Registration Statement no. 333-134553

Dated February 8, 2008

Rule 424(b)(2)

Calculation of the Registration Fee

| | | | |

Title of Each Class of Securities Offered | | Maximum Aggregate Offering Price | | Amount of Registration Fee(1)(2) |

| | |

| Notes | | $12,769,240.00 | | $501.83 |

| (1) | Calculated in accordance with Rule 457(r) of the Securities Act of 1933. |

| (2) | Pursuant to Rule 457(p) under the Securities Act of 1933, filing fees of $1,186,000.82 have already been paid with respect to unsold securities that were previously registered pursuant to a Registration Statement on Form S-3 (No. 333-134553) filed by Lehman Brothers Holdings Inc. and the other Registrants thereto on May 30, 2006, and have been carried forward, of which $501.83 is offset against the registration fee due for this offering and of which $1,185,498.99 remains available for future registration fees. No additional registration fee has been paid with respect to this offering. |

| | |

PRICING SUPPLEMENT NO. 1 (To prospectus dated May 30, 2006 prospectus supplement dated May 30, 2006 and product supplement no. 940-I, dated January 29, 2008) MTNI668 (PG), MTNI667 (PEP), MTNI665 (GE), MTNI669 (XOM), MTNI666(INTC) | |  |

Return Optimization Securities with Partial Protection

Enhanced Return Strategies for Moderate-Return Environments

Lehman Brothers Holdings Inc. $2,161,670 Notes Linked to the Common Stock of The Procter & Gamble Company due August 13, 2009

Lehman Brothers Holdings Inc. $1,233,600 Notes Linked to the Common Stock of PepsiCo, Inc. due August 13, 2009

Lehman Brothers Holdings Inc. $3,807,570 Notes Linked to the Common Stock of General Electric Corporation due August 13, 2009

Lehman Brothers Holdings Inc. $2,028,100 Notes Linked to the Common Stock of Exxon Mobil Corporation due August 13, 2009

Lehman Brothers Holdings Inc. $3,538,300 Notes Linked to the Common Stock of Intel Corporation due August 13, 2009

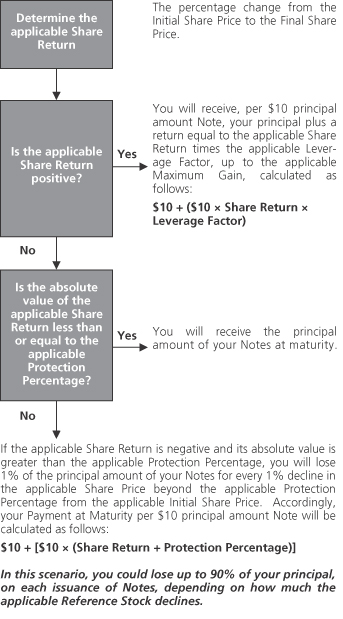

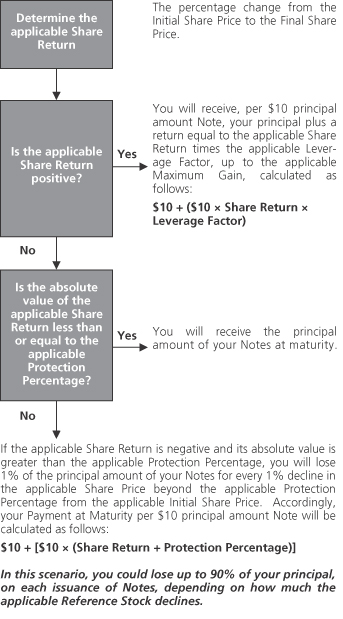

Return Optimization Securities with Partial Protection are notes issued by Lehman Brothers Holdings Inc. linked to the performance of the common stock (the “Reference Stock”) of a single company (the “Reference Stock Issuer”) (each issuance, a “Note” and, collectively, the “Notes”). The Notes provide potentially enhanced returns based on the positive performance of the applicable Reference Stock, as well as protection, at the maturity of the Notes, of a percentage of your principal based on the applicable Protection Percentage. The Notes are designed to enhance returns in a moderate-return environment—meaning an environment in which stocks generally experience no more than moderate appreciation. If the applicable Share Return is positive, at the maturity of the Notes you will receive your principal plus a return equaling twice the applicable Share Return, up to the applicable Maximum Gain, providing you with an opportunity to outperform the applicable Reference Stock. If the applicable Share Return is negative or zero, but its absolute value is less than or equal to the applicable Protection Percentage, at the maturity of the Notes you will receive your principal amount. If the applicable Share Return is negative and its absolute value is greater than the applicable Protection Percentage, at maturity you will lose 1% of your principal for every 1% decline in the Share Return beyond the applicable Protection Percentage. Partial principal protected investments (like the Notes) can help reduce portfolio risk while maintaining an increased exposure to equities. The partial principal protection feature applies only at maturity. Investing in the Notes involves significant risks, including potential loss of up to 90% of principal and a capped appreciation at maturity.

| | q | | Growth Potential—Investors receive enhanced upside participation in the positive performance of the applicable Reference Stock up to the applicable Maximum Gain. |

| | q | | Partial Protection of Principal—At maturity of the Notes, investors will receive a cash payment equal to at least the applicable Protection Percentage multiplied by the principal amount. |

| | |

Trade Date | | February 8, 2008 |

Settlement Date | | February 13, 2008 |

Final Valuation Date* | | August 10, 2009 |

Maturity Date* | | August 13, 2009 |

| | * | Subject to postponement in the event of a market disruption event, as described under “Description of Notes—Payment at Maturity” in accompanying product supplement no. 940-I. |

We are offering five separate issuances of Return Optimization Securities with Partial Protection linked to the common stock of a single company. Each issuance of Notes is linked to a particular Reference Stock with a specified Leverage Factor, Maximum Gain, and Protection Percentage.The performance of each issuance of Notes will not depend on the performance of any other issuance of Notes. The return on the Notes of each issuance is subject to, and will not exceed, the predetermined Maximum Gain applicable to Notes of that issuance, which will be determined on the Trade Date. Each Note is offered at a minimum investment of $1,000 in denominations of $10 and integral multiples of $10 in excess thereof.

| | | | | | | | | | | | | | |

| Reference Stock for each Note | | Ticker Symbol | | Leverage

Factor | | Maximum

Gain | | Protection Percentage | | Initial Share

Price | | CUSIP | | ISIN |

The Procter & Gamble Company | | PG | | 2 | | 19.75% | | 10% | | $65.02 | | 52522L673 | | US52522L6737 |

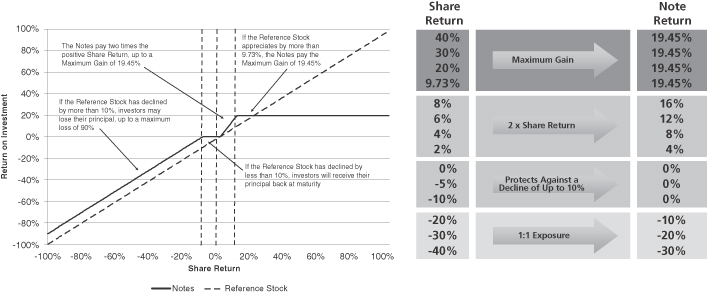

PepsiCo, Inc. | | PEP | | 2 | | 19.45% | | 10% | | $69.81 | | 52522L699 | | US52522L6992 |

General Electric Corporation | | GE | | 2 | | 28.85% | | 10% | | $33.84 | | 52522L723 | | US52522L7230 |

Exxon Mobil Corporation | | XOM | | 2 | | 29.00% | | 10% | | $81.71 | | 52522L707 | | US52522L7073 |

Intel Corporation | | INTC | | 2 | | 42.00% | | 10% | | $20.27 | | 52522L715 | | US52522L7156 |

See “Additional Information about Lehman Brothers Holdings Inc. and the Notes” on page 3. The Notes offered will have the terms specified in the base prospectus dated May 30, 2006, the MTN prospectus supplement dated May 30, 2006, product supplement no. 940-I dated January 29, 2008 and this pricing supplement. See “Key Risks” on page 4 and the more detailed “Risk Factors” beginning on page SS-1 of product supplement no. 940-I for risks related to an investment in the Notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Notes or passed upon the accuracy or the adequacy of this pricing supplement, the accompanying base prospectus, MTN prospectus supplement, product supplement no. 940-I or of any applicable terms supplement. Any representation to the contrary is a criminal offense. The Notes are not deposit liabilities of Lehman Brothers Holdings Inc. and are not FDIC- insured.

| | | | | | | | | | | | |

| | | Price to Public | | Underwriting Discount | | Proceeds to Us |

| Offering of Notes | | Total | | Per Note | | Total | | Per Note | | Total | | Per Note |

Notes linked to PG | | $2,161,670.00 | | 100% | | $37,829.23 | | 1.75% | | $2,123,840.78 | | 98.25% |

Notes linked to PEP | | $1,233,600.00 | | 100% | | $21,588.00 | | 1.75% | | $1,212,012.00 | | 98.25% |

Notes linked to GE | | $3,807,570.00 | | 100% | | $66,632.48 | | 1.75% | | $3,740,937.53 | | 98.25% |

Notes linked to XOM | | $2,028,100.00 | | 100% | | $35,491.75 | | 1.75% | | $1,992,608.25 | | 98.25% |

Notes linked to INTC | | $3,538,300.00 | | 100% | | $61,920.25 | | 1.75% | | $3,476,379.75 | | 98.25% |

UBS Financial Services Inc. | Lehman Brothers Inc. |

Additional Information about Lehman Brothers Holdings Inc. and the Notes

Lehman Brothers Holdings Inc. has filed a registration statement (including a base prospectus) with the U.S. Securities and Exchange Commission, or SEC, for this offering. Before you invest, you should read this pricing supplement together with the base prospectus, as supplemented by the MTN prospectus supplement relating to our Series I medium-term notes of which the Notes are a part, and the more detailed information contained in product supplement no. 940-I (which supplements the description of the general terms of the Notes). Buyers should rely upon the base prospectus, the MTN prospectus supplement, product supplement no. 940-I, this pricing supplement, any other relevant terms supplement and any other relevant free writing prospectus for complete details. This pricing supplement, together with the documents listed below, contains the terms of the Notes and supersedes all prior or contemporaneous communications concerning the Notes. To the extent that there are any inconsistencies among the documents listed below, this pricing supplement shall supersede product supplement no. 940-I, which shall, likewise, supersede the base prospectus and the MTN prospectus supplement. You should carefully consider, among other things, the matters set forth in “Risk Factors” in the accompanying product supplement no. 940-I, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes. You may get these documents and other documents Lehman Brothers Holdings Inc. has filed for free by searching the SEC online database (EDGAR®) atwww.sec.gov, with “Lehman Brothers Holdings Inc.” as a search term or through the links below, or by calling UBS Financial Services Inc. toll-free at 1-877-827-2010 or Lehman Brothers Inc. toll-free at 1-888-603-5847.

You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| | ¨ | | Product supplement no. 940-I dated January 29, 2008: |

http://www.sec.gov/Archives/edgar/data/806085/000119312508014018/d424b2.htm

| | ¨ | | MTN Prospectus supplement dated May 30, 2006: |

http://www.sec.gov/Archives/edgar/data/806085/000104746906007785/a2170815z424b2.htm

| | ¨ | | Base Prospectus dated May 30, 2006: |

http://www.sec.gov/Archives/edgar/data/806085/000104746906007771/a2165526zs-3asr.htm

References to “Lehman Brothers,” “we,” “our” and “us” refer only to Lehman Brothers Holdings Inc. and not to its consolidated subsidiaries. In this document, “Notes” refers collectively to the five separate issuances of Return Optimization Securities with Partial Protection that are offered hereby, unless the context otherwise requires.

The Notes may be suitable for you if, among other considerations:

| | ¨ | | You believe that the Reference Stock to which your Notes are linked will appreciate moderately—meaning that you believe the applicable Reference Stock will appreciate over the term of the Notes and that such appreciation, as leveraged by the applicable Leverage Factor, is unlikely to exceed the indicative Maximum Gain at maturity applicable to such Notes |

| | ¨ | | You seek an investment that offers partial principal protection when the Notes are held to maturity |

| | ¨ | | You are willing to risk losing some of your investment if the Share Price of the applicable Reference Stock declines from the Trade Date to the Final Valuation Date by more than the Protection Percentage applicable to such Notes |

| | ¨ | | You are willing to hold the Notes to maturity |

| | ¨ | | You do not seek current income from this investment |

| | ¨ | | You are willing to invest in the Notes notwithstanding that their return will be limited to the Maximum Gain applicable to such Notes |

| | ¨ | | You are willing to invest in securities for which there may be little or no secondary market |

| | ¨ | | You are willing to forgo dividends paid on the applicable Reference Stock |

The Notes may not be suitable for you if, among other considerations:

| | ¨ | | You are unable or unwilling to hold the Notes to maturity |

| | ¨ | | You do not believe the applicable Reference Stock will appreciate over the term of the Notes, or you believe the leveraged Share Return at maturity will be greater than the Maximum Gain applicable to such Notes |

| | ¨ | | You prefer the lower risk, and therefore accept the potentially lower returns, of fixed income investments with comparable maturities and credit ratings |

| | ¨ | | You seek current income from your investments |

| | ¨ | | You seek an investment for which there will be an active secondary market |

| | ¨ | | You seek an investment that is 100% principal protected |

| | ¨ | | You seek an investment whose return is not subject to a cap that is equivalent to the applicable Maximum Gain |

The suitability considerations identified above are not exhaustive. Whether or not the Notes are a suitable investment for you will depend on your individual circumstances, and you should reach an investment decision only after you and your investment, legal, tax, accounting, and other advisors have carefully considered the suitability of an investment in the Notes in light of your particular circumstances. You should also review carefully the “Key Risks” on page 4, “Risk Factors” in product supplement no. 940-I and the MTN prospectus supplement for risks related to an investment in the Notes.

2

| | |

Issuer | | Lehman Brothers Holdings Inc. (A+/A1/AA-)1 |

| | | |

Issue Price | | $10 per Note |

| | | |

Term | | 18 months |

| | | |

| | | | |

Protection | | Notes Linked to PG | | 10% |

Percentage | | Notes Linked to PEP | | 10% |

| | Notes Linked to GE | | 10% |

| | Notes Linked to XOM | | 10% |

| | Notes Linked to INTC | | 10% |

| | | | | |

| | |

Payment at Maturity (per $10) | | If the applicable Share Return (as defined below) is positive, you will receive a cash payment, per $10 principal amount Note, equal to: $10 + [$10 × (Share Return × Leverage Factor)] provided, however, that in no event will you receive an amount greater than $10 + ($10× the Maximum Gain) If the applicable Share Return is negative or zero, but its absolute value is less than or equal to the applicable Protection Percentage,you will receive the principal amount of your Notes at maturity. If the applicable Share Return is negative and its absolute value is greater than the applicable Protection Percentage, you will receive a cash payment, per $10 principal amount Note, equal to: $10 + [$10 × (Share Return + Protection Percentage)] In this scenario, you will lose some of your principal, the amount depending on how much the Share Price of the applicable Reference Stock declines, from the Trade Date to the Final Valuation Date, beyond the applicable Protection Percentage. |

| |

| | | |

Share Return | | Final Share Price - Initial Share Price |

| | Initial Share Price |

| | | |

| | | | |

Leverage Factor | | Notes Linked to PG | | 2 |

| | Notes Linked to PEP | | 2 |

| | Notes Linked to GE | | 2 |

| | Notes Linked to XOM | | 2 |

| | Notes Linked to INTC | | 2 |

| | | | | |

Maximum Gain | | Notes Linked to PG | | 19.75% |

| | Notes Linked to PEP | | 19.45% |

| | Notes Linked to GE | | 28.85% |

| | Notes Linked to XOM | | 29.00% |

| | Notes Linked to INTC | | 42.00% |

| | | | | |

| | | | |

Share Price | | The closing price per share of the applicable Reference Stock on each trading day. |

| | | | | |

Initial Share Price | | Notes Linked to PG | | $65.02 |

| | Notes Linked to PEP | | $69.81 |

| | Notes Linked to GE | | $33.84 |

| | Notes Linked to XOM | | $81.71 |

| | Notes Linked to INTC | | $20.27 |

| | | | | |

Final Share Price | | The Share Price of the applicable Reference Stock on the Final Valuation Date. |

| | | | | |

Stock Adjustment Factor | | For each Reference Stock, set equal to 1.0 on the Pricing Date, subject to adjustment under certain circumstances. See “Description of Notes—Anti-dilution Adjustments” in the accompanying product supplement no. 940-I for further information about these adjustments. |

Determining Payment at Maturity

1 Lehman Brothers Holdings Inc. is rated A+ by Standard & Poor’s, A1 by Moody’s and AA- by Fitch. A credit rating reflects the creditworthiness of Lehman Brothers Holdings Inc. and is not a recommendation to buy, sell or hold securities, and it may be subject to revision or withdrawal at any time by the assigning rating organization. Each rating should be evaluated independently of any other rating. The creditworthiness of the issuer does not affect or enhance the likely performance of the investment other than the ability of the issuer to meet its obligations.

3

What are the tax consequences of the Notes?

Lehman Brothers Holdings Inc. intends to treat, and by purchasing a Note, for all tax purposes, you agree to treat, a Note as a cash-settled financial contract, rather than as a debt instrument.

Recent Tax Law Developments. On December 7, 2007, the Internal Revenue Service released a Notice indicating that the Internal Revenue Service and the Treasury Department are considering and seeking comments as to whether holders of instruments similar to the Notes should be required to accrue income on a current basis over the term of the Notes, regardless of whether any payments are made prior to maturity. In addition, the Notice provides that the Internal Revenue Service and the Treasury Department are considering related issues, including, among other things, whether gain or loss from such instruments should be treated as ordinary or capital, whether foreign holders of such instruments should be subject to withholding tax, whether the tax treatment of such instruments should vary depending upon the nature of the underlying asset, and whether such instruments should be subject to the special “constructive ownership rules” contained in Section 1260 of the Internal Revenue Code of 1986, as amended. It is not possible to predict what changes, if any, will be adopted, or when they will take effect. Any such changes could affect the amount, timing and character of income, gain or loss in respect of the Notes, possibly with retroactive effect. Holders are urged to consult their tax advisors concerning the impact of the Notice on their investment in the Notes. Subject to future developments with respect to the foregoing, Lehman Brothers Holdings Inc. intends to continue to treat the Notes for U.S. federal income tax purposes in accordance with the treatment described in the accompanying product supplement no. 940-I under the headings “Risk Factors” and “Certain U.S. Federal Income Tax Consequences.

See “Certain U.S. Federal Income Tax Consequences” in the accompanying product supplement no. 940-I.

An investment in the Notes involves significant risks. Investing in the Notes is not equivalent to investing directly in any of the Reference Stocks. These risks are explained in more detail in the “Risk Factors” section of the accompanying product supplement no. 940-I. You should reach an investment decision only after you have carefully considered with your advisors the suitability of an investment in the Notes in light of your particular circumstances.

| | ¨ | | Partial Principal Protection Only Applies if You Hold the Notes to Maturity: You should be willing to hold your Notes to maturity. If you sell your Notes in the secondary market, you may have to sell them at a discount and you will not have partial principal protection for a decline in the Share Price of the applicable Reference Stock up to the applicable Protection Percentage. YOU SHOULD BE WILLING TO HOLD YOUR NOTES TO MATURITY. |

| | ¨ | | Your Investment in the Notes May Result in a Loss: The Notes do not guarantee any return of principal in excess of the applicable Protection Percentage per $10 principal amount. The return on the Notes at maturity is linked to the performance of the applicable Reference Stock and will depend on whether, and the extent to which, the applicable Share Return is positive or negative. Your investment will be fully exposed to any decline in the Share Price of the applicable Reference Stock if, and to the extent to which, the applicable Share Return falls below the applicable Protection Percentage. You may lose a substantial portion of your principal if the Share Price of the applicable Reference Stock declines by more than the applicable Protection Percentage. |

| | ¨ | | Maximum Gain: A direct leveraged investment in the applicable Reference Stock may exceed the applicable Maximum Gain. YOU WILL NOT RECEIVE A RETURN ON THE NOTES GREATER THAN THE APPLICABLE MAXIMUM GAIN EVEN IF THE PRODUCT OF THE APPLICABLE SHARE RETURN AND THE APPLICABLE LEVERAGE FACTOR IS GREATER THAN THE APPLICABLE MAXIMUM GAIN. |

| | ¨ | | Single Stock Risk:The price of the applicable Reference Stock can rise or fall sharply due to factors specific to that Reference Stock and its Reference Stock Issuer, such as stock price volatility, earnings, financial conditions, corporate, industry and regulatory developments, management changes and decisions and other events, as well as general market factors, such as general stock market volatility and levels, interest rates and economic and political conditions. |

| | ¨ | | No Ownership Rights in the Applicable Reference Stock: As a holder of the Notes, you will not have any ownership interest or rights in the applicable Reference Stock, such as voting rights, dividend payments or other distributions. In addition, the applicable Reference Stock Issuer will not have any obligation to consider your interests as a holder of the Notes in taking any corporate action that might affect the value of the applicable Reference Stock and the Notes. |

| | ¨ | | We Cannot Control Actions by the Reference Stock Issuers: We are not affiliated with the Reference Stock Issuers. As a result, we will have no ability to control the actions of such companies, including actions that could affect the value of the stocks. None of the money you pay us will go to any of the Reference Stock Issuers, and none of those companies will be involved in the offering of the Notes in any way. Neither those companies nor we will have any obligation to consider your interests as a holder of the Notes in taking any corporate actions that might affect the value of your Notes. In addition, we assume no responsibility for, and make no representation regarding, the adequacy or completeness of the information about the Reference Stocks contained in this pricing supplement or in product supplement no. 940-I. You should make your own investigation into the Reference Stocks and the Reference Stock Issuers. We are not responsible for the Reference Stock Issuers’ public disclosure of information, whether contained in SEC filings or otherwise. |

| | ¨ | | The Reference Stock May Change Following Certain Corporate Events:Following certain corporate events relating to a Reference Stock Issuer, such as a take-over or a going private transaction, the calculation agent will have the option to replace the applicable Reference Stock with the common stock of a company with the same Standard Industrial Classification Code as such Reference Stock Issuer. We describe the specific corporate events that can lead to these adjustments and the procedures for selecting a Successor Reference Stock under “Description of Notes — Anti-dilution Adjustments — Reorganization Events” in the accompanying product supplement no. 940-I. |

| | ¨ | | Certain Built-in Costs are Likely to Adversely Affect the Value of the Notes Prior to Maturity: While the Payment at Maturity described in this pricing supplement is based on the full principal amount of your Notes, the original issue price of the Notes includes the agent’s commission and the cost of hedging our obligations under the Notes through one or more of our affiliates, which includes |

4

| | our affiliates’ expected cost of providing such hedge as well as the profit our affiliates expect to realize in consideration for assuming the risks inherent in providing such hedge. As a result, the price, if any, at which Lehman Brothers Inc. will be willing to purchase Notes from you in secondary market transactions, if at all, will likely be lower than the original issue price and any sale prior to the Maturity Date could result in a substantial loss to you. The Notes are not designed to be short-term trading instruments. YOU SHOULD BE WILLING TO HOLD YOUR NOTES TO MATURITY. |

| | ¨ | | Dealer Incentives: We, our affiliates and agents, and UBS Financial Services Inc., and its affiliates, act in various capacities with respect to the Notes. Lehman Brothers Inc. and other of our affiliates may act as a principal, agent or dealer in connection with the Notes. Such affiliates, including the sales representatives, will derive compensation from the distribution of the Notes, and such compensation may serve as an incentive to sell the Notes instead of other investments. We will pay compensation of $0.175 per $10 principal amount Note to the principals, agents and dealers in connection with the distribution of the Notes. |

| | ¨ | | Lack of Liquidity: The Notes will not be listed on any securities exchange. Lehman Brothers Inc. intends to offer to purchase the Notes in the secondary market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Notes easily. Because other dealers are not likely to make a secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at which Lehman Brothers Inc. is willing to buy the Notes. If you are an employee of Lehman Brothers Holdings Inc. or one of our affiliates, you may not be able to purchase the Notes from us and your ability to sell or trade the Notes in the secondary market may be limited. |

| | ¨ | | Potential Conflicts: We and our affiliates play a variety of roles in connection with the issuance of the Notes, including acting as calculation agent and hedging our obligations under the Notes. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the Notes. Additionally, UBS Financial Services Inc. and its affiliates may engage in certain activities with companies whose stock is underlying the Notes, and such activities could potentially affect the value of the Notes. |

| | ¨ | | We and our Affiliates and Agents May Publish Research, Express Opinions or Provide Recommendations that are Inconsistent with Investing in or Holding the Notes. Any Such Research, Opinions or Recommendations Could Affect the Price of the Applicable Reference Stock to which the Notes are Linked and, Consequently, the Value of the Notes: We, our affiliates and agents publish research from time to time on matters that may influence the value of the Notes, or express opinions or provide recommendations that may be inconsistent with purchasing or holding the Notes. We, our affiliates and agents may publish or may have published research or other opinions that are inconsistent with an investment position in the Notes. Any research, opinions or recommendations expressed by us, our affiliates or agents may not be consistent with each other and may be modified from time to time without notice. Additionally, UBS Financial Services Inc. and its affiliates may publish or may have published research or other opinions that are inconsistent with an investment position in the Notes. Investors should make their own independent investigation of the merits of investing in the Notes. |

| | ¨ | | Creditworthiness of Issuer: An investment in the Notes will be subject to the credit risk of Lehman Brothers Holding Inc., and the actual and perceived creditworthiness of Lehman Brothers Holdings Inc. may affect the market value of the Notes. |

| | ¨ | | Many Economic and Market Factors Will Impact the Value of the Notes: In addition to the Share Price of the applicable Reference Stock on any day, the value of the Notes will be affected by a number of economic and market factors that may either offset or magnify each other and which are set out in more detail in the product supplement no. 940-I. |

| | ¨ | | Uncertain Tax Treatment: Significant aspects of the tax treatment of the Notes are uncertain. You should consult your own tax advisor about your own tax situation before investing in the Notes. |

| | ¨ | | Anti-Dilution Protection is Limited:For certain adjustment events affecting the applicable Reference Stock, the calculation agent will make adjustments to the Stock Adjustment Factor applicable to such Reference Stock. However, the calculation agent will not make an adjustment in response to all events that could affect the applicable Reference Stock. If an event occurs that does not require the calculation agent to make an adjustment, the value of the Notes may be materially and adversely affected. |

5

Information about the Reference Stocks

Included on the following pages is a brief description of the Reference Stock Issuers of each of the respective Reference Stocks. Lehman Brothers Holdings Inc. has obtained the following information regarding the Reference Stock Issuers from the reports the Reference Stock Issuers filed with the SEC. All information contained herein on the Reference Stocks and the Reference Stock Issuers is derived from publicly available sources and is provided for informational purposes only. We do not make any representation that these publicly available documents are accurate or complete.

Each of the Reference Stocks is registered under the Securities Exchange Act of 1934 (the “Exchange Act”). Companies with securities registered under the Exchange Act are required to file periodically certain financial and other information specified by the SEC. Information provided to or filed with the SEC can be inspected and copied at the public reference facilities maintained by the SEC or through the SEC’s website described under “Where You Can Find More Information” on page 58 of the accompanying base prospectus. In addition, information regarding a Reference Stock Issuer may be obtained from other sources including, but not limited to, press releases, newspaper articles and other publicly disseminated documents.

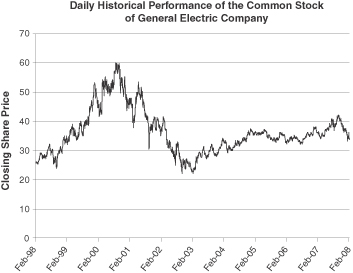

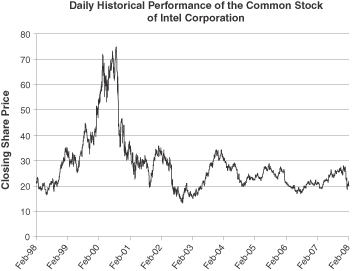

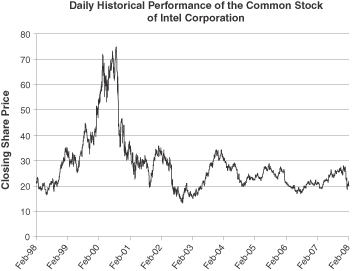

The following graphs set forth the historical performance of the Reference Stock based on the daily closing prices of the applicable Reference Stock. We obtained the closing prices below from Bloomberg Financial Markets, without independent verification. The closing prices may be adjusted by Bloomberg Financial Markets for corporate actions such as public offerings, mergers and acquisitions, spin-offs, delistings and bankruptcy. We make no representation or warranty as to the accuracy or completeness of the information obtained from Bloomberg Financial Markets.

The historical performance of each Reference Stock should not be taken as an indication of future performance, and no assurance can be given as to the Share Prices of each Reference Stock during the term of the Notes. We cannot give you assurance that the performance of each Reference Stock will result in the return of any of your initial investment in excess of the applicable Protection Percentage. We make no representation as to the amount of dividends, if any, that each Reference Stock Issuer will pay in the future. In any event, as an investor in the Notes, you will not be entitled to receive dividends, if any, that may be payable on each Reference Stock.

6

The Procter & Gamble Company

The Procter & Gamble Company has stated in its filings with the SEC that it is a provider of branded consumer goods products. During the fiscal year 2007, it had seven reportable segments under U.S. GAAP: Beauty; Health Care; Fabric Care and Home Care; Pet Health, Snacks, and Coffee; Baby Care and Family Care; Blades and Razors; and Duracell and Braun.

You can obtain the share price of The Procter & Gamble Company at any time from the Bloomberg Financial Markets page “PG <Equity> <GO>“. Information filed by The Procter & Gamble Company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-00434, or its CIK Code: 0000080424. The Procter & Gamble Company’s common stock is listed on the New York Stock Exchange under the ticker symbol “PG.”

The graph below illustrates the historical performance of the common stock of The Procter & Gamble Company based on the daily closing price from February 6, 1998 to February 8, 2008. The historical prices of the common stock of The Procter & Gamble Company should not be taken as an indication of future performance.

Source: Bloomberg L.P.

The closing price of the common stock of The Procter & Gamble Company on February 8, 2008 was $65.02.

7

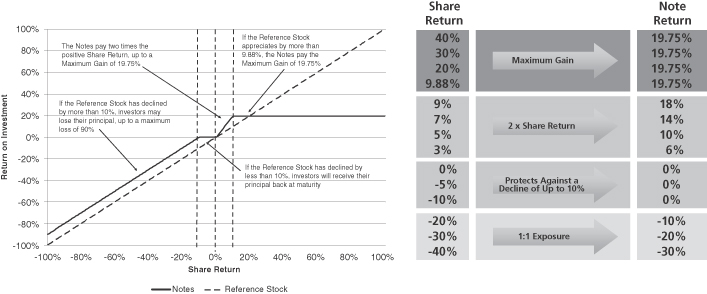

Scenario Analysis and Examples at Maturity for the Notes Linked to the Common Stock of The Procter & Gamble Company

The following scenario analysis and examples reflect the Leverage Factor of 2, the Initial Share Price of $65.02 and the Maximum Gain of 19.75% and assume a range of Share Returns from +40% to -40%.

Example 1—The Share Price of the Reference Stock increases from the Initial Share Price of $65.02 to a Final Share Price of $68.27.Because the Final Share Price is $68.27 and the Initial Share Price is $65.02, the Share Return is 5%, calculated as follows:

($68.27 – $65.02) / $65.02 = 5%

Because the Share Return is 5%, the Payment at Maturity is equal to $11.00 per $10 principal amount Note calculated as follows:

$10 + [$10 × (5% × 2)] = $11.00

Example 2—The Share Price of the Reference Stock increases from the Initial Share Price of $65.02 to a Final Share Price of $71.52.Because the Final Share Price is $71.52 and the Initial Share Price is $65.02 the Share Return is 10%, calculated as follows:

($71.52 – $65.02) / $65.02 = 10%

Because the Share Return is 10% and the Leverage Factor is 2, the return on the Note would be equal to 20%, but it is subject to the Maximum Gain of 19.75%. Therefore, the Payment at Maturity is equal to $11.98 per $10 principal amount Note, calculated as follows:

$10 + ($10 × 19.75%) = $11.98

Example 3—The Share Price of the Reference Stock decreases from the Initial Share Price of $65.02 to a Final Share Price of $61.77. Because the Final Share Price is $61.77 and the Initial Share Price is $65.02, the Share Return is -5%, calculated as follows:

($61.77 – $65.02) / $65.02 = -5%

Because the Share Return is -5%, the absolute value of which is less than the Protection Percentage, the Payment at Maturity is equal to $10.00 per $10 principal amount Note.

Example 4—The Share Price of the Reference Stock decreases from the Initial Share Price of $65.02 to a Final Share Price of $48.77. Because the Final Share Price is $48.77 and the Initial Share Price is $65.02, the Share Return is -25%, calculated as follows:

($48.77 – $65.02) / $65.02 = -25%

Because the Share Return is equal to -25%, the absolute value of which is more than the Protection Percentage, the investor will lose 1% of principal for each 1% that the Share Return exceeds the Protection Percentage and the Payment at Maturity is equal to $8.50 per $10 principal amount Note calculated as follows:

$10 + [$10 × (-25% + 10%)] = $8.50

8

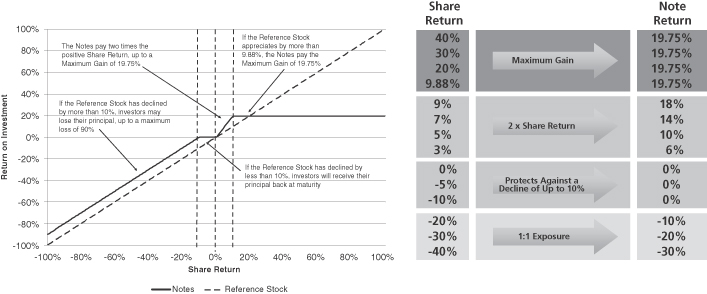

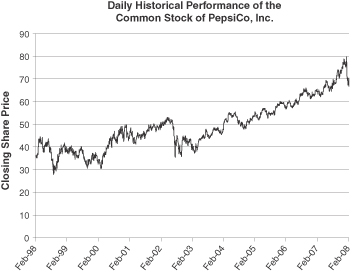

PepsiCo, Inc. has stated in its filings with the SEC that it is a global food and beverage company. It is organized into four divisions: Frito-Lay North America, PepsiCo Beverages North America, PepsiCo International and Quaker Foods North America. PepsiCo, Inc. manufactures, markets and sells a variety of branded carbonated and non-carbonated beverages and foods.

You can obtain the share price of PepsiCo, Inc. at any time from the Bloomberg Financial Markets page “PEP <Equity> <GO>“. Information filed by PepsiCo, Inc. with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-01183, or its CIK Code: 0000077476. PepsiCo, Inc.’s common stock is listed on the New York Stock Exchange under the ticker symbol “PEP.”

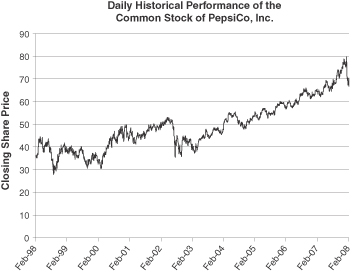

The graph below illustrates the historical performance of the common stock of PepsiCo, Inc. based on the daily closing price from February 6, 1998 to February 8, 2008. The historical prices of the common stock of PepsiCo, Inc. should not be taken as an indication of future performance.

Source: Bloomberg L.P.

The closing price of the common stock of PepsiCo, Inc. on February 8, 2008 was $69.81.

9

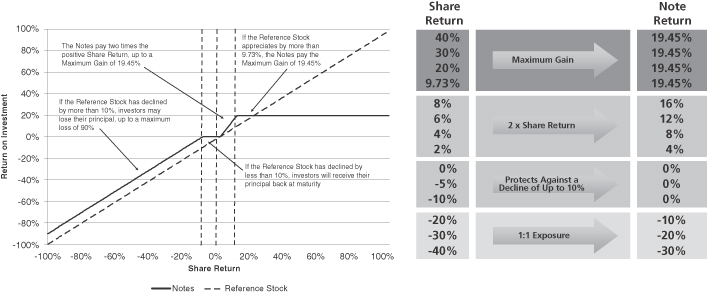

Scenario Analysis and Examples at Maturity for the Notes Linked to the Common Stock of PepsiCo, Inc.

The following scenario analysis and examples reflect the Leverage Factor of 2, the Initial Share Price of $69.81 and the Maximum Gain of 19.45% and assume a range of Share Returns from +40% to -40%.

Example 1—The Share Price of the Reference Stock increases from the Initial Share Price of $69.81 to a Final Share Price of $73.30.Because the Final Share Price is $73.30 and the Initial Share Price is $69.81, the Share Return is 5%, calculated as follows:

($73.30 – $69.81) / $69.81 = 5%

Because the Share Return is 5%, the Payment at Maturity is equal to $11.00 per $10 principal amount Note calculated as follows:

$10 + [$10 × (5% × 2)] = $11.00

Example 2—The Share Price of the Reference Stock increases from the Initial Share Price of $69.81 to a Final Share Price of $76.79.Because the Final Share Price is $76.79 and the Initial Share Price is $69.81 the Share Return is 10%, calculated as follows:

($76.79 – $69.81) / $69.81 = 10%

Because the Share Return is 10% and the Leverage Factor is 2, the return on the Note would be equal to 20%, but it is subject to the Maximum Gain of 19.45%. Therefore, the Payment at Maturity is equal to $11.95 per $10 principal amount Note, calculated as follows:

$10 + ($10 × 19.45%) = $11.95

Example 3—The Share Price of the Reference Stock decreases from the Initial Share Price of $69.81 to a Final Share Price of $66.32. Because the Final Share Price is $66.32 and the Initial Share Price is $69.81, the Share Return is -5%, calculated as follows:

($66.32 – $69.81) / $69.81 = -5%

Because the Share Return is -5%, the absolute value of which is less than the Protection Percentage, the Payment at Maturity is equal to $10.00 per $10 principal amount Note.

Example 4—The Share Price of the Reference Stock decreases from the Initial Share Price of $69.81 to a Final Share Price of $52.36. Because the Final Share Price is $52.36 and the Initial Share Price is $69.81, the Share Return is -25%, calculated as follows:

($52.36 – $69.81) / $69.81 = -25%

Because the Share Return is equal to -25%, the absolute value of which is more than the Protection Percentage, the investor will lose 1% of principal for each 1% that the Share Return exceeds the Protection Percentage and the Payment at Maturity is equal to $8.50 per $10 principal amount Note calculated as follows:

$10 + [$10 × (-25% + 10%)] = $8.50

10

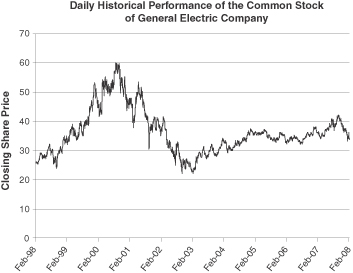

General Electric Company has stated in its filings with the SEC that it develops, manufactures and markets products for the generation, transmission, distribution, control and utilization of electricity. Its products include appliances, lighting products, medical diagnostic imaging systems, electrical distribution and control equipment, locomotives, power generation and delivery products, nuclear power support services and fuel assemblies, aircraft jet engines, security equipment and systems, and plastics.

You can obtain the share price of General Electric Company at any time from the Bloomberg Financial Markets page “GE <Equity> <GO>“. Information filed by General Electric Company with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-00035, or its CIK Code: 0000040545. General Electric Company’s common stock is listed on the New York Stock Exchange under the ticker symbol “GE.”

The graph below illustrates the historical performance of the common stock of General Electric Company based on the daily closing price from February 6, 1998 to February 8, 2008. The historical prices of the common stock of General Electric Company should not be taken as an indication of future performance.

Source: Bloomberg L.P.

The closing price of the common stock of General Electric Company on February 8, 2008 was $33.84.

11

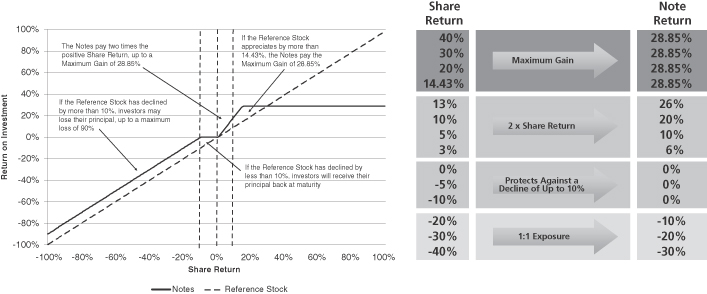

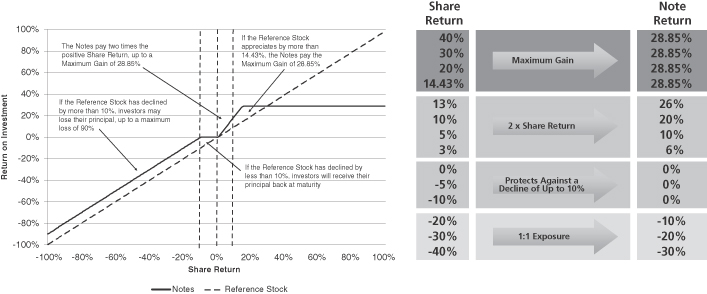

Scenario Analysis and Examples at Maturity for the Notes Linked to the Common Stock of General Electric Company

The following scenario analysis and examples reflect the Leverage Factor of 2, the Initial Share Price of $33.84 and the Maximum Gain of 28.85% and assume a range of Share Returns from +40% to -40%.

Example 1—The Share Price of the Reference Stock increases from the Initial Share Price of $33.84 to a Final Share Price of $35.53.Because the Final Share Price is $35.53 and the Initial Share Price is $33.84, the Share Return is 5%, calculated as follows:

($35.53 – $33.84) / $33.84 = 5%

Because the Share Return is 5%, the Payment at Maturity is equal to $11.00 per $10 principal amount Note calculated as follows:

$10 + [$10 × (5% × 2)] = $11.00

Example 2—The Share Price of the Reference Stock increases from the Initial Share Price of $33.84 to a Final Share Price of $38.92.Because the Final Share Price is $38.92 and the Initial Share Price is $33.84 the Share Return is 15%, calculated as follows:

($38.92 – $33.84) / $33.84 = 15%

Because the Share Return is 15% and the Leverage Factor is 2, the return on the Note would be equal to 30%, but it is subject to the Maximum Gain of 28.85%. Therefore, the Payment at Maturity is equal to $12.89 per $10 principal amount Note, calculated as follows:

$10 + ($10 × 28.85%) = $12.89

Example 3—The Share Price of the Reference Stock decreases from the Initial Share Price of $33.84 to a Final Share Price of $32.15. Because the Final Share Price is $32.15 and the Initial Share Price is $33.84, the Share Return is -5%, calculated as follows:

($32.15 – $33.84) / $33.84 = -5%

Because the Share Return is -5%, the absolute value of which is less than the Protection Percentage, the Payment at Maturity is equal to $10.00 per $10 principal amount Note.

Example 4—The Share Price of the Reference Stock decreases from the Initial Share Price of $33.84 to a Final Share Price of $25.38. Because the Final Share Price is $25.38 and the Initial Share Price is $33.84, the Share Return is -25%, calculated as follows:

($25.38 – $33.84) / $33.84 = -25%

Because the Share Return is equal to -25%, the absolute value of which is more than the Protection Percentage, the investor will lose 1% of principal for each 1% that the Share Return exceeds the Protection Percentage and the Payment at Maturity is equal to $8.50 per $10 principal amount Note calculated as follows:

$10 + [$10 × (-25% + 10%)] = $8.50

12

Exxon Mobil Corporation has stated in its filings with the SEC that it is a global energy corporation engaged in the exploration for and production of crude oil and gas, as well as the manufacture and marketing of petrochemicals and petroleum products.

You can obtain the share price of Exxon Mobil Corporation at any time from the Bloomberg Financial Markets page “XOM <Equity> <GO>“. Information filed by Exxon Mobil Corporation with the SEC under the Exchange Act can be located by reference to its SEC file number: 001-02256, or its CIK Code: 0000034088. Exxon Mobil Corporation’s common stock is listed on the New York Stock Exchange under the ticker symbol “XOM.”

The graph below illustrates the historical performance of the common stock of Exxon Mobil Corporation based on the daily closing price from February 6, 1998 to February 8, 2008. The historical prices of the common stock of Exxon Mobil Corporation should not be taken as an indication of future performance.

Source: Bloomberg L.P.

The closing price of the common stock of Exxon Mobil Corporation on February 8, 2008 was $81.71.

13

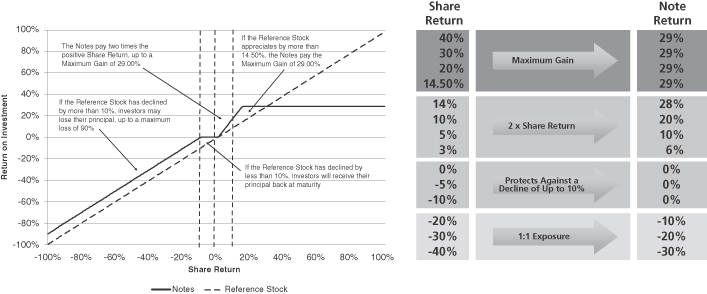

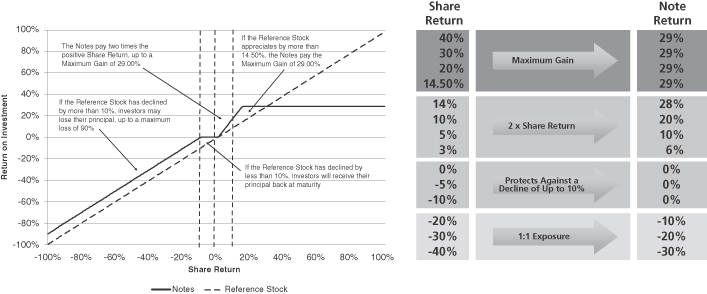

Scenario Analysis and Examples at Maturity for the Notes Linked to the Common Stock of Exxon Mobil Corporation

The following scenario analysis and examples reflect the Leverage Factor of 2, the Initial Share Price of $81.71 and the Maximum Gain of 29.00% and assume a range of Share Returns from +40% to -40%.

Example 1—The Share Price of the Reference Stock increases from the Initial Share Price of $81.71 to a Final Share Price of $85.80.Because the Final Share Price is $85.80 and the Initial Share Price is $81.71, the Share Return is 5%, calculated as follows:

($85.80 – $81.71) / $81.71 = 5%

Because the Share Return is 5%, the Payment at Maturity is equal to $11.00 per $10 principal amount Note calculated as follows:

$10 + [$10 × (5% × 2)] = $11.00

Example 2—The Share Price of the Reference Stock increases from the Initial Share Price of $81.71 to a Final Share Price of $102.14.Because the Final Share Price is $102.14 and the Initial Share Price is $81.71 the Share Return is 25%, calculated as follows:

($102.14 – $81.71) / $81.71 = 25%

Because the Share Return is 25% and the Leverage Factor is 2, the return on the Note would be equal to 50%, but it is subject to the Maximum Gain of 29.00%. Therefore, the Payment at Maturity is equal to $12.90 per $10 principal amount Note, calculated as follows:

$10 + ($10 × 29.00%) = $12.90

Example 3—The Share Price of the Reference Stock decreases from the Initial Share Price of $81.71 to a Final Share Price of $77.62. Because the Final Share Price is $77.62 and the Initial Share Price is $81.71, the Share Return is -5%, calculated as follows:

($77.62 – $81.71) / $81.71 = -5%

Because the Share Return is -5%, the absolute value of which is less than the Protection Percentage, the Payment at Maturity is equal to $10.00 per $10 principal amount Note.

Example 4—The Share Price of the Reference Stock decreases from the Initial Share Price of $81.71 to a Final Share Price of $61.28. Because the Final Share Price is $61.28 and the Initial Share Price is $81.71, the Share Return is -25%, calculated as follows:

($61.28 – $81.71) / $81.71 = -25%

Because the Share Return is equal to -25%, the absolute value of which is more than the Protection Percentage, the investor will lose 1% of principal for each 1% that the Share Return exceeds the Protection Percentage and the Payment at Maturity is equal to $8.50 per $10 principal amount Note calculated as follows:

$10 + [$10 × (-25% + 10%)] = $8.50

14

Intel Corporation has stated in its filings with the SEC that it is a developer of integrated digital technology platforms and components, primarily integrated circuits, for the computing and communications industries. Its products include: microprocessors, chipsets, motherboards, flash memory, wired and wireless connectivity products, communications infrastructure components, including network processors and products for networked storage. Intel Corporation’s customers include: original equipment manufacturers (OEMs) and original design manufacturers who make computer systems, handheld devices, and telecommunications and networking communications equipment; PC and network communications products users who buy PC components and board-level products, networking, communications and storage products, through distributor, reseller, retail, and OEM channels; and other manufacturers, including makers of industrial and communications equipment.

You can obtain the share price of Intel Corporation at any time from the Bloomberg Financial Markets page “INTC <Equity> <GO>“. Information filed by Intel Corporation with the SEC under the Exchange Act can be located by reference to its SEC file number: 000-06217, or its CIK Code: 0000050863. Intel Corporation’s common stock is listed on the NASDAQ under the ticker symbol “INTC.”

The graph below illustrates the historical performance of the common stock of Intel Corporation based on the daily closing price from February 6, 1998 to February 8, 2008. The historical prices of the common stock of Intel Corporation should not be taken as an indication of future performance.

Source: Bloomberg L.P.

The closing price of the common stock of Intel Corporation on February 8, 2008 was $20.27.

15

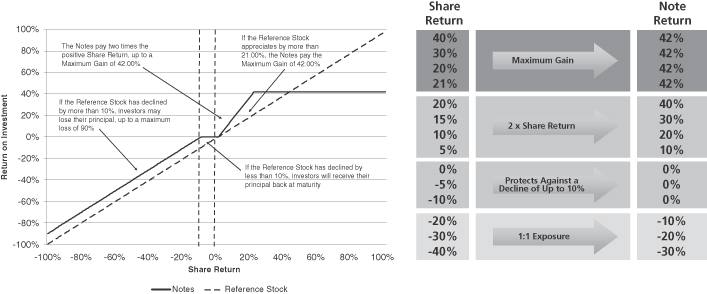

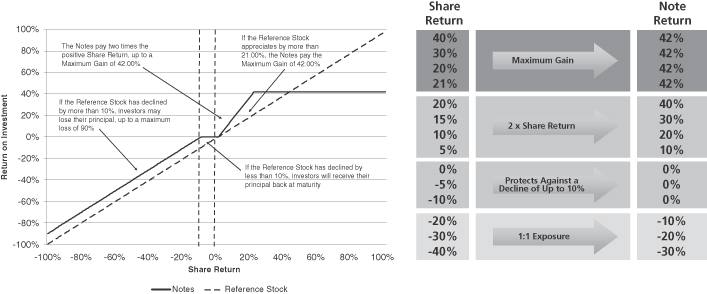

Scenario Analysis and Examples at Maturity for the Notes Linked to the Common Stock of Intel Corporation

The following scenario analysis and examples reflect the Leverage Factor of 2, the Initial Share Price of $20.27 and the Maximum Gain of 42.00% and assume a range of Share Returns from +40% to -40%.

Example 1—The Share Price of the Reference Stock increases from the Initial Share Price of $20.27 to a Final Share Price of $21.28.Because the Final Share Price is $21.28 and the Initial Share Price is $20.27, the Share Return is 5%, calculated as follows:

($21.28 – $20.27) / $20.27 = 5%

Because the Share Return is 5%, the Payment at Maturity is equal to $11.00 per $10 principal amount Note calculated as follows:

$10 + [$10 × (5% × 2)] = $11.00

Example 2—The Share Price of the Reference Stock increases from the Initial Share Price of $20.27 to a Final Share Price of $25.34.Because the Final Share Price is $25.34 and the Initial Share Price is $20.27 the Share Return is 25%, calculated as follows:

($25.34 – $20.27) / $20.27 = 25%

Because the Share Return is 25% and the Leverage Factor is 2, the return on the Note would be equal to 50%, but it is subject to the Maximum Gain of 42.00%. Therefore, the Payment at Maturity is equal to $14.20 per $10 principal amount Note, calculated as follows:

$10 + ($10 × 42.00%) = $14.20

Example 3—The Share Price of the Reference Stock decreases from the Initial Share Price of $20.27 to a Final Share Price of $19.26. Because the Final Share Price is $19.26 and the Initial Share Price is $20.27, the Share Return is -5%, calculated as follows:

($19.26 – $20.27) / $20.27 = -5%

Because the Share Return is -5%, the absolute value of which is less than the Protection Percentage, the Payment at Maturity is equal to $10.00 per $10 principal amount Note.

Example 4—The Share Price of the Reference Stock decreases from the Initial Share Price of $20.27 to a Final Share Price of $15.20. Because the Final Share Price is $15.20 and the Initial Share Price is $20.27, the Share Return is -25%, calculated as follows:

($15.20 – $20.27) / $20.27 = -25%

Because the Share Return is equal to -25%, the absolute value of which is more than the Protection Percentage, the investor will lose 1% of principal for each 1% that the Share Return exceeds the Protection Percentage and the Payment at Maturity is equal to $8.50 per $10 principal amount Note calculated as follows:

$10 + [$10 × (-25% + 10%)] = $8.50

16

Supplemental Plan of Distribution

We have agreed to sell to UBS Financial Services Inc. and Lehman Brothers Inc. (together, the “Agents”), and the Agents will agree to purchase, all of the Notes at the price indicated on the cover of this pricing supplement. UBS Financial Services Inc. may allow a concession not in excess of the underwriting discount to its affiliates.

We have agreed to indemnify the Agents against liabilities, including liabilities under the Securities Act of 1933, as amended, or to contribute to payments that the Agents may be required to make relating to these liabilities as described in the MTN prospectus supplement and the base prospectus. We have agreed that UBS Financial Services Inc. may sell all or a part of the Notes that it purchases from us to its affiliates at the price that will be indicated on the cover of this pricing supplement.

Subject to regulatory constraints, Lehman Brothers Inc. has agreed to use reasonable efforts to make a market in the Notes for so long as the Notes are outstanding.

We have, or our affiliate has, entered into swap agreements or related hedge transactions with one of our other affiliates or unaffiliated counterparties in connection with the sale of the Notes and the Agents and/or an affiliate may earn additional income as a result of payments pursuant to the swap or related hedge transactions.

17