Park National Corporation P A R K N A T I O N A L C O R P O R A T I O N

Safe Harbor Statement P A R K N A T I O N A L C O R P O R A T I O N 2 This presentation contains forward-looking statements that are provided to assist in the understanding of anticipated future financial performance. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward- looking statements are based on management’s expectations and are subject to a number of risks and uncertainties, including those described in Park's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as updated by our filings with the SEC. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include, without limitation: (1) the ability to execute our business plan; (2) the impact of current and future economic and financial market conditions, including unemployment rates, inflation, and interest rates; (3) factors impacting the performance of our loan portfolio, including real estate values and borrowers’ finances; (4) the effects of monetary and fiscal policies, including money supply, and inflation; (5) changes in federal, state, or local tax laws; (6) the impact of changes in governmental policy and regulatory requirements on our operations; (7) changes in consumer spending, borrowing, and saving habits; (8) changes in the performance and creditworthiness of customers, suppliers, and counterparties; (9) increased credit risk and higher credit losses due to loan concentrations; (10) volatility in mortgage banking income due to interest rates and demand; (11) adequacy of our internal controls and risk management programs; (12) competitive pressures among financial services organizations; (13) changes in banking regulations and other regulatory requirements; (14) our ability to meet heightened supervisory requirements and expectations; (15) the impact of changes in accounting policies and practices; (16) the reliability and accuracy of assumptions and estimates used in applying critical accounting estimates; (17) the potential for higher future credit losses due to changes in economic assumptions; (18) the ability to anticipate and respond to technological changes and our reliance on third-party vendors; (19) operational issues related to and capital spending necessitated by the implementation of information technology systems; (20) the ability to secure confidential information and deliver products and services through computer systems and telecommunications networks; (21) the impact of security breaches or failures in operational systems; (22) the costs associated with intellectual property rights and protection; (23) the impact of geopolitical instability and trade policies on our operations; (24) the impact of changes in credit ratings of government debt and financial stability of sovereign governments; (25) the effect of stock market price fluctuations on our asset and wealth management businesses; (26) litigation and regulatory compliance exposure; (27) availability of earnings and excess capital for dividend declarations; (28) the impact of fraud, scams, and schemes; (29) the impact of natural disasters, pandemics, and other emergencies on our operations; (30) potential deterioration of the economy due to financial, political, or other shocks; (31) impact of healthcare laws and potential changes on our costs and operations; (32) the impact of problems encountered by other financial institutions on our business; (33) the ability to grow deposits or maintain adequate deposit levels; (34) the impact of unexpected deposit outflows on our financial condition; and (35) other risk factors related to the banking industry.

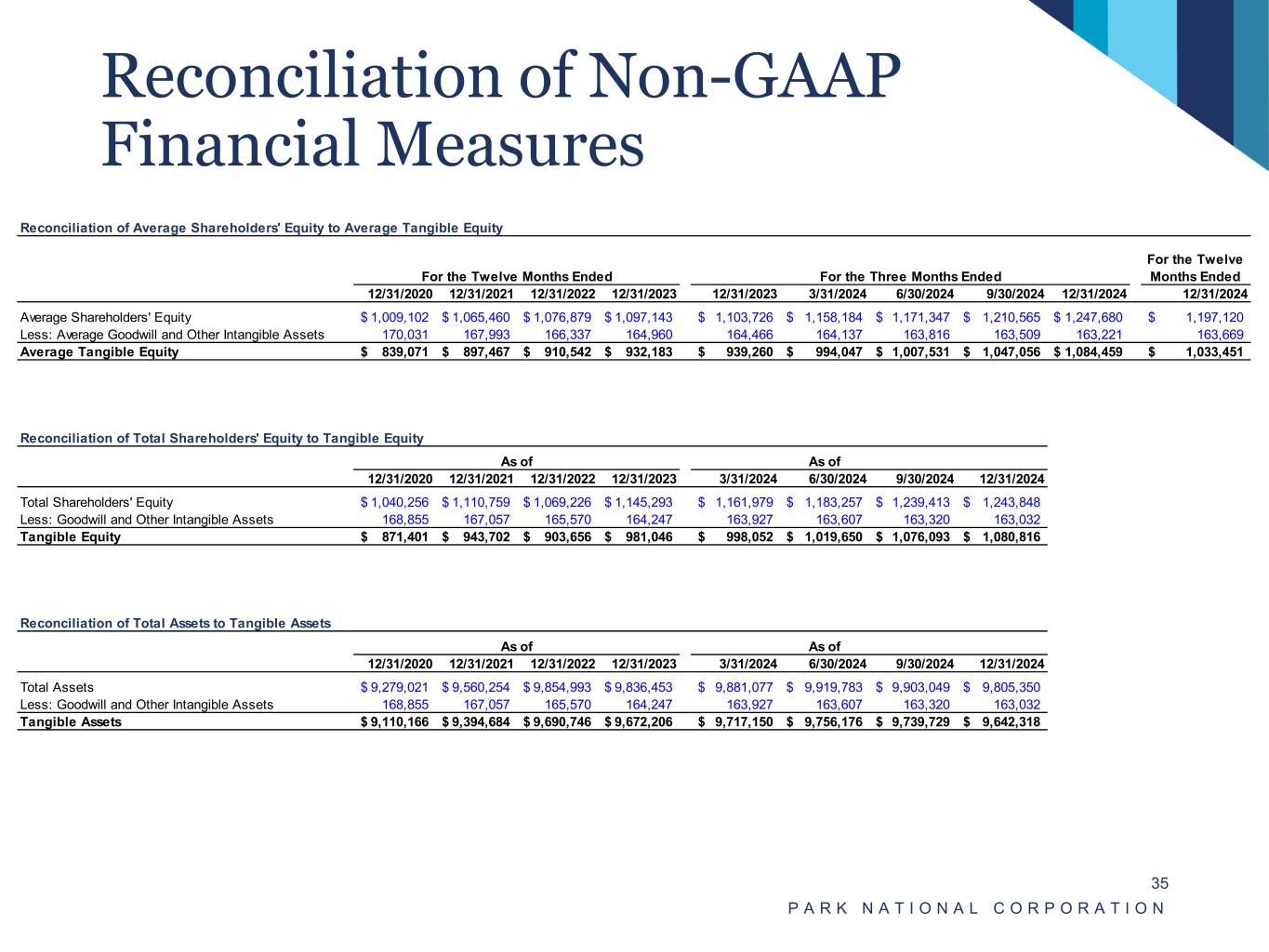

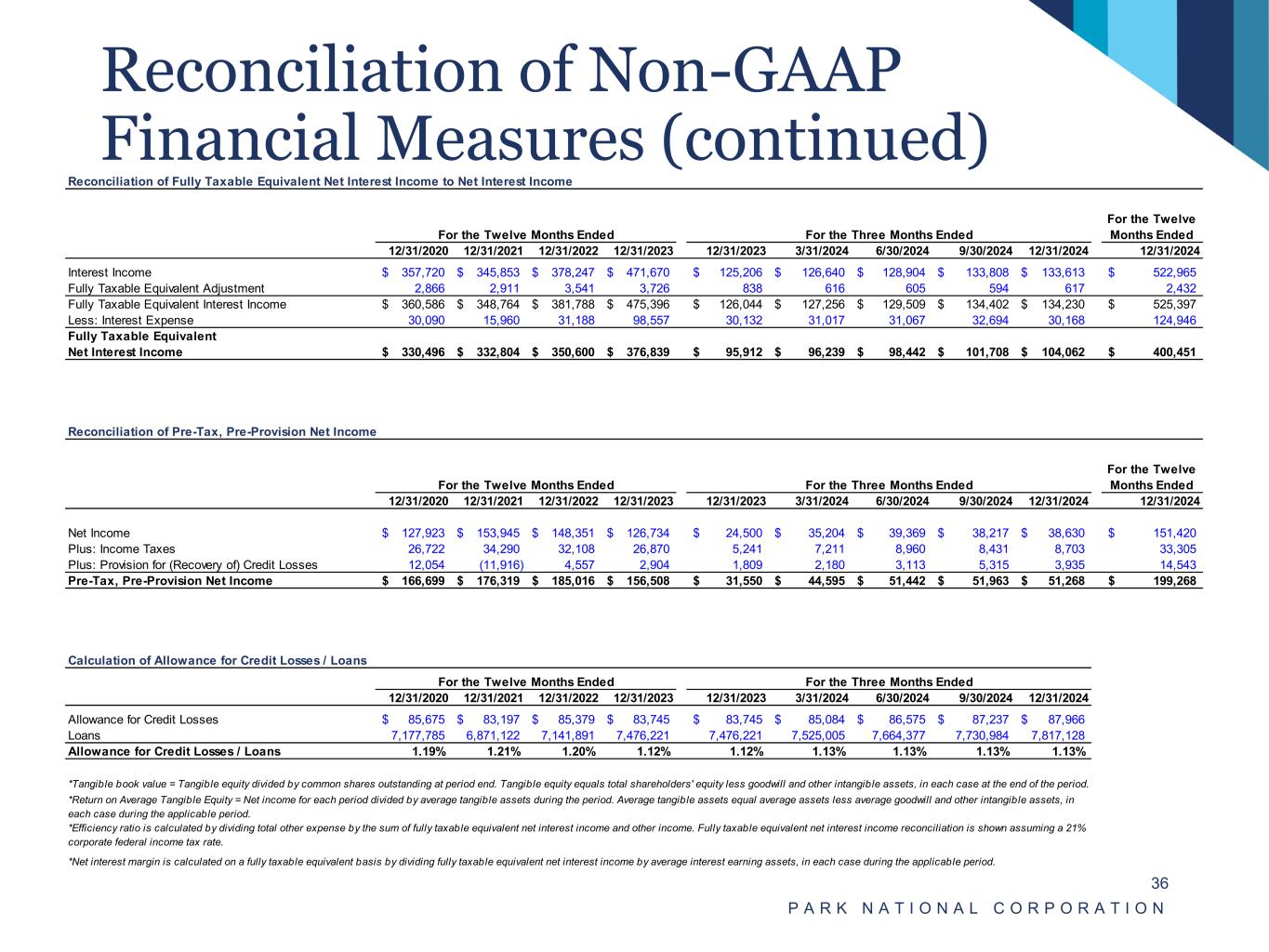

Disclaimer Non-GAAP Financial Measures This presentation contains certain financial information determined by methods other than in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Management believes that the disclosure of these “non-GAAP” financial measures presents additional information which, when read in conjunction with Park’s consolidated financial statements prepared in accordance with GAAP, assists in analyzing Park’s operating performance, ensures comparability of operating performance from period to period, and facilitates comparisons with the performance of Park’s peer financial holding companies, while eliminating certain non-operational effects of acquisitions. Additionally, Park believes this financial information is utilized by regulators and market analysts to evaluate a company’s financial condition, and therefore, such information is useful to investors. The non-GAAP financial measures should not be viewed as substitutes for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation from the most directly comparable GAAP financial measures to the non-GAAP financial measures used in this presentation is provided on pages 35 and 36 of this presentation. P A R K N A T I O N A L C O R P O R A T I O N 3

P A R K N A T I O N A L C O R P O R A T I O N Overview of Park National Corporation

Overview of Park National Corporation P A R K N A T I O N A L C O R P O R A T I O N 5 • Park’s bank subsidiary, The Park National Bank, is headquartered in Newark, Ohio and was founded in 1908. • $9.8 billion of total assets and $8.8 billion of assets under management(1) at December 31, 2024. • Park common shares are publicly traded under the symbol “PRK” on NYSE American. • Diversified revenue base with approximately 23.5% non- interest income to operating revenue(5) ratio for the twelve months ended December 31, 2024. • Diversified loan portfolio funded with customer deposits. • Below average historical net charge-offs relative to Proxy Peer Group. • Low-cost funding profile supports durable net interest margin and extended trend of stable operating results. • At June 30, 2024, Park’s average deposit market share was approximately 34% in Park’s six largest county markets in Ohio. (1) Market value of assets under management. (2) See “Reconciliation of Non-GAAP Financial Measures” shown on pages 35 and 36. (3) NPAs exclude accruing troubled debt restructuring loans and loans 90+ days past due. (4) Net interest margin shown on a fully taxable equivalent basis assuming a 21% corporate federal income tax rate. (5) Definitions: TE – Tangible Equity; TA – Tangible Assets; ACL – Allowance for Credit Losses; NPA – Non-Performing Assets, ROAA – Return on Average Assets; ROATE – Return on Average Tangible Equity; Operating Revenue = Non-Interest Income + Net Interest Income (6) For the purpose of calculating the annualized return on average tangible equity, a non-U.S. GAAP financial measure, net income for each period is divided by average tangible equity during the period. Note: Financial data as of December 31, 2024 unless otherwise noted; Source: S&P Global Market Intelligence. Company Overview $ in millions 12/31/2022 12/31/2023 12/31/2024 Total Assets 9,855$ 9,837$ 9,805$ Total Loans (Gross) 7,142 7,476 7,817 Total Deposits 8,235 8,043 8,144 Total Shareholders' Equity 1,069 1,145 1,244 Total Equity / Total Assets 10.85% 11.64% 12.69% TE / TA (2) (5) 9.33% 10.14% 11.21% ACL / Loans (5) 1.20% 1.12% 1.13% NPAs / Total Assets (3) (5) 0.82% 0.62% 0.70% Net Interest Margin (4) 3.80% 4.11% 4.41% ROAA (5) 1.48% 1.27% 1.53% Return on Average Equity 13.78% 11.55% 12.65% ROATE (2) (5) (6) 16.29% 13.60% 14.65% Year Ended

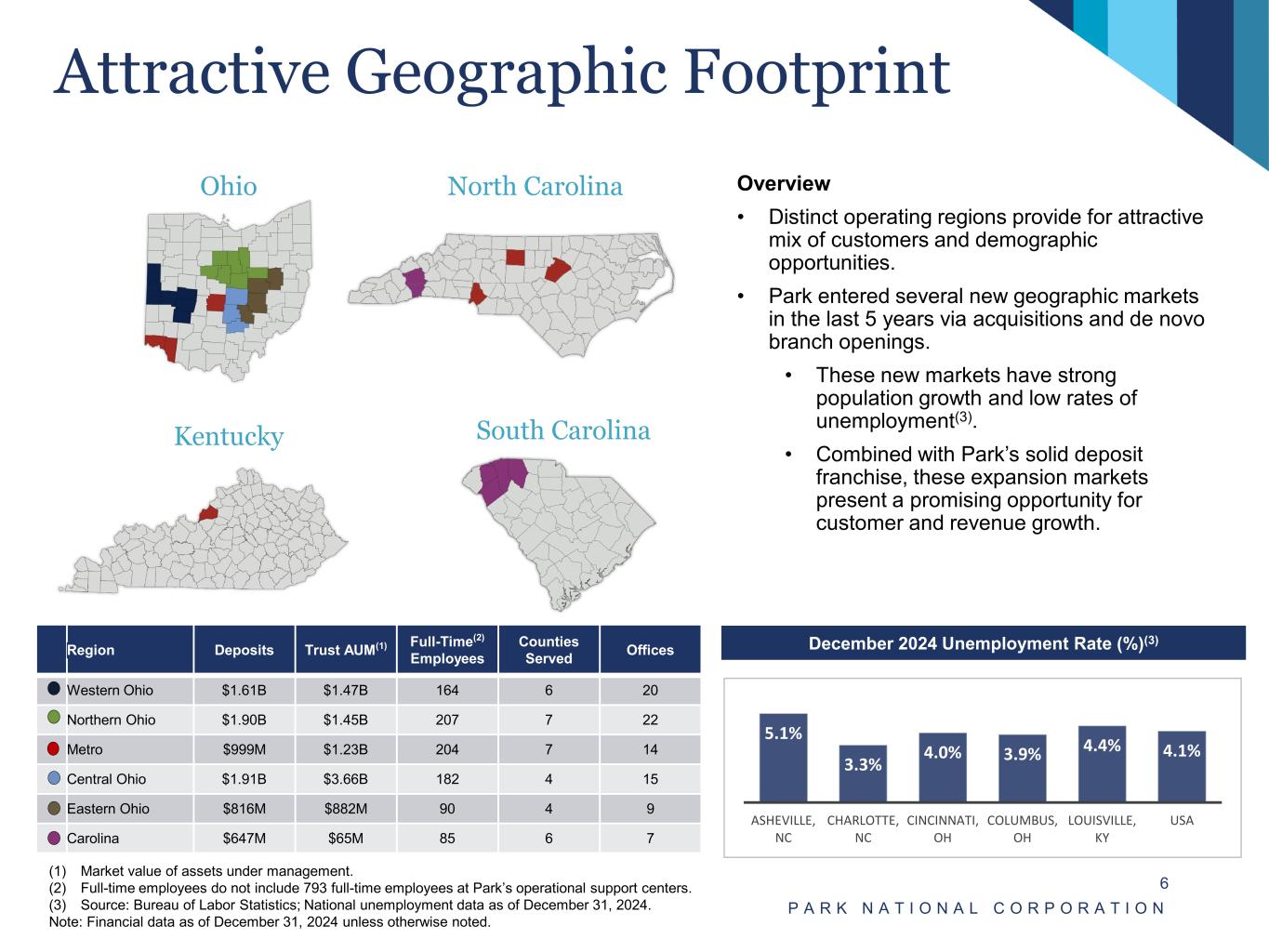

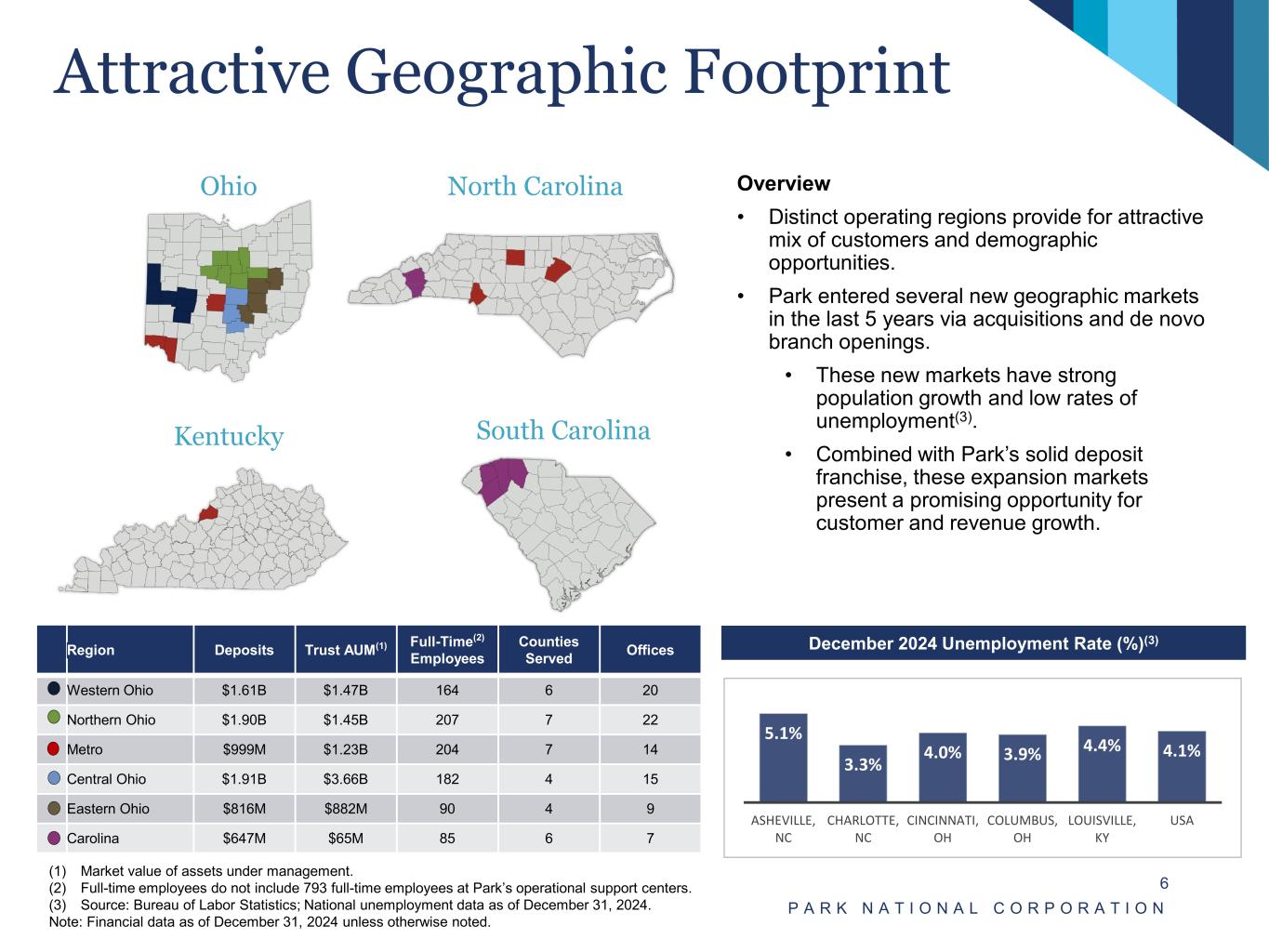

Attractive Geographic Footprint P A R K N A T I O N A L C O R P O R A T I O N 6 Ohio North Carolina South CarolinaKentucky Region Deposits Trust AUM(1) Full-Time(2) Employees Counties Served Offices Western Ohio $1.61B $1.47B 164 6 20 Northern Ohio $1.90B $1.45B 207 7 22 Metro $999M $1.23B 204 7 14 Central Ohio $1.91B $3.66B 182 4 15 Eastern Ohio $816M $882M 90 4 9 Carolina $647M $65M 85 6 7 Overview • Distinct operating regions provide for attractive mix of customers and demographic opportunities. • Park entered several new geographic markets in the last 5 years via acquisitions and de novo branch openings. • These new markets have strong population growth and low rates of unemployment(3). • Combined with Park’s solid deposit franchise, these expansion markets present a promising opportunity for customer and revenue growth. December 2024 Unemployment Rate (%)(3) (1) Market value of assets under management. (2) Full-time employees do not include 793 full-time employees at Park’s operational support centers. (3) Source: Bureau of Labor Statistics; National unemployment data as of December 31, 2024. Note: Financial data as of December 31, 2024 unless otherwise noted. 5.1% 3.3% 4.0% 3.9% 4.4% 4.1% ASHEVILLE, NC CHARLOTTE, NC CINCINNATI, OH COLUMBUS, OH LOUISVILLE, KY USA

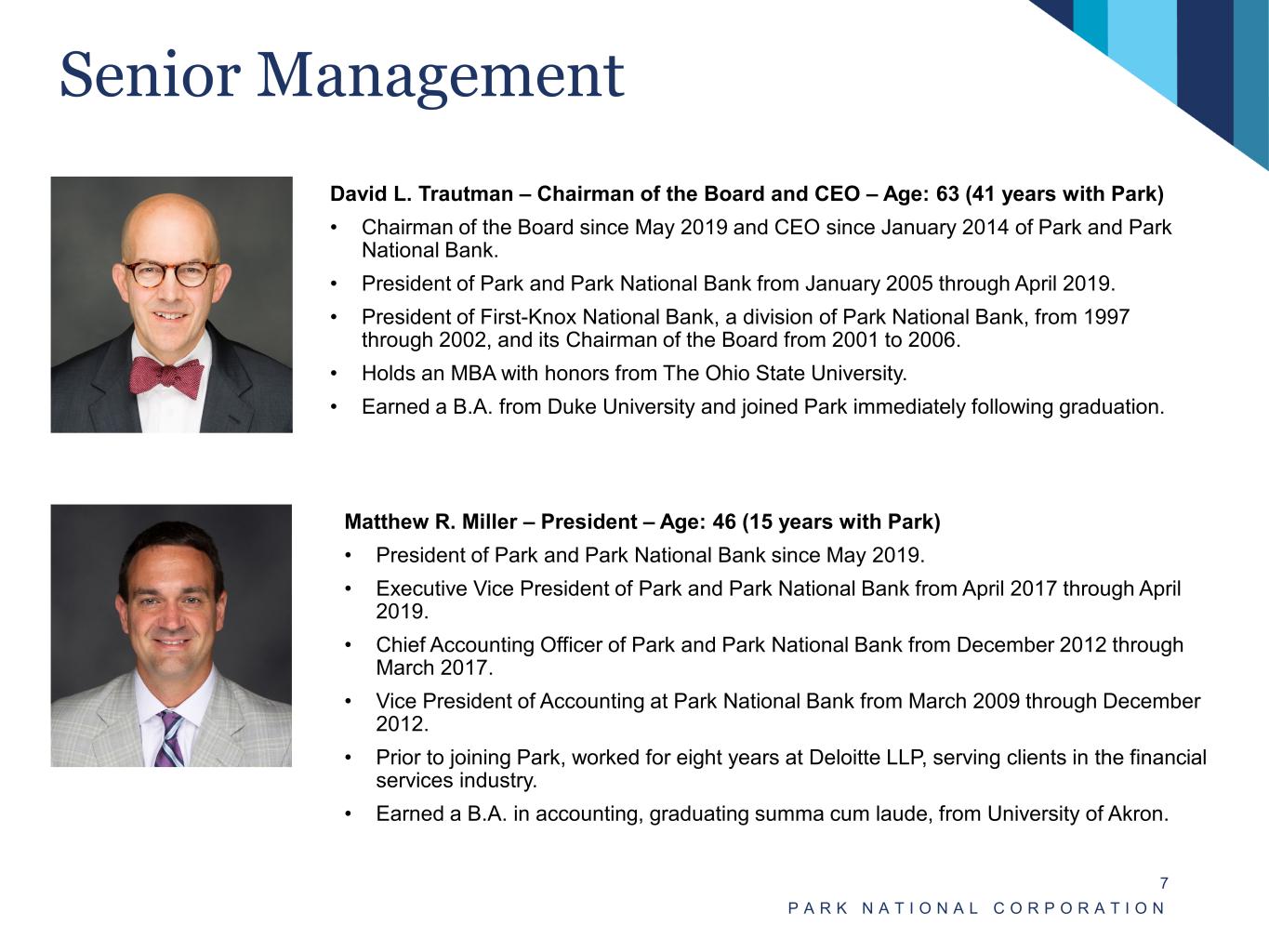

Senior Management P A R K N A T I O N A L C O R P O R A T I O N 7 David L. Trautman – Chairman of the Board and CEO – Age: 63 (41 years with Park) • Chairman of the Board since May 2019 and CEO since January 2014 of Park and Park National Bank. • President of Park and Park National Bank from January 2005 through April 2019. • President of First-Knox National Bank, a division of Park National Bank, from 1997 through 2002, and its Chairman of the Board from 2001 to 2006. • Holds an MBA with honors from The Ohio State University. • Earned a B.A. from Duke University and joined Park immediately following graduation. Matthew R. Miller – President – Age: 46 (15 years with Park) • President of Park and Park National Bank since May 2019. • Executive Vice President of Park and Park National Bank from April 2017 through April 2019. • Chief Accounting Officer of Park and Park National Bank from December 2012 through March 2017. • Vice President of Accounting at Park National Bank from March 2009 through December 2012. • Prior to joining Park, worked for eight years at Deloitte LLP, serving clients in the financial services industry. • Earned a B.A. in accounting, graduating summa cum laude, from University of Akron.

Senior Management (continued) P A R K N A T I O N A L C O R P O R A T I O N 8 Brady T. Burt – Chief Financial Officer – Age: 52 (17 years with Park) • Chief Financial Officer of Park and Park National Bank since December 2012. • Chief Accounting Officer of Park and Park National Bank from April 2007 to December 2012. • Worked at Vail Banks, Inc. in various capacities from 2002 to 2006, including as CFO. • Earned a B.S. in accounting from Miami University. • Member of Board of Directors of Federal Home Loan Bank of Cincinnati, serving on each of the Audit Committee (which he has chaired since January 1, 2021) and the Risk Committee. • Member of Board of Trustees of Central Ohio Technical College since October 2024.

Experienced Management Team • Park National Bank’s management team consists of leaders with deep market knowledge. • The management team averages 26 years of banking experience. • The average team tenure with Park National Bank is approximately 19 years. P A R K N A T I O N A L C O R P O R A T I O N 9 Name Position Age Years with PNB Years in Industry Todd M. Bogdan Chief Operations Officer 56 8 36 Adrienne M. Brokaw Chief Auditor 57 11 25 Bryan M. Campolo Chief Credit Officer 40 18 18 Thomas M. Cummiskey Chief Wealth & Trust Officer 55 25 27 Malory Dcosta Chief Information Officer 51 2 21 Mark H. Miller Corporate Services Director 43 8 8 Cheryl L. Snyder Chief Retail Lending Officer 68 45 47 Laura F. Tussing Chief Banking Officer/Regional Banking Director 43 20 20 Jeffrey A. Wilson Chief Risk Officer 58 20 28

• Strong history of operating in Park’s regional bank model. • To better align its branch network with banking trends, Park National Bank consolidated 23 branch offices (approximately 20% of then existing) in 2020. • Proximity to other branches and few competitors in impacted markets reduced the risk of attrition. • Below average transaction volume at impacted branches. • On October 23, 2023, Park announced the consolidation of 12 branch offices, 3 relocations and 2 new market locations, all of which are in Ohio. • Park continues to analyze its remaining branch network (geography, demographics, transaction volume, etc.) to identify sensible branch optimization opportunities. • Separate presidents and advisory boards, consisting of leaders with deep local market knowledge. • Regional leadership team averages approximately 28 years of banking experience and 19 years of leadership tenure with Park. P A R K N A T I O N A L C O R P O R A T I O N 10 Community Banking Regions Name Position Age Years with PNB Years in Industry John A. Brown President - Western Ohio Region 55 33 33 Bryant W. Fox Market President - Cincinnati 36 12 12 Chris R. Hiner President - Northern Ohio Region & Director of Home Lending 41 19 19 W. Andrew Holden Market President - Louisville 50 6 28 Tim J. Ignasher Market President - Charlotte 63 8 34 John D. Kimberly President - Carolina Region 60 17 38 Patrick L. Nash President - Eastern Ohio Region 60 37 37 Laura F. Tussing President - Central Ohio Region 43 20 20 Brady E. Waltz Market President - Columbus 53 17 31

Preparation to Cross $10 Billion in Assets • Since Q3 2020, Park has been strategically managing the balance sheet size to stay under $10 billion in assets(1) using one-way sell deposits and other balance sheet strategies. • In Q3 2022, Park engaged Promontory (third-party professional services firm) to assess Park’s preparedness as it relates to regulatory expectations that typically present themselves when banks cross $10 billion in assets. • From Q3 2022 to present, Park continues to invest in people, processes and technology to better prepare for the enhanced regulatory expectations. • Park believes that it is well positioned for increased regulatory expectations in the event assets exceed $10 billion, whether by acquisition, merger or organically. P A R K N A T I O N A L C O R P O R A T I O N 11 (1) Park crossed $10 billion in assets two times since then, once on September 30, 2021, and again on September 30, 2023.

Park M&A Strategy Two-prong strategy guidelines: 1. Traditional M&A • Strong franchise, good reputation and asset quality • Competitive market share • Continuity of management and leadership • Traditional community bank structure • Sticky, low-cost core deposits • Disciplined approach to pricing and diligence 2. Metro Strategy • Certain attractive markets in the Midwest, Southeast, and Mid-Atlantic regions • De novo branching – mirror successful Columbus, Ohio and Louisville, Kentucky de novo offices • Partner with banks that have the following characteristics: • Consistent loan growth • Acceptable asset quality • Existing trust and wealth management business, or the potential to grow the business in those areas • Commercial focus with potential to grow consumer • Proven leadership team P A R K N A T I O N A L C O R P O R A T I O N 12

P A R K N A T I O N A L C O R P O R A T I O N Financial Summary

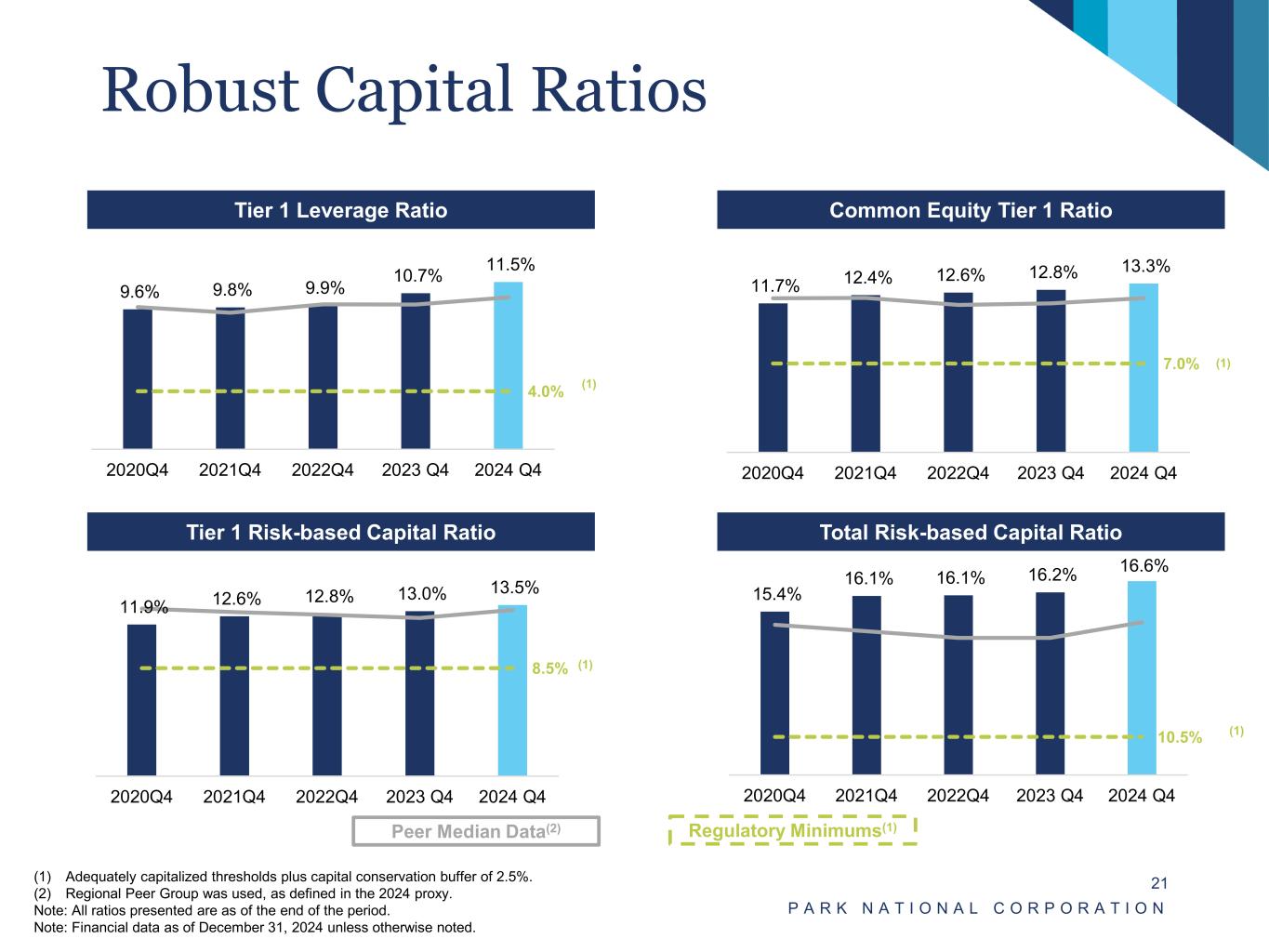

2024 Fourth Quarter Highlights P A R K N A T I O N A L C O R P O R A T I O N 14 • Park’s Consolidated Capital Ratios at December 31, 2024: – Total Shareholders’ Equity to Total Assets of 12.69% – Tangible Common Equity to Tangible Assets of 11.21%(1) – Leverage Ratio of 11.51% – Total Risk-Based Capital Ratio of 16.63% • Book value per common share grew to $76.98 at December 31, 2024 from $76.74 at September 30, 2024. • Tangible book value per common share(1) grew to $66.89 at December 31, 2024 from $66.62 at September 30, 2024. • Net income was reported at $38.6 million for Q4 2024 compared to $38.2 million for Q3 2024. • Net interest margin increased to 4.51% at December 31, 2024 from 4.45% at September 30, 2024, quarter to date. This improvement is a function of Park’s strong funding base. • Pre-tax, pre-provision net income (“PTPP”)(1) was reported at $51.3 million for Q4 2024 compared to $52.0 million for Q3 2024 • Provision for credit losses of $3.9 million for Q4 2024 compared to $5.3 million for Q3 2024. • Loans grew to $7.82 billion at December 31, 2024 from $7.73 billion at September 30, 2024. • ACL / Loans remained unchanged at 1.13% for both December 31, 2024 and September 30, 2024. Park Performance Summary (1) (1) See “Reconciliation of Non-GAAP Financial Measures” shown on pages 35 and 36.

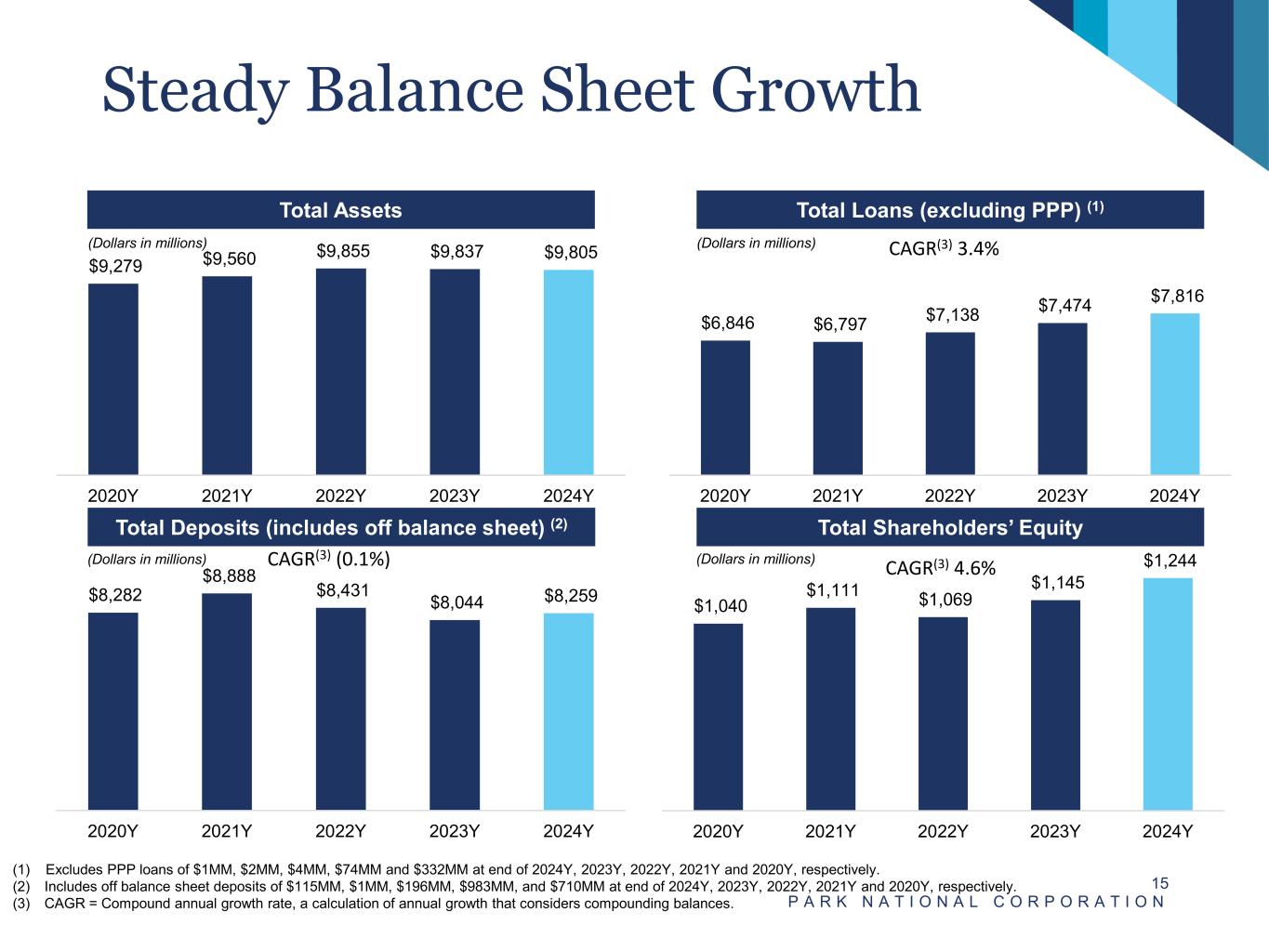

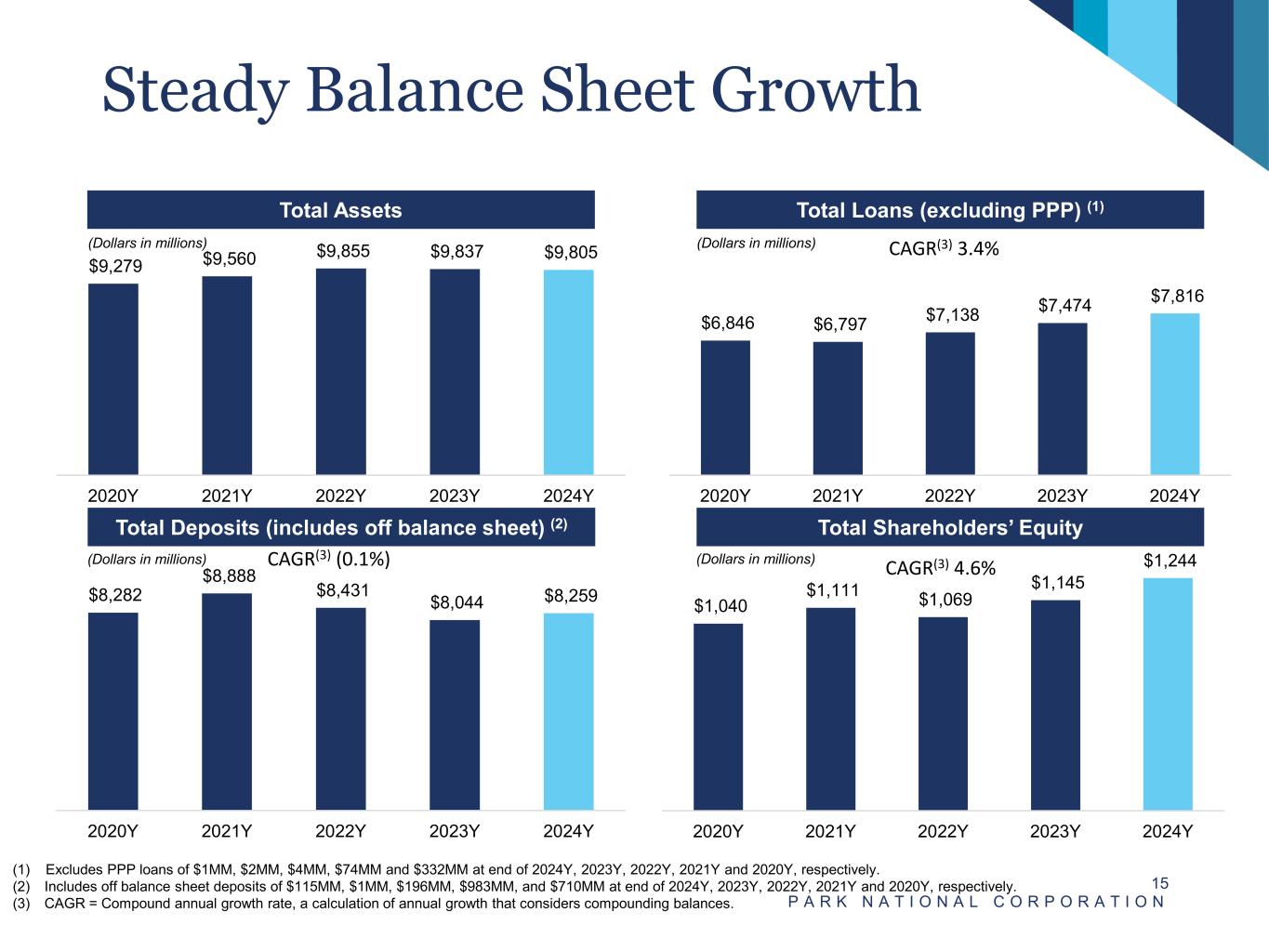

Steady Balance Sheet Growth P A R K N A T I O N A L C O R P O R A T I O N 15 Total Assets Total Loans (excluding PPP) (1) Total Deposits (includes off balance sheet) (2) Total Shareholders’ Equity (Dollars in millions) (Dollars in millions) (Dollars in millions) (Dollars in millions) (1) Excludes PPP loans of $1MM, $2MM, $4MM, $74MM and $332MM at end of 2024Y, 2023Y, 2022Y, 2021Y and 2020Y, respectively. (2) Includes off balance sheet deposits of $115MM, $1MM, $196MM, $983MM, and $710MM at end of 2024Y, 2023Y, 2022Y, 2021Y and 2020Y, respectively. (3) CAGR = Compound annual growth rate, a calculation of annual growth that considers compounding balances. CAGR(3) 3.4% CAGR(3) (0.1%) CAGR(3) 4.6% $9,279 $9,560 $9,855 $9,837 $9,805 2020Y 2021Y 2022Y 2023Y 2024Y $6,846 $6,797 $7,138 $7,474 $7,816 2020Y 2021Y 2022Y 2023Y 2024Y $1,040 $1,111 $1,069 $1,145 $1,244 2020Y 2021Y 2022Y 2023Y 2024Y $8,282 $8,888 $8,431 $8,044 $8,259 2020Y 2021Y 2022Y 2023Y 2024Y

Efficiency Ratio & Non-Int. Exp. / Avg. Assets(1) Strong Earnings P A R K N A T I O N A L C O R P O R A T I O N 16 (Dollars in millions) Net Income, ROAA & ROATE(1) Non-Interest Income / Operating Revenue (2) Pre-Tax, Pre-Provision Net Income / Avg. Assets(1) (1) See Reconciliation of Non-GAAP Financial Measures shown on pages 35 and 36. (2) The decrease of non-interest income for 2023 includes a loss on sale of debt securities of $7.9MM. (Dollars in millions) (Dollars in millions) $153.9$153.9 62.8% 61.3% 61.2% 65.9% 61.4% 3.10% 2.88% 2.97% 3.11% 3.25% 2020Y 2021Y 2022Y 2023Y 2024Y Efficiency Ratio Non-Int. Exp. / Avg. Assets $127.9 $153.9 $148.4 $126.7 $151.4 1.4% 1.6% 1.5% 1.3% 1.5% 15.3% 17.2% 16.3% 13.6% 14.7% – $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 2020Y 2021Y 2022Y 2023Y 2024Y – 4.0% 8.0% 12.0% 16.0% 20.0% Net Income ROAA ROATE $166.7 $176.3 $185.0 $156.5 $199.3 1.80% 1.79% 1.84% 1.57% 2.01% – $20 .0 $40 .0 $60 .0 $80 .0 $10 0.0 $12 0.0 $14 0.0 $16 0.0 $18 0.0 $20 0.0 1.0 0% 1.2 0% 1.4 0% 1.6 0% 1.8 0% 2.0 0% 2.2 0% 2020Y 2021Y 2022Y 2023Y 2024Y PPNR PPNR/Avg. Assets $125.7 $129.9 $135.9 $92.6 $122.6 $327.6 $329.9 $347.1 $373.1 $398.0 27.7% 28.3% 28.1% 19.9% 23.5% 2020Y 2021Y 2022Y 2023Y 2024Y Net Interest Income Non-Interest Income Non-Interest Income / Op. Rev.

Stable Net Interest Margin P A R K N A T I O N A L C O R P O R A T I O N 17 Asset Yields, Liability Costs, and Net Interest Margin(1) (1) Net interest margin shown on an annualized, fully taxable equivalent basis assuming a 21% corporate federal income tax rate. See “Reconciliation of Non-GAAP Financial Measures” shown on pages 35 and 36. 3.86% 4.14% 5.18% 5.66% 5.78% 5.88% 5.82% 3.69% 3.80% 4.11% 4.28% 4.39% 4.45% 4.51% 0.28% 0.54% 1.67% 2.08% 2.10% 2.15% 1.99% 0.12% 0.39% 1.52% 1.94% 1.99% 2.06% 1.90% FY2021 FY2022 FY2023 2024Q1 2024Q2 2024Q3 2024Q4 Interest Earning Asset Yield (%) Net Interest Margin (%) Interest Bearing Liability Cost (%) Interest Bearing Deposit Cost (%)

Diverse Fee Income P A R K N A T I O N A L C O R P O R A T I O N 18 Overview • The business lines responsible for generating the majority of fee income are trust and wealth management, mortgage banking, and retail banking (interchange fees). • Diversified revenue base with approximately 23.5% non-interest income to operating revenue ratio for the twelve-month period ended December 31, 2024. • Anchored by wealth management business line, at December 31, 2024 had aggregate assets under management of $8.8 billion(1). Sources of Non-Interest Income 2024 Non-Interest Income / Operating Revenue (1) Market value of assets under management. (2) Fluctuations driven heavily by increased mortgage fees in 2020 and 2021 due to increased mortgage originations. 2022 included $12.0MM of OREO valuation markups and $5.6MM of OREO gains related to Vision Bank. 2023 included a loss on sale of debt securities of $7.9MM. 2024 included a pension settlement gain of $6.1MM and a 19.8 increase from wealth management compared to the prior year. Note: Financial data as of December 31, 2024 unless otherwise noted. (Dollars in millions) (2) Fiduciary Activities 35% Service Charges 7% Other Service Income 10% Interchange Income 21% BOLI 6% Other Fee Income 21% $125.7 $129.9 $135.9 $92.6 $122.6 $327.6 $329.9 $347.1 $373.1 $398.0 27.7% 28.3% 28.1% 19.9% 23.5% 2020Y 2021Y 2022Y 2023Y 2024Y Net Interest Income Non-Interest Income Non-Interest Income / Op. Rev.

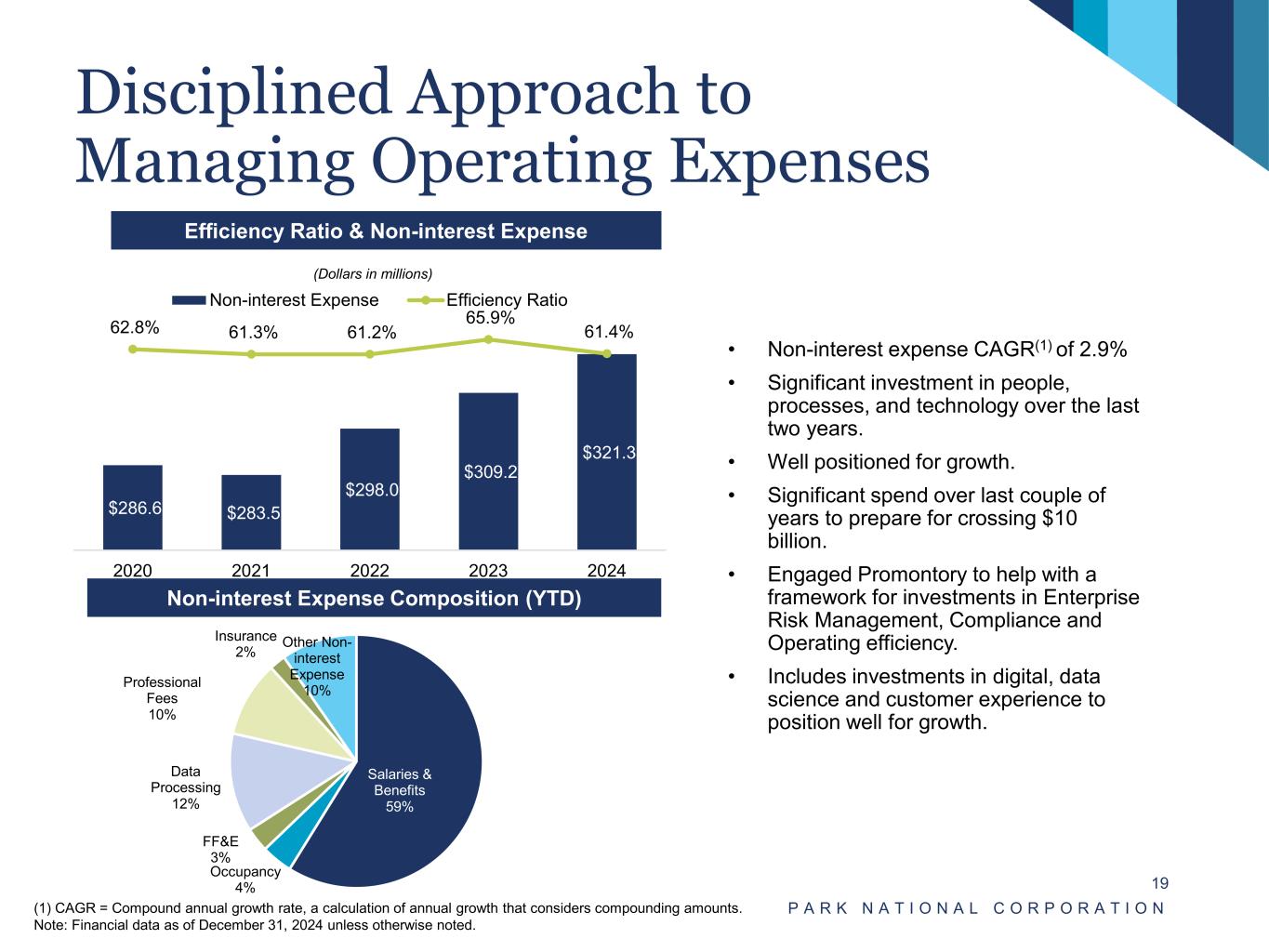

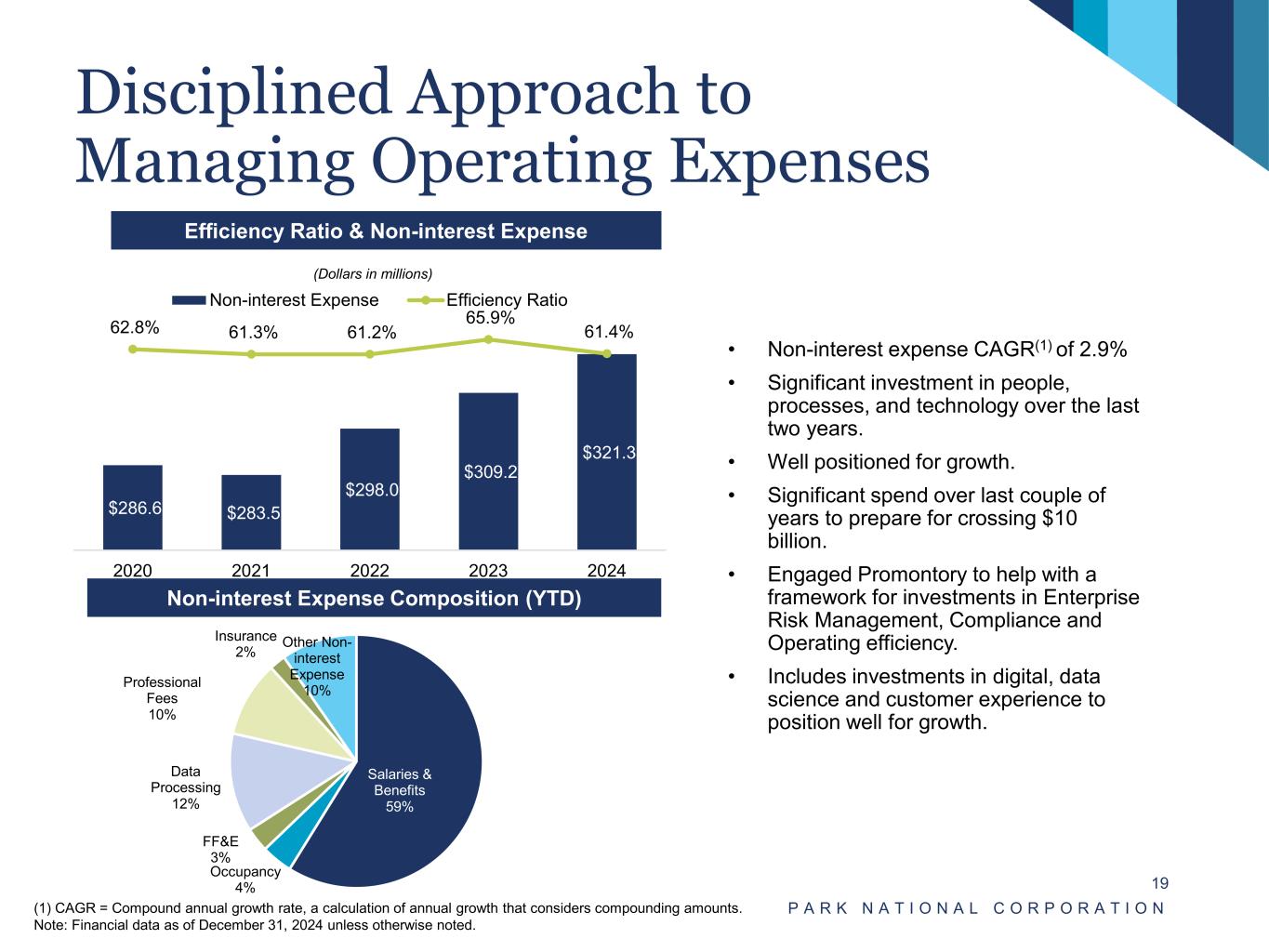

Disciplined Approach to Managing Operating Expenses P A R K N A T I O N A L C O R P O R A T I O N 19 Efficiency Ratio & Non-interest Expense Non-interest Expense Composition (YTD) (1) CAGR = Compound annual growth rate, a calculation of annual growth that considers compounding amounts. Note: Financial data as of December 31, 2024 unless otherwise noted. (Dollars in millions) • Non-interest expense CAGR(1) of 2.9% • Significant investment in people, processes, and technology over the last two years. • Well positioned for growth. • Significant spend over last couple of years to prepare for crossing $10 billion. • Engaged Promontory to help with a framework for investments in Enterprise Risk Management, Compliance and Operating efficiency. • Includes investments in digital, data science and customer experience to position well for growth. $286.6 $283.5 $298.0 $309.2 $321.3 62.8% 61.3% 61.2% 65.9% 61.4% 2020 2021 2022 2023 2024 Non-interest Expense Efficiency Ratio Salaries & Benefits 59% Occupancy 4% FF&E 3% Data Processing 12% Professional Fees 10% Insurance 2% Other Non- interest Expense 10%

High Quality Capital Structure 99% of Park’s Tier 1 Capital is Common Equity P A R K N A T I O N A L C O R P O R A T I O N 20 Common Equity Tier 1 Trust Preferred Receives full Tier 1 Capital treatment Subordinated Notes and Allowance for Credit Losses Tier 1 Capital $1,140.5 million Tier 2 Capital $268.5 million *Subdebt coupon rate is 4.50% and the first call date is 9/1/2025. Note: Financial data as of December 31, 2024 unless otherwise noted. ACL $93.8 Subdebt $174.7 Trust Preferred $15.0 Common Equity Tier 1 $1,125.5 1 Regulatory Capital at December 31, 2024 (Dollars in millions)

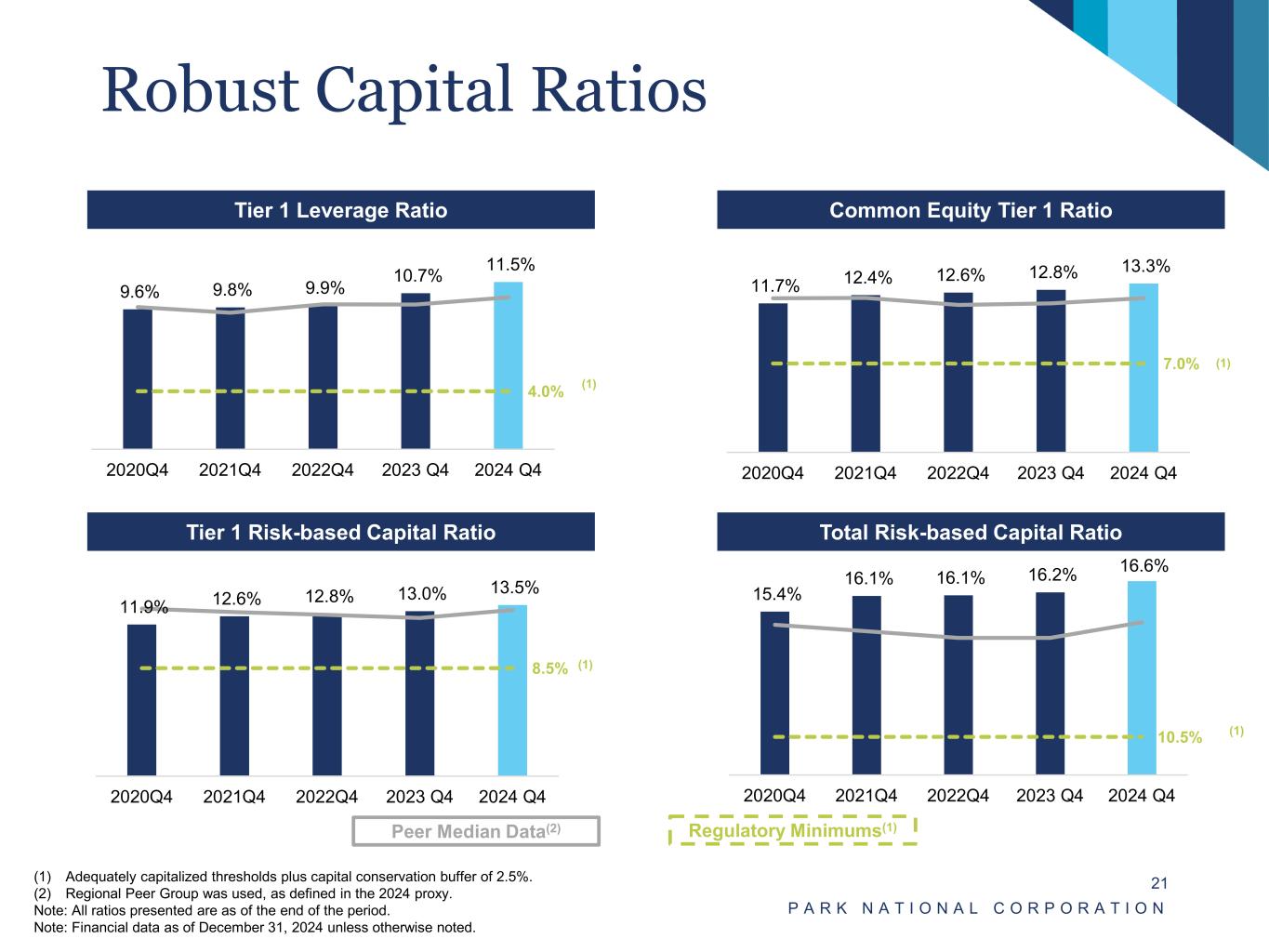

Robust Capital Ratios P A R K N A T I O N A L C O R P O R A T I O N 21(1) Adequately capitalized thresholds plus capital conservation buffer of 2.5%. (2) Regional Peer Group was used, as defined in the 2024 proxy. Note: All ratios presented are as of the end of the period. Note: Financial data as of December 31, 2024 unless otherwise noted. Tier 1 Leverage Ratio Common Equity Tier 1 Ratio Tier 1 Risk-based Capital Ratio Total Risk-based Capital Ratio Regulatory Minimums(1) (1) (1) (1) (1) Peer Median Data(2) 9.6% 9.8% 9.9% 10.7% 11.5% 4.0% – 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 2020Q4 2021Q4 2022Q4 2023 Q4 2024 Q4 11.7% 12.4% 12.6% 12.8% 13.3% 7.0% – 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 2020Q4 2021Q4 2022Q4 2023 Q4 2024 Q4 11.9% 12.6% 12.8% 13.0% 13.5% 8.5% – 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 2020Q4 2021Q4 2022Q4 2023 Q4 2024 Q4 15.4% 16.1% 16.1% 16.2% 16.6% 10.5% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 16.0% 17.0% 2020Q4 2021Q4 2022Q4 2023 Q4 2024 Q4

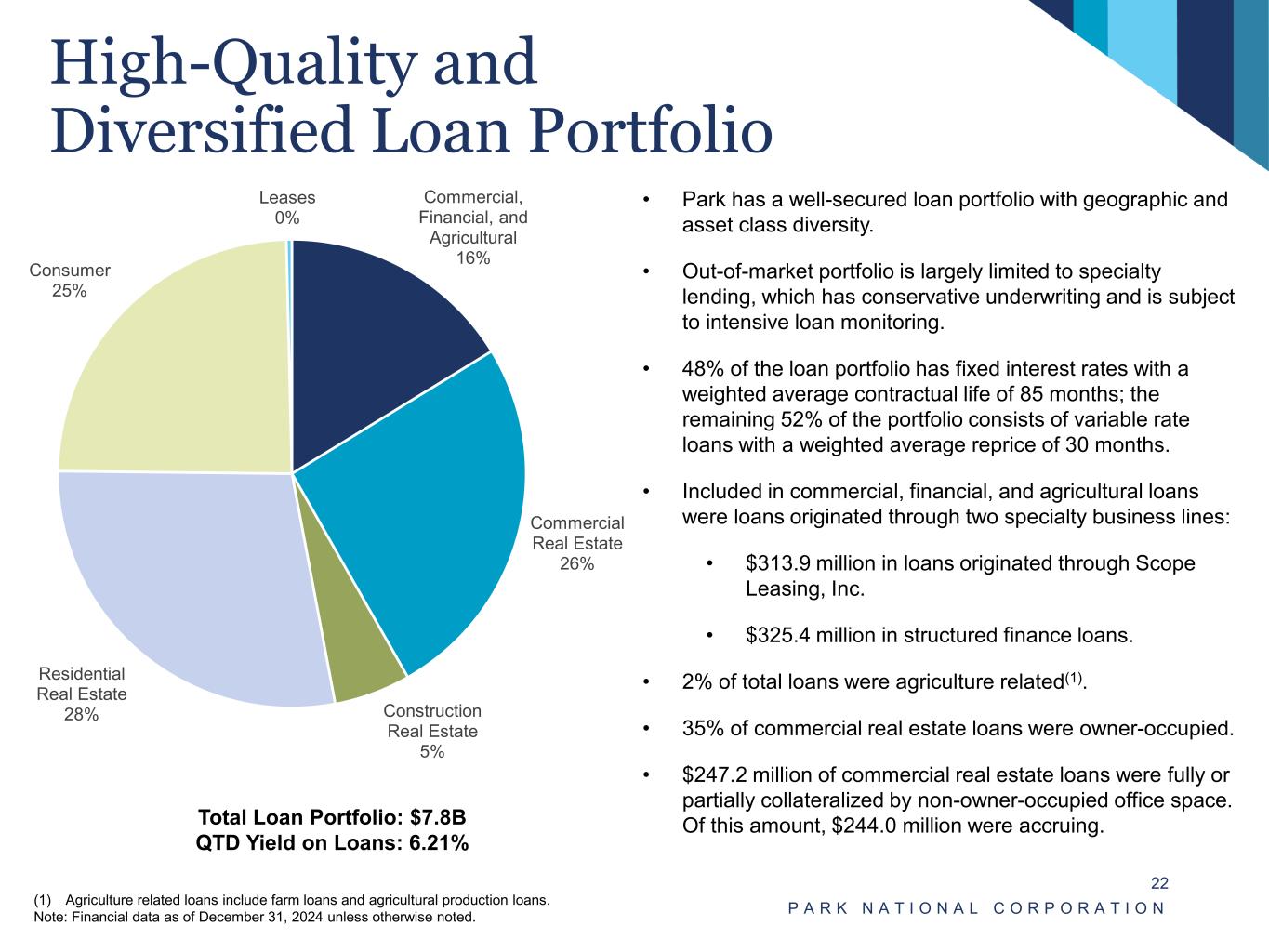

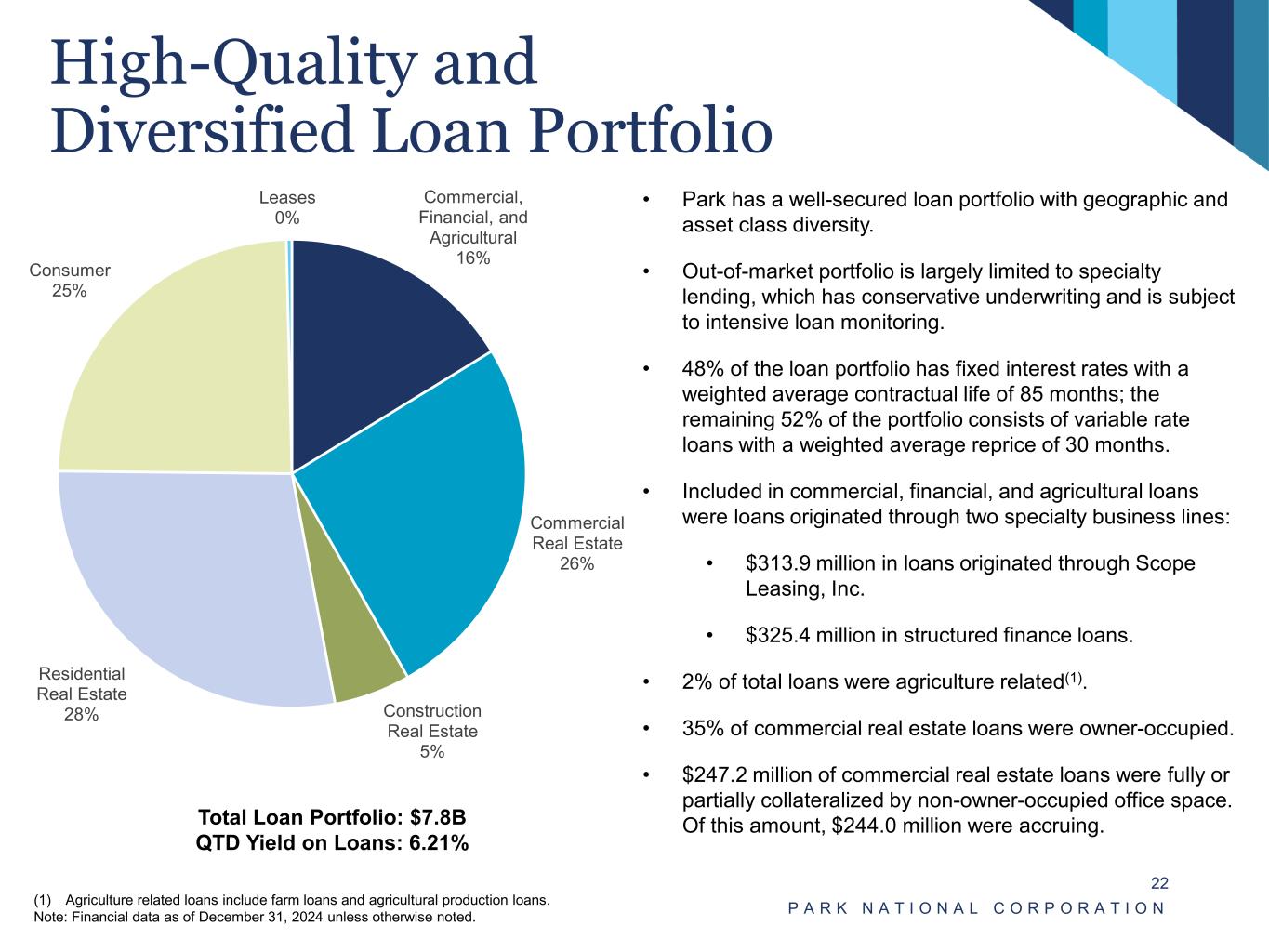

High-Quality and Diversified Loan Portfolio P A R K N A T I O N A L C O R P O R A T I O N 22 • Park has a well-secured loan portfolio with geographic and asset class diversity. • Out-of-market portfolio is largely limited to specialty lending, which has conservative underwriting and is subject to intensive loan monitoring. • 48% of the loan portfolio has fixed interest rates with a weighted average contractual life of 85 months; the remaining 52% of the portfolio consists of variable rate loans with a weighted average reprice of 30 months. • Included in commercial, financial, and agricultural loans were loans originated through two specialty business lines: • $313.9 million in loans originated through Scope Leasing, Inc. • $325.4 million in structured finance loans. • 2% of total loans were agriculture related(1). • 35% of commercial real estate loans were owner-occupied. • $247.2 million of commercial real estate loans were fully or partially collateralized by non-owner-occupied office space. Of this amount, $244.0 million were accruing.Total Loan Portfolio: $7.8B QTD Yield on Loans: 6.21% (1) Agriculture related loans include farm loans and agricultural production loans. Note: Financial data as of December 31, 2024 unless otherwise noted. Commercial, Financial, and Agricultural 16% Commercial Real Estate 26% Construction Real Estate 5% Residential Real Estate 28% Consumer 25% Leases 0%

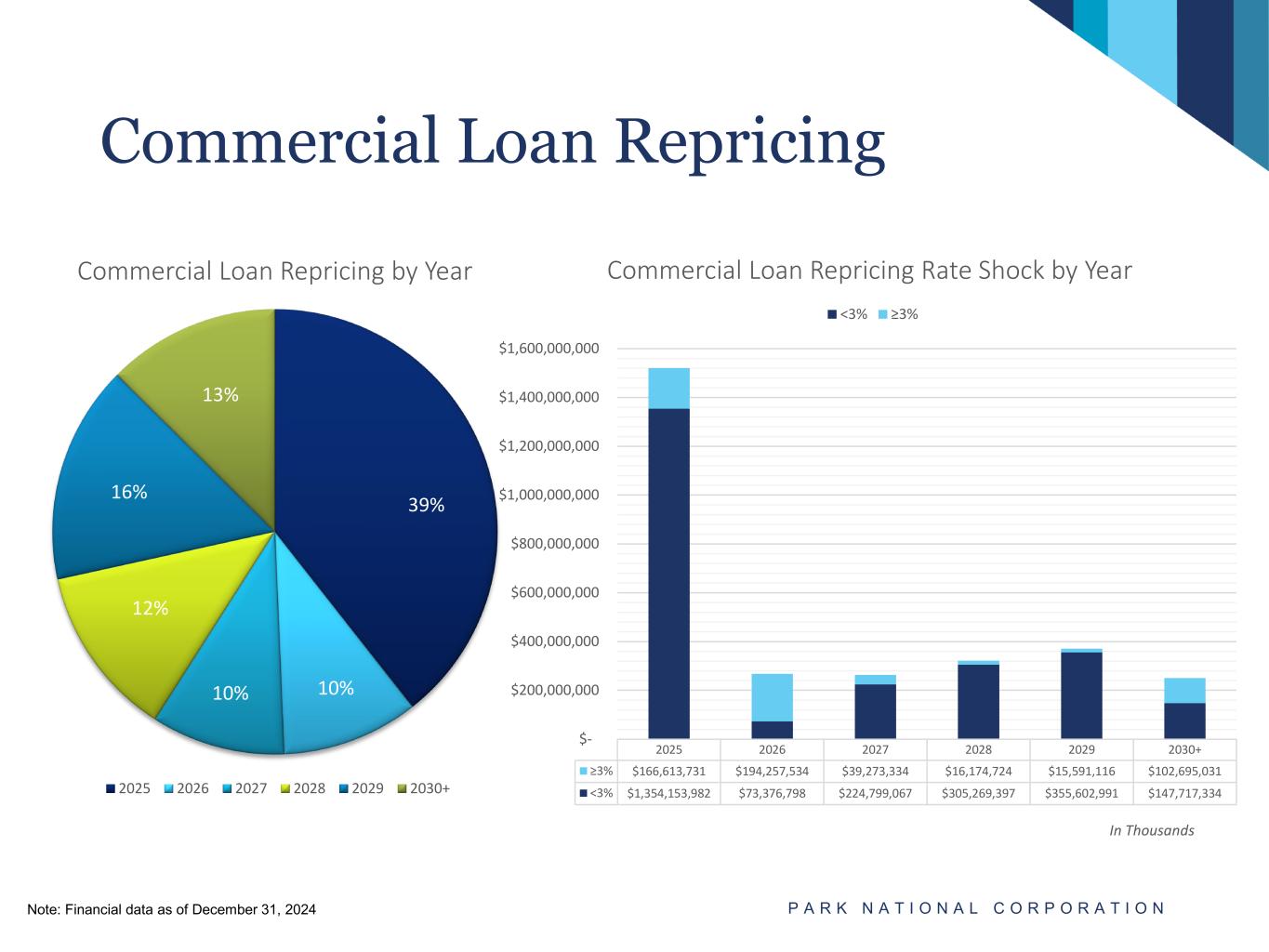

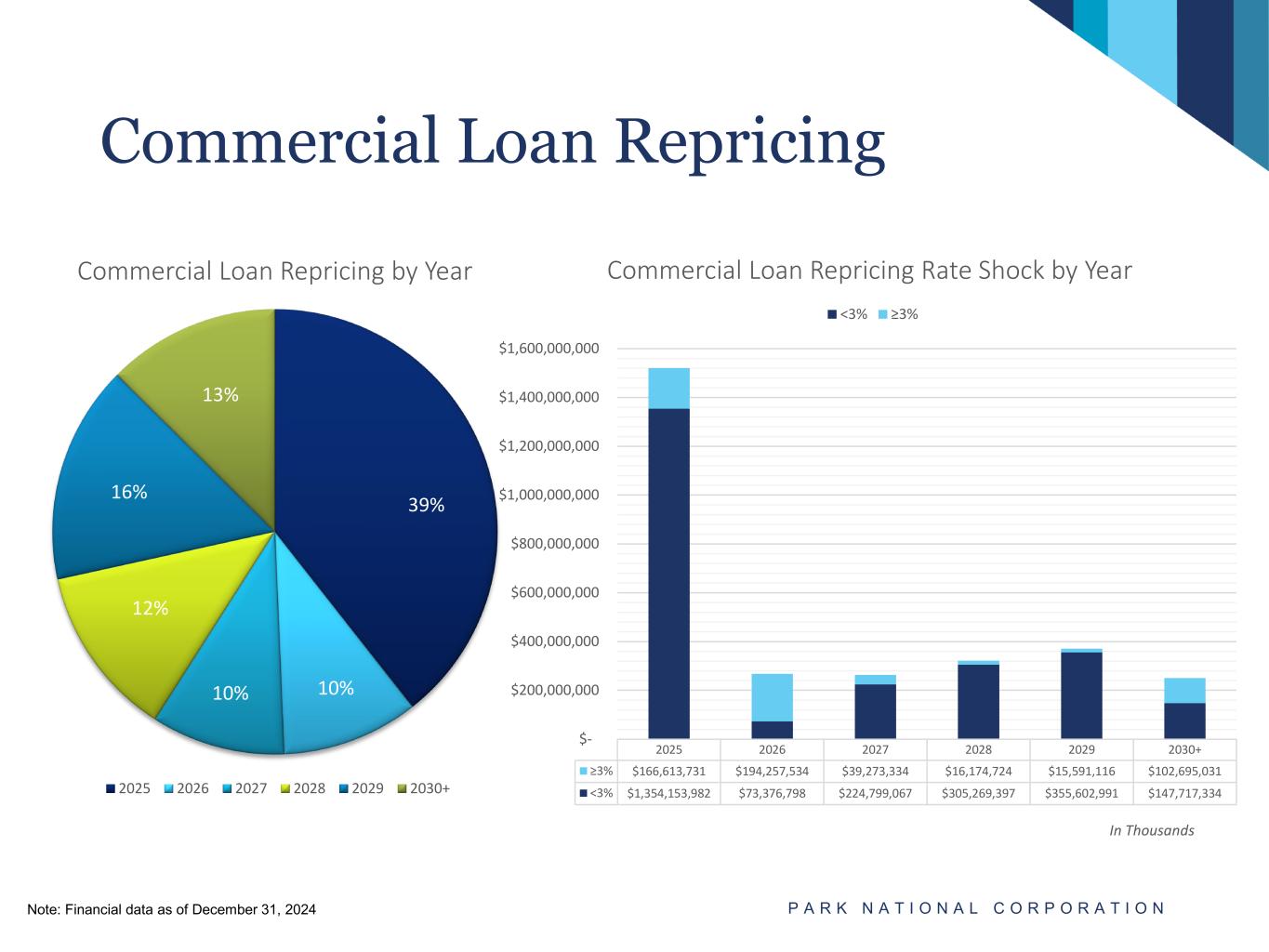

Commercial Loan Repricing P A R K N A T I O N A L C O R P O R A T I O N In Thousands 39% 10%10% 12% 16% 13% Commercial Loan Repricing by Year 2025 2026 2027 2028 2029 2030+ Note: Financial data as of December 31, 2024 2025 2026 2027 2028 2029 2030+ ≥3% $166,613,731 $194,257,534 $39,273,334 $16,174,724 $15,591,116 $102,695,031 <3% $1,354,153,982 $73,376,798 $224,799,067 $305,269,397 $355,602,991 $147,717,334 $- $200,000,000 $400,000,000 $600,000,000 $800,000,000 $1,000,000,000 $1,200,000,000 $1,400,000,000 $1,600,000,000 Commercial Loan Repricing Rate Shock by Year <3% ≥3%

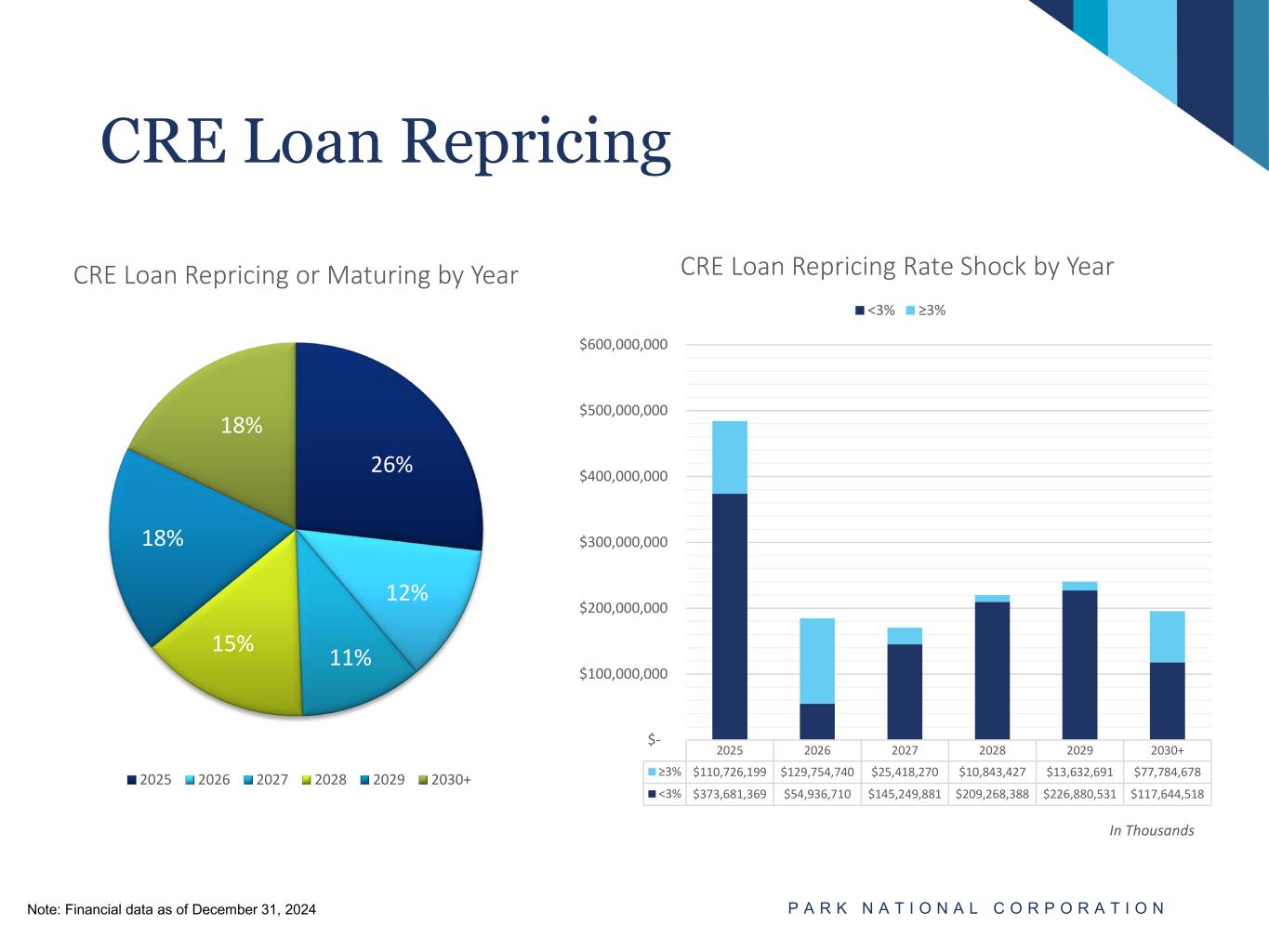

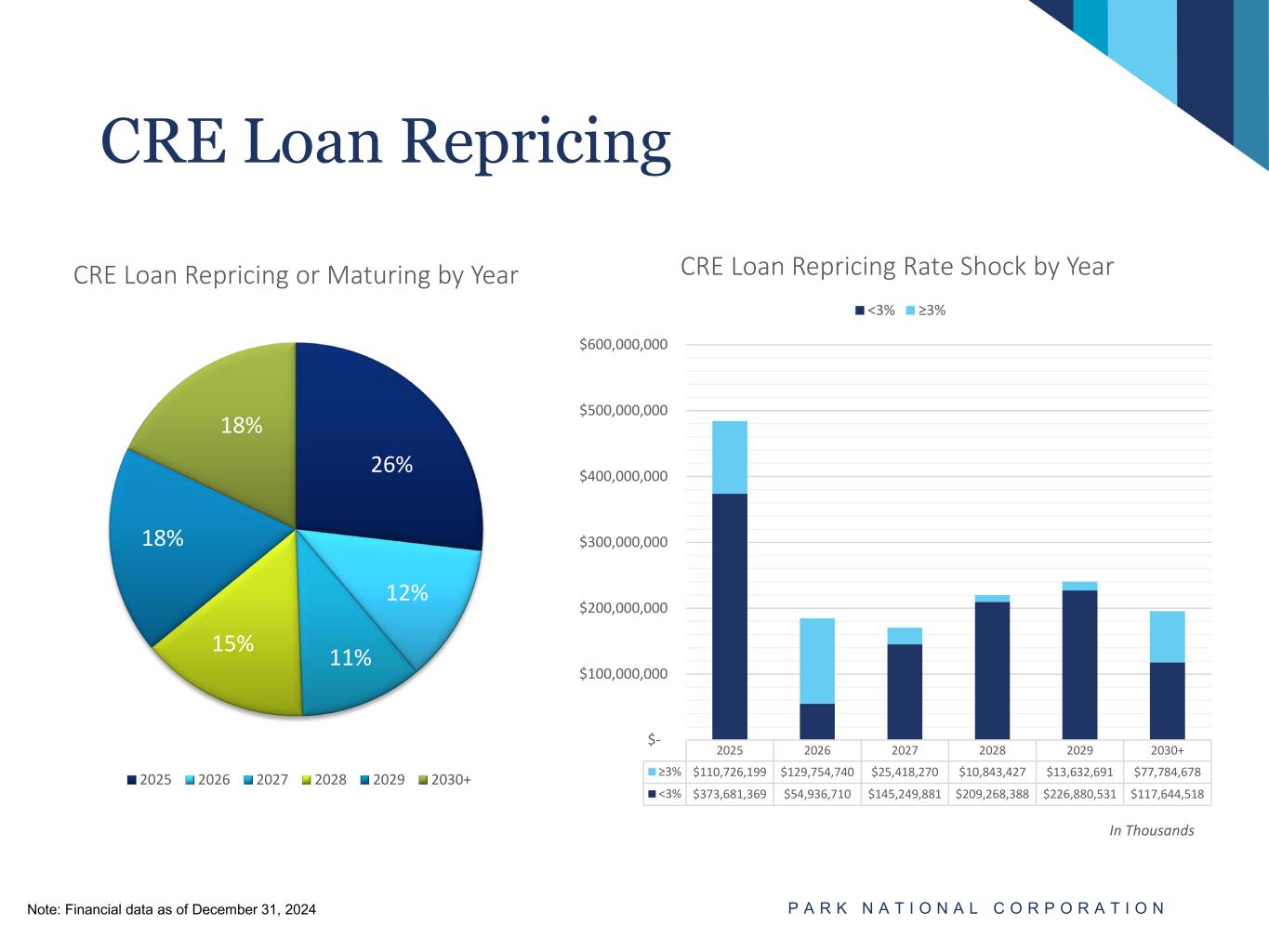

CRE Loan Repricing P A R K N A T I O N A L C O R P O R A T I O N In Thousands Note: Financial data as of December 31, 2024 26% 12% 11%15% 18% 18% CRE Loan Repricing or Maturing by Year 2025 2026 2027 2028 2029 2030+ 2025 2026 2027 2028 2029 2030+ ≥3% $110,726,199 $129,754,740 $25,418,270 $10,843,427 $13,632,691 $77,784,678 <3% $373,681,369 $54,936,710 $145,249,881 $209,268,388 $226,880,531 $117,644,518 $- $100,000,000 $200,000,000 $300,000,000 $400,000,000 $500,000,000 $600,000,000 CRE Loan Repricing Rate Shock by Year <3% ≥3%

Installment Lending Portfolio P A R K N A T I O N A L C O R P O R A T I O N 25 Note: Financial data as of December 31, 2024 • Park National Bank’s installment portfolio includes $1.8B of indirect loans and $184MM of direct loans. • Balances have steadily increased since first exceeding $1B in 2017. 52.09% 26.73% 14.96% 5.08% 0.64% 0.50% Installment Loan Portfolio by Credit Tier Premier (FICO 780+ A+ (FICO 740 - 779) A (FICO 710 - 739) B (FICO 680 - 709) C (FICO 641 - 679) D (FICO < 640) Pre-2019 2019 2020 2021 2022 2023 2024 Total Total 42,824,638 37,741,449 127,778,829 208,343,362 436,233,290 465,683,547 618,911,164 1,937,516,279 Premier (FICO 780+) 15,622,842 19,659,021 72,247,606 110,503,691 234,280,311 233,556,925 323,377,907 1,009,248,303 A+ (FICO 740 - 779) 12,306,619 10,660,820 31,927,525 55,494,281 116,330,629 125,798,088 165,445,824 517,963,786 A (FICO 710 - 739) 8,686,230 5,910,554 17,870,642 30,324,515 63,204,775 74,765,200 88,994,513 289,756,430 B (FICO 680 - 709) 4,535,137 1,227,994 4,724,935 9,994,056 18,786,007 25,483,063 33,585,421 98,336,614 C or D (FICO < 680) 1,673,810 283,060 1,008,121 2,026,819 3,631,567 6,080,271 7,507,499 22,211,147 - 100,000,000 200,000,000 300,000,000 400,000,000 500,000,000 600,000,000 700,000,000 800,000,000 ($ in 0 00 s) Installment Loan Balances by Origination Year/Credit Tier

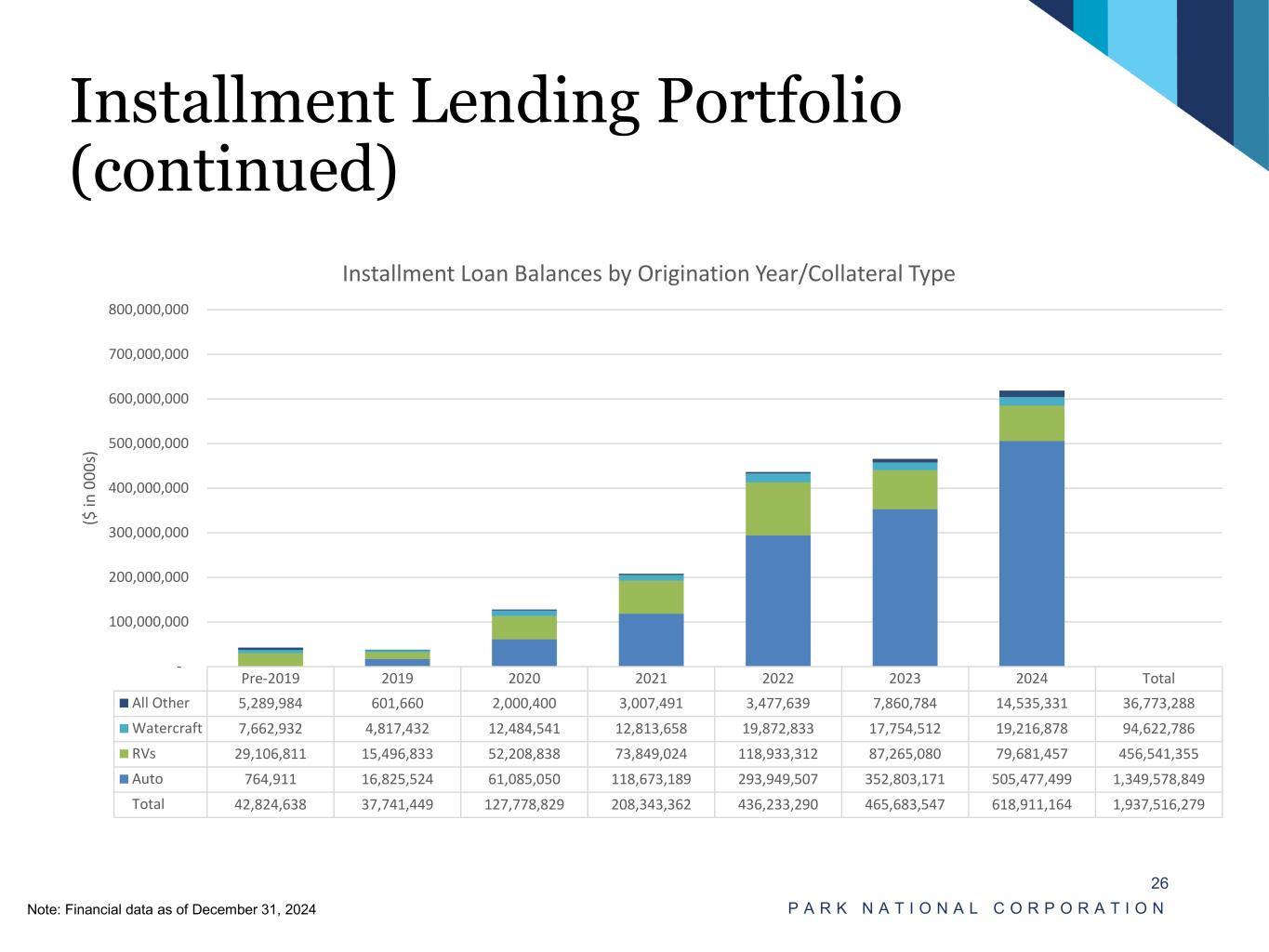

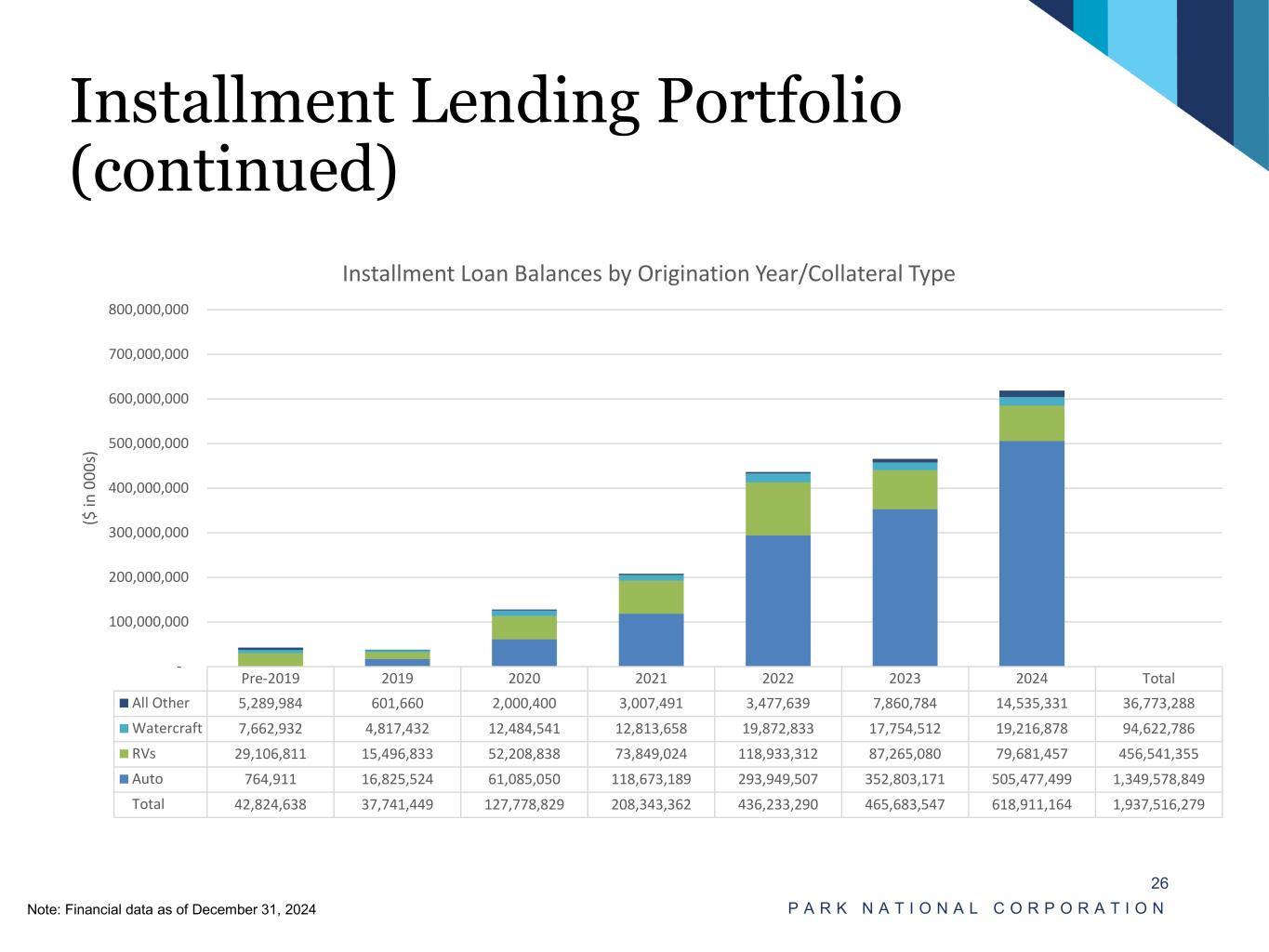

Installment Lending Portfolio (continued) P A R K N A T I O N A L C O R P O R A T I O N 26 Note: Financial data as of December 31, 2024 Pre-2019 2019 2020 2021 2022 2023 2024 Total All Other 5,289,984 601,660 2,000,400 3,007,491 3,477,639 7,860,784 14,535,331 36,773,288 Watercraft 7,662,932 4,817,432 12,484,541 12,813,658 19,872,833 17,754,512 19,216,878 94,622,786 RVs 29,106,811 15,496,833 52,208,838 73,849,024 118,933,312 87,265,080 79,681,457 456,541,355 Auto 764,911 16,825,524 61,085,050 118,673,189 293,949,507 352,803,171 505,477,499 1,349,578,849 Total 42,824,638 37,741,449 127,778,829 208,343,362 436,233,290 465,683,547 618,911,164 1,937,516,279 - 100,000,000 200,000,000 300,000,000 400,000,000 500,000,000 600,000,000 700,000,000 800,000,000 ($ in 0 00 s) Installment Loan Balances by Origination Year/Collateral Type

Specialty Lending • Park has successfully operated in the specialty finance area for many years, specifically focusing on turbo-prop and light jets and structured finance lending to non-bank consumer finance companies. Net charge-offs in specialty lending have not materially impacted Park’s overall net charge-off rates over the last 10 years. • Park acquired Scope Leasing, Inc. in the mid-1990’s. Scope follows the same conservative underwriting posture as the commercial loan portfolio. Its lending team has years of industry experience and maintains a narrow focus as to acceptable aircraft underlying loans. Scope had loans of $313.9 million, or 4.02% of total loans, outstanding as of December 31, 2024. Scope offers aircraft loans from $200,000 to $5 million to individuals, small businesses, and major corporations across the country. • Park entered the structured finance lending business in 2008. It features a traditional asset-based lending line of business with daily cash collections, periodic customer audits, and an attractive risk/reward dynamic. The structured finance loans consist of loans to non-bank consumer finance companies throughout the nation. These asset-based loans are collateralized by cash flows from individuals, typically from auto loans financed by the non-bank consumer finance company. These loans have conservative underwriting and are subject to intensive loan monitoring. Structured finance loans represented $325.4 million, or 4.16% of total loans, outstanding as of December 31, 2024. P A R K N A T I O N A L C O R P O R A T I O N 27 Note: Financial data as of December 31, 2024 unless otherwise noted. Structured Finance 4.16% Scope Aircraft Finance 4.02% All Other Loans 91.82%

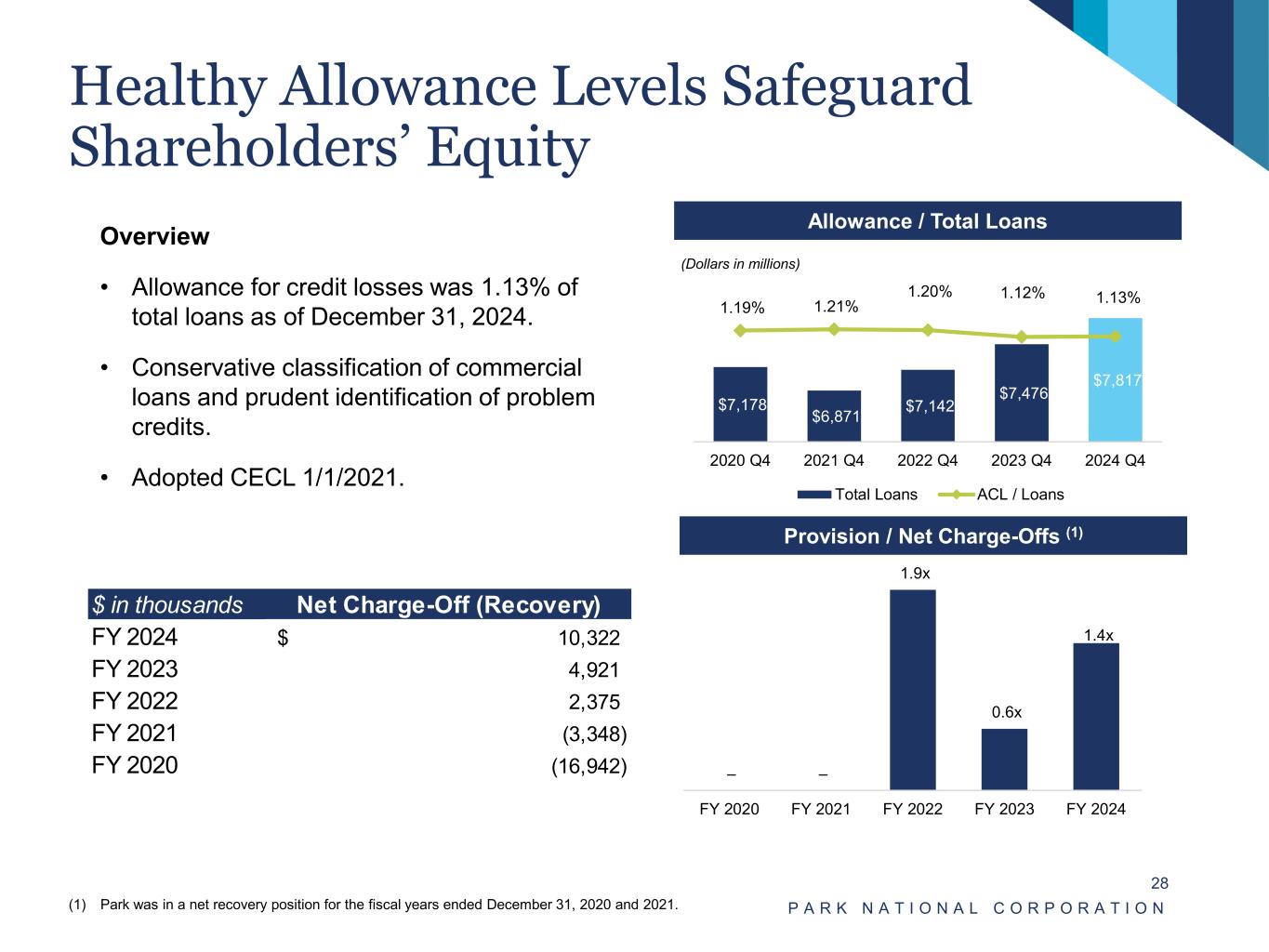

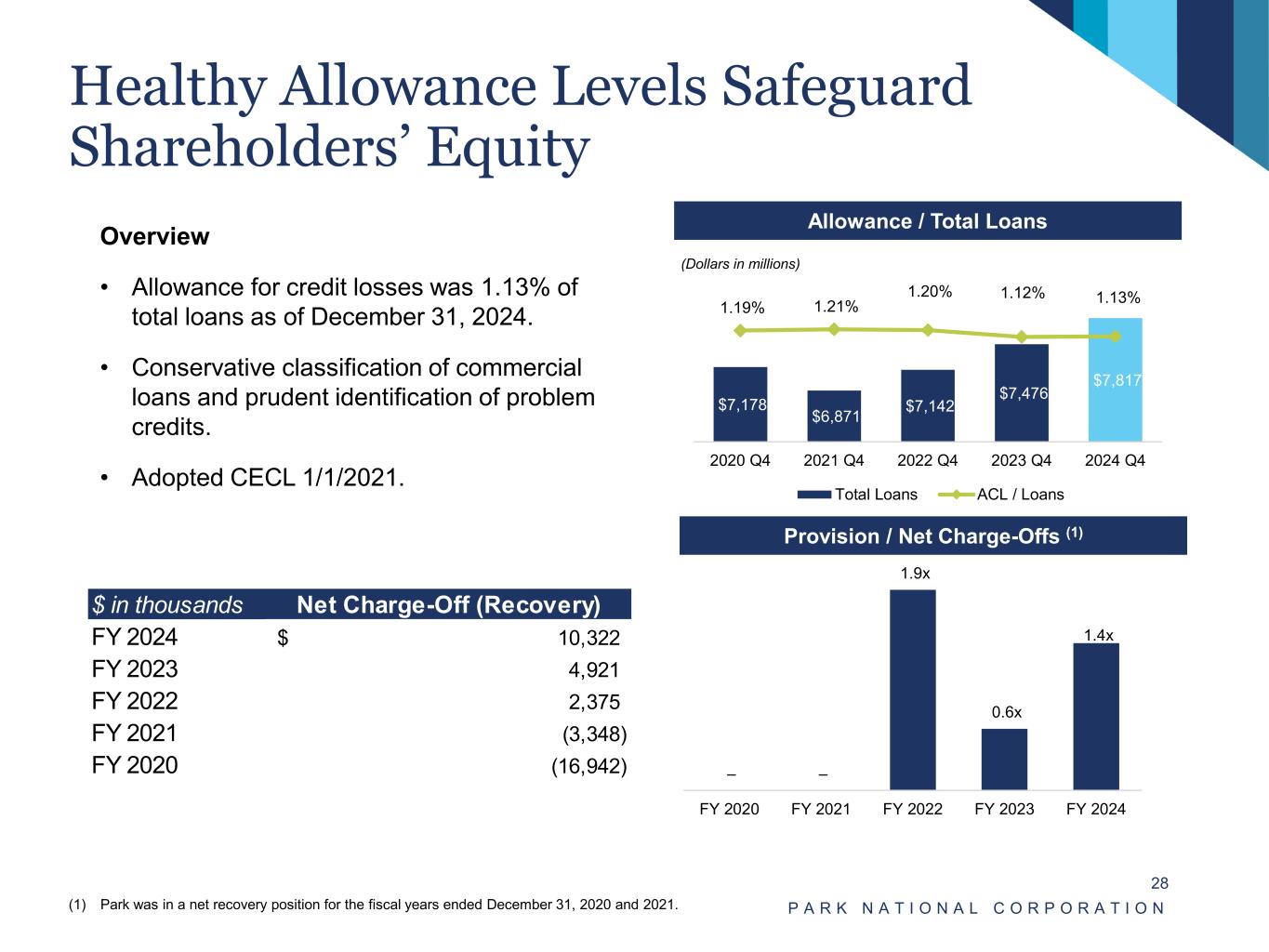

Healthy Allowance Levels Safeguard Shareholders’ Equity P A R K N A T I O N A L C O R P O R A T I O N 28 Allowance / Total LoansOverview • Allowance for credit losses was 1.13% of total loans as of December 31, 2024. • Conservative classification of commercial loans and prudent identification of problem credits. • Adopted CECL 1/1/2021. Provision / Net Charge-Offs (1) (1) Park was in a net recovery position for the fiscal years ended December 31, 2020 and 2021. $7,178 $6,871 $7,142 $7,476 $7,817 1.19% 1.21% 1.20% 1.12% 1.13% 2020 Q4 2021 Q4 2022 Q4 2023 Q4 2024 Q4 (Dollars in millions) Total Loans ACL / Loans $ in thousands Net Charge-Off (Recovery) FY 2024 10,322$ FY 2023 4,921 FY 2022 2,375 FY 2021 (3,348) FY 2020 (16,942) – – 1.9x 0.6x 1.4x FY 2020 FY 2021 FY 2022 FY 2023 FY 2024

Stable Asset Quality P A R K N A T I O N A L C O R P O R A T I O N 29 Net Charge-Offs / Average Loans Classified Loans(2) / Tier 1 Capital + ACL Overview • Conservative underwriting and strong asset quality. • Of the $68.2 million in nonaccrual loans, $44.1 million, or about 65%, were current with contractual payments at December 31, 2024. NPAs / Total Assets (1) (1) NPAs exclude accruing troubled debt restructuring loans and loans 90+ days past due. (2) Classified loans are defined as those rated substandard or individually evaluated, excluding accruing purchase credit deteriorated (PCD) loans associated with the acquisitions of NewDominion Bank and CAB Financial Corporation. 1.31% 0.80% 0.82% 0.62% 0.70% 2020Q4 2021Q4 2022Q4 2023Q4 2024Q4 (0.24%) (0.05%) 0.03% 0.07% 0.14% (0.70%) (0.20%) 0.30% 0.80% 1.30% 1.80% 2021Y 2022Y 2022Y 2023Y 2024Y 11.25% 7.27% 7.27% 4.25% 5.85% 2020Q4 2021Q4 2022Q4 2023Q4 2024Q4

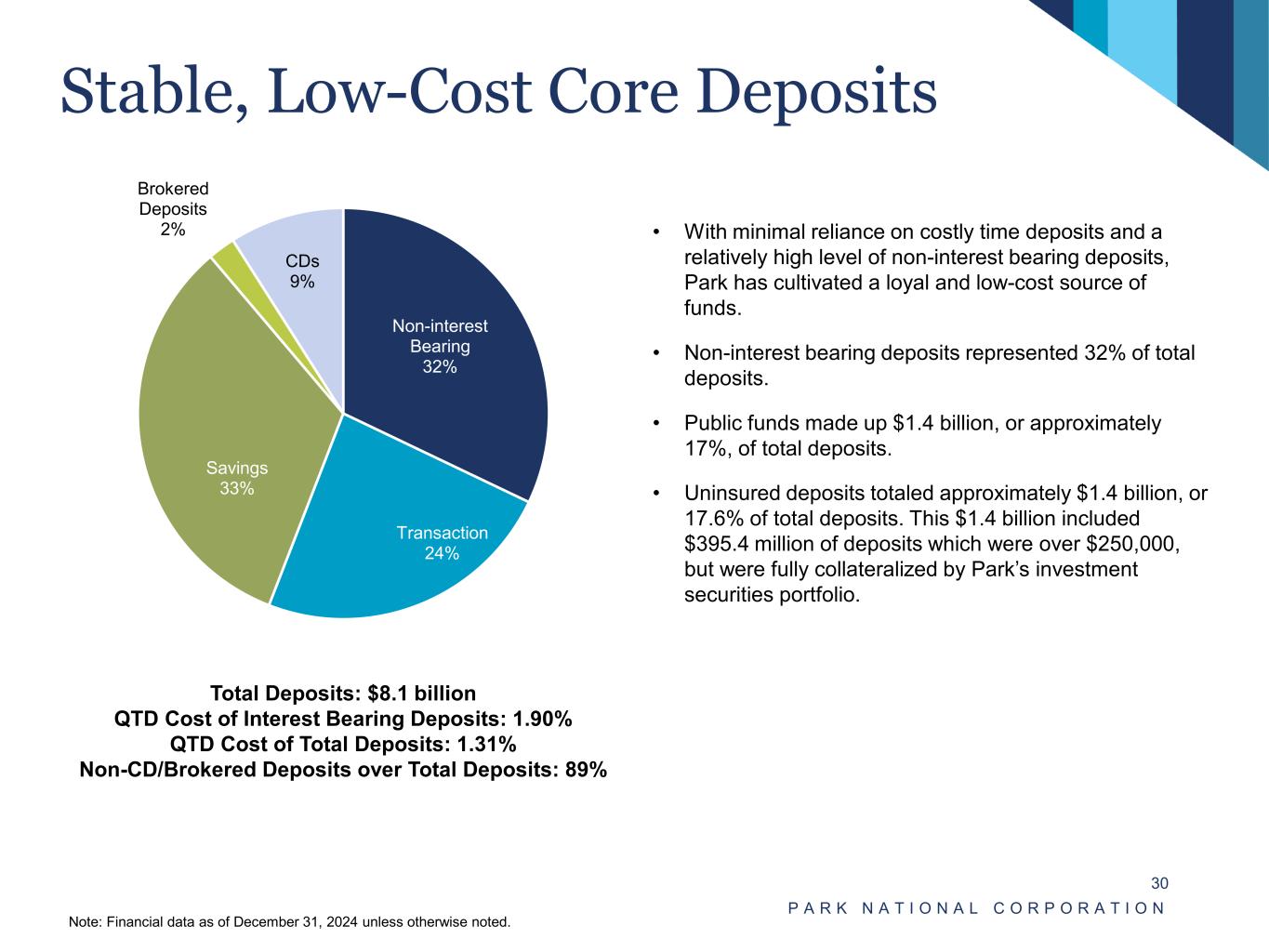

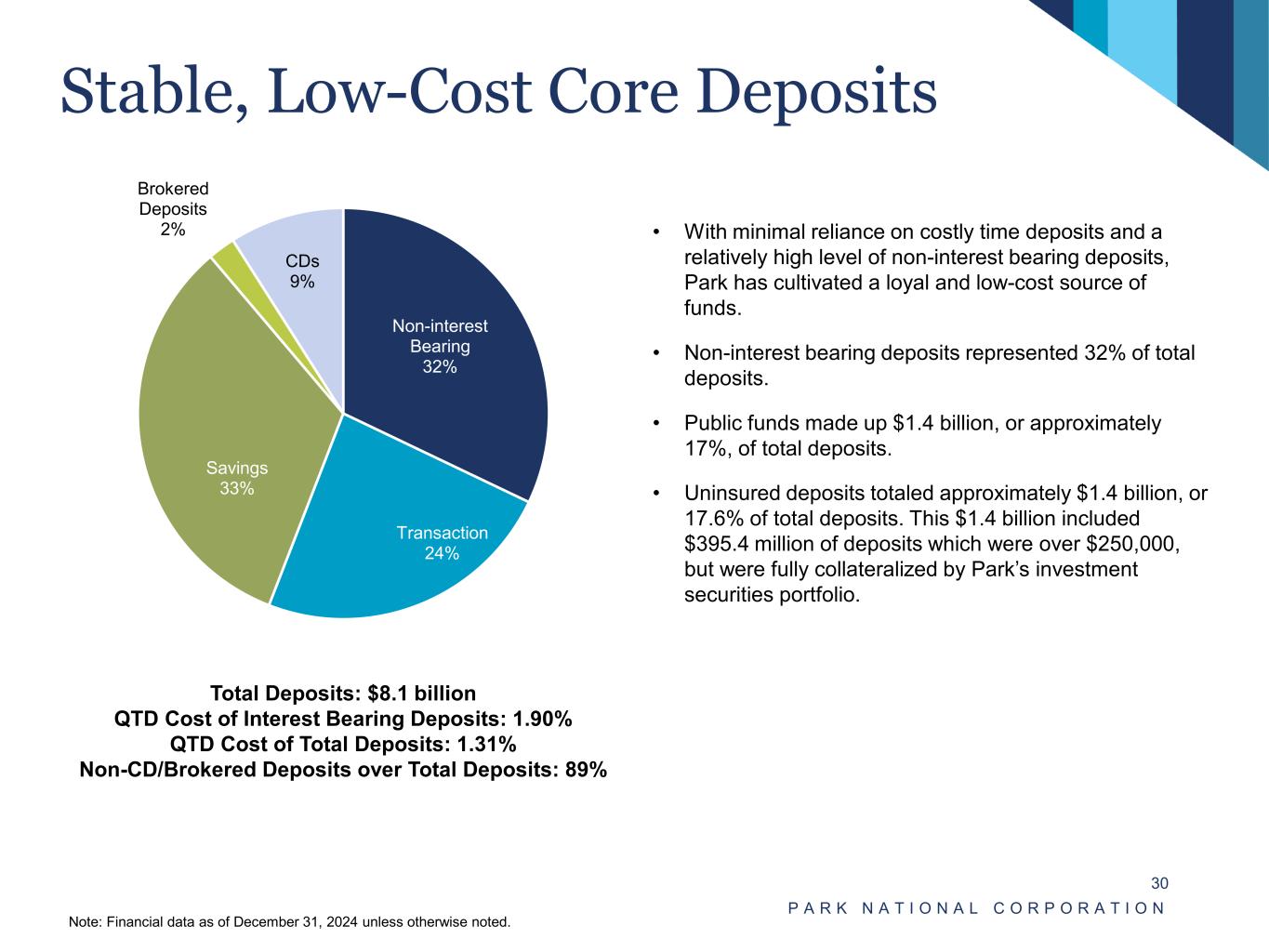

Stable, Low-Cost Core Deposits P A R K N A T I O N A L C O R P O R A T I O N 30 • With minimal reliance on costly time deposits and a relatively high level of non-interest bearing deposits, Park has cultivated a loyal and low-cost source of funds. • Non-interest bearing deposits represented 32% of total deposits. • Public funds made up $1.4 billion, or approximately 17%, of total deposits. • Uninsured deposits totaled approximately $1.4 billion, or 17.6% of total deposits. This $1.4 billion included $395.4 million of deposits which were over $250,000, but were fully collateralized by Park’s investment securities portfolio. Total Deposits: $8.1 billion QTD Cost of Interest Bearing Deposits: 1.90% QTD Cost of Total Deposits: 1.31% Non-CD/Brokered Deposits over Total Deposits: 89% Note: Financial data as of December 31, 2024 unless otherwise noted. Non-interest Bearing 32% Transaction 24% Savings 33% Brokered Deposits 2% CDs 9%

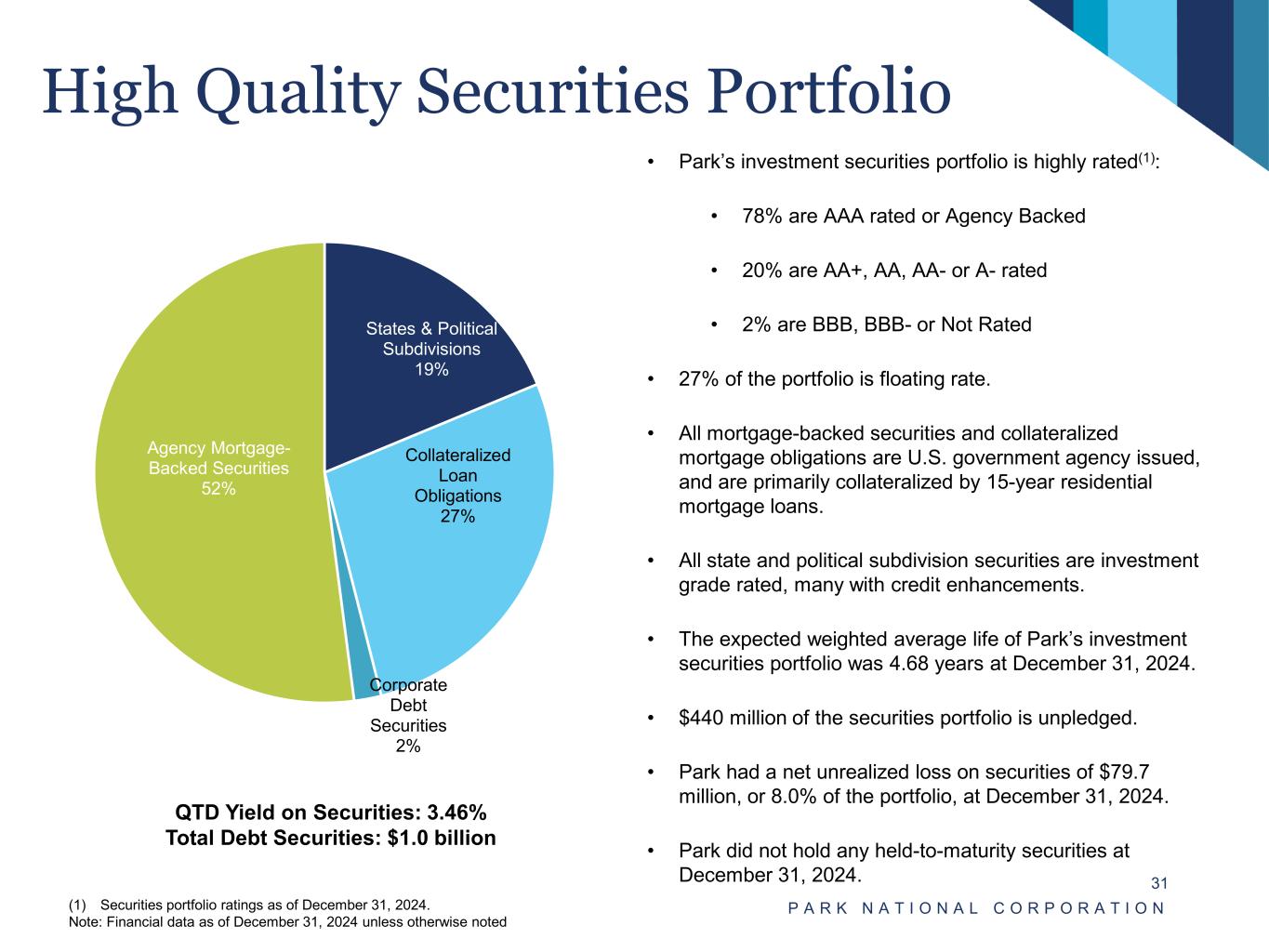

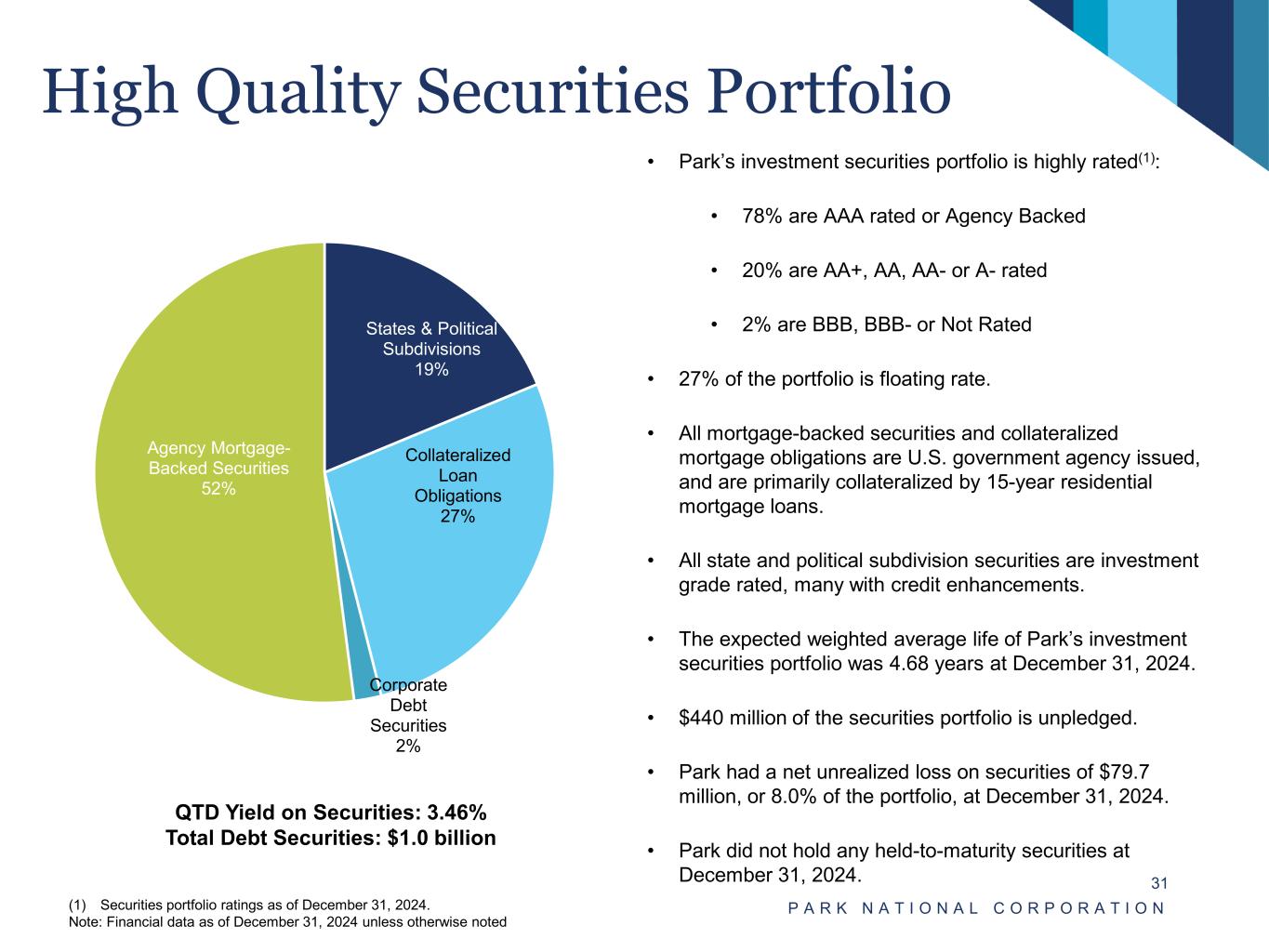

High Quality Securities Portfolio P A R K N A T I O N A L C O R P O R A T I O N 31 • Park’s investment securities portfolio is highly rated(1): • 78% are AAA rated or Agency Backed • 20% are AA+, AA, AA- or A- rated • 2% are BBB, BBB- or Not Rated • 27% of the portfolio is floating rate. • All mortgage-backed securities and collateralized mortgage obligations are U.S. government agency issued, and are primarily collateralized by 15-year residential mortgage loans. • All state and political subdivision securities are investment grade rated, many with credit enhancements. • The expected weighted average life of Park’s investment securities portfolio was 4.68 years at December 31, 2024. • $440 million of the securities portfolio is unpledged. • Park had a net unrealized loss on securities of $79.7 million, or 8.0% of the portfolio, at December 31, 2024. • Park did not hold any held-to-maturity securities at December 31, 2024. QTD Yield on Securities: 3.46% Total Debt Securities: $1.0 billion (1) Securities portfolio ratings as of December 31, 2024. Note: Financial data as of December 31, 2024 unless otherwise noted States & Political Subdivisions 19% Collateralized Loan Obligations 27% Corporate Debt Securities 2% Agency Mortgage- Backed Securities 52%

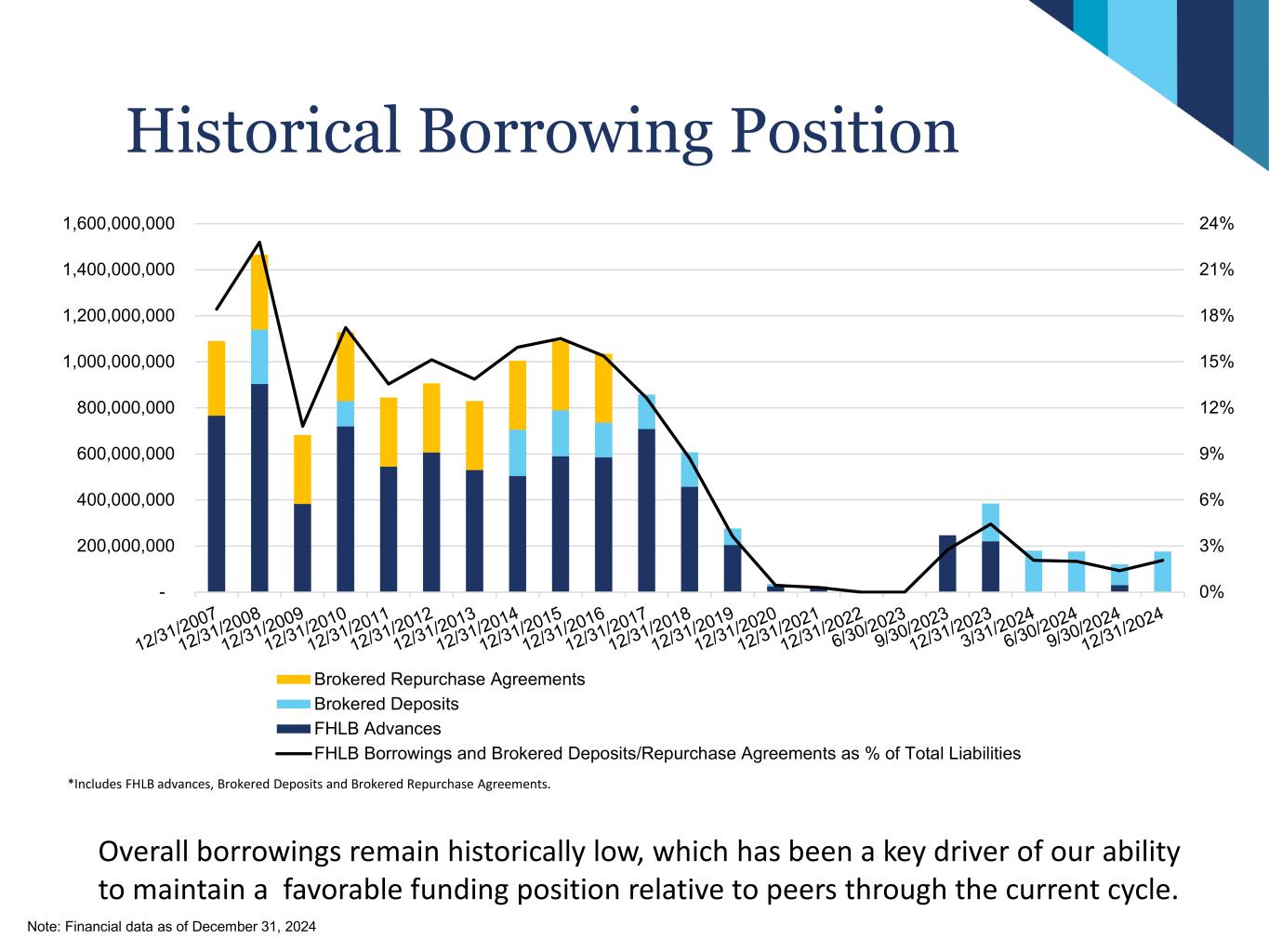

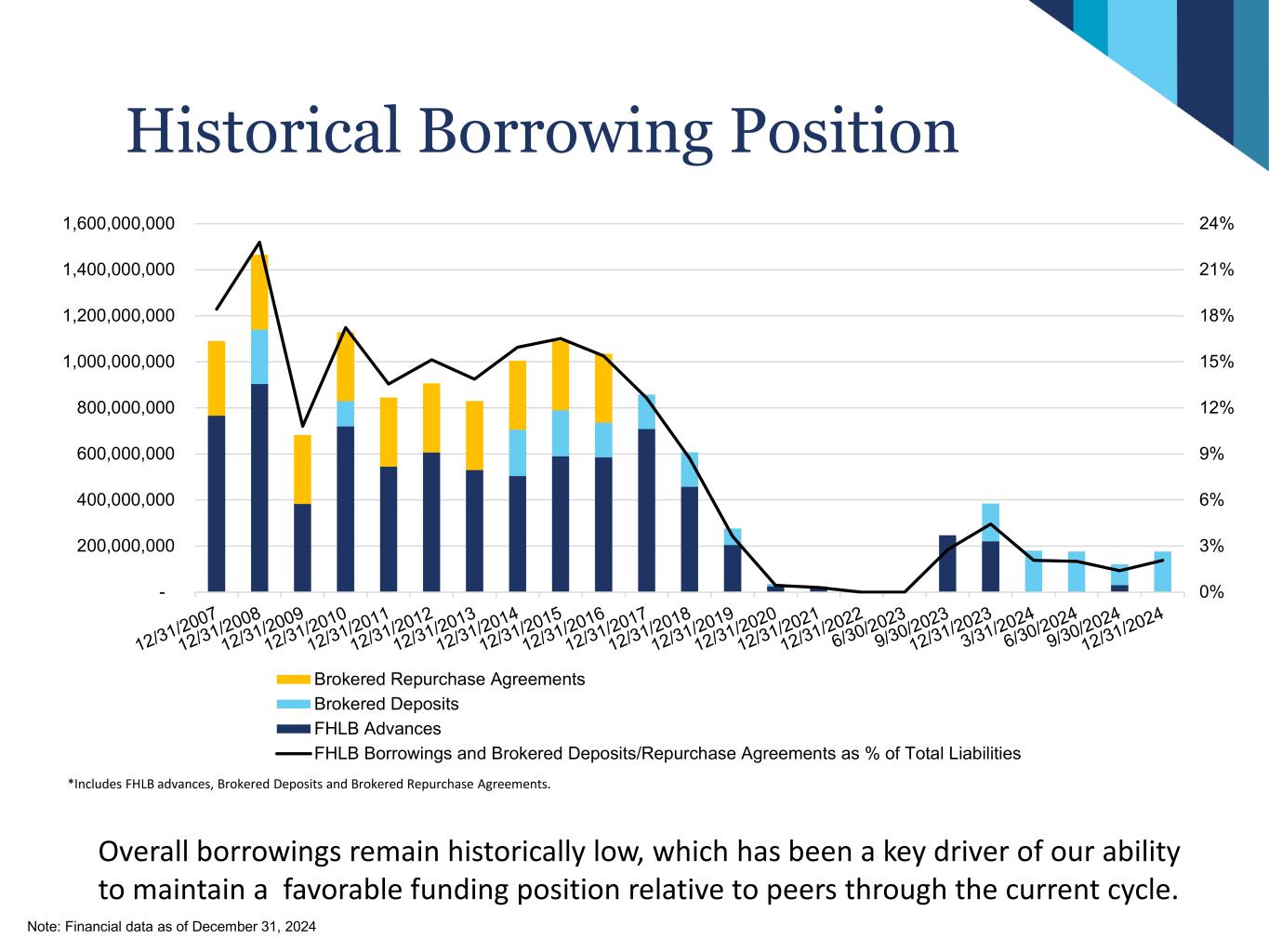

Historical Borrowing Position Overall borrowings remain historically low, which has been a key driver of our ability to maintain a favorable funding position relative to peers through the current cycle. *Includes FHLB advances, Brokered Deposits and Brokered Repurchase Agreements. 0% 3% 6% 9% 12% 15% 18% 21% 24% - 200,000,000 400,000,000 600,000,000 800,000,000 1,000,000,000 1,200,000,000 1,400,000,000 1,600,000,000 Brokered Repurchase Agreements Brokered Deposits FHLB Advances FHLB Borrowings and Brokered Deposits/Repurchase Agreements as % of Total Liabilities Note: Financial data as of December 31, 2024

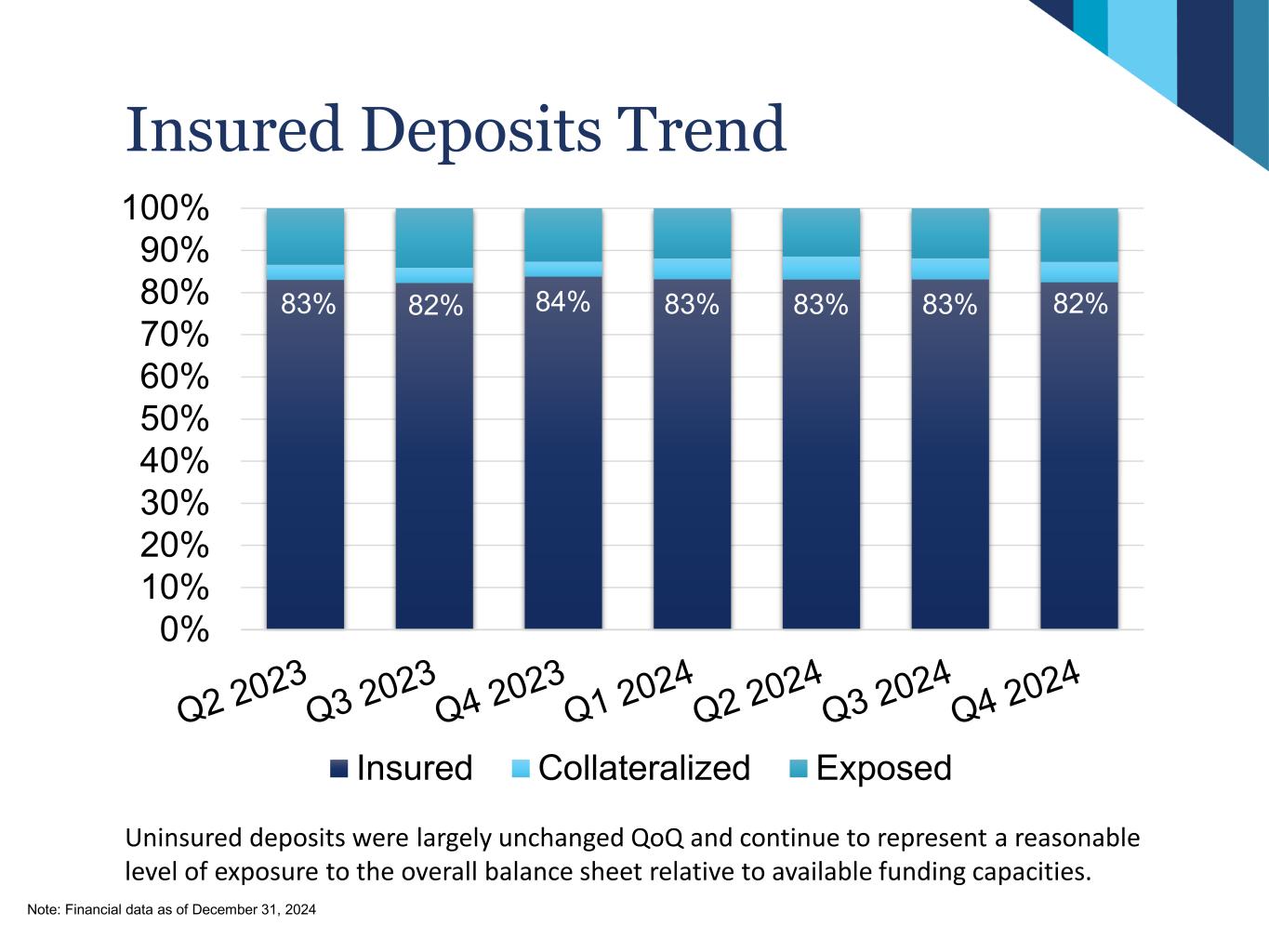

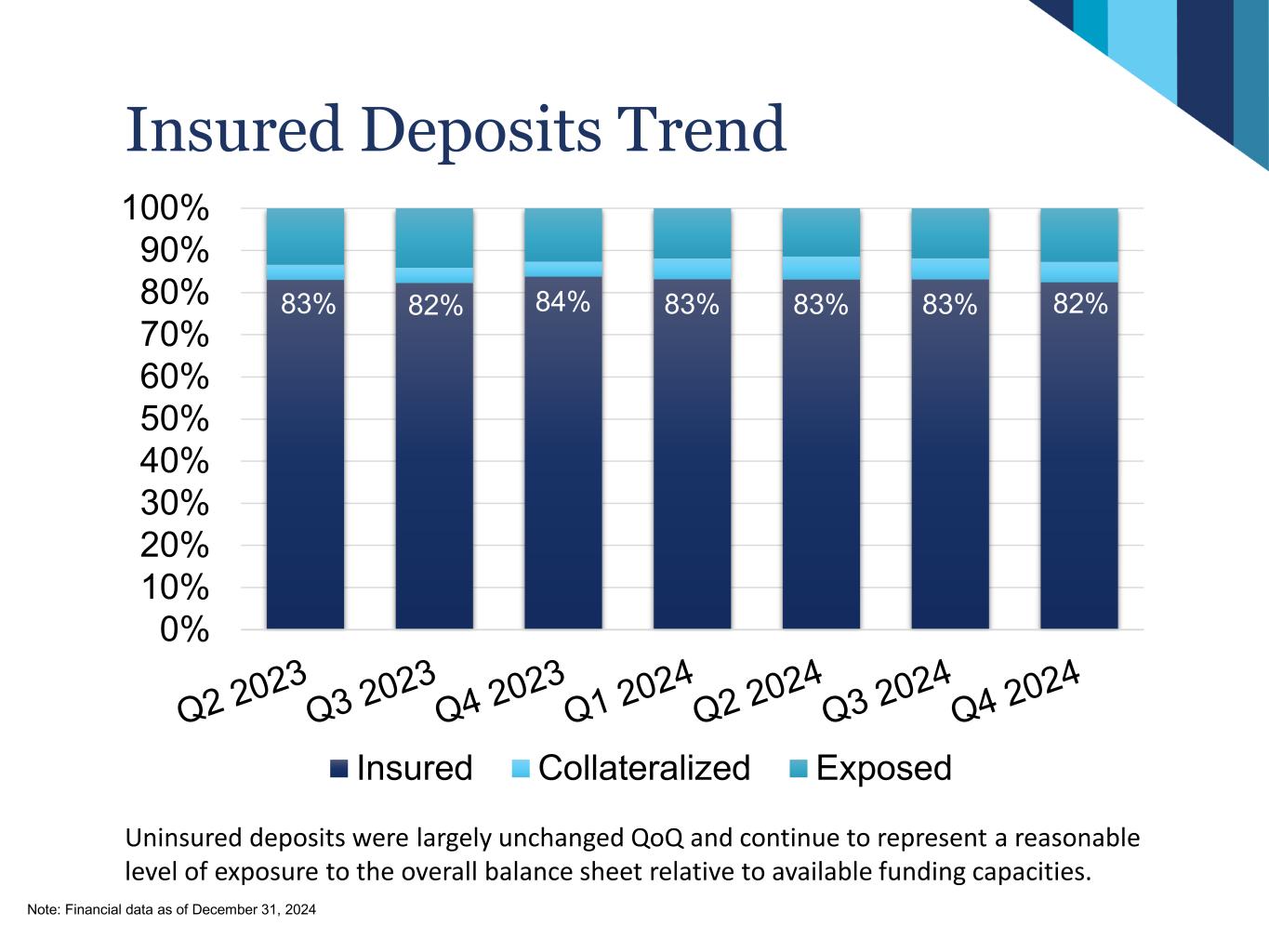

Insured Deposits Trend Uninsured deposits were largely unchanged QoQ and continue to represent a reasonable level of exposure to the overall balance sheet relative to available funding capacities. 83% 82% 84% 83% 83% 83% 82% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Insured Collateralized Exposed Note: Financial data as of December 31, 2024

P A R K N A T I O N A L C O R P O R A T I O N Appendix

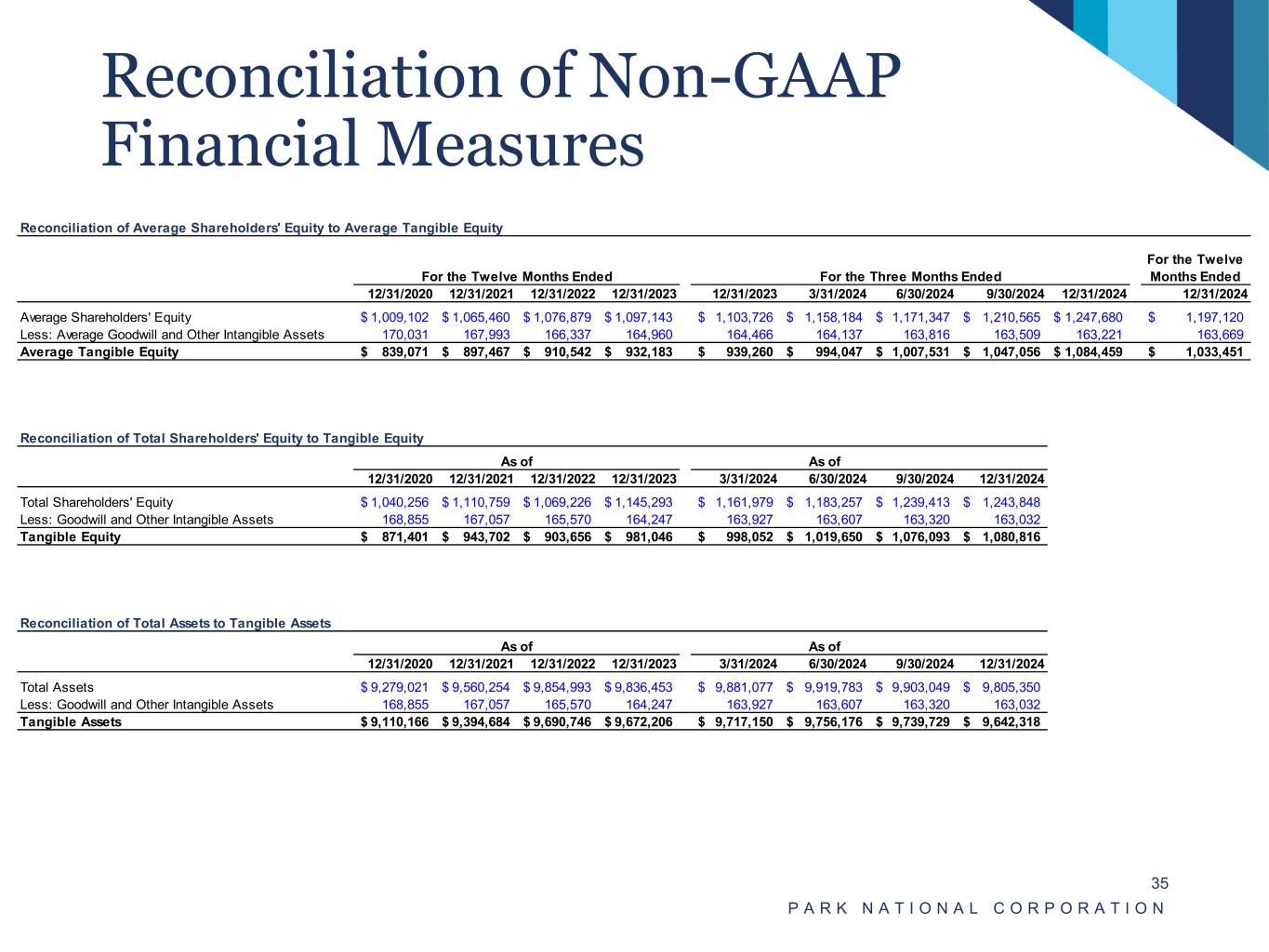

Reconciliation of Non-GAAP Financial Measures P A R K N A T I O N A L C O R P O R A T I O N 35 Reconciliation of Average Shareholders' Equity to Average Tangible Equity For the Twelve Months Ended For the Three Months Ended For the Twelve Months Ended 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2023 3/31/2024 6/30/2024 9/30/2024 12/31/2024 12/31/2024 Average Shareholders' Equity 1,009,102$ 1,065,460$ 1,076,879$ 1,097,143$ 1,103,726$ 1,158,184$ 1,171,347$ 1,210,565$ 1,247,680$ 1,197,120$ Less: Average Goodwill and Other Intangible Assets 170,031 167,993 166,337 164,960 164,466 164,137 163,816 163,509 163,221 163,669 Average Tangible Equity 839,071$ 897,467$ 910,542$ 932,183$ 939,260$ 994,047$ 1,007,531$ 1,047,056$ 1,084,459$ 1,033,451$ Reconciliation of Total Shareholders' Equity to Tangible Equity As of As of 12/31/2020 12/31/2021 12/31/2022 12/31/2023 3/31/2024 6/30/2024 9/30/2024 12/31/2024 Total Shareholders' Equity 1,040,256$ 1,110,759$ 1,069,226$ 1,145,293$ 1,161,979$ 1,183,257$ 1,239,413$ 1,243,848$ Less: Goodwill and Other Intangible Assets 168,855 167,057 165,570 164,247 163,927 163,607 163,320 163,032 Tangible Equity 871,401$ 943,702$ 903,656$ 981,046$ 998,052$ 1,019,650$ 1,076,093$ 1,080,816$ Reconciliation of Total Assets to Tangible Assets As of As of 12/31/2020 12/31/2021 12/31/2022 12/31/2023 3/31/2024 6/30/2024 9/30/2024 12/31/2024 Total Assets 9,279,021$ 9,560,254$ 9,854,993$ 9,836,453$ 9,881,077$ 9,919,783$ 9,903,049$ 9,805,350$ Less: Goodwill and Other Intangible Assets 168,855 167,057 165,570 164,247 163,927 163,607 163,320 163,032 Tangible Assets 9,110,166$ 9,394,684$ 9,690,746$ 9,672,206$ 9,717,150$ 9,756,176$ 9,739,729$ 9,642,318$

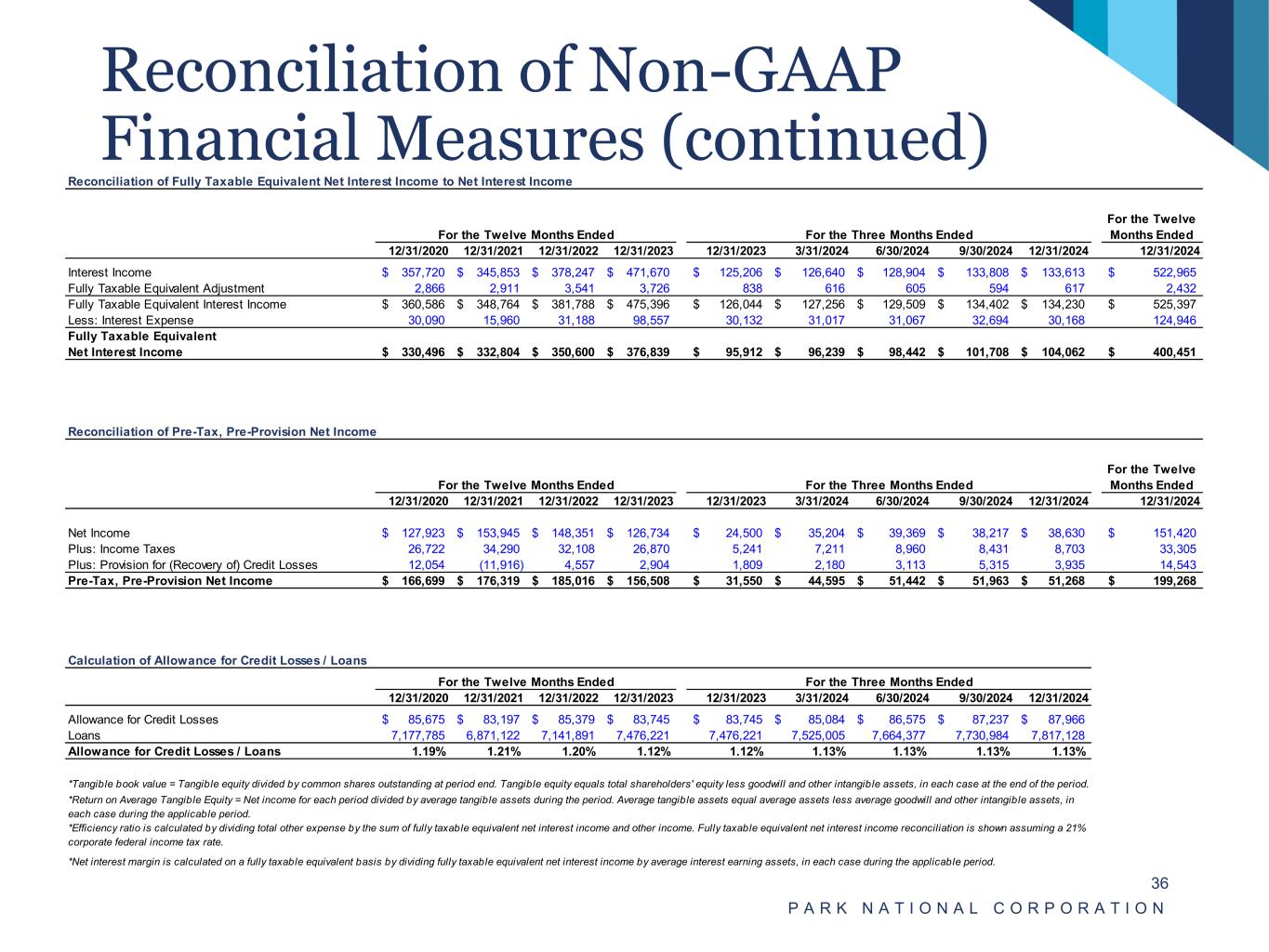

Reconciliation of Non-GAAP Financial Measures (continued) P A R K N A T I O N A L C O R P O R A T I O N 36 Reconciliation of Fully Taxable Equivalent Net Interest Income to Net Interest Income For the Twelve Months Ended For the Three Months Ended For the Twelve Months Ended 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2023 3/31/2024 6/30/2024 9/30/2024 12/31/2024 12/31/2024 Interest Income 357,720$ 345,853$ 378,247$ 471,670$ 125,206$ 126,640$ 128,904$ 133,808$ 133,613$ 522,965$ Fully Taxable Equivalent Adjustment 2,866 2,911 3,541 3,726 838 616 605 594 617 2,432 Fully Taxable Equivalent Interest Income 360,586$ 348,764$ 381,788$ 475,396$ 126,044$ 127,256$ 129,509$ 134,402$ 134,230$ 525,397$ Less: Interest Expense 30,090 15,960 31,188 98,557 30,132 31,017 31,067 32,694 30,168 124,946 Fully Taxable Equivalent Net Interest Income 330,496$ 332,804$ 350,600$ 376,839$ 95,912$ 96,239$ 98,442$ 101,708$ 104,062$ 400,451$ Reconciliation of Pre-Tax, Pre-Provision Net Income For the Twelve Months Ended For the Three Months Ended 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2023 3/31/2024 6/30/2024 9/30/2024 12/31/2024 12/31/2024 Net Income 127,923$ 153,945$ 148,351$ 126,734$ 24,500$ 35,204$ 39,369$ 38,217$ 38,630$ 151,420$ Plus: Income Taxes 26,722 34,290 32,108 26,870 5,241 7,211 8,960 8,431 8,703 33,305 Plus: Provision for (Recovery of) Credit Losses 12,054 (11,916) 4,557 2,904 1,809 2,180 3,113 5,315 3,935 14,543 Pre-Tax, Pre-Provision Net Income 166,699$ 176,319$ 185,016$ 156,508$ 31,550$ 44,595$ 51,442$ 51,963$ 51,268$ 199,268$ Calculation of Allowance for Credit Losses / Loans For the Twelve Months Ended For the Three Months Ended 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2023 3/31/2024 6/30/2024 9/30/2024 12/31/2024 Allowance for Credit Losses 85,675$ 83,197$ 85,379$ 83,745$ 83,745$ 85,084$ 86,575$ 87,237$ 87,966$ Loans 7,177,785 6,871,122 7,141,891 7,476,221 7,476,221 7,525,005 7,664,377 7,730,984 7,817,128 Allowance for Credit Losses / Loans 1.19% 1.21% 1.20% 1.12% 1.12% 1.13% 1.13% 1.13% 1.13% *Tangible book value = Tangible equity divided by common shares outstanding at period end. Tangible equity equals total shareholders' equity less goodwill and other intangible assets, in each case at the end of the period. *Net interest margin is calculated on a fully taxable equivalent basis by dividing fully taxable equivalent net interest income by average interest earning assets, in each case during the applicable period. *Efficiency ratio is calculated by dividing total other expense by the sum of fully taxable equivalent net interest income and other income. Fully taxable equivalent net interest income reconciliation is shown assuming a 21% corporate federal income tax rate. *Return on Average Tangible Equity = Net income for each period divided by average tangible assets during the period. Average tangible assets equal average assets less average goodwill and other intangible assets, in each case during the applicable period. For the Twelve Months Ended

Park National Corporation P A R K N A T I O N A L C O R P O R A T I O N