| | | OMB APPROVAL |

| | | OMB Number: | 3235-0570 |

| | | Expires: | September 30, 2025 |

| | UNITED STATES | Estimated average burden hours per response. . . . . . . . . . . . . . .7.8 |

| | SECURITIES AND EXCHANGE COMMISSION | |

| | Washington, D.C. 20549 | |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-04889 |

| |

| Tekla Healthcare Investors |

| (Exact name of registrant as specified in charter) |

| |

| 100 Federal Street, 19th Floor, Boston, MA | | 02110 |

| (Address of principal executive offices) | | (Zip code) |

| |

| |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 617-772-8500 | |

| |

| Date of fiscal year end: | September 30 | |

| |

| Date of reporting period: | October 1, 2022 to March 31, 2023 | |

| | | | | | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

Semiannual Report

Tekla Healthcare Investors

March 31, 2023

Tekla Healthcare Investors

Distribution policy: The Fund has implemented a managed distribution policy (the Policy) that provides for quarterly distributions at a rate set by the Board of Trustees. Under the current Policy, the Fund intends to make quarterly distributions at a rate of 2% of the Fund's net assets to shareholders of record. The Policy would result in a return of capital to shareholders if the amount of the distribution exceeds the Fund's net investment income and realized capital gains. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund's investment performance and should not be confused with "yield" or "income."

The amounts and sources of distributions reported in the Fund's notices pursuant to Section 19(a) of the Investment Company Act of 1940 are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund's investment experience during its fiscal year and may be subject to changes based on tax regulations. The Fund will send you a Form 1099-DIV for the calendar year that tells you how to report distributions for federal income tax purposes.

You should not draw any conclusions about the Fund's investment performance from the amount of distributions pursuant to the Policy or from the terms of the Policy. The Policy has been established by the Trustees and may be changed or terminated by them without shareholder approval. The Trustees regularly review the Policy and the frequency and rate of distributions considering the purpose and effect of the Policy, the financial market environment, and the Fund's income, capital gains and capital available to pay distributions. The suspension or termination of the Policy could have the effect of creating a trading discount or widening an existing trading discount. At this time there are no reasonably foreseeable circumstances that might cause the Trustees to terminate the Policy.

Consider these risks before investing: As with any investment company that invests in equity securities, the Fund is subject to market risk—the possibility that the prices of equity securities will decline over short or extended periods of time. As a result, the value of an investment in the Fund's shares will fluctuate with the market generally and market sectors in particular. You could lose money over short or long periods of time. Political and economic news can influence marketwide trends and can cause disruptions in the U.S. or world financial markets. Other factors may be ignored by the market as a whole but may cause movements in the price of one company's stock or the stock of companies in one or more industries. All of these factors may have a greater impact on initial public offerings and emerging company shares. Different types of equity securities tend to shift into and out of favor with investors, depending on market and economic conditions. The performance of funds that invest in equity securities of healthcare companies may at times be better or worse than the performance of funds that focus on other types of securities or that have a broader investment style.

Tekla Healthcare Investors

Dear Shareholders,

In our view, the healthcare sector represents an attractive sector of the economy in which to invest over any reasonable timeframe and in particular in the current uncertain macro-environment. The sector has performed well over intermediate and long timeframes and is generally thought of as defensive. In addition, the sector is quite diverse, consisting of at least ten subsectors. We like the fact that these subsectors are diversified and often perform differently in divergent macroeconomic environments. Therefore, we can almost always identify a subsector which will benefit from, and hopefully outperform, in the current environment.

Macroeconomics provides much of the uncertainty currently. There is much debate about whether a U.S. and/or worldwide recession looms. Multi-decade highs in interest rates and inflation, an inverted yield curve and a potential housing slump after a Covid associated boom certainly raise the likelihood of a recession in the next year. But historically low unemployment, adequate real 4Q22 GDP growth and a favorable stock market argue against. Our view tips toward the likelihood of a modest recession sometime in the next year. But we have found over a career that while trying to time the market can be difficult, attempting to predict the timing of the next recession is about impossible. As Paul Samuelson once joked, "the stock market has predicted nine of the last five recessions". We think investment in healthcare could serve to blunt the potential impact of any recession.

Healthcare, along with consumer staples and utilities, are generally thought of as defensive. These sectors tend to address basic non-cyclical needs and therefore tend to deliver consistent earnings and stable dividends. As a sector that addresses the wellness of the population, healthcare spending will be among the last things people give up as money gets tight.

Healthcare can certainly exhibit ups and downs but has performed well over the long-term as can be seen in the following table. Over multiple timeframes, the S&P Composite 1500® Healthcare Index* (S15HLTH), representing the broad healthcare space, has performed well in comparison to the S&P 500® Index* (SPX), the broad market standard against which many or most investment approaches are typically compared.

Index | | One Year (%) | | Five Year (%) | | Ten Year (%) | | Twenty Year (%) | |

SPX | | | -7.8 | | | | 11.2 | | | | 12.2 | | | | 10.4 | | |

S15HLTH | | | -4.4 | | | | 11.5 | | | | 12.9 | | | | 10.6 | | |

We are particularly attracted to the diversity of investment opportunity provided by individual healthcare subsectors. These subsectors include pharmaceuticals, biotechnology, managed care (i.e., MCOs), providers (hospitals), medical technology (medtech), life science tools (LST), distributors, healthcare services and healthcare information technology.

Varying macroeconomic situations often influence our subsector allocation decision making. For example, when investment capital is freely available, speculation typically abounds. At

Tekla Healthcare Investors | SEMIANNUAL REPORT 1

such times, innovative, pre-profit or even pre-revenue companies in the biotech sector can be good investments. By contrast, when interest rates are high and capital is less available, profitable growing companies, including pharmaceuticals, can be better investments. At the moment, there is limited availability of capital. As such we are tending to be underweight not-yet profitable biotech companies and overweight profitable pharmaceuticals.

In an analogous way, when jobs are plentiful and wages are growing, individuals tend to seek more elective medical procedures. In this case, there is more demand for medical products and hospitals are busier. In this situation, managed care companies, which pay for medical procedures, tend to be more challenged. By contrast, when jobs are tight, demand for medical products and services often declines while managed care companies have lessened reimbursement demands and often perform better. At the moment, utilization of products and services is generally up, so we tend to be overweight medtech and hospitals and underweight managed care.

In large part, our management approach is to bias our subsector allocations based on macro factors while using our knowledge of associated individual companies to create a portfolio that is likely to perform well. In general, we seek to produce a solid risk adjusted performance that allows the Fund to continue to deliver the distributions to which shareholders have become accustomed. We summarize some of the macro factors that currently shape our views:

Clinical and commercial progress is always a key contributor to sentiment toward the healthcare area. In the last several years, particularly lately, we have seen some interesting developments that look to be creating enormous opportunities to address the needs of large groups of older patients. One example is the recent approval of Leqembi, a drug that slows the progression of Alzheimer's disease. This drug reduces the presence of beta amyloid plaque in the brain and has demonstrated an ability to slow the progression of Alzheimer's. Several other drugs are in late-stage development in the Alzheimer's disease space. The Alzheimer's Association reports that about one in every nine people over 65 have Alzheimer's.

Diabetes and obesity represent two of the biggest health issues we have seen in recent decades. Each of these conditions represents enormous challenges for the healthcare system. Approximately one in ten Americans have diabetes and approximately 40% of American adults over 20 are obese. This twin condition is often referred to as diabesity. In the last year or two we have seen the development of several drugs (i.e., Mounjaro, Wegovy and Ozempic) in the GLP 1 class that have had impact in one or both of these conditions. This class of drugs has the potential to dramatically impact diabesity with a market size that could reach $100B.

There has also been notable progress in the area of a condition called fatty liver which may affect 25% of the adult American population and particularly in an associated liver condition NASH (Non Alcoholic Steatohepatitus) which is thought to effect up to 6.5% of American adults with fatty liver. After many years and multiple attempts, we have, in the last year, seen

2 TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT

a positive clinical trial (i.e., the MAESTRO_NASH study by Madrigal Pharmaceuticals, Inc.). This Phase III study showed, for the first time, statistically significant benefits in both NASH resolution and fibrosis improvement in a pivotal study. It has reignited the interests of both investors and biopharma companies to NASH, which is a potentially multi-billion dollar market that has heretofore seen few, if any, positive developments.

Merger & Acquisition (M&A) activity also contributes to sentiment in the healthcare space, particularly in the biotech subsector. It is notable that M&A activity is up as we write this letter in late April 2023. Importantly we have recently seen acquisitions of both large (i.e., Horizon Therapeutics plc and Seagen, Inc.) and small (i.e., Prometheus Biosciences, Inc., Bellus Health, Inc., Provention Bio, Inc., Concert Pharmaceuticals, Inc. and CinCor Pharma, Inc.) biotech companies. We are hopeful that this is the start of a longer M&A trend.

On the Regulatory/Legislative side, we note that In August 2022, President Biden signed into law the Inflation Reduction Act (IRA), which contains several material changes to Medicare reimbursement and drug pricing policies. While some aspects of the law may serve to lower patients' financial burden while also increasing access to medicines, such as a cap on Part D out-of-pocket spending, other portions may alter how and which drugs are developed by the biopharma industry. Most notably, beginning in 2026 Medicare will be able to "negotiate" prices for an increasing number of drugs with high overall Medicare spend that have been on the market for a certain length of time. This may result in companies re-evaluating the costs, risks and benefits of bringing certain medicines to market. Importantly, we may see a shift towards the development of more complex biologic drugs, as the IRA provides 13 years of protection prior to negotiation eligibility compared to only 9 years for oral "small molecule" drugs. Another provision of the law imposes a penalty on any company raising the price of their existing drugs more than the rate of inflation, although the impact of this may be limited given that annual price increases have moderated in recent years. The market has taken these developments in stride, but there may be increasing focus on the impacts of the law once CMS releases the initial list of negotiation-eligible drugs later in 2023.

Overall, despite a challenging macro environment that seems to have held the market back a bit, we see more positives than negatives in the above developments. In the short-term we see the defensive characteristics of healthcare as attractive. In the intermediate and longer-term, we see the underlying fundamentals combined with favorable U.S. population demographics compelling in comparison to most other sectors.

Be well,

Daniel R. Omstead

President and Portfolio Manager

TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT 3

Fund Essentials

Objective of the Fund

The Fund's investment objective is to seek long-term capital appreciation by investing primarily in securities of healthcare companies. In addition, the Fund seeks to provide regular distribution of realized capital gains.

Description of the Fund

Tekla Healthcare Investors (HQH) is a non-diversified closed-end healthcare fund traded on the New York Stock Exchange under the ticker HQH. HQH primarily invests in healthcare industries and will emphasize both large established companies and smaller, emerging companies with a maximum of 40% of the Fund's assets in restricted securities of both public and private companies.

Investment Philosophy

Tekla Capital Management LLC, the Investment Adviser to the Fund, believes that:

• Aging demographics and adoption of new medical products and services can provide long-term tailwinds for healthcare companies

• Late stage biotechnology and pharma product pipeline could lead to significant increases in biotechnology sales

• Robust M&A activity in healthcare may create additional investment opportunities

Fund Overview and Characteristics as of 3/31/23

Market Price1 | | $17.65 | |

NAV2 | | $20.25 | |

Premium/(Discount) | | -12.84% | |

Average 30 Day Volume | | 128,285 | |

Net Assets | | $979,087,365 | |

Ticker | | HQH | |

NAV Ticker | | XHQHX | |

Commencement of

Operations Date | | 4/22/87 | |

Fiscal Year to Date

Distributions

Per Share | | $0.81 | |

1 The closing price at which the Fund's shares were traded on the exchange.

2 Per-share dollar value of the Fund, calculated by dividing the total value of all the securities in its portfolio, plus any other assets and less liabilities, by the number of Fund shares outstanding.

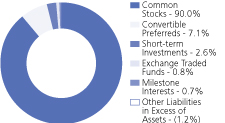

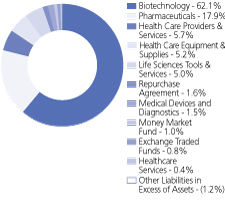

Holdings of the Fund (Data is based on net assets)

Asset Allocation as of 3/31/23

Sector Diversification as of 3/31/23

This data is subject to change on a daily basis.

4 TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT

Largest Holdings by Issuer

(Excludes Short-Term Investments)

As of March 31, 2023

(Unaudited)

| Issuer – Sector | | % of Net

Assets | |

| Gilead Sciences, Inc. – Biotechnology | | | 6.9 | % | |

| Regeneron Pharmaceuticals, Inc. – Biotechnology | | | 6.8 | % | |

| Amgen, Inc. – Biotechnology | | | 6.4 | % | |

| Vertex Pharmaceuticals, Inc. – Biotechnology | | | 5.7 | % | |

| Illumina, Inc. – Life Sciences Tools & Services | | | 3.7 | % | |

| Biogen, Inc. – Biotechnology | | | 3.5 | % | |

| AstraZeneca plc – Pharmaceuticals | | | 3.5 | % | |

| Seagen, Inc. – Biotechnology | | | 3.0 | % | |

| Moderna, Inc. – Biotechnology | | | 2.6 | % | |

| Sarepta Therapeutics, Inc. – Biotechnology | | | 2.2 | % | |

| BioMarin Pharmaceutical, Inc. – Biotechnology | | | 1.9 | % | |

| Alnylam Pharmaceuticals, Inc. – Biotechnology | | | 1.9 | % | |

| AbbVie, Inc. – Biotechnology | | | 1.9 | % | |

| Eli Lilly & Co. – Pharmaceuticals | | | 1.8 | % | |

| argenx SE – Biotechnology | | | 1.5 | % | |

| Johnson & Johnson – Pharmaceuticals | | | 1.5 | % | |

| Bristol-Myers Squibb Co. – Pharmaceuticals | | | 1.3 | % | |

| Jazz Pharmaceuticals plc – Pharmaceuticals | | | 1.3 | % | |

| Abbott Laboratories – Health Care Equipment & Supplies | | | 1.2 | % | |

| Hotspot Therapeutics, Inc. – Biotechnology | | | 1.2 | % | |

Fund Performance

Fund and Benchmark Performance and Other Influencing Factors

HQH is a closed-end fund which invests predominantly in healthcare companies. Subject to regular consideration, the Trustees of HQH have instituted a policy of making quarterly distributions to shareholders. The Fund seeks to make such distributions in the form of long-term capital gains.

The Fund considers investments in companies of all sizes and in all healthcare subsectors, including, but not limited to, biotechnology, pharmaceuticals, healthcare equipment, healthcare supplies, life science tools and services, healthcare distributors, managed healthcare, healthcare technology and healthcare facilities. The Fund emphasizes innovation, investing both in public and pre-public venture companies. The Fund considers its venture investments to be a differentiating characteristic. Among the various healthcare subsectors, HQH has considered the biotechnology subsector, including both pre-public and public companies, to be a key contributor to the healthcare sector. The Fund holds biotech assets, including both public and pre-public, often representing 50-65% of net assets.

TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT 5

There is no commonly published index which matches the investment strategy of HQH. The S&P Composite 1500® Health Care Index* (S15HLTH) consists of approximately 180 companies representing most or all of the healthcare subsectors in which HQH typically invests; biotechnology often represents 15-20% of this index. By contrast, the NASDAQ Biotechnology Index®* (NBI), which contains approximately 270 constituents, is much more narrowly constructed. The vast majority of this index is comprised of biotechnology, pharmaceutical and life science tools companies. In recent years, biotechnology has often represented 72-82% of the NBI. Neither the S15HLTH nor NBI indices contain any material amount of pre-public company assets.

Given the circumstances, we present both NAV and stock returns for the Fund in comparison to several commonly published indices. One index, the S&P 500® Index* (SPX), is a commonly considered broad based index; this index is comprised of companies in many areas of the economy, including, but not limited to healthcare. As described above, the NBI is a healthcare index mostly focused in three healthcare sectors with a high level of biotechnology by comparison. The S15HLTH contains a wider representation of healthcare subsectors, but typically contains a much lower biotechnology composition.

HQH generally invests in a combination of large-cap growth-oriented and earlier stage innovative healthcare companies with a focus on the biotechnology sector. Generally, HQH targets biotechnology exposure below that of the NBI and a higher biotechnology exposure than that of the S15HLTH. We note that, in recent periods, biotechnology has been a significant contributor to returns (both positive and negative) associated with those indices. We believe this sector continues to have significant potential for growth in the future.

Fund Performance for the Period Ended March 31, 2023

For the six-month period ended March 31, 2023, the Fund net asset value was up 9.4% and market value up 6.9%, including reinvestment of dividends and distributions. Over the same period the NBI was up 9.9% and the S15HLTH was up 7.7% percent, including reinvestment of dividends.

Period | | HQH NAV (%) | | HQH MKT (%) | | NBI (%) | | S15HLTH (%) | | SPX (%) | |

| 6 month | | | 9.42 | | | | 6.85 | | | | 9.91 | | | | 7.69 | | | | 15.60 | | |

| 1 year | | | 1.12 | | | | -6.89 | | | | -0.14 | | | | -4.40 | | | | -7.75 | | |

| 5 year | | | 6.27 | | | | 5.10 | | | | 4.92 | | | | 11.45 | | | | 11.17 | | |

| 10 year | | | 8.88 | | | | 7.87 | | | | 10.03 | | | | 12.95 | | | | 12.23 | | |

6 TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT

Change in the value of a $10,000 investment

Cumulative total return from 3/31/2013 to 3/31/2023

All performance over one-year has been annualized. Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. The NAV total return takes into account the Fund's total annual expenses and does not reflect transaction charges. If transaction charges were reflected, NAV total return would be reduced. All distributions are assumed to be reinvested either in accordance with the dividend reinvestment plan (DRIP) for market price returns or NAV for NAV returns. Until the DRIP price is available from the Plan Agent, the market price returns reflect the reinvestment at the closing market price on the last business day of the month. Once the DRIP is available around mid-month, the market price returns are updated to reflect reinvestment at the DRIP price. The graph and table do not reflect the deduction of taxes a shareholder would pay on fund distributions or the sale of fund shares.

Risk Adjusted NASDAQ Biotechnology Index® computed by the Adviser using Bloomberg data for the NBI and applying the Fund's computed 0.90 beta to NBI performance to reflect the Fund's lower historical risk.

Portfolio Management Commentary

The largest positive contribution to Fund relative performance was company stock selection and an underweight allocation to small and mid cap biotechnology companies. Two overweight positions in the period that contributed positively to performance were Horizon Therapeutics plc (HZNP), up 76%, and Seagen, Inc. (SGEN), up 48%. On December 12, 2022, Amgen, Inc. (AMGN) announced its nearly $28 billion acquisition offer (at a 36% premium) for Horizon, which develops treatments for thyroid eye disease. Seagen, which develops cancer treatments, received an acquisition bid of over $41 billion (a 39% premium) from Pfizer, Inc. (PFE) on March 31, 2023. The Fund also benefited from an underweight allocation to small and midcap biotechnology companies, which returned -34% and -4% respectively in the past six months.

TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT 7

The largest negative contribution to Fund relative performance was company stock selection and an underweight allocation to large cap biotech companies. One overweight position in the period that contributed negatively to performance was Rallybio Corp. (RLYB), down 61% in the past six months. Rallybio is typical among the group of early stage biotechs that underperformed in the period even though the company itself did not have significant negative updates. The Fund lost benchmark relative performance being underweight larger and more defensive companies which outperformed small growth companies in the period. We also estimate that the venture portfolio returns lagged the benchmark in the past six months detracting from performance.

Portfolio Highlights as of March 31, 2023

Among other investments, Tekla Healthcare Investors' performance benefited in the six-month period by the following:

Horizon Therapeutics plc (HZNP) is a specialty pharmaceuticals company transitioning to a focused orphan disease business model. With 12 marketed therapies, including first-in-class Tepezza for thyroid eye disease, and a pipeline of over 20 programs in development, Horizon was recently acquired by Amgen for $28 billion. The Fund was overweight Horizon which had a strong positive return following Amgen's acquisition offer in December 2022.

Royalty Pharma plc (RPRX) is the largest purchaser of royalty streams in biopharma and acts as a funding source for its partners. The Company's stock price fell in the period due in part to a negative outcome from partner Roche's Ph3 trial in Alzheimer's disease as well as declining royalties on sales of the blood-cancer drug Imbruvica. Additionally, investors appear to have become uncertain about future royalty stream for Trikafta. Forthcoming data from Vertex Pharmaceuticals, Inc. (VRTX) next-generation cystic fibrosis drug may best Trikafta with royalty payments from this new treatment under dispute. Fund relative performance benefited from an underweight position.

Seagen, Inc. (SGEN) is the leading biotechnology company developing Antibody Drug Conjugates (ADCs) with four approved products in oncology. The Company is rapidly growing drug sales across its product portfolio and has historically attracted M&A interest given its strategic value. In March of 2023, Pfizer, Inc. (PFE) announced its offer to acquire Seagen at a 39 percent premium causing its stock to appreciate while the Fund was overweight.

Among other examples, Tekla Healthcare Investors' performance was negatively impacted by the following investments:

Rallybio Corp. (RLYB) is a clinical stage biotechnology company developing therapies for patients with severe and rare disorders. Its lead candidate, RLYB212, is a monoclonal antibody for the prevention of fetal and neonatal alloimmune thrombocytopenia, a rare condition with no currently approved therapies. In the current risk-off environment, investor interest has shifted away from pre-commercial companies with early-stage assets and no

8 TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT

revenue. As a result, the Company's stock underperformed in the period while the Fund was overweight.

Moderna, Inc. (MRNA) is a vaccine company based on a new therapeutic modality, messenger RNA. The Company has multiple development programs in the clinic but is most well-known for its commercially successful vaccine candidate targeting the COVID-19 virus. At its peak in summer 2021, Moderna had a market capitalization of nearly $200 billion with roughly $20 billion in COVID-19 vaccines sales expected for 2021 and 2022. While the future path of the COVID-19 pandemic is uncertain, we decided the valuation for Moderna reflected too much optimism on the recurring nature of the booster vaccine business in the next decade. The Fund was underweight Moderna and lost relative performance, as the Company stock price was rewarded for preliminary cancer vaccine data in melanoma during this period.

Guardant Health, Inc. (GH) is a leading precision oncology company focused on using liquid biopsy for cancer detection and diagnostics through its proprietary blood tests, vast data sets, and advanced analytics. The Fund has maintained an overweight position in the stock as it underperformed in the six-month period due to disappointing results from its colorectal cancer or CRC screening product. While the accuracy of the Guardant CRC screening test is not best in class, it did meet the bar needed for reimbursement and may see clinical adoption due to its convenience.

*The trademarks NASDAQ Biotechnology Index®, S&P Composite 1500® Health Care Index, SPDR® S&P® Biotech ETF and S&P 500® Index referenced in this report are the property of their respective owners. These trademarks are not owned by or associated with the Fund or its service providers, including Tekla Capital Management LLC.

TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT 9

March 31, 2023 (Unaudited)

| | | Shares | | Value | |

Convertible Preferreds (Restricted) (a) (b) 7.1% | |

Biotechnology 4.2% | |

Arbor Biotechnologies, Series B, 8.00% | | | 82,076 | | | $ | 1,359,999 | | |

Arkuda Therapeutics, Inc. Series A, 6.00% (c) | | | 2,353,932 | | | | 4,162,222 | | |

Arkuda Therapeutics, Inc. Series B, 6.00% (c) | | | 1,044,322 | | | | 1,846,571 | | |

Flamingo Therapeutics, Inc. Series A3 (d) | | | 243,458 | | | | 1,613,224 | | |

Hotspot Therapeutics, Inc. Series B, 6.00% | | | 2,875,000 | | | | 9,317,587 | | |

Hotspot Therapeutics, Inc. Series C, 6.00% | | | 632,394 | | | | 2,049,526 | | |

ImmuneID, Inc. Series A, 8.00% | | | 1,020,000 | | | | 2,040,000 | | |

Invetx, Inc. Series A, 8.00% (c) | | | 7,187,500 | | | | 4,816,344 | | |

Invetx, Inc. Series B, 8.00% (c) | | | 3,089,091 | | | | 2,070,000 | | |

Parthenon Therapeutics, Inc. Series A | | | 528,339 | | | | 2,092,307 | | |

Priothera Ltd. Series A, 6.00% (c) (d) | | | 346,666 | | | | 3,759,592 | | |

Quell Therapeutics Series B (d) | | | 1,553,631 | | | | 2,936,363 | | |

ReCode Therapeutics, Series B, 5.00% | | | 294,589 | | | | 2,719,999 | | |

| | | | | | 40,783,734 | | |

Health Care Equipment & Supplies 0.2% | |

IO Light Holdings, Inc. Series A2 | | | 421,634 | | | | 1,423,015 | | |

Pharmaceuticals 2.7% | |

Amolyt Pharma SAS Series C (d) | | | 1,121,963 | | | | 2,603,885 | | |

Aristea Therapeutics, Inc. Series B, 8.00% | | | 616,645 | | | | 3,399,996 | | |

Biotheryx, Inc. Series E, 8.00% | | | 1,295,238 | | | | 5,440,000 | | |

Curasen Therapeutics, Inc. Series A (c) | | | 18,203,119 | | | | 8,728,396 | | |

Endeavor Biomedicines, Inc. Series B, 8.00% | | | 657,322 | | | | 3,099,996 | | |

HiberCell, Inc. Series B | | | 2,773,472 | | | | 3,399,999 | | |

| | | | | | 26,672,272 | | |

Total Convertible Preferreds (Cost $72,279,649) | | | | | 68,879,021 | | |

Common Stocks 90.0% | |

Biotechnology 57.9% | |

AbbVie, Inc. | | | 115,116 | | | | 18,346,037 | | |

Affimed N.V. (b) (d) | | | 367,414 | | | | 273,944 | | |

Alkermes plc (b) (d) | | | 173,907 | | | | 4,902,438 | | |

Alnylam Pharmaceuticals, Inc. (b) | | | 92,438 | | | | 18,517,180 | | |

Amgen, Inc. | | | 259,901 | | | | 62,831,067 | | |

Apellis Pharmaceuticals, Inc. (b) | | | 82,515 | | | | 5,442,689 | | |

Arcutis Biotherapeutics, Inc. (b) | | | 86,869 | | | | 955,559 | | |

argenx SE ADR (b) | | | 40,621 | | | | 15,134,572 | | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

10 TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT

| | | Shares | | Value | |

Biotechnology (continued) | |

Arrowhead Pharmaceuticals, Inc. (b) | | | 65,953 | | | $ | 1,675,206 | | |

Ascendis Pharma A/S ADR (b) | | | 82,481 | | | | 8,843,613 | | |

BioCryst Pharmaceuticals, Inc. (b) | | | 302,037 | | | | 2,518,989 | | |

Biogen, Inc. (b) | | | 124,233 | | | | 34,540,501 | | |

Biohaven Ltd. (b) (d) | | | 14,216 | | | | 194,191 | | |

BioMarin Pharmaceutical, Inc. (b) | | | 192,884 | | | | 18,756,040 | | |

BioNTech SE ADR | | | 66,396 | | | | 8,270,950 | | |

Black Diamond Therapeutics, Inc. (b) (e) | | | 90,404 | | | | 170,864 | | |

Blueprint Medicines Corp. (b) | | | 44,144 | | | | 1,986,039 | | |

Bridgebio Pharma, Inc. (b) | | | 124,341 | | | | 2,061,574 | | |

Caribou Biosciences, Inc. (b) | | | 385,660 | | | | 2,047,855 | | |

Cerevel Therapeutics Holdings, Inc. (b) | | | 102,322 | | | | 2,495,634 | | |

Chinook Therapeutics, Inc. (b) | | | 44,700 | | | | 1,034,805 | | |

Cytokinetics, Inc. (b) | | | 132,081 | | | | 4,647,930 | | |

Denali Therapeutics, Inc. (b) | | | 214,498 | | | | 4,942,034 | | |

Exelixis, Inc. (b) | | | 534,440 | | | | 10,373,480 | | |

Fusion Pharmaceuticals, Inc. (b) (d) | | | 15,186 | | | | 57,251 | | |

Fusion Pharmaceuticals, Inc. (Restricted) (a) (b) (d) | | | 7,593 | | | | 25,763 | | |

G1 Therapeutics, Inc. (b) | | | 200,492 | | | | 537,319 | | |

Galera Therapeutics, Inc. (b) | | | 296,462 | | | | 758,943 | | |

Gilead Sciences, Inc. | | | 815,795 | | | | 67,686,511 | | |

I-Mab ADR (b) | | | 53,885 | | | | 186,442 | | |

Intellia Therapeutics, Inc. (b) | | | 103,664 | | | | 3,863,557 | | |

Intercept Pharmaceuticals, Inc. (b) | | | 33,437 | | | | 449,059 | | |

Ionis Pharmaceuticals, Inc. (b) | | | 56,499 | | | | 2,019,274 | | |

Karuna Therapeutics, Inc. (b) | | | 39,143 | | | | 7,109,935 | | |

Kura Oncology, Inc. (b) | | | 198,177 | | | | 2,423,705 | | |

Madrigal Pharmaceuticals, Inc. (b) | | | 6,986 | | | | 1,692,428 | | |

Mereo Biopharma Group plc ADR (b) | | | 1,063,799 | | | | 751,999 | | |

Moderna, Inc. (b) | | | 164,742 | | | | 25,301,076 | | |

Neurocrine Biosciences, Inc. (b) | | | 74,216 | | | | 7,512,144 | | |

NexGel, Inc. (b) | | | 2,970 | | | | 3,861 | | |

Novavax, Inc. (b) (e) | | | 37,188 | | | | 257,713 | | |

Praxis Precision Medicines, Inc. (b) | | | 51,406 | | | | 41,587 | | |

Precision BioSciences, Inc. (b) | | | 154,807 | | | | 116,663 | | |

Prometheus Biosciences, Inc. (b) | | | 28,701 | | | | 3,080,191 | | |

Pyxis Oncology, Inc. (b) (e) | | | 481,646 | | | | 1,931,400 | | |

Rallybio Corp. (b) | | | 755,076 | | | | 4,311,484 | | |

Regeneron Pharmaceuticals, Inc. (b) | | | 81,285 | | | | 66,789,446 | | |

Sarepta Therapeutics, Inc. (b) | | | 155,046 | | | | 21,369,990 | | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT 11

| | | Shares | | Value | |

Biotechnology (continued) | |

Scholar Rock Holding Corp. (b) | | | 68,117 | | | $ | 544,936 | | |

Seagen, Inc. (b) | | | 146,222 | | | | 29,605,568 | | |

Sutro Biopharma, Inc. (b) | | | 69,389 | | | | 320,577 | | |

Syndax Pharmaceuticals, Inc. (b) | | | 82,339 | | | | 1,739,000 | | |

Travere Therapeutics, Inc. (b) | | | 262,102 | | | | 5,894,674 | | |

TScan Therapeutics, Inc. (b) | | | 138,057 | | | | 289,920 | | |

Ultragenyx Pharmaceutical, Inc. (b) | | | 44,502 | | | | 1,784,530 | | |

uniQure N.V. (b) (d) | | | 448,264 | | | | 9,028,037 | | |

United Therapeutics Corp. (b) | | | 35,472 | | | | 7,944,309 | | |

Vectivbio Holding AG (b) (d) | | | 512,280 | | | | 4,405,608 | | |

Vertex Pharmaceuticals, Inc. (b) | | | 177,485 | | | | 55,920,199 | | |

Zai Lab Ltd. ADR (b) | | | 22,147 | | | | 736,609 | | |

| | | | | | 567,454,899 | | |

Health Care Equipment & Supplies 5.0% | |

Abbott Laboratories | | | 114,588 | | | | 11,603,181 | | |

Cardiovascular Systems, Inc. (b) | | | 174,859 | | | | 3,472,700 | | |

Cercacor Laboratories, Inc. (Restricted) (a) (b) | | | 160,000 | | | | 302,965 | | |

DexCom, Inc. (b) | | | 56,251 | | | | 6,535,241 | | |

Edwards Lifesciences Corp. (b) | | | 23,108 | | | | 1,911,725 | | |

Guardant Health, Inc. (b) | | | 261,873 | | | | 6,138,303 | | |

IDEXX Laboratories, Inc. (b) | | | 15,551 | | | | 7,776,744 | | |

Lantheus Holdings, Inc. (b) | | | 46,325 | | | | 3,824,592 | | |

Medtronic plc (d) | | | 52,381 | | | | 4,222,956 | | |

Stryker Corp. | | | 12,890 | | | | 3,679,708 | | |

| | | | | | 49,468,115 | | |

Health Care Providers & Services 5.7% | |

Addus HomeCare Corp. (b) | | | 8,909 | | | | 951,125 | | |

Amedisys, Inc. (b) | | | 21,102 | | | | 1,552,052 | | |

Charles River Laboratories International, Inc. (b) | | | 34,616 | | | | 6,986,201 | | |

The Cigna Group | | | 41,860 | | | | 10,696,486 | | |

Elevance Health, Inc. | | | 20,817 | | | | 9,571,865 | | |

HCA Healthcare, Inc. | | | 24,237 | | | | 6,390,812 | | |

Humana, Inc. | | | 4,847 | | | | 2,353,024 | | |

InnovaCare, Inc. Escrow Shares (Restricted) (a) (b) | | | 222,222 | | | | 27,778 | | |

Medpace Holdings, Inc. (b) | | | 6,524 | | | | 1,226,838 | | |

Molina Healthcare, Inc. (b) | | | 18,161 | | | | 4,857,886 | | |

UnitedHealth Group, Inc. | | | 23,499 | | | | 11,105,392 | | |

| | | | | | 55,719,459 | | |

Healthcare Services 0.4% | |

Laboratory Corporation of America Holdings | | | 15,929 | | | | 3,654,431 | | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

12 TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT

| | | Shares | | Value | |

Life Sciences Tools & Services 5.0% | |

Adaptive Biotechnologies Corp. (b) | | | 216,209 | | | $ | 1,909,125 | | |

Illumina, Inc. (b) | | | 155,689 | | | | 36,205,477 | | |

Thermo Fisher Scientific, Inc. | | | 14,873 | | | | 8,572,351 | | |

West Pharmaceutical Services, Inc. | | | 5,474 | | | | 1,896,577 | | |

| | | | | | 48,583,530 | | |

Medical Devices and Diagnostics 1.5% | |

Boston Scientific Corp. (b) | | | 100,556 | | | | 5,030,817 | | |

Danaher Corp. | | | 10,121 | | | | 2,550,897 | | |

Intuitive Surgical, Inc. (b) | | | 26,837 | | | | 6,856,048 | | |

| | | | | | 14,437,762 | | |

Pharmaceuticals 14.5% | |

AstraZeneca plc ADR | | | 494,952 | | | | 34,354,618 | | |

Bristol-Myers Squibb Co. | | | 189,716 | | | | 13,149,216 | | |

Catalent, Inc. (b) | | | 6,711 | | | | 440,980 | | |

Eli Lilly & Co. | | | 51,829 | | | | 17,799,115 | | |

Endo International plc (b) (d) | | | 465,507 | | | | 32,585 | | |

Intra-Cellular Therapies, Inc. (b) | | | 120,019 | | | | 6,499,029 | | |

IQVIA Holdings, Inc. (b) | | | 17,633 | | | | 3,507,027 | | |

Jazz Pharmaceuticals plc (b) | | | 88,683 | | | | 12,976,983 | | |

Johnson & Johnson | | | 93,399 | | | | 14,476,845 | | |

Marinus Pharmaceuticals, Inc. (b) | | | 317,845 | | | | 2,193,130 | | |

McKesson Corp. | | | 19,916 | | | | 7,091,092 | | |

Merck & Co., Inc. | | | 71,668 | | | | 7,624,759 | | |

Mirati Therapeutics, Inc. (b) | | | 42,638 | | | | 1,585,281 | | |

Oculis Holding AG (Restricted) (a) (d) | | | 557,945 | | | | 3,645,613 | | |

Perrigo Co. plc (d) | | | 7,050 | | | | 252,883 | | |

Pfizer, Inc. | | | 223,242 | | | | 9,108,274 | | |

Reata Pharmaceuticals, Inc. Class A (b) | | | 11,550 | | | | 1,050,126 | | |

Spectrum Pharmaceuticals, Inc. (b) | | | 79,790 | | | | 59,843 | | |

Tetraphase Pharmaceuticals, Inc. CVR (a) (b) | | | 28,747 | | | | 1,725 | | |

Teva Pharmaceutical Industries Ltd. ADR (b) | | | 291,666 | | | | 2,581,244 | | |

Theseus Pharmaceuticals, Inc. (b) | | | 51,750 | | | | 459,540 | | |

VYNE Therapeutics, Inc. (b) (e) | | | 5,265 | | | | 16,216 | | |

Zoetis, Inc. | | | 17,924 | | | | 2,983,271 | | |

| | | | | | 141,889,395 | | |

Total Common Stocks (Cost $764,393,463) | | | | | 881,207,591 | | |

Exchange Traded Funds (e) 0.8% | |

iShares Nasdaq Biotechnology ETF | | | 24,569 | | | | 3,173,332 | | |

SPDR S&P Biotech ETF (b) | | | 57,000 | | | | 4,343,970 | | |

Total Exchange Traded Funds (Cost $7,597,986) | | | | | 7,517,302 | | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT 13

| | | Principal Amount | | Value | |

Short-Term Investments 2.6% | |

Repurchase Agreement, Fixed Income Clearing Corp.,

repurchase value $15,307,837, 1.44%, dated 03/31/23,

due 04/03/23 (collateralized by U.S. Treasury Note 2.625%,

due 04/15/25, market value $15,612,136) | | $ | 15,306,000 | | | $ | 15,306,000 | | |

| | | Shares | | | |

State Street Institutional U.S. Government Money Market Fund,

Institutional Class, 4.67% (f) | | | 10,379,633 | | | | 10,379,633 | | |

Total Short-Term Investments (Cost $25,685,633) | | | | | 25,685,633 | | |

Total Investments Before Milestone Interests 100.5%

(Cost $869,956,731) | | | | | 983,289,547 | | |

| | | Interests | | | |

Milestone Interests (Restricted) (a) (b) 0.7% | |

Health Care Equipment & Supplies 0.0% | |

Therox Milestone Interest | | | 1 | | | | 1,090 | | |

Pharmaceuticals 0.7% | |

Afferent Milestone Interest | | | 1 | | | | 262,867 | | |

Ethismos Research Milestone Interest | | | 1 | | | | 0 | | |

Impact Biomedicines Milestone Interest | | | 1 | | | | 1,722,260 | | |

Neurovance Milestone Interest | | | 1 | | | | 5,015,286 | | |

| | | | | | 7,000,413 | | |

Biotechnology 0.0% | |

Amphivena Milestone Interest | | | 1 | | | | 0 | | |

Rainier Therapeutics Milestone Interest | | | 1 | | | | 269,727 | | |

Therachon Milestone Interest | | | 1 | | | | 0 | | |

| | | | | 269,727 | | |

Total Milestone Interests (Cost $7,960,390) | | | | | 7,271,230 | | |

Total Investments 101.2% (Cost $877,917,121) | | | | | 990,560,777 | | |

Other Liabilities in Excess Of Assets (1.2)% | | | | | (11,473,412 | ) | |

Net Assets 100% | | | | $ | 979,087,365 | | |

The percentage shown for each investment category in the Schedule of Investments is based on net assets.

(a) Security fair valued using significant unobservable inputs. See Investment Valuation and Fair Value Measurements.

(b) Non-income producing security.

(c) Affiliated issuers in which the Fund holds 5% or more of the voting securities (total market value of $25,383,125).

(d) Foreign security.

(e) All or a portion of this security is on loan as of March 31, 2023. See Note 1.

(f) This security represents the investment of cash collateral received for securities lending and is a registered investment company advised by State Street Global Advisors. The rate shown is the annualized seven-day yield as of March 31, 2023.

ADR American Depository Receipt

CVR Contingent Value Right

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

14 TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT

STATEMENT OF ASSETS AND LIABILITIES MARCH 31, 2023 (Unaudited)

ASSETS | |

Investments in unaffiliated issuers, at value (cost $844,197,730), including

$9,389,155 of securities loaned | | $ | 957,906,422 | | |

Investments in affiliated issuers, at value (cost $25,759,001) | | | 25,383,125 | | |

Milestone interests, at value (cost $7,960,390) | | | 7,271,230 | | |

Total investments | | | 990,560,777 | | |

Cash | | | 999 | | |

Foreign currency, at value (cost $54) | | | 54 | | |

Dividends and interest receivable | | | 134,986 | | |

Securities lending income receivable | | | 4,820 | | |

Prepaid expenses | | | 61,830 | | |

Other assets (see Note 1) | | | 272 | | |

Total assets | | | 990,763,738 | | |

LIABILITIES | |

Accrued advisory fee | | | 829,152 | | |

Accrued investor support service fees | | | 39,624 | | |

Accrued shareholder reporting fees | | | 90,041 | | |

Accrued trustee fees | | | 3,342 | | |

Payable upon return of securities loaned | | | 10,379,633 | | |

Accrued other | | | 334,581 | | |

Total liabilities | | | 11,676,373 | | |

Commitments and Contingencies (see Notes 1 and 5) | |

NET ASSETS | | $ | 979,087,365 | | |

SOURCES OF NET ASSETS CONSIST OF | |

Shares of beneficial interest, par value $.01 per share, unlimited number of shares authorized,

amount paid in on 48,351,111 shares issued and outstanding | | $ | 483,511 | | |

Additional paid-in-capital | | | 909,161,643 | | |

Total distributable earnings (loss) | | | 69,442,211 | | |

Total net assets (equivalent to $20.25 per share based on 48,351,111

shares outstanding) | | $ | 979,087,365 | | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT 15

STATEMENT OF OPERATIONS SIX-MONTHS ENDED MARCH 31, 2023 (Unaudited)

INVESTMENT INCOME | |

Dividend income | | $ | 4,602,149 | | |

Non-cash dividend income | | | 767,416 | | |

Interest and other income | | | 229,428 | | |

Securities lending, net | | | 28,846 | | |

Total investment income | | | 5,627,839 | | |

EXPENSES | |

Advisory fees | | | 4,865,911 | | |

Investor support service fees | | | 241,229 | | |

Legal fees | | | 100,018 | | |

Administration fees | | | 97,733 | | |

Custodian fees | | | 90,569 | | |

Shareholder reporting | | | 89,238 | | |

Trustees' fees and expenses | | | 80,885 | | |

Professional services fees | | | 64,991 | | |

Transfer agent fees | | | 28,558 | | |

Other (see Note 2) | | | 131,852 | | |

Total expenses | | | 5,790,984 | | |

Net investment loss | | | (163,145 | ) | |

REALIZED AND UNREALIZED GAIN (LOSS) | |

Net realized gain (loss) on | | | |

Investments in unaffiliated issuers | | | 19,577,480 | | |

Foreign currency transactions | | | 3,015 | | |

Net realized gain | | | 19,580,495 | | |

Net change in unrealized appreciation (depreciation) on | | | |

Investments in unaffiliated issuers | | | 64,987,928 | | |

Investments in affiliated issuers | | | 357,133 | | |

Milestone interests | | | (1,599,269 | ) | |

Foreign currency | | | 9 | | |

Net change in unrealized appreciation (depreciation) | | | 63,745,801 | | |

Net realized and unrealized gain (loss) | | | 83,326,296 | | |

Net increase in net assets resulting from operations | | $ | 83,163,151 | | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

16 TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six-months ended

March 31, 2023

(Unaudited) | | Year ended

September 30,

2022 | |

INCREASE (DECREASE) IN NET ASSETS; FROM OPERATIONS | |

Net investment loss | | ($ | 163,145 | ) | | ($ | 3,670,182 | ) | |

Net realized gain | | | 19,580,495 | | | | 66,381,083 | | |

Change in net unrealized appreciation (depreciation) | | | 63,745,801 | | | | (256,940,274 | ) | |

Net increase (decrease) in net assets resulting from operations | | | 83,163,151 | | | | (194,229,373 | ) | |

DISTRIBUTIONS TO SHAREHOLDERS (See Note 1) | | | (38,541,300 | ) | | | (84,311,515 | ) | |

CAPITAL SHARE TRANSACTIONS | |

Reinvestment of distributions (1,007,385 and 1,918,258 shares,

respectively) | | | 17,900,926 | | | | 38,203,392 | | |

Total capital share transactions | | | 17,900,926 | | | | 38,203,392 | | |

Net increase (decrease) in net assets | | | 62,522,777 | | | | (240,337,496 | ) | |

NET ASSETS | |

Beginning of period | | | 916,564,588 | | | | 1,156,902,084 | | |

End of period | | $ | 979,087,365 | | | $ | 916,564,588 | | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT 17

| | | Six-months

ended

March 31, 2023 | | Years ended September 30, | |

| | | (Unaudited) | | 2022 | | 2021 | | 2020 | | 2019 | | 2018 | |

OPERATING PERFORMANCE PER SHARE | |

Net asset value per share,

Beginning of period | | $ | 19.36 | | | $ | 25.47 | | | $ | 24.04 | | | $ | 20.33 | | | $ | 25.62 | | | $ | 26.02 | | |

Net investment income (loss) (1) | | | — | (2) | | | (0.08 | ) | | | (0.14 | ) | | | (0.05 | ) | | | (0.07 | ) | | | (0.10 | ) | |

Net realized and

unrealized gain (loss) | | | 1.70 | | | | (4.20 | ) | | | 3.63 | | | | 5.50 | | | | (3.46 | ) | | | 1.63 | | |

Total increase (decrease)

from investment operations | | | 1.70 | | | | (4.28 | ) | | | 3.49 | | | | 5.45 | | | | (3.53 | ) | | | 1.53 | | |

Distributions to

shareholders from | | | | | | | | | | | | | |

Net investment income | | | — | | | | (0.11 | ) | | | (0.61 | ) | | | (0.01 | ) | | | (0.17 | ) | | | (0.15 | )(3) | |

Net realized capital gains | | | (0.81 | ) | | | (1.72 | ) | | | (1.45 | ) | | | (1.77 | ) | | | (1.65 | ) | | | (1.79 | )(3) | |

Total distributions | | | (0.81 | ) | | | (1.83 | ) | | | (2.06 | ) | | | (1.78 | ) | | | (1.82 | ) | | | (1.94 | ) | |

Increase resulting from

shares repurchased (1) | | | — | | | | — | | | | — | | | | 0.04 | | | | 0.06 | | | | 0.01 | | |

Net asset value per share,

end of period | | $ | 20.25 | | | $ | 19.36 | | | $ | 25.47 | | | $ | 24.04 | | | $ | 20.33 | | | $ | 25.62 | | |

Per share market value,

end of period | | $ | 17.65 | | | $ | 17.28 | | | $ | 25.57 | | | $ | 20.62 | | | $ | 18.34 | | | $ | 23.15 | | |

Total investment return

at market value | | | 6.85 | %* | | | (26.01 | %) | | | 34.64 | % | | | 23.38 | % | | | (12.88 | %) | | | 0.05 | % | |

Total investment return

at net asset value | | | 9.42 | %* | | | (16.78 | %) | | | 15.03 | % | | | 29.77 | % | | | (12.74 | %) | | | 7.37 | % | |

RATIOS | |

Net investment loss to average

net assets | | | (0.03 | %)** | | | (0.36 | %) | | | (0.54 | %) | | | (0.20 | %) | | | (0.31 | %) | | | (0.41 | %) | |

Expenses to average net assets | | | 1.19 | %** | | | 1.19 | % | | | 1.11 | % | | | 1.10 | % | | | 1.12 | % | | | 1.08 | % | |

SUPPLEMENTAL DATA | |

Net assets at end of period

(in millions) | | $ | 979 | | | $ | 917 | | | $ | 1,157 | | | $ | 1,055 | | | $ | 871 | | | $ | 1,082 | | |

Portfolio turnover rate | | | 19.99 | %* | | | 41.21 | % | | | 69.19 | % | | | 52.44 | % | | | 47.65 | % | | | 45.75 | % | |

* Not annualized.

** Annualized.

(1) Computed using average shares outstanding.

(2) Amount represents less than $0.005 per share.

(3) Amount previously presented incorrectly as solely distributions from net realized capital gains has been revised to reflect the proper classification.

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

18TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT

Notes to financial statements MARCH 31, 2023 (Unaudited)

(1) Organization and Significant Accounting Policies

Tekla Healthcare Investors (the Fund) is a Massachusetts business trust formed on October 31, 1986 and registered under the Investment Company Act of 1940 as a non-diversified closed-end management investment company. The Fund commenced operations on April 22, 1987. The Fund's investment objective is long-term capital appreciation through investment in U.S. and foreign companies in the healthcare industry. The Fund invests primarily in securities of public and private companies that are believed by the Fund's Investment Adviser, Tekla Capital Management LLC (the Adviser), to have significant potential for above-average growth. The Fund may invest up to 20% of its net assets in securities of foreign issuers, expected to be located primarily in Western Europe, Canada and Japan, and securities of U.S. issuers that are traded primarily in foreign markets.

The preparation of these financial statements requires the use of certain estimates by management in determining the Fund's assets, liabilities, revenues and expenses. Actual results could differ from these estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Fund, which are in conformity with accounting principles generally accepted in the United States of America (GAAP). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board Accounting Standards Codification 946. Events or transactions occurring after March 31, 2023, through the date that the financial statements were issued, have been evaluated in the preparation of these financial statements.

The market value of the Fund's investments will move up and down, sometimes rapidly and unpredictably, based upon political, regulatory, market, economic and social conditions, as well as developments that impact specific economic sectors, industries or segments of the market, including conditions that directly relate to the issuers of the Fund's investments such as management performance, financial condition and demand for the issuers' goods and services. The Fund is subject to the risk that geopolitical events will adversely affect global economies and markets. War, terrorism, and related geopolitical events have led, and in the future may lead, to increased short-term market volatility and may have adverse long-term effects on global economies and markets. Likewise, natural and environmental disasters and epidemics or pandemics may be highly disruptive to economies and markets. This means that the Fund may lose money on its investment due to unpredictable drops in a security's value or periods of below-average performance in a given security or in the securities market as a whole.

Investment Valuation

Shares of publicly traded companies listed on national securities exchanges or trading in the over-the-counter market are typically valued at the last sale price as of the close of trading,

TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT 19

generally 4 p.m. Eastern Time. The Board of Trustees of the Fund (the Trustees) has established and approved fair valuation policies and procedures with respect to securities for which quoted prices may not be available or which do not reflect fair value. Convertible, corporate and government bonds are valued using a third-party pricing service. Convertible bonds are valued using this pricing service only on days when there is no sale reported. Restricted securities of companies that are publicly traded are typically valued based on the closing market quote on the valuation date adjusted for the impact of the restriction as determined in good faith by the Adviser also using fair valuation policies and procedures approved by the Trustees described below. Non-exchange traded warrants of publicly traded companies are generally valued using the Black-Scholes model, which incorporates both observable and unobservable inputs. Short-term investments with a maturity of 60 days or less are generally valued at amortized cost, which approximates fair value.

Convertible preferred shares, warrants or convertible note interests in private companies, milestone interests and other restricted securities, as well as shares of publicly traded companies for which market quotations are not readily available, such as stocks for which trading has been halted or for which there are no current day sales, or which do not reflect fair value, are typically valued in good faith, based upon the recommendations made by the Adviser pursuant to fair valuation policies and procedures approved by the Trustees.

The Adviser has a Valuation Sub-Committee comprised of senior management which reports to the Valuation Committee of the Board at least quarterly. Each fair value determination is based on a consideration of relevant factors, including both observable and unobservable inputs. Observable and unobservable inputs the Adviser considers may include (i) the existence of any contractual restrictions on the disposition of securities; (ii) information obtained from the company, which may include an analysis of the company's financial statements, products, intended markets or technologies; (iii) the price of the same or similar security negotiated at arm's length in an issuer's completed subsequent round of financing; (iv) the price and extent of public trading in similar securities of the issuer or of comparable companies; or (v) a probability and time value adjusted analysis of contractual terms. Where available and appropriate, multiple valuation methodologies are applied to confirm fair value. Significant unobservable inputs identified by the Adviser are often used in the fair value determination. A significant change in any of these inputs may result in a significant change in the fair value measurement. Due to the uncertainty inherent in the valuation process, such estimates of fair value may differ significantly from the values that would have been used had a ready market for the investments existed, and differences could be material. Additionally, changes in the market environment and other events that may occur over the life of the investments may cause the gains or losses ultimately realized on these investments to be different from the valuations used at the date of these financial statements.

20 TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT

Milestone Interests

The Fund holds financial instruments which reflect the current value of future milestone payments the Fund may receive as a result of contractual obligations from other parties. The value of such payments are adjusted to reflect the estimated risk based on the relative uncertainty of both the timing and the achievement of individual milestones. A risk to the Fund is that the milestones will not be achieved and no payment will be received by the Fund. The milestone interests were received as part of the proceeds from the sale of seven private companies. Any payments received are treated as a reduction of the cost basis of the milestone interests with payments received in excess of the cost basis treated as a realized gain. The contractual obligations with respect to the milestone interests provide for payments at various stages of the development of Afferent, Amphivena, Ethismos Research, Impact Biomedicines, Neurovance, Rainier Therapeutics, Therachon and Therox's principal product candidate as of the date of the sale.

The following is a summary of the impact of the milestone interests on the financial statements as of and for the six-months ended March 31, 2023:

Statement of Assets and Liabilities, Milestone interests, at value | | $ | 7,271,230 | | |

Statement of Assets and Liabilities, Total distributable earnings | | ($ | 689,160 | ) | |

Statement of Operations, Change in unrealized appreciation (depreciation)

on Milestone interests | | ($ | 1,599,269 | ) | |

Options on Securities

An option contract is a contract in which the writer (seller) of the option grants the buyer of the option, upon payment of a premium, the right to purchase from (call option) or sell to (put option) the writer a designated instrument at a specified price within a specified period of time. Certain options, including options on indices, will require cash settlement by the Fund if the option is exercised.

The Fund's obligation under an exchange traded written option or investment in an exchange traded purchased option is valued at the last sale price or in the absence of a sale, the mean between the closing bid and asked prices. Gain or loss is recognized when the option contract expires, is exercised or is closed.

If the Fund writes a covered call option, the Fund foregoes, in exchange for the premium, the opportunity to profit during the option period from an increase in the market value of the underlying security above the exercise price. If the Fund writes a put option it accepts the risk of a decline in the market value of the underlying security below the exercise price. Over-the-counter options have the risk of the potential inability of counterparties to meet the terms of their contracts. The Fund's maximum exposure to purchased options is limited to the premium initially paid. In addition, certain risks may arise upon entering into option contracts including

TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT 21

the risk that an illiquid secondary market will limit the Fund's ability to close out an option contract prior to the expiration date and that a change in the value of the option contract may not correlate exactly with changes in the value of the securities or currencies hedged.

All options on securities and securities indices written by the Fund are required to be covered. When the Fund writes a call option, this means that during the life of the option the Fund may own or have the contractual right to acquire the securities subject to the option or may maintain with the Fund's custodian in a segregated account appropriate liquid securities in an amount at least equal to the market value of the securities underlying the option. When the Fund writes a put option, this means that the Fund will maintain with the Fund's custodian in a segregated account appropriate liquid securities in an amount at least equal to the exercise price of the option.

There were no outstanding put options purchased and call options written for the six-months ended March 31, 2023.

Other Assets

Other assets in the Statement of Assets and Liabilities consists of amounts due to the Fund at various times in the future in connection with the sale of investments in one private company.

Investment Transactions and Income

Investment transactions are recorded on a trade date basis. Gains and losses from sales of investments are recorded using the "identified cost" method. Interest income is recorded on the accrual basis, adjusted for amortization of premiums and accretion of discounts. Dividend income is recorded on the ex-dividend date, less any foreign taxes withheld. Upon notification from issuers, some of the dividend income received may be redesignated as a reduction of cost of the related investment if it represents a return of capital. Stock dividends are reflected as non-cash dividend income on the Statement of Operations.

The aggregate cost of purchases and proceeds from sales of investment securities (other than short-term investments) for the six-months ended March 31, 2023 totaled $201,021,110 and $191,065,785, respectively.

Securities Lending

The Fund may lend its securities to approved borrowers to earn additional income. The Fund receives cash collateral from the borrower and the initial collateral received by the fund is required to have a value of at least 102% of the current value of the loaned securities traded on U.S. exchanges, and a value of at least 105% for all other securities. The Fund will invest its cash collateral in State Street Institutional U.S. Government Money Market Fund (SAHXX), which is registered with the Securities and Exchange Commission (SEC) as an investment

22 TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT

company. SAHXX invests substantially all of its assets in the State Street U.S. Government Money Market Portfolio. The Fund will receive the benefit of any gains and bear any losses generated by SAHXX with respect to the cash collateral.

The Fund has the right to recall loaned securities on demand. If a borrower fails to return loaned securities when due, then the lending agent is responsible and indemnifies the Fund for the lent securities. The lending agent uses the collateral received from the borrower to purchase replacement securities of the same issue, type, class and series of the loaned securities. If the value of the collateral is less than the purchase cost of replacement securities, the lending agent is responsible for satisfying the shortfall but only to the extent that the shortfall is not due to any decrease in the value of SAHXX.

Although the risk of loss on securities lent is mitigated by receiving collateral from the borrower and through lending agent indemnification, the Fund could experience a delay in recovering securities or could experience a lower than expected return if the borrower fails to return the securities on a timely basis. The Fund receives compensation for lending its securities by retaining a portion of the return on the investment of the collateral and compensation from fees earned from borrowers of the securities. Securities lending income received by the Fund is net of fees retained by the securities lending agent. Net income received from SAHXX is a component of securities lending income as recorded on the Statement of Operations.

Obligations to repay collateral received by the Fund are shown on the Statement of Assets and Liabilities as Payable upon return of securities loaned and are secured by the loaned securities. As of March 31, 2023, the Fund loaned securities valued at $9,389,155 and received $10,379,633 of cash collateral.

Repurchase Agreements

In managing short-term investments the Fund may from time to time enter into transactions in repurchase agreements. In a repurchase agreement, the Fund's custodian takes possession of the underlying collateral securities from the counterparty, the market value of which is at least equal to the principal, including accrued interest, of the repurchase transaction at all times. In the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral by the Fund may be delayed. The Fund may enter into repurchase transactions with any broker, dealer, registered clearing agency or bank. Repurchase agreement transactions are not counted for purposes of the limitations imposed on the Fund's investment in debt securities.

Distribution Policy

Pursuant to a Securities and Exchange Commission exemptive order, the Fund may make periodic distributions that include capital gains as frequently as 12 times in any one taxable

TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT 23

year in respect of its common shares, and the Fund has implemented a managed distribution policy (the Policy) providing for quarterly distributions at a rate set by the Trustees. Under the current Policy, the Fund intends to make quarterly distributions at a rate of 2% of the Fund's net assets to shareholders of record. The Fund intends to use net realized capital gains when making quarterly distributions, if available, but the Policy would result in a return of capital to shareholders if the amount of the distribution exceeds the Fund's net investment income and realized capital gains. If taxable income and net long-term realized gains exceed the amount required to be distributed under the Policy, the Fund will at a minimum make distributions necessary to comply with the requirements of the Internal Revenue Code. The Policy has been established by the Trustees and may be changed by them without shareholder approval. The Trustees regularly review the Policy and the frequency and rate of distribution considering the purpose and effect of the Policy, the financial market environment, and the Fund's income, capital gains and capital available to pay distributions.

The Fund's policy is to declare quarterly distributions in stock. The distributions are automatically paid in newly-issued full shares of the Fund unless otherwise instructed by the shareholder. Fractional shares will generally be settled in cash, except for registered shareholders with book entry accounts of the Fund's transfer agent who will have whole and fractional shares added to their accounts. The Fund's transfer agent delivers an election card and instructions to each registered shareholder in connection with each distribution. The number of shares issued will be determined by dividing the dollar amount of the distribution by the lower of net asset value or market price on the pricing date. If a shareholder elects to receive a distribution in cash, rather than in shares, the shareholder's relative ownership in the Fund will be reduced. The shares reinvested will be valued at the lower of the net asset value or market price on the pricing date. Distributions in stock will not relieve shareholders of any federal, state or local income taxes that may be payable on such distributions. Additional distributions, if any, made to satisfy requirements of the Internal Revenue Code may be paid in stock, as described above, or in cash.

Share Repurchase Program

In March 2023, the Trustees approved the renewal of the repurchase program to allow the Fund to repurchase up to 12% of its outstanding shares in the open market for a one-year period ending July 14, 2024. Prior to this renewal, in March 2022, the Trustees approved the renewal of the share repurchase program to allow the Fund to repurchase up to 12% of its outstanding shares for a one-year period ending July 14, 2023. The share repurchase program is intended to enhance shareholder value and potentially reduce the discount between the market price of the Fund's shares and the Fund's net asset value.

During the six-months ended March 31, 2023 and the year ended September 30, 2022, the Fund did not repurchase any shares through the repurchase program.

24 TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT

Federal Taxes

It is the Fund's policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute to its shareholders substantially all of its taxable income and its net realized capital gains, if any. Therefore, no Federal income or excise tax provision is required.

As of March 31, 2023, the Fund had no uncertain tax positions that would require financial statement recognition or disclosure. The Fund's federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distributions

The Fund records all distributions to shareholders on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from GAAP. These differences include temporary and permanent differences from losses on wash sale transactions, passive foreign investment companies transactions, installment sale adjustments, foreign currency gains and losses, book to tax difference due to merger, partnership basis adjustment and net operating losses. Reclassifications are made to the Fund's capital accounts to reflect income and gains available for distribution under income tax regulations.

The cumulative distributions paid this fiscal year-to-date are currently estimated to be from the following sources: net investment income, net realized short-term capital gains, and return of capital or other capital source. The amounts and sources of distributions are only estimates and not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund's investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations.

Commitments and Contingencies

Under the Fund's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund's maximum exposure under these agreements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

Investor Support Services

The Fund has retained Destra Capital Advisors LLC (Destra) to provide investor support services in connection with the ongoing operation of the Fund. The Fund pays Destra a fee in

TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT 25

an annual amount equal to 0.05% of the average aggregate daily value of the Fund's Managed Assets pursuant to the investor support services agreement.

(2) Investment Advisory and Other Affiliated Fees

The Fund has entered into an Investment Advisory Agreement (the Advisory Agreement) with the Adviser. Pursuant to the terms of the Advisory Agreement, the Fund pays the Adviser a monthly fee at the rate when annualized of (i) 2.50% of the average net assets for the month of its venture capital and other restricted securities up to 25% of net assets and (ii) for all other net assets, 0.98% of the average net assets up to $250 million, 0.88% of the average net assets for the next $250 million, 0.80% of the average net assets for the next $500 million and 0.70% of the average net assets thereafter. The aggregate fee would not exceed a rate when annualized of 1.36%.

The Fund has entered into a Services Agreement (the Agreement) with the Adviser. Pursuant to the terms of the Agreement, the Fund reimburses the Adviser for certain services related to a portion of the payment of salary and provision of benefits to the Fund's Chief Compliance Officer. During the six-months ended March 31, 2023, these payments amounted to $60,772 and are included in the Other category of expenses in the Statement of Operations, together with insurance and other expenses incurred to unaffiliated entities. Expenses incurred pursuant to the Agreement as well as certain expenses paid for by the Adviser are allocated to the Fund in an equitable fashion as approved by the Trustees or officers of the Fund who are also officers of the Adviser.

The Fund pays compensation to Independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The Fund does not pay compensation directly to Trustees or officers of the Fund who are also officers of the Adviser.

(3) Other Transactions with Affiliates

An affiliate company is a company in which the Fund holds 5% or more of the voting securities. Transactions involving such companies during the six-months ended March 31, 2023 were as follows:

Affiliated Companies | | Beginning

Value as of

September 30,

2022 | | Purchases at

Cost | | Proceeds

from Sales | | Net Realized

Gain/(Loss)

on sale of

Affiliated

Companies | | Change in

Unrealized

Appreciation/

Depreciation | | Ending Value

as of

March 31,

2023* | |

Arkuda Therapeutics, Inc. | | $ | 5,024,265 | | | $ | 985,141 | | | $ | — | | | $ | — | | | $ | (613 | ) | | $ | 6,008,793 | | |

Curasen Therapeutics, Inc. | | | 8,414,141 | | | | 318,601 | | | | — | | | | — | | | | (4,346 | ) | | | 8,728,396 | | |

Invetx, Inc. | | | 6,886,344 | | | | — | | | | — | | | | — | | | | — | | | | 6,886,344 | | |

Priothera Ltd. | | | 3,397,500 | | | | — | | | | — | | | | — | | | | 362,092 | | | | 3,759,592 | | |

| | | $ | 23,722,250 | | | $ | 1,303,742 | | | $ | — | | | $ | — | | | $ | 357,133 | | | $ | 25,383,125 | | |

26 TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT

Affiliated Companies | | Shares as of

March 31,

2023 | | Principal

Amount as of

March 31,

2023 | | Dividend/

Interest

Income

from

Affiliated

Companies | | Capital Gain

Distributions

from Affiliated

Companies | |

Arkuda Therapeutics, Inc.. | | | 3,398,254 | | | $ | — | | | $ | — | | | $ | — | | |

Curasen Therapeutics, Inc. | | | 18,203,119 | | | | — | | | | — | | | | — | | |

Invetx, Inc. | | | 10,276,591 | | | | — | | | | — | | | | — | | |

Priothera Ltd. | | | 346,666 | | | | — | | | | — | | | | — | | |

| | | | 32,224,630 | | | $ | — | | | $ | — | | | $ | — | | |

* Amphivena Therapeutics, Inc. was an affiliate as of September 30, 2022 but not an affiliate as of March 31, 2023.

(4) Fair Value Measurements

The Fund uses a three-tier hierarchy to prioritize the assumptions, referred to as inputs, used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in the three broad levels. Level 1 includes quoted prices in active markets for identical investments. Level 2 includes prices determined using other significant observable inputs (including quoted prices for similar investments, interest rates, credit risk, etc.). The independent pricing vendor may value bank loans and debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, and/or other methodologies designed to identify the market value for such securities and such securities are considered Level 2 in the fair value hierarchy. Level 3 includes prices determined using significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). These inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

For the six-month period ended March 31, 2023, there were no transfers between levels.

TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT 27

The following is a summary of the levels used as of March 31, 2023 to value the Fund's investments.

Assets at Value | | Level 1 | | Level 2 | | Level 3 | | Total | |

Convertible Preferreds | |

Biotechnology | | $ | — | | | $ | — | | | $ | 40,783,734 | | | $ | 40,783,734 | | |

Health Care Equipment & Supplies | | | — | | | | — | | | | 1,423,015 | | | | 1,423,015 | | |

Pharmaceuticals | | | — | | | | — | | | | 26,672,272 | | | | 26,672,272 | | |

Common Stocks | |

Biotechnology | | | 567,429,136 | | | | 25,763 | | | | — | | | | 567,454,899 | | |

Health Care Equipment & Supplies | | | 49,165,150 | | | | — | | | | 302,965 | | | | 49,468,115 | | |

Health Care Providers & Services | | | 55,691,681 | | | | — | | | | 27,778 | | | | 55,719,459 | | |

Healthcare Services | | | 3,654,431 | | | | — | | | | — | | | | 3,654,431 | | |

Life Sciences Tools & Services | | | 48,583,530 | | | | — | | | | — | | | | 48,583,530 | | |

Medical Devices And Diagnostics | | | 14,437,762 | | | | — | | | | — | | | | 14,437,762 | | |

Pharmaceuticals | | | 138,242,057 | | | | 3,647,338 | | | | — | | | | 141,889,395 | | |

Exchange Traded Funds | | | 7,517,302 | | | | — | | | | — | | | | 7,517,302 | | |

Short-term Investments | | | 10,379,633 | | | | 15,306,000 | | | | — | | | | 25,685,633 | | |

Milestone Interests | |

Biotechnology | | | — | | | | — | | | | 269,727 | | | | 269,727 | | |

Health Care Equipment & Supplies | | | — | | | | — | | | | 1,090 | | | | 1,090 | | |

Pharmaceuticals | | | — | | | | — | | | | 7,000,413 | | | | 7,000,413 | | |

Other Assets | | | — | | | | — | | | | 272 | | | | 272 | | |

Total | | $ | 895,100,682 | | | $ | 18,979,101 | | | $ | 76,481,266 | | | $ | 990,561,049 | | |

28 TEKLA HEALTHCARE INVESTORS | SEMIANNUAL REPORT