UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Rule 14a-12 |

JPMorgan Trust I

JPMorgan Trust II

J.P. Morgan Mutual Fund Investment Trust

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

1. The following email will be sent to certain advisors with clients holding shares of the JPMorgan Large Cap Growth Fund and the JPMorgan Growth Advantage Fund on or around October 4, 2024:

Dear [Financial Advisor],

We understand that some of your clients have received mailings and phone calls from a proxy firm, EQ, in regard to the JPMorgan Large Cap Growth Fund and the JPMorgan Growth Advantage Fund.

Why are my clients being contacted?

Clients are receiving these calls because they are shareholders in one or both of these Funds and there is a proposed change that requires a vote from shareholders in order to move forward. This is standard for any mutual fund seeking a similar change.

More specifically, shareholders are being asked to vote on a proposal to reclassify these two Funds from “diversified” to “non-diversified” under the Investment Company Act of 1940 (the “1940 Act”). The 1940 Act requires this type of change occur through a shareholder vote.

Why is this vote being proposed?

This change, if approved, will give the portfolio management team for each Fund greater flexibility to manage position sizes in the benchmark’s top holdings and express conviction consistent with their respective investment philosophy and process. While approval of the proposal would provide greater long-term flexibility in executing each Fund’s investment strategy by allowing increased exposures to certain holdings, it is not otherwise expected to affect the way the Funds are currently managed.

Can you explain more about why this is important?

Under the 1940 Act, a “diversified” fund is prohibited from investing more than 5% of its assets in a company, if, in aggregate, all single-company positions of 5% or more amount to 25% of a fund’s assets. Said another way, a “diversified” fund is not allowed to make additional purchases in stocks which are greater than 5% of the fund if the cumulative amount of 5%+ holdings comprises 25%+ of the fund. Today, certain stocks make up a substantially large percentage of growth indices. For example, the five biggest stocks by market capitalization and weight in the Russell 1000 Growth Index (the benchmark for the JPMorgan Large Cap Growth Fund) as of August 31, 2024 are:

| | • | | Microsoft (MSFT) at 11.5% |

| | • | | Alphabet (GOOG/GOOGL) at 6.6% |

These five stocks each account for more than 5% of the Russell 1000 Growth Index and their combined weight totals more than 47%, much higher than the 25% maximum amount that can be held by “diversified” funds. So, a “diversified” fund cannot buy these five stocks at their index weight, let alone actively express an overweight position. A non-diversified fund would be able to do so.

How do my clients cast their vote?

There are four convenient methods for clients to cast their vote: by telephone, via the Internet, by returning the proxy card they received by mail, or by participating in the shareholder meeting. See the Proxy Statement for details. Your clients can vote “For” the proposal, “Against” the proposal, or “Abstain” from voting. The Funds’ Board of Trustees is recommending a vote “For” the proposal. If you or your clients have any questions after reviewing the proxy materials, please call 1-888-628-1041.

We value your partnership and appreciate your understanding.

Please let me know if you have any additional questions.

Regards,

[CA Name]

| | |

| | |

FOR INSTITUTIONAL USE ONLY | NOT FOR PUBLIC DISTRIBUTION | | |

Telephone calls and electronic communications may be monitored and/or recorded.

Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://www.jpmorgan.com/privacy.

J.P. Morgan Funds are distributed by JPMorgan Distribution Services, Inc. (JPMDS) and offered by J.P. Morgan Institutional Investments, Inc. (JPMII); both affiliates of JPMorgan Chase & Co. Affiliates of JPMorgan Chase & Co. receive fees for providing various services to the funds. JPMDS and JPMII are both members of FINRA.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

If you do not wish to receive future communication, please contact your J.P. Morgan Asset Management representative.

J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co., and its affiliates worldwide.

2. The following email will be sent to certain advisors and/or recordkeepers of retirement plans holding shares of the JPMorgan Large Cap Growth Fund and the JPMorgan Growth Advantage Fund on or around October 4, 2024:

Subject: Please Encourage Your Plans to Vote This Proxy

We recently announced a shareholder proxy for three of our funds, JPMorgan Large Cap Growth Fund, JPMorgan Growth Advantage Fund and JPMorgan U.S. GARP Equity Fund (the “Funds”), to vote on a proposal to change each Fund from a “diversified company” to a “non-diversified company” by eliminating the related fundamental investment policy (the “Proposal”) (see the supplement to the registration statements filed on July 1, 2024). We are working with our recordkeeping partners to get the proxy materials to the plans holding these Funds, and we wanted to ensure you are aware of this communication to your plan sponsor clients.

We need your help – please encourage your impacted plan sponsors to vote as soon as possible!

| | • | | Plans are eligible to vote if they owned shares of an impacted Fund at the close of business on July 31, 2024. The tickers and CUSIPs for the respective share classes of the Funds are provided below. |

| | • | | Each Plan’s vote is extremely important, and voting is quick and easy. Plans can vote “For” the Proposal, “Against” the Proposal or “Abstain” from voting. The Funds’ Board of Trustees is recommending a vote “FOR” the proposal. |

| | • | | There are four convenient methods for plans to cast their vote: by telephone, via the Internet, by returning the proxy card they receive by mail, or by participating in the shareholder meeting. See the proxy statement filed on August 15, 2024 for details. |

| | • | | The shareholder meeting is scheduled to be held on October 30, 2024, at 277 Park Avenue, New York, NY 10172, 17th Floor. It is possible that the meeting could be postponed to a later date/time to allow additional time for shareholders to vote. |

| | • | | Plans may receive multiple proxy cards if they hold Fund shares in multiple accounts or subplans. Plans should be sure to vote all control numbers associated with their plan accounts. |

| | • | | If a plan hasn’t received its proxy materials, please have them call our proxy coordination partner, EQ, at 1-888-628-1041. They will likely need to provide the recordkeeper name where their shares are held, and, if held through a TPA, they may also need to provide the custodian name (example: holding shares through XYZ TPA, trading through ABC clearing firm). |

If you or your plan sponsor clients have any questions after reviewing the proxy materials, please call 1-888-628-1041. We will get you the answers that you need promptly.

Thank you!

[JPMAM client advisor]

| | | | | | | | |

Fund | | Share Class | | CUSIP | | Ticker | | |

| | | | | |

JPMorgan Growth Advantage Fund | | A | | 62826M483 | | VHIAX | | |

| | | | | | | | | | |

| | | | | | |

JPMorgan Growth Advantage Fund | | I | | | | 4812A3718 | | JGASX | | |

| | | | | | |

JPMorgan Growth Advantage Fund | | R2 | | | | 48123X108 | | JGRJX | | |

| | | | | | |

JPMorgan Growth Advantage Fund | | R3 | | | | 46640W306 | | JGTTX | | |

| | | | | | |

JPMorgan Growth Advantage Fund | | R4 | | | | 46640W405 | | JGTUX | | |

| | | | | | |

JPMorgan Growth Advantage Fund | | R5 | | | | 62826M426 | | JGVRX | | |

| | | | | | |

JPMorgan Growth Advantage Fund | | R6 | | | | 46640W108 | | JGVVX | | |

| | | | | | |

JPMorgan Large Cap Growth Fund | | A | | | | 4812C0506 | | OLGAX | | |

| | | | | | |

JPMorgan Large Cap Growth Fund | | I | | | | 4812C0530 | | SEEGX | | |

| | | | | | |

JPMorgan Large Cap Growth Fund | | R2 | | | | 4812C2544 | | JLGZX | | |

| | | | | | |

JPMorgan Large Cap Growth Fund | | R3 | | | | 4812CA108 | | JLGPX | | |

| | | | | | |

JPMorgan Large Cap Growth Fund | | R4 | | | | 4812CA207 | | JLGQX | | |

| | | | | | |

JPMorgan Large Cap Growth Fund | | R5 | | | | 4812C2379 | | JLGRX | | |

| | | | | | |

JPMorgan Large Cap Growth Fund | | R6 | | | | 48121L841 | | JLGMX | | |

| | | | | | |

JPMorgan U.S. GARP Equity Fund | | A | | | | 4812A0227 | | JIGAX | | |

| | | | | | |

JPMorgan U.S. GARP Equity Fund | | I | | | | 4812A2207 | | JPGSX | | |

| | | | | | |

JPMorgan U.S. GARP Equity Fund | | R2 | | | | 4812A4310 | | JIGZX | | |

| | | | | | |

JPMorgan U.S. GARP Equity Fund | | R5 | | | | 4812A3759 | | JGIRX | | |

| | | | | | |

JPMorgan U.S. GARP Equity Fund | | R6 | | | | 46641U580 | | JGISX | | |

3. The following email will be sent to sponsors of certain retirement plans holding shares of the JPMorgan Large Cap Growth Fund and the JPMorgan Growth Advantage Fund on or around October 4, 2024:

Subject: Please Vote This Proxy

We recently announced a shareholder proxy for three of our funds, JPMorgan Large Cap Growth Fund, JPMorgan Growth Advantage Fund and JPMorgan U.S. GARP Equity Fund (the “Funds”), to vote on a proposal to change each Fund from a “diversified company” to a “non-diversified company” by eliminating the related fundamental investment policy (the “Proposal”) (see the supplement to the registration statements filed on July 1, 2024). We wanted to ensure you are aware of this communication as your plan holds shares in one or more of these Funds.

| | • | | Plans are eligible to vote if they owned shares of an impacted Fund at the close of business on July 31, 2024. The tickers and CUSIPs for the respective share classes of the Funds are provided below. |

| | • | | The vote is extremely important, and voting is quick and easy. Plans can vote “For” the Proposal, “Against” the Proposal or “Abstain” from voting. The Funds’ Board of Trustees is recommending a vote “FOR” the proposal. |

| | • | | There are four convenient methods for plans to cast their vote: by telephone, via the Internet, by returning the proxy card they receive by mail, or by participating in the shareholder meeting. See the proxy statement filed on August 15, 2024 for details. |

| | • | | The shareholder meeting is scheduled to be held on October 30, 2024, at 277 Park Avenue, New York, NY 10172, 17th Floor. It is possible that the meeting could be postponed to a later date/time to allow additional time for shareholders to vote. |

| | • | | Plans may receive multiple proxy cards if they hold Fund shares in multiple accounts or subplans. Plans should be sure to vote all control numbers associated with their plan accounts. |

| | • | | If you haven’t received the plan’s proxy materials, please call our proxy coordination partner, EQ, at 1-888-628-1041. you will likely need to provide the recordkeeper name where their shares are held and, if held through a TPA, you may also need to provide the custodian name (example: holding shares through XYZ TPA, trading through ABC clearing firm). |

If you have any questions after reviewing the proxy materials, please call 1-888-628-1041. We will get you the answers that you need promptly.

Thank you!

[JPMAM client advisor]

| | | | | | | | |

Fund | | Share Class | | CUSIP | | Ticker | | |

| | | | | |

JPMorgan Growth Advantage Fund | | A | | 62826M483 | | VHIAX | | |

| | | | | |

JPMorgan Growth Advantage Fund | | I | | 4812A3718 | | JGASX | | |

| | | | | |

JPMorgan Growth Advantage Fund | | R2 | | 48123X108 | | JGRJX | | |

| | | | | | | | | | |

JPMorgan Growth Advantage Fund | | R3 | | | | 46640W306 | | JGTTX | | |

JPMorgan Growth Advantage Fund | | R4 | | | | 46640W405 | | JGTUX | | |

JPMorgan Growth Advantage Fund | | R5 | | | | 62826M426 | | JGVRX | | |

JPMorgan Growth Advantage Fund | | R6 | | | | 46640W108 | | JGVVX | | |

JPMorgan Large Cap Growth Fund | | A | | | | 4812C0506 | | OLGAX | | |

JPMorgan Large Cap Growth Fund | | I | | | | 4812C0530 | | SEEGX | | |

JPMorgan Large Cap Growth Fund | | R2 | | | | 4812C2544 | | JLGZX | | |

JPMorgan Large Cap Growth Fund | | R3 | | | | 4812CA108 | | JLGPX | | |

JPMorgan Large Cap Growth Fund | | R4 | | | | 4812CA207 | | JLGQX | | |

JPMorgan Large Cap Growth Fund | | R5 | | | | 4812C2379 | | JLGRX | | |

JPMorgan Large Cap Growth Fund | | R6 | | | | 48121L841 | | JLGMX | | |

JPMorgan U.S. GARP Equity Fund | | A | | | | 4812A0227 | | JIGAX | | |

JPMorgan U.S. GARP Equity Fund | | I | | | | 4812A2207 | | JPGSX | | |

JPMorgan U.S. GARP Equity Fund | | R2 | | | | 4812A4310 | | JIGZX | | |

JPMorgan U.S. GARP Equity Fund | | R5 | | | | 4812A3759 | | JGIRX | | |

JPMorgan U.S. GARP Equity Fund | | R6 | | | | 46641U580 | | JGISX | | |

| | | | | | |

| | | |

| | For Institutional / Wholesale / Professional Clients and Qualified Investors only—Not for retail use or distribution | | |  | |

Overview

The JPMorgan Large Cap Growth Fund and JPMorgan Growth Advantage Fund (each, a “Fund”) are currently classified as “diversified” companies and are subject to the diversification rule under the Investment Company Act of 1940 (the “1940 Act”).

What is the Diversified Company rule?

The 1940 Act Diversified Company rule states that individual holdings of 5% or greater cannot exceed 25% of the Fund in aggregate*. The rule is generally interpreted as being at time of purchase (i.e., passive drift above 25% is permitted).

What is being proposed?

Shareholders are being asked to vote to reclassify each Fund from “diversified” to “non-diversified” under the 1940 Act.

Why is this vote happening now?

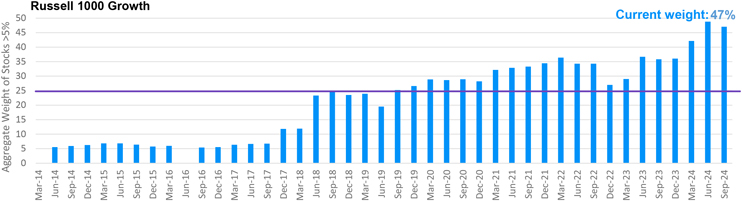

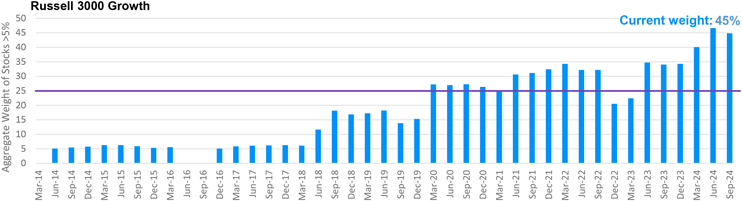

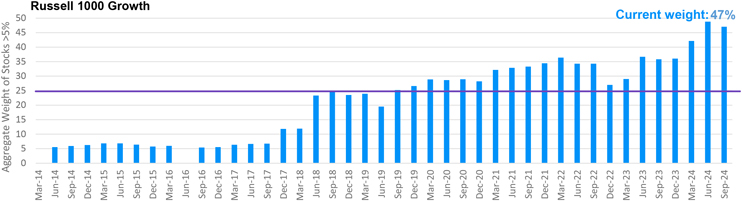

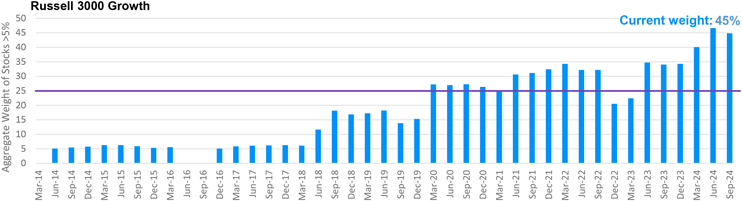

Concentration of holdings in the Russell 1000 Growth Index (benchmark for Large Cap Growth Fund) and Russell 3000 Growth Index (benchmark for Growth Advantage Fund) Indices has increased over the last several years and more significantly in recent quarters. This concentration of holdings in stocks with 5% or greater weight increased after the Russell reconstitution at the end of June and is now at 47% and 45%, respectively (see page 3).

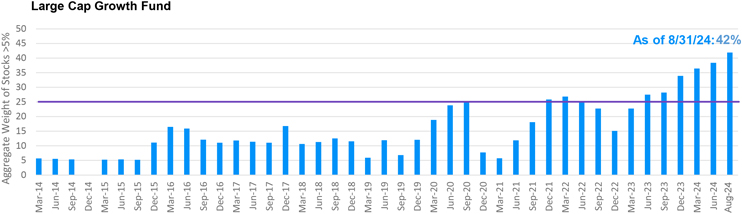

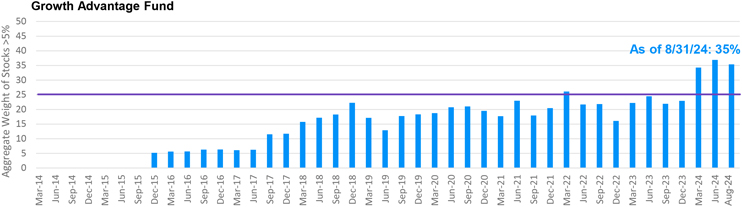

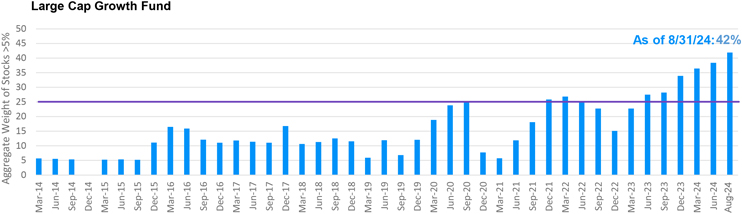

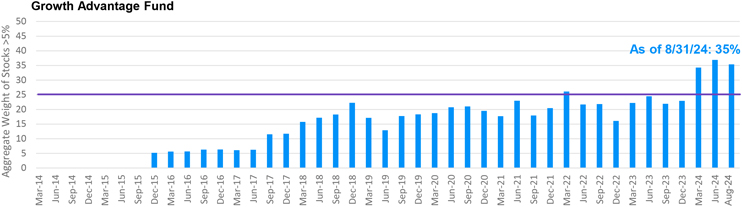

Currently, each Fund is passively above 25%. For each Fund’s historical concentration, see page 4. Aggregate weight in holdings of 5% or greater, as of 8/31/2024:

| | • | | The Large Cap Growth Fund is at 42% |

| | • | | The Growth Advantage Fund is at 35% |

What does reclassification to “non-diversified” mean for the management of each Fund?

Reclassifying the Funds to “non-diversified” will provide the Adviser with greater long-term flexibility in executing each Fund’s investment strategy by allowing increased exposures to certain holdings. The Funds will continue to be managed in a manner consistent with their respective investment philosophy and process while managing risk versus the benchmark.

Reclassification to “non-diversified” is not expected to significantly affect the way the Funds are currently managed.

*Section 5(b)(1) of the Investment Company Act of 1940, 15 U.S.C. 80a-1 et seq. (1940 Act) defines a “diversified company” as a management company that has at least 75 percent of its assets invested in cash and cash items (including receivables), Government securities, securities of other investment companies, and other securities that, for the purpose of this calculation, are limited in respect of any one issuer to an amount not greater in value than 5 percent of the value of the total assets of the management company and to not more than 10 percent of the outstanding voting securities of the issuer. The remaining 25 percent of the management company’s assets may be invested in any manner.

| | | | | | |

| | | |

2 | | For Institutional / Wholesale / Professional Clients and Qualified Investors only—Not for retail use or distribution | | |  | |

The Russell 1000 concentrated Growth and Russell 3000 Growth Indices have become increasingly concentrated

Aggregate weight in the index in holdings of 5% or greater

The inclusion of the securities mentioned above is not to be interpreted as recommendations to buy or sell. For illustrative purposes only. Source: J.P. Morgan Asset Management, Frank Russell Company, Wilshire Atlas (includes cash). The fund is an actively managed portfolio, holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. Past performance is not a guarantee of future results.

| | | | | | |

| | | |

3 | | For Institutional / Wholesale / Professional Clients and Qualified Investors only—Not for retail use or distribution | | |  | |

Aggregate weight in the Fund in holdings of 5% or greater

*Periods above 25% due to passive market drift

The inclusion of the securities mentioned above is not to be interpreted as recommendations to buy or sell. For illustrative purposes only. Source: J.P. Morgan Asset Management, Frank Russell Company, Wilshire Atlas (includes cash). The fund is an actively managed portfolio, holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. Past performance is not a guarantee of future results.

| | | | | | |

| | | |

4 | | For Institutional / Wholesale / Professional Clients and Qualified Investors only—Not for retail use or distribution | | |  | |

J.P. Morgan Asset Management

|

This is a communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purpose. Any examples used are generic, hypothetical and for illustration purposes only. Prior to making any investment or financial decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that take into account all of the particular facts and circumstances of an investor’s own situation. JPMorgan Mutual Funds and ETFs are distributed by JPMorgan Distribution Services, Inc. (JPMDS) and offered by J.P. Morgan Institutional Investments, Inc. (JPMII); both affiliates of JPMorgan Chase & Co. Affiliates of JPMorgan Chase & Co. receive fees for providing various services to the funds. JPMDS and JPMII are both members of FINRA. If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance. J.P. Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase & Co. and its affiliates worldwide. © 2024 JPMorgan Chase & Co. All rights reserved. Material ID: 092g242506090145 |

| | | | | | |

| | | |

5 | | For Institutional / Wholesale / Professional Clients and Qualified Investors only—Not for retail use or distribution | | |  | |