February 7-9, 2018 Keefe, Bruyette & Woods Winter Financial Services Symposium 1

Safe Harbor Statement 2 Park cautions that any forward-looking statements contained in this presentation or made by management of Park are provided to assist in the understanding of anticipated future financial performance. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include, without limitation: Park's ability to execute our business plan successfully and within the expected timeframe; general economic and financial market conditions, specifically in the real estate markets and the credit markets, either nationally or in the states in which Park and our subsidiaries do business, may experience a slowing or reversal of the recent economic expansion in addition to continuing residual effects of recessionary conditions and an uneven spread of positive impacts of recovery on the economy and our counterparties, resulting in adverse impacts on the demand for loan, deposit and other financial services, delinquencies, defaults and counterparties' ability to meet credit and other obligations; changes in interest rates and prices may adversely impact the value of securities, loans, deposits and other financial instruments and the interest rate sensitivity of our consolidated balance sheet as well as reduce interest margins and impact loan demand; changes in consumer spending, borrowing and saving habits, whether due to the newly enacted tax legislation, changing business and economic conditions, legislative and regulatory initiatives, or other factors; changes in unemployment; changes in customers', suppliers', and other counterparties' performance and creditworthiness; asset/liability repricing risks and liquidity risks; our liquidity requirements could be adversely affected by changes to regulations governing bank and bank holding company capital and liquidity standards as well as by changes in our assets and liabilities; competitive factors among financial services organizations could increase significantly, including product and pricing pressures, changes to third-party relationships and our ability to attract, develop and retain qualified bank professionals; clients could pursue alternatives to bank deposits, causing us to lose a relatively inexpensive source of funding; uncertainty regarding the nature, timing and effect of changes in banking regulations or other regulatory or legislative requirements affecting the respective businesses of Park and our subsidiaries, including major reform of the regulatory oversight structure of the financial services industry, such as the easing of restrictions on participants in the financial services industry, and changes in laws and regulations concerning taxes, pensions, bankruptcy, consumer protection, accounting, bank products and services, bank capital and liquidity standards, fiduciary standards, securities and other aspects of the financial services industry, specifically the reforms provided for in the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and the Basel III regulatory capital reforms, as well as regulations already adopted and which may be adopted in the future by the relevant regulatory agencies, including the Consumer Financial Protection Bureau, the OCC, the FDIC, and the Federal Reserve Board, to implement the Dodd-Frank Act's provisions, and the Basel III regulatory capital reforms; the effect of changes in accounting policies and practices, as may be adopted by the Financial Accounting Standards Board, the SEC, the Public Company Accounting Oversight Board and other regulatory agencies, and the accuracy of our assumptions and estimates used to prepare our financial statements; changes in law and policy accompanying the new presidential administration, including the recently enacted Tax Cuts and Jobs Act, and uncertainty or speculation pending the enactment of such changes; uncertainties in Park's preliminary review of, and additional analysis of, the Tax Cuts and Jobs Act; the effect of healthcare laws in the United States and potential changes for such laws which may increase our healthcare and other costs and negatively impact our operations and financial results; significant changes in the tax laws, which may adversely affect the fair values of net deferred tax assets and obligations of state and political subdivisions held in Park's investment securities portfolio; the effect of trade, monetary, fiscal and other governmental policies of the U.S. federal government, including money supply and interest rate policies of the Federal Reserve Board; disruption in the liquidity and other functioning of U.S. financial markets; the impact on financial markets and the economy of any changes in the credit ratings of the U.S. Treasury obligations and other U.S. government-backed debt, as well as issues surrounding the levels of U.S., European and Asian government debt and concerns regarding the creditworthiness of certain sovereign governments, supranationals and financial institutions in Europe and Asia; the uncertainty surrounding the actions to be taken to implement the referendum by United Kingdom voters to exit the European Union; our litigation and regulatory compliance costs and exposure, including any adverse developments in legal proceedings or other claims and unfavorable resolution of regulatory and other governmental examinations or other inquiries; the adequacy of our risk management program; the impact of our ability to anticipate and respond to technological changes on our ability to respond to customer needs and meet competitive demands; the ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; a failure in or breach of our operational or security systems or infrastructure, or those of our third-party vendors and other service providers, including as a result of cyber attacks; fraud, scams and schemes of third parties; the impact of widespread natural and other disasters, pandemics, dislocations, civil unrest, terrorist activities or international hostilities on the economy and financial markets generally or on us or our counterparties specifically; demand for loans in the respective market areas served by Park and our subsidiaries; and other risk factors relating to Park, our subsidiaries and/or the banking industry as detailed from time to time in Park's reports filed with the SEC including those described in "Item 1A. Risk Factors" of Part I of Park's Annual Report on Form 10-K for the fiscal year ended December 31, 2016. Park does not undertake, and specifically disclaims any obligation, to publicly release the results of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward-looking statement was made, or reflect the occurrence of unanticipated events, except to the extent required by law.

3 Safe Harbor Statement (cont.) These forward-looking statements include, but are not limited to, statements relating to the expected timing and benefits of the proposed merger (the “Merger”) between Park National Corporation (“Park”), The Park National Bank and NewDominion Bank (“NewDominion”), including future financial and operating results, cost savings, enhanced revenues, and accretion/dilution to reported earnings that may be realized from the Merger, as well as other statements of expectations regarding the Merger, and other statements of Park’s goals, intentions and expectations; statements regarding the Park’s business plan and growth strategies; statements regarding the asset quality of Park’s loan and investment portfolios; and estimates of Park’s risks and future costs and benefits, whether with respect to the Merger or otherwise. These forward-looking statements are subject to significant risks, assumptions and uncertainties that may cause results to differ materially from those set forth in forward-looking statements, including, among other things: the risk that the businesses of Park and NewDominion will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; expected revenue synergies and cost savings from the Merger may not be fully realized or realized within the expected time frame; revenues following the Merger may be lower than expected; customer and employee relationships and business operations may be disrupted by the Merger; the ability to obtain required governmental and shareholder approvals, and the ability to complete the Merger on the expected timeframe; possible changes in economic and business conditions; the existence or exacerbation of general geopolitical instability and uncertainty; the ability of Park to integrate recent acquisitions and attract new customers; possible changes in monetary and fiscal policies, and laws and regulations; the effects of easing restrictions on participants in the financial services industry; the cost and other effects of legal and administrative cases; possible changes in the credit worthiness of customers and the possible impairment of collectability of loans; fluctuations in market rates of interest; competitive factors in the banking industry; changes in the banking legislation or regulatory requirements of federal and state agencies applicable to bank holding companies and banks like Park’s affiliate bank; continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends; and changes in market, economic, operational, liquidity, credit and interest rate risks associated with the Park’s business. All forward-looking statements included in this communication are made as of the date hereof and are based on information available as of the date hereof. Except as required by law, none of Park, Park National Bank or NewDominion assumes any obligation to update any forward-looking statement. In connection with the proposed merger, Park will file with the SEC a Registration Statement on Form S-4 that will include a Proxy Statement of NewDominion and a Prospectus of Park, as well as other relevant documents concerning the proposed transaction. SHAREHOLDERS OF NEWDOMINION ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PARK, PARK NATIONAL BANK, NEWDOMINION AND THE PROPOSED TRANSACTION. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about Park and NewDominion, may be obtained at the SEC’s website (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Park at the “Investor Information” section of Park's website at www.parknationalcorp.com or from NewDominion at the “Investor Relations” section of NewDominion’s website at www.newdominionbank.com. Copies of the Proxy Statement/Prospectus can also be obtained, free of charge, by directing a request to Park National Corporation, 50 North Third Street, P.O. Box 3500, Newark, OH 43058-3500, Attention: Investor Relations, Telephone: (740) 322-6844 or to NewDominion Bank, PO Box 37389, Charlotte, NC 28237, Attention: Investor Relations, Telephone: (704) 943- 5725. This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. This communication is also not a solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise. No offer of securities or solicitation will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. The communication is not a substitute for the Registration Statement that will be filed with the SEC or the Proxy Statement/Prospectus that will be sent to NewDominion shareholders.

Park National Corporation (PRK) Profile (as of December 31, 2017) • 11 Community Bank Divisions • 2 Specialty Finance Companies • One non-bank workout subsidiary • 29 Ohio counties • 108 bank branches • 6 specialty finance offices • 1,746 FTEs 4

Park Senior Management • David L. Trautman – President and CEO – Age: 56 President , CEO and Board Member of The Park National Bank and Park National Corporation (Park) headquartered in Newark, Ohio. He served as President of First-Knox National Bank, a division of The Park National Bank, from May 1997 through January 2002, and as its Chairman from 2001 to 2006. In addition, he served on the Board of the United Bank of Bucyrus, a division of The Park National Bank, from 2000 to 2006. Mr. Trautman received his B.A. from Duke University and joined Park immediately following graduation. He holds an MBA, with honors, from The Ohio State University. He is a graduate of The Stonier Graduate School of Banking at The University of Delaware and the Ohio Bankers Association Leadership Institute. Mr. Trautman is past Chairman of the Ohio Bankers League, a member of the Newark Rotary Club, past campaign chair for United Way of Licking County, and serves as a Trustee of Dawes Arboretum. • C. Daniel DeLawder – Chairman – Age: 68 Chairman of the Board and Board Member of The Park National Bank and Park headquartered in Newark, Ohio. He served previously as CEO of The Park National Bank and Park for 15 years. He served as President of the Fairfield National Bank, a division of The Park National Bank, from 1985 through 1991. He also currently serves on the Boards of Medical Benefits Mutual Life Insurance Company, Truck One, Inc. and Fleet Service, Inc. Mr. DeLawder received his B.S.Ed., cum laude from Ohio University in Athens and joined Park immediately following graduation. He is a graduate of numerous bank industry educational programs. Mr. DeLawder is a past member of the Board of Directors of the Federal Reserve Bank of Cleveland. He is the past chairman of the Board of Trustees of Ohio University. He served as a member of the American Bankers Association (ABA) BankPac Committee as well as a member of the Government Relations Council of the ABA. He is past Chairman of the Ohio Bankers Association and a past Director-at-Large of the Community Bankers Association of Ohio. Leadership Team 5

Park Senior Management (continued) • Matthew R. Miller – Executive Vice President – Age: 39 Executive Vice President of Park since April 2017. Formerly served as the Chief Accounting Officer of Park from December 2012 to April 2017, and as an Accounting Vice President from April 2009 to December 2012. Prior to joining Park, Mr. Miller worked eight years at Deloitte & Touche, where his experience was primarily focused on financial service industry clients. Mr. Miller holds a bachelor’s degree in accounting, graduating summa cum laude from the University of Akron. He currently is chairman of the Next Generation Advisory Board of the Ohio Bankers League, is board president of the Licking County Family YMCA, served as the 2015-16 campaign chair for the United Way of Licking County, is chair of the Development Council Annual Fund Committee at The Works, serves on the Development Council for Licking Memorial Health Systems, is a board member of the Licking County Chamber of Commerce, is a board member of the advisory board at The Ohio State University – Newark Campus, and is a member of the Newark Rotary Club. • Brady T. Burt – Chief Financial Officer – Age: 45 Chief Financial Officer of Park since 2012. Formerly served as the Chief Accounting Officer of Park from April 2007 to December 2012. Prior to joining Park, Mr. Burt served Vail Banks, Inc. in various capacities from April 2002 to November 2006, including EVP-Chief Financial Officer. Mr. Burt was also employed by PricewaterhouseCoopers from September 1994 to August 2001, working in various accounting roles, both in Ohio and London, England. Mr. Burt received his B.S. Degree in Accounting from Miami University in 1994. He is a board member and serves on both the Audit and Risk Committees of the Federal Home Loan Bank of Cincinnati. In addition, he currently is a board member and serves on the Finance Committee of the Licking County United Way, is a board member and board secretary of Habitat MidOhio, is a member of the Granville Rotary Club, and is an Audit Committee member of the Licking County Foundation. 6

Experienced Leadership Team Name Position Age Years with PRK Years In Industry David L. Trautman President & CEO 56 34 34 C. Daniel DeLawder Chairman 68 46 46 Matthew R. Miller Executive Vice President 39 8 14 Brady T. Burt Chief Financial Officer 45 10 16 • Senior leadership consists of executives with proven local market experience • Leadership team averages 27 years of banking experience • Average management tenure with Park National is approximately 22 years 7

Leadership Team – continued Name Position Age Years with PRK Years In Industry Lindsay M. Alton AVP – Interim Chief Risk Officer 35 14 14 Adrienne M. Brokaw SVP – Director of Internal Audit 50 4 18 Thomas J. Button SVP – Chief Credit Officer 57 21 32 Thomas M. Cummiskey SVP – Trust 48 18 20 Kelly A. Edds VP – Chief Accounting Officer 35 7 12 Robert N. Kent, Jr. President – Scope Aircraft Finance 60 14 34 Timothy J. Lehman SVP and Chief Operating Officer 53 23 23 Laura B. Lewis SVP – Human Resources & Marketing 58 33 33 Greg M. Rhoads VP – Chief Information Officer 40 15 15 Cheryl L. Snyder SVP – Chief Retail Officer 61 38 40 Paul E. Turner SVP - Treasury 50 27 27 Jeffrey A. Wilson SVP – Chief Administrative Officer 51 13 21 8

Affiliate Leadership Name Position Age Years with PRK/Affiliate Years In Industry Brett A. Baumeister President – Unity National Bank 51 13 27 John A. Brown President – Security National Bank 48 26 26 David J. Gooch President – Park National Bank of Southwest Ohio & Northern Kentucky 48 20 26 Chris R. Hiner President – Richland Bank 34 12 12 Brian R. Hinkle President – Farmers & Savings Bank 41 12 16 Matthew R. Marsh President – Guardian Finance Company 52 18 29 Patrick L. Nash President – Century National Bank 53 30 30 Vickie A. Sant President – First-Knox National Bank 62 42 42 Donald R. Stone President – United Bank 60 22 34 John E. Swallow President – Second National Bank 61 32 42 Stephen G. Wells President – Fairfield National Bank 57 34 34 9

Highlights of 2017 • Loan growth of $104.4 million in 2017 (1.99%) at Park National Corporation’s (PRK) national bank subsidiary, The Park National Bank (PNB). • Credit quality remains strong: PRK and PNB experienced net charge-offs of 17 basis points (bps) and 21 bps in 2017, respectively. Delinquencies (30 days or more past due and accruing) remain low at 49 bps and 42 bps for PRK and PNB, respectively. •Nonperforming assets were reduced by $9.0 million (7.39%) and $7.2 million (7.19%) during 2017 at PRK and PNB, respectively. • Deposit growth of $266.5 million (4.7%) from 12/31/16 to 12/31/17 at PNB. Growth consisted of $185.2 million of interest bearing deposits (4.6%) and $81.3 million of noninterest bearing deposits (5.0%). 10

PRK and PRK, excluding Vision & Southeast Property Holdings, LLC (SEPH) ROA and ROE History 1 Calculated using average common equity for Park National Corporation. 2 Calculated using average common equity for Park National Corporation, excluding Vision Bank and SE Property Holdings, LLC. 3 Adjusted for goodwill impairment charges of $55 million in 2008 and $54 million in 2007. Including the goodwill impairment charges, Park’s ROAA for 2008 and 2007 was 0.20% and 0.37%, respectively, and Park’s ROAE for 2008 and 2007 was 2.40% and 3.67% respectively. 4 Due to unavailability of Q4 2017 YTD peer median financial metrics, data utilized herein reflects 3Q 2017 YTD peer results. Source: BHC Performance Report and Company Filings Peers include all bank holding companies nationwide with total assets between $3.0 and $10.0 billion Park ROAA Park ROAA, excluding VB & SEPH Peer median ROAA Park ROAE 1 Park ROAE, excluding VB & SEPH 2 Peer median ROAE 2017 1.09% 1.10% 1.05%4 11.15% 11.59% 9.51%4 2016 1.16% 1.08% 1.01% 11.68% 11.03% 9.16% 2015 1.11% 1.12% 0.97% 11.40% 11.69% 8.68% 2014 1.22% 1.16% 0.95% 12.34% 11.81% 8.34% 2013 1.15% 1.16% 1.04% 11.94% 12.11% 8.89% 2012 1.11% 1.33% 0.98% 11.41% 13.94% 8.56% 2011 1.06% 1.59% 0.80% 11.81% 19.46% 7.27% 2010 0.74% 1.58% 0.25% 8.05% 18.27% 0.88% 2009 0.97% 1.61% (0.16)% 11.81% 20.80% (2.22)% 2008 1.02% 3 1.63% (0.06)% 12.12% 3 21.57% (2.01)% 2007 1.24% 3 1.52% 0.87% 12.40% 3 17.88% 9.45% Average 2007 – 2016 1.08% 1.38% 0.67% 11.50% 15.86% 5.70% 11

The Park National Bank – The bank of choice Source: SNL, June 30, 2017 Headquarter Counties – Deposits (in thousands) 12 Bank Division Year Joined Park Hdqtr. Co. Deposits Total County Deposits % of 2017 Market Share % of 2016 Market Share 2017 Headquarter County Market Share Rank 2016 Headquarter County Market Share Rank Park National 1908 $1,613,780 $2,611,419 61.80% 62.04% 1 1 Fairfield National 1985 374,477 2,096,636 17.86% 18.68% 1 1 Richland Bank 1987 567,846 1,840,054 30.86% 29.17% 1 1 Century National 1990 471,279 1,409,758 33.43% 33.92% 1 1 First-Knox National 1997 543,554 876,117 62.04% 61.62% 1 1 Second National 2000 285,655 1,168,809 24.44% 24.73% 2 2 Security National 2001 492,712 1,529,161 32.22% 32.39% 1 1 Seven largest OH divisions $4,349,303 $11,531,954 37.72% 37.74% Other OH divisions – headquarter counties 626,405 5,387,683 11.63% 11.48% Total OH divisions – headquarter counties $4,975,708 $16,919,637 29.41% 29.39% Remaining Ohio bank deposits $1,061,440 Total Ohio bank deposits $6,037,148

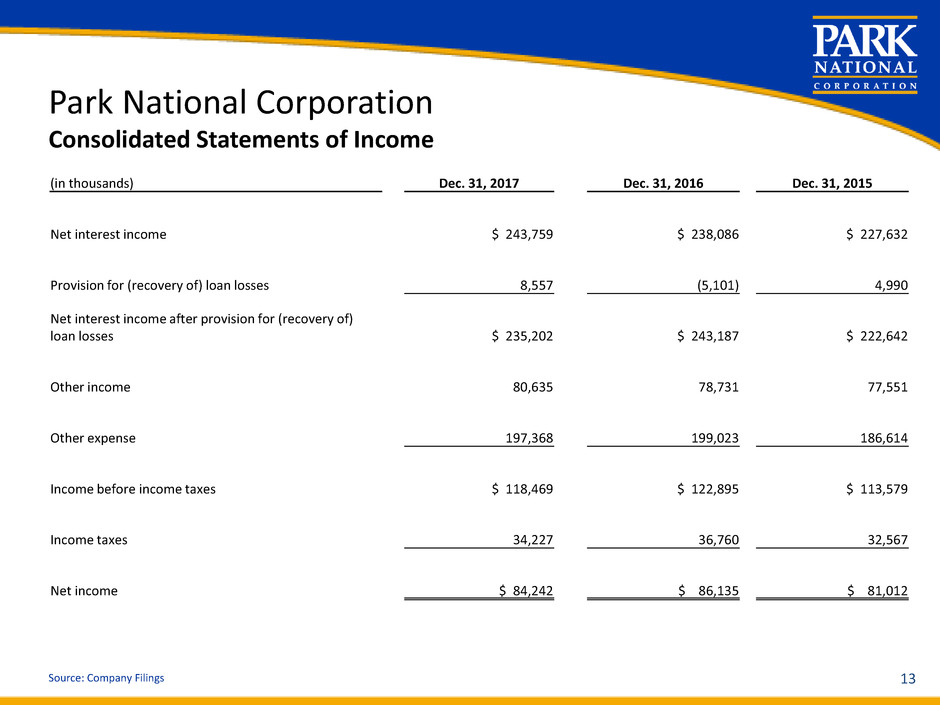

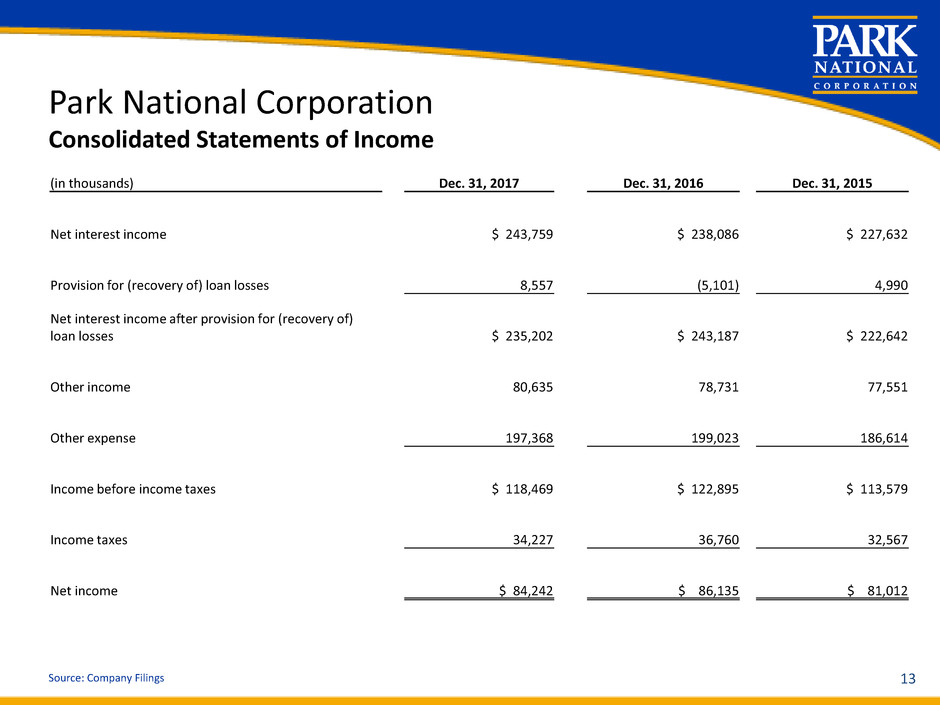

Source: Company Filings 13 (in thousands) Dec. 31, 2017 Dec. 31, 2016 Dec. 31, 2015 Net interest income $ 243,759 $ 238,086 $ 227,632 Provision for (recovery of) loan losses 8,557 (5,101) 4,990 Net interest income after provision for (recovery of) loan losses $ 235,202 $ 243,187 $ 222,642 Other income 80,635 78,731 77,551 Other expense 197,368 199,023 186,614 Income before income taxes $ 118,469 $ 122,895 $ 113,579 Income taxes 34,227 36,760 32,567 Net income $ 84,242 $ 86,135 $ 81,012 Park National Corporation Consolidated Statements of Income

Source: Company Filings 14 Park National Corporation Consolidated Balance Sheets (in millions) Dec. 31, 2017 Dec. 31, 2016 Dec. 31, 2015 Cash & cash equivalents $ 169 $ 146 $ 149 Investment securities 1,513 1,580 1,644 Loans 5,372 5,272 5,068 Allowance for loan losses (50) (51) (56) Other assets 534 521 506 Total assets $ 7,538 $ 7,468 $ 7,311 Noninterest bearing deposits 1,634 1,523 1,404 Interest bearing deposits 4,183 3,999 3,944 Total deposits 5,817 5,522 5,348 Total borrowings 906 1,134 1,177 Other liabilities 59 70 73 Total shareholders’ equity 756 742 713 Total liabilities & shareholders’ equity $ 7,538 $ 7,468 $ 7,311

Quarterly Net Income (Loss)by Operating Segment Source: Company Filings (In thousands) Q4 2017 Q3 2017 Q2 2017 Q1 2017 2017 2016 2015 PNB $24,369 $21,297 $20,163 $21,486 $87,315 $84,451 $84,345 GFSC (208) 84 186 198 260 (307) 1,423 Park Parent Company 1 (417) 105 (919) (1,226) (2,457) (4,557) (4,549) Ongoing operations $23,744 $21,486 $19,430 $20,458 $85,118 $79,587 $81,219 SEPH (913) 626 (398) (191) (876) 6,548 (207) Total Park $22,831 $22,112 $19,032 $20,267 $84,242 $86,135 $81,012 1 The “Park Parent Company” above excludes the results for SEPH, an entity which is winding down commensurate with the disposition of its problem assets. Management considers the “Ongoing operations” results to be reflective of the business of Park and its subsidiaries on a going forward basis. 15

Source: Company Filings 16 The Park National Bank Consolidated Statements of Income (in thousands) Dec. 31, 2017 Dec. 31, 2016 Dec. 31, 2015 Net interest income $ 235,243 $ 227,576 $ 220,879 Provision for loan losses 9,898 2,611 7,665 Net interest income after provision for loan losses $ 225,345 $ 224,965 $ 213,214 Other income 77,126 74,803 75,188 Other expense 180,275 177,562 167,476 Income before income taxes $ 122,196 $ 122,206 $ 120,926 Income taxes 34,881 37,755 36,581 Net income $ 87,315 $ 84,451 $ 84,345

Park National Bank Balance Sheet Highlights Source: Company Filings (In thousands) December 31, 2017 December 31, 2016 % change from 12/31/16 Loans $ 5,339,255 $ 5,234,828 1.99% Allowance for loan losses 47,607 48,782 (2.41)% Net loans 5,291,648 5,186,046 2.04% Investment securities 1,507,926 1,573,320 (4.16)% Total assets 7,467,851 7,389,538 1.06% Total deposits 5,896,676 5,630,199 4.73% Average assets (1) 7,664,725 7,337,438 4.46% Return on average assets 1.14% 1.15% (0.87)% (1) Average assets for the fiscal years ended December 31, 2017 and 2016. 17

Park National Bank Loans by Type Source: Company Filings as of December 31, 2017 • Commercial lending focus is on small, closely-held businesses within our markets. • Consumer mortgage and home equity portfolios are originated by Park within our footprint and have been consistently underwritten for decades 12/31/2017 12/31/2016 % Change from Amount Amount 12/31/2016 Commercial Real Estate Owner Occupied $ 471,103 $ 465,603 1.18% Non-Owner Occupied 556,728 553,540 0.58% Residential Real Estate 1,714,333 1,796,894 (4.59)% Construction Real Estate 181,470 188,945 (3.96)% Commercial & Industrial 1,059,135 995,563 6.39% Consumer 1,213,717 1,094,480 10.89% Farmland 139,776 136,560 2.36% Leases 2,993 3,243 (7.71)% Total Loans $ 5,339,255 $ 5,234,828 1.99% 18

19 Park National Bank Indirect Loans Source: Company Filings Dec. 31, 2014 Dec. 31, 2015 Dec. 31, 2016 Dec. 31, 2017 Other $151,489 $154,172 $106,872 $86,425 Boat/RV $32,821 $68,096 $138,483 $184,862 Auto $507,245 $541,307 $668,018 $778,711 Total Indirect Loans $691,555 $763,575 $913,373 $1,049,998 $0 $250,000 $500,000 $750,000 $1,000,000 $1,250,000 In di re ct L oa ns (i n th ou sa nd s) Indirect Loans (as of 12/31/17) Credit Score Outstanding Balance 30-59 DPD 60-89 DPD 90+ DPD Past Due Balance % Past Due 770 and above $ 509,691,833 82 15 9 $ 1,145,380 0.22% 740-769 $ 177,965,671 62 6 8 $ 807,627 0.45% 700-739 $ 230,232,522 125 16 14 $ 1,635,761 0.71% Other $ 132,107,786 381 97 55 $ 3,981,989 3.01% Total $ 1,049,997,812 650 134 86 $ 7,570,757 0.72%

Park National Corporation Nonperforming assets 1 The carrying balance of impaired commercial loans as a percentage of unpaid principal balance at December 31, 2017 was 83.9% and 100.0% for Park National Corporation and SEPH, respectively. 2 At December 31, 2017, Vision/SEPH participations included in Park National Corporation’s nonperforming assets were approximately $9.0 million. Source: BHC Performance Report and Company Filings (in thousands) Dec. 31, 2017 Dec. 31, 2016 Dec. 31, 2015 Non-accrual loans 1 $ 72,056 $ 87,822 $ 95,887 Renegotiated loans 1 20,111 18,175 24,979 Loans past due 90 days or more (still accruing) 1,792 2,086 1,921 Total nonperforming loans $ 93,959 $ 108,083 $ 122,787 Other real estate owned (OREO) 14,190 13,926 18,651 Other non performing assets – PNB 4,849 - - Total nonperforming assets 2 $ 112,998 $ 122,009 $ 141,438 Percentage of nonaccrual loans and loans 90+ days past due to loans (PRK) 1.37% 1.71% 1.93% Percentage of nonaccrual, restructured and OREO to assets (PRK) 1.41% 1.61% 1.91% Texas Ratio (PRK) 15.40% 16.93% 20.28% Peer Group Information Sep. 30, 2017 Dec. 31, 2016 Dec. 31, 2015 Percentage of nonaccrual loans and loans 90+ days past due to loans (Peer Group) 0.55% 0.64% 0.75% Percentage of nonaccrual, restructured and OREO to assets (Peer Group) 0.64% 0.74% 0.91% Note: The Texas Ratio is calculated as total nonperforming assets divided by the sum of tangible common equity plus the allowance for loan losses. 20

Source: BHC Performance Report and Company Filings (in thousands) Dec. 31, 2017 Dec. 31, 2016 Dec. 31, 2015 Non-accrual loans $ 61,753 $ 76,084 $ 81,468 Renegotiated loans 20,111 18,175 24,979 Loans past due 90 days or more (still accruing) 1,792 2,086 1,921 Total nonperforming loans $ 83,656 $ 96,345 $ 108,368 Other real estate owned (OREO) – PNB 6,524 6,025 7,456 Other non performing assets – PNB 4,849 - - Total nonperforming assets $ 95,029 $ 102,370 $ 115,824 Percentage of nonaccrual loans and loans 90+ days past due to loans (PNB and Guardian) 1.19% 1.49% 1.65% Percentage of nonaccrual, restructured and OREO to assets (PNB and Guardian) 1.18% 1.36% 1.57% Texas Ratio 13.33% 14.66% 16.98% Peer Group Information Sep. 30, 2017 Dec. 31, 2016 Dec. 31, 2015 Percentage of nonaccrual loans and loans 90+ days past due to loans (PRK Peer Group) 0.55% 0.64% 0.74% Percentage of nonaccrual, restructured and OREO to assets (PRK Peer Group) 0.64% 0.74% 0.90% Park National Corporation less Vision Bank/SEPH Nonperforming Assets Note: The Texas Ratio is calculated as total nonperforming assets divided by the sum of tangible common equity plus the allowance for loan losses. 21

PRK comparison to peers 1 Due to unavailability of 4Q 2017 peer median financial metrics, data utilized herein reflects 3Q 2017 peer results. Source: Company Filings and SNL data of $3 to $10 billion bank holding companies PRK Price to Book % Peer Group Price to Book % PRK Price to tangible book Peer Group Price to Tangible Book % PRK Price to Earnings Peer Group Price to Earnings PRK Dividend Yield Peer Group Dividend Yield 4Q 2017 210% 167% 1 233% 210% 1 19.0 18.9 1 3.6 1.8 1 2016 247% 171% 274% 221% 21.4 20.5 3.1 1.7 2015 194% 136% 216% 168% 17.2 16.2 4.2 2.1 2014 196% 146% 218% 178% 16.2 19.8 4.2 1.9 2013 202% 170% 227% 192% 17.0 19.9 4.4 2.1 2012 153% 117% 172% 145% 13.2 13.4 5.8 2.8 2011 156% 109% 176% 135% 13.1 14.7 5.8 2.4 2010 177% 127% 202% 155% 21.1 17.8 5.2 2.1 2009 141% 105% 163% 140% 12.2 16.9 6.4 2.5 2008 183% 135% 217% 211% 14.6 15.7 5.3 2.9 2007 155% 138% 207% 206% 11.9 13.2 5.8 3.3 2006 242% 206% 280% 291% 14.7 17.1 3.8 2.3 22

A Successful History of Disciplined Strategic Growth in Ohio (11 acquisitions; 2 De Novos) 1908 1908 The Park National Bank is established 1985 1985 Acquisition of Fairfield National Bank 1987 1987 Park National Corporation holding company is established Acquisition of Richland Trust Company 1990 1990 Acquisition of Century National Bank 1994 1994 Acquisition of Scope Aircraft Finance 1997 1999 2000 2001 2005 2006 1997 Acquisition of First-Knox National Bank Farmers Savings Bank 1999 Guardian Finance Company established 2000 Acquisition of United Bank Acquisition of Second National Bank 2001 Acquisition of Security National Bank Citizens National Bank Unity National Bank 2005 Acquisition of First Federal Savings Bank of Eastern Ohio (merged with Century National Bank) Acquisition of First Clermont Bank (became the Park National Bank of Southwest Ohio & Northern Kentucky division) 2006 Acquisition of Anderson Bank (merged with The Park National Bank of Southwest Ohio & Northern Kentucky division) 23

24 and Strategic Partnership and Expansion into North Carolina NYSE AMERICAN: PRK | OTC PINK: NDMN

Park National / NewDominion – Transaction Overview 25 Deal value: Blended deal value: $76.4 million1 $79.9 million1,2 Consideration: Option to elect $1.08 in cash or 0.01023 shares of Park common stock for each share of NewDominion common stock, subject to a 60% stock / 40% cash structure Per share price: Blended per share price: $1.081 $1.031,2 Required approvals: • Regulatory• NewDominion shareholder Key assumptions: • Cost savings estimated to be 35% • Estimated one-time charges of $6.5 million • Gross credit mark of approximately 2.5% (including unfunded commitments) Earnings and capital impact2: • Accretive to EPS by 1.6% in 2019 and 3.7% in 2020 • Tangible book value earn-back of approximately 4.2 years • Capital position will remain strong, creating potential for additional acquisitions, stock buybacks, strong dividend payout Anticipated closing: Mid-2018 Strategic opportunity: Similar market in some respects to Park’s home market of Greater Columbus, but with even better growth prospects 1. Based on the 20-day average PRK closing price as of January 19, 2018 2. Takes into account Park’s 8.55% existing ownership at a cost of $3.5 million or $0.54 per NewDominion share, initially made in November 2016

Park National / NewDominion – Selected Highlights 26 Pro Forma Branch Map Transaction Metrics1 Blended price per share / TBVPS: 200.9% Blended price per share / adj. TBVPS2: 188.1% Blended price per share / 2019 EPS w/ synergies: 13.4x NewDominion pro forma ownership: 2.8%Park Branches (108) NewDominion Branches (2) NewDominion Financials (as of and for the year ended 12/31/17) Total assets: $338.3 million Total gross loans: $284.4 million Total deposits: $282.3 million Total equity (all tangible): $39.0 million 2017 efficiency ratio: 86.5% NPAs / assets: 1.02% 2017 NCOs (recoveries) / average loans: (0.08)% 1. Based on the 20-day average PRK closing price as of January 19, 2018 and takes into account Park’s 8.55% existing ownership 2. Reflects adjusted tangible book value per share assuming the inclusion of NewDominion’s $2.7 million off balance sheet deferred tax asset

Park National / NewDominion – Strategic Rationale 27 Demographically accretive, given attractive Charlotte market demographics − Charlotte’s five-year population growth rate projected to be 11x Ohio average and 2x national average (Nielsen) − Charlotte is the largest metropolitan area in the Carolinas with over 2.5 million residents (Nielsen) − Charlotte was rated among top 20 places to live in the U.S. (U.S. News & World Report) − Charlotte’s tech talent pool grew faster than any other top 50 U.S. tech market (CBRE) − Charlotte is home to six Fortune 500 companies (Fortune) Culturally similar; Park has become very familiar with NewDominion since initially investing $3.5 million in NewDominion in a friendly transaction in November 2016 Terrific NewDominion management team that has completed a turnaround effort and is eager to grow its franchise as part of the Park team Strategically important but a small and lower-risk acquisition for Park

PRK M&A Strategy Two prong strategy guidelines: • Traditional M&A • Strong franchise, good reputation • Good market share • Existing leadership continuity • Traditional community bank structure • Core deposits • Metro Strategy – Attractive markets in the Midwest / Southeast / Mid-Atlantic states • Open de novo • Mirror successful Columbus, Ohio office • Partner with banks that have the following characteristics: • Consistent loan growth • Acceptable asset quality • Existing or potential trust and wealth management business • Commercial focused • Proven leadership team 28

February 7-9, 2018 Keefe, Bruyette & Woods Winter Financial Services Symposium 29