SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| Preliminary Proxy Statement | o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

|

|

|

|

|

|

| Definitive Additional Materials |

|

|

|

|

|

|

o | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | ||

Emisphere Technologies, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

x | No fee required | |

|

|

|

o | Fee computed on table below per Exchange Act Rules 14a-6(i) (4) and 0-11. | |

|

|

|

| (1) | Title of each class of securities to which transaction applies: |

|

|

|

| (2) | Aggregate number of securities to which transaction applies: |

|

|

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

| (4) | Proposed aggregate value of transaction: |

|

|

|

| (5) | Total fee paid: |

|

|

|

o | Fee paid previously with preliminary materials. | |

|

|

|

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

|

|

|

| (1) | Amount Previously Paid: |

|

|

|

| (2) | Form, Schedule or Registration Statement No.: |

|

|

|

| (3) | Filing Party: |

|

|

|

| (4) | Date Filed: |

EMISPHERE TECHNOLOGIES, INC.

765 Old Saw Mill River Road

Tarrytown, New York 10591

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 23, 2005

Tarrytown, New York

April 14, 2005

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Emisphere Technologies, Inc., a Delaware corporation (the “Company” or “Emisphere”), to be held on Monday, May 23, 2005 at 10:00 a.m. at the Doubletree Hotel in the Grand Ballroom South located at 455 South Broadway, Tarrytown, New York for the following purposes:

| 1. | To consider the re-election of two (2) directors for a term expiring at the third succeeding annual meeting of stockholders after their re-election; |

|

|

|

| 2. | To approve and adopt an amendment to our Certificate of Incorporation to increase the total number of authorized shares of stock to 50,000,000; |

|

|

|

| 3. | To approve and adopt an amendment to the Qualified Stock Purchase Plan (the “1994 Qualified ESPP”) providing for an increase in the maximum number of shares of Emisphere Common Stock available for issuance there under by 300,000 shares; |

|

|

|

| 4. | To consider the ratification of the Board of Directors’ selection of PricewaterhouseCoopers LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2005; |

|

|

|

| 5. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

In addition, at the Annual Meeting, the Company’s management will discuss the Company’s performance during the fiscal year ended December 31, 2004.

Only those stockholders of record at the close of business on Friday, March 25, 2005 will be entitled to receive notice of, and vote at, the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be open for examination by any stockholder during the ten (10) days prior to the Annual Meeting at our principal offices located at 765 Old Saw Mill River Road, Tarrytown, New York 10591.

The Board of Directors appreciates and encourages stockholder participation in our Annual Meeting and looks forward to your attendance. It is important that your shares be represented, whether or not you choose to attend the meeting. Registered stockholders can vote their shares (a) via the Internet; or (b) by using a toll-free telephone number; or (c) by promptly completing, signing, dating and mailing the enclosed proxy card using the enclosed envelope; or (d) by voting your shares at the meeting in person. Instructions for using these convenient services appear on the enclosed proxy card. Proxy votes are tabulated by an independent agent appointed by the Company, and reported at the Annual Meeting. The proxy is revocable by you at any time prior to its exercise. Your prompt attention to the proxy will be of assistance in preparing for the Annual Meeting. Your cooperation related to this matter is appreciated.

| By order of the Board of Directors, |

|

|

| /S/ Michael M. Goldberg, M.D. |

| Michael M. Goldberg, M.D. |

| Chairman of the Board of Directors |

EMISPHERE TECHNOLOGIES, INC.

765 Old Saw Mill River Road

Tarrytown, New York 10591

PROXY STATEMENT

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

What is the Purpose of this Proxy Statement?

This Proxy Statement (the “Proxy Statement”) and the enclosed Proxy Card (the “Proxy Card”) are furnished to all stockholders of record of Emisphere Technologies, Inc., which we sometimes refer to as the “Company,” or “Emisphere,” as of the close of business on March 25, 2005, in connection with the solicitation of proxies on behalf of the Board of Directors for use at the Annual Meeting of Stockholders on Monday, May 23, 2005 (the “Annual Meeting”).

This Proxy Statement and accompanying form of Proxy are being mailed to stockholders on or about April 19, 2005. The information included in the Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation for directors and our most highly paid executive officers, and certain other required information. Copies of our 2004 Annual Report to Stockholders and the Company’s Annual Report on Form 10-K, as amended, for the fiscal year ended December 31, 2004 (the “2004 Fiscal Year”) are being mailed with this Proxy Statement, but are not incorporated herein by reference and should not be deemed to be part of the Proxy Statement.

Who can attend the Annual Meeting and who is entitled to vote?

All stockholders of the Company as of the record date, March 25, 2005 (the “Record Date”), their authorized representatives and guests of Emisphere will be able to attend the Annual Meeting.

All holders of record of Emisphere’s $0.01 par value Common Stock, which we sometimes refer to as the “Common Stock,” on the Record Date will be entitled to vote at the 2005 Annual Meeting. Each share of Common Stock is entitled to one vote on each matter properly brought before the meeting.

What proposals will be voted upon at the Annual Meeting?

The Annual Meeting has been called to consider and take action on the following items:

| 1. | The re-election of Dr. Michael M. Goldberg and Mr. Robert J. Levenson (“the Director Nominees”) as directors for a term expiring at the third succeeding annual meeting of stockholders after their election; |

|

|

|

| 2. | To approve and adopt an amendment to our Certificate of Incorporation to increase the total number of authorized shares of stock to 50,000,000; |

|

|

|

| 3. | To approved and ratify an amendment to the Qualified Employee Stock Purchase Plan (the “1994 Qualified ESPP”) providing for an increase in the maximum number of shares of Emisphere’s Common Stock available for issuance there under by 300,000 shares; |

|

|

|

| 4. | The ratification of the Board of Directors’ selection of PricewaterhouseCoopers LLP (“PwC”) to serve as Emisphere’s independent registered public accounting firm for the fiscal year ending December 31, 2005; and |

1

| 5. | The transaction of such other business as may properly come before the meeting or any adjournment or postponement thereof. |

What are the Board of Directors’ voting recommendations with respect to the proposals to be voted at the Annual Meeting?

The Board of Directors recommends a vote: | |

• | “FOR” the election of the Director Nominees as directors for the terms expiring at the third succeeding annual meeting of stockholders after their election; |

• | “FOR” the approval and ratification of the amendment to our Certificate of Incorporation to increase the total number of authorized shares of stock to 50,000,000; |

• | “FOR” the approval and ratification of the amendment to the 1994 Qualified ESPP; and |

• | “FOR” the ratification of the Board of Directors’ selection of PricewaterhouseCoopers LLP to serve as Emisphere’s independent registered public accounting firm for the fiscal year ending December 31, 2005. |

If any other matter is properly presented at the Annual Meeting or any adjournments or postponements thereof, your proxy will be voted in accordance with the discretion of the person holding the proxy. At the time this Proxy Statement went to press, Emisphere knew of no matters that needed to be acted on at the Annual Meeting other than those discussed in this Proxy Statement.

How do I vote in person?

If you plan to attend the Annual Meeting on May 23, 2005, please bring proof of identification and the enclosed Proxy Card. However, if your shares are held in the name of your broker, bank or other nominee, you must bring a power of attorney executed by the broker, bank or other nominee that owns the shares of record for your benefit, authorizing you to vote the shares.

How do I vote by proxy?

If you are a registered holder as of the Record Date, you can vote your proxy via the Internet, by telephone, by mail or in person at the Annual Meeting on May 23, 2005.

If you are a beneficial stockholder, you have the right to direct your broker or nominee on how to vote your shares. You should complete a voting instruction card which your broker or nominee is obligated to provide you. If you wish to vote in person at the Annual Meeting, you must first obtain from the record holder a proxy issued in your name.

How do I vote via the Internet?

If you wish to vote via the Internet, follow the Internet voting instructions located on your Proxy Card. A control number, located on the Proxy Card, is designated to verify your identity and allow you to vote the shares and confirm that the voting instructions have been recorded properly.

How do I vote via telephone?

If you wish to vote via telephone, use the toll-free telephone number found on the Proxy Card and follow the voting instructions located on the Proxy Card. A control number, located on the Proxy Card, is designated to verify your identity, allow you to vote the shares and confirm that the voting instructions have been recorded properly.

How do I vote my shares?

If you are a registered stockholder, you can specify how you want your shares voted on each proposal by marking the appropriate boxes on the Proxy Card. Please review the voting instructions on the Proxy Card and read the entire text of the proposals. Please review the recommendation of the Board of Directors in the Proxy Statement prior to marking your vote.

2

If your Proxy Card is signed and returned without specifying a vote or an abstention on a proposal, it will be voted according to the recommendation of the Board of Directors on that proposal. That recommendation is shown for each proposal on the Proxy Card.

What constitutes a quorum?

As of the Record Date, 19,445,122 shares of Common Stock were outstanding. A majority of the total number of our outstanding shares present or represented by proxy, constitutes a quorum for the purpose of adopting proposals at the Annual Meeting. If you submit a properly executed proxy, then you will be considered part of the quorum.

Who counts the vote?

Tabulation of proxies and the votes cast at the meeting are conducted by an independent agent appointed by Emisphere and certified by an independent inspector of elections.

May I revoke my proxy?

You may revoke your Proxy at any time before it is voted at the Annual Meeting by taking one of the following three actions: (i) by giving timely written notice of the revocation to the Secretary of the Company; (ii) by executing and delivering a Proxy with a later date; or (iii) by voting in person at the Annual Meeting. Attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy.

What vote is required to approve each proposal?

A plurality of the votes cast at the Annual Meeting is required to elect the Director Nominees. The affirmative vote of holders of a majority of the shares present in person or by proxy is required for the approval of the increase in authorized Common Stock of the Company and the approval and amendment to the 1994 Qualified ESPP and the ratification of the appointment of PwC as the Company’s independent registered public accounting firm for 2005. The amendment to our Certificate of Incorporation requires the affirmative vote of a majority of the outstanding shares of Common Stock entitled to vote on the Record Date whether or not present in person or represented by proxy.

At the Annual Meeting, abstentions will be counted as votes cast on proposals presented to stockholders, but broker non-votes will not be considered votes cast and the shares represented by broker non-votes with respect to any proposal will be considered present but not eligible to vote on such proposal. Abstentions and broker non-votes will have no effect on the Director Nominees, which is by plurality vote, but abstentions will, in effect, be votes (i) the amendment to increase the authorized Common Stock of the Company, (ii) against the amendment of the 1994 Qualified ESPP, and (iii) against the ratification of the appointment of PwC as the Company’s independent registered public accounting firm for 2005, as these items require the affirmative vote of a majority of the shares present and eligible to vote on such items.

Who bears the cost of soliciting the proxies?

We will pay all costs of preparing, assembling, printing and distributing the proxy materials. We may solicit proxies on behalf of the Board of Directors through the mail, in person, and by telecommunications. We will, upon request, reimburse brokerage firms and others for their reasonable expenses incurred for forwarding solicitation material to beneficial owners of stock.

Where are Emisphere’s Executive Offices?

Our principal executive offices are located at 765 Old Saw Mill River Road, Tarrytown, New York 10591 and our telephone number is (914) 347-2220.

3

How can I get additional information about Emisphere?

We will, upon written request of any stockholder, furnish, without charge, a copy of this Proxy Statement and our Annual Report on Form 10-K, as amended, for the 2004 Fiscal Year, as filed with the Securities and Exchange Commission, which we sometimes refer to as the “SEC.” Please address your requests to Emisphere Technologies, Inc., 765 Old Saw Mill River Road, Tarrytown, New York 10591 Attention: Secretary. Electronic copies of this Proxy Statement, the 2004 Annual Report and the Company’s Annual Report on Form 10-K, as amended, for the 2004 Fiscal Year are located within the Investor Relations section of our website at www.emisphere.com and are also available at the SEC’s website at www.sec.gov. The contents of our website are not incorporated herein by reference and the website address provided in this Proxy Statement is intended to be an inactive textual reference only.

If you wish, you can access future proxy statements and annual reports on the Internet instead of receiving paper copies in the mail. If you are a stockholder of record, you can choose this option by marking the appropriate box on your Proxy Card or by following the instructions if you vote by telephone or the Internet. If you choose to access future proxy statements and annual reports on the Internet, you will receive a Proxy Card in the mail next year with instructions containing the Internet address for those materials. Your choice will remain in effect until you advise us otherwise.

If you are a beneficial owner, and your shares are held in a stock brokerage account or by a bank or other nominee, please refer to the information provided by your broker, bank or nominee for instructions on how to elect to access future proxy statements and annual reports on the Internet. Most beneficial owners who elect electronic access will receive an e-mail message next year containing the Internet address for access to the Proxy Statement and Annual Report.

Emisphere is subject to the informational requirements of the Securities Exchange Act (the “Exchange Act”), which require that the Company’s Annual Report on Form 10-K, the Proxy Statement and other information be filed with the SEC. These filings may be inspected and copied at the public reference facilities of the SEC. Call (800) SEC-0330 for more information regarding public reference facilities. Copies of the material may also be obtained upon request and upon payment of the appropriate fee from the Public Reference Section of the SEC, Room 1024, Judiciary Plaza, 450 Fifth Street, N.W., Washington, DC 20549. In addition, the SEC maintains a website on the Internet that contains reports, proxy and information statements, as well as other information regarding registrants that file electronically with the SEC, including our Company. The SEC’s website address is “www.sec.gov.”

Householding of Annual Meeting Materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of our Proxy Statement and Annual Report to Stockholders may have been sent to multiple stockholders in each household. We will promptly deliver a separate copy of either document to any stockholder upon written or oral request made to our Investor Relations Department, Emisphere Technologies, 765 Old Saw Mill River Road, Tarrytown, New York 10591, telephone: (914) 347-2220. Any stockholder who wants to receive separate copies of the Proxy Statement or Annual Report in the future, or any stockholder who is receiving multiple copies and would like to receive only one copy per household, must make an election on the proxy card or contact the stockholder’s bank, broker, or other nominee record holder. Stockholders may also contact us at the above address and phone number with their election.

4

BOARD OF DIRECTORS

Our business is overseen by the Board of Directors. It is the paramount duty of the Board of Directors to oversee the Chief Executive Officer and other senior management in the competent and ethical operation of the Company on a day-to-day basis and to assure that the long-term interests of the stockholders are being served. To satisfy this duty, our directors take a proactive, focused approach to their position, and set standards to ensure that the Company is committed to business success through maintenance of the highest standards of responsibility and ethics. The Board of Directors is kept advised of our business through regular verbal or written reports, Board of Directors meetings, and analysis and discussions with the Chief Executive Officer and other officers of the Company.

Members of the Board of Directors bring to us a wide range of experience, knowledge and judgment. These varied skills mean that governance is far more than a “check the box” approach to standards or procedures. Our governance organization is designed to be a working structure for principled actions, effective decision-making and appropriate monitoring of both compliance and performance.

The Board of Directors has affirmatively determined that Michael E. Black, Dr. Stephen K. Carter, Arthur Dubroff, Robert J. Levenson, and Howard M. Pack are independent directors within the meaning of Rule 4200 of the National Association of Securities Dealers, Inc. (“NASD”). The independent directors meet in separate sessions at the conclusion of each board meeting and at other times as deemed necessary by the independent directors, in the absence of Dr. Michael M. Goldberg, the sole non-independent director.

Committees of the Board of Directors

The Board of Directors has established an audit committee, a compensation committee and a governance and nominating committee. Each of the committees of the Board of Directors acts pursuant to a separate written charter adopted by the Board of Directors.

The audit committee is currently comprised of Arthur Dubroff (chairman), Michael E. Black and Robert J. Levenson. All of the members of the audit committee are independent within the meaning of Rule 4200 of the NASD. The Board of Directors has determined that Arthur Dubroff, the chairman of the audit committee, is an “audit committee financial expert,” within the meaning of Item 401(h) of Regulation S-K. The audit committee’s responsibilities and duties are summarized below in the report of the audit committee and in the audit committee charter which is available on our website (www.emisphere.com).

The compensation committee is currently comprised of Robert J. Levenson (chairman), Michael E. Black, Dr. Stephen K. Carter, and Howard M. Pack. All of the members of the audit committee are independent within the meaning of Rule 4200 of the NASD, non-employee directors within the meaning of the rules of the Securities and Exchange Commission and “outside” directors within the meaning set forth under Internal Revenue Code Section 162(m). The compensation committee’s responsibilities and duties are summarized in the report of the compensation committee and in the compensation committee charter also available on our website. There were no interlocks or insider participation between any member of the board or compensation committee and any member of the board of the directors or compensation committee of another company.

The governance and nominating committee is currently comprised of Michael E. Black (chairman), Dr. Stephen K. Carter and Robert J. Levenson. All of the members of the governance and nominating committee are independent within the meaning of Rule 4200 of the NASD. The governance and nominating committee’s responsibilities and duties are set forth in the compensation committee charter on our website. Among other things, the governance and nominating committee is responsible for recommending to the board the nominees for election to our Board of Directors and the identification and recommendation of candidates to fill vacancies occurring between annual stockholder meetings.

5

The table below provides membership information for each board committee.

Name |

| Board |

| Audit |

| Compensation |

| Governance |

| ||||||||||||

|

|

|

|

| |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Michael M. Goldberg, M.D. (3) |

|

|

| X | * |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert J. Levenson (3) |

|

|

| X |

|

|

|

| X |

|

|

|

| X | * |

|

|

| X |

|

|

Howard M. Pack (2) |

|

|

| X |

|

|

|

|

|

|

|

|

| X |

|

|

|

|

|

|

|

Arthur Dubroff (2) |

|

|

| X |

|

|

|

| X | * |

|

|

|

|

|

|

|

|

|

|

|

Stephen K. Carter, M.D. (1) |

|

|

| X |

|

|

|

|

|

|

|

|

| X |

|

|

|

| X |

|

|

Michael E. Black (1) |

|

|

| X |

|

|

|

| X |

|

|

|

| X |

|

|

|

| X | * |

|

* Chair | |

| (1) Class I directors: Term as director is expected to expire in 2006 |

| (2) Class II directors: Term as director is expected to expire in 2007 |

| (3) Class III directors: Term as director is expected to expire in 2005 |

Meetings Attendance

During the 2004 Fiscal Year, our Board of Directors held seven (7) meetings. Each director attended 75 percent or more of the aggregate number of Board of Directors meetings and committees of which he was a member that were held during the period of his service as a director.

The audit committee met six (6) times during the 2004 Fiscal Year.

The compensation committee met six (6) times during the 2004 Fiscal Year.

The governance and nominating committee met five (5) times during the 2004 Fiscal Year.

The Company does not have a formal policy regarding attendance by members of the Board of Directors at the Company’s annual meeting of stockholders, although it does encourage attendance by the directors. Historically, more than a majority of the directors have attended the annual meeting. All of our non-employee directors attended our 2004 annual meeting of stockholders.

Code of Conduct for Officers and Employees and Code of Business Conduct and Ethics for Directors

In 2003, we adopted a Code of Conduct that applies to all of our officers and employees. In 2004, the Board of Directors adopted a Code of Business Conduct and Ethics that applies specifically to the members of the Board of Directors. The directors will be surveyed annually regarding their compliance with the policies as set forth in the Code of Conduct for Directors. The Code of Conduct and the Code of Conduct for Directors are available on the Corporate Governance section of our website at www.emisphere.com. The contents of our website are not incorporated herein by reference and the website address provided in this Proxy Statement is intended to be an inactive textual reference only. The Company intends to disclose on its website any amendment to, or waiver of, a provision of the Code of Business Conduct and Ethics that applies to the Chief Executive Officer, Chief Financial Officer or Controller. Our Code of Conduct contains provisions that apply to our Chief Executive Officer, Chief Financial officer and all other finance and accounting personnel. These provisions comply with the requirements of a company code of ethics for financial officers that were promulgated by the SEC pursuant to the Act.

6

Stockholder Communications

We have established an Investor Relations Office for all stockholder inquiries and communications. The Investor Relations Office facilitates the dissemination of accurate and timely information to our stockholders. In addition, the Investor Relations Office ensures that outgoing information is in compliance with applicable securities laws and regulations. All investor queries should be directed to its internal Investor Relations Officer or Chief Financial Officer who is the appointed Corporate Secretary, as set forth in our policy for “Stockholder and Other Communication to the Board” filed as Appendix A to this Proxy Statement

ELECTION OF DIRECTORS

Nominations for the election of directors may be made by the Board of Directors or the governance and nominating committee. The committee did not reject any candidates recommended within the preceding year by a beneficial owner of, or from a group of security holders that beneficially owned, in the aggregate, more than five (5%) per cent of the Company’s voting stock.

Although it has no formal policy regarding shareholder nominees, the governance and nominating committee believes that shareholder nominees should be viewed in substantially the same manner as other nominees. Stockholders may make a recommendation for a nominee by complying with the notice procedures set forth in our by-laws. The governance and nominating committee will give nominees recommended by stockholders in compliance with these procedures the same consideration that it gives to any board recommendations. To date, we have not received any recommendations from stockholders requesting that the nominating and governance committee (or any predecessor) consider a candidate for inclusion among the committee’s slate of nominees in the Company’s proxy statement, and the Director Nominees have been nominated by the governance and nominating committee.

To be considered by the Committee, a Director Nominee must have broad experience at the strategy/policy-making level in a business, government, education, technology or public interest environment, high-level managerial experience in a relatively complex organization or experience dealing with complex problems. In addition, the nominee must be able to exercise sound business judgment and provide insights and practical wisdom based on experience and expertise, possess proven ethical character, be independent of any particular constituency, and be able to represent all stockholders of the Company.

The Committee will also evaluate whether the nominee’s skills are complimentary to the existing board member’s skills, and the board’s needs for operational, management, financial, technological or other expertise; and whether the individual has sufficient time to devote to the interests of Emisphere. The prospective board member cannot be a board member or officer at a competing company nor have relationships with a competing company. He/she must be clear of any investigation or violations that would be perceived as affecting the duties and performance of a director

The nominating and governance committee identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service. Current members of the board with skills and experience that are relevant to the business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the board with that of obtaining a new perspective. If any member of the board does not wish to continue in service, or if the nominating and governance committee or the board decides not to nominate a member for re-election, the nominating and governance committee identifies the desired skills and experience of a new nominee, and discusses with the board suggestions as to individuals that meet the criteria.

7

Compensation of Non-Employee Directors

A director who is a full-time employee of the Company receives no additional compensation for his services as a director. With respect to all other directors (“non-employee directors”), the Company’s philosophy is to provide competitive compensation and benefits necessary to attract and retain high-quality non-employee directors and to encourage ownership of Company stock to further align their interests with those of stockholders.

For each board meeting attended prior to April 1 2004, non-employee directors had the right to receive, under our Directors’ Deferred Compensation Stock Plan, shares of Common Stock, based on a fee of $1,000 and the closing price of the Common Stock on the date of the meeting (the “Annual Board Retainer”). Under that plan, Emisphere maintains a “share account” for each eligible director and is obligated to issue the shares within six months of a director’s retirement from the board or other termination as a director. Through January 31, 2004, Messrs. Pack, Levenson, Carter and Black earned the right to receive 2,767, 2,651, 355 and 355 shares, respectively, in accordance with the Directors’ Deferred Compensation Stock Plan, following their termination of services to the Board of Directors. In January 2005, Emisphere issued 1,957 shares of Common Stock to Dr. Greene (who resigned in 2004).

Our Stock Option Plan for Outside Directors was amended and restated as of April 1, 2004 and renamed the Stock Incentive Plan for Outside Directors (the “Director Stock Plan”). Prior to April 1, 2004, the plan provided that each non-employee director received, upon appointment, a stock option to purchase 35,000 shares of the Common Stock (the “Initial Grant”). On the fifth anniversary of his appointment, and every three (3) years thereafter, each such director had the right to receive a stock option to purchase 21,000 shares of Common Stock (each, an “Additional Grant”). All grants made under the Director Stock Plan prior to April 1, 2004 vest at the rate of 7,000 stock option shares per year. In the event that the holder of an option ceases to serve as a director, all previously granted options may be exercised to the extent vested within six (6) months after termination of directorship (one (1) year if the termination is by reason of death), except that, from and after April 1, 2004 (unless otherwise provided in an option agreement), if a director becomes an “emeritus director” of the Company immediately following his Board service, including Dr. Greene, the vested options may be exercised for six (6) months after termination of service as an “emeritus director.” All unvested options expire upon termination of Board service. As of December 31, 2004, there are 328,380 shares available for future grants under the Director Stock Plan.

Commencing April 1, 2004, the following changes became effective with respect to the compensation of the non-employee members of the Board of Directors:

• | Under the Director Stock Plan each non-employee director receives, on the date of each regular annual stockholders’ meeting and in lieu of the Initial Grant and the Additional Grants, a stock option to purchase 7,000 shares of the Common Stock. The stock options vest on the six (6) month anniversary of the grant date provided the director continuously serves as a director from the grant date through such vesting date. Notwithstanding the foregoing, any director who holds any unvested stock options pursuant to an Initial Grant or Additional Grant is ineligible to receive any stock options described in this paragraph unless and until all such options vest. All other terms of the stock options described above apply to these stock options. |

8

• | In recognition of the roles and responsibilities of the Board of Directors and current market data, the Board of Directors’ compensation includes an annual board retainer of $20,000, half of which is payable in cash and the balance is payable in shares of restricted stock granted under the Director Stock Plan on the date of each regular annual stockholders’ meeting, provided the director is an eligible director on that date. The number of shares of restricted stock is determined by dividing the cash portion of the annual board retainer by the closing price of the Common Stock on the grant date. The shares of restricted stock vest and are issued six months after the grant date provided the director continuously serves as a director from the grant date through such vesting date. | |

|

|

|

• | Board meeting fees of $1,000 per meeting have been discontinued. | |

|

|

|

• | Additional committee and chairperson fees are paid as follows: | |

| o | $3,000 annual committee retainer paid quarterly; |

| o | $1,000 per committee meeting fee, but only if the meeting exceeds 15 minutes and is not held on the same day as a board meeting; and |

| o | An additional $500 payable to the chairperson of each committee for each committee meeting, but only if the meeting exceeds 15 minutes and is not held on the same day as the board meeting. |

The table below summarizes the options granted to our outside directors through February 28, 2005.

Non-employee directors |

| Date of |

| Number of Shares |

| Exercise Price |

| |||||||

|

|

|

| |||||||||||

Howard M. Pack. |

|

| 4/29/92 |

|

|

| 70,000 | (2)(3) |

|

| $ | 13.000 |

|

|

|

|

| 4/28/97 |

|

|

| 21,000 |

|

|

| $ | 13.750 |

|

|

|

|

| 4/28/00 |

|

|

| 21,000 |

|

|

| $ | 41.060 |

|

|

|

|

| 5/10/02 |

|

|

| 35,000 |

|

|

| $ | 13.000 |

|

|

|

|

| 4/28/03 |

|

|

| 21,000 |

|

|

| $ | 2.890 |

|

|

Robert J. Levenson. |

|

| 9/11/98 |

|

|

| 35,000 |

|

|

| $ | 6.125 |

|

|

|

|

| 9/11/03 |

|

|

| 21,000 |

|

|

| $ | 5.780 |

|

|

Arthur Dubroff |

|

| 9/12/03 |

|

|

| 35,000 |

|

|

| $ | 6.190 |

|

|

Stephen K. Carter. |

|

| 12/11/03 |

|

|

| 35,000 |

|

|

| $ | 5.750 |

|

|

Michael E. Black. |

|

| 12/11/03 |

|

|

| 35,000 |

|

|

| $ | 5.750 |

|

|

(1) | Unless indicated otherwise, all options referenced in this table were granted under the 1997 Directors’ Option Plan, as currently in effect. |

|

|

(2) | Options granted prior to January 29, 1997. |

|

|

(3) | 35,000 options granted on April 29, 1992 that were not exercised, expired on April 29, 2002. New grants were issued on May 10, 2002 for the same number of shares and at the same strike price as the expired options. |

9

SECURITIES AVAILABLE FOR FUTURE ISSUANCE UNDER EQUITY PLANS

The following table provides information as of December 31, 2004 about the Common Stock that may be issued upon the exercise of options granted to employees, consultants or members of our Board of Directors under all of our existing equity compensation plans, including the 1991 Stock Option Plan, 1995 Stock Option Plan, 2000 Stock Option Plans, the 2002 Broad Based Plan, (collectively “the Plans” ) the 1997 Directors’ Option Plan, and the 1994 Qualified and Non-Qualified Employee Stock Purchase Plans.

Plan Category |

| (a) |

| (b) |

| (c) |

| |||||||||

|

|

|

| |||||||||||||

Equity Compensation Plans Approved by Security |

|

|

|

|

|

|

|

|

|

| ||||||

The Plans |

|

|

| 4,870,976 |

|

|

| $ | 15.47 |

|

|

|

| 1,045,556 |

|

|

1997 Directors Option Plan |

|

|

| 352,000 |

|

|

| $ | 10.07 |

|

|

|

| 328,380 |

|

|

1994 Qualified and Non-qualified ESPP |

|

|

| - |

|

|

|

| - |

|

|

|

| 372,632 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Compensation Plans not approved by Security |

|

|

| 322,279 |

|

|

| $ | 8.83 |

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Total |

|

|

| 5,545,255 |

|

|

| $ | 14.74 |

|

|

|

| 1,746,568 |

|

|

VOTING SECURITIES AND PRINCIPAL HOLDERS

As the close of business on the Record Date, there were approximately 19,445,122 shares of Common Stock outstanding and entitled to vote. The presence, either in person or by proxy, of persons entitled to vote a majority of our outstanding Common Stock is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes are counted for purposes of determining a quorum. Abstentions are counted as if they were “no” votes in tabulations of the votes cast, whereas broker non-votes, are not considered as having voted for the purposes of determining the outcome of a vote. Holders of Common Stock have one vote for each share on any matter that may be presented for consideration and action by the stockholders as the Annual Meeting.

COMMON STOCK OWNERSHIP BY DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth certain information, as of February 28, 2005, regarding the beneficial ownership of the Common Stock by (i) each director, including the Director Nominees; (ii) each Executive Officer; and (iii) all of our directors and Executive Officers as a group. The number of shares beneficially owned by each director or Executive Officer is determined under the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has the sole or shared voting power (which includes power to vote, or direct the voting of, such security) or investment power (which includes power to dispose of, or direct the disposition of, such security) as well as any shares which the individual has the right to acquire as of sixty (60) days after February 28, 2005. Unless otherwise indicated, all persons named as beneficial owners of Common Stock have sole voting power and sole investment power with respect to the shares indicated as beneficially owned.

10

Name and Address (e) |

| Common Shares |

| Common Shares |

| Percent |

| |||||||||

|

|

|

| |||||||||||||

Michael M. Goldberg, M.D. |

|

|

| 2,339,874 | (c) |

|

|

| 2,292,315 |

|

|

|

| 10.95 | % |

|

Howard M. Pack (f) |

|

|

| 187,978 | (g) |

|

|

| 91,000 |

|

|

|

|

| * |

|

Robert J. Levenson (f) |

|

|

| 54,075 | (d) |

|

|

| 42,000 |

|

|

|

|

| * |

|

Arthur Dubroff |

|

|

| 8,924 |

|

|

|

| 7,000 |

|

|

|

|

| * |

|

Stephen K. Carter, M.D (f) |

|

|

| 9,279 |

|

|

|

| 7,000 |

|

|

|

|

| * |

|

Michael E. Black (f) |

|

|

| 9,279 |

|

|

|

| 7,000 |

|

|

|

|

| * |

|

Lewis H. Bender |

|

|

| 292,387 |

|

|

|

| 276,317 |

|

|

|

| 1.50 | % |

|

Shepard M. Goldberg (h) |

|

|

| 182,895 |

|

|

|

| 174,000 |

|

|

|

|

| * |

|

Steven M. Dinh |

|

|

| 198,025 |

|

|

|

| 182,000 |

|

|

|

|

| * |

|

Elliot M. Maza |

|

|

| 24,716 |

|

|

|

| 20,000 |

|

|

|

|

| * |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

All directors and executive officers as a group |

|

|

| 3,307,432 |

|

|

|

| 3,098,632 |

|

|

|

| 14.92 | % |

|

* | Less than 1% | |

|

|

|

| a) | The number of shares set forth for each director and Executive Officer consists of direct and indirect ownership of shares, including stock options that are currently exercisable or exercisable within 60 days of February 28, 2005, deferred common share units and restricted stock. |

|

|

|

| b) | The number of shares set forth for each director and Executive Officer consists of stock options that are currently exercisable and stock options that will be exercisable within 60 days of February 28, 2005 and are included in the number of shares set forth under the column “Total Shares Owned”. |

|

|

|

| c) | Does not include 130,000 shares with respect to which Dr. Goldberg has transferred options to members of his family and with respect to which Dr. Goldberg disclaims beneficial interest. Dr. Goldberg does not have voting nor investment power as to these shares underlying options. |

|

|

|

| d) | Includes 500 shares held by the Robert J. Levenson Foundation, with respect to which shares Mr. Levenson disclaims beneficial ownership. Also includes 4,000 shares in the Robert J. Levenson pension plan trust and 3,000 shares in an IRA account. |

|

|

|

| e) | Unless otherwise specified, the address of each beneficial owner is c/o Emisphere Technologies, Inc., 765 Old Saw Mill River Road, Tarrytown, New York 10591. Directors and officers are listed in the table based on length of association with the Company. |

|

|

|

| f) | A number of stock units have been credited as of January 1, 2004 to the account of each non-employee director participating in the Company’s Directors Deferred Compensation Stock Plan. These units are payable solely in shares of Company Common Stock following termination of service. Messrs. Pack, Levenson, Black and Carter have accumulated 2,767, 2,651, 355, and 355 shares, respectively, in their account and have no voting or investment power as to those shares. |

|

|

|

| g) | Includes 92,287 shares personally owned by Howard Pack over which he holds the power to vote. |

|

|

|

| h) | Includes 500 shares in the Lauren Goldberg trust fund and 500 shares in the Justin Goldberg trust fund. |

|

|

|

| i) | In determining the number and percentage of shares beneficially owned by each director and Executive Officer, shares that may be acquired by such person pursuant to options currently exercisable or exercisable within 60 days of February 28, 2005 are deemed to be outstanding for the purpose of determining the total number of outstanding Common Stock owned by a director or Executive Officer individually and by all directors and Executive Officers as a group. However, these shares are not deemed to be outstanding for the purpose of computing the individual ownership percentage of any other person. |

11

Principal Holders of Common Stock

The following table sets forth information regarding beneficial owners, other than our CEO, of more than five (5%) percent of the outstanding shares of Common Stock as of March 28, 2005:

Name and Address |

| Number of Shares |

| Percent |

| ||||||

|

|

| |||||||||

|

|

|

|

|

|

|

| ||||

Versant Capital Management (1) |

|

|

| 1,800,000 |

|

|

|

| 9.3 | % |

|

(1) | Based on Schedule 13G/A filed on July 12, 2004 for the period ended December 31, 2003; no additional 13 G filings have been made. |

We are not aware of any change in the ownership of more than five percent (5%) holders as of March 28, 2005.

Compensation Committee Report on Executive Compensation

The Report of the Compensation Committee of the Board of Directors and the subsequent Performance Graph shall not be referenced by any general statement in this Proxy Statement, nor in any filing under the Securities Act of 1933, as amended, or any filing under the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate this information by reference, and this information is not otherwise deemed to be filed under either the Securities Act or the Securities Exchange Act.

Our executive compensation program is administered by the compensation committee of the board. The compensation committee, which is composed of non-employee directors, is responsible for reviewing with Company management and approving compensation policy and all forms of compensation for executive officers and directors in light of the Company’s current business environment and the Company’s strategic objectives. In addition, the compensation committee acts as the administrator of the Company’s stock option plans. The compensation committee’s practices include reviewing and establishing executive officers’ compensation to ensure that base pay and incentive compensation are competitive to attract and retain qualified executive officers, and to provide incentive systems reflecting both financial and operating performance, as well as an alignment with stockholder interests. These policies are based on the principle that total compensation should serve to attract and retain those executives critical to the overall success of Emisphere and should reward executives for their contributions to the enhancement of stockholder value.

The key elements of the executive compensation package are base salary (as determined by the competitive market and individual performance), the Executive Incentive Plan (which provides for annual incentive bonuses), the executive long term disability plan and other health & welfare benefits applicable to all employees, long-term incentive compensation in the form of participation in the Company’s 1994 Qualified and Non-Qualified Employee Stock Purchase Plans, and annual stock option grants. In general, the compensation committee has adopted the practice that compensation for executive officers should be competitive with market data reflected within the 50th-75th percentile of biotechnology companies for corresponding senior executive positions. The compensation committee utilizes stock options as a substantial portion of executive compensation in order to further align the interests of executives with those of Emisphere’s stockholders. The compensation committee’s policy with respect to stock options granted to executives is that grant prices should be equal to the fair market value of the Common Stock on the date of grant, that employee stock options should vest over a five-year period and expire in ten years from date of grant, and that options previously granted at exercise prices higher than the current fair market value should not be repriced. Individual performance is measured against long term strategic goals, short term business goals, new business development, development of employees, fostering of teamwork and other Emisphere values.

12

In determining the compensation for each executive officer, the compensation committee generally considers (i) data from outside studies and proxy materials regarding compensation of executive officers at comparable companies, (ii) the input of other directors and the chief executive officer regarding individual performance of each Executive Officer and (iii) qualitative measures of Emisphere’s performance, such as progress in the development of the Company’s technology, the engagement of corporate partners for the commercial development and marketing of products, effective corporate governance, fiscal responsibility, the success of Emisphere in raising funds necessary to conduct research and development, and the pace at which the Company continues to advance its technologies in various clinical trials. The compensation committee’s consideration of these factors is subjective and informal.

The 2004 salary of our Chief Executive Officer, Michael M. Goldberg, M.D., in the amount of $523,928, was set in accordance with the terms of his employment agreement. See the caption ““Employment Agreement” for a discussion of Dr. Goldberg’s compensation arrangements under his employment agreement.

Members of the Compensation Committee:

Robert J. Levenson (Chairman)

Michael E. Black

Stephen K. Carter, MD

Howard M. Pack

13

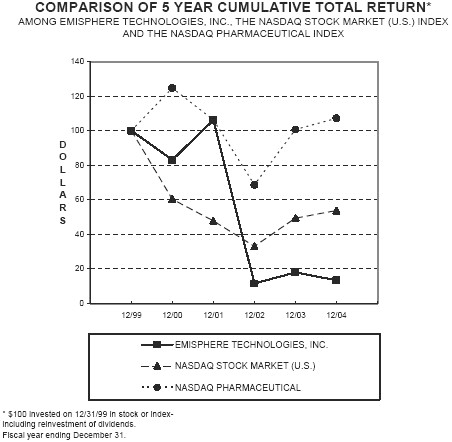

Comparative Stock Performance Graph

The graph and table below compare the cumulative total stockholder return on Emisphere’s Common Stock with the cumulative total stockholder return of (i) the NASDAQ Stock Market (U.S.) Index and (ii) the NASDAQ Pharmaceutical Index, assuming an investment of $100 on December 31, 1999 in each of the Company’s Common Stock, the stocks comprising the NASDAQ Market Index and the stocks comprising the NASDAQ Pharmaceutical Index.

| Measurement Date |

| Emisphere |

| NASDAQ |

| NASDAQ |

|

|

|

|

|

|

|

|

|

|

| 12/31/99 |

| 100 |

| 100 |

| 100 |

|

|

|

|

|

|

|

|

|

|

| 12/31/00 |

| 83 |

| 60 |

| 124 |

|

|

|

|

|

|

|

|

|

|

| 12/31/01 |

| 106 |

| 48 |

| 106 |

|

|

|

|

|

|

|

|

|

|

| 12/31/02 |

| 12 |

| 33 |

| 68 |

|

|

|

|

|

|

|

|

|

|

| 12/31/03 |

| 18 |

| 49 |

| 101 |

|

|

|

|

|

|

|

|

|

|

| 12/31/04 |

| 13 |

| 54 |

| 107 |

|

14

EXECUTIVE COMPENSATION

The following table sets forth information regarding the aggregate compensation Emisphere paid during 2004, 2003 and 2002 to our Chief Executive Officer and each of our other Executive Officers whose total compensation exceeded $100,000:

SUMMARY COMPENSATION TABLE

|

| Annual Compensation |

| Long Term |

|

|

| ||||||||||||||||||

|

|

| Compensation |

|

|

| |||||||||||||||||||

Name and Principal Position |

| Year |

| Salary |

| Bonus |

| Other Annual |

| Securities |

| All Other Compensation |

| ||||||||||||

|

|

|

|

|

|

| |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael M. Goldberg, M.D. |

|

| 2004 |

|

| 510,620 |

|

| - |

|

|

| 13,696 | (5) |

|

|

| - |

|

|

|

| 58,200 |

|

|

Chairman and Chief Executive |

|

| 2003 |

|

| 506,861 | (1) |

| - |

|

|

| 29,394 | (5) |

|

|

| - |

|

|

|

| 49,468 |

|

|

Officer |

|

| 2002 |

|

| 449,521 |

|

| 200,000 |

|

|

| 55,604 | (5) |

|

|

| 622,315 |

|

|

|

| 49,453 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lewis H. Bender |

|

| 2004 |

|

| 292,792 |

|

| - |

|

|

| - |

|

|

|

| - |

|

|

|

| 8,200 |

|

|

Senior Vice President of |

|

| 2003 |

|

| 290,472 | (2) |

| - |

|

|

| - |

|

|

|

| 30,000 |

|

|

|

| 8,000 |

|

|

Business Development |

|

| 2002 |

|

| 302,502 | (2) |

| 75,000 |

|

|

| - |

|

|

|

| 30,000 |

|

|

|

| 8,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shepard M. Goldberg |

|

| 2004 |

|

| 269,085 | (3) |

| - |

|

|

| - |

|

|

|

| - |

|

|

|

| 8,200 |

|

|

Senior Vice President, |

|

| 2003 |

|

| 269,773 | (3) |

| - |

|

|

| - |

|

|

|

| 30,000 |

|

|

|

| 8,000 |

|

|

Operations |

|

| 2002 |

|

| 254,770 | (3) |

| 84,000 |

|

|

| - |

|

|

|

| 30,000 |

|

|

|

| 8,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steve M. Dinh |

|

| 2004 |

|

| 261,499 |

|

| - |

|

|

| - |

|

|

|

| - |

|

|

|

| 8,200 |

|

|

Vice President of Research |

|

| 2003 |

|

| 258,451 | (4) |

| - |

|

|

| - |

|

|

|

| 30,000 |

|

|

|

| 8,000 |

|

|

Technology and Development |

|

| 2002 |

|

| 270,542 | (4) |

| 67,500 |

|

|

| - |

|

|

|

| 25,000 |

|

|

|

| 8,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elliot M. Maza |

|

| 2004 |

|

| 260,394 | (7) |

| 25,000 | (8) |

|

| - |

|

|

|

| - |

|

|

|

| - |

|

|

Chief Financial Officer |

|

| 2003 |

|

| 22,115 |

|

| 25,000 | (8) |

|

| - |

|

|

|

| 100,000 |

|

|

|

| - |

|

|

(1) | Includes payment of $26,615 in 2003 for previously accrued vacation. |

|

|

(2) | Include payments of $5,460 and $22,418 and in 2003 and 2002 respectively, for previously accrued vacation. |

|

|

(3) | Include payments of $5,095, $12,798 and $4,644 in 2004, 2003 and 2002 respectively, for previously accrued vacation. |

|

|

(4) | Include payments of $3,901 and $21,131 in 2003 and 2002 respectively, for previously accrued vacation. |

|

|

(5) | Includes other perquisites (preparation of tax returns, personal usage of company car) required to be disclosed. |

|

|

(6) | Other compensation consists of matching contributions that were made under a defined contribution plan available to substantially all employees plus any split life insurance payments (not included in the Compensation column). |

|

|

(7) | Includes payment of $8,471 for previously accrued vacation. |

|

|

(8) | Represents sign on bonus. |

15

STOCK OPTION GRANTS DURING THE FISCAL YEAR ENDED DECEMBER 31, 2004

There were no stock options granted to executives in 2004.

AGGREGATED OPTION EXERCISES AND YEAR-END OPTION VALUES

The following table sets forth information as to the exercises of options during year 2004, and the number and value of unexercised options held by the Executive Officers named above as of December 31, 2004:

|

| Exercises |

| Number of |

| Value of Unexercised |

| ||||||||||||||||||||||||

|

|

|

|

| |||||||||||||||||||||||||||

Name |

| Number of Shares |

| Value |

| Exercisable |

| Un-Exercisable |

| Exercisable |

| Un-Exercisable |

| ||||||||||||||||||

|

|

|

|

|

|

| |||||||||||||||||||||||||

Michael M. Goldberg |

|

|

| - |

|

|

|

| - |

|

|

|

| 2,132,315 | (1) |

|

|

| 260,000 |

|

|

|

| 18,240 |

|

|

|

| 27,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lewis H. Bender |

|

|

| - |

|

| �� |

| - |

|

|

|

| 258,317 |

|

|

|

| 84,000 |

|

|

|

| 33,141 |

|

|

|

| 38,040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shepard M. Goldberg |

|

|

| - |

|

|

|

| - |

|

|

|

| 162,000 |

|

|

|

| 63,000 |

|

|

|

| 15,060 |

|

|

|

| 38,040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steven Dinh |

|

|

| - |

|

|

|

| - |

|

|

|

| 172,000 |

|

|

|

| 53,000 |

|

|

|

| 13,580 |

|

|

|

| 35,820 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elliot M. Maza |

|

|

| - |

|

|

|

| - |

|

|

|

| 20,000 |

|

|

|

| 80,000 |

|

|

|

| - |

|

|

|

| - |

|

|

(1) | Includes 130,000 shares with respect to which Dr. Goldberg has transferred options to members of his family and with respect to which Dr. Goldberg disclaims beneficial interest. |

|

|

(2) | Does not include shares acquired under our 1994 Qualified ESPP or 1994 Non-Qualified ESPP. |

16

TRANSACTIONS WITH EXECUTIVE OFFICERS AND DIRECTORS

Employment Agreement

In July 2000, we entered into an employment agreement with Michael M. Goldberg, M.D. This agreement was amended in January 2005, such amendment being effective December 15, 2004. Pursuant to the agreement, Dr. Goldberg is to serve as Chairman and Chief Executive Officer of Emisphere at an annual salary of $523,928 in 2004. Also pursuant to the agreement, Dr. Goldberg was granted an option to purchase 800,000 shares of Common Stock.

The employment agreement provides, among other things, that upon termination by Emisphere without Cause or by Dr. Goldberg for Good Reason prior to a Change in Control (as each capitalized term is defined in the agreement) we will make monthly severance payments for a period of 24 months, each equal to one month’s base salary and target bonus. Dr. Goldberg will also receive a pro rata bonus for the year of termination and be entitled to continued health and life insurance coverage during the severance period (subject to cessation upon eligibility for such coverage from a subsequent employer). In addition, all unvested stock options and restricted stock awards will immediately vest in full upon such termination.

In the event Dr. Goldberg’s employment is terminated within two years following a Change in Control without Cause or for Good Reason (as each capitalized term defined in the agreement), Emisphere will make a lump sum severance payment equal to three times the amount of the base salary and target annual bonus payable under the agreement. In addition, upon such termination Dr. Goldberg will be treated as described in the immediately preceding paragraph except that the health and life benefits will continue for up to thirty-six months.

Dr. Goldberg’s employment agreement, as amended, permits annual renewals for successive one year terms unless at least 90 days prior to the expiration of the original term or any renewal term, the board or Dr. Goldberg notifies the other party in writing that they are electing to terminate the employment agreement at the expiration of the current term, July 31, 2005.

Other Agreements

Dr. Goldberg’s employment agreement provides that he is entitled to have the Company pay premiums of up to $50,000 per year for his life insurance. The Company previously obtained a $3.2 million face amount, $37,570 annual premium policy for Dr. Goldberg in accordance with that provision (a “collateral assignment” split-dollar life insurance policy owned by Dr. Goldberg), and in November 2004 converted that policy to an “endorsement” split-dollar life insurance policy owned by the Company. The policy is owned by the Company (with the beneficiary selected by Dr. Goldberg in the event of his death prior to a termination of service) and is governed by a revised split-dollar agreement that entitles Dr. Goldberg to elect to have the policy rolled out to him following a termination of employment for any reason other than cause or death, provided that he pays to the Company in full the aggregate premiums it has paid on the policy.

In July 2000, Emisphere extended a loan to Dr. Goldberg in the amount of approximately $1.5 million pursuant to a secured promissory note bearing interest, payable monthly at a variable rate based upon LIBOR plus 1.0% (3.4% at December 31, 2004 and 2.1% at December 31, 2003). The proceeds of the loan were used to pay the exercise price and income taxes resulting from Dr. Goldberg’s exercise of stock options immediately prior to their expiration on December 31, 2001. The loan is collateralized by the stock issued upon exercise of the stock options. The principal is due the earlier of July 31, 2005 or upon the sale of stock held as collateral. Since extending the loan, interest has been accrued rather than paid, and the outstanding indebtedness under the loan as of March 31, 2005 was approximately $2,025,318.

17

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”), and the rules of the Securities and Exchange Commission (the “SEC”) require our directors, Executive Officers and persons who own more than 10% of Common Stock to file reports of their ownership and changes in ownership of Common Stock with the SEC. Our employees generally prepare these reports on the basis of information obtained from each director and Executive Officer. Based on written representations of the Company’s directors and Executive Officers and on confirmation that no Form 5 was required to be filed, we believe that all reports required by Section 16(a) of the Exchange Act to be filed by its directors, Executive Officers and greater than ten (10%) percent owners during the last fiscal year, were filed on time.

18

PROPOSAL 1: ELECTION OF DIRECTORS

(Item #1 on the Proxy Card)

Our Board of Directors is currently comprised of six (6) members and is divided into three classes with staggered terms so that the term of one class expires at each annual meeting of stockholders. Our Class III directors whose term is expiring, have been nominated by the Board of Directors for election at the Annual Meeting for a term expiring at the third succeeding annual meeting of stockholders after their election and until their successors are duly elected and qualified. At the recommendation of our governance and nominating committee, Dr. Michael M. Goldberg and Mr. Robert J. Levenson have been nominated for re-election. The proxies given pursuant to this solicitation will be voted, unless authority is withheld, in favor of the Director Nominees. All of the Director Nominees have consented to be named and, if elected, to serve. In the event that any of the Director Nominees is unable or declines to serve as a director at the time of the Annual Meeting, the proxies may be voted in the discretion of the persons acting pursuant to the proxy for the election of other nominees. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Voting

The nominees receiving a plurality of the votes cast at the Annual Meeting will be elected as directors.

The Board of Directors deems the re-election of Dr. Michael M. Goldberg and Mr. Robert J. Levenson, as directors for a term expiring at the third succeeding annual meeting of stockholders after their election (Class III Directors), to be in the best interest of Emisphere and its stockholders and recommends a vote “FOR” their election.

Information Concerning Director Nominees, Continuing Directors and Executive Officers

Information regarding the Director Nominees, those directors serving unexpired terms, and our current Executive Officers including their respective ages, the year in which each first joined the Company and their principal occupations or employment during the past five years, is provided below:

Name |

| Age |

| Year |

| Position with the Company |

|

|

|

|

| ||||

Michael M. Goldberg, M.D. |

| 46 |

| 1990 |

| Chairman of the Board of Directors and Chief |

|

Howard M. Pack |

| 86 |

| 1986 |

| Director |

|

Robert J. Levenson |

| 63 |

| 1998 |

| Director |

|

Arthur Dubroff |

| 54 |

| 2003 |

| Director |

|

Stephen K. Carter, M.D. |

| 67 |

| 2003 |

| Director |

|

Michael E. Black |

| 58 |

| 2003 |

| Director |

|

Lewis H. Bender |

| 46 |

| 1993 |

| Senior Vice President, Business Development |

|

Shepard M. Goldberg |

| 49 |

| 1998 |

| Senior Vice President, Operations |

|

Steven M. Dinh, Sc.D. |

| 49 |

| 1999 |

| Vice President, Research and Technology |

|

Elliot M. Maza, J.D., C.P.A. |

| 49 |

| 2003 |

| Chief Financial Officer |

|

19

Michael M. Goldberg, M.D. has served as Chairman of the Board of Directors of the Company since November 1991 and as Chief Executive Officer and a director since August 1990. In addition, Dr. Goldberg served as President from August 1990 to October 1995. Dr. Goldberg received a B.S. from Rensselaer Polytechnic Institute, an M.D. from Albany Medical College of Union University in 1982 and an M.B.A. from Columbia University Graduate School of Business in 1985. Under the terms of our employment agreement with him, Dr. Goldberg is to serve as our Chairman and Chief Executive Officer through July 31, 2005 and is to be nominated to serve as a member of the Board of Directors. He is the first cousin of Shepard M. Goldberg, Emisphere’s Senior Vice President of Operations.

Howard M. Pack has served as a director of the Company since our inception in 1986. He was Executive Vice President of Finance of Emisphere until he retired in October 1988.

Robert J. Levenson has been a director of the Company since 1998. Since June 2000, he has been a managing member of Lenox Capital Group, LLC. Prior to that time, he served as Executive Vice President of First Data Corporation and a member of its Board of Directors. Before that he was Senior Executive Vice President and Chief Operating Officer of Medco Containment Services, Inc. and a member of its Board of Directors and Group President of Automatic Data Processing, Inc. and a member of its Board of Directors.

Arthur Dubroff has been a director of the Company since 2003. Mr. Dubroff is currently the Chief Financial Officer of Net2Phone, Inc. and was previously the Managing Principal of Turnberry Consulting, LLC. He has previously served as the Chief Financial Officer of Virtual Communities, Inc., and prior to that time was the Chief Financial Officer of Enhance Financial Services Group, Inc. Mr. Dubroff currently serves as the audit committee Financial Expert of Kobren Insight Funds, a Massachusetts-based investment company.

Stephen K. Carter, M.D. has been a director of the Company since 2003. From 1996-2000, Dr. Carter was the Senior Vice President of Clinical and Regulatory Affairs at Sugen, Inc. From 1995-1996, Dr. Carter served as a Senior Vice President of Research and Development at Boehringer Ingelheim Pharmaceuticals, Inc.; from 1990-1995, Dr. Carter served as Senior Vice President of Worldwide Clinical Research and Development at Bristol-Myers Squibb. Co. Dr. Carter currently serves on the Board of Directors of Cytogen, Alfacell Corporation, Tapestry, Callisto, Vion and Celator.

Michael E. Black has been a director of the Company since 2003. He is currently the Associate Vice Chancellor/Associate Dean for Administration and Finance and Chief Financial Officer of the School of Medicine at Washington University in St. Louis and from 1998 until 2004, he served as Vice Dean for Administration and Finance at the University of Pennsylvania School of Medicine.

Lewis H. Bender joined Emisphere in 1993. He became Senior Vice President of Business Development in April 1997 and is currently serving an open-ended term. Previously he was a Vice President of Business Development. Mr. Bender received a B.S. and an M.S. in chemical engineering from the Massachusetts Institute of Technology, an M.A. in international studies from the University of Pennsylvania and an M.B.A. from the Wharton School of the University of Pennsylvania.

Shepard M. Goldberg joined the Company in 1998. He became Senior Vice President, Operations in 2001 and is currently serving an open-ended term. Mr. Goldberg also previously served as our Vice President of Operations. Previously, he was President and owner of two regional distribution businesses. He received a B.S. in electrical engineering from Polytechnic Institute of New York and an M.B.A. from Adelphi University. He is the first cousin of Michael M. Goldberg, M.D., Emisphere’s Chairman and Chief Executive Officer.

Steven M. Dinh, Sc.D. joined the Company in April 1999 and is the Vice President of Research Technology and Development and is currently serving an open-ended term. He was previously Vice President and Chief Scientific Officer with Lavipharm Pharmaceuticals, Inc. Before joining us he held various research positions in transdermal product development and basic pharmaceutics research with Novartis Pharmaceuticals Corp., CIBA-Geigy Corporation and with E. I. DuPont de Nemours & Co. Dr. Dinh holds a Sc.D. in Chemical Engineering from the Massachusetts Institute of Technology.

20

Elliot M. Maza, J.D., C.P.A. joined the Company in December 2003 as Chief Financial Officer and is currently serving an open-ended term. He was previously a partner at Ernst and Young LLP. Prior to that time, Mr. Maza served as a Vice President at Goldman Sachs, Inc. Mr. Maza also previously practiced law at Sullivan and Cromwell. Mr. Maza received his J.D. degree from the University of Pennsylvania Law School in 1985 and his C.P.A. from the State of New Jersey in 1981.

AUDIT COMMITTEE MATTERS

Audit Committee Report

The audit committee operates under a written charter adopted by the Board of Directors. The audit committee has reviewed the relevant standards of the Sarbanes-Oxley Act of 2002, the revised rules of the SEC, and the new corporate governance listing standards of the NASDAQ regarding committee policies. The Board of Directors adopted an amendment to the audit committee’s charter on February 5, 2004 to implement these new rules and standards. The committee intends to further amend its charter, if necessary, as the applicable rules and standards evolve to reflect any additional requirements or changes. You can access the latest charter at www.emisphere.com. The contents of our website are not incorporated herein by reference and the website address provided in this Proxy Statement is intended to be an inactive textual reference only.

The audit committee is currently comprised of Arthur Dubroff (chairman), Michael E. Black, and Robert J. Levenson. All of the members of the audit committee are independent within the meaning of Rule 4200 of the NASD. The Board of Directors has determined that Arthur Dubroff, the chairman of the audit committee, is an “audit committee financial expert,” within the meaning of Item 401(h) of Regulation S-K.