly refrigerated, whole chickens and chicken parts in trays, bags or other consumer packs labeled and priced ready for the retail grocer’s fresh meat counter.

PPC’s fresh chicken business is a significant component of its sales and accounted for $3,591.8 million, or 50.7%, of its total U.S. chicken sales for fiscal 2008. In addition to maintaining sales of mature, traditional fresh chicken products, PPC’s strategy is to shift the mix of its U.S. fresh chicken products by continuing to increase sales of faster-growing products, such as marinated whole chicken and chicken parts, and to continually shift portions of this product mix into the higher-value prepared chicken category. Most fresh chicken products are sold to established customers, based upon certain weekly or monthly market prices reported by the U.S. Department of Agriculture (“USDA”) and other public price reporting services, plus a markup, which is dependent upon the customer’s location, volume, product specifications and other factors. PPC believes its practices with respect to sales of fresh chicken are generally consistent with those of its competitors. The majority of these products are sold pursuant to agreements with varying terms that either set a fixed price for the products or set a price according to formulas based on an underlying commodity market, subject in many cases to minimum and maximum prices.

(2)Prepared Chicken: Prepared chicken products, which are products such as portion-controlled breast fillets, tenderloins and strips, delicatessen products, salads, formed nuggets and patties and bone-in chicken parts. These products are sold either refrigerated or frozen and may be fully cooked, partially cooked or raw. In addition, these products are breaded or non-breaded and either pre-marinated or non-marinated. During fiscal 2008, $2,522.1 million of PPC’s U.S. chicken sales were in prepared chicken products to foodservice customers and retail distributors, as compared to $1,861.7 million in fiscal 2004. These numbers reflect the impact of PPC’s historical strategic focus for growth in the prepared chicken markets and its acquisition of Gold Kist. The market for prepared chicken products has experienced, and PPC believes will continue to experience, greater growth and higher average sales prices than fresh chicken products. Also, the production and sale in the U.S. of prepared chicken products reduce the impact of the costs of feed ingredients on our profitability. Feed ingredient costs are the single largest component of PPC’s total U.S. cost of sales, representing approximately 38.1% of its total U.S.

DS-9

cost of sales for fiscal 2008. The production of feed ingredients is positively or negatively affected primarily by the global level of supply inventories, demand for feed ingredients, the agricultural policies of the U.S. and foreign governments and weather patterns throughout the world. As further processing is performed, feed ingredient costs become a decreasing percentage of a product’s total production cost, thereby reducing their impact on PPC’s profitability. Products sold in this form enable PPC to charge a premium, reduce the impact of feed ingredient costs on its profitability and improve and stabilize its profit margins.

PPC establishes prices for its prepared chicken products based primarily upon perceived value to the customer, production costs and prices of competing products. The majority of these products are sold pursuant to agreements with varying terms that either set a fixed price for the products or set a price according to formulas based on an underlying commodity market, subject in many cases to minimum and maximum prices. Many times, these prices are dependent upon the customer’s location, volume, product specifications and other factors.

(3) Export and Other Chicken Products: Export and other chicken products, are primarily parts and whole chicken, either refrigerated or frozen for U.S. export or domestic use, and prepared chicken products for U.S. export. PPC’s export and other products consist of whole chickens and chicken parts sold primarily in bulk, non-branded form, either refrigerated to distributors in the U.S. or frozen for distribution to export markets, and branded and non-branded prepared chicken products for distribution to export markets. In fiscal 2008, approximately $933.2 million, or 13.2%, of PPC’s total U.S. chicken sales were attributable to U.S. chicken export and other products. These exports and other products, other than the prepared chicken products, have historically been characterized by lower prices and greater price volatility than PPC’s more value-added product lines.

| | 5. | Markets for Chicken Products—U.S. |

PPC’s chicken products are sold primarily to foodservices customers, retail customers and export and other product customers.

Foodservice:The foodservice market principally consists of chain restaurants, food processors, broad-line distributors and certain other institutions located throughout the continental U.S. PPC supplies chicken products ranging from portion-controlled refrigerated chicken parts to fully-cooked and frozen, breaded or non-breaded chicken parts or formed products.

PPC believes it is positioned to be the primary or secondary supplier to national and international chain restaurants who require multiple suppliers of chicken products. Additionally, PPC believes it is well suited to be the sole supplier for many regional chain restaurants. Regional chain restaurants often offer better margin opportunities and a growing base of business.

PPC believes it has operational strengths in terms of full-line product capabilities, high-volume production capacities, research and development expertise and extensive distribution and marketing experience relative to smaller and non-vertically integrated producers. While the overall chicken market has grown consistently, PPC believes the majority of this growth in recent years has been in the foodservice market. According to the National Chicken Council, from 2003 through 2007, sales of chicken products to the foodservice market grew at a compounded annual growth rate of approximately 7.5%, versus 6.6% growth for the chicken industry overall. Foodservice growth, outside of any temporary effects resulting from the current recessionary impacts being experienced in the U.S., is anticipated to continue as food-away-from-home expenditures continue to outpace overall industry rates.

DS-10

Foodservice-Prepared Chicken: PPC’s prepared chicken sales to the foodservice market were $2,033.5 million in fiscal 2008 compared to $1,647.9 million in fiscal 2004, a compounded annual growth rate of approximately 5.4%. In addition to the significant increase in sales created by the acquisition of Gold Kist, PPC attributes this growth in sales of prepared chicken to the foodservice market to a number of factors. First, there has been significant growth in the number of foodservice operators offering chicken on their menus and in the number of chicken items offered. Second, foodservice operators are increasingly purchasing prepared chicken products, which allow them to reduce labor costs while providing greater product consistency, quality and variety across all restaurant locations.

There is a strong need among larger foodservice companies for a limited-source supplier base in the prepared chicken market. A viable supplier must be able to ensure supply, demonstrate innovation and new product development and provide competitive pricing. PPC has been successful in becoming a supplier of choice by being the primary or secondary prepared chicken supplier to many large foodservice companies for various reasons. Through vertical integration, PPC manages the breeding, hatching and growing of chickens. PPC also manages the processing, preparation, packaging, sale and distribution of its product lines, which PPC believes has made it one of the highest quality, lowest-cost producers of chicken in North America. PPC’s further processing facilities, with a wide range of capabilities, are particularly well-suited to the high-volume production as well as low-volume custom production runs necessary to meet both the capacity and quality requirements of the foodservice market. In addition, PPC has established a reputation for dependable quality, highly responsive service and excellent technical support. As a result of the experience and reputation developed with larger customers, PPC has increasingly become the principal supplier to mid-sized foodservice organizations.

PPC’s in-house product development group follows a customer-driven research and development focus designed to develop new products to meet customers’ changing needs. PPC’s research and development personnel often work directly with institutional customers in developing products for these customers. PPC is a leader in using advanced processing technology, which enables it to better meet its customers’ needs for product innovation, consistent quality and cost efficiency.

Foodservice-Fresh Chicken: PPC produces and markets fresh, refrigerated chicken for sale to U.S. quick-service restaurant chains, delicatessens and other customers. These chickens have the giblets removed, are usually of specific weight ranges and are usually pre-cut to customer specifications. They are often marinated to enhance value and product differentiation. By growing and processing to customers’ specifications, PPC is able to assist quick-service restaurant chains in controlling costs and maintaining quality and size consistency of chicken pieces sold to the consumer. PPC’s fresh chicken products sales to the foodservice market were $2,550.3 million in fiscal 2008 compared to $1,328.9 million in fiscal 2004, a compounded annual growth rate of approximately 17.7%.

Retail: The retail market consists primarily of grocery store chains, wholesale clubs and other retail distributors. PPC concentrates its efforts in this market on sales of branded, prepackaged cut-up and whole chicken and chicken parts to grocery store chains and retail distributors. For a number of years, PPC has invested in both trade and retail marketing designed to establish high levels of brand name awareness and consumer preferences.

PPC utilizes numerous marketing techniques, including advertising, to develop and strengthen trade and consumer awareness and increase brand loyalty for consumer products marketed under the Pilgrim’s Pride® brand. PPC’s co-founder and senior chairman, Lonnie “Bo” Pilgrim, is the featured spokesperson in its television, radio and print advertising, and a trademark cameo of a person wearing a Pilgrim’s hat serves as the logo on all of PPC’s primary branded products. As a result of this marketing strategy, Pilgrim’s Pride® is a well-known brand name in a number of markets. PPC believes its efforts to achieve and maintain brand awareness and loyalty help to provide more secure distribution

DS-11

for its products. PPC also believes its efforts at brand awareness generate greater price premiums than would otherwise be the case in certain markets. PPC also maintains an active program to identify consumer preferences. The program primarily consists of discovering and validating new product ideas, packaging designs and methods through sophisticated qualitative and quantitative consumer research techniques in key geographic markets.

Due to internal growth and the impact of both the Gold Kist and ConAgra Chicken acquisitions, PPC’s sales to the retail market from fiscal 2004 through fiscal 2008 grew at a compounded annual growth rate of 15.8% and represented 22.0% of the net sales of its U.S. chicken operations in fiscal 2008.

Retail-Prepared Chicken: PPC sells retail-oriented prepared chicken products primarily to grocery store chains located throughout the U.S. PPC’s prepared chicken products sales to the retail market were $518.6 million in fiscal 2008 compared to $213.8 million in fiscal 2004, a compounded annual growth rate of approximately 24.8%. PPC believes that its growth in this market segment will continue as retailers concentrate on satisfying consumer demand for more products that are quick, easy and convenient to prepare at home.

Retail-Fresh Chicken: PPC’s prepackaged retail products include various combinations of freshly refrigerated, whole chickens and chicken parts in trays, bags or other consumer packs labeled and priced ready for the retail grocer’s fresh meat counter. PPC’s retail fresh chicken products are sold in the midwestern, southwestern, southeastern and western regions of the U.S. Its fresh chicken sales to the retail market were $1,041.4 million in fiscal 2008 compared to $653.8 million in fiscal 2004, a compounded annual growth rate of approximately 12.3% resulting primarily from its acquisition of Gold Kist in 2007. PPC believes the retail prepackaged fresh chicken business will continue to be a large and relatively stable market, providing opportunities for product differentiation and regional brand loyalty.

Export and Other Chicken Products: PPC’s export and other chicken products, with the exception of its exported prepared chicken products, consist of whole chickens and chicken parts sold primarily in bulk, non-branded form either refrigerated to distributors in the U.S. or frozen for distribution to export markets. In the U.S., prices of these products are negotiated daily or weekly and are generally related to market prices quoted by the USDA or other public price reporting services. PPC sells U.S.-produced chicken products for export to Eastern Europe, including Russia; the Far East, including China; Mexico; and other world markets.

Historically, PPC has targeted international markets to generate additional demand for its dark chicken meat, which is a natural by-product of its U.S. operations given PPC’s concentration on prepared chicken products and the U.S. customers’ general preference for white chicken meat. PPC also has begun selling prepared chicken products for export to the international divisions of its U.S. chain restaurant customers. PPC believes that U.S. chicken exports will continue to grow as worldwide demand increases for high-grade, low-cost meat protein sources. Also included in this category are chicken by-products, which are converted into protein products and sold primarily to manufacturers of pet foods.

| | 6. | Markets for Other Products—U.S. |

PPC’s other products consist of: (a) other types of meat protein along with various other staples purchased and sold by PPC’s distribution centers as a convenience to its chicken customers who purchase through the distribution centers; and (b) the production and sale of table eggs, commercial feeds and related items, live hogs and proteins.

DS-12

The following table sets forth, for the periods beginning with fiscal 2004, net sales attributable to each of PPC’s primary product lines and markets served with those products. PPC based the table on its internal sales reports and its classification of product types and customers.

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal

2008 | | | Fiscal

2007(a) | | | Fiscal

2006 | | | Fiscal

2005 | | | Fiscal

2004(a) | |

| | | (52 weeks | ) | | | (52 weeks | ) | | | (52 weeks | ) | | | (52 weeks | ) | | | (53 weeks | ) |

| | | (In thousands) | |

U.S. chicken: | | | | | | | | | | | | | | | | | | | | |

Prepared chicken: | | | | | | | | | | | | | | | | | | | | |

Foodservice | | $ | 2,033,489 | | | $ | 1,897,643 | | | $ | 1,567,297 | | | $ | 1,622,901 | | | $ | 1,647,904 | |

Retail | | | 518,576 | | | | 511,470 | | | | 308,486 | | | | 283,392 | | | | 213,775 | |

| | | | | | | | | | | | | | | | | | | | |

Total prepared chicken | | | 2,552,065 | | | | 2,409,113 | | | | 1,875,783 | | | | 1,906,293 | | | | 1,861,679 | |

Fresh chicken: | | | | | | | | | | | | | | | | | | | | |

Foodservice | | | 2,550,339 | | | | 2,280,057 | | | | 1,388,451 | | | | 1,509,189 | | | | 1,328,883 | |

Retail | | | 1,041,446 | | | | 975,659 | | | | 496,560 | | | | 612,081 | | | | 653,798 | |

| | | | | | | | | | | | | | | | | | | | |

Total fresh chicken | | | 3,591,785 | | | | 3,255,716 | | | | 1,885,011 | | | | 2,121,270 | | | | 1,982,681 | |

Export and other: | | | | | | | | | | | | | | | | | | | | |

Export: | | | | | | | | | | | | | | | | | | | | |

Prepared chicken | | | 94,795 | | | | 83,317 | | | | 64,338 | | | | 59,473 | | | | 34,735 | |

Fresh chicken | | | 818,239 | | | | 559,429 | | | | 257,823 | | | | 303,150 | | | | 212,611 | |

| | | | | | | | | | | | | | | | | | | | |

Total export(c) | | | 913,034 | | | | 642,746 | | | | 322,161 | | | | 362,623 | | | | 247,346 | |

Other chicken by-products | | | 20,163 | | | | 20,779 | | | | 15,448 | | | | 21,083 | | | | (b | ) |

| | | | | | | | | | | | | | | | | | | | |

Total export and other | | | 933,197 | | | | 663,525 | | | | 337,609 | | | | 383,706 | | | | 247,346 | |

| | | | | | | | | | | | | | | | | | | | |

Total U.S. chicken | | | 7,077,047 | | | | 6,328,354 | | | | 4,098,403 | | | | 4,411,269 | | | | 4,091,706 | |

Mexico chicken | | | 543,583 | | | | 488,466 | | | | 418,745 | | | | 403,353 | | | | 362,442 | |

| | | | | | | | | | | | | | | | | | | | |

Total chicken | | | 7,620,630 | | | | 6,816,820 | | | | 4,517,148 | | | | 4,814,622 | | | | 4,454,148 | |

Other products: | | | | | | | | | | | | | | | | | | | | |

U.S. | | | 869,850 | | | | 661,115 | | | | 618,575 | | | | 626,056 | | | | 600,091 | |

Mexico | | | 34,632 | | | | 20,677 | | | | 17,006 | | | | 20,759 | | | | 23,232 | |

| | | | | | | | | | | | | | | | | | | | |

Total other products | | | 904,482 | | | | 681,792 | | | | 635,581 | | | | 646,815 | | | | 623,323 | |

| | | | | | | | | | | | | | | | | | | | |

Total net sales | | $ | 8,525,112 | | | $ | 7,498,612 | | | $ | 5,152,729 | | | $ | 5,461,437 | | | $ | 5,077,471 | |

| | | | | | | | | | | | | | | | | | | | |

Total prepared chicken | | $ | 2,646,860 | | | $ | 2,492,430 | | | $ | 1,940,121 | | | $ | 1,965,766 | | | $ | 1,896,414 | |

| (a) | The Gold Kist acquisition on December 27, 2006, and the ConAgra Chicken acquisition on November 23, 2003, have been accounted for as purchases. |

| (b) | The Export and other category historically included the sales of certain chicken by-products sold in international markets as well as the export of chicken products. Prior to fiscal 2005, by-product sales were not specifically identifiable within the Export and other category. Accordingly, a detailed breakout is not available prior to such time; however, PPC believes that the relative split between these categories as shown in fiscal 2005 would not be dissimilar in fiscal 2004. |

| (c) | Export items include certain chicken parts that have greater value in the overseas markets than in the U.S. |

The following table sets forth, beginning with fiscal 2004, the percentage of net U.S. chicken sales attributable to each of PPC’s primary product lines and the markets serviced with those products. PPC based the table and related discussion on its internal sales reports and its classification of product types and customers.

DS-13

| | | | | | | | | | | | | | | |

| | | Fiscal

2008 | | | Fiscal

2007(a) | | | Fiscal

2006 | | | Fiscal

2005 | | | Fiscal

2004(a) | |

Prepared chicken: | | | | | | | | | | | | | | | |

Foodservice | | 28.8 | % | | 30.1 | % | | 38.2 | % | | 36.8 | % | | 40.3 | % |

Retail | | 7.3 | % | | 8.1 | % | | 7.5 | % | | 6.4 | % | | 5.2 | % |

| | | | | | | | | | | | | | | |

Total prepared chicken | | 36.1 | % | | 38.2 | % | | 45.7 | % | | 43.2 | % | | 45.5 | % |

Fresh chicken: | | | | | | | | | | | | | | | |

Foodservice | | 36.0 | % | | 36.0 | % | | 33.9 | % | | 34.2 | % | | 32.5 | % |

Retail | | 14.7 | % | | 15.4 | % | | 12.1 | % | | 13.9 | % | | 16.0 | % |

| | | | | | | | | | | | | | | |

Total fresh chicken | | 50.7 | % | | 51.4 | % | | 46.0 | % | | 48.1 | % | | 48.5 | % |

Export and other: | | | | | | | | | | | | | | | |

Export: | | | | | | | | | | | | | | | |

Prepared chicken | | 1.3 | % | | 1.3 | % | | 1.6 | % | | 1.3 | % | | 0.8 | % |

Fresh chicken | | 11.6 | % | | 8.8 | % | | 6.3 | % | | 6.9 | % | | 5.2 | % |

| | | | | | | | | | | | | | | |

Total export(c) | | 12.9 | % | | 10.1 | % | | 7.9 | % | | 8.2 | % | | 6.0 | % |

Other chicken by-products | | 0.3 | % | | 0.3 | % | | 0.4 | % | | 0.5 | % | | (b | ) |

| | | | | | | | | | | | | | | |

Total export and other | | 13.2 | % | | 10.4 | % | | 8.3 | % | | 8.7 | % | | 6.0 | % |

| | | | | | | | | | | | | | | |

Total US chicken | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | | | | | | | |

Total prepared chicken as a percent of U.S. chicken | | 37.4 | % | | 39.5 | % | | 47.3 | % | | 44.5 | % | | 46.3 | % |

| (a) | The Gold Kist acquisition on December 27, 2006, and the ConAgra Chicken acquisition on November 23, 2003, have been accounted for as purchases. |

| (b) | The Export and other category historically included the sales of certain chicken by-products sold in international markets as well as the export of chicken products. Prior to fiscal 2005, by-product sales were not specifically identifiable within the Export and other category. Accordingly, a detailed breakout is not available prior to such time; however, PPC believes that the relative split between these categories as shown in fiscal 2005 would not be dissimilar in fiscal 2004. |

| (c) | Export items include certain chicken parts that have greater value in the overseas markets than in the U.S. |

PPC has regional distribution centers located in Arizona, Texas and Utah that are primarily focused on distributing its own chicken products; however, the distribution centers also distribute certain poultry and non-poultry products purchased from third parties to independent grocers and quick-service restaurants. PPC’s non-chicken distribution business is conducted as an accommodation to its customers and to achieve greater economies of scale in distribution logistics. Chicken sales from the Debtors’ regional distribution centers are included in the chicken sales amounts contained in the above tables; however, all non-chicken sales amounts are contained in the Other Products sales in the above tables.

PPC markets fresh eggs under the Pilgrim’s Pride® brand name, as well as under private labels, in various sizes of cartons and flats to U.S. retail grocery and institutional foodservice customers located primarily in Texas. PPC has a housing capacity for approximately 2.1 million commercial egg laying hens which can produce approximately 42 million dozen eggs annually. U.S. egg prices are determined weekly based upon reported market prices. The U.S. egg industry has been consolidating over the last few years, with the 25 largest producers accounting for more than 65% of the total number of egg laying hens in service during 2008. PPC competes with other U.S. egg producers primarily on the basis of product quality, reliability, price and customer service.

DS-14

PPC produces and sells livestock feeds at its feed mill in Mt. Pleasant, Texas, and at its farm supply store in Pittsburg, Texas, to dairy farmers and livestock producers in northeastern Texas. PPC engages in similar sales activities at its other U.S. feed mills.

PPC also has a small pork operation that it acquired through the Gold Kist acquisition that raises and sells live hogs to processors.

The Mexico market represented approximately 6.8% of PPC’s net sales in fiscal 2008. PPC is the second-largest producer and seller of chicken in Mexico. PPC believes that it is one of the lower-cost producers of chicken in Mexico.

While the market for chicken products in Mexico is less developed than in the U.S., with sales attributed to fewer, more basic products, PPC has been successful in differentiating its products through high-quality client service and product improvements such as dry-air chilled, eviscerated products. The supermarket chains consider PPC the leader in innovation for fresh products. The market for value-added products is increasing. PPC’s strategy is to capitalize on this trend through its vast U.S. experience in both products and quality and its well-known service.

| | 8. | Markets for Chicken Products—Mexico |

PPC sells its chicken products primarily to wholesalers, large restaurant chains, fast food accounts, supermarket chains and direct retail distribution in selected markets. PPC has national presence and is currently present in all but four of the 32 Mexican States, which in total represent 95% of the Mexican population.

The chicken industry is highly competitive and PPC is one of largest producers of chicken in the U.S., Mexico and Puerto Rico. PPC’s recent liquidity constraints have had a negative effect on its competitive position, relative to its competitors that are less leveraged. In the U.S., Mexico and Puerto Rico, PPC competes principally with other vertically integrated poultry companies.

In general, the competitive factors in the U.S. chicken industry include price, product quality, product development, brand identification, breadth of product line and customer service. Competitive factors vary by major market. In the U.S. retail market, PPC believes that product quality, brand awareness, customer service and price are the primary bases of competition. In the foodservice market, competition is based on consistent quality, product development, service and price. There is some competition with non-vertically integrated further processors in the U.S. prepared chicken business. PPC believes vertical integration generally provides significant, long-term cost and quality advantages over non-vertically integrated further processors.

In Mexico, where product differentiation has traditionally been limited, product quality, service and price have been the most critical competitive factors. In July 2003, the U.S. and Mexico entered into a safeguard agreement with regard to imports into Mexico of chicken leg quarters from the U.S. Under this agreement, a tariff rate for chicken leg quarters of 98.8% of the sales price was established. This tariff was imposed because of concerns that the duty-free importation of such products

DS-15

as provided by the North American Free Trade Agreement would injure Mexico’s poultry industry. This tariff rate was eliminated on January 1, 2008. As a result of the elimination of this tariff, PPC expects greater amounts of chicken to be imported into Mexico from the U.S. This could negatively affect the profitability of Mexican chicken producers, including PPC’s Mexico operations.

PPC is not a significant competitor in the distribution business as it relates to products other than chicken. PPC distributes these products solely as a convenience to its chicken customers. The broad-line distributors do not consider PPC to be a factor in those markets. The competition related to PPC’s other products such as table eggs, feed and protein are much more regionalized and no one competitor is dominant.

PPC’s two largest customers accounted for approximately 16% of its net sales in fiscal 2008, and its largest customer, Wal-Mart Stores Inc., accounted for 11% of its net sales.

| | 11. | Regulation and Environmental Matters |

The chicken industry is subject to government regulation, particularly in the health and environmental areas, including provisions relating to the discharge of materials into the environment, by the USDA, the Food and Drug Administration (“FDA”) and the Environmental Protection Agency (“EPA”) in the U.S. and by similar governmental agencies in Mexico. PPC’s chicken processing facilities in the U.S. are subject to on-site examination, inspection and regulation by the USDA. The FDA inspects the production of PPC’s feed mills in the U.S. PPC’s Mexican food processing facilities and feed mills are subject to on-site examination, inspection and regulation by a Mexican governmental agency that performs functions similar to those performed by the USDA and FDA. PPC believes that it is in substantial compliance with all applicable laws and regulations relating to the operations of its facilities.