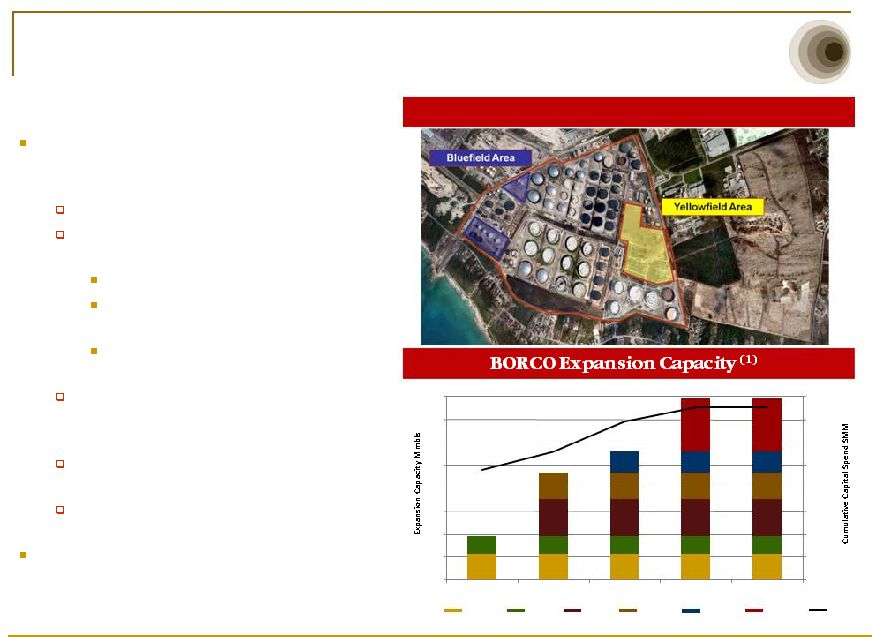

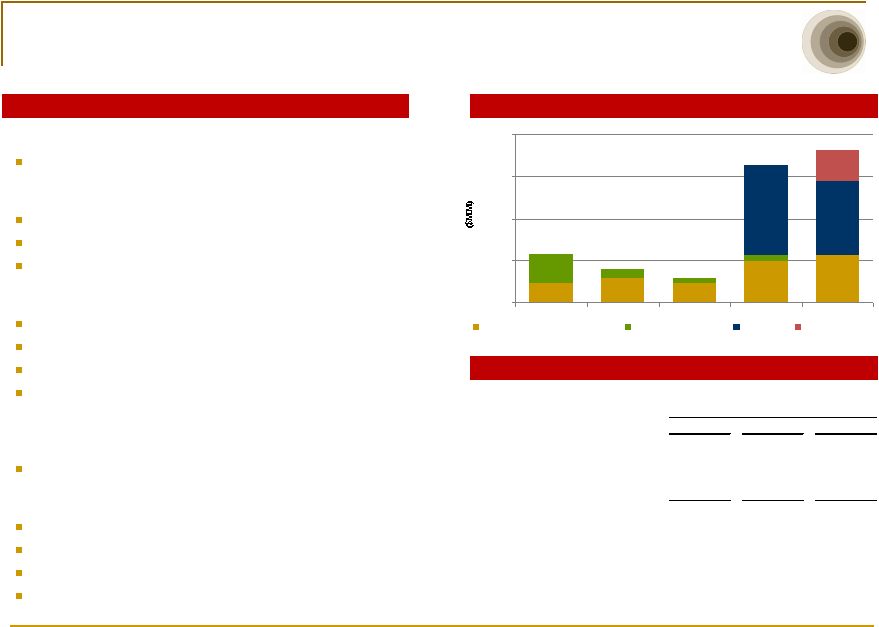

22 Basis of Representation; Explanation of Non–GAAP Measures Buckeye’s equity-funded merger with Buckeye GP Holdings L.P. (“BGH”) in the fourth quarter of 2010 has been treated as a reverse merger for accounting purposes. As a result, the historical results presented herein for periods prior to the completion of the merger are those of BGH, and the diluted weighted average number of limited partnership (“LP”) units outstanding increased from 20.0 million in the fourth quarter of 2009 to 44.3 million in the fourth quarter of 2010. Additionally, Buckeye incurred a non-cash charge to compensation expense of $21.1 million in the fourth quarter of 2010 as a result of a distribution of LP units owned by BGH GP Holdings, LLC to certain officers of Buckeye, which triggered a revaluation of an equity incentive plan that had been instituted in 2007. EBITDA, a measure not defined under U.S. generally accepted accounting principles (“GAAP”), is defined by Buckeye as net income attributable to Buckeye’s unitholders before interest and debt expense, income taxes, and depreciation and amortization. The EBITDA measure eliminates the significant level of non-cash depreciation and amortization expense that results from the capital -intensive nature of Buckeye’s businesses and from intangible assets recognized in business combinations. In addition, EBITDA is unaffected by Buckeye’s capital structure due to the elimination of interest and debt expense and income taxes. Adjusted EBITDA, which also is a non-GAAP measure, is defined by Buckeye as EBITDA plus: (i) non-cash deferred lease expense, which is the difference between the estimated annual land lease expense for Buckeye’s natural gas storage facility in the Natural Gas Storage segment to be recorded under GAAP and the actual cash to be paid for such annual land lease; (ii) non-cash unit-based compensation expense; (iii) the 2009 non-cash impairment expense related to the natural gas liquids pipeline that Buckeye sold in January 2010 (the “Buckeye NGL Pipeline”); (iv) the 2009 expense for organizational restructuring (the “Organizational Restructuring Expense”); (v) the 2010 non-cash BGH GP Holdings, LLC equity plan modification expense (the “Equity Plan Modification Expense”); (vi) income attributable to noncontrolling interests related to Buckeye for periods prior to the merger of Buckeye and BGH (the “Merger”); and (vii) the goodwill impairment expense associated with Lodi Gas Storage, L.L.C. (“Lodi”); less: (i) amortization of unfavorable storage contracts acquired in connection with the acquisition of Bahamas Oil Refining Company International (“BORCO”); and (ii) gain on the sale of our equity interest in West Texas LPG limited partnership (“WT LPG”). The EBITDA and Adjusted EBITDA data presented may not be directly comparable to similarly titled measures at other companies because EBITDA and Adjusted EBITDA exclude some items that affect net income attributable to Buckeye’s unitholders, and these measures may be defined differently by other companies. Management of Buckeye uses Adjusted EBITDA to evaluate the consolidated operating performance and the operating performance of the business segments and to allocate resources and capital to the business segments. In addition, Buckeye’s management uses Adjusted EBITDA as a performance measure to evaluate the viability of proposed projects and to determine overall rates of return on alternative investment opportunities. Distributable cash flow, which is a financial measure included in the schedules to this press release, is another measure not defined under GAAP. Distributable cash flow is defined by Buckeye as net income attributable to Buckeye’s unitholders plus: (i) depreciation and amortization expense; (ii) noncontrolling interests related to Buckeye that were eliminated as a result of the Merger; (iii) deferred lease expense for Buckeye’s Natural Gas Storage segment; (iv) unit-based compensation expense; (v) goodwill impairment expense associated with Lodi; (vi) write-off of deferred financing costs; (vii) amortization of deferred financing costs and debt discounts (all of which are non-cash expense); (viii) Equity Plan Modification Expense; (ix) the Buckeye NGL Pipeline impairment expense; (x) the senior administrative charge; and (xi) the Organizational Restructuring Expense (items (i) through (x) of which are non-cash expense); less: (i) maintenance capital expenditures; (ii) amortization of unfavorable storage contracts acquired in the BORCO acquisition; and (iii) gain on the sale of our equity investment in WTLPG. Buckeye’s management believes that distributable cash flow is useful to investors because it removes non-cash items from net income and provides a clearer picture of Buckeye’s cash available for distribution to its unitholders. This presentation references forward-looking estimates of Adjusted EBITDA investment multiples projected to be generated by the Perth Amboy terminal. A reconciliation of estimated Adjusted EBITDA to GAAP net income is not provided because GAAP net income generated by the Perth Amboy terminal for the applicable periods is not accessible. Buckeye has not yet completed the necessary valuation of the various assets to be acquired, a determination of the useful lives of these assets for accounting purposes, or an allocation of the purchase price among the various types of assets. In addition, interest and debt expense is a corporate-level expense that is not allocated among Buckeye’s segments and could not be allocated to the Perth Amboy terminal operations without unreasonable effort. Accordingly, the amount of depreciation and amortization and interest and debt expense that will be included in the additional net income generated as a result of the acquisition of the Perth Amboy terminal is not accessible or estimable at this time. The amount of such additional resulting depreciation and amortization and applicable interest and debt expense could be significant, such that the amount of additional net income would vary substantially from the amount of projected Adjusted EBITDA. This presentation also references forward-looking estimates of Adjusted EBITDA projected to be generated by expansion activities at BORCO. Reconciliations to GAAP net income are not provided because GAAP net income connected to such expansion activities for the applicable periods is not accessible. Interest and debt expense is a corporate-level expense that is not allocated among Buckeye’s segments and could not be allocated to the BORCO expansion without unreasonable effort. Accordingly, the amount of debt expense that will be included in the additional net income generated as a result of the BORCO expansion is not accessible or estimable at this time. The amount of applicable interest and debt expense could be significant, such that the amount of net income would vary substantially from the amount of projected Adjusted EBITDA. Buckeye believes that investors benefit from having access to the same financial measures used by Buckeye’s management. Further, Buckeye believes that these measures are useful to investors because they are one of the bases for comparing Buckeye’s operating performance with that of other companies with similar operations, although Buckeye’s measures may not be directly comparable to similar measures used by other companies. |