The Procter & Gamble Company: Reg G Reconciliation of Non-GAAP measures

In accordance with the SEC’s Regulation G, the following provides definitions of the non-GAAP measures used in Procter & Gamble's September 4, 2013 Barclays Back-to-School Conference and associated slides with the reconciliation to the most closely related GAAP measure. The measures provided are as follows:

| 1. | Organic Sales Growth – page 1 |

| 2. | Core Earnings Per Share (EPS) – page 2 |

| 3. | Adjusted Free Cash Flow – page 3 |

| 4. | Adjusted Free Cash Flow Productivity – page 3 |

1. Organic Sales Growth:

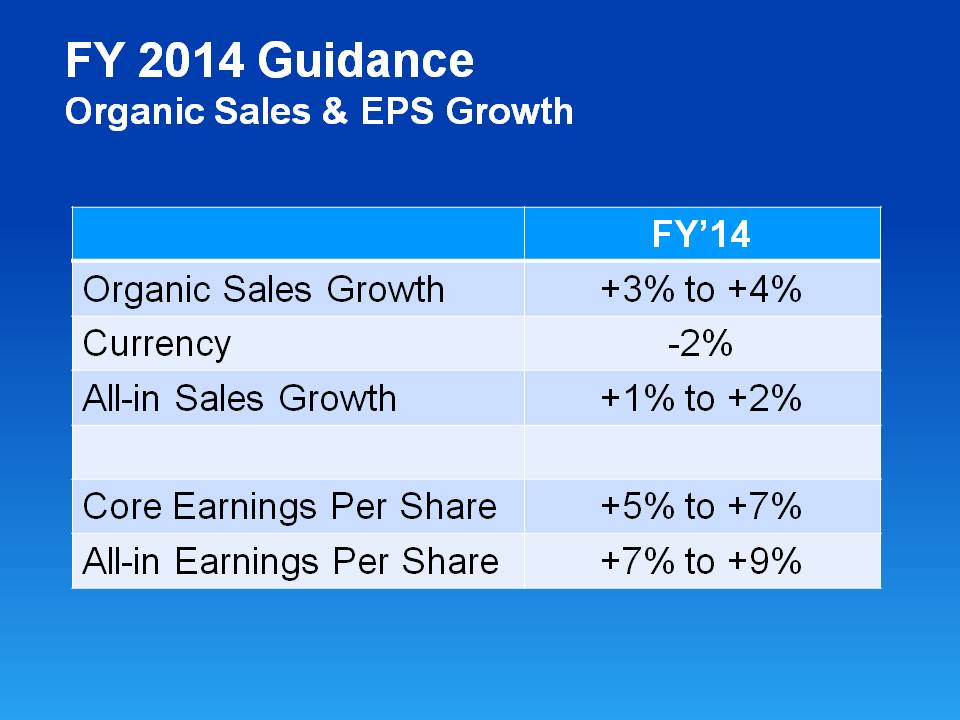

Organic sales growth is a non-GAAP measure of sales growth excluding the impacts of acquisitions, divestitures and foreign exchange from year-over-year comparisons. We believe this provides investors with a more complete understanding of underlying sales trends by providing sales growth on a consistent basis. Organic sales is also one of the measures used to evaluate senior management and is a factor in determining their at-risk compensation. The reconciliation of reported sales growth to organic sales is as follows:

Total P&G | Net Sales Growth | Foreign Exchange Impact | Acquisition/ Divestiture Impact* | Organic Sales Growth | ||||

| FY 2010 | 3% | 1% | -1% | 3% | ||||

| FY 2011 | 5% | 0% | -1% | 4% | ||||

| FY 2012 | 3% | 0% | 0% | 3% | ||||

| FY 2013 | 1% | 2% | 0% | 3% | ||||

| FY 2014 (Estimate) | 1% to 2% | 2% | 0% | 3% to 4% | ||||

*Acquisition/Divestiture Impact includes rounding impacts necessary to reconcile net sales to organic sales.

2. Core EPS:

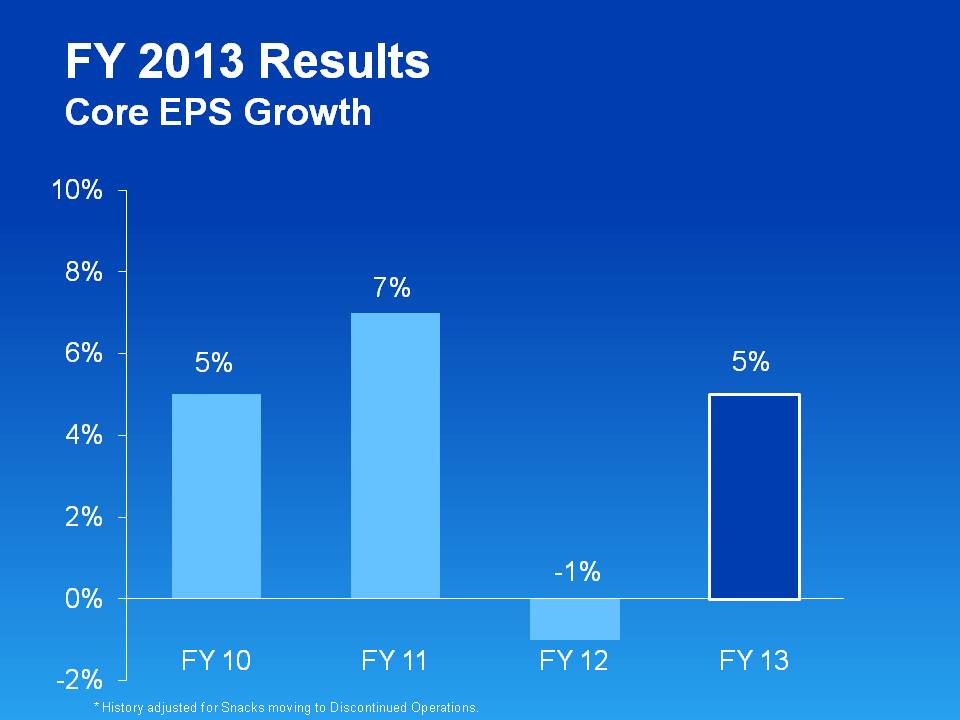

This is a measure of the Company’s diluted net earnings per share from continuing operations excluding certain items that are not judged to be part of the Company’s sustainable results or trends. This includes FY 2013 holding gain on the buyout of our Iberian joint venture, FY 2013 and 2012 charges related to incremental restructuring due to increased focus on productivity and cost savings, FY 2013 charge from the balance sheet impact of the Venezuela devaluation, charges in FY’s 2013, 2012, 2011 and 2010 related to European legal matters, FY 2013 and 2012 impairment charges for goodwill and indefinite lived intangible assets, a significant benefit in FY 2011 from the settlement of U.S. tax litigation primarily related to the valuation of technology donations, a FY 2010 charge related to a tax provision for retiree healthcare subsidy payments in the U.S. healthcare reform legislation, and incremental restructuring charges in FY 2009 to offset the dilutive impact of the Folgers divestiture. We believe the Core EPS measure provides an important perspective of underlying business trends and results and provides a more comparable measure of year-on-year earnings per share growth. Core EPS is also one of the measures used to evaluate senior management and is a factor in determining their at-risk compensation. The reconciliation of diluted net earnings per share to Core EPS is provided below:

Fiscal Year Data: | FY 2013 | FY 2012 | FY 2011 | FY 2010 | FY 2009 | |||||

| $3.86 | $3.12 | $3.85 | $3.47 | $3.35 | ||||||

| Impairment Charges | $0.10 | $0.51 | - | - | - | |||||

| Settlement from U.S. Tax Litigation | - | - | ($0.08) | - | - | |||||

| Charges for European legal matters | $0.05 | $0.03 | $0.10 | $0.09 | - | |||||

| Taxation of retiree healthcare subsidy | - | - | - | $0.05 | - | |||||

| Incremental restructuring | $0.18 | $0.20 | - | - | $0.09 | |||||

| Gain on buyout of Iberian JV | ($0.21) | - | - | - | - | |||||

| Venezuela balance sheet devaluation impacts | $0.08 | - | - | - | - | |||||

| Rounding Impacts | ($0.01) | ($0.01) | - | - | ($0.01) | |||||

| Core EPS | $4.05 | $3.85 | $3.87 | $3.61 | $3.43 | |||||

| Core EPS Growth | 5% | -1% | 7% | 5% | ||||||

Note – All reconciling items are presented net of tax. Tax effects are calculated consistent with the nature of the underlying transaction. The charge for the significant settlement from U.S. tax litigation is tax expense.

3. Adjusted Free Cash Flow:

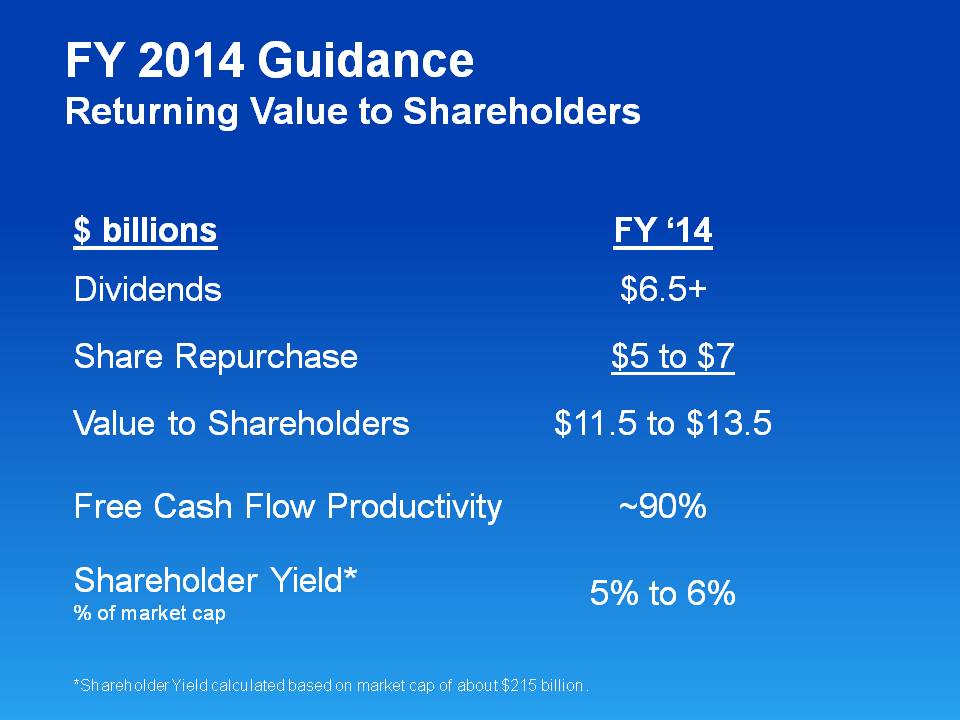

Adjusted free cash flow is defined as operating cash flow less capital spending and the after-tax impacts of tax payments on divestitures. We view adjusted free cash flow as an important measure because it is one factor in determining the amount of cash available for dividends and discretionary investment. Adjusted free cash flow is also one of the measures used to evaluate senior management and is a factor in determining their at-risk compensation. The reconciliation of adjusted free cash flow is provided in the table below (amounts in millions).

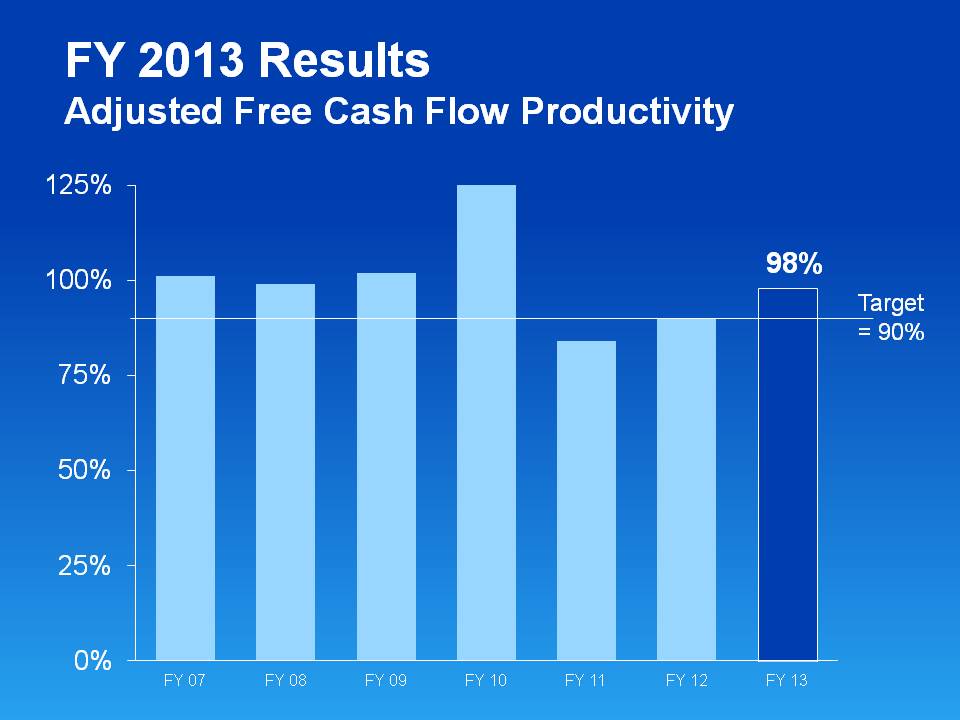

4. Adjusted Free Cash Flow Productivity:

Adjusted free cash flow productivity is defined as the ratio of adjusted free cash flow to net earnings excluding impairment charges, the gains of certain divestitures and the gain from the buyout of the Iberian JV in 2013. Given the size of these impairment charges and gains, as well as our view that they are not part of our sustainable business, we have excluded the gains from our calculation. The Company’s long-term target is to generate free cash productivity at or above 90 percent of net earnings. Adjusted free cash flow productivity is also one of the measures used to evaluate senior management. We believe this provides a better perspective of our underlying liquidity trends. The reconciliation of adjusted free cash flow productivity is provided in the table below (amounts in millions):

Operating Cash Flow | Capital Spending | Tax Payment on Divestitures | Adjusted Free Cash Flow | Net Earnings | Divestiture / Other Gain | Impairment | Net Earnings excluding Divestiture Gain & Impairment | Adjusted Free Cash Flow Productivity | |

| FY ‘07 | $13,410 | ($2,945) | $10,465 | $10,340 | $10,340 | 101% | |||

| FY ‘08 | $15,008 | ($3,046) | $11,962 | $12,075 | $12,075 | 99% | |||

| FY ‘09 | $14,983 | ($3,238) | $11,745 | $13,522 | $2,011 | $11,511 | 102% | ||

| FY ‘10 | $16,131 | ($3,067) | $980 | $14,044 | $12,846 | $1,585 | $11,261 | 125% | |

| FY ‘11 | $13,330 | ($3,306) | $10,024 | $11,927 | $11,927 | 84% | |||

| FY ‘12 | $13,284 | ($3,964) | $519 | $9,839 | $10,904 | $1,418 | ($1,503) | $10,989 | 90% |

| FY ‘13 | $14,873 | ($4,008) | $10,865 | $11,402 | $623 | ($290) | $11,069 | 98% | |