Further Issuances

The Indenture does not limit the amount of other debt that we may incur. We may, from time to time, without the consent of the holders of the Notes, issue other debt securities under the Base Indenture in addition to the Notes. We reserve the right, from time to time and without the consent of any holders of Notes, to re-open the Notes on terms identical in all respects to the outstanding Notes (except for the date of issuance, the date interest begins to accrue and, in certain circumstances, the first interest payment date), so that such additional Notes will be consolidated with, form a single series with and increase the aggregate principal amount of the Notes; provided that if any additional notes issued are not fungible with the Notes for U.S. federal income tax purposes, the additional notes will have a separate CUSIP number.

Principal, Maturity and Interest

We will initially issue an aggregate principal amount of $ of the Notes.

Principal, premium, if any, and interest, if any, on the Notes will be payable at the office or agency we designate for such purpose within the City and State of New York. We will make payments of principal, premium, if any, and interest, if any, in respect of the Notes in book-entry form to DTC in immediately available funds, while disbursement of such payments to owners of beneficial interests in Notes in book-entry form will be made in accordance with the procedures of DTC and its participants in effect from time to time. Unless otherwise designated by us, our office or agency in New York will be the office of the Trustee maintained for such purpose. The Notes will be issued in denominations of $2,000 and integral multiples of $1,000 in excess thereof.

The Notes will mature on , 2023.

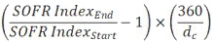

The Notes will bear interest at a floating rate, reset quarterly on each Interest Payment Date, equal to Compounded SOFR, plus %. Interest on the Notes will be payable quarterly in arrears on , , and of each year, commencing on , 2021, and at maturity (each an “Interest Payment Date”), to holders of record on the date that is 15 calendar days prior to each Interest Payment Date. Interest on the Notes will accrue from and including the most recent Interest Payment Date or, if no interest has been paid, from the settlement date of the Notes. If the , , or of any year is not a Business Day, then the next succeeding Business Day will be the applicable Interest Payment Date and interest on the Notes will be paid on such next succeeding Business Day (unless such next succeeding Business Day falls in the succeeding calendar month, in which case the applicable Interest Payment Date will be the Business Day immediately preceding such , , or , and interest on the Notes will be paid on such immediately preceding Business Day). If the maturity date of the Notes is not a Business Day, the payment of principal of, and interest on, the Notes will be made on the next succeeding Business Day, and no interest will accrue for the period from and after the maturity date.

The “initial Interest Period” means the period from and including the settlement date of the Notes to, but excluding, the first Interest Payment Date. Thereafter, each “Interest Period” means the period from and including an Interest Payment Date to, but excluding, the immediately succeeding Interest Payment Date (such succeeding Interest Payment Date, the “Latter Interest Payment Date”); provided that the final interest period for the Notes will be the period from and including the Interest Payment Date immediately preceding the maturity date of the Notes to, but excluding, the maturity date. Interest on the Notes will be computed on the basis of the actual number of days elapsed over a 360-day year.

The interest rate for the initial Interest Period will be Compounded SOFR determined on , 2021, plus %. Thereafter, the interest rate for any Interest Period will be Compounded SOFR, as determined on the applicable date that is the second U.S. Government Securities Business Day (as defined below) preceding such Interest Payment Date (the “Interest Determination Date”), plus a margin of %.

S-14