UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04875

Name of Registrant: Royce Value Trust, Inc.

Address of Registrant: 1414 Avenue of the Americas

New York, NY 10019

| Name and address of agent for service: | John E. Denneen, Esquire |

| | 1414 Avenue of the Americas |

| | New York, NY 10019 |

Registrant’s telephone number, including area code: (212) 486-1445

Date of fiscal year end: December 31

Date of reporting period: January 1, 2006 - December 31, 2006

Item 1: Reports to Shareholders

| |

|

| A N N U A L R E V I E W |

|

| |

Royce Value Trust

Royce Micro-Cap Trust

Royce Focus Trust

www.roycefunds.com

| | AND

R E P O R T T O S T O C K H O L D E R S

2006 |

| |

| | TheRoyceFunds |

| |

| |

VALUE INVESTING IN SMALL COMPANIES FOR MORE THAN 30 YEARS

|

A FEW WORDS ON CLOSED-END FUNDS

| | Royce & Associates, LLC manages three closed-end funds: Royce Value Trust, the first small-cap value closed-end fund offering; Royce Micro-Cap Trust, the only micro-cap closed-end fund; and Royce Focus Trust, a closed-end fund that invests in a limited number of primarily small-cap companies.

A closed-end fund is an investment company whose shares are listed on a stock exchange or are traded in the over-the-counter market. Like all investment companies, including open-end mutual funds, the assets of a closed-end fund are professionally managed in accordance with the investment objectives and policies approved by the fund’s Board of Directors. A closed-end fund raises cash for investment by issuing a fixed number of shares through initial and other public offerings that may include shelf offerings and periodic rights offerings. Proceeds from the offerings are invested in an actively managed portfolio of securities. Investors wanting to buy or sell shares of a publicly traded closed-end fund after the offerings must do so on a stock exchange or the Nasdaq market, as with any publicly traded stock. This is in contrast to open-end mutual funds, in which the fund sells and redeems its shares on a continuous basis.

| |

A CLOSED-END FUND OFFERS SEVERAL DISTINCT ADVANTAGES

NOT AVAILABLE FROM AN OPEN-END FUND STRUCTURE |

| |

• | |

Since a closed-end fund does not issue redeemable securities or offer its securities on a continuous basis, it does not need to liquidate securities or hold uninvested assets to meet investor demands for cash redemptions, as an open-end fund must.

| |

| | • | | In a closed-end fund, not having to meet investor redemption requests or invest at inopportune times is ideal for value managers who attempt to buy stocks when prices are depressed and sell securities when prices are high.

| |

| | • | | A closed-end fund may invest more freely in less liquid portfolio securities because it is not subject to potential stockholder redemption demands. This is particularly beneficial for Royce-managed closed-end funds, which invest in small- and micro-cap securities.

| |

| | • | | The fixed capital structure allows permanent leverage to be employed as a means to enhance capital appreciation potential.

| |

| | • | | Unlike Royce’s open-end funds, our closed-end funds are able to distribute capital gains on a quarterly basis. Each of the Funds has adopted a quarterly distribution policy for its common stock.

| |

| | We believe that the closed-end fund structure is very suitable for the long-term investor who understands the benefits of a stable pool of capital.

| |

WHY DIVIDEND REINVESTMENT IS IMPORTANT |

| |

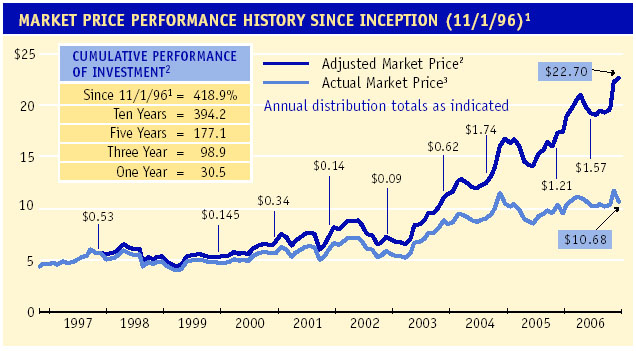

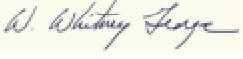

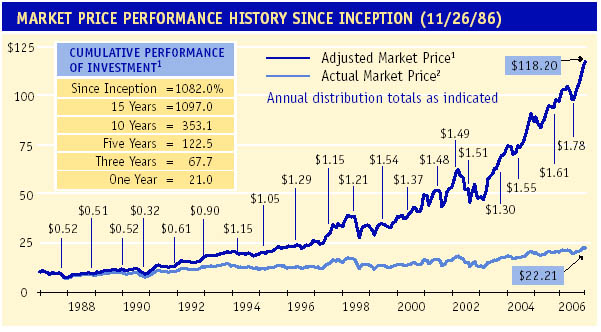

A very important component of an investor’s total return comes from the reinvestment of distributions. By reinvesting distributions, our investors can maintain an undiluted investment in a Fund. To get a fair idea of the impact of reinvested distributions, please see the charts on pages 13, 15 and 17. For additional information on the Funds’ Distribution Reinvestment and Cash Purchase Options and the benefits for stockholders, please see page 19 or visit our website at www.roycefunds.com.

| |

| |

| THIS PAGE IS NOT PART OF THE 2006 ANNUAL REPORT TO STOCKHOLDERS | | |

| Annual Review | | |

|

| Performance Table | | 2 |

|

| Letter to Our Stockholders | | 3 |

|

| | |

|

| Annual Report to Stockholders | | 10 |

|

For more than 30 years, we have used a value approach to invest in smaller-cap securities. We focus primarily on the quality of a company’s balance sheet, its ability to generate free cash flow and other measures of profitability or sound financial condition. At times, we may also look at other factors, such as a company’s unrecognized asset values, its future growth prospects or its turnaround potential following an earnings disappointment or other business difficulties. We then use these factors to assess the company’s current worth, basing the assessment on either what we believe a knowledgeable buyer might pay to acquire the entire company, or what we think the value of the company should be in the stock market.

| |

| THIS PAGE IS NOT PART OF THE 2006 ANNUAL REPORT TO STOCKHOLDERS | 1 |

Charles M. Royce, President

During our security selection process,

we have historically focused on five

categories of risk: valuation,

business strategy, market, portfolio

and financial. Of these, financial

risk is probably the most important.

Small companies, by virtue of their

size, are generally more fragile than

large companies, which makes the

need for strong financial condition

paramount. But how do we evaluate

a company’s financial strength?

One of the most important steps

involves a careful scrutiny of the

balance sheet. This evaluation is as

much art as science, which is one way

of saying that the process entails a

number of subjective measures in

addition to more objective,

quantifiable ones. It is not simply the

numbers that tell the story, but one’s

interpretation of their significance.

Rather than concentrate primarily

on long-term debt, we search for

companies whose balance sheets

Continued on Page 4...

| | | |

| | | |

| | | | PERFORMANCE TABLE |

| | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | AVERAGE ANNUAL NAV TOTAL RETURNS Through December 31, 2006 |

| | | | | | | | Royce | | Royce | | | | Royce | | Russell |

| | | | | | | | Value Trust | | Micro-Cap Trust | | | | Focus Trust | | 2000 |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | Fourth Quarter 2006* | | | | 8.23 | % | | 10.07 | % | | | | | 11.17 | % | | 8.90 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | July-December 2006* | | | | 8.99 | | | 9.74 | | | | | | 7.18 | | | 9.38 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

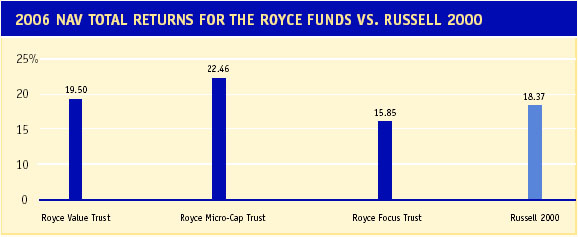

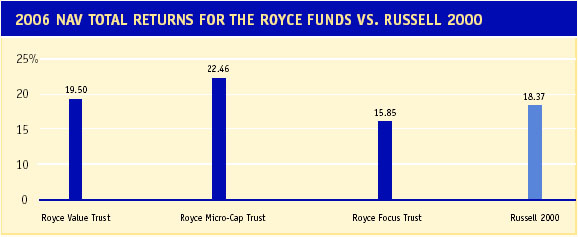

| | | | One-Year | | | | 19.50 | | | 22.46 | | | | | | 15.85 | | | 18.37 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three-Year | | | | 16.30 | | | 15.77 | | | | | | 19.42 | | | 13.56 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | Five-Year | | | | 13.32 | | | 15.78 | | | | | | 18.12 | | | 11.39 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | 10-Year | | | | 13.96 | | | 14.62 | | | | | | 14.09 | | | 9.44 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | 15-Year | | | | 14.14 | | | n/a | | | | | | n/a | | | 11.47 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | 20-Year | | | | 13.05 | | | n/a | | | | | | n/a | | | 10.92 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | Since Inception | | | | 12.99 | | | 14.58 | | | | | | 14.35 | | | — | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | Inception Date | | | | 11/26/86 | | 12/14/93 | | | | 11/1/96** | — | | | |

| | | | * Not annualized. |

| | | | ** Date Royce & Associates, LLC assumed investment management responsibility for the Fund. |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | IMPORTANT PERFORMANCE AND RISK INFORMATION |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | All performance information in this Review and Report reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Performance information does not reflect the deduction of taxes that a stockholder would pay on distributions or on the sale of Fund shares. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Royce Funds invest primarily in securities of small-cap and/or micro-cap companies, which may involve considerably more risk than investments in securities of larger-cap companies.

The thoughts expressed in this Review and Report to Stockholders concerning recent market movements and future prospects for small company stocks are solely the opinion of Royce at December 31, 2006, and, of course, historical market trends are not necessarily indicative of future market movements. Statements regarding the future prospects for particular securities held in the Funds’ portfolios and Royce’s investment intentions with respect to those securities reflect Royce’s opinions as of December 31, 2006 and are subject to change at any time without notice. There can be no assurance that securities mentioned in this Review and Report to Stockholders will be included in any Royce-managed portfolio in the future. |

| | | | |

2 | THIS PAGE IS NOT PART OF THE 2006 ANNUAL

REPORT TO STOCKHOLDERS | | | |

| | | | |

LETTER TO OUR STOCKHOLDERS

|

|

All Things Must Pass . . .

As one year fades into permanent night and a new one greets its first day, talk naturally turns to transitions. The movement from 2006 to 2007 offered far more than a change in calendars to mark the passage of one period to another: The political landscape shifted as Republicans gave way to Democrats; the Federal Reserve Board moved from raising interest rates to a neutral stance; a growing economy slowed; and the real estate bubble either burst or began to leak, depending on where you live. None of these events was surprising in and of itself. One lesson that the asset management business repeatedly teaches is that change is the only constant. And the stock market was hardly immune from its own significant movements in 2006—though it changed in ways that we did not anticipate. While we had been calling for lower returns throughout the market, the Russell 2000 and Dow Jones Industrial Average both reached new highs in December. This was the year’s biggest surprise for us, since some of the conditions for a slump or slowdown in stock prices—most critically a slower-growth economy—had been present throughout much of 2006. Although returns were high across all asset classes, we saw what appeared to be a shift in market leadership after the long-term period of dynamic outperformance for small-cap stocks relative to their larger peers.

A possible shift in market leadership has admittedly been a bit of a preoccupation for us in our communications over the last couple of years. Yet 2006 ended without a clear sense of whether small- or large-cap stocks were leading the market into 2007. While small-cap (as measured by the Russell 2000) did better for the calendar-year period and led during the

|

|

We want to make it clear that we do not see disaster or long-term difficulties ahead for our chosen asset class. However, the recent period of outperformance for small-cap, particularly small-cap value, is subject to the same realities of cyclicality that ensure a limited stay at the top for any investment class or style.

|

|

THIS PAGE IS NOT PART OF THE 2006 ANNUAL REPORT TO STOCKHOLDERS | 3 |

| |

| |

show low leverage. We measure

leverage more broadly by looking at

the ratio of assets to stockholders’

equity. Using this method allows us

to note net changes in long- and

short-term debt, as well as in

accounts receivable. Items that can

have an adverse effect on a

company, such as higher-than-usual

levels of receivables or increasingly

bulging inventories, are not always

financed as long-term debt. This

type of examination paints what we

believe is a more complete picture.

Our general rule-of-thumb is to look

for a two-to-one ratio of assets to

stockholders’ equity for non-financial

companies. This represents

what we refer to as the company’s

“margin of safety.”

If a company is carrying too much

debt, it impedes its own ability to

meet the challenge of out-of-left-field

occurrences such as lawsuits

and overseas currency crises. A

conservatively capitalized company

can better weather these storms

because it has the necessary financial

reserves to do so, while a company

with too much debt on the balance

sheet runs a greater risk that stormy

weather will turn into a hurricane.

Continued on Page 6...

| | |

LETTER TO OUR STOCKHOLDERS

dynamic rallies that opened and closed the year, large-cap (as measured by the S&P 500) led during the second half of the year and from the previous high in May 2006 through the end of the year. We had guessed that large-cap would have a firmer grip on market leadership before December bade farewell, though we were more on target regarding the shift in market leadership than we were in expecting lower returns. In any case, the strong absolute returns of 2006 were welcome, though surprising, news, especially as they benefited smaller companies (to say nothing of Royce-managed portfolios). We’ll gladly exchange that for another forecast being partially incorrect.

The critical question for any investor is how best to deal with a new market-cycle phase that seems likely—to us, anyway—to be different from the last several years of strong returns and relative performance dominance for smaller stocks. We want to make it clear that we do not see disaster or long-term difficulties ahead for our chosen asset class. However, the recent period of outperformance for small-cap, particularly small-cap value, is subject to the same realities of cyclicality that ensure a limited stay at the top for any investment class or style. The last seven years were the reverse of the late ’90s, when large-cap stocks were enjoying a long period of relative outperformance and, within the small-cap universe, growth mostly outpaced value. Having noted that any market cycle contains a hidden expiration date, we remain optimistic about the prospects for small-cap stocks. Our security selection process does not divide the small-cap world into value and growth segments. More importantly, we currently see many companies that we regard as high-quality businesses that have not fully participated in the small-cap bull run. Our task remains what it has always been: to search throughout the small-cap world for what we think are great businesses trading at attractive stock prices.

It’s All Too Much After finishing 2005 with nearly identical returns, the small-cap Russell 2000 took back sole possession of the relative outperformance crown in 2006. The small-cap index gained 18.4% versus 15.8% for the S&P 500 and 9.5% for the Nasdaq Composite. Putting aside its calendar-year relative underperformance, it was a terrific year for large-cap stocks. The lion’s share of small-cap’s performance edge in 2006 occurred during the first quarter, a period during which the Russell 2000 gained an impressive 13.9%, compared to a relatively paltry gain of 4.2% for the S&P 500. However, during the less dynamic second (-5.0% versus -1.4%) and third quarters (+0.4% versus +5.7%), the Russell 2000 decisively trailed the large-cap index. Third-quarter strength was also key to large-cap’s advantage over its small-cap counterparts during the second half of the year: from 6/30/06 through 12/31/06, the Russell 2000 was up 9.4% versus a gain of 12.7% for the large-cap index. Small-cap managed to outpace the S&P 500 during the dynamic fourth quarter (+8.9% versus +6.7%), though the fourth quarter saw the large-cap index finally show a positive performance on a |

4 | THIS PAGE IS NOT PART OF THE 2006 ANNUAL

REPORT TO STOCKHOLDERS

| | |

|

total return basis from its peak established in March 2000. The S&P 500 also enjoyed its strongest calendar-year performance since 2003.

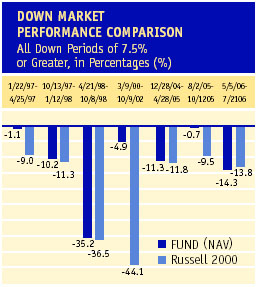

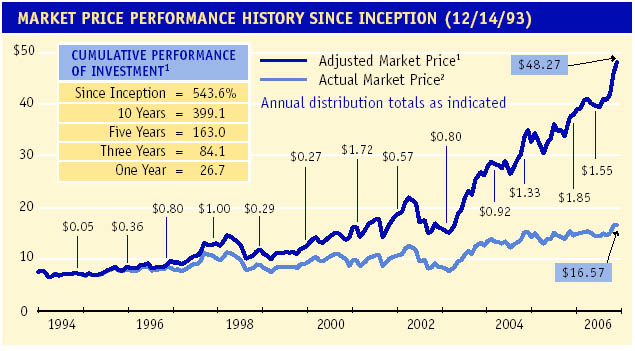

Equally important from our perspective—because of the emphasis we put on down-market performance—was the fact that large-cap also finished ahead of small-cap from the earlier peak on 5/5/06 through 12/31/06, up 8.4% versus 1.6% for the Russell 2000. In our estimation, these stronger performances in the down and relatively flat periods of 2006 provide the most accurate barometer of the market’s subsequent near-term direction. We continue to believe that where investors go when stock prices fall is a telling indicator of nascent market leadership. Last January, we surmised that small-cap was apt to lead in any bullish period, while large-cap would lead in any bearish market environment. By the end of the second quarter, we felt differently. Issues with the economy and contracting worldwide liquidity had us convinced that large-cap was likely to capture leadership in an uptick as well as a downturn, and this reasoning proved sound until the rally that sparked the fourth quarter. What was most surprising about the upswing near the end of 2006 was the strength of more speculative issues within small-cap during a period in which we thought that investors would be looking for more safety and less risk. Micro-cap companies, as measured by the Russell Microcap index, posted significant gains in both the first (+14.1%) and fourth quarters (+10.3%) of 2006, something paralleled by some of our own portfolios with significant micro-cap exposure. Whether this late surge indicated ongoing small-cap strength remains to be seen.

|

Long, Long, Long

It certainly seems that small-cap value has been leading its growth counterpart, as measured by the Russell 2000 Value and Russell 2000 Growth indices, for a long, long, long time. Two thousand six actually marked the third consecutive year of value’s outperformance and sixth out of the last seven. Unlike 2005, which saw a narrowing performance spread between small-cap value and growth, 2006 was a year in which value substantially outperformed growth within small-cap. The Russell 2000 Value index was up an impressive 23.5% for the calendar year, while the Russell 2000 Growth index posted a return of 13.4%, a respectable result on an absolute basis, but more than one thousand basis points behind its value sibling. This considerable advantage for small-cap value only widened its advantage over long-term time periods. The Russell 2000 Value index outgained the Russell 2000 Growth index for the one-, three-, five-, 10-, 15-, 20- and 25-year periods ended 12/31/06.

One interesting sidebar to the recent performance dominance of small-cap value has been its strength during upswings. It’s generally expected that value will prove its mettle during flat or down market periods, and this was certainly the case during the short-lived downdrafts of 2006, as small-cap value bested growth in the second (-2.7% versus -7.3%) and third quarters (+2.6%

|

|

What was most surprising about the upswing near the end of 2006 was the strength of more speculative issues within small-cap during a period in which we thought that investors would be looking for more safety and less risk.

|

|

THIS PAGE IS NOT PART OF THE 2006 ANNUAL REPORT TO STOCKHOLDERS | 5 |

| |

| |

| | |

LETTER TO OUR STOCKHOLDERS

|

| |

We also view financially strong

companies as well-positioned to

grow. The assets of these companies

are derived more from retained

earnings than paid-in capital; i.e.,

they have the ability to foster

growth out of their own success as

a business.

The balance sheet and its

accompanying footnotes and

schedules also reveal companies

whose businesses are conservatively

managed: debts are written off early,

LIFO inventories are used that may

understate profits, and asset

ownership and depreciation are the

norm as opposed to leasing. Such

practices give us critical insight into

the way a company operates. The

presence or absence of such items

tells us something about

management and their goals for

the company.

Other factors are also important to

risk-focused investment managers

like us. We ask certain questions as

we study annual reports and

financial statements: What is the

schedule for bad debt provision? Is

the company massaging earnings in

the short-term via advertising or

Continued on Page 8...

| | |

versus -1.8%). Yet small-cap value was also competitive in the first-quarter rally (+13.5% versus +14.4%), and actually held a slight advantage over small-cap growth in the similarly dynamic fourth quarter (+9.0% versus +8.8%). So while down- and flat-market returns were key to outperformance in the calendar year, strong absolute results in short-term upticks also helped the Russell 2000 Value index hang on to its significant performance edge in 2006.

You’re Asking Me, “Will My Fund Grow?” We were very pleased with the strong absolute returns for our three closed-end portfolios in 2006. On a relative basis, both Royce Value Trust and Royce Micro-Cap Trust outgained the Russell 2000 on a net asset value (NAV) basis, while Royce Focus Trust came up short versus the small-cap index. All three Funds outperformed the Russell 2000 on a market price basis in 2006, and each Fund finished the year with a flourish in the form of a strong fourth quarter. This was the case for the small-cap universe as a whole, with micro-cap stocks finishing a bit stronger than their small-cap peers. Although Royce Value Trust and Royce Micro-Cap Trust each hold an ample number of micro-cap names, Royce Focus Trust has much less exposure. However, its relative underperformance came not in the fourth quarter (in which it outperformed the Russell 2000 on both an NAV and market price basis), but in the bearish second quarter. Its fourth-quarter strength was all the more notable considering the lack of micro-cap names.

Although there are important differences among all three of our closed-end portfolios, each had similar sector strength in 2006. Industrial Products and Technology holdings as a group did well in all three Funds on a dollar basis, posting the largest net gains in each portfolio. The worldwide construction boom continued to benefit many Industrial Products holdings in the metal fabrication and machinery industries. In Technology, successes could be found in several industries, including internet software and services, IT services, and (in RVT and FUND) components and systems. Within the Natural Resources sector, precious metals and mining companies saw a resurgence late in the year and were among the top beneficiaries of the overall market rally during the fourth quarter.

|

6 | THIS PAGE IS NOT PART OF THE 2006 ANNUAL

REPORT TO STOCKHOLDERS

| |

Dark Horse

As it relates to stock-market investing, quality is conventionally defined as a company’s ability to generate consistent growth in earnings and dividends over long-term time periods. It’s a definition that we agree with in large part. Some stock market observers, however, also hold that quality is the near-exclusive province of large-cap companies, mostly because their size and multiple lines of business are thought to make them less risky. By contrast, small-cap companies have traditionally been regarded as more volatile and speculative, and thus lacking the greater level of safety of their larger-cap cohorts. Here, of course, we part company with the conventional wisdom. We have always found quality companies in the small-cap world, and over the years have cultivated a pronounced preference for high-quality small-cap businesses.

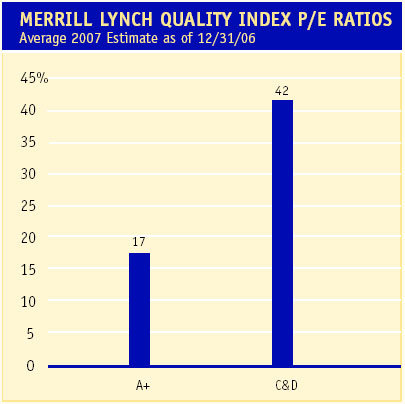

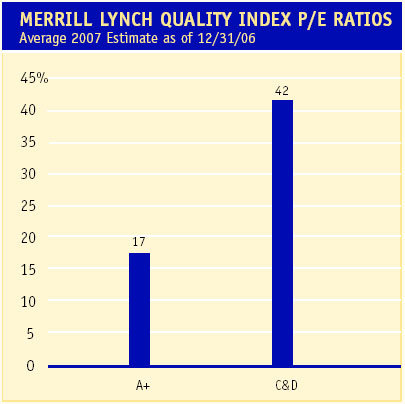

Why is this significant now? We think that in the current economic and stock-market cycles, high-quality companies offer investors several advantages, especially when compared to lower-quality stocks. Economic growth has slowed, corporate profit growth has likely peaked, and global liquidity has shown signs of contracting. Traditionally, more modest economic growth, coupled with an erosion of excess global liquidity, has favored higher quality stocks, as money flows to safer investments. Although it may seem surprising in light of small-cap value’s recent results, many high-quality small-cap stocks look attractively undervalued to us in the current market climate. Moving the capitalization parameters beyond small-cap, quality still appears undervalued. According to the Merrill Lynch Quantitative Strategy Quality Indices, the highest quality stocks (those with “A+” ratings) had an average forward price to earnings ratio of 17 times 2007 earnings, while the lowest quality stocks (those with “C” or “D” ratings) traded at an average 42 times 2007 earnings at the end of December 2006 (See the chart below).

We have always believed that smaller companies with sound fundamentals should deliver strong absolute returns over the long term, especially when purchased at attractively low prices (a critical element in our security selection process). Our quest for quality typically begins with an examination of a company’s historical returns. We examine a business’s returns over full market cycles, with close emphasis paid to seeing precisely how those returns |

| |

Source: Merrill Lynch |

| |

|

We think that in the current economic and stock-market cycles, high-quality companies offer investors several advantages, especially when compared to lower-quality stocks.

|

|

THIS PAGE IS NOT PART OF THE 2006 ANNUAL REPORT TO STOCKHOLDERS | 7 |

| |

repair expenditures? Are there any

notices or indications of pending

litigation? We take an in-depth

look at the ratio of retained earnings

to total equity and capitalized

items such as development costs.

All of these factors may have a

bearing on a company’s—and by

extension our own— exposure to

risk. We take time to look back and

compare balance sheets (as well as

the rest of the financial statements)

from previous years because we are

interested in the history of a

company. We look for changes from

period to period that can tell us

about a company’s direction. If the

balance sheet takes a shape we

like, we want to understand how it

evolved to its current status.

The process of balance sheet

analysis is often time-consuming,

seldom exciting and certainly never

glamorous. It is critical, however, in

our search to find the kind of healthy

small-cap companies that have

been our mainstay for 30 years.

| | | |

| | | |

| | | |

LETTER TO OUR STOCKHOLDERS |

| | | |

|

| | | |

were achieved. Another metric we examine with particular scrutiny is return on assets (ROA), defined as net income divided by assets. This ratio helps to reveal to us the first markings of a quality company. Of course, for most of our managers, a company’s balance sheet, record of success as a business and potential for a profitable future are also critically important. Our disciplined, bottom-up approach focuses on identifying companies that are generating strong (or improving) free cash flow and returns on capital. Our goal is to find quality companies that are trading at a discount to our estimate of their worth as a business.

We believe that the long-term records of The Royce Funds show that we have successfully identified growing businesses that are capable of both producing free cash and surviving potential difficulties in the stock market or the economy. For example, our three closed-end Funds’ portfolios have significant equity investments in U.S.-traded, non-financial common stocks that have a weighted average return on assets (ROA) greater than such companies contained in the Russell 2000. (See the table below). While these Funds may suffer underperformance periods from time to time, our belief is that a turn to quality in the market would benefit companies with such metrics, especially over long-term, full-market cycles. They are the small-cap universe’s ‘dark horses,’ companies that have strong fundamentals, but so far may not have enjoyed the full benefits of small-cap’s extended run.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Percent of Portfolio/Index |

| | | | | | | | Return on Assets | | | | Included in ROA Calculation |

| | | |

|

| | | | Royce Value Trust | | | | | | | 7.1 | | | | | | | | | 71 | % | | |

| | | |

|

| | | | Royce Micro-Cap Trust | | | | | | | 6.1 | | | | | | | | | 71 | | | |

| | | |

|

| | | | Royce Focus Trust | | | | | | | 12.1 | | | | | | | | | 67 | | | |

| | | |

|

| | | | Russell 2000 | | | | | | | 5.9 | | | | | | | | | 71 | | | |

| | | |

|

| | | | Results are the asset-weighted average trailing 12-month ROA for the U.S.-traded non-financial common stocks in each Fund’s portfolio as of 12/31/06. |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | Here Comes The Sun

The beginning and end points of market cycles are always unpredictable, and the timing of any leadership change often looks arbitrary until well after it has been established. It’s also important to remember that the market’s moves do not always make sense, at least until other, related factors come to light with the passage of time. Small-cap has enjoyed an extraordinary run over the last seven years. However, as this long-term small-cap rally matures, the asset class may become increasingly vulnerable to a correction. We do not see the possibility of either a period of large-cap leadership or a potential small-cap correction as bad news for investors with a long-term outlook. While a downturn would cause pain in the short run for small-cap investors, it would also present ample purchase opportunities. We also think that many of the high-quality small-caps we already own would potentially thrive beyond the difficulties of a hopefully short-term correction. Although a widespread shift to |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

8 | THIS PAGE IS NOT PART OF THE 2006 ANNUAL

REPORT TO STOCKHOLDERS | | | |

| | | | |

|

quality would certainly benefit large-cap stocks—and would be consistent with our recent contention that large-cap is overdue for a stint of market leadership—we believe that it would also benefit stocks with high-quality characteristics throughout the market, including small- and micro-cap stocks. As the song says, “It’s all right.”

|

| | | | | | |

| Sincerely, | | | | | |

| | | | | | |

| |  | |  | |

| Charles M. Royce | | W. Whitney George | | Jack E. Fockler, Jr. | |

| President | | Vice President | | Vice President | |

| | | | | | |

| | | | | | |

| January 31, 2007 | | | | | |

| | | | | | |

| | | | | | |

|

Although a widespread shift to quality would certainly benefit large-cap stocks—and would be consistent with our recent contention that large-cap is overdue for a stint of market leadership—we believe that it would also benefit stocks with high-quality characteristics throughout the market, including small- and micro-cap stocks.

|

|

THIS PAGE IS NOT PART OF THE 2006 ANNUAL REPORT TO STOCKHOLDERS | 9 |

| |

| | | |

| TABLE OF CONTENTS | | |

|

| | | |

| Annual Report to Stockholders | | |

|

| Directors and Officers | | 11 |

|

| Managers’ Discussions of Fund Performance | | |

| | | |

Royce Value Trust | | 12 |

|

Royce Micro-Cap Trust | | 14 |

|

Royce Focus Trust | | 16 |

|

| History Since Inception | | 18 |

|

| Distribution Reinvestment and Cash Purchase Options | | 19 |

|

| Schedules of Investments and Other Financial Statements | | |

| | | |

Royce Value Trust | | 20 |

|

Royce Micro-Cap Trust | | 35 |

|

Royce Focus Trust | | 50 |

|

| Notes to Performance and Other Important Information | | 60 |

|

| Stockholder Meeting Results | | 61 |

|

10 | 2006 ANNUAL REPORT TO STOCKHOLDERS |

| |

| All Directors and Officers may be reached c/o The Royce Funds, 1414 Avenue of the Americas, New York, NY 10019 |

|

| | | |

| NAME AND POSITION: | Charles M. Royce, Director*, President | |

| Age: 67 | Number of Funds Overseen: 25 | |

| Tenure: Since 1982 | Non-Royce Directorships: Director of Technology Investment Capital Corp. | |

Principal Occupation(s) During Past Five Years: President, Chief Investment Officer and Member of Board of Managers of Royce & Associates, LLC (“Royce”) (since October 2001), the Trust’s investment adviser. | |

| | | |

| NAME AND POSITION: | Mark R. Fetting, Director* | |

| Age: 52 | Number of Funds Overseen: 46 | |

| Tenure: Since 2001 | Non-Royce Directorships: Director/Trustee of registered investment companies constituting the 21 Legg Mason Funds. | |

Principal Occupation(s) During Past Five Years: Senior Executive Vice President of Legg Mason, Inc.; Member of Board of Managers of Royce (since October 2001); Division President and Senior Officer, Prudential Financial Group, Inc. and related companies, including Fund Boards and consulting services to subsidiary companies (from 1991 to 2000). Mr. Fetting’s prior business experience includes having served as Partner, Greenwich Associates and Vice President, T. Rowe Price Group, Inc. | |

| |

| | | |

| NAME AND POSITION: | Donald R. Dwight, Director | |

| Age: 75 | Number of Funds Overseen: 25 | |

| Tenure: Since 1998 | Non-Royce Directorships: None | |

Principal Occupation(s) During Past Five Years: President of Dwight Partners, Inc., corporate communications consultant; Chairman (from 1982 to March 1998) and Chairman Emeritus (since March 1998) of Newspapers of New England, Inc. Mr. Dwight’s prior experience includes having served as Lieutenant Governor of the Commonwealth of Massachusetts, as President and Publisher of Minneapolis Star and Tribune Company and as a Trustee of the registered investment companies constituting the Eaton Vance Funds. | |

| | | |

| NAME AND POSITION: | Richard M. Galkin, Director | |

| Age: 68 | Number of Funds Overseen: 25 | |

| Tenure: Since 1982 | Non-Royce Directorships: None | |

Principal Occupation(s) During Past Five Years: Private investor. Mr. Galkin’s prior business experience includes having served as President of Richard M. Galkin Associates, Inc., telecommunications consultants, President of Manhattan Cable Television (a subsidiary of Time, Inc.), President of Haverhills Inc. (another Time, Inc. subsidiary), President of Rhode Island Cable Television and Senior Vice President of Satellite Television Corp. (a subsidiary of Comsat). | |

| | | |

| NAME AND POSITION: | Stephen L. Isaacs, Director | |

| Age: 67 | Number of Funds Overseen: 25 | |

| Tenure: Since 1989 | Non-Royce Directorships: None | |

Principal Occupation(s) During Past Five Years: President of The Center for Health and Social Policy (since September 1996); Attorney and President of Health Policy Associates, Inc., consultants. Mr. Isaacs’s prior business experience includes having served as Director of Columbia University Development Law and Policy Program and Professor at Columbia University (until August 1996). | |

| | | |

| NAME AND POSITION: | William L. Koke, Director | |

| Age: 72 | Number of Funds Overseen: 25 | |

| Tenure: Since 1996 | Non-Royce Directorships: None | |

Principal Occupation(s) During Past Five Years: Private investor. Mr. Koke’s prior business experience includes having served as President of Shoreline Financial Consultants, Director of Financial Relations of SONAT, Inc., Treasurer of Ward Foods, Inc. and President of CFC, Inc. | |

| | | |

| NAME AND POSITION: | Arthur S. Mehlman, Director | |

| Age: 64 | Number of Funds Overseen: 46 | |

| Tenure: Since 2004 | Non-Royce Directorships: Director/Trustee of registered investment companies constituting the 21 Legg Mason Funds and Director of Municipal Mortgage & Equity, LLC. | |

Principal Occupation(s) During Past Five Years: Director of The League for People with Disabilities, Inc.; Director of University of Maryland Foundation (non-profits). Formerly: Director of University of Maryland College Park Foundation (non-profit) (from 1998 to 2005); Partner, KPMG LLP (international accounting firm) (from 1972 to 2002); Director of Maryland Business Roundtable for Education (from July 1984 to June 2002). | |

| | | |

| | | |

| | |

| NAME AND POSITION: | David L. Meister, Director |

| Age: 67 | Number of Funds Overseen: 25 |

| Tenure: Since 1982 | Non-Royce Directorships: None |

Principal Occupation(s) During Past Five Years: Consultant. Chairman and Chief Executive Officer of The Tennis Channel (from June 2000 to March 2005). Chief Executive officer of Seniorlife.com (from December 1999 to May 2000). Mr. Meister’s prior business experience includes having served as a consultant to the communications industry, President of Financial News Network, Senior Vice President of HBO, President of Time-Life Films and Head of Broadcasting for Major League Baseball. |

| | |

| NAME AND POSITION: | G. Peter O’Brien, Director |

| Age: 61 | Number of Funds Overseen: 46 |

| Tenure: Since 2001 | Non-Royce Directorships: Director/Trustee of registered investment companies constituting the 21 Legg Mason Funds; Director of Technology Investment Capital Corp. |

Principal Occupation(s) During Past Five Years: Trustee Emeritus of Colgate University (since 2005); Board Member of Hill House, Inc. (since 1999); Formerly: Trustee of Colgate University (from 1996 to 2005), President of Hill House, Inc. (from 2001 to 2005) and Managing Director/Equity Capital Markets Group of Merrill Lynch & Co. (from 1971 to 1999). |

|

| | |

| NAME AND POSITION: | John D. Diederich, Vice President and Treasurer |

| Age: 55 | |

| Tenure: Since 2001 | |

Principal Occupation(s) During Past Five Years: Chief Operating Officer, Managing Director and member of the Board of Managers of Royce; Chief Financial Officer of Royce (since March 2002); Director of Administration of the Trust; and President of RFS, having been employed by Royce since April 1993. |

| | |

| NAME AND POSITION: | Jack E. Fockler, Jr., Vice President |

| Age: 48 | |

| Tenure: Since 1995 | |

Principal Occupation(s) During Past Five Years: Managing Director and Vice President of Royce, and Vice President of RFS, having been employed by Royce since October 1989. |

| | |

| NAME AND POSITION: | W. Whitney George, Vice President |

| Age: 48 | |

| Tenure: Since 1995 | |

Principal Occupation(s) During Past Five Years: Managing Director and Vice President of Royce, having been employed by Royce since October 1991. |

| | |

| NAME AND POSITION: | Daniel A. O’Byrne, Vice President and Assistant Secretary |

| Age: 44 | |

| Tenure: Since 1994 | |

Principal Occupation(s) During Past Five Years: Principal and Vice President of Royce, having been employed by Royce since October 1986. |

| | |

| NAME AND POSITION: | John E. Denneen, Secretary and Chief Legal Officer |

| Age: 39 | |

| Tenure: 1996-2001 and Since April 2002 | |

Principal Occupation(s) During Past Five Years: General Counsel (Deputy General Counsel prior to 2003), Principal, Chief Legal and Compliance Officer and Secretary of Royce (since March 2002); Secretary of The Royce Funds (from 1996 to 2001 and since April 2002); and Principal of Credit Suisse First Boston Private Equity (from 2001 to 2002). |

| | |

| NAME AND POSITION: | Lisa Curcio, Chief Compliance Officer |

| Age: 47 | |

| Tenure: Since 2004 | |

Principal Occupation(s) During Past Five Years: Chief Compliance Officer of The Royce Funds (since October 2004); Compliance Officer of Royce (since June 2004); Vice President, The Bank of New York (from February 2001 to June 2004). |

| | |

|

| * | Interested Director. |

| |

2006 ANNUAL REPORT TO STOCKHOLDERS | 11 |

| |

ROYCE VALUE TRUST

AVERAGE ANNUAL NAV TOTAL RETURNS

Through 12/31/06 | |  Manager’s Discussion Manager’s DiscussionRoyce Value Trust’s (RVT) diversified portfolio of small- and micro-cap stocks more than participated in the mostly good times for small-cap stocks in 2006. The Fund gained 19.5% on a net asset value (NAV) basis and 21.0% on a market price basis, compared to calendar-year returns of 18.4% for the Russell 2000 and 15.1% for the S&P 600. In the third quarter, RVT was up 0.7% on an NAV basis and 8.0% on a market price basis, versus a gain of 0.4% for the Russell 2000 and a loss of 0.9% for the S&P 600. The fourth quarter arrived with a strong rally that closed out the year. The Fund was up 8.2% on an NAV basis and 11.3% on a market price basis, compared to gains of 8.9% for the Russell 2000 and 7.9% for the S&P 600.

RVT’s solid NAV return in 2006 contributed to its strong absolute and relative results over market-cycle and other long-term periods. From the previous small-cap market peak on 3/9/00 through 12/31/06, RVT gained 131.4% versus 41.7% for the Russell 2000 and 90.0% for the S&P 600. During the more bullish phase from the small-cap market trough on 10/9/02 through 12/31/06, the Fund was up 163.5% compared to a gain of 153.5% for the Russell 2000 and 143.7% for the S&P 600. On both an NAV and market price basis, RVT outperformed both of its small-cap benchmarks for the one-, three-, five-, 10-, 15-, 20-year and since inception (11/26/86) periods ended 12/31/06. (The Fund celebrated its twentieth anniversary in November 2006.) RVT’s average annual NAV total return since inception was 13.0%.

While each of the Fund’s equity sectors had positive net gains, holdings in Industrial Products led the way in dollar-based net gains for the full year (as well as in the fourth quarter). Companies in the machinery industry posted the sector’s highest net gains on a dollar basis, though they were not as dominant in the second half as in the first. The metals and distributions and other industrial products industries also showed strong dollar-based gains. Kimball International is a company that we have owned since 1989. The firm, whose low debt and consistent dividend helped to draw and maintain our attraction, makes wood furniture and cabinets, as well as electronic assembly products. Better-than-expected fiscal third- and fourth-quarter earnings, as well as new opportunities for its electronics division, seemed to attract more investors. Unlike many stocks in 2006, Kimball’s price climbed relatively later and more consistently, taking off in May and climbing steadily from then on. We trimmed our position in November.

The same month saw us make a small trim to our position in asset management company, AllianceBernstein Holding. We have long admired the firm for its success in a business that we know well. The Fund’s largest holding at the end of the year, it was also the largest net gainer on a dollar basis in 2006, as the firm benefited from rising profits and earnings. Although our current position dates back to 2000, we have owned the stock periodically since 1993. Fine art, antique and collectibles auction house Sotheby’s was first selected for RVT’s portfolio in 1990, All performance information in this Report reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Funds’ P/E ratio calculations exclude companies with zero or negative earnings. |

|

Fourth Quarter 2006* | | 8.23 | % |

|

July-December 2006* | | 8.99 | |

|

One-Year | | | | | | | | 19.50 | |

|

Three-Year | | | | | | | | 16.30 | |

|

Five-Year | | | | | | | | 13.32 | |

|

10-Year | | | | | | | | 13.96 | |

|

15-Year | | | | | | | | 14.14 | |

|

20-Year | | | | | | | | 13.05 | |

|

Since Inception (11/26/86) | | 12.99 | |

|

CALENDAR YEAR NAV TOTAL RETURNS |

|

Year | | RVT | | | Year | | | RVT | |

|

2006 | | 19.5 | % | | 1996 | | | 15.5 | % |

|

2005 | | 8.4 | | | 1995 | | | 21.1 | |

|

2004 | | 21.4 | | | 1994 | | | 0.1 | |

|

2003 | | 40.8 | | | 1993 | | | 17.3 | |

|

2002 | | -15.6 | | | 1992 | | | 19.3 | |

|

2001 | | 15.2 | | | 1991 | | | 38.4 | |

|

2000 | | 16.6 | | | 1990 | | | -13.8 | |

|

1999 | | 11.7 | | | 1989 | | | 18.3 | |

|

1998 | | 3.3 | | | 1988 | | | 22.7 | |

|

1997 | | 27.5 | | | 1987 | | | -7.7 | |

| | | | | | | | | | |

TOP 10 POSITIONS

% of Net Assets Applicable

to Common Stockholders |

|

AllianceBernstein Holding L.P. | | 2.3 | % |

|

Ritchie Bros. Auctioneers | | 1.4 | |

|

Sotheby’s | | 1.3 | |

|

SEACOR Holdings | | 1.3 | |

|

Lincoln Electric Holdings | | 1.2 | |

|

Newport Corporation | | 1.1 | |

|

Universal Compression Holdings | | 1.0 | |

|

Adaptec | | 1.0 | |

|

Brady Corporation Cl. A | | 0.9 | |

|

Ash Grove Cement Cl. B | | 0.9 | |

| | | | | | | | | | |

PORTFOLIO SECTOR BREAKDOWN

% of Net Assets Applicable

to Common Stockholders |

|

Technology | | 24.2 | % |

|

Industrial Products | | 17.7 | |

|

Industrial Services | | 13.0 | |

|

Financial Intermediaries | | 11.0 | |

|

Natural Resources | | 10.3 | |

|

Financial Services | | 8.2 | |

|

Health | | 7.0 | |

|

Consumer Services | | 6.5 | |

|

Consumer Products | | 4.7 | |

|

Utilities | | 0.2 | |

|

Diversified Investment Companies | | 0.1 | |

|

Miscellaneous | | 5.0 | |

|

Bonds & Preferred Stocks | | 0.2 | |

|

Cash and Cash Equivalents | | 10.5 | |

12 | 2006 ANNUAL REPORT TO STOCKHOLDERS

Performance and Portfolio Review

| | | |

though we took our current position in 1998. Its leadership in its field has long been a source of our attraction. Its share price was volatile, but moved mostly upward in 2006. First purchased in 1998, SEACOR Holdings is a relative newcomer to RVT’s portfolio. The company engages in the ownership, operation, marketing and remarketing of mostly marine transportation and oil and gas equipment. Better-than-expected earnings fueled the rise in its stock price, and we sold a small number of shares in December.

Net losses at the individual company level were relatively modest. The share prices of many energy-related stocks began to cool down during April and May. The problem for ceramic proppant maker Carbo Ceramics (which we’ve owned since 1996) was that its stock price remained in a downdraft for much of the rest of the year. (Proppants are used in the hydraulic fracturing of natural gas and oil wells.) Its balance sheet remained strong and earnings were positive, so we increased our stake in October. Forward Air provides various transportation and logistics services. Its calendar third-quarter earnings were positive, but lower than what analysts were anticipating, which helped to speed the decline of its share price. | | PORTFOLIO DIAGNOSTICS |

GOOD IDEAS THAT WORKED

2006 Net Realized and Unrealized Gain

| | |

|

| | | Average Market Capitalization | $1,188 million |

| | |

|

| AllianceBernstein Holding L.P. | $8,396,172 | | | Weighted Average P/E Ratio | 20.2x |

| | |

|

| Sotheby’s | 6,142,632 | | | Weighted Average P/B Ratio | 2.3x |

| | |

|

| Kimball International Cl. B | 6,012,659 | | | Weighted Average Yield | 0.8% |

| | |

|

| SEACOR Holdings | 4,755,130 | | | Fund Net Assets | $1,180 million |

| | |

|

| Newport Corporation | 4,626,089 | | | Turnover Rate | 21% |

| | | | |

|

| | | | | Net Leverage* | 8% |

GOOD IDEAS AT THE TIME

2006 Net Realized and Unrealized Loss

| | |

|

| | | Symbol | |

| Carbo Ceramics | $2,796,270 | | | Market Price | RVT |

| | | NAV | XRVTX |

| Forward Air | 1,812,269 | | | *Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets applicable to Common Stockholders. |

| | |

| First Albany Companies | 1,620,963 | | |

| | | | | | |

| PXRE Group | 1,390,701 | | | CAPITAL STRUCTURE

Publicly Traded Securities Outstanding at

12/31/06 at NAV or Liquidation Value |

| | |

| Cimarex Energy | 1,285,273 | | |

| | | |

|

| | | | 57.3 million shares

of Common Stock | $1,180 million |

| | | |

|

1 Reflects the cumulative total return of an investment made by a stockholder who purchased one share at inception ($10.00 IPO), reinvested all annual distributions as indicated and fully participated in primary subscriptions of the Fund’s rights offerings.

2 Reflects the actual market price of one share as it traded on the NYSE. | | 5.90% Cumulative

Preferred Stock | $220 million |

| | | | | |

| | RISK/RETURN COMPARISON

Five-Year Period Ended 12/31/06 |

| |

|

| | | Average Annual

Total Return | Standard Deviation | Return

Efficiency* |

| |

|

| | RVT (NAV) | 13.32% | 16.95 | 0.79 |

| |

|

| | S&P 600 | 12.49 | 15.52 | 0.80 |

| |

|

| | Russell 2000 | 11.39 | 17.16 | 0.66 |

| | *Return Efficiency is the average annual total return divided by the annualized standard deviation over a designated time period. |

| | | | | |

| |  |

2006 ANNUAL REPORT TO STOCKHOLDERS | 13

ROYCE MICRO-CAP TRUST

AVERAGE ANNUAL NAV TOTAL RETURNS

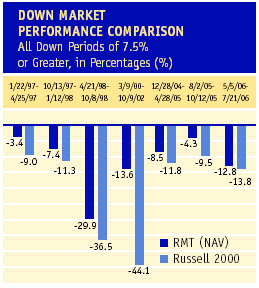

Through 12/31/06 | |  Manager’s Discussion Manager’s DiscussionHelped by a strong surge from micro-caps at the end of the year, the diversified portfolio of Royce Micro-Cap Trust (RMT) posted solid results on both an absolute and relative basis in 2006. RMT gained 22.5% on a net asset value (NAV) basis and 26.7% on a market price basis versus a return of 18.4% for the Russell 2000, the Fund’s small-cap benchmark. In a year that began and ended with vigorous rallies, RMT initially participated only on an NAV basis, with respective NAV and market price gains of 15.2% and 7.00% versus the Russell 2000’s return of 13.9% in the the first quarter. When stock prices fell in the second quarter, RMT displayed impressive down-market strength, losing 3.2% on an NAV basis and 2.3% on a market price basis, both results ahead of the Russell 2000’s 5.0% decline. The flatter-return period of the third quarter saw the Fund giving back some NAV gain, while it continued to be solid on a market price basis. RMT was down 0.3% an NAV basis between July and September, compared to gains of 2.8% in its market price and 0.4% for its small-cap benchmark.

In the rally that enlivened the fourth quarter, the Fund shone on both an NAV and market price basis. RMT gained 10.1% on an NAV basis and an impressive 17.9% on a market price basis versus an 8.9% return for the Russell 2000. From the interim small-cap peak on 5/5/06 through 12/31/06, the Fund was up 3.0% on an NAV basis and 14.7% on a market price basis, both results again better than the small-cap index’s return of 1.6%. Although this latter period represented a short time period, we were pleased with the Fund’s sturdy NAV showing considering the historical volatility and vulnerability of micro-cap stocks.

We were also pleased with the Fund’s NAV results over full market cycle and other long-term periods on both an absolute and relative basis. These are the most critical time spans when it comes to evaluating performance. From the small-cap market peak on 3/9/00 through 12/31/06, RMT gained 147.2% on an NAV basis (+232.6% on a market price basis) versus 47.1% for the Russell 2000. Perhaps more notable was its gain during the mostly bullish phase that ran from the small-cap market trough on 10/9/02 through 12/31/06, a period in which RMT gained 186.2% on an NAV basis (+253.5% on a market price basis) compared to the Russell 2000’s gain of 153.5%.The Fund also outperformed its benchmark for the one-, three-, five, 10-year and since inception (12/14/93) periods on both an NAV and market price basis. RMT’s average annual NAV total return since inception was 14.6%.

Each of the Fund’s sectors posted net gains in 2006, with Technology and Industrial Products in the lead on a dollar basis. At the individual company level, the Fund’s top net gainers came from several different sectors and industry groups, with no single area truly dominating. Securities broker International Assets Holding is involved in asset management. The announcement in June of record revenues and earnings for its fiscal third quarter appeared to attract more investors to the firm’s stock. We took some gains between June and December. La All performance information in this Report reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Funds’ P/E ratio calculations exclude companies with zero or negative earnings. |

|

Fourth Quarter 2006* | | 10.07 | % |

|

July-December 2006* | | 9.74 | |

|

One-Year | | | | | | | | 22.46 | |

|

Three-Year | | | | | | | | 15.77 | |

|

Five-Year | | | | | | | | 15.78 | |

|

10-Year | | | | | | | | 14.62 | |

|

Since Inception (11/26/86) | | 14.58 | |

|

CALENDAR YEAR NAV TOTAL RETURNS |

|

Year | | RMT | | | Year | | | RMT | |

|

2006 | | 22.5 | % | | 1999 | | | 12.7 | % |

|

2005 | | 6.8 | | | 1998 | | | -4.1 | |

|

2004 | | 18.7 | | | 1997 | | | 27.1 | |

|

2003 | | 55.6 | | | 1996 | | | 16.6 | |

|

2002 | | -13.8 | | | 1995 | | | 22.9 | |

|

2001 | | 23.4 | | | 1994 | | | 5.0 | |

|

2000 | | 10.9 | | | | | | | |

| | | | | | | | | | |

TOP 10 POSITIONS

% of Net Assets Applicable

to Common Stockholders |

|

ASA Bermuda | | 1.4 | % |

|

Seneca Foods | | 1.3 | |

|

Highbury Financial | | 1.2 | |

|

Covansys Corporation | | 1.2 | |

|

First Consulting Group | | 1.1 | |

|

PAREXEL International | | 1.0 | |

|

TriZetto Group (The) | | 1.0 | |

|

Aceto Corporation | | 1.0 | |

|

Universal Truckload Services | | 0.9 | |

|

Transaction Systems

Architects Cl. A | | 0.9 | |

| | | | | | | | | | |

PORTFOLIO SECTOR BREAKDOWN

% of Net Assets Applicable

to Common Stockholders |

|

Technology | | 24.3 | % |

|

Health | | 16.9 | |

|

Industrial Products | | 14.9 | |

|

Industrial Services | | 12.8 | |

|

Financial Intermediaries | | 10.1 | |

|

Natural Resources | | 9.4 | |

|

Consumer Services | | 5.7 | |

|

Consumer Products | | 5.6 | |

|

Financial Services | | 3.6 | |

|

Diversified Investment Companies | | 1.9 | |

|

Miscellaneous | | 4.9 | |

|

Preferred Stock | | 0.5 | |

|

Cash and Cash Equivalents | | 6.9 | |

14 | 2006 ANNUAL REPORT TO STOCKHOLDERS

Performance and Portfolio Review

| | | |

Senza Corporation is a women’s apparel retailer based in Canada whose stock we first purchased in 1995. Its share price climbed when its acquisition by a larger competitor was announced in November, which prompted us to sell our position at a substantial net gain. A happy exception to the woes that afflicted many healthcare stocks in 2006 was the terrific performance of First Consulting Group, which provides management and other services to healthcare, pharmaceutical and life sciences businesses. We liked its niche business and balance sheet. The earnings strength of this top-ten position seemed to take Wall Street by surprise in 2006, which in turn drew more investors to its stock.

Net losses for individual companies in the portfolio were generally small. Multi-business holding company BB Holdings spun off a subsidiary that trades in the U.S., but its own domestic de-listing drove investors away from the stock, which continues to trade on the London Exchange. American Bank Note Holographics, a firm that produces holograms for currency, credit card identification and document security saw its stock price fall 60% in March on news that a major credit card company would no longer be using the firm’s security stripe. Its stock was only able to mount a slight rebound. We held on to our position owing to our regard for its niche business, balance sheet and positive earnings. | | PORTFOLIO DIAGNOSTICS |

GOOD IDEAS THAT WORKED

2006 Net Realized and Unrealized Gain

| | |

|

| | | Average Market Capitalization | $280 million |

| | |

|

| International Assets Holding | $2,795,352 | | | Weighted Average P/E Ratio | 18.6x* |

| | |

|

| La Senza Corporation | 2,537,402 | | | Weighted Average P/B Ratio | 1.9x |

| | |

|

| First Consulting Group | 2,167,383 | | | Weighted Average Yield | 0.6% |

| | |

|

| Volt Information Sciences | 1,884,059 | | | Fund Net Assets | $344 million |

| | |

|

| Covansys Corporation | 1,729,279 | | | Turnover Rate | 34% |

| | | | |

|

| | | | | Net Leverage† | 11% |

GOOD IDEAS AT THE TIME

2006 Net Realized and Unrealized Loss

| | |

|

| | | Symbol | |

| BB Holdings | $1,513,960 | | | Market Price | RMT |

| | | NAV | XOTCX |

| American Bank Note Holographics | 838,012 | | | *Excludes 18% of portfolio holdings with zero or negative earnings as of 12/31/06. †Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets, applicable to Common Stockholders. |

| | |

| Stein Mart | 728,121 | | |

| | |

| America’s Car-Mart | 719,317 | | | | | | |

| | | CAPITAL STRUCTURE

Publicly Traded Securities Outstanding at

12/31/06 at NAV or Liquidation Value |

| Hi-Tech Pharmacal | 637,230 | | |

| | | |

|

| | | | 23.3 million shares

of Common Stock | $344 million |

| | | |

|

1 Reflects the cumulative total return of an investment made by a stockholder who purchased one share at inception ($7.50 IPO), reinvested distributions as indicated and fully participated in the primary subscription of the 1994 rights offering.

2 Reflects the actual market price of one share as it traded on Nasdaq and, beginning on 12/1/03, on the NYSE. | | 6.00% Cumulative

Preferred Stock | $60 million |

| | | | | |

| | RISK/RETURN COMPARISON

Five-Year Period Ended 12/31/06 |

| |

|

| | | Average Annual

Total Return | Standard Deviation | Return

Efficiency* |

| |

|

| | RMT (NAV) | 15.78% | 17.83 | 0.89 |

| |

|

| | Russell 2000 | 11.39 | 17.16 | 0.66 |

| | *Return Efficiency is the average annual total return divided by the annualized standard deviation over a designated time period. |

| | | | | |

| |  |

2006 ANNUAL REPORT TO STOCKHOLDERS | 15

ROYCE FOCUS TRUST

AVERAGE ANNUAL NAV TOTAL RETURNS

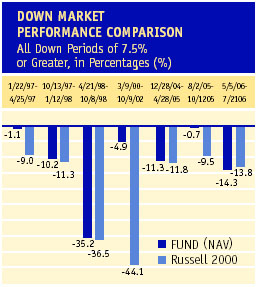

Through 12/31/06 | |  Manager’s Discussion Manager’s DiscussionAlthough its calendar-year net asset value (NAV) performance suffered a bit in comparison to its small-cap benchmark, the Russell 2000, we were pleased with the results for Royce Focus Trust (FUND) on an absolute basis. FUND gained 15.9% on an NAV basis, and an impressive 30.5% on a market price basis, compared to a gain of 18.4% for the Russell 2000. In all but one quarter in 2006, the Fund’s NAV results went much the way that we would expect, with solid up-market turns in the dynamic first and fourth quarters and slightly better relative downmarket performance in the bearish second quarter. During the bullish first quarter, the Fund was up 13.6% on an NAV basis and 18.4% on a market price basis, compared to a 13.9% gain for the Russell 2000. The second quarter saw the Fund lose 4.8% on an NAV basis and 6.5% on a market price basis, while the Russell 2000 declined 5.0%.

However, in the underwhelming environment of the third quarter, FUND declined 3.6% on an NAV basis, compared to a gain of 0.4% for both its market price and the Russell 2000. The Fund rebounded nicely in the fourth quarter, when stock prices in general were on the rise. On an NAV basis, FUND was up 11.2% (+17.5% on a market price basis) versus a return of 8.9% for the small-cap index. So while the portfolio did well to make up for its difficult third quarter, it was not enough to push its calendar-year return past that of the Russell 2000.

The Fund once again posted strong absolute and superior relative results over market-cycle and other long-term performance periods. From the previous small-cap market peak on 3/9/00 through 12/31/06, the Fund gained 200.5% on an NAV basis (+293.4% on a market price basis) versus 41.7% for the Russell 2000. In the more bullish period from the small-cap market trough on 10/9/02 through 12/31/06, FUND’s NAV return was 215.9% (+266.8% on a market price basis) versus a gain of 153.5% for its small-cap benchmark. On both an NAV and market price basis, FUND outperformed the Russell 2000 for the three-, five-, 10-year and since inception of Royce’s management (11/1/96) periods ended 12/31/06. The Fund’s average annual NAV total return since the inception of our management was 14.4%.

The Industrial Products, Natural Resources and Technology sectors led the way for the year as a whole in dollar-based net gains. Net losses at the individual company level were relatively modest, however disappointing. Multi-business holding company BB Holdings spun off a subsidiary that trades in the U.S., but the prospect of its own domestic de-listing sent investors fleeing. Its stock continues to trade in London, and we added to our stake during May and June. Canadian energy services company Trican Well Service manufactures piping and drilling equipment and provides oil well completion, maintenance and repair services. Its share price hit an all-time high early in 2006 and was mostly on a downward slide through the rest of the year, even as it continued to post solid earnings. After trimming our position between early 2005 and February 2006, we began to purchase shares at what we judged to be attractive prices during All performance information in this Report reflects past performance, is presented on a total return basis and reflects the reinvestment of distributions. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current performance may be higher or lower than performance quoted. Current month-end performance may be obtained at www.roycefunds.com. The Funds’ P/E ratio calculations exclude companies with zero or negative earnings. |

|

Fourth Quarter 2006* | | 11.17 | % |

|

July-December 2006* | | 7.18 | |

|

One-Year | | | | | | | | 15.85 | |

|

Three-Year | | | | | | | | 19.42 | |

|

Five-Year | | | | | | | | 18.12 | |

|

10-Year | | | | | | | | 14.09 | |

|

Since Inception (11/1/96)† | | 14.35 | |

† Royce & Associates assumed investment management responsibility for the Fund on 11/1/96. |

CALENDAR YEAR NAV TOTAL RETURNS |

|

Year | | FUND | | | Year | | | FUND | |

|

2006 | | 15.9 | % | | 2001 | | | 10.0 | % |

|

2005 | | 13.3 | | | 2000 | | | 20.9 | |

|

2004 | | 29.2 | | | 1999 | | | 8.7 | |

|

2003 | | 54.3 | | | 1998 | | | -6.8 | |

|

2002 | | -12.5 | | | 1997 | | | 20.5 | |

| | | | | | | | | | |

TOP 10 POSITIONS

% of Net Assets Applicable

to Common Stockholders |

|

New Zealand Government 6.00% Bond | | 4.4 | % |

|

Athena Neurosciences Finance 7.25% Bond | | 3.9 | |

|

IPSCO | | 3.6 | |

|

Harris Steel Group | | 3.5 | |

|

Canadian Government 3.00% Bond | | 3.3 | |

|

Simpson Manufacturing | | 3.0 | |

|

Metal Management | | 3.0 | |

|

Silver Standard Resources | | 2.9 | |

|

Ivanhoe Mines | | 2.8 | |

|

Florida Rock Industries | | 2.7 | |

| | | | | | | | | | |

PORTFOLIO SECTOR BREAKDOWN

% of Net Assets Applicable

to Common Stockholders |

|

Industrial Products | | 25.9 | % |

|

Natural Resources | | 21.8 | |

|

Technology | | 7.5 | |

|

Health | | 6.4 | |

|

Consumer Services | | 6.0 | |

|

Consumer Products | | 5.5 | |

|

Financial Intermediaries | | 4.0 | |

|

Industrial Services | | 3.0 | |

|

Financial Services | | 2.6 | |

|

Bonds | | 11.6 | |

|

Cash and Cash Equivalents | | 21.5 | |

16 | 2006 ANNUAL REPORT TO STOCKHOLDERS

Performance and Portfolio Review

| | | |

July and October. Orchid Cellmark has a dominant position in DNA testing, a promising niche business that we liked a great deal. However, it struggled with losses and meeting new regulations and the resulting accounting difficulties left us with enough uncertainty about the firm’s future prospects to sell our position in August.

Within Industrial Products, several holdings posted impressive net gains. Top-ten holding Harris Steel Group processes, fabricates and installs steel products. Its price began to rise in November with news of a second consecutive quarter of better-than-expected earnings followed by the announcement of Harris being acquired by a competitor in December. After correcting between May and early September, the share price of scrap metal recycling services company Metal Management showed new life, helped in part by strong earnings. In the Natural Resources sector, several precious metals and mining companies overcame their own stock price corrections to end the year on a high note. Six of the Fund’s 20 top-gaining stocks on a dollar basis came from the precious metals and mining group in 2006, including Silver Standard Resources and Glamis Gold. At year-end, our take on the long-term prospects for both energy and precious metals stocks remained positive. We have chosen to act opportunistically, occasionally buying on dips and at times trimming on upticks, our eyes focused firmly on the long view. | | PORTFOLIO DIAGNOSTICS |

GOOD IDEAS THAT WORKED

2006 Net Realized and Unrealized Gain

| | |

|

| | | Average Market Capitalization | $1,672 million |

| | |

|

| Silver Standard Resources | $2,721,635 | | | Weighted Average P/E Ratio | 11.8x |

| | |

|

| Harris Steel Group | 2,226,162 | | | Weighted Average P/B Ratio | 2.0x |

| | |

|

| Metal Management | 2,119,554 | | | Weighted Average Yield | 1.4% |

| | |

|

| Glamis Gold | 1,699,548 | | | Fund Net Assets | $159 million |

| | |

|

| Lincoln Electric Holdings | 1,564,234 | | | Turnover Rate | 30% |

| | | | |

|

| | | | | Net Leverage* | 0% |

GOOD IDEAS AT THE TIME

2006 Net Realized and Unrealized Loss

| | |

|

| | | Symbol | |

| BB Holdings | $1,121,661 | | | Market Price | FUND |

| | | NAV | XFUNX |

| Trican Well Service | 878,364 | | | *Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets applicable to Common Stockholders. |

| | |

| Orchid Cellmark | 800,561 | | |

| | | | | | |

| International Coal Group | 777,511 | | | CAPITAL STRUCTURE

Publicly Traded Securities Outstanding at

12/31/06 at NAV or Liquidation Value |

| | |

| Ensign Energy Services | 767,313 | | |

| | | |

|

| | | | 16.3 million shares

of Common Stock | $159 million |

| | | |

|

1 Royce & Associates assumed investment management responsibility for the Fund on 11/1/96. 1 Reflects the cumulative total return of a continuous common stockholder who reinvested all distributions as indicated and fully participated in the primary subscription of the 2005 rights offering. 3 Reflects the actual market price of one share as it traded on Nasdaq. | | 6.00% Cumulative

Preferred Stock | $25 million |

| | | | | |

| | RISK/RETURN COMPARISON

Five-Year Period Ended 12/31/06 |

| |

|

| | | Average Annual

Total Return | Standard Deviation | Return

Efficiency* |

| |

|

| | FUND (NAV) | 18.12% | 17.31 | 1.05 |

| |

|

| | Russell 2000 | 11.39 | 17.16 | 0.66 |

| | *Return Efficiency is the average annual total return divided by the annualized standard deviation over a designated time period. |

| | | | | |

| |  |

2006 ANNUAL REPORT TO STOCKHOLDERS | 17

HISTORY SINCE INCEPTION

The following table details the share accumulations by an initial investor in the Funds who reinvested all distributions (including fractional shares) and participated fully in primary subscriptions for each of the rights offerings. Full participation in distribution reinvestments and rights offerings can maximize the returns available to a long-term investor. This table should be read in conjunction with the Performance and Portfolio Reviews of the Funds.

|

| | | | | Amount | | Purchase | | | | | NAV | | Market |

| | History | | Invested | | Price* | | Shares | | | Value** | | Value** |

|

| Royce Value Trust | | | | | | | | | | | | | | | | | | |

| 11/26/86 | | Initial Purchase | | $ | 10,000 | | | $ | 10.000 | | | 1,000 | | | $ | 9,280 | | | $ | 10,000 |

| 10/15/87 | | Distribution $0.30 | | | | | | | 7.000 | | | 42 | | | | | | | | |

| 12/31/87 | | Distribution $0.22 | | | | | | | 7.125 | | | 32 | | | | 8,578 | | | | 7,250 |

| 12/27/88 | | Distribution $0.51 | | | | | | | 8.625 | | | 63 | | | | 10,529 | | | | 9,238 |

| 9/22/89 | | Rights Offering | | | 405 | | | | 9.000 | | | 45 | | | | | | | | |

| 12/29/89 | | Distribution $0.52 | | | | | | | 9.125 | | | 67 | | | | 12,942 | | | | 11,866 |

| 9/24/90 | | Rights Offering | | | 457 | | | | 7.375 | | | 62 | | | | | | | | |

| 12/31/90 | | Distribution $0.32 | | | | | | | 8.000 | | | 52 | | | | 11,713 | | | | 11,074 |

| 9/23/91 | | Rights Offering | | | 638 | | | | 9.375 | | | 68 | | | | | | | | |

| 12/31/91 | | Distribution $0.61 | | | | | | | 10.625 | | | 82 | | | | 17,919 | | | | 15,697 |

| 9/25/92 | | Rights Offering | | | 825 | | | | 11.000 | | | 75 | | | | | | | | |

| 12/31/92 | | Distribution $0.90 | | | | | | | 12.500 | | | 114 | | | | 21,999 | | | | 20,874 |

| 9/27/93 | | Rights Offering | | | 1,469 | | | | 13.000 | | | 113 | | | | | | | | |

| 12/31/93 | | Distribution $1.15 | | | | | | | 13.000 | | | 160 | | | | 26,603 | | | | 25,428 |

| 10/28/94 | | Rights Offering | | | 1,103 | | | | 11.250 | | | 98 | | | | | | | | |

| 12/19/94 | | Distribution $1.05 | | | | | | | 11.375 | | | 191 | | | | 27,939 | | | | 24,905 |

| 11/3/95 | | Rights Offering | | | 1,425 | | | | 12.500 | | | 114 | | | | | | | | |

| 12/7/95 | | Distribution $1.29 | | | | | | | 12.125 | | | 253 | | | | 35,676 | | | | 31,243 |

| 12/6/96 | | Distribution $1.15 | | | | | | | 12.250 | | | 247 | | | | 41,213 | | | | 36,335 |

| 1997 | | Annual distribution total $1.21 | | | | | | | 15.374 | | | 230 | | | | 52,556 | | | | 46,814 |

| 1998 | | Annual distribution total $1.54 | | | | | | | 14.311 | | | 347 | | | | 54,313 | | | | 47,506 |

| 1999 | | Annual distribution total $1.37 | | | | | | | 12.616 | | | 391 | | | | 60,653 | | | | 50,239 |

| 2000 | | Annual distribution total $1.48 | | | | | | | 13.972 | | | 424 | | | | 70,711 | | | | 61,648 |

| 2001 | | Annual distribution total $1.49 | | | | | | | 15.072 | | | 437 | | | | 81,478 | | | | 73,994 |

| 2002 | | Annual distribution total $1.51 | | | | | | | 14.903 | | | 494 | | | | 68,770 | | | | 68,927 |

| 1/28/03 | | Rights Offering | | | 5,600 | | | | 10.770 | | | 520 | | | | | | | | |

| 2003 | | Annual distribution total $1.30 | | | | | | | 14.582 | | | 516 | | | | 106,216 | | | | 107,339 |

| 2004 | | Annual distribution total $1.55 | | | | | | | 17.604 | | | 568 | | | | 128,955 | | | | 139,094 |

| 2005 | | Annual distribution total $1.61 | | | | | | | 18.739 | | | 604 | | | | 139,808 | | | | 148,773 |

| 2006 | | Annual distribution total $1.78 | | | | | | | 19.696 | | | 693 | | | | | | | | |

|

| 12/31/06 | | | | $ | 21,922 | | | | | | | 8,102 | | | $ | 167,063 | | | $ | 179,945 |

|

| Royce Micro-Cap Trust | | | | | | | | | | | | | | | | | | |

| 12/14/93 | | Initial Purchase | | $ | 7,500 | | | $ | 7.500 | | | 1,000 | | | $ | 7,250 | | | $ | 7,500 |

| 10/28/94 | | Rights Offering | | | 1,400 | | | | 7.000 | | | 200 | | | | | | | | |

| 12/19/94 | | Distribution $0.05 | | | | | | | 6.750 | | | 9 | | | | 9,163 | | | | 8,462 |

| 12/7/95 | | Distribution $0.36 | | | | | | | 7.500 | | | 58 | | | | 11,264 | | | | 10,136 |

| 12/6/96 | | Distribution $0.80 | | | | | | | 7.625 | | | 133 | | | | 13,132 | | | | 11,550 |

| 12/5/97 | | Distribution $1.00 | | | | | | | 10.000 | | | 140 | | | | 16,694 | | | | 15,593 |

| 12/7/98 | | Distribution $0.29 | | | | | | | 8.625 | | | 52 | | | | 16,016 | | | | 14,129 |

| 12/6/99 | | Distribution $0.27 | | | | | | | 8.781 | | | 49 | | | | 18,051 | | | | 14,769 |

| 12/6/00 | | Distribution $1.72 | | | | | | | 8.469 | | | 333 | | | | 20,016 | | | | 17,026 |

| 12/6/01 | | Distribution $0.57 | | | | | | | 9.880 | | | 114 | | | | 24,701 | | | | 21,924 |

| 2002 | | Annual distribution total $0.80 | | | | | | | 9.518 | | | 180 | | | | 21,297 | | | | 19,142 |

| 2003 | | Annual distribution total $0.92 | | | | | | | 10.004 | | | 217 | | | | 33,125 | | | | 31,311 |

| 2004 | | Annual distribution total $1.33 | | | | | | | 13.350 | | | 257 | | | | 39,320 | | | | 41,788 |

| 2005 | | Annual distribution total $1.85 | | | | | | | 13.848 | | | 383 | | | | 41,969 | | | | 45,500 |

| 2006 | | Annual distribution total $1.55 | | | | | | | 14.246 | | | 354 | | | | | | | | |

|

| 12/31/06 | | | | $ | 8,900 | | | | | | | 3,479 | | | $ | 51,385 | | | $ | 57,647 |

|

| Royce Focus Trust | | | | | | | | | | | | | | | | | | |

| 10/31/96 | | Initial Purchase | | $ | 4,375 | | | $ | 4.375 | | | 1,000 | | | $ | 5,280 | | | $ | 4,375 |

| 12/31/96 | | | | | | | | | | | | | | | | 5,520 | | | | 4,594 |

| 12/5/97 | | Distribution $0.53 | | | | | | | 5.250 | | | 101 | | | | 6,650 | | | | 5,574 |

| 12/31/98 | | | | | | | | | | | | | | | | 6,199 | | | | 5,367 |