UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

COMVERSE TECHNOLOGY, INC. |

| (Name of Registrant as Specified In Its Charter) |

|

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

EXPLANATORY NOTE

The following is a letter that was sent by Comverse Technology, Inc. (“CTI”) to Institutional Shareholder Services, Inc. on September 28, 2012. For additional information, please see the Definitive Additional Materials on Schedule 14A filed on September 21, 2012.

About Comverse Technology, Inc.

CTI, through its wholly—owned subsidiary Comverse, Inc. (“CNS”), is the world’s leading provider of software and systems enabling converged billing and active customer management and value—added voice, messaging and mobile Internet services. CNS’s extensive customer base spans more than 125 countries and covers over 450 communication service providers serving more than two billion subscribers. CTI also holds a majority ownership position in Verint Systems Inc. (Nasdaq: VRNT).

Other Important Information

This filing does not constitute an offer of any securities for sale. In connection with the proposed spin–off by CTI of CNS, a definitive proxy statement for CTI’s shareholders has been filed with the Securities and Exchange Commission (“SEC”) and CTI has also mailed the final proxy statement to its shareholders. BEFORE MAKING ANY VOTING DECISION WITH RESPECT TO SUCH SPIN–OFF, CTI’s SHAREHOLDERS AND INVESTORS ARE URGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE SPIN–OFF. Investors and security holders can obtain, without charge, a copy of the proxy statement relating to the proposed spin–off, as well as other relevant documents containing important information about CTI, at the SEC’s website (http://www.sec.gov). You may also read and copy any reports, statements and other information filed by CTI at the SEC public reference room at 100 F. Street, N.E. Washington D.C 20549. Please call the SEC at 1–800–SEC–0330 for further information. CTI and its directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies from its shareholders in connection with the proposed spinoff. Information concerning the interests of CTI’s participants in the solicitation for the proposed spin–off is set forth in CTI’s Annual Reports on Form 10–K and in the definitive proxy statement relating to the spin–off.

Dear ISS | September 28, 2012 |

As discussed on our recent call, Comverse Technology, Inc (CTI) is required to submit the spin-off of Comverse, Inc (CNS) to a shareholder vote under New York law. As part of the spin-off, all CTI options held by CNS employees will be converted into options in CNS, in a manner consistent with the adjustment provisions in CTI’s existing equity plans. Separately, as you know, CTI is seeking shareholder approval of a new CNS equity incentive plan for awards to be made to employees following the spin-off (Proposal 2) and approval of a reverse stock split at CTI (Proposal 4). We are disappointed in your recommendation to vote against the equity plan and reverse stock split. We would like to clarify several matters with respect to these proposals which we believe, based on your report, may not have been fully understood. We have attached several slides clarifying the points raised and correcting in some instances, some errors in the calculation and numbers used.

Equity Plan – Option Replacement

In connection with the spin-off, all ‘out of the money’ CTI options held by employees who will become or remain CNS employees will be converted into options to purchase CNS common stock, using a Black Scholes valuation model that will preserve the value of the options (the “Replacement Options”). Please note that this adjustment has been made by the CTI Board pursuant to the anti-dilution provisions under CTI’s existing equity plans. The Replacement Options will comply with applicable tax law and NASDAQ listing requirements and will not result in an additional compensation expense under GAAP rules. The shareholders of CTI are not required to approve the Replacement Options (under Proposal 2), and are not being asked to approve the Replacement Options (the new CNS equity plan is merely the vehicle under which the options, upon conversion, will be governed for corporate and securities law purposes).

In terms of the method of the adjustment for the Replacement Options, the CTI Board determined that it was in the best interests of shareholders to develop a formula that minimized the potential share dilution represented by the options while maintaining economic value for employees. The result was a reduction in the number of underlying shares that would have been subject to the Replacement Options in a straight “pro-rata” conversion. To account for the loss in value of the reduced number of underlying shares, certain adjustments were made, such as a 10 year term for the ‘near the money’ options and an exercise price that is 200% of fair market value for ‘deeply underwater’ options (see first slide attached).

810 Seventh Avenue, 32nd Floor, New York, NY 10019 Telephone (212) 739-1000 Facsimile (212) 739-1001

www.cmvt.com

Equity Plan- Shareholder Value Transfer

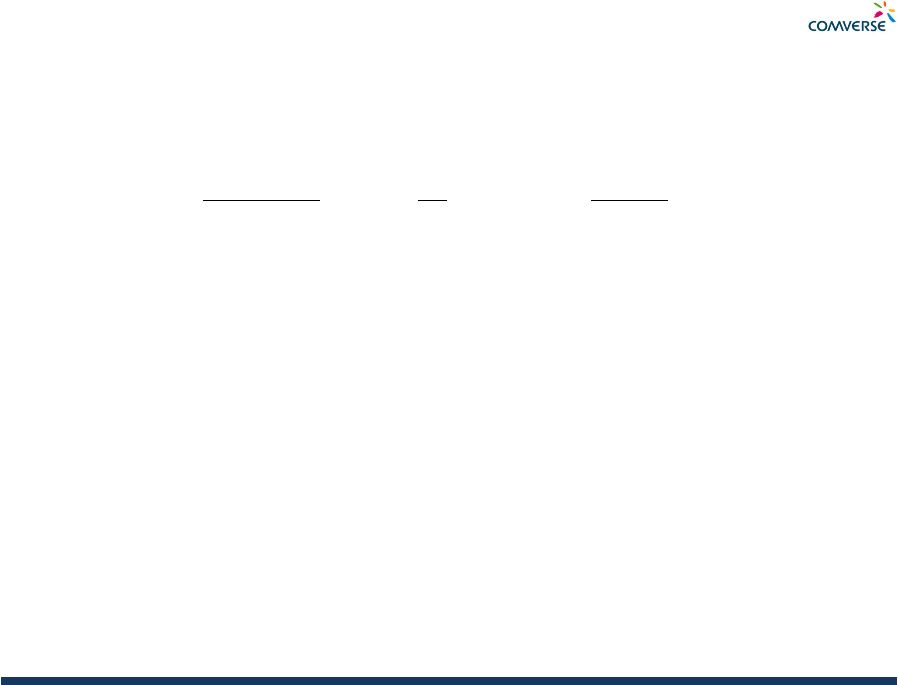

We have a complicated capital structure which includes a valuable holding in Verint in the form of common and convertible preferred shares, with a value of approximately $734m. The second slide will show the existing value today of CTI of $1.350B based on a share price of $6.15 and shares outstanding of 219m and backing out the publically traded value of Verint, a derived value for CNS Spin Co of approximately $600m. We will be issuing a dividend of CNS Spin Co shares at a 1-10 exchange rate which will result in 21.9m. The $600m would be more appropriate as the denominator in your ‘share value transfer’ equation.

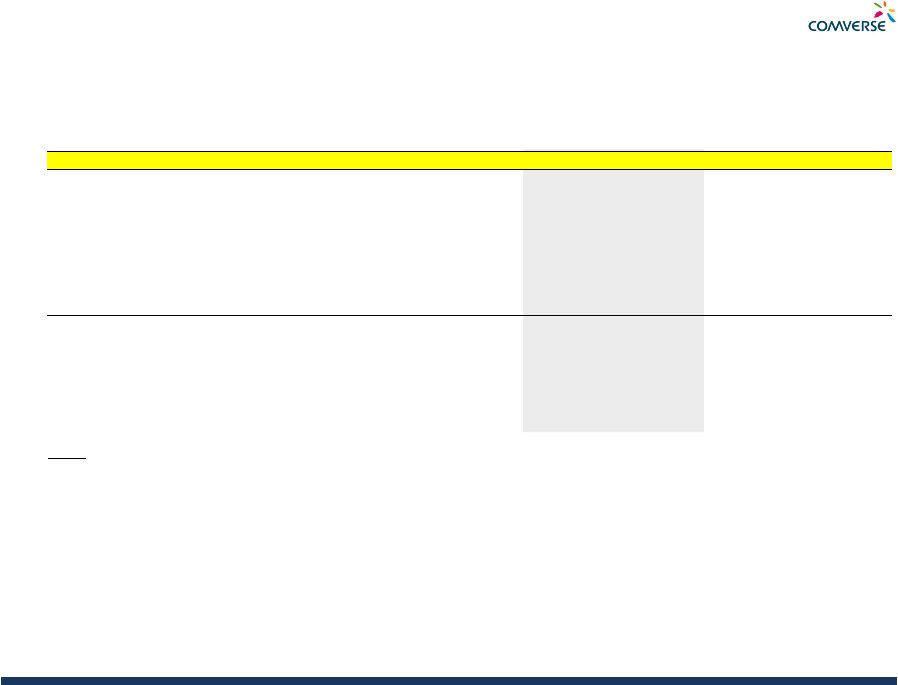

In terms of the numerator, as explained on our call, at the current share price and implied value of CNS we realize that the five million shares originally reserved for Replacement Options is far more than necessary. We currently estimate that less than two million shares will be needed and as discussed and provided for in the CNS equity plan, all excess shares will be canceled and cannot be used for new grants under the plan.

We would expect that you would find with the new denominator and numerator, a value transfer below the 12% threshold. Also as previously discussed, the 2.5 million new shares authorization request is an 11.4% potential dilution to cover the next three-four years of equity grants well within peer group ranges of yearly burn rates.

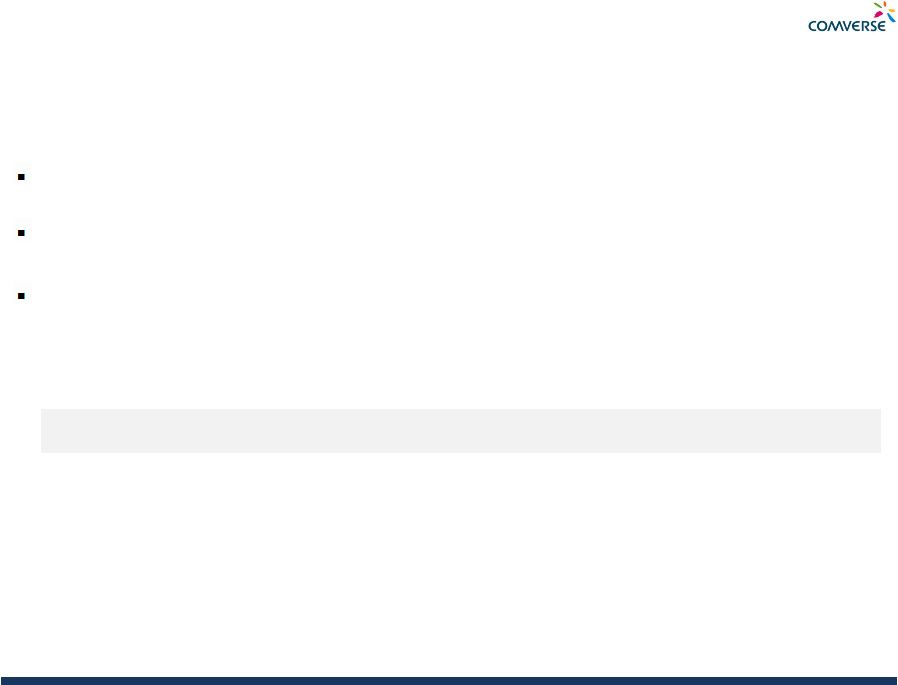

The Reverse Stock Split

The reverse stock split only applies to CTI after the spin and if the contemplated merger occurs CTI will cease to be a public company and will be a subsidiary of Verint. For this interim period, CTI will be a holding company with five employees, and will not be making grants after November 1st. The number of authorized but unissued shares following the reverse stock split should not be considered material to a decision on the whether the reverse stock split should be permitted.

We are in very unique circumstances at Comverse in terms of our history, the upcoming Spin of CNS and the CTI merger with Verint, its subsidiary, and with it our equity grants at a range of prices and instruments and it does not fit into any standard precedents.

We would ask you to consider the attached clarifications and advise if there are any questions.

810 Seventh Avenue, 32nd Floor, New York, NY 10019 Telephone 212 739-1000 Facsimile 212 739-1001

www.cmvt.com

Sincerely

Charles J Burdick

Chairman and Chief Executive Officer

Comverse Technology, Inc

810 Seventh Avenue, 32nd Floor, New York, NY 10019 Telephone 212 739-1000 Facsimile 212 739-1001

www.cmvt.com

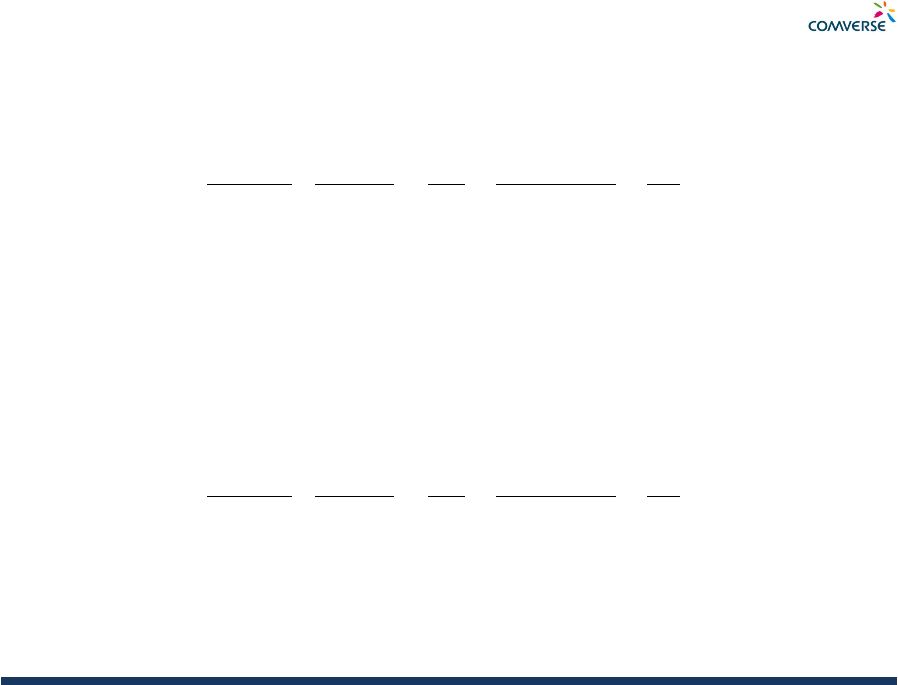

|

Option Replacement UNDERWATER OPTIONS We will be replacing existing CTI options with equivalent Black-Scholes valued CNS Options “At-the-Money” with a ten year life. We will determine Black-Scholes volatility at the distribution date based on a 10 day moving average and use the same volatility for the calculation of the new CNS options. Example: Exercise Price Today’s Price YTM** Black-Scholes Value Value CTI Options 10,000 $8.00 $6.15 8 $1.50 $15,000 New CNS Options 1500* $25.00 $25.00 10 $10.00 $15,000 *10,000 CTI ‘Old’ Options will be replaced with1500 New CNS grant options “At the Money” with a ten year life to provide equivalent value to the equity holder. Again consistent Black-Scholes volatility and methodology in both calculations. DEEPLY UNDERWATER OPTIONS We are required to provide a replacement mechanism even when there is little value in existing deeply underwater options. Setting the strike price at 2x exercise price still provides a meaningful amount of options to existing holders. Using the same mechanism as the previous example would result in fractional shares in most instances. Example: Exercise Price Today’s Price YTM** Black-Scholes Value Value CTI Options 10,000 $15.00 $6.15 3 $.03 $300 New CNS Options 750 $50.00 $25.00 3 $.40 $300 * *Years to Maturity 1 |

|

CNS Value Post Spin The best estimate for the value of CNS Spinco at distribution date is the implied value today in a ‘sum of the parts” analysis Shares Outstanding Price Market Value CTI 219m $6.15 $1,346m Verint Ownership 27.2m* $27.00 $ 734m Implied CNS Value $612m [$1,346 – 734] Implied Value Per Share ** $ 26 * Verint ownership is calculated as the amount of shares of Verint to be received for CTI’s common and convertible preferred holdings in Verint at the merger expected to close at 2/1/2013 ** $612 million / 23.3 million shares [21.9 million shares + 1.4 million options/RSUs] 2 |

|

Reverse Stock Spilt CNS shares will be distributed in a dividend to CTI shareholders at a 1-10 exchange rate. The reverse stock split request for shareholder approval (1-10) applies only to CTI Holdco which will hold only Verint stock at the spin of CNS and cease to exist at the merger. Pre Reverse Split CTI Holdco will trade at approximately: $ 3.35 per share $734 million / 219 million shares = $3.35 per share To ensure compliance with NASDAQ listing rules we are requesting a 1-10 reverse stock split for an implied trading value of $33.50. 3 CTI Holdco will have no activities leading up to the merger with Verint and will have only five employees, no equity grants, and will dissolve at the merger 2/1/2013 |

|

Illustrative Equity Stock Plan Dilution 4 (1) Assumed Equity Value $ 350 $ 400 $ 450 $ 500 $ 550 $ 600 $ 650 $ 700 $ 750 Implied Basic Shares Outstanding At 0.10x Exchange 21.923 21.923 21.923 21.923 21.923 21.923 21.923 21.923 21.923 Implied Diluted Shares Outstanding Common Shares Outstanding 21.923 21.923 21.923 21.923 21.923 21.923 21.923 21.923 21.923 Options 0.706 0.619 0.550 0.495 0.450 0.412 0.380 0.353 0.330 (2) Unvested RSUs & DSUs 1.798 1.573 1.398 1.258 1.144 1.049 0.968 0.899 0.839 Total Diluted Shares Outstanding 24.427 24.115 23.871 23.677 23.517 23.385 23.272 23.176 23.093 Implied Fully Diluted Share Price At 0.10x Exchange $ 14.33 $ 16.59 $ 18.85 $ 21.12 $ 23.39 $ 25.66 $ 27.93 $ 30.20 $ 32.48 Share Dilution -10.3% -9.1% -8.2% -7.4% -6.8% -6.3% -5.8% -5.4% -5.1% Notes: (1) Equity value based on reverse sum of the parts; assume CTI share price of $6.30 (2) There are approximately 4.6m unvested RSUs and DSUs outstanding with an estimated value of $28.7m (at $6.30 / share). |

|

Proxy Excerpt 5 Prior to the completion of the share distribution, Comverse expects to adopt the Comverse, Inc. 2012 Stock Incentive Compensation Plan (or the 2012 Incentive Plan). The purpose of the 2012 Incentive Plan will be to provide Comverse with a competitive advantage in attracting, retaining and motivating employees, non-employee directors and consultants. Comverse’s business requires a highly talented and seasoned team of communication and business professionals capable of managing a sophisticated global business in a rapidly changing industry. The 2012 Incentive Plan is intended to align the interests of Comverse’s employees, non-employee directors and consultants with those of its shareholders through the issuance of equity-based compensation and enhance their focus on improvements in operating performance and the creation of shareholder value. The 2012 Incentive Plan permits the granting of awards that are intended to constitute performance-based compensation for certain executive officers under Section 162(m) of the Internal Revenue Code of 1986, as amended (or the Code). In addition, the 2012 Incentive Plan is expected to provide for the assumption of awards pursuant to the adjustment of awards granted under CTI’s current incentive plan. See “PROPOSAL 1 AUTHORIZATION OF THE SHARE DISTRIBUTION—Treatment of Stock-Based Awards.” The following is a summary of the material terms of the 2012 Incentive Plan, but does not include all of the provisions of the 2012 Incentive Plan. For further information about the 2012 Incentive Plan, we refer you to a complete copy of the 2012 Incentive Plan, which is attached as Annex B to this proxy statement. The 2012 Incentive Plan provides for the issuance of nonqualified stock options, incentive stock options, stock appreciation rights, restricted stock, other stock-based awards and performance-based compensation awards (referred to collectively as the Awards) based on shares of Comverse common stock (referred to as the Shares). Comverse’s employees, non-employee directors and consultants as well as employees and consultants of its subsidiaries and affiliates are eligible to receive Awards. A total of 2.5 million Shares will be reserved for issuance under future awards to be granted under the 2012 Incentive Plan following the effective date of the plan (referred to as the Future Awards). No Future Awards have been granted as of the this time. Pursuant to the terms of the share distribution, certain awards that were previously granted under CTI’s stock incentive plan have been converted to awards that relate to Comverse common stock and have been assumed by the 2012 Incentive Plan (referred to as the Assumed CTI Awards). A total of 5.0 million Shares will be reserved for issuance under the Assumed CTI Awards. Such reserved Shares may only be issued pursuant to the Assumed CTI Awards and may not be issued pursuant to any Future Awards. The numbers of Shares authorized for issuance under Future Awards and under Assumed CTI Awards will represent approximately 11.4% and 22.8%, respectively of the outstanding shares of Comverse stock following the share distribution. In connection with the share distribution, steps have been taken to reduce the number of Shares and potential dilution associated with the Assumed CTI Awards, to the extent reasonably possible within the limitations of the terms of these awards, as well as applicable tax and accounting limitations. As described more fully in “PROPOSAL 1 AUTHORIZATION OF THE SHARE DISTRIBUTION—Treatment of Stock–Based Awards”, the aggregate value of stock options will be preserved using Black-Scholes modeling, but with the result that the number of Shares issuable under the options (as a percentage of outstanding shares) has been reduced significantly. |