UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

Sizeler Property Investors, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules. 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

SIZELER PROPERTY INVESTORS, INC.

September , 2005

Dear Fellow stockholders:

We are pleased to report that we have entered into a settlement agreement with First Union Real Estate Equity and Mortgage Investments that ends the uncertainty, distraction and expense of a threatened proxy contest at Sizeler’s 2005 Annual Meeting of Stockholders that will be held at The Ritz-Carlton, 100 South Ocean Boulevard, Manalapan (Palm Beach), Florida, 33462, on Thursday, October 27, 2005, at 10:00 a.m., local time. The settlement also ends all litigation between the Company and First Union. The terms of the agreement are described more fully in the enclosed proxy statement for the October 27th Meeting.

Your Board and management team believe that the settlement serves the best interests of the Company and its stockholders, and allows us to continue to focus our efforts on implementing the Company’s strategic plan and growing shareholder value.

To this end, Sizeler announced on September 13, 2005 the latest accomplishment under its plan – the acquisition of a 194-unit apartment community in Shreveport, Louisiana. We believe this acquisition is a very positive addition to our portfolio. We intend to continue to keep you informed of additional achievements under our strategic plan as they occur.

It is also critical at this time that we have the ability to devote our time and attention to dealing with the effects of Hurricane Katrina, which struck the Louisiana and Gulf Coast regions with a very tragic impact that will continue to be felt for a long time. Fortunately for Sizeler, substantially all of our properties did not sustain flood or other apparent structural damage and are now fully operational. We continue to await access to certain properties in New Orleans and immediately surrounding areas to assess damage there. We have reopened a temporary corporate office at one of our Mobile, Alabama apartment communities to facilitate our efforts to restore corporate operations as promptly as practical.

Under the settlement agreement, Michael Ashner, the Chairman and Chief Executive Officer of First Union, will join the Board of Directors and three Board Committees: the Compensation Committee, the Strategic Direction and Acquisition Committee and the Nominating/ Corporate Governance Committee. We believe Mr. Ashner’s presence on our Board will bolster our ability to address the challenges and opportunities that lay before us.

The settlement also reduces the number of directors on the Sizeler Board to seven. Harold B. Judell and James R. Peltier agreed to accelerate their previously planned retirements from the Board, and Theodore H. Strauss and Thomas A. Masilla, Jr. agreed to resign from their Board positions, with Mr. Masilla remaining as President and Chief Operating Officer. We would like to acknowledge their long service and valuable contributions as important members of our Board.

At the Annual Meeting, stockholders are being asked to vote for the re-election of two directors: Sidney W. Lassen, Sizeler’s Chairman and Chief Executive Officer, and William G. Byrnes, Vice Chairman of the Board and Lead Independent Director. Pursuant to the settlement with First Union, the Board has also approved and advised that the stockholders adopt a charter amendment providing for the elimination of the staggered board by the 2007 Annual Meeting of Stockholders. In addition, stockholders are being asked to ratify a Directors’ Service Recognition Plan permitting the issuance of shares of the Company’s common stock to former non-employee members of the Board. Finally, we are recommending the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2005 audit.

As a result of your Board’s and management’s execution of Sizeler’s strategic plan during the past year, your Company is substantially stronger financially, and is far better positioned to grow in the future and meet the challenges and opportunities that are presented to us. On behalf of your Board of Directors, we thank you for your continued support.

Please complete and return the enclosed proxy card even if you plan on attending the meeting.

Very truly yours,

| | |

Sidney W. Lassen Chairman & Chief Executive Officer | | William G. Byrnes Vice Chairman & Lead Independent Director |

| | | |

SIZELER PROPERTY INVESTORS, INC.

2542 Williams Boulevard

Kenner, Louisiana 70062*

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD THURSDAY, OCTOBER 27, 2005

To the Stockholders of Sizeler Property Investors, Inc.:

The 2005 Annual Meeting of Stockholders (the “Meeting”) of Sizeler Property Investors, Inc. (the “Company”) will be held at The Ritz-Carlton, 100 South Ocean Boulevard, Manalapan (Palm Beach), Florida, 33462, on Thursday, October 27, 2005, at 10:00 a.m., local time, for the following purposes:

| | 1. | To elect two directors to the Board who, if the Charter Amendment set forth in Proposal 2 is approved by the stockholders, will serve until the 2006 annual meeting of stockholders, and who will serve until the 2008 annual meeting of stockholders if the Charter Amendment is not approved.The Board recommends a vote FOR the election of the Board’s nominees. |

| | 2. | To approve amendments to the Company’s charter to phase-out (by 2007) the staggered terms of the directors and to provide that directors can be removed with or without cause by a vote of 75% of the stockholders entitled to vote at any annual meeting or any special meeting of stockholders called for that purpose (the “Charter Amendment”).The Board recommends a vote FOR this proposal. |

| | 3. | To ratify the adoption of the Sizeler Property Investors Directors’ Service Recognition Plan permitting the issuance of up to 60,000 shares of the Company’s common stock to former members of the Company’s Board (the “Directors’ Service Plan”).The Board recommends a vote FOR this proposal. |

| | 4. | To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2005 audit.The Board recommends a vote FOR this proposal. |

| | 5. | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

Only stockholders of record at the close of business on September 16, 2005 are entitled to receive notice of and to vote at the Meeting or any adjournments thereof.

Whether or not you plan to attend the Meeting, the Board of Directors urges you to make sure your vote is counted by signing, dating and returning your enclosed proxy card promptly in the enclosed postage paid envelope. The Company will reimburse stockholders mailing proxy cards from outside the United States for the cost of mailing.

|

Very truly yours, |

|

| |

Sidney W. Lassen |

Chairman and Chief Executive Officer |

DATED: September , 2005

* Due to Hurricane Katrina the Company is currently unable to work from its corporate offices in Kenner, Louisiana. Until further notice, all communications to the Company should be sent to the following address: 900 Downtowner Boulevard, Suite B, Mobile, Alabama 36609. When the Company is able to return to its corporate offices in Louisiana, the Company will post that information on its website and issue a press release.

|

|

IMPORTANT STOCKHOLDERS ARE URGED TO AUTHORIZE THE PROXIES TO VOTE YOUR SHARES BY

SIGNING, DATING AND RETURNING THE ENCLOSED PROXY IN THE ENCLOSED

ENVELOPE TO WHICH NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED

STATES. |

|

|

IMPORTANT Registration for admittance into the Meeting will begin at 10:00 a.m., local time, on Thursday, October

27, 2005. Please allow ample time for check-in. Please bring proper identification (such as a driver’s

license or passport) and evidence of either your stock ownership or the grant of any valid proxy you

hold with you in order to be admitted to the Meeting. If your shares (or the shares of the stockholder

who granted you the proxy) are held in the name of a bank, broker or other nominee holder and you

plan to attend the Meeting in person, please bring a copy of your broker statement, the proxy card

mailed to you by your bank or broker or other proof of ownership of Company common stock (or the

equivalent proof of ownership as of the close of business on the record date of the stockholder who

granted you the proxy). Cameras, cell phones, recording equipment and other electronic devices will not be permitted at the

Meeting. The Company reserves the right to inspect any persons or items prior to their admission to the

Meeting. |

September , 2005

SIZELER PROPERTY INVESTORS, INC.

2542 Williams Boulevard

Kenner, Louisiana 70062

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD

THURSDAY OCTOBER 27, 2005

The enclosed proxy is solicited on behalf of the Board of Directors of Sizeler Property Investors, Inc. (the “Company”) for use at the 2005 annual meeting of stockholders to be held on Thursday, October 27, 2005, at 10:00 a.m., local time, at The Ritz-Carlton, 100 South Ocean Boulevard, Manalapan (Palm Beach), Florida, 33462 (the “Meeting”) for the purposes set forth in this proxy statement and the accompanying Notice of Annual Meeting of Stockholders. When proxies are properly submitted, the shares they represent will be voted at the Meeting or at any adjournment(s) or postponement(s) thereof in accordance with the directions indicated thereon. If no directions are indicated thereon, the holders of proxies will vote the shares according to the recommendations of the Board of Directors described in this proxy statement. If items of business are presented at the Meeting or at any adjournment or postponement thereof, the holders of proxies will vote the shares represented by those proxies as the Board of Directors may recommend, and otherwise in the proxy holders’ discretion.

The date of this proxy statement is September , 2005. Additional copies of the Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2004, the Notice of Annual Meeting, this Proxy Statement and the form of proxy may be obtained from the Company’s President, at its temporary address at 900 Downtowner Boulevard, Suite B, Mobile, Alabama 36609. A copy of the Company’s Form 10-K filed with the Securities and Exchange Commission (“SEC”), as amended, is available without charge upon written request to the Company’s corporate offices or from the Securities and Exchange Commission’s web site at www.sec.gov. This Proxy Statement and the form of proxy are first being mailed to stockholders on or about September , 2005. A copy of the Company’s Annual Report is being mailed with this Proxy Statement to those stockholders to whom it was not previously mailed.

SOLICITATION AND REVOCABILITY OF PROXIES

The enclosed proxy for the Meeting is being solicited by the Board of Directors of the Company. Any person giving a proxy may revoke it any time prior to its exercise by filing with the President of the Company a written revocation or duly executed proxy bearing a later date. The proxy may also be revoked by a stockholder attending the Meeting, withdrawing the proxy and voting in person.

RECORD DATE AND VOTING SECURITIES

The record date for determining shares of common stock, $0.0001 par value per share, of the Company (“Shares”) entitled to vote at the Meeting has been fixed at the close of business on September 16, 2005. On that date there were Shares outstanding.

1

VOTING

The quorum necessary to transact business at the Meeting is the presence, in person or by properly executed proxy, of the holders of Shares entitled to cast a majority of the votes entitled to be cast by the holders of all outstanding Shares. Shares represented by a properly signed, dated and returned proxy card, including abstentions and broker non-votes, will be treated as present at the Meeting for purposes of determining a quorum. “Broker non-votes” occur when a bank, broker or other nominee holder has not received voting instructions with respect to a particular matter and the nominee holder does not have discretionary power to vote on that matter.

The holders of Shares on the record date will be entitled to one vote for each Share on each matter submitted to a vote at a meeting of stockholders. Pursuant to the Company’s Bylaws, directors will be elected by a plurality of the votes cast at the Meeting with each Share being voted for as many individuals as there are directors to be elected and for whose election the holder of the Share is entitled to vote. The ratification of the Directors’ Service Plan will require the affirmative vote of a majority of the votes cast, provided that, pursuant to the rules of the New York Stock Exchange, a majority of the votes entitled to vote must be cast. Approval of the Charter Amendment will require the affirmative vote of not less than 75% of all votes entitled to be cast. The ratification of the appointment of the Company’s independent registered public accounting firm will require the affirmative vote of a majority of the votes cast. For purposes of the election of directors and the ratifications of the Directors’ Service Plan and appointment of the Company’s independent registered public accounting firm, abstentions and broker non-votes are not considered to be votes cast under Maryland law and therefore do not affect the outcome of those votes, which require the affirmative vote of a specified proportion of the votes cast. However, in the case of the Directors’ Service Plan, if more than a majority of the shares entitled to vote are not voted, whether as a result of abstentions, broker non-votes or otherwise, than those shares have the same effect as votes against the plan. Abstentions and broker non-votes have the same effect as a vote against approval of the Charter Amendment.

If you held Shares on the record date you will retain your voting rights for the Meeting even if you sell your Shares after the record date. Please see the enclosed proxy card for further instructions on how to submit your vote.

If you hold Shares in more than one account or if they are registered in different names, you may receive more than one proxy card. Please sign, date and return all proxies you receive to ensure that all of your Shares are voted.

OVERVIEW

In August, 2004, the Board of Directors announced a strategic plan to increase stockholder value that was focused on reducing debt, positioning the Company for strong funds from operating growth, increasing occupancy, achieving a relative balance between retail and apartment assets, selling fully-appreciated assets and focusing development and acquisition activity in fast growing markets in the southeastern United States. This plan and accomplishments under it have been described in the Company’s Annual Report on Form 10-K and in subsequent press releases, stockholder letters, and SEC filings. Following the Company’s announcement of this strategic plan, First Union began to call for the election of an alternate slate of directors and the Company’s liquidation, and later filed proxy materials with the SEC to solicit stockholder votes on these matters.

A few weeks ago, Hurricane Katrina struck the Louisiana and Gulf Coast regions with a very tragic impact that will continue to be felt for a long time. Fortunately for Sizeler, substantially all of its properties did not sustain flood or other apparent structural damage and are now fully operational. Management continues to await access to certain properties in New Orleans and immediately surrounding areas to assess damage there. The Company has reopened a temporary corporate office at one of its Mobile, Alabama apartment communities to facilitate efforts to restore corporate operations as promptly as practical.

2

The Board of Directors and First Union, as a result of discussions that commenced in early August, have determined that the best interests of Sizeler and its stockholders at the present time is served by a resolution of the proxy contest, the election of Michael L. Ashner, First Union’s chief executive officer, to the Company’s Board of Directors, certain other agreements and changes described below, and the continued pursuit of growth under Sizeler’s strategic plan concurrent with efforts to assess and respond to the tragic consequences of Hurricane Katrina. To this end, Sizeler announced on September 13, 2005 the acquisition of a 194-unit apartment community in Shreveport, Louisiana.

Key points in the settlement with First Union are as follows:

| | • | | First Union has agreed to cease its solicitation of proxies for the Meeting and to support the reelection of Sidney W. Lassen and William G. Byrnes to the Company’s Board. First Union also agreed to withdraw its stockholder proposal. |

| | • | | First Union agreed that until the Company gives public notice of its 2006 annual meeting of stockholders, including 30 days’ advance public notice of the Company’s nominees for election or reelection to the Board, it will not: |

| | • | | solicit proxies from our stockholders or grant proxies with respect to our shares (other than in response to the Board’s solicitation); |

| | • | | take any action to call a special meeting of the Company’s stockholders; |

| | • | | make any stockholder proposals in respect of the Company; or |

| | • | | take any action to acquire Company stock in excess of the 9.9% ownership limit set forth in the Company’s charter, except in response to an attempted acquisition by a third party that was not encouraged or assisted by First Union. |

| | • | | In return, the Company agreed to take certain actions, including electing Michael L. Ashner to a vacancy on the Board to serve until the 2006 annual meeting of stockholders, and to the Board’s Compensation Committee and Strategic Direction and Acquisition Committee. The Board will renominate Mr. Ashner for election in 2006 and 2007 provided that First Union refrains from taking certain actions. The Board will also elect a second First Union designee if it increases the Board size to 8 or more persons. |

| | • | | The Board has recommended a charter amendment to destagger the Board of Directors, which is Proposal 2 “Approval of Amendments to the Company’s Charter to Destagger the Board of Directors” in this proxy statement. |

| | • | | The settlement with First Union also requires that, until October 31, 2006, the Company must obtain the approval of a majority of the Board, including First Union’s designee, prior to issuing equity securities (or securities convertible into or redeemable for equity securities) for cash or making certain amendments to the Company’s Bylaws. |

| | • | | In addition, pursuant to the settlement with First Union, the Company has agreed to reimburse First Union for up to $375,000 of documented legal and proxy-related expenses. |

| | • | | Sizeler and First Union have dismissed all pending litigation and have entered into a mutual general release. |

| | • | | The Company’s obligations under the settlement with First Union shall expire immediately upon First Union being the beneficial owner of less than 2.0% of the Company’s issued and outstanding common stock. |

Additional information on the settlement with First Union can be found below in Proposal 1 at “Certain Transactions and Relationships—Mr. Ashner’s Relationships with First Union Real Estate Equity and Mortgage Investments.”

3

In August 2005, directors Harold B. Judell and James R. Peltier agreed to retire at the time of the Meeting. At the time of the settlement with First Union, Mr. Judell and Dr. Peltier agreed to retire at that time rather than wait for the Meeting, and Theodore H. Strauss and Thomas A. Masilla, Jr. also agreed to retire from the Board, with Mr. Masilla continuing to serve as President and Chief Operating Officer. The entire Board is deeply grateful to these individuals for their many years of thoughtful service and wise counsel. Upon ratification of the Directors’ Service Plan presented as Proposal 3, Mr. Judell, Dr. Peltier, and Mr. Strauss will become entitled to a retirement grant under our Directors’ Service Plan.

PROPOSALS

1. ELECTION OF DIRECTORS

The Board of Directors, based on the recommendation of the Nominating/Corporate Governance Committee, has nominated two directors for election at the Meeting to serve for terms expiring either at the annual meeting of stockholders in 2006, if the Charter Amendment set forth in Proposal 2 has been approved, or at the annual meeting of stockholders in 2008 if the Charter Amendment is not approved. The Board has nominated Sidney W. Lassen, the Company’s Chairman of the Board and Chief Executive Officer, and William G. Byrnes, the Company’s Vice-Chairman and Lead Independent Director. Each is currently serving as a director of the Company, and has consented to being named in this proxy statement and to continue to serve as a director if elected.

Three of the Company’s directors—James Peltier, Theodore Strauss and Harold Judell—have retired from the Board of Directors as discussed above and have become “directors emeritus.” Dr. Peltier served as a director since January 2004. Mr. Strauss served as a director since 1994, and Mr. Judell served as a director since 1986. In addition, Thomas Masilla has resigned as a director to aid in the settlement with First Union, but continues as the Company’s President and Chief Operating Officer.

Information Concerning Directors

The Company’s Charter and Bylaws, as amended, provide that the number of directors will be not less than one and not more than fifteen and that the directors will be divided into three classes containing as nearly equal a number of directors as possible, with one class standing for election each year. On September 9, 2005, the Board declared advisable an amendment to the Charter that, if approved by the stockholders of the Company, would phase out this classified board structure by the 2007 annual meeting of stockholders. Also on September 9, 2005, the Board set the number of directors at seven, with two directors standing for reelection, two serving until the 2006 annual meeting and three serving until the 2007 annual meeting. Each person elected at the Meeting will serve until the 2006 annual meeting of stockholders if the Charter Amendment is approved by the stockholders or until his successor is duly elected and qualified. If the Charter Amendment is not approved, each person so elected will serve until the 2008 annual meeting of stockholders or until his successor is duly elected and qualified. The affirmative vote of a plurality of the votes cast at the Meeting is necessary for election of a director.

Unless instructed otherwise, proxy cards will be votedFOR these nominees. Although the directors do not contemplate that any of the nominees listed below will be unable to serve, if such a situation arises prior to the Meeting, the proxy will be voted in accordance with the best judgment of the person or persons voting the proxy.

4

The following table sets forth information regarding the directors standing for election and directors whose terms continue beyond the Meeting.

| | | | |

Name, Tenure and Position(s) with the Company

| | Age

| | Principal Occupation and Business Experience for Past Five Years

|

| Directors Whose Terms Expire in 2005 |

| | |

Sidney W. Lassen Chairman of the Board and Chief Executive Officer since 1986 | | 70 | | Chairman of the Board and Chief Executive Officer of the Company. |

| | |

William G. Byrnes Non-executive Vice-Chairman since 2004; Director since 2002; Lead Independent Director since August 2, 2005 | | 54 | | Chairman of BuzzMetrics (consulting), whose principal business address is 56 West 22nd St., New York, NY 10010. |

|

| Directors Whose Terms Expire in 2006 |

| | |

James W. McFarland Director since 1994 | | 60 | | Professor of Finance and former Dean of A.B. Freeman School of Business, Tulane University, whose principal business address is 7 McAlister Dr., New Orleans, LA 70118-5669, from 1988 through July 2005; private investor. |

| | |

Michael L. Ashner Director since September 9, 2005 | | 52 | | Chief Executive Officer of First Union Real Estate Equity and Mortgage Investments, Winthrop Financial Associates, A Limited Partnership and Newkirk Master Limited Partnership, each of whose principal address is 2 Jericho Plaza, Wing A, Suite 111, Jericho, NY 11753. Also served as Chief Executive Officer of Shelbourne Properties I, Inc., Shelbourne Properties II, Inc. and Shelbourne Properties III, Inc., three publicly traded REITs that were liquidated in 2004. |

|

| Directors Whose Terms Expire in 2007 |

| | |

J. Terrell Brown Director since 1995 | | 65 | | Chairman of GMFS, LLC (mortgage lending), whose principal business address is 7389 Florida Blvd., Ste. 200A, Baton Rouge, LA 70806. |

| | |

Richard L. Pearlstone Director since 1986 | | 57 | | President of The Pearlstone Group, Inc. (investments), whose principal business address is 5100 Falls Rd., 212 Village Sq. II, Baltimore, MD 21210, since 1995; managing partner of North Investment LP, whose principal business address is 5100 Falls Rd., 212 Village Sq. II, Baltimore, MD 21210. |

| | |

Mark M. Tanz Director since May 11, 2005 | | 73 | | Private investor, whose principal business address is P.O. Box N7776, Lyford Cay, Nassau, Bahamas. |

Independence

The Board, on the recommendation of the Nominating/Corporate Governance Committee, has determined that each current director, other than Mr. Lassen, the Company’s Chairman and Chief Executive Officer is

5

“independent” as defined by the listing standards of the New York Stock Exchange. No director has any material relationship with the Company other than those described in “Certain Transactions and Relationships” below.

The Company has adopted a Code of Business Conduct and Ethics for all its directors, officers and employees. You can access the Company’s Code of Business Conduct and Ethics electronically at the “Corporate Governance” section on the corporate information page of our website at www.sizeler.com or you may request a copy from us by writing to us at Sizeler Property Investors, Inc., Attention: President, 2542 Williams Boulevard, Kenner, Louisiana 70062.

Stockholder Communication With the Board

The Board of Directors has appointed William G. Byrnes, the Vice-Chairman of the Company, as “Lead Independent Director.” In that capacity, he presides over the meetings of the non-management directors of the Company. Stockholders and other parties interested in communicating directly with the Lead Independent Director or with the non-management directors as a group may do so by writing to Mr. William G. Byrnes, Lead Independent Director, Sizeler Property Investors, Inc., 2542 Williams Boulevard, Kenner, Louisiana 70062. Correspondence so addressed will be forwarded directly to Mr. Byrnes.

Other Trusteeships and Directorships

In addition to their service on the Board, the directors of the Company serve on the Boards of Directors or the Boards of Trustees of the following publicly held companies:

| | |

Name

| | Company

|

Michael L. Ashner | | Atlantic Coast Entertainment Holdings, Inc. |

| |

| | | NBTY, Inc. |

| |

| | | First Union Real Estate Equity and Mortgage Investments |

| |

William G. Byrnes | | CapitalSource Inc. |

| |

| | | LaQuinta Corporation |

| |

Sidney W. Lassen | | Hibernia Corporation |

| |

James W. McFarland | | Stewart Enterprises, Inc. |

| |

Mark M. Tanz | | Morguard Corporation |

| |

| | | Revenue Properties Co. Ltd. |

Committees and Meeting Data

As of December 31, 2004, the Audit Committee of the Board of Directors consisted of Messrs. Byrnes and Judell and Drs. McFarland and Peltier. The current members of the committee are Dr. McFarland and Messrs. Byrnes and . Each member of the Audit Committee is “independent” as that term is defined in the New York Stock Exchange listing standards. You can access the charter for the Audit Committee electronically at the “Corporate Governance” section on the corporate information page of our website at www.sizeler.com or you may request a copy from us by writing to us at Sizeler Property Investors, Inc., Attention: President, 2542 Williams Boulevard, Kenner, Louisiana 70062. The Audit Committee and the Board of Directors have determined that Dr. McFarland and Mr. Byrnes are each an “Audit Committee Financial Expert” in accordance with the SEC rules and regulations and the Board has determined that each of them has accounting and related financial management expertise within the meaning of the listing standards of the New York Stock Exchange. Each member of the Audit Committee is financially literate, as such qualification is interpreted by the Company’s Board in its business judgment. The Audit Committee met five times during 2004. As of September 16, 2005 the Audit Committee has met four times in 2005. See “—Audit Committee Report” below.

As of December 31, 2004, the Compensation Committee consisted of Messrs. Brown, Judell and Strauss and Dr. McFarland. The current members of the Compensation Committee are Mr. Brown, Dr. McFarland and

6

Mr. Ashner. The Compensation Committee met once during 2004. As of September 16, 2005 the Compensation Committee has met two times in 2005. The function of the Compensation Committee is to review the compensation program for executive officers and to administer the 1986 Stock Option Plan, the 1996 Stock Option Plan and, if ratified by the stockholders of the Company, the Directors’ Service Plan. You can access the charter for the Compensation Committee electronically at the “Corporate Governance” section on the corporate information page of our website at www.sizeler.com or you may request a copy from us by writing to us at Sizeler Property Investors, Inc., Attention: President, 2542 Williams Boulevard, Kenner, Louisiana 70062.

The Nominating/Corporate Governance Committee consists of all of the independent directors of the Company. As of December 31, 2004, the Nominating/Corporate Governance Committee consisted of Messrs. Byrnes and Judell and Dr. McFarland. The Nominating/Corporate Governance Committee did not meet during 2004. As of September 16, 2005 the Nominating/Corporate Governance Committee has met five times in 2005. The functions of this committee are to identify individuals qualified to become Board members, to recommend Board members to fill vacancies on any committee, to develop and recommend a code of business conduct and ethics and corporate governance guidelines applicable to the Company. You can access the charter for the Nominating/Corporate Governance Committee electronically at the “Corporate Governance” section on the corporate information page of our website at www.sizeler.com or you may request a copy from us by writing to us at Sizeler Property Investors, Inc., Attention: President, 2542 Williams Boulevard, Kenner, Louisiana 70062.

Under the Company’s Corporate Governance Guidelines, the Nominating/Corporate Governance Committee will take into account stockholder input with respect to processes and criteria for director selection, as such stockholders may influence the composition of the Board. Under this principle, the Nominating/Corporate Governance Committee will consider written recommendations for potential nominees suggested by stockholders. Any such person will be evaluated in the same manner as any other potential nominee for director. Any suggestion for a nominee for director by a stockholder should be sent to the Chairman of the Board of the Company at 2542 Williams Boulevard, Kenner, Louisiana 70062 within the time periods set forth under “Stockholder Proposals for the 2006 Annual Meeting of Stockholders” below.

In identifying suitable candidates for nomination as a director, the Nominating/Corporate Governance Committee will consider the needs and appropriateness of the size of the Board and the range of skills and characteristics required for effective functioning of the Board. In evaluating such skills and characteristics, the Nominating/Corporate Governance Committee may take into consideration such factors as it deems appropriate, including those included in the Corporate Governance Guidelines. You can access the Company’s Corporate Governance Guidelines electronically at the “Corporate Governance” section on the corporate information page of our website at www.sizeler.com or you may request a copy from us by writing to us at Sizeler Property Investors, Inc., Attention: President, 2542 Williams Boulevard, Kenner, Louisiana 70062. The Nominating/Corporate Governance Committee will consider nominees suggested by incumbent Board members, management, stockholders and, in certain circumstances, outside search firms.

During 2004 the full Board of Directors met on five occasions. As of September 16, 2005 the full Board of Directors has met nine times in 2005. In 2004, all directors attended at least 75% of the aggregate total number of meetings held by the Board of Directors and all committees of the Board on which such director served. The Company’s Corporate Governance Guidelines provide that all directors are expected to regularly attend all meetings of the Board and the Board committees on which he serves. In addition, each director is expected to attend the annual meeting of stockholders. In 2004, the annual meeting of stockholders was attended by eight of the directors. The Company anticipates that all of the directors will be in attendance at the Meeting.

Audit Committee Report

The following Report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other filing by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934 except to the extent the Company specifically incorporates this Report by reference therein.

7

The Audit Committee of the Board of Directors is responsible for providing independent, objective oversight of the Company’s accounting functions and internal controls. In addition, the Audit Committee is responsible for, among other things, hiring, firing, compensating, overseeing and monitoring the independence of the Company’s independent registered public accounting firm. As of December 31, 2004, the Audit Committee of the Board of Directors consisted of Messrs. Byrnes and Judell and Drs. McFarland and Peltier. On September 9, 2005, Mr. Judell and Dr. Peltier retired from the Board and the Audit Committee. On September , 2005, the Board elected and to the Audit Committee, effective as of September 9, 2005. Each of the aforementioned members is independent as defined by the New York Stock Exchange listing standards and the rules of the Securities and Exchange Commission. The Audit Committee operates under a written charter approved by the Board of Directors.

In carrying out our oversight responsibilities, we have reviewed, and management has described in reasonable detail to us, the Company’s procedures for identifying, recording and verifying the Company’s financial transactions, including the names, functions and practices of the Company personnel who have supervisory functions at various levels with respect to those activities.

Management is responsible for the Company’s financial reporting process, including its system of internal controls, and for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. We have the responsibility to select the Company’s independent accountants and auditors. The Company’s independent auditors are responsible for auditing those financial statements. Our responsibility is to monitor and review these processes. It is not our duty or our responsibility to conduct auditing or accounting reviews or procedures.

The Audit Committee has met and held discussions with management and the independent accountants. Management represented to the Audit Committee that the Company’s audited consolidated financial statements for the year-ended December 31, 2004 were prepared with integrity and in accordance with accounting principles generally accepted in the United States, and the Audit Committee has reviewed and discussed the audited consolidated financial statements with management and the independent accountants. The Audit Committee also discussed with the independent auditors the matters required by Statement on Auditing Standards No. 61 (Communication with Audit Committees). The Audit Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent accountants that firm’s independence and reviewed the internal quality control report required by Section 303A.7(c)(iii)(A) of the New York Stock Exchange Listing Standards. The Audit Committee has determined that the fees paid by the Company to the auditors for non-audit services (disclosed elsewhere in the Proxy Statement) would not affect the auditors’ independence.

Based upon the Audit Committee’s discussions with management and the independent accountants, and the Audit Committee’s review of the representations of management and the written report of the independent accountants on the Company’s audited consolidated financial statements for the year-ended December 31, 2004, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004.

THE AUDIT COMMITTEE

JAMES W. McFARLAND, Chairman

WILLIAM G. BYRNES

HAROLD B. JUDELL*

JAMES R. PELTIER**

| * | Mr. Judell retired from the Board of Directors effective September 9, 2005. |

| ** | Dr. Peltier became a member of the Audit Committee on February 6, 2004 and took no part in the Audit Committee activities prior to that time. Dr. Peltier retired from the Board of Directors effective September 9, 2005. |

8

Executive Officers

The following table sets forth our executive officers, who are elected annually by the Board of Directors and serve at the discretion of the Board.

| | | | |

Name, Tenure and Position(s) with the Company

| | Age

| | Principal Occupation and Business Experience for Past Five Years

|

Sidney W. Lassen Chairman of the Board and Chief Executive Officer since 1986 | | 70 | | See table under “Directors.” |

| | |

Thomas A. Masilla, Jr. President and Chief Operating Officer since 1995 | | 58 | | President and Chief Operating Officer of the Company since 1995, Chief Financial Officer of the Company from 1996 through May 1999. |

| | |

Guy M. Cheramie Chief Financial Officer since 2005 | | 58 | | Chief Financial Officer of the Company since January 2005; Chief Financial Officer of Sizeler Real Estate Management Co., Inc. from 1994 through January 2005. |

Executive Compensation

Summary Compensation Table. The following table contains information with respect to the annual and long-term compensation for the years ended December 31, 2004, 2003 and 2002 for the Company’s chief executive officer and each other person who was an executive officer of the Company on December 31, 2004 who received cash compensation in excess of $100,000 during 2004 (the “Named Officers”).

| | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Long-Term Compensation

Awards

| | |

Name and Principal Position

| | Year

| | Salary

| | Bonus (1)

| | Restricted Stock

Awards (2)

| | Securities

Underlying

Options (3)

| | All Other

Compensation (4)

|

Sidney W. Lassen Chairman of the Board and Chief Executive Officer | | 2004

2003

2002 | | $

| 354,000

354,000

354,000 | | $

| 88,600

75,000

75,000 | | $

| 301,000

0

0 | | 0

0

35,000 | | $

| 41,900

40,992

40,900 |

| | | | | | |

Thomas A. Masilla, Jr. President and Chief Operating Officer | | 2004

2003

2002 | | $

| 275,000

275,000

275,000 | | $

| 62,800

50,000

50,000 | | $

| 198,660

0 | | 0

0

25,000 | | $

| 33,925

33,500

33,000 |

| | | | | | |

James W. Brodie Secretary and Vice-President (5) | | 2004

2003

2002 | | $

| 200,000

200,000

193,000 | | $

| 31,200

20,000

20,000 | | $

| 102,340

0

0 | | 0

0

17,500 | | $

| 26,231

25,994

24,800 |

| | | | | | |

Charles E. Miller, Jr. Chief Financial Officer (6) | | 2004

2003 | | $

| 152,000

152,000 | | $

| 0

12,500 | |

| 0

0 | | 0

0 | | $

| 18,532

15,200 |

| (1) | This amount was paid one-half in shares of common stock and one-half in cash pursuant to the terms of the Company’s Incentive Award Plan. |

| (2) | See “Compensation Committee Report—Long-Term Incentive” below. |

| (3) | These options were granted under the 1996 Stock Option and Incentive Plan, as amended. |

| (4) | This is (i) the amount paid under a nonelective deferred compensation agreement with each Named Officer, pursuant to which an amount of deferred compensation equal to 10 percent of base salary was credited annually to a bookkeeping account maintained for them plus (ii) the Company’s contribution to its 401(k) Plan for the Named Officer’s benefit for that year. |

| (5) | Mr. Brodie was named an executive officer of the Company on February 3, 2000, and resigned on June 10, 2005. |

| (6) | Mr. Miller joined the Company as an executive officer on December 16, 2002 and resigned on January 11, 2005. |

9

Option Grants. No options were granted to the Named Officers during the year ended December 31, 2004.

Option Exercises and Fiscal Year End Values. No Named Officer exercised options during 2004. The following table shows information with respect to the value of unexercised options held by the Named Officers as of December 31, 2004. Valuation calculations for unexercised options are based on the closing price ($11.78) of a Share on the New York Stock Exchange on December 31, 2004.

Aggregated Option/SAR Exercises in Last Fiscal Year and FY-End Option/SAR Values

| | | | |

Name

| | Number of Securities

Underlying Unexercised

Options/SARs at

December 31, 2004 (#)

Exercisable/Unexercisable

| | Value of Unexercised

In-the-Money

Options/SARs at

December 31, 2004 ($) Exercisable/Unexercisable

|

Sidney W. Lassen Chairman of the Board and Chief Executive Officer | | 230,000/0 | | $594,800/$0 |

| | |

Thomas A. Masilla, Jr. President and Chief Operating Officer | | 210,000/0 | | $503,849/$0 |

| | |

James W. Brodie Secretary and Vice-President (1) | | 81,250/0 | | $245,638/$0 |

| | |

Charles E. Miller, Jr. Chief Financial Officer (2) | | 3,000/0 | | $8,880/$0 |

| (1) | Mr. Brodie was named an executive officer of the Company on February 3, 2000, and resigned on June 10, 2005. |

| (2) | Mr. Miller joined the Company as an executive officer on December 16, 2002 and resigned on January 11, 2005. |

Agreements with Executive Officers. On August 3, 2000, the Company entered into severance agreements, which restated prior agreements, with Mr. Lassen, Mr. Masilla and Mr. Brodie pursuant to which each such officer is entitled to a minimum base salary under his agreement (currently $354,000 for Mr. Lassen and $275,000 for Mr. Masilla). The Board may terminate these agreements at any time with no further obligation upon a finding that the officer has breached or neglected his duties, and an officer may resign at any time upon 30 days’ notice. The Board may also terminate the agreements at any time without cause; in that event, or upon death or disability, the officer is entitled to 24 months continued salary and (except in the case of death or disability) benefits. These agreements contain provisions for termination of employment upon a change in control that supersede the agreements’ regular termination provisions. In addition, on May 11, 2005, in connection with the appointment of Guy Cheramie to the position of Chief Financial Officer, the Company entered into a Change in Control Agreement with Mr. Cheramie. Under each of these agreements, a “change in control” is defined, subject to various qualifications, as the acquisition by a person or group of beneficial ownership of 25% or more of the Shares; or the election of a member of the Board whose nomination or election was not approved by a majority of the members of the Board who were members of the Board on the date of the agreement or whose election to the Board was previously so approved; or a merger or similar transaction after which the Company’s stockholders hold 50% or less of the voting securities in the resulting entity. If, within 24 months of a change in control, either the Company terminates an officer’s employment for reasons other than a willful breach of duty that is demonstrably and materially injurious to the Company or disability, or the officer resigns because of certain changes in the circumstances of his employment (including the assignment to the officer of duties inconsistent with his prior position; reduction in salary; or relocation), the officer is entitled to three times the sum of (i) his annual salary, (ii) one-half the amount of the bonuses and nonelective deferred compensation paid or credited to him in the past 24 months, and (iii) the amount the Company would have contributed for the officer for a year under its defined contribution plan. In addition, the officer is entitled to a

10

portion of the incentive bonus he would have earned for the year of termination (proportionate to the part of the year elapsed by termination), continuation of life and health insurance benefits for up to 36 months, and reimbursement for out-placement expenses not in excess of $20,000. The agreements provide that if the receipt of benefits in connection with a change in control would subject an officer to excise tax under section 280G of the Code, then the officer will also receive a cash gross-up payment so that he will realize the same amount net after-tax that he would have realized had the excise tax not been applicable.

Mr. Brodie resigned from the Company on June 10, 2005. Effective upon his resignation, Mr. Brodie’s severance agreement described above was terminated and there are no further obligations on the part of the Company.

On January 11, 2005, Mr. Miller and the Company entered into an Agreement pursuant to which Mr. Miller resigned and the Company agreed to pay Mr. Miller’s annual salary of $152,000 through December 31, 2005, pay the cost of certain benefits under COBRA through December 31, 2005, and maintain certain indemnification for matters arising prior to January 11, 2005. In exchange, Miller agreed to provide the Company with certain consulting services and to restrictions on disclosure of Company information and employment with other real estate companies. The January 11, 2005 agreement generally supersedes other agreements between Mr. Miller and the Company. Mr. Miller received that portion of the funds allocated to his Non-elective Deferred Compensation in which he was vested at January 11, 2005.

Compensation Committee Report

The following Report of the Compensation Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other filing by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934 except to the extent the Company specifically incorporates this Report by reference therein.

Compensation Governance. The Compensation Committee is responsible to the Company’s Board of Directors and to stockholders for approving compensation awarded to the Company’s Chief Executive Officer and other Named Executive Officers. The Committee authorizes all awards under the Company’s equity-based compensation plans and operates under a written charter adopted by the Board.

Compensation Policies. The Compensation Committee believes that the primary goals of the Company’s compensation policies should be as follows:

| | • | | To strengthen the mutuality of interest between management and stockholders through the use of incentive compensation related to corporate performance and through the use of stock-based incentives that result in increased Share ownership by executive officers. |

| | • | | To provide total compensation opportunities for executive officers which are competitive with those provided to persons in similar positions in companies with which the Company competes for employees. |

In furtherance of these policies the Company entered into agreements with certain of its executive officers in the mid-1990s which were amended in 2000 which are described elsewhere herein as well as non-elective deferred compensation agreements that have been amended from time to time to comply with applicable laws and regulations, including most recently the American Jobs Creation Act of 2004. The Compensation Committee believes that these agreements provide the Company’s executive officers with sufficient compensation and security in their present positions as well as provide future benefits to the executive officers for retirement. The Compensation Committee annually evaluates the Company’s compensation program to determine whether it is providing the incentives for which it is intended.

The Compensation Committee adopts and maintains its compensation policies to promote the Company’s business strategies by rewarding executives for effectuating the Company’s long-term business strategies and enhancing stockholder value, while providing sufficient compensation to key executives.

11

Compensation Program. The Compensation Committee, with the help of an independent outside compensation consultant hired by the Committee, studies the compensation programs and policies of comparable companies and considers the recommendation of its outside consultant as applied to the requirements of the Company. The current executive compensation program has three components:

Base Compensation. The Compensation Committee believes that the main purpose of base compensation is to provide sufficient compensation to the executive officers of the Company relative to salary levels for employees of other real estate investment trusts having duties and responsibilities comparable to those of our executive officers. Base salaries are in the range of median base salaries paid by a peer group of real estate companies compiled and analyzed by the Committee’s independent outside compensation consultant.

Annual Bonus. Annual bonuses allow the Company to recognize individual performance and contributions to the Company on an annual basis. The Compensation Committee administers an Incentive Award Plan adopted by the Company in 1994. This Plan was designed to align the interests of the executive officers with those of the stockholders by (i) basing incentive awards on funds from operations (“FFO”) per share, which the Company and the real estate investment trust industry believe to be an important measure of the financial performance of a real estate investment trust, and (ii) paying 50% of each incentive award in Shares. The Incentive Award Plan also grants the Compensation Committee discretion to vary the awards from those indicated by the Incentive Award Plan’s targets if the Compensation Committee believes that such awards are appropriate. The Committee applied this Plan to the bonus awards for 2004. The Committee recognized that the Company did not reach targeted FFO levels due to events beyond the officers’ control as well as several corporate initiatives designed to substantially improve performance in subsequent periods, such as:

| | • | | Hurricane-caused damage to the Alabama and Florida properties. |

| | • | | The renovation and upgrading of the Mobile properties, which involved foregoing rentals on apartment units during their renovation, but which produced substantial increases in occupancy beginning in late 2004. |

| | • | | The Company recognized interest expenses on borrowing on a current basis when new developments became available for occupancy but were still in the lease-up phase (instead of capitalizing such expenses until completion of construction). |

| | • | | Unavoidable expense increases in several categories, including property taxes, utilities and insurance, as well as legal and accounting expenses attributable to the implementation of new regulatory requirements of the Sarbanes-Oxley Act. |

The Committee concluded that bonuses should be awarded under the provisions of the Plan which gave it discretion to award (or withhold) bonuses notwithstanding a shortfall in achieving FFO targets. In this determination, the Committee took into account the recommendations of its independent compensation consultant. In reaching that decision, the Committee considered not only the factors described above, but also the following positive achievements in accordance with the Company’s strategic plan:

| | • | | The substantial increase (to approximately 95.5%) in the occupancy rate at the Mobile apartments as a result of the renovation and upgrading, and an increase in the Company wide apartment occupancy rate to 95%. |

| | • | | Completion of 204 new apartment units at Governors Gate II Apartments in the Pensacola/Escambia County, Florida market, one of the fastest growing communities in Florida. |

| | • | | Progress toward completion of Greenbrier Estates apartments. |

12

| | • | | Sale of Lakeview Club Apartments at year end at a price reflecting a trailing capitalization rate of 4.2%, producing a $17.9 million gain on the sale. This sale also achieved a key Company strategy of improving its debt to equity ratio by reducing its outstanding debt and interest costs which would facilitate a 2005 sale of equity securities and the redemption and/or conversion of its 9% convertible subordinated debentures. |

| | • | | Significant management efforts to execute various aspects of the Company’s strategic plan intended to enhance stockholder value. |

Considering these factors and in line with the recommendation of the Committee’s independent compensation consultant, the Committee awarded each of the executive officers a bonus of approximately 50% of the potential bonus awardable if the Company had achieved the targeted FFO under the Incentive Compensation Plan. In accordance with the provision of that Plan, 50% of each officers’ bonus was paid in the Company’s common stock.

Long-Term Incentive. The Compensation Committee believes that long term stock-based incentive compensation encourages senior management to operate in a manner consistent with the interests of the Company’s stockholders. In 2003, the stockholders of the Company approved amendments to the Company’s 1996 Incentive Plan that give the Company the ability to grant additional types of awards under the plan. In February 2005, based upon the advice of its independent compensation consultant that the compensation levels of the Company’s executives were below the median levels of the Company’s peer group, particularly with respect to long-term incentive compensation, the Compensation Committee awarded the executive officers long-term incentive awards in the form of restricted stock grants that vest 20% on each of February 9, 2006, 2007, 2008, 2009 and 2010 and are subject to certain acceleration provisions, such as upon a change in control of the Company, or forfeiture provisions pursuant to the Company’s 1996 Incentive Plan. The Committee’s intent was to recognize the executives’ performance over a multi-year period and to take into account expected future contributions. The Committee also determined that these long-term incentive awards more strongly aligned the interests of the executives with the long-term performance of the Company’s stock.

CEO Compensation. The Compensation Committee considered a number of factors in setting the base compensation of Mr. Lassen, the Company’s Chief Executive Officer, the most important of which were the level of compensation paid to the chief executive officers of other real estate investment trusts relative in size to the Company, the success of the Company’s program instituting operating efficiencies, controlling costs and selective development of new properties, that was developed under Mr. Lassen’s direction, and his importance in delineating and implementing the Company’s strategies. Nevertheless, recognizing that the Company has been faced with increases in operating costs, Mr. Lassen voluntarily declined to accept any increase in his base compensation in 2004, as he had in several prior years. In each such year, the Committee, after due consideration, approved Mr. Lassen’s proposal to forego any increase in base compensation.

Compensation Deductibility Policy. Section 162(m) of the Internal Revenue Code limits the deductibility of compensation in excess of $1 million paid to the Company’s CEO and to each of the other four highest-paid executive officers, unless the compensation is performance based and satisfies other conditions. The Compensation Committee’s policy is to maximize the deductibility of compensation but does not preclude awards or payments that are not fully deductible if, in our judgment, such awards and payments are necessary to achieve our compensation objectives and to protect stockholder interests.

J. TERRELL BROWN, Chairman

JAMES W. McFARLAND

HAROLD B. JUDELL*

THEODORE H. STRAUSS*

Members of the Compensation Committee

| * | Mr. Judell and Mr. Strauss retired from the Board of Directors effective September 9, 2005. |

13

Compensation Committee Interlocks and Insider Participation

During 2004, Mr. Brown, Dr. McFarland, Mr. Judell and Mr. Strauss served as members of the Compensation Committee. The current members of the committee are Mr. Brown, Dr. McFarland and Mr. Ashner. No member of the Compensation Committee is or was an officer or employee of the Company or any of its subsidiaries. No executive officer of the Company served as a member of the Board of Directors or compensation committee of another entity, one of whose executive officers served as a director or member of the Compensation Committee of the Company.

14

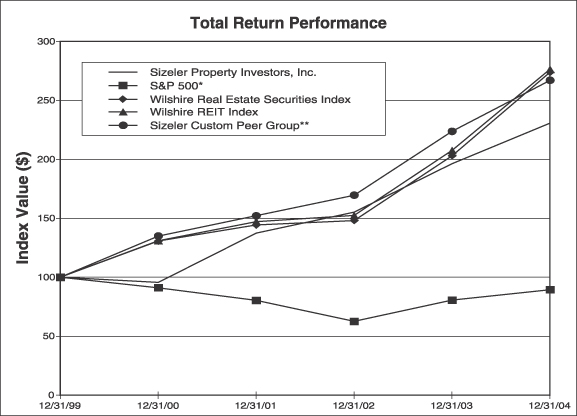

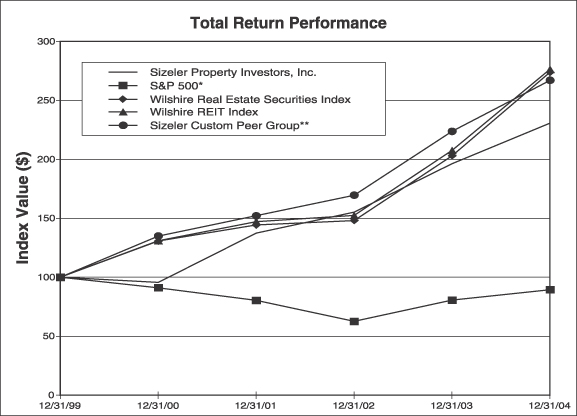

Performance Comparison

Set forth below is a line graph comparing the percentage change in the cumulative total return to stockholders on the Shares over the five years ended December 31, 2004 against the cumulative total return of a Peer Group of diversified real estate investment trusts, the Standard & Poor’s 500, the Wilshire REIT Index and the Wilshire RE Securities Index assuming that the value in the Shares and in each index was $100 on December 31, 1999, and that all dividends were reinvested. The companies contained in the Peer Group are listed in the footnote below. The graph covers the period commencing December 31, 1999 and ending December 31, 2004. This graph is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to the SEC’s proxy rules or to the liabilities of Section 18 of the Exchange Act, and the graph shall not be deemed to be incorporated by reference into any prior or subsequent filing by the Company under the Securities Act of 1933, as amended, or the Exchange Act.

Source : SNL Financial LC, Charlottesville, VA

| | | | | | | | | | | | |

Index

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

|

The Company | | 100 | | 95.80 | | 137.40 | | 155.36 | | 196.34 | | 230.81 |

S&P 500 | | 100 | | 91.20 | | 80.42 | | 62.64 | | 80.62 | | 89.47 |

Wilshire RE Securities Index | | 100 | | 130.70 | | 144.36 | | 148.20 | | 203.15 | | 273.91 |

Wilshire REIT Index | | 100 | | 131.04 | | 147.22 | | 152.49 | | 207.67 | | 276.53 |

Sizeler Custom Peer Group (1) | | 100 | | 135.06 | | 152.18 | | 169.69 | | 223.86 | | 267.14 |

| (1) | The Peer Group consists of the following companies in addition to the Company: BNP Residential Properties, BRT Realty Trust, Colonial Properties Trust, Cousins Properties Incorporated, Duke Realty Corporation, EastGroup Properties, Inc., EQK Realty Investors (data through Sept. 21, 2000), Glenborough Realty Trust, Inc., HMG/Courtland Properties, Inc., Income Opportunity Realty Investors, Inc., Kramont Realty Trust, Lexington Corporate Properties Trust, MGI Properties (data through Sept. 27, 2000), Presidential Realty Corporation, Pennsylvania Real Estate Investment Trust, Pittsburgh & West Virginia Railroad, Transcontinental Realty Investors, and Washington Real Estate Investment Trust. |

15

Compensation of Directors

Directors who are also executive officers of the Company are not separately compensated for their services as directors. Directors who are not executive officers are compensated in accordance with the Company’s 1994 Directors’ Stock Ownership Plan (the “1994 Directors’ Plan”). The 1994 Directors’ Plan provides for a stock award of 2,000 Shares to be made to each director annually on the first business day following January 15. A director may elect to be paid a cash substitute rather than all or part of an annual stock award. The cash substitute will equal 90% of the value of the Shares for which the director elects the cash substitute. Directors are also paid a meeting fee of $1,000 per Board meeting and $500 per committee meeting. In May 2005, as consideration for William G. Byrnes service as Vice-Chairman, the Board of Directors approved additional annual compensation of $10,000 payable to Mr. Byrnes in equal quarterly installments, with payments effective as of January 1, 2005.

The Sizeler Property Investors Directors’ Service Recognition Plan described in Proposal 3 below (the “Directors’ Service Plan”) provides that each non-employee director of the Company whose service on the Board ends by reason of the director’s death, resignation or retirement shall automatically receive a one-time award of 5,000 Shares. Messrs. Judell and Strauss and Dr. Peltier retired from the Board after the effective date of the Directors’ Service Plan and prior to the Meeting. Subject to stockholder ratification of the Directors’ Service Plan, each of these former directors and all current or future directors whose service on the Board ends by reason of the director’s death, resignation or retirement will receive a grant of 5,000 Shares to the extent shares are available for awards under the Directors’ Service Plan.

Section 16(a) Beneficial Ownership Reporting Compliance

The Securities Exchange Act of 1934 requires our directors, executive officers and beneficial owners of more than 10% of any class of our equity securities to file reports of ownership of our equity securities and to furnish these reports to us. Based solely on a review of such reports for 2004, the Company believes that these persons and entities filed all the reports required by the Securities Exchange Act of 1934 on a timely basis.

Certain Transactions and Relationships

The Company’s corporate governance policies require that any related party transactions be on terms no less favorable to the Company then those available in transactions with unrelated third parties and must be approved by a majority of the independent and disinterested directors. In the opinion of the independent members of the Board of Directors, each of the following transactions was entered into on terms at least as favorable to the Company as available in transactions with unrelated third parties.

Mr. Lassen’s Relationships with Sizeler Realty Co., Inc.

Mr. Lassen, our chairman and chief executive officer, is a director and stockholder of Sizeler Realty Co., Inc. (“Sizeler Realty”). The Company’s relationships with Sizeler Realty are as follows:

Engineering Consulting Fees. The Company paid $20,000 in 2004 and $14,000 in both 2003 and 2002, for engineering consulting fees to a majority-owned subsidiary of Sizeler Realty. During 2004, 2003 and 2002, the Company received management fees and commissions of approximately $303,000, $294,000 and $461,000, respectively, from various entities in which Mr. Lassen and/or his spouse have an interest. The Company has entered into relationships for 2005 on similar terms and conditions.

Southwood Shopping Center. In March 1991, the Company paid $900,000 to Sizeler Realty (LaPalco), Inc. (“LaPalco”), a wholly-owned subsidiary of Sizeler Realty, for the purchase of a 50% interest in Southwood Shopping Center (“Southwood”). Southwood is subject to a long-term ground lease expiring on March 31, 2031 from an entity in which Mr. and Mrs. Lassen and Mrs. Lassen’s brother and his wife own the total interests. The rent under the ground lease is 50% of cash flow (after debt service and certain other adjustments) up to a maximum of $225,000, and in the event the rental payment shall reach $225,000 in any year, it shall remain fixed

16

at $225,000 for each year thereafter. No ground rent was paid under the lease agreement in 2004. Ground rent in the amount of $10,000 was paid in 2003 and $27,000 was paid in 2002. In July 2004, LaPalco paid off the entire balance of the mortgage note and subsequently cancelled the mortgage on the property.

Westland Shopping Center Office Lease. The Company leases approximately 14,800 square feet of non-retail space at the Westland Shopping Center to Sizeler Realty. Under this lease, Sizeler Realty paid the Company an annual market rate of rent, including expense reimbursements, of $112,000 in 2004 and $111,000 in 2003 and 2002. The term of the lease expires January 31, 2007 and the lease provides for one remaining five-year renewal option. Pursuant to a month-to-month agreement between Sizeler Real Estate Management Co., Inc. (“SREMCO”), a wholly-owned subsidiary of the Company, and Sizeler Realty, SREMCO occupies approximately 97% of the 14,800 square feet of space. SREMCO paid rent to Sizeler Realty of $112,000 in 2004 and $111,000 in 2003 and 2002 for use of the space. These lease arrangements are continuing in 2005 at similar rates.

Mr. Lassen’s Other Relationships

Westland Shopping Center Ground Rent. The Company holds its interest in the Westland Shopping Center pursuant to a long-term ground lease with Westland Shopping Center LLC (the “LLC”), expiring on December 31, 2046. The LLC is owned by the wife of Mr. Lassen and her brother. The Company contractually paid ground rent of $65,000 in 2004, $63,000 in 2003 and $65,000 in 2002. These ground rent payments are continuing in 2005 at similar rates.

Hibernia Bank Credit Facility. Mr. Lassen is a director and Vice-Chairman of Hibernia National Bank (“Hibernia”) and Hibernia Corporation. At December 31, 2004, $15,000,000 of the Company’s $60,000,000 of bank lines of credit was provided by Hibernia. The Company had no borrowings under this line at July 31, 2005 and borrowing totaling $136,000 at December 31, 2004. The Company had borrowings under a line of credit from Hibernia totaling $11,633,000 at December 31, 2003.

Mr. Ashner’s Relationships with First Union Real Estate Equity and Mortgage Investments

Settlement Agreement. On September 9, 2005, the Company and First Union entered into an agreement pursuant to which First Union agreed to cease its solicitation of proxies for the Company’s 2005 annual meeting of stockholders (the “Settlement Agreement”). In addition, First Union entered into an irrevocable proxy, granting Messrs. Lassen, Masilla and Byrnes the authority to vote First Union’s shares of Company common stock in favor of the Board’s director nominees until the completion of the Company’s 2005 annual meeting of stockholders. In return, the Company agreed to take certain actions, including electing a designee of First Union to the Company’s Board, Compensation Committee and Real Estate Acquisition Committee to serve until the Company’s 2006 annual meeting of stockholders. Mr. Ashner is First Union’s designee. The Settlement Agreement also requires that the Company obtain approval of a majority of the Board, including First Union’s designee, prior to issuing equity securities (or securities convertible into or redeemable for equity securities) or making certain amendments to the Company’s Bylaws. Finally, pursuant to the Settlement Agreement, the Company has agreed to reimburse First Union for up to $375,000 of documented legal and proxy-related expenses.

Mutual General Release. In connection with the Settlement Agreement, on September 9, 2005, the Company and First Union entered into an agreement, pursuant to which the Company and First Union agreed to end litigation in the United States District Court for the District of Maryland. Both the Company and First Union released one another from claims related to the proxy contest and the Company’s and First Union’s actions over the past several months, including the Company’s March 15 common stock offering. Pursuant to the Mutual General Release, First Union retained the right to obtain the economic benefit, if any, as a passive member of a class or derivative action with respect to and claims stemming from actions or events not known, as of the date of the agreement, by First Union or the public. First Union’s release was made on behalf of itself and its affiliates, including its directors and officers. As Chief Executive Officer of First Union, Mr. Ashner is subject to the Mutual General Release.

17

Undertakings. In connection with the Settlement Agreement, Mr. Ashner delivered certain written undertakings to the Company requiring him to take or refrain from taking certain actions with respect to the Company, including:

| | • | | taking all action within Mr. Ashner’s power as Chief Executive Officer to cause First Union to abide by the terms of the Settlement Agreement; |

| | • | | refraining from standing for election to the Company’s Board of Directors at the Meeting; |

| | • | | supporting the election of the Company’s Board of Directors nominees at the Meeting; |

| | • | | refraining from any solicitation efforts for candidates other than the Company’s Board of Directors nominees at the Meeting; and |

| | • | | refraining from any solicitation efforts for a stockholder proposal at the Meeting regarding the possible liquidation of the Company. |

Further Information on Related Party Transactions

Financial Statement Disclosures Concerning These Matters. For further information about transactions between the Company and directors and officers or related interests, including information required to be disclosed under the SEC’s accounting rules, please refer to Note G of the Notes to Consolidated Financial Statements contained in the Company’s 2004 Annual Report on Form 10-K, as amended, filed with the SEC and available on the Company’s website.

In addition to following the corporate governance policies described above, the Board has formed a special committee comprised solely of independent directors to review related party transactions.

Equity Compensation Plans

The following table summarizes equity compensation plan information as of December 31, 2004. The Company has no equity compensation plans that have not been approved by security holders.

| | | | | | | |

| | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a)

| | Weighted-average exercise price of outstanding options, warrants and rights

(b)

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c)

|

Equity compensation plans approved by security holders | | 718,750 | | $ | 9.20 | | 1,305,276 |

The amended 1996 Stock Option and Incentive Plan had 1,132,000 securities remaining available for issue as of December 31, 2004. The 1994 Incentive Award Plan had 173,276 securities remaining available for issue as of December 31, 2004.

2. APPROVAL OF AMENDMENTS TO THE COMPANY’S CHARTER

TO DESTAGGER THE BOARD OF DIRECTORS

Stockholders are being asked to approve an amendment to the Company’s Charter in order to phase out the present three-year staggered terms of the Company’s Board of Directors and to provide instead for the annual election of all directors, as well as to provide that directors may be removed with or without cause. Under the present classified board structure, the Company’s Board of Directors is divided into three classes with directors elected to staggered three-year terms and stockholders may not remove directors except for cause and with the vote of 75% of the stockholders entitled to vote at any annual meeting or any special meeting of stockholders called for that purpose. Approximately one-third of the directors stand for election each year. If the amendment is approved, directors elected or reelected at each of the 2005, 2006 and 2007 annual meetings of the stockholders of the Company will be elected to serve until the next annual meeting of stockholders after such director’s

18

election or until a successor is duly elected and qualified. This will result in the full board standing for re-election annually beginning with the 2007 annual meeting of stockholders.

Companies with staggered boards normally also have provisions in their charters that provide that directors may only be removed for cause. As an integral part of the phase out of the staggered terms of the Company’s directors, the Charter Amendment would remove the requirement in the Company’s Charter of “cause” for the removal of a director and retain the provision that any removal be by a vote of 75% of the votes entitled to be cast in the election of directors at any annual meeting or any special meeting of stockholders called for that purpose. Accordingly, if the proposed amendments to the Company’s Charter are approved, the Company’s stockholders would be able to remove any or all directors without cause at any stockholders’ meeting after the Meeting, provided that 75% of the votes entitled to be cast in the election of directors are voted in favor of removal.

The Board considered the destaggering of the terms of the Company’s directors as part of the Company’s settlement with First Union discussed above at “Overview.” In connection with that settlement agreement, the Board of Directors approved and declared advisable that stockholders approve the amendments to the Charter to destagger the terms of the Company’s directors and provide for the ability to remove directors with or without cause. This amendment is attached to this proxy statement as Annex A. The Board of Directors recommends that stockholders approve the amendments to the Charter.

Proponents of classified boards of directors believe that they help maintain continuity of experience and, as a result, may assist a company in long-term strategic planning. Additionally, supporters argue that a classified board may encourage a person seeking control of a company to initiate arm’s-length discussions with management and the board, who may be in a position to negotiate a higher price on more favorable terms for stockholders or to seek to prevent a takeover that the board believes is not in the best interests of stockholders.