ISSUER FREE WRITING PROSPECTUS Filed Pursuant to Rule 433 Registration Statement No. 333-134553 Dated February 26, 2008 |  |

Return Optimization Securities with Partial Protection

Enhanced Return Strategies for Moderate-Return Environments

Lehman Brothers Holdings Inc. Notes Linked to the S&P 500® Index due September 30, 2009

Lehman Brothers Holdings Inc. Notes Linked to the MSCI EM (Emerging Markets) Index due September 30, 2009

Investment Description

Return Optimization Securities with Partial Protection linked to the S&P 500® Index (the “S&P 500® Notes”) and Return Optimization Securities with Partial Protection linked to the MSCI EM (Emerging Markets) Index (the “MSCI EM Notes”) (each, a “Note” and, collectively, the “Notes”) are respective issuances of notes issued by Lehman Brothers Holdings Inc. The Notes provide potentially enhanced returns based on the positive performance of the applicable index, as well as protection, at maturity of the Notes, of a percentage of your principal based on the applicable Protection Percentage. The Notes are designed to enhance returns in a moderate-return environment – meaning an environment in which stocks generally experience no more than moderate appreciation. If the applicable Index Return is positive, at the maturity of the Notes you will receive your principal plus a return equaling 200% of the applicable Index Return, up to the applicable Maximum Gain, providing you with an opportunity to outperform the applicable index. If the applicable Index Return is less than or equal to 0%, and its absolute value is less than or equal to the applicable Protection Percentage, at maturity of the Notes you will receive your principal amount. If the applicable Index Return is negative and the absolute value of such Index Return is greater than the applicable Protection Percentage, at maturity you will lose 1% of your principal for every 1% decline in the Index Return beyond the applicable Protection Percentage. Partial principal protected investments (like the Notes) can help reduce portfolio risk while maintaining an increased exposure to equities. The partial principal protection feature applies only at maturity. Investing in the Notes involves significant risks, including potential loss of principal, up to 90% for the S&P 500® Notes or up to 85% for the MSCI EM Notes, and a capped appreciation at maturity.

Features

| q | Growth Potential—Investors receive enhanced upside participation in the positive performance of the applicable index up to the applicable Maximum Gain (the actual Maximum Gain for each Note will be determined on the Trade Date). |

| q | Partial Protection of Principal—At maturity of the Notes, investors will receive a cash payment equal to at least the applicable Protection Percentage multiplied by the principal amount. |

Key Dates1

Trade Date | March 26, 2008 | |

Settlement Date | March 31, 2008 | |

Final Valuation Date | September 25, 2009 | |

Maturity Date | September 30, 2009 |

1 | In the event we make any change to the expected Trade Date and Settlement Date, the Final Valuation Date and the Maturity Date will be changed so that the stated term of the Notes remains the same. |

Security Offerings

We are offering two separate issuances of Return Optimization Securities with Partial Protection linked to an index. Each issuance of Notes is linked to a particular index with a specified Leverage Factor, Maximum Gain, and Protection Percentage.The performance of each issuance of Notes will not depend on the performance of any other issuance of Notes. The return on the Notes of each issuance is subject to, and will not exceed, the predetermined Maximum Gain applicable to Notes of that issuance, which will be determined on the Trade Date. Each Note is offered at a minimum investment of $1,000 in denominations of $10 and integral multiples of $10 in excess thereof.

| Underlying Index for each Note | Index Ticker | Leverage Factor | Maximum Gain* | Protection Percentage | Index Starting Level* | CUSIP | ISIN | |||||||

S&P 500® Index | SPX | 2 | 17.50% to 20.50% | 10% | TBD | 52522L806 | US52522L8063 | |||||||

MSCI EM (Emerging Markets) Index | MXEF | 2 | 27.00% to 30.00% | 15% | TBD | 52522L814 | US52522L8147 |

*The actual Maximum Gain and the Index Starting Level for each issuance of Notes will be determined on the Trade Date

See “Additional Information about Lehman Brothers Holdings Inc. and the Notes” on page 3. The Notes offered will have the terms specified in underlying supplement no. 100 dated January 28, 2008 for the S&P 500® Notes and underlying supplement no. 1120 dated February 19, 2008 for the MSCI EM Notes (each, an “Underlying Supplement” and, collectively, the “Underlying Supplements”), the base prospectus dated May 30, 2006, the MTN prospectus supplement dated May 30, 2006, product supplement no. 820-I dated February 21, 2008 and this term sheet. See “Key Risks” on page 5, the more detailed “Risk Factors” beginning on page SS-3 of product supplement no. 820-I for risks related to an investment in the Notes and “Risk Factors” beginning on page US-1 of the applicable Underlying Supplement for risks related to each index.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Notes or passed upon the accuracy or the adequacy of this term sheet, the accompanying base prospectus, MTN prospectus supplement, product supplement no. 820-I or the Underlying Supplements or of any applicable terms supplement. Any representation to the contrary is a criminal offense. The Notes are not deposit liabilities of Lehman Brothers Holdings Inc. and are not FDIC insured.

Price to Public | Underwriting Discount | Proceeds to Us | ||||||||||

| Offering of Notes | Total | Per Note | Total | Per Note | Total | Per Note | ||||||

S&P 500® Notes | $10.00 | $0.175 | $9.825 | |||||||||

MSCI EM Notes | $10.00 | $0.175 | $9.825 | |||||||||

UBS Financial Services Inc. | Lehman Brothers Inc. |

Lehman Brothers Holdings Inc. has filed a registration statement (including a base prospectus) with the U.S. Securities and Exchange Commission, or SEC, for this offering. Before you invest, you should read this term sheet together with the base prospectus, as supplemented by the MTN prospectus supplement relating to our Series I medium-term notes of which the Notes are a part, and the more detailed information contained in product supplement no. 820-I (which supplements the description of the general terms of the Notes) and the applicable Underlying Supplements (which describe the Indices, including risk factors specific to each). Buyers should rely upon the base prospectus, the MTN prospectus supplement, product supplement no. 820-I, the applicable Underlying Supplement, this term sheet, any other relevant terms supplement and any other relevant free writing prospectus for complete details. This term sheet, together with the documents listed below, contains the terms of the Notes and supersedes all prior or contemporaneous communications concerning the Notes. To the extent that there are any inconsistencies among the documents listed below, this term sheet shall supersede product supplement no. 820-I, which shall, likewise, supersede the base prospectus and the MTN prospectus supplement. You should carefully consider, among other things, the matters set forth in “Risk Factors” in the accompanying product supplement no. 820-I and “Risk Factors” in the Underlying Supplement applicable to the relevant issuance of Notes, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes. You may get these documents and other documents Lehman Brothers Holdings Inc. has filed for free by searching the SEC online database (EDGAR®) atwww.sec.gov, with “Lehman Brothers Holdings Inc.” as a search term or through the links below, or by calling UBS Financial Services Inc. toll-free at 1-877-827-2010 or Lehman Brothers Inc. toll-free at 1-888-603-5847.

You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| ¨ | Product supplement no. 820-I dated February 21, 2008: |

http://www.sec.gov/Archives/edgar/data/806085/000119312508035088/d424b2.htm

¨ | For S&P 500® Notes, underlying supplement no. 100 dated January 28, 2008: |

http://www.sec.gov/Archives/edgar/data/806085/000119312508013371/d424b2.htm

| ¨ | For MSCI EM Notes, underlying supplement no. 1120 dated February 19, 2008: |

http://www.sec.gov/Archives/edgar/data/806085/000119312508033719/d424b2.htm

| ¨ | MTN Prospectus supplement dated May 30, 2006: |

http://www.sec.gov/Archives/edgar/data/806085/000104746906007785/a2170815z424b2.htm

| ¨ | Base Prospectus dated May 30, 2006: |

http://www.sec.gov/Archives/edgar/data/806085/000104746906007771/a2165526zs-3asr.htm

References to “Lehman Brothers,” “we,” “our” and “us” refer only to Lehman Brothers Holdings Inc. and not to its consolidated subsidiaries. In this document, “Notes” refers collectively to the two separate issuances of Return Optimization Securities with Partial Protection that are offered hereby, unless the context otherwise requires.

2

Investor Suitability

The Notes may be suitable for you if, among other considerations:

| ¨ | You believe that the index to which your Notes are linked will appreciate moderately—meaning that you believe the applicable index will appreciate over the term of the Notes and that such appreciation, as leveraged by the applicable Leverage Factor, is unlikely to exceed the indicative Maximum Gain at maturity applicable to such Notes |

| ¨ | You seek an investment that offers partial principal protection when the Notes are held to maturity |

| ¨ | You are willing to risk losing some of your investment if the applicable index level declines from the Trade Date to the Valuation Date by more than the Protection Percentage applicable to such Notes |

| ¨ | You are willing to hold the Notes to maturity |

| ¨ | You do not seek current income from this investment |

| ¨ | You are willing to invest in the Notes notwithstanding that their return will be limited to the Maximum Gain based on the range indicated for the Maximum Gain applicable to such Notes (the actual Maximum Gain for each issuance of Notes will be determined on the Trade Date) |

| ¨ | You are willing to invest in securities for which there may be little or no secondary market |

| ¨ | You are willing to forgo (i) dividends paid on the stocks included in the applicable index and (ii) any appreciation above the Maximum Gain |

The Notes may not be suitable for you if, among other considerations:

| ¨ | You are unable or unwilling to hold the Notes to maturity |

| ¨ | You do not believe the applicable index will appreciate over the term of the Notes, or you believe the leveraged Index Return at maturity will be greater than the Maximum Gain applicable to such Notes |

| ¨ | You prefer the lower risk, and therefore accept the potentially lower returns, of fixed income investments with comparable maturities and credit ratings |

| ¨ | You seek current income from your investments |

| ¨ | You seek an investment for which there will be an active secondary market |

| ¨ | You seek an investment that is 100% principal protected |

| ¨ | You seek an investment whose return is not subject to a cap that is equivalent to the applicable Maximum Gain |

The suitability considerations identified above are not exhaustive. Whether or not the Notes are a suitable investment for you will depend on your individual circumstances, and you should reach an investment decision only after you and your investment, legal, tax, accounting, and other advisors have carefully considered the suitability of an investment in the Notes in light of your particular circumstances. You should also review carefully the “Key Risks” on page 5, “Risk Factors” in product supplement no. 820-I, the applicable Underlying Supplement and the MTN prospectus supplement for risks related to an investment in the Notes.

3

Indicative Terms

Issuer | Lehman Brothers Holdings Inc. (A+/A1/AA-)1 | |

Issue Price | $10 per Note | |

Term | 18 months | |

Protection Percentage | S&P 500®Notes 10% MSCI EM Notes 15% | |

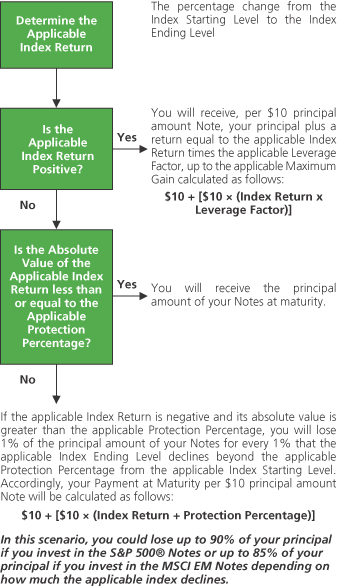

Payment at Maturity (per $10) | If the applicable Index Return (as defined below) is positive, you will receive a cash payment, per $10 principal amount Note, equal to:

$10 + [$10 × (Index Return × Leverage Factor)]

provided, however, that in no event will you receive an amount greater than $10 + ($10× the Maximum Gain) | |

If the applicable Index Return is negative or zero, but its absolute value is less than or equal to the applicable Protection Percentage,you will receive the principal amount of your Notes at maturity. | ||

If the absolute value of the applicable Index Return is greater than the applicable Protection Percentage,you will receive a cash payment, per $10 principal amount Note, equal to:

$10 + [$10 × (Index Return + Protection Percentage)]

In this scenario, you will lose some of your principal, the amount depending on how much the applicable index declines, from the Trade Date to the Final Valuation Date, beyond the applicable Protection Percentage. | ||

Index Return | Index Ending Level - Index Starting Level | |

Index Starting Level | ||

Leverage Factor | S&P 500®Notes 2 | |

MSCI EM Notes 2 | ||

Maximum Gain | S&P 500®Notes 17.50% to 20.50% | |

MSCI EM Notes 27.00% to 30.00% | ||

The actual Maximum Gain for each issuance of Notes will be determined on the Trade Date. | ||

Index Starting Level | The closing level of the applicable index on the Trade Date | |

Index Ending Level | The closing level of the applicable index on the Final Valuation Date |

Determining Payment at Maturity

|

1 | Lehman Brothers Holdings Inc. is rated A+ by Standard & Poor’s, A1 by Moody’s and AA- by Fitch. A credit rating reflects the creditworthiness of Lehman Brothers Holdings Inc. and is not a recommendation to buy, sell or hold securities, and it may be subject to revision or withdrawal at any time by the assigning rating organization. Each rating should be evaluated independently of any other rating. The creditworthiness of the issuer does not affect or enhance the likely performance of the investment other than the ability of the issuer to meet its obligations. |

4

What are the tax consequences of the Notes?

Lehman Brothers Holdings Inc. intends to treat, and by purchasing a Note, for all tax purposes, you agree to treat, a Note as a cash-settled financial contract, rather than as a debt instrument.

Recent Tax Law Developments. On December 7, 2007, the Internal Revenue Service released a Notice indicating that the Internal Revenue Service and the Treasury Department are considering and seeking comments as to whether holders of instruments similar to the Notes should be required to accrue income on a current basis over the term of the Notes, regardless of whether any payments are made prior to maturity. In addition, the Notice provides that the Internal Revenue Service and the Treasury Department are considering related issues, including, among other things, whether gain or loss from such instruments should be treated as ordinary or capital, whether foreign holders of such instruments should be subject to withholding tax, whether the tax treatment of such instruments should vary depending upon the nature of the underlying asset, and whether such instruments should be subject to the special “constructive ownership rules” contained in Section 1260 of the Internal Revenue Code of 1986, as amended. It is not possible to predict what changes, if any, will be adopted, or when they will take effect. Any such changes could affect the amount, timing and character of income, gain or loss in respect of the Notes, possibly with retroactive effect. Holders are urged to consult their tax advisors concerning the impact of the Notice on their investment in the Notes. Subject to future developments with respect to the foregoing, Lehman Brothers Holdings Inc. intends to continue to treat the Notes for U.S. federal income tax purposes in accordance with the treatment described in the accompanying product supplement no. 820-I under the headings “Risk Factors” and “Certain U.S. Federal Income Tax Consequences.”

See “Certain U.S. Federal Income Tax Consequences” in the accompanying product supplement no. 820-I.

Key Risks

An investment in the Notes involves significant risks. Investing in the Notes is not equivalent to investing directly in any of the stocks included in the applicable index. These risks are explained in more detail in the “Risk Factors” section of the accompanying product supplement no. 820-I and in the “Risk Factors” section of the accompanying Underlying Supplement applicable to each issuance of Notes. You should reach an investment decision only after you have carefully considered with your advisers the suitability of an investment in the Notes in light of your particular circumstances.

| ¨ | Partial Principal Protection Only Applies if You Hold the Notes to Maturity: You should be willing to hold your Notes to maturity. If you sell your Notes in the secondary market, you may have to sell them at a discount and you will not have partial principal protection for a decline in the applicable index up to the applicable Protection Percentage. YOU SHOULD BE WILLING TO HOLD YOUR NOTES TO MATURITY. |

| ¨ | Your Investment in the Notes May Result in a Loss: The Notes do not guarantee any return of principal in excess of the applicable Protection Percentage per $10 principal amount. The return on the Notes at maturity is linked to the performance of the applicable index and will depend on whether, and the extent to which, the applicable Index Return is positive or negative. Your investment will be fully exposed to any decline in the applicable index if, and to the extent to which, the applicable Index Return falls below the applicable Protection Percentage. You may lose up to a substantial portion of your principal if the applicable index declines by more than the applicable Protection Percentage. |

| ¨ | Maximum Gain:A direct leveraged investment in the stocks underlying the applicable index may exceed the applicable Maximum Gain. YOU WILL NOT RECEIVE A RETURN ON THE NOTES GREATER THAN THE APPLICABLE MAXIMUM GAIN EVEN IF THE PRODUCT OF THE APPLICABLE INDEX RETURN AND THE APPLICABLE LEVERAGE FACTOR IS GREATER THAN THE APPLICABLE MAXIMUM GAIN. |

| ¨ | No Interest or Dividend Payments or Voting Rights: As a holder of the Notes, you will not receive interest payments, and you will not have voting rights or rights to receive cash dividends or other distributions or other rights that holders of stocks included in the applicable index would have. |

| ¨ | Certain Built-in Costs are Likely to Adversely Affect the Value of the Notes Prior to Maturity: While the Payment at Maturity described in this term sheet is based on the full principal amount of your Notes, the original issue price of the Notes includes the agent’s commission and the cost of hedging our obligations under the Notes through one or more of our affiliates, which includes our affiliates’ expected cost of providing such hedge as well as the profit our affiliates expect to realize in consideration for assuming the risks inherent in providing such hedge. As a result, the price, if any, at which Lehman Brothers Inc. will be willing to purchase Notes from you in secondary market transactions, if at all, will likely be lower than the original issue price and any sale prior to the Maturity Date could result in a substantial loss to you. The Notes are not designed to be short-term trading instruments. YOU SHOULD BE WILLING TO HOLD YOUR NOTES TO MATURITY. |

| ¨ | Dealer Incentives: We, our affiliates and agents, and UBS Financial Services Inc., and its affiliates, act in various capacities with respect to the Notes. Lehman Brothers Inc. and other of our affiliates may act as a principal, agent or dealer in connection with the Notes. Such affiliates, including the sales representatives, will derive compensation from the distribution of the Notes, and such compensation may serve as an incentive to sell the Notes instead of other investments. We will pay compensation of $0.175 per $10 principal amount Note to the principals, agents and dealers in connection with the distribution of the Notes. |

| ¨ | Lack of Liquidity: The Notes will not be listed on any securities exchange. Lehman Brothers Inc. intends to offer to purchase the Notes in the secondary market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Notes easily. Because other dealers are not likely to make a secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at which Lehman Brothers Inc. is willing to buy the Notes. If you are an employee of Lehman Brothers Holdings Inc. or one of our affiliates, you may not be able to purchase the Notes from us and your ability to sell or trade the Notes in the secondary market may be limited. |

| ¨ | Potential Conflicts: We and our affiliates play a variety of roles in connection with the issuance of the Notes, including acting as calculation agent and hedging our obligations under the Notes. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the Notes. |

5

¨ | We and our Affiliates and Agents May Publish Research, Express Opinions or Provide Recommendations that are Inconsistent with Investing in or Holding the Notes. Any Such Research, Opinions or Recommendations Could Affect the Level of the Index and, Consequently, the Value of the Notes: We, our affiliates and agents publish research from time to time on matters that may influence the value of the Notes, or express opinions or provide recommendations that may be inconsistent with purchasing or holding the Notes. We, our affiliates and agents may publish or may have published research or other opinions that are inconsistent with an investment position in the S&P 500® Index or the MSCI EM (Emerging Markets) Index. Any research, opinions or recommendations expressed by us, our affiliates or agents may not be consistent with each other and may be modified from time to time without notice. Additionally, UBS Financial Services Inc. and its affiliates may publish or may have published research or other opinions that are inconsistent with an investment position in the S&P 500® Index or the MSCI EM (Emerging Markets) Index. Investors should make their own independent investigation of the merits of investing in the Notes. |

| ¨ | Credit of Issuer: An investment in the Notes will be subject to the credit risk of Lehman Brothers Holding Inc., and the actual and perceived creditworthiness of Lehman Brothers Holdings Inc. may affect the market value of the Notes. |

| ¨ | Many Economic and Market Factors Will Impact the Value of the Notes: In addition to the level of the applicable index on any day, the value of the Notes will be affected by a number of economic and market factors that may either offset or magnify each other and which are set out in more detail in the product supplement no. 820-I. |

| ¨ | Uncertain Tax Treatment: Significant aspects of the tax treatment of the Notes are uncertain. You should consult your own tax advisor about your own tax situation before investing in the Notes. |

Risks Specific to an Investment in the S&P 500® Notes

¨ | We are One of the Companies that Make up the S&P 500® Index: We are one of the companies that make up the S&P 500® Index. We will not have any obligation to consider your interests as a holder of the S&P 500® Notes in taking any corporate action that might affect the level of the S&P 500® Index and the value of the S&P 500® Notes. |

Risks Specific to an Investment in the MSCI EM Notes

¨ | The Applicable Index Return Will Not Be Adjusted for Changes in Exchange Rates Relative to the U.S. Dollar: The value of the MSCI EM Notes will not be adjusted for exchange rate fluctuations between the U.S. dollar and the currencies in which the stocks included in the MSCI EM (Emerging Markets) Indexare based. Therefore, if the currencies in which the stocks included in the MSCI EM (Emerging Markets) Index are denominated appreciate or depreciate relative to the U.S. dollar over the term of the MSCI EM Notes, you will not receive any additional payment or incur any reduction in your return, if any, at maturity. Because the MSCI EM (Emerging Markets) Index—but not its component stocks—is denominated in U.S. dollars, the MSCI EM Notes will have foreign currency exposure, and the value of the MSCI EM Notes will be affected by exchange rate fluctuations between the U.S. dollar and the currencies in which such component stocks are based. If the applicable currencies appreciate or depreciate relative to the U.S. dollar over the term of the Notes, the value of your Notes may increase or decrease at maturity. |

| ¨ | There are Risks in Emerging Markets: Countries with emerging markets may have relatively unstable governments, may present risks of nationalization of businesses, may impose restrictions on foreign ownership, foreign currency exchange and the repatriation of assets, and may be less protective of property rights than more developed countries. The economies of countries with emerging markets may be based on only a few industries, may be highly vulnerable to changes in local, regional and global economic and trade conditions, and may suffer from extreme and volatile debt burdens or inflation rates. |

¨ | Non-U.S. Securities Markets Risks: The stocks included in the MSCI EM (Emerging Markets) Index are issued by foreign companies in foreign securities markets. These stocks may be more volatile and may be subject to different political, market, economic, exchange rate, regulatory and other risks. This may have a negative impact on the performance of the MSCI EM Notes. |

6

S&P 500® Index

The S&P 500® Index is published by Standard & Poor’s (“S&P”), a division of The McGraw-Hill Companies, Inc. As discussed more fully in underlying supplement no. 100 under the heading “The S&P 500® Index,” the S&P 500® Index is intended to provide a performance benchmark for the U.S. equity markets. The calculation of the value of the S&P 500® Index is based on the relative value of the aggregate market value of the common stocks of 500 companies as of a particular time compared to the aggregate average market value of the common stocks of 500 similar companies during the base period of the years 1941 through 1943. Ten main groups of companies comprise the S&P 500® Index, along with the number of companies included in each group as of January 31, 2008 are indicated below: Consumer Discretionary (87); Consumer Staples (39); Energy (36); Financials (92); Health Care (51); Industrials (56); Information Technology (71); Materials (28); Telecommunications Services (9); and Utilities (31).

You can obtain the level of the S&P 500® Index at any time from the Bloomberg Financial Markets page “SPX <Index> <GO>“ or from the S&P website atwww.spglobal.com.

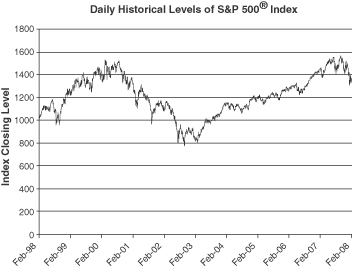

The graph below illustrates the performance of the S&P 500® Index from February 13, 1998 to February 15, 2008. The historical levels of the S&P 500® Index should not be taken as an indication of future performance.

Source: Bloomberg L.P.

The S&P 500® Index closing level on February 15, 2008 was 1,349.99.

The information on the S&P 500® Index provided in this document should be read together with the discussion under the heading “The S&P 500® Index” beginning on page US-2 of underlying supplement no. 100. Information contained in the S&P website referenced above is not incorporated by reference in, and should not be considered a part of, this free writing prospectus.

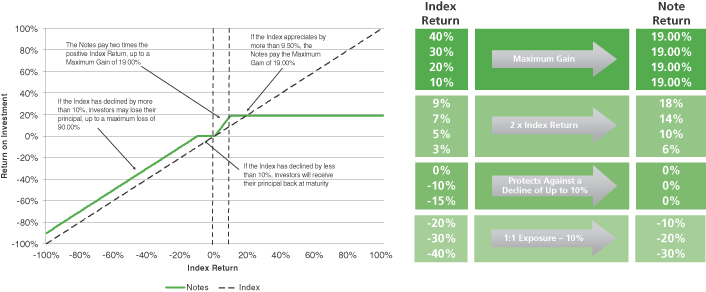

Scenario Analysis and Examples at Maturity for the S&P 500® Notes

The following scenario analysis and examples reflect the Leverage Factor of 2 and assume an Index Starting Level of 1,349.99, a Maximum Gain of 19.00% (the midpoint of the range of 17.50% to 20.50%) and a range of Index Returns from +40% to -40%. The actual Index Starting Level and Maximum Gain will be set on the Trade Date.

7

Example 1—The level of the index increases from the Index Starting Level of 1,349.99 to an Index Ending Level of 1,417.49.

Because the Index Ending Level is 1,417.49 and the Index Starting Level is 1,349.99, the Index Return is 5%, calculated as follows:

(1417.49 – 1349.99)/1,349.99 = 5%

Because the Index Return is 5%, the Payment at Maturity is equal to $11.00 per $10 principal amount Note calculated as follows:

$10 + [$10 × (5% × 2)] = $11.00

Example 2—The level of the index increases from the Index Starting Level of 1,349.99 to an Index Ending Level of 1,484.99.

Because the Index Ending Level is 1,484.99 and the Index Starting Level is 1,349.99 the Index Return is 10%, calculated as follows:

(1,484.99 – 1,349.99)/1,349.99 = 10%

Because the Index Return is 10% and the Leverage Factor is 2, the return on the Note would be equal to 20%, but it is subject to the Maximum Gain of 19.00%. Therefore, the Payment at Maturity is equal to $11.90 per $10 principal amount Note, calculated as follows:

$10 + [$10 × (19.00%)] = $11.90

Example 3—The level of the index decreases from the Index Starting Level of 1,349.99 to an Index Ending Level of 1,282.49.

Because the Index Ending Level is 1,282.49 and the Index Starting Level is 1,349.99, the Index Return is -5%, calculated as follows:

(1,282.49 – 1,349.99)/1,349.99 = -5%

Because the Index Return is -5%, the absolute value of which is less than the Protection Percentage, the Payment at Maturity is equal to $10.00 per $10 principal amount Note.

Example 4—The level of the index decreases from the Index Starting Level of 1,349.99 to an Index Ending Level of 944.99.

Because the Index Ending Level is 944.99 and the Index Starting Level is 1,349.99 the Index Return is -30%, calculated as follows:

(944.99 – 1,349.99)/ 1,349.99 = -30%

Because the Index Return is equal to -30%, the absolute value of which is more than the Protection Percentage, the investor will lose 1% of principal for each 1% that the Index Return exceeds the Protection Percentage and the Payment at Maturity is equal to $8.00 per $10 principal amount Note calculated as follows:

$10 + [$10 × (-30% + 10%)] = $8.00

8

MSCI EM (Emerging Markets) Index

The MSCI EM (Emerging Markets) Index (formerly, the MSCI Emerging Markets IndexSM) is published by MSCI Inc. (the successor to Morgan Stanley Capital International, Inc.). As discussed more fully in underlying supplement no. 1120 under the heading “The MSCI EM (Emerging Markets) Index “, the MSCI EM (Emerging Markets) Index is a free float-adjusted market capitalization index that is intended to measure the performance of certain emerging equity markets. As of February 18, 2008 the five largest sector weights were: Financials (20.98%), Energy (17.82%), Materials (15.57%), Telecommunication Services (11.60%) and Information Technology (10.02%).

You can obtain the level of the MSCI EM (Emerging Markets) Index at any time from the Bloomberg Financial Markets page “MXEF <Index> <GO>“ or from the MSCI Barra website atwww.mscibarra.com.

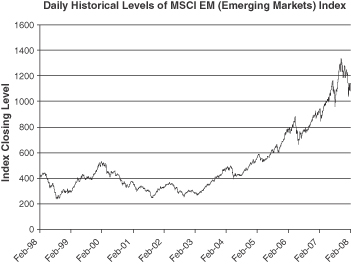

The graph below illustrates the performance of the MSCI EM (Emerging Markets) Index from February 18, 1998 to February 18, 2008. The historical levels of the MSCI EM (Emerging Markets) Index should not be taken as an indication of future performance.

Source: Bloomberg L.P.

The MSCI EM (Emerging Markets) Index closing level on February 18, 2008 was 1,141.69.

The information on the MSCI EM (Emerging Markets) Index provided in this document should be read together with the discussion under the heading “The MSCI EM (Emerging Markets) Index” beginning on page US-2 of underlying supplement no. 1120. Information contained in the MSCI website referenced above is not incorporated by reference in, and should not be considered a part of, this free writing prospectus.

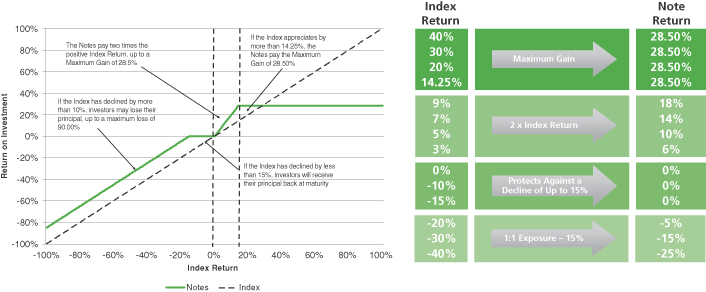

Scenario Analysis and Examples at Maturity for the MSCI EM Notes

The following scenario analysis and examples reflect the Leverage Factor of 2 and assume an Index Starting Level of 1,141.69, a Maximum Gain of 28.50% (the midpoint of the range of 27% to 30%) and a range of Index Returns from +40% to -40%. The actual Index Starting Level and Maximum Gain will be set on the Trade Date.

9

Example 1—The level of the index increases from the Index Starting Level of 1,141.69 to an Index Ending Level of 1,198.77.

Because the Index Ending Level is 1,198.77 and the Index Starting Level is 1,141.69, the Index Return is 5%, calculated as follows:

(1,198.77 – 1,141.69)/1,141.69 = 5%

Because the Index Return is 5%, the Payment at Maturity is equal to $11.00 per $10 principal amount Note calculated as follows:

$10 + [$10 × (5% × 2)] = $11.00

Example 2—The level of the index increases from the Index Starting Level of 1,141.69 to an Index Ending Level of 1,312.94.Because the Index Ending Level is 1,312.94 and the Index Starting Level is 1,141.69 the Index Return is 15%, calculated as follows:

(1,312.94 – 1,141.69)/1,141.69 = 15%

Because the Index Return is 15% and the Leverage Factor is 2, the return on the Note would be equal to 30%, but it is subject to the Maximum Gain of 28.50%. Therefore, the Payment at Maturity is equal to $12.85 per $10 principal amount Note, calculated as follows:

$10 + [$10 × (28.50%)] = $12.85

Example 3—The level of the index decreases from the Index Starting Level of 1,141.69 to an Index Ending Level of 1,084.61.Because the Index Ending Level is 1,084.61 and the Index Starting Level is 1,141.69, the Index Return is -5%, calculated as follows:

(1,084.61 – 1,141.69)/1,141.69 = -5%

Because the Index Return is -5%, the absolute value of which is less than the Protection Percentage, the Payment at Maturity is equal to $10.00 per $10 principal amount Note.

Example 4—The level of the index decreases from the Index Starting Level of 1,141.69 to an Index Ending Level of 799.18.Because the Index Ending Level is 799.18 and the Index Starting Level is 1,141.69 the Index Return is -30%, calculated as follows:

(799.18 – 1,141.69)/1,141.69 = -30%

Because the Index Return is equal to -30%, the absolute value of which is more than the Protection Percentage, the investor will lose 1% of principal for each 1% that the Index Return exceeds the Protection Percentage and the Payment at Maturity is equal to $8.50 per $10 principal amount Note calculated as follows:

$10 + [$10 × (-30% + 15%)] = $8.50

Supplemental Plan of Distribution

We will agree to sell to UBS Financial Services Inc. and Lehman Brothers Inc. (together, the “Agents”), and the Agents will agree to purchase, all of the Notes at the price indicated on the cover of the pricing supplement, the document that will be filed pursuant to Rule 424(b) containing the final pricing terms of the Notes. UBS Financial Services Inc. may allow a concession not in excess of the underwriting discount to its affiliates.

We have agreed to indemnify the Agents against liabilities, including liabilities under the Securities Act of 1933, as amended, or to contribute to payments that the Agents may be required to make relating to these liabilities as described in the MTN prospectus supplement and the base prospectus. We have agreed that UBS Financial Services Inc. may sell all or a part of the Notes that it purchases from us to its affiliates at the price that will be indicated on the cover of the pricing supplement that will be available in connection with the sales of the Notes.

Subject to regulatory constraints, Lehman Brothers Inc. has agreed to use reasonable efforts to make a market in the Notes for so long as the Notes are outstanding.

We or our affiliate may enter into swap agreements or related hedge transactions with one of our other affiliates or unaffiliated counterparties in connection with the sale of the Notes and the Agents and/or an affiliate may earn additional income as a result of payments pursuant to the swap or related hedge transactions.

10