Safe Harbor Statement Park cautions that any forward-looking statements contained in this news release or made by management of Park are provided to assist in the understanding of anticipated future financial performance. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include, without limitation: Park's ability to execute our business plan successfully and within the expected timeframe as well as our ability to manage strategic initiatives; current and future economic and financial market conditions, either nationally or in the states in which Park and our subsidiaries do business, that may reflect deterioration in business and economic conditions, including the effects of higher unemployment rates, an acceleration in the pace of inflation, interest rate fluctuations, changes in the economy or global supply chain, supply-demand imbalances affecting local real estate prices, U.S. fiscal debt, budget and tax matters, geopolitical matters (including the impact of the Russia-Ukraine conflict and associated sanctions and export controls), and any slowdown in global economic growth, in addition to the continuing impact of the COVID-19 pandemic and recovery therefrom on our customers’ operations and financial condition, any of which may result in adverse impacts on the demand for loan, deposit and other financial services, delinquencies, defaults and counterparties' inability to meet credit and other obligations and the possible impairment of collectability of loans;factors that can impact the performance of our loan portfolio, including changes in real estate values and liquidity in our primary market areas, the financial health of our commercial borrowers and the success of construction projects that we finance, including any loans acquired in acquisition transactions; the effect of monetary and other fiscal policies (including the impact of money supply, market interest rate policies and policies impacting inflation, of the Federal Reserve Board, the U.S. Treasury and other governmental agencies) as well as disruption in the liquidity and functioning of U.S. financial markets, may adversely impact prepayment penalty income, mortgage banking income, income from fiduciary activities, the value of securities, deposits and other financial instruments, in addition to the loan demand and the performance of our loan portfolio, and the interest rate sensitivity of our consolidated balance sheet as well as reduce net interest margins; changes in the federal, state, or local tax laws may adversely affect the fair values of net deferred tax assets and obligations of state and political subdivisions held in Park's investment securities portfolio and otherwise negatively impact our financial performance; the impact of the changes in federal, state and local governmental policy, including the regulatory landscape, capital markets, elevated government debt, potential changes in tax legislation that may increase tax rates, infrastructure spending and social programs;changes in laws or requirements imposed by Park's regulators impacting Park's capital actions, including dividend payments and stock repurchases;changes in consumer spending, borrowing and saving habits, whether due to changes in retail distribution strategies, consumer preferences and behaviors, changes in business and economic conditions, legislative and regulatory initiatives, or other factors may be different than anticipated; changes in customers', suppliers', and other counterparties' performance and creditworthiness, and Park's expectations regarding future credit losses and our allowance for credit losses, may be different than anticipated due to the continuing impact of and the various responses to inflationary pressures; Park may have more credit risk and higher credit losses to the extent there are loan concentrations by location or industry of borrowers or collateral;the volatility from quarter to quarter of mortgage banking income, whether due to interest rates, demand, the fair value of mortgage loans, or other factors;the adequacy of our internal controls and risk management program in the event of changes in the market, economic, operational (including those which may result from our associates working remotely), asset/liability repricing, legal, compliance, strategic, cybersecurity, liquidity, credit and interest rate risks associated with Park's business; competitive pressures among financial services organizations could increase significantly, including product and pricing pressures (which could in turn impact our credit spreads), changes to third-party relationships and revenues, changes in the manner of providing services, customer acquisition and retention pressures, and Park's ability to attract, develop and retain qualified banking professionals; uncertainty regarding the nature, timing, cost and effect of changes in banking regulations or other regulatory or legislative requirements affecting the respective businesses of Park and our subsidiaries, including major reform of the regulatory oversight structure of the financial services industry and changes in laws and regulations concerning taxes, FDIC insurance premium levels, pensions, bankruptcy, consumer protection, rent regulation and housing, financial accounting and reporting, environmental protection, insurance, bank products and services, bank and bank holding company capital and liquidity standards, fiduciary standards, securities and other aspects of the financial services industry, specifically the reforms provided for in the Coronavirus Aid, Relief and Economic Security (CARES) Act and the follow-up legislation in the Consolidated Appropriations Act, 2021, the American Rescue Plan Act of 2021, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and the Basel III regulatory capital reforms, as well as regulations already adopted and which may be adopted in the future by the relevant regulatory agencies, including the Consumer Financial Protection Bureau, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, and the Federal Reserve Board, to implement the provisions of the CARES Act and the follow-up legislation in the Consolidated Appropriations Act, 2021, the provisions of the American Rescue Plan Act of 2021, the provisions of the Dodd-Frank Act, and the Basel III regulatory capital reforms; Park's ability to meet heightened supervisory requirements and expectations;the effect of changes in accounting policies and practices, as may be adopted by the Financial Accounting Standards Board (the "FASB"), the SEC, the Public Company Accounting Oversight Board and other regulatory agencies, may adversely affect Park's reported financial condition or results of operations; Park's assumptions and estimates used in applying critical accounting policies and modeling, including under the CECL model, which may prove unreliable, inaccurate or not predictive of actual results; the possibility that future credit losses may be higher than currently expected due to changes in economic assumptions;the impact of Park's ability to anticipate and respond to technological changes on Park's ability to respond to customer needs and meet competitive demands; operational issues stemming from and/or capital spending necessitated by the potential need to adapt to industry changes in information technology systems on which Park and our subsidiaries are highly dependent; the ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks, including those of Park's third-party vendors and other service providers, which may prove inadequate, and could adversely affect customer confidence in Park and/or result in Park incurring a financial loss; a failure in or breach of Park's operational or security systems or infrastructure, or those of our third-party vendors and other service providers, resulting in failures or disruptions in customer account management, general ledger, deposit, loan, or other systems, including as a result of cyber attacks; the impact on Park's business and operating results of any costs associated with obtaining rights in intellectual property claimed by others and of the adequacy of Park's intellectual property protection in general;the existence or exacerbation of general geopolitical instability and uncertainty as well as the effect of trade policies (including the impact of potential or imposed tariffs, a U.S. withdrawal from or significant renegotiation of trade agreements, trade wars and other changes in trade regulations, closing of border crossings and changes in the relationship of the U.S. and its global trading partners); the impact on financial markets and the economy of any changes in the credit ratings of the U.S. Treasury obligations and other U.S. government-backed debt, as well as issues surrounding the levels of U.S., European and Asian government debt and concerns regarding the growth rates and financial stability of certain sovereign governments, supranationals and financial institutions in Europe and Asia and the risk they may face difficulties servicing their sovereign debt; the effect of a fall in stock market prices on Park's asset and wealth management businesses;our litigation and regulatory compliance exposure, including the costs and effects of any adverse developments in legal proceedings or other claims, the costs and effects of unfavorable resolution of regulatory and other governmental examinations or other inquiries, and liabilities and business restrictions resulting from litigation and regulatory investigations; continued availability of earnings and excess capital sufficient for the lawful and prudent declaration of dividends; the impact on Park's business, personnel, facilities or systems of losses related to acts of fraud, scams and schemes of third parties;the impact of widespread natural and other disasters, pandemics (including the COVID-19 pandemic), dislocations, regional or national protests and civil unrest (including any resulting branch closures or damages), military or terrorist activities or international hostilities (especially in light of the Russia-Ukraine conflict) on the economy and financial markets generally and on us or our counterparties specifically; a worsening of the U.S. economy due to financial, political, or other shocks; the effect of healthcare laws in the U.S. and potential changes for such laws, especially in light of the COVID-19 pandemic, which may increase our healthcare and other costs and negatively impact our operations and financial results; risk and uncertainties associated with Park's entry into new geographic markets with our most recent acquisitions, including expected revenue synergies and cost savings from recent acquisitions not being fully realized or realized within the expected time frame; uncertainty surrounding the transition from the London Inter-Bank Offered Rate (LIBOR) to an alternate reference rate; a continuation of recent turmoil in the banking industry, and the impact of responsive measures to mitigate and manage such turmoil, including potential increased supervisory and regulatory actions and costs;and other risk factors relating to the banking industry as detailed from time to time in Park's reports filed with the SEC including those described in "Item 1A. Risk Factors" of Part I of Park's Annual Report on Form 10-K for the fiscal year ended December 31, 2022.Park does not undertake, and specifically disclaims any obligation, to publicly release the results of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward-looking statement was made, or reflect the occurrence of unanticipated events, except to the extent required by law. P A R K N A T I O N A L C O R P O R A T I O N 2

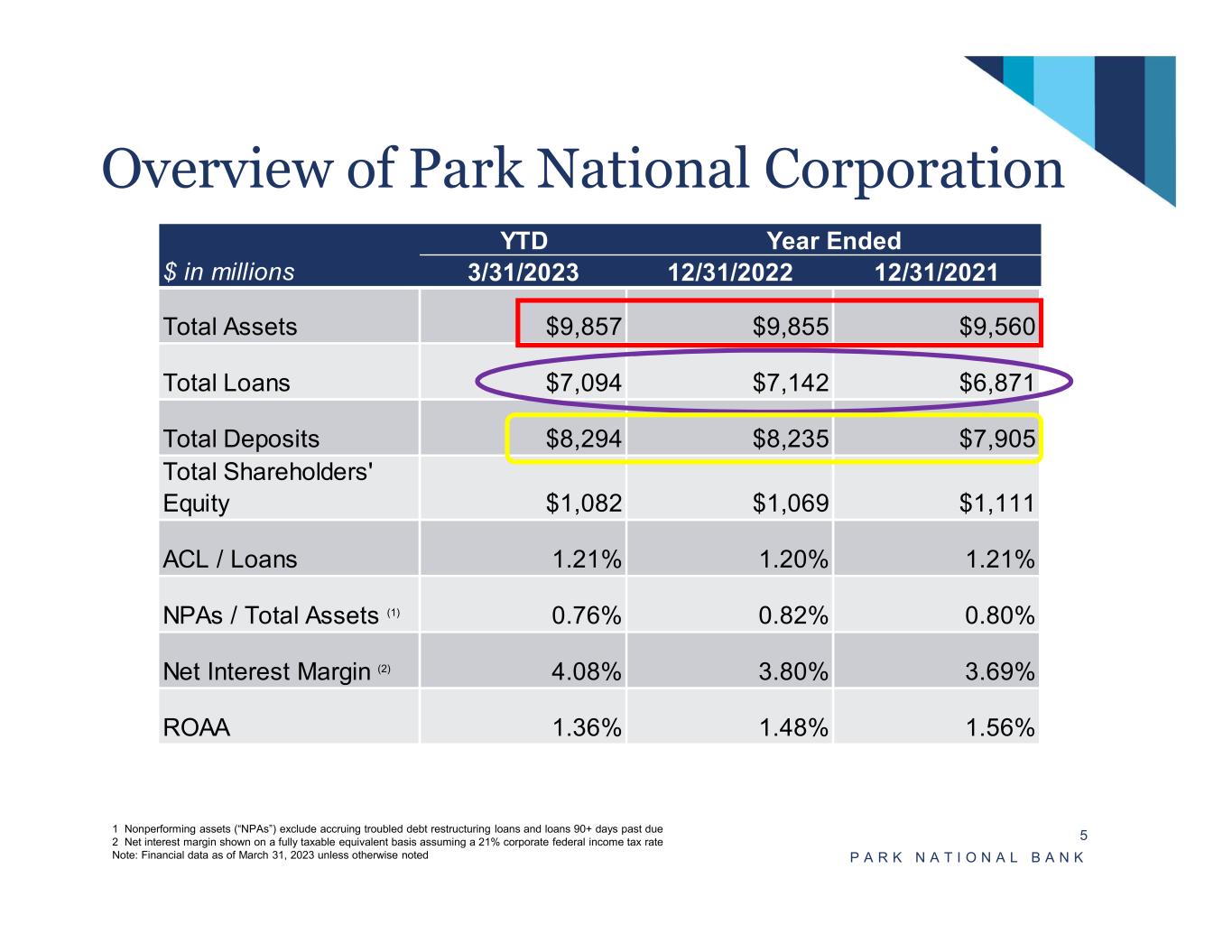

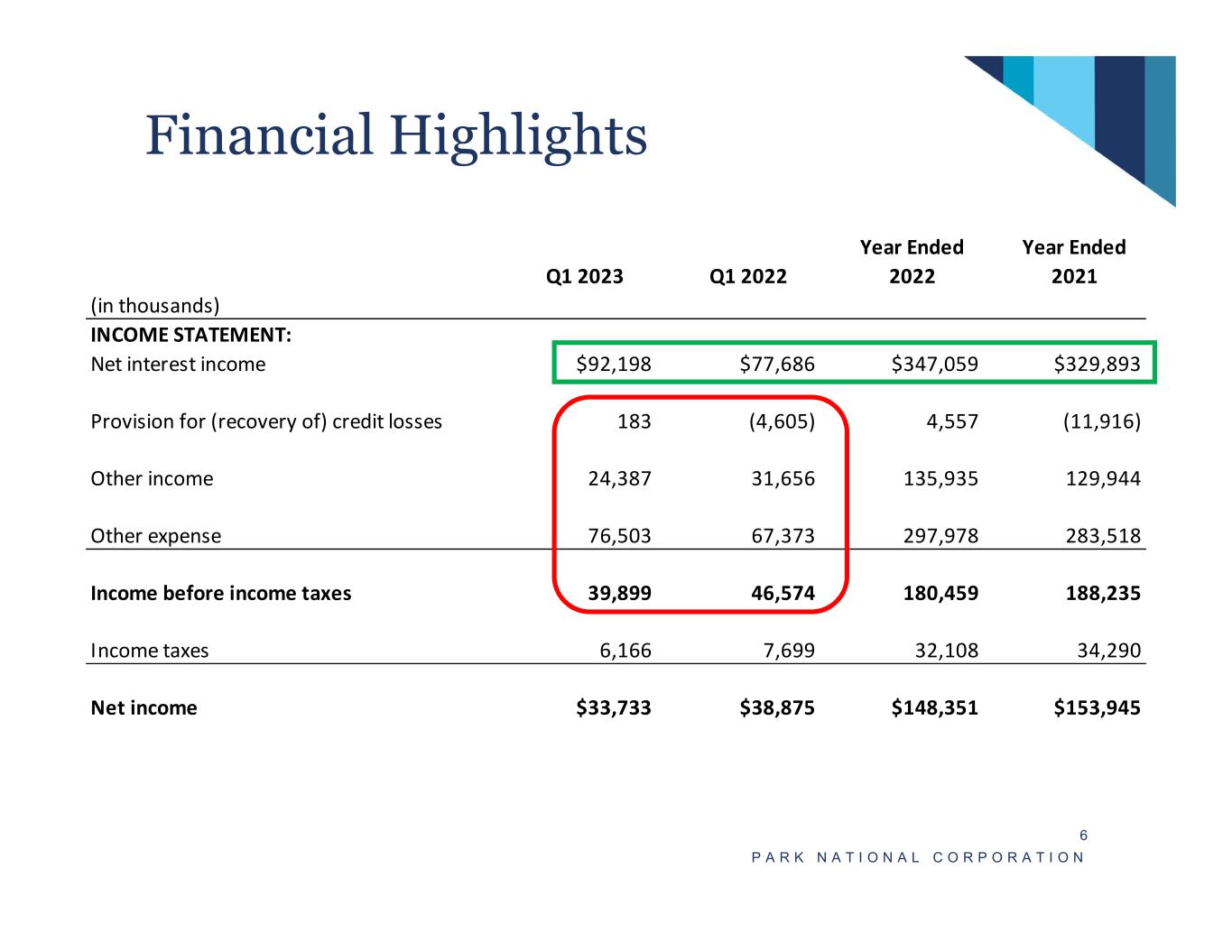

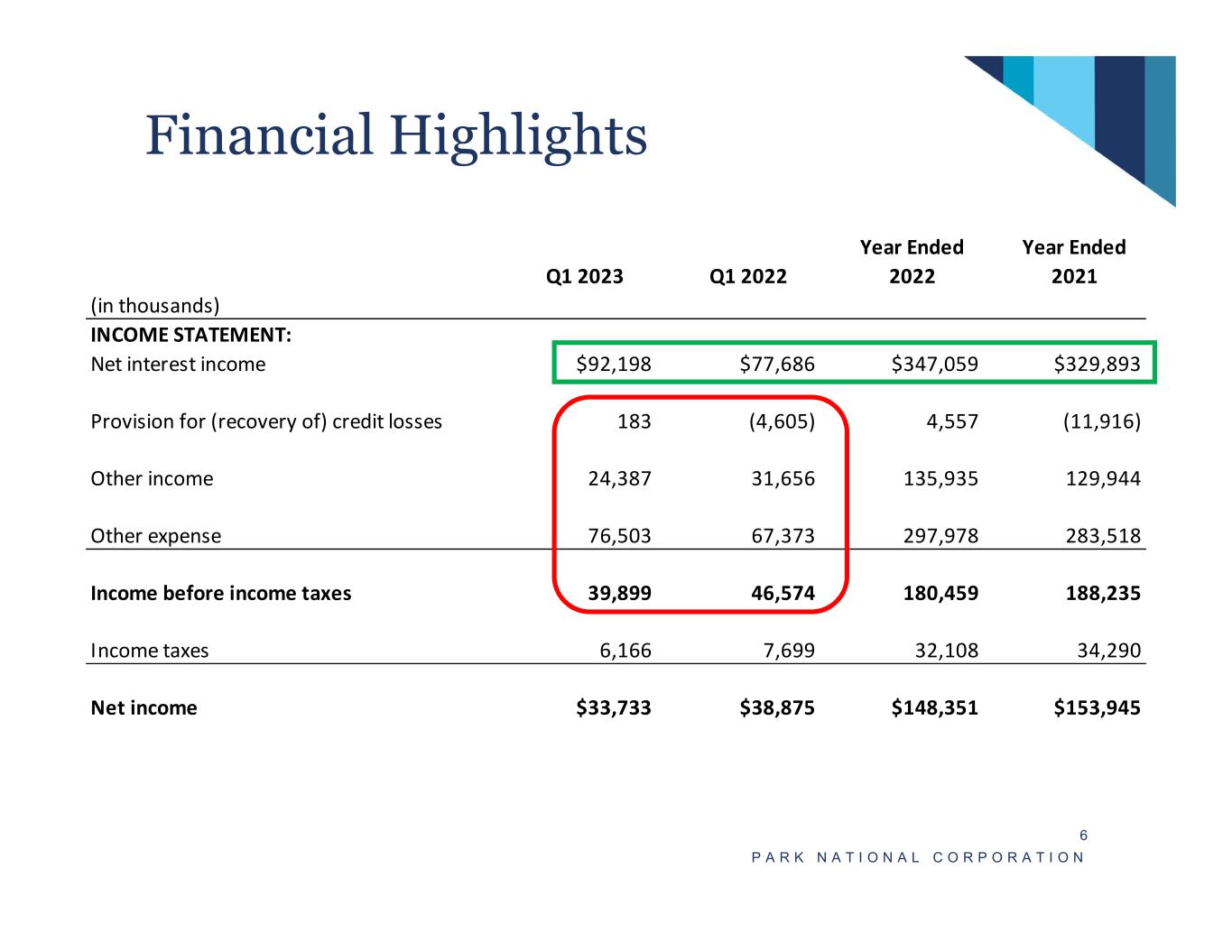

Q1 2023 Q1 2022 Year Ended 2022 Year Ended 2021 (in thousands) INCOME STATEMENT: Net interest income $92,198 $77,686 $347,059 $329,893 Provision for (recovery of) credit losses 183 (4,605) 4,557 (11,916) Other income 24,387 31,656 135,935 129,944 Other expense 76,503 67,373 297,978 283,518 Income before income taxes 39,899 46,574 180,459 188,235 Income taxes 6,166 7,699 32,108 34,290 Net income $33,733 $38,875 $148,351 $153,945 Financial Highlights P A R K N A T I O N A L C O R P O R A T I O N 6