UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________

Form 10-K

____________________________________________________________________________

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

Or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to______________

Commission File Number: 001-36046

AXOGEN, INC.

(Exact name of registrant as specified in its charter)

Minnesota

(State or other jurisdiction of

incorporation or organization)

13631 Progress Blvd., Suite 400 Alachua, FL

(Address of principal executive offices)

41-1301878

(I.R.S. Employer

Identification No.)

32615

(Zip Code)

Registrant’s telephone number, including area code: (386) 462-6800

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

| Common Stock, $0.01 par value | | AXGN | | The Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐

Non-accelerated filer ☐

Accelerated filer x

Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. □

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

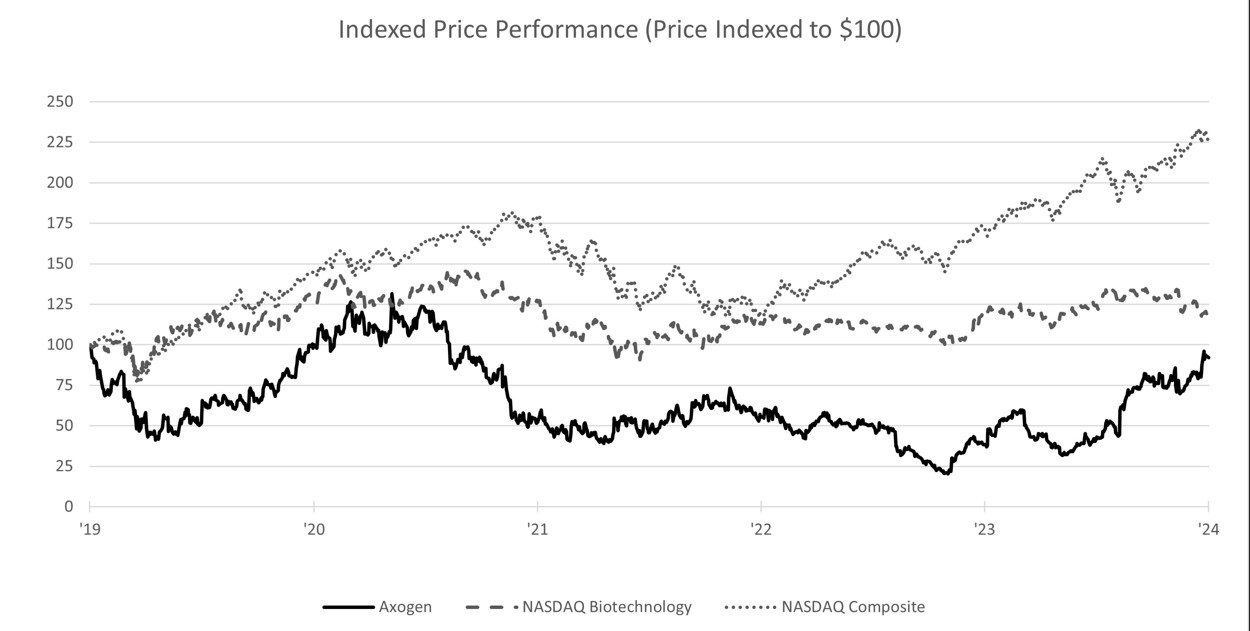

As of June 30, 2024, the last day of the registrant's most recently completed second quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $186,789,502 based upon the last reported sale price of the common stock on the Nasdaq Capital Market.

The number of shares outstanding of the Registrant’s common stock as of February 19, 2025, was 44,343,785 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement to be filed pursuant to Regulation 14A within 120 days after the end of the Registrant’s fiscal year are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

From time to time, in reports filed with the U.S. Securities and Exchange Commission (the “SEC”) (including this Annual Report on Form 10-K), in press releases, and in other communications to shareholders or the investment community, Axogen, Inc. (including Axogen, Inc.’s wholly owned subsidiaries, Axogen Corporation, Axogen Processing Corporation, Axogen Europe GmbH, and Axogen Germany GmbH, (the “Company,” “Axogen,” “we,” “our,” or “us”) may provide forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, concerning possible or anticipated future results of operations or business developments. These statements are based on management's current expectations or predictions of future conditions, events, or results based on various assumptions and management's estimates of trends and economic factors in the markets in which we are active, as well as its business plans. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “continue,” “may,” “should,” “will,” “goals,” and variations of such words and similar expressions are intended to identify such forward-looking statements.

The forward-looking statements in this Form 10-K include, but are not limited to the following:

•Our expectations regarding our ability to market Avive+ Soft Tissue Matrix and our expectations that Avive+ Soft Tissue Matrix will, and will continue to be, regulated solely under Section 361 of the Public Health Service Act ("PHS Act");

•Statements regarding estimates of the total addressable market for our current portfolio, our belief that our total addressable market is comprised of four categories: (i) trauma ("Trauma"), (ii) oral maxillofacial ("OMF") and head and neck ("Head and Neck"), collectively ("OMF/H&N"), (iii) breast reconstruction neurotization ("Breast"), and (iv) Upper Extremity Compression, (together the "Total Addressable Market") and statements regarding estimates of the market for our current portfolio in each of the four categories;

•Statements regarding our belief that there is an additional 10-15% of the breast reconstructions done with implants that can also be neurotized and thus offer us expanded revenue opportunities;

•Statements regarding our beliefs that expanding our products into lower extremity surgery, urology, and the surgical treatment of pain could offer us expanded revenue opportunities;

•Our expectation that the Biologics License Application ("BLA") will be approved in September 2025;

•Our belief that we met the clinical end point required for our pivotal study to support the BLA and that only one study is sufficient to support the BLA;

•Our belief that further innovation and product development is needed to maintain our leadership position and provide expansion opportunities;

•Our belief that additional opportunities exist to develop or acquire complementary products in peripheral nerve repair as well as opportunities to expand our existing portfolio of products in new applications of peripheral nerve repair;

•Our belief that there is a global need for surgical repair of damaged or transected nerves and that a global market exists for our product; and

•Statements regarding our ability to monitor product utilization within accounts and generate improved estimates of our revenue by application.

The forward-looking statements are and will be subject to risks and uncertainties, which may cause actual results to differ materially from those expressed or implied in such forward-looking statements. Forward-looking statements contained in this Form 10-K should be evaluated together with the many uncertainties that affect our business and its market, particularly those discussed in the risk factors and cautionary statements set forth in our filings with the SEC, including as described in “Risk Factors” included in Item 1A of this Form 10-K and “Risk Factor Summary” included in this Form 10-K. Forward-looking statements are not guarantees of future performance, and actual results may differ materially from those projected. The forward-looking statements contained in this report are based on information that is currently available to us and expectations and assumptions that we deem reasonable at the time the statements were made. The forward-looking statements are representative only as of the date they are made and, except as required by applicable law, we assume no responsibility to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or otherwise.

PART I

ITEM 1. BUSINESS

General

We are the leading company focused specifically on the science, development, and commercialization of technologies for peripheral nerve regeneration and repair. We are passionate about providing the opportunity to restore nerve function and quality of life for patients with peripheral nerve injuries. We provide innovative, clinically proven, and economically effective repair solutions for surgeons and healthcare providers. Peripheral nerves provide the pathways for both motor and sensory signals throughout the body. Every day, people suffer traumatic injuries or undergo surgical procedures that impact the function of their peripheral nerves. Physical damage to a peripheral nerve or the inability to properly reconnect peripheral nerves can result in the loss of muscle or organ function, the loss of sensory feeling, or the initiation of pain.

Our platform for peripheral nerve repair features a comprehensive portfolio of products, including:

•Avance® Nerve Graft, a biologically active off-the-shelf processed human nerve allograft for bridging severed peripheral nerves without the comorbidities associated with a second surgical site.

•Axoguard Nerve Connector®, a porcine (pig) submucosa extracellular matrix ("ECM") coaptation aid for tensionless repair of severed peripheral nerves.

•Axoguard Nerve Protector®, a porcine submucosa ECM product used to wrap and protect damaged peripheral nerves and reinforce the nerve reconstruction while minimizing soft tissue attachments.

•Axoguard HA+ Nerve Protector™, a porcine submucosa ECM base layer coated with a proprietary hyaluronate-alginate gel, a next-generation technology designed to enhance nerve gliding and provide short- and long-term protection for peripheral nerve injuries.

•Axoguard Nerve Cap®, a porcine submucosa ECM product used to protect a peripheral nerve end and separate the nerve from the surrounding environment to reduce the development of symptomatic or painful neuroma.

•Avive+ Soft Tissue Matrix™, a multi-layer amniotic membrane allograft used to protect and separate tissues in the surgical bed during the critical phase of tissue healing.

On June 24, 2024, we announced the launch of Avive+ Soft Tissue Matrix. Avive+ Soft Tissue Matrix is processed and distributed in accordance with United States Food and Drug Administration ("FDA") requirements for Human Cellular and Tissue-based Products ("HCT/P") under the Code of Federal Regulations ("CFR") Title 21 ("21 CFR") Part 1271 regulations and United States PHS regulations as a Section 361 human tissue product. Products regulated solely under Section 361 of the PHS Act are a product category under close scrutiny by the FDA for compliance with the regulatory requirements and are potentially subject to regulatory change in the future.

Our portfolio of products is currently available in the United States ("U.S."), and 19 other countries including Canada, Germany, United Kingdom ("UK"), Spain, and several other European, Asian, and Latin American countries.

Revenue from the distribution of our nerve repair products, Avance Nerve Graft, Axoguard Nerve Connector, Axoguard Nerve Protector, Axoguard HA+ Nerve Protector, Axoguard Nerve Cap and Avive+ Soft Tissue Matrix in the U.S. is the main contributor to our total reported sales and have been the key component of our growth to date.

Nerves can be damaged in several ways. When a nerve is cut due to a traumatic injury or inadvertently during a surgical procedure, functionality of the nerve may be compromised, causing the nerve to no longer carry the signals to and from the brain to the muscles and skin, thereby reducing or eliminating functionality. The loss of function can impact a person’s ability to work and perform daily tasks, to properly be aware and respond to their environment (e.g., heat, cold or other dangers), and could negatively impact their ability to experience and enjoy life.

Nerve damage or transection of the type described above generally requires a surgical repair. Traditionally, the standard has been to either suture the nerve ends together directly without tension or to bridge the gap between the nerve ends with a less important nerve surgically removed from elsewhere in the patient’s own body, referred to as a nerve autograft. More recently, synthetic or collagen conduits have been used for the repair of short gaps. Nerves that are not repaired or heal abnormally may result in a permanent loss of motor and/or sensory function. Additionally, abnormal healing can form a neuroma that may send

altered signals to the brain resulting in the sensation of pain. This abnormal section of the nerve can, under certain circumstances, be surgically removed and the nerve can be managed by capping, burying, or surgically repairing the nerve.

In addition, compression on a nerve, blunt force trauma or other physical irritations to a nerve can cause nerve damage that may alter the signal conduction of the nerve, resulting in pain, and may, in some instances, require surgical intervention to address the resulting nerve compression. Finally, when a patient undergoes a mastectomy due to breast cancer or prophylactically due to a genetic predisposition for breast cancer, the nerves are cut to allow the removal of the breast tissue. This can result in a loss of sensation, the potential risk of a symptomatic neuroma, and could negatively impact the patient’s quality of life. When a patient chooses a breast reconstruction after a mastectomy, sensation and quality of life can, in certain cases, be returned through surgical nerve repair.

To improve the options available for the surgical repair and regeneration of peripheral nerves, we have developed and licensed regenerative medicine technologies. Our innovative approach to regenerative medicine has resulted in first-in-class products that we believe are redefining the peripheral nerve repair market. Our products are used by surgeons during surgical interventions to repair a wide variety of physical nerve damage throughout the body, which can range from a simple laceration of a finger to a complex brachial plexus injury (an injury to the network of nerves that control the movement and sensation of the shoulder, arm, and hand) as well as nerve injuries caused by dental, orthopedic, and other surgical procedures.

Peripheral Nerve Regeneration Market Overview

Peripheral nerve injury (“PNI”) through damage or transection is a major source of physical disability impairing the ability to move muscles or to feel normal sensations. Patients suffer traumatic bodily injuries every day that may result in damage or transection to peripheral nerves severe enough to require surgical treatment. We break our total addressable market into four categories: (i) Trauma, (ii) OMF and Head and Neck, collectively OMF/H&N, (iii) Breast, and (iv) Upper Extremity Compression, together the Total Addressable Market.

We previously estimated that U.S. PNI has a potential Total Addressable Market for our current product portfolio and believe it is presently at least $2.7 billion. Estimating the Total Addressable Market for nerve repair is challenging as there is not a simple data source for the incidence of peripheral nerve issues. This is further complicated by the fact that nerves can be injured through a variety of traumatic and surgical injuries and can impact a patient from head to toe. In addition, we believe nerves are often one of many structures injured in a trauma (e.g., amputation) or in surgery and the incidence of these nerve injuries are often not coded or tracked. Quantifying the procedures involving nerve repair may also be challenging. While selected trauma and surgical procedures are dedicated to the repair of nerves, most of the incidence of nerve repair is a step in a larger trauma or surgical procedure. Current Procedural Terminology ("CPT") codes exist for surgeons to code for nerve repair; however, we believe the data substantially underestimates the total number of nerves repaired. Physicians are encouraged to document all steps of procedures, but open trauma often involves many surgical steps, and CPT codes may be inclusive of each other or may not be documented or reported in billing records. As a result, we believe CPT coding underrepresents the total number of nerve repairs performed in trauma. Because we believe CPT claims are not fully representative of the true volumes of nerve repair surgery, we follow an “empirical” methodology to estimate the Total Addressable Market – using published clinical literature and procedure databases to make what we believe are the most objective assumptions.

Trauma

The Trauma portion of the Total Addressable Market encompasses traumatic PNI throughout the body, with approximately 95% of injuries affecting upper and lower extremity nerves. We previously estimated that the Trauma portion of the Total Addressable Market and presently believe it is at least $1.9 billion based upon epidemiological studies regarding the general number of trauma patients, clinical literature review reporting PNI incidence, and physician interviews. We have estimated the portion of these nerve repair procedures due to trauma that would require gap repair, primary repair and/or nerve protection and applied, as we believed was appropriate in each procedure segment, the number of units and average sales price of Avance Nerve Graft and the average market price for nerve connectors and nerve protectors to determine the probable Total Addressable Market.

OMF and Head and Neck

We previously estimated the OMF portion of the Total Addressable Market and presently believe it is at least $300 million annually, based upon research indicating that approximately 56,000 PNI occur in the U.S. each year related to third molar surgeries, anesthetic injections, dental implants, orthognathic surgery, and mandibular resection procedures. We have applied the average sales price of the Avance Nerve Graft, Axoguard Nerve Connector, and Axoguard Nerve Protector that address such PNI to derive the OMF portion of the estimated Total Addressable Market.

In Head and Neck, we are focused on addressing nerve injuries in parotidectomy, thyroidectomy and radical neck dissections, which we believe presently represent a significant opportunity with more than 200,000 procedures performed annually, highly concentrated in large academic hospital centers.

Breast

We previously estimated the Breast portion of the Total Addressable Market based on autologous flap reconstructions (i.e. DIEP flaps) and presently believe it is at least $350 million annually. In 2023, we launched Resensation® to implant-based procedures with neurotization of the nipple area complex. We estimate that there is an additional 10-15% of the breast reconstructions done with implants that can also be neurotized which adds at least $250 million to increase the estimated Total Addressable Market to at least $600 million. Currently, when a patient undergoes autologous or implant-based breast reconstruction after a mastectomy, the patient receives the shape of a natural breast, but often times experiences little to no return of sensory feeling. In certain cases, sensation can be returned to the breast area with the use of our products through an innovative surgical technique called Resensation. We believe that the ideal breast reconstruction should restore breast size, shape, symmetry, and softness, as well as sensation, without the potential risks and comorbidity associated with autograft. We believe the Resensation technique incorporates a patient's desire for the opportunity to return sensation to their breasts with a reproducible and efficient surgical approach for reconstructive plastic surgery.

Upper Extremity Compression

PNI caused by recurrent carpal tunnel syndrome and cubital tunnel syndrome constitutes the "Upper Extremity Compression" portion of the Total Addressable Market. We believe the Upper Extremity Compression portion of the Total Addressable Market is approximately $350 million annually, or 145,000 procedures. We estimate there are approximately 488,000 primary carpal tunnel and 150,000 primary cubital tunnel relief surgeries performed annually in the U.S. We estimate that approximately 96,500 carpal tunnel revision surgeries and 51,600 total cubital tunnel procedures are addressable each year in the U.S. to mitigate the recurrence of symptoms. These revision and primary surgeries are required due to compression of the peripheral nerve associated with soft tissue attachments from the surrounding tissue or tissue infiltration entrapping the nerve. To prevent additional recurrences, surgeons will opt for a nerve protection which includes products such as the Axoguard Nerve Protector, Axoguard HA+ Nerve Protector ("HA+") and Avive+ Soft Tissue Matrix. To derive the carpal and cubital tunnel revision portion of the Total Addressable Market, we multiplied the average market sales price of Axoguard Nerve Protectors by the number of estimated procedures.

Although distribution and sales of products in the Trauma, OMF/H&N, Breast and Upper Extremity Compression portions of the Total Addressable Market constitute our primary revenue sources today, market expansion opportunities in lower extremity surgery, urology, and the surgical treatment of pain could offer us expanded revenue opportunities. We have begun an expansion into the surgical treatment of pain with an initial focus in the treatment of neuroma in our existing call points. The size of the pain market opportunity is challenging to identify as the cause of the chronic pain is often not diagnosed and there has not historically been a surgical treatment to resolve the cause of the pain. We believe the market opportunity is sufficient to apply selected resources to the opportunity and there is a significant patient and societal need to reduce the use of pharmacologic solutions, including opioids.

Our Product Portfolio

Avance Nerve Graft

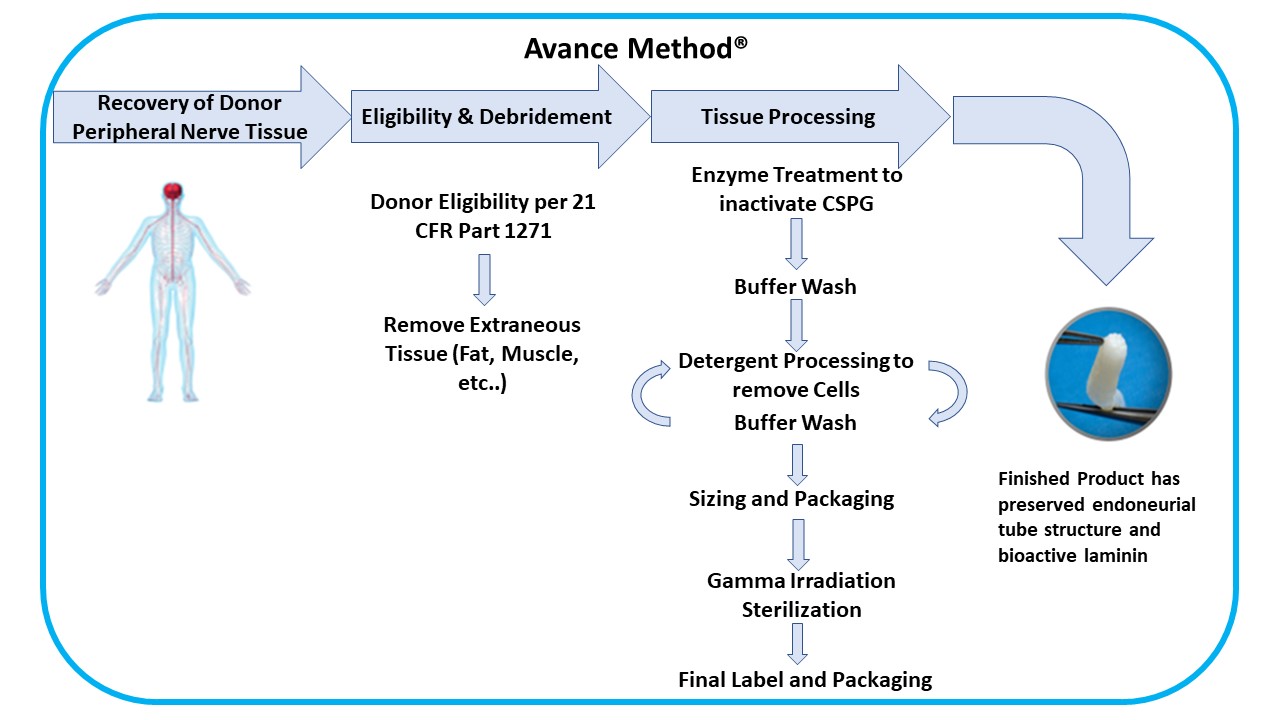

Avance Nerve Graft is a biologically active nerve implant with more than sixteen years of comprehensive clinical evidence and more than 100,000 implants since launch. Avance Nerve Graft is processed nerve allograft intended for the surgical repair of peripheral nerve discontinuities to support regeneration across the defect. It is intended to act as a structural bridge in order to guide and support axonal regeneration across a peripheral nerve gap caused by traumatic injury or surgical intervention. Avance Nerve Graft is decellularized and sterile processed human peripheral nerve tissue. We developed Avance Nerve Graft by following the guiding principle that the human body created the optimal peripheral nerve structure. We, through our licensing efforts and research, developed our Avance Method®, a proprietary method for processing recovered human peripheral nerve tissue in a manner that preserves the essential structure of the ECM while cleansing away cellular and noncellular debris. Avance Nerve Graft provides the natural peripheral nerve structure of a nerve, including the native laminin, to guide the regenerating nerve fibers. The nerve ECM is additionally processed to remove a natural inhibitor to regeneration called chondroitin sulphate proteoglycan.

We believe that Avance Nerve Graft is the first off-the-shelf nerve allograft for bridging nerve transections. Avance Nerve Graft is comprised of bundles of small diameter endoneurial tubes that are held together by an outer sheath called the epineurium. Avance Nerve Graft has been processed to remove cellular and noncellular factors such as cells, fat, blood, and

axonal debris, while preserving the three-dimensional laminin lined tubular bioscaffold (i.e., microarchitecture), epineurium, and microvasculature of the peripheral nerve. After processing, Avance Nerve Graft is flexible and pliable, and its epineurium can be sutured in place allowing for a tension-free approximation of the proximal and distal peripheral nerve stumps. During the healing process, the body revascularizes and gradually remodels the graft into the patient’s own tissue while allowing the processed peripheral nerve allograft to physically support axonal regeneration across the peripheral nerve discontinuities. Avance Nerve Graft does not require immunosuppression for use.

With lengths up to 70 mm and diameters up to 5 mm, Avance Nerve Graft allows surgeons to choose and trim the implant to the correct length for reconstructing the relevant peripheral nerve gap, as well as to match the diameter to the proximal and distal end of the severed peripheral nerve. Avance Nerve Graft is stored frozen and utilizes packaging that maintains the implant in a sterile condition. The packaging is typical for medical products, so the surgical staff is familiar with opening the package for transfer of Avance Nerve Graft into the sterile surgical field. The packaging also provides protection during shipment and storage and a reservoir for the addition of sterile fluid to aid in thawing the product. Avance Nerve Graft thaws in less than 10 minutes, and once thawed, it is ready for implantation.

Avance Nerve Graft provides the following key advantages:

•A three-dimensional bioscaffold for bridging a peripheral nerve gap;

•A biologically active nerve therapy with more than 10 years of comprehensive clinical evidence;

•No patient donor-nerve surgery, therefore no comorbidities associated with a secondary surgical site;

•Available in a variety of diameters up to 5mm to meet a range of anatomical needs;

•Available in a variety of lengths up to 70mm to meet a range of gap lengths;

•Decellularized and cleansed ECM;

•Implanted without the need for immunosuppression, remodels into patient’s own tissue;

•Structurally supports the body’s own regeneration process;

•Handles similar to an autograft, and is flexible and pliable;

•Alleviates tension at the repair site;

•Three-year shelf life; and

•Supplied sterile.

Axoguard Nerve Connector

Axoguard Nerve Connector is a coaptation aid used to align and connect severed peripheral nerve ends in a tensionless repair. The product is in a tubular shape with an open lumen on each end where the severed peripheral nerve ends are inserted. It is typically used when the gap between the peripheral nerve ends is 5mm or less in length. Axoguard Nerve Connector is made from a processed porcine ECM that allows the body’s natural healing process to repair the peripheral nerve while its tube shape isolates and protects the transected nerves during the healing process. During healing, the patient’s own cells incorporate into the ECM product to remodel and form a tissue similar to the outermost layer of the peripheral nerve (nerve epineurium). Axoguard Nerve Connector is provided sterile, for single use only, and in a variety of sizes to meet the surgeon’s needs.

Axoguard Nerve Connector can be used:

•As an alternative to direct suture repair;

•As a peripheral nerve coaptation; Connector-Assisted Repair®;

•To aid coaptation in direct repair, grafting, or cable grafting repairs; and

•To reinforce the coaptation site.

Axoguard Nerve Connector has the following advantages:

•Processed intact porcine ECM with an open, porous structure that allows for cell infiltration and remodeling;

•Designed as a coaptation aid for tensionless repair of transected or severed peripheral nerves;

•Alleviates tension at the repair site;

•Remodels into the patient’s own tissue;

•Reduces the number of required sutures (versus direct repair with suture);

•Allows surgeon to move sutures away from the repair site which may minimize inflammation and aid nerve regeneration;

•Reduces potential for fascicular mismatch;

•Allows visualization of underlying peripheral nerve ends;

•Available in seven different diameters and two different lengths to address a variety of nerve repair situations;

•Strong and flexible, easy to suture; and

•Stored at room temperature with a minimum of 18-month shelf life for the sizes with 6-layers and 24-month shelf life for those with 5-layers.

Axoguard Nerve Protector

Axoguard Nerve Protector is a product used to protect and wrap damaged peripheral nerves and reinforce reconstructed nerve gaps while minimizing soft tissue attachments. It is designed to protect and isolate the peripheral nerve during the healing process after surgery by creating a barrier between the nerve tissue and the surrounding tissue bed. The product is delivered in a slit tube format allowing it to be wrapped around peripheral nerve structures. Axoguard Nerve Protector is made from a processed porcine ECM. During healing, the ECM remodels allowing the protector to separate the peripheral nerve from the surrounding tissue. Axoguard Nerve Protector competes against off-the-shelf biomaterials such as reconstituted bovine collagen as well as the use of the patient’s own tissue such as vein and hypothenar fat pad wrapping. Axoguard Nerve Protector is provided sterile, for single use only, and in a variety of sizes to meet the surgeon’s needs.

Axoguard Nerve Protector can be used to:

•Separate and protect the nerve from the surrounding tissue during the healing process;

•Minimize risk of soft tissue attachments and entrapment in compressed peripheral nerves;

•Protect peripheral nerves in a traumatized wound bed; and

•Reinforce a coaptation site.

Axoguard Nerve Protector has the following advantages:

•Processed porcine submucosa ECM used to reinforce a coaptation site, wrap a partially severed peripheral nerve or protect peripheral nerve tissue;

•Creates a protective layer that isolates and protects the peripheral nerve in a traumatized wound bed;

•Remodels to form a new soft tissue layer;

•Easily conforms and provides 360-degree wrapping of damaged peripheral nerve tissue;

•Allows the body's natural healing process to repair the nerve;

•Minimizes the potential for soft tissue attachments and peripheral nerve entrapment by physically isolating the nerve during the healing process;

•Allows peripheral nerve gliding;

•Strong and flexible, plus easy to suture;

•Is available in five different widths and two different lengths to address a variety of peripheral nerve repair situations; and

•Stored at room temperature with a minimum of 24-month shelf life.

HA+

HA+ is a surgical implant that provides non-constricting protection for peripheral nerves. HA+ is designed to be an interface between the nerve and the surrounding tissue. HA+ is comprised of an ECM and is fully remodeled during the healing process. The lubricant coating on HA+ is composed of sodium hyaluronate and sodium alginate. When hydrated, the lubricant coating reduces friction between the nerve and the surrounding tissue. HA+ is flexible to accommodate movement of the joint and associated tendons and has sufficient mechanical strength to hold sutures. HA+ is provided sterile, for single use only, and in a variety of sizes to meet surgeons’ needs.

HA+ can be used to:

•Separate and protect the nerve from the surrounding tissue during the healing process;

•Minimize risk of soft tissue attachments and entrapment in compressed peripheral nerves;

•Protect peripheral nerves in a traumatized wound bed; and

•Provide tension relief when used in aiding a coaptation.

HA+ has the following advantages:

•Processed porcine submucosa ECM layer is vascularized and remodeled by the patient into new site-specific tissue;

•Double-sided HA+ gel coating to reduce friction and enhance nerve gliding through traumatic tissue beds;

•Formulated for optimized handling and flexibility of surgical application—quick hydration, flat sheet configuration and is easy to suture if needed;

•Allows the body's natural healing process to repair the nerve;

•Minimizes the potential for soft tissue attachments and peripheral nerve entrapment by physically isolating the nerve during the healing process;

•Allows peripheral nerve gliding;

•Is available in five different sizes up to 4cm x 8cm to address a variety of peripheral nerve repair situations; and

•Stored at room temperature with a minimum of 24-month shelf life.

Axoguard Nerve Cap

Axoguard Nerve Cap is a proprietary porcine submucosa ECM product used to protect a peripheral nerve end and separate the nerve from the surrounding environment to reduce the development of symptomatic or painful neuroma.

Nerves are often cut in a variety of surgeries and a nerve that is cut and not reconstructed may form an entangled mass of disorganized nerve and fibrous tissue that could cause debilitating pain called a symptomatic neuroma. Neuromas are a potential cause of pain for those patients who complain of chronic post-surgical pain, including in amputees, which may lead to an inability to use their prosthesis. Despite more than 30 different treatment methods, it is our belief that neuromas continue to be an unresolved problem in microsurgery. We believe the Axoguard Nerve Cap can address these painful neuromas and

address nerve pain without the complications of traditional methods, including pharmacotherapy and chemical injections, among others. Axoguard Nerve Cap can be used to reduce the development of symptomatic or painful neuroma formation.

Axoguard Nerve Cap has the following advantages:

•Separates the nerve end from surrounding tissue, neurotrophic factors and mechanical stimulation;

•Reduces painful neuroma formation;

•Allows for anchoring of a nerve end or stump to nearby tissue structure;

•Material gradually remodels into the patient’s own tissue to protect the nerve end;

•Semi-translucence allows for visualization of nerve ends or stumps and easy visualization for suture placement;

•Is available in six different sizes to address a variety of situations; and

•Stored at room temperature with a minimum of 18-month shelf life.

Avive+ Soft Tissue Matrix

Avive+ Soft Tissue Matrix, a multi-layer amniotic membrane allograft used to protect and separate tissues in the surgical bed during the critical phase of tissue repair.

Acroval Neurosensory and Motor Testing System

Effective November 2019, we discontinued all sales and effective October 15, 2024, we no longer perform maintenance or calibration of the Acroval Neurosensory and Motor Testing System.

Tissue Recovery and Processing

Avance Nerve Graft Processing Overview

We developed our Avance Method®, an advanced and proprietary technique to process Avance Nerve Graft from donated human peripheral nerve tissue. Our Avance Method requires special training over several months for each manufacturing associate who processes Avance Nerve Grafts. The processing and manufacturing system for Avance Nerve Graft has required significant capital investment, and we seek to continually improve our manufacturing and quality assurance processes and systems. Our Avance Method is depicted as follows:

Tissue Processing

Our Avance Method comprises peripheral nerve tissue recovery/acquisition and testing, donor medical review and release, debridement and other processing steps, packaging, and sterilization to meet or exceed all applicable FDA, state, and international regulations and the American Association of Tissue Banks (“AATB”) standards. Our supply agreements with recovery and acquisition agencies for peripheral nerve tissue and our ability to enter into additional supply contracts, as necessary will provide us with the tissue volumes we require to meet the demand for our Avance implants. As an FDA registered tissue establishment, we use both our own personnel and subcontractors for recovery/acquisition, storage, testing, processing, and sterilization of the donated peripheral nerve tissue and placental tissues. Additionally, we and our subcontractors, have contracted with independent Good Manufacturing Practice ("GMP") and Good Laboratory Practice compliant laboratories to perform testing for product release. The safety of Avance Nerve Graft is supported by donor screening, process validation, process controls, and validated terminal sterilization methods. The Axogen Quality System has built in redundancies that are meant to ensure product release only after such product meets our quality control and product requirements.

Tissue Recovery and Processing Facilities

We partner with other FDA registered tissue establishments and AATB accredited recovery agencies or recovery agencies in compliance with FDA, state and international regulations and AATB standards for human tissue recovery. After consent for donation is obtained, donations are screened and tested in detail for safety in compliance with FDA, state and international regulations and AATB standards on communicable disease transmission.

In 2023, we successfully transferred the Avance Nerve Graft tissue processing and packaging from the Solvita facility to our Axogen Processing Center facility (the "APC Facility"), which is comprised of a 107,000 square foot building on approximately 8.6 acres of land located in Vandalia, Ohio. It is expected that the APC Facility, along with the ability for expansion, will provide processing capabilities that will meet our intended sales growth. We submitted the BLA for Avance Nerve Graft in September of 2024, and, on November 1, 2024, the FDA accepted the BLA for filing and assigned a Prescription Drug User Fee Act goal date of September 5, 2025. The APC Facility is expected to allow us to meet the current Good Manufacturing Practices ("cGMPs") required for processing a biologic product. Biologics manufacturing is highly regulated and subject to scrutiny and inspection by the FDA. Any quality or compliance issues, or manufacturing disruptions for any other reasons, may delay approval of the BLA.

We obtained certain economic development grants from state and local authorities totaling up to $2.7 million including $1.3 million of cash grants to offset costs to acquire and develop the APC Facility. Certain economic development grants were

subject to fixed asset investments and job creation milestones by December 31, 2024, and have clawback clauses if we do not meet the minimum requirements for these milestones. We have not met the job creation milestones and have requested a reduction or waiver of clawbacks or extensions from the grant authorities to extend the job creation milestones evaluation date from December 31, 2024 and the expiration date to December 31, 2026. Certain grant authorities have not approved our request. We are continuing discussions with these grant authorities regarding the evaluation, expiration and clawbacks of the job creation milestones and expect to receive a response during 2025. We could be obligated to pay back up to approximately $950 thousand as of December 31, 2024 related to these grants. See "Part II, Item 8. Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements - Note 15 - Commitments and Contingencies - Service Agreements."

We process and package Avive+ Soft Tissue Matrix using our employees and equipment pursuant to a License and Services Agreement, as amended (the “Solvita Agreement”) with Community Blood Center (doing business as Solvita) ("Solvita"), in Dayton, Ohio at their facility ("Solvita facility"). We expect to continue to rely on the Solvita facility for the processing of Avive+ Soft Tissue Matrix. Solvita is an FDA registered tissue establishment and an AATB accredited organization.

The current Solvita Agreement extends through December 31, 2026. Under the Solvita Agreement, we pay Solvita a facility fee for clean-room, manufacturing, storage, and office space. Solvita also provides services in support of our manufacturing such as routine sterilization of daily supplies, providing disposable supplies and microbial services, and office support. The service fee is based on a per donor batch rate. The Solvita facility provides a cost effective, quality controlled and licensed facility. Our processing methods and process controls have been developed and validated to ensure product uniformity and quality. Pursuant to the Solvita Agreement, we pay license fees on a monthly basis to Solvita. See "Item 8. Financial Statements and Supplementary Data – Notes to Consolidated Financial Statements- Note 15 - Commitments and Contingencies - Service Agreements."

Tissue Packaging

After processing, the packaging operation for Avance Nerve Graft is performed in a controlled environment at the APC Facility and the packaging operation for Avive+ Soft Tissue Matrix is performed in a controlled environment at the Solvita facility. Each Avance Nerve Graft and Avive+ Soft Tissue Matrix are visually inspected and organized by size into finished product codes. The tissue implants are then packaged in primary packaging. The outer pouch acts as the primary sterility and moisture barrier.

Tissue Sterilization and Labeling

After being processed and packaged, Avance Nerve Graft and Avive+ Soft Tissue Matrix are then terminally sterilized at a contract sterilization facility. After sterilization, Avance Nerve Graft and Avive+ Soft Tissue Matrix are shipped back to Axogen where the product lots will undergo quality review to ensure the lots meets specifications and then final packaging and labeling. Orders for Avance Nerve Graft and Avive+ Soft Tissue Matrix are placed with our customer care team, and the products are packaged and shipped from our distribution facilities.

Tissue Product Release

We have established quality procedures for review of tissue recovery, relevant donor medical record review, and release to processing that meet or exceed FDA requirements as defined in 21 CFR Part 1271, state regulations, international regulations, and AATB standards. The Axogen Quality System meets the requirements set forth under 21 CFR Part 1271 for HCT/Ps, including Good Tissue Practices (“GTP”) and is compliant with the 21 CFR Part 820 Quality System Regulation (“QSR”). Furthermore, we utilize validated processes for the handling of raw material components, environmental control, processing, packaging, and terminal sterilization. In addition to ongoing monitoring activities for product conformity to specifications and sterility, shipping methods have been validated in accordance with applicable industry standards.

Manufacturing of Our Medical Device Classified Products

Manufacturing for the Axoguard Product Line

Axoguard Nerve Connector, Axoguard Nerve Protector, HA+, and Axoguard Nerve Cap (the "Axoguard Product Line") is manufactured by Cook Biotech Incorporated (acquired on January 31, 2024 by RTI Surgical, Inc. and rebranded on December 17, 2024 as Evergen), in West Lafayette, Indiana (“Evergen”), which was established in 1995 to develop and manufacture implants utilizing porcine ECM. We do not expect this acquisition to have a material impact on our relationship with Evergen or on our operations. We decided to expand our portfolio of products and felt that the unique ECM material offered by Evergen provided the combination of properties needed in nerve reconstruction. Evergen’s ECM material is pliable, capable of being

sutured, and translucent and allows the patient’s own cells to incorporate into the ECM to remodel and form a tissue similar to the nerve’s epineurium. Evergen has its own source of the raw material for the ECM material and manufactures Axoguard products from such sources.

Axoguard Nerve Connector and Axoguard Nerve Protector

In August 2008, we entered into an agreement with Evergen, amended in February 2012, October 10, 2014, February 26, 2018, and August 4, 2023 (the “Distribution Agreement”), to distribute its ECM technology in the form of the Surgisis® Nerve Cuff, the form of a nerve wrap or patch, or any other mutually agreed to configuration. The Surgisis products were rebranded under our Axoguard name and consist of the Axoguard Nerve Connector and Axoguard Nerve Protector. Our distribution rights are worldwide in the field of the peripheral and central nervous system but excluding use of the products in the oral cavity for endodontic and periodontal applications and OMF surgery solely as they relate to dental, soft or hard tissue repair, or reconstruction. We believe the exclusion does not limit our identified OMF market, but expansion into certain additional OMF market areas could be limited to our other products not subject to the Distribution Agreement.

The Distribution Agreement terminates on December 31, 2030. Although the agreement requires certain minimum purchases, through mutual agreement, the parties have not established such minimums and to date have not enforced such provision. The Distribution Agreement also establishes a formula for the transfer cost of the Axoguard Nerve Connector and Axoguard Nerve Protector.

Axoguard Nerve Cap and HA+

We developed, filed several patent applications, and, on August 8, 2017, obtained FDA 510(k) regulatory clearance for the Axoguard Nerve Cap. We developed, filed several patent applications, and, on April 7, 2023, obtained FDA 510(k) regulatory clearance for HA+ and a second 510(k) regulatory clearance expanding the indication for use of HA+ on October 12, 2023. These devices are made with Evergen’s ECM material. Pursuant to the Nerve End Cap Supply Agreement dated June 27, 2017, as amended on April 6, 2020 and August 4, 2023, (the "Amended Supply Agreement"), Evergen is the exclusive contract manufacturer of the Axoguard Nerve Cap and both parties have provided the other party the necessary licenses to their technologies for operation of the Amended Supply Agreement. The Amended Supply Agreement has a term through December 31, 2030. Pursuant to the HA+ Supply Agreement dated May 2, 2023, Evergen is the exclusive contract manufacturer of HA+ and both parties have provided the other party with the necessary licenses to their technologies for operation under the agreement. The HA+ Supply Agreement has a term through June 30, 2030. Consistent with the Axoguard Nerve Connector and Axoguard Nerve Protector products, we are able to sell the Axoguard Nerve Cap and HA+ worldwide in the field of the peripheral and central nervous system, but subject to the same exclusions as Axoguard Nerve Connector and Axoguard Nerve Protector.

Sales and Marketing

Overview

We are focused on developing the peripheral nerve repair and regeneration market, committed to improving awareness of new surgical peripheral nerve repair options and building additional scientific and clinical data to assist surgeons and patients in making informed choices with respect to the repair of peripheral nerve injuries. We believe that there is an opportunity to improve current approaches to peripheral nerve repair and that our approach will solidify our position as a leader in the field of peripheral nerve repair products. The following provides the key elements of our sales and marketing strategy.

Increase Awareness of Our Products

Prior to the introduction of our portfolio of peripheral nerve repair products, surgeons had a limited number of options available to surgically repair damaged or transected peripheral nerves. We entered the market to improve the standard of care for nerve injury patients. We intend to increase market penetration and share by increasing awareness of the impact of nerve damage on quality of life and improving the adoption of nerve repair techniques and our products through the continued use of educational conferences and presentations, training for surgical residents, fellows and attending physicians, scientific publications, digital communication, and a knowledgeable and professional sales team. We work to increase awareness and the use of our products within high potential accounts that include hospitals that are level 1 trauma centers, academic affiliated and have a large number of microsurgical trained surgeons and large procedural volumes across our focus clinical specialties. Our customer call points are focused on plastic reconstructive surgeons, orthopedic and plastic hand surgeons who perform surgeries on patients suffering traumatic nerve damage or transection, on oral maxillofacial and head and neck surgeons who repair damaged oral and facial nerves, and on plastic reconstructive surgeons who perform breast reconstruction and neurotization.

Expand Clinical and Scientific Data Regarding the Performance of Our Products

Generating robust clinical and scientific data is a cornerstone of our marketing and product development strategy. As of December 31, 2024, there have been over two hundred and fifty peer reviewed clinical publications related to our products, with some publications including data on multiple product offerings. This body of evidence underscores the growing adoption and validation of our technologies in peripheral nerve repair.

Our RANGER® clinical study (defined below in “Government Regulations - Clinical Trials”), a comprehensive utilization registry of the Avance Nerve Graft, enrolled more than 2,800 Avance Nerve Graft repairs to date. Enrollment and follow-up in the primary RANGER arms and the MATCH arm - evaluating autograft and conduit repair options - were completed in December 2023. The analyses from these studies were integral to supporting our BLA submission. Another arm of the RANGER study, Sensation-NOW®, is currently tracking neurotization outcomes in breast reconstruction and continues to enroll patients. To date, the RANGER registry has generated eleven peer-reviewed publications and over 70 scientific conference presentations, reflecting the significant impact of these studies in advancing the field of nerve repair.

In December 2023, we initiated enrollment for COVERED, a multi-center series of protection with HA+ in protection applications. Additionally, several investigator-initiated studies, case reports, and publications have been completed, including breast neurotization, mandible reconstruction, compressive neuropathies, and the surgical treatment of pain. Ongoing case series are being developed for brachial plexus, breast reconstruction neurotization, compression injuries, and the surgical treatment of pain. We remain committed to supporting external research efforts and actively collaborate with investigators on grants with translational and clinical impact.

The RECON study (defined below in "Government Regulations - Clinical Trials"), a pivotal phase 3, multicenter, prospective, randomized, comparative study of hollow tube conduits and Avance Nerve Graft has successfully completed enrollment, follow-up, and analysis. The first peer reviewed publication from this study has been published, marking a significant milestone in transitioning the Avance Nerve Graft to a biologic product.

The REPOSE study pilot phase (defined below in "Government Regulations - Clinical Trials"), a multicenter, prospective, randomized, and subject blinded study of Axoguard Nerve Cap as compared to neurectomy alone for the treatment of symptomatic neuroma, has also been published. The comparative phase has completed enrollment and follow-up, providing critical data to guide treatment strategies. Additionally, enrollment in REPOSE XL was completed in January 2025. This study is evaluating the tolerability and feasibility of a large diameter Axoguard Nerve Cap for protecting and preserving terminated nerve ends.

By continuously generating and disseminating clinical and scientific data, we aim to solidify our leadership in the field of peripheral nerve repair, advance clinical practice, and support the adoption of innovative treatment solutions.

Commitment to the Education of Best Practices in Peripheral Nerve Repair

We have established educational conferences and presentations and surgical resident and fellow training that we believe have positioned us as a leader in providing peripheral nerve repair best practices. We have historically provided education on peripheral nerve repair through in-person national programs, including our “Advances and Best Practices in Nerve Repair” as well as local and regional educational events. In 2024, we offered multiple educational programs including virtual and in-person surgeon education programs.

Focused on developing deeper penetration with our existing accounts through development of long-term users of our algorithm in our largest market opportunity of extremity trauma

We provide full sales and distribution services. As of December 31, 2024, we had 114 direct sales professionals in the U.S. Our direct sales force continues to be supplemented by independent sales agencies that represent approximately 10% of our total revenue. We believe that near-term growth can be supported first through expanded productivity of our existing sales force as they go into more depth with existing accounts and then by adding additional accounts. We expect the number of direct sales professionals to increase over time. Additionally, we have successfully utilized a hybrid commercial approach that includes the use of independent agencies in more remote geographies to provide appropriate local support for surgeons, without the travel time required of a direct sales representative.

Our products are available and sold in 19 countries outside the U.S. through a number of independent in-country distributors. We provide support and resources for independent agencies and distributors both within and outside the U.S. We provide our products to hospitals, surgery centers and military hospitals, calling on surgeons, including plastic reconstructive surgeons, orthopedic and plastic hand surgeons, and certain oral and maxillofacial surgeons to review the benefits of our

products. While surgeons make the decision to implant our products in appropriate patients, hospitals make the decision to purchase the products from us. In today’s budget constrained environment, hospital committees review new technologies for cost effectiveness as well as quality. We believe that we have been successful in meeting the needs of these hospital committees by demonstrating the cost/benefit of our products and providing a fair value to the hospital.

Expand the Product Pipeline and Applications in Peripheral Nerve Repair

We have developed and continue to develop new and next generation products to support surgeons in their needs for repairing damaged or transected peripheral nerves. We believe additional opportunities exist to develop or acquire complementary products in peripheral nerve repair. In addition, there are opportunities to expand the existing portfolio of products in new applications of peripheral nerve repair in applications such as lower extremity surgery, head and neck surgery, urology, and the surgical treatment of pain.

Avance Nerve Graft Performance

We have worked with leading institutions, researchers, and surgeons to support innovation in the field of surgical peripheral nerve repair. We believe our RANGER study is the largest multi-center clinical study conducted in peripheral nerve gap repair with over 2,800 enrolled repairs. We have completed the RECON study. This study was a phase 3 trial to support our BLA for Avance Nerve Graft. See “Government Regulations - Clinical Trials - Axogen Clinical Trials.”

International Opportunity for Revenue

We currently focus primarily on the U.S. market, with additional foreign distribution and sales in Canada, Germany, UK, Spain, and several other European, Asian and Latin American countries. The need for the surgical repair of damaged or transected nerves is a global opportunity. Through our revenue outside the U.S., we have demonstrated the capability to take our current peripheral nerve repair surgical portfolio into new geographical markets. We currently have European Union (“E.U.”) wide registration only for Axoguard Nerve Connector and Axoguard Nerve Protector as approval/registration for Avance Nerve Graft as human tissue is required in each individual country. Avance Nerve Graft was granted marketing authorization in Germany and direct commercial operations began in 2022. Currently, Axoguard Nerve Cap is available in the U.S. and New Zealand. Introduction of our products into foreign markets is subject to meeting the appropriate regulatory standards of particular countries and any appropriate regional regulation or directive. In addition to regulatory approval, reimbursement approval is necessary to achieve material product adoption in most countries. Avance Nerve Graft has achieved NICE approval in the UK for digital nerve repair and reimbursement approval in South Korea for repairs up to 50mm in length for sensory nerves when an autograft is not possible. To date, revenue from international distribution and sales have not been material, there are no material risks associated with foreign operations, and we do not have dependencies as to international revenue. See " Item 1A. Risk Factors – Our operations must comply with FDA and other governmental requirements."

Research and Development

We are committed to advancing the field of peripheral nerve repair and providing the most comprehensive portfolio of solutions for peripheral nerve injuries. Our development efforts are focused on expanding the clinical evidence base for nerve repair surgical applications, introducing product line extensions of the Avance and Axoguard products, and innovating new technologies and products to address unmet needs in peripheral nerve repair.

In collaboration with leading academic institutions, we actively support the development of novel treatment approaches for peripheral nerve injuries. Our research initiatives are supported by several government-funded grants that explore the application of our technologies in nerve repair and recovery.

For the fiscal year ended December 31, 2024, we invested approximately $27.8 million in research and development activities. This investment includes costs associated with product development, clinical research, and the transition of Avance Nerve Graft to a biological product, reflecting our dedication to both scientific advancement and regulatory excellence.

Competition

The medical device and biotechnology industries are characterized by rapidly advancing technologies, intense competition, and a strong emphasis on proprietary products. As such, we cannot predict what products may be offered in the future that may compete with our products. In the peripheral nerve repair market, we compete primarily against all transected and non-transected peripheral nerve repair approaches, including direct suture repair, autograft, and hollow-tube nerve conduits and materials used to wrap and protect damaged peripheral nerve tissue.

Because the requirements of the biomaterials used in peripheral nerve repair can vary based on the severity and location of the damaged nerve, the size and function of the nerve, surgical technique, and patient preference, our peripheral nerve repair products compete against both autograft materials (nerve in the case of a bridging repair and vein or fat in the case of a nerve protection repair), and a limited number of off-the-shelf alternatives for repairing and protecting. Competitive aspects of our products focus on their overall value proposition and suitability for specific applications and can include composition and structure of the material, ease of use, clinical evidence, handling, and price. Our major competitors' products include off-the-shelf repair options in hollow-tube conduits, coaptation aids and bio-absorbable wraps.

We believe any current or future competitors face the following important barriers to market entry as it relates to its peripheral nerve repair products. Our intellectual property (“IP”), and that of our partners, including patents, patents-pending, trade secrets, and unique, internal subject matter expertise, is believed to be an important barrier for our Avance Nerve Graft and Axoguard products. We have developed knowledge and experience in understanding and meeting FDA regulatory requirements for Avance Nerve Graft, including having made a substantial investment in conducting the pre-clinical and clinical testing necessary to support a submission for an FDA BLA. Additionally, we believe our ability to offer a portfolio of products focused on peripheral nerve repair and the breadth of clinical data associated with the products provides a unique competitive position versus other entities that do not have this breadth of product offering. However, due to our limited resources, our smaller size, and our relatively early stage, we believe we may face competitive challenges from larger entities and market factors that could negatively impact our growth, including competitors’ introduction of new products and competitors’ bundling of products to achieve pricing benefits. (See “Item 1A. Risk Factors – Technological change and competition for newly developed products could reduce demand for our products”; “Risk Factors –– Our operating results could be adversely impacted if we are unable to effectively manage and sustain our future growth or scale our operations”).

Intellectual Property

Overview

We protect our IP through a combination of patents, trademarks, trade secrets, and copyrights. In addition, we safeguard our trade secrets and other confidential know-how, and carefully protect these and other IP rights when engaging with third parties. For example, we require vendors, contract organizations, consultants, advisors, and employees to execute confidentiality and nondisclosure agreements, and to appropriately protect any information disclosed to them by us so as to preserve confidential and/or trade secret status. We also require consultants, advisors, and employees to assign their rights to any relevant IP arising out of their relationship with us to us.

License Agreements

We have previously entered into license agreements with the University of Florida Research Foundation (the "UFRF") and the University of Texas at Austin ("UTA"). Under the terms of these license agreements, we hold exclusive worldwide licenses to underlying technologies used by us in our Avance Nerve Graft. The license agreements include the right to certain patents and patents pending in the U.S. and international markets. The effective term of the license agreements extends through the term of the related patents. The patents for which royalty obligations exist under the UFRF license agreement expired in December 2023, and the UTA license agreement expired when the last patents licensed thereunder expired in September 2023.

Patents

As of the date of this Annual Report on Form 10-K, we own thirty-two issued U.S. patents, more than fifty pending U.S. patent applications (including those for which we have received a notice of allowance) and three hundred twenty international patents and patent applications with regard to our peripheral nerve products and other related technologies.

In connection with our Avance Nerve Graft, per Section 351(k)(7) and 351(i)(4) of the PHS Act, from the date of BLA approval, we believe we will have a period of 12 years of exclusivity in the U.S. from commercial competition from biosimilars using Avance Nerve Graft as the reference product. Finally, we have Enforcement Discretion from the FDA regarding continued distribution under controls applicable to HCT/Ps with an agreed transition plan to a BLA. We believe a competitive processed peripheral nerve allograft (non-biosimilar) would need to successfully complete BLA Phase I, II and III clinical studies prior to clinical release, the completion of which we believe would take at least eight years.

Each of Axogen’s other products in the U.S. and abroad, is also protected by multiple patents and local laws providing protection for IP, which provides further barriers to entry for potentially competitive products. Axogen’s Axoguard Nerve Cap is protected by numerous issued Axogen patents in the U.S. and globally. Additional allowed Axogen patent applications, as well as other pending Axogen patent applications that are expected to be issued in the U.S. and abroad, will provide further protection of Axoguard Nerve Cap and thus act as additional obstacles to the commercial introduction of competitive products.

Our HA+ is also the subject of multiple pending Axogen patent applications in the U.S. and abroad. The potential for products competitive with Axogen’s Axoguard line of products, including our Axoguard Nerve Connector and Axoguard Nerve Protector, is further encumbered by the additional IP protections related to their methods of manufacture, as discussed further below in the Trade Secrets section.

Our policy is to seek patent protection for, or where strategically preferable, maintain as trade secret, the inventions that we consider important to our products and the development of our business. We have sought, and will continue to seek, patent protection for select proprietary technologies and other inventions emanating from our research and development ("R&D"), including with respect to uses, methods, and compositions, in an effort to further fortify our IP in areas of importance to us and our growing product portfolio. In instances that patent protection is not possible, product value to our portfolio can still be derived.

Trademarks, Trade Secrets and Copyrights

We hold a significant portfolio of hundreds of registered trademarks and applied-for trademarks in the U.S. and worldwide. Protection of our trademarks allows us to prevent competitors from, for example, using the same or a confusingly similar company name, or the same or confusingly similar product names within identified classes of goods that could otherwise wrongfully allow such competitors to capitalize on our brand, reputation, and goodwill, and thereby improperly bolster their sales or reputations through, for example, consumer confusion, a false indication of our endorsement, or of a false indication of corporate or contractual relationship with us. We police and enforce our marks.

We possess trade secrets and material know-how in the following general subject matters: nerve and tissue processing, nerve repair, product testing methods, and pre-clinical and clinical expertise. We have registered copyrights for training tools and artistic renderings. Additionally, we entered into the Distribution Agreement and Supply Agreement with Evergen for the Axoguard products. Evergen believes it has know-how and trade secrets with respect to its ECM technology that provides certain additional competitive obstacles to third parties, in addition to those obstacles existing in view of Axogen-owned IP.

Government Regulations

U.S. Government Regulation Overview

Our products are subject to regulation throughout their lifecycle by the FDA, as well as other federal and state regulatory bodies in the U.S. and comparable authorities in other countries. In addition, our Avance Nerve Graft must comply with the standards of the tissue bank industry’s accrediting organization, the AATB.

We distribute Axoguard Nerve Connector and Axoguard Nerve Protector products for Evergen, and Evergen is responsible for the regulatory compliance of these products. These Axoguard products are regulated as medical devices and subject to pre-market notification requirements under section 510(k) of the Federal Food, Drug, and Cosmetic Act (the “FD&C Act”), 21 CFR Part 820 QSR, and related laws and regulations. Evergen has obtained a 510(k) pre-market clearance for Axoguard Nerve Connector from the FDA for the use of porcine small intestine submucosa for the repair of peripheral nerve transections where gap closure can be achieved by flexion of the extremity. Evergen has also obtained a 510(k) pre-market clearance for Axoguard Nerve Protector for the repair of peripheral nerve damage in which there is no gap or where a gap closure is achieved by flexion of the extremity. We sell the 510(k) cleared devices under the trade names Axoguard Nerve Connector and Axoguard Nerve Protector.

We are the specification developer and authorization holder of the Axoguard Nerve Cap product, which is classified by the FDA as a Class II device. The Axoguard Nerve Cap was cleared for market under 510(k) K163446. It is classified by FDA under 21 CFR § 882.5275 (Nerve Cuff, product code: JXI). Evergen is the contract manufacturer for our Axoguard Nerve Cap product, and we are responsible for the regulatory compliance, distribution, and sale of this product.

We are the specification developer and authorization holder of the HA+ product, which is classified by the FDA as a Class II device. HA+ was cleared for market under 510(k) K223640 on April 7, 2023, and a second 510(k) K231708 regulatory clearance was obtained on October 12, 2023, expanding the indication for use of HA+. The products are classified by the FDA under 21 CFR § 882.5275 (Nerve Cuff, product code: JXI). Evergen is the contract manufacturer, and we are responsible for the regulatory compliance, distribution, and sale of this product.

Avive+ Soft Tissue Matrix Regulation

We launched Avive+ Soft Tissue Matrix in the second quarter of 2024 after engagement with the FDA through the Tissue Reference Group Rapid Inquiry Program, which resulted in feedback that the product appears to be regulated solely under section 361 of the PHS Act and the regulations in 21 CFR Part 1271. Products regulated solely under Section 361 of the PHS Act are a product category under close scrutiny by the FDA for compliance with the regulatory requirements and potentially subject to regulatory change in the future. Failure to comply with applicable regulatory requirements could expose us to potential compliance actions by the FDA or state regulators and could risk the commercial availability of the product.

FDA — General

FDA regulations govern nearly all the activities that we perform, or that are performed on our behalf, to ensure that medical products distributed domestically or exported internationally are safe and effective for their intended uses. The activities the FDA regulates include the following:

•Product design, development, and manufacture;

•Product safety, testing, labeling, and storage;

•Pre-clinical testing in animals and in the laboratory;

•Clinical investigations in humans;

•Pre-marketing clearance, approval, or licensing;

•Record-keeping and document-retention procedures;

•Advertising and promotion;

•The import and export of products;

•Product marketing, sales, and distribution;

•Post-marketing vigilance, surveillance and medical device reporting, including reporting of deaths, serious injuries, communicable diseases, device malfunctions, or other adverse events; and

•Corrective actions, removals and recalls.

Failure to comply with applicable FDA regulatory requirements may subject us to a variety of administrative or judicially imposed penalties or sanctions and/or prevent us from obtaining or maintaining required approvals, clearances, or licenses to manufacture and market our products. It could also subject us to enforcement actions or sanctions, such as agency refusal to approve pending applications, warning letters, product recalls, product seizures, total or partial suspension of production or distribution of products, injunctions, consent decrees or civil monetary penalties or criminal prosecution.

FDA’s Pre-market Clearance and Approval Requirements - Medical Devices

Unless an exemption applies, each medical device distributed commercially in the U.S. requires either a 510(k) pre-market notification submission or a Pre-Market Approval (“PMA”) Application to the FDA, or other FDA regulatory authorization. Medical devices are classified into one of three classes—Class I, Class II, or Class III—depending on the degree of risk, the level of control necessary to assure the safety and effectiveness of each medical device and how much is known about the type of device. For devices first intended for marketing after May 28, 1976, pre-market review and clearance by the FDA for Class I and II medical devices is accomplished through the 510(k) pre-market notification procedure by finding a device substantially equivalent to a legally marketed Class I or II device, unless the device is exempt. The majority of Class I medical devices are exempt from the 510(k) pre-market notification requirement. Devices deemed by the FDA to pose the greatest risk, such as life-sustaining, life-supporting, or implantable devices for which Class II controls are inadequate to assure safety or effectiveness, and novel devices, including devices deemed not substantially equivalent to a previously cleared 510(k) device, are placed in Class III. Class III devices generally require an approved PMA prior to marketing, unless classified into Class I or Class II through a de novo request.

A PMA must be supported by extensive data, including, but not limited to, technical, pre-clinical, clinical trials, manufacturing and labeling to demonstrate to the FDA’s satisfaction, and the safety and effectiveness of the device.

Investigational New Drug Application for Drugs and Biologics

Federal law requires that a new drug be the subject of an approved marketing application and that a biological product be properly licensed before each is introduced or delivered for introduction into interstate commerce. Because a sponsor often needs to ship an investigational drug or biological product to clinical investigators in many states, it must seek an exemption from that legal requirement. The Investigational New Drug ("IND") application is the means through which the sponsor obtains this exemption from the FDA. It is additionally the request from a clinical study sponsor to obtain authorization from the FDA to administer an investigational drug or biological product to humans.

There are two IND categories: Commercial and Research (non-commercial). The IND application must contain information in three broad areas:

•Animal Pharmacology and Toxicology Studies - Preclinical data to permit an assessment as to whether the product is reasonably safe for initial testing in humans. Also included are any previous experience with the drug in humans (often foreign use).

•Manufacturing Information - Information pertaining to the composition, manufacturer, stability, and controls used for manufacturing the drug substance and the drug product. This information is assessed to ensure that the company can adequately produce and supply consistent batches of the drug.

•Clinical Protocols and Investigator Information - Detailed protocols for proposed clinical studies to assess whether the initial-phase trials will expose subjects to unnecessary risks. Also, information on the qualifications of clinical investigators--professionals (generally physicians) who oversee the administration of the experimental compound--to assess whether they are qualified to fulfill their clinical trial duties. Finally, commitments to obtain informed consent from the research subjects, to obtain review of the study by an independent institutional review board ("IRB"), and to adhere to the investigational new drug regulations.

Once the IND is submitted, the sponsor must wait 30 calendar days before initiating any clinical trials. During this time, the FDA has an opportunity to review the IND for safety to assure that research subjects will not be subjected to unreasonable risk. An IND will automatically become effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions about issues such as the conduct of the trials and or supporting pre-clinical data as outlined in the IND. In that case, the IND sponsor and the FDA must resolve any outstanding FDA concerns or questions before clinical trials can proceed. Therefore, submission of an IND may not result in the FDA allowing clinical trials to commence.

The following regulations apply to the IND application process:

•21 CFR Part 201 Drug Labeling

•21 CFR Part 312 Investigational New Drug Application

•21 CFR Part 314 IND and NDA Applications for FDA Approval to Market a New Drug (New Drug Approval)

•21 CFR Part 316 Orphan Drugs

•21 CFR Part 50 Protection of Human Subjects

•21 CFR Part 54 Financial Disclosure by Clinical Investigators

•21 CFR Part 56 Institutional Review Boards

•21 CFR Part 58 Good Lab Practice for Nonclinical Laboratory Studies

Biological Product License Application Pathway