Exhibit 13.1

Commission File No. 0-15261

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES AND EXCHANGE ACT OF 1934

For the Year Ended December 31, 2007

BRYN MAWR BANK CORPORATION

| | |

• Total Loans and Leases up 17.9% • Non-Interest Income increased 18.6% over 2006 • Total Assets increased 21.2% | |  |

| |

| |

DEAR FELLOW SHAREHOLDERS

Despite one of the most challenging banking environments in decades, Bryn Mawr Bank Corporation and our principal subsidiary, The Bryn Mawr Trust Company, had yet another excellent year in 2007. Our diluted earnings-per-share increased 8.2% over the previous year and our Return-on-Equity of 15.8% and Return-on-Assets of 1.59% put us among the top performing financial institutions in the nation.

Investing for the future, the Corporation undertook six major initiatives during the last part of 2006 and during 2007. These initiatives were all dilutive to earnings in 2007, but should all be accretive to earnings in 2008. Let me re-cap these enterprises and summarize their progress this past year.

Our new equipment leasing company, BMT Leasing, has been a resounding success. The company was profitable well ahead of schedule and, as of the date of this letter, lease balances are in excess of $50 million. We are looking for this unit to be a major contributor to earnings in 2008.

Our West Chester Loan Production Office was the result of hiring two highly-seasoned lenders from another bank. We are pleased with our results thus far and look forward to the opening of our regional banking office, to include a commercial loan department and trust office, in West Chester later this year.

The new Ardmore Branch opened up in January 2007 and has performed ahead of our most optimistic projections. Our strategy of building large, full-service, and well-located banking offices has worked well for the Corporation.

In May of 2007, we formed a separate Private Banking Group to handle our most affluent clients. This unit combines our deposit, credit, and wealth services and has been adding new clients much faster than anticipated.

During the entire past year, we spent a great deal of energy, time, and money re-tooling our Wealth Division. Matt Waschull was brought in from Wilmington Trust, where he was one of their top executives, to head up this Division. Our financial planning abilities were greatly enhanced through the addition of a very senior planner hired from Vanguard. In addition, we introduced a new Separately-Managed-Account investment product with a strategic partner, Federated Investors. Our goal for the Wealth Division is to grow our assets under management and administration in this business line to $5 billion, from the current $2.2 billion, within five years.

This past spring we hired five experienced mortgage professionals, who formed BMT Mortgage Group, to serve the Chester County and state of Delaware regions. This

2

2007 ANNUAL REPORT

“Despite what most predict will be another tough year for the banking industry, Bryn Mawr Bank Corporation is poised for another successful year. We appreciate the encouragement and loyalty that you, as shareholders, have given us. I can assure you that both management and the directors are working hard to earn your support.”

—Ted PetersChairman and Chief Executive Officer

complements our other two existing mortgage companies— BMT Mortgage Company and BMT Mortgage Services which handle different markets.

While we are excited about these new enterprises, the Corporation is not standing still. We have three major initiatives planned for 2008.

As mentioned earlier, we will be building a large regional banking office in West Chester. This will solidify our presence in Chester County and will be the anchor of future expansion in that area. Our anticipated opening is in the fourth quarter of this year.

Our Separately-Managed-Account program will continue to evolve in 2008 with the addition of multiple investment styles. We will work with Federated Investors on this project, as well as other outside investment managers. A more robust investment selection should make this program even more attractive to potential clients.

We are applying for trust powers in the State of Delaware and anticipate opening an office in Wilmington later this summer. Delaware’s trust statutes allow the Bank to offer various trust services—such as directed trusts and generation skipping trusts —which are not as attractive when offered in Pennsylvania.

Despite what most predict will be another tough year for the banking industry, Bryn Mawr Bank Corporation is poised for another successful year. We appreciate the encouragement and loyalty that you, as shareholders, have given us. I can assure you that both management and the directors are working hard to earn your support.

As always, please contact me directly at 610-581-4800 or tpeters@bmtc.com if I can help you in any way.

|

| Sincerely, |

|

|

| Ted Peters |

| Chairman and Chief Executive Officer |

3

2007 ANNUAL REPORT

CONSOLIDATED FINANCIAL HIGHLIGHTS

dollars in thousands, except per share data

| | | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | | | CHANGE | |

FOR THE YEAR | | | | | | | | | | | | |

Net interest income | | $ | 34,242 | | | $ | 33,299 | | | $ | 943 | | | 2.8 | % |

Net interest income after loan and lease loss provision | | | 33,351 | | | | 32,467 | | | | 884 | | | 2.7 | |

Non-interest income | | | 21,781 | | | | 18,361 | | | | 3,420 | | | 18.6 | |

Non-interest expenses | | | 34,959 | | | | 31,423 | | | | 3,536 | | | 11.3 | |

Income taxes | | | 6,573 | | | | 6,689 | | | | (116 | ) | | (1.7 | ) |

Net income | | | 13,600 | | | | 12,716 | | | | 884 | | | 7.0 | |

AT YEAR - END | | | | | | | | | | | | | | | |

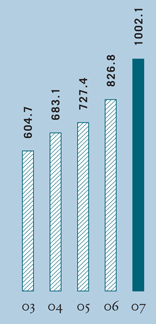

Total assets | | $ | 1,002,096 | | | $ | 826,817 | | | $ | 175,279 | | | 21.2 | % |

Total portfolio loans and leases | | | 802,925 | | | | 681,291 | | | | 121,634 | | | 17.9 | |

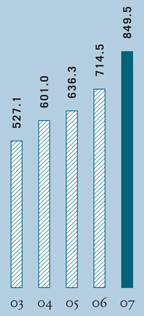

Total deposits | | | 849,528 | | | | 714,489 | | | | 135,039 | | | 18.9 | |

Shareholders’ equity | | | 90,351 | | | | 82,092 | | | | 8,259 | | | 10.1 | |

Assets under management and administration—Wealth Division | | | 2,191,753 | | | | 2,102,468 | | | | 89,292 | | | 4.2 | |

PER COMMON SHARE | | | | | | | | | | | | | | | |

Basic earnings | | $ | 1.59 | | | $ | 1.48 | | | $ | 0.11 | | | 7.4 | % |

Diluted earnings | | | 1.58 | | | | 1.46 | | | | 0.12 | | | 8.2 | |

Dividends declared | | | 0.50 | | | | 0.46 | | | | 0.04 | | | 8.7 | |

Book value | | | 10.60 | | | | 9.59 | | | | 1.01 | | | 10.5 | |

Closing price | | | 22.93 | | | | 23.64 | | | | (0.71 | ) | | (3.0 | ) |

SELECTED RATIOS | | | | | | | | | | | | | | | |

Return on average assets | | | 1.59 | % | | | 1.72 | % | | | | | | | |

Return on average shareholders’ equity | | | 15.87 | | | | 15.71 | | | | | | | | |

Tax equivalent net interest margin | | | 4.37 | | | | 4.90 | | | | | | | | |

Efficiency ratio | | | 62.40 | | | | 60.83 | | | | | | | | |

Our vision is to be the preeminent community banking and wealth management organization in the Philadelphia area.

4

2007 ANNUAL REPORT

| | | | |

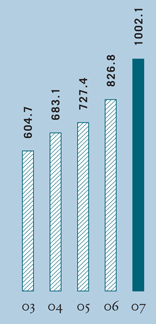

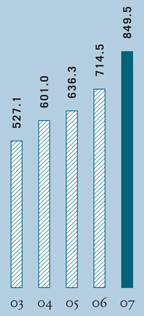

TOTAL ASSETS dollars in millions | | PORTFOLIO LOANS AND LEASES dollars in millions | | TOTAL DEPOSITS dollars in millions |

| | |

| |  | |  |

| | |

NET INCOME dollars in millions | | DILUTED EARNINGS PER SHARE dollars | | ASSETS UNDER MANAGEMENT AND ADMINISTRATION — WEALTH DIVISION dollars in billions |

| | |

| |  | |  |

5

2007 ANNUAL REPORT

p | PICTURED FROM LEFT TO RIGHT SEATED: Michelle L. Wilson, Vice President & Portfolio Manager; Lisa A. Mossie, Assistant Treasurer & Portfolio Manager; Joseph G. Keefer, Executive Vice President; Martin F. Gallagher, Jr., Senior Vice President/Senior Relationship Manager; Marilee N. Connor, Vice President & Portfolio Manager; David W. Glarner, Senior Vice President;STANDING:Peter J. D’Angelo, Senior Vice President; Joseph A. Puccino, Group Vice President; Gary R. Faggioli, Vice President; Alirezqa Zoghi Zarandi, Assistant Vice President & Portfolio Manager; Robert Latshaw, Vice President; Anthony Murphy, Portfolio Manager; James J. Egan, Senior Vice President/Senior Relationship Manager; George M. Teplica, Senior Vice President/Senior Relationship Manager |

OUR MISSION

| • | | To operate the Corporation and its subsidiaries in a sound and ethical manner. |

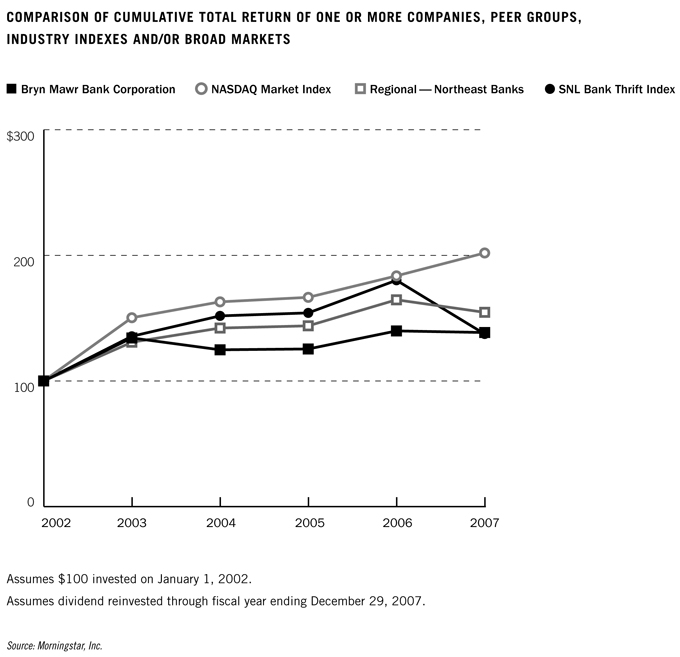

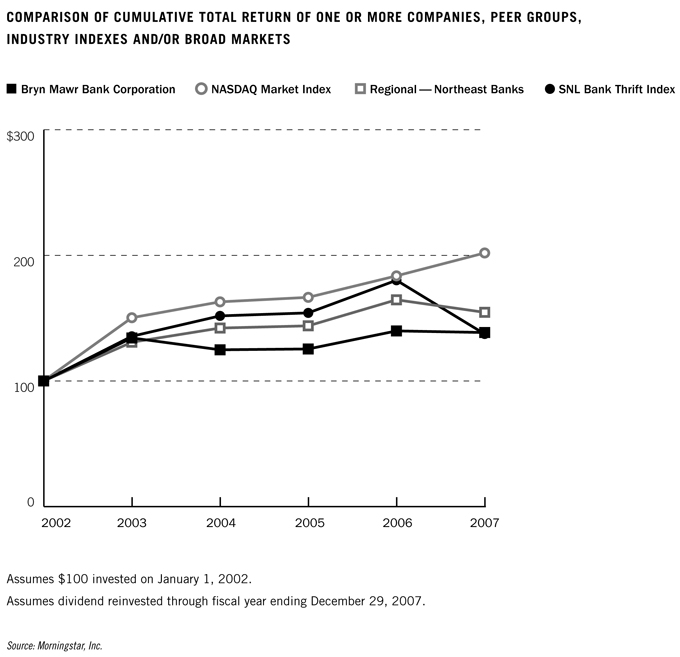

| • | | To provide our shareholders with a return on their investment, superior to comparative bank stock indices. |

| • | | To provide the highest quality products and the finest service to our clients. |

| • | | To be an active and contributing member of the communities we serve. |

| • | | To provide a working environment for our employees that is supportive, challenging, positive and fair. |

6

2007 ANNUAL REPORT

p | PICTURED CLOCKWISE FROM TOP LEFT: Myron H. Headen, Senior Vice President; Mary Cay O’Keefe, Vice President/Assistant Secretary; Margie Pham, Assistant Vice President/Assistant Secretary; Susan S. Shute, Vice President |

| | |

OUR VALUE PROPOSITION • At Bryn Mawr Trust we have only the highest quality banking and investment services. Our staff consists of well-trained professionals who understand that friendly and prompt service is of the utmost importance to our clients. • All clients have access to senior management, including the President. • Bryn Mawr Trust has been an independent local bank and trust company for over a century. We are truly community bankers, dedicated to making the Philadelphia area a better place for residents and businesses. | |  |

7

2007 ANNUAL REPORT

OUR CORE STRATEGIES

| • | | Open a Chester County regional office to include Wealth and Commercial Lending staff. |

| • | | Concentrate on our four competencies—Wealth and Private Banking, Business Banking, “High Touch” Retail Banking, and Mortgage Banking. |

| • | | Increase loan and deposits 8 – 12% per year. Maximize net interest margin. |

| • | | Obsession with client service. Constant emphasis and monitoring by all levels of management. |

| • | | Build an aggressive sales culture. Expand and enhance the Share-the-Client program. Continue to develop incentive compensation programs that emphasize new business development. |

| • | | Maintain a close control on expenses. |

q | PICTURED FROM LEFT TO RIGHT: Gale R. Flandreau, Esquire, Senior Vice President; Matthew G. Waschull, Executive Vice President; Karen A. Fahrner, Esquire, Senior Vice President; Ellen T. Jordan, Vice President |

8

2007 ANNUAL REPORT

YEAR IN REVIEW

Bryn Mawr Trust experienced solid performance in 2007 despite a very challenging banking environment. We are pleased to share with you some highlights of our 2007 strategies and tactics.

TEAMWORK

The success we achieved was, in large part, a result of having a dedicated team of professionals working together for a common goal. Our goal, quite simply, is to be the preeminent community bank and wealth management organization in the Philadelphia area. Our management team, at every level of the organization, consistently emphasizes the importance of providing quality service to our clients along with the finest products in the market. Our sales culture continues to produce positive results. We have developed incentive programs that encourage change and reward exceptional performance. With our experienced management team, supported by a dedicated board of directors, we have created an environment where creativity is encouraged, performance is rewarded, and shareholders, clients and employees benefit.

INVESTING IN PRODUCTS, SERVICES AND FACILITIES

Extensive interior and exterior renovations were begun at our Wayne Branch in the fourth quarter and this project is expected to be completed in the second quarter of 2008. When renovations are completed, this branch will be a more attractive and inviting environment for our clients. Benefits of this project include improved vehicle traffic flow, additional parking and an overall improvement in our ability to serve our clients more efficiently and effectively. We had hoped to open our new West Chester branch in 2007; however, we encountered some unexpected delays. We are moving forward with this facility and anticipate opening late in 2008. Expansion of our branch network is an important strategy and we believe our entry into the West Chester market will provide us access to a large group of potential customers who are in our target demographic market. Our Ardmore Branch, which opened in January 2007, is off to a great start with deposit balances growing well ahead of projections. We are very encouraged with these results and we have high expectations for this branch’s continued growth.

To improve communications with our clients and prospects we have revised our brochures and other point-of-sale materials. The new collateral materials present information about our products and services in a fresh and easy to read format.

One of our goals is to provide customers with the highest quality products and services to meet their financial services needs. We delivered three new products to our customers in 2007 including a non-proprietary separately managed investment account (SMA), e-Z Banking, and e-Z Escrow.

| | |

q PICTURED FROM LEFT TO RIGHT: George Connell, Jr., Senior Vice President, SMA Strategies; F. Peter Brodie, Senior Vice President, Chief Investment Officer; Miguel L. Biamon, Senior Vice President/Director of Fixed Income Management | | q PICTURED FROM LEFT TO RIGHT: Richard Rollins, II, Vice President/Business Development Officer; Mary Beth Birkenmeier, Assistant Vice President; Malcolm Brown, Assistant Treasurer; Walter Smedley, III, Senior Vice President; Mary M. Cunningham, Associate/Administrator; Linda N. Kahley, Vice President and Assistant Secretary |

| |

| |  |

9

2007 ANNUAL REPORT

| | |

| |  |

| |

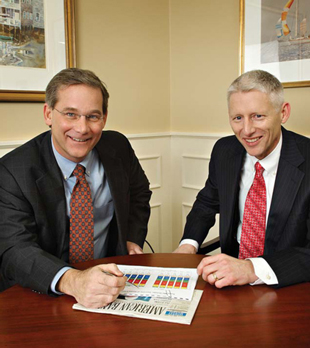

q PICTURED FROM LEFT TO RIGHT: Joseph G. Keefer, Executive Vice President and Chief Lending Officer; J. Duncan Smith, Executive Vice President and Chief Financial Officer | | q PICTURED FROM LEFT TO RIGHT: Robert J. Ricciardi, Executive Vice President/Chief Credit Policy Officer; Francis J. Leto, Board Member |

The introduction of the SMA strategy marked the achievement of our objective to offer this investment option to our clients in 2007. We partnered with Federated Investors, Inc., a prominent investment management firm headquartered in Pittsburgh, PA to deliver this highly valued investment strategy to our wealth clients and prospects. The new SMA strategy was reviewed and approved by our Investment Policy Committee to ensure that clients receive the same quality and asset allocation philosophy inherent in our proprietary solutions. We plan to add other outside managers to our wealth management platform in 2008. To introduce the new SMA strategy, we held a seminar in September, 2007, which was well attended by clients, prospects and referral sources.

Two new business products were added to our product line with the introduction of e-Z Banking and e-Z Escrow. These automated services will allow our business customers to save time and money and operate more efficiently and effectively. Customers can scan and deposit checks into their Bryn Mawr Trust checking account, from their office, with e-Z Banking. It is a safe, secure and convenient way to make deposits, simplify record keeping and improve cash flow.

Any business that handles or administers escrow deposits will benefit from our e-Z Escrow product. We track all client escrow deposits and provide comprehensive monthly statements, eliminating the need for manually tracking and reporting escrow activity.

GIVING BACK TO THE COMMUNITY

At Bryn Mawr Trust we believe it is important to be an active and contributing member of the communities we serve. We support our communities through volunteerism as well as through financial contributions and sponsorships. Last year we contributed generously to a wide variety of educational, cultural and civic organizations that make such a positive impact on the lives of so many members of our community. Through our participation in the Commonwealth of Pennsylvania’s Educational Improvement Tax Credits Program we were able to support scholarship programs at 36 local schools and educational foundations.

WEALTH MANAGEMENT DIVISION CONTINUES TO BUILD MOMENTUM

Financial industry experts, customers and competitors recognize Bryn Mawr Trust as a premier wealth management firm in the Philadelphia area. Our professionals are sought out for their opinions, comments and advice on a variety of wealth management topics. We received a record number of requests from the media during 2007 and our professionals were seen on CNBC, CN8 Money Matters and Bloomberg TV, heard on KYW Radio 1060 and quoted in a variety of publications including:Bloomberg News,Private Asset Management,Smart Money,Associated Press,Investment News,USA Today,Main Line Times andThe Philadelphia Inquirer.

10

2007 ANNUAL REPORT

| | |

| |  |

| |

p PICTURED FROM LEFT TO RIGHT: June M. Falcone, Senior Vice President; Sara P. Worrell, Vice President | | p PICTURED FROM LEFT TO RIGHT: Alison E. Gers, Executive Vice President, Retail Banking; Stephen P. Novak, Senior Vice President, Retail Banking |

Ellen Jordan, CFP (Certified Financial Planner) joined the Wealth Management Division in June, 2007. She has more than 20 years experience in the financial services industry and will work with our clients to prepare comprehensive financial plans.

We expect to expand our market into the state of Delaware with a limited purpose trust company (LPTC) during 2008. Our projected opening in Wilmington, subject to regulatory approval, is scheduled for this coming July. The LPTC will empower the organization to serve as a corporate fiduciary under Delaware statutes, which are more favorable for individuals and families. This initiative will open up a national market for our product offerings. Detailed planning for this initiative was started during 2007.

TWO NEW GROUPS FORMED

In early May we announced the formation of The Private Banking Group at Bryn Mawr Trust. Their mission is to ensure that all of the many resources throughout the Company are dedicated to the comprehensive financial stewardship of affluent individuals and families. Walter Smedley, III, CFP, ChFC, was appointed as the Managing Director of this new division. He is supported by a particularly skilled and knowledgeable team who average over 25 years of experience in all areas of financial services.

The BMT Mortgage Group was formed to augment the Corporation’s existing mortgage operations. This group of experienced mortgage industry professionals focuses their efforts on developing the Chester County, PA and state of Delaware mortgage markets.

CORPORATE GOVERNANCE

Our excellent reputation is one of our most valuable assets. We have worked very hard to earn your trust, and several years ago adopted comprehensive corporate governance policies and practices. Our goal is to promote the highest standards and ethical conduct for our directors and employees in the management of Bryn Mawr Trust. Francis J. Leto, Lead Director of the Board, and Chairman of the Nominating and Corporate Governance Committee, works closely with our executive management team to keep the corporation up-to-date on corporate governance and compliance issues.

One of our goals is to provide customers with the highest quality products and services to meet their financial services needs.

11

2007 ANNUAL REPORT

CORPORATE INFORMATION

CORPORATE HEADQUARTERS

801 Lancaster Avenue

Bryn Mawr, Pennsylvania 19010

610-525-1700

www.bmtc.com

DIRECTORS

Thomas L. Bennett

Private Investor, Director and Trustee of the

Delaware Investments Family of Funds

Andrea F. Gilbert

President, Bryn Mawr Hospital

Wendell F. Holland

Chairman, Pennsylvania Public Utilities Commission

Scott M. Jenkins

President, S.M. Jenkins & Co.

David E. Lees

Senior Partner, myCIO Wealth Partners, LLC

Francis J. Leto

Attorney-at-law, Brett Senior & Associates; President,

Brandywine Abstract Company, L.P.

Britton H. Murdoch

CEO, City Line Motors;

Managing Director, Strattech Partners

Frederick C. “Ted” Peters II

Chairman, President and Chief Executive Officer,

Bryn Mawr Bank Corporation and The Bryn Mawr

Trust Company

B. Loyall Taylor, Jr.

President, Taylor Gifts, Inc.

MARKET MAKERS

Boenning & Scattergood, Inc.

Citigroup Global Markets, Inc.

Ferris Baker Watts, Inc.

Janney Montgomery LLC

Keefe, Bruyette & Woods, Inc.

Knight Equity Markets,

L.P. Lehman Brothers, Inc.

Maxim Group LLC

Morgan Stanley & Co., Inc.

Ryan Beck & Co., Inc.

Sandler O’Neill & Partners

UBS Securities LLC

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

KPMG LLP

1601 Market Street

Philadelphia, Pennsylvania 19103

REGISTRAR & TRANSFER AGENT

Mellon Investor Services LLC

PO Box 3315

South Hackensack, New Jersey 07606

www.mellon-investor.com

PRINCIPAL SUBSIDIARY

The Bryn Mawr Trust Company

A Subsidiary of Bryn Mawr Bank Corporation

EXECUTIVE MANAGEMENT

Frederick C. “Ted” Peters II*

Chairman, President and Chief Executive Officer

Alison E. Gers

Executive Vice President, Retail Banking,

Central Sales, Marketing, Information Systems

& Operations

Joseph G. Keefer

Executive Vice President and Chief Lending Officer

Robert J. Ricciardi*

Executive Vice President, Chief Credit Policy Officer

and Corporate Secretary

J. Duncan Smith, CPA*

Executive Vice President and Chief Financial Officer

Matthew G. Waschull

Executive Vice President, Wealth Management

| *Also | officer of the Corporation |

BRANCH OFFICES

50 West Lancaster Avenue

Ardmore, Pennsylvania 19003

801 Lancaster Avenue

Bryn Mawr, Pennsylvania 19010

237 North Pottstown Pike

Exton, Pennsylvania 19341

18 West Eagle Road

Havertown, Pennsylvania 19083

3601 West Chester Pike

Newtown Square, Pennsylvania 19073

39 West Lancaster Avenue

Paoli, Pennsylvania 19301

330 East Lancaster Avenue

Wayne, Pennsylvania 19087

One Tower Bridge

West Conshohocken, Pennsylvania 19428

WEALTH MANAGEMENT DIVISION

10 South Bryn Mawr Avenue

Bryn Mawr, Pennsylvania 19010

LIFE CARE COMMUNITY OFFICES

Beaumont at Bryn Mawr Retirement Community

Bryn Mawr, Pennsylvania 19010

Bellingham Retirement Living

West Chester, Pennsylvania

Martins Run Life Care Community

Media, Pennsylvania

Rosemont Presbyterian Village

Rosemont, Pennsylvania

The Quadrangle

Haverford, Pennsylvania

Waverly Heights

Gladwyne, Pennsylvania

White Horse Village

Newtown Square, Pennsylvania 19073

OTHER SUBSIDIARIES AND FINANCIAL SERVICES

BMT Leasing, Inc.

A Subsidiary of The Bryn Mawr Trust Company

Bryn Mawr, Pennsylvania

Joseph G. Keefer, Chairman

James A. Zelinskie, Jr., President

BMT Mortgage Company

A Division of The Bryn Mawr Trust Company

Bryn Mawr, Pennsylvania

Myron H. Headen, President

BMT Mortgage Group

A Division of The Bryn Mawr Trust Company

Glen Mills, Pennsylvania

Robert McLaughlin, Co-Managing Partner

Thomas DiBiase, Co-Managing Partner

BMT Mortgage Services, Inc.

A Subsidiary of The Bryn Mawr Trust Company

Bryn Mawr, Pennsylvania

Joseph G. Keefer, Chairman

Myron H. Headen, President

BMT Retirement Services

A Division of The Bryn Mawr Trust Company

Bryn Mawr, Pennsylvania

Gilbert B. Mateer, President

BMT Settlement Services, Inc.

A Subsidiary of The Bryn Mawr Trust Company

Bryn Mawr, Pennsylvania

Joseph G. Keefer, Chairman

Myron H. Headen, President

Insurance Counsellors of Bryn Mawr, Inc.

A Subsidiary of The Bryn Mawr Trust Company

Bryn Mawr, Pennsylvania

Thomas F. Drennan, President

LEGAL COUNSEL

McElroy, Deutsch, Mulvaney & Carpenter, LLP

One Penn Center at Suburban Station

1617 John F. Kennedy Boulevard

Suite 1500 Philadelphia,

Pennsylvania 19103

12

2007 ANNUAL REPORT

BRYN MAWR BANK CORPORATION

801 LANCASTER AVENUE

BRYN MAWR, PENNSYLVANIA 19010

Exhibit 13.1

Annual Report

Selected Financial Data*

| | | | | | | | | | | | | | | | | | | | |

| For the years ended December 31, | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (dollars in thousands, except for share and per share data) | |

Interest income | | $ | 54,218 | | | $ | 45,906 | | | $ | 37,908 | | | $ | 31,347 | | | $ | 29,228 | |

Interest expense | | | 19,976 | | | | 12,607 | | | | 6,600 | | | | 4,553 | | | | 4,330 | |

| | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 34,242 | | | | 33,299 | | | | 31,308 | | | | 26,794 | | | | 24,898 | |

Provision for loan and lease losses | | | 891 | | | | 832 | | | | 762 | | | | 900 | | | | 750 | |

| | | | | | | | | | | | | | | | | | | | |

Net interest income after loan loss provision | | | 33,351 | | | | 32,467 | | | | 30,546 | | | | 25,894 | | | | 24,148 | |

Non-interest income | | | 21,781 | | | | 18,361 | | | | 18,305 | | | | 19,828 | | | | 26,610 | |

Non-interest expense | | | 34,959 | | | | 31,423 | | | | 31,573 | | | | 31,625 | | | | 33,437 | |

| | | | | | | | | | | | | | | | | | | | |

Income before income taxes and discontinued operations | | | 20,173 | | | | 19,405 | | | | 17,278 | | | | 14,097 | | | | 17,321 | |

Applicable income taxes | | | 6,573 | | | | 6,689 | | | | 5,928 | | | | 4,752 | | | | 6,049 | |

| | | | | | | | | | | | | | | | | | | | |

Income from continuing operations | | | 13,600 | | | | 12,716 | | | | 11,350 | | | | 9,345 | | | | 11,272 | |

Loss from discontinued operations | | | — | | | | — | | | | — | | | | — | | | | (1,916 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Income | | $ | 13,600 | | | $ | 12,716 | | | $ | 11,350 | | | $ | 9,345 | | | $ | 9,356 | |

| | | | | | | | | | | | | | | | | | | | |

Per share data: | | | | | | | | | | | | | | | | | | | | |

Earnings per common share from continuing operations: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 1.59 | | | $ | 1.48 | | | $ | 1.33 | | | $ | 1.09 | | | $ | 1.30 | |

Diluted | | $ | 1.58 | | | $ | 1.46 | | | $ | 1.31 | | | $ | 1.07 | | | $ | 1.29 | |

Earnings per common share: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 1.59 | | | $ | 1.48 | | | $ | 1.33 | | | $ | 1.09 | | | $ | 1.08 | |

Diluted | | $ | 1.58 | | | $ | 1.46 | | | $ | 1.31 | | | $ | 1.07 | | | $ | 1.07 | |

| | | | | |

Dividends declared | | $ | .50 | | | $ | .46 | | | $ | .42 | | | $ | 0.40 | | | $ | 0.40 | |

| | | | | |

Weighted-average shares outstanding | | | 8,539,904 | | | | 8,578,050 | | | | 8,563,027 | | | | 8,610,171 | | | | 8,657,527 | |

Dilutive potential common shares | | | 93,638 | | | | 113,579 | | | | 101,200 | | | | 110,854 | | | | 103,107 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted weighted-average shares | | | 8,633,542 | | | | 8,691,629 | | | | 8,664,227 | | | | 8,721,025 | | | | 8,760,634 | |

| | | | | |

Selected financial ratios: | | | | | | | | | | | | | | | | | | | | |

Tax equivalent net interest margin | | | 4.37 | % | | | 4.90 | % | | | 5.05 | % | | | 4.60 | % | | | 4.85 | % |

Net income/average total assets (“ROA”) | | | 1.59 | % | | | 1.72 | % | | | 1.66 | % | | | 1.45 | % | | | 1.98 | % |

Net income/average shareholders’ equity (“ROE”) | | | 15.87 | % | | | 15.71 | % | | | 15.50 | % | | | 13.73 | % | | | 17.85 | % |

Average shareholders’ equity to average total assets | | | 10.04 | % | | | 10.93 | % | | | 10.72 | % | | | 10.59 | % | | | 11.06 | % |

Dividends declared per share to net income per basic common share | | | 31.45 | % | | | 31.08 | % | | | 31.58 | % | | | 36.70 | % | | | 37.04 | % |

| | | | | |

| At December 31, | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Total assets | | $ | 1,002,096 | | | $ | 826,817 | | | $ | 727,383 | | | $ | 683,103 | | | $ | 604,660 | |

Earning assets | | | 874,661 | | | | 733,781 | | | | 664,073 | | | | 627,258 | | | | 546,500 | |

Portfolio loans and leases | | | 802,925 | | | | 681,291 | | | | 595,165 | | | | 555,889 | | | | 498,726 | |

Deposits | | | 849,528 | | | | 714,489 | | | | 636,260 | | | | 600,965 | | | | 527,139 | |

Shareholders’ equity | | | 90,351 | | | | 82,092 | | | | 77,222 | | | | 70,947 | | | | 67,034 | |

Ratio of equity to assets | | | 9.02 | % | | | 9.97 | % | | | 10.66 | % | | | 10.43 | % | | | 11.14 | % |

Loans serviced for others | | | 357,363 | | | | 382,141 | | | | 417,649 | | | | 507,421 | | | | 797,326 | |

Assets under management & administration - Wealth Division | | | 2,191,753 | | | | 2,102,468 | | | | 1,951,424 | | | | 1,887,181 | | | | 1,751,875 | |

Book value per share | | $ | 10.60 | | | $ | 9.59 | | | $ | 9.03 | | | $ | 8.25 | | | $ | 7.74 | |

Allowance as a percentage of portfolio loans and leases | | | 1.01 | % | | | 1.19 | % | | | 1.24 | % | | | 1.23 | % | | | 1.34 | % |

Efficiency ratio | | | 62.40 | % | | | 60.83 | % | | | 63.64 | % | | | 67.83 | % | | | 64.92 | % |

| * | Periods prior to 2007 have been adjusted to reflect the correction of an immaterial error- see Note 1 V. Correction of Prior Financial Statements in the Notes to the Consolidated Financial Statements included in this document. |

1

Management’s Discussion and Analysis of Financial Condition and Results of Operations

BRIEF HISTORYOFTHE CORPORATION

The Bryn Mawr Trust Company (the “Bank”) received its Pennsylvania banking charter in 1889 and is a member of the Federal Reserve System. In 1986, Bryn Mawr Bank Corporation (the “Corporation”) was formed and on January 2, 1987, the Bank became a wholly-owned subsidiary of the Corporation. The Bank and Corporation are headquartered in Bryn Mawr, PA, a western suburb of Philadelphia, PA. The Corporation and its subsidiaries offer a full range of personal and business banking services, consumer and commercial loans, equipment leasing, mortgages, insurance and wealth management services, including investment management, trust and estate administration, retirement planning, custody services, and tax planning and preparation from eight full-service branches and seven limited-hour retirement community offices throughout Montgomery, Delaware and Chester counties. The Corporation trades on the NASDAQ Global Market (“NASDAQ”) under the symbol BMTC.

The goal of the Corporation is to become the preeminent community bank and wealth management organization in the Philadelphia area.

The Corporation operates in a highly competitive market area that includes local, national and regional banks as competitors along with savings banks, credit unions, insurance companies, trust companies, registered investment advisors and mutual fund families. The Corporation and its subsidiaries are regulated by many regulatory agencies including the Securities and Exchange Commission (“SEC”), NASDAQ, Federal Deposit Insurance Corporation (“FDIC”), the Federal Reserve and the Pennsylvania Department of Banking.

RESULTSOF OPERATIONS

The following is Management’s discussion and analysis of the significant changes in the results of operations, capital resources and liquidity presented in its accompanying consolidated financial statements for the Corporation. The Corporation’s consolidated financial condition and results of operations consist almost entirely of the Bank’s financial condition and results of operations. Current performance does not guarantee, and may not be indicative of similar performance in the future.

CRITICAL ACCOUNTING POLICIES, JUDGMENTSAND ESTIMATES

The accounting and reporting policies of the Corporation and its subsidiaries conform with accounting principles generally accepted in the United States of America applicable to the financial services industry (Generally Accepted Accounting Principles “GAAP”). All inter-company transactions are eliminated in consolidation and certain reclassifications are made when necessary to conform the previous year’s financial statements to the current year’s presentation. In preparing the consolidated financial statements, Management is required to make estimates and assumptions that affect the reported amount of assets and liabilities as of the dates of the balance sheets and revenues and expenditures for the periods presented. Therefore, actual results could differ from these estimates.

The allowance for loan and lease losses involves a higher degree of judgment and complexity than other significant accounting policies. The allowance for loan and lease losses is calculated with the objective of maintaining a reserve level believed by Management to be sufficient to absorb estimated probable credit losses. Management’s determination of the adequacy of the allowance is based on periodic evaluations of the loan and lease portfolio and other relevant factors. However, this evaluation is inherently subjective as it requires material estimates, including, among others, expected default probabilities, expected loan commitment usage, the amounts and timing of expected future cash flows on impaired loans and leases, value of collateral, estimated losses on consumer loans and residential mortgages and general amounts for historical loss experience. The process also considers economic conditions, international events, and inherent risks in the loan and lease portfolio. All of these factors may be susceptible to significant change. To the extent actual outcomes differ from Management estimates, additional provisions for loan and lease losses may be required that would adversely impact earnings in future periods. See the section of this document titled Asset Quality and Analysis of Credit Risk for additional information.

Other significant accounting policies are presented in Note 1 in the accompanying financial statements. The Corporation’s Summary of Significant Accounting Policies has not substantively changed any aspect of its overall approach in the application of the foregoing policies.

EXECUTIVE OVERVIEW

2007 Compared to 2006

The Corporation reported 2007 diluted earnings per share of $1.58, an increase of $0.12 per share or 8.2% compared to $1.46 per share in 2006. Net income for the year ended December 31, 2007 was $13.6 million, an increase of 7.0% or $884 thousand, compared to $12.7 million last year.

2

The primary factor contributing to the increase in earnings for the year was a $0.10 per share or $866 thousand after-tax gain on the sale of real estate that previously served as the Bank’s Wynnewood branch location. Excluding the real estate gain, year to date 2007 diluted earnings per share of $1.48 were up $.02 or 1.4% from the same period last year and net income of $12.7 million was flat compared to the prior period. Return on average equity (ROE) and return on average assets (ROA) for the year ended December 31, 2007 were 15.87% (14.86% excluding the real estate gain) and 1.59% (1.49% excluding the real estate gain), respectively. ROE was 15.71% and ROA was 1.72% for the same period last year.

Anticipating a one-time gain on the sale of real estate during the first quarter of 2007, the Corporation invested in many new business initiatives in the latter part of 2006 continuing through 2007. These initiatives included the formation of an equipment leasing company, the start-up of a loan production office in West Chester, the opening of a new branch in Ardmore, Pennsylvania, the roll-out of the Private Banking Group, the formation of BMT Mortgage Group to augment the Corporation’s existing mortgage operations, and the retooling of the Wealth Division through investments in additional personnel, product offerings and service enhancements.

During the third quarter of 2007, an experienced financial planner was hired to enhance the Wealth Division’s overall financial planning services and a new separately-managed investment account (“SMA”) product was launched. The Corporation is also developing plans to establish a limited purpose trust company (“LPTC”) in the State of Delaware in 2008, subject to regulatory approval, to serve as a corporate fiduciary under Delaware statutes, which are more favorable for individuals and families. These new initiatives contributed to the $3.5 million or 11.3% increase in non-interest expenses in 2007 compared to 2006.

The Corporation increased portfolio loans and leases in 2007 by 17.9% or $121.6 million compared with year-end 2006 balances by expanding banking relationships with local businesses, not-for-profit entities, quality builders and high credit quality individuals. Additional opportunities exist also in our residential lending unit with desirable borrowers as competitors have partially, and in some cases entirely, withdrawn from the market. This growth in loan and lease volume was able to offset several prime rate decreases and higher funding costs, to increase the Corporation’s tax equivalent net interest income by $921 thousand or 2.7% for the year ended December 31, 2007 compared to the same period last year.

Credit quality on the overall loan and lease portfolio remains strong as total non-performing loans and leases represent 25 basis points or $2.0 million of portfolio loans and leases at December 31, 2007. This compares with 12 basis points or $823 thousand at December 31, 2006.

The provision for loan and lease losses for the year ended December 31, 2007 and 2006 were $891 thousand and $832 thousand, respectively. At December 31, 2007, the allowance for loan and lease losses (“allowance”) of $8.1 million represents 1.01% of portfolio loans and leases compared with 1.19% at December 31, 2006. For additional information, see the section titled Asset Quality and Analysis of Credit Risk in this document.

Funding from wholesale sources, which includes wholesale deposits and wholesale borrowings, at December 31, 2007 of approximately $174.8 million was $139.8 million higher than the $35.0 million at December 31, 2006. The increase in 2007 was primarily used to fund portfolio loan and lease growth of approximately $122.0 million. During 2007, deposits continued to shift from lower yielding savings and NOW accounts into higher yielding money market accounts, but at a much slower pace than the corporation experienced in 2006. The use of wholesale funding at average rates of 5.30% was the primary reason that the Corporation’s net interest margin declined from 4.90% in 2006 to 4.37% in 2007.

Deposit balances at December 31, 2007 and 2006 reflect approximately $70.0 million and $35.0 million, respectively, in demand deposit balances that represent short term in-flows from customer year-end activity. These short term deposit in-flows pushed the Corporation’s total assets over the $1.0 billion level at December 31, 2007.

For the year ended December 31, 2007, non-interest income excluding the $1.3 million (pre-tax) real estate gain on the Wynnewood property, was $20.4 million, an increase of $2.1 million or 11.4% over the $18.4 million in 2006. The primary factor for this increase was year-to-date Wealth Management revenue of $13.5 million which was $1.1 million or 8.7% higher than 2006.

Wealth Management revenues for the year ended December 31, 2007 and December 31, 2006 include $580 thousand and $403 thousand, respectively, of fees that will no longer be earned relating to one institutional client that was acquired by another financial institution in a business combination on November 16, 2007. Wealth assets under Management and Administration relating to this client were approximately $412.4 million at December 31, 2006 and zero at December 31, 2007.

For the year ended December 31, 2007, non-interest expense was $35.0 million, an increase of $3.5 million or 11.3% over the $31.4 million in the same period last year. Personnel and related support costs associated with the new business initiatives were the largest contributor to this increase in non-interest expenses.

3

2006 Compared to 2005

Bryn Mawr Bank Corporation reported net income for the year ended December 31, 2006 of $12.7 million, an increase of 12.0% or $1.4 million, compared to $11.4 million in 2005. Diluted earnings per share for the year ended December 31, 2006, were $1.46, an increase of $0.15 or 11.5%, compared with $1.31 in 2005. ROE and ROA for 2006 were 15.71% and 1.72%, respectively. ROE was 15.50% and ROA was 1.66% for 2005.

The major factor contributing to the increase in earnings for 2006 compared to 2005 was a $2.1 million or 6.6% increase in the Corporation’s tax equivalent net interest income to $33.7 million from $31.6 million in 2005. This increase was principally loan volume driven, despite a decrease in the tax equivalent net interest margin of 15 basis points to 4.90% in 2006 from 5.05% in 2005. Also contributing to the increase in earnings was a nominal decrease in overall non-interest expense of $150 thousand as total non-interest expenses were $31.4 million. Additionally, fees for Wealth Management services increased 7.7% or $883 thousand to $12.4 million in 2006 versus $11.5 million in 2005, partially offsetting declines in residential mortgage-related revenues.

Asset quality was strong as non-performing assets represented 0.10% of total assets at December 31, 2006. While the allowance increased to $8.1 million at December 31, 2006 from $7.4 million at December 31, 2005, the allowance as a percentage of portfolio loans decreased to 1.19% from 1.24% over the same time period. The decrease in the allowance as a percentage of portfolio loans is attributed to strong loan growth in the second and third quarters of 2006 and continued strength in asset quality. Net loan charge-offs were $112 thousand and $287 thousand for the years ended December 31, 2006 and 2005, respectively.

Portfolio loans increased $86.1 million or 14.5% to $681.3 million at December 31, 2006 from $595.2 million at December 31, 2005, reflecting a significant increase in commercial mortgage and construction loan closings in 2006. Also contributing to the growth was the formation of BMT Leasing Inc., which added $7.0 million in balances in 2006. The Corporation opened its business loan production office in downtown West Chester, Pennsylvania in 2006 to help further this growth.

The Corporation’s interest bearing liabilities at December 31, 2006 include approximately $65.0 million in wholesale certificates and short-term borrowings, compared with $5.0 million at December 31, 2005. Deposit balances at December 31, 2006 and 2005 reflect approximately $35.0 million and $25.0 million, respectively, in demand deposit balances that represent short term in-flows from customer year-end activity. Total deposits, including the short term in-flows were $714.5 million and $636.2 million at December 31, 2006 and 2005, respectively. This represents a year over year increase in total deposits of $78.2 million or 12.3%.

During 2006, the Corporation observed a shift in the mix of its other deposits (total deposits less wholesale deposits) as some lower cost interest bearing checking, money market accounts and savings accounts moved into higher yielding certificates of deposit. This shift in the other deposit mix was a national trend as many financial institutions had similar experiences. The utilization of market rate wholesale funding, the shift in deposit mix and the increase in interest rates resulted in overall funding costs rising faster than the yield on interest earning assets.

NON-GAAP MEASURES

Non-GAAP Measures: A non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that either exclude or include amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles (GAAP). To supplement our financial statements presented in accordance with GAAP, we report certain key financial measurements without the impact of a material real estate transaction.

Our management uses these non-GAAP measures in its analysis of the Corporation’s performance. These non-GAAP measures consist of adjusting net income, non-interest income, diluted earnings per share, ROE, and ROA determined in accordance with GAAP to exclude the effects of the real estate gain in the first quarter of 2007 (i.e. year to date).

Management believes that the inclusion of these non-GAAP financial measures provides useful supplemental information essential to the proper understanding of the operating results of the Corporation’s core business. These measures should be considered in addition to results prepared in accordance with GAAP, and are not substitutes for, or superior to, GAAP results. The non-GAAP measures are provided to enhance investors’ overall understanding of our current financial performance. These non-GAAP measures have been reconciled to the nearest GAAP measure in the accompanying schedule.

| | | | | | | | | | | | | | | | | | | |

| (dollars in thousands | | Year Ended December 31, |

| | Net Income | | Diluted Earnings Per Share |

| except per share data) | | 2007 | | | 2006 | | 2005 | | 2007 | | | 2006 | | 2005 |

As reported (GAAP) | | $ | 13,600 | | | $ | 12,716 | | $ | 11,350 | | $ | 1.58 | | | 1.46 | | $ | 1.31 |

After tax effect of gain on sale of real estate | | | (866 | ) | | | — | | | — | | | (0.10 | ) | | — | | | — |

| | | | | | | | | | | | | | | | | | | |

Adjusted for sale | | $ | 12,734 | | | $ | 12,716 | | $ | 11,350 | | $ | 1.48 | | | 1.46 | | $ | 1.31 |

| | | | | | | | | | | | | | | | | | | |

4

| | | | | | | | | | |

| | | Non-Interest Income |

| | 2007 | | | 2006 | | 2005 |

As reported (GAAP) | | $ | 21,781 | | | $ | 18,361 | | $ | 18,305 |

Gain on sale of real estate | | | (1,333 | ) | | | — | | | — |

| | | | | | | | | | |

Adjusted for sale | | $ | 20,448 | | | $ | 18,361 | | $ | 18,305 |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | ROE | | | ROA | |

| | 2007 | | | 2006 | | | 2005 | | | 2007 | | | 2006 | | | 2005 | |

As reported (GAAP) | | 15.87 | % | | 15.71 | % | | 15.50 | % | | 1.59 | % | | 1.72 | % | | 1.66 | % |

After tax effect of gain on sale of real estate | | (1.01 | )% | | — | | | | | | (0.10 | )% | | — | | | — | |

| | | | | | | | | | | | | | | | | | |

Adjusted for sale | | 14.86 | % | | 15.71 | % | | 15.5 | % | | 1.49 | % | | 1.72 | % | | 1.66 | % |

| | | | | | | | | | | | | | | | | | |

COMPONENTSOF NET INCOME

Net income is affected by five major elements:Net Interest Income, or the difference between interest income and loan fees earned on loans and investments and interest expense paid on deposits and borrowed funds;Provision For Loan and Lease Losses, or the amount added to the allowance for loan and lease losses to provide for estimated inherent losses on loans and leases;Non-Interest Income which is made up primarily of certain fees, wealth revenue, residential mortgage activities and gains and losses from the sale of securities and other assets;Non-Interest Expense, which consists primarily of salaries, employee benefits and other operating expenses; andIncome Taxes. Each of these major elements will be reviewed in more detail in the following discussion.

NET INTEREST INCOME

Rate/Volume Analyses (Tax Equivalent Basis)

The rate volume analysis in the table below analyzes changes in tax equivalent net interest income for the years 2007 compared to 2006 and 2006 compared to 2005 by its rate and volume components. The change in interest income/expense due to both volume and rate has been allocated to changes in volume.

| | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | Year Ended December 31, | |

| | 2007 Compared to 2006 | | 2006 Compared to 2005 | |

| Increase/(decrease) | | Volume | | | Rate | | | Total | | Volume | | | Rate | | Total | |

Interest Income: | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits with other banks | | $ | 44 | | | $ | 2 | | | $ | 46 | | $ | (57 | ) | | $ | 11 | | $ | (46 | ) |

Federal funds sold | | | 21 | | | | 7 | | | | 28 | | | (108 | ) | | | 44 | | | (64 | ) |

Investment securities available for sale | | | (73 | ) | | | 295 | | | | 222 | | | 391 | | | | 434 | | | 825 | |

Loans and leases | | | 7,184 | | | | 810 | | | | 7,994 | | | 3,415 | | | | 3,968 | | | 7,383 | |

| | | | | | | | | | | | | | | | | | | | | | |

Total interest income | | | 7,176 | | | | 1,114 | | | | 8,290 | | | 3,641 | | | | 4,457 | | | 8,098 | |

| | | | | | | | | | | | | | | | | | | | | | |

Interest expense: | | | | | | | | | | | | | | | | | | | | | | |

Savings, NOW and market rate accounts | | | (155 | ) | | | 475 | | | | 320 | | | (217 | ) | | | 1,323 | | | 1,106 | |

Wholesale deposits | | | 4,531 | | | | (185 | ) | | | 4,346 | | | | | | | | | | | |

Time deposits | | | 569 | | | | 956 | | | | 1,525 | | | 1,545 | | | | 2,371 | | | 3,916 | |

Borrowed Funds | | | 1,238 | | | | (60 | ) | | | 1,178 | | | 594 | | | | 391 | | | 985 | |

| | | | | | | | | | | | | | | | | | | | | | |

Total interest expense | | | 6,183 | | | | 1,186 | | | | 7,369 | | | 1,922 | | | | 4,085 | | | 6,007 | |

| | | | | | | | | | | | | | | | | | | | | | |

Interest differential | | $ | 993 | | | $ | (72 | ) | | $ | 921 | | $ | 1,719 | | | $ | 372 | | $ | 2,091 | |

| | | | | | | | | | | | | | | | | | | | | | |

5

Analyses of Interest Rates and Interest Differential

The table below presents the major asset and liability categories on an average daily basis for the periods presented, along with tax-equivalent interest income and expense and key rates and yields:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | For the Year Ended December 31, | |

| | 2007 | | | 2006 | | | 2005 | |

| | Average

Balance | | | Interest

Income/

Expense | | Average

Rates

Earned/

Paid | | | Average

Balance | | | Interest

Income/

Expense | | Average

Rates

Earned/

Paid | | | Average

Balance | | | Interest

Income/

Expense | | Average

Rates

Earned/

Paid | |

Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits with other banks | | $ | 1,506 | | | $ | 76 | | 5.05 | % | | $ | 609 | | | $ | 30 | | 4.93 | % | | $ | 2,398 | | | $ | 76 | | 3.17 | % |

Federal funds sold | | | 3,496 | | | | 174 | | 4.98 | % | | | 3,053 | | | | 146 | | 4.78 | % | | | 6,281 | | | | 210 | | 3.34 | % |

Investment securities available for sale: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Taxable | | | 39,693 | | | | 2,017 | | 5.08 | % | | | 41,489 | | | | 1,790 | | 4.31 | % | | | 29,400 | | | | 958 | | 3.26 | % |

Tax – Exempt | | | 5,029 | | | | 232 | | 4.61 | % | | | 4,993 | | | | 237 | | 4.75 | % | | | 5,069 | | | | 244 | | 4.81 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total investment securities | | | 44,722 | | | | 2,249 | | 5.03 | % | | | 46,482 | | | | 2,027 | | 4.36 | % | | | 34,469 | | | | 1,202 | | 3.49 | % |

Loans and leases(1) | | | 740,694 | | | | 52,053 | | 7.03 | % | | | 636,286 | | | | 44,059 | | 6.92 | % | | | 582,386 | | | | 36,676 | | 6.30 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest earning assets | | | 790,418 | | | | 54,552 | | 6.90 | % | | | 686,430 | | | | 46,262 | | 6.74 | % | | | 625,534 | | | | 38,164 | | 6.10 | % |

Cash and due from banks | | | 22,640 | | | | | | | | | | 25,358 | | | | | | | | | | 29,918 | | | | | | | |

Allowance for loan and lease losses | | | (8,463 | ) | | | | | | | | | (7,828 | ) | | | | | | | | | (7,283 | ) | | | | | | |

Other assets | | | 48,725 | | | | | | | | | | 36,894 | | | | | | | | | | 34,917 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 853,320 | | | | | | | | | $ | 740,854 | | | | | | | | | $ | 683,086 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Savings, NOW and market rate accounts | | $ | 280,371 | | | $ | 4,169 | | 1.49 | % | | $ | 292,075 | | | $ | 3,850 | | 1.32 | % | | $ | 317,205 | | | $ | 2,744 | | 0.87 | % |

Wholesale deposits | | | 92,329 | | | | 4,925 | | 5.53 | % | | | 10,473 | | | | 579 | | 5.53 | % | | | — | | | | — | | — | % |

Time deposits | | | 187,044 | | | | 8,662 | | 4.63 | % | | | 173,271 | | | | 7,136 | | 4.12 | % | | | 130,667 | | | | 3,799 | | 2.91 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing deposits | | | 559,744 | | | | 17,756 | | 3.17 | % | | | 475,819 | | | | 11,565 | | 2.43 | % | | | 447,872 | | | | 6,543 | | 1.46 | % |

Short term borrowings | | | 42,496 | | | | 2,220 | | 5.22 | % | | | 19,442 | | | | 1,042 | | 5.36 | % | | | 1,700 | | | | 57 | | 3.35 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total interest-bearing liabilities | | | 602,240 | | | | 19,976 | | 3.32 | % | | | 495,261 | | | | 12,607 | | 2.55 | % | | | 449,572 | | | | 6,600 | | 1.47 | % |

Non-interest-bearing deposits | | | 148,773 | | | | | | | | | | 150,042 | | | | | | | | | | 148,495 | | | | | | | |

Other liabilities | | | 16,622 | | | | | | | | | | 14,584 | | | | | | | | | | 11,818 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total non-interest-bearing liabilities | | | 165,395 | | | | | | | | | | 164,626 | | | | | | | | | | 160,022 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 767,635 | | | | | | | | | | 659,887 | | | | | | | | | | 609,885 | | | | | | | |

Shareholder’s equity | | | 85,685 | | | | | | | | | | 80,967 | | | | | | | | | | 73,201 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 853,320 | | | | | | | | | $ | 740,854 | | | | | | | | | $ | 683,086 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest spread | | | | | | | | | 3.58 | % | | | | | | | | | 4.19 | % | | | | | | | | | 4.63 | % |

Effect of non-interest-bearing sources | | | | | | | | | 0.79 | % | | | | | | | | | 0.71 | % | | | | | | | | | 0.42 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income/margin on earning assets | | | | | | $ | 34,576 | | 4.37 | % | | | | | | $ | 33,655 | | 4.90 | % | | | | | | $ | 31,564 | | 5.05 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tax equivalent adjustment | | | | | | $ | 334 | | 0.04 | % | | | | | | $ | 356 | | 0.05 | % | | | | | | $ | 256 | | 0.04 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) | Non-accrual loans have been included in average loan balances, but interest on non-accrual loans has not been included for purposes of determining interest income. Average loans and leases include portfolio loans, leases and loans held for sale. |

Net Interest Income 2007 Compared to 2006

Net interest income on a tax equivalent basis for the year ended December 31, 2007 of $34.6 million was 2.7% higher than $33.7 million in 2006. This increase was substantially volume driven as average loan growth of $104.4 million or 16.4% offset was able to offset several prime rate decreases and the impact of funding with higher cost wholesale funds.

Average interest bearing liabilities increased by $107.0 million or 21.6% to $602.2 million during 2007 compared to $495.2 million during 2006. Wholesale deposits and short term borrowings were the primary factors contributing to the increase in average interest bearing liabilities. The change in average other deposit balances in 2007 was a nominal $1.3 million decrease.

Despite the increase in tax equivalent net interest income, the tax equivalent net interest margin on interest earning assets decreased by 53 basis points from 4.90% during 2006 to 4.37% during 2007.

Net Interest Income 2006 Compared to 2005

Net interest income on a tax equivalent basis amounted to $33.7 million for the year ended December 31, 2006, an increase of $2.1 million or 6.6% from the $31.6 million of net interest income earned in 2005. Approximately 82% of the increase in tax equivalent net interest income in 2006 was volume related. During 2006, short term interest rates increased early in the year but stabilized in June 2006. Since the Corporation was asset sensitive, it benefited from rising short term interest rates early in 2006, partially offset by the increasing cost of funding as the deposit market environment became increasingly challenging. To satisfy loan demand, the Corporation utilized more costly time and wholesale deposits together with outside borrowings to a greater extent previously.

Average interest earning assets increased $60.9 million or 9.7% to $686.4 million during 2006 compared to $625.5 million during 2005. The largest portion of this

6

increase in average interest earning assets was attributable to loan growth as average loans increased by $53.9 million or 9.3% to $636.3 million during 2006 compared to 2005. Time deposits, wholesale deposits and short term borrowings were the largest factors contributing to the increase in average interest bearing liabilities.

The tax equivalent net interest margin on interest earning assets decreased 15 basis points from 5.05% during 2005 to 4.90% during 2006.

Net Interest Margin

The Corporation’s tax equivalent net interest margin decreased 54 basis points to 4.11% in the fourth quarter of 2007 from 4.65% in the same period last year. The tax equivalent net interest margin and related components for the past five linked quarters are shown in the table below.

The Corporation anticipates continued pressure on its tax equivalent net interest margin in 2008 as primary funding for incremental loan and lease growth is expected to come from higher cost wholesale funding as growth in other deposit balances is not expected to be significant. The Corporation’s tax equivalent net interest margin was 4.37% in 2007 compared with 4.90% in 2006 and 5.05% in 2005. These results reflect the increased cost of interest bearing liabilities more than offsetting the increased yield on earning assets. However, approximately $140.0 million of the $175.0 million in wholesale funding at December 31, 2007 will mature or re-price in 2008, which will give the Corporation an opportunity to lower funding costs based on current rates.

| | | | | | | | | | | | | | | | | |

| | | Year | | Earning

Asset

Yield | | | Interest

Bearing

Liability

Cost | | | Net

Interest

Spread | | | Effect of

Non-Interest

Bearing

Sources | | | Net

Interest

Margin | |

Net Interest Margin Last Five Quarters | | | | | | | | | | | | | | | | | |

| | | | | | |

4thQuarter | | 2007 | | 6.77 | % | | 3.43 | % | | 3.34 | % | | 0.77 | % | | 4.11 | % |

3rdQuarter | | 2007 | | 6.95 | % | | 3.44 | % | | 3.51 | % | | 0.78 | % | | 4.29 | % |

2ndQuarter | | 2007 | | 6.97 | % | | 3.27 | % | | 3.70 | % | | 0.79 | % | | 4.49 | % |

1stQuarter | | 2007 | | 6.93 | % | | 3.08 | % | | 3.85 | % | | 0.80 | % | | 4.65 | % |

4thQuarter | | 2006 | | 6.85 | % | | 2.99 | % | | 3.86 | % | | 0.79 | % | | 4.65 | % |

| | | | | | |

Net Interest Margin Last Three Years | | | | | | | | | | | | | | | | | |

| | | | | | |

| | 2007 | | 6.90 | % | | 3.32 | % | | 3.58 | % | | 0.79 | % | | 4.37 | % |

| | 2006 | | 6.74 | % | | 2.55 | % | | 4.19 | % | | 0.71 | % | | 4.90 | % |

| | 2005 | | 6.10 | % | | 1.47 | % | | 4.63 | % | | 0.42 | % | | 5.05 | % |

Interest Rate Sensitivity

The Corporation actively manages its interest rate sensitivity position. The objectives of interest rate risk management are to control exposure of net interest income to risks associated with interest rate movements and to achieve sustainable growth in net interest income. Management’s Asset Liability Committee (“ALCO”), using policies and procedures approved by the Corporation’s Board of Directors, is responsible for managing the interest rate sensitivity position. The Corporation manages interest rate sensitivity by changing the mix, pricing and re-pricing characteristics of its assets and liabilities, through the management of its investment portfolio, its offering of loan and selected deposit terms and through wholesale funding and selective use of interest rate floors. Wholesale funding consists of several sources including borrowings from the Federal Home Loan Bank of Pittsburgh (“FHLB”), certificates of deposit from institutional brokers, Certificate of Deposit Account Registry Service (“CDARS”) and Pennsylvania Local Government Investment Trust (“PLGIT”). The Corporation is also evaluating additional wholesale funding sources. The ALCO continues to evaluate various strategies including interest rate swaps and floors to mitigate the impact of future changes in interest rates on its net interest income.

The Corporation uses several tools to manage its interest rate risk including interest rate sensitivity analysis (aka “GAP Analysis”), market value of portfolio equity analysis, interest rate simulations under various rate scenarios and tax equivalent net interest margin reports. The results of these reports are compared to limits established by the Corporation’s ALCO Policies and appropriate adjustments are made if the results are outside of established limits.

The following table demonstrates the annualized result of an interest rate simulation and the estimated effect that a parallel interest rate shift in the yield curve and subjective adjustments in deposit pricing might have on the Corporation’s projected net interest income over the next 12 months.

This simulation assumes that there is no growth in the balance sheet over the next twelve months. The changes to net interest income shown below are in compliance with the Corporation’s policy guidelines. Actual results may differ significantly from the interest rate simulation due to numerous factors including assumptions, the competitive environment, market reactions and customer behavior.

Summary of Interest Rate Simulation

| | | | | | |

| (dollars in thousands) | | December 31, 2007 | |

| | Estimated Change

In Net Interest

Income Over

Next 12 Months | |

Change in Interest Rates | | | | | | |

+200 basis points | | $ | 199 | | .51 | % |

+100 basis points | | $ | 176 | | .45 | % |

-100 basis points | | $ | 183 | | .47 | % |

-200 basis points | | $ | 145 | | .37 | % |

The interest rate simulation above indicates that the Corporation’s balance sheet as of December 31, 2007 is slightly asset sensitive, meaning that an increase in interest rates should increase net interest income and a decline in interest rates will cause a decline in net interest income over the next 12 months when compared to projected net income under a flat or stable rate scenario.

7

The Corporation’s sensitivity to changes in interest rates as measured by the Corporation’s interest rate simulation model decreased from last year (3.41% increase for +200 basis points and 3.60% decrease for -200 basis points). The decrease is a result of direction from its ALCO to add fixed rate commercial loans, residential mortgages and mortgage-backed securities to the asset mix, combined with increased customer preference for fixed rate financing.

Separately, the Corporation purchased a $25.0 million notional, prime rate based, three-year interest rate floor in April 2006 for a total cost of $155 thousand to mitigate the impact on earnings of anticipated declining rates over the next three years. The income related to the interest rate floor of $155 thousand in 2007 and a net expense of $29 thousand in 2006 were included as components of other income and other expense. This position was closed out in January 2008 as rates declined and the value of the contract increased. The Corporation recorded non-interest income of approximately $260 thousand on the close out of this contract in January 2008.

GAP Report

The interest sensitivity or “GAP” report identifies interest rate risk by showing repricing gaps in the bank’s balance sheet. All assets and liabilities are reflected based on behavioral sensitivity, which is usually the earliest of either: repricing, maturity, contractual amortization, prepayments or likely call dates. Non-maturity deposits such as NOW, Savings and money market accounts are spread over various time periods based on the expected sensitivity of these rates considering liquidity and investment preferences for the bank. Non-rate sensitive assets and liabilities are spread over time periods to reflect how the Corporation views the maturity of these funds. The following table presents the Corporation’s GAP Analysis as of December 31, 2007:

| | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | 0 to 90

Days | | | 90 to 365

Days | | | 1 - 5

Years | | | Over 5

Years | | | Non-Rate

Sensitive | | | Total | |

Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits with banks | | $ | 1,209 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 1,209 | |

Federal funds sold | | | 17,000 | | | | — | | | | — | | | | — | | | | — | | | | 17,000 | |

Investment securities | | | 5,628 | | | | 12,126 | | | | 20,526 | | | | 10,122 | | | | — | | | | 48,402 | |

Loans(1) | | | 290,194 | | | | 71,804 | | | | 372,503 | | | | 73,549 | | | | — | | | | 808,050 | |

Allowance | | | — | | | | — | | | | — | | | | — | | | | (8,124 | ) | | | (8,124 | ) |

Cash and due from banks | | | — | | | | — | | | | — | | | | — | | | | 76,965 | | | | 76,965 | |

Other assets | | | — | | | | — | | | | 121 | | | | 477 | | | | 57,996 | | | | 58,594 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 314,031 | | | $ | 83,930 | | | $ | 393,150 | | | $ | 84,148 | | | $ | 126,837 | | | $ | 1,002,096 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Liabilities and shareholders’ equity: | | | | | | | | | | | | | | | | | | | | | | | | |

Demand, non-interest-bearing | | $ | 43,942 | | | $ | 29,104 | | | $ | 155,223 | | | $ | — | | | $ | — | | | $ | 228,269 | |

Savings, NOW and market rate | | | 48,190 | | | | 41,037 | | | | 154,091 | | | | 44,659 | | | | — | | | | 287,977 | |

Time deposits | | | 122,782 | | | | 71,601 | | | | 8,962 | | | | 117 | | | | — | | | | 203,462 | |

Wholesale deposits | | | 20,900 | | | | 98,920 | | | | 10,000 | | | | — | | | | — | | | | 129,820 | |

Borrowed funds | | | 10,000 | | | | 15,000 | | | | 20,000 | | | | — | | | | — | | | | 45,000 | |

Other liabilities | | | — | | | | — | | | | — | | | | — | | | | 17,217 | | | | 17,217 | |

Shareholders’ equity | | | 3,219 | | | | 9,656 | | | | 51,500 | | | | 25,976 | | | | — | | | | 90,351 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 249,033 | | | $ | 265,318 | | | $ | 399,776 | | | $ | 70,752 | | | $ | 17,217 | | | $ | 1,002,096 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Interest earning assets | | $ | 314,031 | | | $ | 83,930 | | | $ | 393,029 | | | $ | 83,671 | | | $ | — | | | $ | 874,661 | |

Interest bearing liabilities | | $ | 201,872 | | | $ | 226,558 | | | $ | 193,053 | | | $ | 44,776 | | | $ | — | | | $ | 666,259 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Difference between interest earning assets and interest bearing liabilities | | $ | 112,159 | | | $ | (142,628 | ) | | $ | 199,976 | | | $ | 38,895 | | | $ | — | | | $ | 208,402 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cumulative difference between interest earning assets and interest bearing liabilities | | $ | 112,159 | | | $ | (30,469 | ) | | $ | 169,507 | | | $ | 208,402 | | | $ | — | | | $ | 208,402 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cumulative earning assets as a % of cumulative interest bearing liabilities | | | 156 | % | | | 93 | % | | | 127 | % | | | 131 | % | | | | | | | | |

(1) | Loans include portfolio loans and leases and loans held for sale. |

The table above indicates that the Corporation is asset sensitive in the immediate to 90 day time frame and should experience an increase in net interest income in the near term if interest rates rise. The converse is also true.

Maturity of Certificates of Deposit of $100,000 or Greater at December 31, 2007

| | | | | | |

| (dollars in thousands) | | Non-

Wholesale | | Wholesale |

Three months or less | | $ | 85,858 | | $ | 20,000 |

Three to six months | | | 28,393 | | | 73,501 |

Six to twelve months | | | 3,533 | | | 20,000 |

Greater than twelve months | | | 1,788 | | | 10,000 |

| | | | | | |

Total | | $ | 119,572 | | $ | 123,501 |

| | | | | | |

8

PROVISIONFOR LOANAND LEASE LOSSES

General Discussion of the Allowance for Loan and Lease Losses

The Corporation uses the allowance method of accounting for credit losses. The balance in the allowance for loan and lease losses (“allowance”) is determined based on Management’s review and evaluation of the loan and lease portfolio in relation to past loss experience, the size and composition of the portfolio, current economic events and conditions, and other pertinent factors, including Management’s assumptions as to future delinquencies, recoveries and losses.

Increases to the allowance are implemented through a corresponding provision (expense) in the Corporation’s statement of income. Loans and leases deemed uncollectible are charged against the allowance. Recoveries of previously charged-off amounts are credited to the allowance.

While Management considers the allowance to be adequate based on information currently available, future additions to the allowance may be necessary due to changes in economic conditions or Management’s assumptions as to future delinquencies, recoveries and losses and Management’s intent with regard to the disposition of loans. In addition, the Pennsylvania Department of Banking and the Federal Reserve Bank of Philadelphia, as an integral part of their examination process, periodically review the Corporation’s allowance.

The Corporation’s allowance is the accumulation of four components that are calculated based on various independent methodologies. All components of the allowance are estimations. Management discusses these estimates earlier in this document under the heading of “Critical Accounting Policies, Judgments and Estimates”. The four components are as follows:

| | • | | Specific Loan Evaluation Component – Includes the specific evaluation of larger classified loans |

| | • | | Historical Charge-Off Component – Applies a five year historical charge-off rate to pools of non-classified loans |

| | • | | Additional Factors Component – The loan portfolio is broken down into multiple homogenous subclassifications upon which multiple factors (such as delinquency trends, economic conditions, loan terms, and regulatory environment) are evaluated resulting in an allowance amount for each of the subclassifications. The sum of these amounts equals the Additional Factors Component. |

| | • | | Unallocated Component – This amount represents a reserve against all loans for factors not included in the components above. |

Asset Quality and Analysis of Credit Risk

Credit quality on the overall loan and lease portfolio remains strong as total non-performing loans and leases of $2.0 million represents 25 basis points of portfolio loans and leases at December 31, 2007. This compares with 12 basis points or $823 thousand at December 31, 2006 and 11 basis points and $415 thousand at December 31, 2005. December 31, 2007 non-performing loan balances include an accruing $1.3 million loan, which is well secured by a local residential property, is now on a current status.

The provision for loan and lease losses for the year ended December 31, 2007, 2006 and 2005 were $891 thousand, $832 thousand and $762 thousand, respectively. At December 31, 2007, the allowance for loan and lease losses of $8.1 million represents 1.01% of portfolio loans and leases compared with 1.19% at December 31, 2006 and 1.24% at December 31, 2005. The decline in the allowance as a percentage of portfolio loans and leases from the end of 2005 to the end of 2007 reflects the Corporation’s low charge-off history over the two year time period and the continued economic strength of the Corporation’s Delaware Valley, Pennsylvania market area.

Additionally, the allowance for loan and lease losses in 2007 was affected by continued loan growth, the maturing of the lease portfolio and related charge-offs, continuing changes to the mix of assets, and periodic refinements along with changes to estimates of loss in certain asset classes. In the aggregate, these changes resulted in a more volatile quarterly provision for loan and lease losses in 2007. Specifically, the changes in loss estimates for residential mortgages and home equity lines of credit, resulted in a lower provision for loan and lease losses in 2007 than would have resulted under the previous loss estimates of approximately $1.2 million. Correspondingly, the allowance for loan and lease losses at December 31, 2007 is approximately $1.2 million lower than it would have been under the previous loss estimates. The Corporation believes that its revised estimates better reflect the loss inherent in the loan and lease portfolio.

| | • | | Portfolio Loans and Leases excluding Leases– The Corporation’s $757.8 million loan portfolio (total portfolio loans and leases excluding leases) is based in the Corporation’s traditional market areas of Chester, Delaware and Montgomery counties (Pennsylvania) and the greater Philadelphia area which have not experienced the hyper real estate price appreciation and subsequent decline that many areas around the country are experiencing. The Corporation has observed a slow-down in new construction in the local area and some home value reductions, but has not seen any impact on the Corporation’s loan quality ratios relative to the loan portfolio. |

9

| | • | | Concentrations – The Corporation has a material portion of its loans (excluding leases) in real estate related loans. As of December 31, 2007, loans secured by real estate are $638.0 million or 84% of the total loan portfolio of $757.8 million, which includes $530.0 of real estate loans. Loans secured by real estate include approximately $108.0 million of commercial and industrial loans. |

A predominant percentage of the Corporation’s real estate exposure, both commercial and residential, is in the Corporation’s primary trade area which includes portions of Delaware, Chester, Montgomery and Philadelphia counties in Southeastern Pennsylvania. Management is aware of this concentration and mitigates this risk to the extent possible in many ways, including the underwriting and assessment of the borrower’s capacity to repay and equity in the underlying real estate collateral.

| | • | | Construction – Residential site development construction loans declined from $46.5 million at December 31, 2006 to $45.4 million at December 31, 2007. Commercial construction projects were $15.1 million at December 31, 2006 and were reduced to $11.0 million at December 31, 2007. Consumer construction loans at December 31, 2006 were $13.3 million and $10.5 million at December 31, 2007. This decrease is attributable to the completion of existing construction projects and a lower level of new projects by the Corporation’s construction clients. |

| | • | | Non Traditional Loan Products – The Corporation’s portfolio of loans and leases as reflected on the balance sheet include $56.8 million of first lien mortgage positions on one to four family residential loans that are interest only loans. |

At December 31, 2007 the total first lien interest only residential loans of $56.8 million included $47.6 million of adjustable rate loans that convert to principal and interest payments between five and ten years after inception and $9.2 million of fixed rate loans that continue as interest only loans until reaching maturity. At December 31, 2007 the balance sheet also includes $7.4 million one to four family residential loans secured by junior lien positions that are interest only loans. These fixed rate loans will remain as interest only loans until maturity.

| | • | | Leasing – The Corporation’s $45.1 million leasing portfolio is national in scope and consists of over 2,500 equipment financing leases to customers in all 50 states with initial lease terms of 24 to 60 months and yields significantly higher than other loans in the Corporation’s loan and lease portfolio. Approximately 70% of the Corporation’s leases are in 12 states with California being the largest at approximately 15%. |