- PG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

The Procter & Gamble Company (PG) 8-KRegulation FD Disclosure

Filed: 20 Apr 21, 9:55am

| 1. | Organic sales growth — page 3 |

| 2. | Core EPS and currency-neutral Core EPS — page 5 |

| 3. | Core gross margin and currency-neutral Core gross margin – page 7 |

| 4. | Core operating profit margin and currency-neutral Core operating profit margin — page 7 |

| 5. | Free cash flow productivity and Adjusted free cash flow productivity — page 8 |

| • | Incremental restructuring: The Company has historically had an ongoing level of restructuring activities. Such activities have resulted in ongoing annual restructuring related charges of approximately $250 - $500 million before tax. Since 2012, the Company has had a strategic productivity and cost savings initiative that resulted in incremental restructuring charges. The adjustment to Core earnings includes only the restructuring costs above what we believe are the normal recurring level of restructuring costs. In fiscal 2021 and onwards, the Company expects to incur restructuring costs within our historical ongoing level. |

| • | Gain on Dissolution of the PGT Healthcare Partnership: The Company finalized the dissolution of our PGT Healthcare partnership, a venture between the Company and Teva Pharmaceuticals Industries, Ltd (Teva) in the OTC consumer healthcare business, in the quarter ended September 30, 2018. The transaction was accounted for as a sale of the Teva portion of the PGT business; the Company recognized an after-tax gain on the dissolution of $353 million. |

| • | Shave Care Impairment: In the fourth quarter of fiscal 2019, the company recognized a one-time, non-cash, after-tax charge of $8.0 billion ($8.3 billion before tax) to adjust the carrying values of the Shave Care reporting unit. This was comprised of a before and after-tax impairment charge of $6.8 billion related to goodwill and an after-tax impairment charge of $1.2 billion ($1.6 billion before tax) to reduce the carrying value of the Gillette indefinite-lived intangible assets. |

| • | Anti-dilutive Impacts: The Shave Care impairment charges caused certain equity instruments that are normally dilutive (and hence normally assumed converted or exercised for the purposes of determining diluted net earnings per share) to be anti-dilutive. Accordingly, for U.S. GAAP diluted earnings per share, these instruments were not assumed to be concerted or exercised. Specifically, in the fourth quarter and total fiscal 2019, the weighted average outstanding preferred shares were not included in the diluted weighted average common shares outstanding. Additionally, in the fourth quarter of fiscal 2019, none of our outstanding share-based equity awards were included in the diluted weighted average common shares outstanding. As a result of the non-GAAP Shave Care impairment adjustment, these instruments are dilutive for non-GAAP earnings per share. |

| • | Early debt extinguishment charges: In the three months ended December 31, 2020, the company recorded after tax charges of $427 million ($512 million before tax), due to early extinguishment of certain long-term debt. These charges represent the difference between the reacquisition price and the par value of the debt extinguished. |

| Three Months Ended March 31, 2021 | Net Sales Growth | Foreign Exchange Impact | Acquisition & Divestiture Impact/Other* | Organic Sales Growth | |||

| Beauty | 9% | (2)% | -% | 7% | |||

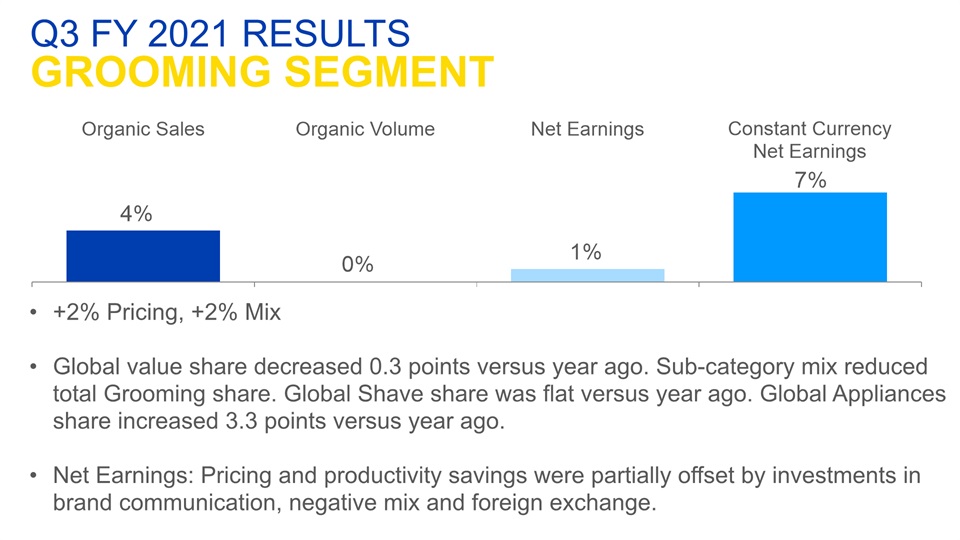

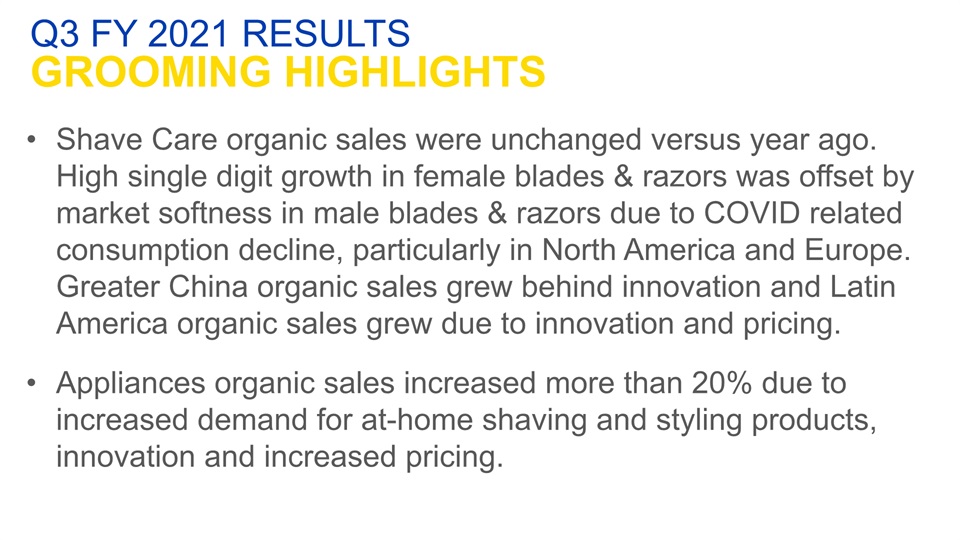

| Grooming | 4% | 0% | -% | 4% | |||

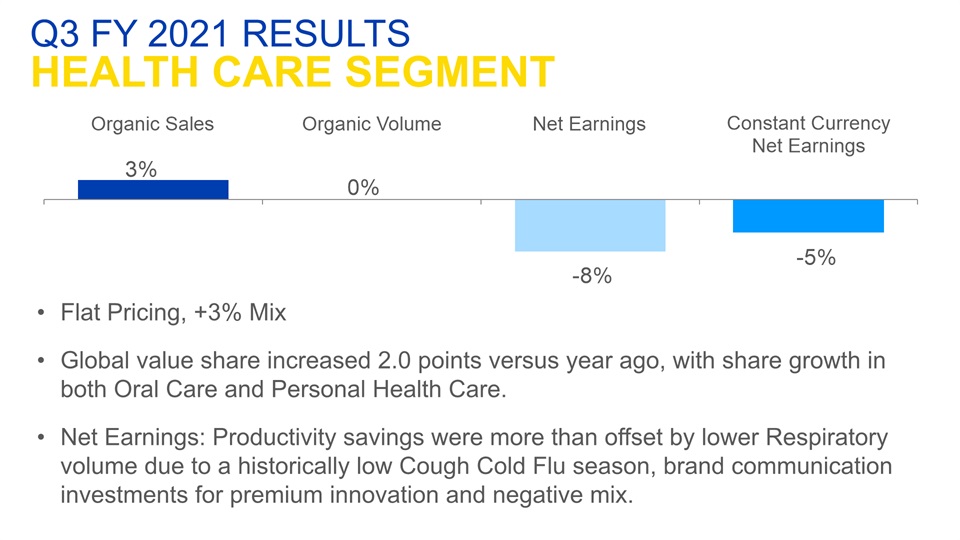

| Health Care | 4% | (1)% | -% | 3% | |||

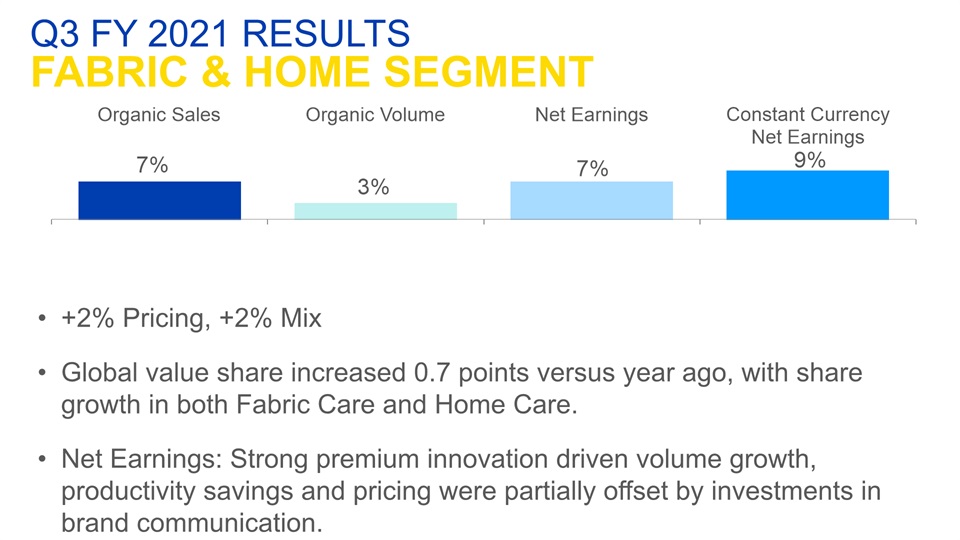

| Fabric Care & Home Care | 8% | (1)% | -% | 7% | |||

| Baby, Feminine & Family Care | -% | (1)% | -% | (1)% | |||

| Total P&G | 5% | (1)% | -% | 4% |

| Nine Months Ended March 31, 2021 | Net Sales Growth | Foreign Exchange Impact | Acquisition & Divestiture Impact/Other* | Organic Sales Growth | |||

| Total P&G | 7% | -% | -% | 7% |

Total Company | Net Sales Growth | Foreign Exchange Impact | Acquisition/ Divestiture Impact/Other* | Organic Sales Growth | |||

| JAS 2019 | 7% | 2% | (2)% | 7% | |||

| OND 2019 | 5% | 1% | (1)% | 5% | |||

| JFM 2020 | 5% | 2% | (1)% | 6% | |||

| AMJ 2020 | 4% | 3% | (1)% | 6% | |||

| JAS 2020 | 9% | 1% | (1)% | 9% | |||

| OND 2020 | 8% | -% | -% | 8% |

| Three Months Ended March 31, 2021 | Net Sales Growth | Foreign Exchange Impact | Acquisition & Divestiture Impact/Other* | Organic Sales Growth | |||

| JFM 2020 | 5% | 2% | (1)% | 6% | |||

| JFM 2021 | 5% | (1)% | -% | 4% | |||

| Past Two Years Stacked | 10% |

Total Beauty | Net Sales Growth | Foreign Exchange Impact | Acquisition/ Divestiture Impact/Other* | Organic Sales Growth | |||

| OND 2015 | (10)% | 7% | 4% | 1% | |||

| JFM 2016 | (8)% | 5% | 4% | 1% | |||

| AMJ 2016 | (5)% | 3% | 3% | 1% | |||

| JAS 2016 | (1)% | 2% | 2% | 3% | |||

| OND 2016 | (1)% | 2% | 2% | 3% | |||

| JFM 2017 | (2)% | 1% | 2% | 1% | |||

| AMJ 2017 | 2% | 2% | 1% | 5% | |||

| JAS 2017 | 5% | -% | -% | 5% | |||

| OND 2017 | 10% | (1)% | -% | 9% | |||

| JFM 2018 | 10% | (5)% | -% | 5% | |||

| AMJ 2018 | 10% | (3)% | -% | 7% | |||

| JAS 2018 | 5% | 3% | (1)% | 7% | |||

| OND 2018 | 4% | 4% | -% | 8% | |||

| JFM 2019 | 4% | 5% | -% | 9% | |||

| AMJ 2019 | 3% | 5% | -% | 8% | |||

| JAS 2019 | 8% | 2% | -% | 10% | |||

| OND 2019 | 7% | 1% | -% | 8% | |||

| JFM 2020 | (1)% | 2% | -% | 1% | |||

| AMJ 2020 | -% | 4% | (1)% | 3% | |||

| JAS 2020 | 7% | 1% | (1)% | 7% | |||

| OND 2020 | 6% | (1)% | -% | 5% |

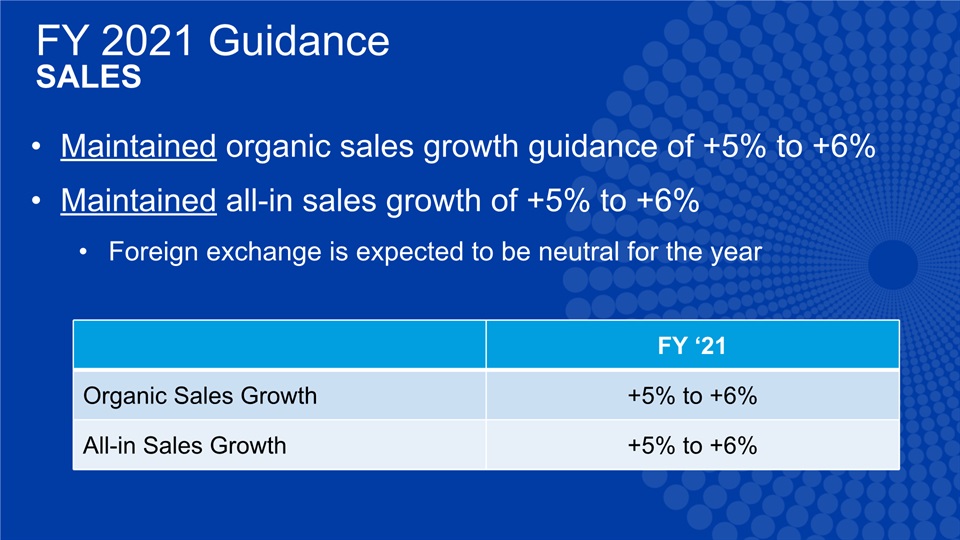

| Total Company | Net Sales Growth | Combined Foreign Exchange & Acquisition/Divestiture Impact/Other* | Organic Sales Growth | |||

| FY 2021 (Estimate) | +5% to +6% | - | +5% to +6% |

| Three Months Ended March 31 | |||

| 2021 | 2020 | ||

| Diluted Net Earnings Per Share | $1.26 | $1.12 | |

| Incremental Restructuring | 0.05 | ||

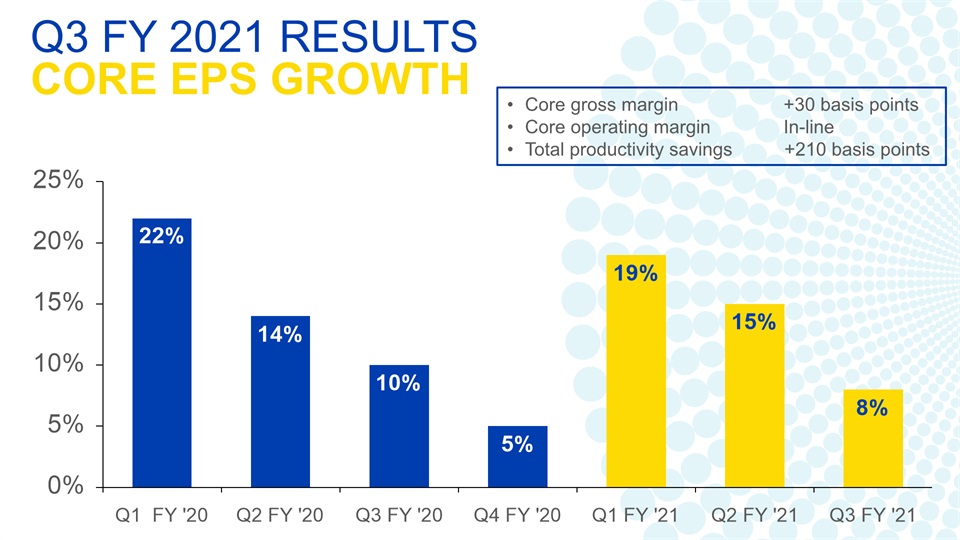

| Core EPS | $1.26 | $1.17 | |

| Percentage change vs. prior period | 8% | ||

| Currency Impact to Earnings | - | ||

| Currency-Neutral Core EPS | $1.26 | ||

| Percentage change vs. prior period Core EPS | 8% | ||

| Nine Months Ended March 31 | |||

| 2021 | 2020 | ||

| Diluted Net Earnings Per Share | $4.37 | $3.89 | |

| Incremental Restructuring | 0.07 | ||

| Early Debt Extinguishment | 0.16 | ||

| Core EPS | $4.53 | $3.96 | |

| Percentage change vs. prior period | 14% | ||

| Currency Impact to Earnings | 0.06 | ||

| Currency-Neutral Core EPS | $4.59 | ||

| Percentage change vs. prior period Core EPS | 16% | ||

| JAS 19 | JAS 18 | OND 19 | OND 18 | JFM 20 | JFM 19 | AMJ 20 | AMJ 19 | JAS 20 | JAS 19 | OND 20 | OND 19 | |

| Diluted Net Earnings Per Share attributable to P&G | $ 1.36 | $ 1.22 | $ 1.41 | $1.22 | $1.12 | $1.04 | $1.07 | $(2.12) | $1.63 | $1.36 | $1.47 | $1.41 |

| Incremental Restructuring | 0.01 | 0.03 | 0.01 | 0.03 | 0.05 | 0.02 | 0.09 | 0.06 | 0.01 | 0.01 | ||

| Gain on Dissolution of PGT Partnership | (0.14) | |||||||||||

| Shave Care Impairment | 3.02 | |||||||||||

| Anti-dilutive Impacts | 0.14 | |||||||||||

| Early Debt Extinguishment | 0.16 | |||||||||||

| Rounding | 0.01 | 0.01 | ||||||||||

| Core EPS | $ 1.37 | $ 1.12 | $1.42 | $1.25 | $1.17 | $1.06 | $1.16 | $1.10 | $1.63 | $1.37 | $1.64 | $1.42 |

| Percentage change vs. prior period | 22% | 14% | 10% | 5% | 19% | 15% | ||||||

| Currency Impact to Earnings | 0.02 | 0.02 | 0.05 | 0.06 | 0.04 | 0.03 | ||||||

| Currency-Neutral Core EPS | $1.39 | $1.44 | $1.22 | $1.22 | $1.67 | $1.67 | ||||||

| Percentage change vs. prior period Core EPS | 24% | 15% | 15% | 11% | 22% | 18% |

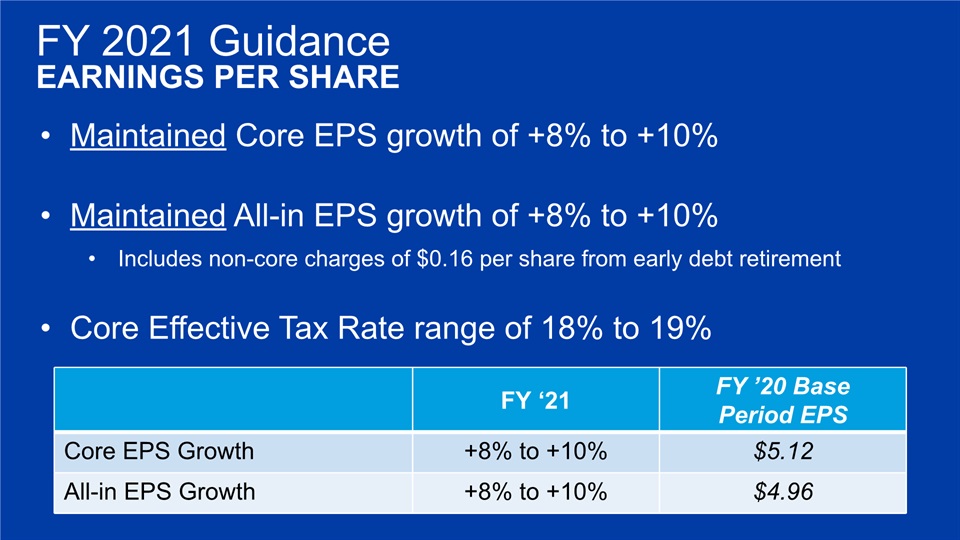

| Total Company | Diluted EPS Growth | Impact of Incremental Non-Core Items* | Core EPS Growth |

| FY 2021 (Estimate) | +8% to +10% | - | +8% to +10% |

| Three Months Ended March 31 | ||

| 2021 | 2020 | |

| Gross Margin | 50.7% | 49.4% |

| Incremental Restructuring | 1.0% | |

| Core Gross Margin | 50.7% | 50.4% |

| Basis point change vs. prior year Core margin | 30 | |

| Currency Impact to Margin | 0.5% | |

| Currency-Neutral Core Gross Margin | 51.2% | |

| Basis point change vs prior year Core margin | 80 | |

| Three Months Ended March 31 | ||

| 2021 | 2020 | |

| Operating Profit Margin | 20.9% | 20.1% |

Incremental Restructuring Rounding | 0.9% (0.1)% | |

| Core Operating Profit Margin | 20.9% | 20.9% |

| Basis point change vs. prior year Core margin | 0 | |

| Currency Impact Margin | 0.3% | |

| Currency-Neutral Core Operating Profit Margin | 21.2% | |

| Basis point change vs. prior year Core Margin | 30 | |

| Three Months Ended March 31, 2021 | ||||

| Operating Cash Flow | Capital Spending | Free Cash Flow | Net Earnings | Free Cash Flow Productivity |

| $4,087 | $(656) | $3,431 | 3,249 | 106% |

| Nine Months Ended March 31, 2021 | |||||||

| Operating Cash Flow | Capital Spending | U.S. Tax Act Payment | Adjusted Free Cash Flow | Net Earnings | Early Debt Extinguishment Charges | Net Earnings Excluding Adjustments | Adjusted Free Cash Flow Productivity |

| $14,250 | $(2,073) | $225 | $12,402 | $11,444 | $427 | $11,871 | 104% |