Filed by ChoiceOne Financial Services

Commission File Number: 000-19202

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: County Bank Corp.

Welcome!

Local Board Members

Our Senior Management Team Adom Greenland SVP Chief Operating Officer Kelly Potes President / CEO Lee Braford SVP Chief Credit Officer Mary Johnson SVP Operations / Cashier Brad Henion SVP Chief Lending Officer Tom Lampen SVP Chief Financial Officer

Forward-Looking Statements This presentation contains forward-looking statements. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “is likely,” “plans,” “predicts,” “projects,” “may,” “could,” “look forward,” “continue”, “future” and variations of such words and similar expressions are intended to identify such forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements regarding the outlook and expectations of ChoiceOne and County with respect to their planned merger, the strategic benefits and financial benefits of the merger, including the expected impact of the transaction on the combined company’s future financial performance (including anticipated accretion to earnings per share, cost savings, the tangible book value earn-back period and other operating and return metrics), and the timing of the closing of the transaction. These statements reflect current beliefs as to the expected outcomes of future events and are not guarantees of future performance. These statements involve certain risks, uncertainties and assumptions (“risk factors”) that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what may be expressed, implied or forecasted in such forward-looking statements. Furthermore, neither ChoiceOne nor County undertake any obligation to update, amend, or clarify forward-looking statements, whether as a result of new information, future events, or otherwise. Such risks, uncertainties and assumptions, include, among others, the following: • the failure to obtain necessary regulatory approvals when expected or at all (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction); • the failure of either ChoiceOne or County to obtain shareholder approval, or to satisfy any of the other closing conditions to the transaction on a timely basis or at all; • the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement; • the possibility that the anticipated benefits of the transaction, including anticipated cost savings and strategic gains, are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy, competitive factors in the areas where ChoiceOne and County do business, or as a result of other unexpected factors or events; • the impact of purchase accounting with respect to the transaction, or any change in the assumptions used regarding the assets purchased and liabilities assumed to determine their fair value; • diversion of management’s attention from ongoing business operations and opportunities; • potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; and • the outcome of any legal proceedings that may be instituted against ChoiceOne or County; Additional risk factors include, but are not limited to, the risk factors described in Item 1A in ChoiceOne Financial Services, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2018. Legal Disclosure

Important Additional Information and Where to Find It This communication is being made in respect of the proposed merger transaction between ChoiceOne and County. In connection with the proposed merger, ChoiceOne will file with the SEC a Registration Statement on Form S-4 that will include the Joint Proxy Statement of ChoiceOne and County and a Prospectus of ChoiceOne, as well as other relevant documents regarding the proposed transaction. A definitive Joint Proxy Statement/Prospectus will also be sent to ChoiceOne and County shareholders. INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. A free copy of the Joint Proxy Statement/Prospectus, once available, as well as other filings containing information about ChoiceOne and County, may be obtained at the SEC’s Internet site http://www.sec.gov. You will also be able to obtain these documents, free of charge, from ChoiceOne by accessing ChoiceOne’s website at http://www.choiceone.com (which website is not incorporated herein by reference) or from County by accessing County’s website at http://www.lakestonebank.com (which website is not incorporated herein by reference). Copies of the Joint Proxy Statement/Prospectus once available can also be obtained, free of charge, by directing a request to ChoiceOne, 109 East Division Street, Post Office Box 186, Sparta, 49345, Attention: Mr. Thomas L. Lampen, or by calling 616-887-7366, or to County, 83 West Nepessing Street, Post Office Box 250, Lapeer, Michigan 48446, Attention Mr. Bruce J. Cady, or by calling 810-664-2977. Participants in Solicitation ChoiceOne and County and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from ChoiceOne and County shareholders in respect of the transaction described in the Joint Proxy Statement/Prospectus. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. Legal Disclosure

Mission & Vision Our Mission: Provide superior service, high-quality advice, and show utmost respect to everyone we meet. Our Vision: Become the Best Bank in Michigan.

Retirements Sheila Clark Dennis Nelson Tim Bull

New Directors Greg Armock Brad McGinnis

Employee Opportunities New Officer Hired in 2018 Promoted Officers in 2018 179 Employees Who Work at ChoiceOne 1,174 Total Years of Service 21 Average Years of Senior Management Financial Experience Eunice Lopez-Martin Patricia Brown Carla Freeland Konrad Raclawski Kelee Iwaniw

Rockford

Grand Rapids

Award Winning National Top 20 Most Innovative Community Bank 2018 2018 Newsmaker of the Year Nominee in Finance 2018 BAI Global Innovation Awards Nominee Best of FinXTech Startup Innovation Finalist 2018 2018 National Bank Marketing Video Award Nominee 2017 National Community Bank Service Award 2019 Community Partner Award 2019 Editor’s Choice Award for Community Commitment 2018 West Michigan Hispanic Chamber of Commerce Nominee

Community Support Kick Start to Career Muskegon County North Kent Connect Newaygo County Museum and Heritage Center Kickstart To Career Newaygo County Habitat for Humanity of Kent County truenorth community services Newaygo County Area Promise Zone Sparta Township Historical Commission $168,000 in community donations and sponsorships 3,600 volunteer hours

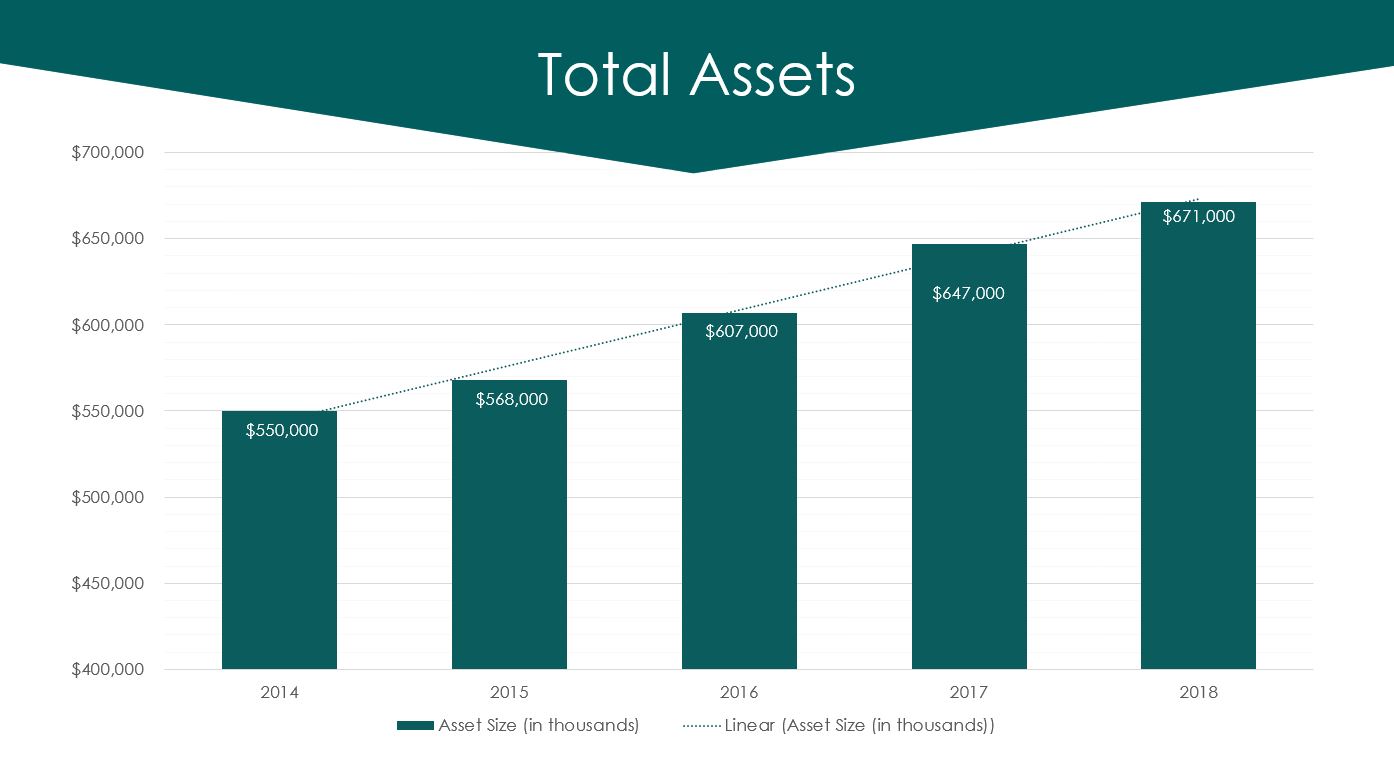

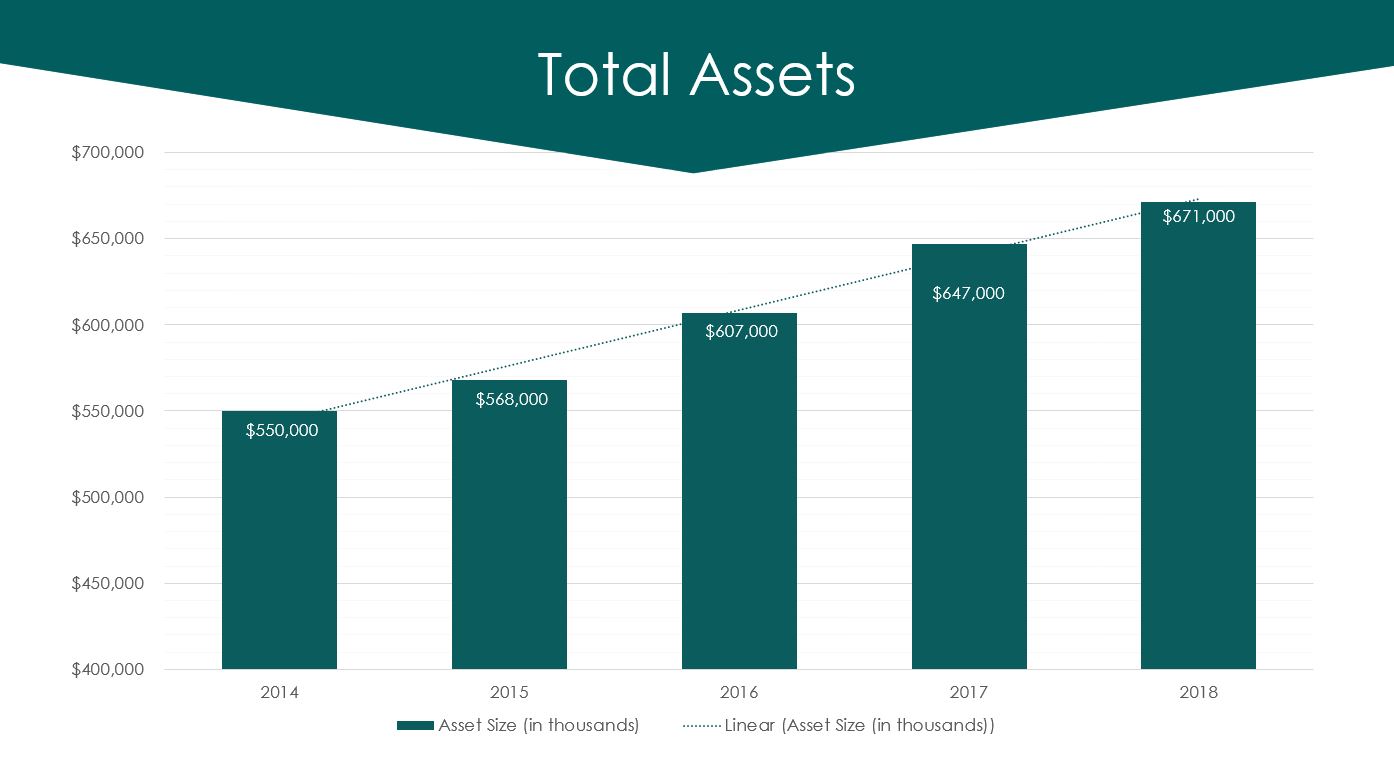

Financial Performance

$550,000 $568,000 $607,000 $647,000 $671,000 $400,000 $450,000 $500,000 $550,000 $600,000 $650,000 $700,000 2014 2015 2016 2017 2018 Asset Size (in thousands) Linear (Asset Size (in thousands)) Total Assets

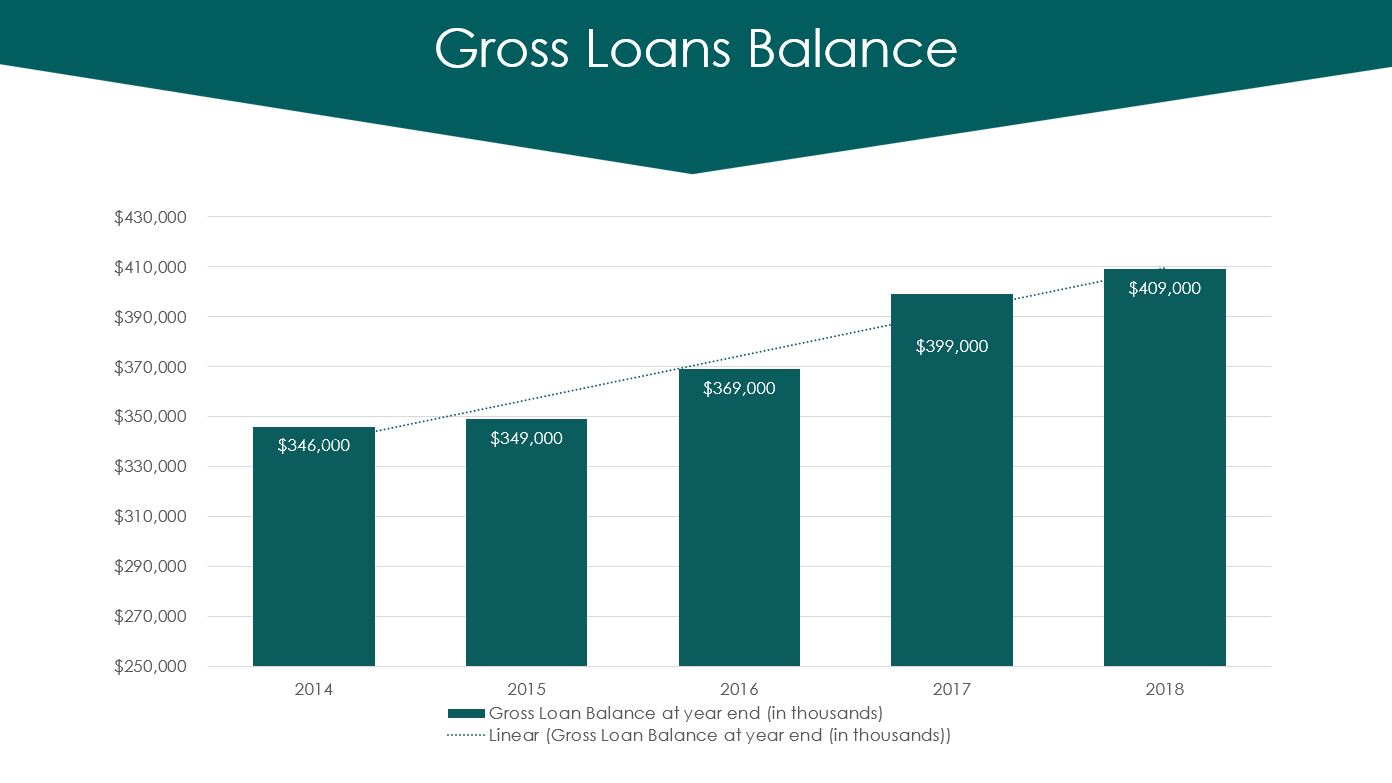

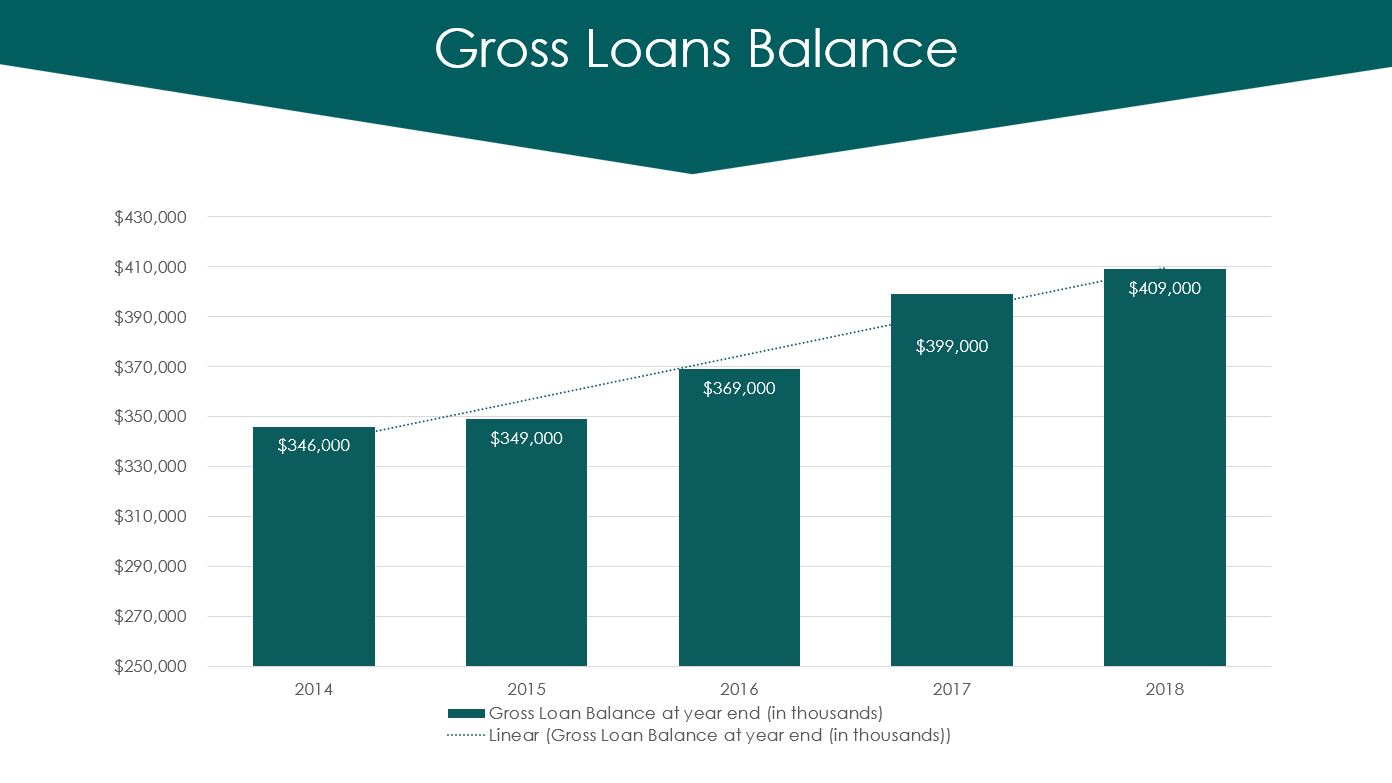

Gross Loans Balance $346,000 $349,000 $369,000 $399,000 $409,000 $250,000 $270,000 $290,000 $310,000 $330,000 $350,000 $370,000 $390,000 $410,000 $430,000 2014 2015 2016 2017 2018 Gross Loan Balance at year end (in thousands) Linear (Gross Loan Balance at year end (in thousands))

Gross Deposit Balances $435,000 $475,000 $512,000 $540,000 $577,000 $250,000 $300,000 $350,000 $400,000 $450,000 $500,000 $550,000 $600,000 2014 2015 2016 2017 2018 Gross Deposit Balance at year end (in thousands) Linear (Gross Deposit Balance at year end (in thousands))

5 Year Net Income $5,695 $5,743 $6,090 $6,168 $7,333 $4,000 $4,500 $5,000 $5,500 $6,000 $6,500 $7,000 $7,500 2014 2015 2016 2017 2018 Net Income at year end (in thousands) Linear (Net Income at year end (in thousands))

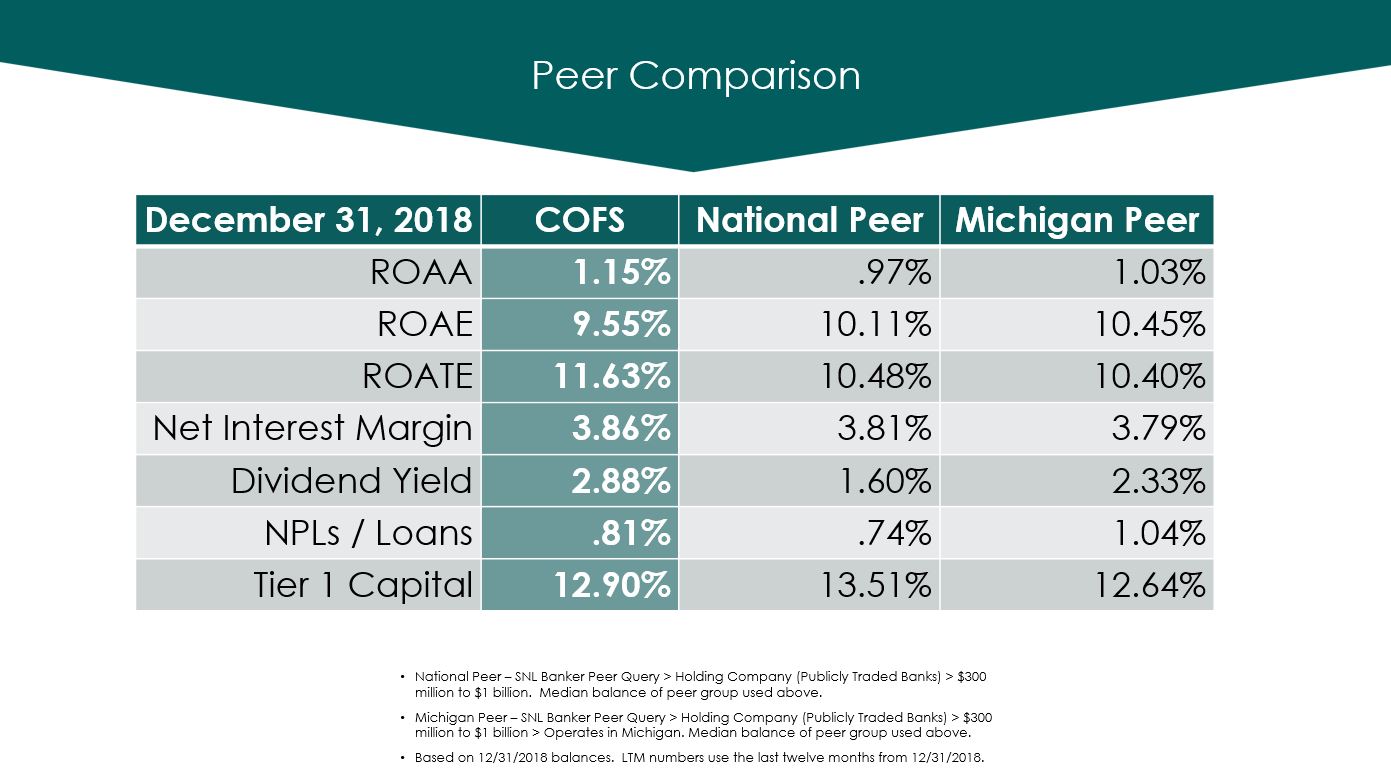

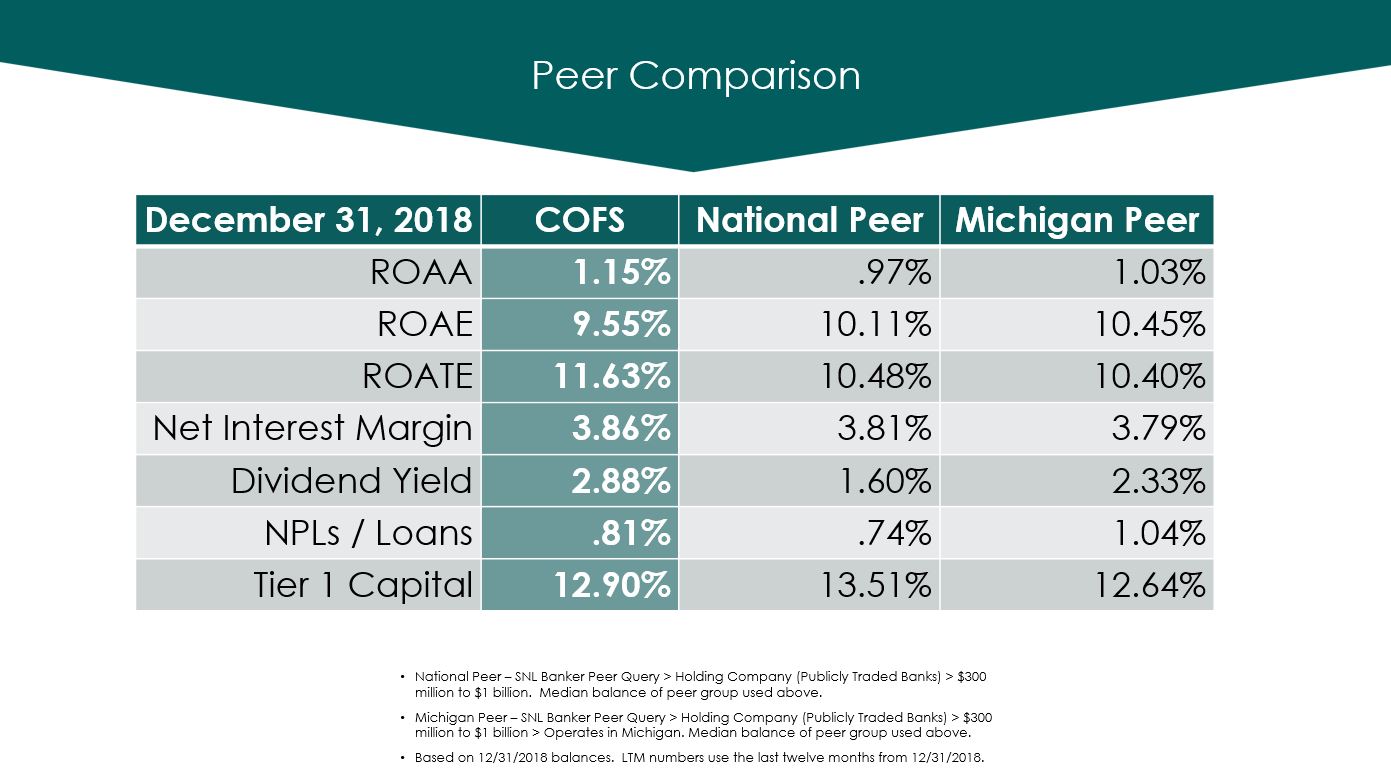

Peer Comparison • National Peer – SNL Banker Peer Query > Holding Company (Publicly Traded Banks) > $300 million to $1 billion. Median balance of peer group used above. • Michigan Peer – SNL Banker Peer Query > Holding Company (Publicly Traded Banks) > $300 million to $1 billion > Operates in Michigan. Median balance of peer group used above. • Based on 12/31/2018 balances. LTM numbers use the last twelve months from 12/31/2018. December 31, 2018 COFS National Peer Michigan Peer ROAA 1.15% .97% 1.03% ROAE 9.55% 10.11% 10.45% ROATE 11.63% 10.48% 10.40% Net Interest Margin 3.86% 3.81% 3.79% Dividend Yield 2.88% 1.60% 2.33% NPLs / Loans .81% .74% 1.04% Tier 1 Capital 12.90% 13.51% 12.64%

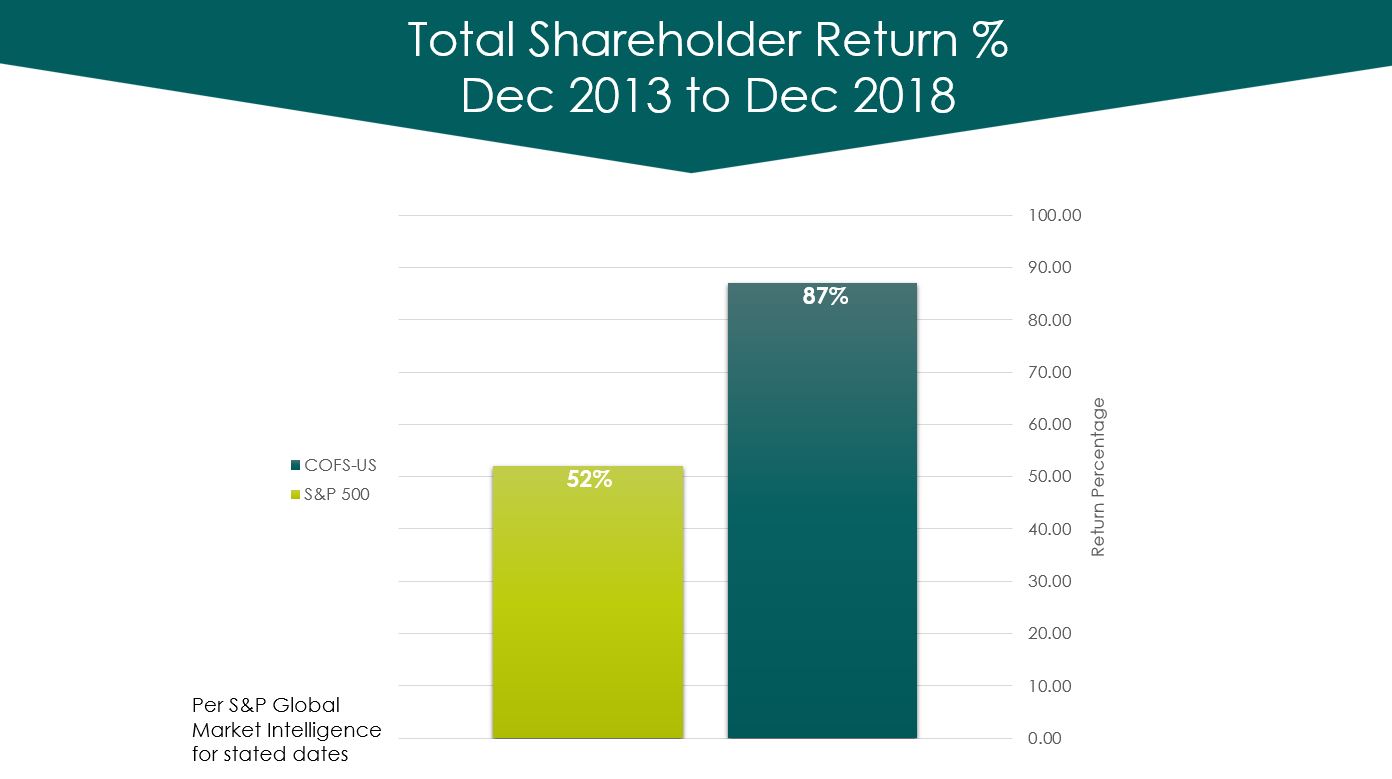

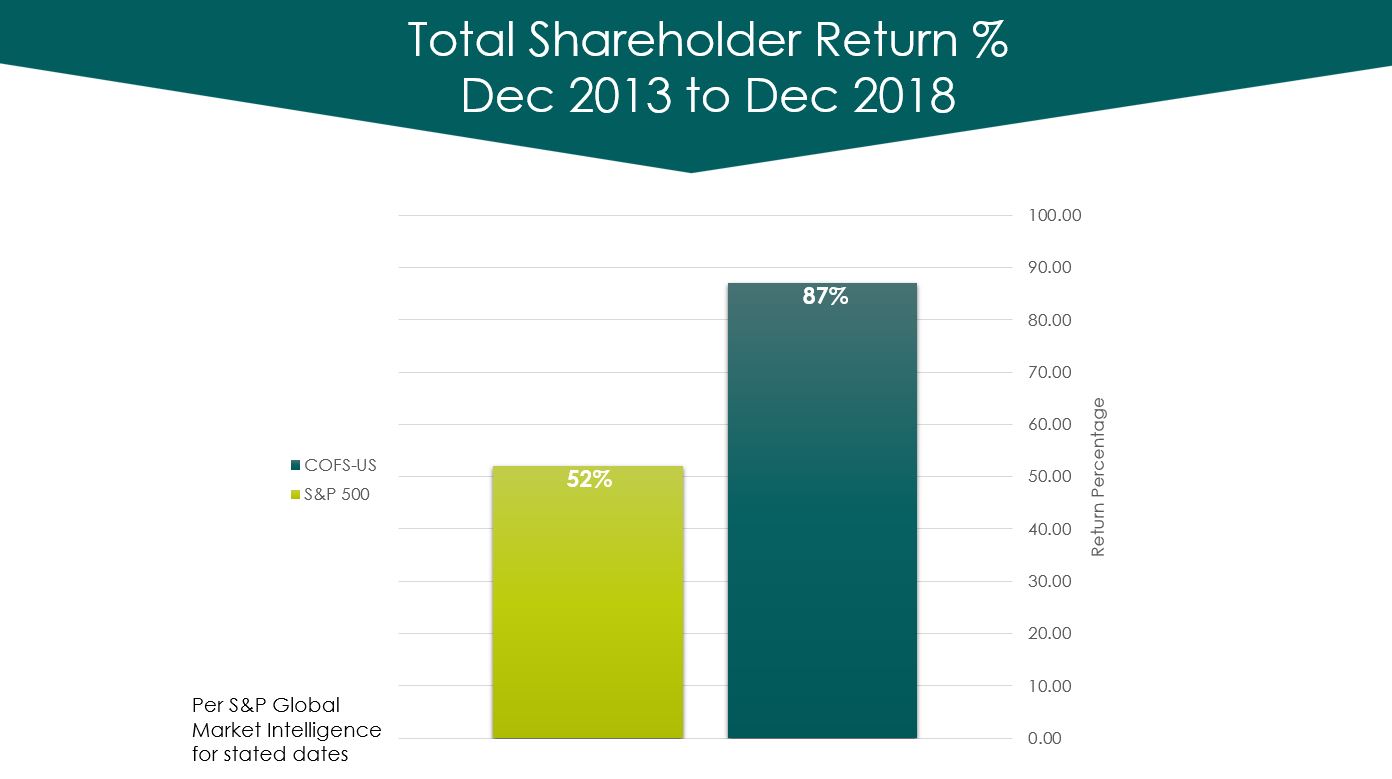

Total Shareholder Return % Dec 2013 to Dec 2018 87% 52% 0.00 10.00 20.00 30.00 40.00 50.00 60.00 70.00 80.00 90.00 100.00 Return Percentage COFS-US S&P 500 Per S&P Global Market Intelligence for stated dates

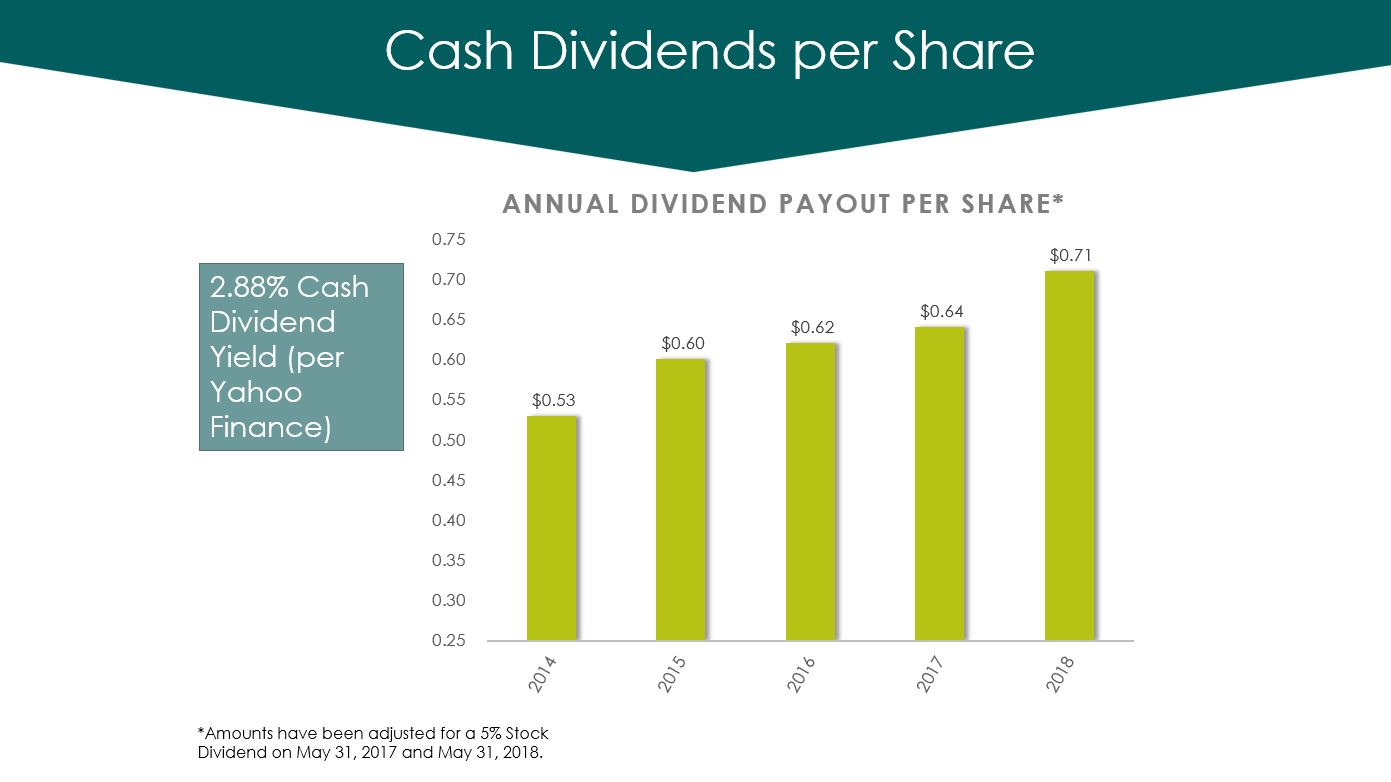

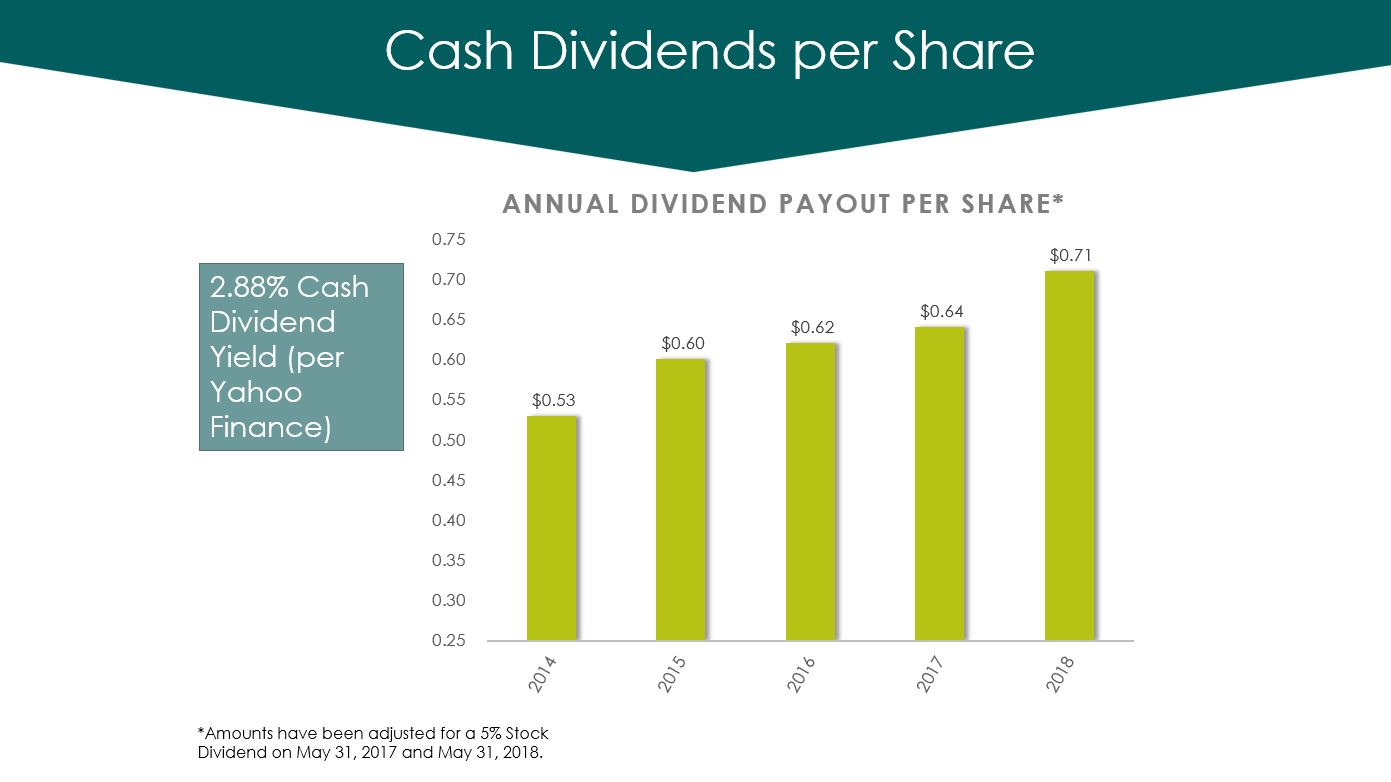

Cash Dividends per Share 2.88% Cash Dividend Yield (per Yahoo Finance) *Amounts have been adjusted for a 5% Stock Dividend on May 31, 2017 and May 31, 2018. $0.53 $0.60 $0.62 $0.64 $0.71 0.25 0.30 0.35 0.40 0.45 0.50 0.55 0.60 0.65 0.70 0.75 2014 2015 2016 2017 2018 ANNUAL DIVIDEND PAYOUT PER SHARE*

Shared Vision: To be the best bank in Michigan

Who Is Lakestone Bank and Trust? Serving Southeast Michigan since 1902 Publicly Traded under ticker CBNC Lakestone is the result of the merger of CSB Bank and Lapeer County Bank in 2016 Over 150 employees all based in Southeast Michigan Approximately $617 million in assets and 14 offices Board of Directors are all Southeast Michigan Natives Committed to community Thousands of hours donated by staff in 2018 $150,000+ in local donations in 2018 CEO Bruce Cady was the CBM 2018 Community Banker of the year

Map of Combined Branches

Post Merger ChoiceOne Financial Services, Inc. Leadership Kelly Potes, CEO Bruce Cady, Vice Chairman Current CEO and Chairman of Lakestone Bank and Trust retiring December 2019 Paul Johnson, Chairman Mike Burke, President Current President of Lakestone Bank and Trust

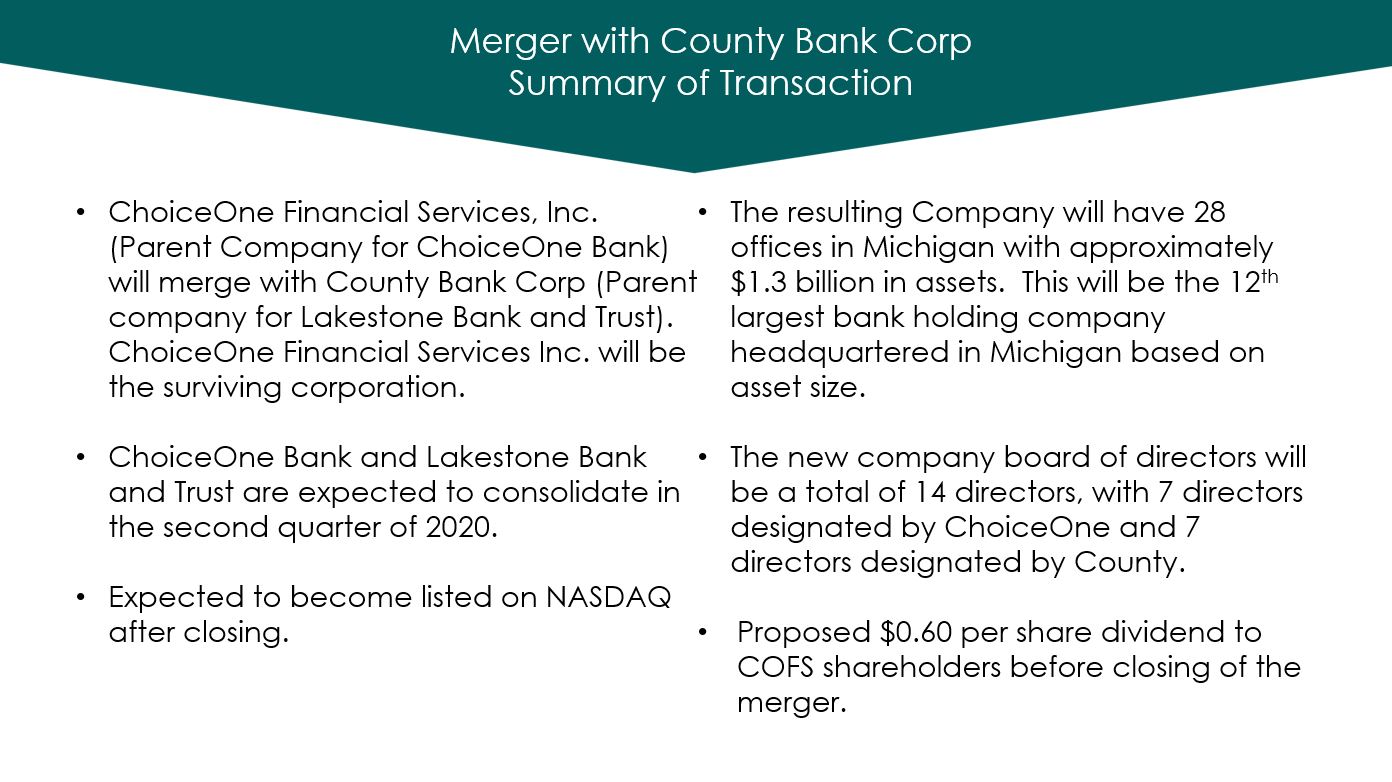

Merger with County Bank Corp Summary of Transaction • ChoiceOne Financial Services, Inc. (Parent Company for ChoiceOne Bank) will merge with County Bank Corp (Parent company for Lakestone Bank and Trust). ChoiceOne Financial Services Inc. will be the surviving corporation. • ChoiceOne Bank and Lakestone Bank and Trust are expected to consolidate in the second quarter of 2020. • Expected to become listed on NASDAQ after closing. • The resulting Company will have 28 offices in Michigan with approximately $1.3 billion in assets. This will be the 12th largest bank holding company headquartered in Michigan based on asset size. • The new company board of directors will be a total of 14 directors, with 7 directors designated by ChoiceOne and 7 directors designated by County. • Proposed $0.60 per share dividend to COFS shareholders before closing of the merger.

Why Merge? ▪ Our vision is to be the best bank in Michigan -- this combination will result in an exceptional company and present efficiencies and new growth opportunities in our expanded network across Michigan. ▪ Two strong community focused banks joining forces ▪ Similar culture, values and financial performance ▪ Leverage our combined size with technology and other vendors ▪ Tremendous opportunity for our communities, staff, customers, and shareholders ▪ Commitment to maintain our involvement in our local communities

Merger Timeline Today Second Half 2019 Regulatory Approval COFS and CBC Shareholder Approvals Proposed $0.60 Dividend to COFS Shareholders CBC Merges into COFS

COFS (Trading Symbol) • Through your own Brokerage Firm • ChoiceOne Investment Center • Brokerage Firms • D.A. Davidson • Raymond James • Stifel Nicolaus • Boenning & Scattergood

Thank You!