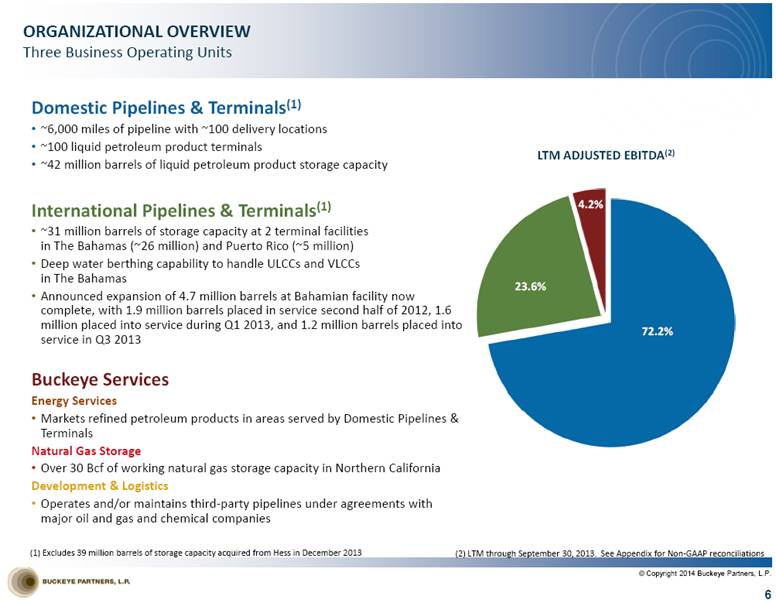

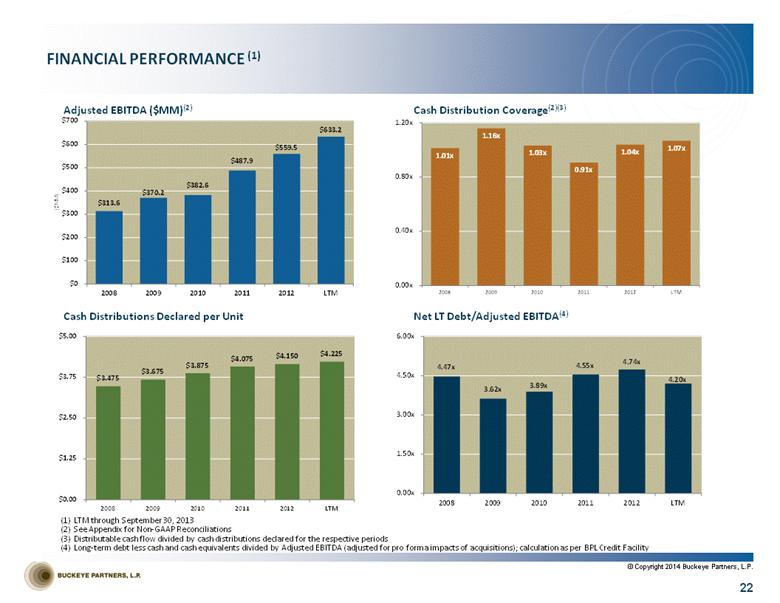

| NON-GAAP RECONCILIATIONS 26 Net Income to Adjusted EBITDA and Distributable Cash Flow ($000) LTM through September 30, 2013 On November 19, 2010, Buckeye merged with Buckeye GP Holdings L.P. Represents cash distributions declared for limited partner units (LP units) outstanding as of each respective period. © Copyright 2014 Buckeye Partners, L.P. 2008 2009 2010 2011 2012 LTM (1) Net income attributable to BPL 26,477 49,594 43,080 108,501 226,417 277,988 Interest and debt expense 75,410 75,147 89,169 119,561 114,980 124,648 Income tax expense (benefit) 801 (343) (919) (192) (675) (1,331) Depreciation and amortization 50,834 54,699 59,590 119,534 146,424 157,736 EBITDA 153,522 179,097 190,920 347,404 487,146 559,041 Net income attributable to noncontrolling interests affected by merger (2) 153,546 90,381 157,467 - - - Amortization of unfavorable storage contracts - - - (7,562) (10,994) (11,004) Gain on sale of equity investment - - - (34,727) - - Non-cash deferred lease expense 4,598 4,500 4,235 4,122 3,901 3,804 Non-cash unit-based compensation expense 1,909 4,408 8,960 9,150 19,520 21,424 Equity plan modification expense - - 21,058 - - - Asset impairment expense - 59,724 - - 59,950 59,950 Goodwill impairment expense - - - 169,560 - - Reorganization expense - 32,057 - - - - Adjusted EBITDA 313,575 370,167 382,640 487,947 559,523 633,215 Less: Interest and debt expense, excluding amortization of deferred financing costs, debt discounts, and other (73,573) (71,863) (84,758) (111,941) (111,511) (118,113) Maintenance capital expenditures (28,936) (23,496) (31,244) (57,467) (54,425) (62,965) Income taxes, excluding non-cash taxes and other 1,210 325 - (6) (1,095) (439) Distributable Cash Flow 212,276 275,133 266,638 318,533 392,492 451,698 Distributions for Coverage ratio (3) 209,412 237,687 259,315 351,245 376,193 423,233 Coverage Ratio 1.01x 1.16x 1.03x 0.91x 1.04x 1.07x Adjusted Segment EBITDA Pipelines & Terminals 253,790 302,164 346,447 361,018 409,055 457,387 International Operations - - (4,655) 112,996 132,104 149,220 Natural Gas Storage 41,814 41,950 29,794 4,204 6,118 (3,926) Energy Services 9,443 19,335 5,861 1,797 524 18,027 Development & Logistics 8,528 6,718 5,193 7,932 11,722 12,507 Total Adjusted EBITDA 313,575 370,167 382,640 487,947 559,523 633,215 |