Axiall Investor Update February 2016 Exhibit 99.1

This presentation contains certain statements relating to future events and our intentions, beliefs, expectations and predictions for the future. Any such statements other than statements of historical fact are forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. Words or phrases such as “anticipate,” “believe,” “plan,” “estimate,” “project,” “may,” “will,” “intend,” “target,” “expect,” “would” or “could” (including the negative variations thereof) or similar terminology used in connection with any discussion of future plans, actions or events generally identify forward-looking statements. These statements relate to, among other things, our expectations regarding: our long-term business strategy as a standalone public company; demand for our products; product mix and margin impacts related thereto; expected growth of our businesses and products; our results of operations, including our joint ventures with Lotte Chemical; our financial and operational performance, our business prospects and opportunities; product pricing and sales volumes; natural gas and ethylene costs; the components of our ethylene supply portfolio; natural gas hedging; our capital allocation strategy and other statements of expectations concerning matters that are not historical facts. These statements are based on the current expectations of our management. There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements included in this presentation. These risks and uncertainties include, among other things: uncertainties regarding future actions that may be taken by Westlake Chemical Corporation (“Westlake”) in furtherance of its unsolicited proposal to acquire the Company; changes, seasonality and/or cyclicality in the industries in which our products are sold and changes in demand for our products or increases in overall industry capacity that could affect production volumes and/or pricing; the costs and operating restrictions associated with compliance with current and future environmental, health and safety laws and regulations; the availability and pricing of energy and raw materials; risks, hazards and potential liabilities associated with manufacturing and transporting chemicals and building products and litigation related thereto; changes in the general economy, including the impacts of the current, and any potential future, economic uncertainties in the housing and construction markets; our level of indebtedness and debt service obligations and ability to continue to comply with the covenants in our asset-based and term loan credit agreements and the indentures governing our 4.875% senior notes due 2023 and 4.625% senior notes due 2021; our reliance on a limited number of suppliers for specified feedstock and services and our reliance on third-party transportation; risks, costs, liabilities, pension and post-retirement welfare benefit obligations; competition within our industry; complications resulting from our multiple enterprise resource planning (“ERP”) systems and the implementation of our new ERP systems, including our project to improve and further integrate the SAP system for our chemicals segment; strikes and work stoppages relating to the workforce under collective bargaining agreements; any impairment of goodwill, indefinite-lived intangible assets or other intangible assets, which may include additional, significant goodwill impairment charges in our chlor-alkali and derivatives reporting unit and/or in reporting units within our building products segment; the failure to realize the benefits of, and/or disruptions resulting from, any asset dispositions, asset acquisitions, joint ventures, business combinations or other transactions; shared control of our joint ventures with unaffiliated third parties, including the ability of such joint venture partners to fulfill their obligations; fluctuations in foreign currency exchange rates, especially with respect to the United States and Canadian dollars, and interest rates; and the failure to adequately protect our data and technology systems. In light of these risks, uncertainties, assumptions and factors, the forward-looking events discussed in this presentation may not occur. Other unknown or unpredictable factors could also have a material adverse effect on Axiall’s actual future results, performance, or achievements. For a further discussion of these and other risks and uncertainties applicable to Axiall and its business, see Axiall’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, and subsequent filings with the SEC. As a result of the foregoing, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. The statements in this presentation concerning Westlake are derived from public sources and/or are statements of Axiall’s beliefs. While Axiall has no reason to believe as of the date of this presentation that such third-party statements are not reliable, it has not verified such statements. Axiall does not undertake, and expressly disclaims, any duty to update any forward-looking statement or statement of belief whether as a result of new information, future events, or changes in its expectations, except as required by law. Forward-Looking Statements

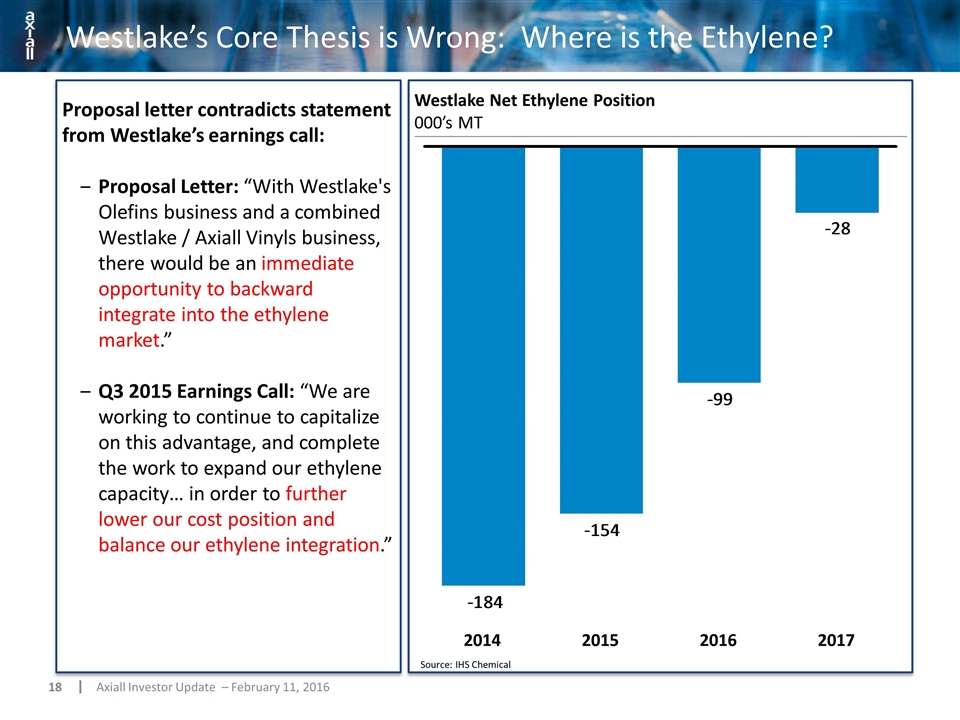

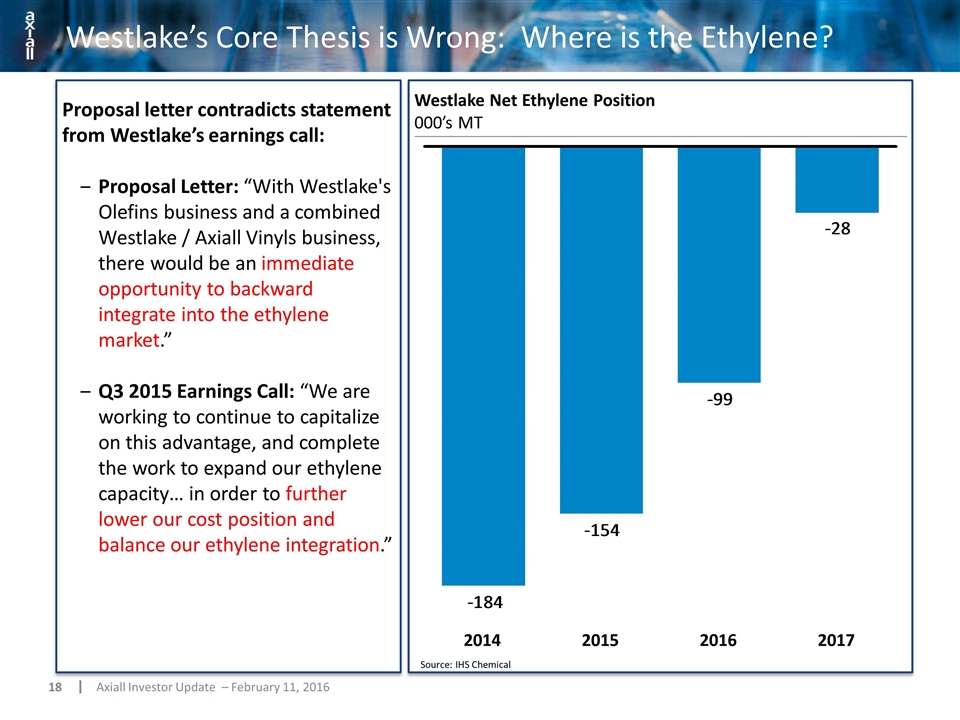

Westlake’s Opportunistic Proposal is a Bad Deal for Axiall Stockholders “Cash and stock proposal values Axiall at $20.00 per share…108% premium to Axiall share price on January 22, 2016, last trading day before proposal submitted” Axiall share price was $21.90 as recently as November 6th and has traded above $20 for more than 90% of the past three years “Offers Axiall shareholders meaningful participation in combined company’s attractive growth outlook, including expected synergy realization” Analysts forecast EBITDA decline of 24% for Westlake from 2015E-2018E1 Westlake fundamentals at peak; Axiall’s at trough Axiall’s $100 million cost reduction and productivity plan and other management initiatives on track Industry dynamics set the stage for recovery “…there would be an immediate opportunity to backward integrate into the ethylene market” Westlake’s ethylene position currently net negative until 2017 ThomsonOne Median Analyst Consensus as of January 28, 2016 Westlake Assertion Facts / Axiall Belief

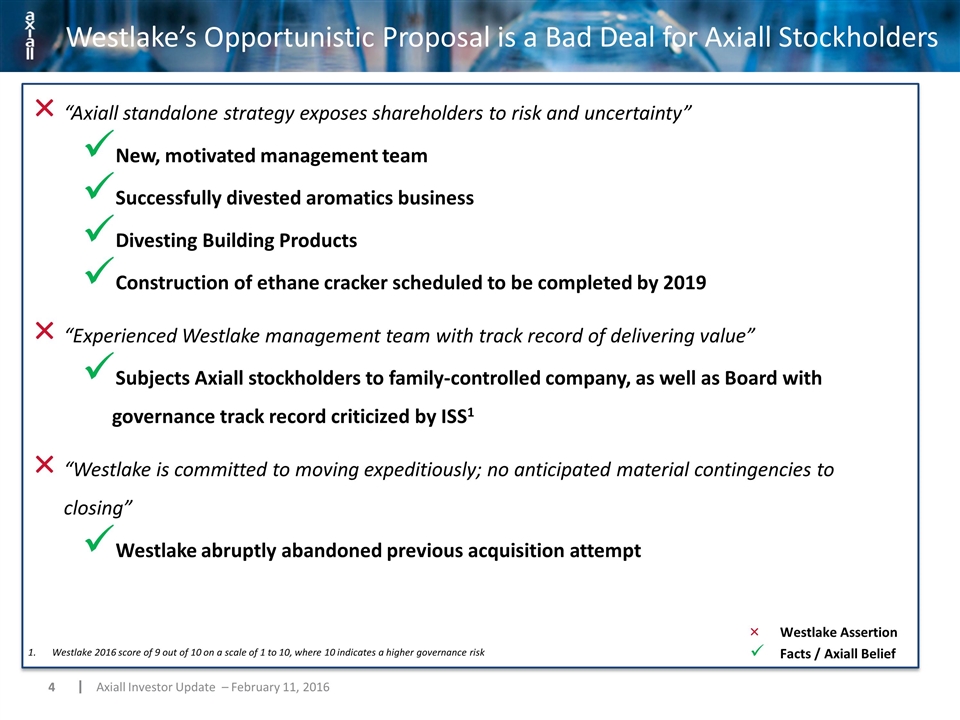

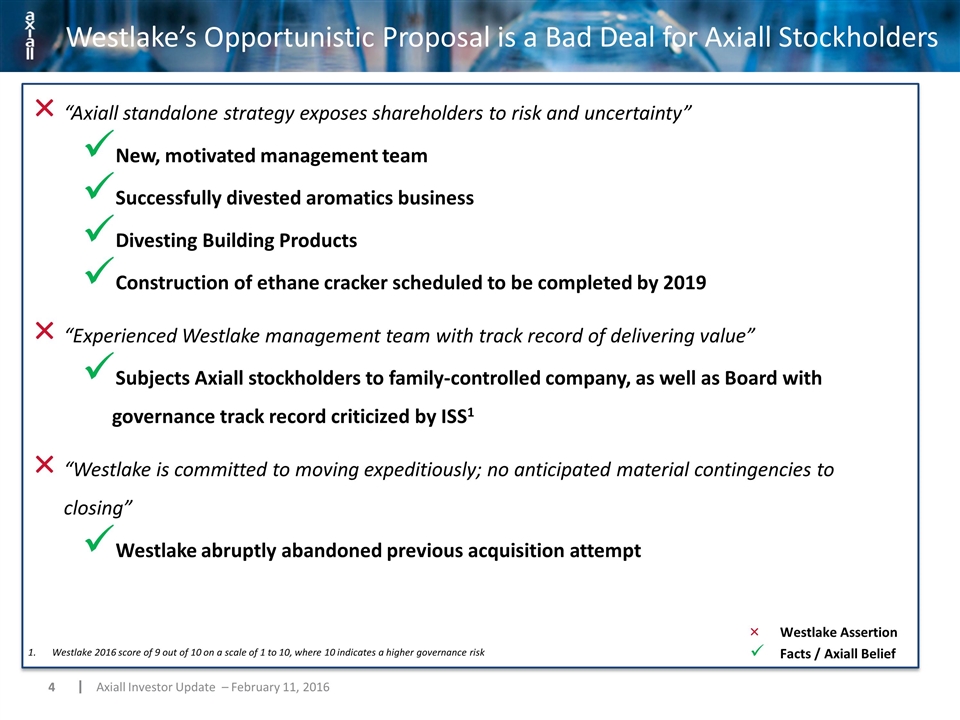

Westlake’s Opportunistic Proposal is a Bad Deal for Axiall Stockholders “Axiall standalone strategy exposes shareholders to risk and uncertainty” New, motivated management team Successfully divested aromatics business Divesting Building Products Construction of ethane cracker scheduled to be completed by 2019 “Experienced Westlake management team with track record of delivering value” Subjects Axiall stockholders to family-controlled company, as well as Board with governance track record criticized by ISS1 “Westlake is committed to moving expeditiously; no anticipated material contingencies to closing” Westlake abruptly abandoned previous acquisition attempt Westlake 2016 score of 9 out of 10 on a scale of 1 to 10, where 10 indicates a higher governance risk Westlake Assertion Facts / Axiall Belief

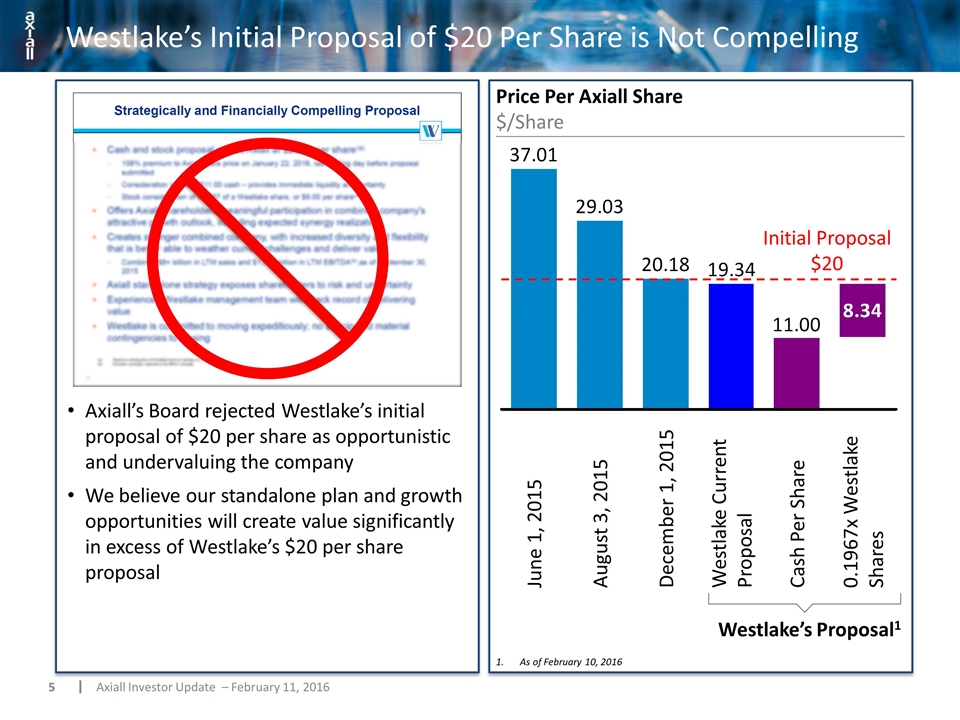

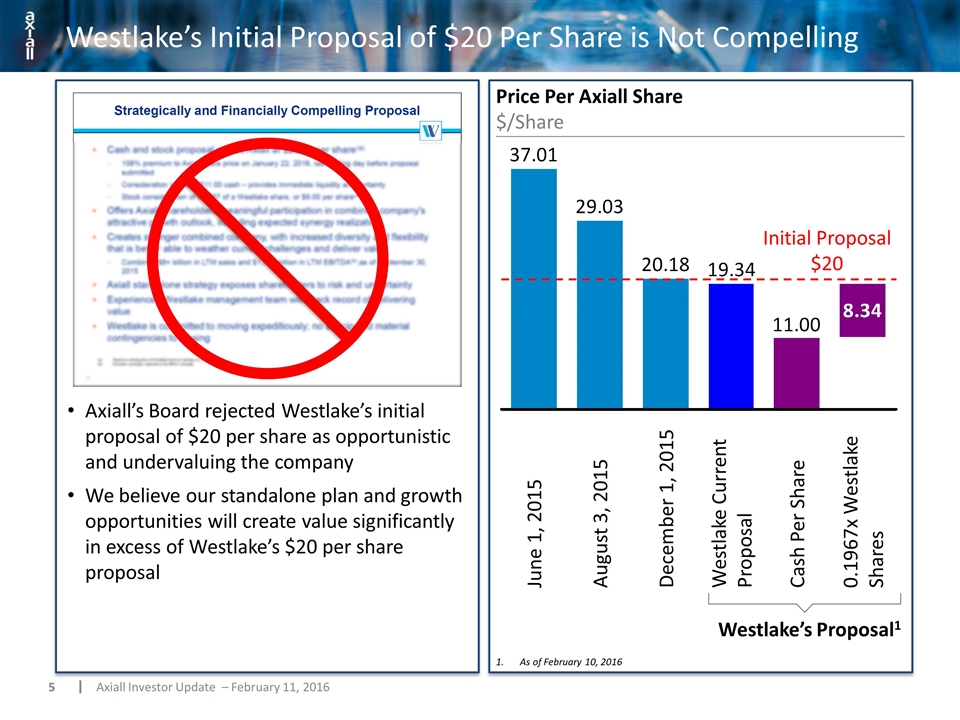

Westlake’s Initial Proposal of $20 Per Share is Not Compelling Westlake’s Proposal1 Axiall’s Board rejected Westlake’s initial proposal of $20 per share as opportunistic and undervaluing the company We believe our standalone plan and growth opportunities will create value significantly in excess of Westlake’s $20 per share proposal 0.1967x Westlake Shares Westlake Current Proposal Price Per Axiall Share $/Share Initial Proposal $20 As of February 10, 2016

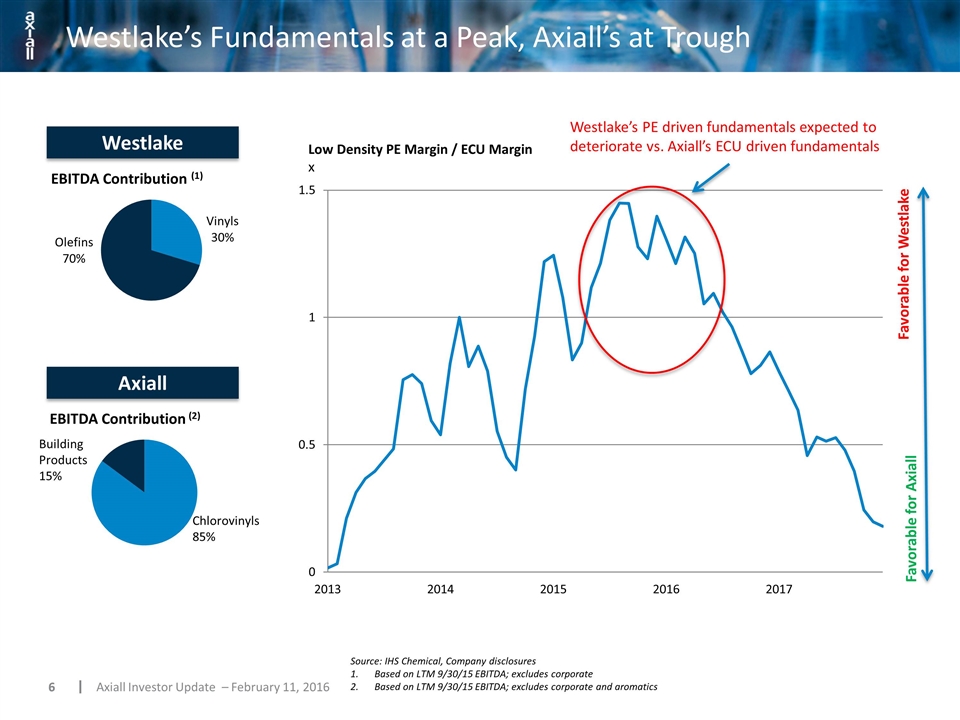

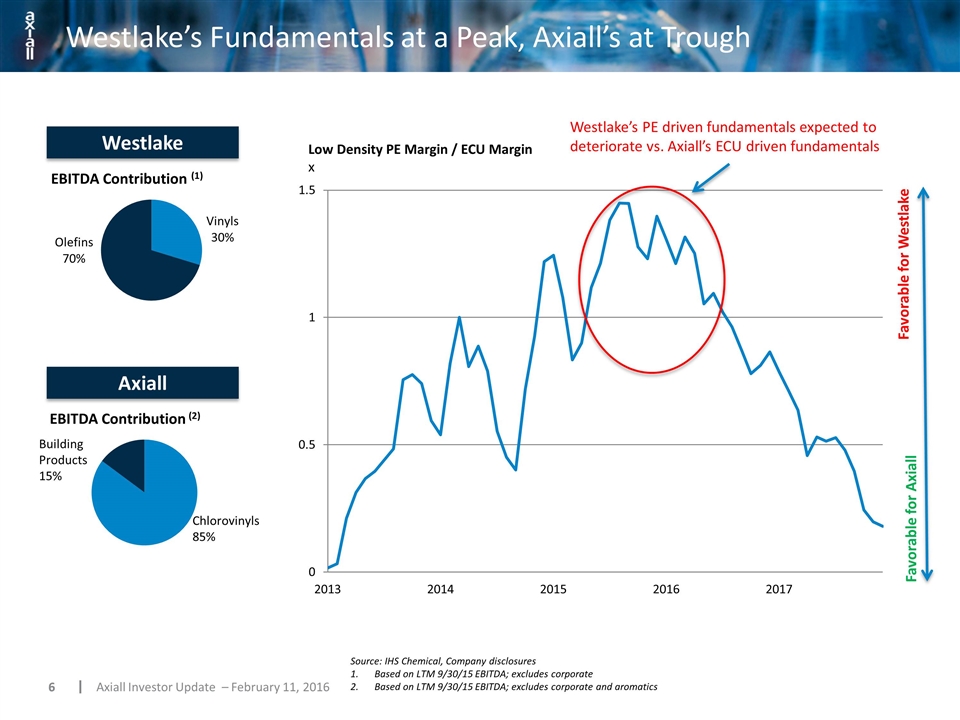

Westlake’s Fundamentals at a Peak, Axiall’s at Trough Low Density PE Margin / ECU Margin x Favorable for Westlake Favorable for Axiall Chlorovinyls 85% Building Products 15% Westlake Axiall Westlake’s PE driven fundamentals expected to deteriorate vs. Axiall’s ECU driven fundamentals Source: IHS Chemical, Company disclosures Based on LTM 9/30/15 EBITDA; excludes corporate Based on LTM 9/30/15 EBITDA; excludes corporate and aromatics

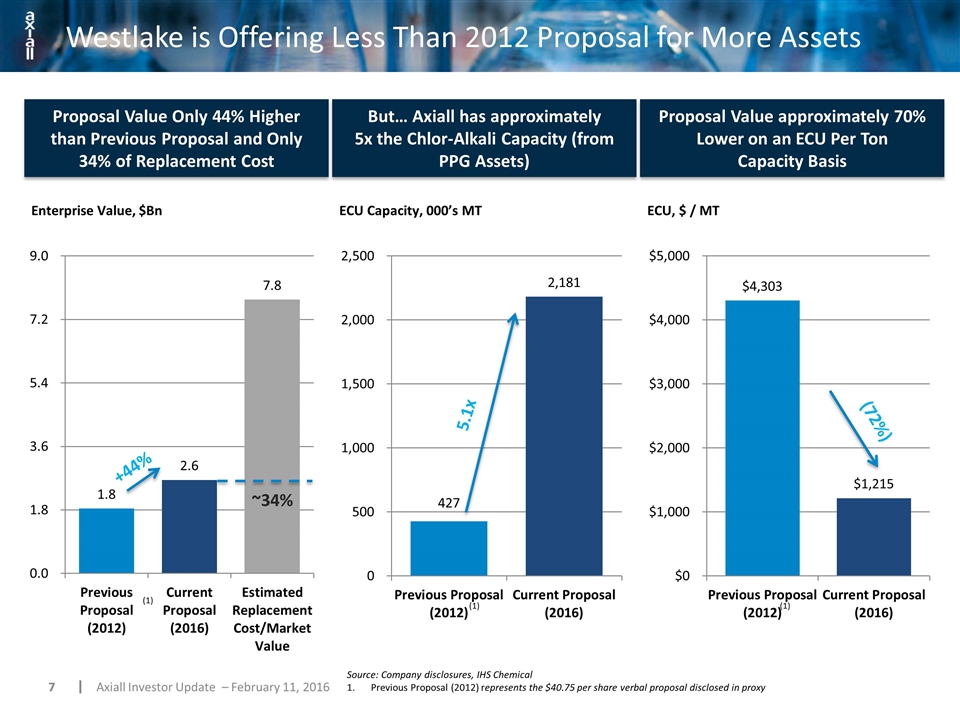

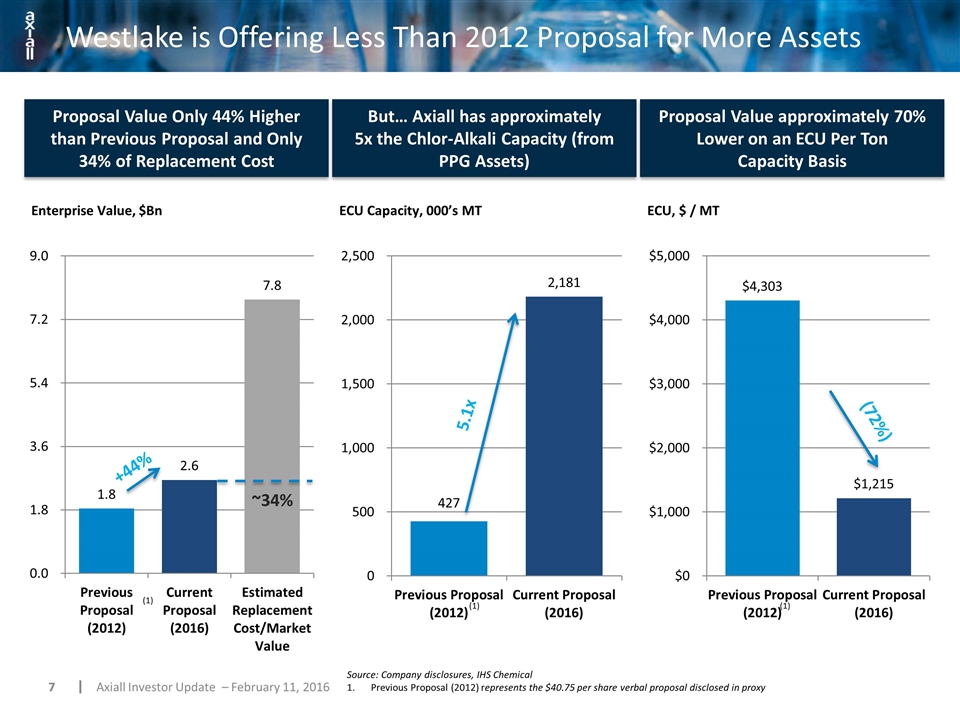

Westlake is Offering Less Than 2012 Proposal for More Assets Enterprise Value, $Bn ECU Capacity, 000’s MT ECU, $ / MT 5.1x (72%) Proposal Value Only 44% Higher than Previous Proposal and Only 34% of Replacement Cost But… Axiall has approximately 5x the Chlor-Alkali Capacity (from PPG Assets) Proposal Value approximately 70% Lower on an ECU Per Ton Capacity Basis +44% ~34% (1) (1) (1) Source: Company disclosures, IHS Chemical Previous Proposal (2012) represents the $40.75 per share verbal proposal disclosed in proxy

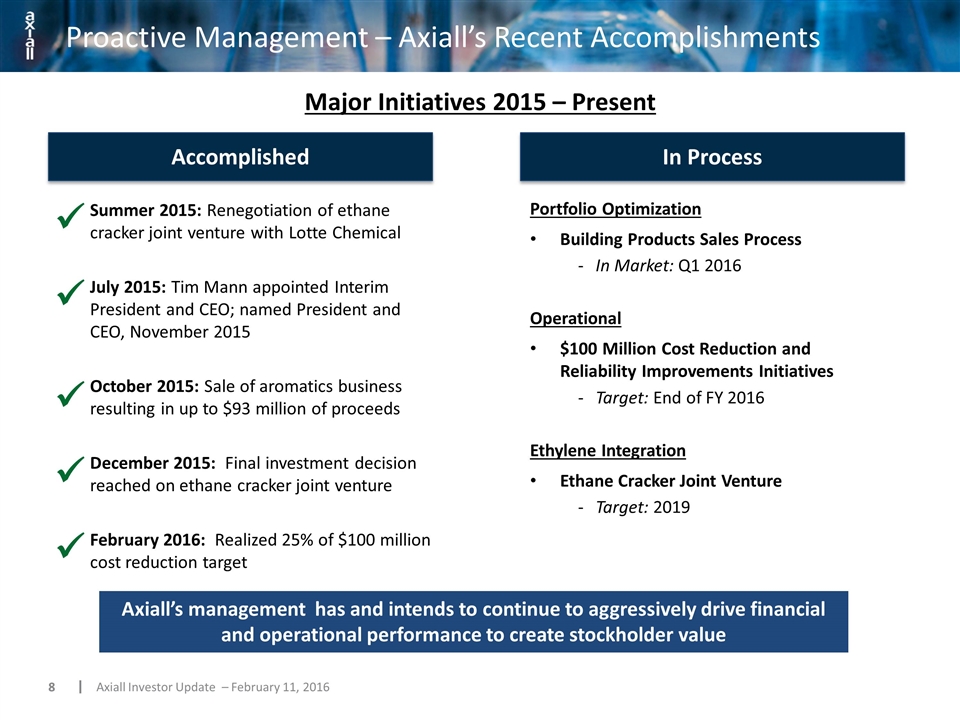

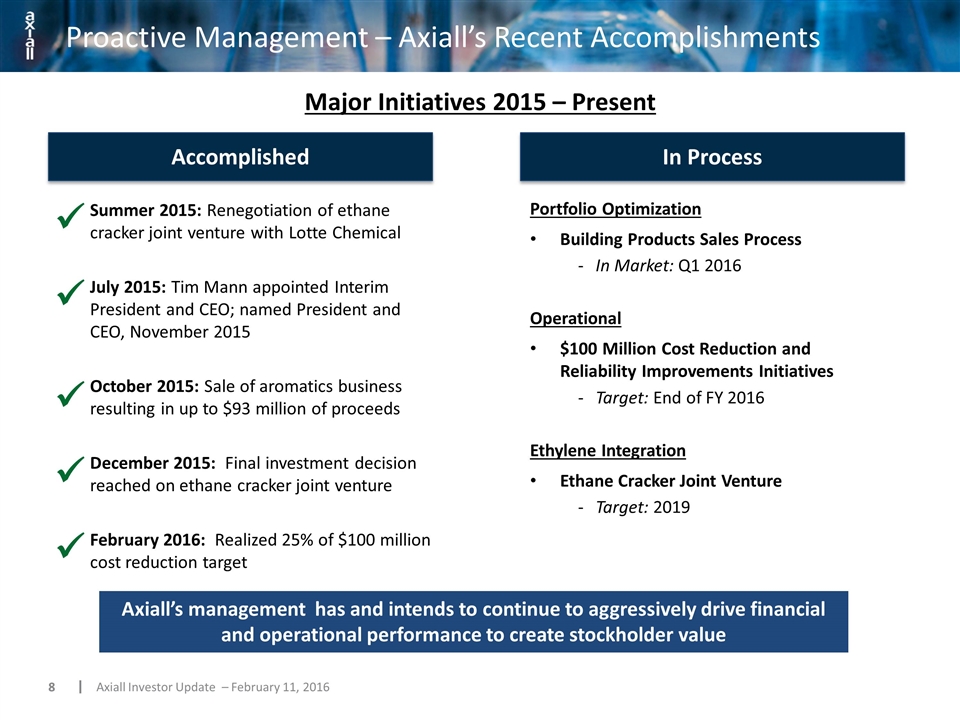

Proactive Management – Axiall’s Recent Accomplishments Major Initiatives 2015 – Present Summer 2015: Renegotiation of ethane cracker joint venture with Lotte Chemical July 2015: Tim Mann appointed Interim President and CEO; named President and CEO, November 2015 October 2015: Sale of aromatics business resulting in up to $93 million of proceeds December 2015: Final investment decision reached on ethane cracker joint venture February 2016: Realized 25% of $100 million cost reduction target Axiall’s management has and intends to continue to aggressively drive financial and operational performance to create stockholder value ü ü ü ü Portfolio Optimization Building Products Sales Process In Market: Q1 2016 Operational $100 Million Cost Reduction and Reliability Improvements Initiatives Target: End of FY 2016 Ethylene Integration Ethane Cracker Joint Venture Target: 2019 Accomplished In Process ü

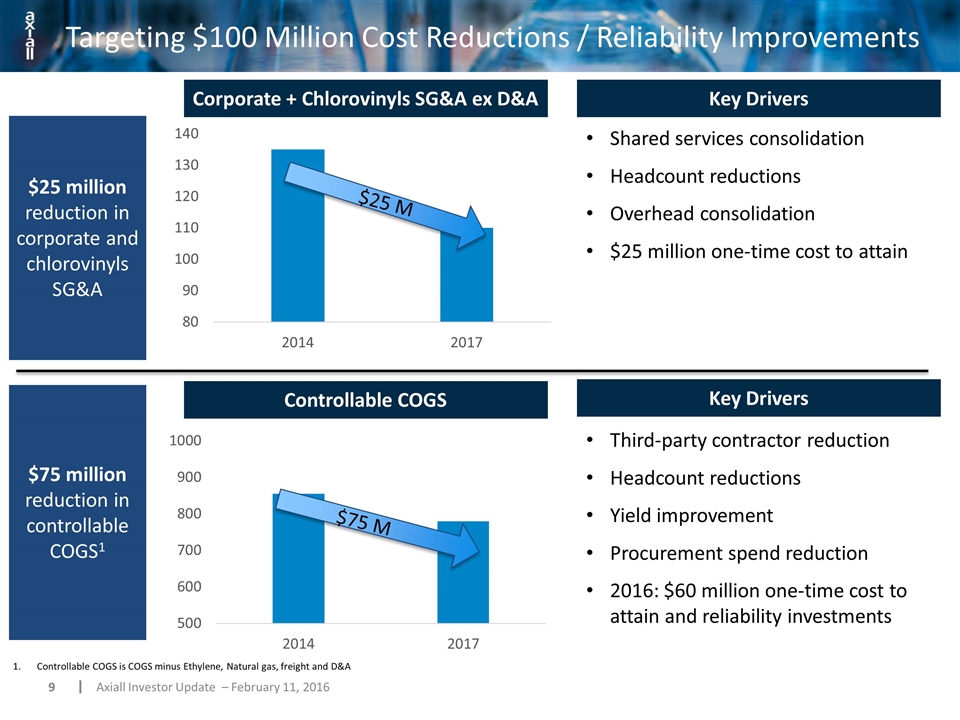

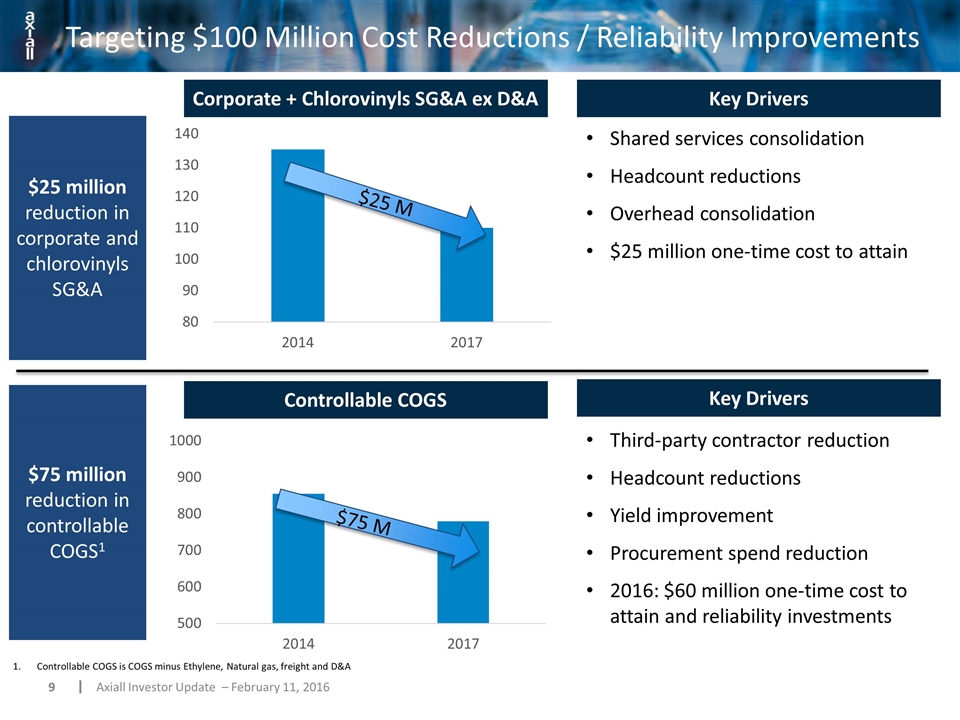

Targeting $100 Million Cost Reductions / Reliability Improvements Shared services consolidation Headcount reductions Overhead consolidation $25 million one-time cost to attain Third-party contractor reduction Headcount reductions Yield improvement Procurement spend reduction 2016: $60 million one-time cost to attain and reliability investments $75 M $25 M $25 million reduction in corporate and chlorovinyls SG&A $75 million reduction in controllable COGS1 Controllable COGS is COGS minus Ethylene, Natural gas, freight and D&A Key Drivers Controllable COGS Key Drivers Corporate + Chlorovinyls SG&A ex D&A

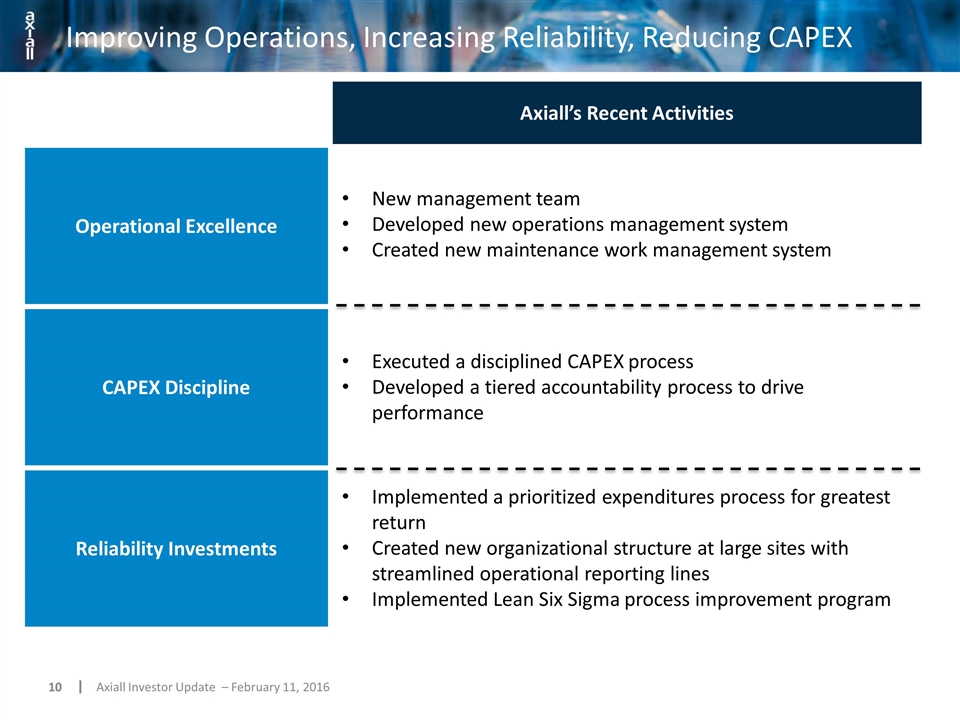

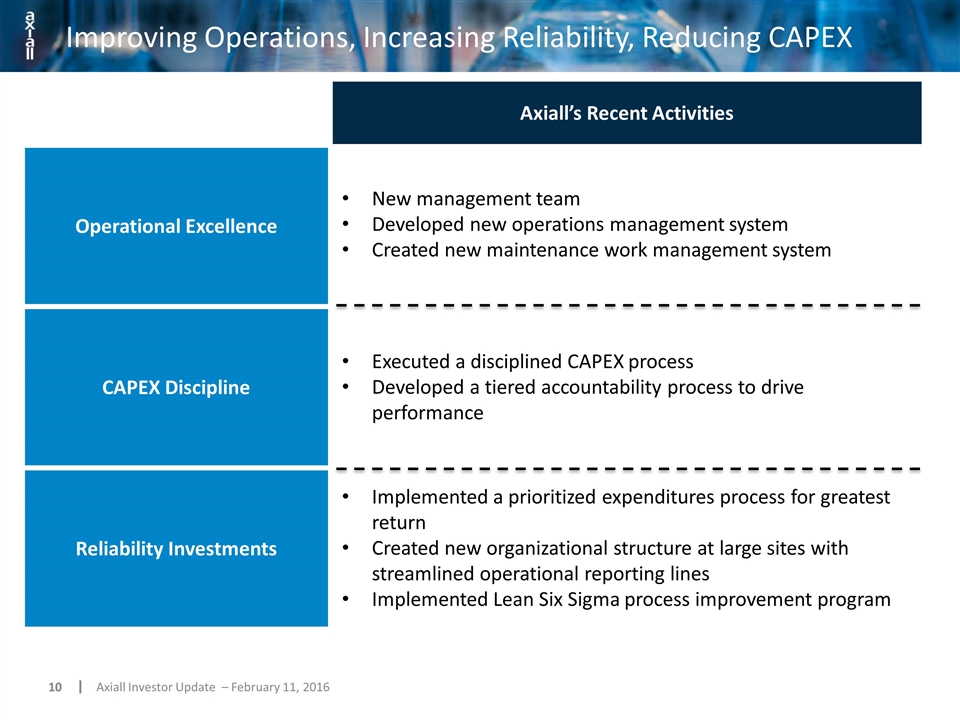

Improving Operations, Increasing Reliability, Reducing CAPEX Operational Excellence CAPEX Discipline Reliability Investments Axiall’s Recent Activities New management team Developed new operations management system Created new maintenance work management system Executed a disciplined CAPEX process Developed a tiered accountability process to drive performance Implemented a prioritized expenditures process for greatest return Created new organizational structure at large sites with streamlined operational reporting lines Implemented Lean Six Sigma process improvement program

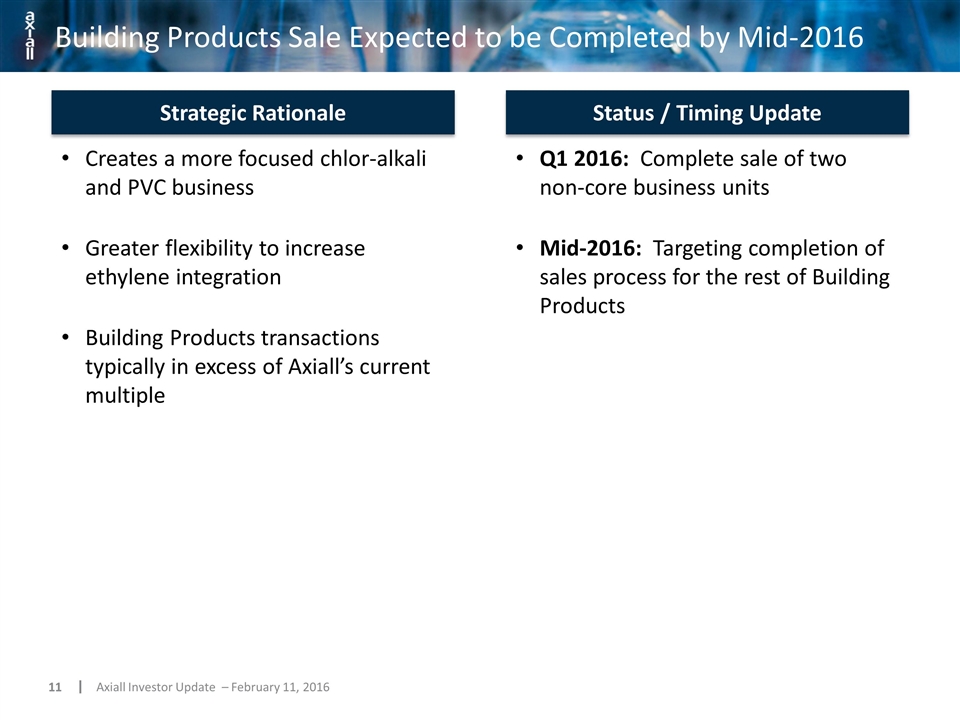

Building Products Sale Expected to be Completed by Mid-2016 Creates a more focused chlor-alkali and PVC business Greater flexibility to increase ethylene integration Building Products transactions typically in excess of Axiall’s current multiple Q1 2016: Complete sale of two non-core business units Mid-2016: Targeting completion of sales process for the rest of Building Products Strategic Rationale Status / Timing Update

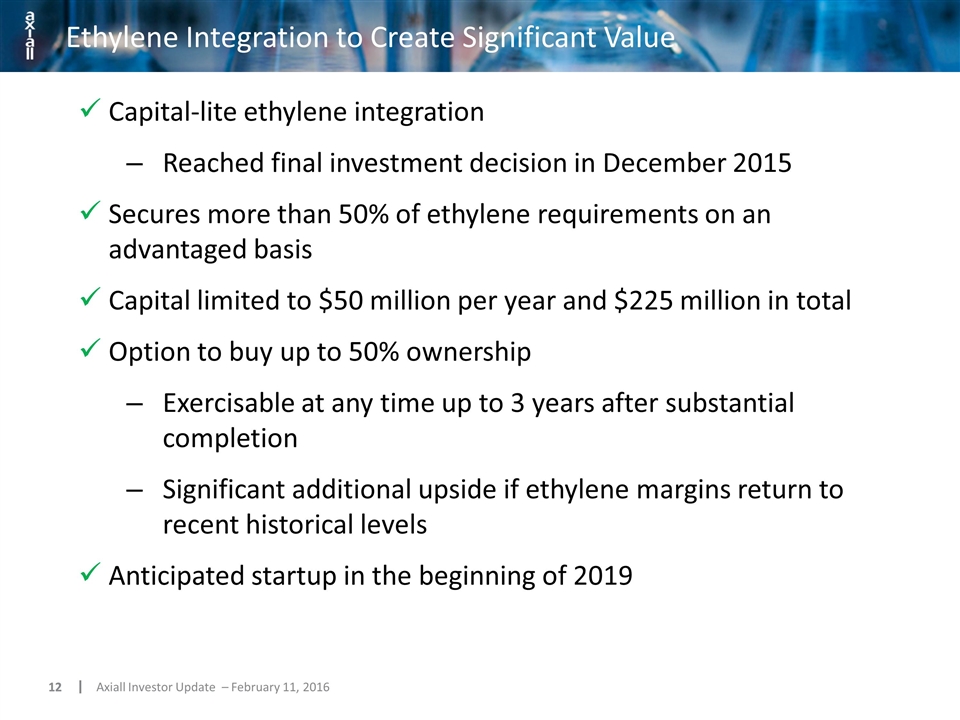

Ethylene Integration to Create Significant Value Capital-lite ethylene integration Reached final investment decision in December 2015 Secures more than 50% of ethylene requirements on an advantaged basis Capital limited to $50 million per year and $225 million in total Option to buy up to 50% ownership Exercisable at any time up to 3 years after substantial completion Significant additional upside if ethylene margins return to recent historical levels Anticipated startup in the beginning of 2019

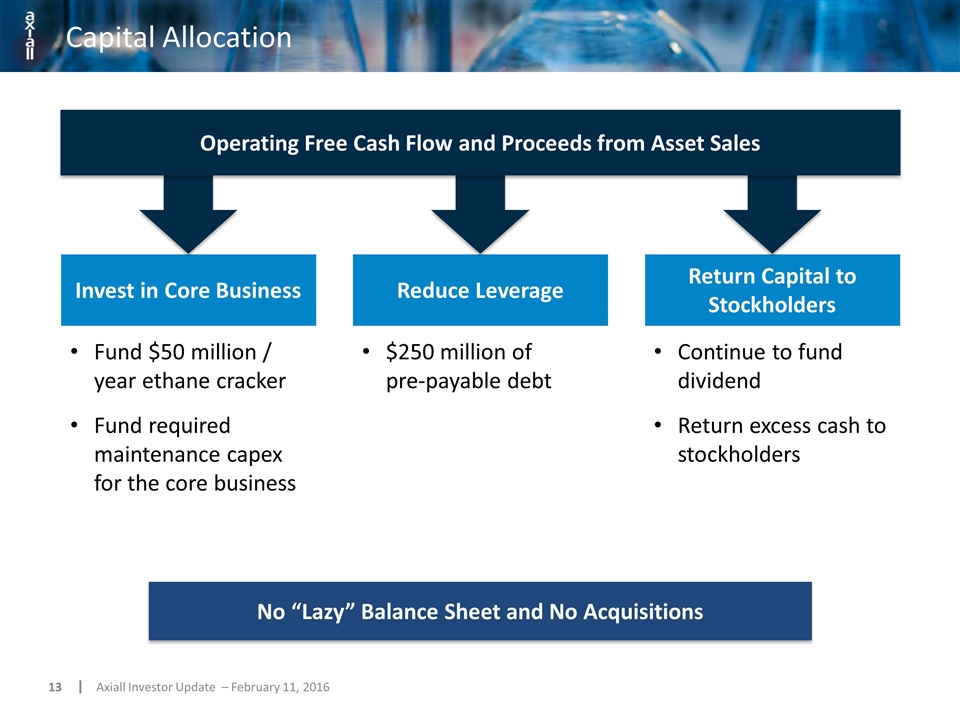

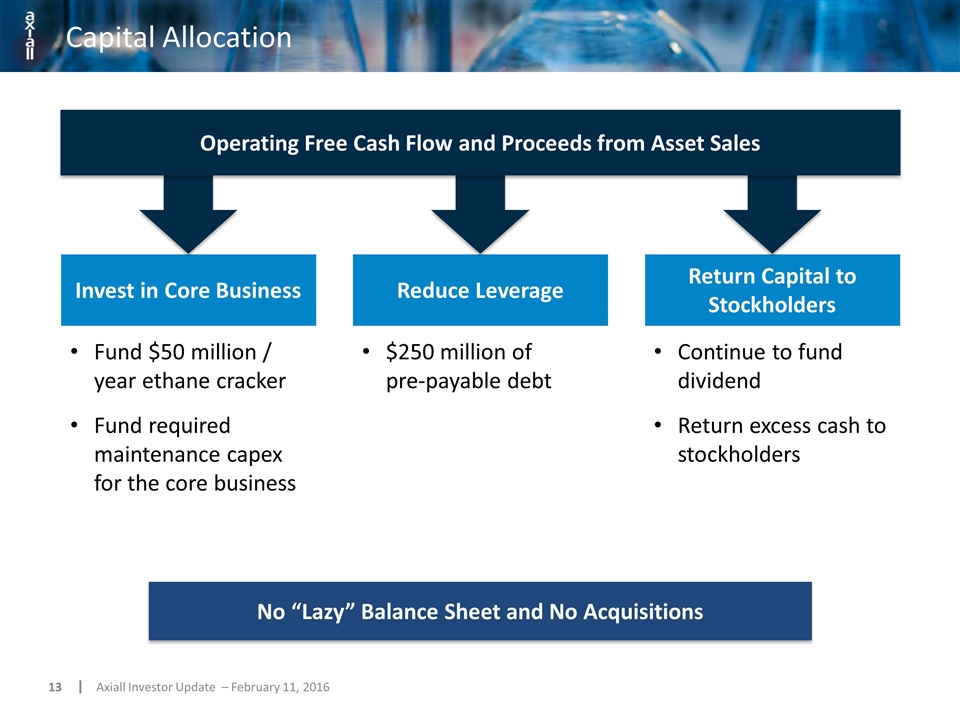

Capital Allocation Invest in Core Business Reduce Leverage Return Capital to Stockholders No “Lazy” Balance Sheet and No Acquisitions Fund $50 million / year ethane cracker Fund required maintenance capex for the core business $250 million of pre-payable debt Continue to fund dividend Return excess cash to stockholders Operating Free Cash Flow and Proceeds from Asset Sales

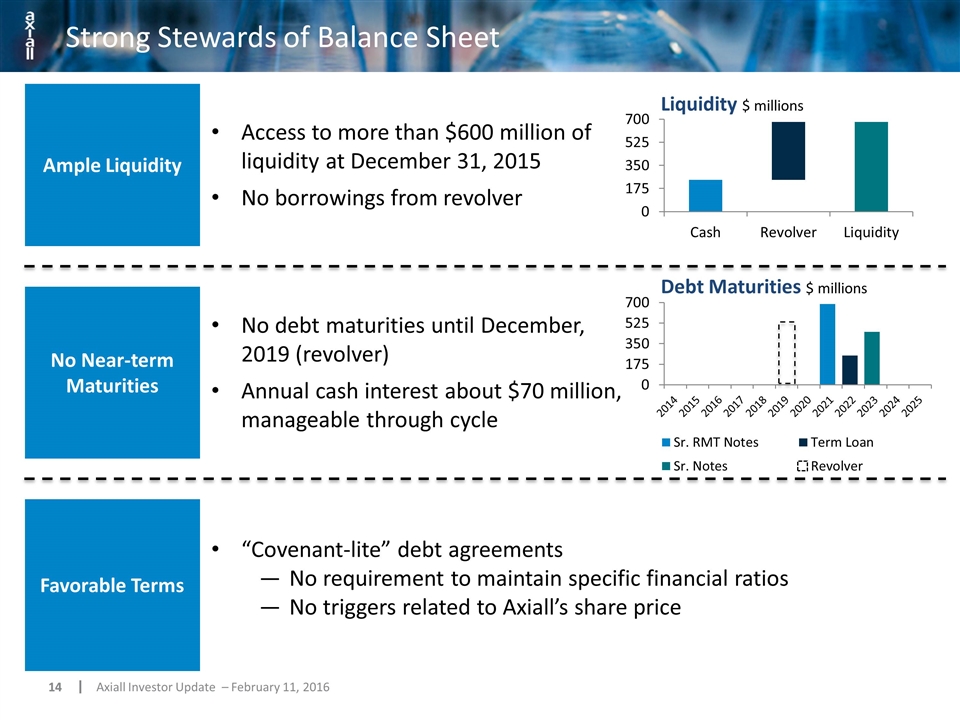

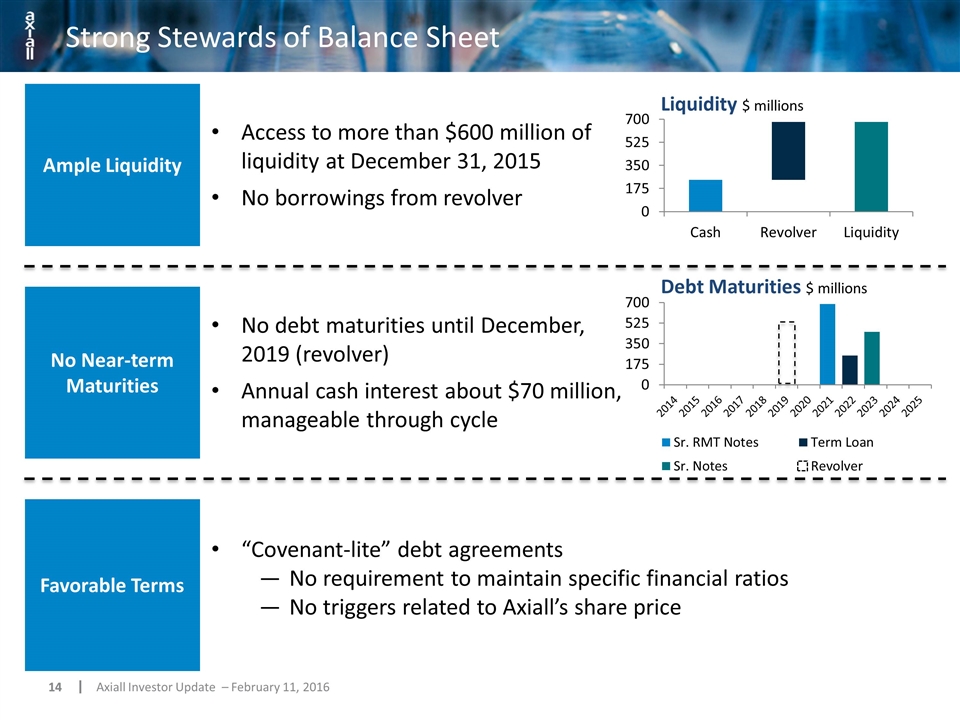

Strong Stewards of Balance Sheet Ample Liquidity No Near-term Maturities Favorable Terms Access to more than $600 million of liquidity at December 31, 2015 No borrowings from revolver No debt maturities until December, 2019 (revolver) Annual cash interest about $70 million, manageable through cycle “Covenant-lite” debt agreements No requirement to maintain specific financial ratios No triggers related to Axiall’s share price Liquidity $ millions Debt Maturities $ millions

Axiall’s Market Driven Upside Supply-demand balance expected to improve Announced supply reductions North America: First Half 2016 Europe: 2016-2017 Demand growth outlook is positive Margins should rise with a steepening cost curve Asymmetrical upside to oil-to-natural gas ratio

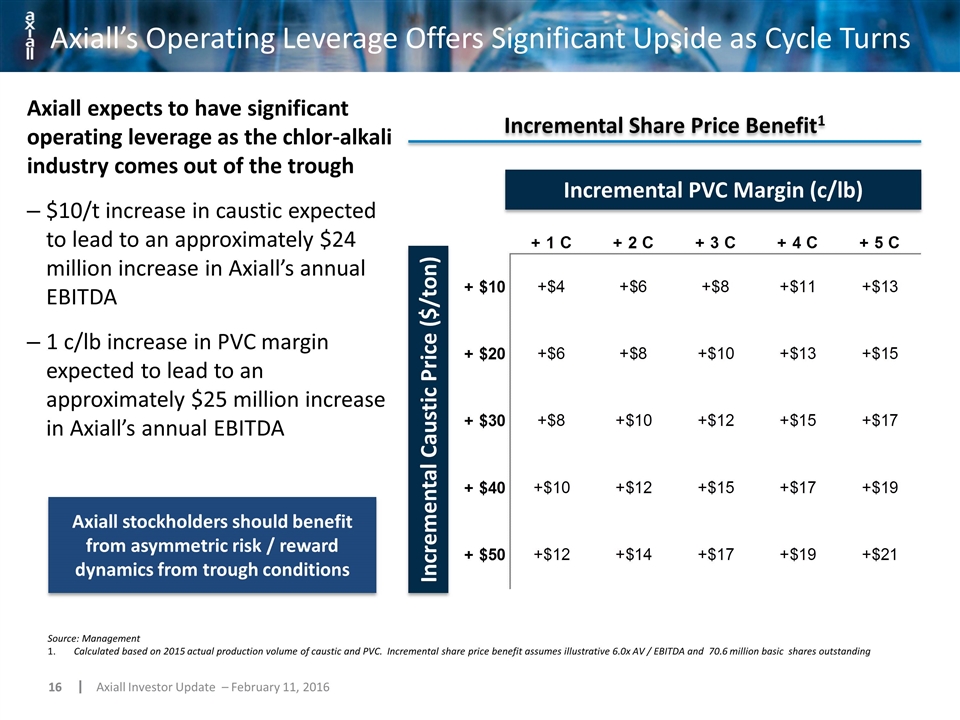

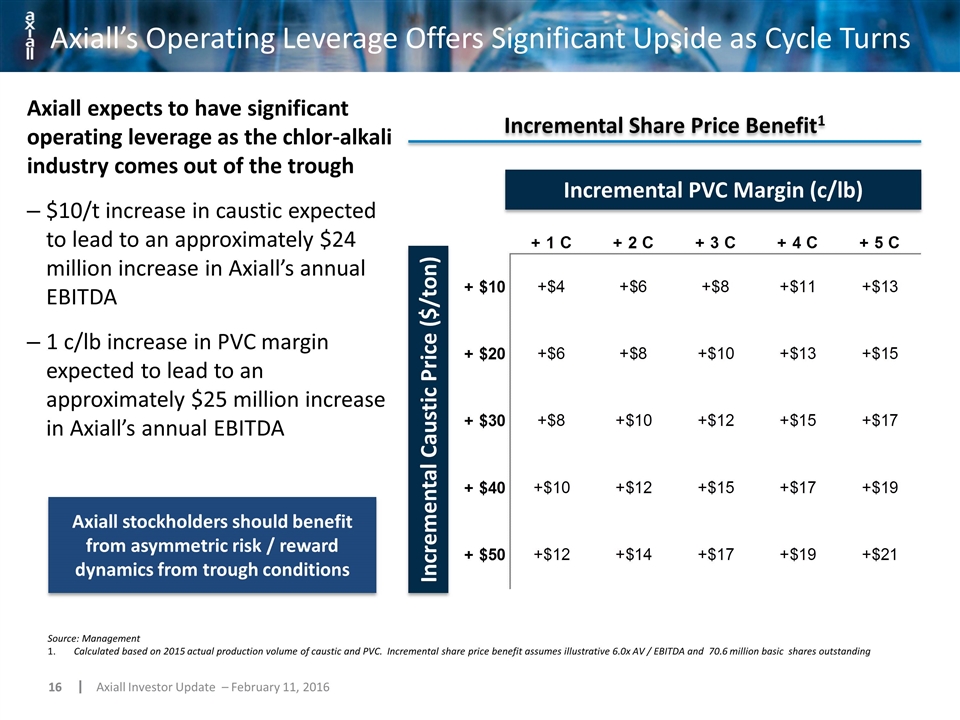

Axiall’s Operating Leverage Offers Significant Upside as Cycle Turns Incremental Share Price Benefit1 Axiall expects to have significant operating leverage as the chlor-alkali industry comes out of the trough $10/t increase in caustic expected to lead to an approximately $24 million increase in Axiall’s annual EBITDA 1 c/lb increase in PVC margin expected to lead to an approximately $25 million increase in Axiall’s annual EBITDA Axiall stockholders should benefit from asymmetric risk / reward dynamics from trough conditions Incremental PVC Margin (c/lb) Incremental Caustic Price ($/ton) Source: Management Calculated based on 2015 actual production volume of caustic and PVC. Incremental share price benefit assumes illustrative 6.0x AV / EBITDA and 70.6 million basic shares outstanding

Axiall’s Value Creation Model Management Actions $100 million cost reductions and productivity plan on track; 25% realized already Market Driven Opportunity Industry capacity rationalization underway; historically, caustic prices start to recover within approximately 6-12 months Liquidity and Capital Allocation December 31, 2015: more than $250 million in cash and more than $600 million in total liquidity Next bond / term loan maturities more than 5 years away: 2021, 2022 and 2023 Return excess capital to stockholders Full Building Products sale process underway Capital-lite, advantaged ethylene integration, securing an actionable and affordable path to meet more than 50% of Axiall’s needs if attractive IRRs $10/t increase in caustic should lead to an approximately $24 million increase in Axiall’s annual EBITDA 1 c/lb increase in PVC margin should lead to an approximately $25 million increase in Axiall’s annual EBITDA

Westlake’s Core Thesis is Wrong: Where is the Ethylene? Proposal letter contradicts statement from Westlake’s earnings call: Proposal Letter: “With Westlake's Olefins business and a combined Westlake / Axiall Vinyls business, there would be an immediate opportunity to backward integrate into the ethylene market.” Q3 2015 Earnings Call: “We are working to continue to capitalize on this advantage, and complete the work to expand our ethylene capacity… in order to further lower our cost position and balance our ethylene integration.” Westlake Net Ethylene Position 000’s MT 2016 2017 2014 2015 Source: IHS Chemical

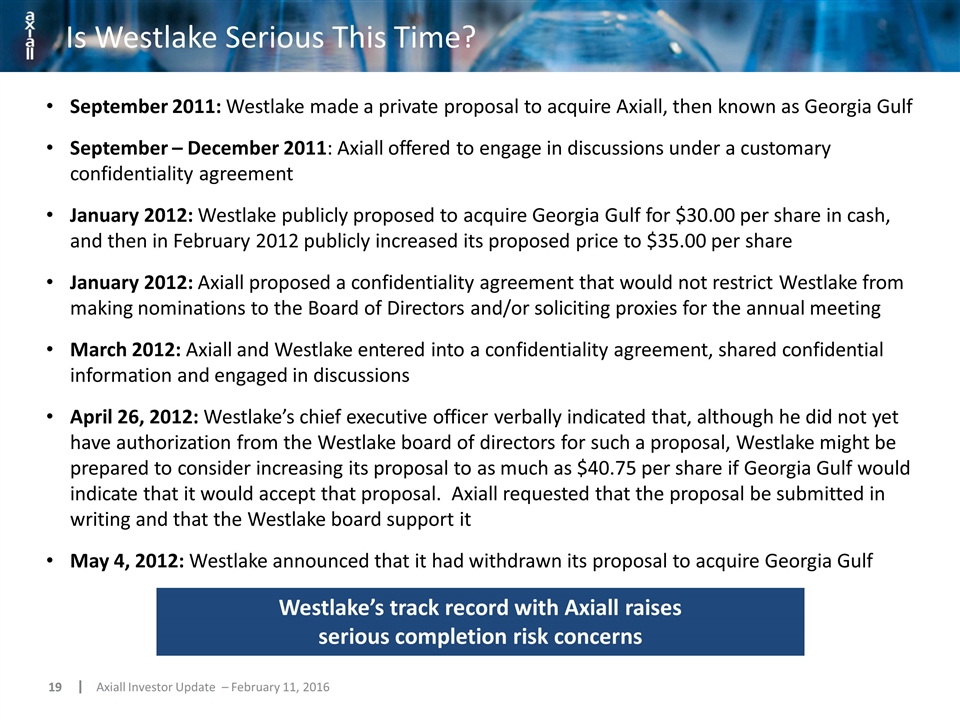

Is Westlake Serious This Time? September 2011: Westlake made a private proposal to acquire Axiall, then known as Georgia Gulf September – December 2011: Axiall offered to engage in discussions under a customary confidentiality agreement January 2012: Westlake publicly proposed to acquire Georgia Gulf for $30.00 per share in cash, and then in February 2012 publicly increased its proposed price to $35.00 per share January 2012: Axiall proposed a confidentiality agreement that would not restrict Westlake from making nominations to the Board of Directors and/or soliciting proxies for the annual meeting March 2012: Axiall and Westlake entered into a confidentiality agreement, shared confidential information and engaged in discussions April 26, 2012: Westlake’s chief executive officer verbally indicated that, although he did not yet have authorization from the Westlake board of directors for such a proposal, Westlake might be prepared to consider increasing its proposal to as much as $40.75 per share if Georgia Gulf would indicate that it would accept that proposal. Axiall requested that the proposal be submitted in writing and that the Westlake board support it May 4, 2012: Westlake announced that it had withdrawn its proposal to acquire Georgia Gulf Westlake’s track record with Axiall raises serious completion risk concerns

Westlake’s Corporate Governance Raises Red Flags for Axiall Stockholders No controlling stockholder Annual elections for all directors by stockholders All directors (except AXLL CEO and PPG Industries CEO) are independent under NYSE rules Since 2012, Axiall has appointed five new directors, bringing fresh perspectives to the Board Broad industry expertise across a range of disciplines that are critical to Axiall’s business, including consumer, professional and industrial products and applications Westlake is a family-controlled company, with Chao family owning 70% of Westlake’s common stock Chairman of the Board is not independent 5 of 8 Board members have served 10 years or more ISS gives Westlake among the lowest Corporate Governance Scores (1) ISS withhold recommendations to re-elect James Chao (2015) and Dorothy Jenkins (2014) Exposure that Westlake stockholders may have to recent IRS MLP rule proposals which could negatively impact Westlake Chemical Partners LP Are stockholders trading away majority rights in a well-governed company for minority rights in a company with legitimate governance questions? Westlake Axiall Source: ISS Westlake 2016 score of 9 out of 10 on a scale of 1 to 10, where 10 indicates a higher governance risk

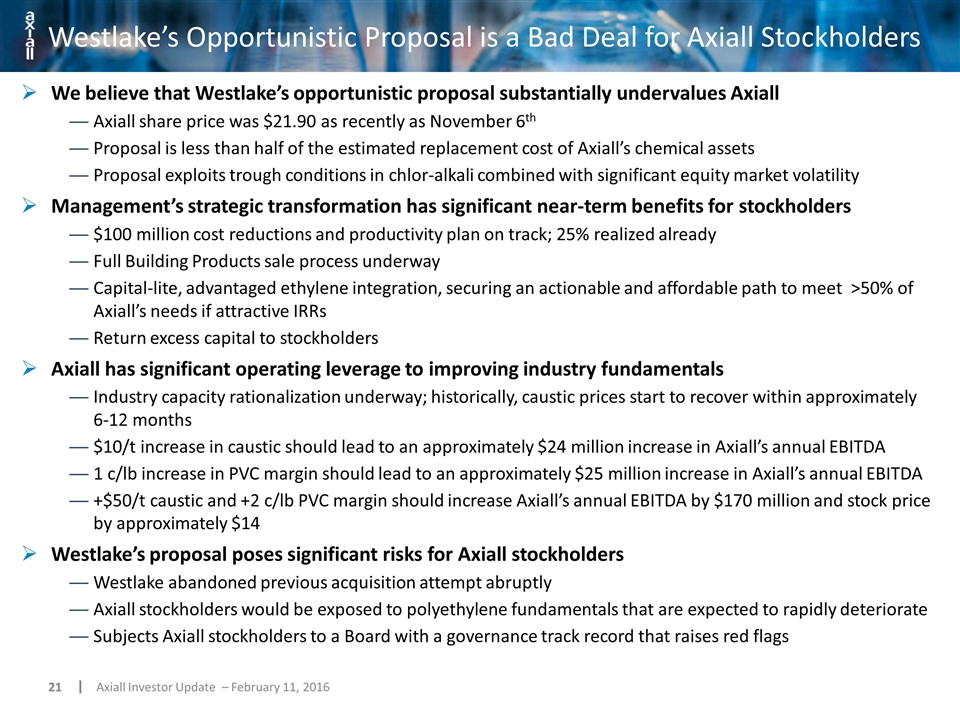

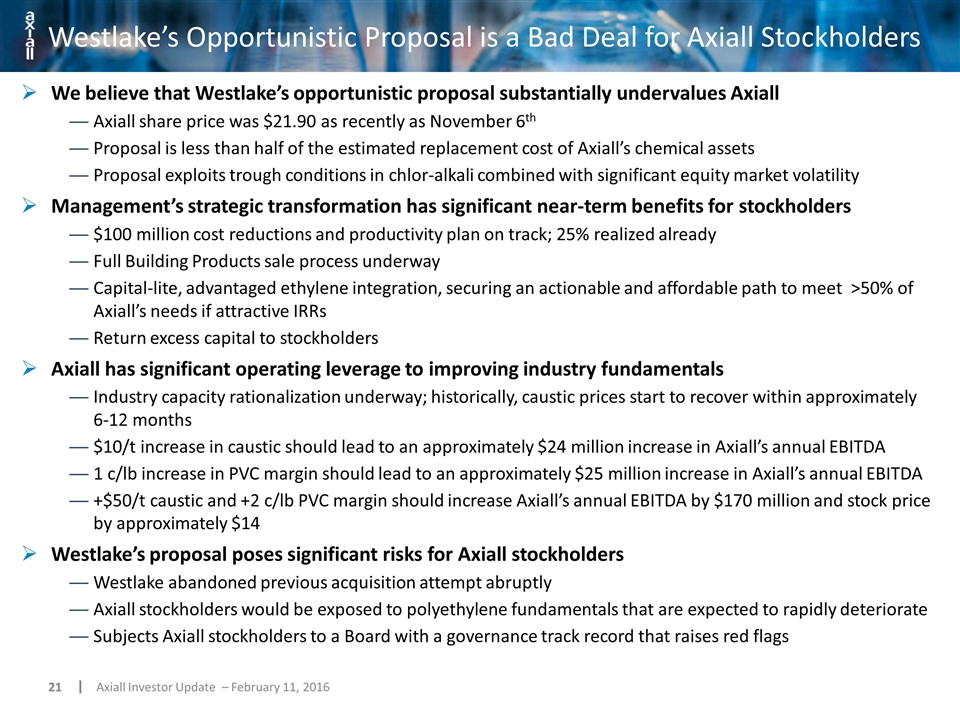

Westlake’s Opportunistic Proposal is a Bad Deal for Axiall Stockholders We believe that Westlake’s opportunistic proposal substantially undervalues Axiall Axiall share price was $21.90 as recently as November 6th Proposal is less than half of the estimated replacement cost of Axiall’s chemical assets Proposal exploits trough conditions in chlor-alkali combined with significant equity market volatility Management’s strategic transformation has significant near-term benefits for stockholders $100 million cost reductions and productivity plan on track; 25% realized already Full Building Products sale process underway Capital-lite, advantaged ethylene integration, securing an actionable and affordable path to meet >50% of Axiall’s needs if attractive IRRs Return excess capital to stockholders Axiall has significant operating leverage to improving industry fundamentals Industry capacity rationalization underway; historically, caustic prices start to recover within approximately 6-12 months $10/t increase in caustic should lead to an approximately $24 million increase in Axiall’s annual EBITDA 1 c/lb increase in PVC margin should lead to an approximately $25 million increase in Axiall’s annual EBITDA +$50/t caustic and +2 c/lb PVC margin should increase Axiall’s annual EBITDA by $170 million and stock price by approximately $14 Westlake’s proposal poses significant risks for Axiall stockholders Westlake abandoned previous acquisition attempt abruptly Axiall stockholders would be exposed to polyethylene fundamentals that are expected to rapidly deteriorate Subjects Axiall stockholders to a Board with a governance track record that raises red flags

Q&A