Exhibit 1

Strengthening Air Liquide’s leadership and building a new growth platform in North America A g ame - changing a cquisition November 18, 2015

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Legal disclaimer 2 CAUTIONARY STATEMENT REGARDING FORWARD - LOOKING STATEMENTS This press release contains certain statements that are “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 , as amended . L’Air Liquide S . A . (“Air Liquide”) and Airgas have identified some of these forward - looking statements with words like “believe,” “may,” “could,” “would,” “might,” “possible,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” or “continue,” the negative of these words, other terms of similar meaning or the use of future dates . Forward - looking statements in this release include without limitation statements regarding the expected timing of the completion of the transactions described in this press release, Air Liquide’s operation of Airgas’s business following completion of the contemplated transactions, and statements regarding the future operation, direction and success of Airgas’s businesses . Such statements are qualified by the inherent risks and uncertainties surrounding future expectations generally, and actual results could differ materially from those currently anticipated due to a number of risks and uncertainties . Risks and uncertainties that could cause results to differ from expectations include : uncertainties as to the timing of the contemplated transactions ; uncertainties as to the approval of Airgas’s stockholders required in connection with the contemplated transactions ; the possibility that a competing proposal will be made ; the possibility that the closing conditions to the contemplated transactions may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant a necessary regulatory approval ; the effects of disruption caused by the announcement of the contemplated transactions making it more difficult to maintain relationships with employees, customers, vendors and other business partners ; the risk that stockholder litigation in connection with the contemplated transactions may affect the timing or occurrence of the contemplated transactions or result in significant costs of defense, indemnification and liability ; other business effects, including the effects of industry, economic or political conditions outside of the control of the parties to the contemplated transactions ; transactions costs ; actual or contingent liabilities ; and other risks and uncertainties discussed in Airgas’s filings with the U . S . Securities and Exchange Commission (the “ SEC ”), including the “Risk Factors” sections of Sangria’s most recent annual report on Form 10 - K . You can obtain copies of Airgas’s filings with the SEC for free at the SEC’s website (www . sec . gov) . Neither Air Liquide nor Airgas undertakes any obligation to update any forward - looking statements as a result of new information, future developments or otherwise, except as expressly required by law . All forward - looking statements in this announcement are qualified in their entirety by this cautionary statement . Additional Information and Where to Find it Airgas intends to file with the SEC a proxy statement in connection with the contemplated transactions . The definitive proxy statement will be sent or given to Airgas stockholders and will contain important information about the contemplated transactions . INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT CAREFULLY AND IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE . Investors and security holders may obtain a free copy of the proxy statement (when it is available) and other documents filed with the SEC at the SEC’s website at www . sec . gov . Certain Information Concerning Participants Airgas and its directors and executive officers may be deemed to be participants in the solicitation of proxies from Airgas investors and security holders in connection with the contemplated transactions . Information about Airgas’s directors and executive officers is set forth in its proxy statement for its 2015 Annual Meeting of Stockholders and its most recent annual report on Form 10 - K . These documents may be obtained for free at the SEC’s website at www . sec . gov . Additional information regarding the interests of participants in the solicitation of proxies in connection with the contemplated transactions will be included in the proxy statement that Airgas intends to file with the SEC .

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas A new step in Air Liquide’s growth strategy Invest in growth markets North America, fastest growing advanced economy Enhance competitiveness Supply chain integration and multiple distribution channels Leverage innovation Wider customer base for advanced technologies deployment Deliver profitable growth over the long - term 3

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Leading national player Multi - channel distribution network Innovation platform A game - changing combination 4

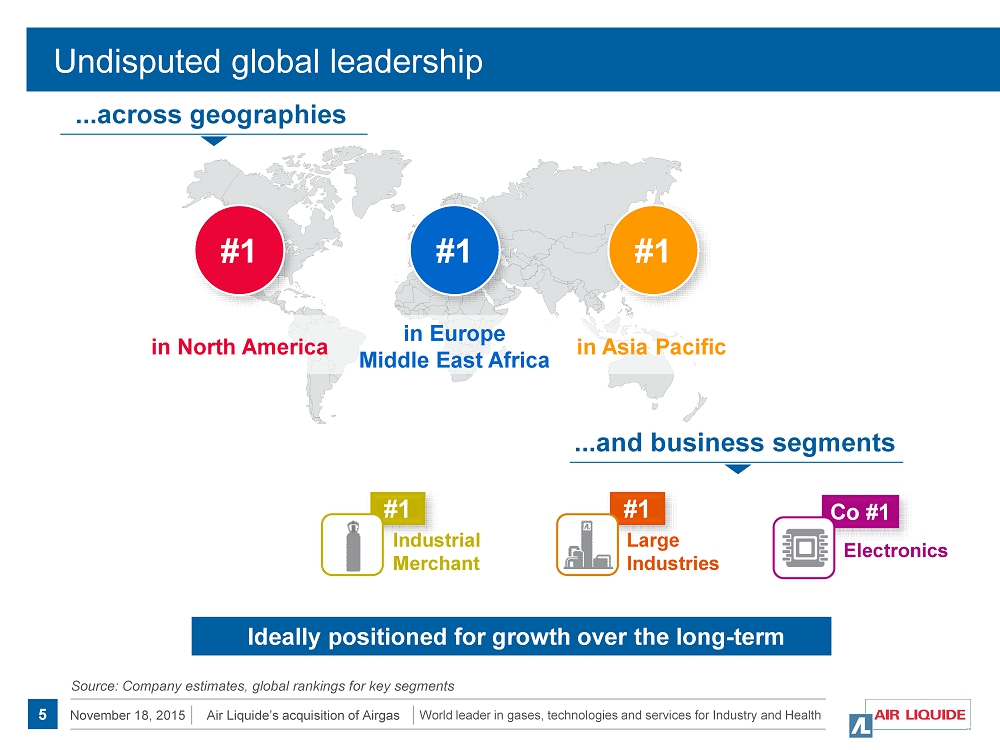

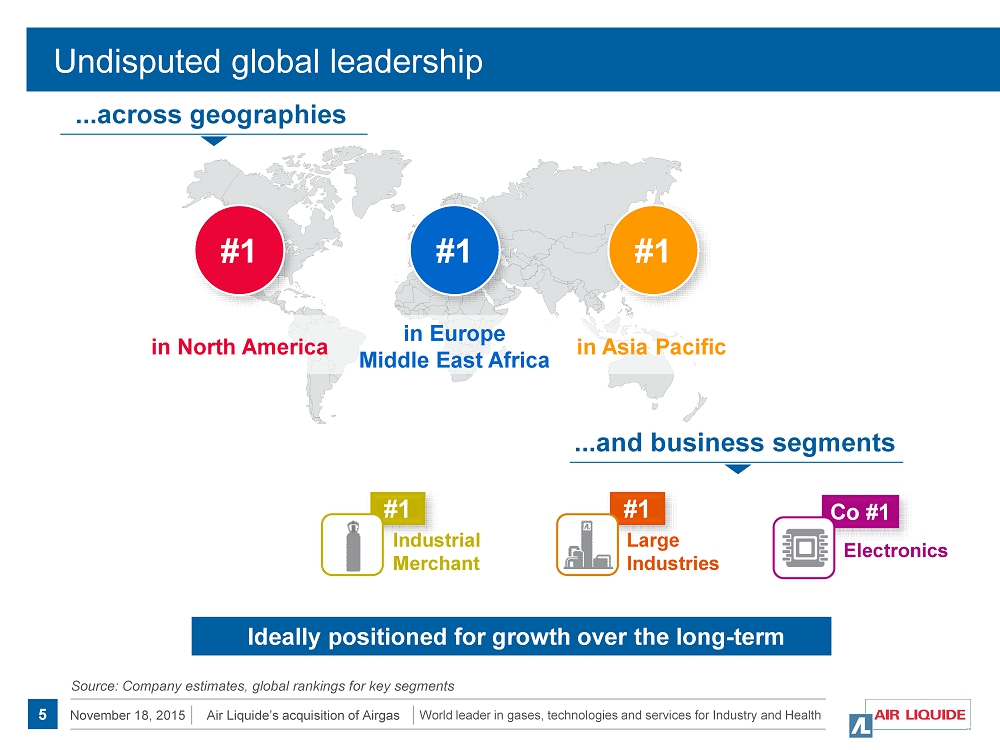

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Undisputed global leadership #1 in North America #1 in Europe Middle East Africa #1 in Asia Pacific Source: Company estimates, global rankings for key segments #1 #1 Co #1 Industrial Merchant Large Industries Electronics Ideally positioned for growth over the long - term ...across geographies ...and business segments 5

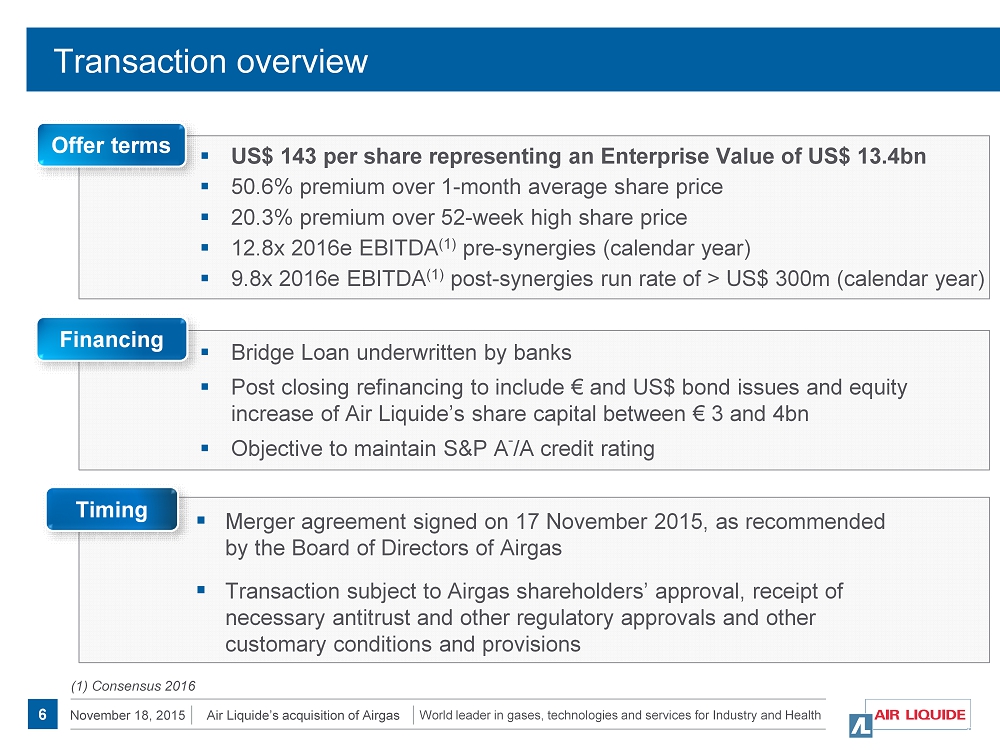

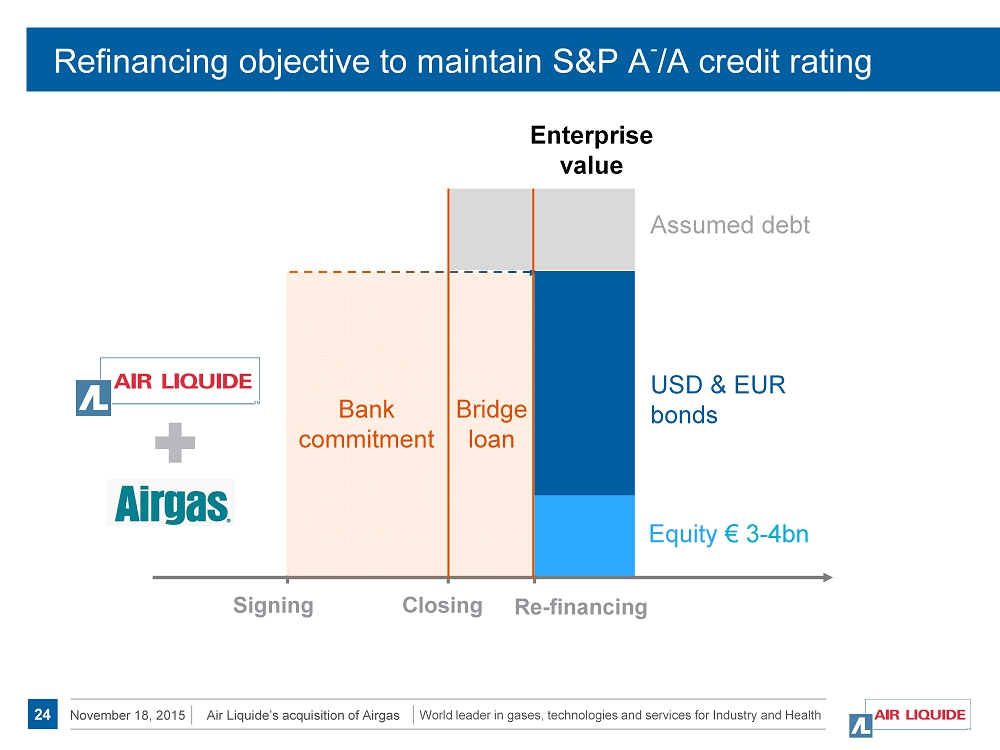

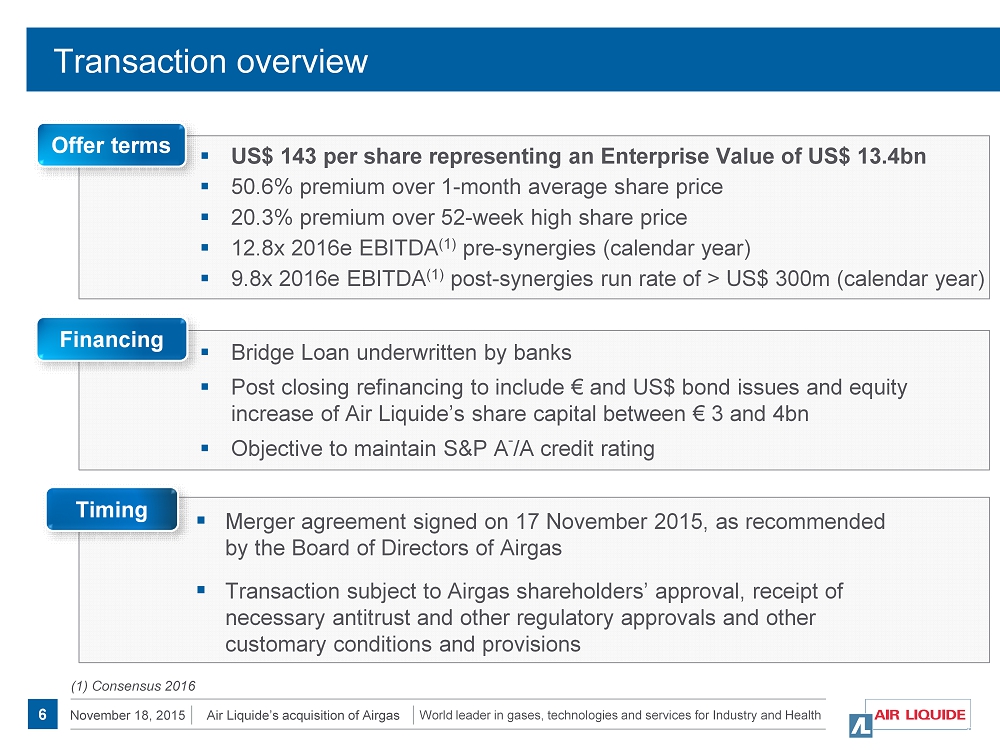

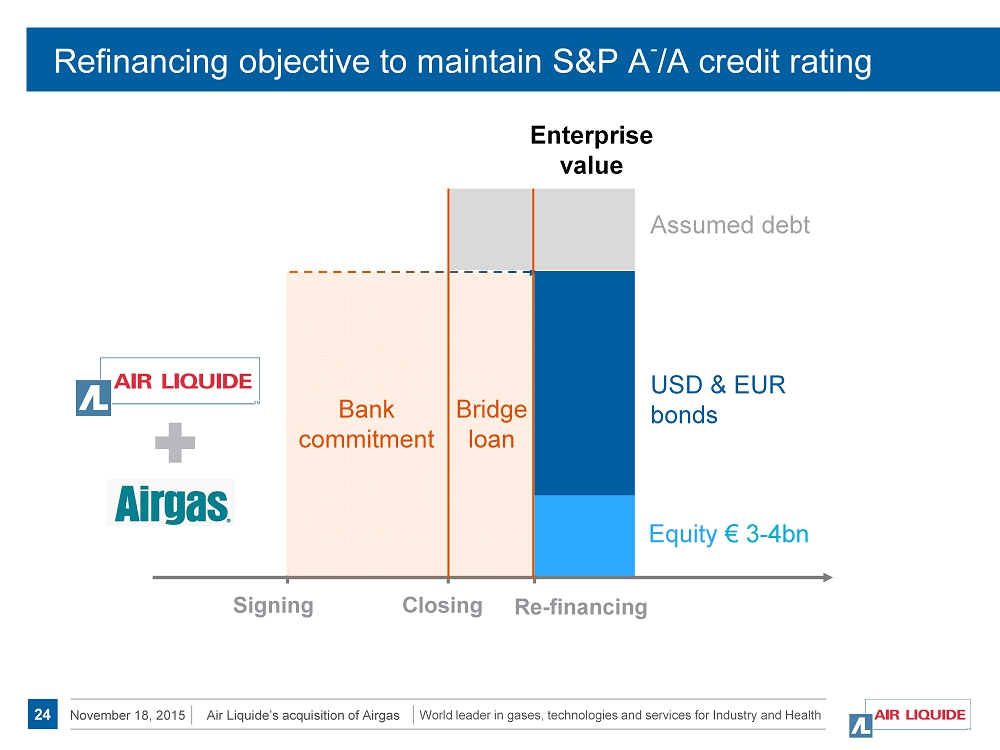

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Transaction overview ▪ Bridge Loan underwritten by banks ▪ Post closing refinancing to include € and US$ bond issues and equity increase of Air Liquide’s share capital between € 3 and 4bn ▪ Objective to maintain S&P A - /A credit rating ▪ Merger agreement signed on 17 November 2015, as recommended by the Board of Directors of Airgas ▪ Transaction subject to Airgas shareholders’ approval, receipt of necessary antitrust and other regulatory approvals and other customary conditions and provisions ▪ US$ 143 per share representing an Enterprise Value of US$ 13.4bn ▪ 50.6% premium over 1 - month average share price ▪ 20.3% premium over 52 - week high share price ▪ 12.8x 2016e EBITDA (1) pre - synergies (calendar year) ▪ 9.8x 2016e EBITDA (1) post - synergies run rate of > US$ 300m (calendar year) (1) Consensus 2016 Offer terms Financing Timing 6

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Agenda 1 3 2 4 Conclusion Strong financial fundamentals A game - changing acquisition Airgas, U.S. leader in packaged gas 7

1. Airgas, U.S. leader in packaged gas

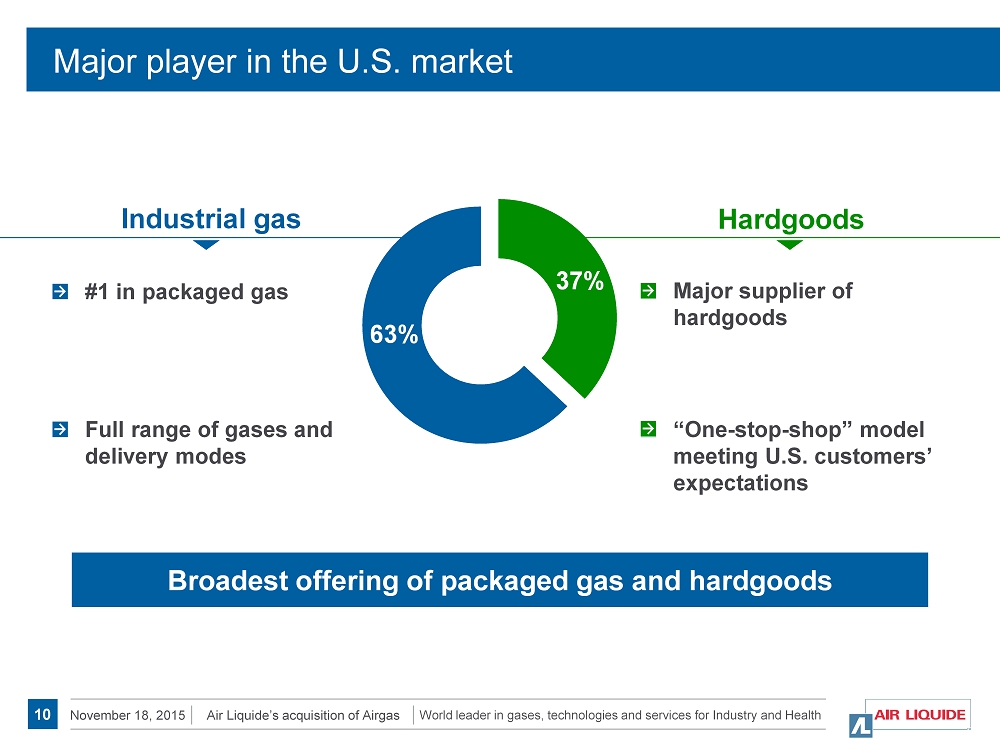

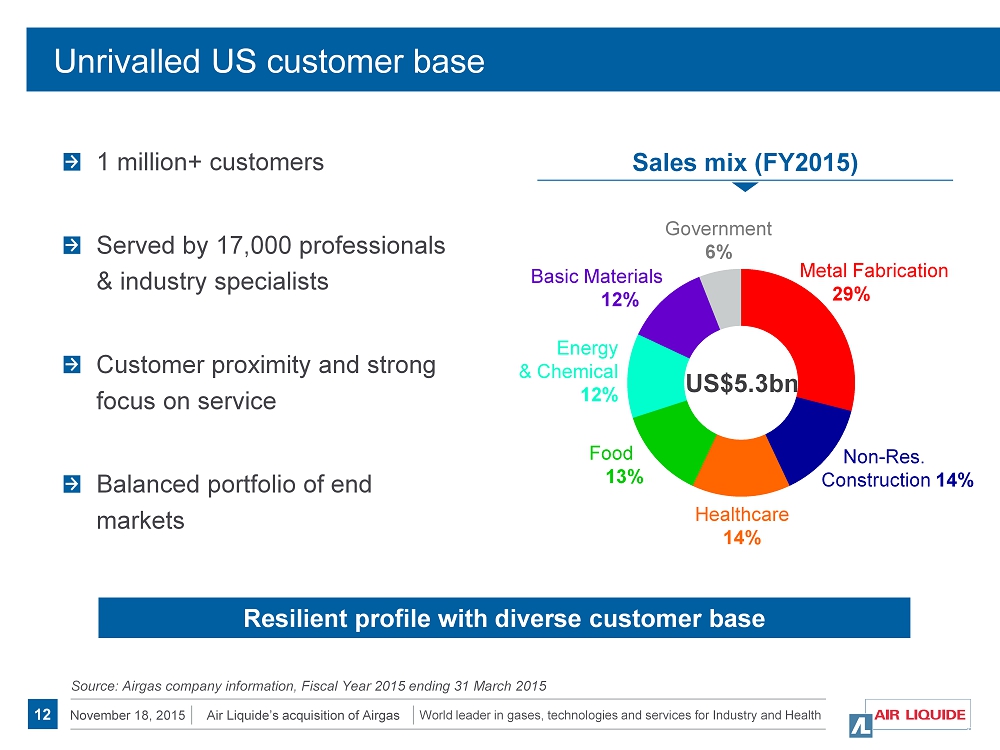

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Proven success story Airgas, the unique partner to capture the North American growth ▪ Leader in packaged gas ▪ Major supplier of h ardgoods ▪ Largest footprint and asset base in the U.S. ▪ Coupled with best - in - class e - commerce platform ▪ 1 million+ customers ▪ Resilient profile with diversified customer segments ▪ Proximity to customers ▪ Unparalleled growth since 1982 ▪ Proven operational excellence ▪ Strong shareholder value creation 9 Major player in the U.S. market Multi - channel distribution network with unmatched reach Unrivalled customer base Solid track record of value creation

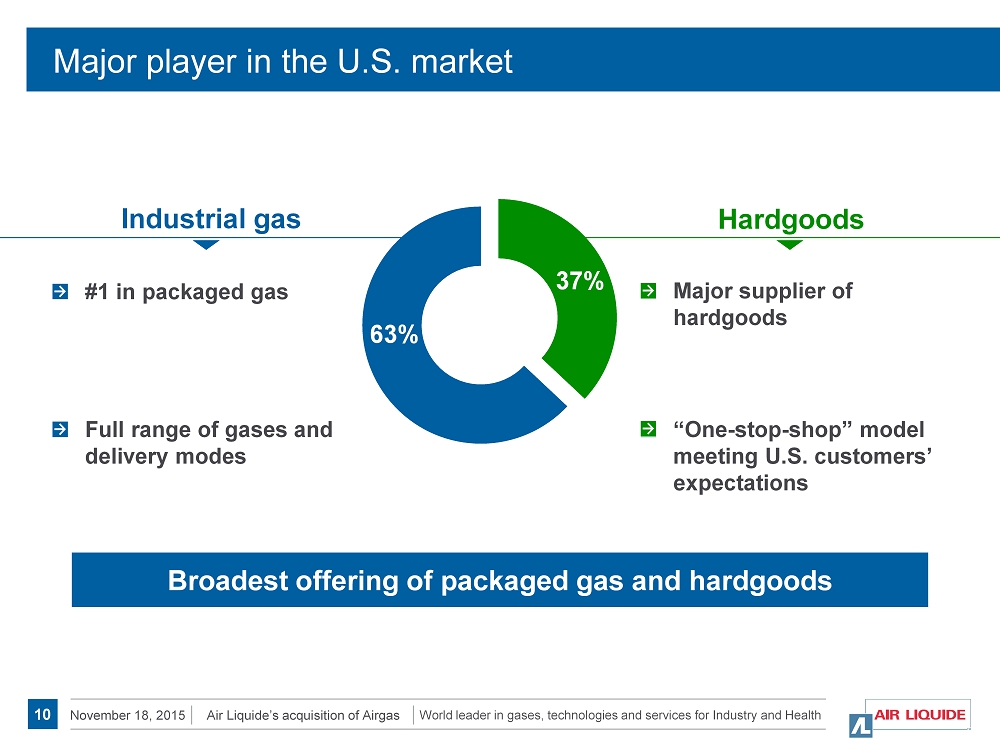

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Hardgoods Industrial gas Major player in the U.S. market Broadest offering of p ackaged g as and h ardgoods 10 63% 37% #1 in packaged gas Major supplier of hardgoods Full range of gases and delivery modes “One - stop - shop” model meeting U.S. customers’ expectations

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Multi - channel distribution network with unmatched reach 1,100 locations >900 branches and retail stores Source: Airgas company information Unparalleled distribution network… …coupled with expanding e - commerce platform 11

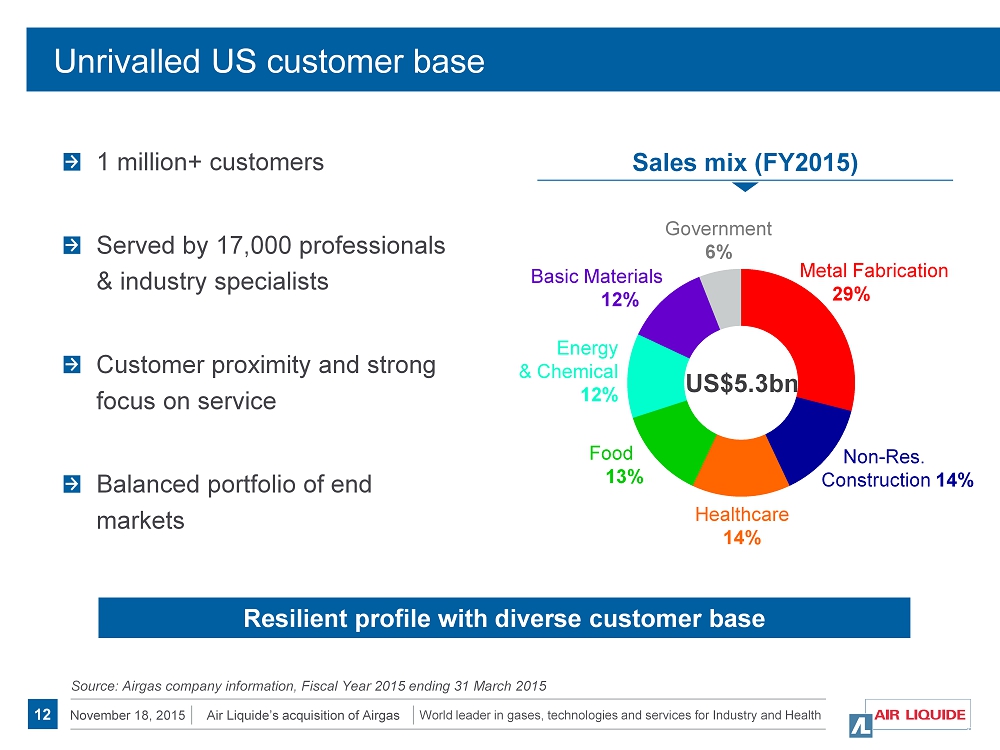

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Unrivalled US customer base 1 million+ customers Served by 17,000 professionals & industry specialists Customer proximity and strong focus on service Balanced portfolio of end markets Sales mix (FY2015) Source: Airgas company information, Fiscal Year 2015 ending 31 March 2015 Resilient profile with diverse customer base 12 US$5.3bn Energy & Chemical 12% Basic Materials 12 % Government 6% Food 13 % Healthcare 14% Non - Res. Construction 14 % Metal Fabrication 29 %

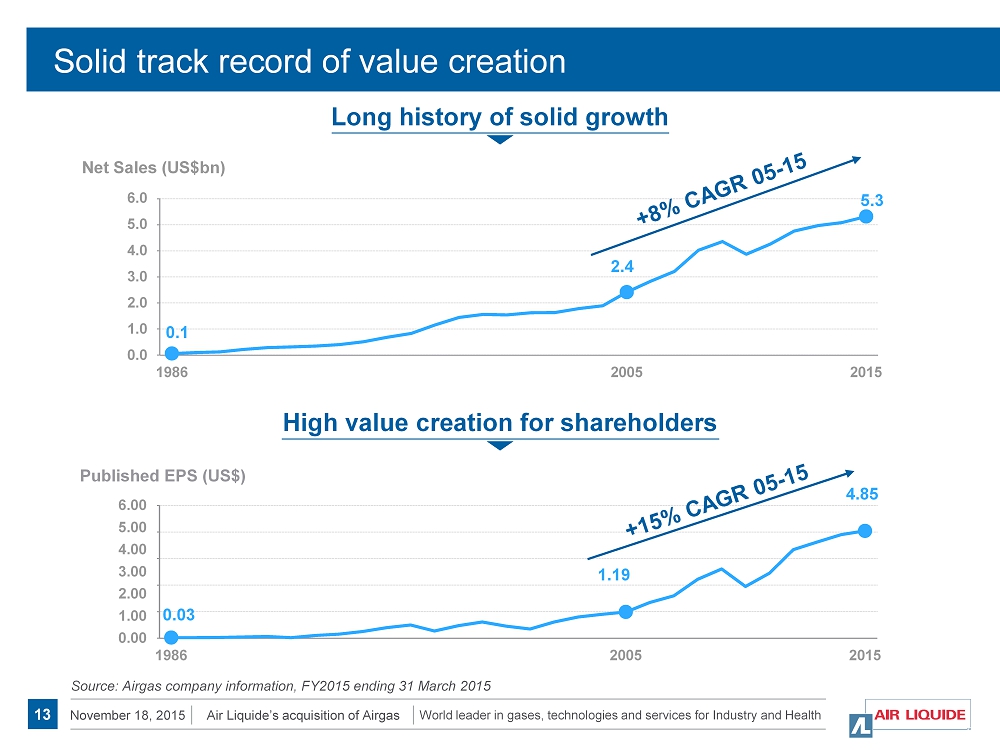

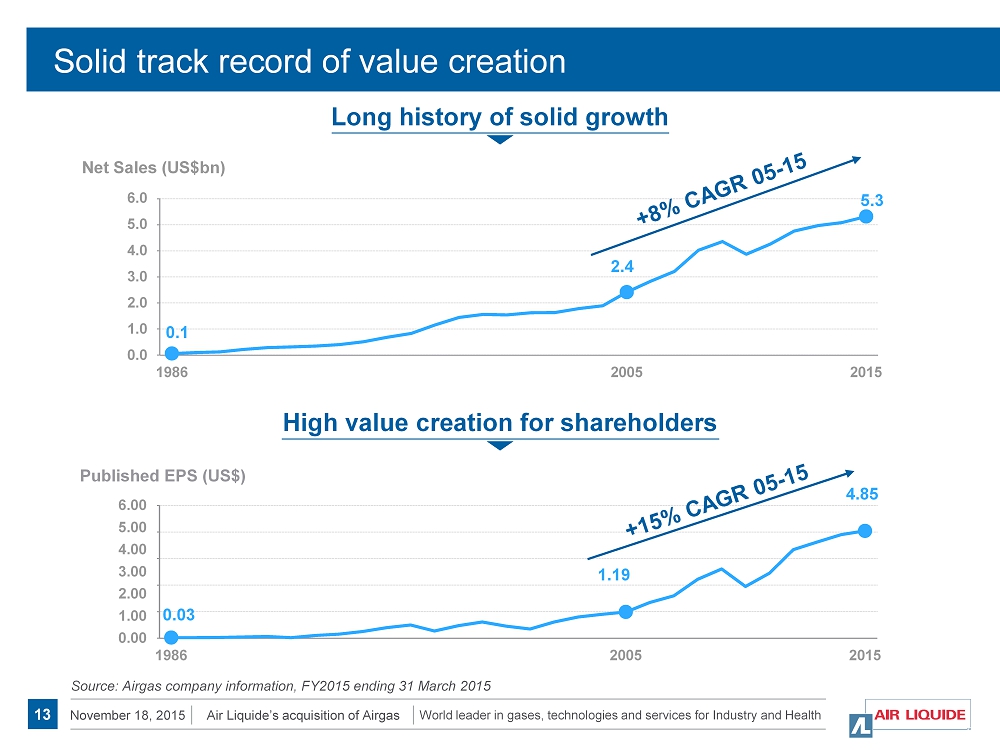

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Solid track record of value creation Source: Airgas company information, FY2015 ending 31 March 2015 High value creation for shareholders 0.00 1.00 2.00 3.00 4.00 5.00 6.00 1986 2005 2010 2015 Published EPS (US$) 0.03 1.19 4.85 Long history of solid growth 0.0 1.0 2.0 3.0 4.0 5.0 6.0 1986 2005 2010 2015 Net Sales ( US$bn ) 0.1 2.4 5.3 13

2. A game - changing acquisition

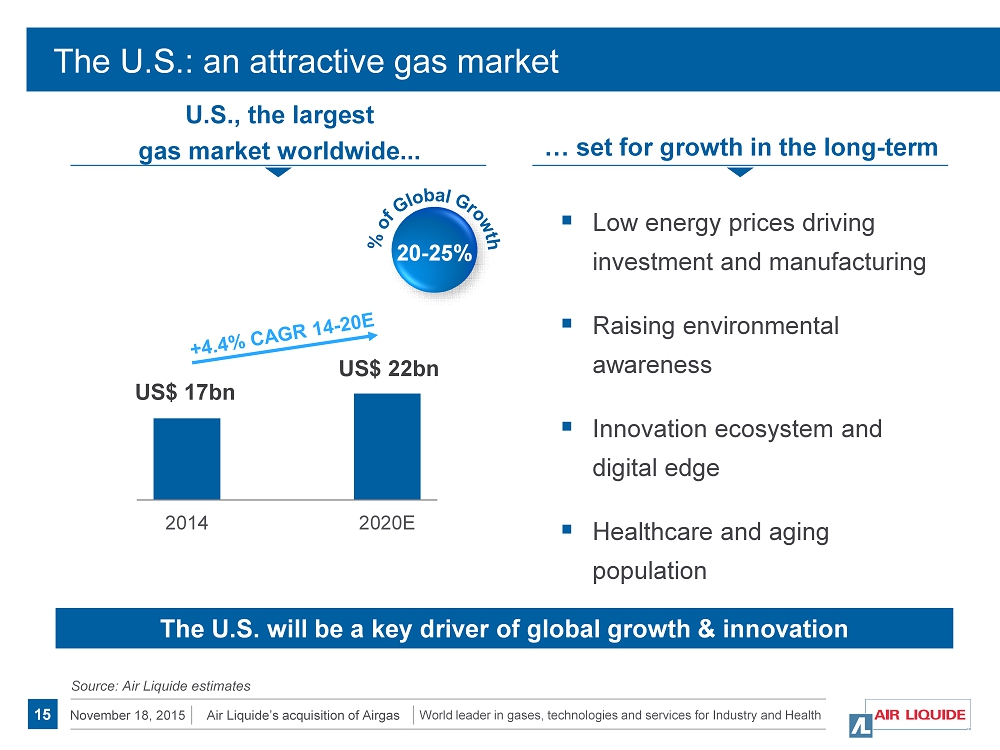

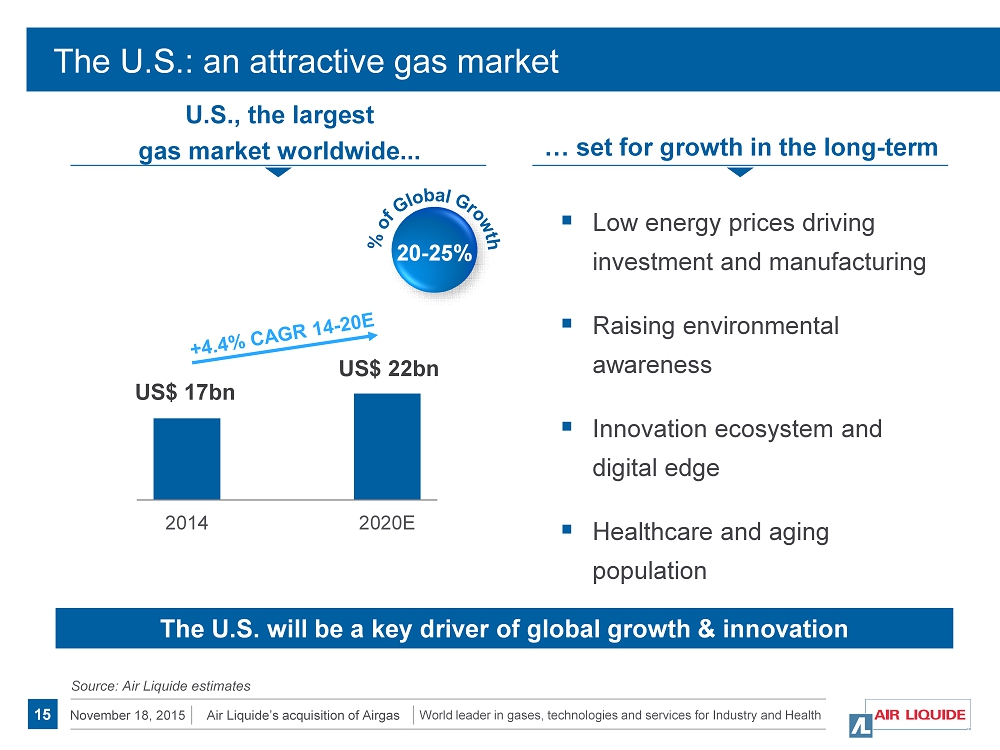

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas The U.S.: an attractive gas market ▪ Low energy prices driving investment and manufacturing ▪ Raising environmental awareness ▪ Innovation ecosystem and digital edge ▪ Healthcare and aging population 20 - 25% Source: Air Liquide estimates The U.S. will be a key driver of global growth & innovation U.S., the largest gas market worldwide... … set for growth in the long - term 15 2014 2020E US$ 22bn US$ 17bn

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Further acquisition opportunities boosting growth Source: Air Liquide estimates Independents Major players U.S. packaged gas market ~ 50% of market composed of independent producers Large potential for bolt - on acquisitions Airgas experience of integrating small players 16

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Unique US business combination Market coverage Cost synergies Improved customer service Leading position in new digital channels Liquid bulk Fill plant Direct delivery Retail Telesales e - commerce Large Industries Merchant bulk Packaged gas Liquid bulk Pipeline & on - sites Bulk deliveries Fill plant Fill plant 17 Primary production Primary production

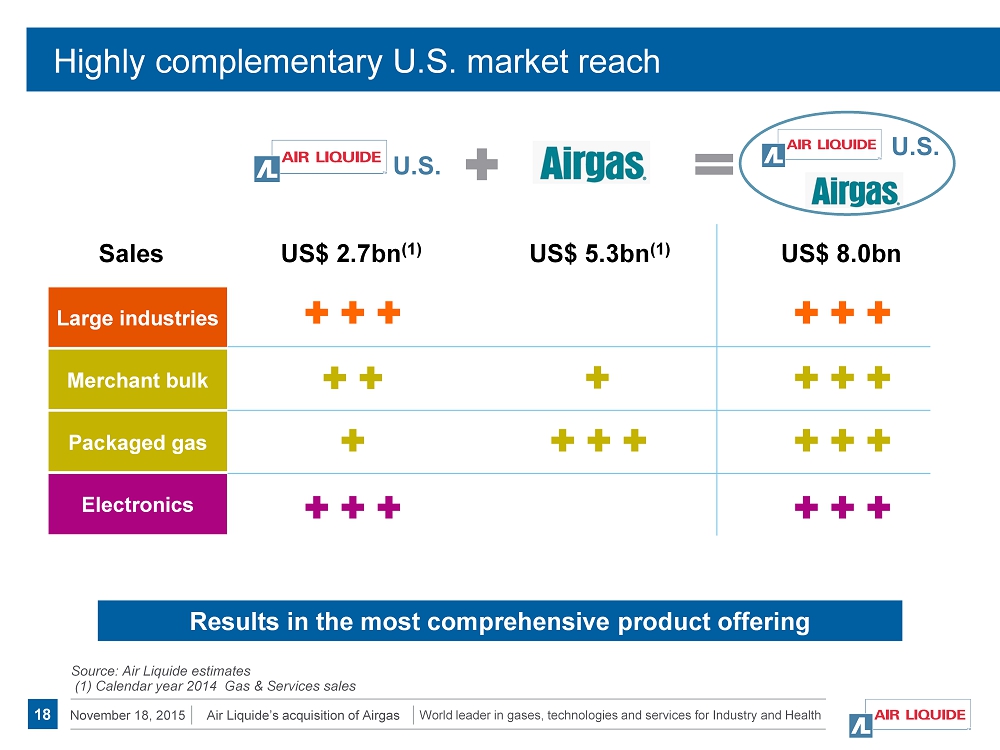

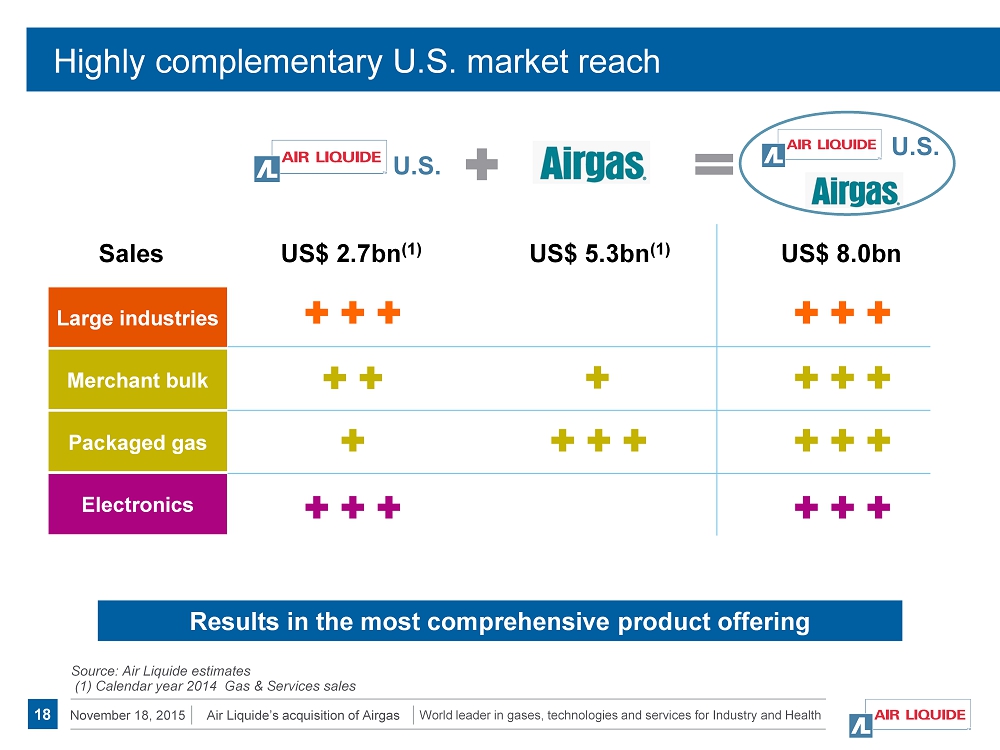

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Highly complementary U.S. market reach Source: Air Liquide estimates (1) Calendar year 2014 Gas & Services sales Results in the most comprehensive product offering U.S. U.S. 18 Large industries Merchant bulk Packaged gas Electronics Sales US$ 2.7bn (1) US$ 5.3bn (1) US$ 8.0bn

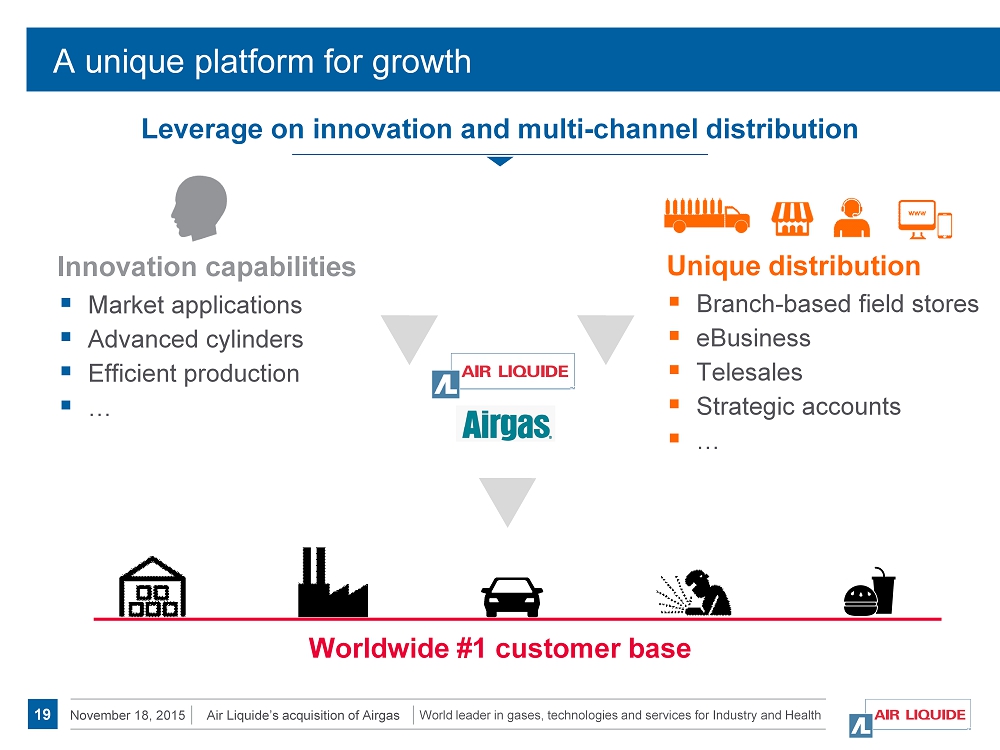

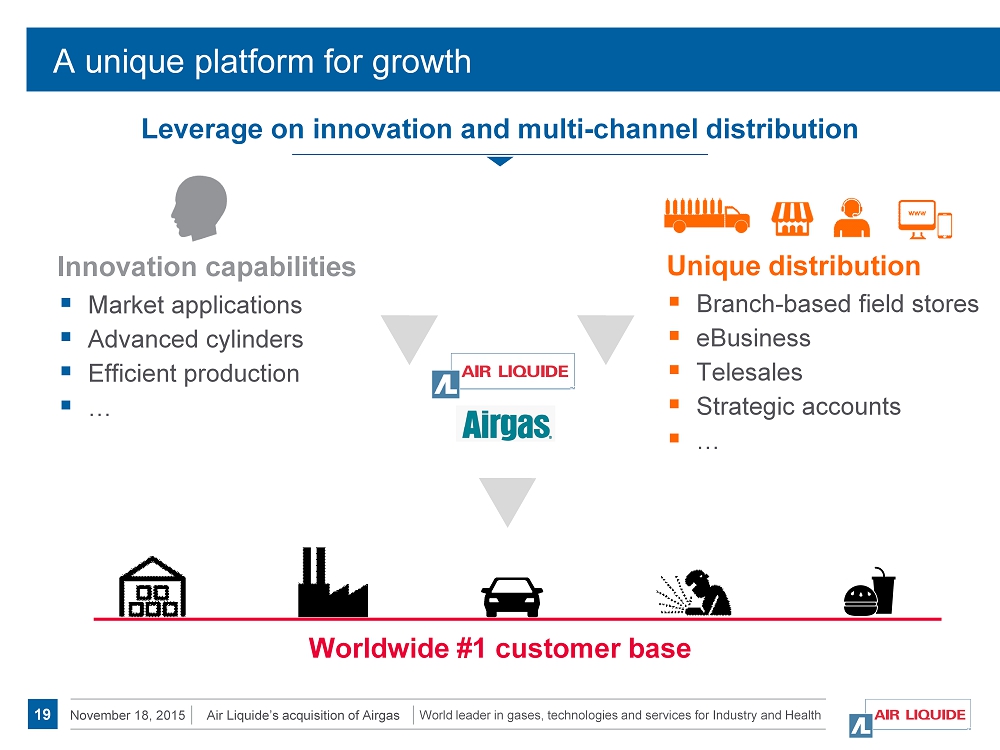

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas A unique platform for growth 19 Innovation capabilities Unique distribution Worldwide #1 customer base ▪ Branch - based field stores ▪ eBusiness ▪ Telesales ▪ Strategic accounts ▪ … ▪ Market applications ▪ Advanced cylinders ▪ Efficient production ▪ … Leverage on innovation and multi - channel distribution

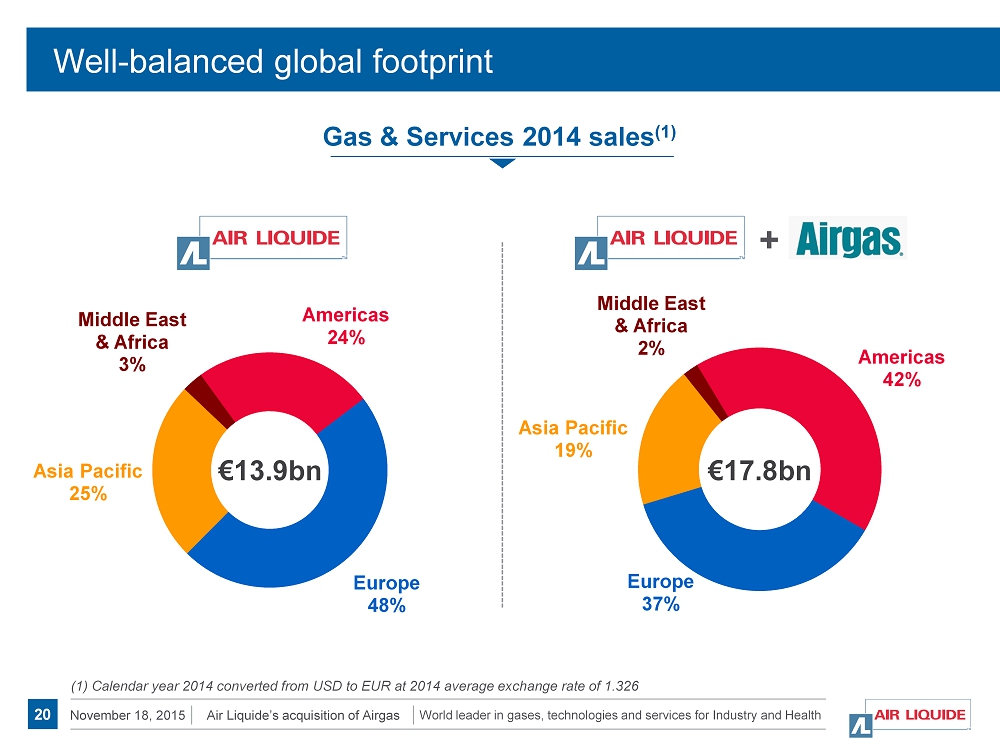

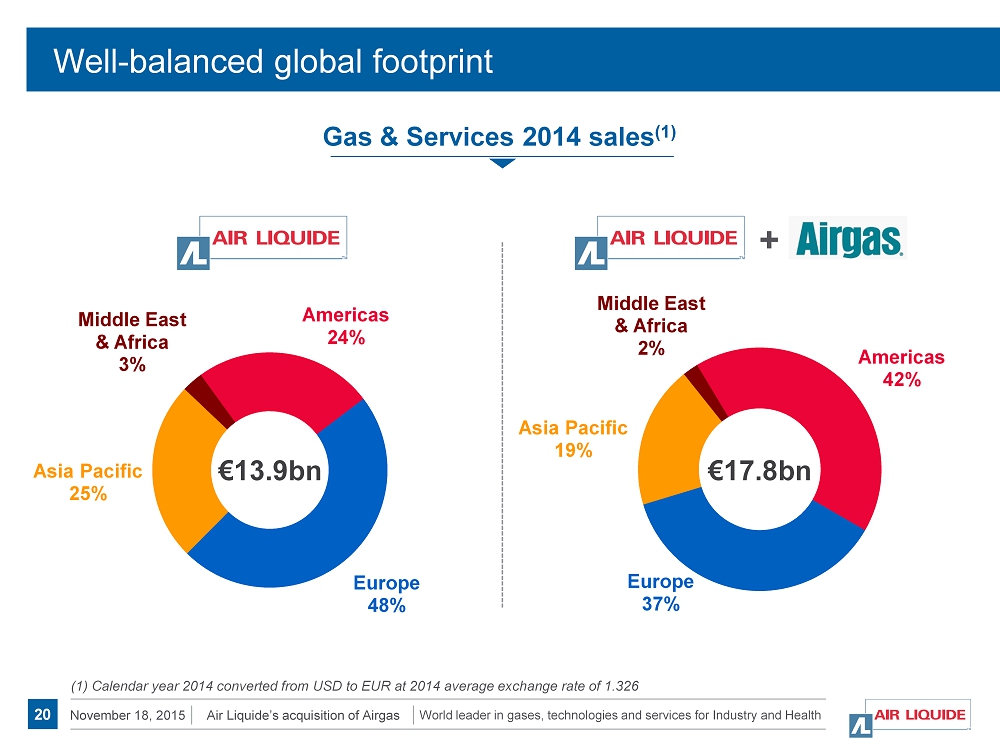

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Well - balanced global footprint Americas 42% Europe 37% Asia Pacific 19% Middle East & Africa 2% Americas 24% Europe 48% Asia Pacific 25% Middle East & Africa 3% € 13.9bn € 17 .8bn + 20 Gas & Services 2014 s ales (1) (1) Calendar year 2014 c onverted from USD to EUR at 2014 average exchange rate of 1.326

3. Strong financial fundamentals

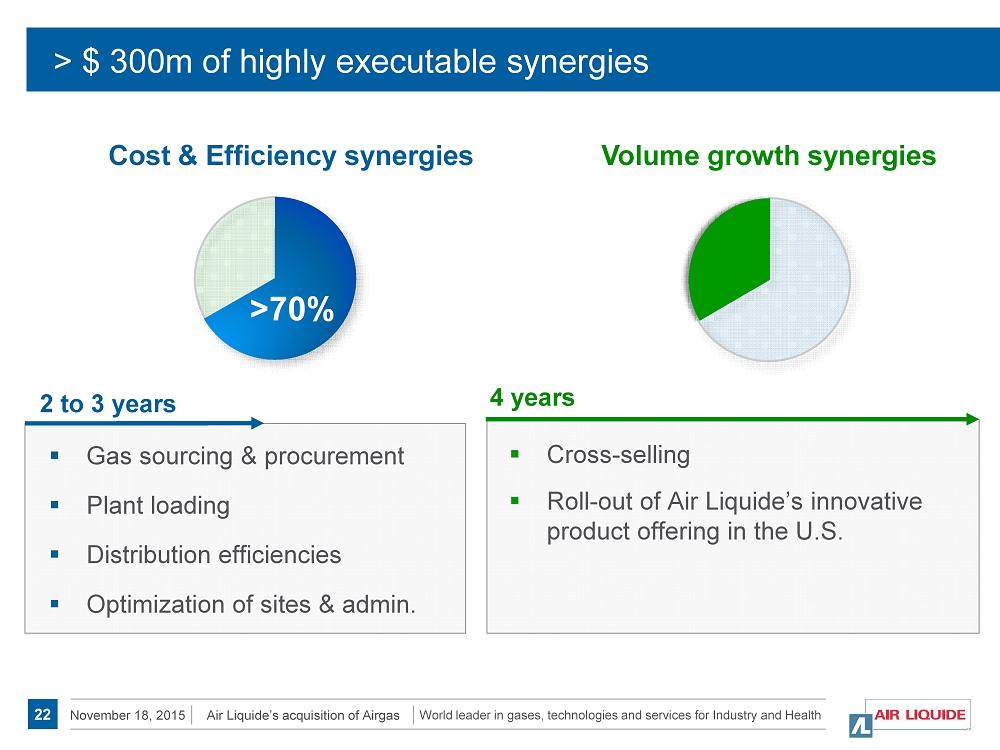

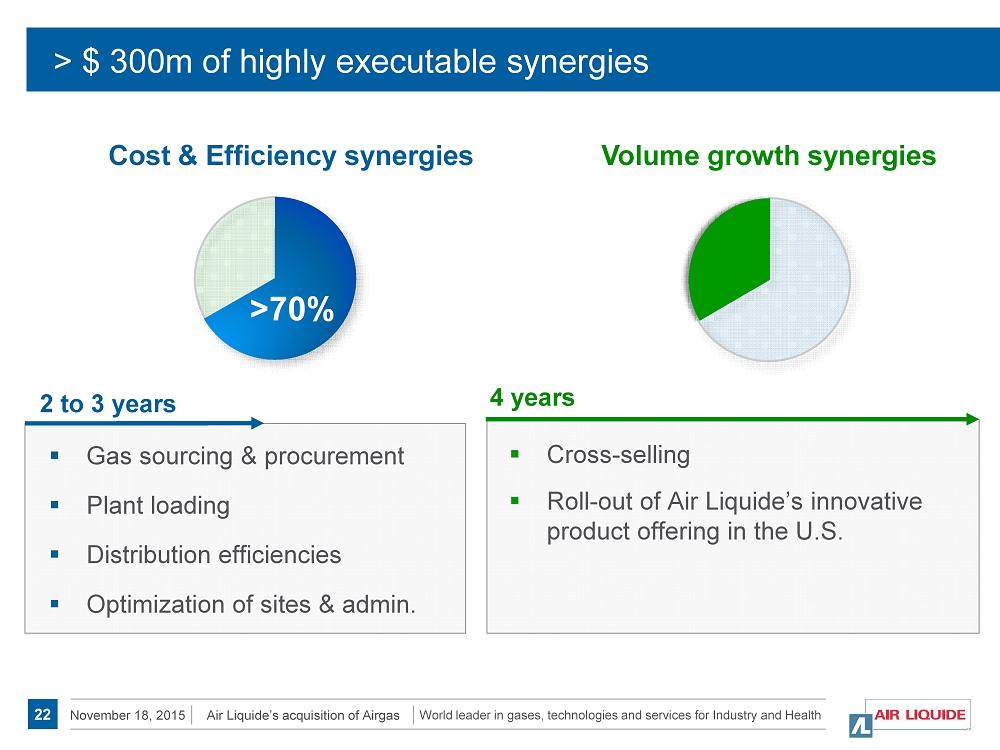

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas > $ 300m of highly executable synergies ▪ Cross - selling ▪ Roll - out of Air Liquide’s innovative product offering in the U.S. ▪ Gas sourcing & procurement ▪ Plant loading ▪ Distribution efficiencies ▪ Optimization of sites & admin. >70% 22 Cost & Efficiency synergies Volume growth synergies 2 to 3 years 4 years

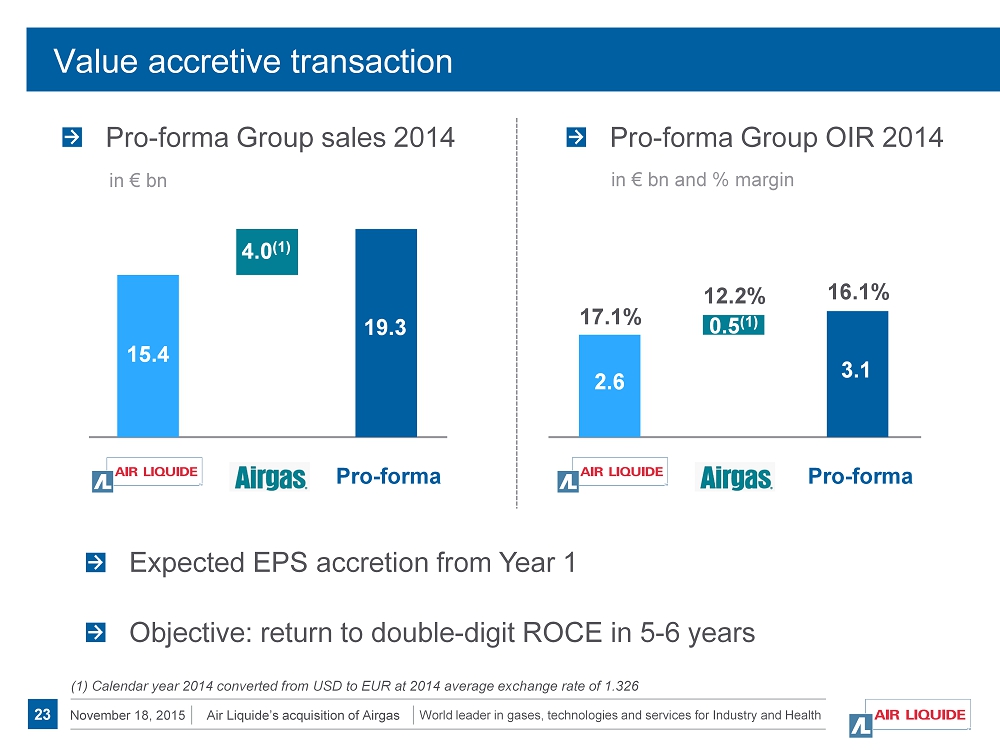

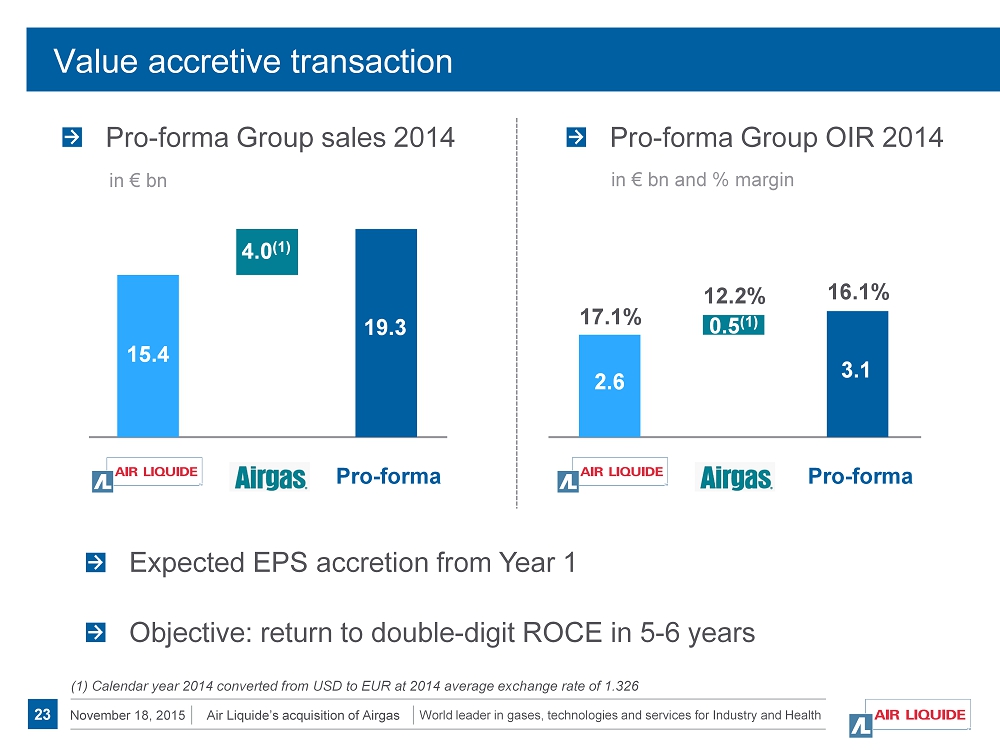

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Value accretive transaction Pro - forma Pro - forma 15.4 4.0 (1) 19.3 2.6 0.5 (1) 3.1 17.1% 12.2% 16.1% in € bn in € bn and % margin 23 Expected EPS accretion from Year 1 Objective: return to double - digit ROCE in 5 - 6 years Pro - forma Group sales 2014 Pro - forma Group OIR 2014 (1) Calendar year 2014 c onverted from USD to EUR at 2014 average exchange rate of 1.326

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Refinancing objective to maintain S&P A - /A credit rating Equity € 3 - 4bn USD & EUR bonds Enterprise value Re - financing 24 Closing Bridge loan Signing Bank commitment Assumed debt

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Approval process Merger agreement unanimously approved by Airgas’ Board of Directors Simple majority of Airgas shareholders required in Extraordinary General Meeting Transaction subject to approval by antitrust and regulatory authorities Immediately followed by closing 25

Creating a unique business combination in North America Strengthening Air Liquide’s ability to grow in North America and beyond World leader in gases, technologies and services for Industry and Health 4. Conclusion +

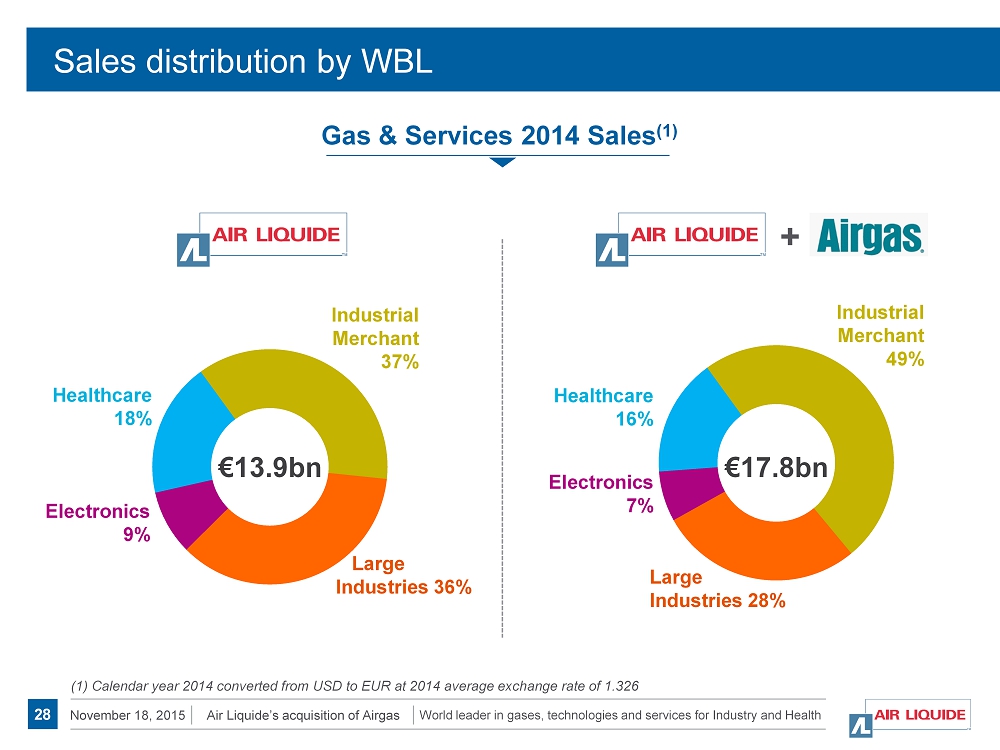

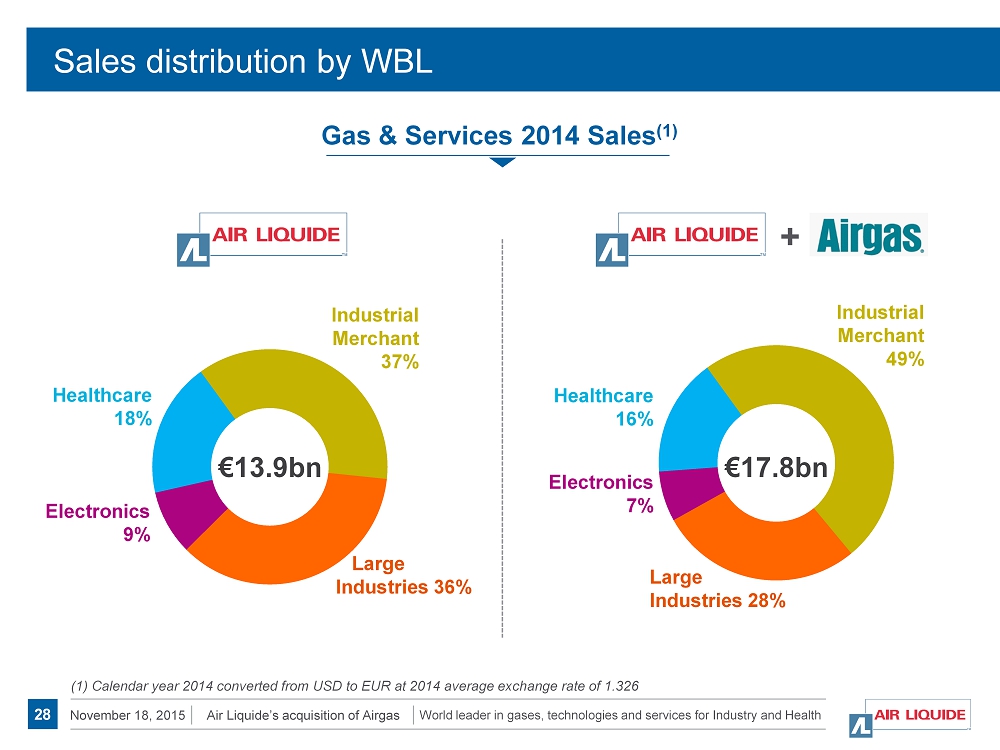

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas Sales distribution by WBL € 13.9bn € 17.8bn + 28 Gas & Services 2014 Sales (1) Large Industries 36% Industrial Merchant 37% Healthcare 18% Electronics 9% Large Industries 28% Industrial Merchant 49% Healthcare 16% Electronics 7% (1) Calendar year 2014 c onverted from USD to EUR at 2014 average exchange rate of 1.326

World leader in gases, technologies and services for Industry and Health November 18, 2015 Air Liquide’s acquisition of Airgas 29 For further information, please contact: Investor Relations Aude Rodriguez + 33 (0)1 40 62 57 08 Erin Sarret + 33 (0)1 40 62 57 37 Louis Laffont + 33 (0)1 40 62 57 18 Jérôme Zaman + 33 (0)1 40 62 59 38 L’Air Liquide S.A. Corporation for the study and application of processes developed by Georges Claude with registered capital of 1,897 ,386,986.00 euros Corporate headquarters : 75, Quai d’Orsay 75321 Paris Cedex 07 Tel : +33 (0)1 40 62 55 55 RCS Paris 552 096 281 www.airliquide.com Follow us on Twitter @AirLiquideGroup Communications Anne Bardot + 33 (0)1 40 62 50 93 Annie Fournier + 33 (0)1 40 62 51 31