- PG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

The Procter & Gamble Company (PG) 8-KRegulation FD Disclosure

Filed: 27 Jul 17, 12:00am

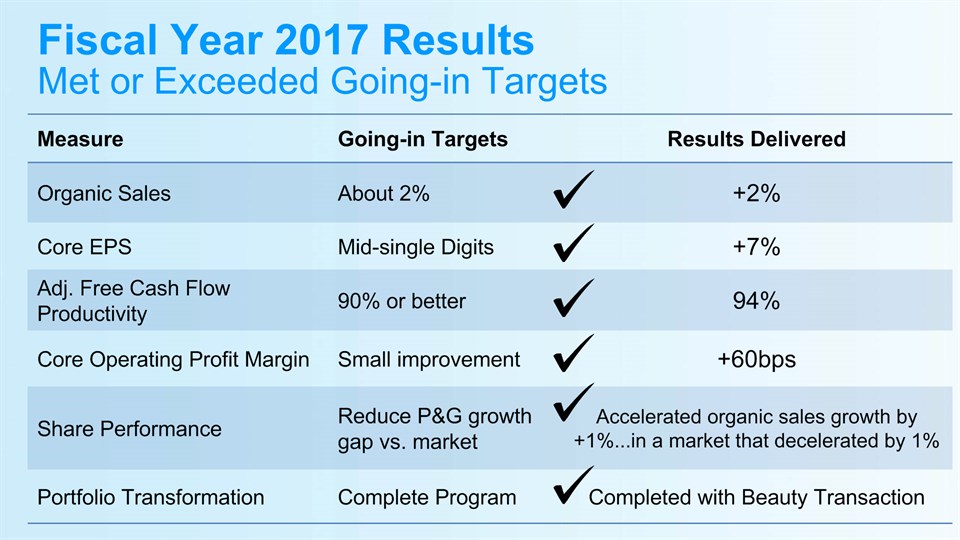

| 1. | Organic sales growth — page 3 |

| 2. | Core EPS and currency-neutral Core EPS — pages 4-5 |

| 3. | Core after tax margin — page 6 |

| 4. | Core operating profit margin and constant currency Core operating profit margin — page 6 |

| 5. | Core gross margin and constant currency Core gross margin — page 6 |

| 6. | Core SG&A margin – page 7 |

| 7. | Core effective tax rate — page 7 |

| 8. | Adjusted free cash flow — page 7 |

| 9. | Adjusted free cash flow productivity – page 7 |

| • | Incremental restructuring: The Company has had and continues to have an ongoing level of restructuring activities. Such activities have resulted in ongoing annual restructuring related charges of approximately $250 - $500 million before tax. Beginning in 2012 Procter & Gamble began a $10 billion strategic productivity and cost savings initiative that includes incremental restructuring activities. In 2017, the company announced elements of an additional multi-year productivity and cost savings plan. These plans result in incremental restructuring charges to accelerate productivity efforts and cost savings. The adjustment to Core earnings includes only the restructuring costs above what we believe are the normal recurring level of restructuring costs. |

| • | Early debt extinguishment charges: During the three months ended December 31, 2016, the Company recorded a charge of $345 million after tax due to the early extinguishment of certain long-term debt. This charge represents the difference between the reacquisition price and the par value of the debt extinguished. Management does not view this charge as indicative of the Company's operating performance or underlying business results. |

| • | Venezuela deconsolidation charge: For accounting purposes, evolving conditions resulted in a lack of control over our Venezuelan subsidiaries. Therefore, in accordance with the applicable accounting standards for consolidation, effective June 30, 2015, we deconsolidated our Venezuelan subsidiaries and began accounting for our investment in those subsidiaries using the cost method of accounting. The charge was incurred to write off our net assets related to Venezuela. |

| • | Charges for certain European legal matters: Several countries in Europe issued separate complaints alleging that the Company, along with several other companies, engaged in violations of competition laws in prior periods. The Company established Legal Reserves related to these charges. Management does not view these charges as indicative of underlying business results. |

| • | Venezuela B/S remeasurement & devaluation impacts: Venezuela is a highly inflationary economy under U.S. GAAP. Prior to deconsolidation, the government enacted episodic changes to currency exchange mechanisms and rates, which resulted in currency remeasurement charges for non-dollar denominated monetary assets and liabilities held by our Venezuelan subsidiaries. |

| • | Non-cash impairment charges: During fiscal years 2013 and 2012 the Company incurred impairment charges related to the carrying value of goodwill and indefinite lived intangible assets in our Appliances and Salon Professional businesses. |

| • | Gain on Iberian JV buyout: During fiscal year 2013 we incurred a holding gain on the purchase of the balance of our Iberian joint venture from our joint venture partner. |

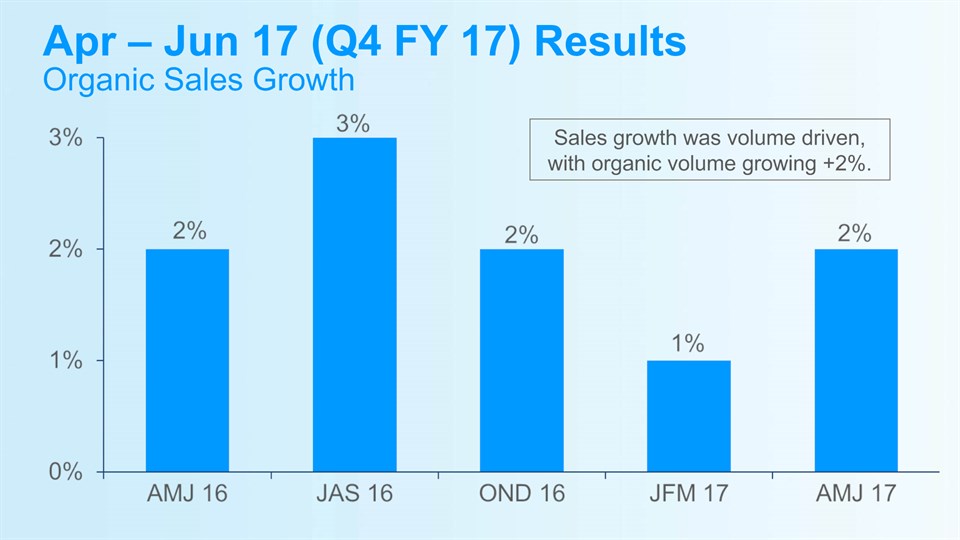

Three Months Ended June 30, 2017 | Net Sales Growth | Foreign Exchange Impact | Acquisition/ Divestiture Impact* | Organic Sales Growth | |||

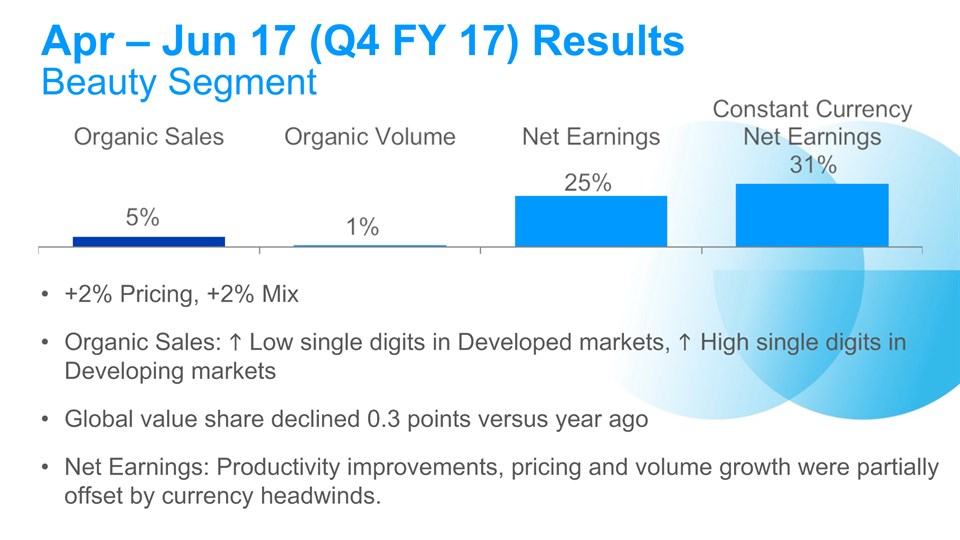

| Beauty | 2% | 2% | 1% | 5% | |||

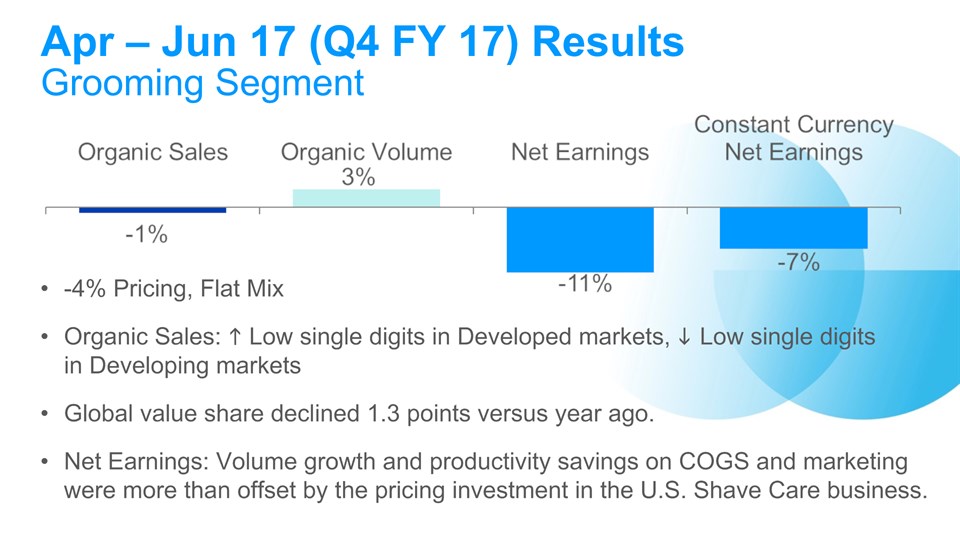

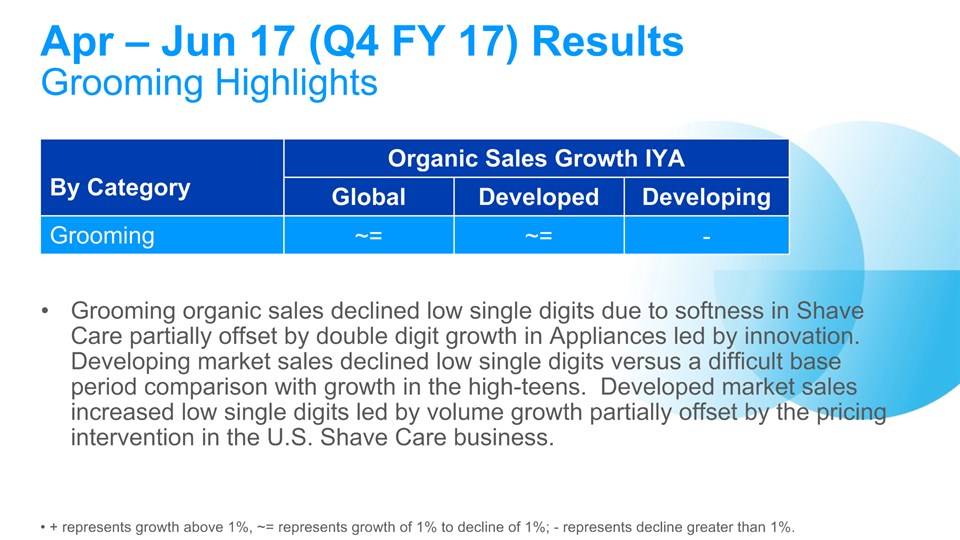

| Grooming | (2)% | 2% | (1)% | (1)% | |||

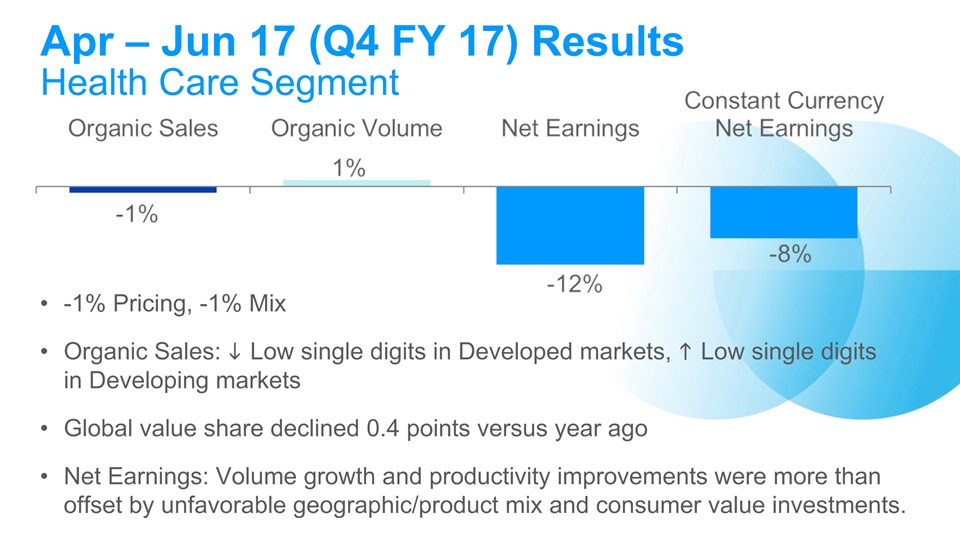

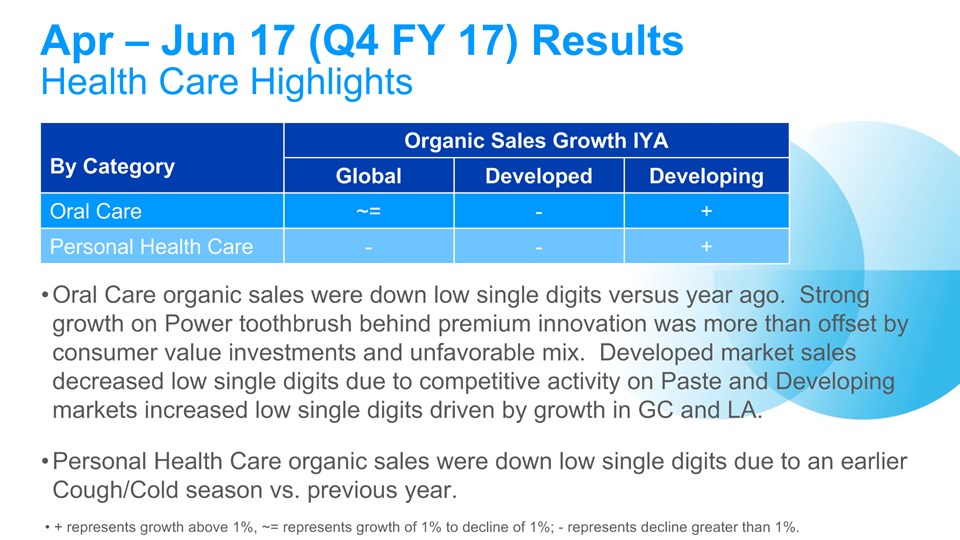

| Health Care | (4)% | 2% | 1% | (1)% | |||

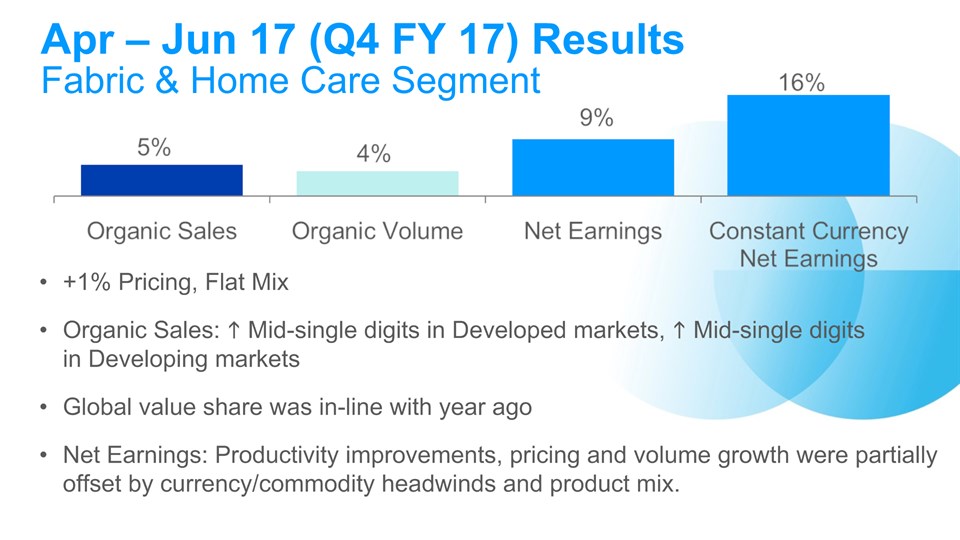

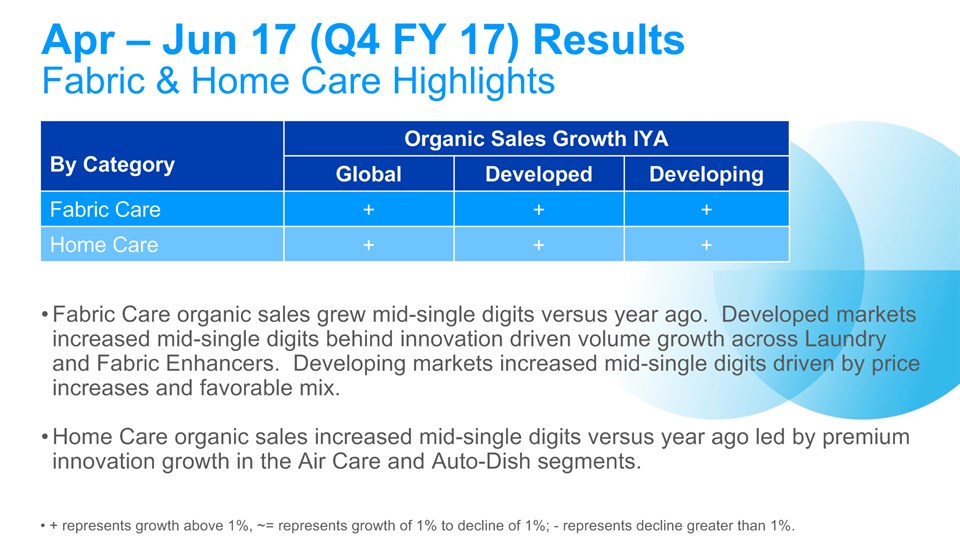

| Fabric Care & Home Care | 2% | 3% | -% | 5% | |||

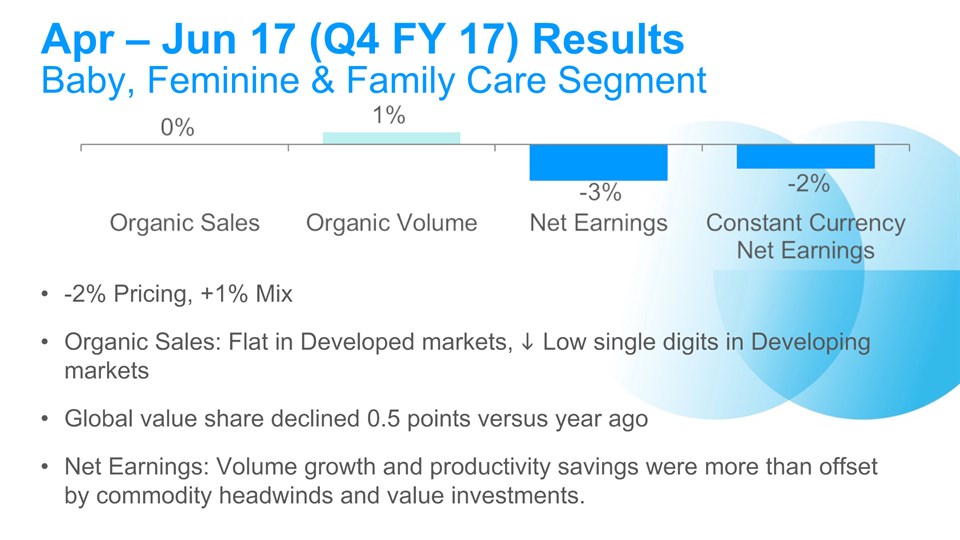

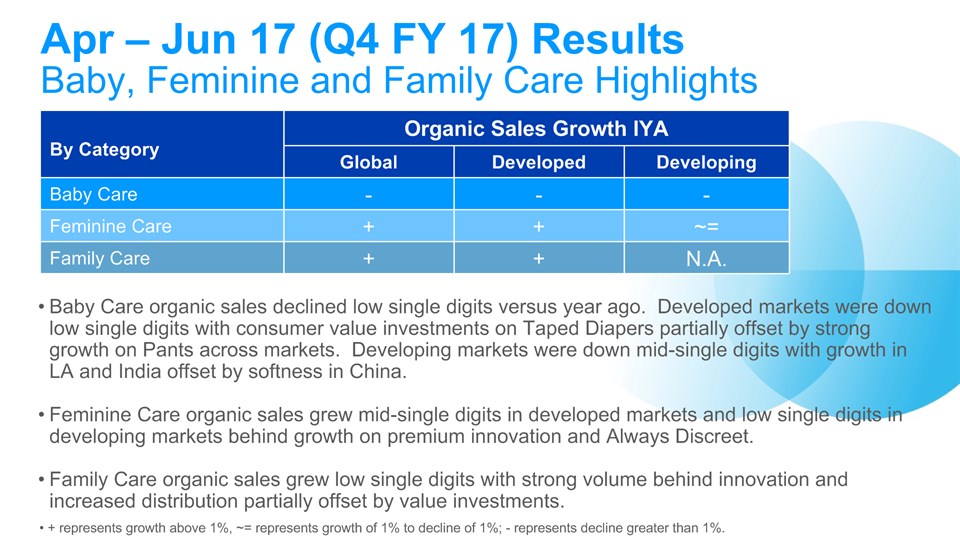

| Baby, Feminine & Family Care | (2)% | 1% | 1% | -% | |||

| Total P&G | -% | 2% | -% | 2% |

| Total Company | Net Sales Growth | Foreign Exchange Impact | Acquisition/ Divestiture Impact* | Organic Sales Growth | ||||

| AMJ 2016 | (3)% | 3% | 2% | 2% | ||||

| JAS 2016 | -% | 3% | -% | 3% | ||||

| OND 2016 | -% | 2% | -% | 2% | ||||

| JFM 2017 | (1)% | 2% | -% | 1% | ||||

| FY 2015 | (5)% | 6% | 1% | 2% | ||||

| FY 2016 | (8)% | 6% | 3% | 1% | ||||

| FY 2017 | --% | 2% | -% | 2% | ||||

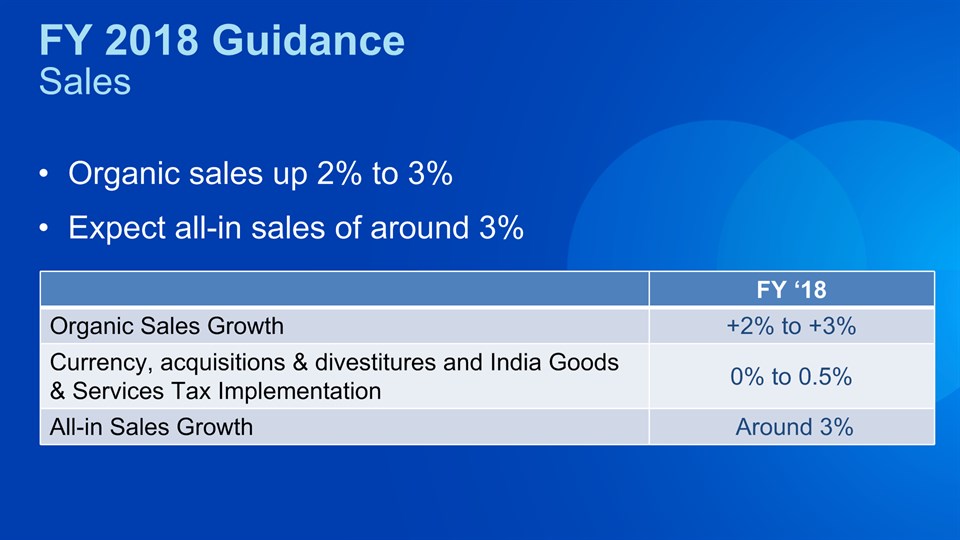

| Total Company | Net Sales Growth | Combined Foreign Exchange & Acquisition/Divestiture Impact | Organic Sales Growth | |||

FY 2018 Estimate | About 3% | (0.5)% to 0% | +2% to +3% |

Three Months Ended June 30 | |||

| 2017 | 2016 | ||

| Diluted Net Earnings Per Share from Continuing Operations | $0.82 | $0.71 | |

| Incremental Restructuring | 0.02 | 0.08 | |

| Rounding | 0.01 | - | |

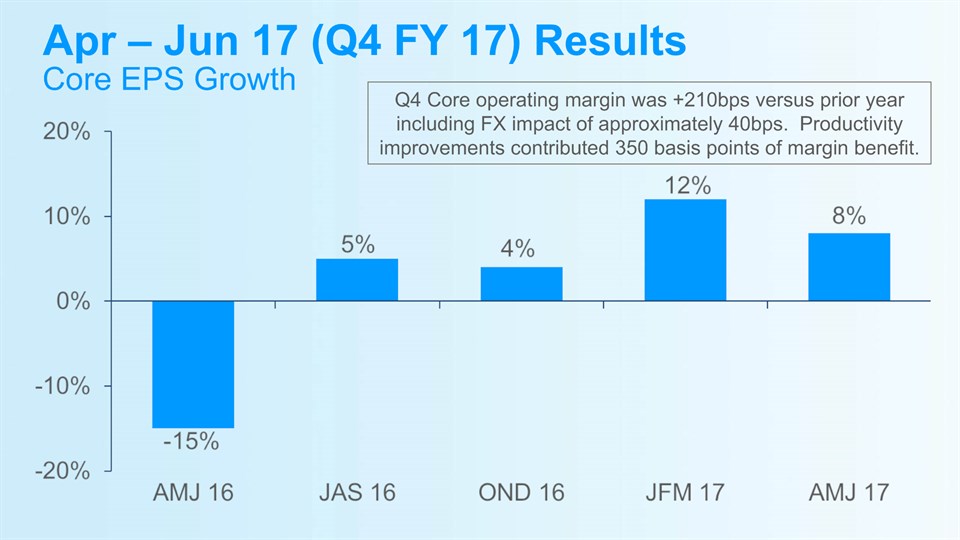

| Core EPS | $0.85 | $0.79 | |

| Percentage change vs. prior period | 8% | ||

| Currency Impact to Earnings | - | ||

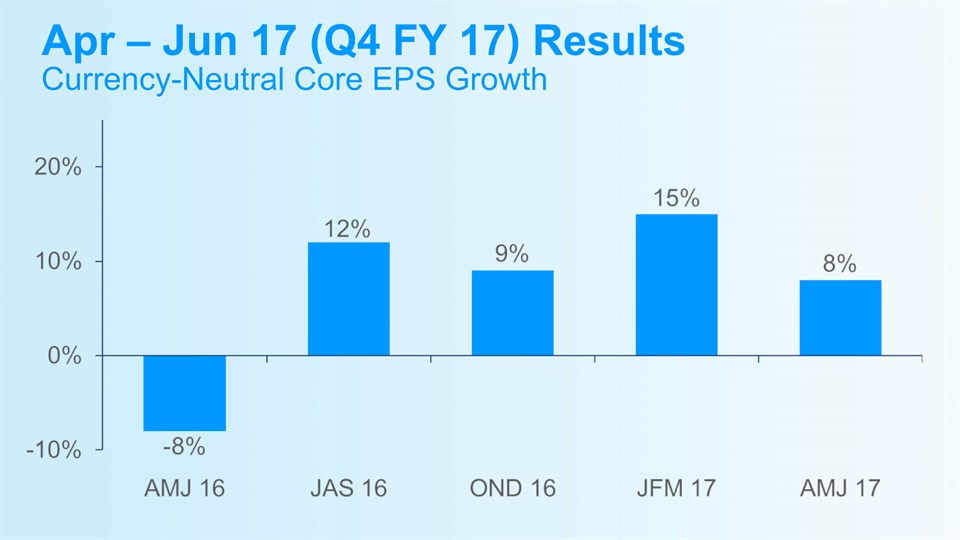

| Currency-Neutral Core EPS | $0.85 | ||

| Percentage change vs. prior period Core EPS | 8% | ||

Twelve Months Ended June 30 | |||

| 2017 | 2016 | ||

| Diluted Net Earnings Per Share from Continuing Operations | $3.69 | $3.49 | |

| Incremental Restructuring | 0.10 | 0.18 | |

| Early Debt Extinguishment Charges | 0.13 | - | |

| Core EPS | $3.92 | $3.67 | |

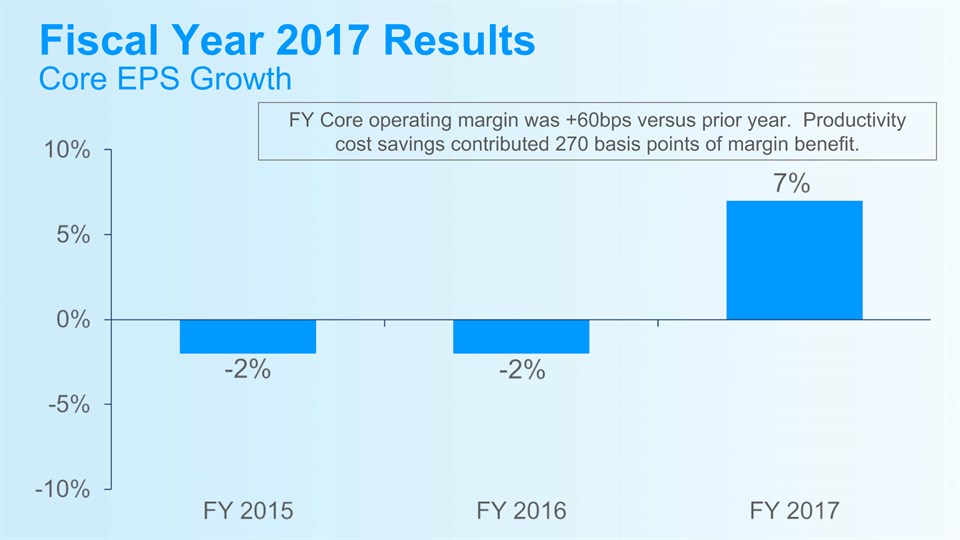

| Percentage change vs. prior period | 7% | ||

| Currency Impact to Earnings | 0.15 | ||

| Currency-Neutral Core EPS | $4.07 | ||

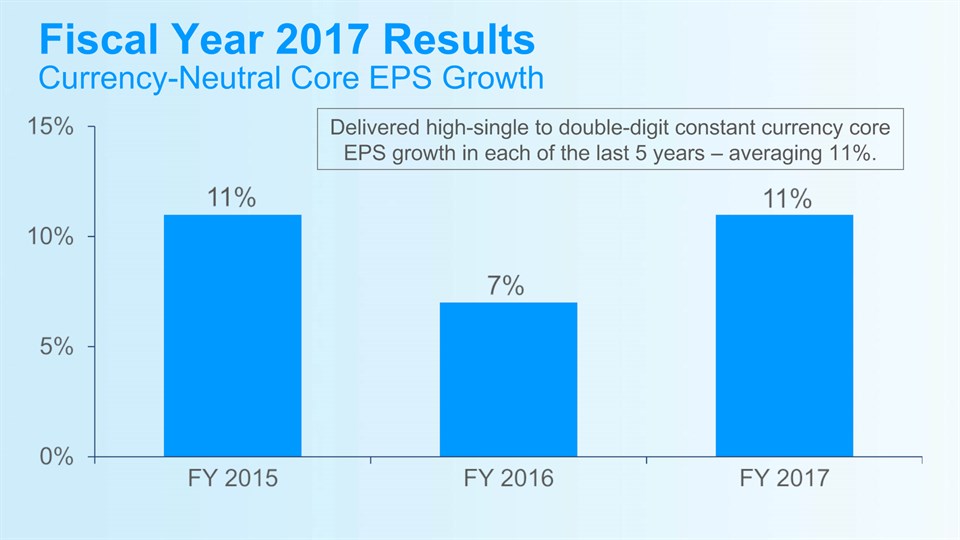

| Percentage change vs. prior period Core EPS | 11% | ||

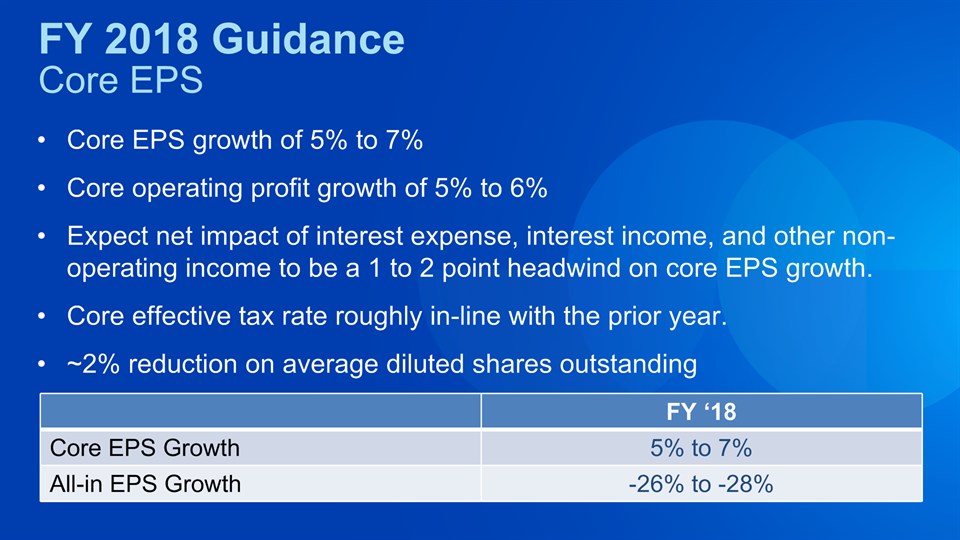

| Total Company | Diluted EPS Growth | Impact of Incremental Non-Core Items* | Core EPS Growth | |

| FY 2018 (Estimate) | (26%) to (28%) | Approximately 33% | +5% to +7% |

| AMJ 16 | AMJ 15 | JAS 16 | JAS 15 | OND 16 | OND 15 | JFM 17 | JFM 16 | |

| Diluted Net Earnings Per Share from Continuing Operations, attributable to P&G | $ 0.71 | $ 0.17 | $ 1.00 | $ 0.96 | $ 0.93 | $ 1.01 | $ 0.93 | $ 0.81 |

| Incremental Restructuring | 0.08 | 0.06 | 0.03 | 0.02 | 0.03 | 0.03 | 0.03 | 0.04 |

| Early Debt Extinguishment Charges | - | - | - | - | 0.13 | - | - | - |

| Charges for Pending European Legal Matters | - | (0.01) | - | - | - | - | - | - |

| Venezuela Deconsolidation Charge | - | 0.71 | - | - | - | - | - | - |

| Rounding | - | - | - | - | (0.01) | - | - | 0.01 |

| Core EPS | $ 0.79 | $ 0.93 | $ 1.03 | $ 0.98 | $ 1.08 | $ 1.04 | $ 0.96 | $ 0.86 |

| Percentage change vs. prior period | (15)% | 5% | 4% | 12% | ||||

| Currency Impact to Earnings | 0.07 | 0.07 | 0.05 | 0.03 | ||||

| Currency-Neutral Core EPS | $ 0.86 | $ 1.10 | $ 1.13 | $ 0.99 | ||||

| Percentage change vs. prior period Core EPS | (8)% | 12% | 9% | 15% |

| FY 12 | FY 13 | FY 14 | FY 15 | FY 16 | |

| Diluted Net Earnings Per Share from Continuing Operations, attributable to P&G | $2.97 | $3.50 | $3.63 | $2.84 | $3.49 |

| Incremental Restructuring | 0.15 | 0.14 | 0.11 | 0.17 | 0.18 |

| Venezuela B/S Remeasurement & Devaluation Impacts | - | 0.08 | 0.09 | 0.04 | - |

| Charges for Certain European Legal Matters | 0.03 | 0.05 | 0.02 | 0.01 | - |

| Venezuela Deconsolidation Charge | - | - | - | 0.71 | - |

| Non-Cash Impairment Charges | 0.31 | 0.10 | - | - | - |

| Gain on Iberian JV Buyout | - | (0.21) | - | - | - |

| Rounding | (0.01) | (0.01) | (0.01) | - | |

| Core EPS | $3.45 | $3.65 | $3.85 | $3.76 | $3.67 |

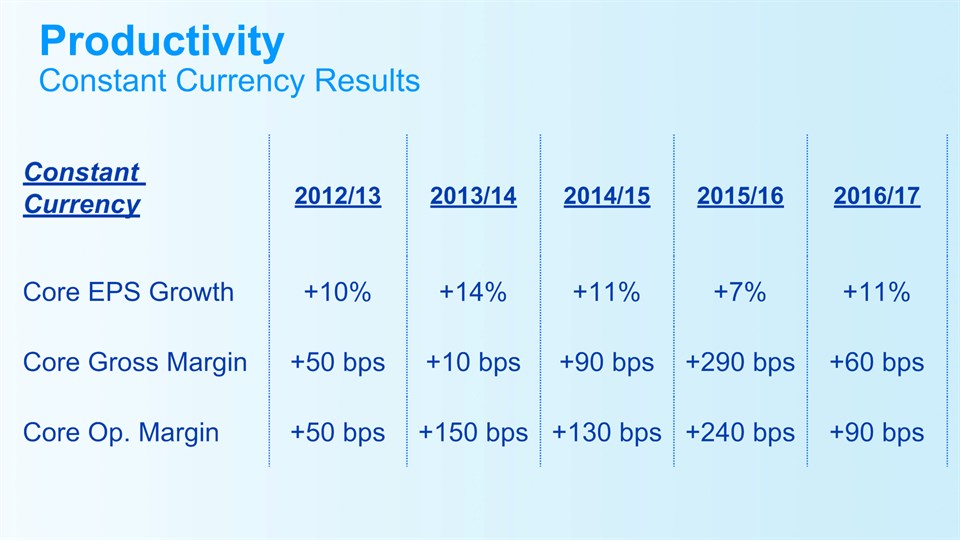

Percentage change vs. prior year Core EPS | 6% | 5% | (2)% | (2)% | |

Currency Impact to Earnings | 0.15 | 0.32 | 0.52 | 0.35 | |

| Currency-Neutral Core EPS | $3.80 | $4.17 | $4.28 | $4.02 | |

Percentage change vs. prior year Core EPS | 10% | 14% | 11% | 7% | |

| Net Earnings Margin | Discontinued Operations | Incremental Restructuring | Early Debt Extinguishment Charges | Core After Tax Margin | |

| FY 2017 | 23.6% | (8.0%) | 0.4% | 0.5% | 16.5% |

| FY 12 | FY 13 | FY 14 | FY 15 | FY 16 | FY 17 | AMJ 16 | AMJ 17 | |

| Operating Profit Margin | 17.1% | 17.7% | 18.7% | 15.6% | 20.6% | 21.5% | 15.5% | 18.3% |

| Incremental Restructuring | 0.7% | 0.7% | 0.5% | 0.9% | 0.9% | 0.6% | 1.4% | 0.8% |

| Charges for Certain European Legal Matters | 0.1% | 0.2% | 0.1% | - | - | - | - | - |

| Venezuela B/S Remeasurement & Devaluation Impacts | - | 0.5% | 0.4% | 0.2% | - | - | - | - |

| Venezuela Deconsolidation Charge | - | - | - | 2.9% | - | - | - | - |

| Non-Cash Impairment | 1.2% | 0.4% | - | - | - | - | - | - |

| Rounding | 0.1% | (0.1)% | - | - | - | - | 0.1% | - |

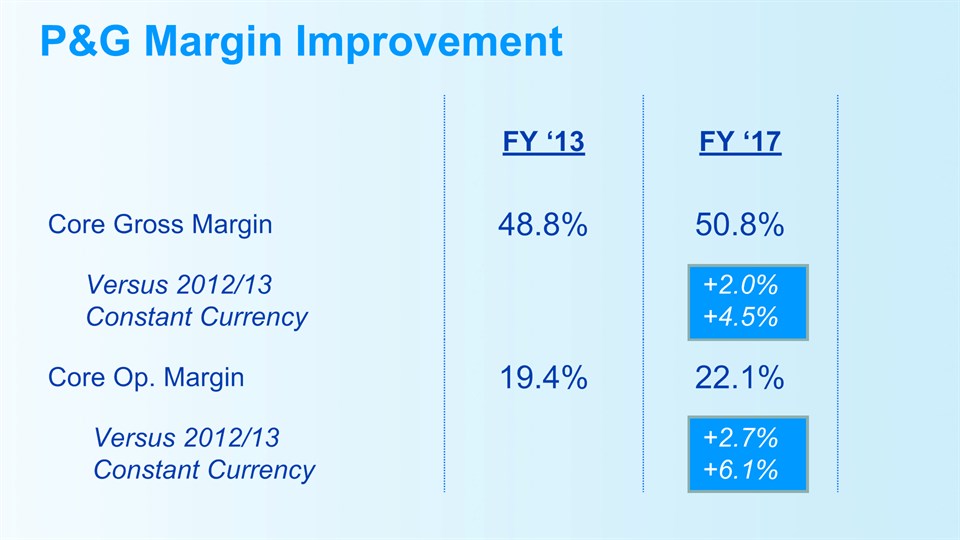

| Core Operating Profit Margin | 19.2% | 19.4% | 19.7% | 19.6% | 21.5% | 22.1% | 17.0% | 19.1% |

| Basis point change vs. prior year Core margin | 20 | 30 | (10) | 190 | 60 | 210 | ||

| Currency Impact to Margin | 0.3% | 1.2% | 1.4% | 0.5% | 0.3% | (0.3)% | ||

| Constant Currency Core Operating Profit Margin | 19.7% | 20.9% | 21.0% | 22.0% | 22.4% | 18.8% | ||

| Basis point change vs. prior year Core margin | 50 | 150 | 130 | 240 | 90 | 180 |

| FY 12 | FY 13 | FY 14 | FY 15 | FY 16 | FY 17 | AMJ16 | AMJ 17 | |

| Gross Margin | 48.2% | 48.5% | 47.5% | 47.6% | 49.6% | 50.0% | 47.9% | 48.4% |

| Incremental Restructuring | 0.2% | 0.3% | 0.4% | 0.7% | 1.0% | 0.8% | 1.5% | 0.9% |

| Rounding | - | - | - | 0.1% | - | - | - | - |

| Core Gross Margin | 48.4% | 48.8% | 47.9% | 48.4% | 50.6% | 50.8% | 49.4% | 49.3% |

| Basis point change vs. prior year Core margin | 40 | (90) | 50 | 220 | 20 | (10) | ||

| Currency Impact to Margin | 0.1% | 1% | 0.4% | 0.7% | 0.4% | 0.2% | ||

| Constant Currency Core Gross Margin | 48.9% | 48.9% | 48.8% | 51.3% | 51.2% | 49.5% | ||

| Basis point change vs. prior year Core margin | 50 | 10 | 90 | 290 | 60 | 10 |

Three Months Ended June 30th | |||

| 2017 | 2016 | ||

| SG&A Margin | 30.0% | 32.4% | |

| Incremental Restructuring | 0.1% | - | |

| Rounding | 0.1% | - | |

| Core SG&A Margin | 30.2% | 32.4% | |

| Basis points change vs. prior period | (220) | ||

Twelve Months Ended June 30th | |||

| 2017 | 2016 | ||

| Effective Tax Rate | 23.1% | 25.0% | |

| Early Debt Extinguishment Charges | 0.5% | - | |

| Incremental Restructuring | 0.2% | (0.4)% | |

| Core Effective Tax Rate | 23.8 | 24.6% | |

| Basis points change vs. prior period | (80) | ||

| Three Months Ended June 30, 2017 | |||||

| Operating Cash Flow | Capital Spending | Free Cash Flow | Cash Tax Payment – Beauty Sale | Adjusted Free Cash Flow | |

| $3,688 | $(1,154) | $2,534 | $215 | $2,749 | |

| Twelve Months Ended June 30, 2017 | |||||

| Operating Cash Flow | Capital Spending | Free Cash Flow | Cash Tax Payment – Beauty Sale | Adjusted Free Cash Flow | |

| $12,753 | $(3,384) | $9,369 | $418 | $9,787 | |

| Three Months Ended June 30, 2017 | ||||||

Adjusted Free Cash Flow | Net Earnings | Loss on Early Debt Extinguishment | Gain on Sale of Beauty Brands | Adjusted Net Earnings | Adjusted Free Cash Flow Productivity | |

| $2,749 | $2,202 | - | - | $2,202 | 125% | |

| Twelve Months Ended June 30, 2017 | ||||||

Adjusted Free Cash Flow | Net Earnings | Loss on Early Debt Extinguishment | Gain on Sale of Beauty Brands | Adjusted Net Earnings | Adjusted Free Cash Flow Productivity | |

| $9,787 | $15,411 | $345 | (5,335) | $10,421 | 94% | |