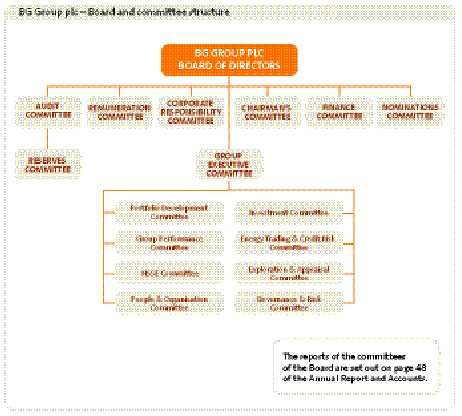

The Board is made up of a non-executive Chairman, the Chief Executive, Deputy Chief Executive, Chief Financial Officer and seven independent non-executive Directors. A list of the individual Directors, their biographies and details of their committee membership is set out on pages 18 and 19. The posts of Chairman and Chief Executive are separate and their responsibilities are set out in writing and agreed by the Board. Copies are available on the Group’s website. The non-executive Directors provide experience and skills from a number of industry and government backgrounds. Following its annual review of the independence of its non-executive Directors, the Board has concluded that each of the non-executive Directors, with the exception of the Chairman, is independent in accordance with the criteria set out in the Combined Code and the applicable rules of the NYSE. At the time of his appointment, the Chairman was considered independent by the Board. In accordance with the Combined Code, the ongoing test of independence of the Chairman is not appropriate. The Board holds regular meetings throughout the year, of which there were eight in 2006. Wherever possible, Directors are expected to attend all Board and applicable committee meetings together with the Annual General Meeting (AGM). | | All Directors are subject to election by shareholders at the first AGM following their appointment to the Board. Thereafter, in accordance with the Combined Code and the Company’s Articles of Association, they are normally subject to re-election every three years. Company Secretary

The Company Secretary, Ben Mathews, is responsible for advising the Board on all governance matters, through the Chairman. The Directors have full access to the advice of the Company Secretary, who is responsible to the Board for ensuring that correct Board procedures are followed. Board evaluation

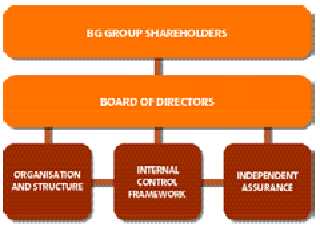

A comprehensive and rigorous evaluation of the Board, its principal committees, the individual non-executive Directors and the Chairman was conducted in 2006. Following this evaluation, the Directors have concluded that the Board and its committees operate effectively and also consider that each Director is contributing to the overall effectiveness and success of the Group. 2. Internal control framework

The second element of the Group’s Governance framework is the internal control framework, which defines the way that BG Group operates. It comprises the Group’s Business Principles, policies, processes, standards and guidelines. The Board is responsible for the | | Group’s system of internal controls and has oversight responsibility for the review and assurance processes. 3. Independent assurance

Independent assurance is provided primarily by the Group’s internal audit department (Group Audit), by the independent external Auditors and by other external advisers. Group Audit provides assurance to the Board, Audit Committee, Group Executive Committee and management that effective and efficient internal control processes are in place to identify and manage business risk across the Group. The independent external Auditors’ opinion on the statement of accounts is set out on page 23 of this Annual Review. In addition, the external reserves consultant, Degolyer and MacNaughton, provides an independent review on certain of BG Group’s gas and oil reserves. RISK MANAGEMENT AND RISK FACTORS

BG Group has established a continuous and systematic process for identifying, evaluating and managing the business risks it encounters as part of its operations. Risk management processes are integrated into all aspects of the Group’s business processes, including strategy development and business planning, investment appraisal, performance management and HSSE controls. The Group breaks down the principal risk factors that may affect its business, strategy and share price into the following areas: portfolio, political climate, exploration and new ventures, pre-sanction, project delivery, operations, commercial, competition, commodity prices, exchange rate, financing, credit, HSSE, insurance, regulation, stakeholder engagement, corporate responsibility and people resources. These risks are explained in more detail in the Annual Report and Accounts pages 41 to 44. |