UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________

FORM 10-K

________________________________________

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: March 31, 2016

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from | to | ||

Commission file number: 1-9344

________________________________________

AIRGAS, INC.

(Exact name of registrant as specified in its charter)

________________________________________

| Delaware | 56-0732648 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

259 North Radnor-Chester Road, Suite 100 Radnor, PA | 19087-5283 | |

| (Address of principal executive offices) | (ZIP code) | |

(610) 687-5253

(Registrant’s telephone number, including area code)

________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.01 per share | New York Stock Exchange | |

| Preferred Stock Purchase Rights | New York Stock Exchange | |

| Securities registered pursuant to Section 12(g) of the Act: None. | ||

________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ý | Accelerated filer | ¨ |

| Non-accelerated filer | o | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of the 65,464,408 shares of voting stock held by non-affiliates of the registrant was approximately $5.8 billion computed by reference to the closing price of such stock on the New York Stock Exchange as of the last day of the registrant’s most recently completed second quarter, September 30, 2015. For purposes of this calculation, only executive officers and directors were deemed to be affiliates.

The number of shares of common stock outstanding as of May 6, 2016 was 72,807,594.

AIRGAS, INC.

FORM 10-K

March 31, 2016

TABLE OF CONTENTS

| ITEM NO. | PAGE | |

| 1. | ||

| 1A. | ||

| 1B. | ||

| 2. | ||

| 3. | ||

| 4. | ||

| 5. | ||

| 6. | ||

| 7. | ||

| 7A. | ||

| 8. | ||

| 9. | ||

| 9A. | ||

| 9B. | ||

| 10. | ||

| 11. | ||

| 12. | ||

| 13. | ||

| 14. | ||

| 15. | ||

3

PART I

| ITEM 1. | BUSINESS. |

GENERAL

Airgas, Inc., together with its subsidiaries (“Airgas,” the “Company,” “we,” “our” or “us”), became a publicly-traded company on the New York Stock Exchange (“NYSE”) in 1986. Through a combination of organic growth initiatives and acquisitions in both its core and adjacent lines of business, the Company has become one of the nation’s leading suppliers of industrial, medical and specialty gases, and hardgoods, such as welding equipment and related products. Airgas is a leading U.S. producer of atmospheric gases, carbon dioxide, dry ice and nitrous oxide, one of the largest U.S. suppliers of safety products, and a leading U.S. supplier of refrigerants, ammonia products and process chemicals. Airgas’ production network and supply agreements, full range of gas supply modes (from cylinders to truckload quantities to on-site pipeline supply) and national footprint make it one of the few fully-integrated industrial gas companies in the U.S. The Company also offers supply chain management services and solutions, and product and process technical support across many diverse customer segments.

The Company markets its products and services through multiple sales channels, including branch-based sales representatives, retail stores, strategic customer account programs, telesales, catalogs, e-Business and independent distributors. Products reach customers through an integrated network of approximately 17,000 associates and more than 1,100 locations, including branches, retail stores, gas fill plants, specialty gas labs, production facilities and distribution centers. The Company’s product and service offering, full range of supply modes, national scale and strong local presence offer a competitive edge to its diversified base of more than one million customers.

The Company’s consolidated net sales were $5.31 billion, $5.30 billion and $5.07 billion in the fiscal years ended March 31, 2016, 2015 and 2014, respectively. The Company’s operations are predominantly in the United States. While the Company does conduct operations outside of the United States in Canada, Mexico, Russia, Dubai and several European countries, revenues from foreign countries represent less than 2% of the Company’s net sales. Information on revenues derived from foreign countries as well as long-lived assets attributable to the Company’s foreign operations can be found in Note 22 to the Company’s consolidated financial statements under Item 8, “Financial Statements and Supplementary Data.”

Since its inception, the Company has made approximately 480 acquisitions. During fiscal 2016, the Company acquired 18 businesses with aggregate historical annual sales of approximately $85 million. The Company acquired these businesses in order to expand its geographic coverage to facilitate the sale of industrial, medical and specialty gases, and related supplies, the addition of businesses that offer products and services complementary to the Company’s existing portfolio, and enhanced geographical coverage abroad to strengthen the Company’s welder and generator rental business. See Note 4 to the Company’s consolidated financial statements under Item 8, “Financial Statements and Supplementary Data,” for a description of current and prior year acquisition activity.

The Company has two business segments, Distribution and All Other Operations. The businesses within the Distribution business segment offer a portfolio of related gas and hardgoods products and services to the end customers. The All Other Operations business segment consists of six business units which primarily manufacture and/or distribute carbon dioxide, dry ice, nitrous oxide, ammonia and refrigerant gases, along with a nitrogen services business. Financial information by business segment can be found in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (“MD&A”), and in Note 22 to the Company’s consolidated financial statements under Item 8, “Financial Statements and Supplementary Data.” A more detailed description of the Company’s business segments follows.

On November 17, 2015, the Company announced that it had entered into a definitive agreement for the acquisition of the Company by L’Air Liquide, S.A. (“Air Liquide”) in a merger pursuant to an Agreement and Plan of Merger, dated as of November 17, 2015, by and among the Company, Air Liquide and AL Acquisition Corporation (“Merger Sub”), an indirect wholly owned subsidiary of Air Liquide (the “Merger Agreement”). The Merger Agreement provides that, among other things and subject to the terms and conditions thereof, Merger Sub will be merged with and into the Company (the “Merger”) with the Company continuing as the surviving corporation in the Merger as an indirect wholly owned subsidiary of Air Liquide. On February 23, 2016, at a special meeting of the Company’s stockholders, the stockholders voted to approve the Merger. See Note 2, “Merger Agreement,” to the Consolidated Financial Statements under Item 8, “Financial Statements and Supplementary Data,” for more information on the Merger Agreement.

DISTRIBUTION BUSINESS SEGMENT

The Distribution business segment accounted for approximately 90% of consolidated net sales in each of the fiscal years 2016, 2015 and 2014.

4

Principal Products and Services

The Distribution business segment’s principal products include industrial, medical and specialty gases sold in packaged and bulk quantities, as well as hardgoods. The Company’s air separation facilities and national specialty gas labs primarily produce gases that are sold by the various regional and other business units within the Distribution business segment as part of the complementary suite of similar products and services for the Company’s customers. Gas sales primarily include the following: atmospheric gases including nitrogen, oxygen and argon; helium; hydrogen; welding and fuel gases such as acetylene, propylene and propane; carbon dioxide; nitrous oxide; ultra high purity grades of various gases; special application blends; and process chemicals. Within the Distribution business segment, the Company also recognizes rent revenue derived from the rental of its gas cylinders, cryogenic liquid containers, bulk storage tanks, tube trailers and welding-related and other equipment. Gas and rent represented 61%, 59% and 60% of the Distribution business segment’s sales in fiscal years 2016, 2015 and 2014, respectively. Hardgoods consist of welding consumables and equipment, safety products, construction supplies, and maintenance, repair and operating supplies. Hardgoods sales represented 39%, 41% and 40% of the Distribution business segment’s sales in fiscal years 2016, 2015 and 2014, respectively.

Principal Markets and Methods of Distribution

The industry has three principal modes of gas distribution: on-site or pipeline supply, bulk or merchant supply, and cylinder or packaged supply. The on-site mode includes the supply of gaseous product to a customer facility via pipeline from a gas supplier’s plant located on or off the customer’s premises. The bulk mode consists of the supply of gases to customers in liquid form in full and partial truckload quantities or in gaseous form in tube trailers. The packaged gas mode includes the supply of gases to customers in gaseous form in cylinders, in liquid form in less-than-truckload quantities of bulk (also known as microbulk), or in liquid form in portable cryogenic vessels known as dewars. Generally, packaged gas distributors, including the Company and its competitors in the packaged gas market, also supply welding-related hardgoods required by customers to complement their use of gases.

The Company participates in all three modes of supply to varying degrees, with the packaged supply mode representing the most significant portion of its gas sales. The Company is one of the nation’s leading suppliers in the U.S. packaged gas and welding hardgoods market, with an estimated share of more than 25%. The Company’s competitors in this market include local and regional independent distributors, which are estimated to account for nearly half of the market’s annual revenues, and certain vertically-integrated gas producers, which account for the remainder of the market.

The Company markets its products and services through multiple sales channels, including branch-based representatives, retail stores, telesales, strategic customer account programs, catalogs, e-Business, and other distributors. Packaged gases and welding-related hardgoods are generally delivered to customers on Company-owned or leased trucks, although third-party carriers are also used in the delivery of welding-related hardgoods and safety products. Packaged gas distribution is a localized business because it is generally not economical to transport gas cylinders more than 50 to 100 miles from a plant or branch. The localized nature of the business makes these markets highly competitive, and competition is generally based on reliable product delivery and availability, technical support, quality and price.

Customer Base

The Company’s operations are predominantly in the United States. The Company’s customer base is diverse and sales are not dependent on a single or small group of customers. The Company’s largest customer accounts for less than 1% of total net sales. The Company estimates the following industry segments account for the approximate indicated percentages of its net sales:

| • | Manufacturing & Metal Fabrication (29%) |

| • | Non-Residential (Energy & Infrastructure) Construction (15%) |

| • | Life Sciences & Healthcare (14%) |

| • | Food, Beverage & Retail (13%) |

| • | Energy & Chemical Production & Distribution (12%) |

| • | Basic Materials & Services (11%) |

| • | Government & Other (6%). |

Supply

The Company’s atmospheric gas production capacity includes 17 air separation plants that produce oxygen, nitrogen and argon, making Airgas the fifth largest U.S. producer of atmospheric gases. In addition, the Company purchases atmospheric and other gases pursuant to contracts with national and regional producers of industrial gases. The Company is a party to take-or-pay supply agreements under which Air Products and Chemicals, Inc. (“Air Products”) will supply the Company with bulk

5

nitrogen, oxygen, argon, hydrogen and helium. The Company is committed to purchase a minimum of approximately $61 million in bulk gases within the next fiscal year under the Air Products supply agreements. The agreements expire at various dates through 2020. The Company also has take-or-pay supply agreements with The Linde Group AG (“Linde”) to purchase oxygen, nitrogen, argon and helium. The agreements expire at various dates through 2025 and represent approximately $95 million in minimum bulk gas purchases for the next fiscal year. Additionally, the Company has take-or-pay supply agreements to purchase oxygen, nitrogen, argon, helium and ammonia from other major producers. Minimum purchases under these contracts for the next fiscal year are approximately $36 million and they expire at various dates through 2026. The level of annual purchase commitments under the Company’s supply agreements beyond the next fiscal year vary based on the expiration of agreements at different dates in the future, among other factors.

The Company’s annual purchase commitments under all of its supply agreements reflect estimates based on fiscal 2016 purchases. The Company’s supply agreements contain periodic pricing adjustments, most of which are based on certain economic indices and market analyses. The Company believes the minimum product purchases under the agreements are within the Company’s normal product purchases. Actual purchases in future periods under the supply agreements could differ materially from those presented due to fluctuations in demand requirements related to varying sales levels as well as changes in economic conditions. If a supply agreement with a major supplier of gases or other raw materials was terminated, the Company would attempt to locate alternative sources of supply to meet customer requirements, including utilizing excess internal production capacity for atmospheric gases. The Company purchases hardgoods from major manufacturers and suppliers. For certain products, the Company has negotiated national purchasing arrangements. The Company believes that if an arrangement with any supplier of hardgoods was terminated, it would be able to negotiate comparable alternative supply arrangements.

ALL OTHER OPERATIONS BUSINESS SEGMENT

The All Other Operations business segment consists of six business units, which in aggregate accounted for approximately 10% of sales in each of the fiscal years 2016, 2015 and 2014. The primary products produced and/or supplied are carbon dioxide, dry ice (carbon dioxide in solid form), nitrous oxide, ammonia and refrigerant gases, along with a nitrogen services business. The following sections describe the primary products and services offered by the Company through the business units within the All Other Operations business segment in further detail.

Carbon Dioxide & Dry Ice

Airgas is a leading U.S. producer of liquid carbon dioxide and dry ice. Customers for carbon dioxide and dry ice include food processors, food service businesses, various businesses in the pharmaceutical and biotech industries, and wholesale trade and grocery outlets, with food and beverage applications accounting for approximately 70% of the market. Some seasonality is experienced within these businesses, as the Company generally experiences a higher level of sales during the warmer months. With 14 dry ice plants (converting liquid carbon dioxide into dry ice), Airgas has the largest network of dry ice conversion plants in the U.S. Additionally, Airgas operates eight liquid carbon dioxide production facilities. The Company’s carbon dioxide production capacity is supplemented by take-or-pay supply contracts with other regional and national liquid carbon dioxide producers.

Nitrous Oxide

Airgas is the largest producer of nitrous oxide gas in the U.S. through its three nitrous oxide production facilities. Nitrous oxide is used as an anesthetic in the medical and dental fields, as a propellant in the packaged food industry and in certain manufacturing processes in the electronics industry. The raw materials utilized in nitrous oxide production are purchased under contracts with major manufacturers and suppliers.

Ammonia Products

Airgas is a leading U.S. distributor of anhydrous and aqua ammonia. Industrial ammonia applications primarily include the abatement of nitrogen oxide compounds (“DeNOx”) in the utilities industry, chemicals processing, commercial refrigeration, water treatment and metal treatment. The Company operates 29 distribution facilities across the U.S. and purchases ammonia from suppliers under agreements.

Refrigerants

Refrigerants are used in a wide variety of commercial and consumer freezing and cooling applications. Airgas purchases and distributes refrigerants and provides technical and refrigerant reclamation services. The primary focus of the refrigerants business is on the sale, distribution and reclamation of refrigerants, with a varied customer base that includes small and large HVAC contractors and distributors, facility owners, transportation companies, manufacturing facilities and government agencies. The refrigerants business typically experiences some seasonality, with higher sales levels during the warmer months as well as during the March and April time frame in preparation for the cooling season.

6

Nitrogen Services

Airgas provides nitrogen pumping services and solutions to the pipeline and energy processing industries. There are a broad range of industrial applications for these services at chemical plants, refineries, power plants, oilfield sites, and shipyards. The majority of revenues are generated from pipeline project work such as purging, pressure testing, cooling, and freezing.

AIRGAS GROWTH STRATEGIES

The Company’s primary objective is to maximize shareholder value by: driving market-leading sales growth through product and service offerings that leverage the Company’s infrastructure, technical expertise, and diverse customer base; executing on strategic organic growth initiatives; pursuing acquisitions in the Company’s core distribution business and in adjacent lines of business to increase customer density; providing outstanding customer service; and improving operational efficiencies. To meet this objective, the Company is focused on the following:

| • | alignment of the sales and marketing organization with key customer segments, particularly within the strategic accounts program, to provide leadership and support throughout all sales channels in tailoring the Company’s broad product and service offerings to the unique needs of each customer segment; |

| • | leveraging all sales channels, including branch-based sales representatives, product and industry specialists, retail stores, the strategic accounts program, telesales, catalogs, e-Business and independent distributors; |

| • | fully leveraging the new District Manager structure to drive local sales and branch operations accountability, enhance depth of customer relationships, continuously improve transaction accuracy, and increase speed to deliver exceptional customer service through the Districts; |

| • | enhancing the effectiveness of the field-based sales organization through improved sales management disciplines at the District and branch levels; |

| • | driving customer adoption of the Company’s new Airgas.com e-Business platform; |

| • | strategic products, which have strong growth profiles due to favorable customer segments, application development, increasing environmental regulation, strong cross-selling opportunities, or a combination thereof (e.g., bulk gases, specialty gases, medical products, carbon dioxide/dry ice and safety products); |

| • | leveraging the Company’s enterprise information system (“SAP”) by capturing strategic pricing benefits, expanding the Airgas Total Access™ telesales platform, developing key metrics, analytics and tools for continuous improvement, optimizing sales channels and maximizing hardgoods and packaged gas distribution efficiencies; |

| • | effective utilization of the Company’s divisional operating structure and Business Support Centers (“BSCs”) to leverage the full benefits of the SAP platform, maximize back-office efficiencies, ensure data integrity, and streamline customer relationship management; |

| • | reducing costs associated with gaseous production, cylinder filling, gas asset utilization and maintenance and distribution logistics; and |

| • | adding density through organic growth, acquisitions and growing share to complement and expand its business and to leverage its significant national platform. |

ENVIRONMENTAL MATTERS

The Company is subject to federal and state laws and regulations adopted for the protection of the environment and the health and safety of employees and users of the Company’s products. The Company has programs for the design and operation of its facilities to achieve compliance with applicable environmental regulations. The Company believes that it is in compliance, in all material respects, with such laws and regulations. Expenditures for environmental compliance purposes during fiscal 2016 were not material.

INSURANCE

The Company has established insurance programs to cover workers’ compensation, business automobile and general liability claims. During fiscal years 2016, 2015 and 2014, these programs had deductible limits of $1 million per occurrence and costs related to the programs were approximately 0.5% of sales during each of these years. For fiscal year 2017, the deductible limits are expected to remain at $1 million per occurrence. The Company accrues estimated losses using actuarial methods and assumptions based on the Company’s historical loss experience.

7

EMPLOYEES

As of March 31, 2016, the Company employed approximately 17,000 associates. Less than 5% of the Company’s associates were covered by collective bargaining agreements. The Company believes it has good relations with its employees and has not experienced a significant strike or work stoppage in over ten years.

PATENTS, TRADEMARKS AND LICENSES

The Company holds the following trademarks and service marks: “Airgas,” “National Carbonation,” “Airgas National Carbonation,” “Airgas Total Access,” “Airgas Retail Solutions,” “Airgas University,” “AcuGrav,” “AcuVend,” “AIR BOSS,” “Aspen,” “Aspen Refrigerants,” “Any Refrigerant, Any Place, Any Time,” “ChillRight,” “Cooler Than Ice,” “EZ-Vend,” “EasyLease,” “For All Your Refrigerant Needs,” “Radnor,” “Gold Gas,” “SteelMIX,” “StainMIX,” “AluMIX,” “OUTLOOK,” “Ny-Trous+,” “Red-D-Arc,” “RED-D-ARC WELDERENTALS,” “Gaspro,” “GAIN,” “MasterCut,” “Walk- O2 -Bout,” “Airgas Puritan Medical,” “Penguin Brand Dry Ice,” “Kangaroo Kart,” “National Farm and Shop,” “National/HEF,” “UNAMIX,” “UNAMIG Xtra,” “UNAMIG Six,” “FreezeRight,” “Reklaim,” “Refrigatron,” “RelEye,” “Safe-T-Cyl,” “StatusChecker,” “Smart-Logic,” “When You’re Ready To Weld,” “WelderHelper,” “Your Total Ammonia Solution,” “You’ll find it with us,” “Worry-Free Carbonation,” “Refreshingly Easy,” “QuartzSight,” “Saffire,” and “Panzer.” Additionally, the Company has registered U.S. Pat. No. 5,622,644.

The Company believes that its businesses as a whole are not materially dependent upon any single patent, trademark or license.

EXECUTIVE OFFICERS OF THE COMPANY

The executive officers of the Company are as follows:

| Name | Age | Position |

| Peter McCausland | 66 | Executive Chairman of the Board |

| Michael L. Molinini | 65 | President, Chief Executive Officer and Director |

| Robert M. McLaughlin | 59 | Senior Vice President and Chief Financial Officer |

| Andrew R. Cichocki | 53 | Senior Vice President - Airgas, Inc. and President - Airgas USA, LLC |

| Robert A. Dougherty | 58 | Senior Vice President and Chief Information Officer |

| Leslie J. Graff | 55 | Senior Vice President - Corporate Development |

| Ronald J. Stark | 52 | Senior Vice President - Sales and Marketing |

| Nicole L. Kahny | 44 | Senior Vice President - Human Resources |

| Robert H. Young, Jr. | 65 | Senior Vice President and General Counsel |

| R. Jay Worley | 47 | Senior Vice President - Distribution Operations |

| Thomas S. Thoman | 53 | Senior Vice President - Gases |

| Douglas L. Jones | 60 | Division President - West |

| Terry L. Lodge | 59 | Division President - Central |

| Pamela J. Claypool | 62 | Division President - North |

| John F. Sheehan | 57 | Division President - South |

| Martin J. Wehner | 57 | Division President - Process Gases |

Thomas M. Smyth (1) | 62 | Vice President and Controller |

____________________

(1) Mr. Smyth serves as the Company’s Principal Accounting Officer, but he is not an executive officer.

Mr. McCausland has been Executive Chairman of the Board since August 2012. He previously served as Chairman of the Board from 1987 to September 2010 and from August 2011 to August 2012. Mr. McCausland also served as the Chief Executive Officer of Airgas from May 1987 to August 2012 and President of Airgas from June 1986 to August 1988, from April 1993 to November 1995, from April 1997 to January 1999 and from January 2005 to August 2012. Mr. McCausland serves as a director of the Independence Seaport Museum. Mr. McCausland also serves on the Board of Visitors of the Boston University School of Law and the College of Arts and Sciences of the University of South Carolina.

Mr. Molinini has been President, Chief Executive Officer and Director since August 2012. Prior to that time, Mr. Molinini served as Executive Vice President and Chief Operating Officer from January 2005 to August 2012, Senior Vice President - Hardgoods Operations from August 1999 to January 2005 and as Vice President - Airgas Direct Industrial from April 1997 to July 1999. Prior to joining Airgas, Mr. Molinini served as Vice President of Marketing of National Welders Supply Company, Inc. (“National Welders”) from 1991 to 1997.

8

Mr. McLaughlin has been Senior Vice President and Chief Financial Officer since October 2006 and served as Vice President and Controller from the time he joined Airgas in June 2001 to September 2006. Prior to joining Airgas, Mr. McLaughlin served as Vice President Finance for Asbury Automotive Group from 1999 to 2001, and was a Vice President and held various senior financial positions at Unisource Worldwide, Inc. from 1992 to 1999. Mr. McLaughlin also serves on the Board of Directors of Axalta Coating Systems Ltd.

Mr. Cichocki was named Senior Vice President - Airgas, Inc. effective August 2014 and President - Airgas USA, LLC effective April 2014. Airgas USA, LLC accounts for the majority of the Company’s consolidated net sales. Mr. Cichocki previously served as Senior Vice President - Distribution Operations and Business Process Improvement from August 2011 through March 2014. From July 2008 to July 2011, he was Division President - Process Gases and Chemicals. Prior to that time, Mr. Cichocki served as President of Airgas National Welders and Airgas’ joint venture, National Welders, from 2003. Prior to that, Mr. Cichocki served in key corporate roles for Airgas, including Senior Vice President of Human Resources, Senior Vice President of Business Operations and Planning, and for ten years as Vice President of Corporate Development.

Mr. Dougherty has been Senior Vice President and Chief Information Officer since joining Airgas in January 2001. Prior to joining Airgas, Mr. Dougherty served as Vice President and Chief Information Officer from 1998 to 2000 and as Director of Information Systems from 1993 to 1998 at Subaru of America, Inc.

Mr. Graff has been Senior Vice President - Corporate Development since August 2006. Prior to that, Mr. Graff held various management positions since joining the Company in 1989, including Director of Corporate Finance, Director of Corporate Development, Assistant Vice President - Corporate Development and Vice President - Corporate Development. He has directed the in-house acquisition department since 2001. Prior to joining Airgas, Mr. Graff worked for KPMG LLP from 1983 to 1989.

Mr. Stark was named Senior Vice President - Sales and Marketing in July 2009 and previously served as President, Airgas North Central, since joining Airgas in 2003. Mr. Stark began his career at Union Carbide - Linde Division (now Praxair) in 1985 and advanced through a series of positions in applications engineering and key account management. In 1992, he joined MVE, a Minnesota-based supplier of cryogenic storage and distribution technology, and advanced to vice president and general manager of the industrial gases market. After Chart Industries acquired MVE in 1999, Mr. Stark became president of Chart’s Distribution and Storage Group and held that post until joining Airgas.

Ms. Kahny was named Senior Vice President - Human Resources in August 2015. Previously, Ms. Kahny served as Vice President - Talent Management since joining Airgas in February 2014. Prior to joining Airgas, Ms. Kahny served as Vice President of Global Talent, Leadership & Organizational Development for Viacom from December 2012 to February 2014. Prior to that time, she served as Vice President, Global Talent & Organizational Capability at Pfizer from October 2009 until December 2011. Ms. Kahny has more than 20 years of experience in the human resources field, serving in various cross-functional and cross-industry roles.

Mr. Young has been Senior Vice President and General Counsel since October 2007. Prior to joining Airgas, Mr. Young was a shareholder of McCausland Keen & Buckman, which he joined in 1985, and served as outside counsel for the Company on many acquisitions and other corporate legal matters. At McCausland Keen & Buckman, Mr. Young focused his practice on general corporate law for both public and private corporations, mergers and acquisitions, and venture capital financing. Mr. Young began his legal career as an attorney at Drinker Biddle & Reath in Philadelphia.

Mr. Worley has served as Senior Vice President - Distribution Operations since February 2015. Prior to that, Mr. Worley served as Vice President - Strategic Pricing since the inception of Airgas’ strategic pricing program in January 2012, and as President of Airgas National Carbonation since October 2013. Previously, Mr. Worley held the position of Vice President - Communications and Investor Relations for Airgas from July 2008 to December 2011, as Director - Investor Relations from 2006 until July 2008 and as Chief Financial Officer of Airgas Southwest from 2001 until 2006. Mr. Worley began his career at Airgas in 1993 as Assistant Controller with what is now Airgas Intermountain and held a variety of roles in that organization, including in sales and human resources.

Mr. Thoman was named Senior Vice President - Gases in August 2015. Previously, Mr. Thoman served as Division President - Gases Production from July 2011 to August 2015 and from 2007 to 2011 he served as Senior Vice President - Tonnage and Merchant Gases and President - Airgas Merchant Gases. Prior to that time, Mr. Thoman served in key corporate roles including Vice President - Gases, which focused on the Company’s gases supply chains, product sourcing, marketing, product management and business development. He has been with Airgas nearly 15 years and in the industrial gas industry for 27 years.

Mr. Jones has been Division President - West since April 2013. Prior to this role, Mr. Jones was President of Airgas Intermountain from 2006 to April 2013, Vice President of Sales and Marketing from 2001 to 2006 and Director of Marketing from 1998 to 2001. Mr. Jones has served the Company in various other roles since joining Airgas in 1989 through the acquisition of Utah Welders Supply.

9

Mr. Lodge has been Division President - Central since July 2011. Prior to that time, Mr. Lodge was President of Airgas Mid South from November 2007, Vice President - Western Division from January 2005 to November 2007 and CFO for Airgas Mid South from August 1994 to January 2005. Prior to joining Airgas, Mr. Lodge was the CFO for The Jimmie Jones Company, an independent distributor acquired by Airgas in 1994 where he originally started his career in the industrial gas industry in 1979.

Ms. Claypool was named Division President - North in August 2015. From December 2013 to August 2015, Ms. Claypool served as Senior Vice President - Human Resources and from January 2013 to December 2013, as Vice President - Talent Management for Airgas. Prior to that time, she served as Vice President - Human Resources for Airgas’ North Division from November 2011 to January 2013. She joined Airgas in 2007 with the acquisition of Linde’s U.S. packaged gas business, serving as Vice President of Finance until May 2009, then Chief Financial Officer until November 2011 for Airgas Great Lakes, Inc. Prior to joining Airgas, Ms. Claypool spent three years in Linde’s U.S. group where she was responsible for business and financial analysis and sales compensation, and fourteen years with Commercial Intertech in multiple finance and management roles.

Mr. Sheehan was named Division President - South in October 2015. Previously, Mr. Sheehan served as an Area Vice President in the Airgas South Region, after selling his former business, TriTech, to Airgas in 2009, after nearly 15 years as President and Managing General Partner. Prior to that, Mr. Sheehan led AirTech Incorporated as President from 1991 to 1996 and launched the company’s packaged gas business. From 1981 to 1990, Mr. Sheehan served as Vice President and Chief Operational Officer of Bishop’s Welding Supply and was responsible for all facets of the business from accounting and sales to human resources and plant operations.

Mr. Wehner was named Division President - Process Gases in August 2015. Previously, Mr. Wehner served as Vice President - Process Gases and Chemicals from March 2015 to August 2015 and prior that served as President - Airgas Specialty Products since 2011. Mr. Wehner joined Airgas in 2005 as Vice President of Sales for Airgas Specialty Products when Airgas acquired LaRoche Industries. Prior to joining Airgas, Mr. Wehner spent six years as Business Manager of the Zeolite Division at UOP, a Honeywell company, and thirteen years at LaRoche Industries, where he held a number of sales, sales management, technical service and distribution management positions.

Mr. Smyth has been Vice President and Controller since November 2006. Prior to that, Mr. Smyth served as Director of Internal Audit since joining Airgas in February 2001 and became Vice President in August 2004. Prior to joining Airgas, Mr. Smyth served in internal audit, controller and chief accounting roles at Philadelphia Gas Works from 1997 to 2001. Prior to that, Mr. Smyth spent 12 years with Bell Atlantic, now Verizon, in a variety of internal audit and general management roles and in similar positions during eight years at Amtrak.

COMPANY INFORMATION

The Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed with or furnished to the Securities and Exchange Commission (“SEC”) are available free of charge on the Company’s website (www.airgas.com) under the “Financial Information” link in the “Investor Relations” section. The Company makes these documents available as soon as reasonably practicable after they are filed with or furnished to the SEC, but no later than the end of the day that they are filed with or furnished to the SEC.

Code of Ethics and Business Conduct

The Company has adopted a Code of Ethics and Business Conduct applicable to its employees, officers and directors. The Code of Ethics and Business Conduct is available on the Company’s website, under the “Corporate Governance” link in the “Investor Relations” section. Amendments to and waivers from the Code of Ethics and Business Conduct will also be disclosed promptly on the website. In addition, stockholders may request a printed copy of the Code of Ethics and Business Conduct, free of charge, by contacting the Company’s Investor Relations department at:

Airgas, Inc.

Attention: Investor Relations

259 N. Radnor-Chester Rd.

Radnor, PA 19087-5283

Telephone: (866) 816-4618

Email: investors@airgas.com

Corporate Governance Guidelines

The Company has Corporate Governance Guidelines as well as charters for its Audit Committee, Finance Committee and Governance & Compensation Committee. These documents are available on the Company’s website, noted above. Stockholders may also request a copy of these documents, free of charge, by contacting the Company’s Investor Relations department at the address and phone number noted above.

10

Certifications

The Company has filed certifications of its Executive Chairman of the Board, President and Chief Executive Officer, and Senior Vice President and Chief Financial Officer pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act of 2002 as exhibits to its Annual Report on Form 10-K for each of the years ended March 31, 2016, 2015 and 2014.

| ITEM 1A. | RISK FACTORS. |

In addition to risk factors discussed in MD&A under “Critical Accounting Estimates” and elsewhere in this report, we believe the following, which have not been sequenced in any particular order, are the most significant risks related to our business that could cause actual results to differ materially from those contained in any forward-looking statements.

Risk Factors Related to Our Business

We face risks related to general economic conditions, which may impact the demand for and supply of our products and our results of operations.

Demand for our products depends in part on the general economic conditions affecting the United States and, to a lesser extent, the rest of the world. Although our diverse product offering and customer base help provide some stability to our business in difficult times, a broad decline in general economic conditions or changes in other external factors including the price of commodities, such as crude oil, could result in customers postponing capital projects and could negatively impact the demand for our products and services as well as our customers’ ability to fulfill their obligations to us. The impact of a strong U.S. dollar could give rise to higher imports and reduce production activity for domestic customers that export, thereby reducing demand for our products. In addition, falling demand could lead to lower sales volumes, lower pricing and/or lower profit margins. It could also impact our ability to fulfill our volume purchase obligations under take-or-pay supply agreements, resulting in lower profit margins. A protracted period of lower product demand and profitability could result in diminished values for both tangible and intangible assets, increasing the possibility of future impairment charges. Further, suppliers could be impacted by an economic downturn, which could impact their ability to fulfill their obligations to us. If economic conditions deteriorate, our operating profit, financial condition and cash flows could be adversely affected.

Our financial results may be adversely affected by gas supply disruptions and supply/demand imbalances.

We are one of the nation’s leading suppliers of industrial, medical and specialty gases and have supply contracts with the major gas producers. Additionally, we operate 17 air separation units, 11 acetylene plants and eight liquid carbon dioxide production facilities, which provide us with substantial production capacity. Our supply contracts and our own production capacity mitigate supply disruptions to various degrees. However, natural disasters, plant shut-downs, labor strikes and other supply disruptions may occur within our industry. Regional supply disruptions may create shortages of raw materials and certain products. Consequently, we may not be able to obtain the products required to meet our customers’ demands or may incur significant costs to ship product from other regions of the country to meet customer requirements. Such additional costs may adversely impact operating results until product sourcing can be restored. When we experience supply shortages, we work to meet customer demand by arranging for alternative supplies and transporting product into an affected region, but we cannot guarantee that we will be successful in arranging alternative product supplies or passing the additional transportation or other costs on to customers in the event of future supply disruptions, which could negatively impact our operations, financial results or liquidity.

Interruptions in the proper functioning of our information systems could disrupt business and operational activities.

We rely on information systems for business and operational activities, including the processing and storage of proprietary and sensitive information. These systems are susceptible to disruptions as a result of events such as fires, natural disasters, hardware and software failures, network outages, power disruptions, and other problems. Although we maintain data center and network resiliency and recovery capabilities for our critical systems, interruptions in the proper functioning of these systems could adversely impact our ability to process orders, shipments, inventory receipts, vendor payments, and accounts receivable collections - any of which could negatively impact our operations or financial results.

Breaches of our information systems and e-Business platform could adversely impact our reputation, disrupt operations, and result in increased costs and loss of revenue.

Information security risks and threats have increased in recent years as a result of the interconnectedness of the systems, networks, and e-Business platform used to conduct business with our customers, suppliers and other third parties. Our business is also subject to complex and evolving U.S. and foreign laws and regulations regarding privacy, data protection and other matters. Despite maintaining and continuously improving our technologies and processes to mitigate these risks and comply with laws and regulations, sophisticated cyberattacks and security breaches could compromise our systems and data. Such events could expose us to reputational damage, business disruptions, regulatory and legal actions, and claims from customers,

11

suppliers, financial institutions, and employees - any of which could have a material adverse impact to our financial condition and results of operations.

Catastrophic events and operating failures may disrupt our business and adversely affect our operating results.

Although our operations are widely distributed across the U.S., and safety is a primary focus in all we do, we manage and distribute hazardous materials and a catastrophic event could result in significant property losses, injuries and third-party claims. Examples of such events include, but are not limited to, the following: a fire, explosion or release of hazardous materials at one of our facilities, a supplier’s facility or a customer’s facility; a natural disaster, such as a hurricane, tornado or earthquake; and an operating failure at one of our facilities or in connection with the delivery of our products. Additionally, such events may severely impact our regional customer base and supply sources resulting in lost revenues, higher product costs and increased bad debts.

Operational and execution risks may adversely impact our financial results.

Our operating results are reliant on the continued operation of our production and distribution facilities and delivery fleet, as well as our ability to meet customer requirements. Inherent in our operations are risks that require continuous oversight and control, such as risks related to mechanical failure, fire, explosion, toxic releases and vehicle accidents. We have policies, procedures and safety protocols in place requiring continuous training, oversight and control in order to address these risks to our operations. However, significant operating failures at our production, distribution or storage facilities, or vehicle transportation accidents, could result in loss of life, loss of production or distribution capabilities, and/or damage to the environment, thereby adversely impacting our operations and financial results. These factors could subject us to lost sales, litigation contingencies and reputational risk.

U.S. credit markets may impact our ability to obtain financing or increase the cost of future financing.

As of March 31, 2016, we had total consolidated debt of approximately $2.6 billion, which had an average length to maturity of approximately four years and includes $250 million of long-term debt obligations maturing during the year ending March 31, 2017. During periods of volatility and disruption in the U.S. credit markets, obtaining additional or replacement financing may be more difficult and costly. Higher cost of new debt may limit our ability to finance future acquisitions on terms that are acceptable to us. Additionally, although we actively manage our interest rate risk through the use of diversified debt obligations and occasional derivative instruments, approximately 30% of our debt has a variable interest rate. If interest rates increase, our interest expense could increase, affecting earnings and reducing cash flows available for working capital, capital expenditures and acquisitions. Based on our outstanding borrowings at March 31, 2016, for every 25 basis point increase in our average variable borrowing rates, we estimate that our annual interest expense would increase by approximately $2.0 million.

Finally, our cost of borrowing can be affected by debt ratings assigned by independent rating agencies which are based in large part on our performance as measured by certain liquidity metrics. An adverse change in these debt ratings could increase the cost of borrowing and make it more difficult to obtain financing on favorable terms.

We operate in a highly competitive environment and such competition could negatively impact us.

The U.S. industrial gas industry operates in a highly competitive environment. Competition is generally based on price, reliable product delivery, product availability, technical support, quality and service. If we are unable to compete effectively with our competitors, we may suffer lower revenue and/or a loss of customers, which could result in lower profits and adversely affect our financial condition and cash flows.

Volatility in product and energy costs could reduce our profitability.

The cost of industrial gases represents a significant percentage of our operating costs. The production of industrial gases requires significant amounts of electricity. Therefore, industrial gas prices have historically increased as the cost of electricity increases. Unforeseen increases in power fuel costs, namely natural gas prices and to a degree oil, can result in unanticipated higher electric prices and operating costs. Severe weather conditions can adversely impact both our sales and expenses, causing an impediment to fully and timely recoup such unanticipated costs from our customers. In addition, a significant portion of our product distribution expenses consists of fuel costs. Energy prices can be volatile and may rise in the future, resulting in an increase in the distribution costs of industrial gases. While we have historically been able to pass increases in operating expenses on to our customers, we cannot guarantee our ability to do so in the future, which could negatively impact our operations, financial results or liquidity.

We may not be successful in integrating acquisitions and achieving intended benefits and synergies.

We have successfully integrated approximately 480 acquisitions in our history and consider the acquisition and integration of businesses to be a core competency. However, the process of integrating acquired businesses into our operations may result in unexpected operating difficulties and may require significant financial and other resources. Unexpected

12

difficulties may impair our ability to achieve targeted synergies or planned operating results, which could diminish the value of acquired tangible and intangible assets resulting in future impairment charges. Acquisitions involve numerous risks, including:

| • | acquired companies may not have internal control structures appropriate for a larger public company, resulting in a need for significant revisions; |

| • | acquired operations, information systems and products may be difficult to integrate; |

| • | acquired operations may not achieve targeted synergies; |

| • | we may not be able to retain key employees, customers and business relationships of acquired companies; and |

| • | our management team may have its attention and resources diverted from ongoing operations. |

We depend on our key personnel to manage our business effectively and they may be difficult to replace.

Our performance substantially depends on the efforts and abilities of our senior management team and key employees. Furthermore, much of our competitive advantage is based on the expertise, experience and know-how of our key personnel regarding our distribution infrastructure, systems and products. The loss of key employees could have a negative effect on our business, revenues, results of operations and financial condition.

We are subject to litigation and reputational risk as a result of the nature of our business, which may have a material adverse effect on our business.

From time-to-time, we are involved in lawsuits that arise from our business. Litigation may, for example, relate to product liability claims, personal injury, property damage, vehicle accidents, regulatory issues, contract disputes or employment matters. The occurrence of any of these matters could also create possible damage to our reputation and our operations. The defense and ultimate outcome of lawsuits against us may result in higher operating expenses. Higher operating expenses or reputational damage could have a material adverse effect on our business, including to our liquidity, results of operations or financial condition.

We have established insurance programs with significant deductibles and maximum coverage limits which could result in the recognition of significant losses.

We maintain insurance coverage for workers’ compensation, business automobile and general liability claims with significant per occurrence deductibles. In the past, we have incurred significant workers’ compensation, business automobile and general liability losses. Such losses could impact our profitability. Additionally, claims in excess of our insurance limits could have a material adverse effect on our financial condition, results of operations or liquidity.

We are subject to extensive government regulation relating to health, safety and environmental matters, as well as anti-corruption laws that generate ongoing compliance costs and could subject us to liability.

We are subject to laws and regulations relating to health, safety and the protection of the environment and natural resources, as well as regulations related to social policy. These include, among other things, reporting on chemical inventories and risk management plans, and management of hazardous substances and wastes, air emissions and water discharges. More recently, we have examined our supply chain with respect to certain products we manufacture or contract to manufacture as a result of new regulations around the use of conflict minerals. Violations of existing laws and enactment of future legislation and regulations could result in substantial penalties, temporary or permanent plant closures, restrictions on our operations caused by the temporary or permanent loss of our licenses and other legal consequences, as well as reputational and other risks. Moreover, the nature of our existing and historical operations exposes us to the risk of liabilities to third parties. These potential claims include property damage, personal injuries and cleanup obligations.

The issue of greenhouse gas emissions has been subject to increased scrutiny and public awareness, and may result in legislation, both internationally and in the U.S., to reduce its effects. Increased regulation of greenhouse gas emissions could impose additional costs on us, both directly through new compliance and reporting requirements as well as indirectly through increased industrial gas and energy costs. Until such time as any new legislation is passed, it will remain unclear as to what industries would be impacted, the period of time within which compliance would be required, the significance of the greenhouse gas emissions reductions and the costs of compliance. Although we do not believe that increased greenhouse gas emissions regulation will have a material adverse effect on our financial condition, results of operations or liquidity, we cannot provide assurance that such costs will not increase in the future or will not become material.

Although our operations are predominantly in the United States, we conduct operations internationally in Canada, Mexico, Russia, Dubai and several European countries. Our international operations are subject to U.S. and foreign anti-corruption laws and regulations, including the U.S. Foreign Corrupt Practices Act and anti-corruption laws of the various jurisdictions in which we operate. We maintain policies and procedures designed to comply with anti-corruption laws.

13

However, there can be no guarantee that these policies and procedures will effectively prevent violations by our employees or representatives in the future.

Risk Factors Related to the Merger

The proposed Merger may not be completed on a timely basis, or at all, and the failure to complete the Merger could adversely affect our business and the market price of our common stock.

On November 17, 2015, we entered into the Merger Agreement with Air Liquide and the Merger Sub. Completion of the Merger is subject to various conditions, including the receipt of necessary antitrust and regulatory approvals. Failure to complete the Merger could adversely affect our business and the market price of our common stock in a number of ways, including the following:

| • | If the Merger is not completed, and there are no other parties willing and able to acquire the Company for consideration that is equivalent or more attractive than that in the Merger Agreement, on terms acceptable to us, our stock price may decline. |

| • | We have incurred, and will continue to incur, significant costs, expenses and fees for professional services and other transaction costs in connection with the proposed Merger, for which we will have received little or no benefit if the Merger is not completed. Many of these fees and costs will be payable by us even if the Merger is not completed and may relate to activities that we would not have undertaken other than to complete the Merger. |

The prospective Merger could adversely affect our business, financial condition and results of operations.

The prospective Merger could cause disruptions in and create uncertainty surrounding our ongoing business operations, which could have an adverse effect on our financial condition and results of operations, regardless of whether the Merger is completed. These risks to our business include the following, all of which could be exacerbated by a delay in the completion of the Merger:

| • | the diversion of significant management time and resources towards the completion of the Merger; |

| • | the impairment of our ability to retain and hire key personnel, including our senior management; |

| • | difficulties maintaining relationships with customers, suppliers and others with whom we conduct business; |

| • | the impairment of our ability to execute on our strategy of growth through acquisitions; and |

| • | potential litigation relating to the Merger and the costs related thereto. |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS. |

None.

| ITEM 2. | PROPERTIES. |

The Company operates in all 50 U.S. states and in Canada, Mexico, Russia, Dubai and several European countries. The principal executive offices of the Company are located in leased space in Radnor, Pennsylvania.

The Company’s Distribution business segment operates a network of multiple use facilities consisting of approximately 900 branches, approximately 300 cylinder fill plants, 70 regional specialty gas laboratories, 11 national specialty gas laboratories, one research and development center, two specialty gas equipment centers, 11 acetylene plants and 17 air separation units, as well as six national hardgoods distribution centers, various customer call centers, buying centers and administrative offices. The Distribution business segment conducts business in all 50 states and internationally in Canada, Mexico, Russia, Dubai and several European countries. The Company owns approximately 47% of these facilities. The remaining facilities are primarily leased from unrelated third parties. A limited number of facilities are leased from employees, generally former owners of acquired businesses, and are on terms consistent with commercial rental rates prevailing in the surrounding rental markets.

The Company’s network of 17 air separation units that it owns and operates supports the Company’s full range of gas supply modes for its customers, making Airgas the fifth-largest producer of atmospheric gases in the U.S. During fiscal 2016, capacity utilization at the Company’s air separation units was approximately 80%, with additional capacity available upon demand. The Company is currently in the planning or construction phases for an additional two air separation units as well as a liquid hydrogen plant, all of which are expected to be on-stream at various points through calendar year 2018.

The Company’s All Other Operations business segment consists of businesses located throughout the U.S., which operate multiple use facilities consisting of approximately 90 branch/distribution locations, eight liquid carbon dioxide and 14 dry ice

14

production facilities, and three nitrous oxide production facilities. The Company owns approximately 32% of these facilities. The remaining facilities are leased from unrelated third parties.

The Company believes that its facilities are adequate for its present needs and that its properties are generally in good condition, well-maintained and suitable for their intended use.

| ITEM 3. | LEGAL PROCEEDINGS. |

The Company is involved in various legal and regulatory proceedings that have arisen in the ordinary course of business and have not been fully adjudicated. These actions, when ultimately concluded and determined, will not, in the opinion of management, have a material adverse effect upon the Company’s consolidated financial condition, results of operations or liquidity. See Note 18, “Commitments and Contingencies,” to the Company’s consolidated financial statements under Part II, Item 8, “Financial Statements and Supplementary Data,” for additional information regarding the Company’s legal proceedings.

| ITEM 4. | MINE SAFETY DISCLOSURES. |

Not applicable.

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Market Information, Dividends and Holders

The Company’s common stock is listed on the New York Stock Exchange (ticker symbol: ARG). The following table sets forth, for each quarter during the last two fiscal years, the high and low closing price per share for the common stock as reported by the New York Stock Exchange and cash dividends per share for the period from April 1, 2014 to March 31, 2016:

| High | Low | Dividends Per Share | |||||||||

| Fiscal 2016 | |||||||||||

| First Quarter | $ | 107.97 | $ | 100.29 | $ | 0.60 | |||||

| Second Quarter | 106.94 | 88.10 | 0.60 | ||||||||

| Third Quarter | 138.93 | 87.97 | 0.60 | ||||||||

| Fourth Quarter | 141.87 | 137.80 | 0.60 | ||||||||

| Fiscal 2015 | |||||||||||

| First Quarter | $ | 109.95 | $ | 102.35 | $ | 0.55 | |||||

| Second Quarter | 113.19 | 106.78 | 0.55 | ||||||||

| Third Quarter | 117.98 | 103.55 | 0.55 | ||||||||

| Fourth Quarter | 118.90 | 103.89 | 0.55 | ||||||||

The closing sale price of the Company’s common stock on May 6, 2016, as reported by the New York Stock Exchange, was $142.60 per share. As of May 6, 2016, there were 271 stockholders of record, a number that by definition does not count those who hold the Company’s stock in street name including the many employee owners under the Amended and Restated Airgas, Inc. 2003 Employee Stock Purchase Plan (“Employee Stock Purchase Plan” or “ESPP”).

Future dividend declarations and associated amounts paid will depend upon the Company’s earnings, financial condition, loan covenants, capital requirements and other factors deemed relevant by management and the Company’s Board of Directors.

15

Stockholder Return Performance Presentation

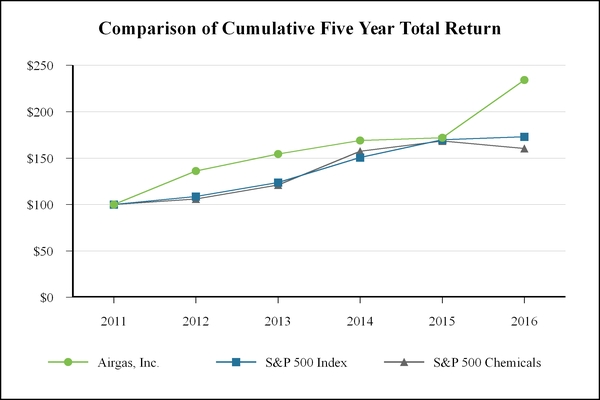

Below is a graph comparing the yearly change in the cumulative total stockholder return on the Company’s common stock against the cumulative total return of the S&P 500 Index and the S&P 500 Chemicals Index for the five-year period that began April 1, 2011 and ended March 31, 2016.

The Company believes the use of the S&P 500 Index and the S&P 500 Chemicals Index for purposes of this performance comparison is appropriate because Airgas is a component of the indices and they include companies of similar size to Airgas.

| March 31, | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | ||||||

| l | Airgas, Inc. | 100.00 | 136.22 | 154.58 | 169.11 | 171.86 | 234.26 | |||||

| n | S&P 500 Index | 100.00 | 108.54 | 123.69 | 150.73 | 169.92 | 172.95 | |||||

| Å | S&P 500 Chemicals | 100.00 | 106.03 | 121.01 | 157.35 | 168.56 | 160.42 | |||||

The graph above assumes that $100 was invested on April 1, 2011 in Airgas, Inc. common stock, the S&P 500 Index and the S&P 500 Chemicals Index and that all dividends have been reinvested.

16

Issuer Purchases of Equity Securities

During the three months ended March 31, 2016, the Company acquired the following shares of its common stock:

| Period | (a) Total Number of Shares Purchased (1) | (b) Average Price Paid per Share (1) | (c) Total Number of Shares Purchased as Part of Publicly Announced Program (2) | (d) Maximum Dollar Value of Shares that May Yet Be Purchased Under the Program (2) | ||||||||||

| 1/1/16 - 1/31/16 | — | $ | — | — | $ | 125,294,139 | ||||||||

| 2/1/16 - 2/29/16 | 7,248 | $ | 141.81 | — | $ | 125,294,139 | ||||||||

| 3/1/16 - 3/31/16 | — | $ | — | — | $ | 125,294,139 | ||||||||

| Total | 7,248 | $ | 141.81 | — | ||||||||||

____________________

(1) | Consists of shares that were attested to upon the exercise of stock options by participants of the Company’s Second Amended and Restated 2006 Equity Incentive Plan (“Equity Incentive Plan”) in satisfaction of the payment of the exercise of stock options under the plan. During the three months ended March 31, 2016, the Company acquired 7,248 shares of its common stock with an average fair market value per share of $141.81 for the exercise of 12,000 stock options. |

(2) | On May 28, 2015, the Company announced plans to purchase up to $500 million of Airgas, Inc. common stock under a stock repurchase program approved by the Company’s Board of Directors. Airgas may repurchase shares from time to time for cash in open market transactions or in privately-negotiated transactions in accordance with applicable federal securities laws. The Company will determine the timing and the amount of any repurchases based on its evaluation of market conditions, share price, and other factors. The stock repurchase program has no pre-established closing date. However, stock repurchases are currently suspended in accordance with the Merger Agreement. |

17

| ITEM 6. | SELECTED FINANCIAL DATA. |

Selected financial data for the Company is presented in the following table and should be read in conjunction with MD&A included in Item 7 and the Company’s consolidated financial statements and accompanying notes included in Item 8.

| Years Ended March 31, | |||||||||||||||||||

| (In thousands, except per share amounts): | 2016 (1) | 2015 | 2014 (2) | 2013 (3) | 2012 (4) | ||||||||||||||

| Operating Results: | |||||||||||||||||||

| Net sales | $ | 5,313,777 | $ | 5,304,885 | $ | 5,072,537 | $ | 4,957,497 | $ | 4,746,283 | |||||||||

| Depreciation and amortization | $ | 352,747 | $ | 329,058 | $ | 305,306 | $ | 288,900 | $ | 270,285 | |||||||||

| Operating income | $ | 580,711 | $ | 641,278 | $ | 630,534 | $ | 596,417 | $ | 556,221 | |||||||||

| Interest expense, net | 60,071 | 62,232 | 73,698 | 67,494 | 66,337 | ||||||||||||||

| Losses on the extinguishment of debt | — | — | 9,150 | — | — | ||||||||||||||

| Other income, net | 9,077 | 5,075 | 4,219 | 14,494 | 2,282 | ||||||||||||||

| Income taxes | 192,217 | 216,035 | 201,121 | 202,543 | 178,792 | ||||||||||||||

| Net earnings | $ | 337,500 | $ | 368,086 | $ | 350,784 | $ | 340,874 | $ | 313,374 | |||||||||

| Net Earnings Per Common Share: | |||||||||||||||||||

| Basic earnings per share | $ | 4.60 | $ | 4.93 | $ | 4.76 | $ | 4.45 | $ | 4.09 | |||||||||

| Diluted earnings per share | $ | 4.54 | $ | 4.85 | $ | 4.68 | $ | 4.35 | $ | 4.00 | |||||||||

Dividends per common share declared and paid (5) | $ | 2.40 | $ | 2.20 | $ | 1.92 | $ | 1.60 | $ | 1.25 | |||||||||

| Balance Sheet and Other Data at March 31: | |||||||||||||||||||

| Working capital | $ | 236,364 | $ | 286,637 | $ | 68,312 | $ | 602,116 | $ | 344,157 | |||||||||

| Total assets | 6,134,956 | 5,973,610 | 5,793,314 | 5,618,225 | 5,320,585 | ||||||||||||||

| Short-term debt | 383,258 | 325,871 | 387,866 | — | 388,452 | ||||||||||||||

| Current portion of long-term debt | 250,107 | 250,110 | 400,322 | 303,573 | 10,385 | ||||||||||||||

| Long-term debt, excluding current portion | 1,954,820 | 1,748,662 | 1,706,774 | 2,304,245 | 1,761,902 | ||||||||||||||

| Non-current deferred income tax liability, net | 894,344 | 854,574 | 825,897 | 825,612 | 793,957 | ||||||||||||||

| Other non-current liabilities | 92,660 | 89,741 | 89,219 | 89,671 | 84,419 | ||||||||||||||

| Stockholders’ equity | 2,045,298 | 2,151,586 | 1,840,649 | 1,536,983 | 1,750,258 | ||||||||||||||

| Capital expenditures for years ended March 31, | 456,899 | 468,789 | 354,587 | 325,465 | 356,514 | ||||||||||||||

____________________

(1) | The results for fiscal 2016 include the following: $29.0 million ($18.0 million after tax) or $0.24 per diluted share for costs associated with the Air Liquide merger and $7.0 million (non-tax-deductible) or $0.09 per diluted share for costs accrued related to a Plea Agreement by Airgas Doral, Inc. (“Airgas Doral”), a wholly-owned subsidiary of Airgas, Inc., with the U.S. Attorney’s Office for the Southern District of Florida. See Note 18, “Commitments and Contingencies,” to the Company’s consolidated financial statements under Item 8, “Financial Statements and Supplementary Data” for additional information. During the fiscal year, long term debt increased primarily related to the issuance of the $400 million 3.05% senior notes maturing on August 1, 2020, partially offset by the repayment of the $250 million 3.25% senior notes on September 14, 2015 which were originally due to mature on October 1, 2015. |

(2) | The results for fiscal 2014 include the following: $9.1 million ($5.6 million after tax) or $0.08 per diluted share recorded for a loss on the early extinguishment of the Company’s $215 million of 7.125% senior subordinated notes, which were originally due to mature in October 2018 but were redeemed in full on October 2, 2013, as well as $3.3 million or $0.04 per diluted share of state income tax benefits recognized for changes to enacted state income tax rates and a change in a state income tax law. The proceeds from the Company’s commercial paper program were used in part for the early redemption of the senior subordinated notes and repayment of the Company’s $300 million 2.85% senior notes upon their maturity in October 2013, causing the $388 million increase to short-term debt. In addition, the Company reclassified its $400 million 4.5% senior notes maturing in September 2014 to the “Current portion of long-term debt” line item of the Company’s consolidated balance sheet based on the maturity date. |

18

(3) | The results for fiscal 2013 include the following: $8.1 million ($5.1 million after tax) or $0.07 per diluted share of net restructuring and other special charges and $6.8 million ($5.5 million after tax) or a benefit of $0.07 per diluted share of a gain on the sale of five branch locations in western Canada. The $6.8 million gain on sale of businesses was recorded in the “Other income, net” line item of the Company’s consolidated statement of earnings. Also during fiscal 2013, the Company’s $300 million 2.85% senior notes were reclassified to the “Current portion of long-term debt” line item of the Company’s consolidated balance sheet based on the maturity date. Additionally, during the three months ended March 31, 2013, proceeds from the issuance of an aggregate $600 million of senior notes in February 2013 were used to pay down the balance on the commercial paper program and, as a result, there were no outstanding borrowings under the program at March 31, 2013, resulting in a decrease to short-term debt and an increase in working capital in the table above. |

(4) | The results for fiscal 2012 include the following: $24.4 million ($15.6 million after tax) or $0.19 per diluted share of net restructuring and other special charges, $7.9 million ($5.0 million after tax) or $0.06 per diluted share in benefits from lower than previously estimated net costs related to a prior year unsolicited takeover attempt, $4.3 million ($2.7 million after tax) or $0.04 per diluted share in multi-employer pension plan withdrawal charges, and $4.9 million or $0.06 per diluted share of income tax benefits related to the LLC reorganization as well as a true-up of the Company’s foreign tax liabilities. Additionally, during fiscal 2012, the Company commenced a $750 million commercial paper program supported by its revolving credit facility. The Company has used proceeds under the commercial paper program to pay down amounts outstanding under its revolving credit facility and for general corporate purposes. Borrowings under the commercial paper program are classified as short-term debt on the Company’s consolidated balance sheet, which led to a $388 million decrease in both working capital and long-term debt in the table above. |

(5) | The Company’s quarterly cash dividends declared and paid to stockholders for the years presented above are disclosed in the following table: |

| Years Ended March 31, | |||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| First Quarter | $ | 0.60 | $ | 0.55 | $ | 0.48 | $ | 0.40 | $ | 0.29 | |||||||||

| Second Quarter | 0.60 | 0.55 | 0.48 | 0.40 | 0.32 | ||||||||||||||

| Third Quarter | 0.60 | 0.55 | 0.48 | 0.40 | 0.32 | ||||||||||||||

| Fourth Quarter | 0.60 | 0.55 | 0.48 | 0.40 | 0.32 | ||||||||||||||

| Fiscal Year | $ | 2.40 | $ | 2.20 | $ | 1.92 | $ | 1.60 | $ | 1.25 | |||||||||

19

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

RESULTS OF OPERATIONS: 2016 COMPARED TO 2015

OVERVIEW

Airgas, Inc. and its subsidiaries (“Airgas” or the “Company”) had net sales for the year ended March 31, 2016 (“fiscal 2016” or “current year”) of $5.3 billion, essentially flat compared to the year ended March 31, 2015 (“fiscal 2015” or “prior year”). Organic sales decreased 1% compared to the prior year, with gas and rent up 2% and hardgoods down 7%. Current and prior year acquisitions contributed sales growth of 1% in the current year. The Company’s organic sales continue to reflect the challenging industrial economy and in particular the pressure on sales to customers engaged in the energy and chemical and the manufacturing and metal fabrication sectors. The sluggish U.S. industrial economy, slowing global economy and strong dollar continue to challenge the Company’s customers across these and other sectors. Continued strength in certain sectors, such as non-residential construction, helped to mitigate these sales declines.

The consolidated gross profit margin (excluding depreciation) in the current year was 56.7%, an increase of 110 basis points from the prior year, primarily reflecting a sales mix shift toward higher margin gas and rent, and higher margins in the Company’s All Other Operations business segment.

The Company’s operating income margin in the current year was 10.9%, a decrease of 120 basis points from the prior year. The current year's operating income margin was burdened by 70 basis points of costs related to the Agreement and Plan of Merger with Air Liquide (see below for additional information) and other special charges. Excluding the merger-related costs and other special charges, the operating income margin was down 50 basis points, primarily reflecting challenging economic conditions and the impact of rising operating costs (including depreciation and amortization expenses) in the current negative organic sales growth environment, in the Company’s Distribution business segment.

Net earnings per diluted share was $4.54 in the current year versus $4.85 in the prior year. Net earnings per diluted share in the current year included a $0.24 per diluted share charge related to merger costs associated with the Air Liquide Merger and a non-tax-deductible $0.09 per diluted share charge related to a Plea Agreement by Airgas Doral, Inc. (“Airgas Doral”) with the U.S. Attorney’s Office for the Southern District of Florida.

Air Liquide Merger Agreement

On November 17, 2015, the Company announced that it had entered into a definitive agreement for the acquisition of the Company by L’Air Liquide, S.A. (“Air Liquide”) in a merger pursuant to an Agreement and Plan of Merger, dated as of November 17, 2015, by and among the Company, Air Liquide and AL Acquisition Corporation (“Merger Sub”), an indirect wholly owned subsidiary of Air Liquide (the “Merger Agreement”). The Merger Agreement provides that, among other things and subject to the terms and conditions thereof, Merger Sub will be merged with and into the Company (the “Merger”) with the Company continuing as the surviving corporation in the Merger as an indirect wholly owned subsidiary of Air Liquide. See Note 2, “Merger Agreement,” to the Consolidated Financial Statements under Item 8, “Financial Statements and Supplementary Data,” for more information on the Merger Agreement.

In connection with the Merger, the Company has incurred $29 million of merger-related costs during the year ended March 31, 2016, primarily consisting of legal, advisory and other professional fees in connection with the Merger. These costs are included in the “Merger costs and other special charges” line item of the Company’s consolidated statement of earnings.

Stock Repurchase Program