Exhibit 99.1

THIS IS NOT A SOLICITATION OF ACCEPTANCE OR REJECTION OF THE PLAN. ACCEPTANCES OR REJECTIONS MAY NOT BE SOLICITED UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED BY THE BANKRUPTCY COURT. THIS DISCLOSURE STATEMENT IS BEING SUBMITTED FOR APPROVAL BUT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT.

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

------------------------------------------------------------------- | x | |

| : | |

In re: | : | Chapter 11 Case No. |

| : | |

LEHMAN BROTHERS HOLDINGS INC., et al. | : | 08-13555 (JMP) |

| : | |

Debtors. | : | (Jointly Administered) |

| : | |

------------------------------------------------------------------- | x | |

DEBTORS’ DISCLOSURE STATEMENT FOR JOINT CHAPTER 11

PLAN OF LEHMAN BROTHERS HOLDINGS INC. AND ITS AFFILIATED

DEBTORS PURSUANT TO SECTION 1125 OF THE BANKRUPTCY CODE

| WEIL, GOTSHAL & MANGES LLP |

| Attorneys for Debtors and |

| Debtors in Possession |

| 767 Fifth Avenue |

| New York, New York 10153 |

| (212) 310-8000 |

| |

| |

Dated: April 14, 2010 | |

New York, New York | |

TABLE OF CONTENTS

| | Page |

| | |

I. | INTRODUCTION | 1 |

| | |

II. | OVERVIEW OF THE PLAN | 2 |

| | |

| A. | Summary of the Plan | 2 |

| | | |

| B. | Classification, Treatment and Estimated Recovery for Each Class Under the Plan | 3 |

| | | |

| C. | Holders of Claims Entitled to Vote | 23 |

| | | |

| D. | Voting Procedures | 24 |

| | | |

| E. | Confirmation Hearing | 25 |

| | |

III. | GENERAL INFORMATION | 26 |

| | |

| A. | Overview of Chapter 11 | 26 |

| | | |

| B. | Description and History of the Business of Lehman | 27 |

| | | |

| | 1 | General Information Regarding Lehman | 27 |

| | | | |

| | 2 | Business Segments | 28 |

| | | | |

| | | a. | Capital Markets Division | 28 |

| | | | | |

| | | b. | Investment Banking Division | 29 |

| | | | | |

| | | c. | Investment Management Division | 29 |

| | | | |

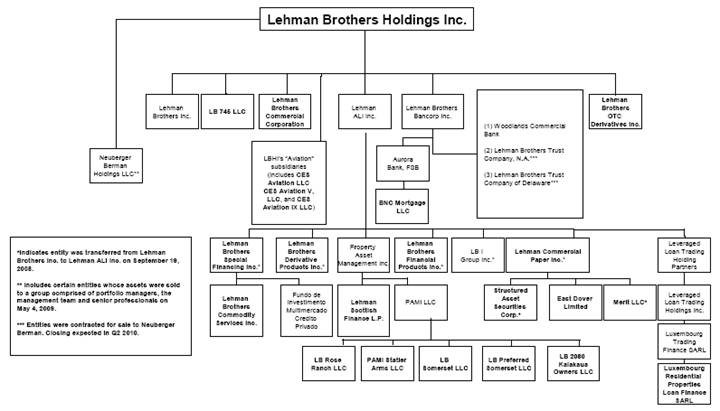

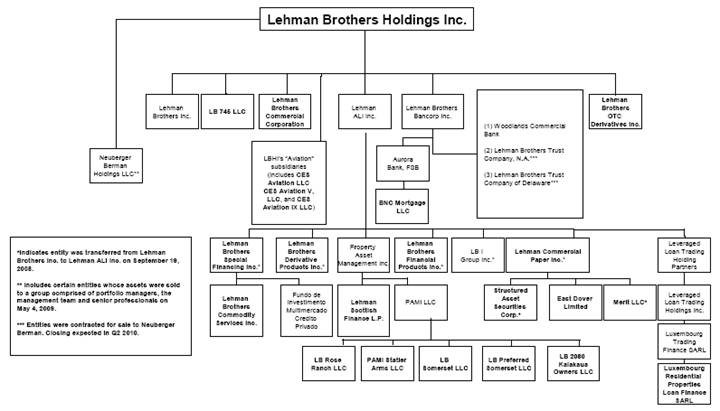

| | 3 | Corporate Structure | 30 |

| | | | |

| | 4 | Description of the Business of Each Debtor | 32 |

| | | | |

| | | a. | Lehman Brothers Holdings Inc. | 32 |

| | | | | |

| | | b. | Lehman Commercial Paper Inc. | 32 |

| | | | | |

| | | c. | Lehman Brothers Commodity Services Inc. | 32 |

| | | | | |

| | | d. | Lehman Brothers Special Financing Inc., Lehman Brothers Derivative Products Inc. and Lehman Brothers Financial Products Inc. | 32 |

| | | | | |

| | | e. | Lehman Brothers OTC Derivatives Inc. | 32 |

| | | | | |

| | | f. | Lehman Brothers Commercial Corporation | 32 |

| | | | | |

| | | g. | LB 745 LLC | 32 |

| | | | | |

| | | h. | PAMI Statler Arms, LLC | 32 |

| | | | | |

| | | i. | CES Aviation LLC, CES Aviation V LLC and CES Aviation IX LLC | 32 |

i

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

| | | j. | East Dover Limited | 32 |

| | | | | |

| | | k. | Lehman Scottish Finance L.P | 33 |

| | | | | |

| | | l. | Luxembourg Residential Properties Loan Finance S.a.r.l. | 33 |

| | | | | |

| | | m. | BNC Mortgage LLC | 33 |

| | | | | |

| | | n. | LB Rose Ranch LLC | 33 |

| | | | | |

| | | o. | Structured Asset Securities Corporation | 33 |

| | | | | |

| | | p. | LB 2080 Kalakaua Owners LLC | 33 |

| | | | | |

| | | q. | Merit LLC | 33 |

| | | | | |

| | | r. | LB Somerset LLC and LB Preferred Somerset LLC | 33 |

| | | | | |

| | 5. | Description of Debtors’ Principal Non-Debtor Affiliates | 33 |

| | | | | |

| | | a. | Lehman Brothers Inc. | 33 |

| | | | | |

| | | b. | Lehman Brothers Bankhaus AG (in Insolvenz) | 33 |

| | | | | |

| | | c. | Lehman Brothers Treasury Co. B.V. | 33 |

| | | | | |

| | | d. | Lehman Brothers Finance A.G. a.k.a. Lehman Brothers Finance S.A. | 33 |

| | | | | |

| | | e. | Lehman Brothers International (Europe) | 33 |

| | | | | |

| | | f. | LB I Group | 34 |

| | | | | |

| | | g. | Property Asset Management Inc. | 34 |

| | | | | |

| | 6. | Directors and Executive Officers of LBHI | 34 |

| | | | | |

| | | a. | Directors | 34 |

| | | | | |

| | | b. | Executive Officers | 35 |

| | | | | |

| | 7. | Capital Structure | 36 |

| | | | | |

| | | a. | Prepetition Short Term Borrowings | 36 |

| | | | | |

| | | b. | Prepetition Long-Term Borrowings | 37 |

| | | | | |

| | | c. | Prepetition Credit Facilities | 38 |

| | | | | |

| | | d. | Other Secured Borrowings | 38 |

| | | | | |

| | | e. | Bank Platforms | 39 |

| | | | | |

| | | f. | Preferred Stock | 39 |

| | | | | |

| | | g. | Common Stock | 41 |

| | | | | |

| | | h. | Trust Securities | 41 |

ii

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

| | 8. | Liquidity Pool | 41 |

| | | | | |

IV. | EVENTS LEADING UP TO CHAPTER 11 | 42 |

| | | | | |

V. | THE CHAPTER 11 CASES | 44 |

| | | | | |

| A. | Stabilization of the Business | 45 |

| | | | | |

| | 1. | Retention of A&M and Other Professionals | 46 |

| | | | | |

| | 2. | Creditors’ Committee | 47 |

| | | | | |

| B. | Lehman Brothers Inc.’s SIPA Proceeding; Lehman ALI | 48 |

| | | |

| C. | Sale of the North American Capital Markets and Investment Banking Business to Barclays Capital Inc. | 49 |

| | | |

| D. | Significant Developments During the Chapter 11 Case | 52 |

| | | | | |

| | 1. | Significant Asset Dispositions | 52 |

| | | | | |

| | | a. | Sale of Investment Management Division | 52 |

| | | | | |

| | | b. | Sale of European and Asian Assets and Businesses to Nomura | 53 |

| | | | | |

| | | c. | De Minimis Sale Order | 54 |

| | | | | |

| | 2. | Significant Settlements and Transactions | 54 |

| | | | | |

| | | a. | Settlement with the Pension Benefit Guaranty Corporation (“PBGC”) | 54 |

| | | | | |

| | | b. | Settlement with Lehman Brothers Bankhaus AG | 54 |

| | | | | |

| | | c. | Transaction with JPMorgan | 55 |

| | | | | |

| | 3. | Cross Border Insolvency Protocol | 56 |

| | | | | |

| | | a. | Summary of Material Terms of the Protocol | 57 |

| | | | | |

| | | b. | Meetings and Benefits of the Protocol | 58 |

| | | | | |

| | 4. | Appointment of Examiner | 59 |

| | | | |

| | 5. | Employee Retention Programs | 60 |

| | | | | |

| | | a. | Retention and Recruitment Program | 60 |

| | | | | |

| | | b. | Derivatives Group Employees Incentive Plan | 60 |

| | | | | |

| E. | Administration of the Debtors’ Assets During the Chapter 11 Cases | 61 |

| | | | | |

| | 1. | Derivatives Contracts | 61 |

| | | | | |

| | | a. | Derivatives Protocols | 61 |

iii

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

| | | b. | Key Litigation Relating to Derivative Contracts | 64 |

| | | | | |

| | | c. | Updated Information Regarding Derivative Contracts | 65 |

| | | | | |

| | 2. | Real Estate Assets | 66 |

| | | | | |

| | | a. | Real Estate Protocols Established by the Debtors | 66 |

| | | | | |

| | | b. | Significant Transactions/Restructurings/Sales | 66 |

| | | | | |

| | | c. | Updated Information Regarding the Debtors’ Real Estate Assets | 69 |

| | | | | |

| | 3. | Commercial Loans | 69 |

| | | | | |

| | | a. | Termination of Unfunded Commitment and Restructurings | 69 |

| | | | | |

| | | b. | Settlements of Prepetition Open Trades | 70 |

| | | | | |

| | | c. | Updated Information Regarding the Debtors’ Commercial Loan Portfolio | 71 |

| | | | | |

| | 4. | Bank Platforms | 71 |

| | | | | |

| | | a. | Transactions with Woodlands Commercial Bank | 71 |

| | | | | |

| | | b. | Transactions with Aurora Bank | 72 |

| | | | | |

| | | c. | Updated Information Regarding the Debtors’ Interest in the Banks | 74 |

| | | | | |

| | 5. | Private Equity/Principal Investments | 74 |

| | | | | |

| | | a. | Significant Transactions/Sales | 74 |

| | | | | |

| | | b. | Updated Information Regarding the Debtors’ Private Equity/Principal Investments | 75 |

| | | | | |

| F. | Adversary Proceedings | 76 |

| | | | | |

VI. | CLAIMS PROCESS AND BAR DATE | 76 |

| | | | | |

| A. | Schedules and Statements | 76 |

| | | | | |

| B. | Claims Bar Date | 77 |

| | | | | |

VII. | DEBTORS’ RELATIONSHIP WITH LEHMAN BROTHERS INC. | 79 |

| | |

VIII. | INTERCOMPANY CLAIMS | 79 |

| | | | | |

IX. | LAMCO | 80 |

| | | | | |

X. | SUMMARY OF THE CHAPTER 11 PLAN | 81 |

| | | | | |

| A. | Considerations Regarding the Chapter 11 Plan | 82 |

iv

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

| | 1. | Substantive Consolidation | 82 |

| | | | |

| | 2. | Non-Substantive Consolidation of the Debtors | 82 |

| | | | |

| | 3. | The Plan is a Fair Proposal to the Economic Stakeholders | 83 |

| | | | | |

| B. | Rationale Underlying Plan Treatment of Claims | 84 |

| | | | | |

| | 1. | Economic Solutions With Respect To Third-Party Guarantee Claims and Affiliate Guarantee Claims | 84 |

| | | | | |

| | | a. | Third Party Guarantee Claims | 85 |

| | | | | |

| | | b. | Affiliate Guarantee Claims | 87 |

| | | | | |

| | 2. | Treatment of Intercompany Claims | 89 |

| | | | | |

| C. | Classification and Treatment of Claims and Equity Interests | 90 |

| | | | | |

| | 1. | Treatment of Unclassified Claims | 90 |

| | | | | |

| | | a. | Administrative Expense Claims | 90 |

| | | | | |

| | | b. | Compensation and Reimbursement Claims | 91 |

| | | | | |

| | | c. | Priority Tax Claims | 91 |

| | | | | |

| | 2. | Summary of Classes | 93 |

| | | | | |

| | | a. | Treatment of Classified Claims Against and Equity Interests in LBHI | 93 |

| | | | | |

| | | b. | Treatment of Classified Claims Against and Equity Interests in the Subsidiary Debtors | 96 |

| | | | | |

| D. | Means for Implementation of the Plan | 98 |

| | | | | |

| | 1. | Continued Corporate Existence of Debtors | 98 |

| | | | |

| | 2. | Revesting of Assets | 98 |

| | | | |

| | 3. | Plan Administrator | 98 |

| | | | | |

| | | a. | Authority of the Plan Administrator | 98 |

| | | | | |

| | | b. | Liability of Plan Administrator | 99 |

| | | | | |

| | | c. | Indenture Trustee and Creditors’ Committee Members Fees | 100 |

| | | | | |

| | 4. | Treatment of Disputed Claims | 100 |

| | | | | |

| E. | Provisions Governing Distributions | 101 |

| | | | | |

| | 1. | Obligations to Make Distributions | 101 |

v

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

| | 2. | Post Petition Interest | 101 |

| | | | |

| | 3. | Method of Distributions Under the Plan | 101 |

| | | | | |

| | | a. | In General | 101 |

| | | | | |

| | | b. | Distributions of Cash | 101 |

| | | | | |

| | 4. | Timing of Distributions | 101 |

| | | | | |

| | | a. | Distributions of Available Cash | 101 |

| | | | | |

| | | b. | Distributions on Claims After Allowance | 102 |

| | | | | |

| | | c. | Distribution Record Date | 102 |

| | | | | |

| | | d. | Time Bar to Cash Payment Rights | 102 |

| | | | | |

| | 5. | Unclaimed Distributions | 102 |

| | | | | |

| | 6. | Withholding and Reporting Requirements | 103 |

| | | | |

| | 7. | Setoff and Recoupment | 103 |

| | | | | |

| F. | Treatment of Executory Contracts and Unexpired Leases | 103 |

| | | | | |

| | 1. | Rejected Contracts and Leases of the Debtors | 103 |

| | | | |

| | 2. | Assumed Contracts and Leases of the Debtors | 104 |

| | | | |

| | 3. | Right to Modify Schedules of Assumed Contracts | 104 |

| | | | |

| | 4. | Insurance Policies | 104 |

| | | | |

| | 5. | Cure of Defaults | 104 |

| | | | |

| | 6. | Bar Date for Filing Proofs of Claim Relating to Executory Contracts and Unexpired Leases Rejected Pursuant to the Plan | 104 |

| | | | | |

| G. | Conditions Precedent to Plan’s Confirmation and Effective Date | 105 |

| | | | | |

| | 1. | Conditions to Confirmation of the Plan | 105 |

| | | | |

| | 2. | Conditions to Effective Date | 105 |

| | | | |

| | 3. | Waiver of Conditions | 105 |

| | | | | |

| H. | Effect of Confirmation of the Plan | 106 |

| | | | | |

| | 1. | Release, Exculpation and Limitation of Liability | 106 |

| | | | |

| | 2. | Injunction | 106 |

| | | | |

| | 3. | Retention of Litigation Claims and Reservation of Rights | 107 |

| | | | |

| | 4. | Terms of Injunctions or Stays | 107 |

| | | | | |

| I. | Summary of Other Provisions of Plan | 107 |

vi

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

| | 1. | Amendment or Modification of the Plan | 107 |

| | | | |

| | 2. | Survival of Debtors’ Reimbursement Obligations of Officers and Directors | 108 |

| | | | |

| | 3. | Allocation of Plan Distributions Between Principal and Interest | 108 |

| | | | |

| | 4. | Maximum Distribution | 108 |

| | | | |

| | 5. | Revocation or Withdrawal of the Plan | 108 |

| | | | |

| | 6. | Dissolution of the Creditors’ Committee | 109 |

| | | | |

| | 7. | Exemption from Transfer Taxes | 109 |

| | | | | |

| | 8. | Effectuating Documents and Further Transactions | 109 |

| | | | |

| | 9. | Retention of Jurisdiction | 109 |

| | | | |

| | 10. | Plan Supplement | 110 |

| | | | | |

| J. | Summary of Recovery Analysis Under the Plan | 111 |

| | | | | |

XI. | CONFIRMATION AND CONSUMMATION OF THE PLAN | 111 |

| | | | | |

| A. | Solicitation of Votes | 111 |

| | | |

| B. | The Confirmation Hearing | 112 |

| | | |

| C. | Confirmation | 112 |

| | | | | |

| | 1. | Acceptance | 112 |

| | | | |

| | 2. | Unfair Discrimination and Fair and Equitable Tests | 113 |

| | | | |

| | 3. | Feasibility | 113 |

| | | | |

| | 4. | Best Interests Test | 114 |

| | | | | |

| D. | Consummation | 116 |

| | | | | |

XII. | CORPORATE GOVERNANCE AND MANAGEMENT OF THE DEBTORS ON THE EFFECTIVE DATE | 117 |

| | | | | |

| A. | Board of Directors and Management | 117 |

| | | | | |

| | 1. | Board of Directors | 117 |

| | | | |

| | 2. | Management of the Debtors | 117 |

| | | | |

| | 3. | Holders of the Stock of Debtors On Effective Date | 117 |

| | | | |

| | 4. | Plan Administrator | 117 |

| | | | |

| | 5. | Corporate Existence | 118 |

| | | | |

| | 6. | Certificates of Incorporation and By-laws | 118 |

vii

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

| | 7. | Wind-Down | 118 |

| | | | |

| | 8. | Other Corporate Governance Matters | 118 |

| | | | | |

XIII. | SECURITIES LAWS MATTERS | 119 |

| | |

XIV. | CERTAIN RISK FACTORS TO BE CONSIDERED | 119 |

| | | | | |

| A. | Certain Bankruptcy Law Considerations | 119 |

| | | |

| B. | Conditions Precedent to Consummation of the Plan | 120 |

| | | |

| C. | Asset Sales | 120 |

| | | |

| D. | Estimation of Allowed Claims | 120 |

| | | |

| E. | Certain Tax Considerations | 120 |

| | | | | |

XV. | CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN | 121 |

| | | | | |

| A. | Consequences to LBHI and Subsidiary Debtors | 122 |

| | | | | |

| | 1. | Tax Filing Status; Tax Attributes | 122 |

| | | | |

| | 2. | General Discussion of Plan | 123 |

| | | | | |

| | | a. | Asset Dispositions | 123 |

| | | | | |

| | | b. | Plan Distributions | 123 |

| | | | | |

| | 3. | Tax Impact of the Plan on the Debtors | 124 |

| | | | | |

| | | a. | Cancellation of Debt | 124 |

| | | | | |

| | | b. | Limitation of NOL Carryforwards and other Tax Attributes | 124 |

| | | | | |

| | | c. | Non-U.S. Income Tax Matters | 126 |

| | | | | |

| B. | Consequences to Holders of Claims and LBHI Equity Interests | 126 |

| | | | | |

| | 1. | Realization and Recognition of Gain or Loss, In General | 126 |

| | | | |

| | 2. | Holders of Allowed General Unsecured Claims (for LBHI, Classes 3, 4, 6, 7 and 8; for all other Debtors, Classes 3 and 4) | 127 |

| | | | |

| | 3. | Allocation of Consideration to Interest | 127 |

| | | | |

| | 4. | Withholding on Distributions, and Information Reporting | 127 |

| | | | | |

XVI. | ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF THE PLAN | 128 |

| | | | | |

| A. | Alternative Plan(s) | 128 |

| | | |

| B. | Liquidation under Chapter 7 | 129 |

viii

TABLE OF CONTENTS

(continued)

| | | | | Page |

| | | | | |

XVII. | VOTING PROCEDURES AND REQUIREMENTS | 130 |

| | | | | |

| A. | Ballots and Voting Deadline | 130 |

| | | |

| B. | Voting Procedures | 131 |

| | | |

| C. | Special Note for Holders of Notes Issued Directly by LBHI | 132 |

| | | | | |

| | 1. | Beneficial Owners | 132 |

| | | | |

| | 2. | Nominees | 132 |

| | | | | |

| | | a. | Pre-Validated Ballots | 133 |

| | | | | |

| | | b. | Master Ballots | 133 |

| | | | | |

| | 3. | Securities Clearing Agencies | 133 |

| | | | |

| | 4. | Miscellaneous | 133 |

| | | | | |

| D. | Fiduciaries and other Representatives | 134 |

| | | |

| E. | Parties Entitled to Vote | 134 |

| | | |

| F. | Agreements Upon Furnishing Ballots | 135 |

| | | |

| G. | Waivers of Defects, Irregularities, Etc. | 135 |

| | | |

| H. | Withdrawal of Ballots; Revocation | 136 |

| | | |

| I. | Further Information; Additional Copies | 136 |

| | | | | |

XVIII. | CONCLUSION AND RECOMMENDATION | 138 |

| | | | | |

Schedule A- Definitions | |

ix

TABLE OF CONTENTS

(continued)

| | | | Page |

| | | | |

Exhibits | | | | |

Exhibit 1 | | Chapter 11 Plan | | |

Exhibit 2A | | Balance Sheets of Each Debtor, as of September 14, 2008 | | |

Exhibit 2B | | Balance Sheets of Each Debtor, as of the Applicable Commencement Date | | |

Exhibit 2C | | Balance Sheets of Each Debtor, as of June 30, 2009 | | |

Exhibit 2D | | Balance Sheets of Each Debtor, as of December 31, 2009 (To Be Provided When Issued) | | |

Exhibit 3 | | Balance Sheets of Aurora Bank and Woodlands, as of December 31, 2009 | | |

Exhibit 4 | | Recovery Analysis for Each Debtor | | |

Exhibit 5 | | Liquidation Analysis for Each Debtor | | |

Exhibit 6 | | Debtors’ Estimates of Claims and Claims Data | | |

Exhibit 7 | | Five-Year Cash Flow Estimates | | |

Exhibit 8 | | Corporate Structure Charts of LBHI and its Subsidiaries | | |

Exhibit 9 | | Significant Intercompany Balances | | |

Exhibit 10 | | Third-Party Guarantee Class Maximum (Schedule 6 to the Plan) | | |

Exhibit 11 | | Affiliate Third Derivative Liabilities | | |

Exhibit 12 | | Foreign Administrators (Schedule 2 to the Plan) | | |

Exhibit 13 | | Foreign Proceedings (Schedule 3 to the Plan) | | |

Exhibit 14 | | Primary Obligors (Schedule 4 to the Plan) | | |

Exhibit 15 | | Schedule 5 Affiliates (Schedule 5 to the Plan) | | |

x

I. INTRODUCTION

Lehman Brothers Holdings Inc. (“LBHI”) and certain of its direct and indirect subsidiaries, as debtors (collectively, the “Debtors”), submit this Disclosure Statement pursuant to section 1125 of title 11 of the United States Code (the “Bankruptcy Code”) to holders of Claims against and Equity Interests in the Debtors for (i) the solicitation of acceptances of each of the Debtors’ plans under Chapter 11 of the Bankruptcy Code, dated April 14, 2010, as the same may be amended (the “Plan”), filed by the Debtors with the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”) and (ii) the hearing to consider confirmation of the Plan (“Confirmation Hearing”) scheduled for [ ]. Unless otherwise defined herein, all capitalized terms contained herein have the meanings ascribed to them on Schedule A attached hereto.

The key Exhibits attached to this Disclosure Statement include:

· The Chapter 11 Plan (Exhibit 1)

· The Balance Sheets of each Debtor (i) as of September 14, 2008; (ii) as of the applicable Commencement Date for Each Debtor; (iii) as of June 30, 2009; and (iv) as of December 31, 2009, to be provided when issued (Exhibits 2A, 2B, 2C and 2D)

· The Recovery Analysis for Each Debtor (Exhibit 4)

· The Liquidation Analysis for Each Debtor (Exhibit 5)

· Debtors’ Estimates of Claims and Claims Data (Exhibit 6)

· Five-Year Cash Flow Estimates (Exhibit 7)

A Ballot for the acceptance or rejection of the Plan is enclosed with the Disclosure Statement mailed to the holders of Claims that the Debtors believe may be entitled to vote to accept or reject the Plan.

On , 2010, after notice and a hearing, the Bankruptcy Court approved this Disclosure Statement as containing adequate information of a kind and in sufficient detail to enable a hypothetical investor of the relevant classes to make an informed judgment whether to accept or reject the Plan (the “Disclosure Statement Order”). APPROVAL OF THIS DISCLOSURE STATEMENT DOES NOT, HOWEVER, CONSTITUTE A DETERMINATION BY THE BANKRUPTCY COURT AS TO THE FAIRNESS OR MERITS OF THE PLAN.

The Disclosure Statement Order sets forth in detail, among other things, the deadlines, procedures and instructions for voting to accept or reject the Plan and for filing objections to confirmation of the Plan, the record date for voting purposes and the applicable standards for tabulating Ballots. In addition, detailed voting instructions accompany each Ballot. Each holder of a Claim entitled to vote on the Plan should read the Disclosure Statement, the Plan, the Disclosure Statement Order and the instructions

1

accompanying the Ballots in their entirety before voting on the Plan. These documents contain important information concerning the classification of Claims and Equity Interests for voting purposes and how the votes will be tabulated. No solicitation of votes to accept or reject the Plan may be made except pursuant to section 1125 of the Bankruptcy Code.

II. OVERVIEW OF THE PLAN

For a more detailed description of the Plan, refer to section X—“Summary of the Chapter 11 Plan.” In addition, the Plan is attached hereto as Exhibit 1.

A. Summary of the Plan

Prior to the commencement of the Chapter 11 Case by LBHI on September 15, 2008, Lehman constituted the fourth largest investment banking firm in the United States, which operated as a single globally integrated economic unit with its center of main interest at its New York City headquarters. The Plan proposes an economic resolution of the Claims of creditors of all of the Debtors and incorporates resolutions of various inter-Debtor, Debtor-creditor and inter-creditor disputes designed to achieve a global and efficient resolution of the Claims and interests asserted in the Chapter 11 Cases. The proposed Plan will expedite the administration of the Debtors’ Chapter 11 Cases, accelerate recoveries to creditors and avoid the potential enormous costs and extended time that would otherwise be incurred in connection with litigation of multifaceted and complex issues associated with these extraordinary cases.

The Plan separately applies to each of the Debtors and constitutes 23 distinct chapter 11 plans. The Plan recognizes the corporate integrity of each Debtor and, therefore, Allowed Claims against a particular Debtor will be satisfied from the assets of that Debtor.

In developing the Plan, the Debtors considered whether substantive consolidation was appropriate for the resolution of the Debtors’ Chapter 11 Cases at this time. Substantive consolidation of debtors’ estates is a judicially created equitable remedy pursuant to which the assets and liabilities of two or more entities are pooled, and the pooled assets are aggregated and used to satisfy the Claims of creditors of all the consolidated debtors as if only one debtor existed. Substantive consolidation eliminates intercompany Claims, guarantee Claims against any consolidated entity that guaranteed the obligations of another consolidated entity, and any issues concerning the ownership of assets among the consolidated entities. The Debtors’ management considered the manner in which the Debtors operated and interacted with each other and their Affiliates prior to the Commencement Date, the financial book-keeping for each Debtor and creditor reliance on the credit of a particular Debtor as opposed to Lehman as a single entity, among other relevant factors. Substantive consolidation is dependent upon mixed questions of fact and law. There are facts relating to the manner in which the Debtors operated their businesses that strongly support a finding that certain of the Debtors are susceptible to being substantively consolidated. The Debtors’ management is also cognizant that (i) certain significant Affiliates are currently in insolvency proceedings in foreign jurisdictions, (ii) other significant Affiliates are regulated entities, and (iii) there exist potential difficulties in implementing a plan that substantively consolidated the Debtors with all or some of their Affiliates. As a result, the

2

Debtors have elected, at this time, to propose the Plan which will treat claimants/creditors in an economic and fair manner. Acceptance of the Plan will allow the avoidance of substantial, expensive and time consuming proceedings that may result from the pursuit of substantive consolidation. However, if it appears that the Plan may not be accepted, the Debtors may elect to amend the Plan to provide for the substantive consolidation of all or certain of the Debtors and their Affiliates. The Debtors’ management believes that any plan to substantively consolidate all or certain of the Debtors’ Chapter 11 Cases would be vigorously contested and would result in expensive and lengthy litigation that would delay any distributions to creditors for years.

The Plan strikes a balance between competing interests by recognizing the corporate integrity of each Debtor while including certain resolutions to alleviate the potential negative implications that may result from the indiscriminate enforcement of asserted Guarantee Claims. The proposed Plan will expedite the administration of the Debtors’ Chapter 11 Cases and accelerate and expedite recoveries to creditors and avoid the potential enormous costs that would otherwise be incurred in connection with litigation of the numerous complex issues raised by these Chapter 11 Cases.

B. Classification, Treatment and Estimated Recovery for Each Class Under the Plan

The Claims asserted against each Debtor and Equity Interests in each Debtor are separated into Classes. Generally, the classification structure of the Plan applicable to each of the Debtors is identical other than for LBHI, which includes additional Classes for senior and subordinated unsecured debt and Guarantee Claims filed by third-parties as well as Affiliates. As it relates to LBHI (as set forth in detail below and in Section X.C.2.a— “Treatment of Classified Claims Against and Equity Interests in LBHI” of this Disclosure Statement), after payment in full in cash of administrative and priority creditors and the satisfaction in full of secured creditors in the manner provided in the Plan, the Plan proposes to distribute Cash to holders of Senior Unsecured Claims, General Unsecured Claims, Intercompany Claims and Guarantee Claims filed by Third-Parties and Affiliates in the amount of their Pro Rata Share, provided that the aggregate Allowed amount of Third-Party and Affiliate Guarantee Claims against LBHI for distribution purposes does not exceed $115,324 million.

To implement a cap on Guarantee Claims, the Plan distinguishes between Guarantee Claims filed directly by third-party creditors and Guarantee Claims filed by Affiliates. Third-Party Guarantee Claims are separately classified on the basis of the identity of the Primary Obligor of the underlying Guarantee Claim. The Plan incorporates a formula in the definition of “Permitted Third-Party Guarantee Claim” which is used to calculate a claimant’s Pro Rata Share of the maximum aggregate class Allowed amount. The Permitted Third-Party Guarantee Claim will be calculated after the Allowed amount of such holder’s Guarantee Claim has been determined under the ordinary Claims reconciliation process.

Holders of Affiliate Guarantee Claims will have an aggregate Allowed Claim in the amount of $21,186 million. The individual allocation for each Affiliate that has asserted a Guarantee Claim on any basis is not set forth in the Plan. Rather, holders of Affiliate Guarantee Claims, by voting in favor of the Plan, will be voting in favor of the Plan’s proposed aggregate Allowed Claim,

3

and the process for allocating the Allowed Claim at a later date, as set forth below. The Debtors intend to allocate the $21,186 million to holders of Affiliate Guarantee Claims on a pro rata basis based on the amount of each Affiliate’s Allowed Affiliate Guarantee Claim after evaluating the enforceability of the Claims.

An allocation will be proposed by the Plan Administrator within six months after the Effective Date. The allocation will be subject to a vote of holders of Allowed Affiliate Guarantee Claims and will be binding on all such holders if the proposed allocation is accepted by holders of at least two-thirds in amount of Allowed Affiliate Guarantee Claims and more than one-half in number of holders of such Affiliate Guarantee Claims. The Debtors will solicit votes to accept or reject the allocation by distributing ballots to the Affiliates. Each Affiliate entitled to vote will be permitted to vote to accept or reject the allocation based on its Allowed Affiliate Guarantee Claim amount. If such proposed allocation is not accepted in accordance with the foregoing, the allocation of the total $21,186 million shall be determined by the Bankruptcy Court.

As to each of the Subsidiary Debtors, the Plan adopts a common classification scheme. The Plan proposes, after payment in full, in Cash of administrative and priority creditors and the satisfaction of secured creditors in full in the manner provided in the Plan, to distribute Cash to holders of General Unsecured Claims and Intercompany Claims in the amount of their Pro Rata Share.

Solely for illustrative purposes, the Debtors have analyzed estimated recoveries under the Plan based on a range of discount rates. This range was applied to the Debtors’ cash flow estimates for the recovery of distributable assets under the Plan.

4

Based on this analysis, estimated Plan recoveries for General Unsecured Claims against the following Debtors (whose estimated distributable assets on an undiscounted basis under the Plan collectively amount to approximately 75% of the total estimated undiscounted directly held assets1 of all Debtors and Debtor-Controlled Entities under the Plan), are as follows.2

Illustrative Plan Recoveries Under Different Discount Rates for Selected Debtors

| | Discount Rate | |

| | Undiscounted | | 6% | | 12% | | 18% | |

LBHI | | | | | | | | | |

General Unsecured Claims (Class 4) | | 14.7 | % | 12.9 | % | 11.5 | % | 10.4 | % |

| | | | | | | | | |

LCPI | | | | | | | | | |

General Unsecured Claims (Class 3) | | 44.2 | % | 37.5 | % | 32.4 | % | 28.6 | % |

| | | | | | | | | |

LBCS | | | | | | | | | |

General Unsecured Claims (Class 3) | | 26.8 | % | 26.4 | % | 26.1 | % | 25.8 | % |

| | | | | | | | | |

LBSF | | | | | | | | | |

General Unsecured Claims (Class 3) | | 24.1 | % | 23.3 | % | 22.5 | % | 21.9 | % |

The Debtors have also estimated recoveries under both the Plan and a hypothetical liquidation at various discount rates. Based on this analysis, which incorporates the multitude of projections and assumptions used to project the total distributable assets available and the total Allowed Claims under the Plan and in a hypothetical liquidation, the Debtors estimate that at discount rates up to 25% the Plan is preferable for all Creditor classes in comparison to a hypothetical liquidation.

The following schedules detail recoveries to each class of creditors for each Debtor on an undiscounted cash flow basis.

(1) Includes all assets (Cash, Restricted Cash, real estate, loans, investments and derivatives) and excludes recoveries on Intercompany Claims, equity in affiliates and recoveries on Guarantee Claims from Lehman Brothers Holdings Inc.

(2) Recovery percentages shown represent the Debtors’ estimates of recoveries under the Plan divided by the Debtors’ estimate of Allowed Claims in each Class.

5

SUMMARY OF CLASSIFICATION, TREATMENT AND ESTIMATED RECOVERY OF CLAIMS AND EQUITY INTERESTS UNDER THE PLAN

Lehman Brothers Holdings Inc. (“LBHI”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery3 | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against LBHI | | Payment in full, in Cash. Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against LBHI | | At the option of LBHI: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | Senior Unsecured Claims against LBHI | | Payment in Cash in the amount of (i) its Pro Rata Share of Available Cash from LBHI, and (ii) its Pro Rata Senior Unsecured Claim Share of Reallocated Distributions. | | 17.4% | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | General Unsecured Claims against LBHI | | Payment in Cash of its Pro Rata Share of Available Cash from LBHI. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Subordinated Unsecured Claims against LBHI | | No Distribution (because such Distributions are automatically reallocated to Senior Unsecured Claims in accordance with the underlying agreements). | | 0% | | Impaired, Not Entitled to Vote, Deemed to Reject |

| | | | | | | | |

6 | | Intercompany Claims against LBHI | | Payment in Cash of its Pro Rata Share of Available Cash from LBHI. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7A | | Third-Party Guarantee Claims for which LBSF is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7A will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7B | | Third-Party Guarantee Claims for which LBCS is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7B will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

(3) With respect to all Debtors: (i) where the recovery percentage is shown as “N/A,” the amount of estimated Claims in such Class is $0 and (ii) where 0% is shown, the Allowed Claims for such Class is less than $500,000.

6

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery3 | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

7C | | Third-Party Guarantee Claims for which LBCC is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7C will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7D | | Third-Party Guarantee Claims for which LOTC is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7D will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7E | | Third-Party Guarantee Claims for which LBDP is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7E will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. The Debtors estimate that the Clams in this Class will recover 100% of their Allowed Claim amounts from LBDP | | N/A | | Impaired, Entitled to Vote |

| | | | | | | | |

7F | | Third-Party Guarantee Claims for which LCPI is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7F will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7G | | Third-Party Guarantee Claims for which LBIE is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7G will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7H | | Third-Party Guarantee Claims for which LBL is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7H will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7I | | Third-Party Guarantee Claims for which LBT is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7I will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7J | | Third-Party Guarantee Claims for which Bankhaus is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7J will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

7

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery3 | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

7K | | Third-Party Guarantee Claims for which LB Finance is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7K will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7L | | Third-Party Guarantee Claims for which LB Securities is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7L will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7M | | Third-Party Guarantee Claims for which LBJ is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7M will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7N | | Third-Party Guarantee Claims for which LBHJ is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7N will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7O | | Third-Party Guarantee Claims for which Sunrise is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7O will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7P | | Third-Party Guarantee Claims for which LBCCA is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7P will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7Q | | Third-Party Guarantee Claims for which LBI is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7Q will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

7R | | Third-Party Guarantee Claims for which a Schedule 5 Affiliate is the Primary Obligor on the corresponding Primary Claims | | Each holder of a Claim in Class 7R will participate in recoveries under the Plan on the basis of its Permitted Third-Party Guarantee Claim. Each Permitted Third-Party Guarantee Claim will receive a Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

8

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery3 | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

8 | | Affiliate Guarantee Claims against LBHI | | Allowed Affiliate Guarantee Claims shall be Allowed in the aggregate amount of $21,186 million. Within a period of six months after the Effective Date, the Plan Administrator shall review and consult with holders of Affiliate Guarantee Claims as necessary and propose an allocation of $21,186 million to each holder of an Affiliate Guarantee Claim. If the proposed allocation is accepted by holders of at least two-thirds in amount of Allowed Affiliate Guarantee Claims and more than one-half in number of holders of such Allowed Claims within 30 days of the solicitation of such vote, such allocation shall be binding on all holders of Allowed Affiliate Guarantee Claims. If such proposal is not accepted, the allocation of the total $21,186 million among the holders of Allowed Affiliate Guarantee Claim shall be determined by the Bankruptcy Court. Each holder of an Allowed Affiliate Guarantee Claim against LBHI shall receive its Pro Rata Share of Available Cash. | | 14.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

9 | | Equity Interests in LBHI | | No Distributions (unless all other creditors have been paid in full). All Equity Interests will be cancelled and one new share of LBHI common stock will be issued to the Plan Administrator which will hold such share for the benefit of the holders of the former Equity Interests consistent with their former economic entitlement. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

Lehman Commercial Paper Inc. (“LCPI”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against LCPI | | Payment in full, in Cash Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against LCPI | | At the option of LCPI: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against LCPI | | Payment in Cash of its Pro Rata Share of Available Cash from LCPI. | | 44.2% | | Impaired, Entitled to Vote |

9

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

4 | | Intercompany Claims against LCPI | | Payment in Cash of its Pro Rata Share of Available Cash from LCPI. | | 44.2% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in LCPI | | No Distributions (unless all other holders of Allowed Claims against LCPI have been paid in full). Equity Interest shall remain in place until LCPI is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

Lehman Brothers Commodity Services Inc. (“LBCS”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against LBCS | | Payment in full, in Cash Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against LBCS | | At the option of LBCS: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against LBCS | | Payment in Cash of its Pro Rata Share of Available Cash from LBCS. | | 26.8% | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against LBCS | | Payment in Cash of its Pro Rata Share of Available Cash from LBCS. | | 26.8% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in LBCS | | No Distributions (unless all other holders of Allowed Claims against LBCS have been paid in full). Equity Interest shall remain in place until LBCS is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

Lehman Brothers Special Financing Inc. (“LBSF”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against LBSF | | Payment in full, in Cash Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

10

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

2 | | Secured Claims against LBSF | | At the option of LBSF: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against LBSF | | Payment in Cash of its Pro Rata Share of Available Cash from LBSF. | | 24.1% | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against LBSF | | Payment in Cash of its Pro Rata Share of Available Cash from LBSF. | | 24.1% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in LBSF | | No Distributions (unless all other holders of Allowed Claims against LBSF have been paid in full). Equity Interest shall remain in place until LBSF is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

Lehman Brothers OTC Derivatives Inc. (“LOTC”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against LOTC | | Payment in full, in Cash

Claims in Class 1 shall not receive post petition interest.

| | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against LOTC | | At the option of LOTC: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against LOTC | | Payment in Cash of its Pro Rata Share of Available Cash from LOTC. | | 18.3% | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against LOTC | | Payment in Cash of its Pro Rata Share of Available Cash from LOTC. | | 18.3% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in LOTC | | No Distributions (unless all other holders of Allowed Claims against LOTC have been paid in full). Equity Interest shall remain in place until LOTC is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

11

Lehman Brothers Commercial Corporation (“LBCC”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against LBCC | | Payment in full, in Cash

Claims in Class 1 shall not receive post petition interest.

| | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against LBCC | | At the option of LBCC: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against LBCC | | Payment in Cash of its Pro Rata Share of Available Cash from LBCC. | | 30.8% | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against LBCC | | Payment in Cash of its Pro Rata Share of Available Cash from LBCC. | | 30.8% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in LBCC | | No Distributions (unless all other holders of Allowed Claims against LBCC have been paid in full). Equity Interest shall remain in place until LBCC is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

Lehman Brothers Derivatives Products Inc. (“LBDP”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against LBDP | | Payment in full, in Cash

Claims in Class 1 shall not receive post petition interest.

| | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against LBDP | | At the option of LBDP: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against LBDP | | Payment in Cash of its Pro Rata Share of Available Cash from LBDP. | | 100% | | Impaired, Entitled to Vote |

12

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

4 | | Intercompany Claims against LBDP | | Payment in Cash of its Pro Rata Share of Available Cash from LBDP. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in LBDP | | No Distributions (unless all other holders of Allowed Claims against LBDP have been paid in full). Equity Interest shall remain in place until LBDP is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

Lehman Brothers Financial Products Inc. (“LBFP”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against LBFP | | Payment in full, in Cash

Claims in Class 1 shall not receive post petition interest.

| | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against LBFP | | At the option of LBFP: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against LBFP | | Payment in Cash of its Pro Rata Share of Available Cash from LBFP. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against LBFP | | Payment in Cash of its Pro Rata Share of Available Cash from LBFP. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in LBFP | | No Distributions (unless all other holders of Allowed Claims against LBFP have been paid in full). Equity Interest shall remain in place until LBFP is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

LB 745 LLC (“LB 745”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against LB 745 | | Payment in full, in Cash Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

13

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

2 | | Secured Claims against LB 745 | | At the option of LB 745: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against LB 745 | | Payment in Cash of its Pro Rata Share of Available Cash from LB 745 | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against LB 745 | | Payment in Cash of its Pro Rata Share of Available Cash from LB 745. | | N/A | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in LB 745 | | No Distributions (unless all other holders of Allowed Claims against LB 745 have been paid in full). Equity Interest shall remain in place until LB 745 is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

PAMI Statler Arms LLC (“PAMI”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against PAMI | | Payment in full, in Cash Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against PAMI | | At the option of PAMI: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against PAMI | | Payment in Cash of its Pro Rata Share of Available Cash from PAMI. | | N/A | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against PAMI | | Payment in Cash of its Pro Rata Share of Available Cash from PAMI. | | N/A | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in PAMI | | No Distributions (unless all other holders of Allowed Claims against PAMI have been paid in full). Equity Interest shall remain in place until PAMI is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

14

CES Aviation LLC (“CES”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against CES | | Payment in full, in Cash Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against CES | | At the option of CES: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against CES | | Payment in Cash of its Pro Rata Share of Available Cash from CES. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against CES | | Payment in Cash of its Pro Rata Share of Available Cash from CES. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in CES | | No Distributions (unless all other holders of Allowed Claims against CES have been paid in full). Equity Interest shall remain in place until CES is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

CES Aviation V LLC (“CES V”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against CES V | | Payment in full, in Cash

Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against CES V | | At the option of CES V: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against CES V | | Payment in Cash of its Pro Rata Share of Available Cash from CES V. | | 42.1% | | Impaired, Entitled to Vote |

15

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

4 | | Intercompany Claims against CES V | | Payment in Cash of its Pro Rata Share of Available Cash from CES V. | | 42.1% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in CES V | | No Distributions (unless all other holders of Allowed Claims against CES V have been paid in full). Equity Interest shall remain in place until CES V is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

CES Aviation IX LLC (“CES IX”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against CES IX | | Payment in full, in Cash

Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against CES IX | | At the option of CES IX: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against CES IX | | Payment in Cash of its Pro Rata Share of Available Cash from CES IX. | | 61.2% | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against CES IX | | Payment in Cash of its Pro Rata Share of Available Cash from CES IX. | | 61.2% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in CES IX | | No Distributions (unless all other holders of Allowed Claims against CES IX have been paid in full). Equity Interest shall remain in place until CES IX is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

East Dover Limited (“East Dover”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against East Dover | | Payment in full, in Cash Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

16

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

2 | | Secured Claims against East Dover | | At the option of East Dover: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against East Dover | | Payment in Cash of its Pro Rata Share of Available Cash from East Dover. | | N/A | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against East Dover | | Payment in Cash of its Pro Rata Share of Available Cash from East Dover. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in East Dover | | No Distributions (unless all other holders of Allowed Claims against East Dover have been paid in full). Equity Interest shall remain in place until East Dover is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

Lehman Scottish Finance L.P. (“LS Finance”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against LS Finance | | Payment in full, in Cash Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against LS Finance | | At the option of LS Finance: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against LS Finance | | Payment in Cash of its Pro Rata Share of Available Cash from LS Finance. | | N/A | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against LS Finance | | Payment in Cash of its Pro Rata Share of Available Cash from LS Finance. | | N/A | | Impaired, Entitled to Vote |

17

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

5 | | Equity Interests in LS Finance | | No Distributions (unless all other holders of Allowed Claims against LS Finance have been paid in full). Equity Interest shall remain in place until LS Finance is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

Luxembourg Residential Properties Loan Finance S.a.r.l. (“LUXCO”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against LUXCO | | Payment in full, in Cash Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against LUXCO | | At the option of LUXCO: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against LUXCO | | Payment in Cash of its Pro Rata Share of Available Cash from LUXCO. | | N/A | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against LUXCO | | Payment in Cash of its Pro Rata Share of Available Cash from LUXCO. | | 51.7% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in LUXCO | | No Distributions (unless all other holders of Allowed Claims against LUXCO have been paid in full). Equity Interest shall remain in place until LUXCO is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

BNC Mortgage LLC (“BNC”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against BNC | | Payment in full, in Cash Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

18

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

2 | | Secured Claims against BNC | | At the option of BNC: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against BNC | | Payment in Cash of its Pro Rata Share of Available Cash from BNC. | | 0% | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against BNC | | Payment in Cash of its Pro Rata Share of Available Cash from BNC. | | 0% | | Impaired, Entitled to Vote |

| | | | | | | | |

5 | | Equity Interests in BNC | | No Distributions (unless all other holders of Allowed Claims against BNC have been paid in full). Equity Interest shall remain in place until BNC is dissolved. | | N/A | | Impaired, Not Entitled to Vote, Deemed to Reject |

LB Rose Ranch LLC (“LB Rose Ranch”)

Class | | Type of Claim or

Equity Interest | | Treatment of Allowed Claims Under the Plan | | Estimated

Recovery | | Impairment;

Entitlement to

Vote |

| | | | | | | | |

1 | | Priority Non-Tax Claims against LB Rose Ranch | | Payment in full, in Cash Claims in Class 1 shall not receive post petition interest. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

2 | | Secured Claims against LB Rose Ranch | | At the option of LB Rose Ranch: (i) payment in Cash in an amount equal to the Allowed amount of such Secured Claim on the later of the Effective Date and the date such Secured Claim becomes an Allowed Secured Claim; (ii) the sale or disposition proceeds of the Collateral securing such Allowed Secured Claim to the extent of the value of the Collateral securing such Allowed Secured Claim; (iii) surrender to the holder of such Allowed Secured Claim of the Collateral securing such Allowed Secured Claim; or (iv) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of the Allowed Secured Claim is entitled. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

3 | | General Unsecured Claims against LB Rose Ranch | | Payment in Cash of its Pro Rata Share of Available Cash from LB Rose Ranch. | | 100% | | Impaired, Entitled to Vote |

| | | | | | | | |

4 | | Intercompany Claims against LB Rose Ranch | | Payment in Cash of its Pro Rata Share of Available Cash from LB Rose Ranch. | | N/A | | Impaired, Entitled to Vote |

19

Class | | Type of Claim or