UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. __)

Filed by the Registrant o

Filed by a Party other than the Registrant þ

Check appropriate box:

o Preliminary Proxy Statement

o Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

o Definitive Additional Materials

þ Soliciting Material under Rule 14a-12

Airgas, Inc.

(Name of Registrant as Specified in Its Charter)

Air Products and Chemicals, Inc.

(Name of Persons Filing Proxy Statement, if Other than Registrant)

Payment of filing fee (Check the appropriate box):

þ No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| | (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Offer to Acquire Airgas

February 5, 2010

Offer to Acquire Airgas

2

ADDITIONAL INFORMATION

• This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. No

tender offer for the shares of [Airgas], Inc. (“[Airgas]”) has commenced at this time. In connection with the

proposed transaction, [Air Products], Inc. (“[Air Products]”) may file tender offer documents with the U.S.

Securities and Exchange Commission (“SEC”). Any definitive tender offer documents will be mailed to

stockholders of [Airgas]. INVESTORS AND SECURITY HOLDERS OF [Airgas], INC. ARE URGED TO READ THESE

AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors

and security holders will be able to obtain free copies of these documents (if and when available) and

other documents filed with the SEC by [Air Products] through the web site maintained by the SEC at

http://www.sec.gov.

• In connection with the proposed transaction, [Air Products] may file a proxy statement with the SEC. Any

definitive proxy statement will be mailed to stockholders of [Airgas]. INVESTORS AND SECURITY HOLDERS OF

[Airgas] ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR

ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of these

documents (if and when available) and other documents filed with the SEC by [Air Products] through the

web site maintained by the SEC at http://www.sec.gov.

CERTAIN INFORMATION REGARDING PARTICIPANTS

• [Air Products] and certain of its respective directors and executive officers may be deemed to be

participants in the proposed transaction under the rules of the SEC. Security holders may obtain

information regarding the names, affiliations and interests of [Air Products]’s directors and executive

officers in [Air Products]’s Annual Report on Form 10-K for the year ended September 30, 2009, which was

filed with the SEC on November 25, 2009, and its proxy statement for the 2010 Annual Meeting, which was

filed with the SEC on December 10, 2009. These documents can be obtained free of charge from the

sources indicated above. Additional information regarding the interests of these participants in the proxy

solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will also

be included in any proxy statement and other relevant materials to be filed with the SEC when they

become available.

Offer to Acquire Airgas

Forward-Looking Statements

• All statements included or incorporated by reference in this communication other

than statements or characterizations of historical fact, are forward-looking

statements. These forward-looking statements are based on our current

expectations, estimates and projections about our business and industry,

management’s beliefs, and certain assumptions made by us, all of which are

subject to change. Forward-looking statements can often be identified by words

such as “anticipates”, “expects”, “intends”, “plans”, “predicts”, “believes”, “seeks”,

“estimates”, “may”, “will”, “should”, “would”, “could”, “potential”, “continue”,

“ongoing”, similar expressions, and variations or negatives of these words.

• These forward-looking statements are not guarantees of future results and are

subject to risks, uncertainties and assumptions that could cause our actual results to

differ materially and adversely from those expressed in any forward-looking

statement. Important risk factors that could contribute to such differences or

otherwise affect our business, results of operations and financial condition include

the possibility that [Air Products] will not pursue a transaction with [Airgas] and the

risk factors discussed in our Annual Report on Form 10-K, subsequent Quarterly

Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings.

The forward-looking statements in this release speak only as of the date of this filing.

We undertake no obligation to revise or update publicly any forward-looking

statement, except as required by law.

3

John Mc Glade

Air Products Chairman, President and CEO

4

Offer to Acquire Airgas

Transaction highlights

5

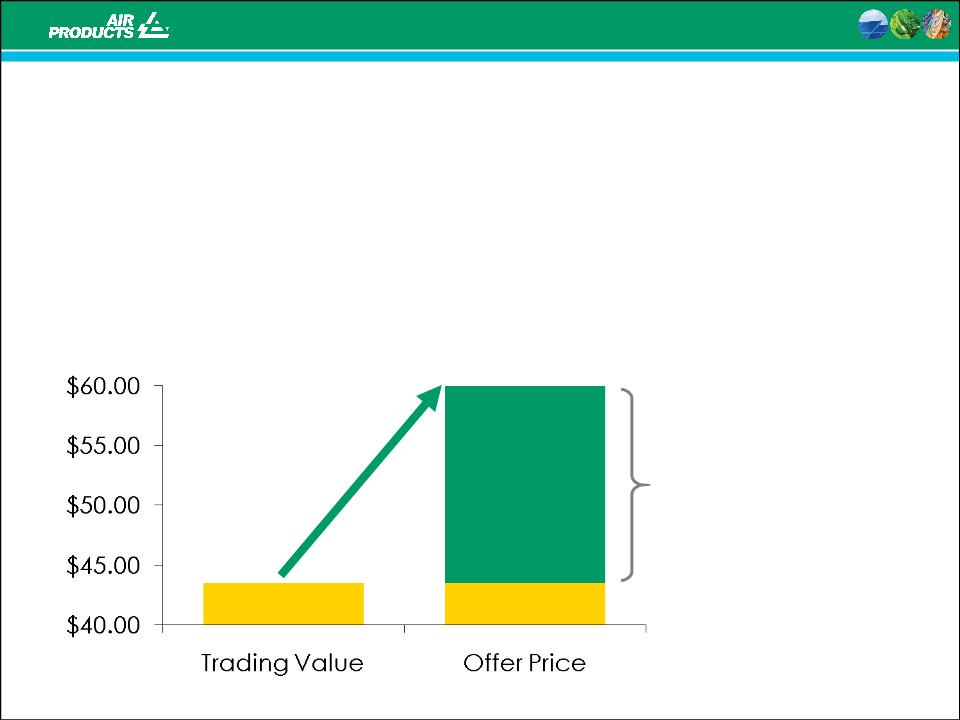

Consideration | All-cash offer for all Airgas shares at $60.00 per share |

Premium | Premium of 38% to Airgas’ closing price on 2/04/10

of $43.53 |

Accretion | Expected to be substantially accretive to Air Products

cash EPS beginning in 2011 |

Synergies | Substantial cost synergies yielding $250 million run rate

by the end of year 2 |

Financing | Air Products has secured committed financing.

Air Products is committed to remaining investment

grade and to returning to an A rating |

Regulatory

Approval | Air Products has thoroughly considered potential

regulatory issues and is prepared to make appropriate

divestitures |

Offer to Acquire Airgas

Compelling strategic and industrial logic

• Creates one of the world’s leading integrated industrial gas companies

− Largest industrial gas company in North America and one of the largest in the

world

− Diversified across geographies and distribution channels with competitive

positions in all three supply modes: Packaged Gases, Liquid Bulk, Tonnage

• Combination of highly complementary skills and strengths enables us to better

serve the needs of customers

− Air Products’ leadership in tonnage, strong European and joint venture

packaged gas positions

− Airgas’ leadership in U.S. packaged gases

− Air Products’ Engineering and Technology Skills

• Timing is excellent

− Provides Air Products a highly efficient re-entry into U.S. packaged gas market

− Air Products’ global infrastructure enables more rapid Airgas international

expansion

− Leverages Air Products’ supply chain and SAP capabilities

• Significant synergies available

− Substantial cost savings

− Growth opportunities as economy recovers

6

Offer to Acquire Airgas

Airgas at a glance

7

Broad Coverage - 1,500 Sales Representatives

Source: Based on Airgas public disclosures

Revenue (FY2009) | $4.3B |

Total CAGR (over last 5 years) | 19% |

Same Store Sales Growth | 7% |

Offer to Acquire Airgas

Combination creates significant value

8

A Company of Greater Capability

• Global presence & infrastructure

• Significant European packaged

gas business

• Gas application skills

• Tonnage asset base

• Operations & Engineering skills

• SAP experience & infrastructure

Air Products Strengths

• Broad U.S. sales coverage

• Packaged gas skills

• Distribution expertise

• Acquisition sourcing & integration

capabilities

Airgas Strengths

Increased Shareholder Value

• Lower costs

• Increased growth

• Greater cash generation

Offer to Acquire Airgas

A world leading integrated industrial gas company

9

Source: Based on Airgas public disclosures

Packaged

Gas

90%

Liquid/Bulk

10%

Pro-forma

Air Products

Pro-forma

Air Products

Airgas

Revenues

Airgas

Revenues

Air Products

Revenues

Air Products

Revenues

Liquid/Bulk

17%

Onsite

25%

Equipment

& Services

10%

Onsite/Pipeline

37%

Liquid/Bulk

24%

Equipment &

Services

14%

Packaged

Gas

11%

• One of the largest industrial gas companies in the world

• Largest industrial gas company in North America

• World-class competencies across all modes of supply

+

=

Specialty

Materials

14%

Spec

Mat’ls

9%

Packaged

Gas

39%

Offer to Acquire Airgas

Benefits of an integrated industrial gas company

10

Liquid/Bulk

Tonnage/Onsites

• Co-product economics

• Liquid back-up

• Sales coverage

• Product supply/outlet

• Broader scope of

industries served

• Brand recognition

Cylinders

Bulk

Packaged Gases

Mode of Supply

Mode of Supply

Integration Benefit

Integration Benefit

Tonnage

Offer to Acquire Airgas

Enhances Air Products’

Multiple Growth Opportunities

11

• Hydrogen for refining

• Oxygen for gasification

• LNG heat exchangers

Energy

Environment

Emerging Markets

• Oxyfuel

• Carbon capture

• Multiple Gas Applications

• Electronics across Asia

• Equity Affiliate positions

• Expanding Merchant

positions in Asia

Paul Huck

Air Products Senior Vice President and Chief Financial Officer

12

Offer to Acquire Airgas

• $60.00 per share in cash

• 38% premium comparable to similar transactions

− 10.5x multiple of EBITDA

• Immediate liquidity in an uncertain economic environment

and removes any uncertainly with respect to future stock

performance

13

Certain Value for Airgas Shareholders

Immediate

Shareholder Premium

Offer to Acquire Airgas

Financial details

•Transaction value ($billions)

•Committed financing secured

•Maintain investment grade credit rating

•Maintain dividend policy

14

Equity Purchase | $5.1 |

Assumption of debt | $1.9 |

Total Consideration | $7.0 |

Offer to Acquire Airgas

Key goals

15

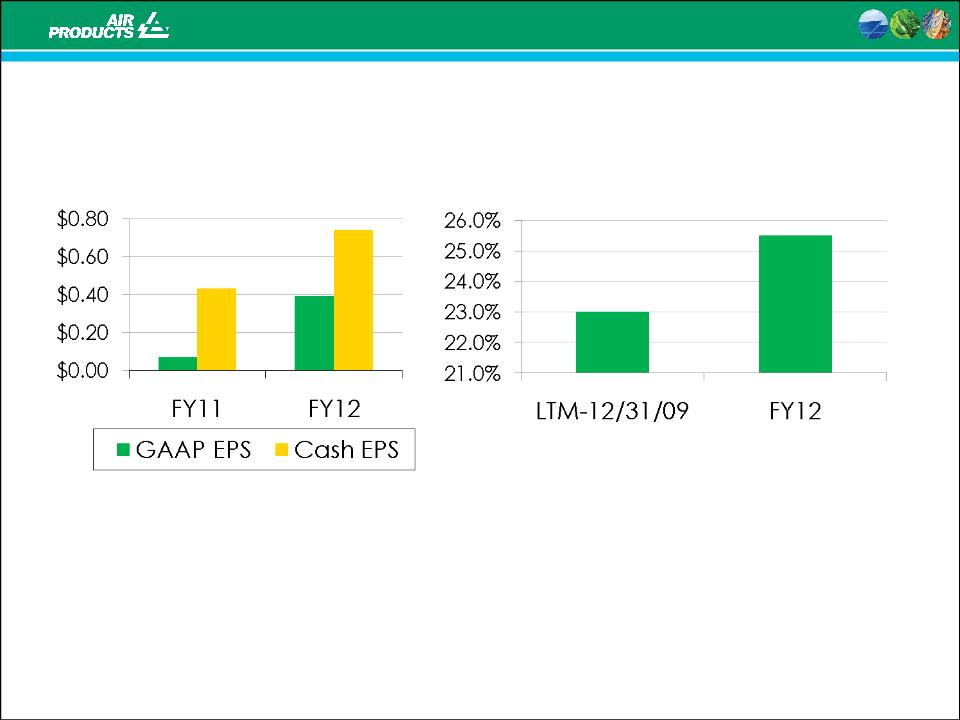

• Transaction accretive in the

first year

• Solid shareholder value

• Excludes transaction and

integration costs

• Synergies enable greater

cash flow generation

• Combination provides for

significant margin benefits

Accretion/Dilution

EBITDA Margin

Offer to Acquire Airgas

16

Synergies

Infrastructure

Infrastructure

•Fully integrated ERP platform

Fully integrated ERP platform

•Shared Services

Shared Services

Supply Chain Efficiencies

Supply Chain Efficiencies

•Utilize Air Products’ continuous improvement tools to

optimize supply chain

Utilize Air Products’ continuous improvement tools to

optimize supply chain

•Procurement Benefits

Procurement Benefits

Growth through new offerings, density and international expansion

Cost savings run rate of $250 million by end of year two

Overheads

Overheads

•Overlapping operations

Overlapping operations

•Streamlined management structure

Streamlined management structure

Offer to Acquire Airgas

17

Path Forward . . .

Air Products

committed to

completing the

transaction

Begin regulatory process

• Prepared to make

appropriate divestitures

Proceed with tender offer if needed

• Financing committed

Litigation

Proxy Contest

• Commenced litigation in

Delaware

• Proceed with proxy contest

if needed

John McGlade

Air Products Chairman, President and CEO

18

Offer to Acquire Airgas

RESULTS

• Accretive to

cash, GAAP EPS

Compelling transaction that delivers on

our promises…

STABILITY

• Diversified across

geographies and

distribution

channels with

competitive

positions in all three

supply modes

• Maintain strong

balance

sheet/investment

grade rating

GROWTH

• Highly efficient

re-entry into U.S.

packaged gas

market

• Enhanced growth

opportunities,

domestic and

international

Well-positioned for long-term value creation

19

Thank you

tell me more

20

www.airproducts.com/airgasoffer

* * *

ADDITIONAL INFORMATION

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. No tender offer for the shares of Airgas, Inc. (“Airgas”) has commenced at this time. In connection with the proposed transaction, Air Products and Chemicals, Inc. (“Air Products”) may file tender offer documents with the U.S. Securities and Exchange Commission (“SEC”). Any definitive tender offer documents will be mailed to stockholders of Airgas. INVESTORS AND SECURITY HOLDERS OF AIRGAS ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Air Products through the web site maintained by the SEC at http://www.sec.gov.

In connection with the proposed transaction, Air Products may file a proxy statement with the SEC. Any definitive proxy statement will be mailed to stockholders of Airgas. INVESTORS AND SECURITY HOLDERS OF AIRGAS ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Air Products through the web site maintained by the SEC at http://www.sec.gov.

CERTAIN INFORMATION REGARDING PARTICIPANTS

Air Products and certain of its respective directors and executive officers may be deemed to be participants in the proposed transaction under the rules of the SEC. Security holders may obtain information regarding the names, affiliations and interests of Air Products’ directors and executive officers in Air Products’ Annual Report on Form 10-K for the year ended September 30, 2009, which was filed with the SEC on November 25, 2009, and its proxy statement for the 2010 Annual Meeting, which was filed with the SEC on December 10, 2009. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of these participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in any proxy statement and other relevant materials to be filed with the SEC when they become available.

FORWARD-LOOKING STATEMENTS

All statements included or incorporated by reference in this communication other than statements or characterizations of historical fact, are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and projections about our business and industry, management’s beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking statements can often be identified by words such as “anticipates”, “expects”, “intends”, “plans”, “predicts”, “believes”, “seeks”, “estimates”, “may”, “will”, “should”, “would”, “could”, “potential”, “continue”, “ongoing”, similar expressions, and variations or negatives of these words.

These forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause our actual results to differ materially and adversely from those expressed in any forward-looking statement. Important risk factors that could contribute to such differences or otherwise affect our business, results of operations and financial condition include the possibility that Air Products will not pursue a transaction with Airgas and the risk factors discussed in our Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other SEC filings. The forward-looking statements in this release speak only as of the date of this filing. We undertake no obligation to revise or update publicly any forward-looking statement, except as required by law.