Exhibit 13.01

2003

FINANCIAL REPORT

32

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Lehman Brothers Holdings Inc. (“Holdings”) and subsidiaries (collectively, the “Company” or “Lehman Brothers”) is a leading financial services firm that provides investment banking and capital markets facilitation to a global client base. The Company’s business activities are divided into three segments: Investment Banking, Capital Markets and Client Services. The investment banking industry is significantly influenced by worldwide economic conditions as well as other factors inherent in the global financial markets. As a result, revenues and earnings may vary from quarter to quarter and from year to year.

Forward-Looking Statements

Some of the statements contained in this Management’s Discussion and Analysis of Financial Condition and Results of Operations, including those relating to the Company’s strategy and other statements that are predictive in nature, that depend upon or refer to future events or conditions or that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates” and similar expressions, are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These statements are not historical facts but instead represent only the Company’s expectations, estimates and projections regarding future events. These statements are not guarantees of future performance and involve uncertainties that are difficult to predict, which may include, but are not limited to, the factors listed below. As a global investment bank, the Company’s results of operations have varied significantly in response to global economic and market trends and geopolitical events. The nature of the Company’s business makes predicting the future trends of revenues difficult. Caution should be used when extrapolating historical results to future periods.

The Company’s actual results and financial condition may differ, perhaps materially, from the anticipated results and financial condition in any such forward-looking statements and, accordingly, readers are cautioned not to place undue reliance on such statements. The Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

The Company’s results of operations may be affected by uncertain or unfavorable economic, market, legal and other conditions. These conditions include but are not limited to:

Market Fluctuations and Volatility

Changes in interest and foreign exchange rates, securities, commodities and real estate valuations and increases in volatility can increase credit and market risks and may also impact customer-flow-related revenues and proprietary trading revenues as well as impact the volume of debt and equity underwritings and merger and acquisition transactions. The Company uses derivatives and other financial contracts to hedge many of these market risks.

Industry Competition and Changes in Competitive Environment

Increased competition from banking institutions, asset managers and non-traditional financial services providers and industry consolidation could impact fees earned from the Company’s Investment Banking, Client Services and Capital Markets businesses.

Investor Sentiment

Recent accounting and corporate governance scandals have had a significant impact on investor confidence. In addition, geopolitical concerns about terrorist activities can affect the global financial markets.

Liquidity

Liquidity and liquidity management are of critical importance to the Company. Liquidity could be impacted by the inability to access the long-term or short-term debt markets or the repurchase and securities-lending markets. However, the Company’s liquidity and funding policies have been designed with the goal of providing sufficient

33

liquidity resources to continually fund its balance sheet and to meet its obligations in all market environments.

Credit Ratings

The Company’s access to the unsecured funding markets is dependent upon the Company’s credit ratings. A reduction in the Company’s credit ratings could adversely affect the Company’s access to liquidity alternatives and its competitive position, and could increase the cost of funding or trigger additional collateral requirements.

Credit Exposure

Credit risk represents the possibility that a counterparty will be unable to honor its contractual obligations to the Company. Although the Company actively manages credit risk exposure daily as part of its risk management framework, counterparty default risk may arise from unforeseen events or circumstances.

Legal/Regulatory

Legal and regulatory changes in the U.S. and other jurisdictions could have unfavorable effects on the Company’s businesses and results of operations. In particular, there have been a number of legislative, legal and regulatory developments related to research analyst conflicts of interest and mutual fund trading issues in the financial services industry that may affect future results of operations. In 2002, the U.S. Congress enacted the Sarbanes-Oxley Act, which significantly affected corporate governance and securities laws. In addition, various Federal and state securities regulators, self-regulatory organizations (including the New York Stock Exchange) and industry participants reviewed and, in many cases, adopted significant changes to their established rules including rules in the areas of corporate governance, potential research analyst conflicts of interest and auditor independence.

Neuberger Berman Integration

The Company acquired Neuberger Berman Inc. and its subsidiaries (“Neuberger”), an asset management company, in October 2003. The Company’s ability to achieve the anticipated benefits of the merger, including revenue and cost synergies, is dependent upon a number of factors, certain of which may be beyond the Company’s control. These synergies may not be realized in the anticipated amounts or time frame. For additional information about this acquisition see the Client Services business segment discussion on page 45 and Note 6 to the Consolidated Financial Statements.

Business Environment

The principal business activities of the Company are investment banking, capital markets facilitation and asset management, which by their nature are subject to volatility, primarily due to changes in interest and foreign exchange rates, security and real estate valuations, global economic and political trends and industry competition. Through the Company’s investment banking, trading, research, structuring and distribution capabilities in equity and fixed income products, the Company continues to build on its client/customer business model. This model focuses on customer flow activities. The customer flow model is based on the Company’s principal focus of facilitating customer transactions in all major global capital markets products and services. The Company generates customer flow revenues from institutional and high-net-worth clients/customers by (i) advising on and structuring transactions specifically suited to meet client needs; (ii) serving as a market-maker and/or intermediary in the global marketplace, including having securities and other financial instrument products available to allow clients to rebalance their portfolios and diversify risks across different market cycles; (iii) providing asset management services; and (iv) acting as an underwriter to clients. In addition to its customer flow activities, the Company also takes proprietary positions.

During 2003, the global market environment began to emerge from a prolonged slump. Gross domestic product (“GDP”) growth rates began to improve, worldwide capacity indicated core inflation would remain low, labor markets began showing signs of stabilization, and corporate governance issues and geopolitical concerns eased their grip on investor sentiment—all serving to increase the sense of stability. While expectations improved as 2003 progressed, a global economic recovery was not yet fully in evidence.

The fixed income markets performed extremely well in 2003, benefiting from a historically low interest rate environment, improved investor confidence as economic indicators became increasingly positive, and significantly lower levels of corporate downgrades and defaults. During 2003, the U.S. Treasury rate reached a 45-year low, and credit spreads tightened significantly. During the second half of 2003, the fixed income markets saw significant steepening of treasury curves in the U.S. and Japan on the prospects of stronger economic growth. Bond market volatility soared during the second half of 2003, resulting in record fixed income related volumes as customers reallocated investment portfolios and engaged in more dynamic hedging.

The U.S. equity markets reached an 18-month high late in the year, as GDP growth, corporate profitability, manufacturing indices and capital spending all improved. The S&P 500 and NASDAQ indices rose 13% and 33%, respectively, in the year ended November 30, 2003. Monetary and fiscal policy provided an additional stimulus in the form

34

of a 25 basis-point rate cut by the Federal Reserve in June and tax policy changes enacted earlier in the year, both of which had the objective of encouraging more rapid growth.

Global fixed income origination volumes reached a record high in 2003. Investment grade spreads tightened compared with 2002 and, together with low absolute interest rates, led to a favorable environment for new issues, which increased 25% from 2002. The high yield market also benefited as low rates and significantly tighter credit spreads resulted in more than a doubling of the 2002 volume levels. Throughout 2003, issuers took advantage of interest rates that remained low even though rates began an upward climb in the second half of 2003 from the historical lows reached earlier in the year. Equity origination market volume in 2003 declined 2% from the already depressed levels of 2002; however origination activity improved in the second half of 2003, as economic indicators showed more consistent signs of recovery. Equity issuance was concentrated in secondaries, follow-ons and convertibles, while IPO volume declined a further 42% compared with already depressed 2002 levels.

Europe followed the U.S. lead in terms of monetary policy as both the European Central Bank and the Bank of England reduced interest rates. Even with such stimulus, European economic growth continued to trail U.S. levels with three of Europe’s major economies—Germany, Italy and the Netherlands—all in recession. However, anticipation of stronger U.S. growth prompted the major European equity indices to rally on the prospect of an export driven recovery. The FTSE 100 and DAX composite rose 4% and 13%, respectively, during 2003. Asian equity markets also exhibited gains during the year, with the Hang Seng index rising 22% during 2003. In Japan, stronger GDP growth, increased corporate profitability, central bank focus on deflation, and progress in bank reform caused the Nikkei to rise 10% in 2003.

Mergers and acquisitions (“M&A”) completions in fiscal 2003 were the lowest in over five years, with corporate executives awaiting definitive signs of an economic and market recovery before initiating transactions. Volumes were down 17% from fiscal 2002. However, M&A activity showed some signs of improving in late 2003, and the dollar value of overall announced M&A transactions rose 8% in 2003 from 2002.

Economic Outlook

The financial services industry remains highly linked to global economic growth both in banking and capital markets. The Company expects U.S. GDP to increase by 4.4% in 2004 as the recovery solidifies. The Company anticipates more moderate growth rates of 1.5% in Europe and 2.3% in Japan, with robust growth of 6.8% in Asia excluding Japan. The Company expects fiscal and monetary policy to remain supportive during 2004 and expects that the low interest rate environment will continue to persist for some time.

The Company anticipates that the equities markets will continue strengthening, supported by expansive monetary policy, equity valuations that are attractive relative to bonds, increasing corporate cash flows, and growing investor confidence. The corporate profit recovery has been a key element supporting a stronger equity market. With market appreciation and diminished volatility, the equity origination markets have become more active, and equity origination volume in the last half of 2003 represented the most active issuance period since 2000. Given these economic factors, the Company expects equity origination to continue to improve throughout 2004.

While the Company does not expect fixed income origination levels to reach the record volume of $9.6 trillion issued in 2003, the outlook for fixed income origination is still quite positive. The Company expects a drop in 2004 originations by approximately 15%—still representing the second highest level of annual fixed income origination volume. Weaker mortgage and high grade issuance in 2004 are expected to be partly offset by stronger levels of public finance, sovereign, high yield, emerging market and asset-backed offerings.

The Company believes the favorable economic fundamentals that existed in 2003 will remain in place throughout 2004, resulting in continued strength in fixed income customer flow-related activity. Globally, the fixed income market has grown over 50% since 1999 to a market size of over $19 trillion in par value of securities outstanding, the market is significantly more diverse. Given the sheer size and diversity of this market and the natural flow of principal and coupon inherent to these securities, the Company believes the baseline level of fixed income flow and activity has increased well beyond that experienced in the past. As the market has become far more global, the Company anticipates continued growth of securitization products in both Europe and Asia.

The outlook for Client Services is also positive, given favorable demographics and the trends toward pension reform, higher savings rates globally, and intergenerational wealth transfer. The high-net-worth client increasingly seeks multiple providers and greater asset diversification along with a high service component. The Company believes the significant expansion of its asset management business, including the October 2003 Neuberger acquisition, was well-timed, and integration is progressing well.

With the Company’s diversified business model, the scale of the Company’s businesses, the increased market share the Company now enjoys, the productivity of the Company’s people, the prudent manner in which the Company’s businesses are managed day to day, and management’s outlook for the global economy and for the Company’s individual businesses, the Company believes it is well-positioned to continue to perform at the upper end of its peer group throughout the various stages of the business and economic cycle.

35

The Company provides a full array of capital markets products, investment banking services and investment management and advisory services worldwide. Through the Company’s banking, trading, research, structuring and distribution capabilities in equity and fixed income products, the Company continues to effectively build its client/customer business model. This model focuses on customer flow activities, which represent a preponderance of the Company’s revenues. In addition to its customer flow activities, the Company also takes proprietary positions, the success of which is dependent upon its ability to anticipate economic and market trends. The Company believes its customer flow orientation helps to mitigate its overall revenue volatility.

The Company, through its subsidiaries, is a market maker in all major equity and fixed income products in both the U.S. and international markets. To facilitate its market-making activities, the Company is a member of all principal securities and commodities exchanges in the U.S. and holds memberships or associate memberships on several principal international securities and commodities exchanges including the London, Tokyo, Hong Kong, Frankfurt, Milan and Paris stock exchanges. As part of its customer flow activities, the Company maintains inventory positions of varying amounts across a broad range of financial instruments that are marked-to-market daily and, along with proprietary trading positions, give rise to Principal transactions and net interest revenue.

Net income totaled $1,699 million or $6.35 per diluted share in 2003, up 74% and 83%, respectively, from net income of $975 million and diluted earnings per share of $3.47 in 2002. Net revenues rose 40% to $8,647 million in 2003 from $6,155 million in 2002. The improvements reflect strong performance in Capital Markets, complemented by modest improvements in debt underwriting and Client Services activities. Equity underwriting and M&A advisory declined moderately compared with already depressed 2002 levels, as global market volumes declined further. The effect of the global equity underwriting volume decline was somewhat offset by the Company’s improved market share. Overall revenue growth is primarily attributable to a more favorable economic climate in 2003, and the continued growth in the depth and breadth of the Capital Markets customer franchise. Net income and diluted earnings per share in 2002 declined 22% and 21%, respectively, from $1,255 million and $4.38 in 2001. Net revenues in 2002 declined $581 million or 9% from $6,736 in 2001.

The Company continues to maintain a strict discipline in its core competencies around managing expenses, risk and capital. Compensation and benefits expense as a percentage of net revenues was 49.9% in 2003 and 51.0% in both 2002 and 2001. Non-personnel expenses in 2003, 2002 and 2001 include a number of special items described on page 38 (the “Special Items”).

Non-personnel expenses rose 11% (13% excluding the Special Items) in 2003 compared with 2002 and rose 4% (7% excluding the Special Items) in 2002 compared with 2001. Non-personnel expenses as a percentage of net revenue were 21%, 26% and 23%, respectively, in 2003, 2002 and 2001 (20%, 25% and 21% in 2003, 2002 and 2001, respectively, excluding the Special Items).

Return on average common stockholders’ equity was 18.2%, 11.2% and 15.9% in 2003, 2002 and 2001, respectively (18.7%, 12.2% and 16.9%, respectively, excluding the Special Items). The Special Items reduced diluted earnings per share by $0.17, $0.30 and $0.26 in 2003, 2002 and 2001, respectively. Average common stockholders’ equity was appropriately weighted for the effect of the equity issued in connection with the Neuberger acquisition on October 31, 2003.

(1) Market share, volume and ranking statistics in this Management’s Discussion and Analysis were obtained from Thomson Financial.

NET REVENUES

IN MILLIONS | | | | | | | | Percent Change | |

YEAR ENDED NOVEMBER 30 | | 2003 | | 2002 | | 2001 | | 2003/2002 | | 2002/2001 | |

| | | | | | | | | | | |

Principal transactions | | $ | 4,280 | | $ | 1,951 | | $ | 2,779 | | 119 | % | (30 | )% |

Investment banking | | 1,747 | | 1,771 | | 2,000 | | (1 | ) | (11 | ) |

Commissions | | 1,210 | | 1,286 | | 1,091 | | (6 | ) | 18 | |

Interest and dividends | | 9,942 | | 11,728 | | 16,470 | | (15 | ) | (29 | ) |

Other | | 108 | | 45 | | 52 | | 140 | | (13 | ) |

Total revenues | | 17,287 | | 16,781 | | 22,392 | | 3 | | (25 | ) |

Interest expense | | 8,640 | | 10,626 | | 15,656 | | (19 | ) | (32 | ) |

Net revenues | | $ | 8,647 | | $ | 6,155 | | $ | 6,736 | | 40 | % | (9 | )% |

36

Net revenues totaled $8,647 million, $6,155 million and $6,736 million in 2003, 2002 and 2001, respectively. Net revenues in 2003 were a record for the Company, representing a 12% increase over the prior peak in 2000. Net revenues grew 40% compared with 2002, primarily attributable to improved Fixed Income and Equities Capital Markets results, which rose $2,398 million or 66% from 2002. Client Services net revenues rose $103 million or 13% from 2002, while Investment Banking net revenues were essentially unchanged from 2002. The Company’s net revenues declined 9% in 2002 compared with 2001 as difficult global market conditions resulted in lower M&A, equity origination and Equity Capital Markets revenues, partially offset by an increase in Fixed Income Capital Markets revenues. Client Services revenues and debt origination revenues remained relatively unchanged in 2002 compared with 2001. See pages 40-46 for a detailed discussion of revenues by segment.

Investment Banking continued to gain market share in key products (specifically, in announced M&A transactions, global equities, convertibles and asset-backed securities), while maintaining a significant share in debt origination. In Fixed Income Capital Markets, the Company continued to grow its client base and significantly improved market share in interest rate derivatives, foreign exchange, corporate and government debt and mortgage-backed securities. In Equity Capital Markets the Company made considerable progress in terms of sales and trading share. In Client Services, the Company continued to introduce new products and services to an expanding client base and completed the acquisition of Neuberger in October 2003.

Principal Transactions, Commissions and Net Interest Revenues

In each of its Capital Markets and Client Services businesses, the Company evaluates revenue performance in the aggregate, including Principal transactions, Commissions and net interest. Management of these activities is based on aggregate revenues, which includes an assessment of the potential gain or loss associated with a transaction, including associated commissions, and the interest and dividend revenue or expense associated with financing or hedging positions. Caution should be used when analyzing these revenue categories individually because they may not be indicative of the overall performance of the Capital Markets and Client Services activities.

Principal transactions, Commissions and net interest revenues totaled $6,792 million, $4,339 million and $4,684 million in 2003, 2002 and 2001, respectively. The 57% improvement in 2003 compared with 2002 reflected record revenues from fixed income products and improved equity product revenues. Fixed income products reached record levels in 2003, as historically low interest rates, increased interest rate volatility and narrowing credit spreads drove record customer flow activities. The improved equity product revenues were driven by improvements in the global economy, with stronger corporate earnings and a steady rise in global equity indices. The 7% decline in 2002 from 2001 principally reflects the negative conditions within the global equity markets, which resulted in a decline in Equity Capital Markets revenues, most notably in equity derivatives, as investor concerns regarding corporate governance and geopolitical risks resulted in reduced demand for these products. Equity Capital Markets revenues also were reduced by losses on the Company’s private equity investments in 2002. Despite these negative conditions, the Company improved its market share in both listed and NASDAQ trading volumes. Partially offsetting these revenue declines in 2002 was an increase in Fixed Income Capital Markets revenues, particularly in mortgage products, which benefited from their less credit-sensitive nature and low interest rate levels.

Principal transactions revenue increased $2,329 million or 119% in 2003 compared with 2002, principally reflecting record revenues from fixed income products. Revenues from equity products also improved in 2003 as a result of rising global equity indices and improved performance in private equity. Principal transactions revenue declined $828 million or 30% in 2002 compared with 2001, principally reflecting reduced equity product revenues resulting from poor global market conditions. In addition, Principal transactions revenue declined in 2002 as a result of the transition to a commission-based revenue structure on NASDAQ trades, whereby these revenues are classified as Commissions in 2002 and 2003. In prior years, NASDAQ trades for substantially all institutional customers were transacted on a spread basis, with related revenues classified within Principal transactions.

Commission revenue declined $76 million or 6% in 2003 compared with 2002, primarily reflecting lower trading volumes. Commission revenue grew $195 million or 18% in 2002 compared with 2001 due to the transition to institutional commission-based pricing in the NASDAQ market, growth in market trading volumes and an increase in the Company’s market share of listed and NASDAQ trading volumes.

Interest and dividends revenue and Interest expense are a function of the level and mix of total assets and liabilities (principally financial instruments owned and secured financing activities), the prevailing level of interest rates, and the term structure of the Company’s financings. Interest and dividends revenue and Interest expense are integral components of the overall customer flow activities. The decrease in Interest and dividends revenue and in Interest expense in 2003 and 2002 is principally due to the substantial declines in interest rates during these periods. The 18% increase in net interest revenue to $1,302 million in 2003 from $1,102 million in 2002 was primarily due to an increase in total assets, including higher levels of secured financing activities, and a steeper yield curve in 2003 that reduced interest expense on secured short-term funding. The 35% increase in net interest revenue to $1,102 million

37

in 2002 from $814 million in 2001 was primarily due to a change in inventory mix to higher levels of interest-bearing assets in response to shifts in customer asset preferences.

Investment Banking

Investment banking revenues totaled $1,747 million, $1,771 million and $2,000 million in 2003, 2002 and 2001, respectively. Investment banking revenues result primarily from fees and related revenues earned for underwriting public and private offerings of fixed income and equity securities, advising clients on M&A activities and corporate financing activities. Investment banking revenues of $1,747 million in 2003 were essentially unchanged compared with $1,771 million in 2002, as lower equity underwriting and M&A market volumes were mostly offset by record fixed income underwriting volumes. Industry-wide, global equity market volume declined 2%, while completed M&A advisory market volume was down 17% compared with the already depressed levels of 2002. Fixed income market volume was up 25% compared with 2002. Investment banking revenues declined 11% in 2002 compared with 2001, reflecting significant market weakness in equity underwriting and M&A advisory activities partially offset by improvements in the Company’s market share for completed M&A transactions and underwriting of certain fixed income and equity products (see page 41 for a discussion of the Company’s Investment Banking segment).

NON-INTEREST EXPENSES

IN MILLIONS | | | | | | | | Percent Change | |

YEAR ENDED NOVEMBER 30 | | 2003 | | 2002 | | 2001 | | 2003/2002 | | 2002/2001 | |

| | | | | | | | | | | |

Compensation and benefits | | $ | 4,318 | | $ | 3,139 | | $ | 3,437 | | 38 | % | (9 | )% |

Non-personnel expenses (excluding the Special Items described below) | | 1,716 | | 1,517 | | 1,424 | | 13 | | 7 | |

Other real estate reconfiguration charge | | 77 | | 128 | | — | | (40 | ) | — | |

September 11th related (recoveries)/expenses, net | | — | | (108 | ) | 127 | | — | | — | |

Regulatory settlement | | — | | 80 | | — | | — | | — | |

Total non-interest expenses | | $ | 6,111 | | $ | 4,756 | | $ | 4,988 | | 28 | % | (5 | )% |

Compensation and benefits/ Net revenues | | 49.9 | % | 51.0 | % | 51.0 | % | | | | |

A significant portion of the Company’s expense base is variable, including compensation and benefits, brokerage and clearing, and business development. The Company expects its variable expenses as a percentage of net revenues to remain in approximately the same proportions in future periods.

Non-interest expenses were $6,111 million in 2003, $4,756 million in 2002 and $4,988 million in 2001 and include a number of Special Items. Non-interest expenses in 2003 include a pre-tax real estate charge of $77 million ($45 million after-tax) associated with the Company’s previous decision to dispose of certain excess real estate. Non-interest expenses in 2002 include a pre-tax net gain of $108 million associated with September 11th related costs and insurance settlement proceeds, a $128 million pre-tax charge associated with decisions to reconfigure certain global real estate facilities and an $80 million pre-tax charge related to the settlement of allegations of research analyst conflicts of interest. The 2003 and 2002 real estate-related charges were recognized in accordance with Emerging Issues Task Force (“EITF”) Issue No. 94-3, “Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (including Certain Costs Incurred in a Restructuring).” These charges represent estimated sublease losses expected to be incurred upon exiting certain of the Company’s facilities, prinicipally in London and New York. The Company expects that substantially all of such facilities will be subleased by the end of 2004. The net pre-tax effect of these 2002 items is a charge of $100 million ($78 million after-tax). Non-interest expenses in 2001 include a $127 million pre-tax charge ($71 million after-tax) stemming from the events of September 11th, which resulted in the displacement and relocation of substantially all of the Company’s New York based employees. Additional information about these Special Items can be found in Notes 20 and 21 to the Consolidated Financial Statements.

Compensation and benefits expense was $4,318 million, $3,139 million and $3,437 million in 2003, 2002 and 2001, respectively. Compensation and benefits expense as a percentage of net revenues was 49.9% in 2003 and 51.0% in 2002 and 2001. Compensation and benefits expense includes the cost of salaries, bonuses, the amortization of deferred stock compensation awards and employee benefit plans. Variable compensation, consisting primarily of bonuses, increased to $2,283 million in 2003 up from $1,198 million in 2002,

38

while fixed compensation, consisting primarily of salaries and benefits, increased to $2,035 million in 2003 from $1,941 million in 2002. The increase in fixed compensation primarily resulted from increased salary costs associated with several business acquisitions completed during the year (see “Business Acquisitions”) as well as increases in pension expense. Compensation and benefits expense declined 9% in 2002 compared with 2001 commensurate with the 9% decline in Net revenues. Included in compensation and benefits expense is net pension expense/(income) of $45 million, $26 million and $(32) million in 2003, 2002 and 2001, respectively. Amortization of deferred stock compensation awards totaled $625 million, $570 million and $544 million in 2003, 2002 and 2001, respectively.

Non-personnel expenses (excluding the Special Items) were $1,716 million in 2003, up $199 million or 13% compared with $1,517 million in 2002. The increase in non-personnel expenses is principally attributable to increases in occupancy, technology and communications, and brokerage and clearance expenses, as well as the effect of business acquisitions during 2003 (for additional information see Note 6 to the Consolidated Financial Statements). Occupancy expenses increased 11% to $319 million in 2003 from $287 million in 2002 principally attributable to the increased cost of the Company’s new corporate headquarters and additional space needed to accommodate the growth in headcount. Technology and communications expenses were $598 million in 2003 compared with $552 million in 2002, an increase of 8%. The growth reflects amortization of technology assets at new facilities and higher spending associated with the enhancement of capital markets trading platforms and technology infrastructure. Brokerage and clearance expenses rose 12% in 2003 primarily attributable to increased volumes in fixed income products, in addition to the Company’s expansion in equities-related businesses in 2003. Professional fees increased by 22% in 2003 compared with 2002, principally due to higher legal, accounting and audit fees incurred in the current industry environment. In the aggregate, $53 million of non-personnel expenses in 2003 are attributable to business acquisitions. Non-personnel expenses (excluding the Special Items) increased 7% in 2002 from 2001 primarily due to investments in technology and communications, higher occupancy expenses to accommodate headcount growth and the increased cost of the new corporate headquarters, and increased brokerage and clearance expenses due to higher volumes in certain fixed income structured products.

Income Taxes

The provision for income taxes totaled $765 million, $368 million and $437 million in 2003, 2002 and 2001, respectively. These provisions resulted in effective tax rates of 30.2%, 26.3% and 25.0%, respectively. The increase in the effective tax rate in 2003 compared with 2002 was primarily due to a higher level of pre-tax income, which reduced the impact of permanent differences, including a decrease in tax-exempt income, partially offset by an increase in tax benefits from foreign operations. The increase in the effective tax rate in 2002 compared with 2001 was primarily due to a less favorable mix of geographic earnings, partially offset by a greater impact of permanent differences, including tax-exempt income. For additional information see Note 19 to the Consolidated Financial Statements.

Business Acquisitions

On October 31, 2003, the Company purchased Neuberger as part of the Company’s strategic plan to build out its Client Services segment. This acquisition positions the Company as one of the industry’s leading providers of services to high-net-worth investors, bringing the Company’s assets under management to over $116 billion at November 30, 2003. The Company, with this acquisition, significantly strengthened its Client Services segment and further diversified its revenue base. The Neuberger acquisition strengthened the Company’s revenues from fee-based activities, allowing for improved cross-cycle performance and reduced earnings volatility. The Company believes this acquisition will provide revenue synergies by (a) making Neuberger products available to the Lehman Brothers network of institutional and high-net worth individual clients in all three geographic regions and (b) offering Neuberger clients an expanded range of investment and risk management products, including structured capital markets products, private equity, and other alternative asset management products. The Company’s estimated $100 million of revenue and cost synergies of the combined businesses leads the Company to believe that the Neuberger acquisition will be slightly dilutive to earnings per share in 2004 and approximately break even by 2005.

The Company purchased Neuberger for a net purchase price of approximately $2,788 million, including cash consideration and incidental costs of $690 million, equity consideration of $2,374 million (including 32.3 million shares of common stock, 0.3 million shares of restricted common stock and 3.5 million vested stock options) and excluding net cash and short-term investments acquired of $276 million. The Company also issued approximately 0.5 million shares of restricted common stock valued at $42 million, which is subject to future service requirements and will be amortized over the applicable service periods (for additional information see Note 15 to the Consolidated Financial Statements). The Company intends for the Neuberger brand to remain intact. The Neuberger acquisition resulted in an increase of approximately 1,200 employees.

During the second quarter of 2003, the Company acquired a controlling interest in Aurora Loan Services (“ALS”), a residential mortgage loan originator and servicer. The Company believes this acquisition adds long-term value to its mortgage franchise by allowing further vertical integration of the business platform. Mortgage loans originated by ALS are intended to provide a more cost efficient source of loan product for the Company’s securitization pipeline. The Company also made three

39

other small acquisitions during 2003. In July 2003, the Company acquired a controlling interest in another residential mortgage loan originator. The strategic objective of this acquisition mirrors that of ALS–to increase the vertical integration of the Company’s mortgage business by expanding the pipeline of loan product for securitization. In October 2003, the Company acquired substantially all of the operating assets of The Crossroads Group (“Crossroads”), a diversified private equity fund manager with approximately $2 billion of assets under management. The Crossroads acquisition expanded the Company’s global private equity franchise to approximately $7 billion under management. In January 2003, the Company acquired the fixed income asset management business of Lincoln Capital Management as part of the Company’s strategic objective to build out its Client Services segment. The Company’s headcount increased by approximately 2,200 as a result of these acquisitions. The aggregate total cost of these four acquisitions was approximately $172 million, which was paid in cash and notes. For additional information about these acquisitions, see the Capital Markets and Client Services business segment discussions below and Note 6 to the Consolidated Financial Statements.

The Company operates in three business segments (each of which is described below): Investment Banking, Capital Markets and Client Services. These business activities result in revenues from both institutional and high-net-worth individual clients, which are recognized in all revenue categories in the Consolidated Statement of Income. (Net revenues also contain certain internal allocations, including funding costs, which are centrally managed.) Net revenues from the Company’s customer flow activities are recorded as either Principal transactions, Commissions or net interest revenues in the Consolidated Statement of Income, depending on the method of execution, financing and/or hedging related to specific inventory positions. In each of its Capital Markets and Client Services businesses, the Company evaluates revenue performance in the aggregate, including Principal transactions, Commissions and net interest. Management of these activities is based on aggregate revenues, which includes an assessment of the potential gain or loss associated with a transaction, including associated commissions, and the interest and dividends revenue and interest expense associated with financing or hedging the Company’s positions. Caution should be used when analyzing these revenue categories individually because they may not be indicative of the performance of the overall Capital Markets and Client Services activities. The following table summarizes the net revenues of the Company’s business segments:

BUSINESS SEGMENTS

IN MILLIONS | | | | | | | | Percent Change | |

YEAR ENDED NOVEMBER 30 | | 2003 | | 2002 | | 2001 | | 2003/2002 | | 2002/2001 | |

| | | | | | | | | | | |

Net revenues: | | | | | | | | | | | |

Investment Banking | | $ | 1,722 | | $ | 1,731 | | $ | 1,925 | | (1 | )% | (10 | )% |

Capital Markets | | 6,018 | | 3,620 | | 4,024 | | 66 | | (10 | ) |

Client Services | | 907 | | 804 | | 787 | | 13 | | 2 | |

Total net revenues | | 8,647 | | 6,155 | | 6,736 | | 40 | | (9 | ) |

Compensation and benefits | | 4,318 | | 3,139 | | 3,437 | | 38 | | (9 | ) |

Non-personnel expenses (1) | | 1,793 | | 1,617 | | 1,551 | | 11 | | 4 | |

Earnings before taxes | | $ | 2,536 | | $ | 1,399 | | $ | 1,748 | | 81 | % | (20 | )% |

(1) Non-personnel expenses include special items (the “Special Items”) totaling $77 million, $100 million and $127 million in 2003, 2002 and 2001, respectively. Additional information about these Special Items can be found in “Management’s Discussion and Analysis—Results of Operations—Non-Interest Expenses” and in Notes 20, 21 and 22 to the Consolidated Financial Statements. The following business segment discussions do not include the Special Items.

40

INVESTMENT BANKING

IN MILLIONS | | | | | | | | Percent Change | |

YEAR ENDED NOVEMBER 30 | | 2003 | | 2002 | | 2001 | | 2003/2002 | | 2002/2001 | |

| | | | | | | | | | | |

Investment banking net revenues | | $ | 1,722 | | $ | 1,731 | | $ | 1,925 | | (1 | )% | (10 | )% |

Non-interest expenses (1) | | 1,321 | | 1,321 | | 1,552 | | — | | (15 | ) |

Earnings before taxes (1) | | $ | 401 | | $ | 410 | | $ | 373 | | (2 | )% | 10 | % |

(1) Excludes the effect of Special Items.

The Investment Banking segment provides advice to corporate, institutional and government clients throughout the world on mergers, acquisitions and other financial matters. The segment also raises capital for clients by underwriting public and private offerings of debt and equity securities. The segment is composed of global industry groups—Communications and Media, Consumer/Retailing, Financial Institutions, Financial Sponsors, Healthcare, Industrial, Natural Resources, Power, Real Estate and Technology—that include bankers who deliver industry knowledge to meet clients’ objectives. Specialized product groups within Mergers and Acquisitions and Global Finance—which includes Equity Capital Markets, Debt Capital Markets, Leveraged Finance and Private Placements—are partnered with global relationship managers in the global industry groups to provide comprehensive solutions for clients. Specialists in product development and derivatives also are engaged to tailor specific structures for clients.

INVESTMENT BANKING NET REVENUES

IN MILLIONS | | | | | | | | Percent Change | |

YEAR ENDED NOVEMBER 30 | | 2003 | | 2002 | | 2001 | | 2003/2002 | | 2002/2001 | |

| | | | | | | | | | | |

Debt Underwriting | | $ | 980 | | $ | 886 | | $ | 893 | | 11 | % | (1 | )% |

Equity Underwriting | | 363 | | 420 | | 440 | | (14 | ) | (5 | ) |

Merger and Acquisition Advisory | | 379 | | 425 | | 592 | | (11 | ) | (28 | ) |

| | $ | 1,722 | | $ | 1,731 | | $ | 1,925 | | (1 | )% | (10 | )% |

Net revenues of $1,722 million in 2003 were essentially unchanged from $1,731 million in 2002 as lower equity underwriting and M&A advisory revenues were substantially offset by growth in debt underwriting. Net revenues declined 10% in 2002 to $1,731 million from $1,925 million in 2001 primarily due to lower M&A advisory and equity underwriting revenues.

Debt underwriting revenues increased 11% in 2003 to a record $980 million from $886 million in 2002, as the tightening of credit spreads and a full year of historically low interest rates resulted in record debt underwriting volumes. Industry-wide fixed income origination volume rose 25% from 2002, while the Company’s fixed income origination volume was up 26%. Investment grade and high yield market underwriting volumes were particularly strong as credit spreads tightened 89 basis points and 452 basis points, respectively, from fiscal 2002 levels. The market volume growth in 2003 was largely in high grade debt which generally has lower fee spreads. The Company ranked fourth in market share of worldwide debt underwriting volumes in calendar 2003, up from fifth in calendar 2002 and 2001, with the Company recording market share of 6.9%, 6.9% and 6.4% for the calendar years ended 2003, 2002 and 2001, respectively. Debt underwriting revenues of $886 million in 2002 were essentially unchanged compared with the Company’s 2001 results of $893 million, as issuers continued to take advantage of low interest rates.

41

Equity underwriting revenues declined 14% in 2003 to $363 million from $420 million in 2002 as industry-wide global equity market volumes declined 2% in fiscal 2003 compared with fiscal 2002. The decline in revenues also is attributable to a change in the mix of equity underwriting, with initial public offerings, which generally are the most lucrative, contributing only 14% of market volume in fiscal 2003, down from 23% in fiscal 2002. The Company increased its global equity-related market share to 3.7% in calendar 2003 from 3.5% in calendar 2002, primarily due to the strong performance in secondary, follow-ons, and convertible offerings globally. Equity origination revenues of $420 million in 2002 declined 5% compared with $440 million in 2001. The Company’s global equity-related market share declined to 3.5% in 2002 from 4.4% in 2001.

M&A advisory fees declined 11% in 2003 to $379 million from $425 million in 2002, as M&A activity remained extremely weak with the market volume for completed transactions in fiscal 2003 reaching its lowest level since 1996. M&A activities continued to be negatively affected by lackluster global growth rates in the first half of 2003, continued weak investor confidence amid geopolitical concerns and uncertainty regarding the global economic recovery. M&A market volume for completed transactions was down 17% compared with fiscal 2002 while the Company’s completed transaction volume was down only 5%. Despite the low volume of activity in fiscal 2003 for completed transactions, M&A activity began to improve in the second half of fiscal 2003, leading to an 8% increase in announced market volume in fiscal 2003 compared with fiscal 2002. The Company’s M&A fee backlog at November 30, 2003 more than doubled from November 30, 2002 indicating an upturn in potential future M&A fee revenue. The Company’s market share for announced transactions was essentially unchanged at 11.0% in calendar 2003 from 10.9% in calendar 2002. M&A advisory fees declined 28% to $425 million in 2002 from $592 million 2001. This decline reflected difficult global market conditions and weak demand for strategic transactions, as corporations remained conservative amid an uncertain business climate. Despite the low volume of activity in the advisory markets, the Company’s market share for completed transactions in calendar 2002 improved to 10.5% compared with 7.4% in calendar 2001.

Non-interest expenses of $1,321 million in 2003 were unchanged from 2002, attributable to a modest increase in compensation and benefits expense reflecting the improved environment at the end of the year, offset by lower business development expense as spending was curtailed in early 2003 when the market environment was subdued. Non-interest expenses in 2002 declined $231 million or 15% compared with 2001, reflecting lower compensation expenses and headcount levels associated with lower revenue and reduced non-personnel-related expenses, particularly business development and professional fees, as the Company focused on minimizing discretionary spending.

Earnings before taxes of $401 million in 2003 declined from $410 million in 2002 driven by the decline in net revenues. Earnings before taxes of $410 million in 2002 increased 10% from 2001 as the 10% decline in net revenues was more than offset by lower expenses.

CAPITAL MARKETS

IN MILLIONS | | | | | | | | Percent Change | |

YEAR ENDED NOVEMBER 30 | | 2003 | | 2002 | | 2001 | | 2003/2002 | | 2002/2001 | |

| | | | | | | | | | | |

Principal transactions | | $ | 3,800 | | $ | 1,474 | | $ | 2,342 | | 158 | % | (37 | )% |

Interest and dividends | | 9,903 | | 11,691 | | 16,371 | | (15 | ) | (29 | ) |

Commissions | | 911 | | 1,059 | | 879 | | (14 | ) | 20 | |

Other | | 14 | | 1 | | 13 | | — | | (92 | ) |

Total revenues | | 14,628 | | 14,225 | | 19,605 | | 3 | | (27 | ) |

Interest expense | | 8,610 | | 10,605 | | 15,581 | | (19 | ) | (32 | ) |

Net revenues | | 6,018 | | 3,620 | | 4,024 | | 66 | | (10 | ) |

Non-interest expenses (1) | | 4,011 | | 2,722 | | 2,702 | | 47 | | 1 | |

Earnings before taxes (1) | | $ | 2,007 | | $ | 898 | | $ | 1,322 | | 123 | % | (32 | )% |

(1) Excludes the effect of Special Items.

42

The Capital Markets segment includes institutional customer flow activities, research, and secondary-trading and financing activities in fixed income and equity products. These products include a wide range of cash, derivative, secured financing and structured instruments and investments. The Company is a leading global market-maker in numerous equity and fixed income products including U.S., European and Asian equities, government and agency securities, money market products, corporate high grade, high yield and emerging market securities, mortgage- and asset-backed securities and real estate, preferred stock, municipal securities, bank loans, foreign exchange, financing and derivative products. The Company is one of the largest investment banks in terms of U.S., and pan-European listed equities trading volume and maintains a major presence in over-the-counter U.S. stocks, major Asian large capitalization stocks, warrants, convertible debentures and preferred issues. The segment also includes the risk arbitrage and secured financing businesses as well as realized and unrealized gains and losses related to private equity investments. The secured financing business manages the Company’s equity and fixed income matched book activities, supplies secured financing to institutional clients and customers, and provides secured funding for the Company’s inventory of equity and fixed income products.

CAPITAL MARKETS NET REVENUES

| | 2003 | | 2002 | | 2001 | |

IN MILLIONS

YEAR ENDED NOVEMBER 30 | | Gross

Revenues | | Interest

Expense | | Net

Revenues | | Gross

Revenues | | Interest

Expense | | Net

Revenues | | Gross

Revenues | | Interest

Expense | | Net

Revenues | |

| | | | | | | | | | | | | | | | | | | |

Fixed Income | | $ | 10,963 | | $ | (6,572 | ) | $ | 4,391 | | $ | 10,674 | | $ | (8,055 | ) | $ | 2,619 | | $ | 13,984 | | $ | (11,757 | ) | $ | 2,227 | |

Equities | | 3,665 | | (2,038 | ) | 1,627 | | 3,551 | | (2,550 | ) | 1,001 | | 5,621 | | (3,824 | ) | 1,797 | |

| | $ | 14,628 | | $ | (8,610 | ) | $ | 6,018 | | $ | 14,225 | | $ | (10,605 | ) | $ | 3,620 | | $ | 19,605 | | $ | (15,581 | ) | $ | 4,024 | |

Net revenues of $6,018 million in 2003 rose 66% from 2002, reflecting record fixed income net revenues and a 63% increase in equities net revenues. Net revenues declined $404 million or 10% in 2002 compared with 2001, as a 44% decline in equities net revenues was only partially offset by an 18% improvement in fixed income net revenues.

Fixed income net revenues increased 68% to a record $4,391 million in 2003 from $2,619 million in 2002. Historically low interest rates, significant credit spread tightening, and volatile currency markets all contributed to an extremely favorable environment for fixed income products and record customer flow activities. The Company’s diverse set of fixed income asset classes experienced increased trading volumes that resulted in improved results across a broad range of asset classes including high yield, mortgage, interest rate, and municipal products. High yield products produced record results driven by a combination of strong customer flow activities and improved proprietary position revenues. High yield revenues benefited from the significant tightening of credit spreads, which saw a 452 basis-point tightening during 2003, and improved trading volumes as corporate downgrades were at the lowest level in five years. Record revenues from mortgage-related products were bolstered by robust refinancings and heavy investor demand for newly securitized products, slightly offset by a softening of certain sectors within the commercial real estate market. Refinancings were fueled by historically low interest rates in the U.S. and Europe, with residential refinancings reaching a record high in May 2003. Interest rate products, including derivatives and governments, improved driven by record customer flow activities as issuers and investors sought to diversify and hedge risks. Fixed income net revenues increased $392 million or 18% to $2,619 million in 2002 from $2,227 million in 2001. The increase was principally driven by strong institutional customer flow activity, particularly in mortgage-related products, as secondary flow was aided by strong origination activity and investors sought to minimize risk by moving to more diversified and defensive asset categories. The low interest rate environment throughout 2002 contributed to strong results in the mortgage businesses, principally from increases in securitization transactions and the distribution of various mortgage loan products, which were bolstered by the active refinancing environment. Strong results also were posted in structured credit-related products, particularly in collateralized debt obligations, as clients migrated to products offering diversification and hedging capabilities.

43

Equities net revenues totaled $1,627 million in 2003, up 63% from 2002 as improvements in the global economy and stronger corporate earnings fueled a steady improvement in global equity indices that began in March and continued through year end. The rise in global equity indices contributed to improved performance in a number of asset classes including derivatives, convertibles, and private equity investments. While U.S. equity trading volumes declined slightly, European and Asian markets experienced a rise in trading volumes contributing to improved performance in these regions. The Company’s share of NASDAQ market volumes continued to increase to 3.8% in fiscal 2003 from 3.6% in fiscal 2002 and 3.2% in fiscal 2001; however, the Company’s share of listed NYSE market volumes decreased to 7.0% in fiscal 2003 from 7.2% in fiscal 2002, but remained well above the Company’s 5.7% share in 2001. The derivative business benefited from improved customer flow activity, particularly in Europe, as customers increasingly used customized derivative products to hedge risk and reduce concentrations. Convertibles revenues were bolstered by improved credit markets and strong customer activity on the heels of increased new issuance activity. The Company recorded net gains on its private equity investments in 2003 compared with losses in 2002. Equities net revenues declined 44% in 2002 to $1,001 million from $1,797 million in 2001 attributable to difficult market conditions that resulted in revenue declines across most equity products including equity derivatives, equity financing and private equity. Equity derivative revenues declined primarily as a result of lower demand for structured equity derivative products. The decline in equity finance revenues was primarily attributable to a decline in customer balances in the prime brokerage business, while private equity investments reported losses on both private and public investments in 2002. These declines were partially offset by improvements in the Company’s market share in both listed and NASDAQ securities during 2002.

Interest and dividends revenue declined 15% compared with 2002, while Interest expense declined by 19%, primarily reflecting a decline in U.S. interest rates from 2002. Net interest revenue rose 19% to $1,293 million in 2003 principally due to increased total assets, including higher levels of secured financing activities and a steeper yield curve. In 2002 interest and dividends revenue declined 29% while Interest expense declined 32% from 2001, reflecting the significant decline in interest rates during the year. Net interest revenue increased 37% in 2002 compared with 2001 reflecting a steeper yield curve environment and higher interest earning asset levels in 2002 compared with 2001.

Non-interest expenses increased to $4,011 million in 2003 from $2,722 million in 2002, primarily due to an increase in compensation and benefits expense commensurate with the increase in net revenues. Non-personnel expenses increased principally due to higher brokerage and clearance costs associated with higher volumes in certain fixed income products, increased technology and communications expenses associated with the enhancement of capital markets trading platforms, and higher professional fees associated with increased legal, accounting and audit costs. Non-interest expenses were essentially unchanged in 2002 compared with 2001, as lower compensation and benefits expense was offset by higher non-personnel expenses, including increased occupancy costs associated with increased headcount levels and higher technology spending to enhance trading platforms and technology infrastructure.

Earnings before taxes increased to $2,007 million in 2003 from $898 million in 2002 as a 66% increase in net revenues was partially offset by a 47% increase in non-interest expenses. Earnings before taxes of $898 million in 2002 declined 32% from $1,322 million in 2001 primarily due to a 10% decline in net revenues.

In February 2003, the Company acquired a controlling interest in ALS, a residential mortgage loan originator and servicer, and in July 2003 the Company acquired a controlling interest in another residential mortgage loan originator. The Company believes the acquisitions add long-term value to its mortgage franchise by allowing further integration of the business platform. Mortgage loans originated are expected to provide a more cost efficient source of loan product for the Company’s securitization pipeline. (See “Management’s Discussion and Analysis–Business Acquisitions” on page 39). These acquisitions contributed approximately $238 million of net revenues, $36 million of non-personnel expenses and $59 million of net income in 2003. For additional information see Note 6 to the Consolidated Financial Statements.

44

CLIENT SERVICES

IN MILLIONS | | | | | | | | Percent Change | |

YEAR ENDED NOVEMBER 30 | | 2003 | | 2002 | | 2001 | | 2003/2002 | | 2002/2001 | |

| | | | | | | | | | | |

Principal transactions | | $ | 480 | | $ | 477 | | $ | 437 | | 1 | % | 9 | % |

Interest and dividends | | 39 | | 37 | | 99 | | 5 | | (63 | ) |

Investment banking | | 25 | | 40 | | 75 | | (38 | ) | (47 | ) |

Commissions | | 299 | | 227 | | 212 | | 32 | | 7 | |

Other | | 94 | | 44 | | 39 | | 114 | | 13 | |

Total revenues | | 937 | | 825 | | 862 | | 14 | | (4 | ) |

Interest expense | | 30 | | 21 | | 75 | | 43 | | (72 | ) |

Net revenues | | 907 | | 804 | | 787 | | 13 | | 2 | |

Non-interest expenses (1) | | 702 | | 613 | | 607 | | 15 | | 1 | |

Earnings before taxes (1) | | $ | 205 | | $ | 191 | | $ | 180 | | 7 | % | 6 | % |

(1) Excludes the effect of Special Items.

The Client Services segment consists of the Private Client and Asset Management business lines. Private Client generates customer-flow transactional revenues from high-net-worth clients, and Asset Management generates fee-based revenues from customized investment management services for high-net-worth clients as well as asset management fees from mutual fund and other institutional investors. Asset Management also generates management and incentive fees from the Company’s role as general partner for private equity and alternative investment partnerships. The Company’s Private Equity business operates in five major asset classes: Merchant Banking, Real Estate, Venture Capital, Fixed Income-related and Third Party Funds.

The Company significantly enhanced its market position in providing asset management services to high-net-worth clients in 2003 through the acquisition of Neuberger. (See “Management’s Discussion and Analysis—Business Acquisitions” on page 39). The Company acquired Neuberger on October 31, 2003, and therefore the Company’s 2003 results reflect only one month of Neuberger’s activity contributing approximately $50 million in net revenues (solely from asset management activities).

CLIENT SERVICES NET REVENUES

AND ASSETS UNDER MANAGEMENT

IN MILLIONS | | | | | | | | Percent Change | |

YEAR ENDED NOVEMBER 30 | | 2003 | | 2002(1) | | 2001(1) | | 2003/2002 | | 2002/2001 | |

| | | | | | | | | | | |

Private Client | | $ | 766 | | $ | 714 | | $ | 667 | | 7 | % | 7 | % |

Asset Management | | 141 | | 90 | | 120 | | 57 | | (25 | ) |

| | $ | 907 | | $ | 804 | | $ | 787 | | 13 | % | 2 | % |

(1) Reclassified to conform to the 2003 presentation.

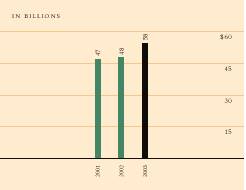

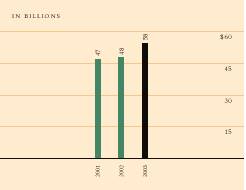

IN BILLIONS | | | | | | | | Percent Change | |

NOVEMBER 30 | | 2003 | | 2002 | | 2001 | | 2003/2002 | | 2002/2001 | |

| | | | | | | | | | | |

Assets under management | | $ | 116.2 | | $ | 8.6 | | $ | 11.7 | | — | | (26 | )% |

| | | | | | | | | | | | | | |

45

Client Services net revenues increased $103 million or 13% in 2003 compared with 2002, primarily due to increased revenues associated with the acquisitions of Neuberger, Lincoln Capital Management and Crossroads which contributed $71 million of net revenues in 2003, as well as increased distribution of products to high-net-worth clients. Client Services net revenues rose $17 million or 2% in 2002 compared with 2001 principally due to strong fixed income distribution activity.

Private Client net revenues increased $52 million or 7% in 2003 compared with 2002 reflecting strong fixed income product distribution activities partially offset by lower equity sales, as investors were cautious in the first half of the year before gradually beginning to shift asset allocations in the latter half of the year. Despite the weak equity markets in 2002, Private Client net revenues increased $47 million or 7% in 2002 compared with 2001 driven by strong fixed income activity as high-net-worth clients repositioned their portfolios to more defensive asset classes.

Asset management net revenues increased $51 million or 57% in 2003 compared with 2002 as a result of the acquisitions, partially offset by a decline in Private Equity management fees attributable to the expiration of commitment periods on two of the Company’s funds. Net revenues declined $30 million or 25% in 2002 compared with 2001 primarily as a result of lower Private Equity incentive fees.

Assets under management increased by $108 billion in 2003 compared with 2002 primarily attributable to the acquisitions.

Client Services non-interest expenses of $702 million in 2003 rose $89 million or 15% compared with 2002 primarily due to the acquisitions, coupled with higher compensation and benefits expense related to organic revenue growth. Client Services non-interest expenses of $613 million in 2002 were essentially unchanged from 2001. The acquisitions added approximately 1,400 personnel to the Client Services segment headcount as of November 30, 2003.

Earnings before taxes increased to $205 million in 2003 from $191 million in 2002 as revenue growth outpaced expense growth. Earnings before taxes of $191 million in 2002 improved from $180 million in 2001 as a result of higher revenues.

NET REVENUES BY GEOGRAPHIC REGION

IN MILLIONS | | | | | | | | Percent Change | |

YEAR ENDED NOVEMBER 30 | | 2003 | | 2002 | | 2001 | | 2003/2002 | | 2002/2001 | |

| | | | | | | | | | | |

Europe | | $ | 1,864 | | $ | 1,674 | | $ | 1,955 | | 11 | % | (14 | )% |

Asia Pacific | | 875 | | 612 | | 540 | | 43 | | 13 | |

Total International | | 2,739 | | 2,286 | | 2,495 | | 20 | | (8 | ) |

U.S. | | 5,908 | | 3,869 | | 4,241 | | 53 | | (9 | ) |

Total | | $ | 8,647 | | $ | 6,155 | | $ | 6,736 | | 40 | % | (9 | )% |

International net revenues were $2,739 million, $2,286 million and $2,495 million in 2003, 2002 and 2001, respectively, representing approximately 32% of total net revenues in 2003 and 37% in both 2002 and 2001. International net revenues grew 20% in 2003 compared with 2002 and declined 8% in 2002 compared with 2001.

Net revenues in Europe increased 11% to $1,864 million in 2003 from $1,674 million in 2002 attributable to improvements in the capital markets environment, primarily equities, driven by increased customer flow activity in derivative and convertible products. Investment banking revenue grew, driven by increased activity in debt and equity origination. These improvements were partially offset by declines in fixed income capital markets revenues due to a softening of certain sectors within the commercial real estate markets and in M&A. Net revenues declined 14% in 2002 compared with 2001 attributable to a significant decline in equity capital markets and investment banking net revenues due to low corporate demand for equity derivative products and a decline in the European equity origination markets. These declines were partially offset by growth in the fixed income capital markets business, which experienced a record year driven by growth in structured transactions as well as strong performance in interest rate and mortgage-related products.

Net revenues in Asia Pacific of $875 million in 2003 increased 43% from $612 million in 2002 attributable to improved performance in fixed income and equities capital markets and investment banking results. Fixed income capital markets revenue increased primarily due to

46

a higher level of activity in interest rate products. Equities capital markets revenue growth was driven by strength in derivatives corresponding with the increase in the Nikkei. Investment banking revenue also grew, driven by the Company’s improved position in advisory activity, where completed M&A market share improved to 12.3% in calendar 2003 compared with 4.7% in calendar 2002. Asia Capital Markets and Investment Banking partnered together to deliver solutions to regional clients that included the resolution of non-performing loan portfolios, innovative capital raising and price hedging of a portfolio of cross shareholdings, consistent with the Company’s primary strategic theme for the Asia region of delivering the restructuring capabilities of the Company to regional clients. Net revenues increased $72 million or 13% in 2002 compared with 2001. Growth in the fixed income capital markets business in 2002 was driven by strength in derivatives, high yield and mortgage-related products as a result of strong customer flow activities and new transactions, particularly in the distressed asset securitization business. This performance was partially offset by a decline in equity capital markets and investment banking net revenues due to a lack of corporate demand for equity derivatives, depressed equity markets and poor market conditions in the investment banking environment.

LIQUIDITY, FUNDING AND CAPITAL RESOURCES

The Company’s Finance Committee is responsible for developing, implementing and enforcing its liquidity, funding and capital policies. These policies include recommendations for capital and balance sheet size as well as the allocation of capital and balance sheet to the business units. Through the establishment and enforcement of capital and funding limits, the Finance Committee oversees compliance with policies and limits throughout the Company with the goal of ensuring the Company is not exposed to undue funding or liquidity risk.

Liquidity Risk Management

Liquidity and liquidity management are of critical importance to the Company. The Company’s funding strategy seeks to ensure the Company maintains sufficient liquid financial resources to continually fund its balance sheet and meet all of its funding obligations in all market environments. The strategy is based on the following principles:

• Liquidity providers are credit and market sensitive and quick to react to any perceived market or firm-specific risks. Consequently, the Company remains in a state of constant liquidity readiness.

• During a liquidity event, certain secured lenders will require higher quality collateral, resulting in a lower availability of secured funding for “hard-to-fund” asset classes. Consequently, the Company only relies on secured funding to the extent it believes it would be available in all market environments.

• A firm’s legal entity structure may constrain liquidity. Some regulators or rating agency considerations may prevent the free flow of funds between the subsidiaries they supervise (“Restricted Subsidiaries”) and Holdings and its other subsidiaries (“Unrestricted Subsidiaries”). Consequently, the Company seeks to ensure that the Restricted Subsidiaries on the one hand, and Holdings and its Unrestricted Subsidiaries collectively on the other, have sufficient “stand alone” liquidity and that there is no “cross subsidization” of liquidity from these Restricted Subsidiaries to Holdings and its Unrestricted Subsidiaries.

• For planning purposes, the Company does not assume that, in a liquidity crisis, assets can be sold to generate cash, unsecured debt can be issued or any cash and unencumbered liquid collateral outside of the liquidity pool can be used to support the liquidity of Holdings and the Unrestricted Subsidiaries.

When managing liquidity, the Company pays particularly close attention to the size of its liquidity pool, its long-term funding sources and requirements and its reliable secured funding capacity. Each of these metrics is explained in more detail below.

Liquidity Pool The Firm’s policy is to maintain a sizable liquidity pool for Holdings and its Unrestricted Subsidiaries that covers all expected cash outflows in a stressed liquidity environment for one year without being able to access the unsecured debt market. This liquidity pool is invested in cash and unencumbered liquid collateral such as U.S. government and agency obligations, investment grade securities and index equities that can be monetized at short notice in all market environments to provide liquidity to Holdings, which issues most of the unsecured debt. At November 30, 2003 the estimated pledge value of this portfolio, along with the undrawn portion of Holdings’ committed credit facility (see “Credit Facilities” on page 51), totaled approximately $16.3 billion. Cash and unencumbered liquid assets that are presumed to be “trapped” in a Restricted Subsidiary or required for operational purposes are not counted as available liquidity to Holdings and the Unrestricted Subsidiaries.

The Company’s liquidity pool is expected to be available to cover expected cash outflows in a stressed liquidity environment including:

• The repayment of all unsecured debt of Holdings and the Unrestricted Subsidiaries maturing within twelve months.

• The drawdown of commitments to extend credit made by Holdings and the Unrestricted Subsidiaries based on an analysis of the probability of such drawdown (see “Summary of Contractual Obligations and Commitments—Lending-Related Commitments” on page 53).

• Additional collateralization of derivative contracts and other secured funding arrangements by Holdings and the Unrestricted Subsidiaries to counterparties that would be required in the event of a lowering of debt ratings (see “Credit Ratings” on page 52).

47

• Continuing equity repurchases to offset the dilutive effect of the Company’s employee incentive plans (see “Stock Repurchase Plan” on page 52) and anticipated debt repurchases.

These projected outflows are re-assessed weekly and as they change, management adjusts the size requirement for the liquidity pool.

The liquidity of the Restricted Subsidiaries is separately managed to comply with their applicable liquidity and capital requirements and to minimize dependence on Holdings and the Unrestricted Subsidiaries.

Long-Term Funding Sources and Requirements Cash capital is the metric used by management to assess the long-term funding sources and requirements of the Company as a whole. The Company’s policy is to operate with an excess of long-term funding sources over its consolidated long-term funding requirements.

In 2003, the Company added materially to its cash capital sources (i.e., total stockholders’ equity, preferred securities subject to mandatory redemption and long-term debt excluding current portion, other liabilities with remaining terms greater than one year and deposit liabilities at the Company’s banking institutions, Lehman Brothers Bank, FSB (“LBB”) and Lehman Brothers Bank AG (“LBBAG”), which are considered to be core in nature). The Company also considers the undrawn portion of its committed facilities at Holdings and LBBAG as a source of cash capital (see “Credit Facilities” on page 51).

At November 30, 2003, the Company had raised more than $64 billion of cash capital across all its legal entities—the majority of it through long-term debt. Sources of cash capital at November 30 were as follows:

CASH CAPITAL SOURCES

IN BILLIONS

NOVEMBER 30 | | 2003 | | 2002 | |

| | | | | |

Total stockholders’ equity and preferred securities subject to mandatory redemption | | $ | 14 | | $ | 10 | |

Long-term debt, excluding current portion | | 36 | | 31 | |

Deposit liabilities at LBB and LBBAG | | 8 | | 3 | |

Other long-term secured obligations | | 4 | | 4 | |

Undrawn portion of unsecured committed facilities at Holdings and LBBAG | | 2 | | 1 | |

Total cash capital sources | | $ | 64 | | $ | 49 | |

Cash capital is used to fund the following long-term funding requirements:

• Less liquid assets, such as fixed assets and goodwill.

• Less liquid inventory, such as high yield loans, private equity investments, commercial mortgages and certain real estate positions.

• Unencumbered inventory irrespective of collateral quality.

• Secured funding “haircuts” (i.e., the difference between the market value of the available inventory and the value of cash advanced to the Company by counterparties against that inventory).

• Operational cash deposited by the Company at banks.

• Liquid investments held to fund certain projected cash outflow as described in “Liquidity Pool” on page 47. These investments are managed as part of the Liquidity Pool.

The Company also utilizes LBB and LBBAG to fund certain asset classes such as mortgage products and selected loan assets. These entities operate in a deposit-protected environment and are able to source low-cost unsecured funds that generally are insulated from a Company or market-specific event, thereby providing a reliable funding source for these asset classes.

48

At November 30, 2003, the Company had an $11 billion cash capital surplus across all legal entities. Cash capital sources and uses at November 30 are as follows:

CASH CAPITAL SURPLUS

IN BILLIONS

NOVEMBER 30 | | 2003 | | 2002 | |

| | | | | |

Cash capital sources | | $ | 64 | | $ | 49 | |

Cash capital uses: | | | | | |

Trading and trading-related assets | | 42 | | 35 | |

Non-trading assets | | 11 | | 8 | |

Total cash capital uses | | 53 | | 43 | |

Cash capital surplus | | $ | 11 | | $ | 6 | |

Cash capital surplus, which is part of the various liquidity pools of the Company, increased $5 billion in 2003 from $6 billion to $11 billion. Of the $11 billion in cash capital surplus, $6 billion is available to Holdings and its Unrestricted Subsidiaries. The Company targets maintaining a cash capital surplus available to Holdings and its Unrestricted Subsidiaries of not less than $2 billion.

Reliable Secured Funding Capacity The Company takes what management believes is a conservative approach to secured funding by depending on it only to the extent it is reliable in all market environments. The Company regularly performs a detailed assessment of its secured funding capacity by asset class and by counterparty to determine how much is reliable in a stressed liquidity environment. Reliable secured funding capacity is usually set at a significant discount to normal funding capacity. In particular, less liquid inventory such as high yield loans and commercial mortgages are funded entirely with cash capital—any short-term secured funding that might exist for these asset classes in a normal market environment is not considered to be reliable.

The Company has developed and regularly updates its Contingency Funding Plan, which represents a detailed action plan to manage a stressed liquidity event, including a communication plan for creditors, investors and clients during a funding crisis.

The liquidity policies and funding strategy discussed above have enabled the Company to build a strong liquidity position, which has played an important role in the narrowing of its credit spreads relative to its major competitors and in its credit ratings being raised by rating agencies. (See “Credit Ratings” on page 52).

Funding and Capital Resources

TOTAL CAPITAL

IN MILLIONS

NOVEMBER 30 | | 2003 | | 2002 | |

| | | | | |

Long-term debt: | | | | | |

Senior notes | | $ | 41,303 | | $ | 36,283 | |

Subordinated indebtedness | | 2,226 | | 2,395 | |

Subtotal | | 43,529 | | 38,678 | |

Preferred securities subject to mandatory redemption | | 1,310 | | 710 | |

Stockholders’ equity: | | | | | |

Preferred stockholders’ equity | | 1,045 | | 700 | |

Common stockholders’ equity | | 12,129 | | 8,242 | |

Subtotal | | 13,174 | | 8,942 | |

Total Capital | | $ | 58,013 | | $ | 48,330 | |

The Company’s Total Capital (defined as long-term debt, preferred securities subject to mandatory redemption and total stockholders’ equity) increased 20% to $58.0 billion at November 30, 2003 compared with $48.3 billion at November 30, 2002. The Company believes Total Capital is useful to investors as a measure of the Company’s financial strength because it aggregates the Company’s long-term funding sources. The increase in Total Capital principally resulted from a net increase in long-term debt and increased equity from the retention of earnings and the issuance of common stock to acquire Neuberger.

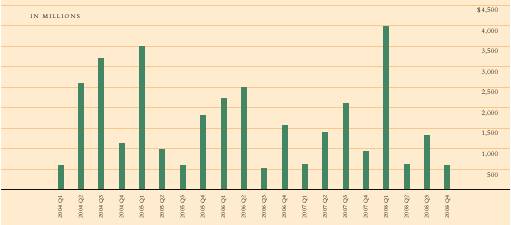

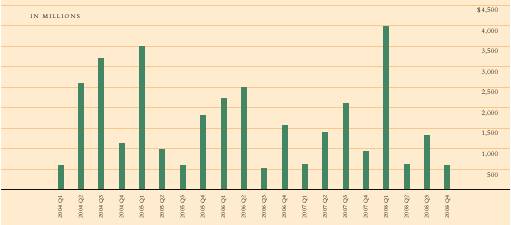

The Company actively manages long-term debt to minimize refinancing risk and investor concentration. The Company sets limits for the amount maturing over any three, six and twelve month horizon at 10%, 15% and 25% of outstanding long-term debt, respectively—that is, $4.4 billion, $6.5 billion and $10.9 billion, respectively, at November 30, 2003. The Company seeks to diversify its creditor base when issuing unsecured debt. The quarterly long-term debt maturity schedule over the next five years at November 30, 2003 is as follows: