SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement | ¨ Confidential, for Use of the Commission Only (as permitted |

by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

INTERTAN, INC.

(Name of Registrant as Specified In Its Certificate)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

279 Bayview Drive, Barrie, Ontario L4M 4W5

September 20, 2002

Dear Fellow Stockholder:

It is a pleasure to invite you to InterTAN’s 2002 Annual Meeting at 10:00 a.m. at the offices of the Company located at 279 Bayview Drive, Barrie, Ontario, on Friday, November 8, 2002. At the meeting, stockholders will vote for the election of one director and on such other business as may properly come before the meeting. In addition, you will receive a report on the operations of your company for the 2002 fiscal year and your management will be pleased to answer any of your questions.

I urge each of you to read the accompanying Proxy Statement and the enclosed 2002 Annual Report, particularly the letter to stockholders included in the Annual Report, which describe the changes in the operating performance of your company that occurred in fiscal 2002.

Whether you own a few or many shares of stock and whether or not you plan to attend in person, it is important that your shares be voted on matters that come before the meeting. I urge you to specify your choices by completing the enclosed proxy card and returning it promptly. If you sign and return your proxy card without specifying your choices, it will be understood that you wish to have your shares voted in accordance with the Board of Directors’ recommendations.

I look forward to seeing you at InterTAN’s 2002 Annual Meeting.

| Very truly yours, |

|

| BRIAN E. LEVY |

| President and Chief Executive Officer |

InterTAN, Inc.

279 Bayview Drive

Barrie, Ontario, Canada L4M 4W5

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held November 8, 2002

TO THE HOLDERS OF COMMON STOCK OF INTERTAN, INC.

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of InterTAN, Inc. (the “Company”) will be held at the offices of the Company, located at 279 Bayview Drive, Barrie, Ontario, on Friday, November 8, 2002 at 10:00 a.m., local time, for the following purposes:

| | (1) | | To elect one Class I Director to serve for a three-year term; and |

| | (2) | | To transact such other business as may properly come before the meeting and any adjournments or postponements thereof. |

The date fixed by the Board of Directors as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting is the close of business on September 10, 2002. A list of stockholders of record who may vote at the Annual Meeting or at any adjournments or postponements will be available during business hours for any stockholder of the Company to examine for any purpose relevant to the Annual Meeting. The list will be available for at least ten days before the Annual Meeting at the office of the Secretary of the Company, 279 Bayview Drive, Barrie, Ontario, Canada L4M 4W5.

| By Order of the Board of Directors |

|

| JEFFREY A. LOSCH |

Senior Vice President, Secretary and General Counsel |

Barrie, Ontario, Canada

September 20, 2002

REGARDLESS OF WHETHER YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND PROMPTLY MAIL IT IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. IN THE EVENT YOU DECIDE TO ATTEND THE MEETING, YOU MAY, IF DESIRED, REVOKE THE PROXY AND VOTE YOUR SHARES IN PERSON.

InterTAN, Inc.

279 Bayview Drive

Barrie, Ontario, Canada L4M 4W5

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD NOVEMBER 8, 2002

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of InterTAN, Inc. (the “Company”) of proxies to be voted at the annual meeting of stockholders to be held in Barrie, Ontario on November 8, 2002 at 10:00 a.m., local time (the “Annual Meeting”). The date fixed by the Board of Directors as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting is the close of business on September 10, 2002 (the “Record Date”). The solicitation of the enclosed form of proxy is made by and on behalf of the Board of Directors.

Copies of this Proxy Statement and the form of proxy are being mailed to stockholders on or about September 25, 2002. A copy of the Company’s annual report containing financial statements for the fiscal year ended June 30, 2002 is included herewith, but is not to be considered as a part of the proxy solicitation materials.

The Annual Meeting is called for the following purposes: (i) to elect one Class I Director to serve for a three-year term; and (ii) to transact such other business as may properly come before the meeting and any adjournments or postponements thereof.

The total number of outstanding shares of the Company’s Common Stock as of the Record Date was 21,319,839. The Common Stock is the only class of the Company’s stock outstanding and, therefore, is the only class entitled to vote at the Annual Meeting, with each share entitling the holder thereof to one vote. A stockholder may revoke a proxy at any time before such proxy is voted by giving written notice of such revocation, or delivering a later dated proxy, to the Secretary of the Company at the address set forth above. A proxy may also be revoked by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy). All properly executed proxies delivered pursuant to this solicitation and not revoked will be voted at the Annual Meeting in accordance with the directions given, or if no directions are given, such proxies will be voted for the named director nominee.

The presence, either by proxy or in person, of holders of a majority of the issued and outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum for the Annual Meeting. Provided a quorum is present, the election of the Class I Director nominee will be by a plurality of the votes cast by the stockholders voting in person or by proxy at the Annual Meeting. Any abstentions, “broker non-votes” (shares held by brokers or nominees as to which they have no discretionary authority to vote on a particular matter and have received no instructions from the beneficial owners or persons entitled to vote thereon) or other limited proxies will have no effect on the election of directors.

1

ELECTION OF DIRECTORS

(Item 1)

Board of Directors

As provided in the Restated Certificate of Incorporation and the Amended and Restated Bylaws of the Company, the Board of Directors presently consists of five directors and is divided as evenly as possible into three classes, with one class of directors to be elected at each annual meeting of stockholders to serve for a three-year term.

As disclosed in last year’s Proxy Statement, three directors of the Company, Messrs. Clark A. Johnson, John H. McDaniel and Mr. John A. Capstick retired from the Board of Directors effective November 9, 2001. Accordingly, and as a result of the disposition of the Company’s Australian subsidiary, InterTAN Australia Ltd., in fiscal 2001, the Board of Directors subsequently determined that the interests of the stockholders can be served by a Board of Directors comprised of five directors. The Board of Directors, pursuant to provisions of the Restated Certificate of Incorporation and the Amended and Restated Bylaws of the Company, took the appropriate action to reduce the number of directors on the Board of Directors from eight to five. The Board of Directors also modified the size of the classes of the Board of Directors so that the Board of Directors currently consists of five directors, comprised of one Class I Director, two Class II Directors and two Class III Directors.

Accordingly, one Class I Director is to be elected at the Annual Meeting to hold office for a three-year term to expire at the Annual Meeting of Stockholders in 2005. Mr. James T. Nichols has been nominated for election, and it is the intention of the persons named in the accompanying form of proxy to vote for his election. Mr. Nichols has indicated his willingness to serve for an ensuing term, but if Mr. Nichols is unable or should decline to serve as a director at or prior to the Annual Meeting, which is not anticipated, it is the intention of the persons named in the proxy to vote for such other person as they, in their discretion, shall determine.

Recommendation of the Board of Directors

The Board of Directors of the Company recommends that stockholders vote FOR James T. Nichols as a Class I Director to hold office until the 2005 Annual Meeting of Stockholders and until his successor is elected and qualified. Proxies received by the Board of Directors will be voted FOR the director nominee unless stockholders mark their proxy to “withhold vote” for such nominee.

Board of Directors and Management

The following table sets forth certain information regarding the current directors and executive officers of the Company:

Name

| | Age

| | Position

|

| William C. Bousquette | | 65 | | Director— Class III (Director Nominee – term expiring 2004) |

| Brian E. Levy | | 43 | | Director— Class III (Director Nominee – term expiring 2004) and President and Chief Executive Officer |

| James T. Nichols | | 59 | | Director— Class I (Director Nominee – term expiring at Annual Meeting) and Vice Chairman |

| W. Darcy McKeough | | 69 | | Director— Class II (term expiring 2003) |

| Ron G. Stegall | | 55 | | Director— Class II (term expiring 2003) and Chairman of the Board |

| Michael D. Flink | | 42 | | Executive Vice President, Merchandising and Marketing |

| Jeffrey A. Losch | | 43 | | Senior Vice President, Secretary and General Counsel |

| James P. Maddox | | 48 | | Vice President and Chief Financial Officer |

2

William C. Bousquette has served as a director of the Company since July 1997. Since December 1996, Mr. Bousquette has been an independent businessman. From January 1995 until December 1996, Mr. Bousquette served as Senior Vice President and Chief Financial Officer of Texaco Inc. Prior thereto Mr. Bousquette served as Executive Vice President and Chief Financial Officer of Tandy Corporation (the predecessor company to RadioShack Corporation) from November 1990 to January 1995. From January 1993 until January 1994, Mr. Bousquette also served as the Chief Executive Officer of TE Electronics, a subsidiary of Tandy Corporation. Mr. Bousquette previously served as a director of the Company from July 1991 until August 1992. Mr. Bousquette also serves as a director of Gadzooks, Inc. and Arch Wireless, Inc.

James T. Nichols served as the President of the Company from January 1995 to January 1998 and has served as a director of the Company since February 1995, and as Vice Chairman of the Board of Directors since January 1998. From April 1996 to December 1998, Mr. Nichols served as the Chief Executive Officer of the Company; from January 1995 to April 1996, Mr. Nichols was the Company’s Chief Operating Officer. Prior to joining the Company, Mr. Nichols was the Executive Vice President of Retail Operations with the RadioShack division of Tandy Corporation (the predecessor company to RadioShack Corporation) from January 1992 until January 1995.

W. Darcy McKeough has served as a director of the Company since February 1994. Mr. McKeough has been the chairman of McKeough Supply Inc. for over 10 years and serves as a director of The Canadian Imperial Bank of Commerce and other Canadian corporations.

Ron G. Stegall has served as a director of the Company since September 1996. In July 1997, Mr. Stegall became the Chairman of the Board of Directors. Mr. Stegall has been the Chief Executive Officer of Arlington Equity Partners, Inc. since February 1992. From September 1987 until December 1991, Mr. Stegall was the Chairman and Chief Executive Officer of BizMart, Inc. Mr. Stegall also serves as a director of Hastings Entertainment Inc., Gadzooks, Inc., and Organized Living, Inc.

Brian E. Levyhas served as President and Chief Executive Officer of the Company since January 1999 and has served as a director since November 1998. Previously, he had served as President and Chief Operating Officer of the Company from January 1998 to January 1999. From September 1996 until December 1997 Mr. Levy served as President of Store Operations of Levitz Furniture Incorporated. Prior to September 1996, Mr. Levy served in various capacities for 22 years at Tandy Corporation (the predecessor company to RadioShack Corporation), most recently including Senior Vice President – Tandy Specialty Retail Group, Vice President – Retail Operations, Incredible Universe, and Vice President – Midwest Division, RadioShack.

Michael D. Flink has served as Executive Vice President, Merchandising and Marketing since April 2002. From August 1997 to April 2002, Mr. Flink served as Vice President, Technology and Telecom Marketing at Levin Consulting, a privately held management consulting firm. From 1990 through 1997, Mr. Flink served as a merchandising & marketing executive in a number of consumer electronic, computer and appliance retailers. From June 1978 to November 1990, Mr. Flink worked at Tandy Corporation (the predecessor to RadioShack Corporation) in the United States; serving in a variety of positions.

Jeffrey A. Loschhas served as Senior Vice President, Secretary and General Counsel of the Company since September 2001. From March 1999 to September 2001, Mr. Losch served as Vice President, Secretary and General Counsel of the Company. From December 1993 to March 1999, Mr. Losch was Corporate Counsel and Secretary at Inglis Limited, the Canadian subsidiary of Whirlpool Corporation. Prior to December 1993, Mr. Losch was engaged in the private practice of law at the Toronto, Ontario office of the law firm Lang Michener.

James P. Maddox has served as Vice President and Chief Financial Officer of the Company since January 2002. From September 2001 to January 2002, Mr. Maddox served as Vice President, Finance of the Company. From January 2000 to September 2001, Mr. Maddox was Vice President, Finance/Controller of the Company’s Canadian subsidiary, InterTAN Canada Ltd. From August 1994 to July 1999, Mr. Maddox held several senior financial positions with The Oshawa Group Limited, a large grocery retailer in Canada.

Each executive officer is elected annually by the Board of Directors immediately following the Annual Meeting of Stockholders to serve for the ensuing year, or until his successor is duly appointed.

3

Meetings and Committees of the Board of Directors; Compensation of Directors

The Board of Directors of the Company held sixteen meetings during fiscal 2002, five by personal attendance, and eleven by telephone conference, and acted on one other matter by unanimous written consent. Each of the directors attended at least 75% of the total number of meetings of the Board of Directors and of the committees on which he served with the exception of Mr. Clark Johnson who was unable to participate in four of the five Board of Directors meetings held during fiscal 2002 prior to the date of his retirement.

In accordance with the Amended and Restated Bylaws of the Company, the Board of Directors has established an Audit Committee and an Organization and Compensation Committee. As a result of the reduced size of the Board of Directors, the Board of Directors determined that an Executive Committee was no longer required and disbanded such committee effective November 9, 2001. The Executive Committee existing up to the time it was disbanded did not hold any meetings during fiscal 2002.

At the time of the writing of this Proxy Statement, the New York Stock Exchange has proposed amendments to its listing standards relating to, among other things, independence requirements for boards of directors and committees of boards of directors. The Company will continue to review the independence of the members of its Board of Directors and each committee of the Board of Directors as the amendments become final and as the U.S. Securities and Exchange Commission adopts regulations pursuant to the U.S. Sarbanes-Oxley Act of 2002 to ensure compliance with applicable regulations.

Messrs. McKeough, Bousquette, and Nichols, each of whom is a non-employee director under existing New York Stock Exchange listing standards, are the current members of the Audit Committee through the Annual Meeting.Mr. McKeough is the Chairman of such committee. The functions of the Audit Committee include reviewing the Company’s quarterly operating results and earnings releases; reviewing the audited financial statements and the recommendation to include them in the Company’s annual report; reviewing with the independent auditors their assessment of the Company’s reporting processes; the engagement, compensation and monitoring of the performance of the Company’s independent auditors; reviewing the scope and timing of the Company’s audit and non-audit services to be rendered by the independent accountants; confirming the independence of the auditors; and reviewing the report of the independent accountants upon completion of their audit. The Audit Committee held five meetings during fiscal 2002, three of which were by telephone conference.

Messrs. Bousquette, McKeough and Stegall, each of whom is a non-employee director under existing New York Stock Exchange listing standards, are the members of the Organization and Compensation Committee through the Annual Meeting. Mr. Bousquette is the Chairman of such committee. The principal functions of the committee are reviewing and making recommendations to the Board of Directors concerning compensation plans; the granting of stock options to executive officers and other personnel; appointments and promotions to official positions; reviewing corporate structure and making recommendations to the Board as to alterations thereof; and making recommendations to the Board of Directors with respect to any candidate for director of the Company and compensation of Board members. The Organization and Compensation Committee met one time during fiscal 2002 and acted on five other matters by unanimous written consent. To be considered by the Organization and Compensation Committee, stockholders who wish to suggest nominees for election to the Board of Directors at the 2003 Annual Meeting should submit their suggestions in writing no later than August 15, 2003 to the Secretary of the Company.

A director who is an employee of the Company is not compensated for service as a member of the Board of Directors or any committee of the Board. In fiscal 2002, non-employee directors received cash compensation consisting of an annual retainer of $30,000, payable quarterly, plus $2,000 for each Board of Directors meeting personally attended and $500 for each meeting of the Board of Directors conducted by telephone conference call. In addition, board members personally attending committee meetings not held in conjunction with a board meeting receive $1,000 per committee meeting. If the committee meeting is conducted by telephone conference call, the compensation is $500. In fiscal 2002, the Chairman of the Board was paid an additional fee of $100,000 for services rendered to the Company, payable quarterly. As stated above, in fiscal 2002 there were sixteen board meetings, five meetings where directors were in personal attendance, and eleven meetings by telephone conference. There were two committee meetings not held in conjunction with a board meeting, each where committee members participated in person or by telephone. Expenses of attendance at board and committee meetings are paid by the Company. During fiscal 2002, the Board of Directors acted once on other matters by unanimous written consent.

4

As disclosed in last year’s Proxy Statement, the Board of Directors approved a one-time payment in the amount of $60,000 to each of Messrs. Capstick, Johnson and McDaniel, the three directors who had tendered their retirement notices to the Company, in recognition of their respective past contributions to the Company and tenure on the Board of Directors. These payments were made following last year’s annual meeting, being the effective date of their retirement. The Board of Directors also accelerated the vesting of options to purchase the final tranche of 7,500 shares of Common Stock for each of the three retiring directors of the total 30,000 shares purchasable under options granted to each non-employee director pursuant to the Director Stock Option Grant approved in 1999, such acceleration being effective on the date of last year’s annual meeting.

Beneficial Ownership of Voting Securities by Executive Officers and Directors

The following table sets forth, as of August 31, 2002, information with respect to the beneficial ownership of Common Stock by the Company’s directors, the Chief Executive Officer, each of the Company’s three other most highly compensated executive officers, two other named executive officers who retired from the Company during fiscal 2002 and all present directors and named executive officers as a group.

Name

| | Aggregate Number of Shares Beneficially Owned (1)

| | Percent of Outstanding Shares

|

| William C. Bousquette | | 99,600 | | * |

| W. Darcy McKeough | | 67,500 | | * |

| Ron G. Stegall | | 80,000 | | * |

| James T. Nichols | | 176,559 | | * |

| Brian E. Levy | | 454,925 | | 2.1% |

| Michael D. Flink | | 1,371 | | * |

| Jeffrey A. Losch | | 27,679 | | * |

| James P. Maddox | | 20,641 | | * |

| James G. Gingerich | | 24,000 | | * |

| Heinz E. Stier | | 44,672 | | * |

| All Present Directors and Named Executive Officers as a Group (10 persons) | | 996,947 | | 4.5% |

| * | | Less than 1% of issued and outstanding shares of Common Stock. |

| (1) | | The number of shares of Common Stock beneficially owned by each non-employee director (except for Mr. Nichols) includes 37,500 shares each pursuant to the 1991 Non-Employee Director Stock Option Plan and 22,500 shares beneficially owned by each non-employee director (including Mr. Nichols) pursuant to the Director Stock Option Grant approved in 1999, which such persons have a right to acquire on or within 60 days after August 31, 2002. The number of shares of Common Stock beneficially owned by Messrs. Levy, Flink, Losch and Maddox include 391,500, 0, 24,800 and 10,999 shares, respectively, or 427,299 shares in the aggregate, which such persons have a right to acquire on or within 60 days after August 31, 2002 pursuant to certain stock options granted under the Company’s 1996 Stock Option Plan. The number of shares beneficially held by Messrs. Levy, Flink, Losch and Maddox include 915, 371, 243 and 243 shares, respectively, indirectly held as at August 31, 2002 pursuant to the Company’s Employee Stock Purchase Program (but excludes acquisitions made on behalf of these four individuals under such Program for the month of August 2002). The number of shares beneficially held by Mr. Levy also includes 10,000 shares that he received in October 2000 pursuant to a contingent restricted stock unit award made in June 1999. |

5

Principal Stockholders

The Company, based upon information available to it, including from its review of public filings with the Securities and Exchange Commission, knows of no person who was the beneficial owner, as of August 31, 2002, of more than five percent (5%) of its issued and outstanding Common Stock on such date other than as set forth in the following table:

Name and Address

| | Number of Shares Beneficially Owned*

| | Percent of Class

|

| Palisade Capital Management, L.L.C. | | 3,427,000(1) | | 16.1% |

One Bridge Plaza, Suite 695 Fort Lee, NJ 07024 | | | | |

| FleetBoston Financial Corporation | | 1,841,991(2) | | 8.6% |

100 Federal Street Boston, MA 02110 | | | | |

| * | | Unless indicated otherwise in the notes below, according to public filings made by such beneficial owners, each beneficial owner has sole voting and dispositive power with respect to the indicated shares. |

| (1) | | According to an amendment to the Schedule 13G filed by Palisade Capital Management, L.L.C. on January 24, 2002. Palisade Capital reports it has sole voting power over 3,127,000 shares and sole dispositive power over 3,427,000 shares. |

| (2) | | According to a Schedule 13G filed by FleetBoston Financial Corporation on February 14, 2002. FleetBoston reports it has sole voting power over 1,450,781 shares and sole dispositive power over 1,841,991 shares. |

EXECUTIVE COMPENSATION

The following table sets forth the total annual compensation paid, payable, or accrued by the Company during fiscal 2002 and the two preceding fiscal years to or for the account of the Company’s current Chief Executive Officer and each of the Company’s three other most highly compensated executive officers. Also included are two other most highly compensated executive officers who retired during fiscal 2002 (Messrs. James G. Gingerich and Heinz E. Stier). Information set forth in the Summary Compensation Table below under the heading “Options/SARs” refers to shares of Common Stock underlying stock options. The Company has never granted any stock appreciation rights (“SARs”).

Dollar amounts referenced in this proxy statement refer to U.S. dollars, unless otherwise indicated.

6

Summary Compensation Table

| | | | | Annual Compensation

| | | | | | Long-Term Compensation

|

Name and Principal Position | | Fiscal Year | | Salary ($) | | Bonus(1) ($) | | Other Annual Compensation(2) ($) | | Restricted Stock Awards ($) | | Securities Underlying Options/SARs (#Shs) | | | LTIP Payouts ($) | | All Other Compensation(3) ($) |

| Brian E. Levy | | 2002 | | 500,000 | | 34,723 | | 9,000 | | — | | 75,000 | | | — | | 65,155 |

| (President and Chief Executive Officer) | | 2001 2000 | | 475,000 460,000 | | 161,417 354,224 | | 9,000 9,000 | | — — | | -0- 66,000 | | | — — | | 78,121 46,271 |

| Michael D. Flink(4)(5) | | 2002 | | 57,123 | | 14,390 | | 1,598 | | — | | 20,000 | | | — | | 6,778 |

| (Executive Vice President, Merchandising and Marketing) | | 2001 2000 | | — — | | — — | | — — | | — — | | — — | | | — — | | — — |

| Jeffrey A. Losch(5) | | 2002 | | 117,008 | | 3,534 | | 8,220 | | — | | 15,000 | | | — | | 16,519 |

| (Senior Vice President, Secretary and General Counsel) | | 2001 2000 | | 86,935 82,862 | | 14,378 32,387 | | 6,586 5,434 | | — — | | -0- 7,200 | | | — — | | 18,380 11,295 |

| James P. Maddox(5)(6) | | 2002 | | 96,888 | | 10,132 | | 4,746 | | — | | 15,000 | | | — | | 20,928 |

| (Vice President and Chief Financial Officer) | | 2001 2000 | | — — | | — — | | — — | | — — | | — — | | | — — | | — — |

| James G. Gingerich(7) | | 2002 | | 141,085 | | -0- | | 4,604 | | — | | -0- | | | — | | 28,367 |

| (Former Executive Vice President and Chief Financial Officer) | | 2001 2000 | | 263,000 255,000 | | 86,556 222,242 | | 9,000 9,000 | | — — | | -0- 24,000 | | | — — | | 92,784 55,716 |

| Heinz E. Stier(5)(8) | | 2002 | | 92,126 | | -0- | | 6,570 | | — | | 18,000 | (8) | | — | | 42,413 |

| (Former Executive Vice President) | | 2001 2000 | | — — | | — — | | — — | | — — | | — — | | | — — | | — — |

| (1) | | All bonus awards are paid in cash; estimated bonus amounts are accrued at fiscal year end and typically paid shortly thereafter. Fiscal 2002 bonus amounts for Messrs. Levy, Flink, Losch and Maddox include the Company’s matching contribution to the Employee Stock Purchase Program of $2,572, $1,066, $171 and $751, respectively. |

| (2) | | Amounts consist of the following: for Mr. Levy in each of fiscal years 2002, 2001 and 2000, $9,000 as a car allowance; for Mr. Flink in fiscal year 2002, $1,598 in car lease payments; for Mr. Losch in fiscal 2002, $8,220 as a car allowance, in fiscal year 2001, $6,586 as a car allowance and in fiscal year 2000, $5,434 as a car allowance; for Mr. Maddox in fiscal 2002, $4,746 in taxable benefits in respect of a leased Company car; for Mr. Gingerich in fiscal 2002, $4,604 as a car allowance and in each of fiscal years 2001 and 2000, $9,000 as a car allowance; and for Mr. Stier in fiscal 2002, $6,570 in taxable benefits in respect of a leased Company car. |

| (3) | | Amounts for fiscal 2002 consist of the following: for Mr. Levy, $24,193 was accrued for under the Company’s Deferred Compensation Plan (“DCP”), $29,954 representing the Company’s matching contribution to the Employee Stock Purchase Program (“SPP”), and $3,199 and $3,508 representing premiums paid, respectively, on term life and long-term disability insurance policies; for Mr. Flink, $6,353 was accrued for under the DCP, $425 representing the Company’s matching contribution to the SPP; for Mr. Losch, a nil amount was accrued for under the DCP as the existing accrual was reduced by $2,050 as at June 30, 2002 to reflect reduced interest rates, $3,726 representing the Company’s matching contribution to the SPP, $3,810 representing a housing allowance, and $2,064 and $2,239 representing premiums paid, respectively, on term life and long-term disability insurance policies; and for Mr. Maddox, $11,775 was accrued for under the DCP, $3,934 representing the Company’s matching contribution to the SPP, and $1,352 and $1,993 representing premiums paid, respectively, on term life and long-term disability insurance policies; for Mr. Gingerich, $9,032 was accrued for under the DCP, $11,287 |

7

representing the Company’s matching contribution to the SPP, and $3,389 and $5,782 representing premiums paid, respectively, on term life and long-term disability policies; and for Mr. Stier, $28,771 was accrued for under the DCP, $7,589 representing the Company’s matching contribution to the SPP and $753 and $1,506 representing premiums paid, respectively, on term life and long-term disability policies. Amounts also include the Company’s matching contributions for Messrs. Levy, Losch, Maddox and Gingerich of $4,301, $4,680, $1,874 and $2,266, respectively, under the Company’s Group Registered Retirement Savings Plan, a Canadian retirement plan that is substantially similar to a United States 401(k) plan, and Mr. Stier received $3,794 in Company matching contributions to an employee savings plan offered by the Company’s Canadian subsidiary.

| (4) | | Mr. Flink began employment with the Company on April 22, 2002; fiscal 2002 Annual Compensation amounts reflect prorated annual figures. |

| (5) | | All payments to Messrs. Flink, Maddox, Losch and Stier are made in Canadian funds; the exchange rate used herein in converting such payments to U.S. funds for reporting purposes is $0.6371 USD = $1.00 CDN for fiscal 2002, $0.6586 USD = $1.00 CDN for fiscal 2001 and $0.6792 USD = $1.00 CDN for fiscal 2000. |

| (6) | | Mr. Maddox began employment with the Company on September 6, 2001; fiscal 2002 Annual Compensation amounts reflect prorated annual figures. |

| (7) | | Mr. Gingerich retired from the Company effective December 31, 2001. Mr. Gingerich entered into a retirement agreement with the Company; the terms of which are disclosed in the section of this proxy statement entitled “Retirement Agreements of Former Executive Officers”. |

| (8) | | Mr. Stier began employment with the Company on September 6, 2001 and retired from the Company effective April 26, 2002. The grant of 18,000 option shares was no longer exercisable upon his retirement. Mr. Stier entered into a retirement agreement with the Company; the terms of which are disclosed in the section of the proxy statement entitled “Retirement Agreements of Former Executive Officers”. |

The following table sets forth information relating to stock options granted to the individuals listed in the Summary Compensation Table during fiscal 2002, together with related information. No SARs were granted by the Company in fiscal 2002.

Option/SAR Grants in Last Fiscal Year

| | | Individual Grants

| | | | | | |

Name | | Securities Underlying Options/SARS Granted (1) (# Shares) | | % of Total Options/SARS Granted to Employees in Fiscal Year | | Exercise or Base Price ($/sh) | | Expiration Date | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term*(2)

|

| | | | | | 5%($)(3) | | 10%($)(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Brian E. Levy | | 75,000 | | 28.4 | | 7.71 | | 10/15/11 | | 363,750 | | 921,750 |

| Michael D. Flink | | 20,000 | | 7.6 | | 11.95 | | 06/03/12 | | 150,200 | | 381,000 |

| Jeffrey A. Losch | | 15,000 | | 5.7 | | 7.71 | | 10/15/11 | | 72,750 | | 184,350 |

| James P. Maddox | | 15,000 | | 5.7 | | 7.71 | | 10/15/11 | | 72,750 | | 184,350 |

| James G. Gingerich | | -0- | | n/a | | n/a | | n/a | | n/a | | n/a |

| Heinz E. Stier(5) | | 18,000 | | 6.8 | | 7.71 | | 10/15/11 | | n/a | | n/a |

| * | | The dollar gains under these columns result from calculations assuming 5% and 10% annual growth rates as set by the Securities and Exchange Commission and are not intended to forecast future price appreciation of the Common Stock of the Company. The gains reflect a future value based upon growth, compounded annually during the 10-year option period, at these prescribed rates. The Company did not use an alternative formula for a grant date valuation, an approach which would state gains at present, and therefore lower, value. The Company is not aware of any formula that will determine with reasonable accuracy a present value based on unknown future or volatility factors. Consequently, the potential realizable value has not been discounted to present value. |

It is important to note that options have value to the listed executives and to all option recipients only if the market price of the Common Stock increases above the exercise price shown in the table during the effective option period.

8

| (1) | | Options become exercisable, on a cumulative basis, in annual installments of one-third of the total amount awarded beginning one year after the date of grant. |

| (2) | | Assumes a rate of return based upon annually compounded values at the beginning of each period. |

| (3) | | In order to realize these aggregate amounts, the market price per share of Common Stock would have to equal $12.56 for the options granted to Messrs. Levy, Losch and Maddox at an exercise price of $7.71 per share and $19.46 per share for the options granted to Mr. Flink at an exercise price of $11.95 per share. |

| (4) | | In order to realize these aggregate amounts, the market price per share of Common Stock would have to equal $20.00 for the options granted to Messrs. Levy, Losch and Maddox at an exercise price of $7.71 per share and $31.00 per share for the options granted to Mr. Flink at an exercise price of $11.95 per share. |

| (5) | | The grant of 18,000 option shares to Mr. Stier was no longer exercisable upon his retirement from the Company. |

The following table provides information relating to the exercise of stock options by the individuals listed in the Summary Compensation Table during fiscal 2002, together with related information, and the number and value of exercisable and unexercisable options held by such individuals at June 30, 2002. The Company has never granted any SARs.

Aggregated Option/SAR Exercises In

Last Fiscal Year and Fiscal Year-End

Option/SAR Values

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Securities

Underlying

Unexercised Options/SARs at

FY-End (#)

Exercisable/ Unexercisable

| | Value of Unexercised In-the-Money Options/SARs at FY-End ($) (1) Exercisable/ Unexercisable

|

| Brian E. Levy | | — | | — | | 366,500/97,000 | | $1,857,123/$258,000 |

| Michael D. Flink | | — | | — | | 0/20,000 | | $0/$0 |

| Jeffrey A. Losch | | — | | — | | 19,800/17,400 | | $46,937/$51,600 |

| James P. Maddox | | — | | — | | 5,999/18,001 | | $2,375/$52,788 |

| James G. Gingerich | | 133,250 | | $814,913 | | 24,000/0 | | $12,900/$0 |

| Heinz E. Stier | | 74,250 | | $606,840 | | 21,000/0 | | $9,750/$0 |

| (1) | | For purposes of determining whether an option was “In-the-Money,” this table uses the June 28, 2002 closing share price on the New York Stock Exchange for the Company’s Common Stock of $11.15. The value of unexercised in-the-money options has been computed as the difference between the respective option exercise prices and $11.15. |

Employment Contracts

Brian E. Levy.Brian E. Levy serves as the President and Chief Executive Officer of the Company. Mr. Levy and the Company entered into an employment agreement dated June 10, 1999, which superseded a prior employment letter, and which was amended by a letter agreement dated February 19, 2001 (the “Amended Levy Employment Contract”).

Pursuant to the Amended Levy Employment Contract, if Mr. Levy’s employment is terminated for any reason other than his voluntary resignation from the Company, his death or disability, his “gross misconduct” or if certain change of control events as described in the Deferred Compensation Plan of the Company occur (a “Change in Control”), Mr. Levy is entitled to receive severance benefits equal to twelve (12) months of his then current base salary and bonus; such amount to be paid out in twelve (12) equal monthly installments. “Gross misconduct” means

9

a conviction of, or the entry of a plea ofnolo contendere or similar plea arrangement relating to a felony, whether relating to Company business or not, or the finding of reckless or willful misconduct in the performance of Mr. Levy’s duties. Additionally, Mr. Levy becomes entitled to all unvested restricted stock units awarded to him pursuant to a contingent stock unit award made June 7, 1999 under the Company’s Restricted Stock Unit Plan if a Change in Control occurs.

If Mr. Levy’s employment is involuntarily terminated within an eighteen (18) month period following, or the scope of his responsibilities is materially modified or reduced due to, a Change in Control, Mr. Levy is entitled to receive severance benefits equal to twenty-four (24) months of his then current amount base salary and bonus; such amount to be paid in a single lump sum payment.

Michael D. Flink.Michael D. Flink serves as the Executive Vice President, Merchandising and Marketing of the Company. Mr. Flink and the Company entered into an employment agreement dated March 21, 2002 (the “Flink Employment Contract”). Pursuant to the Flink Employment Contract, Mr. Flink was entitled to receive through June 30, 2003, compensation comprised of an annual base salary of CDN$496,000 and a base bonus of CDN$198,500, both subject to annual review in subsequent years.

Pursuant to the Flink Employment Contract, if Mr. Flink’s employment is terminated for any reason other than his voluntary resignation from the Company, or resulting from a Change in Control, or for “Cause” or his death or disability, Mr. Flink is entitled to receive a severance payment. Such severance payment will be in an amount equal to twelve (12) months of his then current base salary and base bonus. “Cause” shall be determined in accordance with the laws of the Province of Ontario.

In the event there is a Change in Control and Mr. Flink is either involuntarily terminated or there is a material reduction in the scope of his duties or responsibilities, occurring within eighteen (18) months following the Change in Control, Mr. Flink is entitled to receive severance benefits in an amount equal to twelve (12) months of his then current base salary and base bonus, payable in a single lump sum payment, and to the continuation of Company paid health, dental and life insurance for that twelve (12) month period.

Jeffrey A. Losch.Jeffrey A. Losch serves as Senior Vice President, Secretary and General Counsel of the Company. Mr. Losch and the Company entered into an employment agreement dated September 11, 2001 (the “Losch Employment Contract”) that replaced a prior employment agreement dated February 23, 1999, as amended by a letter agreement dated February 15, 2000. Pursuant to the Losch Employment Contract, if Mr. Losch’s employment with the Company is terminated for any reason other than his voluntary resignation from the Company, or resulting from a Change in Control, or his death or disability, or for “Cause”, Mr. Losch is entitled to a severance payment. Such severance payment will be in an amount equal to nine (9) months of his then current base salary and base bonus. “Cause” shall be determined in accordance with the laws of the Province of Ontario.

In the event that there is a Change in Control and Mr. Losch is either involuntarily terminated or there is a material reduction in the scope of his duties or responsibilities, occurring within eighteen (18) months following the Change in Control, Mr. Losch is entitled to receive severance benefits in an amount equal to twelve (12) months of his then current base salary and base bonus, payable in a single lump sum payment, and to the continuation of Company-paid health, dental and life insurance for that twelve (12) month period.

James P. Maddox.James P. Maddox serves as Vice President and Chief Financial Officer of the Company. Mr. Maddox and the Company entered into an employment agreement dated September 10, 2001 (the “Maddox Employment Contract”).

Pursuant to the Maddox Employment Contract, if Mr. Maddox’s employment is terminated for any reason other than his voluntary resignation from the Company, or resulting from a Change in Control, or for “Cause” or his death or disability, Mr. Maddox is entitled to receive a severance payment. Such severance payment will be in an amount equal to nine (9) months of his then current base salary and base bonus. “Cause” shall be determined in accordance with the laws of the Province of Ontario.

In the event there is a Change in Control and Mr. Maddox is either involuntarily terminated or there is a material reduction in the scope of his duties or responsibilities, occurring within eighteen (18) months following the Change in Control, Mr. Maddox is entitled to receive severance benefits in an amount equal to twelve (12) months

10

of his then current base salary and base bonus, payable in a single lump sum payment, and to the continuation of Company paid health, dental and life insurance for that twelve (12) month period.

Deferred Compensation Plan

In fiscal 1989, the Board of Directors approved the InterTAN, Inc. Deferred Compensation Plan (“DCP”). Under the DCP, the Organization and Compensation Committee of the Board of Directors (the “Committee”) has the authority to select full-time executive employees for participation therein. During fiscal 1998, the Committee selected Mr. Levy as a DCP participant. During fiscal 2000, Mr. Losch was selected as a DCP participant and during fiscal 2002, Messrs. Flink and Maddox were selected as DCP participants. Under the DCP, the Committee determines, in its discretion, the “plan benefit amount” for each participant; the current amounts established for each of Messrs. Levy, Flink, Maddox and Losch are $3,725,000, CDN $3,473,000, CDN $1,375,000 and CDN $1,250,000, respectively.

The DCP is designed to provide benefits to a participant following retirement between the ages of 55 and 75. A participant’s plan benefit amount is designed to represent his age 65 “normal” retirement payment. “Normal” retirement is from age 65 through 70. The earliest a participant may retire and receive benefits under the DCP is at age 55. A participant retiring “early” at age 55 is only entitled to one-half of his then current plan benefit amount; such amount cumulatively increasing by 10% for each year after age 55 (up to age 64) in which “early” retirement occurs. A participant retiring “late,” between ages 71 and 75, will have his plan benefit amount cumulatively reduced 20% per year for each year, commencing at age 71, in which “late” retirement occurs.

All retirement payments required to be made by the Company to a participant retiring between the ages of 55 and 75 are required to be paid in equal monthly instalments over a period of 120 months. If a participant dies prior to age 55 while being employed full-time by the Company, the full plan benefit amount is required to be paid, in a lump sum, to the participant’s designated beneficiary. To the greatest extent practicable, the Company intends to maintain corporate-owned life insurance on each participant in order to fund any required death payment. If a participant dies at or after age 55, and is then receiving payments under the DCP, such payments will continue to be paid to the participant’s designated beneficiary. In the event a participant leaves the Company’s employ for any reason prior to age 55, the participant will no longer be entitled to any benefits, at any time, under the DCP, except as described below. All payment obligations of the Company under the DCP are deemed to be unsecured and payable from the Company’s general assets.

The DCP contains a change of control provision. In the event of a change of control of the Company, a participant’s plan benefit amount vests at the full amount (age 65 amount) regardless of the participant’s actual age at the time of the change of control event. Subsequently, if a participant’s employment with the Company terminates, whether voluntarily or involuntarily, during a three-year period commencing on the date of the change of control event, the participant will be entitled to his plan benefit amount and has the right to elect to either: (i) be paid his full plan benefit amount in equal monthly instalments over a period of 120 months; or (ii) receive a single lump sum payment equal to the net present value of the full plan benefit amount, calculated using an appropriate discount rate. Additionally, in the event a participant is involuntarily terminated and, within one year of such termination date, there occurs a change of control event, the participant will be entitled to be paid his full plan benefit amount in equal monthly instalments over a period of 120 months. Under the DCP, a “change of control” occurs if: (a) any person, corporation, partnership, association, joint stock company, trust, unincorporated organization, or government, including a political subdivision thereof (or any combination thereof acting for the purpose of acquiring, holding, voting, or disposing of equity securities of the Company), acquires beneficial ownership of at least twenty percent (20%) of the then issued and outstanding Common Stock of the Company; or (b) on any day more than fifty percent (50%) of the members of the Board of Directors of the Company (excluding those members replacing deceased directors) were not directors two (2) years prior to such date; or (c) substantially all the assets of the Company are sold or the Company is merged or consolidated or otherwise acquired by or with another corporation (other than a subsidiary of the Company) unless, as the result of any such merger, consolidation, or acquisition, (i) the Company is the surviving entity, and (ii) not more than twenty percent (20%) of the Company’s then issued and outstanding Common Stock is sold or exchanged as the result of such merger, consolidation or acquisition. If there were a change of control (as defined under the DCP) as of the date of this Proxy Statement, each of Messrs. Levy, Flink, Maddox and Losch would only be entitled to payments under the DCP if his employment with the Company was

11

terminated as described above; assuming such a termination, the individual has the right to elect that the payment be a present value lump sum payment or that all payments be made over a ten-year period as described above.

Retirement Agreements of Former Executive Officers

James G. Gingerich. The Company and James G. Gingerich entered into a retirement agreement dated September 25, 2001 (the “Gingerich Retirement Agreement”). Mr. Gingerich served as Executive Vice President and Chief Financial Officer of the Company until his retirement effective December 31, 2001. Pursuant to the Gingerich Retirement Agreement, the Company agreed to pay Mr. Gingerich the sum of $1,541,108 in 120 equal monthly installments commencing on February 1, 2002. In the event of Mr. Gingerich’s death, the monthly payments then remaining, if any, will be made to a beneficiary designated by Mr. Gingerich. The Company also accelerated the unvested portion of certain stock options previously granted to Mr. Gingerich in June, 2000. Mr. Gingerich agreed to be bound by non-competition and non-solicitation covenants until December 31, 2006.

Heinz E. Stier. The Company and Heinz E. Stier entered into a retirement agreement dated July 22, 2002 (the “Stier Retirement Agreement”). Mr. Stier served as Executive Vice President from September 2001 until his retirement effective April 26, 2002. Pursuant to the Stier Retirement Agreement, the Company agreed to pay Mr. Stier the sum of CDN$323,500 in a lump sum payment. Mr. Stier agreed to be bound by a non-competition covenant for a two year period and, provided he is not in breach of such covenant, will be paid the additional amount of CDN$47,900 in a lump sum payment after the first year of such period. In the event of Mr. Stier’s death prior to him receiving that additional payment, the CDN$47,900 amount will be paid to a beneficiary designated by Mr. Stier.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

This report discusses the actions of the Company’s Organization and Compensation Committee (the “Compensation Committee”) regarding compensation paid to executive officers in fiscal 2002. In writing this report, the Compensation Committee has tried to provide stockholders with a better understanding of the Company’s executive compensation program, its basic provisions, the purpose of such program, and how it is administered. The role of the Compensation Committee is described under “Meetings and Committees of the Board of Directors; Compensation of Directors.”

Compensation Philosophy

The Compensation Committee believes that the primary objective of the Company’s compensation program should be to maximize stockholder value over time. To accomplish this objective, the Company has adopted a comprehensive business strategy. The overall goal of the Compensation Committee is to develop executive compensation policies and practices that are consistent with and linked to the Company’s strategic business objectives. More particularly, the Compensation Committee believes this overall goal can be primarily accomplished by linking the financial interests of the Company’s management to the financial interests of the stockholders of the Company. The Company’s compensation program is designed to achieve the overall goal by: (i) motivating executive officers toward effective long-term management of the Company through prudent use of equity-based programs that focus management attention on increasing long-term stockholder value, (ii) rewarding effective management of the Company’s operations through annual performance incentives tied to increased performance levels of the Company, (iii) placing at risk a portion of an executive officer’s total compensation, and (iv) providing executive officers with competitive compensation opportunities as measured against industry norms in order to attract, motivate and retain key executive officers. The long-term and at-risk pay focus, orientation towards the use of equity-based compensation, and compensation competitiveness are the general principles to which the Compensation Committee adheres in the structuring of the compensation packages of executive officers. However, the Compensation Committee does not follow the principles in a mechanical fashion; rather, the Compensation Committee uses its experience and independent judgment in determining the compensation mix for each individual. The Compensation Committee believes that current compensation practices and levels meet the principles described herein.

12

As discussed below in more detail, aside from certain benefits and “All Other Compensation” (which are reported as required in the tables preceding this report), an executive officer’s total compensation package is comprised of three components: (i) base salary, (ii) annual performance incentives (i.e., bonuses and special bonuses), and (iii) long-term performance incentives (i.e., stock options and awards of restricted stock or restricted stock units).

Base Salary. Base salaries for the Company’s executive officers are generally determined with reference to, and so as to fall within the competitive range of, compensation paid to executives in similar positions at comparable companies in the retailing and consumer electronics industries, and with a view to setting a base salary at a sufficient level so as to provide proper motivation for long-term performance. Base salaries are reviewed annually by the Compensation Committee. Base salary adjustments are based on the Company’s performance, the executive’s performance, time in job, level of pay, competitive compensation and other factors.

For fiscal 2003, the base salaries of Messrs. Levy, Flink, Maddox and Losch have been set at $512,500, CDN$496,000, CDN$205,000 and CDN$205,000, respectively.

Annual Performance Incentives. The amount of annual incentive compensation paid to the executive officers was comprised of a bonus amount calculated using a formula based upon certain key financial performance measures of the Company being achieved as well as some performance measures that are primarily influenced by actions of that executive officer. The Compensation Committee reserves the right to grant discretionary bonuses based upon subjective evaluation of each executive officer’s individual performance.

In determining the amount of the annual performance incentive compensation to be paid to the executive officers in fiscal 2003, Messrs. Levy, Flink, Maddox and Losch have been assigned bases of $290,075, CDN$198,500, CDN$76,900 and CDN$51,300, respectively. Additionally, in the event that the Company meets or exceeds budget targets for both gross profit and operating income for fiscal 2003, Messrs. Levy, Flink, Maddox and Losch will receive an additional incentive bonus of $50,000, CDN$25,000, CDN$10,000 and CDN$10,000, respectively.

Long-Term Performance Incentives. The form of long-term performance incentives currently utilized by the Company for executive officers is stock options and awards of restricted stock units (which are exchangeable for shares of Common Stock on a one-for-one basis). The number of stock options granted to an executive (other than the Chief Executive Officer) is determined by the Compensation Committee after consultation with the Chief Executive Officer. The Compensation Committee, in its sole discretion, determines the number of stock options to be granted to the Chief Executive Officer. Awards of restricted stock units are made at the discretion of the Compensation Committee. Factors that influence decisions regarding the size of the grant of options or award of restricted stock units to a particular executive officer include tenure with the Company, history of past grants and awards, time in current job and level of, or significant changes in, responsibility, the past and potential future contribution of the executive to the achievement of Company objectives, as well as other relevant considerations. These subjective criteria are used for determining grants and awards to all executive officers. Stock options previously have been granted under the provisions of the Company’s 1986 Stock Option Plan and 1996 Stock Option Plan and provide the basis for aligning the financial interests of the Company’s executive officers with the long-term financial interests of the stockholders of the Company. Stock options are granted with an exercise price not less than the fair market value of the Company’s Common Stock on the date of such grant, generally vest over three years, and provide value to the recipient only when the market price of the Common Stock increases above the option exercise price. The Compensation Committee believes that stock options and awards of restricted stock units provide executives with the opportunity to acquire an equity interest in the Company and to share in the appreciation of the value of the Company’s Common Stock.

CEO Compensation

The compensation of Mr. Levy, the President and Chief Executive Officer of the Company, for fiscal 2002 was determined by the Compensation Committee to reflect his past experience in senior positions in the retail industry and to provide the adequate motivation and incentive to develop, implement and execute both short and long-term strategic initiatives that would result in the realization of corporate growth and the commensurate appreciation of stockholder value.

13

Summary

The Compensation Committee believes the executive compensation policies and programs described above serve the interests of the stockholders and the Company. Compensation delivered to executives is intended to be linked to, and commensurate with, Company performance and with stockholder expectations. The Compensation Committee cautions that the practice and the performance results of the compensation philosophy described herein should be measured over a period sufficiently long to determine whether strategy development and implementation are in line with, and responsive to, stockholder expectations.

| |

| | | Organization and Compensation Committee |

| | | |

| | | William C. Bousquette, Chairman |

| | | W. Darcy McKeough |

| | | Ron G. Stegall |

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is composed entirely of the three non-employee directors named as signatories to the above Compensation Committee report. During fiscal 2002, no member of the Compensation Committee (nor any of their respective family members) was a party to any transaction with the Company exceeding $60,000. No executive officer of the Company serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Board of Directors or Compensation Committee.

REPORT OF THE

AUDIT COMMITTEE

To the Stockholders of InterTAN, Inc.:

This report discusses the responsibilities of the Audit Committee of the Company’s Board of Directors (the “Audit Committee”), which are set forth in a written charter adopted by the Audit Committee. Management is responsible for preparing the Company’s consolidated financial statements and implementing internal controls. The independent auditors are responsible for auditing the consolidated financial statements and assessing the effectiveness of the internal controls. The Audit Committee’s mandate is one of oversight, and the review of the consolidated financial statements by the Audit Committee is not of the same detail as the audit performed by the independent auditors. Because management and the independent auditors spend more time preparing and auditing the Company’s consolidated financial statements and have more knowledge and detailed information about the Company than the Audit Committee, the Audit Committee is not responsible for providing any expert or special assurance as to the Company’s consolidated financial statements or any professional certification as to the independent auditors’ work.

Review and Discussion

The Audit Committee has reviewed and discussed with management the Company’s audited consolidated financial statements contained in its Annual Report on Form 10-K for the fiscal year ended June 30, 2002. It has also discussed with PricewaterhouseCoopers LLP the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU 380). Additionally, the Audit Committee has received the written disclosures and the letter from PricewaterhouseCoopers LLP as required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and has discussed with PricewaterhouseCoopers LLP its independence.

14

Independence of Audit Committee Members

All three members of the Audit Committee are currently independent as independence is defined in Sections 303.01 (B)(2)(a) and (3) of the New York Stock Exchange’s Listed Company Manual.

Recommendation to Include Audited Consolidated Financial Statements in Annual Report

Based on the Audit Committee’s discussions with management and PricewaterhouseCoopers LLP, and its review of the representations of management and the report of PricewaterhouseCoopers LLP to the Audit Committee, the Audit Committee recommended that the Board of Directors of the Company include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2002 with the Securities and Exchange Commission.

| |

| | | Audit Committee |

| | | |

| | | W. Darcy McKeough, Chairman |

| | | William C. Bousquette |

| | | James T. Nichols |

SECTION 16(a) BENEFICIAL OWNERSHIP

REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires the Company’s executive officers, directors and persons who own more than 10% of the Company’s Common Stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission (the “SEC”). These reports are also filed with the New York Stock Exchange. A copy of each report is required to be furnished to the Company.

SEC regulations require the Company to identify anyone who filed a required report late during the most recent fiscal year. Based solely upon a review of reports furnished to the Company during and with respect to fiscal 2002 and written representations that no other reports were required during fiscal 2002, all Section 16(a) filing requirements were met. Mr. Michael Flink, an officer of the Company, made a late filing in respect of a previously unreported acquisition of shares of common stock of the Company that occurred in May 2002 and which was not reported until August 2002 due to a clerical oversight.

INDEPENDENT PUBLIC ACCOUNTANTS

PricewaterhouseCoopers LLP, which has served as the Company’s independent public accountants since the Company’s inception, has been appointed by the Audit Committee to audit the consolidated financial statements of the Company for the fiscal year ending June 30, 2003. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting and will be given the opportunity to make a statement, if they desire to do so, and to respond to appropriate questions from stockholders.

Audit Fees

For the fiscal year ended June 30, 2002, the Company paid PricewaterhouseCoopers LLP total audit fees of $194,300 in respect of: (i) the audit of the Company’s consolidated financial statements included in the Company’s Annual Report on Form 10-K; and (ii) review of the unaudited consolidated financial statements included in the Company’s quarterly reports on Form 10-Q filed during the fiscal year.

15

Financial Information Systems Design and Implementation

PricewaterhouseCoopers LLP did not perform any financial information systems design and implementation services for the Company during the fiscal year ended June 30, 2002.

All Other Fees

The Company paid $252,875 to PricewaterhouseCoopers LLP in respect of other professional services rendered for the fiscal year ended June 30, 2002. Of this amount, $240,000 was paid for tax services rendered by PricewaterhouseCoopers LLP and $12,875 was paid for other accounting services, including research activities. The Audit Committee considered the non-audit services rendered by PricewaterhouseCoopers LLP and concluded that the rendering of such services was compatible with maintaining its independence.

STOCKHOLDER PROPOSALS

From time to time, qualifying stockholders present proposals, which may be proper items for inclusion in the proxy statement and for consideration at an annual meeting. To be considered, proposals must be duly submitted on a timely basis in accordance with the Company’s Amended and Restated Bylaws and the rules and regulations of the SEC. Proposals for the 2003 Annual Meeting of Stockholders (other than nominations for election to the Board of Directors) must be received by the Company no later than May 31, 2003. Any such proposals, as well as any questions related thereto, should be directed to the Secretary of the Company at 279 Bayview Drive, Barrie, Ontario, Canada L4M 4W5.

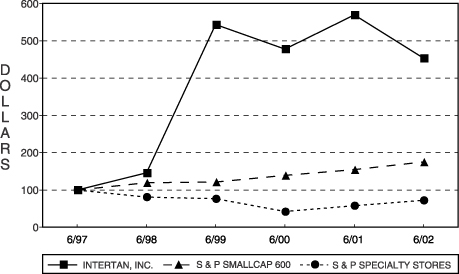

STOCKHOLDER RETURN PERFORMANCE GRAPH

Set forth below is a line graph comparing the cumulative total returns of the Company’s Common Stock, the Standard & Poor’s SmallCap 600 Index, and the Standard & Poor’s Specialty Stores Index. The graph reflects the assumption of $100 invested on June 30, 1997 in the Common Stock and each of the indices, reinvestment of all dividends, and successive fiscal years ending June 30.

16

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG INTERTAN, INC., THE S&P SMALLCAP 600 INDEX

AND THE S&P SPECIALTY STORES INDEX

*$100 Invested on 6/30/97 in stock or index-including reinvestment of dividends. Fiscal year ending June 30.

Copyright © 2002, Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved.

www.researchdatagroup.com/S&P.htm

| | | Cumulative Total Return

|

| | | 6/97 | | 6/98 | | 6/99 | | 6/00 | | 6/01 | | 6/02 |

| | | | | | | | | | | | | |

| INTERTAN, INC. | | 100.00 | | 145.76 | | 542.37 | | 477.94 | | 569.46 | | 453.54 |

| S & P SMALLCAP 600 | | 100.00 | | 119.46 | | 121.47 | | 138.94 | | 154.39 | | 174.93 |

| S & P SPECIALTY STORES | | 100.00 | | 81.07 | | 76.42 | | 41.87 | | 57.93 | | 72.29 |

PROXY SOLICITATION AND EXPENSE

The cost of soliciting proxies will be borne by the Company, including expenses in connection with the preparation and mailing of this Proxy Statement and all materials that now accompany or may hereafter supplement it. The solicitation will be undertaken by mail. The Company will also supply brokers, fiduciaries, custodians, or similar persons holding stock in their names or in the names of their nominees with such number of proxies, proxy materials and annual reports as they may require for mailing to beneficial owners, and will reimburse them for their expenses in accordance with the rules and regulations of the SEC and the New York Stock Exchange.

Certain directors, officers and employees of the Company, not specifically employed for the purpose of soliciting proxies, may solicit proxies, without remuneration therefore, by mail, telephone, facsimile transmission, telegraph or personal interview.

17

INFORMATION NOT INCORPORATED BY REFERENCE

The above Report of the Audit Committee, the Compensation Committee Report on Executive Compensation and the Stockholder Return Performance Graph and the information disclosed therein shall not be deemed to be “soliciting materials” or “filed” with the SEC or subject to the SEC’s proxy rules or to the liabilities imposed by Section 18 of the Exchange Act, and such information shall not be deemed to be incorporated by reference into any filing made by the Company under the Exchange Act or under the Securities Act of 1933.

OTHER INFORMATION

As of the date of this Proxy Statement, management has no knowledge of any other business to be presented at the Annual Meeting; but if other business is properly brought before the meeting, the persons named in the enclosed form of proxy will vote according to their discretion.

The form of proxy and this Proxy Statement have been approved by the Board of Directors and are being mailed and delivered to stockholders by its authority.

InterTAN, Inc.

Barrie, Ontario, Canada

September 20, 2002

The Annual Report to Stockholders of the Company for the fiscal year ended June 30, 2002, which includes financial statements, has been mailed to stockholders of the Company contemporaneously with the mailing of this Proxy Statement. The Annual Report does not form any part of the material for the solicitation of proxies.

18

INTERNET ACCESS IS HERE!

InterTAN, Inc. is pleased to announce that registered shareholders now have an innovative and secure means of accessing and managing their registered accounts on-line. This easy-to-use service is only a click away at:

http://www.equiserve.com

In order to access your account and request your temporary password (or PIN), you will need your Social Security number and Issue ID (064810). Please click on the “Account Access” tab and follow the instructions and a temporary password will be mailed to your address of record. If you have any questions on this process please call 1-877-THE-WEB7 (1-877-843-9327).

DETACH HERE ZINT62

PROXY

InterTAN, Inc.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF INTERTAN, INC.

The undersigned, having received the Notice of Annual Meeting and Proxy Statement, hereby appoints Ron G. Stegall and W. Darcy McKeough, and each or either of them, attorneys and proxies for and in the name of the undersigned, with full power of substitution, to vote in person or by proxy all the shares of common stock of InterTAN, Inc. held of record by the undersigned on September 10, 2002 and which the undersigned is entitled to vote on all matters which may come before the 2002 Annual Meeting of Stockholders of InterTAN, Inc. to be held in Barrie, Ontario, Canada on November 8, 2002 and any adjournments or postponements thereof, as indicated on this proxy. The proxies, in their discretion, are further authorized to vote for the election of a person to the Board of Directors if any nominee named herein becomes unable to serve or for good cause will not serve, are further authorized to vote on any matters which the Board of Directors did not know would be presented at the meeting by a reasonable time before the proxy solicitation was made, and are further authorized to vote on other matters which may properly come before the 2002 Annual Meeting and any adjournments or postponements thereof.

If no directions are given, this Proxy will be voted “FOR” Item 1.

Please Sign, Date and Promptly Return This Proxy in the Enclosed Envelope.

The Proxies Cannot Vote Your Shares Unless You Sign on the Reverse Side and Return This Card.

| | |

|

|

SEE REVERSE SIDE | | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | | SEE REVERSE SIDE |

| | |

|

|

| INTERTAN, INC. | | THIS IS YOUR PROXY. |

| C/O EQUISERVE | | YOUR VOTE IS IMPORTANT. |

| P.O. BOX 43068 | | |

| PROVIDENCE, RI 02940 | | |

Regardless of whether you plan to attend the Annual Meeting of Stockholders, you can be sure your shares are represented at the Annual Meeting by promptly returning your proxy in the enclosed envelope.

DETACH HERE ZINT62

x | | Please mark | | |

| | votes as in | | |

| | this example. | | |

This Proxy when executed will be voted in the manner directed herein. If no direction is made this Proxy will be voted FOR the election of the Director Nominee.

1. Election of Director.

Class I Nominee:(01) James T. Nichols

| | | | | | | FOR NOMINEE | | ¨ | | | | | ¨ | | WITHHELD FROM NOMINEE |

MARK HERE FOR ADDRESS CHANGE AND NOTE AT LEFT¨

IMPORTANT: Whether or not you expect to attend the Annual Meeting in person, please date, sign and return this proxy. Please sign EXACTLY as your name appears hereon. Joint owners should EACH sign. When signing as partner, corporate officer, attorney, executor, administrator, trustee or guardian, please give full title as such.

Signature: Date: Signature: Date: