Filed pursuant to Rule 424(b)(2)

SEC File No. 333-268704

PROSPECTUS SUPPLEMENT

(To Prospectus dated December 7, 2022)

$2,500,000,000

GENERAL MOTORS FINANCIAL COMPANY, INC.

$400,000,000 Floating Rate Senior Notes due 2027

$1,100,000,000 5.350% Senior Notes due 2027

$1,000,000,000 5.600% Senior Notes due 2031

We are offering $400,000,000 aggregate principal amount of our floating rate senior notes due 2027 (the “Floating Rate Notes”), $1,100,000,000 aggregate principal amount of our 5.350% senior notes due 2027 (the “2027 Notes”) and $1,000,000,000 aggregate principal amount of our 5.600% senior notes due 2031 (the “2031 Notes” and, together with the Floating Rate Notes and the 2027 Notes, the “Notes”).

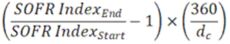

The Floating Rate Notes will bear interest at a floating rate, reset quarterly, equal to Compounded SOFR (as defined herein), plus 1.050%. We will pay interest on the Floating Rate Notes quarterly in arrears on January 15, April 15, July 15 and October 15 of each year, commencing on October 15, 2024. Interest will accrue on the Floating Rate Notes from the date of original issuance. The Floating Rate Notes will mature on July 15, 2027.

We will pay interest on the 2027 Notes semi-annually in arrears on January 15 and July 15 of each year, commencing on January 15, 2025. We will pay interest on the 2031 Notes semi-annually in arrears on June 18 and December 18 of each year, commencing on December 18, 2024. Interest will accrue on the 2027 Notes and the 2031 Notes from the date of original issuance. The 2027 Notes will mature on July 15, 2027 and the 2031 Notes will mature on June 18, 2031.

We may not redeem the Floating Rate Notes prior to maturity. At our option, we may redeem the 2027 Notes and the 2031 Notes offered hereby, in whole or in part, at any time and from time to time before their maturity, at the redemption prices set forth under “Description of the Notes—Optional Redemption.”

The Notes will be our unsecured senior obligations. The Notes will rank senior in right of payment to all of our existing and future indebtedness and other obligations that are expressly subordinated in right of payment to the Notes; pari passu in right of payment with all of our existing and future indebtedness that is not so subordinated, including, without limitation, our other senior notes; effectively junior to any of our secured indebtedness and other secured obligations to the extent of the assets securing such indebtedness or other secured obligations; and effectively junior to any liabilities of our subsidiaries.

We do not intend to apply for listing of the Notes on any securities exchange or for inclusion of the Notes in any automated quotation system. Currently there is no public market for any series of the Notes.

Investing in the Notes involves risks. See “Risk Factors” beginning on page S-5 of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Per Floating

Rate Note | | | Total | | | Per 2027

Note | | | Total | | | Per 2031

Note | | | Total | |

Public offering price(1) | | | 100.000% | | | $ | 400,000,000 | | | | 99.986% | | | $ | 1,099,846,000 | | | | 99.857% | | | $ | 998,570,000 | |

Underwriting discounts | | | 0.250% | | | $ | 1,000,000 | | | | 0.250% | | | $ | 2,750,000 | | | | 0.400% | | | $ | 4,000,000 | |

Proceeds, before expenses, to us | | | 99.750% | | | $ | 399,000,000 | | | | 99.736% | | | $ | 1,097,096,000 | | | | 99.457% | | | $ | 994,570,000 | |

| (1) | Plus accrued interest, if any, from the date of original issuance. |

The underwriters expect to deliver the Notes to the purchasers in book-entry only form through the facilities of The Depository Trust Company, including its participants Clearstream Banking S.A. and Euroclear Bank SA/NV, as operator of the Euroclear System, on or about June 18, 2024.

Joint Book-Running Managers

| | | | |

| BofA Securities | | Credit Agricole CIB | | Mizuho |

| | |

| Morgan Stanley | | Scotiabank | | SOCIETE GENERALE |

Co-Managers

| | | | |

Academy Securities | | Bradesco BBI | | Loop Capital Markets |

| | |

| Cabrera Capital Markets LLC | | CastleOak Securities, L.P. | | Ramirez & Co., Inc. |

The date of this prospectus supplement is June 13, 2024.