The table below sets out, for the periods indicated, the reported high and low quoted prices for the Company’s ordinary shares on the London Stock Exchange and the high and low quoted prices for the shares in the form of ADSs on the New York Stock Exchange. Past performance of the Company’s ordinary shares cannot be relied on as a guide to future performance.

These prices have not been restated for the effect of the demerger of Centrica plc in February 1997, the capital restructuring and refinancing effective in December 1999 or the demerger of Lattice in October 2000.

Back to Contents

| | |

| | |

| ADDITIONAL SHAREHOLDER INFORMATION continued |

|

MAJOR SHAREHOLDERS

The Company’s authorised share capital consists of ordinary shares with a nominal value of 10p each. So far as the Company is aware, no person is the beneficial owner of 5% of the Company’s ordinary shares, nor is the Company directly or indirectly owned by another corporation or by a foreign government.

As at 20 February 2003, 5 495 873 ADSs (equivalent to 27 479 365 ordinary shares or approximately 0.78% of the total outstanding ordinary shares) were outstanding and held of record by 266 registered holders in the United States. The Company is aware that many ADSs are held of record by brokers and other nominees and accordingly the above numbers are not necessarily representative of the actual number of persons who are beneficial holders of ADSs or the number of ADSs beneficially held by such persons.

As at 20 February 2003, there were about 1 019 000 holders of record of BG Group plc ordinary shares. Of these holders, around 2 500 had registered addresses in the United States and held a total of some 1 036 183 BG Group plc ordinary shares, approximately 0.03% of the total outstanding ordinary shares. In addition, certain accounts of record with registered addresses other than in the United States hold BG Group plc ordinary shares, in whole or in part, beneficially for United States persons.

As far as is known to the Company, it is not directly or indirectly owned or controlled by another company or by any government or any other natural or legal person, and there are no arrangements known to the Company, the operation of which may result in a change of control.

MEMORANDUM AND ARTICLES OF ASSOCIATION

The Company is incorporated in England and Wales under Company Number 3690065.

The Memorandum of the Company provides that the Company has general commercial objects including to act as a holding company or an investment holding company and to carry on the business of transporting, manufacturing, processing, storing and dealing in different forms of energy including natural gases, petroleum and electricity.

The Articles of Association (Articles) of the Company and applicable English law contain, among others, provisions to the following effect:

Directors

1. General

Unless otherwise determined by ordinary resolution of the Company, there must be at least four Directors. A Director need not be a shareholder, but a Director who is not a shareholder can still attend and speak at shareholders’ meetings.

At each annual general meeting, any Director who was elected or last re-elected a Director at or before the Annual General Meeting held in the third calendar year before the current year shall automatically retire from office. A retiring Director is eligible for re-election by the shareholders.

No maximum age limit for Directors applies.

2. Directors’ interests

Unless otherwise provided in the Articles, a Director cannot cast a vote on any contract, arrangement or any other kind of proposal in which he knows he has a material interest. For this purpose, interests of a person who is connected with a Director under Section 346 of the Companies Act 1985 are added to the interests of the Director himself. Interests purely as a result of an interest in the Company’s shares, debentures or other securities are disregarded. In relation to an alternate Director, an interest of his appointor shall be treated as an interest of the alternate Director, in addition to any interest which the alternate Director has in his own right. A Director may not be included in the quorum of a meeting in relation to any resolution on which he is not allowed to vote.

3. Borrowing powers

So far as the relevant English law allows, the Directors can exercise all the powers of the Company to (i) borrow money, (ii) issue debentures and other securities, and (iii) give any form of guarantee and security for any debt, liability or obligation of the Company or of any third party.

The Directors must limit the Borrowings (as defined in the Articles) of the Company and exercise all voting and other rights or powers of control exercisable by the Company in relation to its subsidiary undertakings, so as to ensure that the total amount of all Borrowings by the Group (as defined in the Articles) outstanding at any time will not exceed twice the Adjusted Total Capital and Reserves (as defined in the Articles) at such time. This limit may be exceeded if the Company’s consent has been given in advance by an ordinary resolution passed at a general meeting.

Shareholder meetings

There are two types of meetings of shareholders, annual general meetings (AGM) and extraordinary general meetings (EGM). The Company must hold an AGM in each calendar year, not more than 15 months from the previous AGM. The Directors will decide when and where to hold the AGM. Any other general meeting is known as an EGM.

The Directors can decide to call an EGM at any time. In addition, an EGM must be called by the Directors promptly in response to a requisition by shareholders under the relevant English law. When an EGM is called, the Directors must decide when and where to hold it. At least 21 clear days’ notice in writing (or, where the relevant legislation permits, by electronic mail) must be given for every AGM and for any other meeting where it is proposed to pass a special resolution or to pass some other resolution of which special notice under the Companies Act 1985 has been given to the Company. For every other general meeting, at least 14 clear days’ notice in writing (or, where the relevant legislation permits, by electronic mail) must be given.

There must be a quorum present at every general meeting. Unless provided otherwise in the Articles, a quorum is two people who are entitled to vote.

A resolution that is put to the vote at a general meeting will be decided by a show of hands, unless a poll is demanded when, or before, the result of the show of hands is declared by the Chairman.

Back to Contents

Transfer of shares

Unless otherwise provided in the Articles or the terms of issue of any shares, any shareholder may transfer any or all of his shares. However, the Directors can refuse to register a transfer (i) in certificated form, if such shares are not fully paid up or the evidence of entitlement to such shares is missing, (ii) if it is in respect of more than one class of share, (iii) if it is in favour of more than four persons jointly, or (iv) if it is not properly stamped where required. However, if any of those shares have been admitted to the Official List of the London Stock Exchange, the Directors cannot refuse to register a transfer if this would stop dealings in the shares from taking place on an open and proper basis.

If the Directors decide not to register a transfer, they must notify the person to whom the shares were to be transferred within two months.

The Directors can decide to suspend the registration of transfers by closing the Register, but the Register cannot be closed for more than 30 days per year. In the case of shares in uncertificated form, the Register must not be closed without the consent of the Operator of a relevant system (currently CRESTCO Limited, the operator of a relevant system under the UK CREST Regulations).

Share capital

The Company’s authorised share capital is £500 000 001, consisting of 5 000 000 010 ordinary shares of 10p each.

Shareholders’ rights

1. Voting rights

When a shareholder is entitled to attend a general meeting and vote, he has only one vote on a show of hands. A proxy cannot vote on a show of hands. Where there is a poll, subject to any special rights or restrictions attaching to any class of shares, a shareholder who is entitled to be present and to vote has one vote for every share which he holds.

To decide who can attend or vote at a general meeting, the notice of the meeting can give a time by which people must be entered on the Register which must not be more than 48 hours before the meeting. Unless provided otherwise in the Articles, the only people who can attend or vote at general meetings are shareholders who have paid the Company all calls, and all other sums, relating to the shares which are due at the time of the meeting.

2. Restrictions on shareholders’ rights

If a shareholder has been properly served with a notice under Section 212 of the Companies Act 1985 requiring information about interests in shares, and has failed to supply such information within 14 days of the notice, then (subject to the Articles and unless the Directors otherwise decide) the shareholder is not (for so long as the default continues) entitled to attend or vote at a shareholders’ meeting or to exercise any other right in relation to a meeting as holder of any shares held by the shareholder in default.

Any person who acquires shares in relation to which a default has occurred (Default Shares) is subject to the same restrictions unless:

| – | the transfer was an approved transfer pursuant to a takeover or one which, to the Directors’ satisfaction, is a bona fide sale to a person unconnected with the shareholder; or |

| | |

| – | the transfer was by a shareholder who was not himself in default in supplying the information required by the notice and (a) the transfer is of only part of his holding and (b) the transfer is accompanied by a certificate in a form satisfactory to the Directors stating that after due and careful enquiries the shareholder is satisfied that none of the shares included in the transfer are Default Shares. |

Where the Default Shares represent 0.25% or more of the existing shares of a class, the Directors can, in their absolute discretion, by notice to the shareholder direct that (i) any dividend or other money which would otherwise be payable on the Default Shares shall be retained by the Company (without any liability to pay interest when that dividend or money is finally paid to the shareholder) and/or (ii) the shareholder will not be allowed to choose to receive shares in place of dividends and/or (iii) no transfer of any of the shares held by the shareholder will be registered unless one of the provisos specified above is satisfied.

3. Variation of rights

If the Company’s share capital is split into different classes of shares, subject to the relevant English law and unless the Articles or rights attaching to any class of shares provide otherwise, the special rights which are attached to any of these classes can be varied or abrogated as provided by those rights or approved by an extraordinary resolution passed at a separate meeting of that class. Alternatively, the holders of at least three-quarters of the existing shares of the class (by nominal value) can give their consent in writing.

Alteration of share capital

The shareholders can by ordinary resolutions (i) increase the Company’s authorised share capital, (ii) consolidate, or consolidate and then divide, all or any of the Company’s share capital into shares of a larger nominal amount than the existing shares, (iii) cancel any shares which have not been taken, or agreed to be taken, by any person at the date of the resolution, and reduce the amount of the Company’s share capital by the amount of the cancelled shares, and (iv) subject to the relevant English law divide some or all of the Company’s shares into shares which are of a smaller nominal amount than is fixed in the Memorandum.

The shareholders can, subject to the relevant English law, pass a special resolution to (i) reduce the Company’s authorised share capital in any way or (ii) reduce any capital redemption reserve, share premium account or other undistributable reserve in any way.

The Company can, subject to the relevant English law, buy back, or agree to buy back in the future, any shares of any class. However, if the Company has existing shares which are admitted to the Official List of the London Stock Exchange and which are convertible into equity shares, then the Company can only buy back equity shares of that class if either the terms of issue of the convertible shares permit the Company to buy back equity shares or the buy back or agreement to buy back has been approved by an extraordinary resolution passed by such holders.

Back to Contents

| | |

| | |

| ADDITIONAL SHAREHOLDER INFORMATION continued |

|

Dividends

The shareholders can declare final or interim dividends by ordinary resolution. No dividend can exceed the amount recommended by the Directors. No interim dividend shall be paid on shares which carry deferred or non-preferred rights if, at the time of payment, any preferential dividend is in arrears. Unless the rights attaching to shares or the terms of any shares provide otherwise, dividends are paid based on the amounts which have been paid up on the shares in the relevant period.

The Directors can recommend the shareholders to pass an ordinary resolution to direct all or part of a dividend to be paid by distributing specific assets. The Directors must give effect to such a resolution.

If a dividend has not been claimed for one year, the Directors may invest the dividend or use it in some other way for the benefit of the Company until the dividend is claimed. Any dividend which has not been claimed for 12 years may be forfeited and belong to the Company if the Directors so decide.

Winding up

If the Company is wound up, the liquidator can, with the authority of an extraordinary resolution and any other sanction required by relevant law, divide among the shareholders all or part of the assets of the Company or transfer any part of the assets to trustees on trust for the benefit of the shareholders. No past or present shareholder can be compelled to accept any shares or other property under the Articles which carries a liability.

Rights of foreign shareholders

There are no limitations imposed by the relevant English law or the Articles on the rights to own securities, including the rights of non-resident or foreign shareholders to hold or exercise voting rights on the securities.

Notification of interest in shares

Section 198 of the Companies Act 1985 requires any shareholder, subject to exceptions, who acquires an interest of 3% or more or, in the case of certain interests, 10% or more in the shares to notify the Company of his interest within two business days following the day on which the obligation to notify arises. After the 3% or 10%, as the case may be, level is exceeded, similar notification must be made in respect of the whole percentage figure increases or decreases.

EXCHANGE CONTROLS

There are currently no UK exchange control laws, decrees or regulations that restrict or would affect the transfer of capital or payments of dividends, interest, or other payments to US citizens or residents who are holders of the Company’s securities except as otherwise set out under ‘Taxation’ below.

TAXATION

The taxation discussion set out below is intended only as a summary of the principal US federal and UK tax consequences to a holder of ADSs resident in the US and does not purport to be a complete analysis or listing of all potential tax consequences of owning ADSs. Investors are advised to consult their tax advisers with respect to the tax consequences of their holdings and sales, including the consequences under applicable US state and local law. The statements of US and UK tax laws set out below, except as otherwise stated, are based on the laws in force as of the date of this Annual Report and Accounts and are subject to any changes occurring after that date in US or UK law or in the double taxation convention between the US and UK (the ‘current convention’). The US and the UK signed a new US-UK double taxation convention (the ‘new convention’) on 24 July 2001, as amended by a protocol to the new convention signed on 19 July 2002, the provisions of which will not enter into force until the new convention has completed its passage through the US Senate and the UK Parliament and has been ratified by both governments. The discussion below notes the instances in which the relevant provisions of the new convention would produce a materially different result for a US holder.

This discussion does not address all aspects of US federal income taxation that may apply to holders subject to special tax rules, including US expatriates, insurance companies, tax-exempt organisations, financial institutions, securities broker-dealers, persons subject to the alternative minimum tax, investors that own (directly, indirectly or by attribution) 10% or more of the outstanding share capital or voting stock of the Company, persons holding their ADSs as part of a straddle, hedging transaction or conversion transaction, persons who acquired their ADSs pursuant to the exercise of options or similar derivative securities or otherwise as compensation, or persons whose functional currency is not the US$, among others. Those holders may be subject to US federal income tax consequences different from those set forth below.

Back to Contents

For the purposes of the current conventions between the US and UK for the avoidance of double taxation with respect to taxes on dividend income and capital gains and estate and gift taxes and for the purposes of the US Internal Revenue Code of 1986 as amended, as discussed below, a US holder of ADSs will be treated as the beneficial owner of the underlying ordinary shares represented thereby.

Taxation of dividends

UK taxation of dividends

Under current UK tax legislation, no UK tax will be withheld from dividend payments made by the Company.

Under the current convention, subject to certain exceptions, a US holder of ADSs who is a resident of the US (and is not a resident of the UK) for the purposes of the current convention is generally entitled to receive, in addition to any dividend that the Company pays, a payment from the UK Inland Revenue in respect of such dividend equal to the tax credit to which an individual resident in the UK for UK tax purposes would have been entitled had that individual received the dividend (which is currently equal to one-ninth of the dividend received) reduced by a UK withholding tax equal to an amount not exceeding 15% of the sum of the dividend paid and the UK tax credit payment. At current rates, the withholding tax entirely eliminates the tax credit payment but no withholding in excess of the tax credit payment will be imposed upon the US holder. Thus, for example, a US holder that receives a £100 dividend will also be treated as receiving from the UK Inland Revenue a tax credit payment of £11.11 (one-ninth of the dividend received) but the entire £11.11 payment will be eliminated by UK withholding tax, resulting in a net receipt of £100.

Under the new convention (pending ratification), there is no right to receive, in addition to any dividend that the Company pays, a payment from the UK Inland Revenue in respect of such dividend or any UK tax credit that may be associated with such dividend.

US federal income taxation of dividends

The gross amount of dividends (including any additional dividend income arising from a foreign tax credit claim as described below) paid to a US holder of ADSs will be taxable as ordinary income to the extent paid out of the current or accumulated earnings and profits of the Company as determined for US federal income tax purposes but are not eligible for the dividends received deduction allowed to corporations. The amount to be included in gross income will be the US$ value of the payment at the time the distribution is received by the ADS Depositary. Distributions by the Company in excess of current and accumulated earnings and profits will be treated first as a tax-free return of capital to the extent of the US holder’s basis in the ADSs, thus reducing the holder’s adjusted tax basis in such ADSs and, thereafter, as a capital gain. For foreign tax credit limitation purposes, dividends paid by the Company will be income from sources outside the United States. Pounds Sterling received by a US holder of ADSs will have a tax basis equal to the US$ value at the time of the distribution. Gain or loss, if any, realised on a subsequent sale or other disposition of the pounds Sterling will be US source ordinary income or loss.

Dividends paid will be treated as ‘passive income’ or, in the case of certain US holders, ‘financial services income’, for purposes of computing allowable foreign tax credits for US federal income tax purposes. Under the current convention, a US holder that is eligible for benefits with respect to income derived in connection with the ADSs (each such holder referred to as an ‘eligible US holder’) and that claims the benefits of the current convention with respect to a dividend from the Company will be entitled to a foreign tax credit for the UK tax notionally withheld with respect to such dividend. If an eligible US holder is so entitled, the foreign tax credit would be equal to one-ninth of any dividend received and would give rise to additional dividend income in the same amount. Each eligible US holder that relies on the current convention to claim a foreign tax credit under these circumstances must file IRS Form 8833 (Treaty-Based Return Position Disclosure) disclosing this reliance with its US federal income tax return for the year in which the foreign tax credit is claimed. In order to obtain this benefit in a particular year, a US holder generally must elect to claim the credit with respect to all foreign taxes paid (or treated as paid) in that year. US holders are advised that under the new convention (pending ratification) there would be no notional UK withholding tax applied to a dividend payment and it therefore would not be possible to claim a foreign tax credit in respect of any dividend payment made by the Company. The UK currently does not apply a withholding tax on dividends under its internal tax laws. Were such withholding imposed in the UK as permitted under the new convention, the UK generally will be entitled in certain circumstances to impose a withholding tax at a rate of 15% on dividends paid to US holders. The rules governing the foreign tax credit are complex. Each US holder is urged to consult its own tax advisor concerning whether the holder is eligible for benefits under the current convention, whether, and to what extent, a foreign tax credit will be available under the current convention with respect to dividends received from the Company, and whether the holder will be eligible for benefits under the new convention.

TAXATION OF CAPITAL GAINS

A holder of ADSs will be liable for UK tax on capital gains accruing on a disposal of ADSs only if such holder is resident or ordinarily resident for tax purposes in the UK or if such holder carries on a trade in the UK through a branch or agency and the ADSs are used, held or acquired for the purposes of the trade or branch or agency. Special rules can also impose UK capital gains tax on disposals by individuals who recommence UK residence after a period of non-residence. US citizens or corporations who are so liable for UK tax may be liable for both UK and US tax in respect of a gain on the disposal of ADSs. However, such persons generally will be entitled to a tax credit against their US federal tax liability for the amount of the UK tax paid in respect of such gain (subject to applicable credit limitations).

For US federal income tax purposes, a US holder generally will recognise capital gain or loss on the sale or other disposition of ADSs held as capital assets, in an amount equal to the difference between the US$ value of the amount realised on the disposition and the US holder’s adjusted tax basis, determined in US$, in the ADSs. Such gain or loss generally will be treated as US source gain or loss, and will be treated as a long-term capital gain or loss if the US holder’s holding period in the ADSs exceeds one year at the time of disposition. In the case of a US holder who is an individual, capital gains, if any, generally will be subject to US federal income tax at preferential rates if specified minimum holding periods are met. The deductibility of capital losses is subject to significant limitations.

US INFORMATION REPORTING AND BACKUP WITHHOLDING

A US holder who holds ADSs may in certain circumstances be subject to information reporting to the IRS and possible US backup withholding at a current rate of 30% with respect to dividends on ADSs and proceeds from the sale or other disposition of ADSs unless such holder furnishes

Back to Contents

| ADDITIONAL SHAREHOLDER INFORMATION continued |

|

a correct taxpayer identification number or certificate of foreign status and makes any other required certification, or is otherwise exempt. US persons who are required to establish their exempt status generally must provide IRS Form W-9 (Request for Taxpayer Identification Number and Certification). Non-US holders generally will not be subject to US information reporting or backup withholding. However, such holders may be required to provide certification of non-US status in connection with payments received in the US or through certain US-related financial intermediaries. Backup withholding is not an additional tax. Amounts withheld as backup withholding may be credited against a holder’s US federal income tax liability. A holder may obtain a refund of any excess amounts withheld under the backup withholding rules by filing the appropriate claim for refund with the IRS and furnishing any required information.

INHERITANCE TAX

ADSs held by an individual, who is domiciled in the US for the purposes of the Convention between the US and the UK for the avoidance of double taxation with respect to taxes on estates and gifts (the Estate Tax Convention) and is not for the purposes of the Estate Tax Convention a national of the UK, will not be subject to UK inheritance tax on the individual’s death or on a transfer of the ADSs during the individual’s lifetime unless the ADSs form part of the business property of a permanent establishment situated in the UK or pertain to a fixed base in the UK used for the performance of independent personal services. In the exceptional case where ADSs are subject both to UK inheritance tax and to US federal gift or estate tax, the Estate Tax Convention generally provides for the tax paid in the UK to be credited against tax payable in the US or for the tax paid in the US to be credited against tax payable in the UK based on priority rules set forth in the Estate Tax Convention.

STAMP DUTY AND STAMP DUTY RESERVE TAX

No UK stamp duty will be payable on the acquisition or transfer of ADSs provided that the instrument of transfer is not executed in the UK and remains at all times outside the UK subsequently. Neither will an agreement to transfer ADSs in the form of ADRs give rise to a liability to stamp duty reserve tax. An agreement to purchase ordinary shares, as opposed to ADSs, will normally give rise to a charge to UK stamp duty or stamp duty reserve tax at the rate of 0.5% of the price. Stamp duty reserve tax is the liability of the purchaser and the stamp duty is normally also paid by the purchaser. Where such ordinary shares are later transferred to the depositary’s nominee, further stamp duty or stamp duty reserve tax will normally be payable at the rate of 1.5% of the price payable for the ordinary shares so acquired.

A transfer of ordinary shares to the relative ADS holder without transfer of beneficial ownership will give rise to UK stamp duty at the rate of £5 per transfer. Transfers that are not sales will generally be exempt from the £5 stamp duty charge if made under the CREST system for paperless share transfers.

DOCUMENTS ON DISPLAY

All reports and other information that BG Group files with the US Securities and Exchange Commission may be inspected at the SEC’s public reference facilities at Room 1200, 450 Fifth Street, NW, Washington, DC 20549, USA. These reports may also be accessed via the SEC’s website at www.sec.gov.

Back to Contents

| | |

| | |

| BG GROUP PLC 2002 | 137 |

| | |

| | |

| CROSS-REFERENCE TO FORM 20-F | |

|

Back to Contents

| | |

| | |

| 138 | BG GROUP PLC 2002 |

| | |

| | |

| INDEX |

|

| | |

| Item | Page |

| | |

| Accounting policies | 71-73 |

| | |

| American Depositary Shares | 46, 112, 124, 131 |

| | |

| Annual General Meeting | 4, 58 |

| | |

| Assets | 77, 84 |

| | |

| Gross | 84, 124 |

| | |

| Net | 84, 123, 126 |

| | |

| Associated undertakings | 95-96, 116 |

| | |

| Auditors’ remuneration | 86 |

| | |

| Auditors’ Report | 70 |

| | |

| Balance sheets | 77 |

| | |

| Five Year Financial Summary | 123, 126 |

| | |

| Basis of consolidation | 71 |

| | |

| Basis of preparation | 71 |

| | |

| BG Foundation | 37 |

| | |

| Borrowings | 45, 47, 77, 79-80,

98-101, 124 |

| | |

| Business Review | 6-11 |

| | |

| Capital and reserves | 77, 103-104, 123 |

| | |

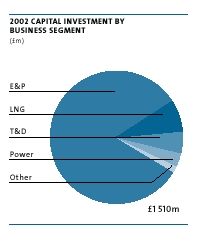

| Capital investment/ | |

| expenditure | 43-44, 47, 79, 84-85, 94, 111 |

| | |

| Capital gains tax information | 135-136 |

| | |

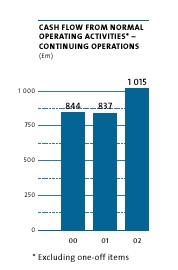

| Cash flow | 44, 47, 79, 110-111 |

| | |

| Five Year Financial Summary | 123, 127 |

| | |

| Certain forward-looking statements | 130 |

| Chairman’s and Chief | |

| Executive’s Statement | 2-4 |

| | |

Changes in financing during

the year | 80 |

| | |

| Charitable donations | 58 |

| | |

| Commitments and contingencies | 49, 104-105 |

| | |

| Committees | 28-29 |

| | |

| Community | 37, 58 |

| | |

| Competition | 33 |

| | |

| Corporate governance | 27 |

| | |

| Corporate Responsibility | 34-37 |

| | |

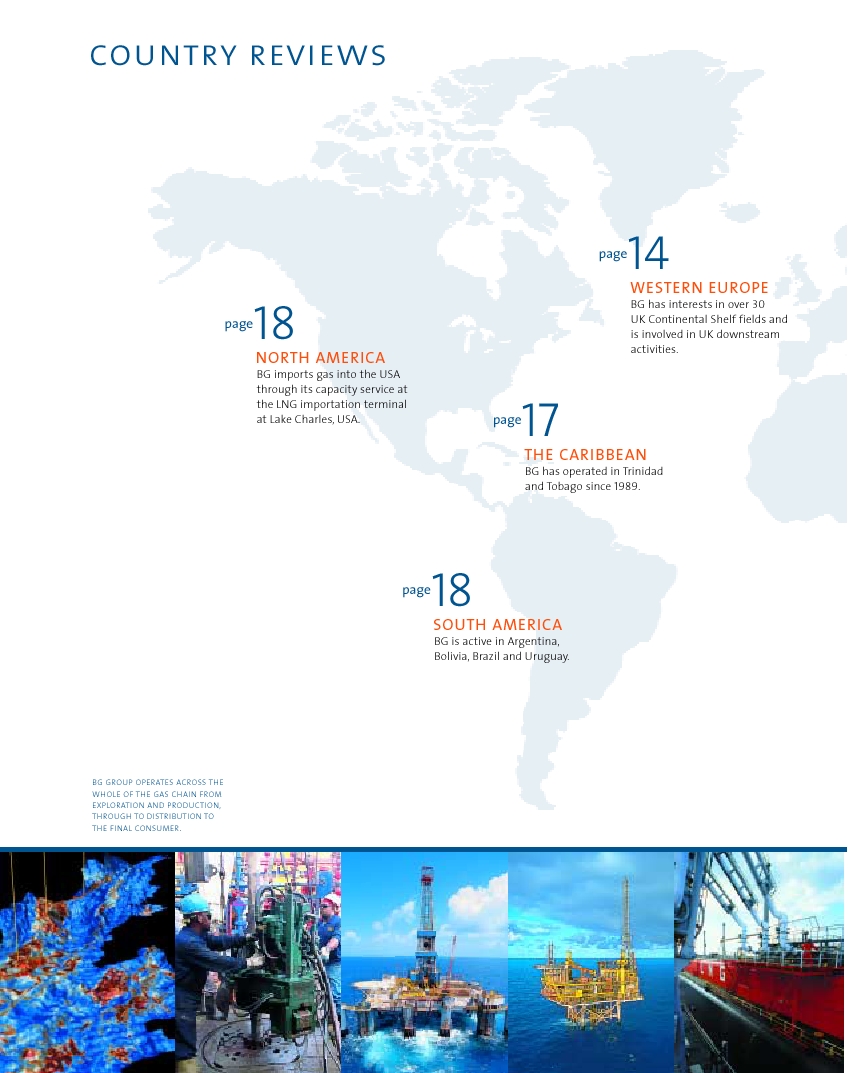

| Country Reviews | 12-26 |

| | |

| Creditors | 77, 101, 123, 126 |

| | |

| Cross-Reference to Form 20-F | 137 |

| | |

| Debt/equity ratio | 124 |

| | |

| Debtors | 77, 97 |

| | |

| Decommissioning | 50, 72, 101-102 |

| | |

| Deferred taxation | 72, 91-92, 101-102 |

| | |

| Definitions | 140 |

| | |

| Demerger | 46, 81, 90, 130 |

| | |

| Depreciation and | |

| amortisation | 50, 71, 84-86, 94-95 |

| | |

| Derivatives | 48, 50, 73, 100 |

| | |

| Directors | 52-53 |

| | |

| Item | Page |

| | |

| Directors’ Report | 57-59 |

| | |

| Discontinued operations | 38, 46-47, 71 |

| | |

| Disposals | 42, 90 |

| | |

| Dividends | 46, 57, 74-75, 92, 125 |

| | |

| Earnings/(loss) per | 43, 47, 74-75, 93-94, |

| ordinary share | 122, 124, 126 |

| | |

| EBITDA | 93, 114 |

| | |

| Employees | 58, 87-90, 124 |

| | |

| Euro | 51 |

| | |

| Exceptional items | 42, 74-75, 90, 122, 126 |

| | |

| Exchange rate information | 125 |

| | |

| Executive officers | 57-58, 87-90 |

| | |

| Exploration and Production | |

| (E&P) | 6-8, 38-40, 57, 81-84, 117-121, 128 |

| | |

| Exploration expenditure | 43, 49, 72, 85-86, 94 |

| | |

| External appointments | 69 |

| | |

| Financial Calendar | 4 |

| | |

| Financial instruments | 48, 73, 100-101 |

| | |

| Financial highlights | 3 |

| | |

Financial Reporting

Standards | 81 |

| | |

Five Year Financial

Summary | 122-127 |

| | |

| Fixed assets | 71-72, 77, 123, 126 |

| | |

| Intangible | 77, 94 |

| | |

| Tangible | 77, 94-95 |

| | |

| Foreign currencies | 48, 72, 99-100 |

| | |

| Gearing | 11, 44-45, 124 |

| | |

| Glossary of terms | 139 |

| | |

| Going concern | 58 |

| | |

| Goodwill | 71, 94 |

| | |

| Governance and Risk | 27-33 |

| | |

Group Executive

Committee | 54-55 |

| | |

| Guarantees | 105 |

| | |

| Health, Safety, Security | |

| and Environment | 35-36 |

| | |

| Impairment | 50, 72, 90 |

| | |

| Interest | 42-43, 47, 74-75, 91, 99, 122, 126 |

| | |

| Internal control | 29 |

| | |

| Investments | 77 |

| | |

| Current asset | 77, 97-98 |

| | |

| Fixed asset | 77, 95-96 |

| | |

| Joint ventures | 95-96, 116 |

| | |

| Lattice | 46-47, 81 |

| | |

| Leases | 73, 85-86, 104 |

| | |

| Liquefied Natural Gas | |

| (LNG) | 6, 8-9, 38, 40, 57, 81-84 |

| | |

| Litigation | 49, 105 |

| | |

| Item | Page |

| | |

| Long-term gas contracts | 101-102 |

| | |

Movement in BG

shareholders’ funds | 78 |

| | |

Operating and Financial

Review | 38-51 |

| | |

| Operating costs | 74-75, 85-86, 122, 126 |

| | |

| Operating profit/(loss) | 38, 74-75, 82, 122, 126 |

| | |

| Other activities | 41-42, 47, 81-84 |

| | |

| Pensions and post-retirement | |

| benefits | 73, 102, 106-110 |

| | |

| Petroleum revenue tax | 72, 91-92, 101-102 |

| | |

| Power Generation | |

| (Power) | 6, 10, 38, 41, 57, 81-84 |

| | |

| Principal Accounting Policies | 71-73 |

| | |

| Principal activities | 57 |

| | |

| Profit and loss account | 74-75 |

| | |

| Five Year Financial Summary | 122, 126 |

| | |

| Provisions for liabilities | |

| and charges | 77, 101-103, 123, 126 |

| | |

Reconciliation of net

borrowings | 79 |

| | |

| Related party transactions | 51, 106 |

| | |

| Remuneration Report | 60-69 |

| | |

| Research and development | 51, 73, 85-86 |

| | |

| Reserves | 77, 103-104, 123 |

| | |

| Return on average capital | |

| employed | 44, 124 |

| | |

| Risk factors | 32-33 |

| | |

| Segmental analysis | 81-85 |

| | |

| Share capital | 57, 77, 80, 103 |

| | |

| Shareholder Information | 129-136 |

| | |

| Shareholders’ funds | 77-78, 123, 124 |

| | |

Statement of Business

Principles | 34 |

| | |

| Statement of total recognised | |

| gains and losses | 76 |

| | |

| Stocks | 72, 77, 97 |

| | |

| Storage | 11, 38, 41, 42, 81-84, 90 |

| | |

| Subsidiary undertakings | 96, 116 |

| | |

| Substantial shareholdings | 57 |

| | |

| Supplementary Information | |

| – Gas and Oil | 117-121 |

| | |

| Suppliers | 58 |

| | |

| Taxation | 43, 47, 72, 74-75, 79, |

| | 91-92, 97,101-103, 114, 121, 122, 126 |

| | |

| Transco | 46-47 |

| | |

| Transmission and Distribution | |

| (T&D) | 6, 9-10, 38, 40-41, 57,

81-84 |

| | |

| Treasury policy | 47-49 |

| | |

| US GAAP | 50, 51, 112-115, 124 |

Back to Contents

| | |

| | |

| BG GROUP PLC 2002 | 139 |

| | |

| | |

| GLOSSARY |

|

| |

Term used in

Annual Report Accounts Acquisition accounting Advance corporation tax

Allotted Associated undertaking Called-up share capital

Capital allowances

Class of business Closing rate method CO2e

Consolidated accounts Creditors Creditors: amounts falling due

after more than one year Creditors: amounts falling due

within one year Debtors Finance lease Financial year Freehold |

| |

US equivalent or

brief description Financial statements Purchase accounting No direct US equivalent –

tax paid on company

distribution recoverable from

UK taxes due on income Issued 20-50% owned investee Common stock, issued

and fully paid Tax term equivalent to US tax

depreciation allowances Industry segment Current rate method Carbon Dioxide Equivalent

(carbon dioxide and methane

aggregated in proportion to

greenhouse warming potential

Methane = x21 CO2) Consolidated financial statements Accounts payable/payables Long-term accounts

payable/payables Current accounts

payable/payables Accounts receivable/receivables Capital lease Fiscal year Ownership with absolute rights

in perpetuity |

| |

Term used in

Annual Report continued Freehold land Gearing Interest receivable Interest payable Loan capital Net asset value Nominal value Pension scheme Profit Profit and loss account reserve Profit and loss account Profit attributable to

ordinary shareholders Reconciliation of movements

in shareholders’ funds Reserves

Share capital Share premium account Share scheme Shares in issue Shareholders’ funds Stocks Tangible fixed assets Turnover |

| |

US equivalent or

brief description continued Land owned Leverage Interest income Interest expense Debt Book value Par value Pension plan Income (or earnings) Retained earnings Income statement Net income

Statement of changes in

stockholders’ equity Stockholders’ equity other

than capital stock Capital stock or common stock Additional paid-in capital Share plan Shares outstanding Stockholders’ equity Inventories Property, plant and equipment Revenues (or sales) |

Back to Contents

| | |

| | |

| 140 | BG GROUP PLC 2002 |

| | |

| | |

| DEFINITIONS |

|

For the purpose of this document the following definitions apply:

| ‘€’ | | Euros |

| | | |

| ‘$’ | | US dollars |

| | | |

| ‘£’ | | UK pounds Sterling |

| | | |

| ‘API’ | | American Petroleum Institute |

| | | |

| ‘bcf’ | | Billion cubic feet |

| | | |

| ‘bcm’ | | Billion cubic metres |

| | | |

| ‘bcma’ | | Billion cubic metres per annum |

| | | |

| ‘BG’ | | The Company or the Group or any of its

subsidiary undertakings, joint ventures or

associated undertakings |

| | | |

‘BG Energy Holdings

Limited’ or ‘BGEH’ | |

BG Energy Holdings Limited, a subsidiary

of the Company |

| | | |

| ‘BG Energy Holdings’ | | BG Energy Holdings Limited and its |

| | | subsidiary undertakings consolidated with |

| | | its share of joint ventures and associated |

| | | undertakings |

| | | |

| ‘BG Transco Holdings’ | | Transco Holdings plc (formerly named BG

Transco Holdings plc) and its subsidiary

undertakings consolidated with its share

of joint ventures and associated

undertakings |

| | | |

| ‘billion’ or ‘bn’ | | One thousand million |

| | | |

| ‘boe’ | | Barrels of oil equivalent |

| | | |

| ‘boed’ | | Barrels of oil equivalent per day |

| | | |

| ‘bopd’ | | Barrels of oil per day |

| | | |

| ‘CCGT’ | | Combined Cycle Gas Turbine |

| | | |

| ‘Combined Code’ | | The Combined Code on Corporate

Governance appended to the Listing Rules

of the UK Listing Authority |

| | | |

| ‘Company’ | | BG Group plc |

| | | |

| ‘DCQ’ | | Daily Contract Quantity |

| | | |

| ‘demerger’ | | The demerger of certain businesses

(principally Transco) by BG to Lattice

Group plc, which became effective on

23 October 2000 |

| | | |

| ‘DTI’ | | Department of Trade and Industry |

| | | |

| ‘EPC’ | | Engineer Procure Construct |

| ‘FEED’ | | Front End Engineering Design |

| | | |

| ‘Group’ | | The Company and its subsidiary

undertakings |

| | | |

| ‘GW’ | | Gigawatt |

| | | |

| ‘km’ | | Kilometres |

| | | |

‘Lattice’ or

‘Lattice Group’ | | Lattice Group plc or any of its subsidiary

undertakings, joint ventures or associated

undertakings |

| | | |

| ‘Lattice Group plc’ | | Lattice Group plc, the ultimate parent

company of Lattice |

| | | |

| ‘mmbbl’ | | Million barrels |

| | | |

| ‘mmboe’ | | Million barrels of oil equivalent |

| | | |

| ‘mmcm’ | | Million cubic metres |

| | | |

| ‘mmcmd’ | | Million cubic metres per day |

| | | |

| ‘mmscf’ | | Million standard cubic feet |

| | | |

| ‘mmscfd’ | | Million standard cubic feet per day |

| | | |

| ‘mmscm’ | | Million standard cubic metres |

| | | |

| ‘mmscmd’ | | Million standard cubic metres per day |

| | | |

| ‘mtpa’ | | Million tonnes per annum |

| | | |

| ‘MW’ | | Megawatt |

| | | |

| ‘Ofgem’ | | The Office of Gas and Electricity Markets |

| | | |

| ‘PSA’ | | Production Sharing Agreement |

| | | |

| ‘PSC’ | | Production Sharing Contract |

| | | |

| ‘ROACE’ | | Return on Average Capital Employed |

| | | |

| ‘sq km’ | | Square kilometres |

| | | |

| ‘tcf’ | | Trillion cubic feet |

| | | |

| ‘Transco’ | | The gas transportation business carried

out by Transco plc |

| | | |

| ‘Transco Holdings plc’ | | Transco Holdings plc (formerly known as

BG Transco Holdings plc), which became

part of Lattice on demerger |

| | | |

| ‘Transco plc’ | | Transco plc (formerly known as BG Transco

plc and before that as BG plc), a subsidiary

of Transco Holdings plc and which became

part of Lattice on demerger |

| | | |

| ‘UKCS’ | | United Kingdom Continental Shelf |

Back to Contents

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | BG Group plc

100 Thames Valley Park Drive

Reading, Berkshire RG6 1PT

www.bg-group.com Registered in England No. 3690065 |

| | |

| | |