UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04875

Name of Registrant: Royce Small-Cap Trust, Inc.

Address of Registrant: One Madison Avenue

New York, NY 10010

Name and address of agent for service: John E. Denneen, Esq.

One Madison Avenue

New York, NY 10010

Registrant's telephone number, including area code: (212) 508-4500

Date of fiscal year end: December 31

Date of reporting period: January 1, 2024 – December 31, 2024

Item 1. Reports to Shareholders.

| | | | |

| | | | |

| | | | |

| | royceinvest.com | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | Royce Closed-End Funds 2024 Annual | | |

| | | | |

| | Review and Report to Stockholders

December 31, 2024 | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | Royce Global Trust | | |

| | | | |

| | Royce Micro-Cap Trust | | |

| | | | |

| | Royce Small-Cap Trust | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | |

| |  |  | |

| | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

A Few Words on Closed-End Funds

Royce Investment Partners (“Royce”) manages three closed-end funds: Royce Global Trust, which primarily invests in both U.S. and non-U.S. companies with market capitalization below $10 billion; Royce Micro-Cap Trust, which primarily invests in micro-cap securities; and Royce Small-Cap Trust, which primarily invests in small-cap securities. A closed-end fund is an investment company whose shares are listed and traded on a stock exchange. Like all investment companies, including open-end mutual funds, the assets of a closed-end fund are professionally managed in accordance with the investment objectives and policies approved by the fund’s Board of Directors. A closed-end fund raises cash for investment by issuing a fixed number of shares through initial and other public offerings that may include shelf offerings and periodic rights offerings. Proceeds from the offerings are invested in an actively managed portfolio of securities. Investors wanting to buy or sell shares of a publicly traded closed-end fund after the initial and any subsequent offerings must do so on a stock exchange, as with any publicly traded stock. Shares of closed-end funds frequently trade at a discount to their net asset value. This is in contrast to open-end mutual funds, which sell and redeem their shares at net asset value on a continuous basis.

A Closed-End Fund Can Offer Several Distinct Advantages

| • | A closed-end fund does not issue redeemable securities or offer its securities on a continuous basis, so it does not need to liquidate securities or hold uninvested assets to meet investor demands for cash redemptions. |

| • | In a closed-end fund, not having to meet investor redemption requests or invest at inopportune times can be effective for value managers who attempt to buy stocks when prices are depressed and sell securities when prices are high. |

| • | A closed-end fund may invest in less liquid portfolio securities because it is not subject to potential stockholder redemption demands. This is potentially beneficial for Royce-managed closed-end funds, with significant investments in small- and micro-cap securities. |

| • | The fixed capital structure allows permanent leverage to be employed as a means to enhance capital appreciation potential. |

| • | Royce Micro-Cap Trust and Royce Small-Cap Trust distribute capital gains, if any, on a quarterly basis. Each of these Funds has adopted a quarterly distribution policy for its common stock. |

We believe that the closed-end fund structure can be an appropriate investment for a long-term investor who understands the benefits of a more stable pool of capital.

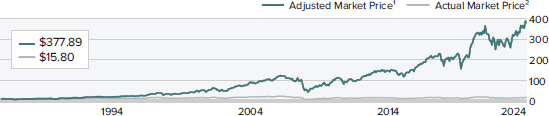

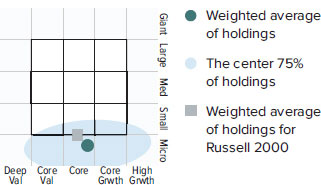

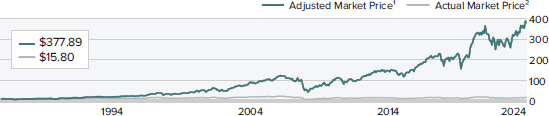

Why Dividend Reinvestment Is Important

A very important component of an investor’s total return comes from the reinvestment of distributions. By reinvesting distributions, our investors can maintain an undiluted investment in a Fund. To get a fair idea of the impact of reinvested distributions, please see the charts on pages 61 and 62. For additional information on the Funds’ Distribution Reinvestment and Cash Purchase Options and the benefits for stockholders, please see page 63 or visit our website at www.royceinvest.com.

Managed Distribution Policy

The Board of Directors of each of Royce Micro-Cap Trust and Royce Small-Cap Trust has authorized a managed distribution policy (MDP). Under the MDP, Royce Micro-Cap Trust and Royce Small-Cap Trust pay quarterly distributions at an annual rate of 7% of the average of the prior four quarter-end net asset values, with the fourth quarter being the greater of these annualized rates or the distribution required by IRS regulations. With each distribution, the Fund will issue a notice to its stockholders and an accompanying press release that provides detailed information regarding the amount and composition of the distribution (including whether any portion of the distribution represents a return of capital) and other information required by a Fund’s MDP. You should not draw any conclusions about a Fund’s investment performance from the amount of distributions or from the terms of a Fund’s MDP. A Fund’s Board of Directors may amend or terminate the MDP at any time without prior notice to stockholders; however, at this time there are no reasonably foreseeable circumstances that might cause the termination of any of the MDPs.

This page is not part of the 2024 Annual Report to Stockholders

Table of Contents

This page is not part of the 2024 Annual Report to Stockholders | 1

Letter to Our Stockholders

A QUICK LOOK BACK

The last several years have not been especially kind to small-cap stocks, at least in relation to their bigger counterparts. The asset class’s long-running historical performance advantage over large-caps—an advantage that often went hand in hand with higher volatility—has steadily eroded. In what, for the purposes of this letter, we’ll call the “Old Normal,” small-cap companies generally had higher long-term returns but also experienced higher volatility, while larger companies trailed but tended to be steadier in their performance patterns. Since the introduction of the Russell Indexes on 12/31/78, a similar pattern often held true for value and growth investing: the former typically enjoyed a better long-term performance record while the latter had higher volatility but also often had attractively high short-term performance.

There were exceptions to these patterns, of course, and the persistence of leadership could span several years. For example, small-cap, and small-cap value in particular, dominated performance from the peak of the Internet bubble in March of 2000 up until the market peaks in the summer of 2007 that presaged the Great Financial Crisis of 2008-09. In retrospect, any path out of that seismic series of events and back to what history might see as normal, or at least typical, was bound to be winding and uncertain. There were also additional and unprecedented

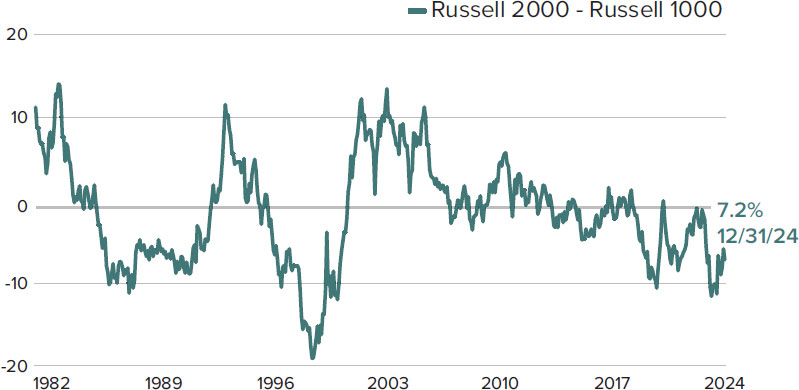

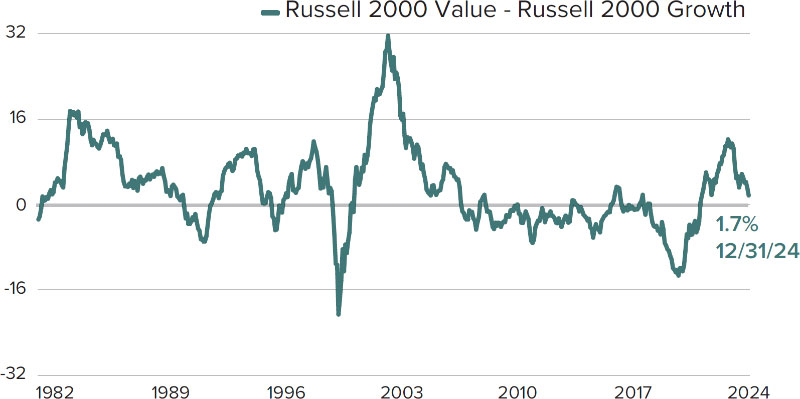

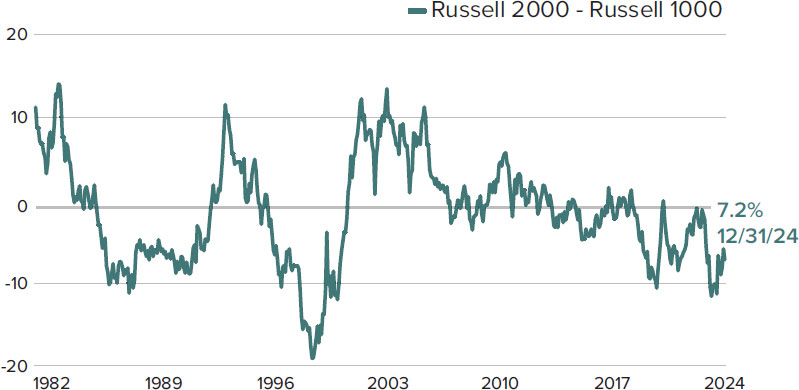

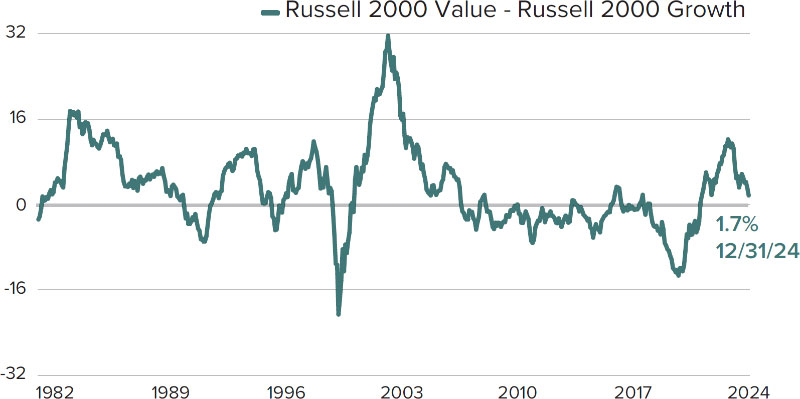

obstacles, the biggest by far being the covid pandemic, which saw policymakers once again slashing rates and keeping the flow of cash into the economy steady and strong. The current period of large-cap leadership, dominated by mega-cap stocks within the big stock cohort, stretches back to 2011, when a steep and sudden bear market lasted from April through October on fears that the economy was falling into a recession. This 14-year span has also been better for small-cap growth than value. The two charts below show the spreads for the 3-year monthly rolling average returns, first for the Russell 2000 and Russell 1000 Indexes and second for the Russell 2000 Value and Growth Indexes from their shared inception dates through 12/31/24.

Leadership Shifts Between Small-Cap and Large-Cap

The Spread of 3-Year Monthly Rolling Average Annual Total Returns for the Russell 2000 and Russell 1000, 12/31/81-12/31/24

Past performance is no guarantee of future results.

2 | This page is not part of the 2024 Annual Report to Stockholders

LETTER TO OUR STOCKHOLDERS

Leadership Shifts Between Small-Cap Value and Growth

The Spread of 3-Year Monthly Rolling Average Annual Total Returns for the Russell 2000 Value and Russell 2000 Growth, 12/31/81-12/31/24

Past performance is no guarantee of future results.

2024 thus marked the eighth straight year of small-cap underperformance relative to large-cap. In fact, the Russell 2000 has beaten the Russell 1000 in only four of the last 20 calendar years, during which large-cap’s average outperformance spread was 6.1%. Small-cap last beat large-cap in 2016, making the period ended 12/31/24 the longest underperformance stretch measured by calendar years since each index’s inception. And while we are all too keenly aware of how long we have been calling for a sustained period of small-cap leadership, we do see several promising signs on the horizon for a sustained leadership phase for small-cap stocks.

DO VALUATIONS FAVOR THE ODDS OF SMALL-CAP LEADERSHIP?

Much ink has been spilled and even more bandwidth has been spent discussing, worrying about, or otherwise focusing on the sky-high state of valuations in the U.S. equity market over the last 12-18 months. We would offer what follows as a corrective to what looks to us like a narrow viewpoint on share prices. Most of these observations have used the S&P 500 as the proxy for the entire market, occasionally adding the Nasdaq Composite or Nasdaq 100. We have no disagreement with the idea that large-cap valuations are unsustainably high. However, small-cap valuations remain attractive versus large-cap valuations, having finished 2024 still near their lowest relative valuation versus large-caps in more than 25 years, based on the index valuation metric we use most: the last 12 months’ enterprise value over earnings before interest & taxes, aka LTM EV/EBIT. The chart below shows this picture in compelling detail—while also revealing that this wide valuation spread has persisted for more than five years.

With small-cap’s underperformance versus large cap having reached an extreme point, it should come as no surprise that small-cap’s weighting in the Russell 3000 Index was also near a historical low at the end of 2024.

Relative Valuations for Small-Caps vs. Large-Caps Are Near Their Lowest in 25 Years

Russell 2000 vs. Russell 1000 Median LTM EV/EBIT1 (ex. Negative EBIT Companies), 12/31/99-12/31/24

1 Enterprise Value/Earnings Before Interest and Taxes

Source: FactSet

This page is not part of the 2024 Annual Report to Stockholders | 3

LETTER TO OUR STOCKHOLDERS

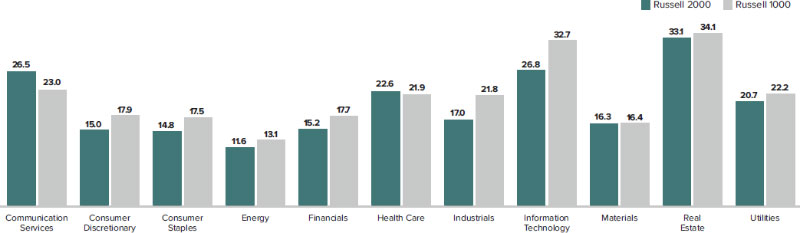

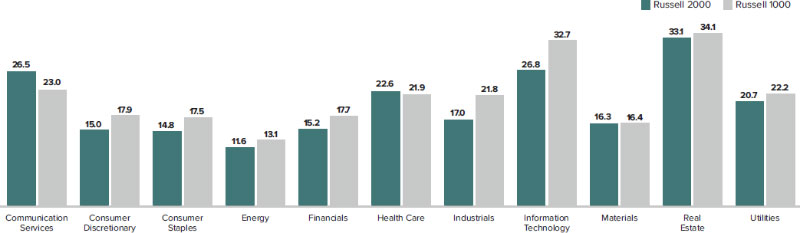

Wide Breadth of Undervaluation Across the Small-Cap Asset Class

Russell 2000 and Russell 1000 Median EV/EBIT1 (ex. Negative EBIT) by Sector as of 12/31/24

1 Enterprise Value/Earnings Before Interest and Taxes

Source: FactSet

Equally, if not more important is the fact that small-cap’s more attractive valuation could be seen across all 11 sectors. These disparities in sector valuations between small- and large-cap are notable, especially in the broad and diverse areas such as Information Technology, Industrials, Financials, and Consumer Discretionary. They add further credence to the idea that, while mega-cap behemoths such as Nvidia or Apple may be priced beyond perfection (or at least reason), attractive bargains can be found in several corners of the small-cap universe. (In fact, Apple’s market cap at the end of 2024 was 122% of the entire Russell 2000.)

However, the most important factor about valuations from our perspective as small-cap specialists is that many companies in the asset class continue to trade at attractively cheap prices on an absolute basis in diverse areas such as machinery; semiconductors & semiconductor equipment; capital markets; electronic equipment, instruments & components; banks; construction & engineering; healthcare; and energy.

EARNING THEIR WAY TO MARKET LEADERSHIP

While attractive absolute and relative valuations for small-caps are noteworthy, valuation is seldom enough to catalyze stock price performance. We are fond of saying that psychology runs the market in the short run, but earnings run it in the long run. Across the U.S. equity markets, earnings are expected to be pretty healthy in 2025, with the current consensus indicating 15% earnings per share (EPS) growth for the Russell 1000, along with solid to strong results anticipated for 4Q24, which are in the midst of being reported and will pick up steam

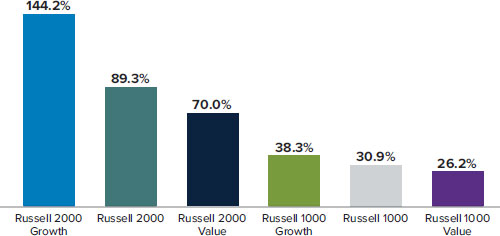

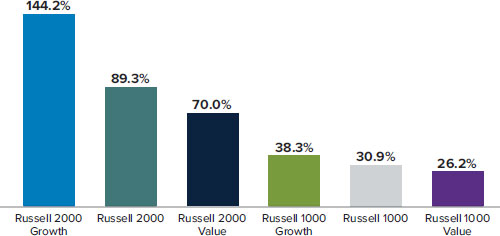

within small-caps as we move further into February. Consensus EPS estimates for the Russell 2000, however, are considerably higher than they are for large-caps in 2025, coming in at an impressive 89.3% versus 30.9% for the Russell 1000.

There is some important context to accompany this encouraging data: the Russell 2000 finished 2024 having endured a two-year earnings recession, so a substantive rebound makes a certain amount of sense. It’s also important to keep in mind that more than 40% of the companies in the Russell 2000 currently have no earnings. We think it’s equally relevant to remind our readers that our own portfolios typically hold companies that have established histories of earnings or those where our respective investment teams have identified a catalyst for earnings to resume or begin.

Average Expected Earnings Growth for 2025-2026

Index Aggregate Estimated Two-Year EPS Growth

Earnings per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. The EPS Growth Estimates are the pre-calculated mean two-year EPS growth rate estimates by brokerage analysts. Estimates are the average of those provided by analysts working for brokerage firms who provide research coverage on each individual security as reported by FactSet. All non-equity securities, investment companies, and companies without brokerage analyst coverage are excluded. Source: FactSet.

4 | This page is not part of the 2024 Annual Report to Stockholders

LETTER TO OUR STOCKHOLDERS

One critical advantage of having been small-cap investors for more than five decades is how it’s bred

a deep appreciation for the cyclical nature of markets and the long-term benefit of contrarian thinking.

Bull markets, bear markets, and long periods of outperformance for one style or asset class—

all are subject to cyclical dynamics, and none lasts forever.

WHAT FOLLOWS LOW-RETURN SMALL-CAP MARKETS?

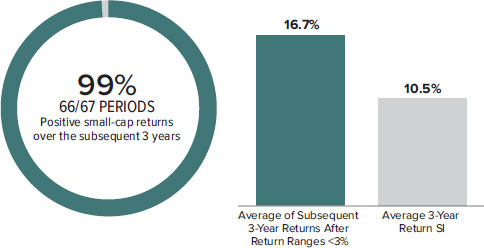

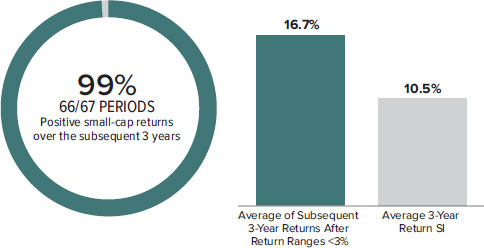

At 12/31/24, the Russell 2000’s 3-year average annual total return was 1.2%, well below the small-cap index’s monthly rolling average 3-year return of 10.5% since inception. This highly underwhelming number perhaps distills the frustrations of small-cap investors better than any other. Yet it may also be a sign that improved results may be close. Subsequent 3-year average annualized performance for small-caps following previous low-return periods have been stellar, as seen in the chart below.

99% of the Time, Positive 3-Year Returns Have Followed Low Return Markets

Subsequent Average Annualized 3-Year Performance for the Russell 2000 Following 3-Year Annualized Return Ranges of Less Than 3%, 12/31/81-12/31/24

Past performance is no guarantee of future results. As of 12/31/24, the average of subsequent 3-year return ranges <3% has 481 periods, the average 3-year return since inception has 517 periods.

Of course, this dynamic has a kind of logic to it. The cyclical nature of share prices would support the notion that low-return periods are typically succeeded by higher-return periods. What makes the data above particularly compelling from our standpoint is not just the fact that small-caps generally recovered from low, flat, or negative return periods with better results but also that these subsequent performances averaged a 60% higher return than the historical 3-year monthly rolling average.

LOOKING FORWARD TO HEIGHTENED VOLATILITY?

Just a few weeks into the new administration, and the stock market has already seen some highly volatile days. February

began with the markets swooning from President Trump’s announcement of tariffs on goods coming into the U.S. from China, Canada, and Mexico. Markets quickly fell into disarray before some measure of calm returned following reports that there would be a pause on tariffs for goods, first those from Mexico and later that same day with those from Canada, in each case following constructive negotiations. The initial indications were that tariffs involving Canada and Mexico would be implemented as part of an effort at solving non-economic issues such as the cross-border drug trade and immigration—so the hope is that they will remain on pause, assuming that the ostensible goals are met. As of this writing we expect the greatest areas of potential impact, if these tariffs are sustained, would be on the housing, auto, and farm sectors of the U.S. economy.

We suspect that most if not all of the tariffs being proposed are being used tactically and, while disruptive, will impact market sentiment, volatility, and risk taking more than longer-term business fundamentals. Regardless of their ultimate duration and scale, however, tariffs are expected to hasten the now established trends of deglobalization, business reshoring to the U.S., and better supply chain management in U.S. manufacturing. All of which support our well-documented case for U.S. small-cap stocks regaining leadership in the market, driven by a meaningful upswing in small-cap earnings and supported by valuations far more attractive than found in other market capitalization or style segments.

We also think it’s important to be mindful of volatility as we believe we are entering a period of heightened uncertainty driven by the disruptive nature of both the rhetoric and policy proposals of the new Trump administration. We have often talked about how we welcome short-term volatility as a foundational element for building long-term, market-beating returns. One critical advantage of having been small-cap investors for more than five decades is how it’s bred a deep appreciation for the cyclical nature of markets and the long-term benefit of contrarian thinking.

This page is not part of the 2024 Annual Report to Stockholders | 5

LETTER TO OUR STOCKHOLDERS

Bull markets, bear markets, and/or long periods of outperformance for one style or asset class—all are subject to cyclical dynamics, and none lasts forever. We find that understanding what drives inflection points along with a willingness to think critically beyond the market’s conventional wisdom are the underpinnings that can generate long-term outperformance.

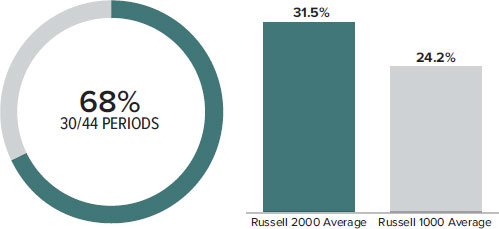

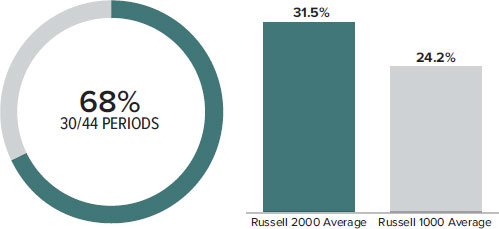

While still in the early days, many signals seem to be pointing to the likelihood that equities will experience heightened levels of volatility as we move further into 2025 and, if history is our guide, this could be an additional positive sign for small cap’s absolute and relative returns. Looking at subsequent average annualized returns for the Russell 2000 and the large-cap Russell 1000 following periods when the CBOE S&P 500 Volatility Index—aka the VIX or the ‘fear gauge,’—was elevated showed a positive edge for small-cap stocks. Our research revealed that the percentage of periods when the Russell 2000 had better average annualized 3-year returns than the Russell 1000 were at their highest following periods of heightened volatility.

Russell 2000 vs Russell 1000 Monthly Rolling VIX Regimes

Subsequent Average 1-Year Return Periods After VIX 1-Month Average was ≥28% from 12/31/89-12/31/24

VIX was ≥28% in 44/408 periods. Source: Bloomberg. Past performance is no guarantee of future results. The chart above measures the average returns and spread of the monthly trailing three-year return periods in month where the monthly average three-year VIX level falls within the specified range.

Interestingly, recent uncertainty—and the now familiar idea that the new administration’s policies seem likely to create ample doses of (ideally short-lived) market gyrations—has not yet translated to a higher-than-average VIX, which was lower than average between election day through February 7th. What has been on the rise, according to an article in the February 10th issue of Barron’s, is the VVIX—which measures the volatility of the VIX and can be seen as a “fear of fear” index. The VVIX has risen past its historical average of 92.86 to 99.04 over the same post-election day period. This is hardly the worst development for highly active small-cap investors with a long-term investment horizon like us. We welcome a market environment that, at least in the short run, distracts investors from longer-term business fundamentals and economic value, which is often the case when markets experience elevated volatility. These distractions often appear to blur the distinctions between companies that possess higher quality attributes versus those that do not. As we move further into 2025, we remain highly constructive on the backdrop for small-cap stocks and for our differentiated and highly active approach to constructing our portfolios.

Sincerely,

|  |

| Christopher D. Clark | Francis D. Gannon |

Chief Executive Officer, and

Co-Chief Investment Officer | Co-Chief Investment Officer |

February 13, 2025

6 | This page is not part of the 2024 Annual Report to Stockholders

Performance

NAV Average Annual Total Returns

As of December 31, 2024 (%)

| | 1-YR | 3-YR | 5-YR | 10-YR | 15-YR | 20-YR | 25-YR | 30-YR | SINCE

INCEPTION | INCEPTION

DATE |

| Royce Global Trust | 11.80 | -1.78 | 5.69 | 7.40 | N/A | N/A | N/A | N/A | 6.23 | 10/17/13 |

| Royce Micro-Cap Trust | 13.47 | 3.23 | 11.86 | 9.16 | 11.33 | 8.65 | 10.24 | 10.94 | 10.74 | 12/14/93 |

| Royce Small-Cap Trust | 12.64 | 2.57 | 9.54 | 9.37 | 10.51 | 8.15 | 9.32 | 10.35 | 10.38 | 11/26/86 |

| INDEX | | | | | | | | | | |

| MSCI ACWI Small Cap Index | 7.66 | 0.76 | 6.68 | 7.26 | 8.69 | 7.72 | 7.50 | 7.79 | N/A | N/A |

| Russell Microcap Index | 13.70 | -1.00 | 6.97 | 6.77 | 9.81 | 6.36 | N/A | N/A | N/A | N/A |

| Russell 2000 Index | 11.54 | 1.24 | 7.40 | 7.82 | 10.33 | 7.79 | 7.55 | 9.02 | N/A | N/A |

Important Performance and Risk Information

All performance information in this Review and Report reflects past performance, is presented on a total return basis, net of the Fund’s investment advisory fee, reflects the reinvestment of distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the sale of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when sold. Current month-end performance may be higher or lower than performance quoted and may be obtained at www.royceinvest.com. The Funds are closed-end registered investment companies whose respective shares of common stock may trade at a discount to the net asset value. Shares of each Fund’s common stock are also subject to the market risk of investing in the underlying portfolio securities held by each Fund. Each Fund is subject to market risk-the possibility that common stock prices will decline, sometimes sharply and unpredictably, over short or extended periods of time. Such declines may be caused by various factors, including market, financial, and economic conditions, governmental or central bank actions, and other factors, such as pandemics, acts of terrorism, or the armed conflicts in Europe and the Middle East, that may not be directly related to the issuer of a security held by a Fund. These conflicts, along with any banking industry instability, could adversely affect global market, financial, and economic conditions, as well as individual companies, in ways that cannot necessarily be foreseen. Investments in securities of micro-cap or small-cap companies may involve considerably more risk than investments in securities of larger-cap companies. Investments in securities of foreign issuers may be subject to different risks than investments in securities of U.S. companies, including adverse political, social, economic, or other developments that are unique to a particular country or region. Therefore, the prices of securities of foreign companies in particular countries or regions may, at times, move in a different direction than those of securities of U.S. companies. Because such investments are usually denominated in foreign currencies and the Funds do not intend to hedge their foreign currency exposures, the U.S. dollar value of such investments may be harmed by declines in the value of foreign currencies in relation to the U.S. dollar. Royce Global Trust invests a significant portion of its assets in foreign companies. A broadly diversified portfolio does not ensure a profit or guarantee against loss. All indexes referenced are unmanaged and capitalization-weighted. Each index’s returns include net reinvested dividends and/or interest income. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. The Russell 2000 Index is an index of domestic small-cap stocks that measures the performance of the 2,000 smallest publicly traded U.S. companies in the Russell 3000 Index. The Russell Microcap Index includes 1,000 of the smallest securities in the small-cap Russell 2000 Index, along with the next smallest eligible securities as determined by Russell. The MSCI ACWI Small Cap Index is an unmanaged, capitalization-weighted index of global small-cap stocks. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Index returns include net reinvested dividends and/or interest income. Royce Global, Micro-Cap, and Small-Cap Trust shares of common stock trade on the NYSE. Royce Fund Services, LLC (“RFS”) is a member of the Finanancial Industry Regulatory Authority (“FINRA”) and files certain material with FINRA on behalf of each Fund. RFS is not an underwriter or distributor of any of the Funds.

This page is not part of the 2024 Annual Report to Stockholders | 7

MANAGER’S DISCUSSION (UNAUDITED)

Royce Global Trust (RGT)

Steven McBoyle

FUND PERFORMANCE

Royce Global Trust (RGT) advanced 11.8% on a NAV (net asset value) basis and an impressive 14.8% based on its market price, well ahead of the 7.7% gain for its benchmark, the MSCI ACWI Small Cap Index, for the same period. The Fund also beat its benchmark on an NAV basis for the 10-year period ended 12/31/24 while lagging for the 3- and 5-year period.

WHAT WORKED… AND WHAT DIDN’T

Eight of the Fund’s 10 equity sectors made positive contributions to performance in 2024, led by Financials, Industrials, and Information Technology. Health Care and Consumer Discretionary detracted while Communication Services made the smallest positive contribution. At the industry level, capital markets (Financials), software (Information Technology), and trading companies & distributors (Industrials) were the top contributors while the biggest detractors were media (Communication Services), health care equipment & supplies (Health Care), and building products (Industrials).

At the position level, the top contributor was FTAI Aviation, which provides maintenance, repair, and exchange of CFM56 and V2500 aircraft engines, the workhorses of the global aircraft fleet, to smaller airlines globally. Contributing to its notable performance in 2024 were the market’s recognition of the tight supply of aircraft engines, FTAI’s growth runway as it closed deals with Latam Airlines and Pratt & Whitney—a burgeoning cost advantage after FTAI purchased its management fee agreement and a key maintenance facility in Montreal—and FAA approval for critical aftermarket engine parts. Tel Aviv Stock Exchange operates Israel’s only stock exchange and provides trading services for stocks, mutual funds, corporate and government bonds, short-term T-bills, and index and currency options. A key element of its business model is that trading commissions only account for 38% of revenue, with the remainder coming from listing fees and annual levies, clearing/custodial fees, and data distribution fees. Despite Israel’s war against Hamas and Lebanon and a weak environment for IPOs/secondary equity offerings, the stock delivered strong returns in 2024 due to robust demand for Treasury Bills, corporate bonds, and government bond issuance, as well as from the exchange’s derivatives business, which benefited from increased volatility, and the securing of regulatory approval for bringing pricing in line with global peers.

| | | | | | |

| | Top Contributors to Performance | | Top Detractors from Performance | |

| | For 2024 (%)1 | | | For 2024 (%)2 | | |

| | FTAI Aviation | 2.68 | | EVI Industries | -0.69 | |

| | Tel Aviv Stock Exchange | 1.72 | | Dish TV India | -0.42 | |

| | Cellebrite DI | 1.34 | | Carel Industries | -0.39 | |

| | PAR Technology | 0.79 | | Teqnion | -0.37 | |

| | Protector Forsikring | 0.75 | | AutoCanada | -0.35 | |

| | 1 Includes dividends | | | 2 Net of dividends | | |

| | | | | | | |

EVI Industries, which distributes commercial laundry and dry cleaning equipment, industrial boilers, and related parts for its U.S. customer base, was the top-detracting position in 2024. While continuing to operate effectively, both its business and stock have also continued to face challenges, including declining profits, increased operating costs and interest expenses, competitive pressures, and environmental regulations. We began to reduce our stake in its shares in December 2024. Dish TV India is a subscription based satellite television provider whose offerings include multilingual services, entertainment, lifestyle, devotional and astrology, kids and games, and learning programs. The company faced challenges in the highly competitive direct-to-home and cable television industries, including difficulties expanding its market share and remaining profitable in the face of increased competition. We held a small position at year-end.

RGT’s advantage over the MSCI ACWI Small Cap was attributable to both stock selection and sector allocation decisions in 2024. At the sector level, stock selection and our substantially higher weighting in Financials, stock selection in Information Technology, and stock selection and, to a lesser extent, a higher weighting in Materials helped most with relative results. Conversely, stock selection in Health Care and Consumer Discretionary, as well as a combination of stock selection and a higher weight in Communication Services hindered relative performance the most in 2024.

CURRENT POSITIONING AND OUTLOOK

Having endured a multi-year earnings recession in small-cap, we are expecting a (long-awaited) period of sustained small-cap leadership, driven by stronger relative earnings growth and more attractive valuations. Prior small-cap leadership cycles have distinct dynamics at different points in the cycle, and low-quality factors often drive performance as the cycle gets under way. Given RGT’s disciplined focus on owning quality companies—those with high returns on invested capital, consistent free cash flow, and strong balance sheets—we are often challenged to keep pace with the initial run for lower-quality names. In time, however, this dynamic has reversed, as more high-quality factors assumed long-term leadership and outperformed. A key differentiator of our approach is the long-term investment horizon inherent in taking a business buyer’s approach. This enables the Fund to arbitrage time by adding to existing names or buying new high-quality holdings when their valuations contract due to short-term sentiment that often overshadows attractive and sustainable long-term value creation drivers. Though positioning changed little throughout the year, with relatively few new names being added, we were active in reducing multi-year outperformers while adding to lower market cap holdings that were down due to cyclical or macro concerns and where our conviction in the business model and long-term earnings power remains strong.

8 | 2024 Annual Report to Stockholders

| PERFORMANCE AND PORTFOLIO REVIEW (UNAUDITED) | SYMBOLS MARKET PRICE RGT NAV XRGTX |

Performance

Average Annual Total Return (%) Through 12/31/24

| | JUL-DEC 20241 | 1-YR | 3-YR | 5-YR | 10-YR | SINCE INCEPTION (10/17/13) |

| RGT (NAV) | 4.40 | 11.80 | -1.78 | 5.69 | 7.40 | 6.23 |

1 Not Annualized

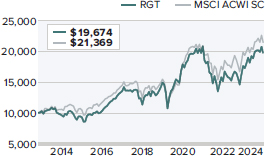

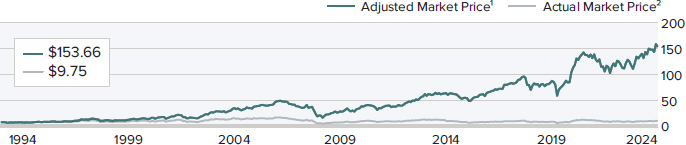

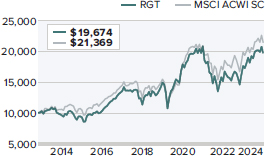

Market Price Performance History Since Inception (10/17/13)

Cumulative Performance of Investment through 12/31/241

| | 1-YR | 5-YR | 10-YR | 15-YR | 20-YR | SINCE INCEPTION (10/17/13) |

| RGT | 14.8% | 31.1% | 100.7% | N/A | N/A | 83.2% |

| 1 | Reflects the cumulative performance experience of a continuous common stockholder who purchased one share at inception ($8.975 IPO) and reinvested all distributions. |

| 2 | Reflects the actual month-end market price movement of one share as it has traded on NYSE. |

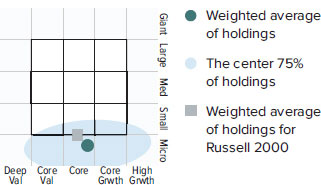

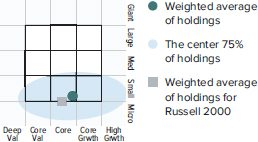

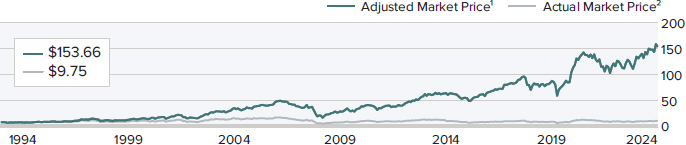

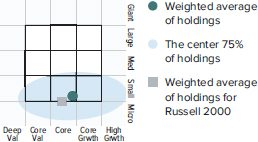

Morningstar Style Map™ As of 12/31/24

The Morningstar Style Map is the Morningstar Style Box™ with the center 75% of fund holdings plotted as the Morningstar Ownership Zone™. The Morningstar Style Box is designed to reveal a fund’s investment strategy. The Morningstar Ownership Zone provides detail about a portfolio’s investment style by showing the range of stock sizes and styles. The Ownership Zone is derived by plotting each stock in the portfolio within the proprietary Morningstar Style Box. Over time, the shape and location of a fund's ownership zone may vary. See page 65 for additional information.

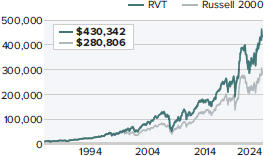

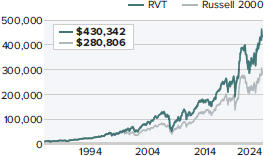

Value of $10,000

Invested on 10/17/13 as of 12/31/24 ($)

Top 10 Positions

% of Net Assets

| FTAI Aviation | 3.8 |

| Tel Aviv Stock Exchange | 3.2 |

| SEI Investments | 2.8 |

| Sprott | 2.4 |

| Protector Forsikring | 2.1 |

| Alamos Gold Cl. A | 2.1 |

| APi Group | 2.0 |

| Morningstar | 2.0 |

| ESAB Corporation | 2.0 |

| TMX Group | 1.8 |

Portfolio Sector Breakdown

% of Net Assets

| Industrials | 34.1 |

| Financials | 26.5 |

| Information Technology | 14.2 |

| Materials | 8.5 |

| Health Care | 5.6 |

| Communication Services | 3.9 |

| Consumer Discretionary | 3.5 |

| Energy | 2.4 |

| Real Estate | 1.1 |

| Consumer Staples | 0.9 |

| Outstanding Line of Credit, Net of Cash and Cash Equivalents | -0.7 |

| Calendar Year Total Returns (%) | |

| YEAR | RGT |

| 2024 | 11.8 |

| 2023 | 16.1 |

| 2022 | -27.0 |

| 2021 | 16.3 |

| 2020 | 19.7 |

| 2019 | 31.2 |

| 2018 | -16.1 |

| 2017 | 31.1 |

| 2016 | 11.1 |

| 2015 | -3.4 |

| 2014 | -6.2 |

| | |

| | |

| Portfolio Country Breakdown 1,2 | |

| % of Net Assets | |

| United States | 42.8 |

| Canada | 17.8 |

| Israel | 7.2 |

| United Kingdom | 6.9 |

| Sweden | 5.1 |

| 1 | Represents countries that are 3% or more of net assets. |

| 2 | Securities are categorized by the country of their headquarters. |

Portfolio Diagnostics

| Fund Net Assets | $82 million |

| Number of Holdings | 116 |

| Turnover Rate | 16% |

| Net Asset Value | $12.55 |

| Market Price | $10.72 |

| Net Leverage1 | 0.7% |

| Average Market Capitalization2 | $2,539 million |

| Weighted Average P/E Ratio3,4 | 22.8x |

| Weighted Average P/B Ratio3 | 2.9x |

| Active Share5 | 98% |

| 1 | Net leverage is the percentage, in excess of 100%, of the total value of equity type investments, divided by net assets. |

| 2 | Geometric Average. This weighted calculation uses each portfolio holding’s market cap in a way designed to not skew the effect of very large or small holdings; instead, it aims to better identify the portfolio’s center, which Royce believes offers a more accurate measure of average market cap than a simple mean or median. |

| 3 | Harmonic Average. This weighted calculation evaluates a portfolio as if it were a single stock and measures it overall. It compares the total market value of the portfolio to the portfolio’s share in the earnings or book value, as the case may be, of its underlying stocks. |

| 4 | The Fund’s P/E Ratio calculation excludes companies with zero or negative earnings (16% of portfolio holdings as of 12/31/24). |

| 5 | Active Share is the sum of the absolute values of the different weightings of each holding in the Fund versus each holding in the benchmark, divided by two. |

Important Performance and Risk Information

All performance information reflects past performance, is presented on a total return basis, net of the Fund’s investment advisory fee, reflects the reinvestment of distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the sale of fund shares. Past performance is no guarantee of future results. Current month-end performance may be higher or lower than performance quoted and may be obtained at www.royceinvest.com. The market price of the Fund’s shares will fluctuate, so that shares may be worth more or less than their original cost when sold. The Fund invests primarily in securities of small- and mid-cap companies, which may involve considerably more risk than investments in securities of larger-cap companies. The Fund’s broadly diversified portfolio does not ensure a profit or guarantee against loss. The Fund generally invests a significant portion of its net assets in foreign securities, which may involve political, economic, currency and other risks not encountered in U.S. investments. Regarding the “Top Contributors” and “Top Detractors” tables shown above, the sum of all contributors to, and all detractors from, performance for all securities in the portfolio would approximate the Fund’s year-to-date performance for 2024.

2024 Annual Report to Stockholders | 9

Royce Global Trust

Schedule of Investments

Common Stocks – 100.7%

| | | SHARES | | | VALUE |

| | | | | | |

| AUSTRALIA – 2.7% | | | | | |

| Cochlear 1 | | | 4,000 | | | $ | 716,527 |

| IPH 1 | | | 233,881 | | | | 726,709 |

| Technology One 1 | | | 40,400 | | | | 780,366 |

| Total (Cost $1,267,991) | | | | | | | 2,223,602 |

| | | | | | | | |

| BERMUDA – 0.9% | | | | | | | |

| Bank of N.T. Butterfield & Son | | | 21,000 | | | | 767,550 |

| Total (Cost $745,408) | | | | | | | 767,550 |

| | | | | | | | |

| BRAZIL – 0.9% | | | | | | | |

| Odontoprev 1 | | | 171,600 | | | | 301,694 |

| TOTVS 1 | | | 97,885 | | | | 421,534 |

| Total (Cost $750,794) | | | | | | | 723,228 |

| | | | | | | | |

| CANADA – 17.8% | | | | | | | |

| Alamos Gold Cl. A | | | 94,100 | | | | 1,736,083 |

| Altus Group | | | 22,470 | | | | 875,384 |

| AutoCanada 2 | | | 45,840 | | | | 552,650 |

| Canaccord Genuity Group | | | 97,143 | | | | 683,235 |

| Computer Modelling Group | | | 109,901 | | | | 814,251 |

| Descartes Systems Group (The) 2,3 | | | 8,424 | | | | 956,966 |

| IMAX Corporation 2 | | | 51,171 | | | | 1,309,978 |

| Major Drilling Group International 2 | | | 194,300 | | | | 1,109,745 |

| Onex Corporation | | | 17,813 | | | | 1,391,383 |

| Pan American Silver 3 | | | 12,700 | | | | 256,794 |

| Pason Systems | | | 71,300 | | | | 675,079 |

| Sprott | | | 45,635 | | | | 1,922,927 |

| Stella-Jones | | | 12,000 | | | | 594,302 |

| TELUS Corporation | | | 16,311 | | | | 221,157 |

| TMX Group | | | 47,600 | | | | 1,466,297 |

| Total (Cost $9,919,801) | | | | | | | 14,566,231 |

| | | | | | | | |

| FRANCE – 0.9% | | | | | | | |

| Ayvens 1 | | | 39,000 | | | | 263,307 |

| Esker 1 | | | 1,800 | | | | 486,336 |

| Total (Cost $516,235) | | | | | | | 749,643 |

| | | | | | | | |

| GERMANY – 0.3% | | | | | | | |

| Carl Zeiss Meditec 1 | | | 3,400 | | | | 160,162 |

| STRATEC 1 | | | 3,300 | | | | 101,907 |

| Total (Cost $540,371) | | | | | | | 262,069 |

| | | | | | | | |

| GREECE – 0.9% | | | | | | | |

| Sarantis 1 | | | 64,500 | | | | 726,921 |

| Total (Cost $554,222) | | | | | | | 726,921 |

| | | | | | | | |

| ICELAND – 0.3% | | | | | | | |

| Embla Medical 1,2 | | | 51,000 | | | | 252,197 |

| Total (Cost $321,244) | | | | | | | 252,197 |

| | | | | | | | |

| INDIA – 2.4% | | | | | | | |

| AIA Engineering 1 | | | 28,440 | | | | 1,125,808 |

| †BSE 1 | | | 7,232 | | | | 450,078 |

| Dish TV India 1,2 | | | 3,017,686 | | | | 365,828 |

| Total (Cost $1,407,224) | | | | | | | 1,941,714 |

| | | | | | | | |

| INDONESIA – 0.2% | | | | | | | |

| Aspirasi Hidup Indonesia 1 | | | 4,000,000 | | | | 194,576 |

| Total (Cost $169,716) | | | | | | | 194,576 |

| | | | | | | | |

| IRELAND – 0.5% | | | | | | | |

| †Avadel Pharmaceuticals 2 | | | 35,460 | | | | 372,685 |

| Total (Cost $590,636) | | | | | | | 372,685 |

| | | | | | | | |

| ISRAEL – 7.2% | | | | | | | |

| Cellebrite DI 2 | | | 54,893 | | | | 1,209,293 |

| Global-e Online 2 | | | 5,200 | | | | 283,556 |

| Nova 2,3,4 | | | 5,700 | | | | 1,122,615 |

| Phoenix Financial 1 | | | 48,500 | | | | 708,239 |

| Tel Aviv Stock Exchange 1 | | | 222,300 | | | | 2,578,284 |

| Total (Cost $2,106,727) | | | | | | | 5,901,987 |

| | | | | | | | |

| ITALY – 0.7% | | | | | | | |

| Carel Industries 1 | | | 28,300 | | | | 542,326 |

| Total (Cost $342,471) | | | | | | | 542,326 |

| | | | | | | | |

| JAPAN – 1.7% | | | | | | | |

| As One 1 | | | 11,200 | | | | 187,167 |

| Fukui Computer Holdings 1 | | | 10,800 | | | | 208,927 |

| NSD 1 | | | 12,200 | | | | 260,602 |

| TechnoPro Holdings 1 | | | 7,200 | | | | 134,489 |

| TKC Corporation 1 | | | 25,500 | | | | 613,097 |

| Total (Cost $1,109,922) | | | | | | | 1,404,282 |

| | | | | | | | |

| NETHERLANDS – 1.0% | | | | | | | |

| IMCD 1 | | | 5,500 | | | | 814,542 |

| Total (Cost $387,492) | | | | | | | 814,542 |

| | | | | | | | |

| NEW ZEALAND – 0.5% | | | | | | | |

| Fisher & Paykel Healthcare 1 | | | 17,000 | | | | 364,716 |

| Total (Cost $101,973) | | | | | | | 364,716 |

| | | | | | | | |

| NORWAY – 2.1% | | | | | | | |

| Protector Forsikring 1 | | | 70,000 | | | | 1,753,525 |

| Total (Cost $521,854) | | | | | | | 1,753,525 |

| | | | | | | | |

| PANAMA – 0.6% | | | | | | | |

| †Banco Latinoamericano de Comercio | | | | | | | |

| Exterior Cl. E | | | 13,716 | | | | 487,878 |

| Total (Cost $379,574) | | | | | | | 487,878 |

| | | | | | | | |

| SINGAPORE – 0.0% | | | | | | | |

| Midas Holdings 2,5 | | | 400,000 | | | | 0 |

| Total (Cost $50,439) | | | | | | | 0 |

| | | | | | | | |

| SOUTH AFRICA – 2.7% | | | | | | | |

| CA Sales Holdings 1 | | | 147,597 | | | | 126,698 |

| Curro Holdings 1 | | | 258,594 | | | | 179,074 |

| PSG Financial Services 1 | | | 550,976 | | | | 572,910 |

| Stadio Holdings 1 | | | 3,686,928 | | | | 1,347,828 |

| Total (Cost $1,125,199) | | | | | | | 2,226,510 |

| | | | | | | | |

| SWEDEN – 5.1% | | | | | | | |

| Biotage 1 | | | 37,900 | | | | 551,811 |

| Bravida Holding 1 | | | 68,900 | | | | 499,274 |

| CDON 1,2 | | | 25,000 | | | | 198,807 |

| Karnov Group 1,2 | | | 145,381 | | | | 1,082,146 |

| OEM International Cl. B 1 | | | 107,000 | | | | 1,081,112 |

| †Teqnion 1,2 | | | 47,800 | | | | 714,081 |

| Total (Cost $3,671,717) | | | | | | | 4,127,231 |

| | | | | | | | |

| SWITZERLAND – 1.6% | | | | | | | |

| Kardex Holding 1 | | | 2,400 | | | | 715,300 |

| 10 | 2024 Annual Report to Stockholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

December 31, 2024

Schedule of Investments (continued)

| | | SHARES | | | VALUE |

| | | | | | | | |

| SWITZERLAND (continued) | | | | | | | |

| LEM Holding 1 | | | 150 | | | $ | 122,474 |

| VZ Holding 1 | | | 2,900 | | | | 460,281 |

| Total (Cost $482,877) | | | | | | | 1,298,055 |

| | | | | | | | |

| UNITED KINGDOM – 6.9% | | | | | | | |

| Diploma 1 | | | 8,200 | | | | 436,143 |

| DiscoverIE Group 1 | | | 70,800 | | | | 633,973 |

| FDM Group Holdings 1 | | | 46,800 | | | | 184,855 |

| Genuit Group 1 | | | 54,600 | | | | 266,249 |

| Halma 1 | | | 21,500 | | | | 719,666 |

| Judges Scientific 1 | | | 7,600 | | | | 802,483 |

| Keystone Law Group 1 | | | 95,940 | | | | 690,750 |

| Marlowe 1 | | | 112,600 | | | | 456,395 |

| Mortgage Advice Bureau Holdings 1 | | | 36,100 | | | | 275,662 |

| †Optima Health 1,2 | | | 112,600 | | | | 203,025 |

| Restore 1 | | | 83,000 | | | | 250,754 |

| SThree 1 | | | 146,600 | | | | 541,723 |

| Team Internet Group 1 | | | 80,000 | | | | 94,231 |

| YouGov 1 | | | 18,600 | | | | 96,730 |

| Total (Cost $5,271,467) | | | | | | | 5,652,639 |

| | | | | | | | |

| UNITED STATES – 42.8% | | | | | | | |

| ACV Auctions Cl. A 2 | | | 33,400 | | | | 721,440 |

| Air Lease Cl. A 3 | | | 22,023 | | | | 1,061,729 |

| APi Group 2,3,4 | | | 46,008 | | | | 1,654,908 |

| Arcosa | | | 12,660 | | | | 1,224,728 |

| Artisan Partners Asset Management Cl. A | | | 33,200 | | | | 1,429,260 |

| †Atmus Filtration Technologies | | | 20,870 | | | | 817,687 |

| Blue Owl Capital Cl. A | | | 24,876 | | | | 578,616 |

| †CBIZ 2 | | | 7,053 | | | | 577,147 |

| Diodes 2,3 | | | 1,420 | | | | 87,571 |

| Element Solutions 3 | | | 36,400 | | | | 925,652 |

| Enovis Corporation 2 | | | 14,998 | | | | 658,112 |

| †Enpro | | | 1,770 | | | | 305,236 |

| ESAB Corporation | | | 13,420 | | | | 1,609,595 |

| EVI Industries 3 | | | 68,563 | | | | 1,121,005 |

| FormFactor 2,3,4 | | | 13,500 | | | | 594,000 |

| FTAI Aviation | | | 21,360 | | | | 3,076,694 |

| GCM Grosvenor Cl. A | | | 101,682 | | | | 1,247,638 |

| Griffon Corporation 3 | | | 11,250 | | | | 801,787 |

| Hagerty Cl. A 2 | | | 39,300 | | | | 379,245 |

| Innospec 3 | | | 6,228 | | | | 685,454 |

| Kadant 3 | | | 1,928 | | | | 665,141 |

| KBR 3 | | | 16,416 | | | | 950,979 |

| Lindsay Corporation 3 | | | 3,547 | | | | 419,646 |

| Mesa Laboratories | | | 3,829 | | | | 504,930 |

| MKS Instruments | | | 2,907 | | | | 303,462 |

| Morningstar 3 | | | 4,835 | | | | 1,628,235 |

| NewtekOne | | | 22,650 | | | | 289,240 |

| nLIGHT 2 | | | 32,100 | | | | 336,729 |

| PAR Technology 2,3,4 | | | 11,000 | | | | 799,370 |

| Quaker Houghton | | | 5,560 | | | | 782,626 |

| RB Global | | | 2,000 | | | | 180,420 |

| †Repligen Corporation 2 | | | 1,286 | | | | 185,107 |

| Richardson Electronics | | | 11,356 | | | | 159,325 |

| Rogers Corporation 2 | | | 3,428 | | | | 348,319 |

| Royal Gold | | | 6,320 | | | | 833,292 |

| SEI Investments 3 | | | 27,650 | | | | 2,280,572 |

| †Teledyne Technologies 2 | | | 1,340 | | | | 621,934 |

| Transcat 2,3 | | | 13,705 | | | | 1,449,167 |

| †Victory Capital Holdings | | | 5,283 | | | | 345,825 |

| †Viper Energy Cl. A | | | 25,649 | | | | 1,258,596 |

| Vontier Corporation 3,4 | | | 29,889 | | | | 1,090,052 |

| Total (Cost $21,746,084) | | | | | | | 34,990,471 |

| | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | |

| (Cost $54,081,438) | | | | | | | 82,344,578 |

| | | | | | | | |

| INVESTMENTS AT VALUE | | | | | | | |

| (Cost $54,081,438) | | | | | | | 82,344,578 |

| | | | | | | | |

| REPURCHASE AGREEMENT– 0.8% | | | | | | | |

Fixed Income Clearing Corporation, 3.75% dated 12/31/24, due 1/2/25, maturity value $675,533 (collateralized by obligations of U.S. Government Agencies, 3.625% due 3/31/30, valued at $688,905) |

| (Cost $675,392) | | | | | | | 675,392 |

| | | | | | | | |

| TOTAL INVESTMENTS – 101.5% | | | | | | | |

| (Cost $54,756,830) | | | | | | | 83,019,970 |

| | | | | | | | |

| LIABILITIES LESS CASH AND OTHER ASSETS – (1.5)% | | | | | | | (1,220,074) |

| | | | | | | | |

| NET ASSETS – 100.0% | | | | | | $ | 81,799,896 |

| 1 | These securities are defined as Level 2 securities due to fair value being based on quoted prices for similar securities and/or due to the application of fair value factors. See Notes to Financial Statements. |

| 3 | All or a portion of these securities were pledged as collateral in connection with the Fund's revolving credit agreement as of December 31, 2024. Total market value of pledged securities as of December 31, 2024, was $7,322,408. |

| 4 | As of December 31, 2024, a portion of these securities, in the aggregate amount of $2,066,402, were rehypothecated by BNP Paribas Prime Brokerage International, Limited in connection with the Fund's revolving credit agreement. See Notes to Financial Statements. |

| 5 | A security for which market quotations are not readily available represents 0.0% of net assets. This security has been valued at its fair value under procedures approved by the Fund's Board of Directors. This security is defined as a Level 3 security due to the use of significant unobservable inputs in the determination of fair value. See Notes to Financial Statements. |

Securities are categorized by the country of their headquarters.

Bold indicates the Fund’s 20 largest equity holdings in terms of December 31, 2024, market value.

TAX INFORMATION: The cost of total investments for Federal income tax purposes was $58,354,899. As of December 31, 2024, net unrealized appreciation for all securities was $24,665,071 consisting of aggregate gross unrealized appreciation of $28,496,640 and aggregate gross unrealized depreciation of $3,831,569. The primary causes of the difference between book and tax basis cost are the timing of the recognition of losses on securities sold, underlying investments and mark-to-market of Passive Foreign Investment Companies.

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | 2024 Annual Report to Stockholders | 11 |

| Royce Global Trust | December 31, 2024 |

Statement of Assets and Liabilities

| ASSETS: | | | |

| Investments at value | | $ | 82,344,578 | |

| Repurchase agreements (at cost and value) | | | 675,392 | |

| Foreign currency (cost $5,489) | | | 5,481 | |

| Receivable for investments sold | | | 962,454 | |

| Receivable for dividends and interest | | | 125,682 | |

| Receivable for insurance reimbursement | | | 24,299 | |

| Prepaid expenses and other assets | | | 17,759 | |

| Total Assets | | | 84,155,645 | |

| LIABILITIES: | | | | |

| Revolving credit agreement | | | 2,000,000 | |

| Payable for investments purchased | | | 106,096 | |

| Payable for investment advisory fee | | | 71,693 | |

| Payable for directors' fees | | | 7,226 | |

| Payable for interest expense | | | 16,936 | |

| Accrued legal expense | | | 24,299 | |

| Accrued other expenses | | | 64,719 | |

| Deferred capital gains tax | | | 64,780 | |

| Total Liabilities | | | 2,355,749 | |

| Commitments and Contingent Liabilities1 | | | | |

| Net Assets | | $ | 81,799,896 | |

| ANALYSIS OF NET ASSETS: | | | | |

| Paid-in capital - $0.001 par value per share; 6,519,010 shares outstanding (150,000,000 shares authorized) | | $ | 57,834,408 | |

| Total distributable earnings (loss) | | | 23,965,488 | |

| Net Assets (net asset value per share - $12.55) | | $ | 81,799,896 | |

| Investments at identified cost | | $ | 54,081,438 | |

1 See Notes to Financial Statements.

| 12 | 2024 Annual Report to Stockholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| Royce Global Trust | Year Ended December 31, 2024 |

Statement of Operations

| INVESTMENT INCOME: | | | |

| INCOME: | | | |

| Dividends | | $ | 1,532,223 | |

| Foreign withholding tax | | | (94,650 | ) |

| Interest | | | 67,014 | |

| Rehypothecation income | | | 20 | |

| Total income | | | 1,504,607 | |

| EXPENSES: | | | | |

| Investment advisory fees | | | 806,996 | |

| Legal expense1 | | | 855,838 | |

| Insurance reimbursement of legal expense1 | | | (855,838 | ) |

| Interest expense | | | 255,173 | |

| Custody and transfer agent fees | | | 79,724 | |

| Professional fees | | | 67,554 | |

| Stockholder reports | | | 65,696 | |

| Administrative and office facilities | | | 48,594 | |

| Directors' fees | | | 24,984 | |

| Other expenses | | | 34,653 | |

| Total expenses | | | 1,383,374 | |

| Net investment income (loss) | | | 121,233 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | |

| NET REALIZED GAIN (LOSS): | | | | |

| Investments | | | 375,541 | |

| Foreign currency transactions | | | (7,420 | ) |

| NET CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION): | | | | |

| Investments | | | 8,064,824 | |

| Other assets and liabilities denominated in foreign currency | | | (26,245 | ) |

| Net realized and unrealized gain (loss) on investments and foreign currency | | | 8,406,700 | |

| NET INCREASE (DECREASE) IN NET ASSETS FROM INVESTMENT OPERATIONS | | $ | 8,527,933 | |

| 1 | The Fund incurred $855,838 in legal fees and expenses in 2024 in connection with an action filed on June 29, 2023 against the Fund and numerous unrelated funds in Saba Capital Master Funds., Ltd., et al. v. Clearbridge Energy Midstream Opportunity Fund, Inc., et al., No. 1:23-cv-05568 (S.D.N.Y.) See Notes to Financial Statements. |

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | 2024 Annual Report to Stockholders | 13 |

Statement of Changes in Net Assets

| | | YEAR ENDED 12/31/24 | | | YEAR ENDED 12/31/23 | |

| INVESTMENT OPERATIONS: | | | | | | | | |

| Net investment income (loss) | | $ | 121,233 | | | $ | (307,034 | ) |

| Net realized gain (loss) on investments and foreign currency | | | 368,121 | | | | 170,469 | |

| Net change in unrealized appreciation (depreciation) on investments and foreign currency | | | 8,038,579 | | | | 10,485,406 | |

| Net increase (decrease) in net assets from investment operations | | | 8,527,933 | | | | 10,348,841 | |

| DISTRIBUTIONS: | | | | | | | | |

| Total distributable earnings | | | (2,989,773 | ) | | | (946,548 | ) |

| Total distributions | | | (2,989,773 | ) | | | (946,548 | ) |

| CAPITAL STOCK TRANSACTIONS: | | | | | | | | |

| Reinvestment of distributions | | | 1,683,617 | | | | 483,560 | |

| Total capital stock transactions | | | 1,683,617 | | | | 483,560 | |

| Net Increase (Decrease) In Net Assets | | | 7,221,777 | | | | 9,885,853 | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 74,578,119 | | | | 64,692,266 | |

| End of year | | $ | 81,799,896 | | | $ | 74,578,119 | |

| 14 | 2024 Annual Report to Stockholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

| Royce Global Trust | Year Ended December 31, 2024 |

Statement of Cash Flows

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net increase (decrease) in net assets from investment operations | | $ | 8,527,933 | |

| Adjustments to reconcile net increase (decrease) in net assets from investment operations to net cash provided by operating activities: | | | | |

| Purchases of long-term investments | | | (12,982,487 | ) |

| Proceeds from sales and maturities of long-term investments | | | 14,795,632 | |

| Net purchases, sales and maturities of short-term investments | | | 1,197,332 | |

| Net (increase) decrease in dividends and interest receivable and other assets | | | 371,845 | |

| Net increase (decrease) in interest expense payable, accrued expenses and other liabilities | | | (299,898 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | (8,064,824 | ) |

| Net realized gain (loss) on investments | | | (375,541 | ) |

| Net cash provided by operating activities | | | 3,169,992 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Repayment of borrowings | | | (2,000,000 | ) |

| Distributions net of reinvestment (reinvestment $1,683,617) | | | (1,306,156 | ) |

| Net cash used for financing activities | | | (3,306,156 | ) |

| INCREASE (DECREASE) IN CASH: | | | (136,164 | ) |

| Cash and foreign currency at beginning of year | | | 141,645 | |

| Cash and foreign currency at end of year | | $ | 5,481 | |

Supplemental disclosure of cash flow information:

For the year ended December 31, 2024, the Fund paid $260,695 in interest expense.

| THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS | 2024 Annual Report to Stockholders | 15 |

Royce Global Trust

Financial Highlights

This table is presented to show selected data for a share of Common Stock outstanding throughout each period, and to assist stockholders in evaluating the Fund’s performance for the periods presented.

| | | YEARS ENDED | |

| | | 12/31/24 | | | 12/31/23 | | | 12/31/22 | | | 12/31/21 | | | 12/31/20 | |

| Net Asset Value, Beginning of Period | | $ | 11.72 | | | $ | 10.25 | | | $ | 14.26 | | | $ | 14.95 | | | $ | 13.60 | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.03 | | | | (0.05 | )1,2 | | | 0.09 | | | | (0.01 | ) | | | (0.05) | |

| Net realized and unrealized gain (loss) on investments and foreign currency | | | 1.32 | | | | 1.69 | | | | (3.96 | ) | | | 2.19 | | | | 2.63 | |

| Net increase (decrease) in net assets from investment operations | | | 1.35 | | | | 1.64 | | | | (3.87 | ) | | | 2.18 | | | | 2.58 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.43 | ) | | | – | | | | (0.10 | ) | | | (0.09 | ) | | | – | |

| Net realized gain on investments and foreign currency | | | (0.04 | ) | | | (0.15 | ) | | | (0.03 | ) | | | (2.66 | ) | | | (1.19) | |

| Return of capital | | | – | | | | – | | | | (0.00 | ) | | | – | | | | – | |

| Total distributions | | | (0.47 | ) | | | (0.15 | ) | | | (0.13 | ) | | | (2.75 | ) | | | (1.19 | ) |

| CAPITAL STOCK TRANSACTIONS: | | | | | | | | | | | | | | | | | | | | |

| Effect of reinvestment of distributions by Common Stockholders | | | (0.05 | ) | | | (0.02 | ) | | | (0.01 | ) | | | (0.12 | ) | | | (0.04) | |

| Total capital stock transactions | | | (0.05 | ) | | | (0.02 | ) | | | (0.01 | ) | | | (0.12 | ) | | | (0.04 | ) |

| Net Asset Value, End of Period | | $ | 12.55 | | | $ | 11.72 | | | $ | 10.25 | | | $ | 14.26 | | | $ | 14.95 | |

| Market Value, End of Period | | $ | 10.72 | | | $ | 9.75 | | | $ | 8.65 | | | $ | 13.12 | | | $ | 13.36 | |

| TOTAL RETURN:3 | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value | | | 11.80 | % | | | 16.15 | % | | | (27.04 | )% | | | 16.34 | % | | | 19.67 | % |

| Market Value | | | 14.81 | % | | | 14.50 | % | | | (33.08 | )% | | | 19.77 | % | | | 24.42 | % |

| RATIOS BASED ON AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Investment advisory fee expense | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| Other operating expenses | | | 0.71 | % | | | 1.52 | %1 | | | 0.54 | % | | | 0.39 | % | | | 0.34 | % |

| Total expenses (net) | | | 1.71 | % | | | 2.52 | %1 | | | 1.54 | % | | | 1.39 | % | | | 1.34 | % |

| Expenses excluding interest expense | | | 1.40 | % | | | 2.15 | %1 | | | 1.38 | % | | | 1.33 | % | | | 1.24 | % |

| Expenses prior to balance credits | | | 1.71 | % | | | 2.52 | %1 | | | 1.54 | % | | | 1.39 | % | | | 1.34 | % |

| Net investment income (loss) | | | 0.15 | % | | | (0.45 | )%1,2 | | | 0.79 | % | | | (0.13 | )% | | | (0.15 | )% |

| SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net Assets, End of Period (in thousands) | | $ | 81,800 | | | $ | 74,578 | | | $ | 64,692 | | | $ | 89,394 | | | $ | 83,752 | |

| Portfolio Turnover Rate | | | 16 | % | | | 14 | % | | | 24 | % | | | 52 | % | | | 54 | % |

| REVOLVING CREDIT AGREEMENT: | | | | | | | | | | | | | | | | | | | | |

| Asset coverage | | | 4190 | % | | | 1964 | % | | | 1717 | % | | | 2335 | % | | | 1147 | % |

| Asset coverage per $1,000 | | $ | 41,900 | | | $ | 19,645 | | | $ | 17,173 | | | $ | 23,349 | | | $ | 11,469 | |

| | | | | | | | | | | | | | | | | | | | | |

| 1 | Due to an action filed against the Fund and numerous unrelated funds in Saba Capital Master Funds., Ltd., et al. v. Clearbridge Energy Midstream Opportunity Fund, Inc., et al., No.1:23-cv-05568 (S.D.N.Y.), the Fund accrued net $500,000 in legal fees and expenses which resulted in a decrease in net investment income (loss) per share of $0.08, a decrease in the ratio of net investment income (loss) to average net assets of 0.73% and an increase in the noted expense ratios to average net assets of 0.73%. |

| 2 | A special distribution from Tel Aviv Stock Exchange resulted in an increase in net investment income (loss) per share of $0.02 and an increase in the ratio of net investment income (loss) to average net assets of 0.17%. |

| 3 | The Market Value Total Return is calculated assuming a purchase of Common Stock on the opening of the first business day and a sale on the closing of the last business day of each period. Dividends and distributions are assumed for the purposes of this calculation to be reinvested at prices obtained under the Fund’s Distribution Reinvestment and Cash Purchase Plan. Net Asset Value Total Return is calculated on the same basis, except that the Fund’s net asset value is used on the purchase, sale and dividend reinvestment dates instead of market value. |

| 16 | 2024 Annual Report to Stockholders | THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS |

Royce Global Trust

Notes to Financial Statements

Summary of Significant Accounting Policies

Royce Global Trust, Inc. (formerly Royce Global Value Trust, Inc.) (the “Fund”), is a diversified closed-end investment company that was incorporated under the laws of the State of Maryland on February 14, 2011. The Fund commenced operations on October 18, 2013.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

The Fund is an investment company registered under the Investment Company Act of 1940 (the “1940 Act”) and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services-Investment Companies.”

Royce & Associates, LP, the Fund’s investment adviser, is a majority-owned subsidiary of Franklin Resources, Inc. and primarily conducts business using the name Royce Investment Partners (“Royce”). As of December 31, 2024, officers and employees of Royce, Fund directors, the Royce retirement plans and other affiliates owned more than 19% of the Fund.

VALUATION OF INVESTMENTS:

Portfolio securities held by the Fund are valued as of the close of trading on the New York Stock Exchange (“NYSE”) (generally 4:00 p.m. Eastern time) on the valuation date. Investments in money market funds are valued at net asset value per share. Values for non-U.S. dollar denominated equity securities are converted to U.S. dollars daily based upon prevailing foreign currency exchange rates as quoted by a major bank.

Portfolio securities that are listed on an exchange or Nasdaq, or traded on OTC Market Group Inc.’s OTC Link ATS or other alternative trading system, are valued: (i) on the basis of their last reported sales prices or official closing prices, as applicable, on a valuation date; or (ii) at their highest reported bid prices in the event such equity securities did not trade on a valuation date. Such inputs are generally referred to as “Level 1” inputs because they represent reliable quoted prices in active markets for identical securities.

If the value of a portfolio security held by the Fund cannot be determined solely by reference to Level 1 inputs, such portfolio security will be “fair valued.” The Fund’s Board of Directors has designated Royce as valuation designee to perform fair value determinations for such portfolio securities in accordance with Rule 2a-5 under the 1940 Act (“Rule 2a-5”). Pursuant to Rule 2a-5, fair values are determined in accordance with policies and procedures approved by the Fund’s Board of Directors and policies and procedures adopted by Royce in its capacity as valuation designee for the Fund. Fair valued securities are reported as either “Level 2” or “Level 3” securities.

As a general principle, the fair value of a security is the amount which the Fund might reasonably expect to receive for the security upon its current sale. However, in light of the judgment involved in fair valuations, no assurance can be given that a fair value assigned to a particular portfolio security will be the amount which the Fund might be able to receive upon its current sale. When a fair value pricing methodology is used, the fair value prices used by the Fund for such securities will likely differ from the quoted or published prices for the same securities.

Level 2 inputs are other significant observable inputs (e.g., dealer bid side quotes and quoted prices for securities with comparable characteristics). Examples of situations in which Level 2 inputs are used to fair value portfolio securities held by the Fund on a particular valuation date include:

| • | Over-the-counter equity securities other than those traded on OTC Market Group Inc.’s OTC Link ATS or other alternative trading system (collectively referred to herein as “Other OTC Equity Securities”) are fair valued at their highest bid price when Royce receives at least two bid side quotes from dealers who make markets in such securities; |

| • | Certain bonds and other fixed income securities may be fair valued by reference to other securities with comparable ratings, interest rates, and maturities in accordance with valuation methodologies maintained by certain independent pricing services; and |

| • | The Fund uses an independent pricing service to fair value certain non-U.S. equity securities when U.S. market volatility exceeds a certain threshold set by Royce as valuation designee. This pricing service uses proprietary correlations it has developed between the movement of prices of non-U.S. equity securities and indices of U.S.-traded securities, futures contracts, and other indications to estimate the fair value of such non-U.S. securities. |

Level 3 inputs are significant unobservable inputs. Examples of Level 3 inputs include (without limitation) the last trade price for a security before trading was suspended or terminated; discounts to last trade price for lack of marketability or otherwise; market price information regarding other securities; information received from the issuer and/or published documents, including SEC filings and financial statements; and other publicly available information. Pursuant to the above-referenced policies and procedures, Royce may use various techniques in making fair value determinations based upon Level 3 inputs, which techniques may include (without limitation): (i) workout valuation methods (e.g., earnings multiples, discounted cash flows, liquidation values, derivations of book value, firm or probable

2024 Annual Report to Stockholders | 17

Royce Global Trust

Notes to Financial Statements (continued)

VALUATION OF INVESTMENTS (continued):

offers from qualified buyers for the issuer’s ongoing business, etc.); (ii) discount or premium from market, or compilation of other observable market information, for other similar freely traded securities; (iii) conversion from the readily available market price of a security into which an affected security is convertible or exchangeable; and (iv) pricing models or other formulas.

A security that is valued by reference to Level 1 or Level 2 inputs may drop to Level 3 on a particular valuation date for several reasons, including if:

| • | an equity security that is listed on an exchange or Nasdaq, or traded on OTC Market Group Inc.’s OTC Link ATS or other alternative trading system, has not traded and there are no bids; |

| • | Royce does not receive at least two bid side quotes for an Other OTC Equity Security; |

| • | the independent pricing services are unable to supply fair value prices; or |

| • | the Level 1 or Level 2 inputs become otherwise unreliable for any reason (e.g., a significant event occurs after the close of trading for a security but prior to the time the Fund prices its shares). |

The table below shows the aggregate value of the various Level 1, Level 2, and Level 3 securities held by the Fund as of December 31, 2024. Any Level 2 or Level 3 securities held by the Fund are noted in its Schedule of Investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with owning those securities.

| | LEVEL 1 | LEVEL 2 | LEVEL 3 | TOTAL |

| Common Stocks | $53,800,279 | $28,544,299 | $0 | $82,344,578 |

| Repurchase Agreement | – | 675,392 | – | 675,392 |

REPURCHASE AGREEMENTS:

The Fund may enter into repurchase agreements with institutions that the Fund’s investment adviser has determined are creditworthy. The Fund restricts repurchase agreements to maturities of no more than seven days. Securities pledged as collateral for repurchase agreements, which are held until maturity of the repurchase agreements, are marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest). Repurchase agreements could involve certain risks in the event of default or insolvency of the counter-party, including possible delays or restrictions upon the ability of the Fund to dispose of its underlying securities. The remaining contractual maturity of the repurchase agreement held by the Fund as of December 31, 2024, is next business day and continuous.

FOREIGN CURRENCY:

Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, expiration of currency forward contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investments in securities at the end of the reporting period, as a result of changes in foreign currency exchange rates.

The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

The Fund invests a significant portion of its assets in foreign companies that may be subject to different risks than investments in securities of U.S. companies, including adverse political, social, economic, or other developments that are unique to a particular country or region. Therefore, the prices of securities of foreign companies in particular countries or regions may, at times, move in a different direction than those of securities of U.S. companies. Because such investments in securities of foreign companies are usually denominated in foreign currencies and the Fund does not intend to hedge its foreign currency exposure, the U.S. dollar value of such investments may be harmed by declines in the value of foreign currencies in relation to the U.S. dollar.

For the purposes of the Statement of Cash Flows, the Fund defines Cash as cash, including foreign currency.

DISTRIBUTIONS AND TAXES:

As a qualified regulated investment company under Subchapter M of the Internal Revenue Code, the Fund is not subject to income taxes to the extent that it distributes substantially all of its taxable income for its fiscal year. The Schedule of Investments includes information regarding income taxes under the caption “Tax Information.”

The Fund pays any dividends and capital gain distributions annually in December. Because federal income tax regulations differ from generally accepted accounting principles, income and capital gain distributions determined in accordance with tax regulations may differ from net investment income and realized gains recognized for financial reporting purposes. Accordingly, the character of distributions and composition of net assets for tax purposes differ from those reflected in the accompanying financial statements.

18 | 2024 Annual Report to Stockholders

Royce Global Trust

Notes to Financial Statements (continued)

CAPITAL GAINS TAXES:

The Fund may be subject to a tax imposed on capital gains on securities of issuers domiciled in certain countries. This amount, if any, is reported as deferred capital gains tax in the accompanying Statement of Assets and Liabilities, assuming those positions were disposed of at the end of the period, and accounted for as a reduction in the market value of the security.

INVESTMENT TRANSACTIONS AND RELATED INVESTMENT INCOME:

Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date except for certain dividends from securities where the dividend rate is not available. In such cases, the dividend is recorded as soon as the information is received by the Fund. Non-cash dividend income is recorded at the fair market value of the securities received. Interest income is recorded on an accrual basis. Premiums and discounts on debt securities are amortized using the effective yield-to-maturity method. Realized gains and losses from investment transactions are determined on the basis of identified cost for book and tax purposes.

CASH INCLUDING FOREIGN CURRENCIES:

Cash, including foreign currencies, consists of deposits maintained at State Street Bank and Trust Company, the Fund’s Custodian (in such capacity, the "Custodian"), and through the Custodian’s global sub-custodian network. Accordingly, the Fund’s risk for the possible insolvency loss of a cash deposit lies with the Custodian or the relevant sub-custodian bank. Fund cash deposits maintained at the Custodian or through a particular sub-custodian bank may be significant, and may, at times, exceed U.S. or other applicable insurance limits.

EXPENSES:

The Fund incurs direct and indirect expenses. Expenses directly attributable to the Fund are charged to the Fund, while expenses applicable to more than one of the Royce Funds are allocated equitably. Certain personnel, occupancy costs and other administrative expenses related to all of the Royce Funds are allocated by Royce under an administration agreement and are included in administrative and office facilities and professional fees.

INDEMNIFICATION PROVISIONS: