Exhibit 13

LETTERfrom theCHAIRMAN

The CHALLENGESof 2004 —Our SUCCESSESand Our DISAPPOINTMENTS

Let’s start with our successes.

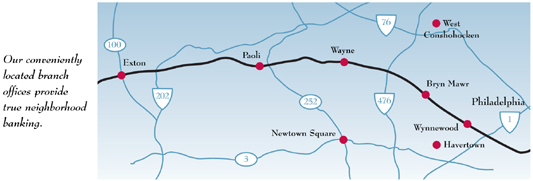

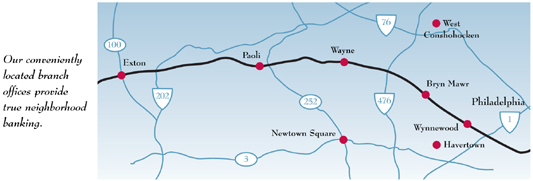

| | • | | Our new branch in Newtown Square, Pennsylvania, which opened in January 2004, far exceeded expectations and finished the year with over $21 million of deposits. Credit goes to our manager, Barb Newcomer, and her caring staff. |

| | • | | Our eighth full-service office is scheduled to open in March 2005 in Exton, Pennsylvania. We have an excellent site at the corner of Route 100 and Swedesford Road, which affords us superb visibility, access and egress, all of which are crucial for a successful branch office. |

| | • | | We are close to finalizing a re-location of our Wynnewood office to a nearby, but far superior, site. This new location should enable us to grow that office at a much faster pace. |

| | • | | In 2004, the Bank had a strong increase in loans (+12%) deposits (+14%), and total Corporation assets (+13%). This was a result of an active sales culture as well as a client retention rate far above industry averages. |

| | • | | Our Wealth Management Division had another solid year with revenues up 6% and profitability up 9%. This follows 2003 where the figures were 11% and 21% respectively. In addition, we were able to recruit John Pickering to head up this area. Before joining Bryn Mawr Trust, John had been a top executive with the prestigious private bank, Brown Brothers Harriman. |

| | • | | Our new Small Business Package was well received in the marketplace, with checking accounts and loans for this important constituency increasing sharply. Our low-cost, and in many cases free, package including a checking account, a line of credit, a credit card, a debit card, and computer banking, is the best offering of any bank in the entire Philadelphia area. |

| | • | | Our stock price held up relatively well during 2004 despite our earnings results. Over the past four years we have seen the Corporation’s stock rise from $10.56 per share (adjusted for stock-splits) to $21.99 at year-end 2004, an appreciation of 108%. |

Now, for the disappointments.

Our net income and earnings per share were below our normal levels of profitability. The confluence of three factors caused this to happen.

First, the low level of short-term interest rates throughout the year greatly impacted our net interest income. We began to get some relief towards the end of the year as the Federal Reserve started to increase interest rates. We should see the full benefit, however, in 2005.

Second, the residential refinancing boom ended and our mortgage division processed far fewer loans for resale into the secondary marketplace. If you look at the line “gain on sale of loans” on our income statement, you will see the large variance over the prior year.

PAGE 2

BRYN MAWR BANK CORPORATION

Third, provisions of the Sarbanes-Oxley legislation mandated certain actions by all public companies, including the Bank’s parent company, Bryn Mawr Bank Corporation. Our compliance costs for Sarbanes-Oxley alone were over $470,000 in actual cash and over 8,000 hours of our staff’s time. Fortunately, the burden of complying with this legislation going forward will be less onerous.

While some banks might have been satisfied with our results, we certainly were not. I anticipate a sharp improvement in our financial performance in 2005 as short-term interest rates rise, as our Wealth Management Division maintains its growth pattern, and as we continue our close control on overhead expenses.

As always, I would like to thank the Corporation’s Directors for their dedication and hard work. With the recent changes in corporate governance and regulatory oversight, their participation and contributions are more important than ever.

Thank you for your support and for being a shareholder of the Corporation.

Sincerely,

|

|

| /s/ TED PETERS |

| Ted Peters |

| Chairman and Chief Executive Officer |

PAGE 3

2004 CORPORATE HIGHLIGHTS

Consolidated FINANCIAL HIGHLIGHTS

(Dollars in thousands, except per share amounts)

| | | | | | | | | | | |

| | | 2004

| | | 2003

| | | Change

| |

FORTHEYEAR | | | | | | | | | | | |

Net interest income | | $ | 26,828 | | | $ | 24,931 | | | 8 | % |

Other income | | | 19,794 | | | | 26,577 | | | -26 | |

Other expenses | | | 31,625 | | | | 33,437 | | | -5 | |

Income from continuing operations | | | 9,345 | | | | 11,272 | | | -17 | |

Net income | | | 9,345 | | | | 9,356 | | | 0 | |

| | | |

ATYEAR-END | | | | | | | | | | | |

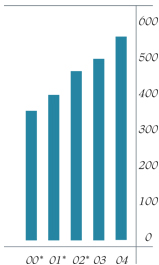

Total assets | | $ | 682,946 | | | $ | 604,848 | | | 13 | % |

Total net loans | | | 557,670 | | | | 495,746 | | | 12 | |

Total deposits | | | 600,965 | | | | 527,139 | | | 14 | |

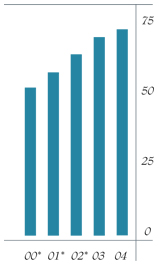

Shareholders’ equity | | | 71,238 | | | | 67,382 | | | 6 | |

| | | |

PERCOMMONSHARE | | | | | | | | | | | |

Basic earnings per common share from continuing operation | | $ | 1.09 | | | $ | 1.30 | | | -16 | % |

Diluted earnings per common share from continuing operation | | | 1.06 | | | | 1.28 | | | -17 | |

Basic earnings per common share | | | 1.09 | | | | 1.08 | | | 1 | |

Diluted earnings per common share | | | 1.06 | | | | 1.06 | | | 0 | |

Dividends declared | | | .40 | | | | .40 | | | 0 | |

Book value | | | 8.29 | | | | 7.77 | | | 7 | |

Closing price | | | 21.99 | | | | 24.10 | | | -9 | |

| | | |

SELECTEDRATIOS* | | | | | | | | | | | |

Return on average assets | | | 1.45 | % | | | 1.98 | % | | | |

Return on average shareholders’ equity | | | 13.67 | | | | 17.76 | | | | |

| * | Selected ratios are based on income from continuing operations. |

Significant CORPORATE HIGHLIGHTS

| | • | | Expanding our footprint |

| | • | | Special focus on small business initiative |

| | • | | Strong growth in loans and deposits |

| | • | | New residential mortgage strategies |

| | • | | Media recognition of expertise of BMT wealth professionals |

PAGE 4

BRYN MAWR BANK CORPORATION

| | | | | | |

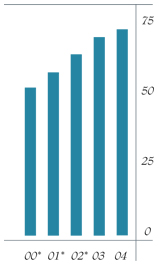

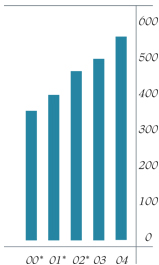

SHAREHOLDERS’

EQUITY (Dollars in millions) | | EARNINGS PER

COMMON SHAREFROM CONTINUING OPERATIONS (Dollars) | | COMMON STOCK

MARKET VALUE (Dollars per share) | | COMMON STOCK

BOOK VALUE (Dollars per share) |

| | | |

| |  | |  | |  |

| | | |

TOTAL ASSETS (Dollars in millions) | | TOTAL NET LOANS (Dollars in millions) | | TOTAL DEPOSITS (Dollars in millions) | | NET INCOMEFROM CONTINUING OPERATIONS (Dollars in millions) |

| | | |

| |  | |  | |  |

| * | Reclassified for comparative purposes |

PAGE 5

THE YEARinREVIEW 2004

EXPANDINGOur FOOTPRINT

During 2004, we focused on expanding and upgrading our branch office network and already we are seeing positive results.

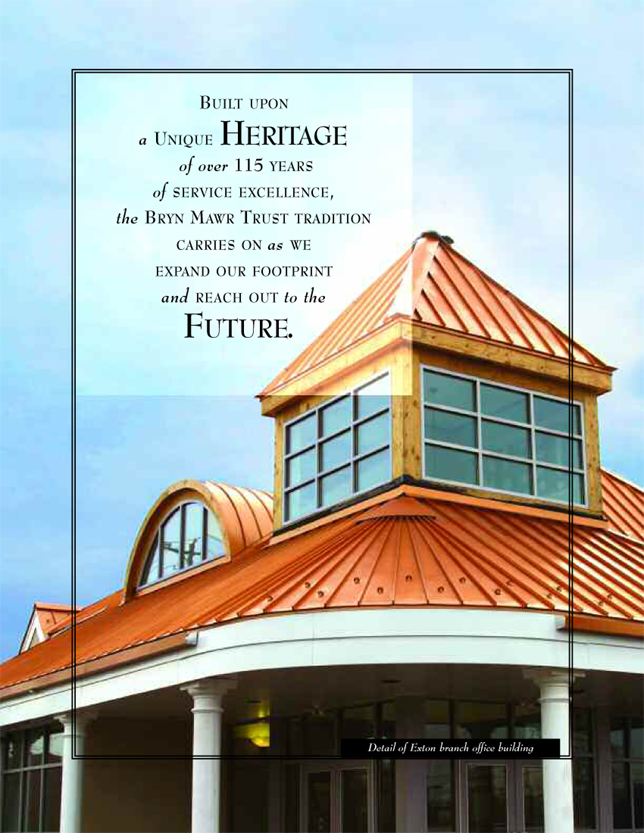

As the year 2004 began, we were in the final construction phase of the handsome edifice that now serves as our Newtown Square office. As 2004 drew to a close, the finishing touches to the major renovation project were being accomplished at our newest facility in Exton.

The opening of our Newtown Square office was extremely successful on all counts. First year business volume has far exceeded expectations. This is a testament to the continued importance of convenient neighborhood banking and to the dedication and diligence of the branch office staff. The award-winning building itself has been hailed as a definite enhancement to the Newtown Square business area. The commissioning of the painting “Newtown Square Station” by local artist Nick Santoleri heightened for the local residents their appreciation of their heritage and drew attention from the public at large to the historical significance of this area.

The acquisition of an office site in Exton and its complete renovation is also becoming an exciting project. A rather pedestrian functional building has been transformed into a striking landmark similar in style to the Newtown Square building. The office is expected to open for business in March and grand opening festivities will be scheduled throughout the spring.

As in Newtown Square, groundwork is already underway to weave Bryn Mawr Trust into the entire fabric of the community: the large corporate presence, the ever-expanding small business community, and the rapidly expanding residential community. Our goal is to ensure the fiscal soundness of businesses, individuals and future generations. Negotiations are also in progress to acquire a better strategic location for the community now served by our office in Wynnewood.

PAGE 6

BRYN MAWR BANK CORPORATION

Our efforts have not been limited to enhancing our physical environment. Building for the future encompasses an element even more important than our physical plant.

Our OBSESSIONis

to PROVIDE

SUPERB PERSONAL

SERVICEto

ourCLIENTS

Strategies have been put in place to enable Bryn Mawr Trust to continue to be a high-performing financial institution.

Our intention is to continue to concentrate on our four core competencies — wealth management services, business banking, value-added retail banking and residential mortgage banking. Above all, we will maintain our commitment to high values, integrity, teamwork and respect for our clients, our fellow workers and the community at large.

Retail Banking Executive Vice President Robert J. Ricciardi and Exton Branch Manager Vice President Annette C. McNee check the progress of renovations at the Exton office site.

PAGE 7

THE YEARinREVIEW 2004

SMALL BUSINESS INITIATIVEGains MOMENTUM

Group Vice President Regina F. Kemery is dedicated to alerting the small business community to our excellent package of services tailor-made to meet their financial needs.

Our all-inclusive platform of services is extremely well received.

Our small business banking team, which includes all of our branch managers and is headed up by seasoned banking professional Regina Kemery, has initiated a massive calling effort to acquaint small businesses with our small business package — a platform of services first introduced in the spring of 2003. The team members have become intricately involved with the business community, actively participating in local business organizations and establishing themselves as the definitive resource for business financial information. Their efforts have been extremely successful.

To complement the services included in the small business package, and to enable our small business client to respond quickly to customer needs and effectively manage the bottom line, Bryn Mawr Trust recently introduced the Bryn Mawr Trust Productivity Card for Business.

At year-end 2004, Bryn Mawr Trust made arrangements to introduce a forum of educational programs on topics of interest to the small business owner. The first program, which was held in January of 2005, addressed the retirement planning issues that will impact financial support of senior business members in retirement. It also addressed financial support of the managing generation, as well as the successful operation of the business.

PAGE 8

BRYN MAWR BANK CORPORATION

CONSISTENT EFFORT PAYS OFF

The Bank enjoyed strong growth in total outstanding loans and a healthy increase in deposits.

Advances in business must be sustained by the solid dependable effort of dedicated staff members consistently providing the backbone upon which a strong financial footing is based. This is best exemplified by the untiring efforts of our commercial lenders, commercial real estate lenders and the consumer lending team. The fruits of their outreach and attention to the client have produced a healthy increase in loans as well as deposits and a firm roster of dedicated and loyal clients. We get to know our clients, their financial goals and pride ourselves on helping them attain these goals.

REACHING OUTto really

GET TO KNOW

ourCLIENTS

To reinforce the importance of focusing on the needs of the client, a company-wide referral program was instituted in 2001. Our staff seeks to cultivate expanded relationships with existing clients by learning as much as possible about each individual’s financial situation. A discussion of the many services that the bank has to offer is encouraged. In 2004, a total of 2,222 referrals were generated through this program.

Commercial Banking Group Vice President George M. Teplica serves on the planning committee for expanding our commercial business in the Newtown Square and Exton communities.

PAGE 9

THE YEARin REVIEW 2004

RESIDENTIAL MORTGAGE MARKET CHALLENGE

Recently appointed Bryn Mawr Trust Vice President Susan S. Shute, a real estate veteran, and BMT Mortgage President Myron H. Headen, a long-term Bryn Mawr Trust staff member.

New strategies, new dimensions and new faces are being brought into play.

In 2004, there were two major challenges facing our Residential Mortgage team. One was the unexpected departure of BMT Mortgage’s three senior officers. Even more dramatic was the collapse of the residential refinancing boom.

Myron Headen, an 18-year Bryn Mawr Trust veteran, was appointed President of BMT Mortgage Company. Assisted by senior staff members, he has expertly led the residential mortgage lending team throughout this troubled time. Our advertising effort in this area has been greatly beefed up, and a 30-year real estate industry veteran has come on board.

We’reKNOWNfor our

SOLID EXPERIENCE

and SUPERIOR

SERVICE

An innovative new strategy for attracting new mortgage business is in the process of being implemented. Negotiations were started for the formation of a new BMBC subsidiary, whereby BMT Mortgage would handle the mortgage financing needs of a major agency, Keller Williams Main Line Realty.

PAGE 10

BRYN MAWR BANK CORPORATION

WEALTH MANAGEMENTStrengthens LEADERSHIP

Technology is providing a firm foundation for future growth.

A key administrative enhancement in 2004 was the implementation of a new Wealth Management accounting system. The conversion to the new system was a major effort for the entire Wealth Management Division and Trust Operations staff. Clients now reap the benefit of an easy-to-understand statement and a secure on-line internet system that allows access to real-time account information. Also, they now have the ability to monitor unrealized gains and losses on-line.

In recognition of the importance of wealth management and trust services as a key ingredient for sustained business growth, John Pickering was chosen to head up the Wealth Management Division. Mr. Pickering comes to Bryn Mawr Trust after a long and successful tenure at Brown Brothers Harriman in Philadelphia, Pa.

In August of 2004, Karen A. Fahrner, Esquire joined the Wealth Management Division as Senior Vice President and head of Trust Administration. She has over 30 years experience in the trust and estate field. She was a partner at the law firm, Pelino & Lentz, P.C. in Philadelphia. A member of the Pennsylvania and Florida Bars, she is the author of a highly regarded treatise on Pennsylvania trust and estate law.

During 2004, the Employee Benefit Department of the Wealth Management Division was renamed the “Retirement

Executive Vice President John Pickering has overseen Wealth Management’s continued growth and increased revenue.

PAGE 11

THE YEARin REVIEW 2004

A TRUSTED SOURCEof FINANCIAL INFORMATION

Senior Vice President Karen A. Fahrner brings 30 years of experience in the trust and estate field to her position as head of Trust Administration.

Services Department” to more accurately reflect the services this group offers to clients. Bryn Mawr Trust’s Retirement Services Department offers a complete range of services for group retirement plans. The Retirement Services Department is also responsible for Bryn Mawr Bank Corporation’s Thrift & Savings Plan, Defined Benefit Pension Plan, Deferred Bonus Plan for executives, and the Deferred Payment Plan for directors.

Our CLIENTS

EXPECTthe most

DISCERNING ADVICE &

GUIDANCE.

And THEY GET IT.

The Wealth Management Division continued its series of informational and educational programs for the legal community, CPAs, clients and the public at large. One of the most well received programs was held in October 2004 on the subject of Managing an Inheritance. Two distinguished guest speakers offered their perspectives on the financial and emotional issues involved with the inter-generational transfer of wealth.

PAGE 12

BRYN MAWR BANK CORPORATION

MAKING NATIONAL NEWS

Our Portfolio Managers and Wealth Consultants have become a much-sought-after source for their financial commentary, perspective and expert advice.

On April 15, 2004, Bryn Mawr Bank Corporation celebrated its 20th consecutive year on the NASDAQ Exchange, and 115 years of Bryn Mawr Trust’s dedication and service to the Philadelphia region with Ted Peters presiding over the NASDAQ opening bell ceremonies. The Bryn Mawr Trust Company, which opened for business in 1889, was accepted as a member of the NASDAQ National Market in 1985. Effective January 2, 1987, Bryn Mawr Bank Corporation was formed as a bank holding company with The Bryn Mawr Trust Company as a wholly owned subsidiary. CNN, CNBC, CNNfn, Fox News, CNN Headline News and BLOOMBERG USA, among others, aired the opening ceremonies.

REGULARLY

FEATURED

on TELEVISION, RADIO

& FINANCIALMEDIA

Bryn Mawr Bank Corporation dominates Times Square during NASDAQ Opening Ceremony. Bryn Mawr Trust’s portfolio managers and wealth consultants have become nationally recognized for their expertise and valued opinions.

PAGE 13

THE YEARinREVIEW 2004

CORPORATE INFORMATION

CORPORATE HEADQUARTERS

801 Lancaster Avenue

Bryn Mawr, Pennsylvania 19010-3396

610-525-1700

www.bmtc.com

DIRECTORS

Warren W. Deakins

Self-employed, Insurance Sales

Andrea F. Gilbert

President, Bryn Mawr Hospital

William Harral, III

Chairman, C&D Technologies, Inc.; President, the Barra Foundation

Wendell F. Holland

Chairman, Pennsylvania Public Utilities Commission

Francis J. Leto

Partner, Celli and Leto, LLP, Attorneys at Law; President, The Brandywine Abstract Companies

Frederick C.“Ted” Peters II

Chairman, President and Chief Executive Officer, Bryn Mawr Bank Corporation and The Bryn Mawr Trust Company

James J. Smart

Managing Partner, Smart and Associates, LLP, a certified public accounting firm

B. Loyall Taylor, Jr.

President, Taylor Gifts, Inc.

Nancy J. Vickers

President, Bryn Mawr College

Thomas A. Williams

Retired, formerly Vice President, Secretary/Treasurer, Houghton International, Inc.

MARKET MAKERS

Boenning & Scattergood

Citigroup Global Markets

FTN Midwest Securities Corp.

Goldman, Sachs & Co.

Hill, Thompson, Magid & Coe

Janney Montgomery LLC

Keefe, Bruyette & Woods Inc.

Knight Equity Markets, L.P.

McConnell Budd & Downes

Merrill Lynch, Pierce Fenner & Smith

Moors & Cabot, Inc.

Morgan Stanley & Co., Inc.

Ryan Beck & Co., Inc.

Susquehanna Capital Group

UBS Capital Markets L.P.

PRINCIPAL SUBSIDIARY

The Bryn Mawr Trust Company

A Subsidiary of Bryn Mawr Bank Corporation

EXECUTIVE MANAGEMENT

Frederick C. “Ted” Peters II*

Chairman, President and Chief Executive Officer

Alison E. Gers

Executive Vice President, Support Division, Administration and Operations

Joseph G. Keefer

Executive Vice President, Credit Division, and Chief Lending Officer

John Pickering

Executive Vice President, Wealth Management Division

Joseph W. Rebl*

Executive Vice President, Finance Division, Corporate Treasurer, and Chief Financial Officer

Robert J. Ricciardi*

Executive Vice President, Retail Banking, Chief Credit Policy Officer and Corporate Secretary

| * | Also officer of the Corporation |

BRANCH OFFICES

801 Lancaster Avenue

Bryn Mawr, Pennsylvania 19010

237 North Pottstown Pike

Exton, Pennsylvania 19341

18 West Eagle Road

Havertown, Pennsylvania 19083

3601 West Chester Pike

Newtown Square, PA 19073

39 West Lancaster Avenue

Paoli, Pennsylvania 19301

330 East Lancaster Avenue

Wayne, Pennsylvania 19087

One Tower Bridge

West Conshohocken,

Pennsylvania 19428

312 East Lancaster Avenue

Wynnewood, Pennsylvania 19096

WEALTH MANAGEMENT DIVISION

10 South Bryn Mawr Avenue

Bryn Mawr, Pennsylvania 19010

LIMITED SERVICE OFFICES

Beaumont at Bryn Mawr Retirement Community

Bryn Mawr, Pennsylvania

Bellingham Retirement Living

West Chester, Pennsylvania

Martins Run Life Care Community

Media, Pennsylvania

Rosemont Presbyterian Village

Rosemont, Pennsylvania

The Quadrangle

Haverford, Pennsylvania

Waverly Heights

Gladwyne, Pennsylvania

White Horse Village

Newtown Square, Pennsylvania

OTHER SUBSIDIARIES AND FINANCIAL SERVICES

BMT Mortgage Company

A Division of The Bryn Mawr Trust Company

Bryn Mawr, Pennsylvania

Myron H. Headon, President

BMT Settlement Services, Inc.

A Subsidiary of The Bryn Mawr Trust Company

Bryn Mawr, Pennsylvania

Joseph G. Keefer, Chairman

Myron H. Headon, President

Insurance Counsellors of Bryn Mawr, Inc.

A Subsidiary of The Bryn Mawr Trust Company

Bryn Mawr, Pennsylvania

Thomas F. Drennan, President

PAGE 14

BRYN MAWR BANK CORPORATION

ANNUAL MEETING

The Annual Meeting of Shareholders of Bryn Mawr Bank Corporation will be held in The Gregg Conference Center at The American College, Bryn Mawr, Pennsylvania, on Tuesday, April 19, 2005, at 2:00 p.m.

AUDITORS

KPMG LLP

1601 Market Street

Philadelphia, Pennsylvania 19103-2499

LEGAL COUNSEL

Monteverde, McAlee & Hurd, P.C.

One Penn Center at Suburban Station

1617 John F. Kennedy Boulevard

Suite 1500

Philadelphia, Pennsylvania 19103-1815

STOCK LISTING

Bryn Mawr Bank Corporation common stock is traded over-the-counter and is listed on the NASDAQ National Market System under the symbol BMTC.

FORM 10-K

A copy of the Corporation’s Form 10-K, including financial statement schedules as filed with the Securities and Exchange Commission, is available without charge to shareholders upon written request to Robert J. Ricciardi, Secretary, Bryn Mawr Bank Corporation, 801 Lancaster Avenue, Bryn Mawr, Pennsylvania 19010-3396, or via e-mail to bricciardi@bmtc.com.

EQUAL EMPLOYMENT OPPORTUNITY

The Corporation continues its commitment to equal opportunity employment and does not discriminate against minorities or women with respect to recruitment, hiring, training, or promotion. It is the policy of the Corporation to comply voluntarily with the practices of Affirmative Action.

REGISTRAR& TRANSFER AGENT

Mellon Investor Services L.L.C.

P.O. Box 3315

South Hackensack, NJ 07606

www. mellon-investor.com

PRICE RANGEof SHARES

| | | | | | | | | |

| | | High

Bid

| | Low

Bid

| | Dividend

Declared

|

2004 HIGH-LOW QUOTATIONS | | | | | | | | | |

First quarter | | $ | 24.26 | | $ | 21.50 | | $ | 0.10 |

Second quarter | | | 23.73 | | | 19.30 | | | 0.10 |

Third quarter | | | 22.82 | | | 19.67 | | | 0.10 |

Fourth quarter | | | 22.55 | | | 19.10 | | | 0.10 |

2003 HIGH-LOW QUOTATIONS | | | | | | | | | |

First quarter | | $ | 19.19 | | $ | 17.08 | | $ | 0.10 |

Second quarter | | | 20.50 | | | 17.39 | | | 0.10 |

Third quarter | | | 21.81 | | | 18.50 | | | 0.10 |

Fourth quarter | | | 25.07 | | | 20.00 | | | 0.10 |

The approximate number of registered holders of record of common stock as of December 31, 2004 was 370.

The shares are traded on the over-the-counter market, and the price information was obtained from The National Association of Securities Dealers (NASD).

PAGE 15

Selected Financial Data

| | | | | | | | | | | | | | | | | | | | |

| | | (in thousands, except for share and per share data) | |

| For the years ended December 31, | | 2004

| | | 2003*

| | | 2002*

| | | 2001*

| | | 2000*

| |

Interest income | | $ | 31,381 | | | $ | 29,261 | | | $ | 29,412 | | | $ | 30,311 | | | $ | 31,985 | |

Interest expense | | | 4,553 | | | | 4,330 | | | | 4,484 | | | | 6,302 | | | | 7,072 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net interest income | | | 26,828 | | | | 24,931 | | | | 24,928 | | | | 24,009 | | | | 24,913 | |

Loan loss provision | | | 900 | | | | 750 | | | | 1,000 | | | | 1,200 | | | | 250 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net interest income after loan loss provision | | | 25,928 | | | | 24,181 | | | | 23,928 | | | | 22,809 | | | | 24,663 | |

Other income | | | 19,794 | | | | 26,577 | | | | 23,899 | | | | 18,846 | | | | 15,322 | |

Other expenses | | | 31,625 | | | | 33,437 | | | | 31,642 | | | | 28,199 | | | | 27,854 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before income taxes and discontinued operations | | | 14,097 | | | | 17,321 | | | | 16,185 | | | | 13,456 | | | | 12,131 | |

Applicable income taxes | | | 4,752 | | | | 6,049 | | | | 5,543 | | | | 4,524 | | | | 4,137 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income from continuing operations | | | 9,345 | | | | 11,272 | | | | 10,642 | | | | 8,932 | | | | 7,994 | |

(Loss) income from discontinued operations | | | — | | | | (1,916 | ) | | | (435 | ) | | | 194 | | | | 267 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Income | | $ | 9,345 | | | $ | 9,356 | | | $ | 10,207 | | | $ | 9,126 | | | $ | 8,261 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Per share data | | | | | | | | | | | | | | | | | | | | |

Earnings per common share from continuing operations: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 1.09 | | | $ | 1.30 | | | $ | 1.22 | | | $ | 1.03 | | | $ | 0.93 | |

Diluted | | $ | 1.06 | | | $ | 1.28 | | | $ | 1.20 | | | $ | 1.00 | | | $ | 0.90 | |

Earnings per common share | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 1.09 | | | $ | 1.08 | | | $ | 1.17 | | | $ | 1.05 | | | $ | 0.96 | |

Diluted | | $ | 1.06 | | | $ | 1.06 | | | $ | 1.15 | | | $ | 1.02 | | | $ | 0.93 | |

Dividends declared | | $ | 0.40 | | | $ | 0.40 | | | $ | 0.38 | | | $ | 0.36 | | | $ | 0.34 | |

Weighted-average shares outstanding | | | 8,610,171 | | | | 8,657,527 | | | | 8,706,390 | | | | 8,651,040 | | | | 8,585,676 | |

Dilutive potential common shares | | | 170,545 | | | | 158,543 | | | | 130,020 | | | | 254,180 | | | | 322,816 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Adjusted weighted-average shares | | | 8,780,716 | | | | 8,816,070 | | | | 8,836,410 | | | | 8,905,220 | | | | 8,908,492 | |

| |

| | | (in thousands) | |

| At December 31, | | 2004

| | | 2003

| | | 2002*

| | | 2001*

| | | 2000*

| |

Total assets | | $ | 682,946 | | | $ | 604,848 | | | $ | 577,242 | | | $ | 476,823 | | | $ | 444,424 | |

Earning assets | | | 628,754 | | | | 547,637 | | | | 520,562 | | | | 427,805 | | | | 389,053 | |

Deposits | | | 600,965 | | | | 527,139 | | | | 483,620 | | | | 391,059 | | | | 386,966 | |

Shareholders’ equity | | | 71,238 | | | | 67,382 | | | | 62,607 | | | | 57,307 | | | | 50,970 | |

Ratio of equity to assets | | | 10.43 | % | | | 11.14 | % | | | 10.85 | % | | | 12.02 | % | | | 11.47 | % |

Loans serviced for others | | | 507,421 | | | | 797,326 | | | | 631,105 | | | | 442,373 | | | | 325,040 | |

| | | | | |

| For the years ended December 31, | | 2004

| | | 2003

| | | 2002*

| | | 2001*

| | | 2000*

| |

Selected financial ratios: | | | | | | | | | | | | | | | | | | | | |

Net interest margin | | | 4.46 | % | | | 4.70 | % | | | 5.34 | % | | | 5.85 | % | | | 6.33 | % |

Income from continuing operations to: | | | | | | | | | | | | | | | | | | | | |

Average total assets | | | 1.45 | % | | | 1.98 | % | | | 2.01 | % | | | 2.05 | % | | | 1.94 | % |

Average shareholders’ equity | | | 13.67 | % | | | 17.76 | % | | | 17.26 | % | | | 16.95 | % | | | 17.20 | % |

Average shareholders’ equity to average total assets | | | 10.64 | % | | | 11.13 | % | | | 11.67 | % | | | 12.09 | % | | | 11.28 | % |

Dividends declared per share to net income per basic common share | | | 36.85 | % | | | 37.01 | % | | | 32.41 | % | | | 34.13 | % | | | 35.34 | % |

| * | Reclassified for comparative purposes |

1

Management’s Discussion and Analysis

The following is a discussion of the consolidated results of operations of Bryn Mawr Bank Corporation and its subsidiaries (the “Corporation”) for each of the three years ended December 31, 2004, as well as the financial condition of the Corporation as of December 31, 2004 and 2003. The Bryn Mawr Trust Company (the “Bank”), and Joseph W. Roskos & Co. (“JWR & Co.”) are wholly-owned subsidiaries of the Corporation. Insurance Counsellors of Bryn Mawr, Inc. (“ICBM”) and BMT Settlement Services, Inc. (“BMTSS”) are wholly owned subsidiaries of the Bank. This discussion should be read in conjunction with the Corporation’s consolidated financial statements beginning on page 26.

SPECIAL CAUTIONARY NOTICE REGARDING FORWARD LOOKING STATEMENTS

Certain of the statements contained in this Report may constitute forward-looking statements for the purposes of the Securities Act of 1933, as amended and the Securities Exchange Act of 1934, as amended, and may involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements of the Corporation to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements include statements with respect to the Corporation’s financial goals, business plans, business prospects, credit quality, credit risk, reserve adequacy, liquidity, origination and sale of residential mortgage loans, impairment of goodwill, the effect of changes in accounting standards, and market and pricing trends. The words “expect,” “anticipate,” “intended,” “plan,” “believe,” “seek,” “estimate,” and similar expressions are intended to identify such forward-looking statements. The Corporation’s actual results may differ materially from the results anticipated by the forward-looking statements due to a variety of factors, including without limitation:

| | • | | the effect of future economic conditions on the Corporation and its customers, including economic factors which affect consumer confidence in the securities markets, wealth creation, investment and savings patterns, and the Corporation’s interest rate risk exposure and credit risk; |

| | • | | changes in the securities markets with respect to the market values of financial assets and the stability of particular securities markets; |

| | • | | governmental monetary and fiscal policies, as well as legislation and regulatory changes; |

| | • | | changes in accounting requirements or interpretations; |

| | • | | the risks of changes in interest rates on the level and composition of deposits, loan demand, and the value of loan collateral and securities, as well as interest rate risk; |

| | • | | the effects of competition from other commercial banks, thrifts, mortgage companies, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money-market and mutual funds and other institutions operating in the Corporation’s trade market area and elsewhere including institutions operating locally, regionally, nationally and internationally and such competitors offering banking products and services by mail, telephone, computer and the Internet; |

| | • | | any extraordinary events (such as the September 11, 2001 events, the war on terrorism and the U.S. Government’s response to those events, including the war in Iraq); |

| | • | | the Corporation’s success in continuing to generate new business in its existing markets, as well as its success in identifying and penetrating targeted markets and generating a profit in those markets in a reasonable time; |

| | • | | the Corporation’s ability to continue to generate satisfactory investment results for customers and the ability to continue to develop investment products in a manner that meets customers needs; |

| | • | | the Corporation’s timely development of competitive new products and services in a changing environment and the acceptance of such products and services by customers; |

| | • | | the Corporation’s ability to originate and sell residential mortgage loans; |

| | • | | the accuracy of assumptions underlying the establishment of reserves for loan losses and estimates in the value of collateral, and various financial assets and liabilities and technological changes being more difficult or expensive than anticipated; and |

| | • | | the Corporation’s success in managing the risks involved in the foregoing. |

All written or oral forward-looking statements attributed to the Corporation are expressly qualified in their entirety by the foregoing cautionary statements. All forward-looking statements included in this Report are based upon information presently available, and the Corporation assumes no obligation to update any forward-looking statements.

2

Introduction

The Corporation derives the vast majority of its income from its primary subsidiary, the Bank. The Bank is a state chartered member bank of the Federal Reserve System and was chartered in 1889. Located in an affluent western suburb of Philadelphia, Pennsylvania, the Bank provides commercial banking, trust and fiduciary services to its customer base. In 1986, the Corporation was formed and on January 2, 1987, the Bank became a wholly-owned subsidiary of the Corporation. The Corporation’s profitability is primarily derived from a number of segments or lines of business within the Bank. The traditional Banking segment includes the generation of net interest income from the gathering of deposits and funding of commercial, real estate and consumer loans, and the ability to purchase and sell investment securities. Due primarily to the structure of its deposit base, providing a source of low cost funding, the Bank was able to maintain a net interest margin of 4.46% for 2004.

In addition to its traditional banking activities of deposit gathering and lending, the Bank’s Wealth Management segment provides a stream of revenue, primarily related to its ability to grow its assets under management, which amounted to $1,887,000,000 as of December 31, 2004. In addition to the assets stated above the Bank acts as an investment advisor for $51,000,000 of assets for Community Banks located in Harrisburg, Pennsylvania.

Executive Summary

In prior years, the Bank’s Mortgage Banking segment had grown significantly. This growth was due to the increased demand for mortgage loans and the Mortgage Banking segment’s ability to meet the demands of its customers to originate and to then sell those mortgages to the secondary residential mortgage market. This demand slowed sharply beginning in the third quarter 2003 through December 31, 2004. While the Mortgage Banking segment had expanded its volume of residential loan originations and sales in prior years, recent volume decreases indicate that the demand for mortgage loans is likely to remain at a reduced level causing a reduction in the Bank’s mortgage loan originations and sales compared to the years prior to 2003. This decrease in residential mortgage loan origination and sale activity was primarily responsible for the Corporation’s lack luster 2004 income from continuing operations, which was 17% below 2003.

In addition to these three business segments, the Bank presently offers through ICBM insurance products which include commercial, personal lines, life and benefits insurance products.

Both the Corporation’s and Bank’s capital levels remain above those capital levels necessary to be considered “Well Capitalized” by their respective regulators. “Well Capitalized” is the highest rating available from the regulators. The Corporation’s annualized return on equity was 13.67% and its annualized return on assets was 1.45% as of December 31, 2004. The Uniform Bank Performance Report Peer Group Data as of September 30, 2004, the most recent data available, for banks with assets between $300 million and $1 billion had an annualized return on equity of 13.32% and an annualized return on assets of 1.21%.

The $3,224,000 decrease in income before income taxes and discontinued operations for 2004, over the same period in 2003, is primarily due to the decrease in residential mortgage originations and sales, as well as expenses associated with the implementation of the requirements of section 404 of the Sarbanes Oxley Act of 2002 (“SOX-404”). The gains on the sale of residential mortgage loans declined $7,751,000 and the related title insurance income from BMTSS declined $342,000. Partially offsetting the decline in income, due to the reduction in mortgage loan sale activity, was a decrease of $1,975,000 in the amortization of mortgage servicing rights (“MSRs”). During the first quarter of 2004, the Bank sold MSRs, generating a net gain, after the accelerated amortization of the sold MSRs, of $1,145,000. No such sales or gains were reported for 2003. In order to become compliant with SOX-404, the Corporation incurred an expense of $470,000 for consulting and accounting fees for 2004. No such fee expense was incurred in 2003. It is anticipated that fees for SOX-404 related activity will be less in 2005 and thereafter.

Also partially offsetting the decline in gains on mortgage loan sales was an increase in net interest income of $1,897,000 for 2004 compared to 2003 due primarily to strong growth in the Bank’s earning assets. The Bank’s balance sheet is asset interest rate sensitive, meaning that an increase in interest rates should cause an increase in the net interest margin and related net interest income. Recent prime rate increases have, and should continue to have, a positive effect on net interest income. The fees for trust services also increased in 2004 compared to 2003, up by $603,000 or 6%. In addition to the reduction in amortization of MSRs, discussed previously, the Corporation’s other operating expenses decreased by $947,000 or 20%. The decrease in residential loan sale activity is directly responsible for a $1,202,000 or 59% decrease in other operating expenses in the Mortgage Banking segment. There was an increase in the provision for loan loss of $150,000, due to an increase in net charge-offs in the second half of 2004. These net changes, from 2003 to 2004, account for $2,983,000 in year-to-year changes in income before income taxes and discontinued operations, compared to the net change reported of $3,224,000.

Critical Accounting Policies

The Corporation’s most critical accounting policy is the allowance for loan loss. The allowance for loan loss represents management’s estimate of the loan losses that may occur. The allowance is continually monitored to determine its adequacy. Ongoing review of credit standards, the level of delinquencies on loan products and loan segments, and the current state of the economy are included in this review. Actual losses may differ from management’s estimates. This is explained in more detail on pages 11 - 12.

3

In December 2001, the Corporation adopted Statement of Financial Accounting Standard No. 142 “Goodwill and Other Intangible Assets” (“SFAS No. 142”). In compliance with SFAS No. 142, the Corporation ceased amortizing the goodwill related to JWR & Co. During 2003, Corporation management determined that JWR & Co. was not attaining its strategic goals and that it would be in the best interest of the Corporation to discontinue offering family office services through JWR & Co. Therefore, the Corporation sold substantially all of the assets of JWR & Co. to Private Family Office, Inc. (“PFO”), which is owned by the former president of JWR & Co. (the “Asset Sale”). The Asset Sale was accomplished on August 1, 2003, effective as of June 30, 2003. The Asset Sale resulted in the charge-off of the balance of goodwill on the books of the Corporation, amounting to $1,005,000. As of December 31, 2003 and 2004, there was no goodwill on the books of the Corporation.

Since the assets which were sold in the Asset Sale met all the requirements of Statement of Financial Accounting Standard No. 144 “Accounting for the Impairment or Disposal of Long-Lived Assets” (“SFAS No. 144”), other revenue and expenses, the write-down of goodwill and other related disposal expenses have been classified as a loss from discontinued operations, net of taxes in the respective statements of income, to reflect the accounting for discontinued operations under SFAS No. 144. There are no longer any assets of JWR & Co. associated with the family office operation on the books of JWR & Co. at December 31, 2004 or 2003.

As a part of its Mortgage Banking segment’s loan servicing business, the Bank records the value of MSRs as an asset when the mortgage loans are sold and the servicing is retained by the Bank. MSRs represent the right to receive cash flows from servicing mortgage loans. The servicing rights are capitalized based on the fair value of the servicing right and the mortgage loan on the date the mortgage loan is sold. MSRs are amortized in proportion to and over the period of the estimated net servicing income. MSRs are carried at the lower of cost or estimated fair value. The Corporation obtains an independent appraisal of the fair value of its MSRs quarterly, which approximates the fair value expected in a sale between a willing buyer and seller.

MSRs are assessed quarterly for impairment based on the estimated fair value of those rights. For purposes of performing the impairment valuation, the MSR portfolio is stratified on the basis of certain predominant risk characteristics, including loan type and note rate. To the extent that the carrying value of the servicing rights exceeds estimated fair value for any stratum, a valuation allowance is established; this allowance may be adjusted in the future as the estimated fair value of the MSRs increase or decrease. This valuation allowance is included in the consolidated balance sheet and the valuation allowance is recognized in the consolidated statement of operation during the period in which the change occurs.

The following summarizes the Corporation’s activity related to MSRs for the twelve months ended December 31, 2004 and 2003:

| | | | | | | | |

| (In thousands) | | 2004

| | | 2003

| |

Balance, January 1 | | $ | 4,391 | | | $ | 3,956 | |

Additions | | | 1,019 | | | | 3,249 | |

Amortization | | | (839 | ) | | | (2,814 | ) |

Impairment | | | — | | | | — | |

Sales | | | (1,399 | ) | | | — | |

| | |

|

|

| |

|

|

|

Balance, December 31 | | $ | 3,172 | | | $ | 4,391 | |

| | |

|

|

| |

|

|

|

Fair Value | | $ | 4,132 | | | $ | 6,828 | |

There has been no impairment of the MSR portfolio or any change in the valuation allowance for MSRs for the twelve months ended December 31, 2004 or 2003.

At December 31, 2004, key economic assumptions and the sensitivity of the current fair value of MSRs to immediate 10 and 20 percent adverse changes in those assumptions are as follows:

| | | | |

| | | December 31,

2004

| |

Fair value amount of MSRs | | $ | 4,132 | |

Weighted average life (in years) | | | 3.7 | |

| |

Prepayment speeds (constant prepayment rate) (1): | | | 19.92 | % |

Impact on fair value: | | | | |

10% adverse change | | | (293 | ) |

20% adverse change | | | (558 | ) |

| |

Discount rate: | | | 10.05 | % |

Impact on fair value: | | | | |

10% adverse change | | | (128 | ) |

20% adverse change | | | (248 | ) |

| (1) | Represents the weighted average prepayment rate for the life of the MSR asset |

These assumptions and sensitivities are hypothetical and should be used with caution. As the figures indicate, changes in fair value based on a 10% variation in assumptions generally cannot be extrapolated because the relationship of the change in assumptions to the change in fair value may not be linear. Also, the effect of a variation in a particular assumption on the fair value of the MSRs is calculated without changing any other assumption. In realty, changes in one factor may result in changes in another, which could magnify or counteract the sensitivities.

New Accounting Pronouncements

During 2004, the Financial Accounting Standards Board issued one accounting standard applicable to banks, revised Financial Interpretation No. 46 (FIN 46R) and the Emerging Issues Task Force issued EITF 03-1. These pronouncements are discussed in detail in Note 2 to the Consolidated Financial Statements – Summary of Significant Accounting Policies, which are a part of this Report.

4

SIGNIFICANT ITEMSFOR 2004

Opening of New Full Service Branch Office in Newtown Square

During the first quarter of 2004, the Bank established a new full service branch office in Newtown Square, Pennsylvania, thereby enabling the Bank to both broaden and strengthen its footprint in Delaware County. By December 2004, the branch reported total deposits of $21 million.

Sale of Servicing for $245 million in Loans Serviced for Others

Effective March 31, 2004, the Bank sold MSRs associated with $245 million in mortgage loans serviced for others to EVERBANK, a federal savings bank located in Jacksonville FL. The transaction generated a net gain on the sale of $1,145,000. This gain on the sale of the MSRs helped to mitigate the negative impact on earnings caused by the decline in gains on the sale of residential mortgage loans in the Mortgage Banking segment, compared to gains in 2003 and 2002. The primary reason for the decline in gains on loan sales was a decrease in the amount of residential mortgage loan refinances sold to the secondary mortgage market in 2004, compared to 2003 and 2002.

Continuation of the Stock Repurchase Program

Corporation management continues to believe that the repurchase of the Corporation’s stock is a very beneficial use of Corporation capital. In October 2002, management was authorized to repurchase up to 4% of the outstanding shares as of October 2002 or 348,094 shares, effective January 2003, while not spending more than $7,500,000. Under that program, from January 2004 through December 2004, the Corporation repurchased 114,600 shares of Corporation stock, at a cost of $2,574,000, for an average cost of $22.46 per share. To date the shares repurchased under this program total 213,600 at a cost of $4,401,000. This stock repurchase program is authorized to extend for a five-year period, with annual reviews by the Corporation’s Board of Directors. The Corporation’s stock repurchasing activity, from 1997 through December 31, 2004, resulted in the repurchase of a total of 1,407,252 shares of the Corporation’s common stock, at a cost of $20,797,000 for an average purchase price of $14.78 per share. The use of the Corporation’s capital to repurchase stock increases the Corporation’s return on equity, as well as offsetting the dilutive effect on earnings per share of issuing stock options.

Compliance with Section 404 of the Sarbanes Oxley Act of 2002

As required by SOX-404, during 2004, the Corporation undertook a project to determine (1) what internal controls for public financial reporting were in place and (2) what additional internal controls needed to be implemented in order to gain assurance that the Corporation properly presents its financial statements and related footnotes, under generally accepted accounting principles of the United States (“GAAP”). To accomplish this task, the Corporation hired an independent consultant, experienced in complying with SOX-404, to assist management in completing the project and thereby enabling the chief executive officer and chief financial officer to certify whether or not there were any significant deficiencies or material weaknesses in the internal controls established to assure that the Corporation’s financial statements were prepared under GAAP.

KPMG LLP (“KPMG”), the Corporation’s Independent Registered Public Accounting Firm, has issued an attestation report that management’s assessment that the Corporation maintained effective internal control over financial reporting as of December 31, 2004 is fairly stated, in all material respects, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). Also in their opinion, KPMG stated that the Corporation maintained, in all material respects, effective internal control over financial reporting as of December 31, 2004, based on COSO.

DISCONTINUED OPERATIONS

As a result of Corporation management’s decision to accomplish the JWR & Co Asset Sale, the Corporation had long-lived assets meeting the criterion of SFAS No. 144 for being classified as available for sale on its balance sheet. Therefore, the revenues and expenses, the write-down of goodwill and other related disposal expenses have been classified as a loss from discontinued operations, net of taxes in the respective statements of income. Following is a table outlining (1) the amounts of revenue, expenses and after-tax losses reported in the results from discontinued operations and (2) the non-recurring transactions’ impact, that are a result of the Asset Sale:

| | | | | | | | | | | |

| | | For the twelve months ended

| |

| | | 2004

| | 2003

| | | 2002

| |

| | | (000) omitted | |

Revenues of JWR & Co.* | | $ | — | | $ | 773 | | | $ | 2,228 | |

Expenses of JWR & Co.* | | | — | | | (1,091 | ) | | | (2,207 | ) |

| | |

|

| |

|

|

| |

|

|

|

Pre-tax (loss) income | | | — | | | (318 | ) | | | 21 | |

Applicable income (tax) benefit | | | — | | | 108 | | | | (7 | ) |

| | |

|

| |

|

|

| |

|

|

|

(Loss) income | | | — | | | (210 | ) | | | 14 | |

Non-recurring transactions | | | | | | | | | | | |

Write-down of Goodwill | | | — | | | (1,005 | ) | | | (400 | ) |

Accounts receivable charge-off | | | — | | | (148 | ) | | | — | |

Other | | | — | | | (245 | ) | | | (74 | ) |

Income (tax ) benefit | | | — | | | (308 | )** | | | 25 | |

| | |

|

| |

|

|

| |

|

|

|

Total of non-recurring transactions | | | | | | (1,706 | ) | | | (449 | ) |

| | |

|

| |

|

|

| |

|

|

|

Loss from discontinued operations | | $ | — | | $ | (1,916 | ) | | $ | (435 | ) |

| | |

|

| |

|

|

| |

|

|

|

| * | Revenues and expenses of JWR & Co not specifically related to discontinued operations are excluded from the respective categories in this chart. |

| ** | Includes $444,000 of income tax expense on the sale of JWR & Co.’s assets. |

5

While there was no (loss) income from discontinued operations in 2004, the Corporation reported net income of $9,345,000 for the twelve months ended December 31, 2004, an $11,000 decrease from $9,356,000 reported for the same period in 2003 which was an $851,000 or an 8% decrease from $10,207,000 reported in 2002. Basic earnings per common share on net income amounted to $1.09, a 1% increase from $1.08 reported for 2003, which was an 8% decrease from $1.17 reported in 2002. Diluted earnings per common share on net income were even at $1.06 for both 2004 and 2003, which was an 8% decrease from $1.15 reported in 2002.

While there was no (loss) income from discontinued operations for 2004, for both basic or diluted earnings per share, the basic and diluted loss per common share from discontinued operations amounted to $.22 for year end 2003, compared to a loss of $.05 for the same period in 2002. The loss per common share from discontinued operations assuming dilution also amounted to $.22 for 2003, compared to a loss of $.05 in 2002.

SELECTIONOF NEW AUDITORS

On December 19, 2003 the Corporation retained KPMG LLP (“KPMG”) as its new independent registered public accounting firm to audit the financial statements for the fiscal year ended December 31, 2004. PricewaterhouseCoopers LLP (“PwC”) served as the independent registered public accounting firm for the fiscal year ended December 31, 2003. The decision to change independent registered public accounting firms was made by the Audit Committee of the Board of Directors of the Corporation.

During each of the fiscal years ended December 31, 2003 and 2002 and subsequent interim period through March 15, 2004, there were no disagreements between the Corporation and PwC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of PwC would have caused it to make reference to the subject matter of the disagreements in connection with its reports; and there were no “reportable events” as that term is defined in Item 304 (a)(1)(v) of Regulation S-K occurring within the Corporation’s two most recent fiscal years and the subsequent interim period through March 15, 2004.

The reports of PwC on the financial statement for the past two years contained no adverse opinions or disclaimer of opinion and were not qualified or modified as to their uncertainty, audit scope or accounting principle.

The Corporation provided PwC and KPMG with a copy of the foregoing disclosures regarding the change of independent registered public accounting firms pursuant to Item 304 of the SEC’s Regulation S-K giving them the opportunity to provide a statement for inclusion herein, if either of them disagrees with the accuracy or completeness of these disclosures. After their review, neither PwC nor KPMG expressed any disagreement with these disclosures. A copy of PWC’s letter response to such request was attached to the Corporation’s 8-K/A filed with the SEC on March 15, 2004.

RESULTSOF CONTINUING OPERATIONS

Overview

The Corporation reported a 17% decrease in income from continuing operations for 2004 to $9,345,000 from $11,272,000 for 2003.

Basic earnings per common share from continuing operations amounted to $1.09 in 2004, a 16% decrease from $1.30 for 2003. Diluted earnings per common share from continuing operations decreased by 17% to $1.06 for 2004 from $1.28 for 2003. The dilutive potential common shares added to the weighted-average shares outstanding were 170,545, 158,543 and 130,020 for 2004, 2003 and 2002, respectively.

The decline in earnings for 2004 was primarily due to a decrease in the origination and subsequent sale of residential mortgage loans in the Mortgage Banking segment, causing a decline in the respective gains on the sale of residential mortgage loans in 2004. As presented on Table 1 – Line of Business Segment Analysis, the Mortgage Banking segment’s profitability declined 71% or $4,232,000 to $1,756,000 for 2004, compared to $5,988,000 for 2003. The primary reason for this decline was a $7,751,000 decrease in net gains on the sale of loans, a direct result of declines in the level of residential mortgage loan refinancing activity in 2004, compared to 2003 and 2002. This decline in net gains on loan sales was partially offset by a $3,177,000 decrease in other operating expenses, due primarily to a decline in the amortization of MSRs, as well as expenses related to the Mortgage Banking business segment. Partially offsetting the decline in the Mortgage Banking segment’s profitability was a 5% or $404,000 increase in the Banking segment’s profitability. Short term interest rates began rising in the second half of 2004, which was beneficial to the Bank’s net interest income in the final two quarters of 2004, compared to 2003. However, this increase in short term interest rates in 2004 was not sufficient to increase the Bank’s net interest margin ahead of 2003. The net interest margin decreased 24 basis points in 2004, compared to 2003. However, a 14% increase in average outstanding earning assets in 2004, compared to 2003, offset the decreased net interest margin and is primarily responsible for the Banking segment’s net interest income increasing 7% over 2003 levels. The Banking segment also reported net gains on the sale of mortgage servicing rights of $1,145,000. No such sales were reported for 2003 or 2002. Due to larger net charge-offs in the second half of 2004, the loan loss provision was increased by $150,000 to $900,000. The Banking segment also incurred expenses related to the requirements of SOX-404. Accounting and consulting expenses for SOX-404 amounted to $470,000 for 2004. No such expenses were incurred in 2003 or 2002.

6

A 6% increase in fees for investment management and trust services, combined with holding the wealth management expenses to 3% growth, are primarily responsible for a 12% increase in Wealth Management segment profits for 2004, compared to 2003.

Return on average assets (“ROA”) for the year was 1.45%, compared to 1.98% in 2003, while return on average equity (“ROE”) for 2004 was 13.67% compared to 17.76% in 2003.

EARNINGS PERFORMANCE

Lines of Business

The Corporation continues to have four significant business segments or lines from which it derives its earnings, one of which is the Banking line of business. Additional earnings streams are obtained from its Wealth Management line of business and its Mortgage Banking line of business - the origination, servicing and sale of mortgage loans to the secondary mortgage market. The fourth segment, included in “All Other” in the following segmentation analysis, derives net revenues from insurance services and products, offered through the Bank’s subsidiary, ICBM and interest income on notes in JWR & Co.

Following is a segmentation analysis of the results of operations for those lines of business for 2004 and 2003:

TABLE 1 - Line of Business Segment Analysis

| | | | | | | | | | | | | | | | | | | | |

| | | 2004

| |

| (dollars in thousands) | | Banking

| | | Wealth

Management

| | | Mortgage

Banking**

| | | All

Other*

| | | Consolidated

| |

Net interest income | | $ | 26,487 | | | $ | — | | | $ | 255 | | | $ | 86 | | | $ | 26,828 | |

Less loan loss provision | | | 900 | | | | — | | | | — | | | | — | | | | 900 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net interest income after loan loss provision | | | 25,587 | | | | — | | | | 255 | | | | 86 | | | | 25,928 | |

Other income: | | | | | | | | | | | | | | | | | | | | |

Fees for investment management and trust services | | | — | | | | 10,087 | | | | — | | | | — | | | | 10,087 | |

Service charges on deposit accounts | | | 1,827 | | | | — | | | | — | | | | — | | | | 1,827 | |

Other fees and service charges | | | 209 | | | | — | | | | 1,670 | | | | — | | | | 1,879 | |

Net gain on sale of loans | | | 34 | | | | — | | | | 2,886 | | | | — | | | | 2,920 | |

Net gain on sale of mortgage servicing rights | | | 1,145 | | | | | | | | — | | | | | | | | 1,145 | |

Other operating income | | | 1,547 | | | | — | | | | 112 | | | | 667 | | | | 2,326 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total other income | | | 4,762 | | | | 10,087 | | | | 4,668 | | | | 667 | | | | 20,184 | |

Other expenses: | | | | | | | | | | | | | | | | | | | | |

Salaries-regular | | | 8,789 | | | | 3,674 | | | | 904 | | | | 200 | | | | 13,567 | |

Salaries-other | | | 942 | | | | 322 | | | | 171 | | | | 11 | | | | 1,446 | |

Fringe benefits | | | 3,260 | | | | 820 | | | | 165 | | | | 52 | | | | 4,297 | |

Occupancy | | | 3,246 | | | | 572 | | | | 249 | | | | 131 | | | | 4,198 | |

Other operating expenses | | | 5,343 | | | | 1,046 | | | | 1,678 | | | | 440 | | | | 8,507 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total other expenses | | | 21,580 | | | | 6,434 | | | | 3,167 | | | | 834 | | | | 32,015 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Segment profit (loss) | | $ | 8,769 | | | $ | 3,653 | | | $ | 1,756 | | | $ | (81 | ) | | $ | 14,097 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

% of segment profit (loss) | | | 62 | % | | | 26 | % | | | 13 | % | | | (1 | )% | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | 2003***

| |

| (dollars in thousands) | | Banking

| | | Wealth

Management

| | | Mortgage

Banking**

| | | All

Other*

| | | Consolidated

| |

Net interest income | | $ | 24,707 | | | $ | — | | | $ | 160 | | | $ | 64 | | | $ | 24,931 | |

Loan loss provision | | | 750 | | | | — | | | | — | | | | — | | | | 750 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net interest income after loan loss provision | | | 23,957 | | | | — | | | | 160 | | | | 64 | | | | 24,181 | |

Other income: | | | | | | | | | | | | | | | | | | | | |

Fees for investment management and trust services | | | — | | | | 9,484 | | | | — | | | | — | | | | 9,484 | |

Service charges on deposit accounts | | | 1,896 | | | | — | | | | — | | | | — | | | | 1,896 | |

Other fees and service charges | | | 199 | | | | — | | | | 2,221 | | | | — | | | | 2,420 | |

Net gain on sale of loans | | | 13 | | | | — | | | | 10,637 | | | | — | | | | 10,650 | |

Other operating income | | | 1,496 | | | | — | | | | 454 | | | | 637 | | | | 2,587 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total other income | | | 3,604 | | | | 9,484 | | | | 13,312 | | | | 637 | | | | 27,037 | |

Other expenses: | | | | | | | | | | | | | | | | | | | | |

Salaries-regular | | | 8,274 | | | | 3,665 | | | | 1,343 | | | | 314 | | | | 13,596 | |

Salaries-other | | | 479 | | | | 113 | | | | 833 | | | | 13 | | | | 1,438 | |

Fringe benefits | | | 3,267 | | | | 839 | | | | 195 | | | | 52 | | | | 4,353 | |

Occupancy | | | 2,994 | | | | 617 | | | | 258 | | | | 216 | | | | 4,085 | |

Other operating expenses | | | 4,182 | | | | 1,002 | | | | 4,855 | | | | 386 | | | | 10,425 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total other expenses | | | 19,196 | | | | 6,236 | | | | 7,484 | | | | 981 | | | | 33,897 | |

Segment profit (loss) | | $ | 8,365 | | | $ | 3,248 | | | $ | 5,988 | | | $ | (280 | ) | | $ | 17,321 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

% of segment profit (loss) | | | 48 | % | | | 19 | % | | | 35 | % | | | (2 | )% | | | 100 | % |

| * | Bryn Mawr Bank Corporation, Insurance Counsellors of Bryn Mawr, Inc., and Joseph W. Roskos & Co. have all been aggregated in All Other. |

| ** | BMT Mortgage Company, a division of the Bank and BMT Settlement Services, Inc. have been aggregated in Mortgage Banking. |

| *** | Reclassified for comparative purposes. |

The table reflects operating profits or losses of each corporate line of business before income taxes and excluding inter-company interest income and expense, related to inter-company borrowings and excludes loss from discontinued operations.

The Banking segment’s percentage of operating profits stood at 62% for 2004, compared to 48% for 2003. The Wealth Management segment’s percentage of operating profit was 26%, up from 19% for 2003. The Mortgage Banking segment’s share of operating profits decreased from 35% in 2003 to 13% in 2004, while the “All Other” segment, including the Corporation and all non-banking subsidiaries, went from (2%) in 2003 to (1%) in 2004.

Banking Line of Business

The Bank’s average outstanding earning assets for 2004 of $587,150,000 increased 14% from $516,358,000 for 2003. Average outstanding loans also grew by 13% in 2004. The largest dollar increase in average outstanding loans occurred in the consumer line of credit loans, up $30,740,000 or 43% over 2003 average balances. Average commercial mortgage loan balances grew by $17,622,000 or 16%, compared to 2003 levels and, average construction loan balances increased $2,835,000 or 9% in 2004, compared to the same period in 2003. Due to some commercial loan prepayments in 2004, average commercial loan balances remained level with 2003, decreasing $698,000 or less than 1%, compared to similar average outstanding balances in 2003.

Reflecting the Bank’s strategy to hold some shorter term residential mortgage loans in its loan portfolio, the average

7

balance of residential mortgage loans increased $15,827,000 or 25% from 2003 average balances. The average outstanding balances of the Bank’s consumer small business loan product increased by $6,263,000 or 50% from 2003’s average outstanding balances. This growth is attributed to the superior package of small business services designed to provide small business customers with high quality, competitively-priced loan, deposit and investment services. The average balance of the consumer loan portfolio decreased by $13,031,000 or 62%. This reflects the planned run-off of the Bank’s indirect automobile dealer paper portfolio, as well as a decline in fixed rate home equity loan balances.

The average outstanding balances of federal funds sold increased by $2,414,000 or 23% in 2004 compared to 2003 levels. Average outstanding investments increased by $8,658,000 or 37% for 2004 compared to 2003.

Average outstanding total deposits increased $67,700,000 or 14% in 2004 compared to 2003. The largest dollar increase occurred in the Bank’s money market account average balances. The Bank increased its money market account interest rate structure, making the interest rates competitive with interest rates paid on off-balance sheet money market sweep accounts. This competitive rate structure offered by the Bank resulted in the movement of off-balance sheet sweep balances, as well as other money market mutual funds, into the Bank’s money market accounts. The money market account balances grew by $37,668,000 or 44% over 2003 average balances. Average outstanding NOW account balances increased by $21,130,000 or 17%, while average non-interest bearing demand deposit account balances increased by $2,001,000 or 2%. Average outstanding savings accounts increased 3% or $1,527,000, while the average balances of certificates of deposit (“CDs”) grew by $5,373,000 or 6%. As a result of the strong growth in the Bank’s average deposit base in 2004 the Bank was not reliant on short-term borrowings, having average outstanding balances of short-term borrowings and federal funds purchased of $850,000, compared to $496,000 for 2003. The increases in the average balances of lower costing money market accounts, NOW account and non-interest bearing demand deposit accounts are the primary reasons for the cost of funds decreasing 10 basis points. However, a continued low prime rate for much of 2004, partially offset by increases in earning assets, is primarily responsible for a decrease in the net interest margin to 4.46% in 2004 from 4.70% for 2003. An expanded discussion of the Bank’s net interest income follows in the section below entitled“Net Interest Income.”

Total other income from the Banking segment increased by 32% in 2004 compared to 2003. The Bank sold MSRs associated with the servicing of $245 million of residential mortgage loans serviced for others. This sale generated a net gain on the sale of $1,145,000. There was no such sale or gain in 2003. Exclusive of this gain, total other income increased less than 1%. The largest increase in other income was on other operating income, up $51,000 or 3%, due primarily to increases in sweep fees. Service charges on deposit accounts decreased $69,000 or 4%.

Total other expenses of the Banking business segment increased by 12% in 2004 compared to 2003 levels. While regular salaries increased by 6%, other salaries, primarily incentives and a corporate-wide bonus pool of $275,000 increased by $463,000 or 97%, compared to similar corporate-wide incentives incurred in 2003. A corporate-wide bonus pool of $275,000 was accrued for 2004. No such bonus pool was accrued in 2003. Fringe benefits remained level with 2003. Occupancy expenses increased by $252,000 or 8%, due primarily to expenses related to the new Newtown Square branch, put into service in January 2004. Other operating expenses increased by 28% which included a decrease in advertising expenses of 35%. The increase in other operating expenses in 2004 was mainly due to accounting and consulting expenses related to implementing the requirements of SOX-404 of $470,000. No such expenses were incurred in 2003. Included in other operating expense in 2003 was a $250,000 elimination of a prior accrual for potential litigation that was deemed unnecessary as of December 31, 2003. Exclusive of the above mentioned items, other operating expenses increased by 10% over 2003.

Strong growth in the Bank’s average earning assets, over 2003, is primarily responsible for a $1,780,000 or 7% increase in net interest income. The Bank also increased its loan loss provision by $150,000. The result was a $404,000 or 5% increase in the Banking segment profit for 2004, over 2003.

Wealth Management Line of Business

The Wealth Management business segment reported a 12% increase in operating profit for 2004 compared to 2003 levels. A $603,000 or 6% increase in fees for investment management and trust services is primarily responsible for this increase. An overall increase in asset values combined with the growth in new business was the primary cause for the increase in trust fees. The market value of assets managed increased by 11% from $1,752,000,000 at December 31, 2003, to $1,938,000,000 as of December 31, 2004.

Total other expenses of the Wealth Management line of business increased by $198,000 or 3% in 2004 over 2003 levels.

The primary reason for this increase was an increase in the salary - other expense of $209,000 or 185%, due primarily to increased incentive payments in 2004 related to the growth in new business, compared to 2003. Occupancy expenses declined $45,000 or 7% and other operating expenses increased by $44,000 or 4%.

Mortgage Banking Line of Business

The operating profit of the Bank’s Mortgage Banking line of business decreased 71% in 2004 compared to 2003 due to a significant decline in the volume of residential refinancing

8

activity in 2004 compared to 2003. The sale of residential mortgage loans decreased by 77% and the respective gains declined by 73% or $7,751,000. Other fees and service charges decreased 25% primarily due to decreased fees associated with the decline in residential mortgage originations, as well as a decline in loan servicing fees caused by the sale of MSRs in the first quarter of 2004. Other operating income, consisting of fees earned by BMTSS, decreased 75%. This decrease is directly related to the 77% decrease in the sale of residential loans in 2004, compared to 2003.

Regular salaries declined 33% due to a decrease in overtime, as well as not replacing three Mortgage Banking segment officers, who resigned in the first quarter of 2004. Salaries – other decreased 79% due to lower incentives related to the lower volume of respective loan sales. Fringe benefits declined 15%, related to lower salary expense in 2004, while other operating expenses decreased 65%. Of this decrease $1,975,000 was due to lower amortization of MSRs, due to the decline in refinancing activity previously discussed, and other expenses, directly related to the volume of loan sales, such as appraisal fees, loan pair off fees and credit reports, decreased by $1,228,000. The total decrease in other operating expense amounted to $3,177,000.

Following is a table showing the volume of residential mortgage loans originated and sold to the secondary mortgage market, the total net gains realized, and the yield on these loan sales:

TABLE 2: Summary of Residential Loan Sale Activity

| | | | | | | | |

| (dollars in thousands) | | 2004

| | | 2003

| |

Volume of loans sold | | $ | 144,916 | | | $ | 628,052 | |

Loan fees and net gains on sales | | | 2,886 | | | | 10,637 | |

Yield on sales | | | 1.99 | % | | | 1.69 | % |

As of December 31, 2004, the Bank serviced $480,494,000 in residential mortgage loans for others, compared to $755,132,000 in loans serviced for others at year-end 2003. This decrease reflects the sale of MSRs in 2004 associated with $245,000,000 in residential mortgage loans serviced for others.

Bryn Mawr Bank Corporation

The Corporation is a one-bank holding company, generating intercompany revenues from the rental of Corporation owned properties to the Bank. The Corporation’s expenses are primarily of an administrative nature.

Insurance Counsellors of Bryn Mawr, Inc.

In January 1998, the Bank established a wholly owned subsidiary, ICBM (a full-service insurance agency), to enable the Bank to offer insurance products and related services to its customer base. ICBM offers a full line of life, property and casualty and commercial lines to its customer base. ICBM reported net income of $44,000 for 2004, compared to a loss of $28,000 in 2003. While insurance commissions grew by $26,000 or 6%, expenses decreased by $90,000 or 20%. This decrease is primarily related to the elimination of one senior position in ICBM at year-end 2003.

BMT Settlement Services, Inc.

In January 2002, the Bank formed BMTSS, a Pennsylvania Corporation, to be a limited partner in a limited partnership, established to provide title search and abstract services to Bank customers either refinancing their existing residential mortgage loans or obtaining new residential mortgage loans. BMTSS entered into an agreement (the “Partnership Agreement”) with Commonwealth Land Transfer Company, whereby BMTSS would receive 70% of the profits, after expenses, from the partnership. Due to the significant decrease in the volume of mortgage loan refinancing in 2004, compared to 2003, as described in the Mortgage Banking segment, BMTSS earned $82,000 in net income for 2004, a 68% decrease from $258,000 reported for 2003.

Joseph W. Roskos & Co.

On August 1, 2003, effective June 30, 2003, the Corporation concluded the Asset Sale and, as a result of that transaction, JWR & Co. took back notes from PFO, the purchaser. Income from continuing operations for 2004, representing the interest on the notes totaling $1,287,000 at December 31, 2004 was $81,000 compared to $47,000 for 2003.

Net Interest Income

During 2003 and for the first seven months of 2004, the Bank’s prime rate remained at 4.25%. From August to December 2004, the bank increased its prime rate by 100 basis points, ending 2004 at 5.25%. The continued low prime rate for much of 2004 and all of 2003, compared to 2002, reduced the Bank’s net interest margin. In 2004, the compressed net interest margin was offset by a 14% increase in average outstanding earning assets and resulted in a $2,120,000 or 7% increase in total interest income. Strong growth in the Bank’s low cost deposits, partially offset by a decline in interest rates paid on deposits during 2004, compared to 2003 deposit rates, was primarily responsible for a $223,000 or 5% increase in total interest expense for the year ended December 31, 2004. This resulted in net interest income for 2004 of $26,828,000 being 8% ahead of $24,931,000 in net interest income reported for 2003. In an effort to increase interest income the Bank grew the investment portfolios, average outstanding investments balances by 37%. This growth, being partially offset by a 50 basis point decrease in the yield on investments, is primarily responsible for an 18% increase in interest on investments. Primarily the result of strong average deposit growth in 2004, average outstanding balances of federal funds sold increased by 23%. The yield on earning assets decreased by 40 basis points, from 5.7% for 2003 to 5.3% for 2004.

Total average deposits increased 14%. The largest increases occurred in the Bank’s lower costing deposits. The largest dollar increase occurred in the Bank’s money market account average balances, up $37,668,000 or 44%. This is due to the

9