Exhibit 99.1 Strategic and Operational Overview October 29, 2019 2020 Chevrolet Corvette Stingray 1

Safe Harbor Statement This presentation contains several “forward-looking statements.” Forward-looking statements are those that use words such as “believe,” “expect,” “intend,” “plan,” “may,” “likely,” “should,” “estimate,” “continue,” “future” or “anticipate” and other comparable expressions. These words indicate future events and trends. Forward-looking statements are our current views with respect to future events and financial performance. These forward-looking statements are subject to many assumptions, risks and uncertainties that could cause actual results to differ significantly from historical results or from those anticipated by us. The most significant risks are detailed from time to time in our filings and reports with the Securities and Exchange Commission, including our annual report on Form 10-K for the year ended December 31, 2018. Such risks include - but are not limited to - GM’s ability to sell new vehicles that we finance in the markets we serve; the viability of GM-franchised dealers that are commercial loan customers; changes in the automotive industry that result in a change in demand for vehicles and related vehicle financing; the sufficiency, availability and cost of sources of financing, including credit facilities, securitization programs and secured and unsecured debt issuances; our joint ventures in China, which we cannot operate solely for our benefit and over which we have limited control; the adequacy of our underwriting criteria for loans and leases and the level of net charge-offs, delinquencies and prepayments on the loans and leases we purchase or originate; the adequacy of our allowance for loan losses on our finance receivables; the effect, interpretation or application of new or existing laws, regulations, court decisions and accounting pronouncements; adverse determinations with respect to the application of existing laws, or the results of any audits from tax authorities, as well as changes in tax laws and regulations, supervision, enforcement and licensing across various jurisdictions; the prices at which used vehicles are sold in the wholesale auction markets; vehicle return rates, our ability to estimate residual value at the inception of a lease and the residual value performance on vehicles we lease; interest rate fluctuations and certain related derivatives exposure; foreign currency exchange rate fluctuations and other risks applicable to our operations outside of the U.S.; changes to the LIBOR calculation process and potential phasing out of LIBOR; our ability to effectively manage capital or liquidity consistent with evolving business or operational needs, risk management standards and regulatory or supervisory requirements; changes in local, regional, national or international economic, social or political conditions; our ability to maintain and expand our market share due to competition in the automotive finance industry from a large number of banks, credit unions, independent finance companies and other captive automotive finance subsidiaries; our ability to secure private customer and employee data or our proprietary information, manage risks related to security breaches and other disruptions to our networks and systems and comply with enterprise data regulations in all key market regions; and changes in business strategy, including expansion of product lines and credit risk appetite, acquisitions and divestitures. If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, our actual results may vary materially from those expected, estimated or projected. It is advisable not to place undue reliance on any forward-looking statements. We undertake no obligation to, and do not, publicly update or revise any forward-looking statements, except as required by federal securities laws, whether as a result of new information, future events or otherwise. Unless otherwise noted, prior period information excludes Discontinued Operations and reflects results for North America and our continuing International Operations. The IHS reports, data and information (“IHS Markit Materials”) referenced herein are copyrighted property of IHS Markit Ltd and its subsidiaries (“IHS Markit”) and represent data, research, opinions or viewpoints published by IHS Markit, and are not representations of fact. The IHS Markit Materials speak as of the date of the original publication date thereof and not as of the date of this document. The information and opinions expressed in the IHS Markit Materials are subject to change without notice and IHS Markit has no duty or responsibility to update the IHS Markit materials. Moreover, while the IHS Markit Materials reproduced herein are from sources considered reliable, the accuracy and completeness thereof are not warranted, nor are the opinions and analyses which are based upon it. IHS Markit and R.L. Polk & Co. are trademarks of IHS Markit. 2

GM Financial Company Overview Focused on delivering strategic and financial value to General Motors Operations cover ~90% of GM’s worldwide sales >6.5 million retail contracts outstanding Offering auto finance products to 14,000 dealers worldwide Earning assets of $97.8B Captive Value Proposition Enhance Customer Provide Support Contribute to Drive Vehicle Experience and Across Economic Enterprise Sales Loyalty Cycles Profitability 3

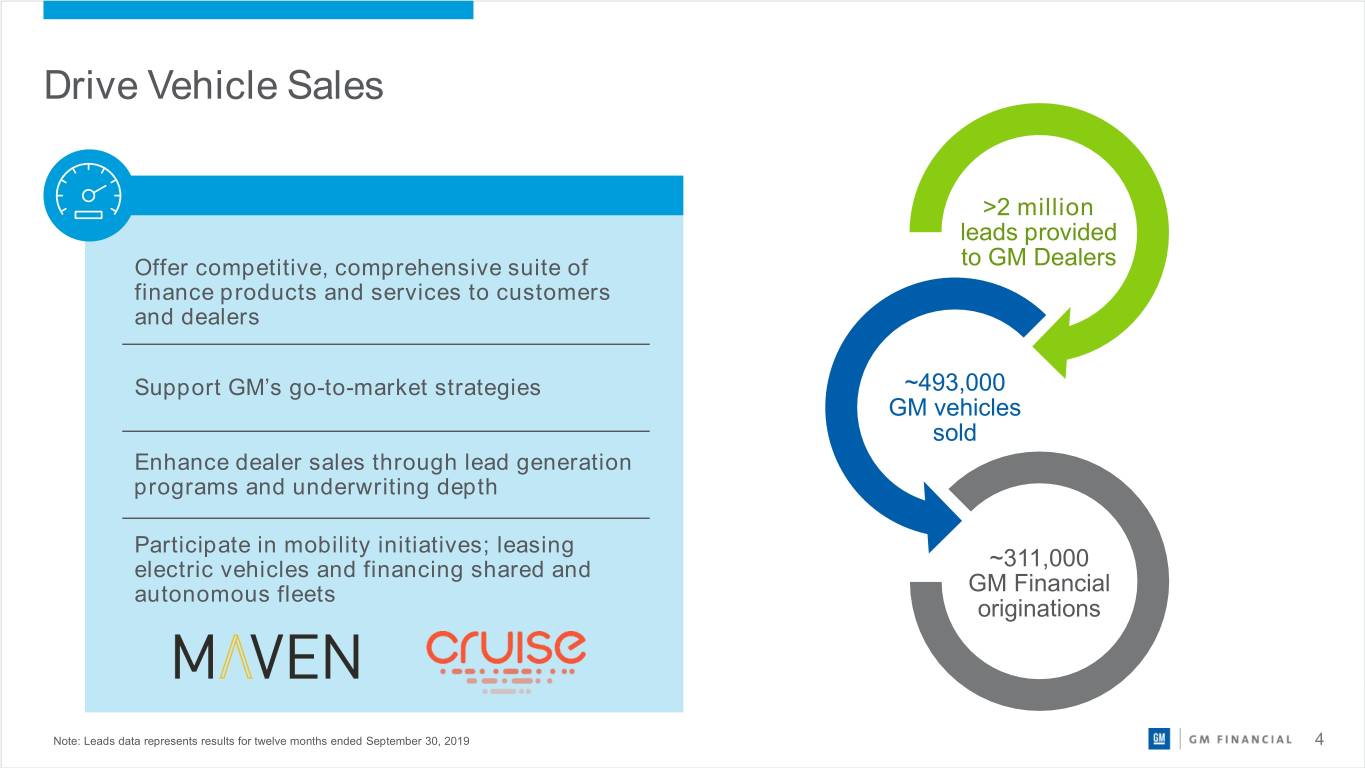

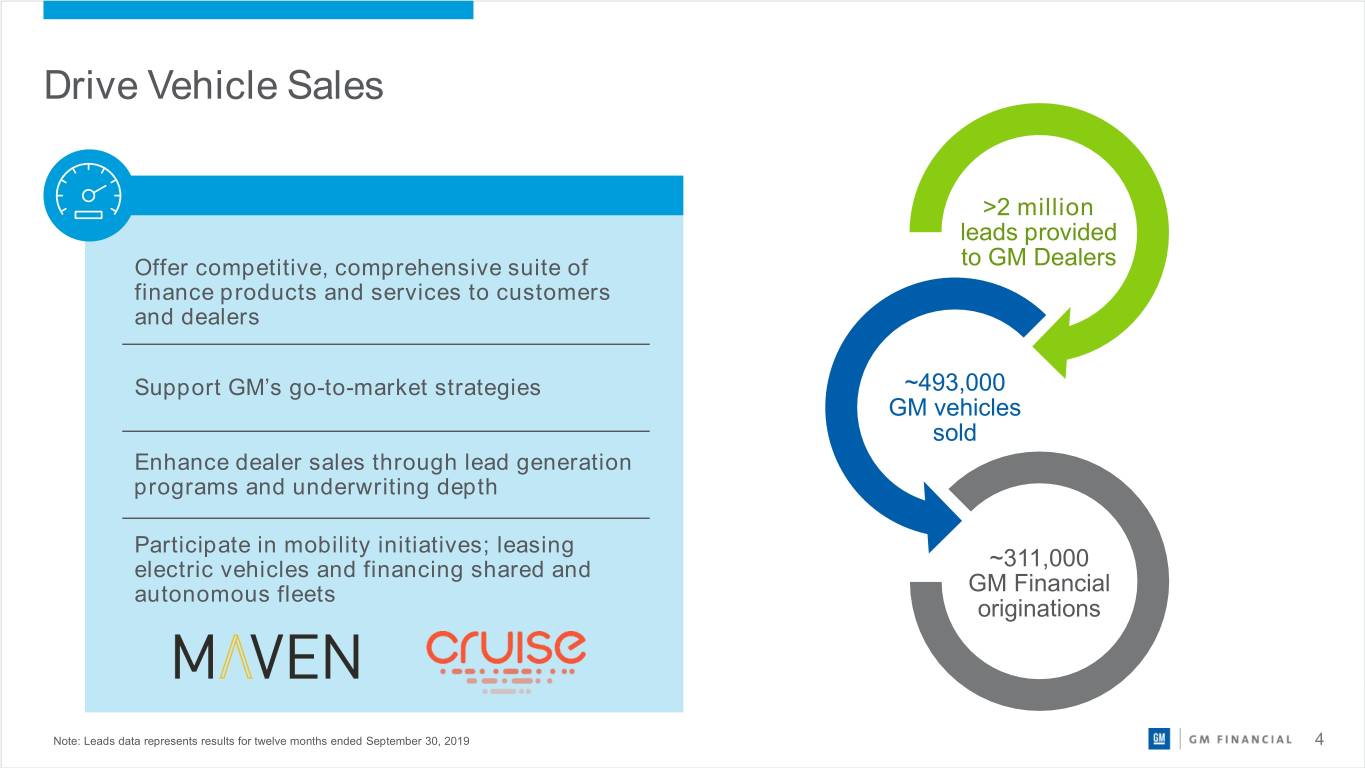

Drive Vehicle Sales >2 million leads provided Offer competitive, comprehensive suite of to GM Dealers finance products and services to customers and dealers Support GM’s go-to-market strategies ~493,000 GM vehicles sold Enhance dealer sales through lead generation programs and underwriting depth Participate in mobility initiatives; leasing ~ electric vehicles and financing shared and 311,000 autonomous fleets GM Financial originations Note: Leads data represents results for twelve months ended September 30, 2019 4

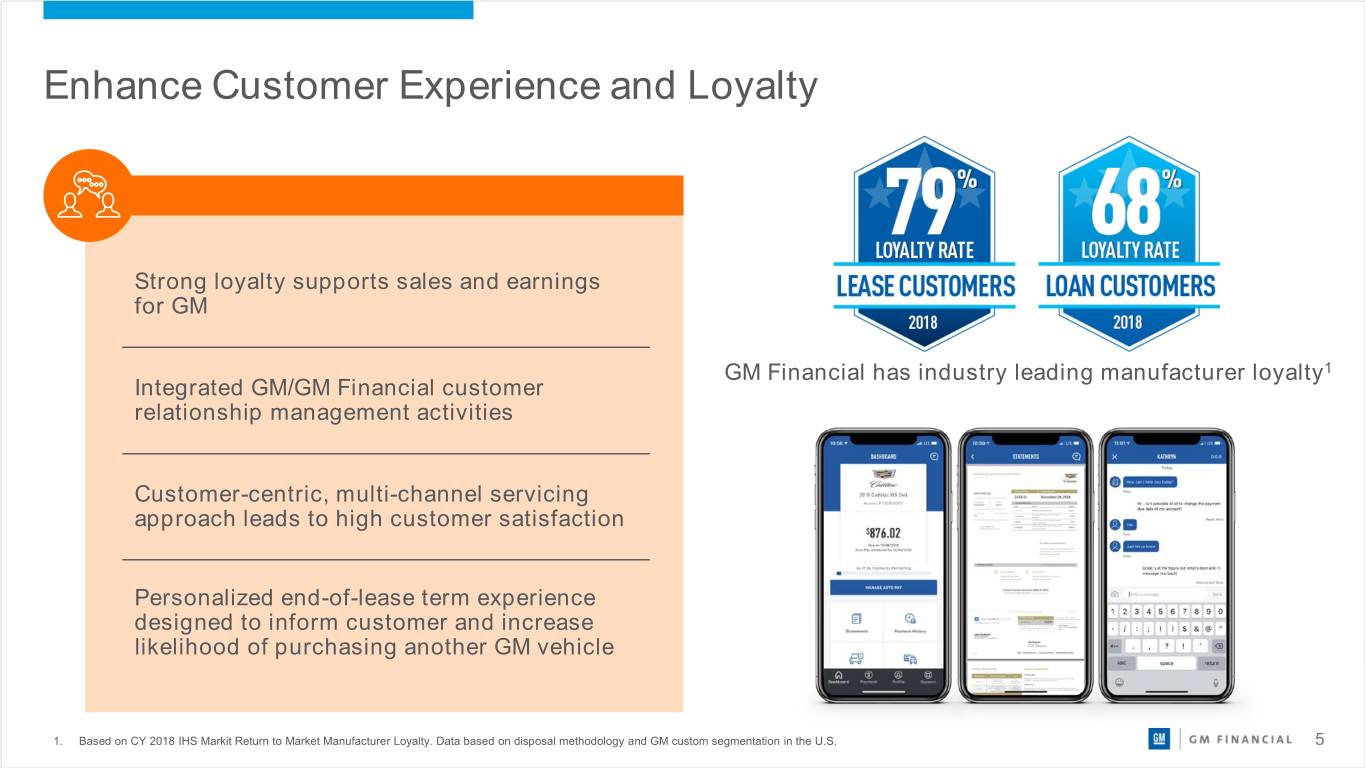

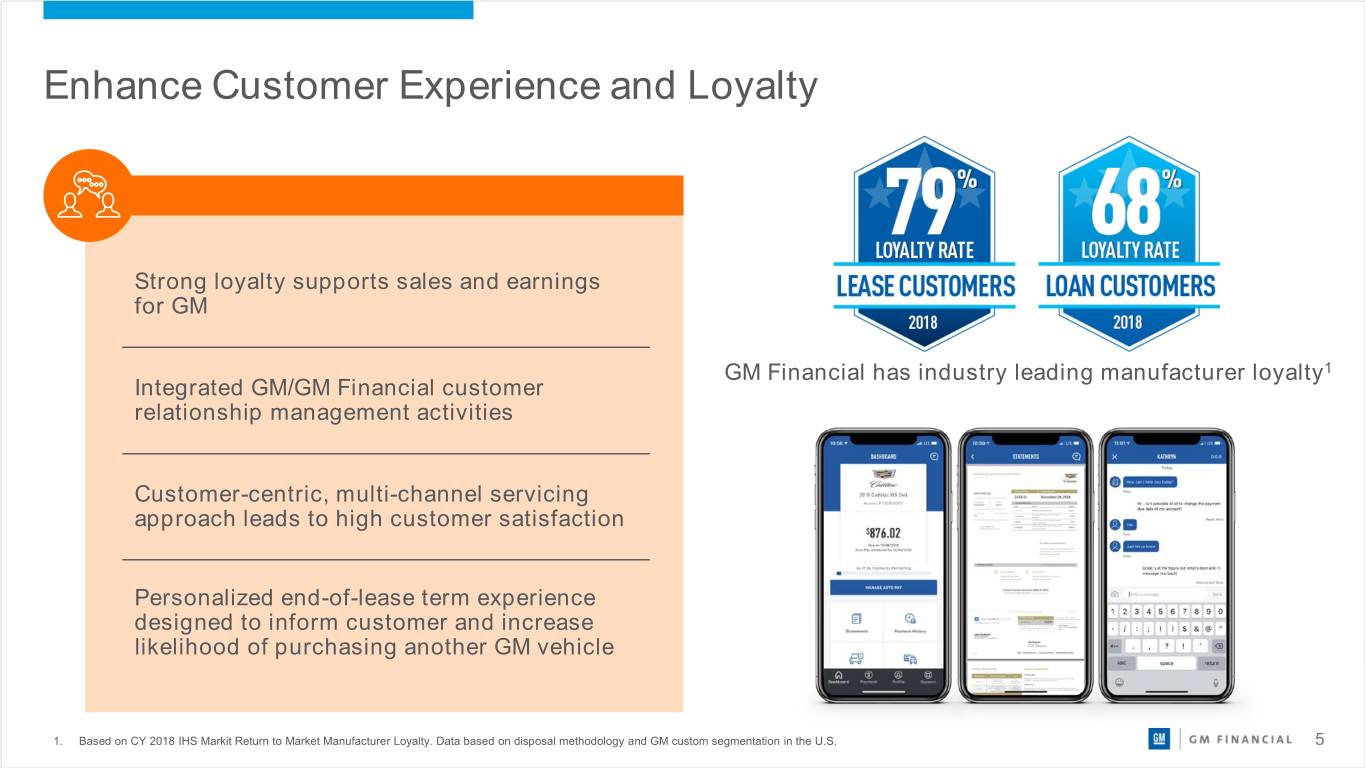

Enhance Customer Experience and Loyalty Strong loyalty supports sales and earnings for GM GM Financial has industry leading manufacturer loyalty1 Integrated GM/GM Financial customer relationship management activities Customer-centric, multi-channel servicing approach leads to high customer satisfaction Personalized end-of-lease term experience designed to inform customer and increase likelihood of purchasing another GM vehicle 1. Based on CY 2018 IHS Markit Return to Market Manufacturer Loyalty. Data based on disposal methodology and GM custom segmentation in the U.S. 5

Provide Support Across Economic Cycles Available Liquidity ($B) $26.2 $27.2 $17.9 Maintain strong liquidity position Dec 31, 2017 Dec 31, 2018 Sep 30, 2019 Manage leverage ratio within target of ~10x Borrowing capacity Cash Leverage Ratio1 Execute diversified funding plan with Managerial Target ~10x unsecured debt mix ~50% 9.49x 9.05x 8.36x Committed to investment grade rating; critical for captive strategy execution Dec 31, 2017 Dec 31, 2018 Sep 30, 2019 1. Calculated consistent with GM/GM Financial Support Agreement, filed with the Securities and Exchange Commission as an exhibit to our Current Report on Form 8-K dated April 18, 2018 6

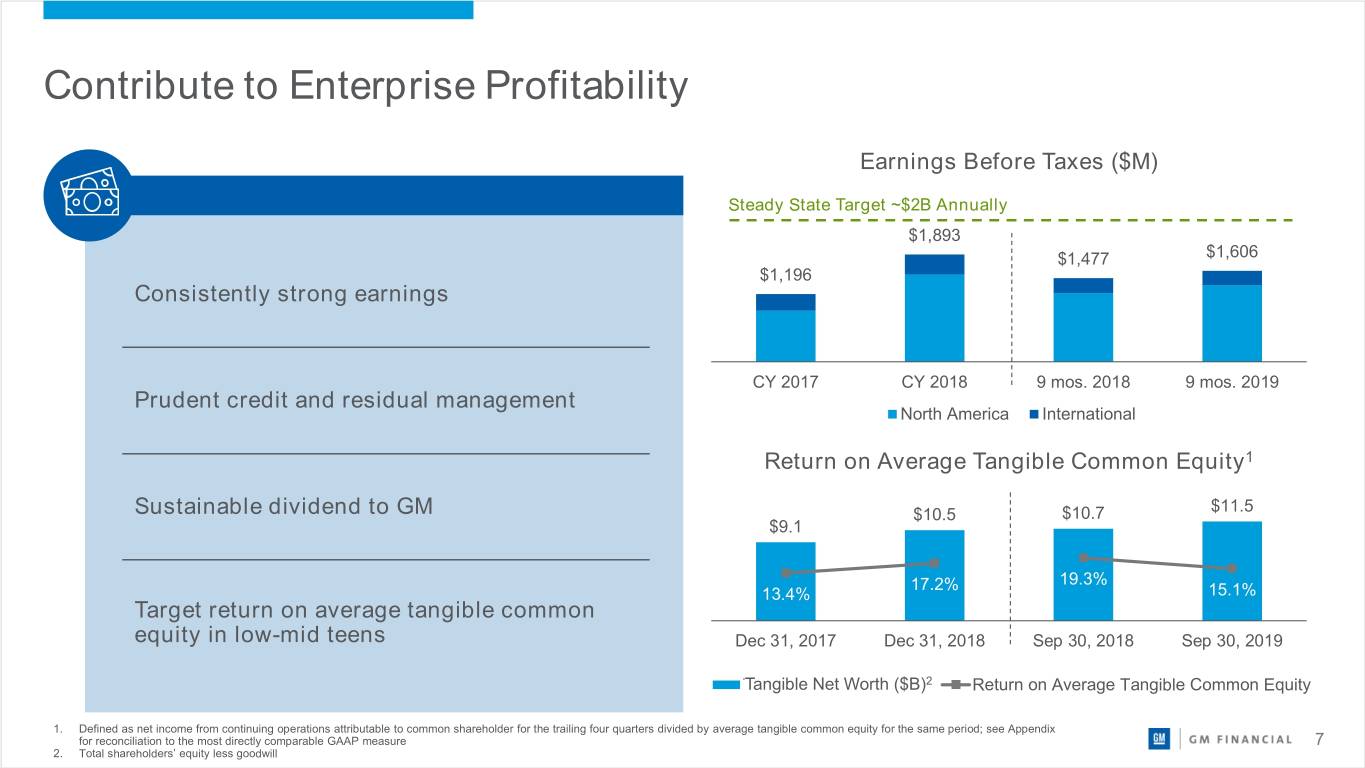

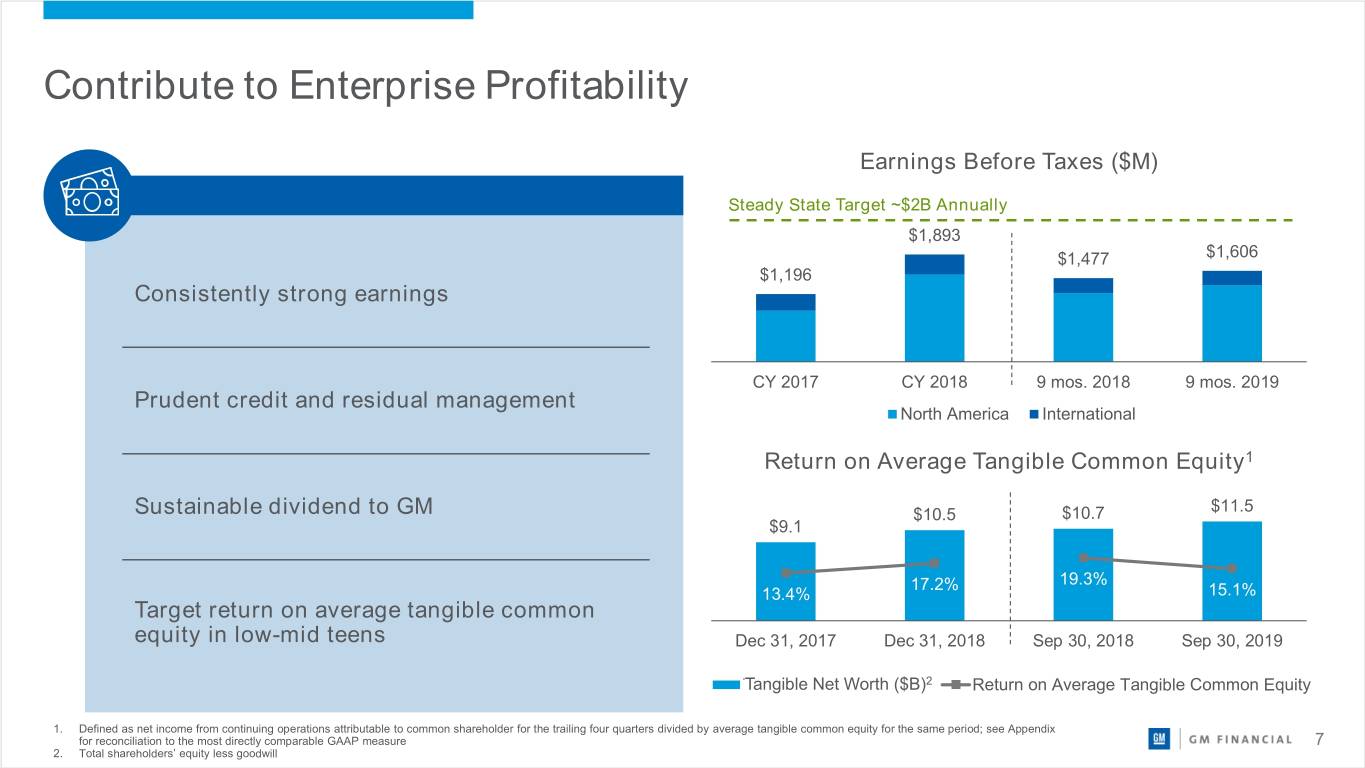

Contribute to Enterprise Profitability Earnings Before Taxes ($M) Steady State Target ~$2B Annually $1,893 $1,477 $1,606 $1,196 Consistently strong earnings CY 2017 CY 2018 9 mos. 2018 9 mos. 2019 Prudent credit and residual management North America International Return on Average Tangible Common Equity1 $11.5 Sustainable dividend to GM $10.5 $10.7 $9.1 17.2% 19.3% 13.4% 15.1% Target return on average tangible common equity in low-mid teens Dec 31, 2017 Dec 31, 2018 Sep 30, 2018 Sep 30, 2019 TangibleTangible Net Worth ($B)2 Return on Average Tangible Common Equity 1. Defined as net income from continuing operations attributable to common shareholder for the trailing four quarters divided by average tangible common equity for the same period; see Appendix for reconciliation to the most directly comparable GAAP measure 7 2. Total shareholders’ equity less goodwill

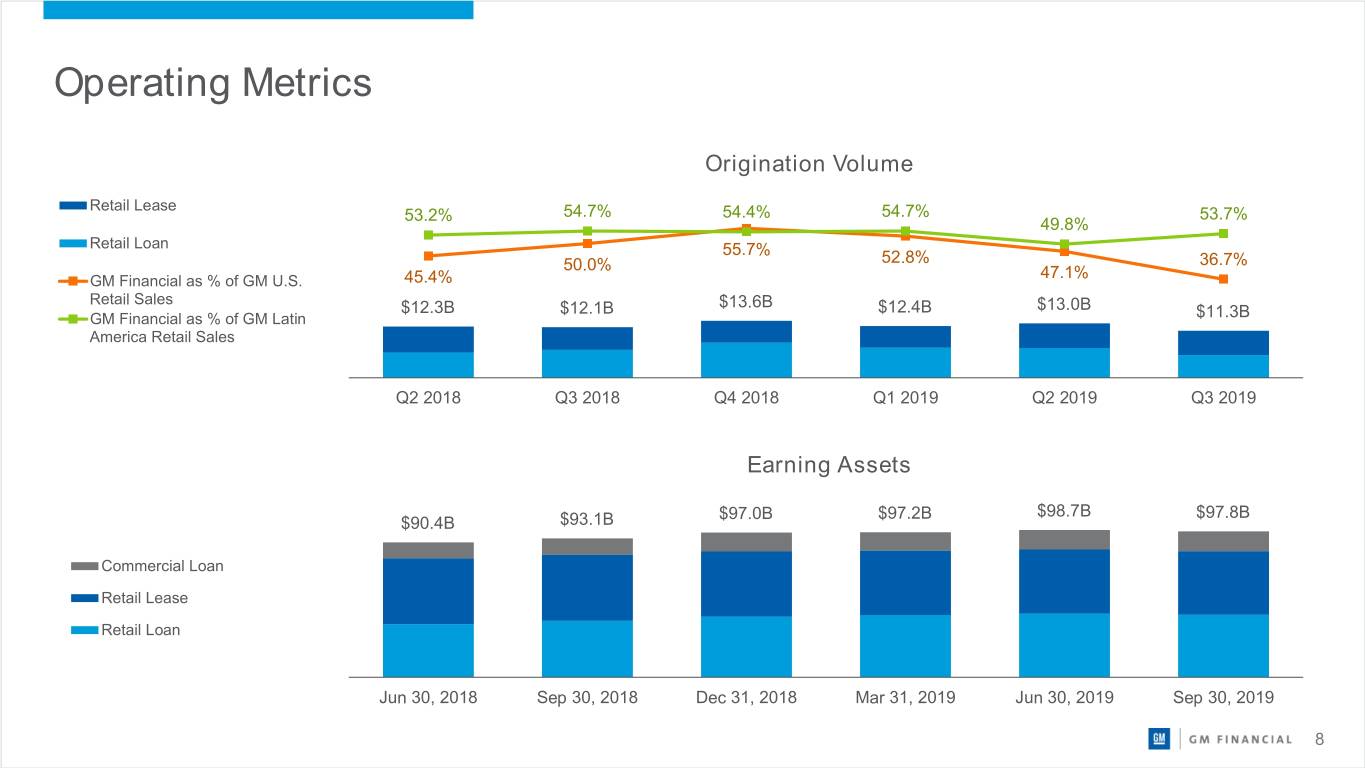

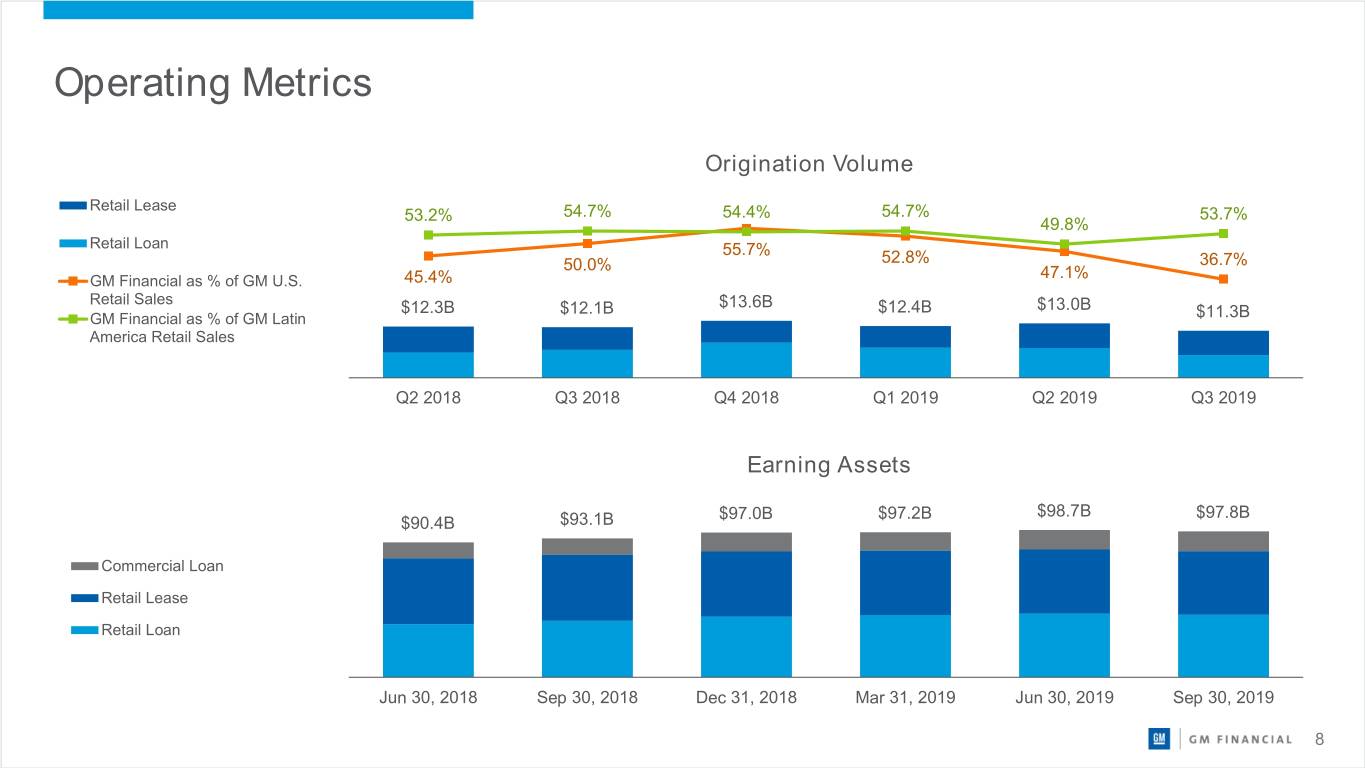

Operating Metrics Origination Volume Retail Lease 53.2% 54.7% 54.4% 54.7% 53.7% 49.8% Retail Loan 55.7% 50.0% 52.8% 36.7% GM Financial as % of GM U.S. 45.4% 47.1% Retail Sales $12.3B $12.1B $13.6B $12.4B $13.0B GM Financial as % of GM Latin $11.3B America Retail Sales Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Earning Assets $97.0B $97.2B $98.7B $97.8B $90.4B $93.1B Commercial Loan Retail Lease Retail Loan Hold Jun 30, 2018 Sep 30, 2018 Dec 31, 2018 Mar 31, 2019 Jun 30, 2019 Sep 30, 2019 8

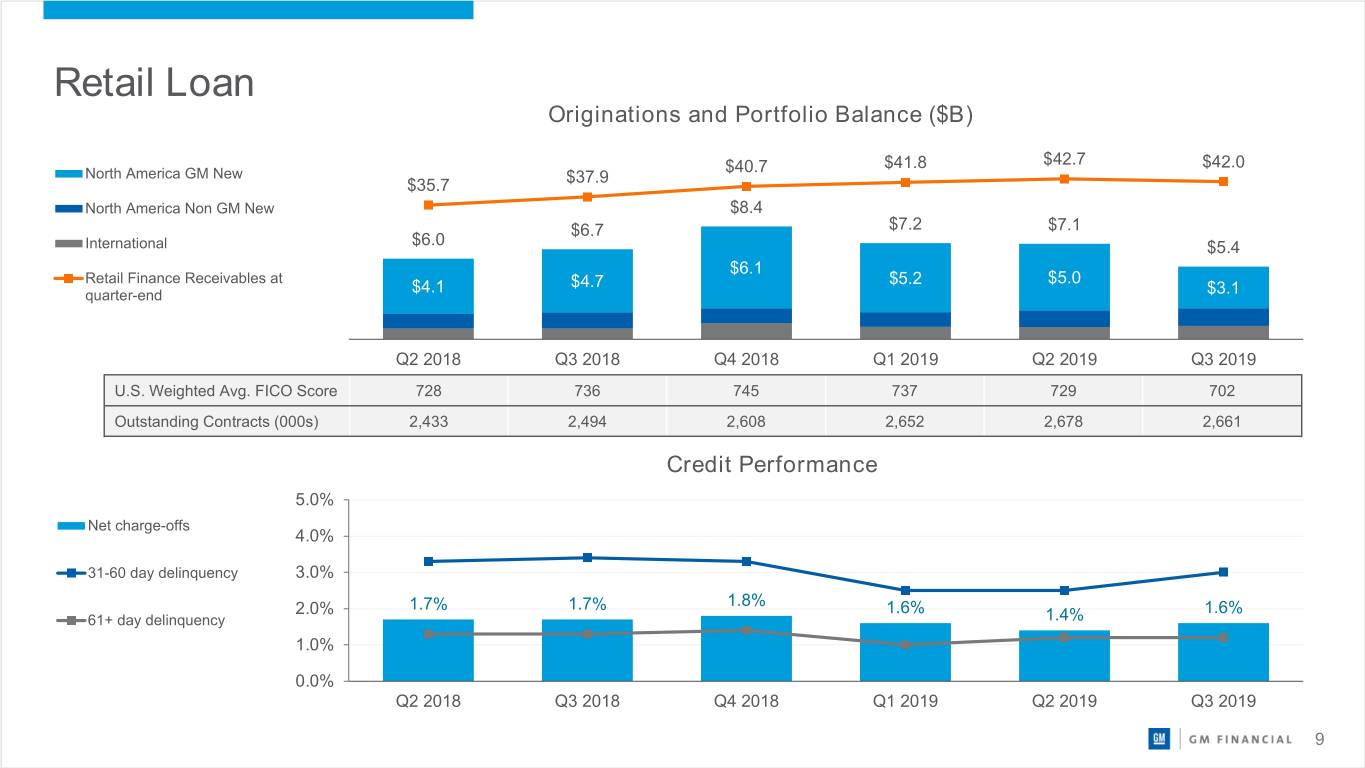

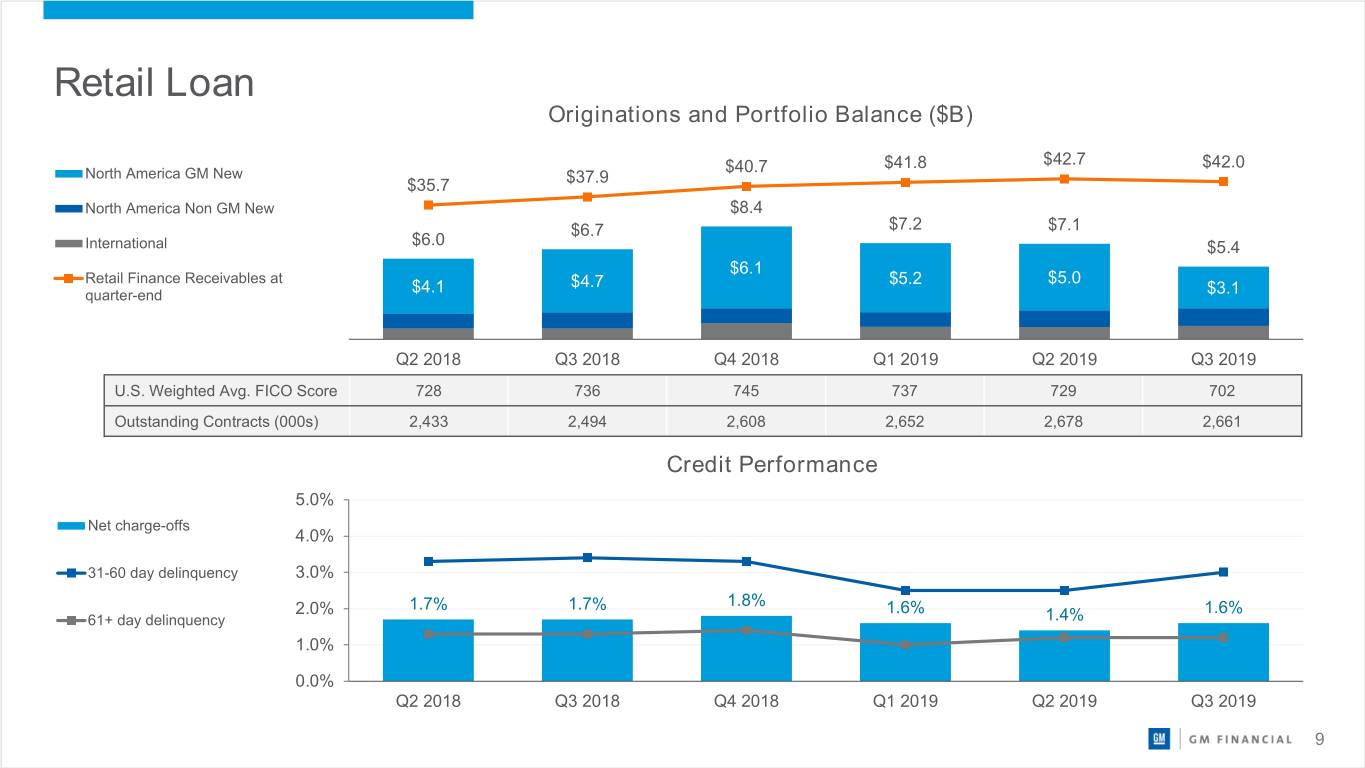

Retail Loan Originations and Portfolio Balance ($B) $41.8 $42.7 $42.0 North America GM New $40.7 $35.7 $37.9 North America Non GM New $8.4 $6.7 $7.2 $7.1 International $6.0 $5.4 $6.1 Retail Finance Receivables at $4.7 $5.2 $5.0 quarter-end $4.1 $3.1 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 U.S. Weighted Avg. FICO Score 728 736 745 737 729 702 Outstanding Contracts (000s) 2,433 2,494 2,608 2,652 2,678 2,661 Credit Performance 5.0% Net charge-offs 4.0% 31-60 day delinquency 3.0% 2.0% 1.7% 1.7% 1.8% 1.6% 1.6% 61+ day delinquency 1.4% 1.0% 0.0% Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 9

Retail Lease Originations and Portfolio Balance ($B) $44.1 $44.1 $43.6 $43.1 $42.9 $42.5 Other Volume $6.2 $5.9 $5.8 $5.4 $5.2 $5.2 U.S. Volume Lease portfolio at quarter-end $5.7 $5.5 $5.5 $5.0 $4.9 $5.0 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 GM Type of U.S. Sale – Lease1 26% 24% 23% 26% 24% 23% U.S. Weighted Avg. FICO Score 772 772 773 772 774 775 Outstanding Contracts (000s) 1,699 1,710 1,703 1,687 1,668 1,638 1. Lease as a percentage of GM U.S. retail sales mix (Source: J.D. Power and Associates’ Power Information Network PIN) 10

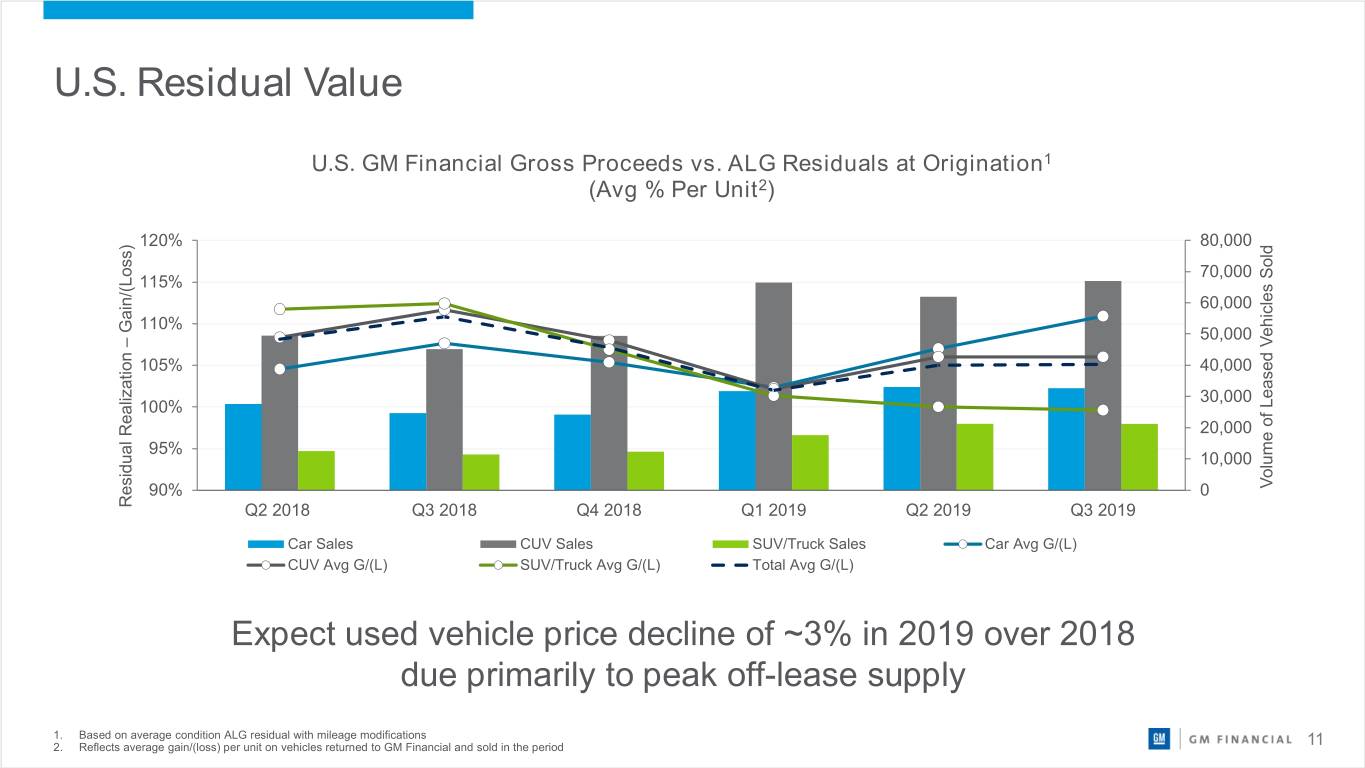

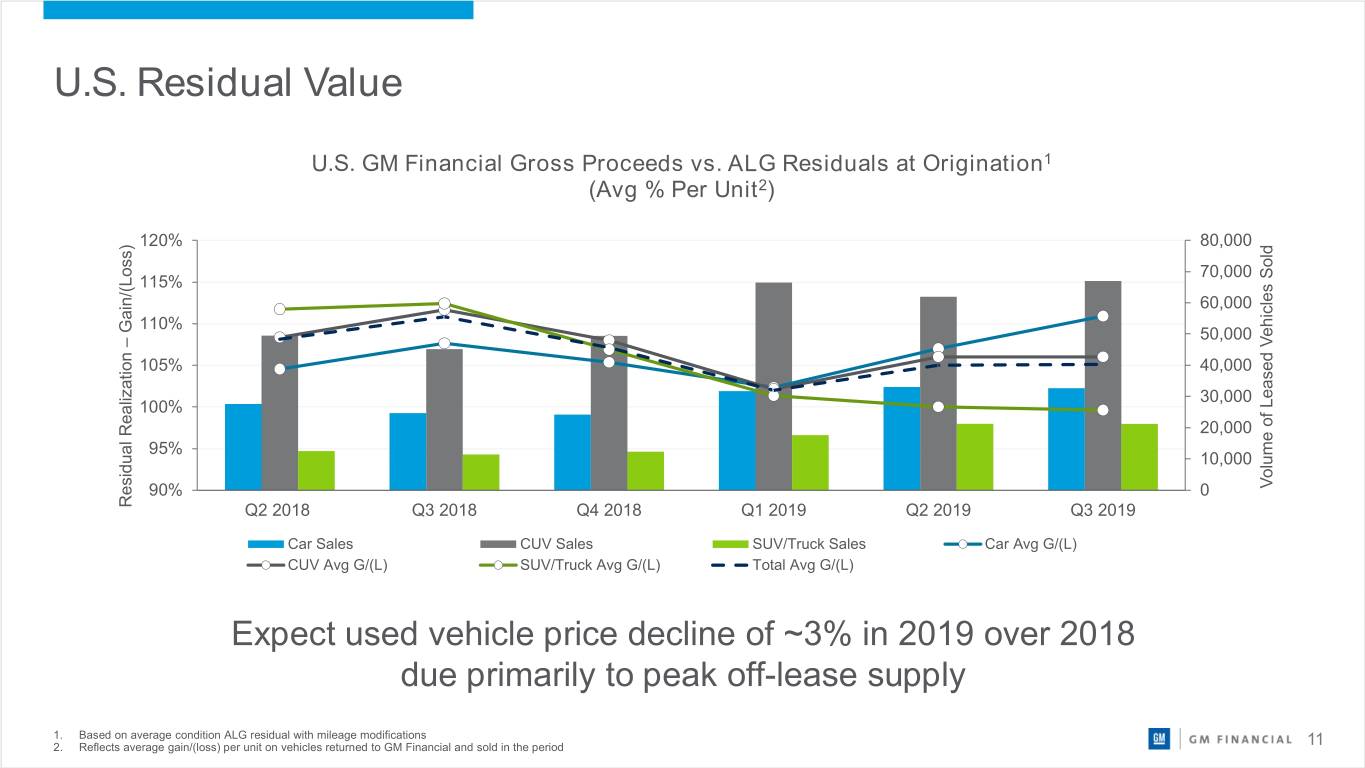

U.S. Residual Value U.S. GM Financial Gross Proceeds vs. ALG Residuals at Origination1 (Avg % Per Unit2) 120% 80,000 70,000 115% 60,000 Gain/(Loss) 110% 50,000 – 105% 40,000 30,000 100% 20,000 95% 10,000 90% 0 Sold Leased Vehicles of Volume Residual Realization Residual Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Car Sales CUV Sales SUV/Truck Sales Car Avg G/(L) CUV Avg G/(L) SUV/Truck Avg G/(L) Total Avg G/(L) Expect used vehicle price decline of ~3% in 2019 over 2018 due primarily to peak off-lease supply 1. Based on average condition ALG residual with mileage modifications 2. Reflects average gain/(loss) per unit on vehicles returned to GM Financial and sold in the period 11

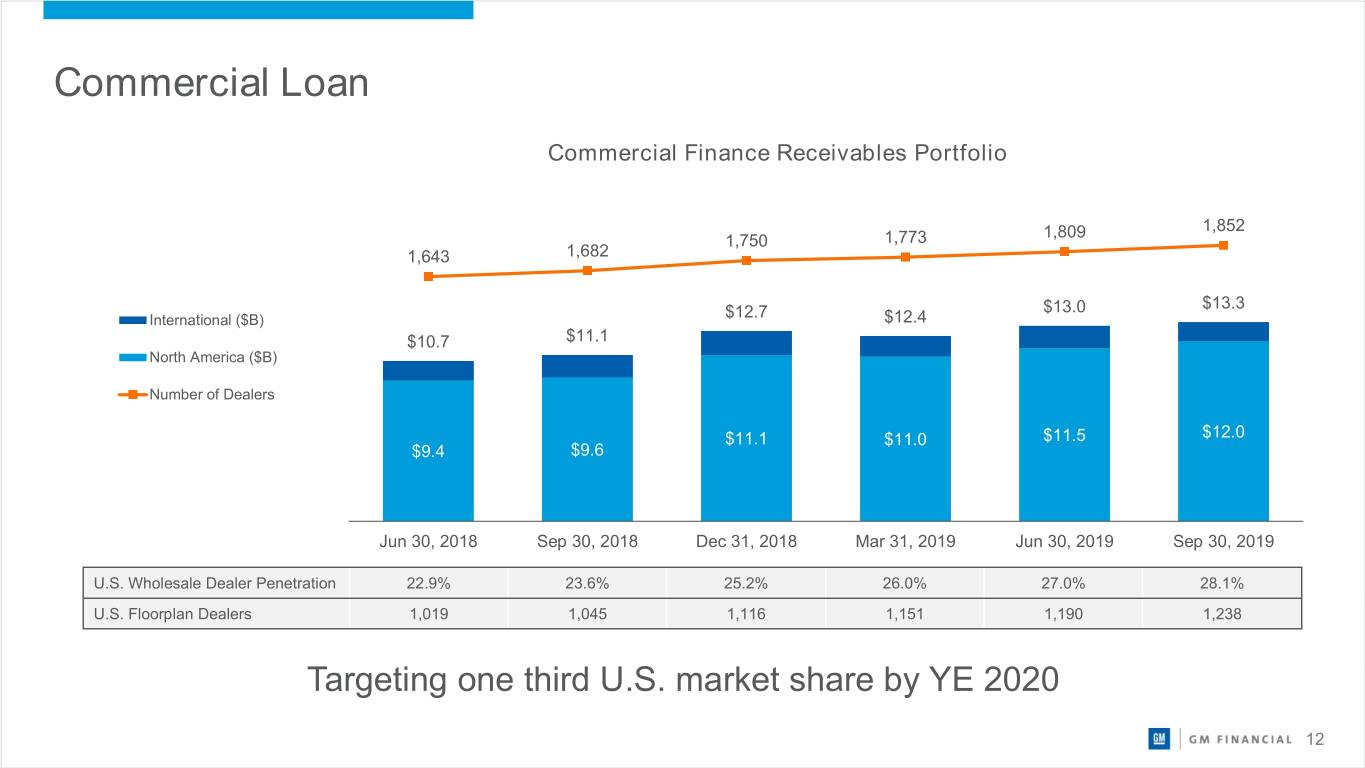

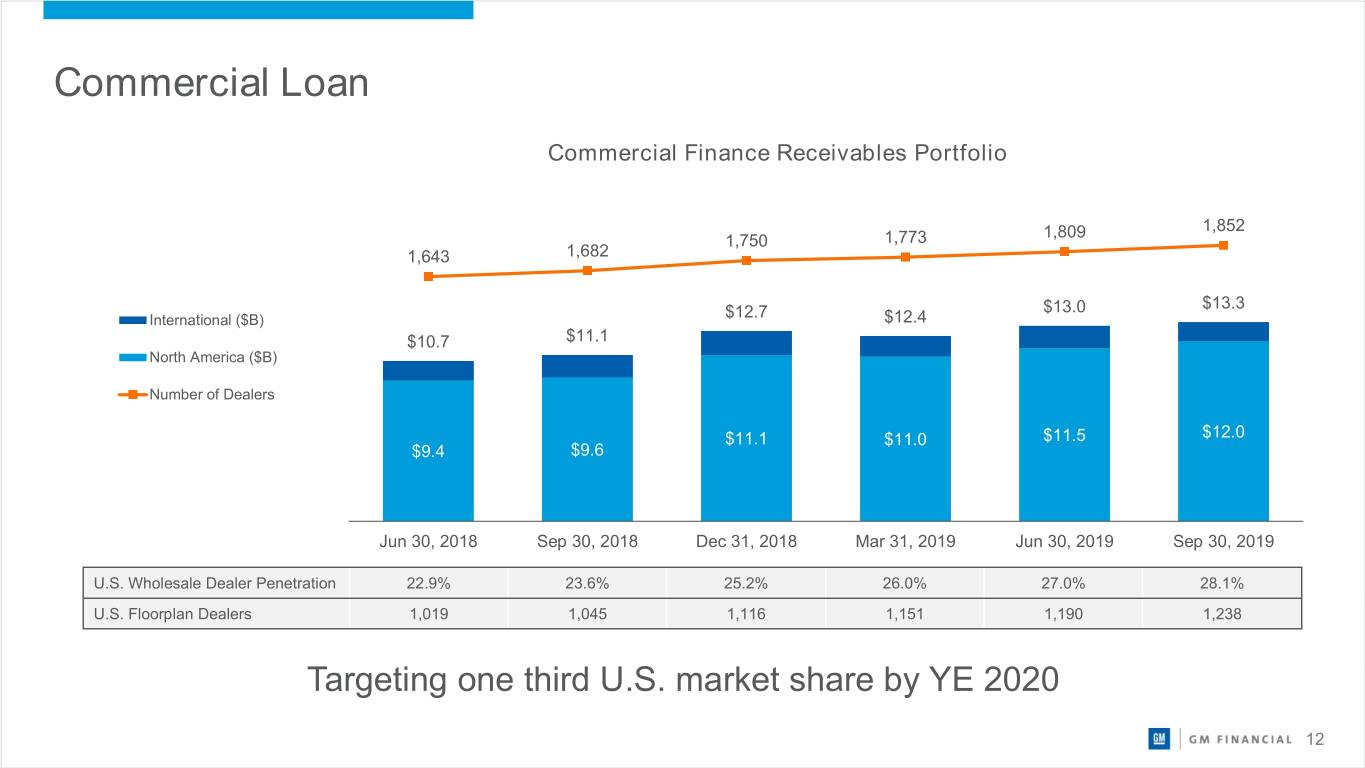

Commercial Loan Commercial Finance Receivables Portfolio 1,809 1,852 1,750 1,773 1,643 1,682 $13.0 $13.3 International ($B) $12.7 $12.4 $10.7 $11.1 North America ($B) Number of Dealers $11.1 $11.0 $11.5 $12.0 $9.4 $9.6 Jun 30, 2018 Sep 30, 2018 Dec 31, 2018 Mar 31, 2019 Jun 30, 2019 Sep 30, 2019 U.S. Wholesale Dealer Penetration 22.9% 23.6% 25.2% 26.0% 27.0% 28.1% U.S. Floorplan Dealers 1,019 1,045 1,116 1,151 1,190 1,238 Targeting one third U.S. market share by YE 2020 12

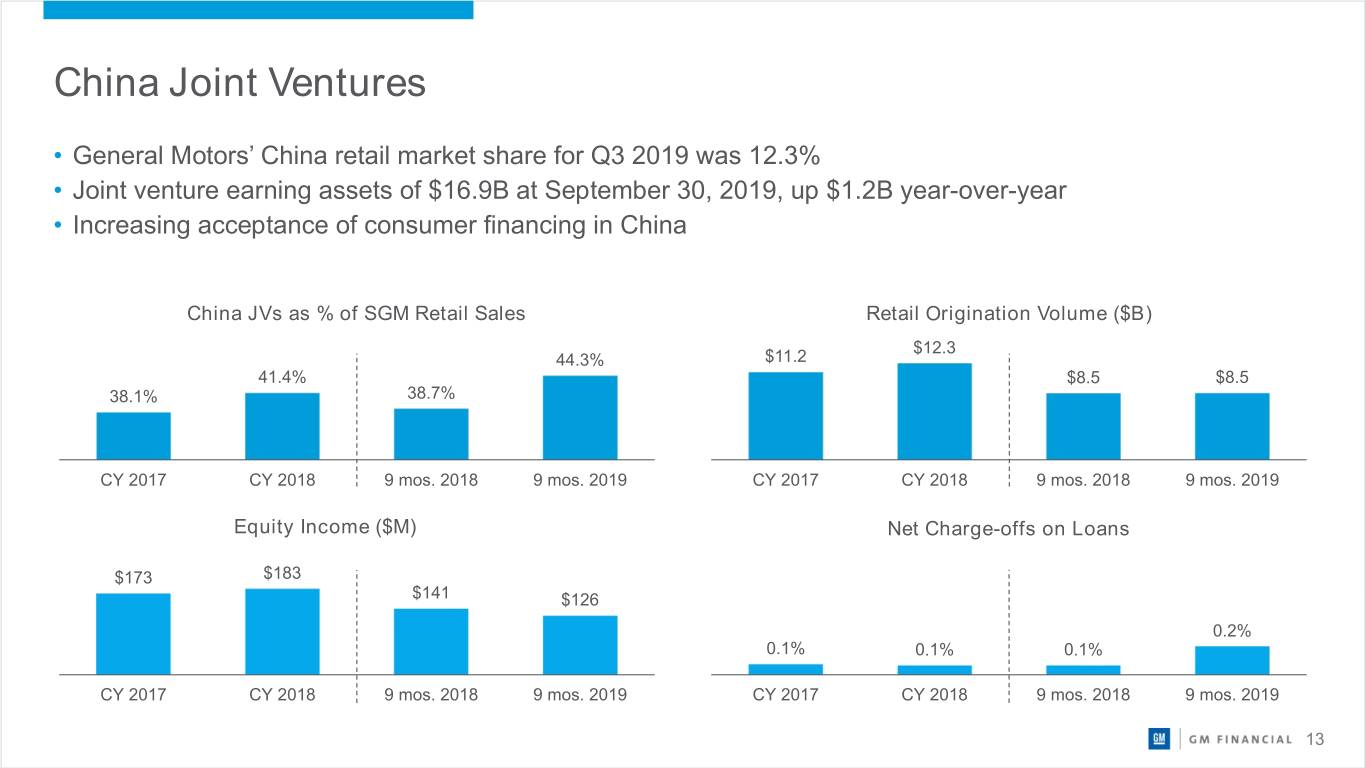

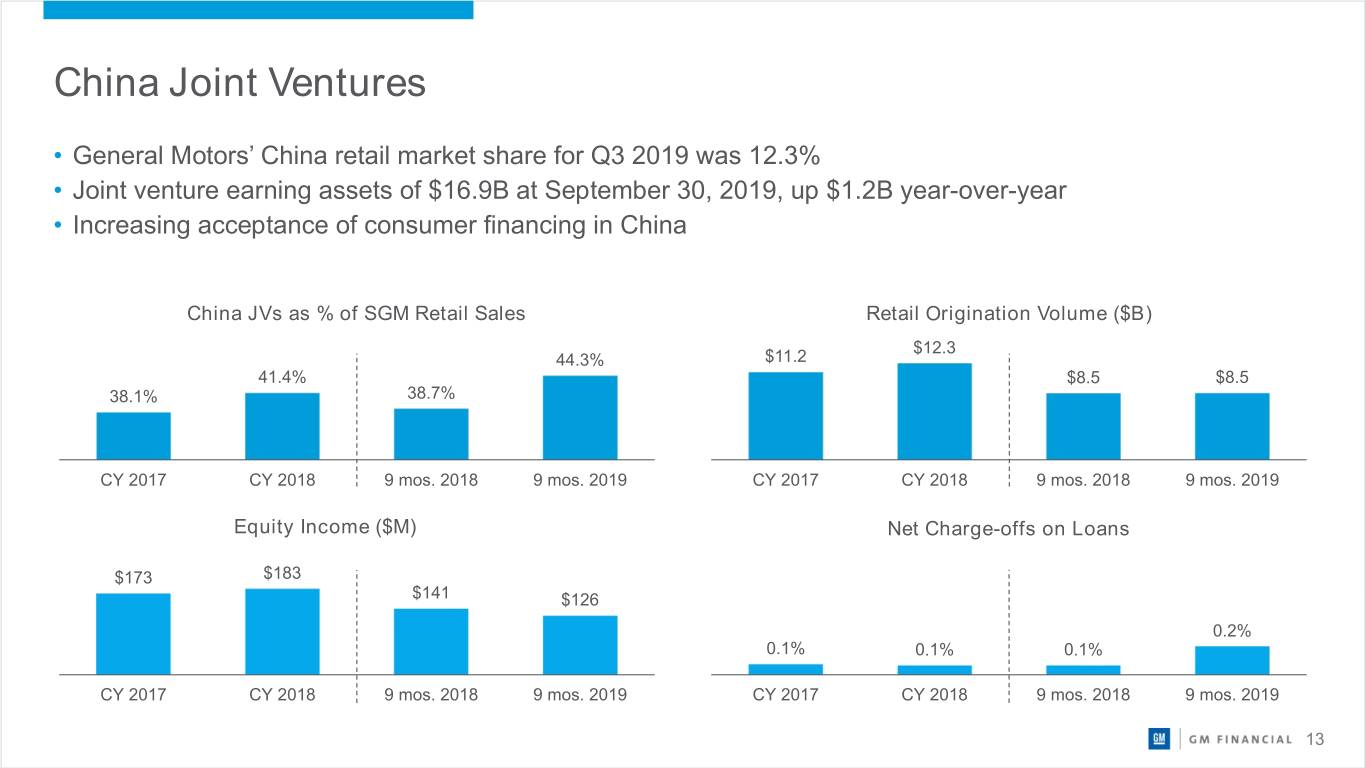

China Joint Ventures • General Motors’ China retail market share for Q3 2019 was 12.3% • Joint venture earning assets of $16.9B at September 30, 2019, up $1.2B year-over-year • Increasing acceptance of consumer financing in China China JVs as % of SGM Retail Sales Retail Origination Volume ($B) $12.3 44.3% $11.2 41.4% $8.5 $8.5 38.1% 38.7% CY 2017 CY 2018 9 mos. 2018 9 mos. 2019 CY 2017 CY 2018 9 mos. 2018 9 mos. 2019 Equity Income ($M) Net Charge-offs on Loans $173 $183 $141 $126 0.2% 0.1% 0.1% 0.1% CY 2017 CY 2018 9 mos. 2018 9 mos. 2019 CY 2017 CY 2018 9 mos. 2018 9 mos. 2019 13

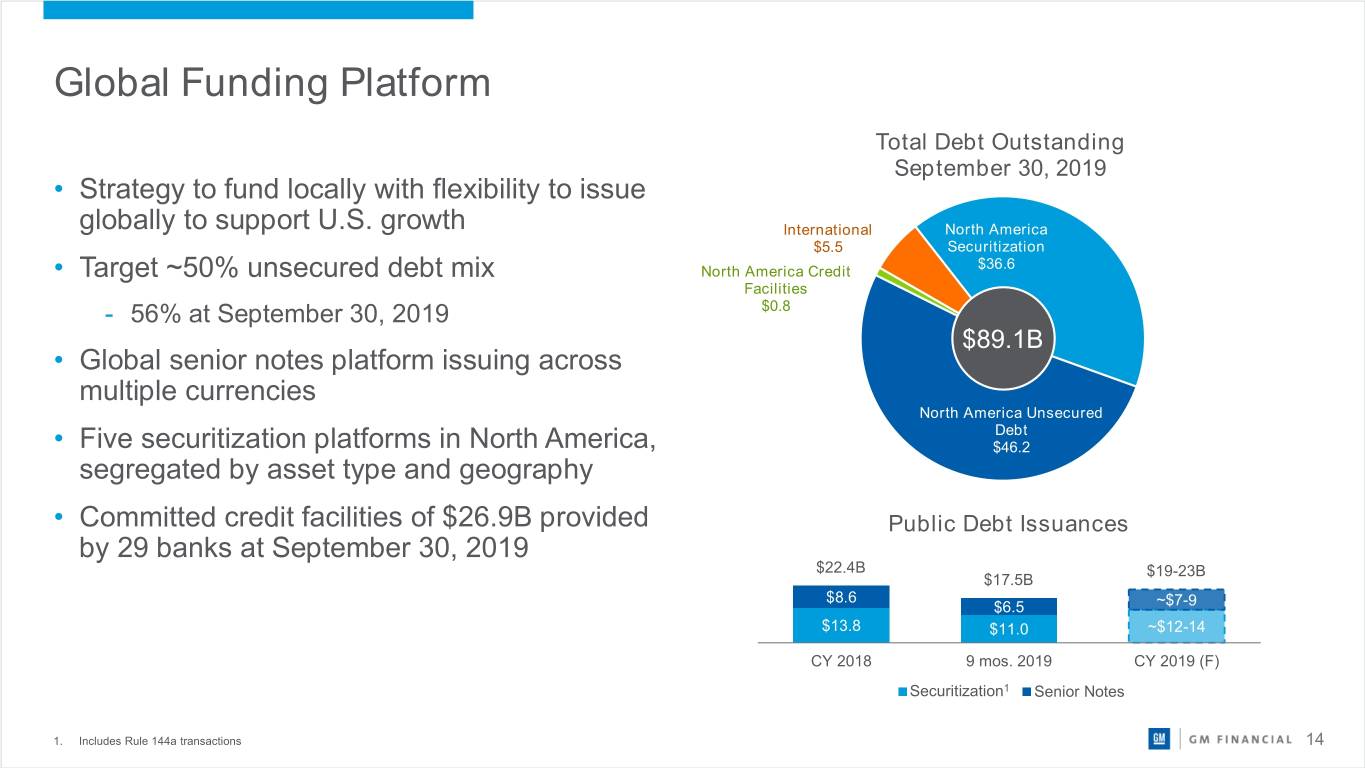

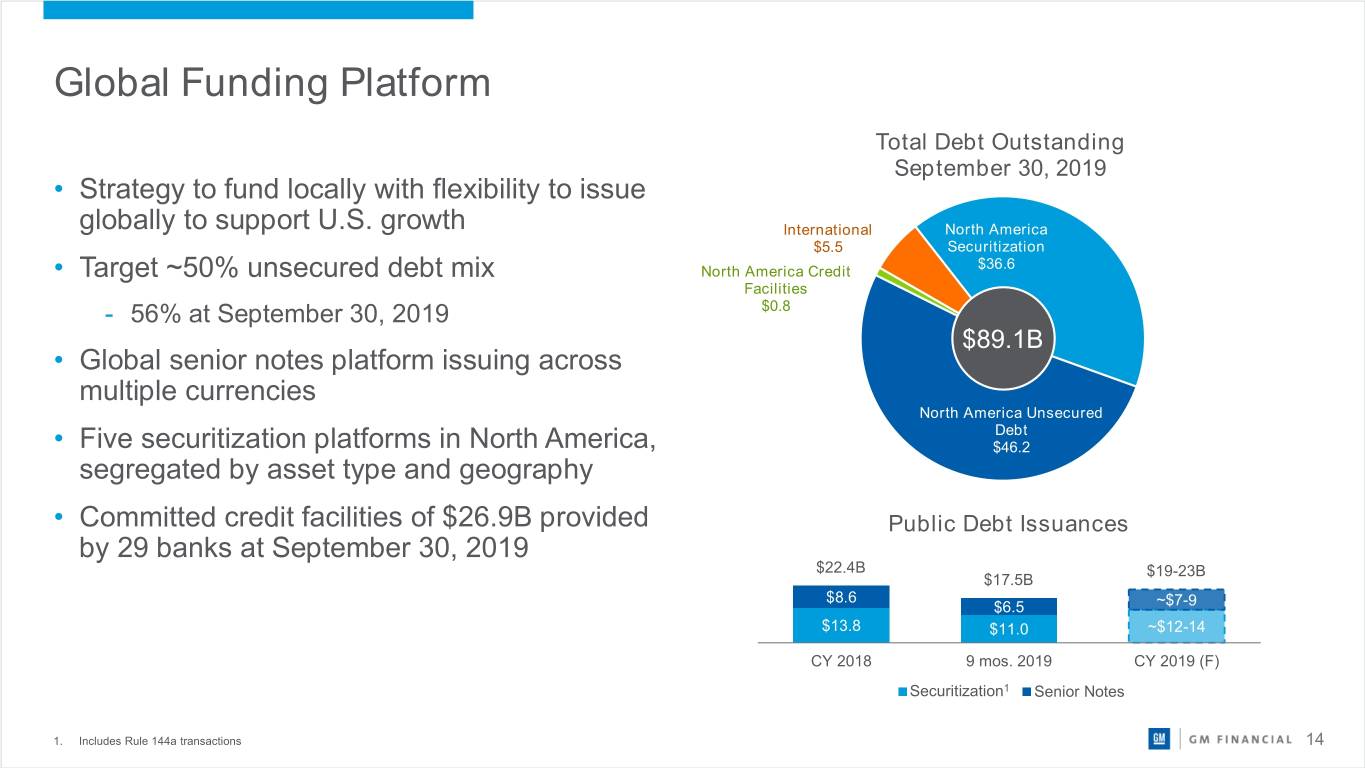

Global Funding Platform Total Debt Outstanding September 30, 2019 • Strategy to fund locally with flexibility to issue globally to support U.S. growth International North America $5.5 Securitization $36.6 • Target ~50% unsecured debt mix North America Credit Facilities - 56% at September 30, 2019 $0.8 $89.1B • Global senior notes platform issuing across multiple currencies North America Unsecured Debt • Five securitization platforms in North America, $46.2 segregated by asset type and geography • Committed credit facilities of $26.9B provided Public Debt Issuances by 29 banks at September 30, 2019 $22.4B $19-23B $17.5B $8.6 $6.5 ~$7-9 $13.8 $11.0 ~$12-14 CY 2018 9 mos. 2019 CY 2019 (F) Securitization1 Senior Notes 1. Includes Rule 144a transactions 14

Financial Support from GM • Support Agreement between GM and GM Financial solidifies GM Financial as core component of GM’s business and strengthens ability to support GM’s strategy • Requires 100% voting ownership of GM Financial by GM as long as GM Financial has unsecured debt securities outstanding • Augments GM Financial’s liquidity position through $1.0B junior subordinated unsecured credit line from GM, and exclusive access to $2.0B, 364-day tranche of GM’s Revolving Credit Facility • Establishes leverage limits and provides capital support if needed - Leverage limits (Net Earning Assets divided by Adjusted Equity; including any amount outstanding on the Junior Subordinated Revolving Credit Facility) above the thresholds triggers funding request from GM Financial to GM1 Leverage limit of 11.5x at September 30, 2019; increases to 12.0x when Net Earning Assets exceed $100B 1. Measured at each calendar quarter 15

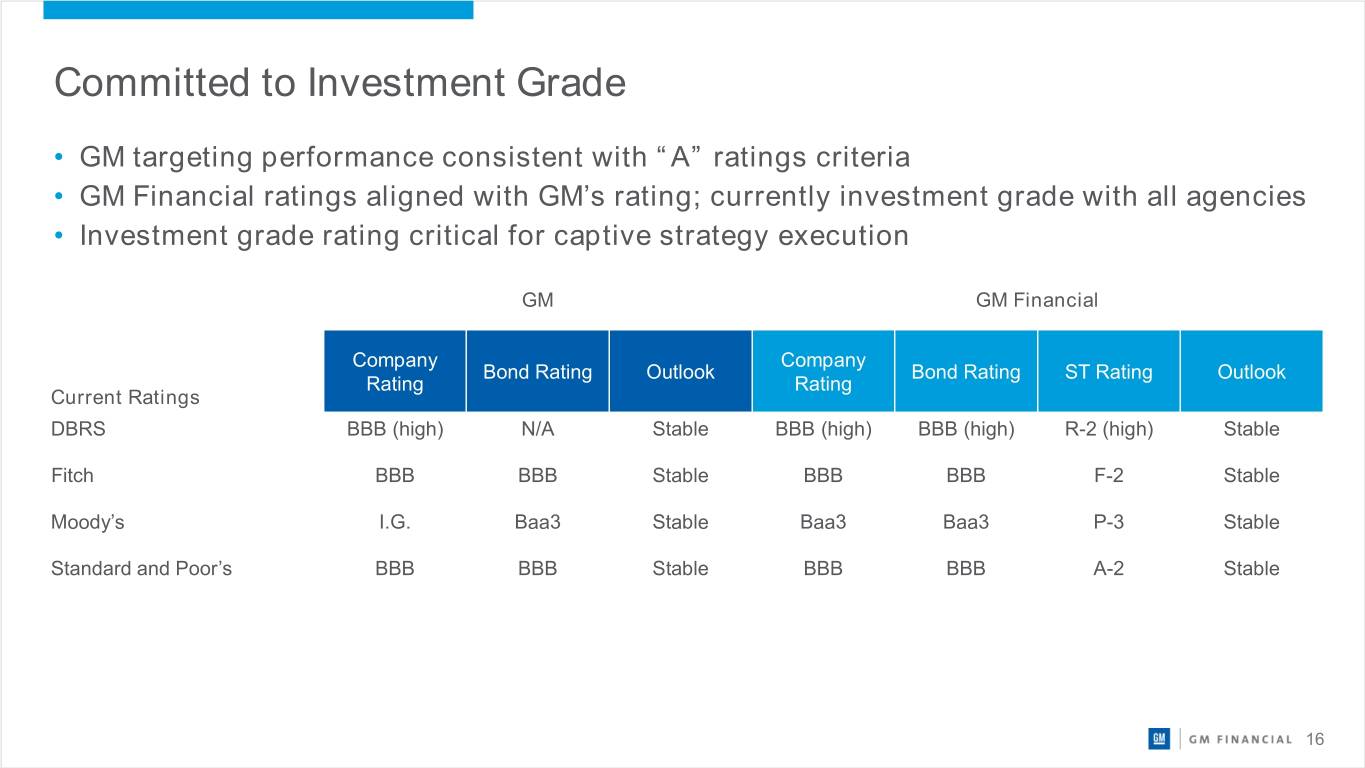

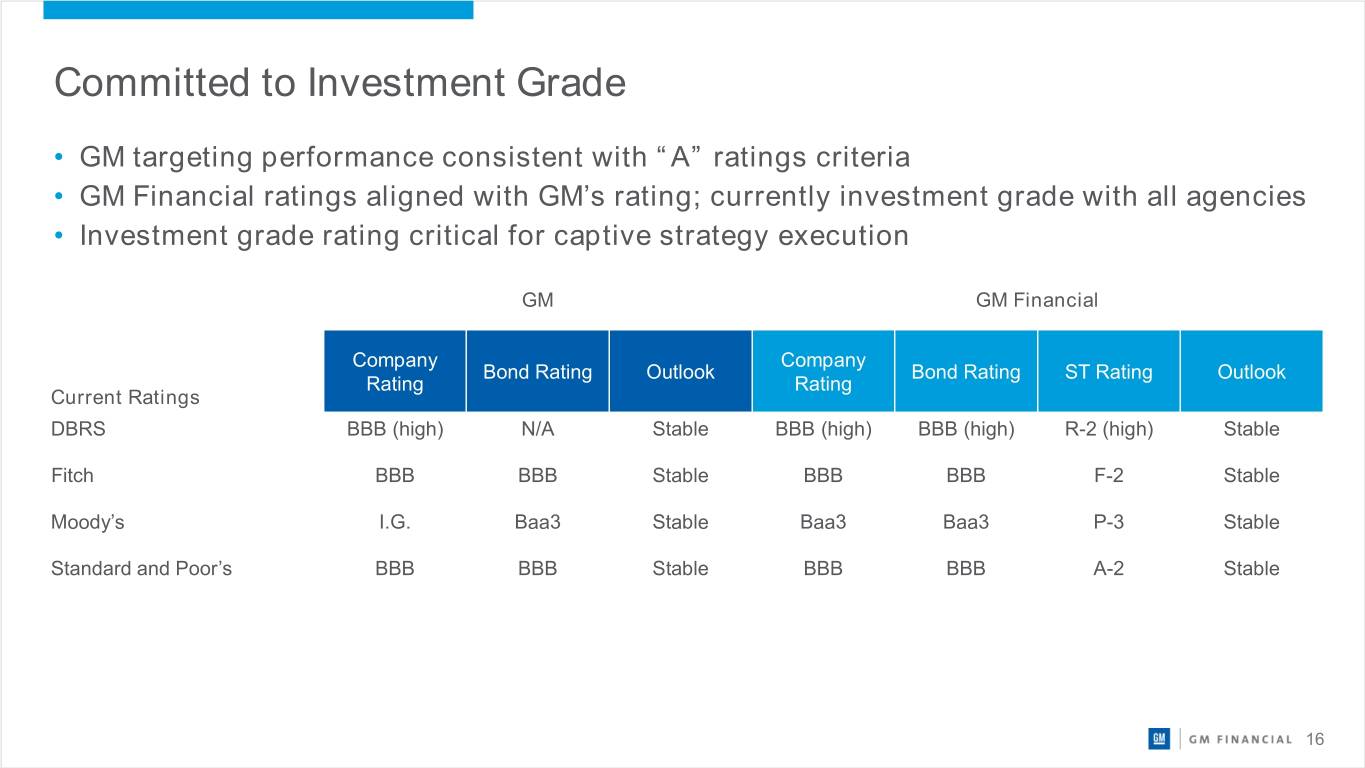

Committed to Investment Grade • GM targeting performance consistent with “A” ratings criteria • GM Financial ratings aligned with GM’s rating; currently investment grade with all agencies • Investment grade rating critical for captive strategy execution GM GM Financial Company Company Bond Rating Outlook Bond Rating ST Rating Outlook Rating Rating Current Ratings DBRS BBB (high) N/A Stable BBB (high) BBB (high) R-2 (high) Stable Fitch BBB BBB Stable BBB BBB F-2 Stable Moody’s I.G. Baa3 Stable Baa3 Baa3 P-3 Stable Standard and Poor’s BBB BBB Stable BBB BBB A-2 Stable 16

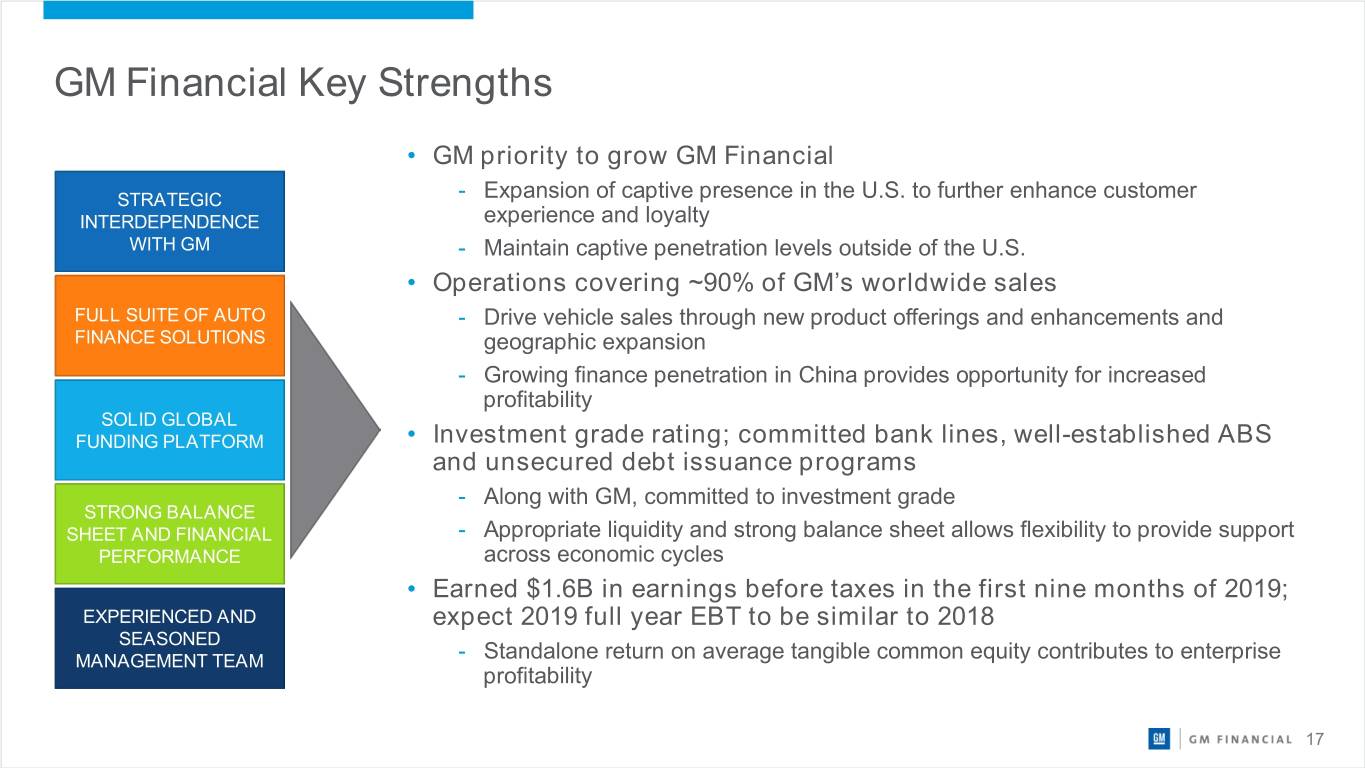

GM Financial Key Strengths • GM priority to grow GM Financial STRATEGIC - Expansion of captive presence in the U.S. to further enhance customer INTERDEPENDENCE experience and loyalty WITH GM - Maintain captive penetration levels outside of the U.S. • Operations covering ~90% of GM’s worldwide sales FULL SUITE OF AUTO - Drive vehicle sales through new product offerings and enhancements and FINANCE SOLUTIONS geographic expansion - Growing finance penetration in China provides opportunity for increased profitability SOLID GLOBAL FUNDING PLATFORM • Investment grade rating; committed bank lines, well-established ABS and unsecured debt issuance programs - Along with GM, committed to investment grade STRONG BALANCE SHEET AND FINANCIAL - Appropriate liquidity and strong balance sheet allows flexibility to provide support PERFORMANCE across economic cycles • Earned $1.6B in earnings before taxes in the first nine months of 2019; EXPERIENCED AND expect 2019 full year EBT to be similar to 2018 SEASONED MANAGEMENT TEAM - Standalone return on average tangible common equity contributes to enterprise profitability 17

Appendix GM Financial Return on Average Common Equity Four Quarters Ended Dec 31, Dec 31, Sep 30, Sep 30, 2017 2018 2018 2019 Net income attributable to common shareholder $645 $1,504 $1,389 $1,418 Plus: loss from discontinued operations, net of tax 424 -- 255 -- Net income from continuing operations attributable to common shareholder 1,069 1,504 1,644 1,418 Average equity 9,451 11,049 10,748 12,070 Less: average preferred equity (303) (1,136) (1,023) (1,476) Average common equity 9,148 9,913 9,725 10,594 Less: average goodwill (1,199) (1,192) (1,195) (1,187) Average tangible common equity $7,949 $8,721 $8,530 $9,407 Return on average common equity 11.7% 15.2% 16.9% 13.4% Return on average tangible common equity1 13.4% 17.2% 19.3% 15.1% 1. Defined as net income from continuing operations attributable to common shareholder for the trailing four quarters divided by average tangible common equity for the same period 18

2020 Buick Encore GX 19