“** Confidential Treatment Requested” indicates portions of this document that have been deleted from this document and have been separately filed with the Securities and Exchange Commission.

| | |

| | HUNTON & WILLIAMS LLP FOUNTAIN PLACE 1445 ROSS AVENUE SUITE 3700 DALLAS, TEXAS 75202-2799 TEL 214 • 979 • 3000 FAX 214 • 880 • 0011 |

| |

| | GREGORY J. SCHMITT DIRECT DIAL: (214) 468-3375 DIRECT FAX: (214) 740-7166 EMAIL:GSCHMITT@HUNTON.COM |

| |

January 23, 2012 | | FILE NO: 70131-000133 |

| |

| | |

United States Securities and Exchange Commission | | VIA EDGAR |

101 F Street, NE | | |

Washington, DC 20549 | | |

Attention: Ms. Sharon M. Blume, Assistant Chief Accountant

| | Re: | General Motors Financial Company, Inc. |

| | | Amendment No. 2 to Registration Statement on Form S-4 (the “Registration |

Ladies and Gentlemen:

On behalf of General Motors Financial Company, Inc. (the “Company”), we are transmitting the following responses of the Company to the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), as set forth in the letter of Ms. Sharon M. Blume, Assistant Chief Accountant, dated December 16, 2011 (the “Comment Letter”), regarding the Registration Statement referenced above. The Company is filing on EDGAR these responses concurrently with the filing of Amendment No. 3 to the Registration Statement (the “Amendment”). The Amendment incorporates changes responsive to the comments set forth in the Comment Letter. For your convenience, we have repeated each comment in italics prior to the response. All references to page numbers in the discussion below each heading are to the pages in the Amendment. The references to page numbers in the headings are to the Amendment No. 2 to the Registration Statement.

Form S-4/A filed December 9, 2011

Note 2. Financial Statement Effects of the Merger, page F-16

| | 1. | We note your response to comment 26b in your October 31, 2011 letter where you state that your acquired loans individually met the first condition of ASC 825 that there was evidence of credit losses inherent in the pool of acquired loans. Please explain to us how you determined that each individual loan experienced credit deterioration since origination. Specifically tell us the credit analysis that you performed at the individual |

United States Securities and Exchange Commission

January 23, 2012

Page 2

| | loan level. Also, tell us if you believe each individual loan must show evidence of credit deterioration since origination in order to use the guidance in the AICPA confirming letter. If so, please tell us why you believe that. |

Company Response:

In the October 31, 2011 letter to the Staff, the Company inadvertently said that “the acquired loans individually met the first condition of ASC 825”. The Company supplementally advises the Staff that at the acquisition date the Company determined that it was probable that it would collect less than the contractual amount due on the pool of acquired loans. However, it was not possible for the Company to determine – on a loan-by-loan basis – which of the approximately 700,000 loans showed evidence of credit deterioration as of the date of the acquisition. Additionally, the Company supplementally advises the Staff that it does not believe that each “individual” loan must show evidence of credit deterioration in order to use the guidance in the AICPA confirming letter.

| | 2. | We note your response to comment 12a in your December 9, 2011 letter where you state that substantially all the acquired loan portfolio had custom credit scores ranging from 215 to 265. Please tell us if those credit scores were at the date of the acquisition or at origination of the loan. |

Company Response:

The Company supplementally advises the Staff that credit scores are determined at the origination of the loan and are not subsequently updated or rescored, i.e., the Company’s credit scores werenot as of the date of the acquisition. Further, it would not be practicable to “rescore” loans as a large part of the origination credit score is impacted by loan structure at the time of origination (e.g., down payment amount, debt-to-income and payment-to-income ratios, loan to value ratios, etc.). Finally, credit scores are a “snapshot” of an applicant’s credit quality at the date of origination, which may have subsequently improved or declined due to changes in the borrower’s financial or other circumstances since the date of origination.

| | 3. | We note your response to comment 14 in your December 9, 2011 letter where you state that you have one pool of sub-prime loans for your ASC 310-30 accounting and that you believe that all of the sub-prime loans have similar credit risk. We also note your disclosure on page 3 of your S-4/A #2 in which you disclose that you utilize a proprietary credit scoring system to support the credit approval process and that credit scoring is used to differentiate credit applications and to statistically rank-order credit risk in terms |

United States Securities and Exchange Commission

January 23, 2012

Page 3

of expected default rates, which enables you to evaluate credit applications for approval and tailor loan pricing and structure.

| | a. | Please provide us with information regarding your pricing matrix that details the range of interest rates offered to customers for each credit score. |

| | b. | Please explain to us how you considered the fact that your credit approval process differentiates customers based on credit risk characteristics in determining that all of your loans have similar credit risk related to your ASC 310-30 accounting. |

| | c. | Please provide us the expected default rates for a customer with a FICO score or equivalent proprietary credit score of 520, 560, 600 and 660. If the default rates are not similar, please explain why you believe these customers have similar credit risk related to your ASC 310-30 accounting. |

Company Response:

| | a. | The Company supplementally advises the Staff that the Company’s pricing matrix has Annual Percentage Rate’s (“APR’s”) ranging from slightly below 10% to over 20% within the sub-prime portfolio. Further, the Company supplementally advises the Staff that pricing is not solely tied to credit risk, but is highly judgmental and dependent on competitive and other factors. While the Company provides its underwriters with a pricing matrix with suggested pricing for various risk tiers, the underwriter has the ability and authority (within certain parameters) to price an individual loan as they deem appropriate and necessary given various judgmental, factors including the applicant’s credit profile, loan structure, the competitive environment, and the Company’s relationship with the selling/originating dealer and/or the applicant (in the case of an applicant that has a prior loan from the Company). |

The following table sets forth, by applicable FICO and custom credit score bands, the weighted average APR and range of APR’s for loans originated during the calendar year ended December 31, 2011:

Calendar Year December 2011 GM Financial APR and range of APR’s based on FICO and custom credit score:

United States Securities and Exchange Commission

January 23, 2012

Page 4

| | | | | | | | | | |

FICO | | **_** | | **_** | | **_** | | **_** | | |

Weighted Average APR | | **% | | **% | | **% | | **% | | |

Range | | **%-**% | | **%-**%

| | **%-**%

| | **%-**%

| | |

| | | | | |

Custom Credit Score | | <** | | **_** | | **_** | | **_** | | >** |

Weighted Average APR | | **% | | **% | | **% | | **% | | **% |

Range | | **%-**% | | **%-**% | | **%-**%

| | **%-**%

| | **%-**%

|

As illustrated in the table above, APR’s offered at the different score band levels, whether FICO or custom credit score, all have similar ranges.

| | b. | The Company supplementally advises the Staff that approximately $775 billion per year in auto loans are originated across the entire credit spectrum, i.e., prime through sub-prime (based on information obtained from CNW Marketing, JD Power PIN, and the Bureau of Economic Analysis). Of this amount, approximately $103 billion, or 11%, is considered sub-prime. Sub-prime is typically defined as a loan with a borrower that has a FICO score of less than 620. Auto finance industry participants, including investors and creditors, view prime, near-prime and sub-prime as distinct credit segments and the loan portfolios within these segments as having similar characteristics. The Company’s acquired portfolio consisted of a $0.5 billion prime portfolio, a $0.5 billion near-prime portfolio and a $7.7 billion predominately sub-prime portfolio. The Company utilized a prime, near-prime, and sub-prime split because of the way the portfolios are serviced, funded and managed. Additionally, the Company supplementally advises the Staff that the purchase price allocation at the acquisition date was done for the same three pools: prime, near-prime and sub-prime. Regarding funding of the Company’s loan portfolios, the Company had one funding facility for the prime/near prime portfolios and had one funding facility for the sub-prime portfolio. Additionally, the Company had two securitization platforms, one for the prime/near prime portfolios (the AmeriCredit Prime Automobile Receivables Trust platform), and one for the sub-prime portfolio (the AmeriCredit Automobile Receivables Trust platform). Based on the points above and the narrow credit band in which the Company originates loans, the Company believes these factors support the use of one sub-prime pool. |

The Company supplementally advises the Staff that the Company’s proprietary scoring system statistically rank orders credit risk in a group of loans. For example, a group of loans with a higher custom credit score will have a lower default rate than a group of loans with a lower custom

[**Confidential Treatment Requested.]

United States Securities and Exchange Commission

January 23, 2012

Page 5

credit score. Notwithstanding the effectiveness of the Company’s proprietary scoring system in rank ordering risk, most if not all of the loans in the Company’s core portfolio are still considered to be “sub-prime” by the Company’s investors and creditors, and by the rating agencies (e.g., Moody’s, S&P and Fitch, which all rate the Company) and would similarly be considered sub-prime by regulatory agencies overseeing federal banks (e.g., the OCC). As noted above, “sub-prime” is a distinct credit segment and sub-prime loan portfolios are conventionally viewed as having similar credit characteristics. In determining that all of the loans in our sub-prime portfolio had similar credit risk, we considered industry conventions and generally accepted views on the similarity of credit characteristics in sub-prime portfolios. These considerations, along with all of the other items listed in the December 9, 2011 letter to the Staff, when taken as a whole support management’s view that the appropriate grouping of the Company’s sub-prime portfolio was as one pool.

| | | Additionally and equally important, the historical and expected credit losses across the Company’s custom score bands closely mirror each other. Thus, if there is deterioration in credit performance in the overall portfolio, it occurs very consistently across all the custom scores and in the same direction, a fact that management believes demonstrates similar credit risk. Please see the chart attached to this letter as Insert A. |

| | | The chart in Insert A illustrates how losses developed over a five-year period for a static pool of receivables consisting of all loans in the Company’s portfolio ($11.9 billion) as of December 2006, prior to the adverse credit cycle that began in late 2007. This shows how each credit band performed similarly over a credit cycle. For example, if credit performance improved all credit score bands improved in a similar pattern, thus further segmentation of the loan pool would not yield a materially different financial statement result (see discussion below). |

| | | Auto loans perform differently than a portfolio of mortgage loans. Auto loans tend to collectively deteriorate in value or improve in value. They are less dependent on geography or regional economic differences that may create large variations in mortgage credit losses (e.g., South Florida vs. Texas during the 2007-2009 cycle). Additionally, because the collateral for the loan is easily transported following repossession, if the Company sees weakness in the wholesale market in a geographic area, it is able to move the collateral to a market that is not seeing the same weakness. |

United States Securities and Exchange Commission

January 23, 2012

Page 6

| | | Based on all of the information provided in the previous response letters and above the Company continues to believe that the sub-prime pool of loans is one pool. Additionally, as described in the response to question 2 above, the Company believes that because the custom credit score is not updated after origination, it may not be a meaningful measure of credit risk at the acquisition date. The custom credit score is used to derive a loss estimate at origination of the loan. However, after the loan has aged three months, the original loss estimate is no longer utilized; rather, at that point actual loss performance to date of monthly loan vintages is used. |

| | | Because the custom credit score does rank order credit risk, the Company has recently performed an analysis and concluded that if it were to split the sub-prime pool into five separate pools based on custom credit score bands, determined as of the origination date, there would be no material impact to the Company’s financial statements. To illustrate this point, the Company took its loss forecast for the core sub-prime portfolio at October 1, 2010 and split it into five separate pools of 20-point custom score bands and re-assessed the expected cash flows, accretable yield, and resulting carrying values. Based on management’s preliminary analysis of this reassessment the impact would represent a decrease to accretable yield of approximately $10 million, or 1.5% of total accretable yield and total income before taxes for the year ended December 31, 2011. The reason for this is that loan performance across custom score tier bands moves in tandem and all pools have improved in performance. The one pool method is not masking potential impairments (i.e., the better-than-expected performance of the better scoring tier bands is not “masking” a possible impairment in one of the lower scoring tier bands). While all bands in the analysis demonstrated improved cash flow performance at each period end, there would likely have been similar accounting results for one pool versus the five pools if the receivables at the acquisition date had experienced credit deterioration as each of the five pools would have likely experienced impairments. |

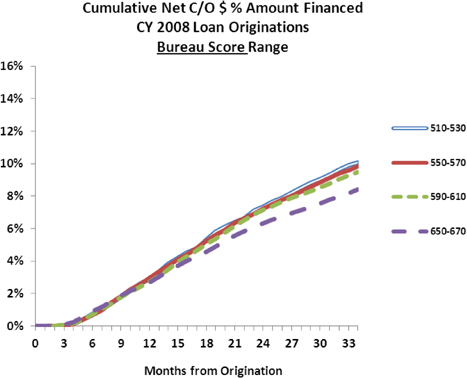

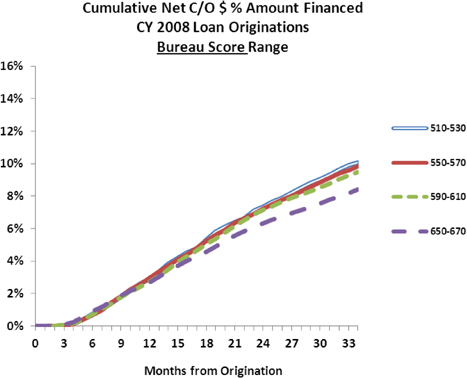

| | | c. The Company supplementally advises the Staff that it does not forecast losses based on a FICO score. Due to this fact, the Company used actual loss rates for loans originated during calendar year 2008 (the Company selected a population of loans that had aged so performance could be |

United States Securities and Exchange Commission

January 23, 2012

Page 7

| | seen) as an example of how an actual pool of loans would have performed. The Company ran actual default rates for loans with FICO scores ten points on either side of the Staff’s requested credit scores. Thus the Company looked at all loans with a FICO score of 510-530 to provide information for a group of loans with an average score of 520 (the Company also provided similar data for the other requested credit scores). |

| | | The graph below depicts cumulative loss rates at different FICO score ranges. |

Based upon this analysis, the average cumulative loss rate for all of the loans in the analysis at month 24 of origination was 7.0% with the four groups having losses of 6.3%, 7.1%, 7.2% and 7.4%. Thus, each group’s cumulative loss was +/- 10% of the average, a rather tight band which supports similar loss expectations. Similar results were found at other points of aging of the loans.

United States Securities and Exchange Commission

January 23, 2012

Page 8

| | 4. | We note your response to comment 14 in your December 9, 2011 letter. Please tell us the financial statement impact for the periods presented if you concluded that all delinquent accounts at the acquisition date met the scope requirements of ASC 310-30 and were accounted for in one pool and all other accounts were determined not to be in the scope of ASC 310-30 and were accounted for by analogy to ASC 310-30 using the guidance in the AICPA confirming letter and accounted for in a another pool. |

Company Response:

The Company supplementally advises the Staff that because it forecasts the cash flows on a total pool basis (one for the prime portfolio, one for the near prime and one for the sub-prime portfolio) it does not forecast how a pool of delinquent accounts would perform over the life of the loans and is not able to perform a cash flow analysis that would provide the financial statement impact if the Company had concluded delinquent accounts were a separate pool. As noted in the Company’s 10-K for the period ended December 31, 2010 because of the Company’s target customer base, “a relatively high percentage of accounts become delinquent at some point in the life of a loan and there is a high rate of account movement between current and delinquent status in the portfolio.” The Company supplementally advises the Staff that due to the nature of the sub-prime consumer approximately 85% (based on the Company’s historical data) of the accounts in the sub-prime portfolio will be delinquent at some point during their life. The Company does not believe that delinquency levels are a good measure of credit risk due to the fact that an approximate 85% delinquency rate for accounts over their life equates to an approximate 20% cumulative loss rate, which means 65% of the accounts that are delinquent at some point in their lives will not go to loss. Additionally, the Company supplementally advises the Staff that the large majority (approximately 80%) of accounts that were in a delinquency status at the acquisition date were no longer delinquent the following month. Thus the expected performance of those accounts that were no longer delinquent would be no different than other accounts that were not delinquent at the acquisition date. Due to the turnover in delinquent accounts, it is the Company’s opinion that accounting for delinquent accounts as a separate pool would not be appropriate. While the Company cannot determine the specific financial statement impact of dividing the core sub-prime pool into a delinquent pool and a non-delinquent pool, as discussed in question 3b above, the financial statement impact of dividing the core sub-prime portfolio into five pools based on custom credit score is not material.

United States Securities and Exchange Commission

January 23, 2012

Page 9

Note 5. Finance Receivables, page F-19

| | 5. | Your finance receivable disclosures should clearly indicate whether they present the carrying value or contractual outstanding balance of finance receivables. In disclosures presenting the carrying value, please revise to only present charge-off’s that reduce the recorded investment in your finance receivables. |

Company Response:

The disclosures in the Amendment on pages 48, 55, 66, F-20 and F-66 have been amended to present only charge-offs related to the post-acquisition portfolio. Additionally, the disclosure in the Amendment has been amended to include the required “non-GAAP” related disclosures required by Regulation S-K.

| | 6. | When you disclose credit metrics/trends related to the contractual outstanding balance, please revise to clearly explain the difference between contractual outstanding balance and your carrying value and explain why this information is relevant and useful. |

Company Response:

The disclosure in the Amendment on page 64 has been amended to add the required “non-GAAP” related disclosures required by Regulation S-K, which includes a description of why the information is relevant and useful.

Thank you for your consideration. Please do not hesitate to call the undersigned at the number referenced above if you have any questions or comments regarding the foregoing or the Amendment or if we can be of service in facilitating your review.

Sincerely,

/s/ Gregory J. Schmitt

Gregory J. Schmitt

L. Steven Leshin, Esq.

Douglas M. Berman, Esq.

Supplement Material

* *

[Note: Chart]

[**Confidential Treatment Requested.]