QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant /x/

|

Filed by a Party other than the Registrant / / |

Check the appropriate box: |

/ / |

|

Preliminary Proxy Statement |

/ / |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14-6(e)(2)) |

/x/ |

|

Definitive Proxy Statement |

/ / |

|

Definitive Additional Materials |

/ / |

|

Soliciting Material under Rule 14a-12 |

LEHMAN BROTHERS HOLDINGS INC.

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| /x/ | | No fee required. |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4)

and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

/ / |

|

Fee paid previously with preliminary materials. |

/ / |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

February 26, 2004

Dear Stockholder,

The 2004 Annual Meeting of Stockholders of Lehman Brothers Holdings Inc. will be held on Friday, April 2, 2004, at 10:30 a.m. (New York time) at our global headquarters, 745 Seventh Avenue, New York, New York 10019, on the Concourse Level in the Allan S. Kaplan Auditorium. A notice of the meeting, a proxy card and a proxy statement containing information about the matters to be acted upon are enclosed. You are cordially invited to attend.

All holders of record of the Company's outstanding shares of Common Stock at the close of business on February 13, 2004 will be entitled to vote at the Annual Meeting. It is important that your shares be represented at the meeting. You will be asked to (i) elect four Class II Directors and (ii) ratify the selection of Ernst & Young LLP as the Company's independent auditors for the 2004 fiscal year. Accordingly, we request that you promptly sign, date and return the enclosed proxy card, or register your vote online or by telephone according to the instructions on the proxy card, regardless of the number of shares you hold.

Very truly yours,

Richard S. Fuld, Jr.

Chairman and Chief Executive Officer

LEHMAN BROTHERS HOLDINGS INC.

745 Seventh Avenue

New York, NY 10019

LEHMAN BROTHERS HOLDINGS INC.

Notice of 2004 Annual Meeting of Stockholders

To the Stockholders of Lehman Brothers Holdings Inc.:

The 2004 Annual Meeting of Stockholders of Lehman Brothers Holdings Inc. (the "Company") will be held on Friday, April 2, 2004, at 10:30 a.m. (New York time) at the Company's global headquarters, 745 Seventh Avenue, New York, New York 10019, on the Concourse Level in the Allan S. Kaplan Auditorium, to:

- 1.

- Elect four Class II Directors for terms of three years each;

- 2.

- Ratify the selection of Ernst & Young LLP as the Company's independent auditors for the 2004 fiscal year; and

- 3.

- Act on any other business which may properly come before the Annual Meeting or any adjournment thereof.

Common stockholders of record at the close of business on February 13, 2004 are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

The Company will admit to the Annual Meeting (1) all Stockholders of record at the close of business on February 13, 2004, (2) persons holding proof of beneficial ownership as of such date, such as a letter or account statement from the person's broker, (3) persons who have been granted proxies and (4) such other persons that the Company, in its sole discretion, may elect to admit.All persons wishing to be admitted must present photo identification. If you plan to attend the Annual Meeting, please check the appropriate box on your proxy card or register your intention when voting online or by telephone according to the instructions provided.

A copy of the Company's 2003 Annual Report to Stockholders is enclosed herewith for all Stockholders other than Lehman Brothers employees, to whom the Annual Report is being separately distributed.

New York, New York

February 26, 2004

WHETHER OR NOT YOU INTEND TO BE PRESENT AT THE ANNUAL MEETING, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED PREPAID ENVELOPE, OR REGISTER YOUR VOTE ONLINE OR BY TELEPHONE ACCORDING TO THE INSTRUCTIONS ON THE PROXY CARD.

PROXY STATEMENT TABLE OF CONTENTS

| | Page

|

|---|

| Introduction | | 1 |

Security Ownership of Principal Stockholders |

|

3 |

Proposal 1—Election of Class II Directors |

|

3 |

Nominees for Election as Class II Directors to Serve until the 2007 Annual Meeting of Stockholders |

|

4 |

Class I Directors whose Terms Continue until the 2005 Annual Meeting of Stockholders |

|

5 |

Class III Directors whose Terms Continue until the 2006 Annual Meeting of Stockholders |

|

6 |

Committees of the Board of Directors |

|

7 |

Non-Management Directors |

|

9 |

Attendance at Meetings by Directors |

|

9 |

Compensation of Directors |

|

10 |

Executive Officers of the Company |

|

11 |

Security Ownership of Directors and Executive Officers |

|

12 |

Compensation Committee Report on Executive Officer Compensation |

|

13 |

Compensation and Benefits Committee Interlocks and Insider Participation |

|

14 |

Compensation of Executive Officers |

|

15 |

Performance Graph |

|

19 |

Director Independence |

|

20 |

Certain Transactions and Agreements with Directors and Executive Officers |

|

22 |

Proposal 2—Ratification of the Company's Selection of its Auditors |

|

25 |

Ernst & Young LLP Fees and Services |

|

26 |

Audit Committee Report |

|

28 |

Section 16(a) Beneficial Ownership Reporting Compliance |

|

29 |

Other Matters |

|

29 |

Directions to the Lehman Brothers Holdings Inc. 2004 Annual Meeting of Stockholders |

|

31 |

APPENDIX A—Audit Committee Charter |

|

A-1 |

LEHMAN BROTHERS HOLDINGS INC.

745 SEVENTH AVENUE

NEW YORK, NEW YORK 10019

Proxy Statement

February 26, 2004

INTRODUCTION

Vote by Proxy

This proxy statement (the "Proxy Statement") is furnished in connection with the solicitation of proxies by the Board of Directors of Lehman Brothers Holdings Inc. (the "Company" and, together with its subsidiaries, the "Firm") for use at the 2004 Annual Meeting of Stockholders of the Company to be held on Friday, April 2, 2004 at 10:30 a.m. (New York time), or any adjournment thereof (the "Annual Meeting"). The Company expects to mail this Proxy Statement and the accompanying proxy card to the Company's common stockholders of record at the close of business on February 13, 2004 (the "Stockholders") on or about February 26, 2004.

You are cordially invited to attend the Annual Meeting. Whether or not you expect to attend in person, you are urged to complete, sign and date the enclosed proxy card and return it as promptly as possible in the enclosed, prepaid envelope, or to vote your shares online or by telephone according to the instructions on the proxy card. Stockholders have the right to revoke their proxies at any time prior to the time their shares are actually voted by (i) giving written notice to the Corporate Secretary of the Company, (ii) subsequently filing a later dated proxy or (iii) attending the Annual Meeting and voting in person. Please note that attendance at the meeting will not by itself revoke a proxy.

The enclosed proxy indicates on its face the number of shares of common stock registered in the name of each Stockholder at the close of business on February 13, 2004 (the "Record Date"). Proxies furnished to Company employees also indicate the following amounts, as applicable:

- •

- The amount of shares held by the employee under either the Lehman Brothers Holdings Inc. Employee Stock Purchase Plan (the "Lehman ESPP") or the Neuberger Berman Inc. Employee Stock Purchase Plan (the "Neuberger ESPP");

- •

- The amount of restricted stock unit awards granted to the employee pursuant to various of the Incentive Plans (as defined below), a portion of the underlying shares for which are held in, and will be voted in accordance with the employee's instructions by, the 1997 Trust Under Lehman Brothers Holdings Inc. Incentive Plans (the "Incentive Plans Trust");

- •

- The amount of shares held by the employee under the Lehman Brothers Savings Plan (the "Savings Plan");

- •

- The amount of restricted shares held by the employee pursuant to the Neuberger Berman Inc. Wealth Accumulation Plan and/or the 1999 Neuberger Berman Inc. Long-Term Incentive Plan; and

- •

- The amount of shares held by the employee in a brokerage account at Lehman Brothers Inc. ("LBI") or Neuberger Berman, LLC ("NBLLC"), each of which is a wholly owned subsidiary of the Company, and/or a brokerage account at Fidelity Brokerage Services LLC ("Fidelity Brokerage").

Proxies returned by employees holding restricted stock units related to shares held in the Incentive Plans Trust will be considered to be voting instructions returned to the Incentive Plans Trust trustee (the "Incentive Plans Trustee") with respect to the number of shares determined pursuant to the terms of the

agreement governing the Incentive Plans Trust, as described below under "The Voting Stock." Proxies returned by employees holding shares in the Savings Plan will be considered to be voting instructions returned to the Savings Plan trustee (the "Savings Plan Trustee") with respect to such shares, and Savings Plan shares for which no proxies are returned shall be voted in the same proportions as Savings Plan shares for which proxies are returned, as described below under "The Voting Stock." Proxies returned by employees holding shares in an LBI, NBLLC or Fidelity Brokerage account will be considered to be voting instructions returned to LBI, NBLLC or Fidelity Brokerage, as applicable, with respect to such shares. Except with respect to Savings Plan shares, no voting instructions will be confidential.

General

Unless contrary instructions are indicated on the proxy or in a vote registered online or by telephone, all shares represented by valid proxies received pursuant to this solicitation (and not revoked before they are voted) will be voted as follows:

FOR the election of the four nominees for Class II Directors named below; and

FOR the ratification of the selection of Ernst & Young LLP as the Company's independent auditors for the 2004 fiscal year.

In the event a Stockholder specifies a different choice on the proxy or by online or telephone vote, his or her shares will be voted in accordance with the specification so made.

The Company's 2003 Annual Report to Stockholders is being distributed to Stockholders in connection with this solicitation.A copy (exclusive of exhibits) of the Company's 2003 Form 10-K as filed with the Securities and Exchange Commission (the "SEC") may be obtained without charge by writing to: Lehman Brothers Holdings Inc., 399 Park Avenue, 11th Floor, New York, New York 10022, Attention: Corporate Secretary. The Company's 2003 Annual Report and 2003 Form 10-K also will be available through the Lehman Brothers web site at http://www.lehman.com.

Cost of Solicitation

The cost of soliciting proxies will be borne by the Company. In addition to solicitation by mail, proxies may be solicited by directors, officers or employees of the Company in person or by telephone or telegram, or other means of communication, for which no additional compensation will be paid. The Company has engaged the firm of Georgeson Shareholder to assist the Company in the distribution and solicitation of proxies. The Company has agreed to pay Georgeson Shareholder a fee of $11,000 plus expenses for its services.

The Company also will reimburse brokerage houses, including LBI and NBLLC, and other custodians, nominees and fiduciaries for their reasonable expenses, in accordance with the rules and regulations of the SEC, the New York Stock Exchange and other exchanges, in sending proxies and proxy materials to the beneficial owners of shares of the Company's Common Stock.

The Voting Stock

The Company's Common Stock, par value $.10 per share (the "Common Stock"), is its only class of voting stock. As of the Record Date, 277,256,627 shares of Common Stock (exclusive of 17,699,919 shares held in treasury) were outstanding. Stockholders are entitled to one vote per share with respect to each matter to be voted on at the Annual Meeting. There is no cumulative voting provision applicable to the Common Stock.

The presence in person or by proxy at the Annual Meeting of the holders of a majority of the shares of Common Stock outstanding on the Record Date shall constitute a quorum.

2

The Incentive Plans Trust holds shares of Common Stock ("Trust Shares") issuable to future, current and former employees of the Company in connection with the granting to such employees of Restricted Stock Units ("RSUs") under the Company's Employee Incentive Plan (the "Employee Incentive Plan"), the Company's 1994 Management Ownership Plan (the "1994 Plan") and the Company's 1996 Management Ownership Plan (together with the Employee Incentive Plan and the 1994 Plan, the "Incentive Plans"). The Incentive Plans Trustee will vote or abstain from voting all Trust Shares in the same proportions as the RSUs in respect of which it has received voting instructions from current employees who have received RSUs under the Incentive Plans ("Current Participants"). As of the Record Date, 43,458,833 Trust Shares (representing 15.68% of the votes entitled to be cast at the Annual Meeting) were held by the Incentive Plans Trust and 55,609,464 RSUs were held by Current Participants.

The Savings Plan Trustee will vote or abstain from voting any Savings Plan shares for which proxy instructions are received in accordance with such instructions, and will vote or abstain from voting any Savings Plan shares for which no proxy instructions are received in the same proportions as the Savings Plan shares for which it has received instructions. As of the Record Date, 1,317,959 Savings Plan shares (representing 0.48% of the votes entitled to be cast at the Annual Meeting) were held by the Savings Plan Trustee.

Stockholders Entitled to Vote

Only common stockholders of record at the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS

To the knowledge of management, except for the Incentive Plans Trust (described above), no person beneficially owned more than five percent of the Common Stock as of the Record Date.

PROPOSAL 1—ELECTION OF CLASS II DIRECTORS

At the Annual Meeting four Class II Directors are to be elected, each to serve until the Annual Meeting in 2007 and until his or her successor is elected and qualified. The Restated Certificate of Incorporation of the Company establishes a classified Board of Directors with three classes, designated Class I, Class II and Class III. The terms of the Class I and Class III Directors continue until the Annual Meetings in 2005 and 2006, respectively, and until their respective successors are elected and qualified.

The four nominees for Director are Roger S. Berlind, Marsha Johnson Evans, Sir Christopher Gent and Dina Merrill. Mr. Berlind was first elected Director in 1985 and Ms. Merrill was first elected Director in 1988. Sir Christopher Gent was appointed Director effective September 1, 2003 by the Board of Directors. Ms. Evans is not presently a Director.

The four nominees receiving the greatest number of votes cast by the Stockholders will be elected as Class II Directors of the Company. Abstentions and broker nonvotes will be disregarded and will have no effect on the vote for directors. Except as stated in the following sentence, the persons specified on the enclosed proxy card intend to vote for the nominees listed below, each of whom has consented to being named in this Proxy Statement and to serving if elected. Although management knows of no reason why any nominee would be unable to serve, the persons designated as proxies reserve full discretion to vote for another person in the event any such nominee is unable to serve.

The Board of Directors unanimously recommends a vote FOR all Nominees.

The following information is provided with respect to the nominees for Director and the incumbent Directors. Italicized wording indicates principal occupation(s). As discussed below under "Director Independence," the Board of Directors has determined in accordance with the new corporate governance rules of the New York Stock Exchange ("NYSE") that all of the members of the Board of Directors and nominees for Director, other than Richard S. Fuld, Jr. and Henry Kaufman, are independent and have no material relationships with the Firm.

3

NOMINEES FOR ELECTION AS CLASS II DIRECTORS TO SERVE

UNTIL THE 2007 ANNUAL MEETING OF STOCKHOLDERS

| ROGER S. BERLIND | | Director since 1985 | | Age: 73 |

Theatrical Producer.Roger S. Berlind, who is also a private investor, has been a theatrical producer and principal of Berlind Productions since 1981. Mr. Berlind is also a Governor of the League of American Theaters and Producers and has served as a Trustee of Princeton University, the Eugene O'Neill Theater Center and the American Academy of Dramatic Arts. Mr. Berlind serves as a member of the Audit Committee and the Finance Committee.

| MARSHA JOHNSON EVANS | | | | Age: 56 |

President of American Red Cross.Ms. Evans has been President and Chief Executive Officer of the American Red Cross since August 2002 and previously served as the National Executive Director of Girl Scouts of the U.S.A. from January 1998 until July 2002. A retired Rear Admiral in the United States Navy, Ms. Evans has served as superintendent of the Naval Postgraduate School in Monterey, California from 1995 to 1998 and headed the Navy's worldwide recruiting organization from 1993 to 1995. She is a director of The May Department Stores Company, AutoZone, Inc. and Weight Watchers International, Inc. She also serves on the Advisory Board of the Pew Partnership for Civic Change, a project of the Pew Charitable Trusts, is a director of the Naval Academy Foundation and a Presidential Appointee to the Board of Visitors of the United States Military Academy at West Point.

| SIR CHRISTOPHER GENT | | Director since 2003 | | Age: 55 |

Former Chief Executive Officer, Vodafone Group Plc.Sir Christopher Gent is the former Chief Executive Officer of Vodafone Group Plc. Prior to his retirement from Vodafone in July 2003, he had been a member of its Board of Directors since August 1985 and its Chief Executive Officer since January 1997. Sir Christopher joined Vodafone as Managing Director of Vodafone Limited in January 1985 when the mobile phone service was first launched, and held that position until December 1996. Prior to joining Vodafone, Sir Christopher was Director of Network Services for ICL. In this role, he was Managing Director of Baric, a computer services company owned jointly by Barclays and ICL, and was responsible for ICL's computer bureau services worldwide. Sir Christopher was Knighted for his services to the mobile telecommunications industry in 2001. He served as the National Chairman of the Young Conservatives from 1977 to 1979, and was Vice President of the Computer Services Association Council at the time he left ICL.

| DINA MERRILL | | Director since 1988 | | Age: 80 |

Director and Vice Chairman of RKO Pictures, Inc. and Actress.Dina Merrill, a Director and Vice Chairman of RKO Pictures, Inc., is an actress and also a private investor. Ms. Merrill was a Presidential Appointee to the Kennedy Center Board of Trustees and is a Vice President of the New York City Mission Society, a Trustee of the Eugene O'Neill Theater Foundation and a member of the Board of Orbis International, the Juvenile Diabetes Foundation and the Museum of Television and Radio. Ms. Merrill serves as the Chairman of the Nominating and Corporate Governance Committee and as a member of the Compensation and Benefits Committee.

4

CLASS I DIRECTORS WHOSE TERMS CONTINUE

UNTIL THE 2005 ANNUAL MEETING OF STOCKHOLDERS

| MICHAEL L. AINSLIE | | Director since 1996 | | Age: 60 |

Private Investor and Former President and Chief Executive Officer of Sotheby's Holdings.Mr. Ainslie, a private investor, is the former President, Chief Executive Officer and a Director of Sotheby's Holdings. He was Chief Executive Officer of Sotheby's from 1984 to 1994. From 1980 to 1984 he was President and Chief Executive Officer of the National Trust for Historic Preservation. From 1975 to 1980, he was Chief Operating Officer of N-Ren Corp., a Cincinnati-based chemical manufacturer. From 1971 to 1975, he was President of Palmas Del Mar, a real estate development company. He began his career as an associate with McKinsey & Company. Mr. Ainslie is a Director of the St. Joe Company and Artesia Technologies, an internet software provider. He is a Trustee of Vanderbilt University, Chairman of the Posse Foundation and Director of the U.S. Tennis Association Foundation. Mr. Ainslie serves as a member of the Audit Committee.

| JOHN F. AKERS | | Director since 1996 | | Age: 69 |

Retired Chairman of International Business Machines Corporation.Mr. Akers, a private investor, is the retired Chairman of the Board of Directors of International Business Machines Corporation. Mr. Akers served as Chairman of the Board of Directors and Chief Executive Officer of IBM from 1985 until his retirement in 1993, completing a 33-year career with IBM. Mr. Akers is a Director of W. R. Grace & Co., The New York Times Company, PepsiCo, Inc. and Hallmark Cards, Inc. He is a former member of the Board of Trustees of the California Institute of Technology and The Metropolitan Museum of Art, as well as the former Chairman of the Board of Governors of United Way of America. Mr. Akers was also a member of former President George Bush's Education Policy Advisory Committee. Mr. Akers serves as a member of the Finance Committee and the Compensation and Benefits Committee.

| RICHARD S. FULD, JR. | | Director since 1990 | | Age: 57 |

Chairman and Chief Executive Officer.Mr. Fuld has been Chairman of the Board of Directors of the Company and LBI since April 1994 and Chief Executive Officer of the Company and LBI since November 1993. Mr. Fuld serves as the Chairman of the Executive Committee. Mr. Fuld was President and Chief Operating Officer of the Company and LBI from March 1993 to April 1994 and was Co-President and Co-Chief Operating Officer of both corporations from January 1993 to March 1993. He was President and Co-Chief Executive Officer of the Lehman Brothers Division of Shearson Lehman Brothers Inc. from August 1990 to March 1993. Mr. Fuld was a Vice Chairman of Shearson Lehman Brothers from August 1984 until 1990 and has been a Director of LBI since 1984. Mr. Fuld joined Lehman Brothers in 1969. Mr. Fuld is Chairman of the U.S.-Thailand Business Council. Mr. Fuld is also a trustee of the Mount Sinai Medical Center, and the former Chairman of the Mount Sinai Children's Center Foundation; he currently serves on the foundation's Executive Committee. In addition, he is a member of the Executive Committee of the New York City Partnership and serves on the Board of Directors of Ronald McDonald House.

5

CLASS III DIRECTORS WHOSE TERMS CONTINUE

UNTIL THE 2006 ANNUAL MEETING OF STOCKHOLDERS

| THOMAS H. CRUIKSHANK | | Director since 1996 | | Age: 72 |

Retired Chairman and Chief Executive Officer of Halliburton Company.Mr. Cruikshank was the Chairman and Chief Executive Officer of Halliburton Company, a major petroleum industry service company, from 1989 to 1995, was President and Chief Executive Officer of Halliburton from 1983 to 1989, and served as a Director of Halliburton from 1977 to 1996. He joined Halliburton in 1969, and served in various senior accounting and finance positions before being named Chief Executive Officer. Mr. Cruikshank is a Director of LBI and is a member of the Board of Directors of The Williams Companies, Inc. Mr. Cruikshank serves as the Chairman of the Audit Committee and as a member of the Nominating and Corporate Governance Committee.

| HENRY KAUFMAN | | Director since 1995 | | Age: 76 |

President of Henry Kaufman & Company, Inc.Dr. Kaufman has been President of Henry Kaufman & Company, Inc., an investment management and economic and financial consulting firm, since 1988. For the previous 26 years, he was with Salomon Brothers Inc, where he was a Managing Director, Member of the Executive Committee, and in charge of Salomon's four research departments. He was also a Vice Chairman of the parent company, Salomon Inc. Before joining Salomon Brothers, Dr. Kaufman was in commercial banking and served as an economist at the Federal Reserve Bank of New York. Dr. Kaufman is a Director of the Federal Home Loan Mortgage Corporation and the Statue of Liberty-Ellis Island Foundation Inc. He is a Member (and the Chairman Emeritus) of the Board of Trustees of the Institute of International Education, a Member of the Board of Trustees of New York University, a Member (and the Chairman Emeritus) of the Board of Overseers of the Stern School of Business of New York University and a Member of the Board of Trustees of the Animal Medical Center. Dr. Kaufman is a Member of the Board of Trustees of the Whitney Museum of American Art, a Member of the International Advisory Committee of the Federal Reserve Bank of New York, a Member of the Advisory Committee to the Investment Committee of the International Monetary Fund Staff Retirement Plan, a Member of the Board of Governors of Tel-Aviv University and Treasurer (and former Trustee) of The Economic Club of New York. Dr. Kaufman serves as the Chairman of the Finance Committee.

| JOHN D. MACOMBER | | Director since 1994 | | Age: 76 |

Principal of JDM Investment Group.Mr. Macomber has been a Principal of JDM Investment Group, a private investment firm, since 1992. He was Chairman and President of the Export-Import Bank of the United States from 1989 to 1992, Chairman and Chief Executive Officer of Celanese Corporation from 1973 to 1986 and a Senior Partner at McKinsey & Co. from 1954 to 1973. Mr. Macomber is a Director of AEA Investors Inc., Mettler-Toledo International, Sovereign Specialty Chemicals, Inc. and Textron Inc. He is Chairman of the Council for Excellence in Government and Vice Chairman of the Atlantic Council. He is a Director of the National Campaign to Prevent Teen Pregnancy and the Smithsonian Institute and a Trustee of the Carnegie Institution of Washington and the Folger Library. Mr. Macomber serves as the Chairman of the Compensation and Benefits Committee and as a member of the Executive Committee and the Nominating and Corporate Governance Committee.

6

COMMITTEES OF THE BOARD OF DIRECTORS

The Executive, Audit, Compensation and Benefits, Finance, and Nominating and Corporate Governance Committees of the Board of Directors are described below.

Executive Committee

The Executive Committee consists of Mr. Fuld, who chairs the Executive Committee, and Mr. Macomber. The Executive Committee has the authority, in the intervals between meetings of the Board of Directors, to exercise all the authority of the Board of Directors, except for those matters that the Delaware General Corporation Law or the Company's Restated Certificate of Incorporation reserves to the full Board of Directors. The Executive Committee held one meeting and acted by unanimous written consent fourteen times during the fiscal year ended November 30, 2003 ("Fiscal 2003").

Audit Committee

The Audit Committee consists of Mr. Cruikshank, who chairs the Audit Committee, and Messrs. Ainslie and Berlind, all of whom have been determined by the Board of Directors to be independent directors under the recently adopted NYSE corporate governance rules that will be effective for the Company as of the date of the Annual Meeting (the "New NYSE Governance Rules"). In addition, each of Messrs. Cruikshank, Ainslie and Berlind meet the independence requirements for audit committee membership under existing NYSE rules as well as SEC rules. The Board of Directors has determined that Mr. Cruikshank is an "audit committee financial expert" as defined under SEC rules. The Audit Committee operates under a written charter adopted by the Board of Directors, which is attached hereto as Appendix A and is available through the Lehman Brothers web site at http://www.lehman.com. The Audit Committee assists the Board of Directors in fulfilling its oversight of the quality and integrity of the Company's financial statements and the Company's compliance with legal and regulatory requirements. The Audit Committee is responsible for retaining (subject to shareholder ratification) and, as necessary, terminating, the independent auditors, annually reviews the qualifications, performance and independence of the independent auditors and the audit plan, fees and audit results, and pre-approves audit and non-audit services to be performed by the auditors and related fees. The Audit Committee also oversees the performance of the Company's internal audit and compliance functions. The Audit Committee held seven meetings during Fiscal 2003.

Compensation and Benefits Committee

The Compensation and Benefits Committee (the "Compensation Committee") consists of Mr. Macomber, who chairs the Compensation Committee, and Mr. Akers and Ms. Merrill, all of whom are independent under the New NYSE Governance Rules. The Compensation Committee operates under a written charter adopted by the Board of Directors which is available through the Lehman Brothers web site at http://www.lehman.com. The Compensation Committee has general oversight responsibility with respect to compensation and benefits programs and compensation of the Company's executives, including reviewing and approving compensation policies and practices, such as salary, cash incentive, restricted stock, long-term incentive compensation and stock purchase plans and other programs, and grants under such plans. The Compensation Committee evaluates the performance of the Chief Executive Officer of the Company and other members of senior management and, based on such evaluation, reviews and approves the annual salary, bonus, share and option awards, other long-term incentives and other benefits to be paid to the Chief Executive Officer and such other members of senior management. The Compensation Committee has the authority, where appropriate, to delegate its duties. The Compensation Committee held five meetings and acted by unanimous written consent five times during Fiscal 2003.

7

Finance Committee

The Finance Committee consists of Dr. Kaufman, who chairs the Finance Committee, and Messrs. Akers and Berlind. The Finance Committee reviews and advises the Board of Directors on the financial policies and practices of the Company, and periodically reviews, among other things, major capital expenditure programs and significant capital transactions and recommends a dividend policy to the Board of Directors. The Finance Committee held two meetings during Fiscal 2003.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee (the "Nominating Committee") consists of Ms. Merrill, who chairs the Nominating Committee, and Messrs. Cruikshank and Macomber, all of whom are independent under the New NYSE Governance Rules. The Nominating Committee operates under a written charter adopted by the Board of Directors which is available through the Lehman Brothers web site at http://www.lehman.com. The Nominating Committee is responsible for overseeing the Company's corporate governance and recommending to the Board of Directors corporate governance principles applicable to the Company. The Nominating Committee also considers and makes recommendations to the Company's Board of Directors with respect to the size and composition of the Board of Directors and its Committees and with respect to potential candidates for membership on the Board of Directors.

The Nominating Committee seeks Director candidates who possess personal characteristics consistent with those who:

- •

- have demonstrated high ethical standards and integrity in their personal and professional dealings;

- •

- possess high intelligence and wisdom;

- •

- are financially literate (i.e., who know how to read a balance sheet, an income statement, and a cash flow statement, and understand the use of financial ratios and other indices for evaluating company performance);

- •

- ask for and use information to make informed judgments and assessments;

- •

- approach others assertively, responsibly, and supportively, and who are willing to raise tough questions in a manner that encourages open discussion; and/or

- •

- have a history of achievements that reflect high standards for themselves and others;

while retaining the flexibility to select those candidates whom it believes will best contribute to the overall performance of the Board of Directors. In addition, the Nominating Committee seeks candidates who will contribute knowledge, expertise or skills in at least one of the following core competencies, in order to promote a Board of Directors that possessesas a whole these core competencies:

- •

- a record of making good business decisions;

- •

- an understanding of management "best practices";

- •

- relevant industry-specific or other specialized knowledge;

- •

- business experience in international markets;

- •

- a history of motivating high-performing talent; and

- •

- the skills and experience to provide strategic and management oversight, and to help maximize the long-term value of Lehman Brothers for its shareholders.

In connection with each annual meeting, and at such other times as it may become necessary to fill one or more seats on the Board, the Nominating Committee will consider in a timely fashion potential candidates for director that have been recommended by the Company's Directors, Chief Executive Officer (the "CEO") and other members of senior management, and shareholders. The Nominating Committee may also determine to engage a third-party search firm as and when it deems appropriate to identify potential

8

candidates for its consideration. The Nominating Committee will meet such number of times as it deems necessary to narrow the list of potential candidates, review any materials provided by shareholders or other parties in connection with the potential candidates and cause appropriate inquiries to be conducted into the backgrounds and qualifications of potential candidates in order to enable it to properly evaluate the candidates. During this process, the Nominating Committee also reports to and receives feedback from other outside Directors, and meets with and considers feedback from the CEO and other members of senior management, with respect to potential candidates. Interviews of potential candidates for nomination are conducted by members of the Nominating Committee, other outside Directors, the CEO and other members of senior management.

In evaluating any potential candidate, the Nominating Committee considers the extent to which the candidate has the personal characteristics and core competencies discussed above, and takes into account all other factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity and the extent to which a candidate would fill a present need on the Board of Directors. In addition, the Nominating Committee considers independence and potential conflicts issues with respect to Directors standing for re-election and other potential nominees, and whether any candidate has special interests that would impair his or her ability to effectively represent the interests of all shareholders. The Nominating Committee also takes into account the candidates' current occupations and the number of other boards on which they serve in determining whether they would have the ability to devote sufficient time to carry out their duties as Directors.

Sir Christopher Gent was initially recommended to the Nominating Committee by a senior officer of the Company, the CEO and SpencerStuart, a third-party search firm engaged by the Company in October 2002 to help recruit two new Directors. Marsha Johnson Evans was initially recommended to the Nominating Committee by SpencerStuart. In the course of its engagement, SpencerStuart identified and provided background information about the potential Director candidates.

As indicated above, the Nominating Committee will consider candidates for Director recommended by shareholders of the Company. The procedures for submitting shareholder recommendations are explained below under "Other Matters."

The Nominating Committee held three meetings and acted by unanimous written consent one time during Fiscal 2003.

NON-MANAGEMENT DIRECTORS

The Board of Directors has adopted a policy of regularly scheduled executive sessions where non-management Directors will meet independent of management. At least one executive session per year will include only the independent non-management Directors. The non-management Directors held six executive sessions during Fiscal 2003. The presiding Director at the executive sessions is Mr. Macomber.

Shareholders of the Company may communicate their concerns to the non-management Directors in accordance with the procedures described on the Lehman Brothers website at http://www.lehman.com.

ATTENDANCE AT MEETINGS BY DIRECTORS

The Board of Directors held eight meetings during Fiscal 2003. During Fiscal 2003, each Director other than Sir Christopher Gent attended 75 percent or more of the aggregate of (a) the total number of meetings of the Board of Directors held during the period when he or she was a Director and (b) the total number of meetings held by all Committees of the Board on which he or she served during the period when he or she was a member. Sir Christopher Gent attended two of the three Board of Directors meetings held in Fiscal 2003 during the period when he was a Director. Overall Director attendance at Board and Board Committee meetings during Fiscal 2003 averaged 97.5%. The number of meetings held by each Committee during Fiscal 2003 is set forth above.

Each Director is expected to attend the Company's Annual Meeting of Stockholders. Each Director then in office attended the Company's 2003 Annual Meeting of Stockholders.

9

COMPENSATION OF DIRECTORS

Non-management Directors receive an annual cash retainer of $55,000 and are reimbursed for reasonable travel and related expenses. The annual retainer is paid quarterly; however, the fourth quarter payment will be withheld from any Director who has been a Director for the full year for failure to attend 75% of the total number of meetings. The chairman of the Audit Committee receives an additional annual retainer of $25,000, and each non-management Director who serves as a chairman of any other Committee of the Board of Directors receives an additional annual retainer of $15,000 per Committee. Each non-management Director who serves as a Committee member (including as chairman) receives $2,500 per Committee meeting and $1,500 per unanimous written consent.

Restricted Stock Unit and Option Grants for Non-Management Directors

An annual equity retainer in the form of a grant of 2,500 RSUs is made to each non-management Director on the day of the Company's Annual Meeting of Stockholders. As of each date that a dividend is paid on Common Stock, each non-management Director holding RSUs is credited with a number of additional RSUs equal to the product of (A) the dividend paid on one share of Common Stock, multiplied by (B) the number of RSUs held by the non-management Director, divided by (C) the closing price of the Common Stock on the New York Stock Exchange on such date. The RSUs vest immediately and are payable in Common Stock upon death, disability or termination of service.

Alternatively, a non-management Director may elect to receive an option to purchase 7,500 shares of Common Stock, with an exercise price per share equal to the closing price of the Common Stock on the New York Stock Exchange on the date the award is made. Such option has a ten-year term, is not forfeitable, and becomes exercisable in one-third increments on each of the first three anniversaries of the award date or, if sooner, upon termination of service.

The Company's Deferred Compensation Plan for Non-Management Directors

The Company's Deferred Compensation Plan for Non-Management Directors is a nonqualified deferred compensation plan, which provides each non-management Director an opportunity to elect to defer receipt of cash compensation to be earned for services on the Board of Directors. Each non-management Director may elect to defer all or a portion of his or her future cash compensation with respect to one or more terms as Director. Such election can be revoked only by a showing of financial hardship and with the consent of the Compensation Committee. Amounts deferred are credited quarterly with interest, based upon the average 30-day U.S. Treasury Bill rate, and compounded annually. Deferred amounts will be paid in either a lump sum or in annual installments over a period not to exceed ten years as elected by the non-management Director. Payments commence as the non-management Director elects, at a specified date in the future or upon termination of service as a non-management Director.

The Company's Frozen Retirement Plan for Non-Management Directors

Prior to May 1994, the Company maintained the Company's Retirement Plan for Non-Management Directors which was a nonqualified retirement plan providing a limited annual retirement benefit for non-management Directors who had earned five or more years of service as defined in the plan. Participation in this plan was frozen on May 31, 1994. Any non-management Director who had, on such date, completed at least five years of service as a Director (determined in accordance with the plan) has vested benefits under the plan. Any individual who was a non-management Director on such date, but had not completed five years of service as of such date, acquired vested benefits under this plan at the time such individual completed such five years of service as a Director. Any individual who became a non-management Director after such date was ineligible to participate in this plan. Vested benefits under this plan will be paid after a participant ceases to be a Director.

10

EXECUTIVE OFFICERS OF THE COMPANY

Biographies of the current executive officers of the Company are set forth below, excluding Mr. Fuld's biography, which is included above. Each executive officer serves at the discretion of the Board of Directors.

Chief of Operations and Technology.Mr. Beyman has been the Chief of Operations and Technology since July 2002 and is an Executive Vice President of the Company. From July 2000 to July 2002 Mr. Beyman was the Firm's Chief Information Officer, from July 1999 to July 2000 he was the Firm's Global Head of Operations, and from March 1999 to July 1999 he was the Firm's U.S. Head of Operations. From December 1997 to February 1999, Mr. Beyman was Chief Operating Officer of Cendant Corporation's Internet-based business, and Chief Information Officer of Cendant from July 1994 to June 1998. Prior thereto, Mr. Beyman was with the Firm for eight years, in a variety of technology and operations senior management roles. Mr. Beyman is a member of the Board of Directors of the Depository Trust and Clearing Corporation.

Chief Financial Officer.Mr. Goldfarb has been the Chief Financial Officer of the Company since April 2000 and is an Executive Vice President of the Company and a member of the Firm's Executive Committee. Mr. Goldfarb served as the Company's Controller from July 1995 to April 2000. Mr. Goldfarb has been the Chief Financial Officer of LBI since July 1998. Mr. Goldfarb joined the Firm in December 1993; prior to that, Mr. Goldfarb was a partner at Ernst & Young LLP.

| JOSEPH M. GREGORY | | Age: 51 |

Chief Operating Officer.Mr. Gregory has been Chief Operating Officer of the Company since May 2002 and is a member of the Firm's Executive Committee. From April 2000 until May 2002, Mr. Gregory was the Firm's Chief Administrative Officer, and from 1996 to April 2000, Mr. Gregory was Head of the Firm's Global Equities Division, in charge of the overall equities business. From 1991 to 1996, he was Co-Head of the Firm's Fixed Income Division. From 1980 to 1991, he held various management positions in the Fixed Income Division, including Head of the Firm's Mortgage Business. Mr. Gregory joined the Firm in 1974 as a commercial paper trader. Mr. Gregory is a member of the Board of Directors of The Posse Foundation Inc. and is a member of the Board of Trustees of The Millbrook School.

Chief Operating Officer.Mr. Jack has been Chief Operating Officer of the Company since May 2002 and is a member of the Firm's Executive Committee. From 1996 to May 2002 Mr. Jack was Head of the Firm's Investment Banking Division, and from 1993 to 1996 he was a Sector Head in Investment Banking, responsible for the Firm's businesses involving Debt Capital Markets, Financial Services, Leveraged Finance and Real Estate. Prior to that he was head of the Firm's Fixed-Income Global Syndicate activities. Mr. Jack joined the Firm in 1984 as an associate in the Fixed Income Division. Mr. Jack is a member of the Board of Directors of the Dorothy Rodbell Cohen Foundation and a member of the Board of Trustees of the Juilliard School.

Chief Legal Officer.Mr. Russo has been Chief Legal Officer of the Company since 1993 and is an Executive Vice President of the Company. Mr. Russo also serves as counsel to the Firm's Executive Committee. He has been a Vice Chairman of LBI since July 1999. Mr. Russo joined the Firm in 1993; prior to that, Mr. Russo was a partner at the Wall Street law firm of Cadwalader, Wickersham & Taft and a member of its management committee. Mr. Russo is a member of the Executive Committee of the Board of Directors of the March of Dimes, Chairman and a member of the Executive Committee of the Board of Trustees of the Institute for Financial Markets, and Chairman of the Executive Committee of the Board of Trustees of the Institute for International Education. He is also Co-Chairman of the Global Documentation Steering Committee and a member of the Board of Trustees of NYU Downtown Hospital.

11

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth beneficial ownership information as of January 31, 2004 with respect to the Common Stock for each current Director and nominee for Director, each executive officer named in the tables set forth under "Compensation of Executive Officers" below and all current Directors and executive officers as a group. Except as described below, each of the persons listed below has sole voting and investment power with respect to the shares shown. None of the Directors or executive officers beneficially owned any of the Company's other outstanding equity securities as of January 31, 2004.

Beneficial Owner

| | Number of Shares of

Common Stock (a)

| | Number of Shares of Common Stock which may be acquired within 60 days of January 31, 2004

| | Percent of

Outstanding

Common Stock (b)

|

|---|

| Michael L. Ainslie (c) | | 23,979 | | 23,298 | | * |

| John F. Akers | | 13,518 | | 23,298 | | * |

| Roger S. Berlind (d) | | 291,610 | | 23,298 | | * |

| Thomas H. Cruikshank | | 28,966 | | 0 | | * |

| Marsha Johnson Evans | | 0 | | 0 | | * |

| Richard S. Fuld, Jr. | | 4,422,798 | | 1,206,640 | | 2.10 |

| Sir Christopher Gent | | 0 | | 0 | | * |

| David Goldfarb | | 272,857 | | 75,708 | | * |

| Joseph M. Gregory | | 2,151,388 | | 716,666 | | 1.07 |

| Bradley H. Jack | | 1,573,641 | | 816,666 | | * |

| Henry Kaufman (e) | | 33,867 | | 20,894 | | * |

| John D. Macomber | | 62,123 | | 23,298 | | * |

| Dina Merrill | | 22,090 | | 23,298 | | * |

| Thomas A. Russo | | 576,579 | | 50,000 | | * |

| All current Directors and executive officers as a group (14 individuals) | | 9,570,116 | | 3,012,437 | | 4.67 |

- *

- Less than one percent.

- (a)

- Amounts include vested and unvested RSUs. RSUs are convertible on a one-for-one basis into shares of Common Stock, but cannot be sold or transferred until converted to Common Stock and, with respect to each person identified in the table, are not convertible within 60 days following January 31, 2004. A portion of the vested RSUs held by the executive officers are subject to forfeiture for detrimental or competitive activity. Nonetheless, an executive officer who holds RSUs will be entitled to direct the Incentive Plans Trustee to vote a number of Trust Shares that is proportionate to the number of RSUs held irrespective of vesting; such number of Trust Shares will be calculated prior to the Annual Meeting and will be determined by the number of Trust Shares held by the Incentive Plans Trust on the Record Date and the extent to which Current Participants under the Incentive Plans return voting instructions to the Incentive Plans Trustee. See "Introduction—The Voting Stock."

- (b)

- Percentages are calculated in accordance with applicable SEC rules and are based on the number of shares issued and outstanding on January 31, 2004.

- (c)

- Includes 3,500 shares held by Mr. Ainslie's private charitable foundation, as to which Mr. Ainslie disclaims beneficial ownership.

- (d)

- Includes 80,000 shares held by Mr. Berlind's wife, as to which Mr. Berlind disclaims beneficial ownership.

- (e)

- Includes 25,000 shares held by Dr. Kaufman's wife, as to which Dr. Kaufman disclaims beneficial ownership.

12

COMPENSATION COMMITTEE REPORT ON EXECUTIVE OFFICER COMPENSATION

The Compensation Committee oversees the compensation and benefit programs of the Company, with particular attention to the compensation of the Company's Chief Executive Officer and other executive officers. The Compensation Committee is comprised of Mr. Macomber, who chairs the Compensation Committee, Mr. Akers and Ms. Merrill.

In making its decisions with respect to the compensation of executive officers, the Compensation Committee has adopted the following philosophical positions and policies:

- •

- Deliver a significant portion of total compensation in equity-based awards, thereby aligning the financial interests of executive officers with those of stockholders and encouraging prudent long-term strategic decisions. Where feasible, based on market conditions and other factors, shares will be repurchased in the market to avoid stockholder dilution.

- •

- Tie compensation for executive officers to both annual and long-term performance goals, which further aligns the interests of executive officers with those of stockholders and rewards executive officers for results.

- •

- Ensure that compensation opportunities are comparable with those at major competitors, so that the Firm can attract, retain and motivate talented executive officers who are essential to the Company's long-term success.

The overall objective in determining total compensation levels across the Firm is to balance competitive pressures in the market for professional talent with cost considerations. The elements and weightings of the compensation program at the Company are comparable to those used in the securities industry, but are considerably different from those of other major corporations operating in different industries. The nature of the securities industry requires a large percentage of highly skilled professionals, who are in great demand due to the revenue they can generate. Competitive pressure to hire these professionals results in high levels of compensation in order to attract and retain the talent needed to compete effectively.

Total compensation is comprised of base salary and both cash and equity incentive compensation. Base salaries are intended to make up a small portion of total compensation. The larger part of total compensation, incentive compensation, is based on the Company's financial performance and other factors and is delivered through a combination of cash and equity-based awards. This approach results in overall compensation levels that reflect the financial performance of the Company.

As in prior years, a key element of executive officer compensation for Fiscal 2003 was pre-established compensation formulas, which in Fiscal 2003 were based on the Company's net income. The formulas are intended to provide a specific amount of annual compensation, which is paid in cash and Restricted Stock Units ("RSUs"). The RSUs are subject to significant vesting and forfeiture restrictions, and cannot be sold or transferred until converted to Common Stock.

Additionally, Fiscal 2003 executive officer compensation included a long-term incentive plan ("LTIP") as a component of total compensation. Whereas the cash and RSU components of total compensation are based upon annual performance goals, the LTIP is based upon performance over a longer period and is initially in the form of Performance Stock Units ("PSUs"). Under the current LTIP, the Company's return on equity as well as any price appreciation in the Common Stock over a three and one-half year period which began June 1, 2000 determined an award of RSUs that will vest in one-third increments in 2006 through 2008. The performance component of the LTIP seeks to further align executive performance with stockholder interests. The vesting component seeks to encourage the retention of talented executives, particularly if the Company's return on equity and stock price result in a meaningful award.

The Compensation Committee also utilized stock option awards in Fiscal 2003 to further encourage executive officers to strive for long-term stockholder value. The options were awarded with exercise prices equal to the fair market value on the date of the grant, and with terms providing for exercisability if the market price of the Common Stock increases to a level well above the market price on the date of grant, but no earlier than 2 years. However, if the target price is not achieved, exercisability of the options is

13

delayed until four and one-half years after the date of grant. The stock options expire five years from the date of grant. The Compensation Committee believes that options assist the Firm in maintaining a competitive compensation program.

In determining overall executive officer compensation for Fiscal 2003, the Compensation Committee considered the Company's financial performance as well as a number of other business factors and conditions. Fiscal 2003 was a record year for the Company, which posted the highest level of revenues in its history, in addition to achieving strong results as measured by return on equity, EPS, and net income. The Company also continued to make improvements in expense management, strengthen its total capital and equity positions, and improve the quality of the franchise. In addition, the Compensation Committee reviewed compensation provided in prior years, along with estimates of compensation for the current year for competitors. In making its determinations, the Compensation Committee had available to it third-party advisors knowledgeable about industry practices.

Compensation of the Chairman and Chief Executive Officer for Fiscal 2003

In establishing Fiscal 2003 compensation for Richard S. Fuld, Jr., the Company's Chairman and Chief Executive Officer, the Compensation Committee considered, in addition to the financial results of the Company relative to competitors, the following performance factors:

- •

- Market share gains in major product categories in investment banking and capital markets.

- •

- Broad recognition of the Company's franchise building efforts, both in select market segments and overall.

- •

- Long-term credit rating improvement.

- •

- The successful acquisition of Neuberger Berman.

The Committee did not assign specific relative weights to the performance factors above.

The Compensation Committee concluded that Mr. Fuld's performance in 2003 was outstanding. Mr. Fuld's strong leadership and strategic vision continue to position the Company well for future growth and profitability. Since the majority of Mr. Fuld's compensation is based on the Company's financial results, his Fiscal 2003 compensation reflects a significant increase relative to 2002. Due to a large portion of Mr. Fuld's compensation being delivered in RSUs and stock options, realization of remuneration from his equity awards will ultimately depend on the future performance of the Company and the value of its stock.

Section 162(m) of the Internal Revenue Code limits the tax deductibility of compensation in excess of $1 million unless the payments are made under qualifying performance-based plans. While the Compensation Committee generally seeks to maximize the deductibility of compensation paid to executive officers, it will maintain flexibility to take other actions which may be based on considerations other than tax deductibility.

Compensation and Benefits Committee:

John D. Macomber, Chairman

John F. Akers

Dina Merrill

February 26, 2004

COMPENSATION AND BENEFITS COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During the last completed fiscal year, John D. Macomber, John F. Akers and Dina Merrill served on the Compensation Committee. None of these individuals has ever served as an officer or employee of the Firm.

14

COMPENSATION OF EXECUTIVE OFFICERS

The following table shows, for the years ended November 30, 2003, 2002 and 2001, as applicable, the cash and other compensation paid or accrued and certain long-term awards made to the Chairman and Chief Executive Officer (the "CEO") and to the Company's four most highly compensated executive officers for Fiscal 2003 other than the CEO for services in all capacities. Mr. Russo became an executive officer in the fiscal year ended November 30, 2002 ("Fiscal 2002").

SUMMARY COMPENSATION TABLE

| |

| | Annual Compensation

| | Long-Term

Compensation Awards

| |

|

|---|

Name and Principal

Position at

November 30, 2003

| | Fiscal

Year

| | Salary

| | Bonus

| | Other Annual

Compensation

| | Restricted

Stock Unit

Awards (a)

| | Securities

Underlying

Options

| | All Other

Compensation

(b)

|

|---|

| R. S. Fuld, Jr. | | 2003 | | $ | 750,000 | | $ | 6,650,000 | | — | | $ | 8,000,000 | | 400,000 | | $ | 14,439 |

| Chairman and Chief | | 2002 | | | 750,000 | | | 1,050,000 | | — | | | 5,771,003 | | 400,000 | | | 13,008 |

| Executive Officer | | 2001 | | | 750,000 | | | 4,000,000 | | — | | | 6,785,299 | | 450,000 | | | 12,517 |

J. M. Gregory |

|

2003 |

|

$ |

450,000 |

|

$ |

5,050,000 |

|

— |

|

$ |

5,714,629 |

|

300,000 |

|

$ |

7,912 |

| Chief Operating Officer | | 2002 | | | 450,000 | | | 1,050,000 | | — | | | 3,571,803 | | 300,000 | | | 7,128 |

| | | 2001 | | | 450,000 | | | 2,800,000 | | — | | | 4,642,616 | | 350,000 | | | 6,373 |

B. H. Jack |

|

2003 |

|

$ |

450,000 |

|

$ |

5,050,000 |

|

— |

|

$ |

5,714,629 |

|

300,000 |

|

$ |

0 |

| Chief Operating Officer | | 2002 | | | 450,000 | | | 1,050,000 | | — | | | 3,571,803 | | 300,000 | | | 0 |

| | | 2001 | | | 450,000 | | | 2,800,000 | | — | | | 4,642,616 | | 350,000 | | | 0 |

D. Goldfarb |

|

2003 |

|

$ |

450,000 |

|

$ |

2,550,000 |

|

— |

|

$ |

3,571,643 |

|

200,000 |

|

$ |

0 |

| Chief Financial Officer | | 2002 | | | 450,000 | | | 1,049,000 | | — | | | 1,787,331 | | 575,000 | | | 0 |

| | | 2001 | | | 450,000 | | | 1,550,000 | | — | | | 1,428,528 | | 225,000 | | | 0 |

T. A. Russo |

|

2003 |

|

$ |

450,000 |

|

$ |

2,550,000 |

|

— |

|

$ |

2,857,314 |

|

50,000 |

|

$ |

0 |

| Chief Legal Officer | | 2002 | | | 450,000 | | | 1,050,000 | | — | | | 1,428,721 | | 0 | | | 0 |

- (a)

- The values indicated are calculated by multiplying the closing market price of the Common Stock on the respective dates the awards were granted by the number of shares awarded. RSUs are subject to significant vesting and forfeiture restrictions and pursuant to the terms of the awards cannot be sold or transferred until they convert to Common Stock, which in the case of the RSUs granted for Fiscal 2003 will occur November 30, 2008. Dividends are payable by the Company on all such holdings from their respective dates of award and are reinvested in additional RSUs. The total number of RSUs granted for Fiscal 2003 that underlies the value shown for Messrs. Fuld, Gregory, Jack, Goldfarb and Russo was 93,786.64, 80,048.03, 80,048.03, 50,030.02 and 40,024.01, respectively. Of such RSUs, 35% will vest on November 30, 2006 and the balance will vest on November 30, 2008. Notwithstanding the foregoing, RSUs may become vested (and may convert to Common Stock) sooner upon certain termination events or upon death or disability.

- Including the RSUs described immediately above, as of November 30, 2003, the total number of RSUs held by Messrs. Fuld, Gregory, Jack, Goldfarb and Russo was 2,465,942.11, 1,727,172.17, 1,273,102.39, 227,356.58 and 419,771.54, respectively. The value of these holdings at the November 28, 2003 closing price per share of Common Stock of $72.21 was $178,065,680, $124,719,102, $91,930,724, $16,417,419 and $30,311,703, respectively. These RSU holdings as of November 30, 2003 include Extended RSUs, described under "Employment Contracts, Termination of Employment and Change in Control Arrangements," which vest (and convert to Common Stock) upon certain termination events or upon death or disability or a change in control, and that were based upon the Company's 1995, 1996 and 1997 PSU award programs.

- RSU awards may also be received by executives in accordance with the Firm's PSU award programs following the initial performance periods specified in the PSU awards. The RSUs are subject to significant vesting and forfeiture restrictions and cannot be sold or transferred until they convert to

15

Common Stock upon the lapse of such restrictions. In addition to the RSUs reflected in the table above, in Fiscal 2003 Messrs. Fuld, Gregory, Jack, Goldfarb and Russo received 60,000, 45,000, 45,000, 30,000 and 20,000 RSUs, respectively, that are based upon PSU awards made in 2000, and in Fiscal 2002 they received 96,500, 72,750, 72,750, 43,500 and 33,500 RSUs, respectively, that are based upon PSU awards made in 2000. In the fiscal year ended November 30, 2001, none of the named executive officers received any RSUs based upon PSU awards. All such RSUs are included in the total RSU holdings disclosed in the second paragraph of this footnote (a).

- (b)

- The amounts reported under "All Other Compensation" for Fiscal 2003 consist of the dollar value of above-market earnings on deferred compensation. Included are credits to compensation deferred pursuant to the Executive and Select Employees Plan, which was established in 1985, and the Lehman Brothers Kuhn Loeb Deferred Compensation Plans, which were established in 1977 and 1980.

Options

The following table contains information concerning the grant of nonqualified stock options in Fiscal 2003 to the named executive officers.

OPTION GRANTS IN LAST FISCAL YEAR

Name

| | Number of

Securities

Underlying

Options

Granted (a)

| | Percent of

Total Options

Granted to

Employees in

Fiscal Year

| | Exercise or

Base Price

Per Share

| | Expiration

Date

| | Grant Date

Present Value (b)

|

|---|

| R. S. Fuld, Jr. | | 400,000 | | 2.6 | | $ | 54.42 | | 12/10/07 | | $ | 4,372,000 |

| J. M. Gregory | | 300,000 | | 1.9 | | | 54.42 | | 12/10/07 | | | 3,279,000 |

| B. H. Jack | | 300,000 | | 1.9 | | | 54.42 | | 12/10/07 | | | 3,279,000 |

| D. Goldfarb | | 200,000 | | 1.3 | | | 54.42 | | 12/10/07 | | | 2,186,000 |

| T.A. Russo | | 50,000 | | 0.3 | | | 54.42 | | 12/10/07 | | | 546,500 |

- (a)

- Five-year nonqualified stock options were granted on December 11, 2002 with terms providing for exercisability in four and one-half years and for accelerated exercisability, to no earlier than the second anniversary of the grant date, if and when the price of the Common Stock on the NYSE exceeds $70.75, which has since occurred. Notwithstanding the foregoing, the options will become exercisable without regard to the two-year holding period upon certain termination events, and without regard to either the holding period or the stock price thresholds upon death or disability.

- (b)

- These values were calculated using the Black-Scholes option pricing model as of the grant date. The Black-Scholes model is a mathematical formula that is widely used and accepted for valuing traded stock options. The model is premised on immediate exercisability and transferability of the options, neither of which was true for the options granted to the named executive officers at the time of grant. Therefore, certain discounting assumptions about the time of exercise and risk of forfeiture were applied, as indicated below. These hypothetical present values are presented pursuant to SEC rules even though there is no assurance that such values will ever be realized. The actual amount, if any, realized upon the exercise of stock options would depend upon the market price of Common Stock relative to the exercise price per share of the stock option at the time the stock option is exercised.

The following assumptions were used in employing the Black-Scholes option pricing model: an exercise price equal to the closing price of the Common Stock on the date of grant; an expected time to exercise of three and one-half years; a dividend rate of $0.36 per share; a risk-free rate of return equal to the yield for the U.S. Treasury Strip security with a maturity date closest to the expected option life of the grant; an expected Common Stock price volatility rate of 42% per annum; a 10% adjustment for the target stock price requirement; and a 10% per annum adjustment for risk of forfeiture.

16

The following table sets forth information concerning the exercise of options during Fiscal 2003 by each of the named executive officers and the fiscal year-end value of unexercised options.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

| |

| |

| | Number of Securities

Underlying Unexercised Options

at Fiscal Year End

| | Value of Unexercised

In-The-Money Options

at Fiscal Year End (a)

|

|---|

Name

| | Shares Acquired

on Exercise

| |

|

|---|

| | Value Realized

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| R. S. Fuld, Jr. | | 700,000 | | $ | 37,539,600 | | 1,056,640 | | 1,250,000 | | $ | 45,746,464 | | $ | 20,128,250 |

| J. M. Gregory | | 700,000 | | | 25,566,020 | | 600,000 | | 950,000 | | | 24,351,000 | | | 15,359,750 |

| B. H. Jack | | 600,000 | | | 23,746,803 | | 700,000 | | 950,000 | | | 27,728,250 | | | 15,359,750 |

| D. Goldfarb | | 83,333 | | | 2,502,072 | | 59,041 | | 1,139,386 | | | 2,821,754 | | | 25,912,352 |

| T. A. Russo | | 75,000 | | | 2,098,419 | | — | | 425,000 | | | — | | | 12,057,750 |

- (a)

- Aggregate values in these two columns represent the excess of $72.21 per share, the closing price of the Common Stock on November 28, 2003 on the NYSE, over the respective exercise prices of the options. The actual amount, if any, realized upon exercise of stock options will depend upon the market price of the Common Stock relative to the exercise price per share of the stock option at the time the stock option is exercised. There is no assurance that the values of unexercised in-the-money options reflected above will be realized.

Pension Benefits

U.S. Pension Plan. The Lehman Brothers Holdings Inc. Retirement Plan (the "U.S. Pension Plan") is a funded, qualified, noncontributory, integrated, defined benefit pension plan covering eligible U.S. employees.

All U.S. employees of the Company or a designated subsidiary who have attained the age of 21 and completed one year of service are generally eligible to participate in the U.S. Pension Plan. The U.S. Pension Plan formula provides for an annual retirement benefit payable at age 65, calculated as a straight life annuity. Pensionable earnings are total Form W-2 earnings (plus elective deferrals under the Lehman Brothers Savings Plan and certain other health plan deferral amounts) up to the applicable Internal Revenue Service maximum. For each year of plan participation prior to 1989, the annual accrual was based on percentages of pensionable earnings up to and in excess of the social security taxable wage base. After 1988 the annual accrual is equal to one percent of pensionable earnings up to the average Social Security taxable wage base plus 1.65% of pensionable earnings in excess of the average taxable wage base. Generally, participants have a nonforfeitable right to their accrued benefits upon completing five years of vesting service. As of November 30, 2003, the estimated annual projected benefits payable upon retirement at a normal retirement age of 65 for Messrs. Fuld, Gregory, Jack, Goldfarb and Russo are approximately $103,262, $115,143, $102,795, $74,160 and $38,978, respectively.

Supplemental Retirement Plan. The Company has adopted a nonqualified, noncontributory Supplemental Retirement Plan (the "SRP"), which is a defined benefit plan, covering Messrs. Fuld, Gregory, Jack, Goldfarb and Russo and certain other executives. For Messrs. Fuld, Gregory, Jack and Goldfarb, full benefits are payable to those who upon retirement are at least age 60 and who have completed at least five years of service, or whose age plus years of service equals or exceeds the sum of 85. For these individuals, the SRP provides for the payment beginning at age 60 of reduced benefits payable to those who upon retirement are not yet age 60 if upon retirement the participant is above age 45 or has completed five years of service. For Mr. Russo, who became an executive officer in Fiscal 2002, full benefits are payable if upon retirement he is at least age 65, and reduced benefits are payable beginning at age 65 if he retires on or after January 1, 2007 but prior to age 65. Benefits are not payable in cases of termination by the Company

17

for cause or if the participant engages in competitive or detrimental activity. As of January 31, 2004, the estimated annual projected benefits payable in 25 annual installments upon retirement at age 60 (age 65 in the case of Mr. Russo) are $1.25 million for Mr. Fuld, and $700,000 for each of Messrs. Gregory, Jack, Goldfarb and Russo. In the event of a change in control, participants are considered to have met the eligibility for full benefits if the participant is terminated without cause or resigns for good reason within three years of the change in control.

On December 10, 2003, the Company entered into a Trust Agreement with Boston Safe Deposit and Trust Company to establish a rabbi trust (the "Trust") to hold assets for the payment of benefits under the SRP. The Trust is revocable until a change in control occurs and remains subject to the claims of the Company's creditors in the event of the Company's insolvency. Upon a change in control and annually thereafter, the Company must fund each participant's account under the Trust such that the amount in each such account equals at least 110% of the present value of the applicable participant's projected future remaining benefits.

Employment Contracts, Termination of Employment

and Change in Control Arrangements

Pursuant to its authority to accelerate vesting and waive the transfer restrictions for grants of RSUs, in 1994 the Compensation Committee determined to provide for the acceleration of vesting and the waiver of transfer restrictions of existing and any subsequently granted RSUs (other than RSUs based upon PSU awards) held by executive officers (and made comparable provisions for all other employees) in the event of a hostile change in control, which generally means a tender offer, acquisition of 20% of the Company's voting securities or a change of a majority of the incumbent Board of Directors, in each case without the prior approval of a majority of the independent members of the incumbent Board of Directors. To the extent there is a change in control which is not hostile, these RSUs would be paid out but the difference between the acquisition price and the RSU value at grant would be deferred for the shorter of two years or the term of any remaining restrictions and the conditions of the original RSU grant would govern the deferred amounts. Comparable arrangements were implemented for options held by the executive officers and all other employees. In the case of 1996 PSU award grants and 1997 PSU award grants, an additional number of RSUs would be payable following a change of control (which aggregate payouts, upon a change in control, would represent the full awards earned pursuant to the performance formula). The number of such additional RSUs payable following a change of control for Messrs. Fuld, Gregory, Jack and Russo would be 1,231,978, 847,482, 615,987 and 222,995, respectively. In addition, under a Cash Award Plan, if a change of control occurs within six months after a grant of RSUs or the receipt of RSUs that are based upon PSU awards, then Mr. Fuld would receive a payment equal to 350% of his previous annual cash compensation, Messrs. Gregory, Jack and Goldfarb would receive 300% and Mr. Russo would receive 200%.

The Compensation Committee has delayed the payout of certain RSU awards received by executives in accordance with the Firm's 1995, 1996 and 1997 PSU award programs (the "Extended RSUs"). Such extended vesting will support the Company's executive stock ownership objectives and ensure that senior executives continue to have a substantial economic interest in the Company. The Extended RSUs were initially scheduled to vest (and convert to Common Stock) in tranches at several successive fiscal year ends (the "Prior Vesting Dates"). Each tranche of the Extended RSUs will now vest following termination of employment with the Firm, provided such termination occurs after the relevant Prior Vesting Date, or sooner upon death or disability or a change in control. Until the relevant Prior Vesting Date, each tranche of Extended RSUs was or will be subject to forfeiture under the terms of the original award; thereafter, the Extended RSUs will remain subject to forfeiture for involuntary termination with cause or if the recipient engages in detrimental activity. Pursuant to the foregoing, Messrs. Fuld, Gregory, Jack and Russo presently hold 1,482,451.07, 1,089,037.99, 634,968.21 and 191,741.39 Extended RSUs, respectively, with values based on the November 28, 2003 closing price per share of Common Stock of $72.21 totaling $107,047,792, $78,639,433, $45,851,054 and $13,845,646, respectively. All of the Extended RSUs are included in the total RSU holdings disclosed in footnote (a) to the Summary Compensation Table contained herein.

18

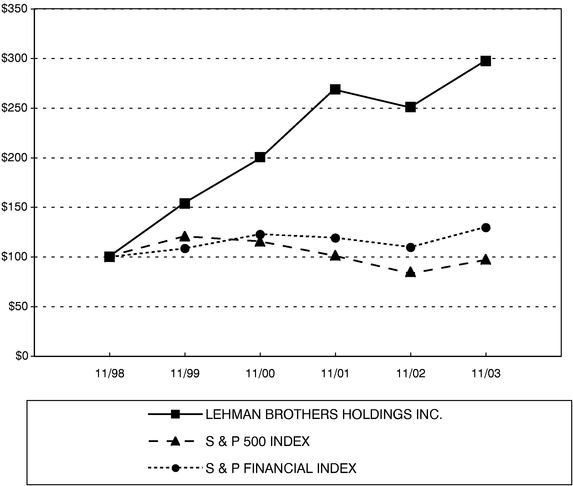

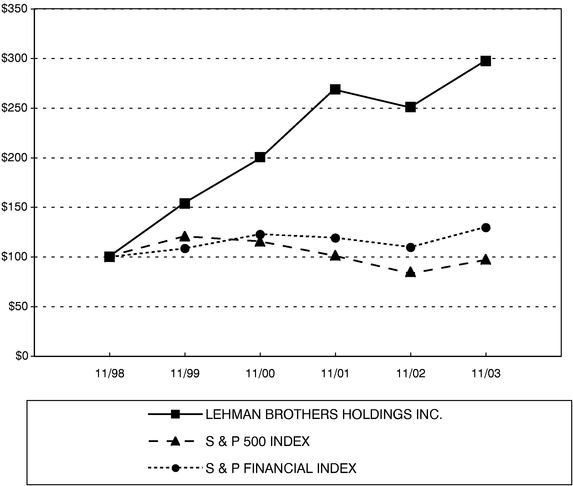

PERFORMANCE GRAPH

The performance graph below illustrating cumulative stockholder return compares the performance of the Common Stock, measured at each of the Company's last five fiscal year-ends, with that of (1) the S&P 500 Index and (2) the S&P Financial Index.

The graph assumes $100 was invested in the Common Stock and each index on November 30, 1998, and that all dividends were reinvested in full.

CUMULATIVE TOTAL RETURN

FOR LEHMAN BROTHERS HOLDINGS INC. COMMON STOCK,

THE S & P 500 INDEX AND THE S & P FINANCIAL INDEX

| | Cumulative Total Return (in dollars)

|

|---|

| | 11/30/98

| | 11/30/99

| | 11/30/00

| | 11/30/01

| | 11/30/02

| | 11/30/03

|

|---|