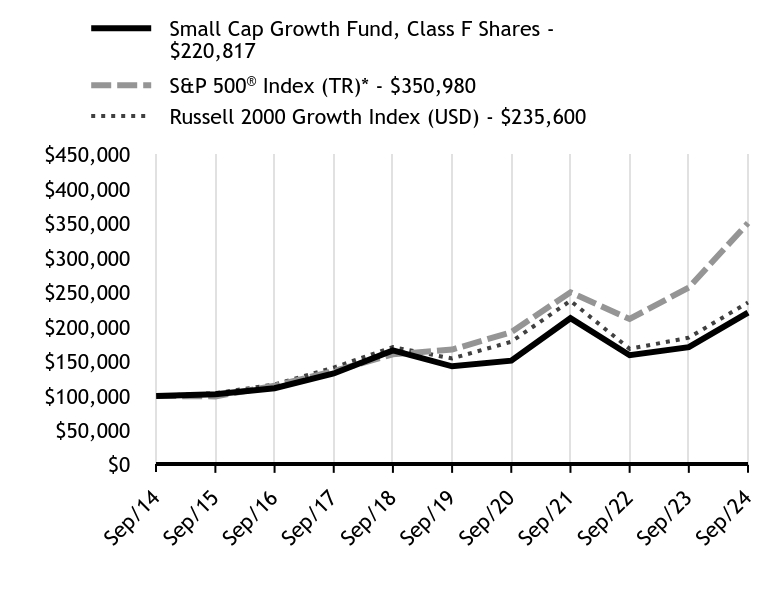

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-04878

SEI Institutional Managed Trust

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

Timothy D. Barto, Esq.

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-610-676-1000

Date of fiscal year end: September 30, 2024

Date of reporting period: September 30, 2024

Item 1. Reports to Stockholders.

| (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto. |

0000804239sei:Russell2000ValueIndexUSD166AdditionalIndexMember2022-09-300000804239sei:C000085250Membersei:ATIInc8214002CTIMember2024-09-30

Annual Shareholder Report - September 30, 2024

SEI Institutional Managed Trust/Class F Shares - SLGAX

This annual shareholder report contains important information about Class F Shares of the Large Cap Fund (the "Fund") for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000. This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Large Cap Fund, Class F Shares | $103 | 0.89% |

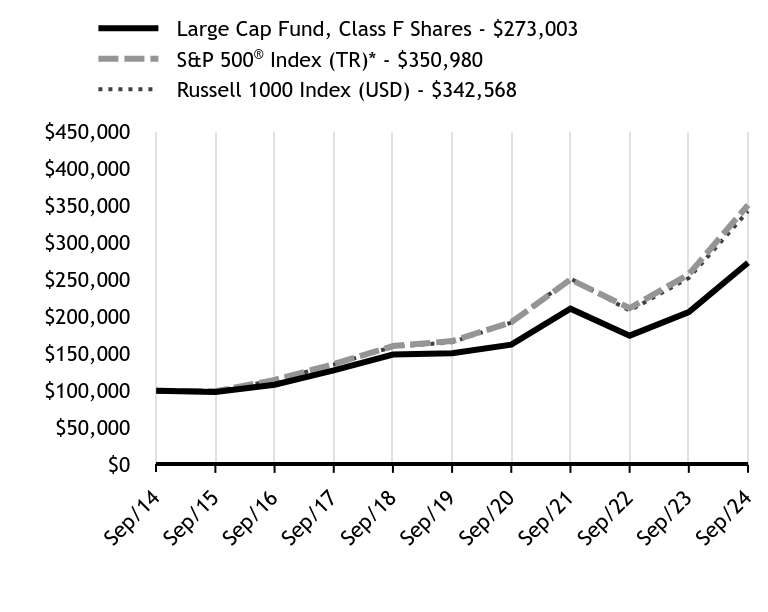

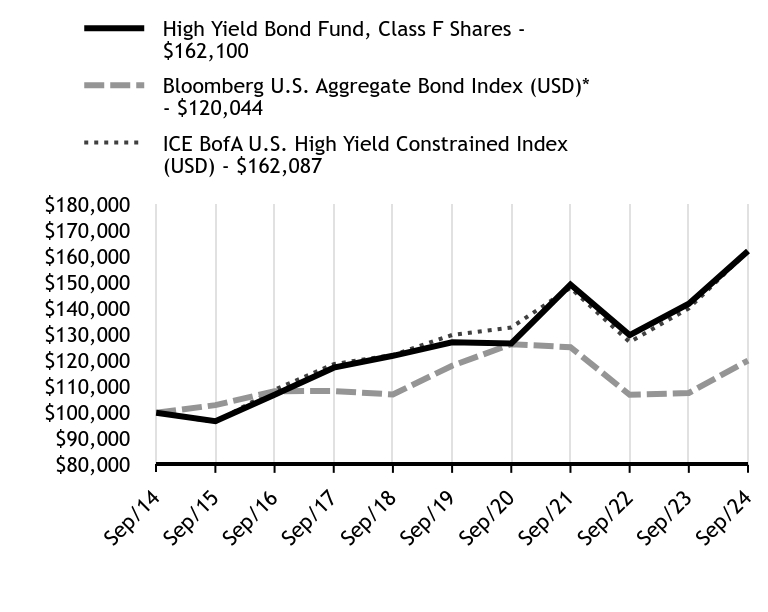

How did the Fund perform during the last 10 years?

Total Return Based on $100,000 Investment

| Large Cap Fund, Class F Shares - $273003 | S&P 500® Index (TR)* - $350980 | Russell 1000 Index (USD) - $342568 |

|---|

| Sep/14 | $100000 | $100000 | $100000 |

| Sep/15 | $98272 | $99385 | $99386 |

| Sep/16 | $108246 | $114721 | $114226 |

| Sep/17 | $127598 | $136070 | $135402 |

| Sep/18 | $149038 | $160441 | $159456 |

| Sep/19 | $150787 | $167266 | $165632 |

| Sep/20 | $162349 | $192605 | $192155 |

| Sep/21 | $210948 | $250396 | $251653 |

| Sep/22 | $174560 | $211654 | $208330 |

| Sep/23 | $206310 | $257408 | $252483 |

| Sep/24 | $273003 | $350980 | $342568 |

How did the Fund perform in the last year?

Class F Shares underperformed its benchmark, the Russell 1000 Index, for the 12-month period ending September 30, 2024.

The Fund recorded a positive absolute return for the reporting period, but underperformed the benchmark due to its tilt toward value stocks and away from the mega-cap growth stocks that led the market upturn. The Fund’s underweight exposure to the information technology sector also weighed on performance.

Among the Fund’s sub-advisors, Brandywine Global Investment Management, LLC lagged the benchmark due to its value orientation and stock selection within the energy and consumer discretionary sectors. LSV Asset Management lagged the benchmark due to its value orientation, an overweight allocation to the energy sector, an underweight to the information technology sector, and security selection within the industrials sector. Fred Alger Management, LLC outperformed the benchmark due to its growth orientation, a large weight in the information technology sector, and stock selection within the information technology sector. Mar Vista Investment Partners, LLC’s underperformance was attributable to its lower-beta (a measure of an investment’s volatility relative to a benchmark) tilt, underweights to the mega-cap growth stocks that led the market upturn over the period, and stock selection within the information technology sector. SEI’s Quantitative Investment Management (QIM) team’s factor-based momentum strategy outperformed due to security selection within the industrials and information technology sectors. The QIM Team’s factor-based quality strategy lagged the benchmark due to security selection within the information technology sector. Copeland Capital Management LLC’s (Copeland) performance lagged during the portion of the reporting period that it was a Fund sub-advisor because of its lower-beta tilt and stock selection within the consumer discretionary and financials sectors.

Regarding the use of derivatives during the reporting period, the Fund employed equity index futures in an effort to provide stock-like performance to the liquidity reserve account, which contained cash available for fund withdrawals. This contributed positively to the Fund’s absolute return for the period.

Average Annual Total Returns as of September 30, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Large Cap Fund, Class F Shares | 32.33% | 12.61% | 10.56% |

S&P 500® Index (TR)* | 36.35% | 15.98% | 13.38% |

| Russell 1000 Index (USD) | 35.68% | 15.64% | 13.10% |

The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.

* As of September 30, 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Key Fund Statistics as of September 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,652,125 | 307 | $5,980 | 34% |

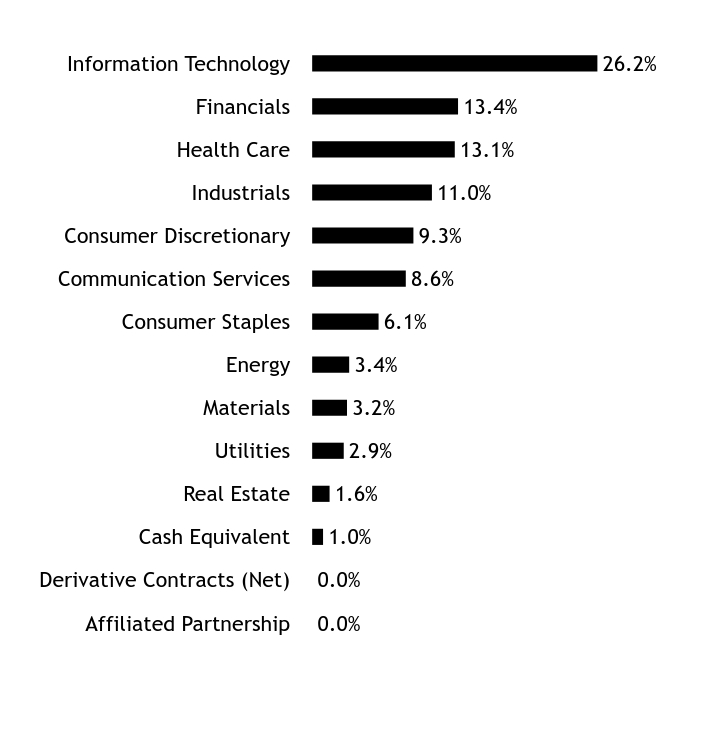

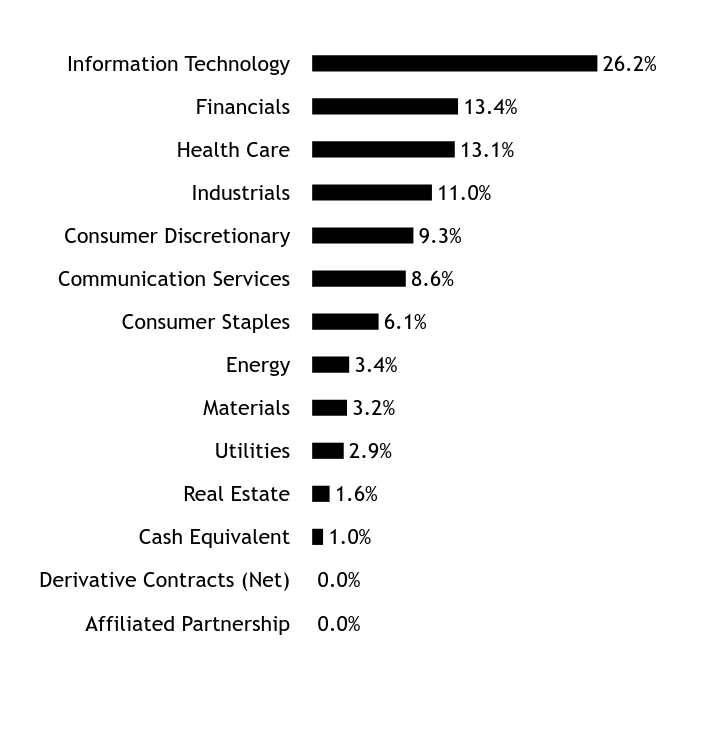

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Affiliated Partnership | 0.0% |

| Derivative Contracts (Net) | 0.0% |

| Cash Equivalent | 1.0% |

| Real Estate | 1.6% |

| Utilities | 2.9% |

| Materials | 3.2% |

| Energy | 3.4% |

| Consumer Staples | 6.1% |

| Communication Services | 8.6% |

| Consumer Discretionary | 9.3% |

| Industrials | 11.0% |

| Health Care | 13.1% |

| Financials | 13.4% |

| Information Technology | 26.2% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| Microsoft Corp | | | 4.6% |

| Apple Inc | | | 3.9% |

| NVIDIA Corp | | | 2.6% |

| Meta Platforms Inc, Cl A | | | 2.4% |

| Amazon.com Inc, Cl A | | | 2.0% |

| Visa Inc, Cl A | | | 1.6% |

| Broadcom Inc | | | 1.6% |

| Johnson & Johnson | | | 1.5% |

| Eli Lilly & Co | | | 1.2% |

| TransDigm Group Inc | | | 1.2% |

| Footnote | Description |

Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

During the reporting period, Ceredex Value Advisors LLC and Coho Partners, Ltd. were terminated as Fund sub-advisers, while Copeland was hired as a manager.

This is a summary of certain changes to the Fund as of September 30, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by January 28, 2025, at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports or upon request at 1-800-DIAL-SEI.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

SEI Institutional Managed Trust/Class F Shares - SLGAX

Annual Shareholder Report - September 30, 2024

SLGAX-AR-24

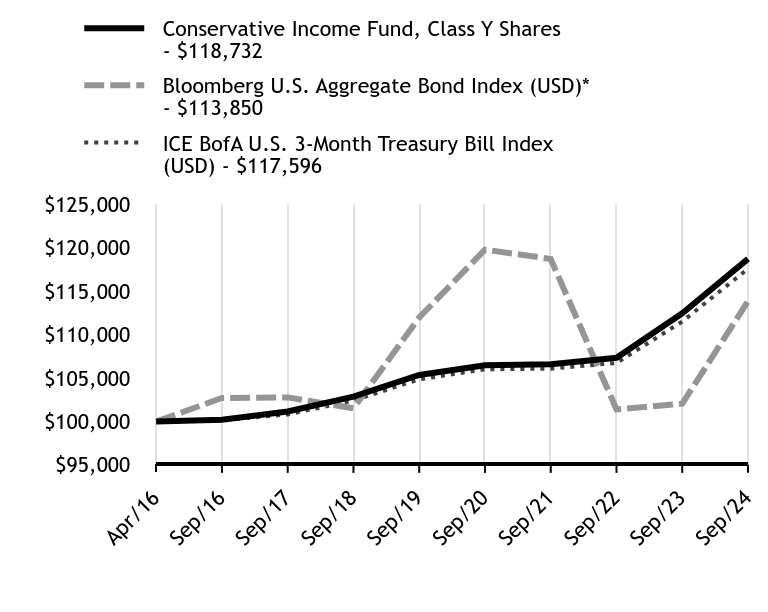

Annual Shareholder Report - September 30, 2024

SEI Institutional Managed Trust/Class Y Shares - SLYCX

This annual shareholder report contains important information about Class Y Shares of the Large Cap Fund (the "Fund") for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000. This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Large Cap Fund, Class Y Shares | $76 | 0.65% |

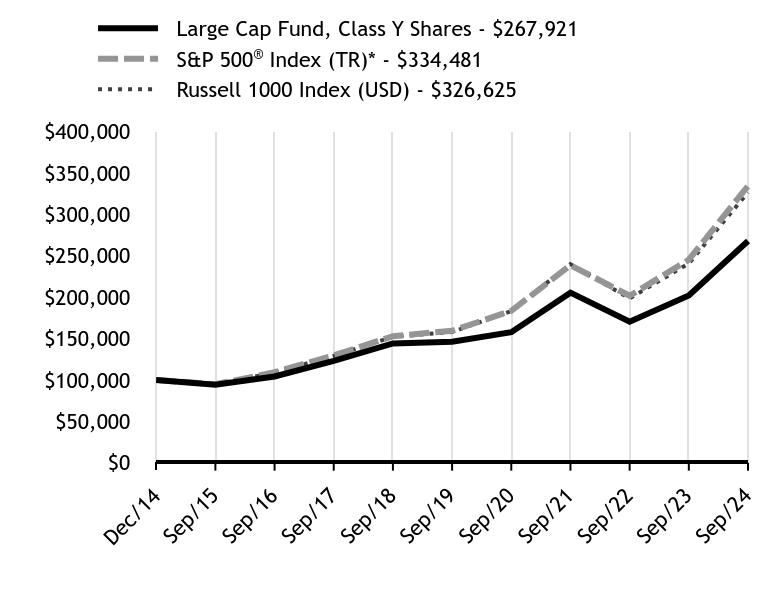

How did the Fund perform during the last 10 years?

Total Return Based on $100,000 Investment

| Large Cap Fund, Class Y Shares - $267921 | S&P 500® Index (TR)* - $334481 | Russell 1000 Index (USD) - $326625 |

|---|

| Dec/14 | $100000 | $100000 | $100000 |

| Sep/15 | $94260 | $94714 | $94761 |

| Sep/16 | $104156 | $109328 | $108910 |

| Sep/17 | $123066 | $129674 | $129101 |

| Sep/18 | $144087 | $152899 | $152035 |

| Sep/19 | $146160 | $159403 | $157923 |

| Sep/20 | $157652 | $183551 | $183212 |

| Sep/21 | $205464 | $238625 | $239941 |

| Sep/22 | $170365 | $201705 | $198634 |

| Sep/23 | $202031 | $245308 | $240732 |

| Sep/24 | $267921 | $334481 | $326625 |

How did the Fund perform in the last year?

Class Y Shares underperformed its benchmark, the Russell 1000 Index, for the 12-month period ending September 30, 2024.

The Fund recorded a positive absolute return for the reporting period, but underperformed the benchmark due to its tilt toward value stocks and away from the mega-cap growth stocks that led the market upturn. The Fund’s underweight exposure to the information technology sector also weighed on performance.

Among the Fund’s sub-advisors, Brandywine Global Investment Management, LLC lagged the benchmark due to its value orientation and stock selection within the energy and consumer discretionary sectors. LSV Asset Management lagged the benchmark due to its value orientation, an overweight allocation to the energy sector, an underweight to the information technology sector, and security selection within the industrials sector. Fred Alger Management, LLC outperformed the benchmark due to its growth orientation, a large weight in the information technology sector, and stock selection within the information technology sector. Mar Vista Investment Partners, LLC’s underperformance was attributable to its lower-beta (a measure of an investment’s volatility relative to a benchmark) tilt, underweights to the mega-cap growth stocks that led the market upturn over the period, and stock selection within the information technology sector. SEI’s Quantitative Investment Management (QIM) team’s factor-based momentum strategy outperformed due to security selection within the industrials and information technology sectors. The QIM Team’s factor-based quality strategy lagged the benchmark due to security selection within the information technology sector. Copeland Capital Management LLC’s (Copeland) performance lagged during the portion of the reporting period that it was a Fund sub-advisor because of its lower-beta tilt and stock selection within the consumer discretionary and financials sectors.

Regarding the use of derivatives during the reporting period, the Fund employed equity index futures in an effort to provide stock-like performance to the liquidity reserve account, which contained cash available for fund withdrawals. This contributed positively to the Fund’s absolute return for the period.

Average Annual Total Returns as of September 30, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Large Cap Fund, Class Y Shares | 32.61% | 12.88% | 10.83% |

S&P 500® Index (TR)Footnote Reference* | 36.35% | 15.98% | 13.38% |

| Russell 1000 Index (USD) | 35.68% | 15.64% | 13.10% |

The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance. Class Y Shares commenced operations on December 31, 2014. For periods prior to December 31, 2014, the performance of the Fund’s Class F Shares has been used. Returns for Class Y Shares would have been substantially similar to those of Class F Shares and would have differed only to the extent that Class Y Shares have lower total annual fund operating expenses than Class F Shares.

* As of September 30, 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Key Fund Statistics as of September 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,652,125 | 307 | $5,980 | 34% |

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Affiliated Partnership | 0.0% |

| Derivative Contracts (Net) | 0.0% |

| Cash Equivalent | 1.0% |

| Real Estate | 1.6% |

| Utilities | 2.9% |

| Materials | 3.2% |

| Energy | 3.4% |

| Consumer Staples | 6.1% |

| Communication Services | 8.6% |

| Consumer Discretionary | 9.3% |

| Industrials | 11.0% |

| Health Care | 13.1% |

| Financials | 13.4% |

| Information Technology | 26.2% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| Microsoft Corp | | | 4.6% |

| Apple Inc | | | 3.9% |

| NVIDIA Corp | | | 2.6% |

| Meta Platforms Inc, Cl A | | | 2.4% |

| Amazon.com Inc, Cl A | | | 2.0% |

| Visa Inc, Cl A | | | 1.6% |

| Broadcom Inc | | | 1.6% |

| Johnson & Johnson | | | 1.5% |

| Eli Lilly & Co | | | 1.2% |

| TransDigm Group Inc | | | 1.2% |

| Footnote | Description |

Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

During the reporting period, Ceredex Value Advisors LLC and Coho Partners, Ltd. were terminated as Fund sub-advisers, while Copeland was hired as a manager.

This is a summary of certain changes to the Fund as of September 30, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by January 28, 2025, at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports or upon request at 1-800-DIAL-SEI.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

SEI Institutional Managed Trust/Class Y Shares - SLYCX

Annual Shareholder Report - September 30, 2024

SLYCX-AR-24

Annual Shareholder Report - September 30, 2024

SEI Institutional Managed Trust/Class F Shares - TRMVX

This annual shareholder report contains important information about Class F Shares of the Large Cap Value Fund (the "Fund") for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Large Cap Value Fund, Class F Shares | $100 | 0.89% |

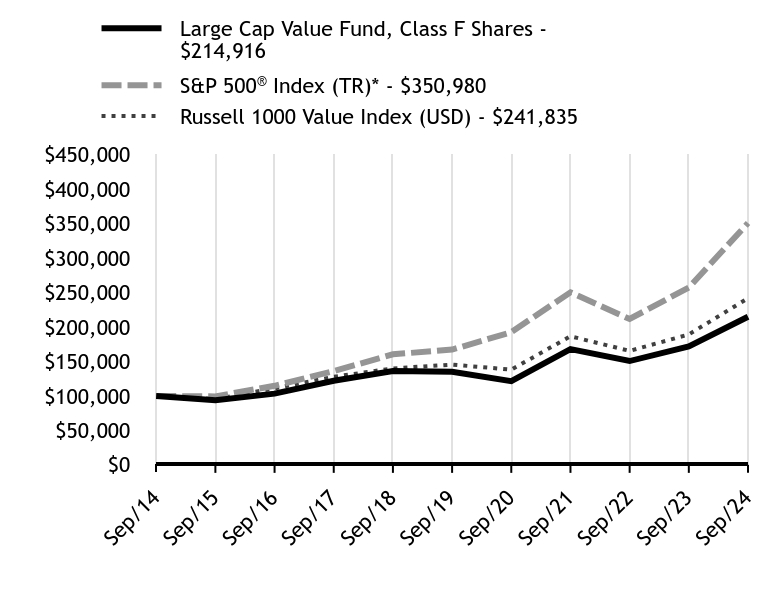

How did the Fund perform during the last 10 years?

Total Return Based on $100,000 Investment

| Large Cap Value Fund, Class F Shares - $214916 | S&P 500® Index (TR)* - $350980 | Russell 1000 Value Index (USD) - $241835 |

|---|

| Sep/14 | $100000 | $100000 | $100000 |

| Sep/15 | $93854 | $99385 | $95576 |

| Sep/16 | $103385 | $114721 | $111055 |

| Sep/17 | $122124 | $136070 | $127849 |

| Sep/18 | $136214 | $160441 | $139931 |

| Sep/19 | $134975 | $167266 | $145529 |

| Sep/20 | $121536 | $192605 | $138216 |

| Sep/21 | $167970 | $250396 | $186608 |

| Sep/22 | $150669 | $211654 | $165405 |

| Sep/23 | $171805 | $257408 | $189286 |

| Sep/24 | $214916 | $350980 | $241835 |

How did the Fund perform in the last year?

Class F Shares underperformed its benchmark, the Russell 1000 Value Index, for the 12-month period ending September 30, 2024.

The Fund’s more significant value tilt compared to that of the benchmark detracted from performance during the reporting period as relatively cheaper stocks underperformed more expensive shares. Stock selection within the health care and industrials sectors also weighed on Fund performance. However, stock selection within the utilities sector benefited performance.

Among the Fund’s sub-advisors, Cullen Capital Management, LLC lagged the benchmark over the reporting period due to an underweight to the financials sector, as well as stock selection within the energy and health care sectors. LSV Asset Management’s underperformance was attributable to its strong value tilt, an overweight allocation to the energy sector, and stock selection within the industrials sector. Brandywine Global Investment Management, LLC (Brandywine) lagged the benchmark due its strong value tilt, as well as stock selection and an overweight position in the health care sector. Stock selection within the financials sector also detracted from Brandywine’s performance, while holdings in the utilities sector had a positive impact. SEI’s Quantitative Investment Management (QIM) Team’s factor-based value strategy underperformed during the period due to its strong value tilt, stock selection within the consumer staples sector, and an overweight to the energy sector.

Average Annual Total Returns as of September 30, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Large Cap Value Fund, Class F Shares | 25.09% | 9.75% | 7.95% |

S&P 500® Index (TR)* | 36.35% | 15.98% | 13.38% |

| Russell 1000 Value Index (USD) | 27.76% | 10.69% | 9.23% |

The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.

* As of September 30, 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Key Fund Statistics as of September 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,365,522 | 217 | $4,250 | 15% |

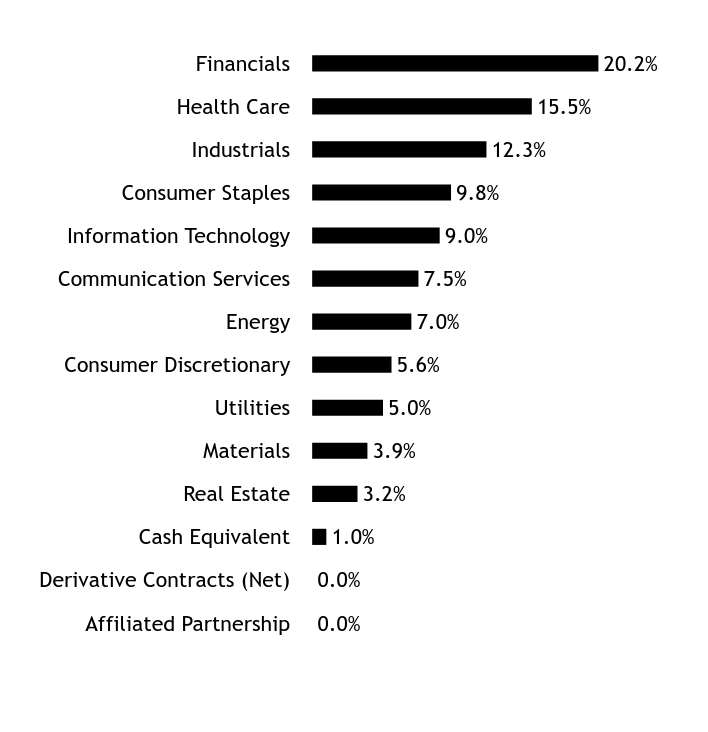

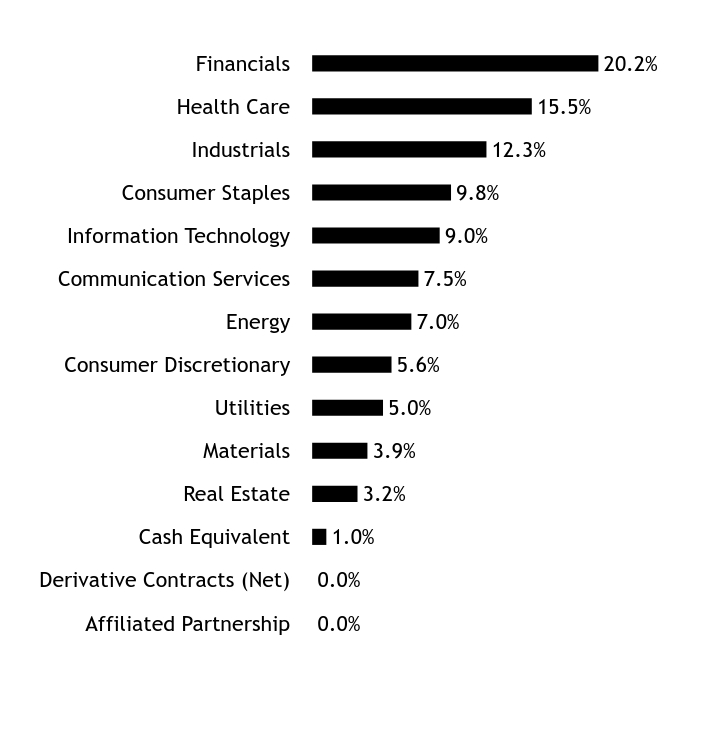

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Affiliated Partnership | 0.0% |

| Derivative Contracts (Net) | 0.0% |

| Cash Equivalent | 1.0% |

| Real Estate | 3.2% |

| Materials | 3.9% |

| Utilities | 5.0% |

| Consumer Discretionary | 5.6% |

| Energy | 7.0% |

| Communication Services | 7.5% |

| Information Technology | 9.0% |

| Consumer Staples | 9.8% |

| Industrials | 12.3% |

| Health Care | 15.5% |

| Financials | 20.2% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| AT&T Inc | | | 2.5% |

| Citigroup Inc | | | 2.4% |

| JPMorgan Chase & Co | | | 2.0% |

| Exxon Mobil Corp | | | 2.0% |

| Johnson & Johnson | | | 1.9% |

| Merck & Co Inc | | | 1.7% |

| Bank of America Corp | | | 1.6% |

| Comcast Corp, Cl A | | | 1.6% |

| Kroger Co/The | | | 1.5% |

| RTX Corp | | | 1.4% |

| Footnote | Description |

Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

SEI Institutional Managed Trust/Class F Shares - TRMVX

Annual Shareholder Report - September 30, 2024

TRMVX-AR-24

Annual Shareholder Report - September 30, 2024

SEI Institutional Managed Trust/Class I Shares - SEUIX

This annual shareholder report contains important information about Class I Shares of the Large Cap Value Fund (the "Fund") for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Large Cap Value Fund, Class I Shares | $125 | 1.11% |

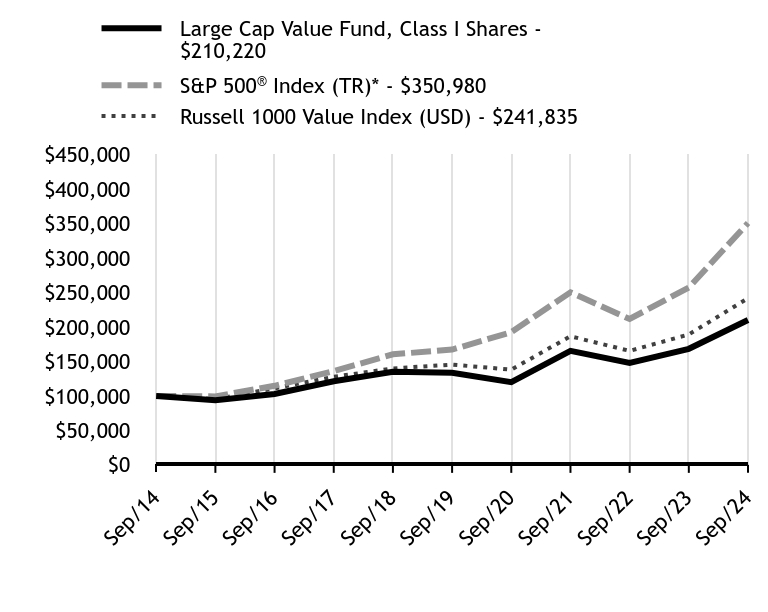

How did the Fund perform during the last 10 years?

Total Return Based on $100,000 Investment

| Large Cap Value Fund, Class I Shares - $210220 | S&P 500® Index (TR)* - $350980 | Russell 1000 Value Index (USD) - $241835 |

|---|

| Sep/14 | $100000 | $100000 | $100000 |

| Sep/15 | $93664 | $99385 | $95576 |

| Sep/16 | $102966 | $114721 | $111055 |

| Sep/17 | $121336 | $136070 | $127849 |

| Sep/18 | $135050 | $160441 | $139931 |

| Sep/19 | $133517 | $167266 | $145529 |

| Sep/20 | $119933 | $192605 | $138216 |

| Sep/21 | $165422 | $250396 | $186608 |

| Sep/22 | $148023 | $211654 | $165405 |

| Sep/23 | $168429 | $257408 | $189286 |

| Sep/24 | $210220 | $350980 | $241835 |

How did the Fund perform in the last year?

Class I Shares underperformed its benchmark, the Russell 1000 Value Index, for the 12-month period ending September 30, 2024.

The Fund’s more significant value tilt compared to that of the benchmark detracted from performance during the reporting period as relatively cheaper stocks underperformed more expensive shares. Stock selection within the health care and industrials sectors also weighed on Fund performance. However, stock selection within the utilities sector benefited performance.

Among the Fund’s sub-advisors, Cullen Capital Management, LLC lagged the benchmark over the reporting period due to an underweight to the financials sector, as well as stock selection within the energy and health care sectors. LSV Asset Management’s underperformance was attributable to its strong value tilt, an overweight allocation to the energy sector, and stock selection within the industrials sector. Brandywine Global Investment Management, LLC (Brandywine) lagged the benchmark due its strong value tilt, as well as stock selection and an overweight position in the health care sector. Stock selection within the financials sector also detracted from Brandywine’s performance, while holdings in the utilities sector had a positive impact. SEI’s Quantitative Investment Management (QIM) Team’s factor-based value strategy underperformed during the period due to its strong value tilt, stock selection within the consumer staples sector, and an overweight to the energy sector.

Average Annual Total Returns as of September 30, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Large Cap Value Fund, Class I Shares | 24.81% | 9.50% | 7.71% |

S&P 500® Index (TR)* | 36.35% | 15.98% | 13.38% |

| Russell 1000 Value Index (USD) | 27.76% | 10.69% | 9.23% |

The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.

* As of September 30, 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Key Fund Statistics as of September 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,365,522 | 217 | $4,250 | 15% |

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Affiliated Partnership | 0.0% |

| Derivative Contracts (Net) | 0.0% |

| Cash Equivalent | 1.0% |

| Real Estate | 3.2% |

| Materials | 3.9% |

| Utilities | 5.0% |

| Consumer Discretionary | 5.6% |

| Energy | 7.0% |

| Communication Services | 7.5% |

| Information Technology | 9.0% |

| Consumer Staples | 9.8% |

| Industrials | 12.3% |

| Health Care | 15.5% |

| Financials | 20.2% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| AT&T Inc | | | 2.5% |

| Citigroup Inc | | | 2.4% |

| JPMorgan Chase & Co | | | 2.0% |

| Exxon Mobil Corp | | | 2.0% |

| Johnson & Johnson | | | 1.9% |

| Merck & Co Inc | | | 1.7% |

| Bank of America Corp | | | 1.6% |

| Comcast Corp, Cl A | | | 1.6% |

| Kroger Co/The | | | 1.5% |

| RTX Corp | | | 1.4% |

| Footnote | Description |

Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

SEI Institutional Managed Trust/Class I Shares - SEUIX

Annual Shareholder Report - September 30, 2024

SEUIX-AR-24

Annual Shareholder Report - September 30, 2024

SEI Institutional Managed Trust/Class Y Shares - SVAYX

This annual shareholder report contains important information about Class Y Shares of the Large Cap Value Fund (the "Fund") for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Large Cap Value Fund, Class Y Shares | $72 | 0.64% |

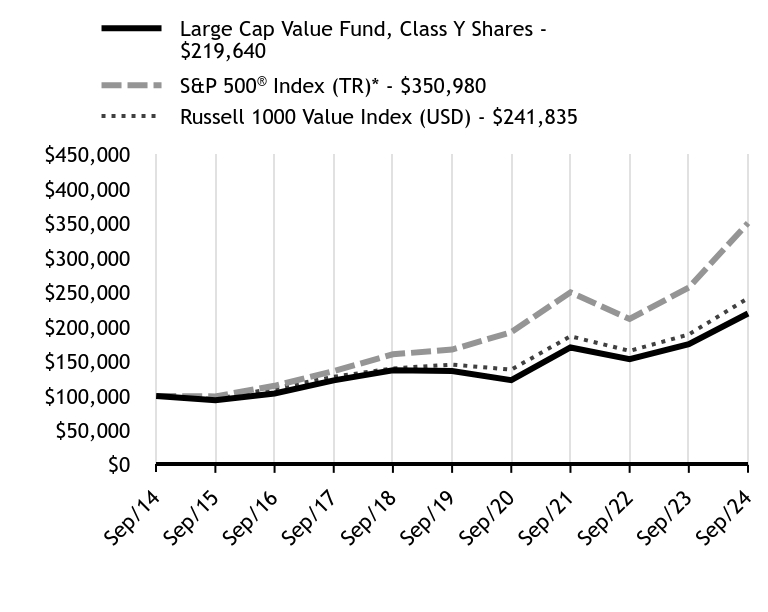

How did the Fund perform during the last 10 years?

Total Return Based on $100,000 Investment

| Large Cap Value Fund, Class Y Shares - $219640 | S&P 500® Index (TR)* - $350980 | Russell 1000 Value Index (USD) - $241835 |

|---|

| Sep/14 | $100000 | $100000 | $100000 |

| Sep/15 | $93854 | $99385 | $95576 |

| Sep/16 | $103624 | $114721 | $111055 |

| Sep/17 | $122656 | $136070 | $127849 |

| Sep/18 | $137149 | $160441 | $139931 |

| Sep/19 | $136303 | $167266 | $145529 |

| Sep/20 | $122998 | $192605 | $138216 |

| Sep/21 | $170408 | $250396 | $186608 |

| Sep/22 | $153257 | $211654 | $165405 |

| Sep/23 | $175204 | $257408 | $189286 |

| Sep/24 | $219640 | $350980 | $241835 |

How did the Fund perform in the last year?

Class Y Shares underperformed its benchmark, the Russell 1000 Value Index, for the 12-month period ending September 30, 2024.

The Fund’s more significant value tilt compared to that of the benchmark detracted from performance during the reporting period as relatively cheaper stocks underperformed more expensive shares. Stock selection within the health care and industrials sectors also weighed on Fund performance. However, stock selection within the utilities sector benefited performance.

Among the Fund’s sub-advisors, Cullen Capital Management, LLC lagged the benchmark over the reporting period due to an underweight to the financials sector, as well as stock selection within the energy and health care sectors. LSV Asset Management’s underperformance was attributable to its strong value tilt, an overweight allocation to the energy sector, and stock selection within the industrials sector. Brandywine Global Investment Management, LLC (Brandywine) lagged the benchmark due its strong value tilt, as well as stock selection and an overweight position in the health care sector. Stock selection within the financials sector also detracted from Brandywine’s performance, while holdings in the utilities sector had a positive impact. SEI’s Quantitative Investment Management (QIM) Team’s factor-based value strategy underperformed during the period due to its strong value tilt, stock selection within the consumer staples sector, and an overweight to the energy sector.

Average Annual Total Returns as of September 30, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Large Cap Value Fund, Class Y Shares | 25.36% | 10.01% | 8.19% |

S&P 500® Index (TR)Footnote Reference* | 36.35% | 15.98% | 13.38% |

| Russell 1000 Value Index (USD) | 27.76% | 10.69% | 9.23% |

The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance. Class Y Shares commenced operations on October 30, 2015. For periods prior to October 30, 2015, the performance of the Fund’s Class F Shares has been used. Returns for Class Y Shares would have been substantially similar to those of Class F Shares and would have differed only to the extent that Class Y Shares have lower total annual fund operating expenses than Class F Shares.

* As of September 30, 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Key Fund Statistics as of September 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,365,522 | 217 | $4,250 | 15% |

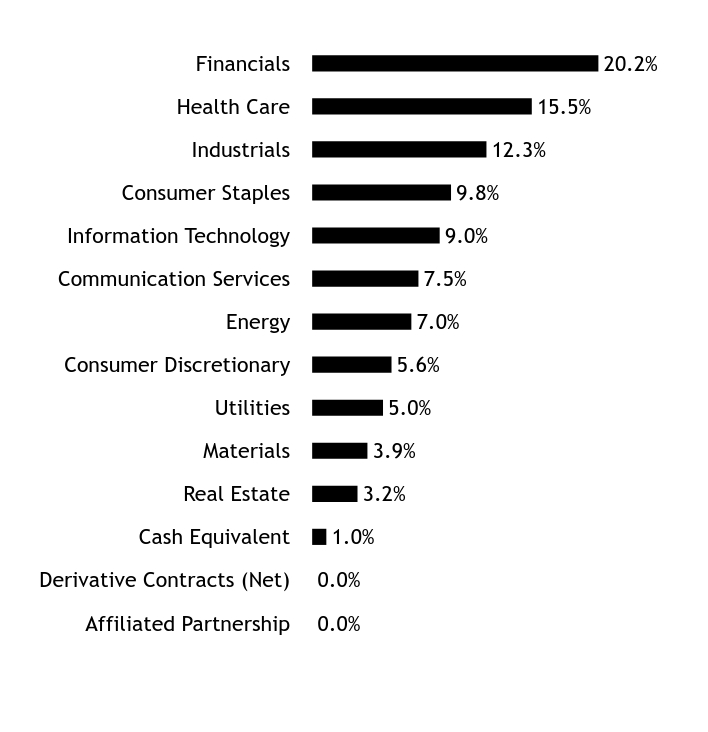

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Affiliated Partnership | 0.0% |

| Derivative Contracts (Net) | 0.0% |

| Cash Equivalent | 1.0% |

| Real Estate | 3.2% |

| Materials | 3.9% |

| Utilities | 5.0% |

| Consumer Discretionary | 5.6% |

| Energy | 7.0% |

| Communication Services | 7.5% |

| Information Technology | 9.0% |

| Consumer Staples | 9.8% |

| Industrials | 12.3% |

| Health Care | 15.5% |

| Financials | 20.2% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| AT&T Inc | | | 2.5% |

| Citigroup Inc | | | 2.4% |

| JPMorgan Chase & Co | | | 2.0% |

| Exxon Mobil Corp | | | 2.0% |

| Johnson & Johnson | | | 1.9% |

| Merck & Co Inc | | | 1.7% |

| Bank of America Corp | | | 1.6% |

| Comcast Corp, Cl A | | | 1.6% |

| Kroger Co/The | | | 1.5% |

| RTX Corp | | | 1.4% |

| Footnote | Description |

Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

SEI Institutional Managed Trust/Class Y Shares - SVAYX

Annual Shareholder Report - September 30, 2024

SVAYX-AR-24

Annual Shareholder Report - September 30, 2024

SEI Institutional Managed Trust/Class F Shares - SELCX

This annual shareholder report contains important information about Class F Shares of the Large Cap Growth Fund (the "Fund") for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Large Cap Growth Fund, Class F Shares | $108 | 0.89% |

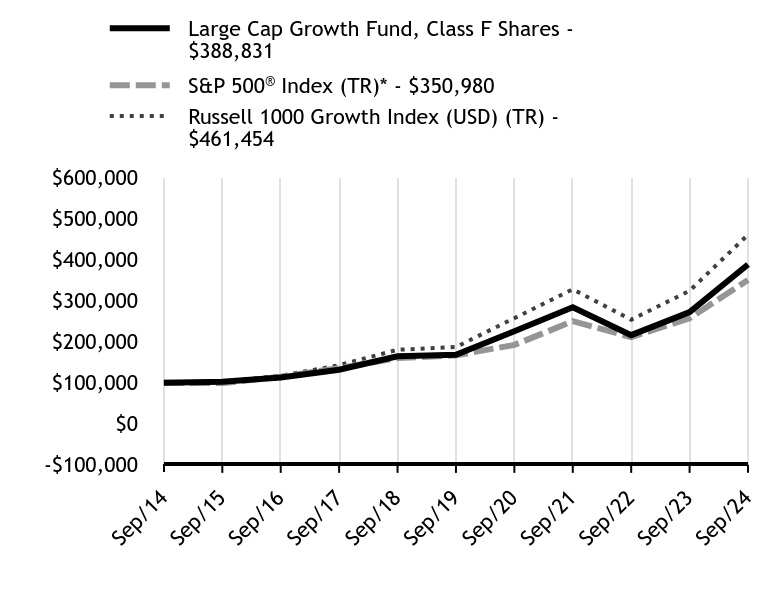

How did the Fund perform during the last 10 years?

Total Return Based on $100,000 Investment

| Large Cap Growth Fund, Class F Shares - $388831 | S&P 500® Index (TR)* - $350980 | Russell 1000 Growth Index (USD) (TR) - $461454 |

|---|

| Sep/14 | $100000 | $100000 | $100000 |

| Sep/15 | $102873 | $99385 | $103173 |

| Sep/16 | $112928 | $114721 | $117371 |

| Sep/17 | $132003 | $136070 | $143123 |

| Sep/18 | $164660 | $160441 | $180759 |

| Sep/19 | $168660 | $167266 | $187459 |

| Sep/20 | $226126 | $192605 | $257816 |

| Sep/21 | $284455 | $250396 | $328245 |

| Sep/22 | $216443 | $211654 | $254095 |

| Sep/23 | $272465 | $257408 | $324533 |

| Sep/24 | $388831 | $350980 | $461454 |

How did the Fund perform in the last year?

Class F Shares modestly outperformed its benchmark, the Russell 1000 Growth Index, for the 12-month period ending September 30, 2024.

Fund performance for the reporting period was enhanced by favorable security selection within the industrials, consumer discretionary, and health care sectors. This was partially offset by the negative impact of an underweight position and stock selection in the semiconductor industry.

Among the Fund’s sub-advisors, Fred Alger Management, LLC outperformed the benchmark due to stock selection within the information technology, industrials, and health care sectors. PineStone Asset Management Inc.’s performance lagged due to an underweight to the information technology sector and holdings in the communication services, financials and health care sectors. Mackenzie Investments Corporation outperformed the benchmark due to an overweight to the utilities sector and favorable stock selection in the consumer discretionary sector. The outperformance of SEI’s Quantitative Investment Management (QIM) Team’s factor-based momentum strategy was attributable to stock selection in the industrials and information technology sectors.

Average Annual Total Returns as of September 30, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Large Cap Growth Fund, Class F Shares | 42.71% | 18.18% | 14.54% |

S&P 500® Index (TR)* | 36.35% | 15.98% | 13.38% |

| Russell 1000 Growth Index (USD) (TR) | 42.19% | 19.74% | 16.52% |

The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.

* As of September 30, 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Key Fund Statistics as of September 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,541,858 | 189 | $4,733 | 65% |

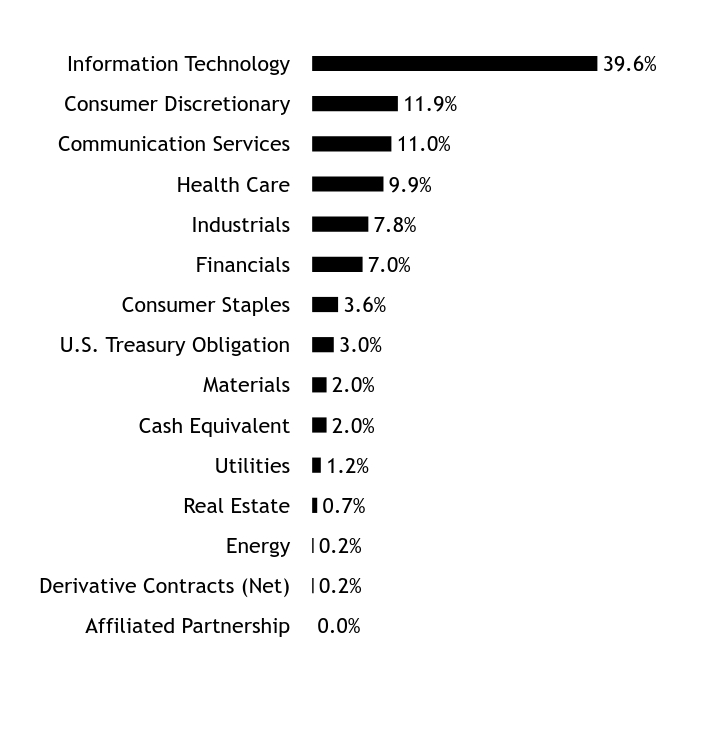

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Affiliated Partnership | 0.0% |

| Derivative Contracts (Net) | 0.2% |

| Energy | 0.2% |

| Real Estate | 0.7% |

| Utilities | 1.2% |

| Cash Equivalent | 2.0% |

| Materials | 2.0% |

| U.S. Treasury Obligation | 3.0% |

| Consumer Staples | 3.6% |

| Financials | 7.0% |

| Industrials | 7.8% |

| Health Care | 9.9% |

| Communication Services | 11.0% |

| Consumer Discretionary | 11.9% |

| Information Technology | 39.6% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| Microsoft Corp | | | 10.1% |

| Apple Inc | | | 7.7% |

| NVIDIA Corp | | | 4.8% |

| Meta Platforms Inc, Cl A | | | 4.3% |

| Amazon.com Inc, Cl A | | | 4.2% |

| Alphabet Inc, Cl A | | | 3.3% |

| U.S. Treasury Bill, 5.02%, 11/29/2024 | | | 3.0% |

| Broadcom Inc | | | 2.6% |

| Eli Lilly & Co | | | 1.9% |

| UnitedHealth Group Inc | | | 1.8% |

| Footnote | Description |

Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

SEI Institutional Managed Trust/Class F Shares - SELCX

Annual Shareholder Report - September 30, 2024

SELCX-AR-24

Annual Shareholder Report - September 30, 2024

SEI Institutional Managed Trust/Class I Shares - SPGIX

This annual shareholder report contains important information about Class I Shares of the Large Cap Growth Fund (the "Fund") for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Large Cap Growth Fund, Class I Shares | $135 | 1.11% |

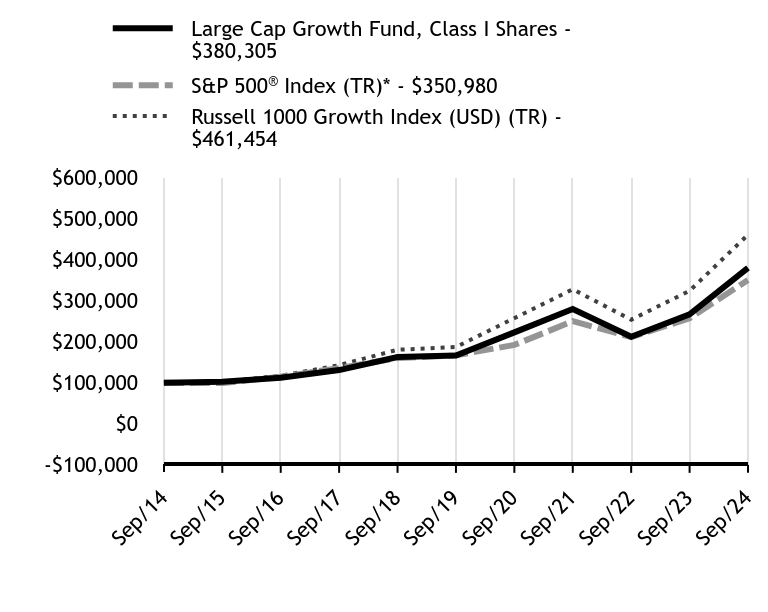

How did the Fund perform during the last 10 years?

Total Return Based on $100,000 Investment

| Large Cap Growth Fund, Class I Shares - $380305 | S&P 500® Index (TR)* - $350980 | Russell 1000 Growth Index (USD) (TR) - $461454 |

|---|

| Sep/14 | $100000 | $100000 | $100000 |

| Sep/15 | $102653 | $99385 | $103173 |

| Sep/16 | $112450 | $114721 | $117371 |

| Sep/17 | $131147 | $136070 | $143123 |

| Sep/18 | $163179 | $160441 | $180759 |

| Sep/19 | $166806 | $167266 | $187459 |

| Sep/20 | $223096 | $192605 | $257816 |

| Sep/21 | $280057 | $250396 | $328245 |

| Sep/22 | $212624 | $211654 | $254095 |

| Sep/23 | $267083 | $257408 | $324533 |

| Sep/24 | $380305 | $350980 | $461454 |

How did the Fund perform in the last year?

Class I Shares modestly outperformed its benchmark, the Russell 1000 Growth Index, for the 12-month period ending September 30, 2024.

Fund performance for the reporting period was enhanced by favorable security selection within the industrials, consumer discretionary, and health care sectors. This was partially offset by the negative impact of an underweight position and stock selection in the semiconductor industry.

Among the Fund’s sub-advisors, Fred Alger Management, LLC outperformed the benchmark due to stock selection within the information technology, industrials, and health care sectors. PineStone Asset Management Inc.’s performance lagged due to an underweight to the information technology sector and holdings in the communication services, financials and health care sectors. Mackenzie Investments Corporation outperformed the benchmark due to an overweight to the utilities sector and favorable stock selection in the consumer discretionary sector. The outperformance of SEI’s Quantitative Investment Management (QIM) Team’s factor-based momentum strategy was attributable to stock selection in the industrials and information technology sectors.

Average Annual Total Returns as of September 30, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Large Cap Growth Fund, Class I Shares | 42.39% | 17.92% | 14.29% |

S&P 500® Index (TR)* | 36.35% | 15.98% | 13.38% |

| Russell 1000 Growth Index (USD) (TR) | 42.19% | 19.74% | 16.52% |

The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.

* As of September 30, 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Key Fund Statistics as of September 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,541,858 | 189 | $4,733 | 65% |

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Affiliated Partnership | 0.0% |

| Derivative Contracts (Net) | 0.2% |

| Energy | 0.2% |

| Real Estate | 0.7% |

| Utilities | 1.2% |

| Cash Equivalent | 2.0% |

| Materials | 2.0% |

| U.S. Treasury Obligation | 3.0% |

| Consumer Staples | 3.6% |

| Financials | 7.0% |

| Industrials | 7.8% |

| Health Care | 9.9% |

| Communication Services | 11.0% |

| Consumer Discretionary | 11.9% |

| Information Technology | 39.6% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| Microsoft Corp | | | 10.1% |

| Apple Inc | | | 7.7% |

| NVIDIA Corp | | | 4.8% |

| Meta Platforms Inc, Cl A | | | 4.3% |

| Amazon.com Inc, Cl A | | | 4.2% |

| Alphabet Inc, Cl A | | | 3.3% |

| U.S. Treasury Bill, 5.02%, 11/29/2024 | | | 3.0% |

| Broadcom Inc | | | 2.6% |

| Eli Lilly & Co | | | 1.9% |

| UnitedHealth Group Inc | | | 1.8% |

| Footnote | Description |

Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

SEI Institutional Managed Trust/Class I Shares - SPGIX

Annual Shareholder Report - September 30, 2024

SPGIX-AR-24

Annual Shareholder Report - September 30, 2024

SEI Institutional Managed Trust/Class Y Shares - SLRYX

This annual shareholder report contains important information about Class Y Shares of the Large Cap Growth Fund (the "Fund") for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Large Cap Growth Fund, Class Y Shares | $78 | 0.64% |

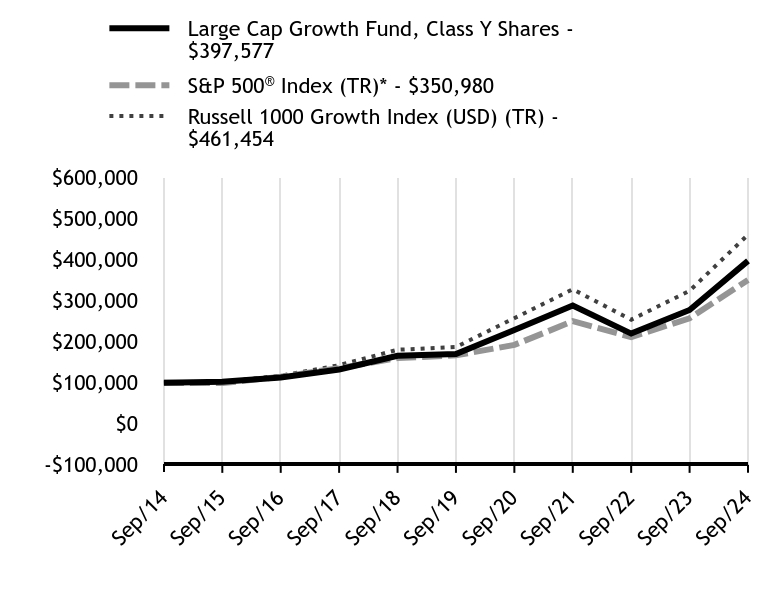

How did the Fund perform during the last 10 years?

Total Return Based on $100,000 Investment

| Large Cap Growth Fund, Class Y Shares - $397577 | S&P 500® Index (TR)* - $350980 | Russell 1000 Growth Index (USD) (TR) - $461454 |

|---|

| Sep/14 | $100000 | $100000 | $100000 |

| Sep/15 | $102873 | $99385 | $103173 |

| Sep/16 | $113222 | $114721 | $117371 |

| Sep/17 | $132662 | $136070 | $143123 |

| Sep/18 | $165880 | $160441 | $180759 |

| Sep/19 | $170355 | $167266 | $187459 |

| Sep/20 | $228943 | $192605 | $257816 |

| Sep/21 | $288690 | $250396 | $328245 |

| Sep/22 | $220191 | $211654 | $254095 |

| Sep/23 | $277917 | $257408 | $324533 |

| Sep/24 | $397577 | $350980 | $461454 |

How did the Fund perform in the last year?

Class Y Shares modestly outperformed its benchmark, the Russell 1000 Growth Index, for the 12-month period ending September 30, 2024.

Fund performance for the reporting period was enhanced by favorable security selection within the industrials, consumer discretionary, and health care sectors. This was partially offset by the negative impact of an underweight position and stock selection in the semiconductor industry.

Among the Fund’s sub-advisors, Fred Alger Management, LLC outperformed the benchmark due to stock selection within the information technology, industrials, and health care sectors. PineStone Asset Management Inc.’s performance lagged due to an underweight to the information technology sector and holdings in the communication services, financials and health care sectors. Mackenzie Investments Corporation outperformed the benchmark due to an overweight to the utilities sector and favorable stock selection in the consumer discretionary sector. The outperformance of SEI’s Quantitative Investment Management (QIM) Team’s factor-based momentum strategy was attributable to stock selection in the industrials and information technology sectors.

Average Annual Total Returns as of September 30, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Large Cap Growth Fund, Class Y Shares | 43.06% | 18.47% | 14.80% |

S&P 500® Index (TR)Footnote Reference* | 36.35% | 15.98% | 13.38% |

| Russell 1000 Growth Index (USD) (TR) | 42.19% | 19.74% | 16.52% |

The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance. Class Y Shares commenced operations on October 30, 2015. For periods prior to October 30, 2015, the performance of the Fund’s Class F Shares has been used. Returns for Class Y Shares would have been substantially similar to those of Class F Shares and would have differed only to the extent that Class Y Shares have lower total annual fund operating expenses than Class F Shares.

* As of September 30, 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Key Fund Statistics as of September 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,541,858 | 189 | $4,733 | 65% |

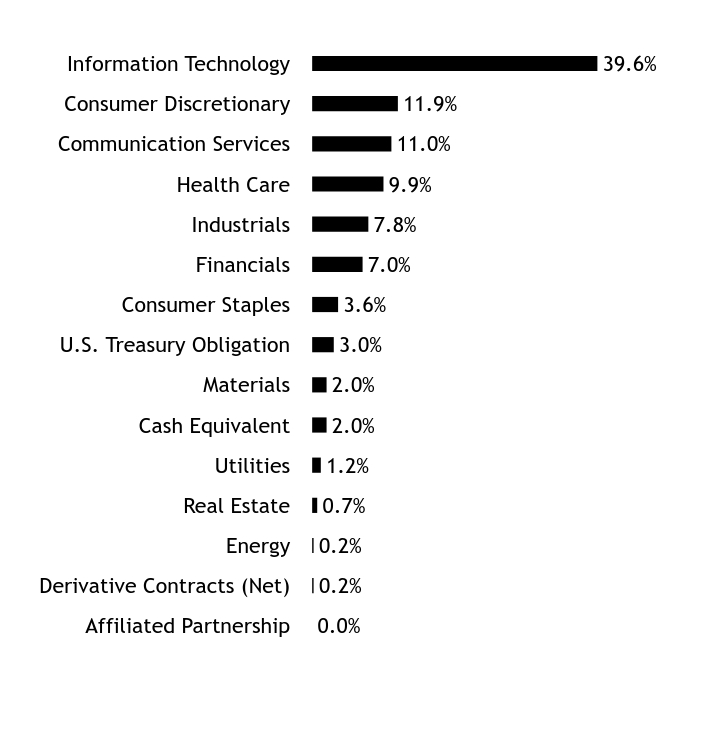

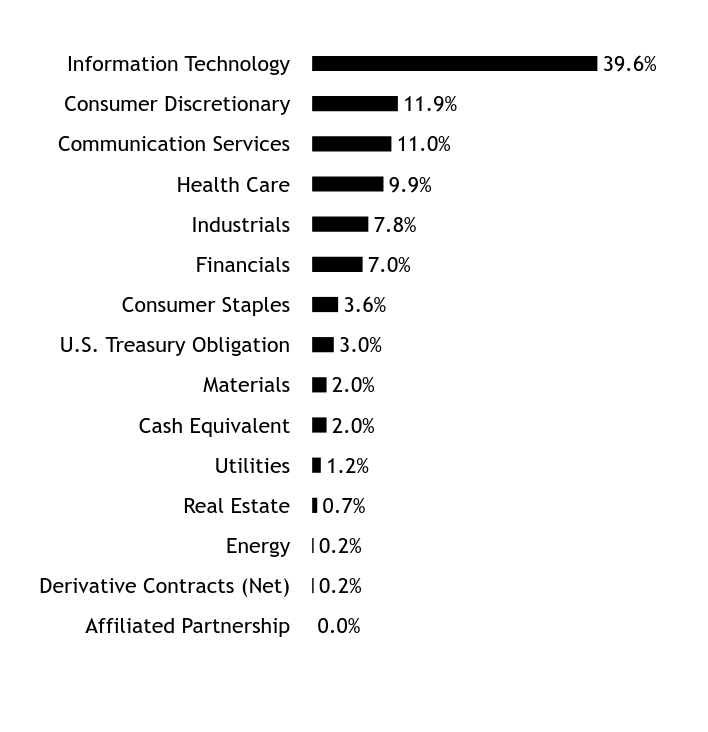

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Affiliated Partnership | 0.0% |

| Derivative Contracts (Net) | 0.2% |

| Energy | 0.2% |

| Real Estate | 0.7% |

| Utilities | 1.2% |

| Cash Equivalent | 2.0% |

| Materials | 2.0% |

| U.S. Treasury Obligation | 3.0% |

| Consumer Staples | 3.6% |

| Financials | 7.0% |

| Industrials | 7.8% |

| Health Care | 9.9% |

| Communication Services | 11.0% |

| Consumer Discretionary | 11.9% |

| Information Technology | 39.6% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| Microsoft Corp | | | 10.1% |

| Apple Inc | | | 7.7% |

| NVIDIA Corp | | | 4.8% |

| Meta Platforms Inc, Cl A | | | 4.3% |

| Amazon.com Inc, Cl A | | | 4.2% |

| Alphabet Inc, Cl A | | | 3.3% |

| U.S. Treasury Bill, 5.02%, 11/29/2024 | | | 3.0% |

| Broadcom Inc | | | 2.6% |

| Eli Lilly & Co | | | 1.9% |

| UnitedHealth Group Inc | | | 1.8% |

| Footnote | Description |

Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

SEI Institutional Managed Trust/Class Y Shares - SLRYX

Annual Shareholder Report - September 30, 2024

SLRYX-AR-24

Annual Shareholder Report - September 30, 2024

SEI Institutional Managed Trust/Class F Shares - SLGFX

This annual shareholder report contains important information about Class F Shares of the Large Cap Index Fund (the "Fund") for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Large Cap Index Fund, Class F Shares | $29 | 0.25% |

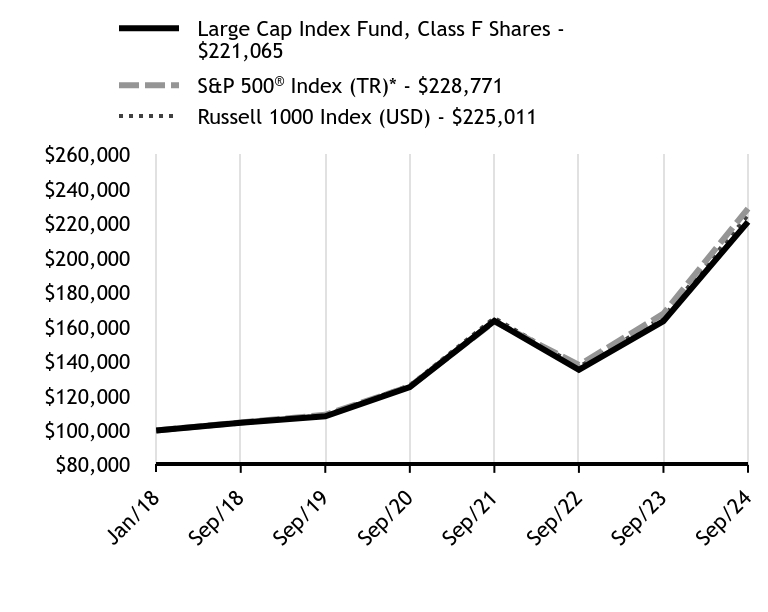

How did the Fund perform since inception?

Total Return Based on $100,000 Investment

| Large Cap Index Fund, Class F Shares - $221065 | S&P 500® Index (TR)* - $228771 | Russell 1000 Index (USD) - $225011 |

|---|

| Jan/18 | $100000 | $100000 | $100000 |

| Sep/18 | $104469 | $104576 | $104737 |

| Sep/19 | $108239 | $109025 | $108793 |

| Sep/20 | $125201 | $125541 | $126214 |

| Sep/21 | $163559 | $163210 | $165294 |

| Sep/22 | $135139 | $137958 | $136839 |

| Sep/23 | $163388 | $167780 | $165840 |

| Sep/24 | $221065 | $228771 | $225011 |

How did the Fund perform in the last year?

Class F Shares achieved its objective of tracking, before fees and expenses, the performance of its benchmark, the Russell 1000 Index, for the 12-month period ending September 30, 2024.

The Fund uses a sub-advisor to manage the Fund’s portfolio under the general supervision of SEI Investments Management Corporation. The sole sub-advisor as of September 30, 2024, was SSGA Funds Management, Inc.

The U.S. stock market rallied sharply during the reporting period, led by mega-cap growth stocks. The gains were concentrated in the higher-beta (a measure of an investment’s volatility relative to a benchmark) stocks, and low-beta stocks generally lagged in the bull market. The strongest-performing sector was information technology. The energy sector was the primary market laggard for the period.

Average Annual Total Returns as of September 30, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Large Cap Index Fund, Class F Shares | 35.30% | 15.35% | 12.63% |

S&P 500® Index (TR)* | 36.35% | 15.98% | 13.21% |

| Russell 1000 Index (USD) | 35.68% | 15.64% | 12.93% |

Since its inception on January 31, 2018. The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.

* As of September 30, 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Key Fund Statistics as of September 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,183,715 | 1,018 | $221 | 4% |

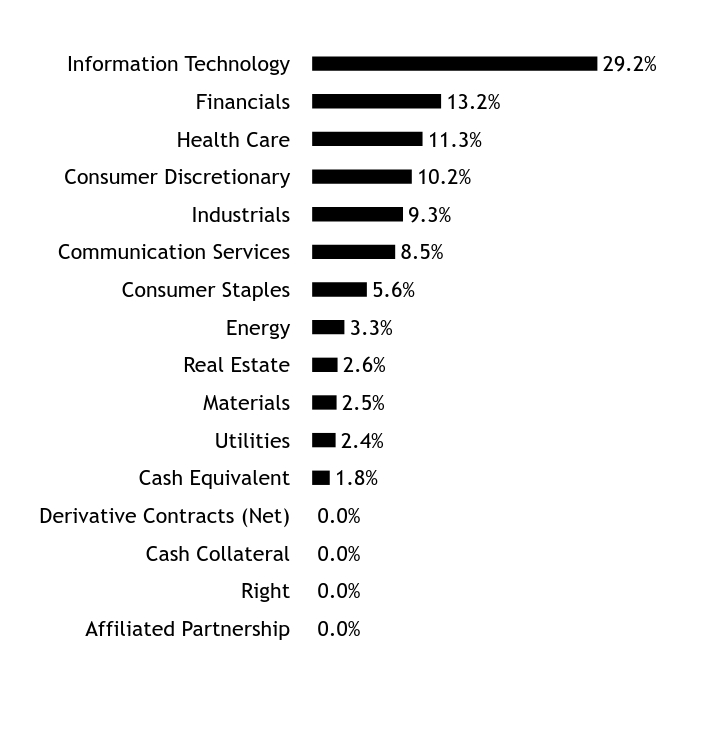

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Affiliated Partnership | 0.0% |

| Right | 0.0% |

| Cash Collateral | 0.0% |

| Derivative Contracts (Net) | 0.0% |

| Cash Equivalent | 1.8% |

| Utilities | 2.4% |

| Materials | 2.5% |

| Real Estate | 2.6% |

| Energy | 3.3% |

| Consumer Staples | 5.6% |

| Communication Services | 8.5% |

| Industrials | 9.3% |

| Consumer Discretionary | 10.2% |

| Health Care | 11.3% |

| Financials | 13.2% |

| Information Technology | 29.2% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| Apple Inc | | | 6.3% |

| Microsoft Corp | | | 5.9% |

| NVIDIA Corp | | | 5.3% |

| Amazon.com Inc, Cl A | | | 3.2% |

| Meta Platforms Inc, Cl A | | | 2.3% |

| Alphabet Inc, Cl A | | | 1.8% |

| Berkshire Hathaway Inc, Cl B | | | 1.6% |

| Alphabet Inc, Cl C | | | 1.5% |

| Broadcom Inc | | | 1.5% |

| Tesla Inc | | | 1.4% |

| Footnote | Description |

Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

SEI Institutional Managed Trust/Class F Shares - SLGFX

Annual Shareholder Report - September 30, 2024

SLGFX-AR-24

Annual Shareholder Report - September 30, 2024

Tax-Managed Large Cap Fund

SEI Institutional Managed Trust/Class F Shares - TMLCX

This annual shareholder report contains important information about Class F Shares of the Tax-Managed Large Cap Fund (the "Fund") for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000. This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Tax-Managed Large Cap Fund, Class F Shares | $102 | 0.89% |

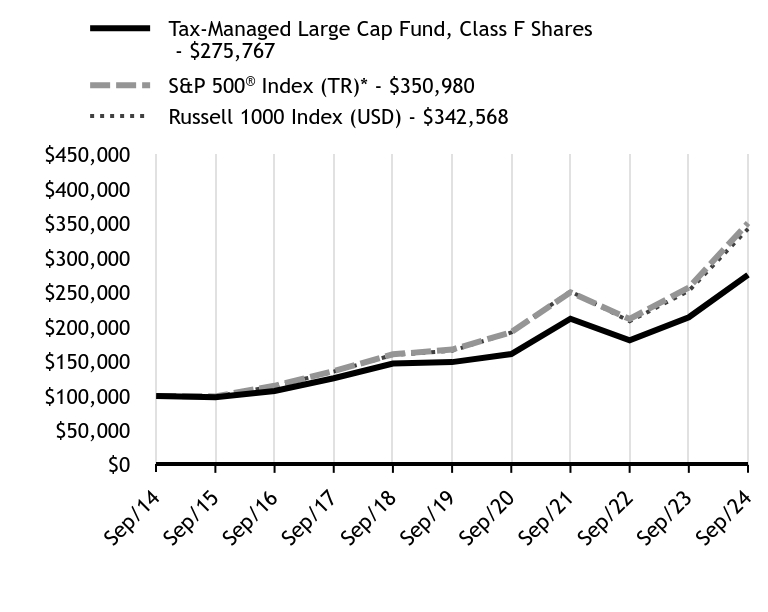

How did the Fund perform during the last 10 years?

Total Return Based on $100,000 Investment

| Tax-Managed Large Cap Fund, Class F Shares - $275767 | S&P 500® Index (TR)* - $350980 | Russell 1000 Index (USD) - $342568 |

|---|

| Sep/14 | $100000 | $100000 | $100000 |

| Sep/15 | $98013 | $99385 | $99386 |

| Sep/16 | $107250 | $114721 | $114226 |

| Sep/17 | $125683 | $136070 | $135402 |

| Sep/18 | $147033 | $160441 | $159456 |

| Sep/19 | $149118 | $167266 | $165632 |

| Sep/20 | $160807 | $192605 | $192155 |

| Sep/21 | $212005 | $250396 | $251653 |

| Sep/22 | $180806 | $211654 | $208330 |

| Sep/23 | $214152 | $257408 | $252483 |

| Sep/24 | $275767 | $350980 | $342568 |

How did the Fund perform in the last year?

Class F Shares underperformed its benchmark, the Russell 1000 Index, for the 12-month period ending September 30, 2024.

The Fund garnered a positive return for the reporting period, but underperformed the benchmark due to its tilt toward value stocks and away from the mega-cap growth stocks that led the market upturn over the period. An underweight to the information technology sector also was a detractor.

Among the Fund’s sub-advisors, Brandywine Global Investment Management, LLC lagged the benchmark due to its value orientation and stock selection within the energy and consumer discretionary sectors. LSV Asset Management lagged the benchmark due to its value orientation, an overweight allocation to the energy sector, an underweight to the information technology sector, and security selection within the industrials sector. PineStone Asset Management Inc.’s underperformance was attributable to its lower-beta (a measure of the volatility of an investment relative to a benchmark) tilt and security selection within the information technology and financials sectors. Mar Vista Investment Partners, LLC lagged the benchmark due to its lower-beta tilt, underweights to the mega-cap growth stocks that led the market upturn over the period, and stock selection within the information technology sector. SEI Investments Management Corporation’s (SIMC) factor-based momentum strategy outperformed the benchmark due to stock selection within the industrials and information technology sectors. SIMC’s factor-based quality strategy lagged the benchmark because of stock selection within the information technology sector.

Regarding the use of derivatives during the reporting period, the Fund employed equity index futures to provide stock-like performance to the liquidity reserve account, which contained cash available for fund withdrawals. This contributed positively to the Fund’s absolute return for the period.

Average Annual Total Returns as of September 30, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Tax-Managed Large Cap Fund, Class F Shares | 28.77% | 13.08% | 10.68% |

S&P 500® Index (TR)* | 36.35% | 15.98% | 13.38% |

| Russell 1000 Index (USD) | 35.68% | 15.64% | 13.10% |

The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.

* As of September 30, 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Key Fund Statistics as of September 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $4,351,207 | 269 | $16,393 | 15% |

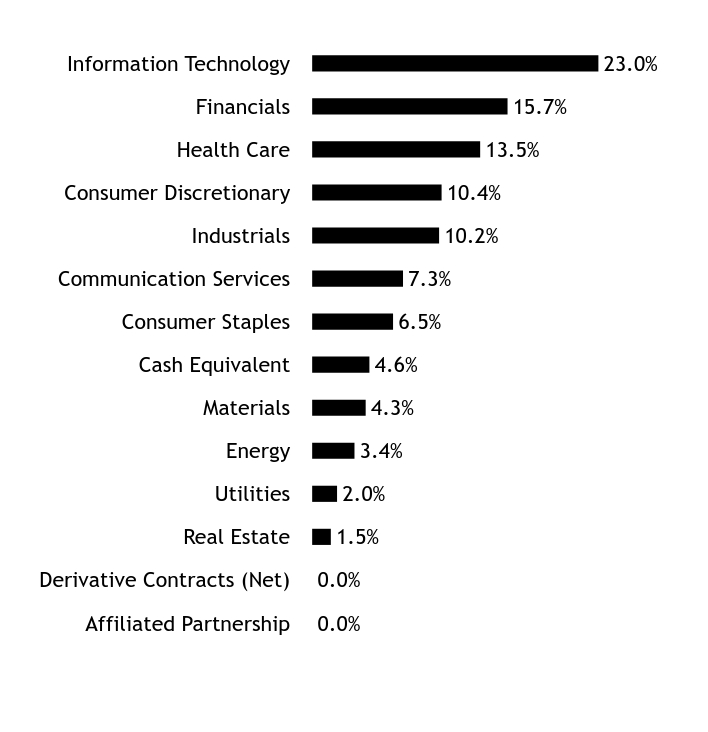

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Affiliated Partnership | 0.0% |

| Derivative Contracts (Net) | 0.0% |

| Real Estate | 1.5% |

| Utilities | 2.0% |

| Energy | 3.4% |

| Materials | 4.3% |

| Cash Equivalent | 4.6% |

| Consumer Staples | 6.5% |

| Communication Services | 7.3% |

| Industrials | 10.2% |

| Consumer Discretionary | 10.4% |

| Health Care | 13.5% |

| Financials | 15.7% |

| Information Technology | 23.0% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| Microsoft Corp | | | 4.8% |

| Apple Inc | | | 3.7% |

| Johnson & Johnson | | | 1.9% |

| Lowe's Cos Inc | | | 1.8% |

| Oracle Corp, Cl B | | | 1.8% |

| Alphabet Inc, Cl A | | | 1.8% |

| Alphabet Inc, Cl C | | | 1.7% |

| Moody's Corp | | | 1.7% |

| JPMorgan Chase & Co | | | 1.6% |

| UnitedHealth Group Inc | | | 1.6% |

| Footnote | Description |

Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

Coho Partners, Ltd. was terminated as a Fund sub-advisor during the reporting period.

This is a summary of certain changes to the Fund as of September 30, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by January 28, 2025, at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports or upon request at 1-800-DIAL-SEI.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Tax-Managed Large Cap Fund

SEI Institutional Managed Trust/Class F Shares - TMLCX

Annual Shareholder Report - September 30, 2024

TMLCX-AR-24

Annual Shareholder Report - September 30, 2024

Tax-Managed Large Cap Fund

SEI Institutional Managed Trust/Class Y Shares - STLYX

This annual shareholder report contains important information about Class Y Shares of the Tax-Managed Large Cap Fund (the "Fund") for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000. This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Tax-Managed Large Cap Fund, Class Y Shares | $73 | 0.64% |

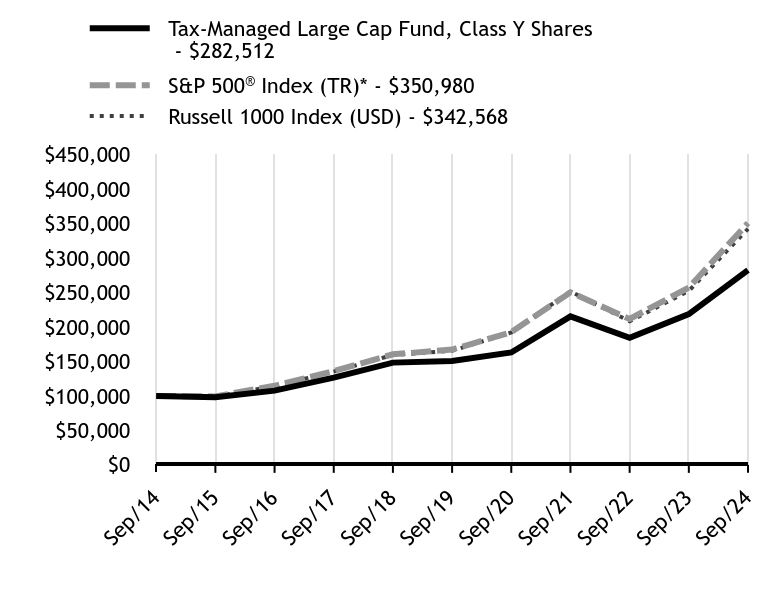

How did the Fund perform during the last 10 years?

Total Return Based on $100,000 Investment

| Tax-Managed Large Cap Fund, Class Y Shares - $282512 | S&P 500® Index (TR)* - $350980 | Russell 1000 Index (USD) - $342568 |

|---|

| Sep/14 | $100000 | $100000 | $100000 |

| Sep/15 | $98137 | $99385 | $99386 |

| Sep/16 | $107704 | $114721 | $114226 |

| Sep/17 | $126573 | $136070 | $135402 |

| Sep/18 | $148369 | $160441 | $159456 |

| Sep/19 | $150849 | $167266 | $165632 |

| Sep/20 | $163084 | $192605 | $192155 |

| Sep/21 | $215572 | $250396 | $251653 |

| Sep/22 | $184343 | $211654 | $208330 |

| Sep/23 | $218802 | $257408 | $252483 |

| Sep/24 | $282512 | $350980 | $342568 |

How did the Fund perform in the last year?

Class Y Shares underperformed its benchmark, the Russell 1000 Index, for the 12-month period ending September 30, 2024.

The Fund garnered a positive return for the reporting period, but underperformed the benchmark due to its tilt toward value stocks and away from the mega-cap growth stocks that led the market upturn over the period. An underweight to the information technology sector also was a detractor.

Among the Fund’s sub-advisors, Brandywine Global Investment Management, LLC lagged the benchmark due to its value orientation and stock selection within the energy and consumer discretionary sectors. LSV Asset Management lagged the benchmark due to its value orientation, an overweight allocation to the energy sector, an underweight to the information technology sector, and security selection within the industrials sector. PineStone Asset Management Inc.’s underperformance was attributable to its lower-beta (a measure of the volatility of an investment relative to a benchmark) tilt and security selection within the information technology and financials sectors. Mar Vista Investment Partners, LLC lagged the benchmark due to its lower-beta tilt, underweights to the mega-cap growth stocks that led the market upturn over the period, and stock selection within the information technology sector. SEI Investments Management Corporation’s (SIMC) factor-based momentum strategy outperformed the benchmark due to stock selection within the industrials and information technology sectors. SIMC’s factor-based quality strategy lagged the benchmark because of stock selection within the information technology sector.

Regarding the use of derivatives during the reporting period, the Fund employed equity index futures to provide stock-like performance to the liquidity reserve account, which contained cash available for fund withdrawals. This contributed positively to the Fund’s absolute return for the period.

Average Annual Total Returns as of September 30, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Tax-Managed Large Cap Fund, Class Y Shares | 29.12% | 13.37% | 10.94% |

S&P 500® Index (TR)Footnote Reference* | 36.35% | 15.98% | 13.38% |

| Russell 1000 Index (USD) | 35.68% | 15.64% | 13.10% |

The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance. Class Y Shares commenced operations on December 31, 2014. For periods prior to December 31, 2014, the performance of the Fund’s Class F Shares has been used. Returns for Class Y Shares would have been substantially similar to those of Class F Shares and would have differed only to the extent that Class Y Shares have lower total annual fund operating expenses than Class F Shares.

* As of September 30, 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Key Fund Statistics as of September 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $4,351,207 | 269 | $16,393 | 15% |

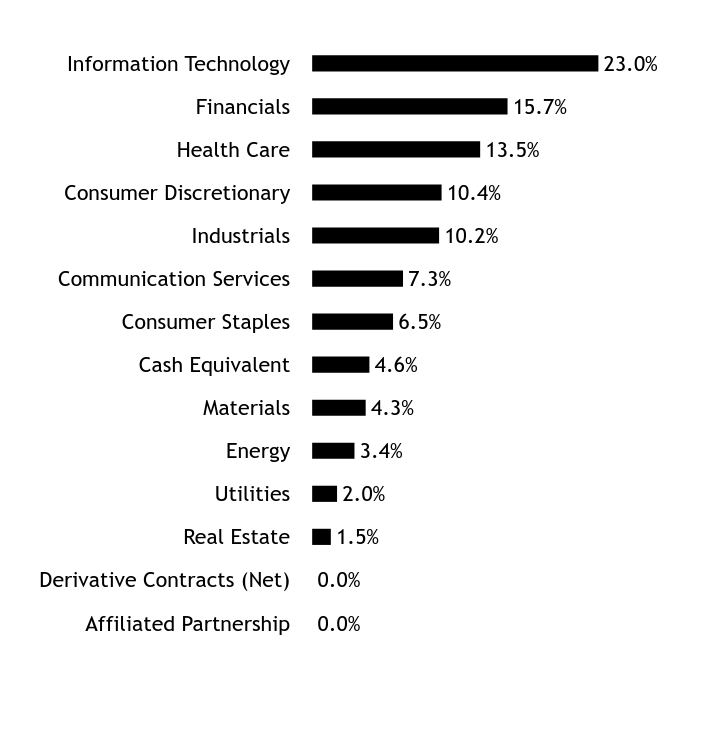

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Affiliated Partnership | 0.0% |

| Derivative Contracts (Net) | 0.0% |

| Real Estate | 1.5% |

| Utilities | 2.0% |

| Energy | 3.4% |

| Materials | 4.3% |

| Cash Equivalent | 4.6% |

| Consumer Staples | 6.5% |

| Communication Services | 7.3% |

| Industrials | 10.2% |

| Consumer Discretionary | 10.4% |

| Health Care | 13.5% |

| Financials | 15.7% |

| Information Technology | 23.0% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| Microsoft Corp | | | 4.8% |

| Apple Inc | | | 3.7% |

| Johnson & Johnson | | | 1.9% |

| Lowe's Cos Inc | | | 1.8% |

| Oracle Corp, Cl B | | | 1.8% |

| Alphabet Inc, Cl A | | | 1.8% |

| Alphabet Inc, Cl C | | | 1.7% |

| Moody's Corp | | | 1.7% |

| JPMorgan Chase & Co | | | 1.6% |

| UnitedHealth Group Inc | | | 1.6% |

| Footnote | Description |

Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

Coho Partners, Ltd. was terminated as a Fund sub-advisor during the reporting period.

This is a summary of certain changes to the Fund as of September 30, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by January 28, 2025, at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports or upon request at 1-800-DIAL-SEI.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Tax-Managed Large Cap Fund

SEI Institutional Managed Trust/Class Y Shares - STLYX

Annual Shareholder Report - September 30, 2024

STLYX-AR-24

Annual Shareholder Report - September 30, 2024

SEI Institutional Managed Trust/Class F Shares - SSPIX

This annual shareholder report contains important information about Class F Shares of the S&P 500 Index Fund (the "Fund") for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| S&P 500 Index Fund, Class F Shares | $29 | 0.25% |

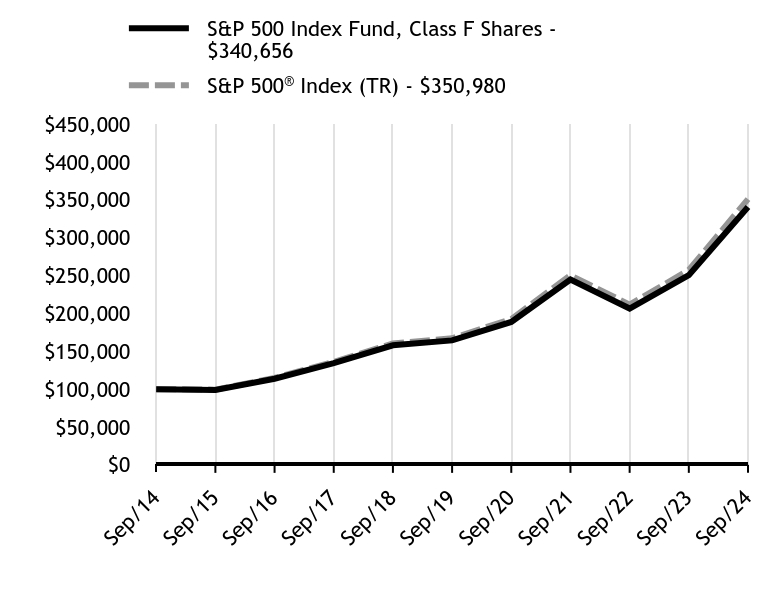

How did the Fund perform during the last 10 years?

Total Return Based on $100,000 Investment

| S&P 500 Index Fund, Class F Shares - $340656 | S&P 500® Index (TR) - $350980 |

|---|

| Sep/14 | $100000 | $100000 |

| Sep/15 | $99027 | $99385 |

| Sep/16 | $113807 | $114721 |

| Sep/17 | $134433 | $136070 |

| Sep/18 | $158005 | $160441 |

| Sep/19 | $164436 | $167266 |

| Sep/20 | $188802 | $192605 |

| Sep/21 | $244932 | $250396 |

| Sep/22 | $206521 | $211654 |

| Sep/23 | $250527 | $257408 |

| Sep/24 | $340656 | $350980 |

How did the Fund perform in the last year?

Class F Shares achieved its objective of tracking, before fees and expenses, the performance of its benchmark, the S&P 500 Index, for the 12-month period ending September 30, 2024.

The Fund uses a sub-advisor to manage the Fund’s portfolio under the general supervision of SEI Investments Management Corporation. The sole sub-advisor as of September 30, 2024, was SSGA Funds Management, Inc.

The U.S. stock market rallied sharply during the reporting period, led by mega-cap growth stocks. The gains were concentrated in the higher-beta (a measure of an investment’s volatility relative to a benchmark) stocks, and low-beta stocks generally lagged in the bull market. The strongest-performing sector was information technology. The energy sector was the primary market laggard for the period.

Average Annual Total Returns as of September 30, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| S&P 500 Index Fund, Class F Shares | 35.98% | 15.68% | 13.04% |

S&P 500® Index (TR) | 36.35% | 15.98% | 13.38% |

The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.

Key Fund Statistics as of September 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,029,295 | 505 | $197 | 3% |

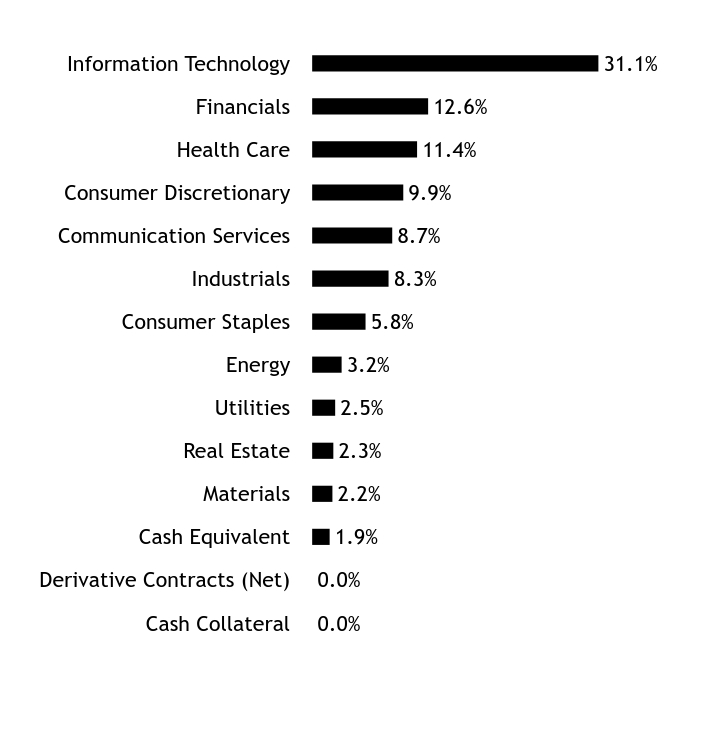

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Cash Collateral | 0.0% |

| Derivative Contracts (Net) | 0.0% |

| Cash Equivalent | 1.9% |

| Materials | 2.2% |

| Real Estate | 2.3% |

| Utilities | 2.5% |

| Energy | 3.2% |

| Consumer Staples | 5.8% |

| Industrials | 8.3% |

| Communication Services | 8.7% |

| Consumer Discretionary | 9.9% |

| Health Care | 11.4% |

| Financials | 12.6% |

| Information Technology | 31.1% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| Apple Inc | | | 7.1% |

| Microsoft Corp | | | 6.4% |

| NVIDIA Corp | | | 6.0% |

| Amazon.com Inc, Cl A | | | 3.5% |

| Meta Platforms Inc, Cl A | | | 2.5% |

| Alphabet Inc, Cl A | | | 2.0% |

| Berkshire Hathaway Inc, Cl B | | | 1.7% |

| Alphabet Inc, Cl C | | | 1.6% |

| Broadcom Inc | | | 1.6% |

| Tesla Inc | | | 1.5% |

| Footnote | Description |

Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit:

SEI Institutional Managed Trust/Class F Shares - SSPIX

Annual Shareholder Report - September 30, 2024

SSPIX-AR-24

Annual Shareholder Report - September 30, 2024

SEI Institutional Managed Trust/Class I Shares - SPIIX

This annual shareholder report contains important information about Class I Shares of the S&P 500 Index Fund (the "Fund") for the period from October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| S&P 500 Index Fund, Class I Shares | $77 | 0.65% |

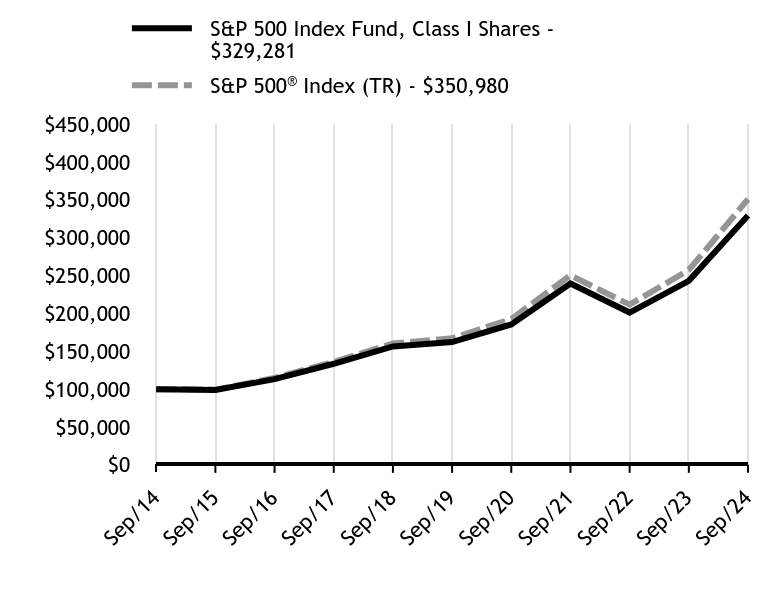

How did the Fund perform during the last 10 years?

Total Return Based on $100,000 Investment

| S&P 500 Index Fund, Class I Shares - $329281 | S&P 500® Index (TR) - $350980 |

|---|

| Sep/14 | $100000 | $100000 |

| Sep/15 | $98810 | $99385 |

| Sep/16 | $113305 | $114721 |

| Sep/17 | $133549 | $136070 |

| Sep/18 | $156431 | $160441 |

| Sep/19 | $162151 | $167266 |

| Sep/20 | $185446 | $192605 |

| Sep/21 | $239608 | $250396 |

| Sep/22 | $201211 | $211654 |

| Sep/23 | $243122 | $257408 |

| Sep/24 | $329281 | $350980 |

How did the Fund perform in the last year?

Class I Shares achieved its objective of tracking, before fees and expenses, the performance of its benchmark, the S&P 500 Index, for the 12-month period ending September 30, 2024.

The Fund uses a sub-advisor to manage the Fund’s portfolio under the general supervision of SEI Investments Management Corporation. The sole sub-advisor as of September 30, 2024, was SSGA Funds Management, Inc.

The U.S. stock market rallied sharply during the reporting period, led by mega-cap growth stocks. The gains were concentrated in the higher-beta (a measure of an investment’s volatility relative to a benchmark) stocks, and low-beta stocks generally lagged in the bull market. The strongest-performing sector was information technology. The energy sector was the primary market laggard for the period.

Average Annual Total Returns as of September 30, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| S&P 500 Index Fund, Class I Shares | 35.44% | 15.22% | 12.66% |

S&P 500® Index (TR) | 36.35% | 15.98% | 13.38% |

The line graph represents historical performance of a hypothetical investment of $100,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.

Key Fund Statistics as of September 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,029,295 | 505 | $197 | 3% |

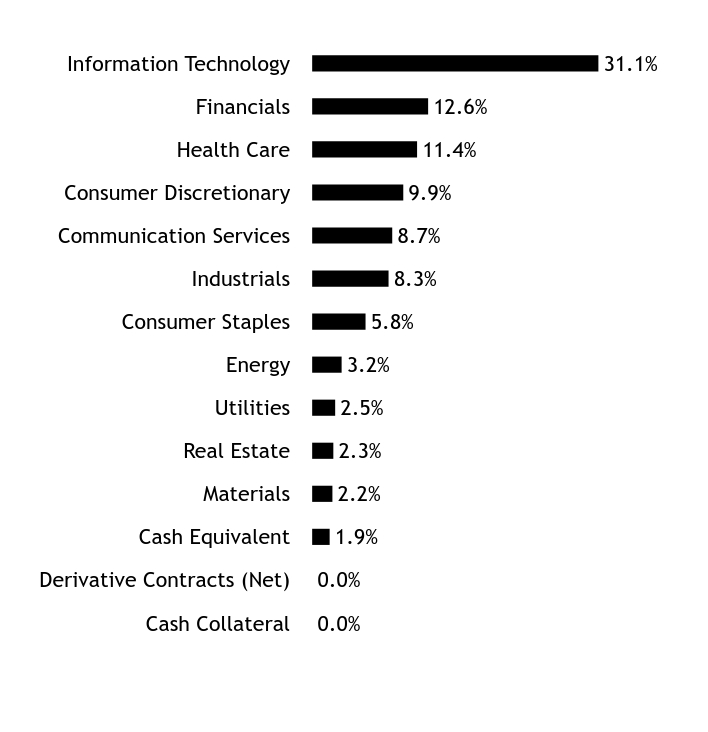

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Cash Collateral | 0.0% |

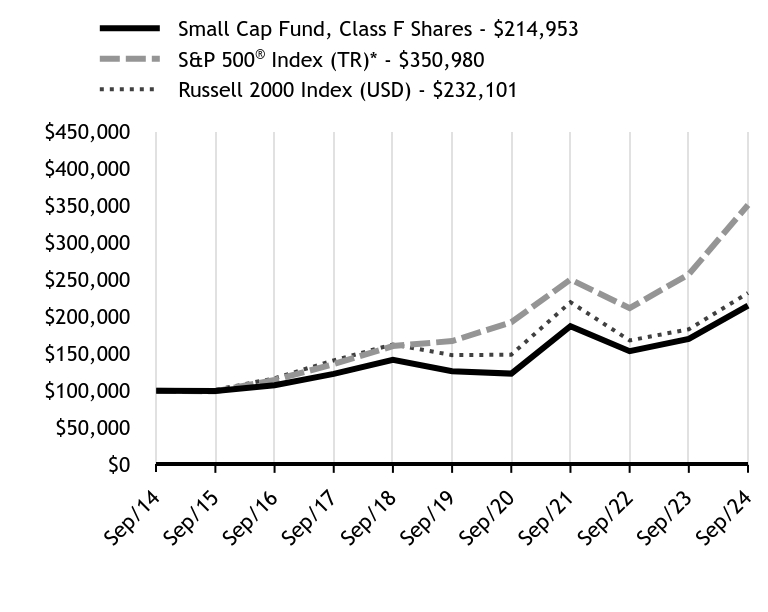

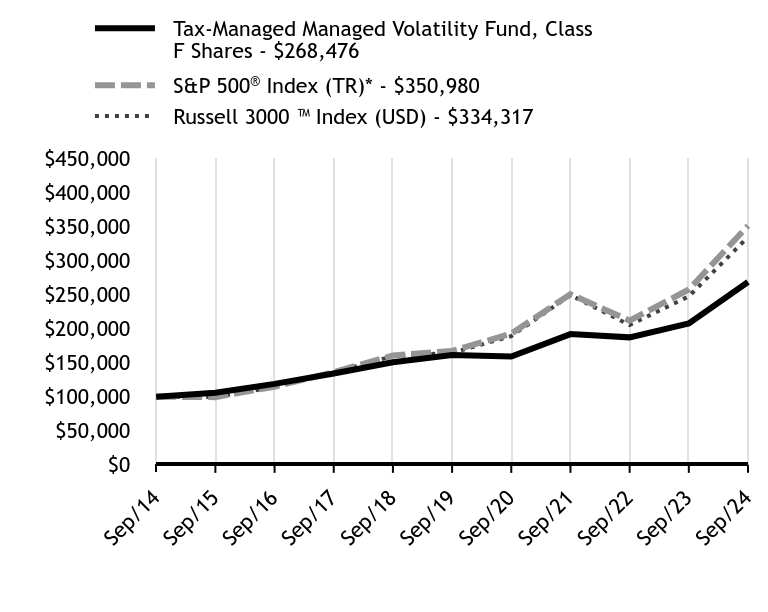

| Derivative Contracts (Net) | 0.0% |